African-skies

Panafrican Journal on Air Transport, Issue No. 52 : December 2022

In this issue: AFRAA Secretary General’s interview with Hermes

Liberalisation of African air transport under the AfCFTA

Preparing for the future, today AFRAA’s position on environment

Innovative leadership

AFRAA’s

AFRAA’s

Road to recovery and sustainability of the airline industry

The airline industry’s recovery trajectory in 2023 has been positive and promising; however, African airlines are not yet out of the woods. According to AFRAA estimates, the year closes with traffic at 85.7% of the 2019 levels, while we estimate that intraAfrican connectivity has reached 94% of the pre-COVID levels as of November 2022. The revenue loss attributed to COVID-19 has reduced to US$ 3.5 billion in 2022 from the recorded US$ 8.6 billion in 2021 and US$ 10.21 in 2020.

As a matter of priority, AFRAA is preoccupied with actions for Africa’s air transport sustainability, much so that we spearheaded the first ever laboratory for the sustainability of the air transport sector in Africa. The laboratory approach was necessary to develop roadmaps for the sustainability of the air transport sector in Africa, which will be overseen by the Air Transport Sustainability Steering Committee (ATSSC). Through collaboration, AFRAA and the relevant stakeholders will work closely to achieve the Laboratory outcomes to ensure that Africa achieves

survival in the short term and its sustainability in the long-term.

To pair transport industry leaders from across the globe at this year’s AFRAA Annual General Assembly (AGA) & Summit, taking place from 11-13 December 2022 in Dakar, Senegal, will deliberate on the recovery and sustainability of the air transport industry in Africa. Topics have been carefully aligned to the main conference theme:” Acing the Road map to Sustainable African Aviation.” This will better prepare stakeholders to continue to rebuild Africa’s aviation to make the travel ecosystem more resilient and viable. Therefore, the Assembly is a critical forum for us to create the much needed environment for air transport business to thrive and contribute to the continent’s development.

Alongside the drive for sustainability into 2023 and beyond, AFRAA will continue to steer actions that will catalyse the airline industry’s growth through advocacy, partnerships for development, and data & intelligence – the three pillars of our mandate.

Mr. Abdérahmane Berthé AFRAA Secretary General

FOREWORD

We continue to steer actions that will catalyse the airline industry’s growth.

FOREWORD 1

SG’s interview with Hermes Insights on AFRAA’s perspective and actions on the sustainability of the aviation industry.

14

AFRAA’s position on environment

Leaders are focusing on reducing the environmental impact through technological improvement.

17

Airline passengers on their attitudes

Demand for air travel and enthusiasm to further embrace the mobile and touchless technologies that will make the journey as convenient and seamless as possible.

Innovative leadership

COVID-19 was a catalyst of the digital transition and a stimulator for innovative leadership.

Preparing for the future, today

We can never know what tomorrow will look like, scenario planning offers a chance to explore the possibilities.

Liberalisation of the African air transport under AfCFTA

The market is becoming steadily middle class, young, increasingly educated and by 2050 it will account for more than a quarter of the world’s working population.

The new shape of business travel

Changes brought about by the pandemic, and the new ways of working in many companies, are also creating new opportunities for business travel.

Environmental sustainability

The world is watching and waiting for major decisions that will protect our planet from the adverse effects of climate change.

African-skies AFRAA’sPanafricanJournalonAirTransport,Issue In this issue: AFRAA Secretary General’s interview with Hermes Liberalisation of African air transport under the AfCFTA Preparing for the future, today AFRAA’s position on environment Innovative leadership @AFRAA.AfricanAirlinesAssociation https://www.linkedin.com/company/african-airlines-association/ @AfricanAirlines www.afraa.org 2 | African-skies | DECEMBER 2022 07

24

04

10

Contents

28 FEATURES 26

Rolls-Royce: A partnership success story

Rolls-Royce is ideally positioned to steer Africa’s growing regional aviation sector in a sustainable direction over the coming years.

REGULARS

African-skies

PUBLISHERS

Camerapix Magazines Limited

EDITORIAL DIRECTOR

Rukhsana Haq

MANAGING EDITOR

Maureen Kahonge

SENIOR DESIGNER

Sam Kimani

PRODUCTION MANAGER

Rachel Musyoni

ADMINISTRATION | ADVERTISING

Azra Chaudhry (UK)

Rose Judha (Kenya)

African-skies is published quarterly for AFRAA by Camerapix Magazines Limited

Correspondence on editorial and advertising matters may be sent to either of these addresses

Regional International speaks to Kirsten Rehmann, Chief Executive Officer of Hahn Air on her achievement and her plans for leading the company into the future.

Accelerating the pace to aviation AFRAA is convinced that, the aviation industry commitment to net zero CO2 emissions by 2050 would require supportive government policies.

State

International routes and intra-African connectivity have improved since the COVID-19 pandemic period.

Editorial and Advertising Offices: Camerapix Magazines Limited

PO Box 45048, 00100, GPO Nairobi, Kenya

Tel: +254 (20) 4448923/4/5

Fax: +254 (20) 4448818 or 4441021

Email: creative@camerapix.co.ke

Camerapix Magazines (UK) Limited

32 Friars Walk, Southgate, London, N14 5LP

Tel: +44 (20) 8361 2942

Mobile: +447756340730

Email: camerapixuk@btinternet.com

afraa@afraa.org

Printed in Nairobi, Kenya

Message from AFRAA’s Secretary General 01 AFRAA diary 2022 at a glance. 40 All rights reserved. No part of this magazine may be reproduced by any means without permission in writing from AFRAA. While every care is taken to ensure accuracy in preparing African-skies, the publishers and AFRAA take no responsibility for any errors or omissions contained in this publication. © 2022 CAMERAPIX MAGAZINES LTD

of the industry

49

30 A rewarding journey

34

37

Interview with Mr. Abdérahmane Berthé, Secretary General, AFRAA

1. How do you define sustainability in aviation?

Mr. Abdérahmane Berthé, AFRAA Secretary General shares with Hermes insights on AFRAA’s perspective and actions on the sustainability of the aviation industry.

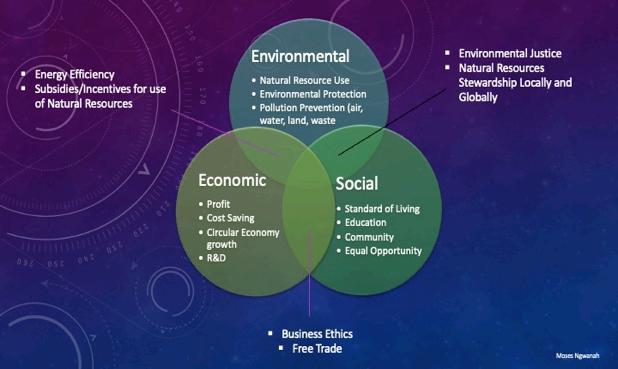

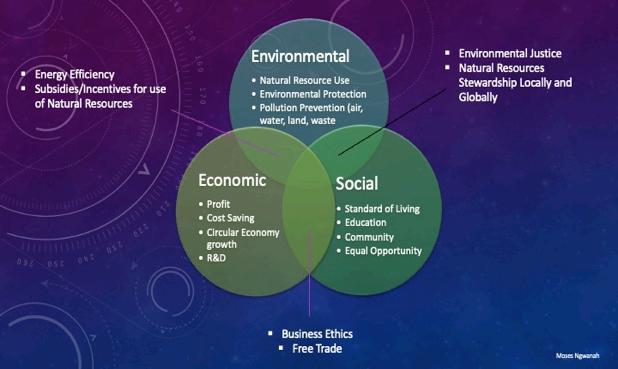

Aviation provides the only worldwide transportation network, which makes it essential for global business and tourism. It is vital in facilitating economic growth, particularly in developing countries. Air transport has become a driver of economic, social, and cultural development and has fundamentally changed how we travel, interact with others, and do business. Sustainability is defined simply as “meeting the needs of the present without compromising the ability of future generations to meet their needs.” Sustainability is a business strategy that drives long-term corporate growth and profitability by mandating the inclusion of environmental and social issues in the business model.

Building a sustainability strategy creates long-term value, improves efficiency and reputation, meets customer demands, and fosters the Aviation Industry’s resilience and longevity.

2. What are the key features of a sustainable aviation industry?

Sustainability is not just about the environment and society. It is about ensuring a prosperous future for the next generations.

Social, environment, and economy are the three features of the sustainable aviation industry. It is referred to as people, planet, and profits in today’s business environment.

3. How can the aviation industry best reduce its environmental footprint?

Air Transport contributes to 2% of humanmade CO2 emissions. The climate change trends put pressure on the sector to further reduce its modest share of CO2 emissions faster. ICAO Assembly adopted the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA).

We believe that the aviation industry will contribute to protecting the environment better with coordinated efforts in line with five pillars:

- Continuous Fuel Efficiency Improvement through New Technology.

- Alternative Fuel.

- Implementation of Fuel Conservation Initiatives in Operations.

- Air Navigation Infrastructure.

- CORSIA.

4. How will investments in sustainability impact the efficiency and profitability of aviation?

Aviation sustainability, in addition to addressing the industry’s environmental

INTERVIEW 4 | African-skies | DECEMBER 2022

impact, focuses on the survival and success of the aviation value chain.

To achieve the five pillars and positively impact efficiency and profitability requires investment in new technologies, alternative fuel, efficient infrastructure, and cost-saving competitive operations. Airlines need finance to invest in the modern, efficient fleet and relevant technologies that will make them competitive and sustainable. Aviation and tourism infrastructure investments are also required to boost the sector’s total development.

5. What are the industry’s best practices, already in place, that improve sustainability?

The good thing is that, in aviation, best practices are not traded secrets. They can be easily accessed and learned from.

The African Continent will have to learn from other regions where airline ownership limits are relaxed and foreign equity capital encouraged and not frowned upon. A deliberate policy to privatise state-owned airlines and invite foreign investors to take a stake will attract the capital and managerial expertise needed to run such airlines professionally. Airlines that are efficiently and profitably run are sure to be sustainable, provided the right regulatory environment is created to support business. This is the trend in many parts of the world.

