African-Skies

AFRAA’s panafrican Journal on Air Transport, Issue N56, August - October 2025

As we look to the future, I am filled with optimism. The African aviation industry is resilient, ambitious, and innovative. But success will require unity of purpose. We must continue to speak with one voice, advocate collectively, and leverage our continental strengths. ”

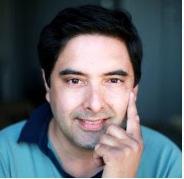

Abderahmane Berthé Secretary General, AFRAA

EDITORIAL

Ascending Together: Unlocking Africa’s Boundless Potential

Across the African continent, we are witnessing a wave of bold developments—new fleets being inducted, major airport expansions, strengthened partnerships, and leadership transitions that signal renewed determination. From Ethiopia’s landmark Bishoftu mega-hub project to the innovative hybrid-electric fleet commitments by Safarilink to the EHang EH216-S Electric Vertical Take-Off and Landing (eVTOL) flight that took place in Kigali on 3rd September 2025, African aviation is not just keeping pace with global trends—it is defining them. These stories embody the resilience, ingenuity, and ambition of our airlines and partners, and they reinforce AFRAA’s belief that Africa’s skies are filled with opportunity.

AFRAA’s Strategic Focus

As the leading voice of African airlines, AFRAA continues to align its efforts with the shared priorities of our members. Our strategic pillars—advocacy and lobbying, knowledge and data intelligence, and industry development—remain our guiding compass. We are championing initiatives that

strengthen connectivity, reduce operational bottlenecks, and unlock growth opportunities for carriers of all sizes.

Central to our mission is the implementation of the Single African Air Transport Market (SAATM), a cornerstone project of the African Union’s Agenda 2063. Liberalizing African skies is no longer an option but an imperative. Connectivity is the lifeblood of commerce, tourism, and integration; yet, today, traveling between two African capitals can often cost more—and take longer—than flying to another continent. AFRAA is working with governments, regulators, and industry stakeholders to break these barriers, promote competitive market access, and deliver the seamless travel experience that African citizens deserve.

Sustainability and Innovation

The aviation industry faces global scrutiny over environmental sustainability, and Africa is taking proactive steps to chart its own path. Airlines such as EgyptAir, Airlink, Safarilink, and TAAG are leading the way with fuel-efficient fleets and decarburization strategies. Well outlined in AFRAA’s NetZero roadmap, we are committed to supporting these transitions by fostering the adoption of sustainable aviation fuels (SAFs), promoting operational efficiency, and driving regional initiatives aligned with ICAO’s long-term aspirational goal of net-zero carbon emissions by 2050.

At the same time, technology and innovation are reshaping every aspect of our business. From digital transformation in airline operations to the exciting possibilities of advanced air mobility, African carriers are embracing smart solutions that enhance efficiency, safety, and customer experience. AFRAA will continue to provide platforms for dialogue, knowledge exchange, and partnerships that accelerate innovation across our sector.

Partnerships and Regional Integration

The power of collaboration cannot be overstated. This edition of African Skies is rich with examples of partnerships—Kenya Airways and Air Tanzania’s cooperative MoU, codeshare agreements linking Air Sénégal with ASKY Airlines and Royal Air Maroc, and Turkish Airlines’ codeshare with Airlink. These alliances demonstrate that when African carriers work together, we expand market access, strengthen competitiveness, and deliver greater value to our passengers.

AFRAA is committed to nurturing such partnerships, fostering a spirit of “coopetition” where airlines compete but also collaborate for mutual benefit under the auspices of AFRAA Route Network Coordination and Cargo Committee.

Looking Ahead

As we look to the future, I am filled with optimism. The African aviation industry is resilient, ambitious, and innovative. But success will require unity of purpose. We must continue to speak with one voice, advocate collectively, and leverage our continental strengths. AFRAA will remain steadfast in its mission to be the trusted partner and catalyst for a competitive, sustainable, and globally respected African airline industry. Together, we can transform challenges into opportunities and ensure that African skies remain a frontier of growth, connectivity, and prosperity.

I invite you to enjoy the inspiring stories in this edition of African Skies and to join us in our journey to shape the next chapter of African aviation. The journey is bold, the vision is clear, and the future is ours to seize.

Abderahmane Berthé Secretary General, AFRAA

Ethiopian Airlines and AfDB Launch Financing for Africa’s Largest Airport

On 11 August, Ethiopian Airlines Group and the African Development Bank (AfDB) signed a mandate letter appointing the Bank as the lead arranger to mobilize up to USD 8 billion for the new Bishoftu International Airport, located 40 km south of Addis Ababa.

The mega-hub, with a total estimated cost of USD 10 billion, will handle 60 million passen-

gers annually at launch, expandable to 110 million, complementing the existing Bole hub. A cornerstone of Ethiopian Airlines’ Vision 2040, the project will boost intra-African trade, tourism, and regional integration while creating thousands of jobs.

AfDB will anchor the financing with an initial USD 500 million loan and coordinate the mobilization of the remaining funds.

500 million

Ethiopian Airlines et la BAD lancent le financement du plus grand aéroport africain

Le 11 août, Ethiopian Airlines Group et la Banque Africaine de Développement (BAD) ont signé une lettre de mandat désignant l’institution financière comme arrangeur principal pour mobiliser jusqu’à 8 milliards USD pour le nouvel aéroport international de Bishoftu, à 40 km au sud d’Addis-Abeba.

Le méga-hub aérien, dont la construction est estimé à 10 milliards USD, accueillera 60 millions de pas-

sagers annuels dès l’ouverture, extensibles à 110 millions, et complétera l’actuel hub de Bole . Le projet, clé de la Vision 2040 d’Ethiopian Airlines, favorisera le commerce intra-africain, le tourisme et l’intégration régionale, tout en générant des milliers d’emplois. La BAD ancrera le financement avec un prêt initial de 500 millions USD et coordonnera la mobilisation des fonds restants.

Air Algérie launches Domestic Airlines with 16 ATR 72-600

On 12 March 2025, Algerian

President Abdelmadjid Tebboune announced the creation of Domestic Airlines, a new subsidiary of Air Algérie dedicated exclusively to domestic routes.

The airline will build on the assets and workforce of Tassili Airlines, which was officially integrated into the Air Algérie Group on 27 May.

To support its launch, expected in August 2025, Air Algérie placed on 4 July 2025 a record order for 16 ATR 72-600 aircraft—the largest ever placed in Africa for this type.

This strategic initiative is designed to strengthen national connectivity and enhance service quality across the domestic network.

Air Algérie lance Domestic Airlines avec 16 ATR 72-600

Le 12 mars 2025, le président algérien Abdelmadjid Tebboune a annoncé la création de Domestic Airlines, une nouvelle filiale d’Air Algérie dédiée exclusivement aux liaisons intérieures.

La compagnie s’appuiera sur les actifs et le personnel de Tassili Airlines, officiellement intégrée au groupe Air Algérie le 27 mai.Pour accompagner ce lancement, prévu courant août, Air Algérie a passé le 4 juillet une commande record de 16 ATR 72-600, la plus importante jamais enregistrée en Afrique pour ce type d’appareil. Cette initiative vise à renforcer la connectivité nationale et à améliorer la qualité de service sur l’ensemble du réseau domestique algérien.

Air Mauritius renforce sa direction dans un contexte de transformation et de performance solide au T1

Air Mauritius a nommé Andre Viljoen au poste de directeur général à compter du 15 octobre 2025, marquant son retour dans l’entreprise où il avait précédemment occupé les fonctions de directeur financier et PDG. Cette décision stratégique suit la reconstitution du conseil d’administration en janvier 2025, présidé par Kremchand Beegoo, et s’appuie sur l’expertise de plusieurs administrateurs expérimentés.

Malgré des défis opérationnels récents, la compagnie a transporté 403 127 passagers au T1 2025/26 (+0,8 %) avec un taux de remplissage en hausse de 4,7 %, générant un bénéfice net de 252,7 M MUR. La flotte de 12 appareils soutient un plan de transformation pour renforcer la résilience et la rentabilité durable.

Air Mauritius strengthens leadership amid transformation and robust Q1 performance

Air Mauritius has appointed Andre Viljoen as Chief Executive Officer, effective 15 October 2025, marking his return to the airline where he previously served as CFO and CEO. This strategic move follows the Board’s reconstitution in January 2025, chaired by Kremchand Beegoo, supported by directors with extensive governance experience. Despite recent operational and financial challenges, the airline carried 403,127 passengers in Q1 2025/26 (+0.8%) with a 4.7% higher load factor, generating a net profit of MUR 252.7 million (€4.9 million). The 12-aircraft fleet, including A350-900s, A330s, and ATR 72s, drives a transformation plan to strengthen resilience and sustainable profitability.

EEthiopian Airlines Expands MRO Capabilities with State-of-the-Art Facilities

thiopian Airlines Group has inaugurated a major MRO expansion, featuring a new Component Maintenance Workshop, a 15,000 m² Central Warehouse, and two 2-bay General Maintenance Hangars, with a total investment exceeding USD 150 million. The opening ceremony on 22 July was attended by CEO Mesfin Tasew and Ethiopian Airlines Board Chairman Let. Gen. Yilma Merdasa. These advanced facilities enhance maintenance capacity, add over 170 new repairable components, and integrate an automated storage and retrieval system, reinforcing Ethiopian MRO’s leadership in Africa while supporting both the airline’s growing fleet and third-party operators.

Ethiopian Airlines inaugure un hub de maintenance avancé pour soutenir sa flotte

Ethiopian Airlines Group a inauguré un ambitieux développement MRO comprenant un nouvel atelier de maintenance de composants, un entrepôt central de 15 000 m² et deux hangars généraux à deux baies, pour un investissement de plus de 150 millions USD.

La cérémonie du 22 juillet a réuni le CEO Mesfin Tasew et le président du conseil d’administration, Let. Gen. Yilma Merdasa.

Ces installations ultramodernes augmentent la capacité de maintenance, ajoutent plus de 170 composants réparables et intègrent un système automatisé de gestion des stocks, renforçant Ethiopian MRO comme leader continental et soutenant les opérateurs tiers.

5 Boeing 737 MAX 8 for Royal Air Maroc FLEET MONITOR

Since late May, Royal Air Maroc has taken delivery of five Boeing 737 MAX 8 aircraft, bringing its MAX 8 fleet to seven and strengthening its medium-haul capacity alongside 28 Boeing 737-800s. The latest aircraft arrived on July 24.

These deliveries are part of the airline’s ongoing fleet renewal and expansion plan, targeting 73 aircraft by the end of 2026 and a long-term fleet of 200 planes by 2038.

Madagascar Airlines strengthens its fleet with a new ATR 72-500

On 2 April 2025, Madagascar Airlines received a new ATR 72-500 (5R-EJK, MSN 904) on a dry lease from ACIA Aero Leasing, bringing its operational ATR 72 fleet to five aircraft. This delivery follows the arrival of a previous ATR 72-500 in December 2024 and is part of the Phénix 2030 Plan, a multi-million-dollar modernization and recovery program supported by the World Bank. At the same time, the airline extended the leases of two ATR72s with Abelo until 2028 and 2029, reinforcing its fleet strategy. With 300,000 passengers carried in 2023, this expansion strengthens operational profitability and domestic connectivity while supporting national tourism development.

5 Boeing 737 MAX 8 pour Royal Air Maroc

Depuis fin mai, Royal Air Maroc a réceptionné cinq Boeing 737 MAX 8, portant sa flotte de ce type à sept appareils et renforçant sa capacité moyen-courrier aux côtés des 28 Boeing 737-800. Ces livraisons, dont le dernier appareil est arrivé le 24 juillet, s’inscrivent dans le plan de renouvellement et d’expansion de la compagnie, visant 73 avions d’ici fin 2026 et une flotte long terme de 200 appareils à l’horizon 2038.

Madagascar Airlines renforce sa flotte avec un nouvel ATR 72-500

Le 2 avril 2025, Madagascar Airlines a réceptionné un ATR 72-500 (5R-EJK, MSN 904) en location sèche auprès d’ACIA Aero Leasing, portant à cinq le nombre d’ATR 72 opérationnels.

Cette livraison fait suite à l’arrivée d’un ATR 72-500 en décembre 2024 et s’inscrit dans le Plan Phénix 2030, programme de modernisation et de redressement soutenu par la Banque mondiale. Parallèlement, la compagnie a prolongé la location de deux ATR72 auprès d’Abelo jusqu’en 2028 et 2029, consolidant sa stratégie de flotte.

Avec 300 000 passagers transportés en 2023, cette expansion renforce la rentabilité et la connectivité aérienne, soutenant le développement touristique national.

Astral Aviation Expands Cargo Fleet with

Boeing 767-300F

In April, Kenya’s Astral Aviation took delivery of a Boeing 767300F (MSN 24146 / Reg. 5Y-SVR), marking another milestone in its growth strategy.

With a payload capacity of over 52 tons, the aircraft strengthens Astral’s long-haul fleet alongside its 767-200F and 737-400F.

Leased from Flight Lease Capital Management, the freighter offers greater operational flexibility to meet rising demand in e-commerce, perishables, and high-value cargo. This addition is part of Astral’s fleet modernization plan as the airline celebrates its 25th anniversary in 2025 and expands its network between Africa and Asia.