On economic sustainability, consolidation and collaboration are crucial elements in the success of the African airlines. Airline consolidation across other regions has positively impacted the growth and sustainability of the airline industry. In the African context, the ripple effect of strengthened collaboration amongst airlines will be an increase in the industry’s contribution to the sustainable development of Africa. The engagement of states, airlines, and all relevant

stakeholders is necessary to achieve the required outcomes on airline consolidation in Africa effectively. On social sustainability, industry stakeholders across the globe are taking various actions to address gender diversity and develop the Next Generation of Aviation Professionals (NGAP) to meet the African global needs of the aviation industry of tomorrow. The development of skilled aviation professionals in Africa’s aviation and aerospace industry is critical as a large contingent of the current aviation professionals will retire, and aviation growth will require more qualified and competent professionals. The continent can train, develop and groom youth.

6. How can these best practices be fully implemented throughout the industry?

The acceleration to aviation sustainability will be realised if Africa allows the private sector to drive the commercial side of the business. At the same time, governments focus on enacting the enabling regulations to support the industry.

7. What are the regulatory impediments to increasing sustainability?

African aviation sustainability renaissance began with adopting the African Union (AU) Vision 2063, a continental development roadmap. Among the flagship projects in this document are the Single African Air Transport Market (SAATM); the African Continental Free Trade Agreement (AfCFTA); and the Protocols on the free movement of people and goods – three inter-related projects aimed at liberalising the air transport market, facilitating trade and the movement of people across borders.

To ensure the successful implementation of all three projects, conscious efforts are being made to put the regulatory framework and institutional structures in

place and to disband or amend national regulations that may not align with the letter and spirit of the AU Agenda 2063 and these flagship projects.

8. How can regulations incentivize and facilitate the aviation industry to be more efficient and more sustainable? The full implementation of the Yamoussoukro Decision (YD), AfCFTA, and facilitation of mobility through visa and passport protocols will guarantee aviation sustainability in Africa.

Harmonisation and implementation of appropriate policies and regulations are essential for the oversight of the AUC Agenda 2063 projects which will spur the sustainability of the air transport sector in Africa. Governments, Development Financing Institutions (DFIs), and other partners should support the efforts to implement all the regulations and set up functional structures.

9. How can industry participants, including airport, airlines, and air navigation providers, cooperate to improve sustainability?

Aviation has traditionally been a business that collaborates and coordinates to provide transportation services. Historically, airlines work with governments, airports, air navigation service providers, civil aviation authorities, tourism organisations, safety/security institutions, and other sectors.

Indeed, collaboration has seen the aviation industry agree on CORSIA to address the global environmental challenges instead of the earlier unilateral regional/country measures that would have been expensive and chaotic.

AFRAA believes that aviation ‘talks too much to itself’ and excludes other relevant players that influence the industry.

As the leading air transport body on the continent, AFRAA is conscious of this reality and has decided that in 2022, it will

INTERVIEW 5

Author: AFRAA

begin to change the narrative and establish broader consultation with all stakeholders for the industry’s good. In furtherance of this, AFRAA organised in June 2022 a ‘Laboratory’ of relevant players to consult broadly on critical issues of the aviation, trade, tourism, financial and regulatory sectors. The LAB brought together government, international development partners, aviation entities, trade and tourism organisations, financiers, regional economic communities, and selected consumers of air transport services. The laboratory developed roadmaps grouped under five projects that deliberated on out-of-the-box solutions on specific subject areas, including fuel and customs taxes, high taxes and charges, navigation – Free Routing Area (FRA), implementation of the Single African Air Transport Market (SAATM) and partnerships between airlines, hospitality and tourism bodies to improve intraAfrican tourism. The roadmap, which will be tabled for adoption by AU Policy Organs, shall be monitored, assessed, and reviewed by a multi-sectoral steering committee coordinated by AFRAA.

10. Sustainability is often thought of as a long-term goal, but what three key changes can the aviation industry implement within the next five years to increase sustainability?

A sector struggling to survive will find it difficult to focus on the long-term environmental goals that do not yield short-term visible results. This does not mean the environmental priorities are less critical.

The aviation world can do more by ensuring that all regions have viable and sustainable aviation businesses in the first place. Particularly in the developing world, where connectivity and mobility are limited, costly, and local airlines cannot sustain their businesses, there is a need for stakeholder collaboration to address some of the bottlenecks.

At the same time, governments should prioritise aviation and support the industry with the right laws that guarantee market access, capital access, and capacity development.

Finally, the efforts made by African states under the leadership of the African Union to implement SAATM and AfCFTA and facilitate the movement of people and goods are giant steps toward aviation sustainability in Africa.

INTERVIEW 6 | African-skies | DECEMBER 2022

Preparing for the future, today

We can never know what tomorrow will look like, scenario planning offers a chance to explore the possibilities. We examine potential paths for the future and how they could impact travel.

While the acute phase of the pandemic appears to be passing in many regions, the path towards a healthier and growing global economy remains tentative. COVID-19 continues to create uncertainty across all industries, and travel is no exception. What is encouraging is that there are many positive signs of recovery, with global travel search data almost back

at pre-pandemic levels, and with bookings steadily rising. However, this is no time for complacency, with the future shape of the sector still unclear.

It is therefore incumbent upon us, and other global organisations, to seek to understand the major drivers of change which are likely to shape the future. This is why already last year we commissioned scenario experts Stratforma, the experts in scenario planning and advisory consultancy, to work in partnership with us and explore different scenarios to help us understand how travel may evolve in the coming years.

FEATURE

7

Technology will be the key enabler to help the industry recover and develop.

The Scenario Planning methodology has been identified as one of the best approaches to address critical uncertainty around the future. However, while this type of work is vital to anticipate the emerging challenges and potential opportunities and to stress-test and re-evaluate our strategy, it is important to note this is not forecasting. We are not making predictions, but instead understanding the trends and drivers that are likely to shape the future.

Before we move on to the outcomes –a little about the process. During this exercise we hosted interviews with thought leaders, both from within and outside the travel industry, seeking expertise, views and unique perspectives on the future. This allowed us to identify more than 100 forces likely to impact travel in the coming decade. Following a process of selection, aggregation and evaluation, the 14 macro technological, economic, environmental and political (STEEP) pressures with the strongest impact on travel were identified. These included an increase in protectionism, disruptive natural events, the growth of the internet of things and the next wave of digital engagement, among others. Some of these we have some influence over while others we do not. With this information, future scenarios were codified along two axes of uncertainty: with drivers of demand ranging from increasing consumerism versus more values-based decisions along one, and a world which is less open versus more open along the other. These ‘critical uncertainties’ have shaped the main thrust of our analysis. In this context, consumerism is taken to mean a desire for consumption, personalised experiences, and gamification while a values-led mindset sees demand shaped by concerns, like sustainability, conscious consumption and political activism.

More open is taken to mean a commitment to global trade, freedom of movement of people, data, goods and capital, with porous borders and a commitment to a rules-based global order. Whereas less open is the antithesis, meaning a move toward nationalism, economic selfreliance, greater friction and stronger border controls.

Plotted on these axes, we can see the following four potential macroeconomic scenarios:

The most likely future will be a combination of these scenarios, drawing on elements of each. With dozens of forces pushing and pulling the world

With so much uncertainty – how will we prepare?

We believe that demand for travel will continue to grow, as the current data and evidence suggest. As restrictions have lifted, we have seen a rise in demand, demonstrating an appetite for travel that remains unwavering. However, we know change is constant, so what we see today may be very different from what we see in the longer-term. Why, where and for how long we travel is likely to shift.

With this in mind, we have identified four areas of focus we believe will benefit Amadeus, whatever tomorrow brings.

in different directions, no single trend or scenario is likely to dominate. We also cannot expect uniformity in terms of geography, with different outcomes expected across different continents. Nonetheless, as an industry we must be ready to respond to whichever scenarios we find ourselves confronted with.

As the global centre of gravity of the world’s economy continues to shift, we will work to reinforce our business in Asia to access the growth potential of the region. We will continue to strengthen our footprint, working to develop local relationships and adjusting our portfolio to meet the specific needs of our partners.

8 | African-skies | DECEMBER 2022 FEATURE

And around the world, we will continue seeking to secure market access to increase our ability to operate in a range of geographies.

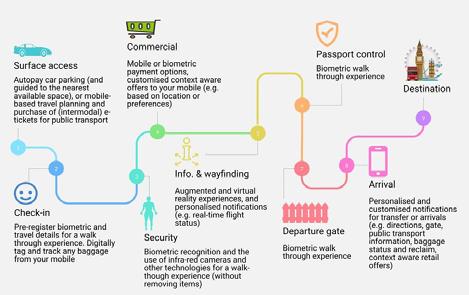

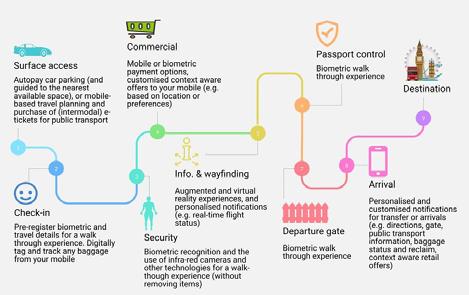

Technology will be the key enabler to help the industry recover and develop. We will work to integrate with the digital giants –a process we have embarked upon as we migrate our cloud services to Microsoft. As an industry, we will see the wider adoption of digital payments and biometric data, for example.

There is a growing demand – from consumers, travellers and governments – to make travel more sustainable. To facilitate this, we will work to enrich our IT solutions portfolio in fundamental areas, optimising our operations for key players and offering them enhanced technology to support the green transformation. Also, requirements from an increasingly less open world (‘blockism’) need to be taken into account in future planning.

Finally, Amadeus will continue work to develop our businesses to help our customers serve the end traveller. Including a greater focus on our ability to distribute leisure content, including experiences, while also targeting new leisure-oriented travel resellers, including lifestyle brands and super-apps. We will continue to have a traveller-centric model, making tangible improvements to each travel experience.

This is just the start of an ongoing journey. Even as we take the steps outlined above, the market continues to evolve, and we must be prepared. Amadeus will continue to assess the world around us, supporting our customers as their strategies evolve. However, one thing is constant: we will always focus on the traveller. Only by doing so can we renew travel and harness the growth opportunities for travel in the decade ahead.

This is the first in a series of blogs that Amadeus will be publishing around scenario planning.

Author: Amadeus

Digitalizing engine services

The future of engine services is digital. As a global leader for customized solutions for aero engines, MTU Maintenance continues to pioneer new technology. Our growing portfolio consists of a number of digital services, including our highly-advanced maintenance costing and planning tool, CORTEX. Our engine experts’ know-how and artificial intelligence allow for tailored, data-driven decision making. As a result, you benefit from optimized, cost-effective maintenance strategies that fit your needs. Contact us and find your solution today.

9 FEATURE

www.mtu.de/en

Maint_E_180x115_African_skies_202210_01.indd 1 01.09.22 11:41

Proud partner of AFRAA

Liberalisation of the African air transport Sector under the African Continental Free Trade Area (AfCFTA) Agreement in Africa

1. Introduction

The Agreement establishing the African Continental Free Trade Area (AfCFTA)1 entered into force in May 20192, and now has 54 signatories and 44 State Parties3. The start of trading under the AfCFTA was launched from 1 January 20214. The AfCFTA Agreement also includes the Protocol on Trade in Services (hereinafter “AfCFTA Protocol on TiS”). To Africa’s general public and businesses across the continent, the AfCFTA is considered a catalyst for growth: it aims to create a market environment that promotes certainty, predictability, and transparency, and leads to reduced trade and transaction costs. Africa’s market of 1.2 billion people and US $2.6 trillion in GDP is expected to grow to as much as US $16 trillion GDP and 2.75 billion people by 2060. This market is becoming steadily middle class, young, increasingly educated and by 2050 it will account for more than a quarter of the world’s working population.

Five (5) priority services sectors (Business; Communication; Financial; Transport, and Tourism and Travel), were selected as the subjects of the first round of liberalisation under the AfCFTA trade in services negotiations5. The choice of these sectors was

strategic: first, communication, financial and transport services are backbone or infrastructural services to many economic activities, with business services (particularly professional services) substantially contributing to services delivery through the movement of persons; second, most African countries have liberalised tourism in some form either in the WTO General Agreement on Trade in Services (GATS) or in their Regional Economic Communities (RECs), making it the most liberalised of the services sectors and presenting “low hanging fruit” in terms of the potential socio-economic impact on micro, small and medium sized enterprises (MSMEs), women and youth.6

The transport services sector comprises of air transport, land transport (both road and rail), maritime transport, pipeline transport and space transport. The transport services sector acts both as an enabler of trade in both goods and services, and a key factor in the facilitation of trade in general. The success of the AfCFTA partly hinges on establishing an efficient, cost-effective transport sector because transporting people, goods and services at competitive rates will foster the growth of intra-African trade.

1 Agreement establishing the African Continental Free Trade Area available at: https://au.int/sites/default/files/treaties/36437-treaty-consolidated_text_on_cfta_-_en.pdf Thirty days after the 22nd instrument of ratification was deposited.

2 Thirty days after the 22nd instrument of ratification was deposited.

3 State Parties are signatories that have ratified the AfCFTA Agreement.

4 Thirteenth extraordinary session on the AfCFTA: The Assembly of the Union adopts decision on the start of trading | African Union (au.int)

5 Assembly/AU/Dec.690-712 (XXXI) found at 36130-assembly_au_dec_690_-_712_xxxi_e.pdf

6 Beatrice Chaytor, Creating a Single African Market on Trade in Services: Negotiating the Schedules of Specific Commitments under the Protocol on Trade in Services, Tralac Newsletter, Issue 14, October 2019, available at tralac Newsletter | October 2019 (mailchi.mp)

10 | African-skies | DECEMBER

FEATURE

2022

Symbiotic relationship between trade and air transport

Together with associated logistics services, air transport services are essential for the development and optimal functioning of regional value chains envisaged under the AfCFTA. A well-functioning air transport service sector also delivers positive effects on intra-African passenger travel that is likely to spark growth in education, healthcare, and tourism services. However, intra-African trade has largely been constrained by the state of air transport services across the continent. Africa has 925 airports, out of which 122 are considered international airports. Africa’s air transport network includes a total of 14,762 air routes (connecting each airport with the other 121 airports).7

But current air travel route networks are inadequate and air fares are high compared with those in other regions of the world. In 2019, air transport accounted for only 0.09% of intra-African freight transport.8 The African airline industry supports more than 6.2 million people in Africa directly and indirectly, including in tourism and other sectors. Tourism alone accounts for 8.5 percent of Africa’s GDP, and as much as 38 percent in some small island countries.9 COVID-19 has severely disrupted these service sectors, and generally the continent lacks effective and affordable air connectivity.10 In many cases, airport and air traffic management infrastructure are also inadequate for the growth that is expected to take place over the next 40 years.

That growth is likely to be driven by the implementation of the Single African Air Transport Market (SAATM) and the AfCFTA Protocol on TiS. The AfCFTA Protocol takes a hybrid approach to liberalisation, on the one hand, State Parties make specific commitments to open up service sectors through the

11 FEATURE

Author: Beatrice Chaytor, AfCFTA Secretariat

Author: Emily MBURU-NDORIA

four modes of supply, and on the other hand they agree to cooperate on broad regulatory frameworks.11 A similar approach is taken as the GATS, so the Protocol restricts air transport services to those affecting aircraft repair and maintenance services and selling and marketing of air transport services.12 It specifically excludes air traffic rights and services directly related to the exercise of air traffic rights. Since both the SAATM13 (which deals with air traffic rights) and the AfCFTA are flagship projects of the African Union, cooperation and joint implementation of SAATM and AfCFTA Protocol on TiS specific commitments in the air transport sector will be instrumental in aligning the two initiatives. The AfCFTA Protocol specifically references the Yamoussoukro Decision (YD) in its preamble, highlighting the significant contribution of air transport and SAATM in particular to boost intra-African trade and the AfCFTA in particular. Moreover, in Article 26.1 (c) reference is made to an Annex on air transport services as one of the legal instruments to be outlined under the Protocol.

According to UNECA, implementation of AfCFTA would double air cargo transport from 2.3 to 4.5 million tonnes.14 Air traffic is therefore expected to double in 2030 compared to 2019, with the AfCFTA requiring 254 aircraft by 2030, and the estimated cost of required aircrafts being estimated at US $25 billion.15 The largest demand for aircraft to support the AfCFTA is within West Africa (13.5%). Demand from North to West Africa is 15.2% and within Southern Africa is 12.2%.

Future air transport aervices shaped by the AfCFTA protocol on trade in services

The Schedules of Specific Commitments of State Parties in the five priority sectors that have recently been adopted by the AfCFTA Council of Ministers provide significant tailwinds for the air transport service sector, and will complement the tariff schedules in goods being implemented by State Parties, as the demand for air transport services to ship goods across the continent grows. The opportunities provided for increased trade in manufactures and agri-business means growth in economic activities and in job creation. Thus, increasing investments in vital infrastructure such as airports, warehousing and cargo aircraft will help African entrepreneurs, who trade in agricultural and food products and medicines requiring cold chain, storage, and long-distance transportation to access the markets of their trading partners on the continent. Such infrastructure will unlock Africa’s trade potential under the AfCFTA, leading to improvements in airport facilities and security, and streamlined cargo handling procedures.

To complement the market opening commitments a regulatory framework on air transport services will be developed as envisaged under the Protocol reducing the impact of the diversity of national regulatory regimes, by providing key elements for harmonisation across the countries. The development of such a regulatory framework will be informed by developments in the RECs as well as continent-wide legal instruments

such as the YD framework. Trade in air transport on the continent is governed by an elaborate structure of bilateral air service agreements (BASAs) based on reciprocity – the granting of traffic rights to contracting states. BASAs determine the degree of market access and provide rules that give airlines the rights to fly on specific routes, define the capacity of designated airlines and limit the capacity of airlines from third countries. The system thus imposes a set of country-specific quotas in each market, as competition on each route is limited to suppliers designated by the relevant BASA. This can result in underdeveloped networks and a lack of competition, and leads to higher fares. Open skies agreements on the other hand, such as the AfCFTA Agreement and SAATM, remove restrictions on fares, capacity, frequency and aircraft type for designated airlines.16

Effectively the regulatory framework under the AfCFTA Protocol on TiS will seek to promote and guarantee free and fair competition in air transport services, and support the market access and national treatment commitments undertaken by State Parties in their schedules of specific commitments. The idea is that the specific commitments by State Parties and the regulatory framework in the air Transport sector should support ease of market entry by removing restrictions such as discriminatory licensing, giving other African service suppliers the opportunity to compete equally with domestic suppliers and as far as practicable, ensuring they are treated no less favourably than domestic suppliers.

8 Ibid, Chapter 5, pp 132-133.

9 Ibid.

12

12 | African-skies | DECEMBER 2022 FEATURE

7 Africa’s Services Trade Liberalisation & Integration under the AfCFTA, Assessing Regional Integration in Africa (ARIA), Volume X, UNECA, 2021, Chapter 5, available at https://repository.uneca. org/handle/10855/46739.

10 The African aviation industry recorded revenue loss of US$ 8.2 billion in 2021. ARIA X, pp. 11 AfCFTA Protocol on Trade in Services, Articles 18-22.

Ibid. Article 2 paras. 5 and 6. 1335 countries are signatories to the Solemn Declaration.

In an attempt to fast track the start of commercially meaningful trade under the AfCFTA, the Guided Trade Initiative (GTI) has been established, to enable those countries that are better prepared to begin to trade with each other.17 Eight State Parties are participating in the GTI,18 whose aims include (i) to allow commercially meaningful trading under the AfCFTA; (ii) to test the operational, institutional, legal and trade policy environment under the AfCFTA; and (iii) to send an important positive message to African economic operators that trade under the AfCFTA is possible and beneficial. About 100 goods are subject of trade under the GTI, which will be reviewed annually to expand the participating countries and available products eligible for trade. Shipments under the GTI have already commenced, with tea exports from Kenya to Ghana, transported by air, being the first among these.19

The Council of Ministers has also mandated the AfCFTA Secretariat to expand the GTI to include trade in services, incorporating the priority services sectors.20 The potential for services trade under the GTI is huge, and will feature services sectors in their role as enablers for trade in goods (transport, finance, communication services) as well as trading in services in their own right (professional, tourism and travel services); in both

aspects air transport services have a huge role to play.

Conclusion

The liberalisation of air transport services as a trade-facilitating tool presents a game-changer for Africa’s trade. A key factor in determining growth of the African aviation industry will be the extent of air transport market liberalisation under both the AfCFTA and the SAATM. It is particularly helpful that transport is being negotiated in the current round of services negotiations, in which significant progress has been made. Specific commitments in transport services undertaken by State Parties will spawn investments in infrastructure that can address bottlenecks among African countries, enabling them to increase cross border trade in manufacturing and agribusiness, driving industrialisation.