Astral Aviation renforce sa flotte cargo avec un Boeing 767-300F

En avril dernier, la compagnie kényane Astral Aviation, a réceptionné un Boeing 767-300F (MSN 24146 / Reg. 5Y-SVR), marquant une nouvelle étape dans sa stratégie de croissance. L’appareil, d’une capacité de plus de 52 tonnes, vient renforcer la flotte long-courrier d’Astral aux côtés du 767200F et du 737-400F.

Loué auprès de Flight Lease

Capital Management, ce nouvel avion offre davantage de flexibilité opérationnelle et permettra d’accompagner la hausse de la demande en e-commerce, produits périssables et fret de valeur.

Cette acquisition s’inscrit dans le plan de modernisation d’Astral Aviation, qui célèbre en 2025 son 25ᵉ anniversaire et poursuit l’expansion de son réseau entre l’Afrique et l’Asie.

Badr Airlines Modernizes and Diversifies Its Fleet

Sudan’s Badr Airlines is advancing its growth strategy despite challenging operational conditions. In June, the carrier received a Boeing 737-800NG (MSN 41158), strengthening its medium-haul fleet to nine Boeing aircraft. Two months later, in August, the private airline reached a new milestone with the addition of its first Bombardier CRJ200 (MSN 8045, Reg. ST-BAT), a 50seat regional jet well-suited for domestic routes. These acquisitions, complementing a fleet largely composed of Boeing 737s, reflect Badr Airlines’ commitment to enhancing connectivity, diversifying its offerings, and reinforcing its role as a key carrier from its relocated Port Sudan base, operating over 90 weekly flights.

Jambojet Boosts Capacity with Return of Pioneering Q400 Plane

Late June, Jambojet welcomed a new Dash 8-Q400 (5Y-JXA), the airline’s very first aircraft of this type, briefly operated in 2017. It joins a fleet now comprising nine Q400s with an average age of seven years, among the most modern in Africa. Over the past ten years, Jambojet, a subsidiary of Kenya Airways, has carried more than 8.6 million passengers, including 44% firsttime flyers, and holds 53% of the domestic market.

CEO Karanja Ndegwa emphasizes that this return reflects the airline’s commitment to operational excellence, sustainable growth, and customer satisfaction, while meeting rising demand on domestic and regional routes.

EgyptAir Expands Long-Haul Capabilities with Six New A350-900s

At the Paris Air Show 2025, EgyptAir signed an agreement with Airbus for six additional A350-900 aircraft, bringing its total order to 16 units. This expansion supports the airline’s fiveyear long-haul network growth plan while advancing its sustainability goals, offering a 25% reduction in fuel consumption and CO₂ emissions compared to previous aircraft. Deliveries, intended to replace its aging 777s, will begin in December 2025, with six more units scheduled in 2026. Simultaneously, a certified A350 pilot training program has been established at the EgyptAir Training Academy. The airline is also modernizing its short- and

Jambojet renforce sa flotte avec un nouvel Dash 8-Q400

Fin juin, Jambojet a accueilli un nouveau Dash 8-Q400 (5Y-JXA).

Ce dernier fut le tout premier appareil de ce type de la compagnie, brièvement exploité en 2017.

Il rejoint une flotte qui comprend désormais neuf Q400 d’une moyenne d’age de sept ans, parmi les plus modernes d’Afrique. Au cours des dix dernières années, Jambojet, filiale de Kenya Airways, a transporté plus de 8,6 millions de passagers, dont 44 % de primo-voyageurs, et détient 53 % du marché domestique.

Le CEO Karanja Ndegwa souligne que ce retour illustre l’engagement de la compagnie pour l’excellence opérationnelle, la croissance durable et la satisfaction client, tout en répondant à la demande croissante sur les lignes domestiques et régionales.

medium-haul fleet with an order of 18 B737 MAX 8, the first expected in January 2026, and seven additional aircraft later that year.

EgyptAir renforce sa flotte long-courrier avec six A350-900 supplémentaires

Lors du Paris Air Show 2025, EgyptAir a signé un accord avec Airbus pour l’acquisition de six A350-900 supplémentaires, portant son carnet de commandes à 16 modules.

Ce renforcement soutient le plan quinquennal d’expansion du réseau long-courrier de la compagnie, tout en contribuant à ses objectifs de durabilité grâce à une réduction de 25 % de la consommation de carburant et des émissions de CO₂ par rapport aux précédents avions.

Les livraisons, prévues pour remplacer ses 777s, débuteront en décembre 2025, avec six unités supplémentaires en 2026. Parallèlement, un programme de formation certifié pour pilotes A350 est mis en place à l’EgyptAir Training Academy. La compagnie modernise également sa flotte court- et moyen-courrier avec 18 B737 MAX 8 en commande.

Le premier module est attendu en janvier 2026, et sept autres devraient être livrés au cours de la même année.

Safarilink Selects AURA

AERO’s Hybrid-Electric ERA

At the 2025 Paris Air Show, Safarilink Airlines signed a Letter of Intent with AURA AERO for six 19-seat ERA hybrid-electric aircraft, including four firm orders and two options.

This move supports the Kenyan safari carrier’s fleet modernization and decarbonization strategy. Safarilink operates scheduled services to 17 key destinations across Kenya and northern Tanzania. The ERA, featuring eight electric motors and SAF-compatible turbogenerators, offers a range of 1,666 km, a pressurized cabin, and up to 80% CO₂ emissions reduction.

The order underscores Safarilink’s commitment to sustainable regional aviation while enhancing passenger comfort and operational efficiency.

Safarilink choisit l’ERA hybride-électrique d’AURA AERO

Lors du Salon du Bourget 2025, Safarilink Airlines a signé une lettre d’intention avec AURA AERO pour l’acquisition de six avions ERA hybrides-électriques, 19 places, dont quatre fermes et deux options. Cette commande s’inscrit dans la stratégie de décarbonation et de modernisation de la flotte de la compagnie kenyane, spécialiste des safaris et vols domestiques vers 17 destinations clés au Kenya et au nord de la Tanzanie. L’ERA, doté de huit moteurs électriques et de turbogénérateurs compatibles SAF, offre une autonomie de 1 666 km, un confort pressurisé et une réduction des émissions de CO₂ jusqu’à 80 %.

TAAG Angola Adds Third A220-300, Secures 787-10 Financing

At the end of June, TAAG Angola Airlines welcomed its third Airbus A220-300, D2-TAI, enhancing regional connectivity to Windhoek, Johannesburg, Cape Town, Maputo, and São Tomé with 137-seat versatility and fuel efficiency.

The airline’s order book includes twelve A220-300s. In parallel, TAAG secured $297M EXIM funding for two soon-to-arrive Boeing 787-10 Dreamliners, complementing its fleet of 787-9s (the first unit was delivered on January 30, 2025) and 777s.

These widebodies will replace aging aircraft and expand TAAG’s network, supporting the airline’s strategic 2024–2029 growth plan.

TAAG intègre un troisième

A220-300 supplémentaire et prépare ses 787-10

Fin juin, TAAG Angola Airlines a accueilli son troisième Airbus A220-300, D2-TAI, renforçant la connectivité régionale vers Windhoek, Johannesburg, Le Cap, Maputo et São Tomé. Son carnet de commande comprend douze A220300.

Parallèlement, la compagnie a sécurisé un financement EXIM de 297 M$ pour deux Boeing 787-10 bientôt livrés, complétant sa flotte de 787-9 (premier livré le 30 janvier 2025) et de 777.

Ces gros-porteurs remplaceront progressivement les appareils vieillissants, étendront le réseau et soutiendront son plan stratégique 2024–2029.

ACMI in Africa as a strategy to scale airline operations

Linas Dovydėnas, président de Chapman Freeborn IMEA,

ACMI – a solution gaining traction

With Africa’s young and rapidly growing population seeking more opportunities for travel, air traffic in the region is expected to rise by an average of 6.4 percent annually, more than tripling by 2043. At the same time, African airlines are facing rising costs and supply chain disruptions that demand flexibility and adaptability to changing market conditions.

ACMI leasing emerges as a strategic response to this surging demand, offering airlines the flexibility to scale operations without the financial burden of aircraft ownership. This wet-leasing model provides airlines with aircraft and crew to handle seasonal peaks or bridge service gaps caused by aircraft maintenance.

There are over 1,500 aircraft available globally for ACMI leasing, with half operated solely under ACMI contracts. However, this capacity remains underutilized by African carriers, according to Linas Dovydėnas, Chapman Freeborn IMEA President:

L’ACMI, un levier pour la croissance des compagnies africaines

La demande de transport aérien en Afrique devrait tripler d’ici 2043, avec une croissance annuelle estimée à 6,4 %. Mais cette dynamique se heurte à des contraintes majeures : hausse des coûts, difficultés de financement, retards de livraison d’avions et manque d’accès au leasing sec.

Dans ce contexte, la formule ACMI (Aircraft, Crew, Maintenance, Insurance), ou wet-lease, apparaît comme une solution stratégique. Elle offre aux compagnies aériennes la possibilité de renforcer rapidement leurs capacités, en couvrant les périodes de forte demande ou les interruptions liées à la maintenance, sans supporter les coûts fixes liés à la propriété d’appareils.

Aviation leaders gathered in Zanzibar in June for the AviaDev Africa 2025 conference to address the continent’s mounting challenges and opportunities. Linas Dovydėnas, Chapman Freeborn IMEA President, participated in the panel titled ‘Beyond the headwinds: Navigating rising costs, finance hurdles and supply chain challenges. His insights shed light on how ACMI (Aircraft, Crew, Maintenance and Insurance) solutions can transform African aviation.

“ACMI leasing is gaining traction in Africa – African carriers are increasingly reaching out due to growing demand and passenger numbers, supply chain bottlenecks, and a shortage of aircraft for dry leasing. However, it is still often seen as a short-term or emergency solution, which in turn drives up costs.”

This perception creates broader trends, with African airlines approaching ACMI providers just weeks before peak season,

leading to inflated prices. Such procurement strategies ultimately undermine the cost-effectiveness that makes ACMI attractive in the first place.

Planning ahead pays off

While African airlines are increasingly adopting ACMI, they still need to shift from last-minute decisions to strategic forward planning. Dovydėnas advocates embracing ACMI not as an emergency fix, but as a long-term strategic tool that can help generate profit: “Proper planning allows airlines to scale flexibly during peak seasons without committing to year-round fixed costs. We recommend signing ACMI agreements one to three years in advance to secure better pricing and availability.”

Chapman Freeborn is actively working with African airlines and authorities to position ACMI solutions as components of long-term capacity planning. Encouragingly, the company is beginning to see early-stage discussions around multi-year ACMI partnerships, which Dovydėnas views as a positive shift.

Addressing African aviation needs

The panelists addressed a critical market constraint: the availability of aircraft remains extremely tight. Global OEM delivery delays are pushing even mature markets toward ACMI solutions, which reduces the availability of second-hand aircraft flowing into African markets. This creates a complex supply dynamic where traditional acquisition models become increasingly challenging, making ACMI’s on-demand availability particularly valuable for African carriers.

Lors du salon AviaDev Africa 2025 à Zanzibar, Linas Dovydėnas, président de Chapman Freeborn IMEA, a rappelé que l’ACMI est encore trop souvent perçu comme une mesure d’urgence, sollicitée à la dernière minute, ce qui renchérit son coût. Il plaide pour une approche proactive, avec des accords négociés un à trois ans en amont, permettant de sécuriser prix et disponibilité.

Chapman Freeborn, filiale d’Avia Solutions Group – premier fournisseur mondial d’ACMI – collabore déjà avec plusieurs compagnies africaines. Dans un marché mondial tendu, l’ACMI pourrait devenir un outil clé pour accompagner la croissance du transport aérien africain.

Chapman Freeborn currently supports African airlines with ACMI and cargo services. As part of the world’s largest ACMI group, the company provides African airlines with additional aircraft capacity when needed – for busy travel seasons, operational gaps, or unexpected demand surges.

The company also plays a significant role in moving cargo across the continent, particularly humanitarian aid and urgent relief supplies to hard-to-reach areas.

“We are working with both airlines and aviation authorities to make it easier and faster for foreign aircraft to get approval to operate in Africa,” Dovydėnas explains. “Our local office in Johannesburg helps us stay close to the market, respond quickly, and build strong relationships across the region. Africa remains a key focus for Chapman Freeborn, and we continue to

About Chapman Freeborn

explore ways to strengthen our partnerships and presence across the continent.” The Chapman Freeborn Group was established in the UK in 1973. The company has offices worldwide including North America, Europe, Africa, Asia and Australia. In the cargo market, Chapman Freeborn Airchartering specialises in the charter and lease of aircraft for a wide-ranging customer base, including freight forwarders, multinational corporations, governments, humanitarian agencies and a host of industries around the globe.

In addition to freight services, Chapman Freeborn offers specialist passenger services including private jet charters for executive travel and large aircraft for crew rotations and international group travel, as well as on board courier services.