Regulatory frameworks to support market access openings will also ensure a level playing field among airline operators and reduce transaction costs. If the opportunities for investment in air transport infrastructure can be captured, the continent will be transformed beyond expectations. As the Guided Trade Initiative gets underway and more transactions among the participating State Parties are concluded, the more business confidence will be generated about the AfCFTA, and more likely the success of the free trade area generally.

15 Ibid.

16 ARIA X, Chapter 5, pp.139-145.

13 FEATURE

14 African Continental Free Trade Area (AfCFTA) to significantly increase traffic flows on all transport modes | United Nations Economic Commission for Africa (uneca.org)

17 The AfCFTA Guided Trade Initiative - AfCFTA (au-afcfta.org)

18 Cameroun, Egypt, Ghana, Kenya, Mauritius, Rwanda, Tanzania, and Tunisia.

19 AfCFTA’s Guided Trade Initiative takes off, set to ease and boost intra-African trade | Africa Renewal (un.org)

20 Report of the 10th Meeting of the Council of Ministers, 7 October 2022, on file with the author.

AfCFTA is considered a catalyst for growth: it aims to create a market environment that promotes certainty, predictability, and transparency.

AFRAA’s position on environment

1. Introduction

Sustainability has become a major subject of concern within the global aviation industry. Leaders are focusing on reducing the environmental impact through technological improvement. Global warming, environmental degradation, climate change and depletion of resources are becoming widespread. In response, aviation is conducting business with the long term goal of reducing aviation’s net CO2 emissions to half of what they were in 2005, by 2050. Aviation aims to do this by focusing on technology improvements, operational efficiencies, infrastructure development and sustainable aviation fuels (SAF).

Air Transport contributes to 2% of human-made CO2 emissions. Though air traffic doubles every 15 to 20 years, the Aviation sector has developed a strategy to attain and maintain carbon neutral growth by 2020. Africa aviation share in the global CO2 reduction goals and AFRAA have been working with stakeholders in coordinating the African response. This policy paper summarises AFRAA’s position relating to the environment in Africa.

2. Africa status vis-à-vis the environment

In Africa, though the industry is growing, airlines’ share of global traffic has stagnated at around 2% for a very long time. In real terms, African airlines’ market share for intercontinental traffic has shrunk from 60% some 40-50 years ago to just about 20% in recent times and still shrinking. African aviation contribution to the global aviation emission of 2% CO2 is very negligible. However, as the potential for aviation growth on the continent is enormous, to the sector is proactively working on and promoting measures and programs to protect the environment.

3. AFRAA regional approach for environment

Climate change effects are more visible across the Continent. The southwards expansion of the Sahara, the changing rainfall

patterns, severe flooding and droughts are indications of global warming and environmental degradation.

Therefore, AFRAA strategy is to drive global aviation environmental initiatives with local targets and deliverables to ensure a sustainable industry. In partnership with other stakeholders, AFRAA 5 pillar approach to a improving the environment from the aviation perspective are as follows:

Pillar 1: Continuous fuel efficiency improvement through new technology

Encouraging airlines to invest in new technology and aircraft that are more efficient and emit less CO2. Striving to meet more stringent environmental SARPS and operations procedures aircraft will burn less fuel and consequently lessening their environmental footprint.

Pillar 2: Alternative fuel

Promote the adoption of the use of bio-fuel as one way to reduce the dependence on jet A1 from crude oil. In Africa, SAA pioneered the use of blend-in bio-fuel in a demonstration operations between Johannesburg and Cape Town. With Africa’s vast arable land, it could grow much needed by-products for bio-fuels.

14 | African-skies | DECEMBER 2022 FEATURE

Africa and African airlines should prepare for the use of bio-fuel as technology mature in the medium term.

Pillar 3: Implementation of Fuel Conservation Initiatives in Operations

Focused on maintenance, ground, and flight operations, AFRAA urges members to implement relevant fuel conservation initiatives to burn less fuel in operations, to emit less CO2 while reducing their fuel bills.

AFRAA is working closely with member airlines towards the implementation of fuel conservation programs in operations.

Flight Procedure Program (A-FPP) to assist the African States in designing the procedures at very competitive costs. These PBN procedures support the performance of safe Continuous Climb Operations (CCOs) and Continuous Descend Operations (CDOs) along Standard Instrument Departure (SID) and Standard Arrival Routes (STARs) while improving fuel efficiency in the TMAs.

It is AFRAA’s view that Air Navigation Service Providers (ANSPs) should provide flexible routings in clusters of airspaces with entry and exit points, taking advantage of the low-density flights across the Continent’s huge area. Flight operations along flexible routings exploit high altitude winds, reduce flight times, decrease fuel burnt, and limit CO2 emission significantly.

AFRAA urges airlines, ANSPs, and states to build on gained experience in the Atlantic Ocean Random Routing Area (AORRA) to extent flexible routing operations gradually in the continental airspace.

Pillar 5: CORSIA

Pillar 4:

Air Navigation

Infrastructure Stakeholders agreed to set as a priority the implementation of PerformanceBased Navigation (PBN) procedures in terminal areas (TMAs) at African airports. To support the deployment of PBN in TMAs, ICAO established the African

In 2016, the ICAO Assembly adopted the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), to stabilise net CO2 emissions from international aviation from 2021. ICAO has now agreed that 2019 emissions will be used as the baseline for net CO2 emissions from international aviation. AFRAA actively participated in regional coordinated position of African States for CORSIA.

CORSIA has applied to international aviation since 1 January 2019 when all airlines were required to report their CO2 emissions on an annual basis. From 1 January 2021, international flights will become subject to offsetting obligations.

Author: AFRAA

Author: AFRAA

15 FEATURE

Sustainability has become a major subject of concern within the global aviation industry.

The CORSIA voluntary phase for states is from 2021 until 2026. As of July 2021, 106 states (including 17 from Africa) representing 77% of international aviation activity have committed to the voluntary phase.

From 2027 onwards, CORSIA comes into force and will be mandatory. AFRAA is encouraging more African States to sign up for the voluntary phase so as to test their monitoring and reporting efficiency and accuracy. This phase gives opportunity for participating states to make corrections and adjustments in readiness for the mandatory phase beginning 2027.

Industry capacity building, advocacy and sensitisation events by AFRAA and partners will continue aimed at assisting particularly airlines to better understand their role and obligations.

4. Conclusion

Climate change trends are a wake-up call for all economic sectors to take action and reduce human-induced CO2 emissions worldwide. Though air transport emission

share is only 2% of the world’s CO2, the aviation sector has developed several initiatives to reach and maintain carbonneutral growth by 2020 and reduce aviation’s net CO2 emissions to half of what they were in 2005, by 2050, while air traffic increases.

AFRAA believes that African aviation will contribute to protecting better the environment; it requires that aviation stakeholders continue coordinated efforts

in line with the five pillars:

• Continuous Fuel Efficiency Improvement through New Technology;

• Alternative Fuel;

• Implementation of Fuel Conservation Initiatives in Operations;

• Air Navigation Infrastructure and;

• Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA).

16 | African-skies | DECEMBER 2022 FEATURE

SITA worldwide survey of airline passengers on their attitudes and use of IT and mobile digital Technology in air travel

As we emerge from the COVID-19 pandemic, passengers are showing pent-up demand for air travel and enthusiasm to further embrace the mobile and touchless technologies that will make the journey as convenient and seamless as possible.

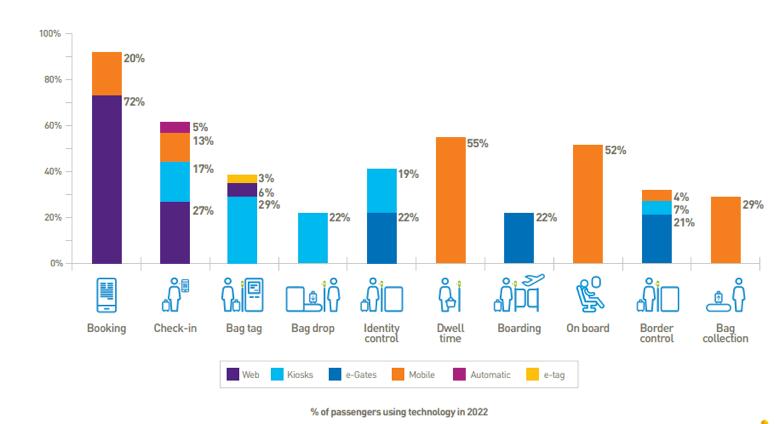

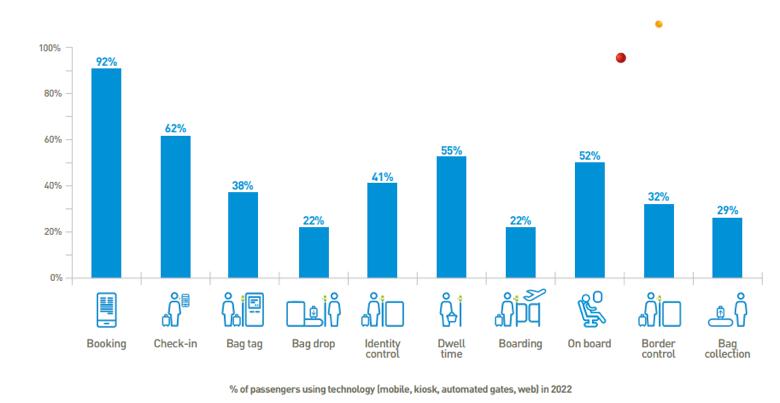

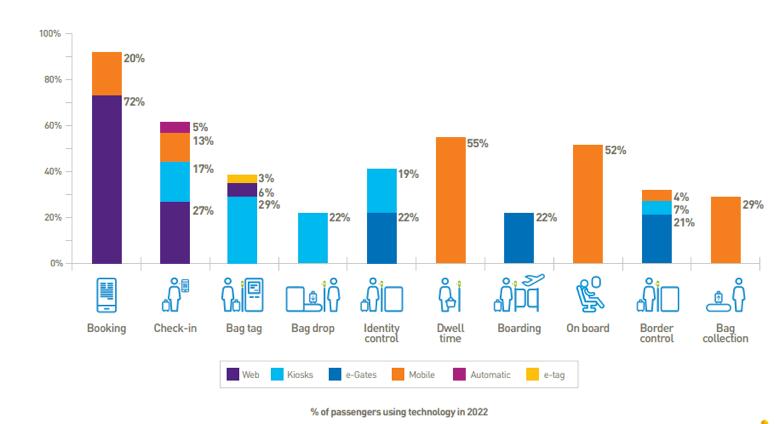

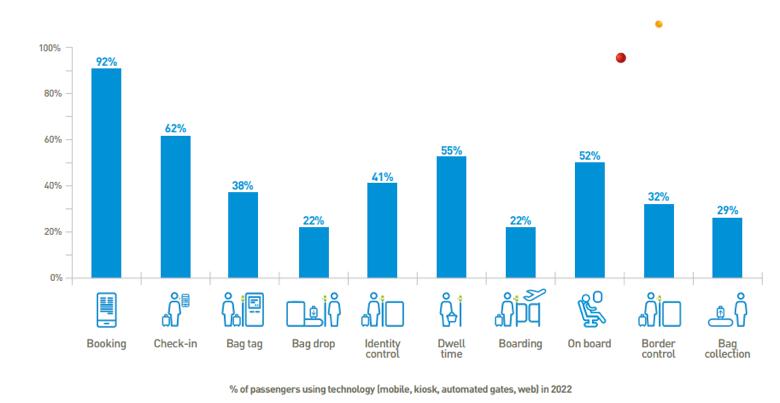

SITA’s 2022 Passenger IT Insights research reveals that passenger use of mobile devices increased for booking, on board the airplane, and for bag collection in Q1 2022 compared to Q1 2020, while automated gates saw increases in adoption for identity control, boarding, and border control.

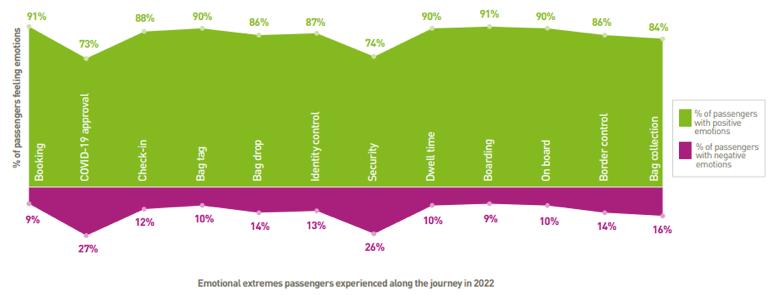

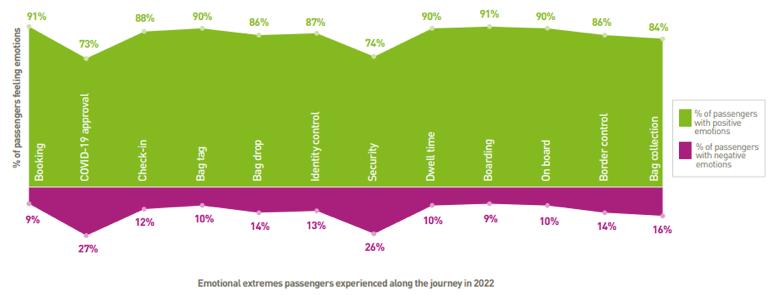

However, health verification, still largely manual, is a pain point that has slowed end-to-end automation. Our survey finds reduced technology adoption in the early stages of the journey (check-in, bag tag, and bag drop) in favour of manual processing. Uncertainty about health requirements and travel rules has likely led passengers to seek more staff interaction when starting the journey. Even so, it is clear that the more technology there is during travel, the happier passengers are. The research unveils that two journey stages have seen particularly significant increases in positive emotions since 2016: identity control (up 11%) and bag collection (up 9%). These are also the areas where technology adoption has risen the most, driven by mobile and automated gates, with half of passengers now also receiving real-time information at bag collection on time until delivery.

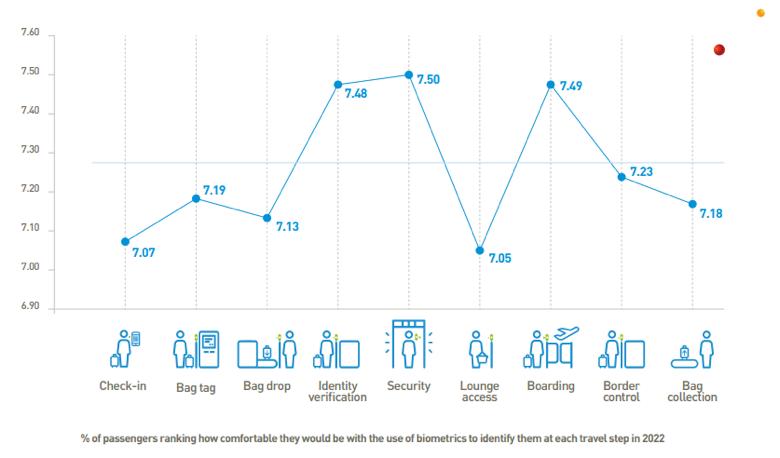

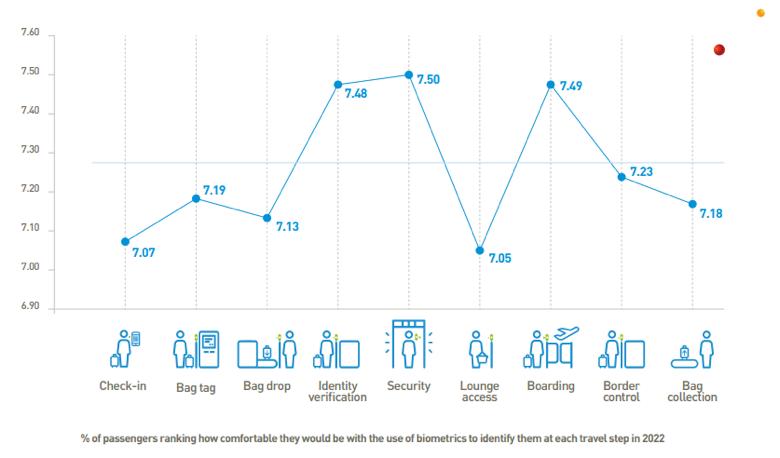

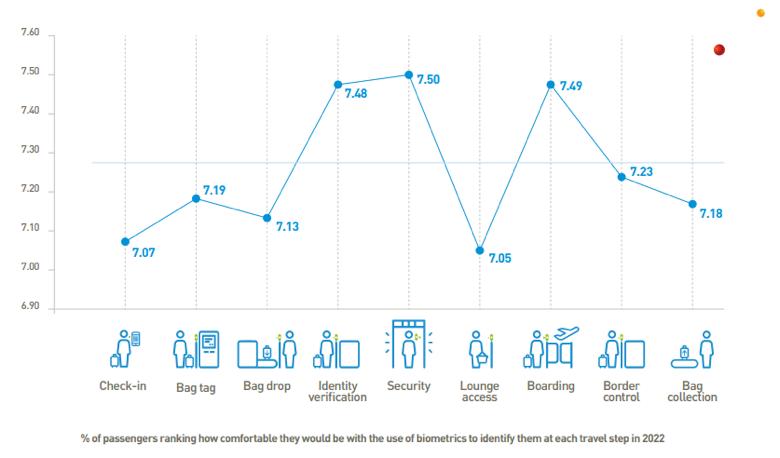

Asked about comfort levels with biometric identification throughout the journey, passengers scored an average of almost 7.3 out of 10 (with 10 representing most comfortable), most likely reflecting their desire for ease of travel moving forward from the pandemic.