About Avia Solutions Group

Chapman Freeborn is part of Avia Solutions Group, the world’s largest ACMI (Aircraft, Crew, Maintenance, and Insurance) provider, operating a fleet of 209 aircraft on 6 continents. The group also provides a range of aviation services: MRO (Maintenance, Repair, and Overhaul), pilot and crew training, ground handling, as well as a variety of associated aviation services. Supported by 14,000 highly skilled aviation professionals, the group is parent company to over 250+ subsidiaries.

For more information, please visit www.chapmanfreeborn.aero

Strategic Partnerships – Codeshares, joint ventures, alliances

Airlink partage désormais ses codes avec Turkish Airlines

Depuis le 1er août , Turkish Airlines et la compagnie sud-africaine Airlink opèrent un accord de partage de codes.

Cette collaboration intègre les réseaux internationaux de Turkish Airlines et les lignes régionales d’Airlink sur un billet unique, offrant aux passagers une connectivité renforcée vers des destinations clés comme Johannesburg et Le Cap

Airlink Inks Codeshare Deal with Turkish Airlines

Since August 1, Turkish Airlines and South Africa-based Airlink have operated a codeshare agreement.

The collaboration integrates Turkish Airlines’ international network with Airlink’s regional routes on a single ticket, providing passengers with enhanced connectivity to key destinations such as Johannesburg and Cape Town.

The partnership improves the travel experience, supports tourism and economic exchange, and strengthens Turkish Airlines’ strategic presence across the African continent.

Kenya Airways et Air Tanzania signent un MoU stratégique pour renforcer la coopération régionale

Le 28 juillet, Kenya Airways et Air Tanzania ont signé un protocole d’accord visant à renforcer la coopération stratégique et améliorer la connectivité en Afrique de l’Est et australe. Le MoU privilégie la collaboration plutôt que la concurrence, mobilisant les ressources des deux compagnies pour une croissance durable.

Les domaines clés incluent la formation, l’ingénierie, la maintenance aéronautique, les opérations cargo, la sécurité et l’innovation. Ce partenariat offrira aux passagers et aux clients cargo des solutions de voyage plus flexibles et efficaces, tout en soutenant le développement économique, le commerce et le tourisme, créant un secteur aérien régional intégré et compétitif.

Kenya Airways and Air Tanzania Sign Strategic MoU to Boost Regional Cooperation

On 28 July, Kenya Airways and Air Tanzania signed a Memorandum of Understanding to strengthen strategic cooperation and enhance connectivity across East and Southern Africa. The MoU focuses on collaboration rather than competition, leveraging both airlines’ resources for sustainable growth. Key areas include human resource training, engineering, aircraft maintenance,

MRO, cargo operations, safety, and innovation. The partnership aims to provide passengers and cargo clients with more flexible and efficient travel options, while supporting economic growth, trade, and tourism.

Formalized in Dar Es Salaam, the agreement reflects a shared ambition for a more integrated, efficient, and competitive regional aviation sector.

Air Sénégal renforce sa connectivité avec Asky Airlines et Royal Air Maroc

Le 17 juillet, Air Sénégal a signé un accord de partage de codes avec Asky Airlines pour améliorer la connectivité en Afrique de l’Ouest et centrale. Ce partenariat élargit les réseaux des deux compagnies, offrant aux passagers des vols vers Bissau, Lomé, Douala, N’Djamena, Bangui et Praia, tandis qu’Asky intègre des destinations d’Air Sénégal, dont Nouakchott, Banjul, Casablanca et Paris.

Parallèlement, dès le 21 juillet, Air Sénégal a étendu son accord avec Royal Air Maroc à Montréal, Milan, Barcelone et Lyon via Casablanca.

Selon la compagnie, ces collaborations stratégiques optimisent les opérations, facilitent les correspondances, renforcent la position concurrentielle de la compagnie et élargissent l’accès à des destinations clés, tout en maîtrisant les coûts d’exploitation.

Air Sénégal Inks Codeshare

Deals with Asky Airlines and Royal Air Maroc

On 17 July, Air Sénégal signed a codeshare agreement with Asky Airlines to enhance connectivity across West and Central Africa. The partnership expands both carriers’ networks, offering passengers flights to Bissau, Lomé, Douala, N’Djamena, Bangui, and Praia, while Asky integrates Air Sénégal destinations including Nouakchott, Banjul, Casablanca, and Paris. In parallel, from 21 July, Air Sénégal extended its codeshare with Royal Air Maroc to Montréal, Milan, Barcelona, and Lyon via Casablanca.

These strategic collaborations optimize operations, streamline connections, strengthen the airline’s competitive position, and broaden access to key destinations, while maintaining operational efficiency and cost control.

Digital Decarbonization: Simple IT Tools Making Aviation More Sustainable

In the global push to combat climate change, industries of every kind are under pressure to reduce their carbon footprints. Aviation, contributing approximately 2–3% of global CO₂ emissions, has long been recognized as a sector where change is both necessary and complex.

Moreover, with the aviation industry under increased pressure from regulators, investors, and climate-conscious passengers, demonstrating real progress in emissions reduction is no longer optional—it’s a competitive necessity.

Africa’s aviation sector, in particular, is growing rapidly, with passenger demand up 14.9% each year and strong forecasts predicting an average annual growth of 4.2% through 2043.

Major initiatives—like sustainable aviation fuels, next-generation aircraft, and more efficient engines— are already in progress but often require years of investment and planning.

However, there’s a surprisingly simple and available solution that offers immediate impact with minimal disruption: Inflight Optimization

As a software-based approach, it provides a low-threshold, high-im-

La digitalisation, un outil simple pour réduire l’empreinte carbone de l’aviation

Face à la pression croissante des régulateurs, investisseurs et passagers, l’aviation doit accélérer sa transition vers plus de durabilité. Si les biocarburants durables, les nouveaux avions et moteurs sont des solutions prometteuses, elles nécessitent des années d’investissement. En attendant, des outils numériques simples peuvent offrir des gains immédiats et mesurables.

C’est le cas de Lido Inflight Optimization (Lido IFO), développé par Lufthansa Systems. Ce logiciel optimise en temps réel la trajectoire verticale des avions en vol, en tenant compte des conditions réelles (météo, restrictions de trafic, NOTAM). Contrairement aux plans établis avant le départ, il permet aux pilotes d’adapter leurs décisions avec des données actualisées, sans charge de travail supplémentaire ni modification matérielle des appareils.

Les résultats sont concrets : une économie moyenne de 0,55 % de carburant par vol, soit environ 550 kg économisés sur un long-courrier consommant 100 000 kg de car-

pact way for airlines to reduce fuel consumption and emissions.

Lido Inflight Optimization (Lido IFO) by Lufthansa Systems is a prime example of how small digital interventions can produce relevant environmental and financial results.

Without the need for physical modifications to aircraft or infrastructure, such innovations empower airlines to reduce emissions simply by flying smarter.

Lido IFO works by providing real-time vertical trajectory optimization for flights already enroute. While traditional flight planning involves calculating a trajectory before departure based on expected conditions, the reality of air travel is much more fluid.

Conditions often change after pushback—due to weather, air traffic flow restrictions, or NOTAMs—and these changes can cause the original flight plan to become suboptimal. When that happens, pilots are left to make decisions based on outdated data, inevitably leading to fuel inefficiencies.

This is where real-time inflight optimization makes a difference. By using current data to suggest improved vertical flight profiles while the aircraft is enroute, such

systems help crews make more informed decisions without additional workload. Optimization suggestions are delivered via familiar communication channels, require no new aircraft hardware, and are aligned with existing operational and regulatory frameworks. The result is a streamlined path to better performance which is integrated into the natural flow of flight operations.

Most importantly, these recommendations are not just theoretical. They are instantly usable, compliant with regulations, and tailored to the specific flight plan and aircraft configuration. This ensures pilots can confidently implement them without hesitation. At the same time, dispatch and operations teams are kept in the loop via the Lido Flight 4D interface, where all calculations are displayed in real time, offering full transparency into how the system operates.

Airline case studies have shown that implementing Lido IFO can lead to fuel savings starting at 0.55% of trip fuel. While that might seem like a small percentage, the scale of modern aviation transforms it into something truly significant. Consider a typical long-haul flight that uses around 100,000 kilograms of fuel. A 0.55% saving means 550 kilograms of fuel conserved—on just one flight. Across a fleet operating thousands of flights annually, this can amount to millions of kilograms of fuel, and a corresponding reduction in CO₂ emissions.

For every kilogram of jet fuel burned, roughly 3.16 kilograms of CO2 are emitted. These calculations clearly demonstrate the environmental benefits.

These benefits are particularly attractive for African carriers operating in cost-sensitive environments where every kilogram of fuel counts—especially given that fuel prices in the region can be up to 30% higher than the global av-

burant. À l’échelle d’une flotte, cela représente des millions de kilogrammes de kérosène et des milliers de tonnes de CO₂ évitées.

Pour les compagnies africaines, où le carburant coûte jusqu’à 30 % plus cher que la moyenne mondiale, ces technologies représentent un levier stratégique. Accessibles, rapides à déployer et conformes aux normes, elles permettent d’améliorer la compétitivité tout en contribuant aux objectifs mondiaux de décarbonation.

erage. This is largely due to limited infrastructure and high transport costs for fuel imports (Source: IATA 2024, Chart of the Week).

This is where advanced operational technologies—particularly automation—become relevant. Optimizations are continually recalculated using the original flight plan’s constraints and logic. Automation reduces workload for pilots and dispatchers and ensures consistency across the fleet. The system flags improvements only when they meaningfully enhance efficiency, allowing crews to act at precisely the right moment.

Flight efficiency isn’t just a technical matter—it’s increasingly a strategic one. Due to the growing pressure from regulators, investors and passengers, tools that help quantify and report real progress are be-

coming essential. Inflight optimization stands out here, offering an easy-toadopt, data-backed solution that delivers measurable environmental and cost benefits.

The simplicity of implementation is a major advantage. As a software-based solution, inflight optimization doesn’t require physical changes to aircraft or downtime for installations. It leverages existing systems and communication methods, making it accessible even to operators with limited technical resources. With so many decarbonization technologies still years away from large-scale viability, low-barrier digital tools fill an important gap.

Although the aviation industry is actively pursuing long-term structural changes, there is a clear opportunity today to reduce emissions through smarter operational practices. Lido IFO demonstrates how digital intelligence applied in the cockpit can enhance outcomes for both the environment and profitability. Rather than waiting for large-scale technological breakthroughs, airlines can begin reducing emissions now with tools that are already proven, already available, and surprisingly easy to adopt. Inflight optimization is not a silver bullet—but it is a smart, scalable step toward more sustainable skies.

By embracing solutions that are already available and working, particularly African airlines can improve efficiency, reduce costs, meet international environmental standards, and build the foundations for a more sustainable aviation future.

Sustainability & SAF

Positioning Africa in the Global SAF Landscape

In August, the African Airlines Association (AFRAA) convened a new edition of its SkyConnect Leadership Dialogues, focusing on Africa’s role in shaping the future of Sustainable Aviation Fuels (SAF). The session brought together two experts: Mr. Serguei Poppeleer – CEO, Bleriot Holdings, a SAF producer based in Kenya, and Ms. Sharon Mahony, Associate in Sustainable Aviation at ENVISA. The discussion was moderated by Mr. Raphael Kuuchi, AFRAA Director Government, Legal and Industry Affairs.

Although Africa contributes only about 2% of global aviation CO₂ emissions, the continent is projected to experience rapid traffic growth driven by its youthful population. Both panelists stressed that this creates a unique opportunity to adopt sustainable practices from the start.

“Africa has abundant land and feedstock potential. The question is whether growth will be sustainable. We must act now to ensure energy resilience for decades to come.”

— Serguei Popelier, Bleriot Group

Africa offers significant potential for SAF feedstock such as cotton oil, castor oil, groundnuts, and coconut shells. Yet, technology and certification infrastructure remain major constraints.

“Everything exists to advance SAF—feedstock, markets, and motivation. The challenge is to bring it together, ensure certification, and create viable business models.”

— Sharon Mahony, ENVISA

The panel suggested that smaller modular SAF plants adapted to local infrastructure could be more practical for Africa than massive European-style refineries. Europe’s SAF growth has been driven by strict regulation and airline offtake commitments. Africa, however, lacks binding mandates. Both experts called for stronger government frameworks, financial incentives, and airline commitments to accelerate SAF development.

“Cash is king. Long-term offtake agreements from airlines, backed by clear government policy, will unlock investor confidence.”

— Serguei Popelier, Bleriot Group

Current SAF remains 2–3 times more expensive than conventional jet fuel. Certification and quality assurance are additional hurdles, with African labs often lacking the resources to comply with global standards. Nevertheless, SAF is

expected to deliver up to 65% of future CO₂ reductions in aviation, making it central to the sector’s decarbonisation pathway.

AFRAA reaffirmed its commitment to supporting African airlines in the sustainability journey, aligning with ICAO and IATA’s net-zero by 2050 framework. Through its dialogues, AFRAA seeks to drive awareness, capacity building, and coordinated action across the continent.

“Sustainable Aviation Fuel is one of the essential bricks in building Africa’s aviation future. The time to move from talk to action is now.”