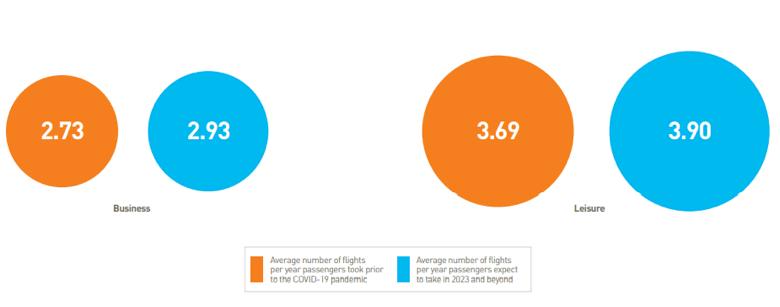

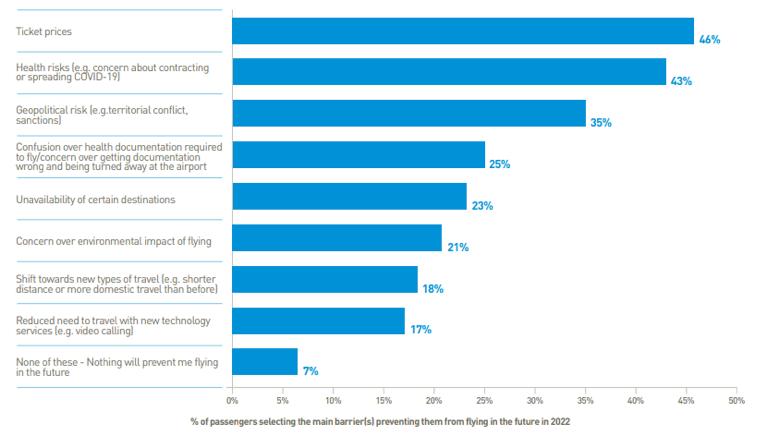

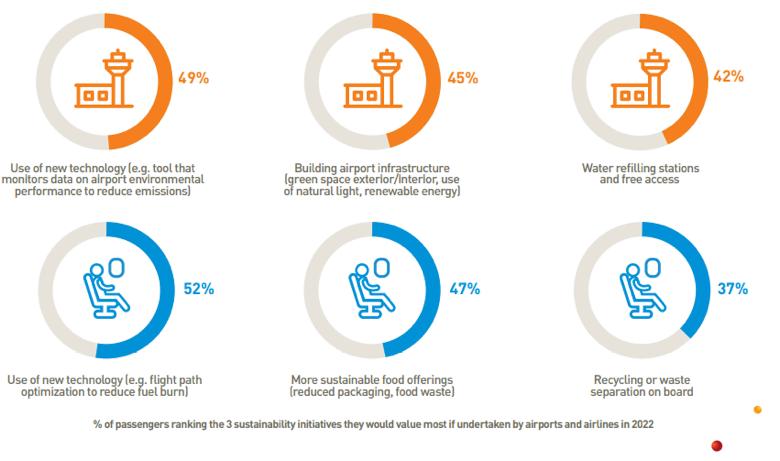

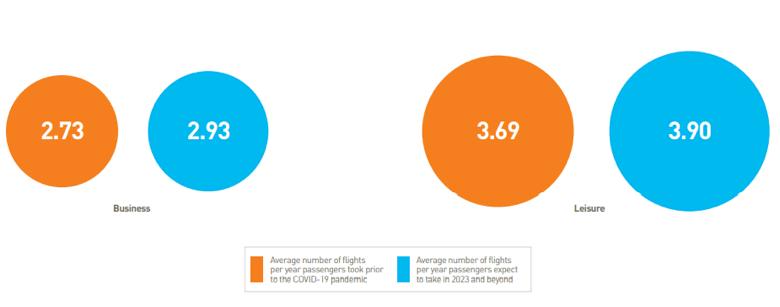

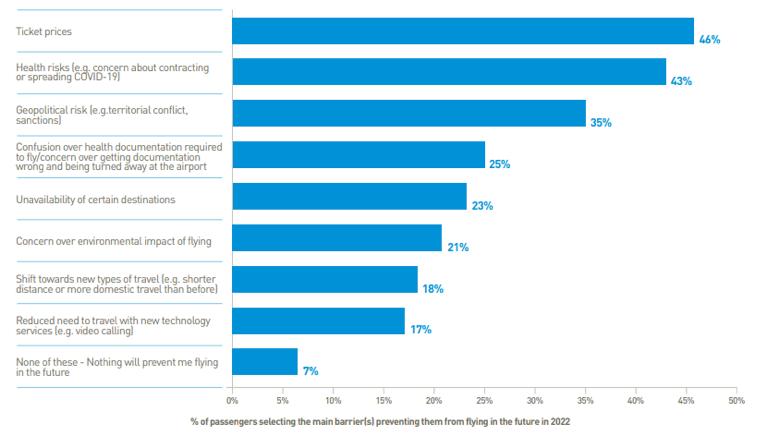

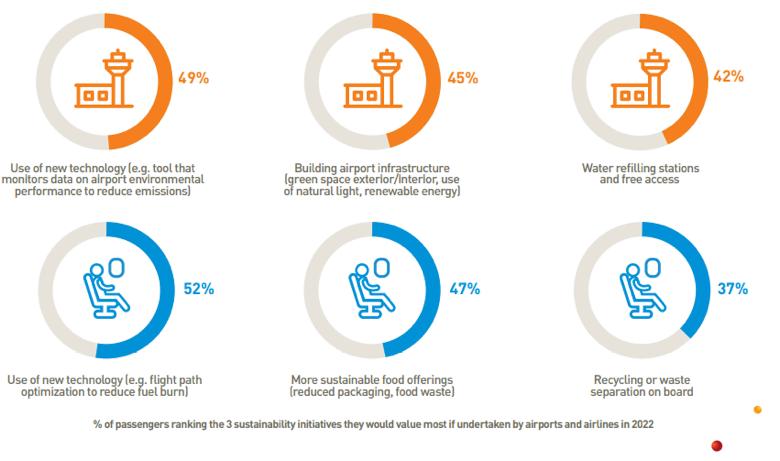

Passengers surveyed intend to fly more from 2023 onwards than they did prior to the pandemic, expecting averages of 2.93 flights per passenger per year for business and 3.90 for leisure. When weighing up whether to fly or not, the main barriers are ticket prices, health risks, and geopolitical risks. But before flying, passengers also consider sustainability. The initiative they would most value seeing from airports and airlines is the use of new IT to support sustainability, such as monitoring airport environmental performance to reduce emissions, and use of technologies to reduce fuel burn. Almost all passengers would pay on average 11% of their ticket price to offset carbon emissions from their flight.

Asked if the air transport industry is doing enough to become more sustainable, more than half of passengers either think not, or don’t know. The key takeaway is that there is room for improvement in the communication of industry sustainability initiatives and actions.

Methodology: Fieldwork for the 15th edition of the Passenger IT Insights was conducted globally in Q1 2022. The key findings are based on an online survey of 6448 respondents from 27 countries across the Americas, Asia, Europe, Middle East, and Africa. The number of respondents by country is relative to the amount of passenger traffic for each country, based on data from Airports Council International (ACI). Collectively, the respondents represent over 85% of global passenger traffic. Survey respondents were selected based on having traveled at least once in the previous five months. The main countries included: Australia, Brazil, Canada, China, Egypt, France, Germany, India, Indonesia, Italy, Japan, Kenya, Mexico, Morocco, Nigeria, Republic of Korea, Russia, Saudi Arabia, Singapore, South Africa, Spain, Turkey, UAE, UK, USA, Vietnam.

Herewith presented are the highlights of the analysis of SITA’s survey:

17 FEATURE

PASSENGER TECHNOLOGY ADOPTION

Technology adoption in 2022 reflects the pandemic’s effects on the passenger journey: Rates of technology adoption have remained relatively stable at each journey stage since the survey was last conducted in Q1 2020. However, there is a slight trend towards reduced technology usage in favour of manual interaction in the first half of the journey followed by increased technology adoption in the second half. Technology adoption at the check-in stage has decreased by 4% since Q1 2020, while the bag tag and bag drop stages have also seen decreases of 2 to 6%. Meanwhile, identity control, boarding, on board, border control, and bag collection have all seen increases in technology adoption of 3 to 5% from 2020. The overall lack of significant increase may be due to reduced travel during the COVID-19 pandemic, meaning passengers have not had the chance to familiarise themselves with new technologies. At the same time, due to the uncertainty around travel rules imposed by the pandemic, some flyers may have felt the need for more staff interaction at the beginning of the journey to ensure they were doing things correctly, but felt comfortable relying on technology in the second half.

Passenger technology usage preferences along the journey

18 | African-skies | DECEMBER 2022 FEATURE

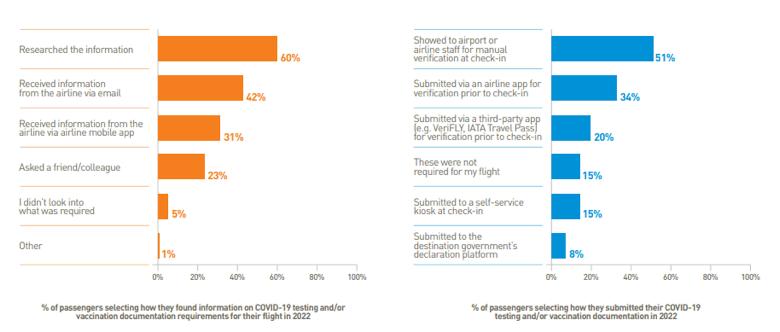

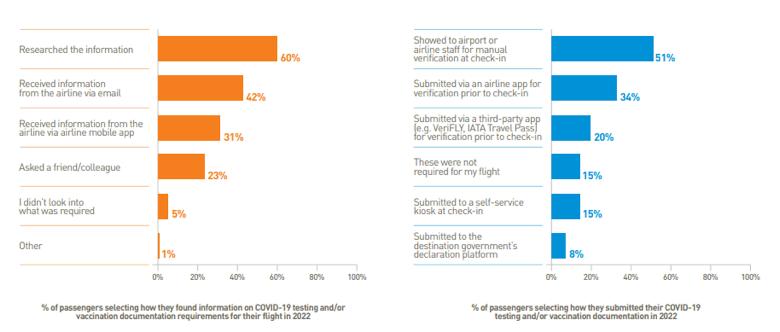

Health verification remains largely manual at the flight preparation stage, to understand COVID-19 verification requirements, most passengers (60%) actively researched the information, consulting sources such as government or airport websites, with nearly one quarter also asking others. At the same time, significant numbers of passengers received information on COVID-19 requirements directly from their airline, with 42% receiving this via email and 31% via the airline’s mobile app. At the stage of submitting COVID-19 documentation, just over half of passengers did so by manually showing it to staff. There was still some technology adoption at this stage, with just over one-third of passengers submitting documentation via an airline app and smaller numbers submitting via a third party app or self-service kiosk. The complexity of understanding ever-changing COVID-19 requirements is reflected in the high percentages of passengers who took multiple actions through various channels at each step. Over half of passengers who received COVID-19 information from the airline also did their own research online, and just over a third of those who submitted documentation via an app before check-in also underwent manual verification.

19 FEATURE

Technology adoption for health verification

Passenger journey

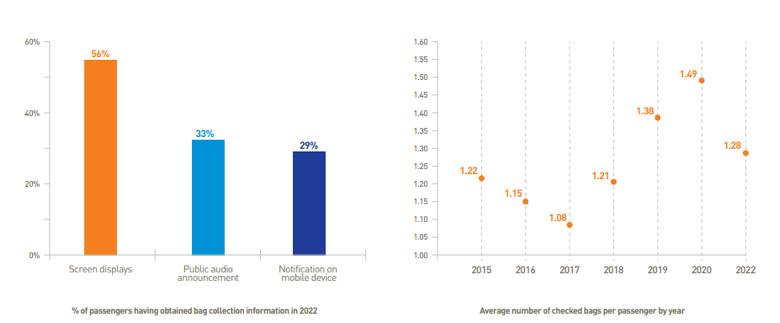

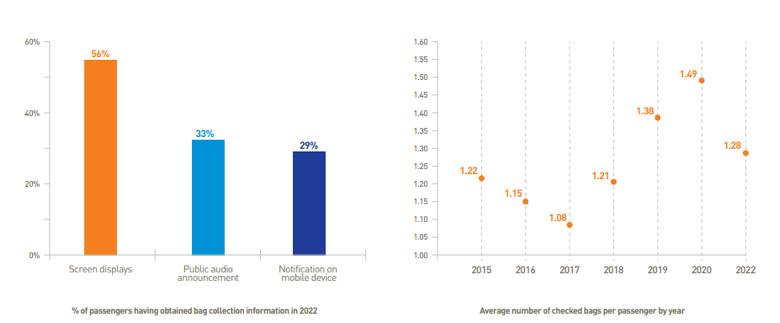

Mobile usage and real-time information growing at bag collection: The percentages of passengers who received information at bag collection via screen displays and public audio announcements have stayed the same since Q1 2020; however, a growing proportion of passengers are receiving notifications via their mobile devices (up 5% from 2020). Regarding the types of information passengers received, 57% were told belt numbers, and 50% were told time until delivery – the latter is up 8% from 2020, signaling a shift towards more real-time information being made available to passengers. Looking to the average number of checked bags per passenger, after steadily rising from 2017 to 2020 to reach 1.49, the figure dropped back down to 1.28 in 2022, a 14% decrease from 2020. This may be related to changes in airline pricing models for checked bags, as well as the shift towards greater proportions of domestic over international travel during the recent recovery period. IATA data shows that April 2022 traffic stood at -43.4% of April 2019 international traffic levels, but a significantly higher -25.85% for domestic.