— Raphael Kuuchi, AFRAA

Key Figures

Africa:

~2% of global aviation CO2 emissions today

SAF global production share from Africa: <0.1%

Cost of a SAF plant:

USD 200–300 million

SAF expected to deliver 65% of aviation’s emission reductions by 205

Positionner l’Afrique dans le paysage mondial des SAF

Quote of the Dialogue

“SAF is not just an option—it is the cornerstone of Africa’s sustainable aviation future.”

— Sharon Mahony

En août, l’African Airlines Association (AFRAA) a organisé une nouvelle édition de ses SkyConnect Leadership Dialogues, consacrée au rôle de l’Afrique dans l’avenir des carburants d’aviation durables (SAF). La session a réuni deux experts : M. Serguei Popelier, PDG de Bleriot Group, producteur de SAF basé au Kenya, et Mme Sharon Mahony, Associate en aviation durable chez ENVISA. La discussion a été modérée par M. Raphael Kuuchi, Directeur Gouvern-

ance, Affaires juridiques et industrielles à l’AFRAA.

Bien que l’Afrique ne représente qu’environ 2 % des émissions mondiales de CO2 du secteur aérien, le continent devrait connaître une croissance rapide du trafic, portée par sa population jeune. Les deux intervenants ont souligné que cette dynamique offrait une opportunité unique d’adopter dès maintenant des pratiques durables.

« L’Afrique dispose de vastes terres et d’un fort potentiel en matières premières. La question est de savoir si la croissance sera durable. Il faut agir dès aujourd’hui pour assurer la résilience énergétique des décennies à venir. »

— Serguei Popelier, Bleriot Group

Le continent offre un potentiel important pour les matières premières destinées aux SAF, comme l’huile de coton, de ricin, d’arachide ou encore la coque de noix de coco. Pourtant, les infrastructures technologiques et de certification restent un obstacle majeur.

« Tout est en place pour développer les SAF : matières premières, marchés, motivation. Le défi est de rassembler ces éléments, de garantir la certification et de créer des modèles économiques viables. »

— Sharon Mahony, ENVISA

Le panel a suggéré que des unités de production modulaires et de petite taille, adaptées aux infrastructures locales, pourraient être plus pertinentes pour l’Afrique que les énormes raffineries de type européen.

La croissance des SAF en Europe a été soutenue par des réglementations strictes et des engagements d’achat par les compagnies aériennes. En Afrique, il n’existe pas encore de mandats contraignants. Les experts ont appelé à des cadres réglementaires solides, des incitations financières et des engagements des compagnies aériennes pour accélérer le développement des SAF.

« L’argent est roi. Des contrats d’achat à long terme, soutenus par une politique gouvernementale claire, permettront de rassurer les investisseurs. » — Serguei Popelier, Bleriot Group

Actuellement, les SAF restent 2 à 3 fois plus coûteux que le carburant classique. La certification et l’assurance qualité représentent également des défis, les laboratoires africains manquant souvent des ressources nécessaires pour se conformer aux normes internationales. Néanmoins, les SAF devraient permettre de réaliser jusqu’à 65 % des réductions futures de CO₂ dans l’aviation, en faisant un élément

central de la décarbonation du secteur.

L’AFRAA a réaffirmé son engagement à soutenir les compagnies africaines dans leur transition vers la durabilité, en alignement avec le cadre net zéro 2050 de l’ICAO et de l’IATA. Par le biais de ses dialogues, l’AFRAA vise à sensibiliser, renforcer les capacités et coordonner l’action sur l’ensemble du continent.

« Le carburant d’aviation durable est l’une des briques essentielles pour construire l’avenir de l’aviation africaine. Il est temps de passer de la parole aux actes. » — Raphael Kuuchi, AFRAA

Chiffres clés

Afrique : ~2 % des émissions mondiales de CO2 du secteur aérien aujourd’hui

Part de la production mondiale de SAF issue d’Afrique : <0,1 %

Coût d’une unité de production de SAF : 200 à 300 millions USD

Contribution attendue des SAF aux réductions d’émissions du secteur aérien d’ici 2050 : 65 %

Citation marquante

« Les SAF ne sont pas une simple option : ils constituent la pierre angulaire de l’avenir durable de l’aviation en Afrique. » — Sharon Mahony

Innovation Watch

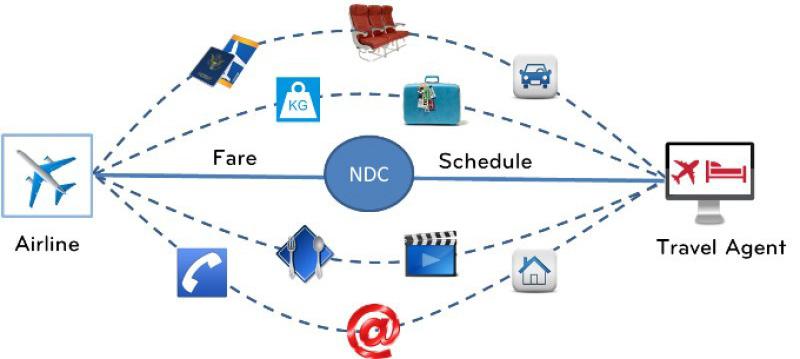

Rethinking DistributionAirline in Africa

In July, the African Airlines Association (AFRAA) hosted a new edition of the SkyConnect Dialogues, the Association’s flagship leadership platform.

Moderated by Ms. Maureen Kahonge, Senior Manager Business Development and Communications at AFRAA, the session brought together two distinguished experts to explore one of the industry’s pressing issues: airline product distribution in Africa. The panel featured Mr. Hassan Aurag, Brand Ambassador Africa & Middle East at Hitit, and Mr. Michael François, Managing Director at DataWings.

Discussions highlighted that Africa’s airline distribution remains highly fragmented, with a heavy reliance on traditional travel agencies. In some markets, over 70% of ticket sales are still generated through these intermediaries.

“This reality limits the ability of airlines to optimize costs and build stronger direct relationships with passengers,” — Hassan Aurag, Hitit

Digitalisation as a pathway to competitiveness

The panellists emphasized the need for consolidation of distribution channels and greater investment in digital solutions such as mobile applications, chatbots, and integrated payment platforms. These innovations are essential to improve profitability and deliver world-class customer experience.

“Current fragmentation prevents airlines from achieving economies of scale and complicates interline arrangements. Digitalisation is the key to autonomy and competitiveness,” — Michael François, DataWings

Payments and blocked funds: a pressing challenge

The issue of payments and blocked funds was central to the debate. With more than 600 million Mobile Money users in Africa, the opportunity for greater access to air services is significant. Yet, the diversity of local payment solutions, high conversion fees, and persistent blocked funds remain a burden for African carriers.