20 | African-skies | DECEMBER 2022 FEATURE

1 1. Source: IATA, “Strong International Traffic Propels Continuing Air Travel Recovery,” June 2022

Technology

Emotional extremes along the journey

adoption at baggage collection

Greater technology adoption correlates with more positive emotions at key travel steps: Passengers appear happier overall throughout the journey in 2022 than in 2016 (the last time this metric was taken into account), with three particular pain points from 2016 seeing significant increases in positive emotions. The following all saw shifts in favour of more positive emotions: identity control (up 11% from 2016), security (up 6%), and bag collection (up 9%). Of these stages, the two where emotions have seen the greatest positive shifts since 2016 are also among the stages that have seen the highest increase in technology adoption over the same period. In fact, in 2016, there was no technology adoption for either identity control or bag collection, whereas in 2022, 41% of passengers are using kiosks and e-gates for identity control and 29% are receiving mobile notifications for bag collection.

Frequency of flying pre-pandemic vs. post-pandemic

For recent travellers, demand has rebounded to – and even surpassed – pre-pandemic levels: Passengers report intentions to fly slightly more from 2023 onwards than they did prior to the COVID-19 pandemic. This holds true for both leisure and business travel, reflecting pent-up demand for travel following the period of disruption imposed by the pandemic. Passengers expect to take an average of 2.93 flights per year for business purposes from 2023 onwards, compared to the average of 2.73 flights per year taken before the pandemic. They in turn expect to take an average of 3.90 flights per year for leisure from 2023 onwards, up from 3.69 before the pandemic.

Note: the sample for this survey considers only individuals who traveled in Q1 2022, therefore representing the sentiments of those who were willing to travel before the wider lifting of travel restrictions.

21 FEATURE

Current geopolitical and economic factors strongly influence anticipated barriers to flying:

The top three barriers to flying in the future that passengers anticipate in 2022 appear to closely relate to current global geopolitical and economic factors. Ticket prices come out as the number one anticipated barrier, with close to half of passengers citing this as a concern. While ticket prices are always likely to be a barrier, this may be exacerbated by the current inflation and rising costs facing many countries. Concern over health risks, ranked as the second biggest barrier, is clearly linked to COVID-19, suggesting that concerns are likely to continue, even among those who have been willing to fly during the pandemic. Geopolitical risk comes third, with about one-third of passengers listing it as a top concern; this is likely related to current crises such as the one in Ukraine, which may be creating further global uncertainties around the possibility and safety of travel on an ongoing basis. Indeed, the latter is ranked even higher (second, surpassing health risks) in Europe, the region most affected by the Ukraine conflict. On the other hand, health risks outweigh both ticket prices and geopolitical risks for first place in Asia, the Middle East, and Africa, where COVID-19 restrictions remain in fuller force.

22 | African-skies | DECEMBER 2022 FEATURE

Passengers’ main barriers to flying in future

Author: SITA Author: SITA

Comfort levels with biometric identification vary along the journey: When scoring out of 10 how comfortable they would be with biometric identity checks at each stage of the journey, passengers appear relatively comfortable with the use of biometrics. Passengers ranked identity control, security, and boarding the highest, possibly because they already expect various checks to occur in these areas. Conversely, check-in, bag drop, and lounge access came out as the lowest ranked, perhaps because passengers do not see the value of biometric identification at these stages.

Top 3 Sustainability initiatives valued most by passengers

Growing interest in IT to support sustainability: Passengers have maintained from Q1 2020 the same top three sustainability initiatives they would value the most if undertaken by airports and airlines, with a strong interest in new IT solutions to support sustainability (valued by around half of passengers). On the airport front, this initiative has overtaken green airport infrastructure for first place (up 4% from 2020), suggesting all eyes are on the promises of technology to support concrete reductions to the environmental impacts of the industry. The continued sensitivity of passengers toward sustainable food options (47%), recycling, and water refilling stations are key areas of attention for the industry.

23 FEATURE

Innovative leadership: A key strategy amidst recovery

Over the last two years, COVID-19 on one hand, has been for some airline companies an era of stagnations and on the other hand an era of innovation and continuous improvement for others. In fact, some airline companies faced this disruptive change as a threat and a risk, while others as an opportunity to seize for reinvention. However, we cannot deny that COVID-19 was a catalyst of the digital transition and a stimulator for innovative leadership.

In this context, it’s worth mentioning that Royal Air Maroc (RAM), one of Africa’s leading airline organisations has set the bar high by making a pioneering initiative with its Digital Open Innovation Program that spread out worldwide in a few months. Indeed, this Program is a great example of self-leadership application.

During the pandemic, RAM's vision evolved from 2.0 to 3.0, and the Open Innovation Program was a successful strategic recovery initiative for the year 2022. The Program was a great initiative for the company to open to the startup ecosystem worldwide, seeking innovative ideas. In fact, more than 300 applicants varying from students, startups, and scaleups from around the world; Asia, Africa, America, and Europe, participated to the RAM’s challenges. Challenges include real time information, enhancing customer experience and operational efficiency, leveraging sustainability, etc., and led to build new organisational capabilities. In this context, the program has spread out globally, thanks to the synergy between RAM and their strategic partners, such as Innova Conseil which accompanied RAM’s teams with a selfleadership approach.

24 | African-skies | DECEMBER 2022 FEATURE

FEATURE

The new shape of business travel Sabre InsightsJune 2022

While leisure travel continues to lead the postCOVID-19 recovery, recent data indicates that the return of corporate travel is accelerating. In recent months, the difference in the recovery between corporate and leisure has narrowed significantly, presenting opportunities for travel management companies (TMCs) and other players in the business travel segment.

The reasons for the initially slower return of corporate travel were also explored in Sabre’s latest research study; after two years of relying on Zoom and Teams, most companies are now accustomed to, and dependent on, vir tual meetings. Many also have a conservative approach to duty of care and allow their staff to travel only when it is very safe; and some simply see virtual meets as a way to save costs.

On the other hand, during the interviews that Sabre conducted with airline and agency executives, it became apparent that the changes brought about by the pandemic, and the new ways of working in many companies, are also creating new opportunities for business travel.

26 | African-skies | DECEMBER 2022 FEATURE

In an era of remote, flexible work, travel is more important to business culture than ever before

There’s no doubt that the pandemic has brought about huge changes to working culture. We’ve all seen the power of technology in helping us stay connected and to keep business moving from afar. People are working from home, processes have been digitised, office space has been downsized, and many people used the opportunity to relocate away from their place of work. Sabre introduced a permanent ‘Work from Anywhere’ policy 18 months ago and has seen benefits in supporting work/life balance, improving productivity, motivation and job satisfaction.

Ultimately, people are spending less time in the office and with their colleagues than before the pandemic, meaning that companies have had fewer opportunities to cultivate their corporate culture and team spirit. Business travel for in-person meet-ups has therefore become key for companies to drive and maintain their corporate culture. As CEO of Amex GBT Paul Abbot wrote in a column, ‘The office used to drive culture. Now it will be travel.’

The lines will continue to blur, facilitating the rise in ‘revenge travel’ and the new ‘bleisure’

Pent-up demand to travel freely again has resulted in an increase in ‘revenge travel’ – the strong desire to travel even more than before the onset of the pandemic to make up for lost time. This desire to travel, combined with a newfound flexibility when it comes to remote work or learning, is expected to mean travellers may stay longer at a destination. Boundaries between work and travel are blurring as people take ‘workcations’ – taking longer trips and combining work with a vacation. Doors have opened on ‘dream’ trips that perhaps would not have been possible pre-pandemic, such as spending a month in the Caribbean, working during the week and taking advantage of the locale on the evenings and weekends.

Delivering the corporate travel experience of the future

To succeed in the current ecosystem, travel companies should take advantage of these emerging trends in the business travel space while supporting ‘traditional’ business travel as it makes its return. However, these trends add further complexity to the already complicated interplay between travellers and their employers, as well as TMCs and their suppliers and technology providers. Take ‘workcations’ as an example: There are considerable additional considerations with these – both in terms of traveller needs (e.g., type of accommodation, requirements such as high-speed internet, flexible cancellation) and for corporations, with impacts on duty of care, tax implications, etc. Added to this, business travellers will continue to expect more from their travel experiences, demanding highly personalised, flexible trips that offer the level of choice and control they’ve come to expect from interactions with onlinenative businesses, and this will need to be complemented with the high level of service, quality assurance and disruption management that customers came to appreciate during the pandemic.

Sabre is working on the right technology to support this evolution and to allow its customers to embrace new opportunities as they arise. Sabre believes there is enormous opportunity to make corporate travel better – through personalised offers, enhanced service, disruption management, customer identification, and loyalty. Sabre is focused on creating an open and multi-source ecosystem across a range of travel content, which the broader travel community can benefit from. Under this strategy, Sabre will focus on delivering the corporate travel experience of the future – which will include the enablement of highly personalised business travel offers, bleisure travel experiences, and technology that supports the most complex travel itineraries and most demanding customers.

Author: Sabre

Author: Sabre

27 FEATURE

Aviation environmental sustainability in Africa

As global leaders converge at the Mediterranean Pavilion in Egypt for the UN climate change Conference (COP 27) from November 6th to the 18th 2022, the world is watching and waiting for major decisions that will protect our planet from the adverse effects of climate change. This edition of the climate change conference shall allow Africa to spotlight its special needs, circumstances and opportunities. Building on the outcomes and momentum of COP 26 in Glasgow, nations are expected to demonstrate at COP 27 that they can walk the talk by putting their commitments under the Paris Agreement into action in a just and equitable manner.

This is also an opportunity for the air transport sector in Africa to rise up to the occasion by designing and implementing adaptable decarbonizing policies in the industry. The global aviation industry contributes about 2% to global carbon emissions and there have been great strides towards cleaner skies and a greener environment. But it is not only Carbon dioxide that is an issue.

Author: Moses Ngwanah Chief Operating Officer GS Aviation, Madagascar

According to the Intergovernmental Panel on Climate Change (IPCC 2011), Aviation is responsible for 3.5% net of Anthropogenic ERF

28 | African-skies | DECEMBER 2022 FEATURE

GHG- Green House Gases (Carbon Dioxide-C02, Nitrogen-NOX, Fine particulate matter-PM);

Contrails and Aircraft Induced Cloud-AIC.

The global aviation industry has invested heavily in R&D as a means to reduce its footprints on global warming. In response to the need to reduce carbon emission while minimising market distortion, ICAO designed the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) which is being implemented in 3 phases. But this market-based measure may not be sustainable in the long run, reasons for which the shift is towards:

I. Sustainable Aviation Fuels (SAF) which include Biofuels and Power to Liquid Fuels (PtL);

II. Fuel Cells (Electric) and Hydrogen Combustion.

SAF looks very likely to be the most acceptable and adaptable solution given the difficulties related to hydrogen combustion (size and production) and Fuel Cells (capacity and range).

Is the aviation industry in Africa ready?

29 FEATURE

Rolls-Royce powering the Embraer ERJ- a partnership success story

The African aviation market has been underserved for a long time. Before 2020, only 9% of Africa's air traffic was between African countries, the rest being intercontinental. And today, globally, the region accounts for less than 2% of total air traffic despite being home to around 17% of the world’s population.

Africa urgently needs a more extensive and robust aviation network, given the region's relative lack of alternative longdistance transportation infrastructure. Indeed, unlike the United States and Europe, where there is an extensive road and rail network, in Africa, these vital modes of intracontinental transport remain underdeveloped.

“African countries have experienced unprecedented economic growth in the past years, with a fast-growing population,

but the airline industry has not enjoyed the same positive trend. African airlines have been marginalised and this is evidenced by the sharp drop of their market share in the past years. In the intra-African regional market, there is need for airlines to deploy the appropriate right-sized aircraft. As the air transport sector resumes the growth trajectory post-COVID, growth will be enhanced by the implementation of the Single African Air Transport Market (SAATM) and the African Continental Free Trade Agreement (AfFCFTA). A shift of strategies and focus on the regional operations to feed and de-feed major hubs is important for African carriers to harness the growth opportunity and enhance competitiveness.”

Mr. Abderahmane Berthé – AFRAA Secretary General.

30 | African-skies | DECEMBER 2022 FEATURE

While infrastructure is being developed, aircraft manufacturers are also responding to the call. Embraer, in particular, has long seen the potential for its planes in Africa and has thus extensively marketed its aircraft to African airlines.

Rolls-Royce proudly supplies the Brazil-based aircraft manufacturer with AE3007 engines for its 50-seater ERJ family of aircraft. Since the engine achieved FAA/EASA certification in 1995 for Embraer, Rolls-Royce has delivered more than 3,200 engines worldwide, with more than 65 million flight hours. The AE3007 also reliably and efficiently

powers the Cessna Citation X passenger aircraft. In the Defence sector, the AE3007 powers the Northrop Grumman RQ-4A Global Hawk & Triton; in fact, the AE engine family was initially developed for defence applications. Still, the constant development of the common core has given us a range of highly robust and versatile engines.

In Africa, Rolls-Royce powers more than 100 regional aircraft in operation. These range from premium full-serviced regional airlines, government-owned flagship airlines, charter operations, and mining companies to operators serving

humanitarian missions for the United Nations and the World Food Program.

The majority of these aircraft, however, are ERJ 145/140/135 and Legacy twinturbofan regional jets. The Long Range version of the ERJ140 can carry a full load of passengers over a distance of more than 3,000 kilometres. This range can intra-connect Eastern, Central, Western, Southern and Northern African subregions.

As this connectivity increases and barriers to trade and travel are lowered, we expect demand for this aircraft type to grow.

31 FEATURE

Crucial to keeping the Embraer fleet in the air is ensuring as little engine downtime as possible.

During the pandemic, with many aircraft grounded, Rolls-Royce took the opportunity to complete an extensive maintenance program on the AE3007 in the region, upgrading to the latest standards without charge. This allowed operators to comply with an Airworthiness Directive (necessary for all grounded aircraft) before operations restarted, giving them an all-important head start.

Meanwhile, in September 2021, RollsRoyce penned an important extension of its TotalCare service agreement with South African airline Airlink, which happens to be its oldest customer. Covering 28 of the carrier’s aircraft, the 10-year deal marked the continuation of a fruitful agreement which has been in place since Airlink introduced the ERJ 135 into its fleet in 2001.

“I’m very proud to say that we have had a long-standing relationship with

Rolls-Royce on TotalCare since 2001. These engines power up our 28-aircraft Embraer ERJ fleet. Rolls-Royce has never dropped the ball, and Airlink has extreme reliability on these engines. Kudos to Rolls-Royce, who has been awarded our supplier of the year and on an unbelievable and excellent relationship.” Rodger Foster, Chief Executive Officer, Managing Director Airlink.

The key to TotalCare is that Rolls-Royce takes back time-on-wing and shop visit cost risks, providing airlines with peace of

mind that their maintenance schedules will run at a fixed cost per engine flying hour. The service is underpinned by predictive maintenance, i.e. fixing problems before they occur. It relies on extensive gathering and analysis of performance data, which helps engineers to diagnose potential future faults and act on them to avoid downtime.

Aircraft covered by TotalCare generally operate at higher levels of availability and retain enhanced long-term value. Meanwhile, users benefit from the global

32 | African-skies | DECEMBER 2022 FEATURE

Image courtesy of Airlink

Image courtesy of Airlink

Rolls-Royce Care Network –an extensive service network that serves engines at every stage of their lifecycle.

Indeed, this has been central to Airlink’s impressive on-time performance, consistently above 97% throughout its use of TotalCare. Today, more than 35% of all ERJ aircraft in Africa are on Rolls-Royce TotalCare engine maintenance agreements – and since the sector emerged from the pandemic, most agreements have been extended.

Moving forwards, if Africa is to build a more extensive regional flying network, maintenance infrastructure will be essential to ensure it runs smoothly. Indeed, Rolls-Royce has observed the need to diversify services to keep as many aircraft flying in the region as possible.

A relentless focus on efficiency and the pathway to zero-emissions

Deploying the right aircraft on suitable routes is also crucial to running the network as environmentally and sustainably as possible.

According to research by Embraer, some 14% of all domestic African flights are operated on widebody aircraft. In addition, the company observes that almost all (99%) of these flights flown with widebodies fly on sectors under 4,500 kilometres – in other words, the scope for narrowbody aircraft seating 120150 passengers to increase operational efficiency is sizeable.

In the longer term, the regional aviation industry has a huge opportunity to be a flagbearer for net zero flying.

And here, as one example in Norway, Embraer and Rolls-Royce, in collaboration

with Widerøe, are deep into a study on a conceptual zero-emission regional aircraft. The 12-month project, set to conclude in February 2023, aims to accelerate the knowledge of the technologies necessary for the net zero transition, progress which could pave the way for clean fuels and electrification to be the significant enablers of a new era of regional aviation. The study examines a variety of potential solutions, including all-electric, hydrogen fuel cell or hydrogen-fuelled gas turbine-powered aircraft.

Meanwhile, Rolls-Royce has submitted a proposal to Embraer to power the new 70-90 seater rear-mounted turboprop that the airframer plans to launch in early 2023. A key reason why Embraer has chosen to switch the design to rear-mounted engines is that it enables easier accommodation of a hydrogen system which could be integrated in the future. With its ongoing R&D into hydrogen-propelled aircraft, Rolls-Royce will be well-placed to fulfil this need.

In addition, the company is set to prove that all its aero engines will be able to run on 100% Sustainable Aviation Fuel by the end of 2023. Any sustainable fuel that meets the D1655 jet fuel standard and requirements is now approved for use in AE3007 engines. Currently, seven different blend varieties can be used, some being certified to blend up to 50% with conventional jet fuel, dramatically reducing carbon footprints.

In keeping its fingers on the pulse, Rolls-Royce is ideally positioned to steer Africa’s growing regional aviation sector in a sustainable direction over the coming years.

33 FEATURE

Author: LCH Consultancy & Associates for Rolls-Royce Civil Aerospace for leading the company into the future

A rewarding journey

Kirsten Rehmann has spent the past 19 years working her way up the career ladder at the airline and ticket distribution company Hahn Air. Having taken on the role of CEO at the start of the year, Regional International speaks to Rehmann on this achievement and her plans for leading the company into the future.

Interview also published in the September/October edition of the ERA magazine “Regional International”

Can you tell us a bit about your career and what led you to this role?

I have been with Hahn Air almost two decades now. Back in 2003, I joined the company when Hahn Air was still a small start-up with a brilliant business idea. Equipped with a diploma in international business administration with the majors tourism and travel, I started as sales and marketing executive. We were only a handful of people in the beginning and as the company grew, I was fortunate to expand my knowledge of aviation distribution by holding various different roles. Hahn Air’s distribution solutions for airlines made the company advance to market leader and, over time, our portfolio grew to more than 350 partner airlines.

As Director of the Airlines Business Group, I was able to support this development by acquiring partner airlines from French speaking markets in Africa and other regions. Later, I moved to the position of Chief Commercial Officer and, in 2012, I joined the corporate management alongside the owners and founders of Hahn Air, Hans Nolte and Nico Gormsen. I am so grateful that they gave me their trust and support and prepared me well for the responsibilities of a future company CEO. In January 2022, I took over the responsibility for the company’s affairs, the global business, as well as operational and strategic planning. Hans Nolte and Nico Gormsen will remain closely connected to Hahn Air in their role as owners.

34 | African-skies | DECEMBER 2022 FEATURE

What initially interested you about the industry and what continues to inspire you day-to-day?

Like everybody working in the airline industry, I have always been fascinated with travel. This fascination grew even more when I started to frequently visit Africa as part of my role in our Airline Business Group. This special love for Africa continues to this day. In addition, I am extremely proud to lead the Hahn Air affairs, as I believe that we provide an important missing link in airline distribution: We connect airlines of any size with travel agents in 190 markets and thereby close distribution gaps for our partners. With our solutions, airlines can sell tickets in markets that they would otherwise not be able to reach through indirect

distribution. As a result, we provide millions of passengers who book through travel agencies with additional travel options. In a nutshell: we connect any airline to the world of indirect distribution, thereby enabling travel to the most remote destinations of this world.

Where do you see the company expanding or focusing its efforts in the next few years and what excites you the most about where the company is headed?

Hahn Air has always been closely monitoring the development of the market, looking for new technologies and distribution opportunities for our partner airlines. The pre-COVID years have been seeing dynamic changes, for example with the advancement of new distribution

35 FEATURE

Author: Kirsten Rehmann, Hahn Air