“Unless airlines integrate payment solutions seamlessly, they will continue to lose efficiency and revenue. Payment orchestration platforms are a crucial part of the solution,” — Hassan Aurag, Hitit

AFRAA’s catalytic role

By convening strategic dialogues with industry leaders, AFRAA continues to position itself as a catalyst for change and innovation in African aviation.

The Association’s leadership platform offers space for critical reflection on challenges, best practices, and solutions tailored to the continent’s realities.

“Improving distribution systems is not only a technological issue—it is a lever for sustainability and growth in African aviation,” — Maureen Kahonge, AFRAA

Key Figures

70%+ of sales in some African markets still go through traditional travel agencies

600 million

Mobile Money users across Africa

Distribution costs can represent up to 15% of airline expenditure

Quote of the Dialogue

« Digitalisation is the key to autonomy and competitiveness for African airlines.» — Michael François

AFRAA SkyConnect Dialogues : Réinventer la distribution aérienne en Afrique

En juillet 2025, l’Association des Compagnies Aériennes Africaines (AFRAA) a tenu une nouvelle édition des SkyConnect Dialogues, son rendez-vous de réflexion et de leadership sectoriel.

Modéré par Mme Maureen Kahonge, Senior Manager Business Development and Communications à l’AFRAA, ce dialogue a réuni deux experts autour d’un enjeu central : la distribution des produits aériens en Afrique. Les panélistes étaient M.

Hassan Aurag, Brand Ambassador Afrique & Moyen-Orient chez Hitit, et M. Michael François, Managing Director de DataWings.

Les échanges ont révélé que la distribution aérienne en Afrique reste marquée par une fragmentation importante et une dépendance aux agences de voyages traditionnelles. Dans certains marchés, plus de 70 % des ventes passent encore par ce canal.

« Cette réalité limite la capacité

des compagnies à optimiser leurs coûts et à renforcer leur relation directe avec les passagers », a souligné Hassan Aurag.

Miser sur le digital pour accroître la compétitivité

Face à ce constat, les deux intervenants ont plaidé pour une consolidation des canaux de distribution et un recours accru aux outils digitaux. Applications mobiles, chat-

bots, solutions de paiement intégrées ou encore intelligence artificielle constituent des leviers essentiels pour améliorer la rentabilité et rehausser l’expérience client.

Selon Michael François,

« la fragmentation actuelle empêche les compagnies de réaliser des économies d’échelle et complique la mise en place d’interlignes efficaces. Le digital est une voie incontournable pour gagner en autonomie et en compétitivité. »

Paiements et fonds bloqués : un défi urgent

La problématique des paiements et des fonds bloqués a également été au centre des discussions.

L’Afrique compte plus de 600 millions d’utilisateurs de Mobile Money, mais la multiplicité des solutions locales et les frais de conversion élevés complexifient les opérations.

« Si les compagnies ne parviennent pas à intégrer ces solutions de manière fluide, elles perdent en efficacité et en revenus », a noté Hassan Aurag, avant de recommander le développement de plateformes d’« orchestration des paiements » capa-

bles de simplifier les transactions transfrontalières. En donnant la parole aux acteurs clés de l’industrie, les SkyConnect Dialogues confirment le rôle de l’AFRAA comme plateforme stratégique d’échanges et de solutions adaptées au contexte africain.

« L’amélioration des systèmes de distribution n’est pas seulement un enjeu technologique, c’est un levier de durabilité et de croissance pour l’aviation africaine », a conclu Maureen Kahonge.

Insights from KQ & SAA Cargo Cargo Spot

In June 2025, the African Airlines Association (AFRAA) hosted a new edition of the SkyConnect Dialogues, focusing on the critical role of air cargo in Africa’s aviation and trade landscape.

Moderated by Mr. Raphael Kuuchi, AFRAA’s Director Government, Legal and Industry Affairs, the session featured two seasoned leaders:

• Mr. Fitsum Abadi Gebrehawaria, Cargo Director – Kenya Airways Cargo

• Mr. Kekeletso Mokwena, Cargo Manager – South African Airways Cargo

Cargo: A Silent Driver of African Aviation

While passenger traffic often dominates industry headlines, cargo operations remain a vital yet underappreciated contributor to African aviation. Both panellists highlighted that cargo drives significant trade flows, particularly perishables and high-value exports, despite facing structural and economic challenges.

“Africa contributes less than 2% to global trade. To change this, we must build value addition, invest in infrastructure, and strengthen intra-African trade.”

— Fitsum Abadi, Kenya Airways Cargo

Regional Dynamics and Perishable Exports

East Africa emerged as a dominant hub, with Kenya exporting over 360,000 tonnes annually, primarily perishables such as flowers, fruits, and vegetables.

Egypt and South Africa follow closely, each exceeding 300,000 tonnes. However, yields remain low due to limited value addition and heavy reliance on raw exports. Maintaining cold chains

Intra-African Trade and AfCFTA

and balancing directional flows were identified as key obstacles.

“Fresh produce requires seamless cold chain solutions, but the thin margins make freighter operations challenging. We must diversify cargo and markets.”

— Kekeletso Mokwena, SAA Cargo

The speakers emphasized that the African Continental Free Trade Area (AfCFTA) and the Single African Air Transport Market (SAATM) are game-changers for cargo. By reducing barriers and fostering connectivity, they can unlock intra-African trade and create opportunities for e-commerce and industrial exports.

“Intra-African trade is the missing link. With regulatory flexibility and infrastructure, cargo can become a true growth engine for the continent.”

— Fitsum Abadi, Kenya Airways Cargo

Competition vs. Collaboration

Although competition among African carriers is healthy, both experts stressed the urgent need for collaboration to withstand pressure from global players.

Strategic partnerships, joint freighter operations, and shared infrastructure could help African airlines grow their modest 25% share of intra-African cargo traffic.

“Without collaboration, African airlines will continue to lose market share to foreign carriers. Partnership is not a choice—it is a necessity.” — Kekeletso Mokwena, SAA Cargo

Partners Technology and the Future

The dialogue concluded with a strong call for digitalisation and adoption of artificial intelligence to improve cargo predictability, efficiency, and customer experience. Technology was cited as an unavoidable accelerator, particularly with the rise of e-commerce logistics in Africa.

Quote of the Dialogue

“Partnership is not a choice—it is a necessity for African airlines.” — Kekeletso Mokwena

Key Figures

360,000+ tonnes of perishables exported annually via Kenya

Less than 2% of global trade contribution by Africa 25%

intra-African cargo market share for African airlines

Développement du fret aérien en Afrique : Perspectives de KQ & SAA Cargo

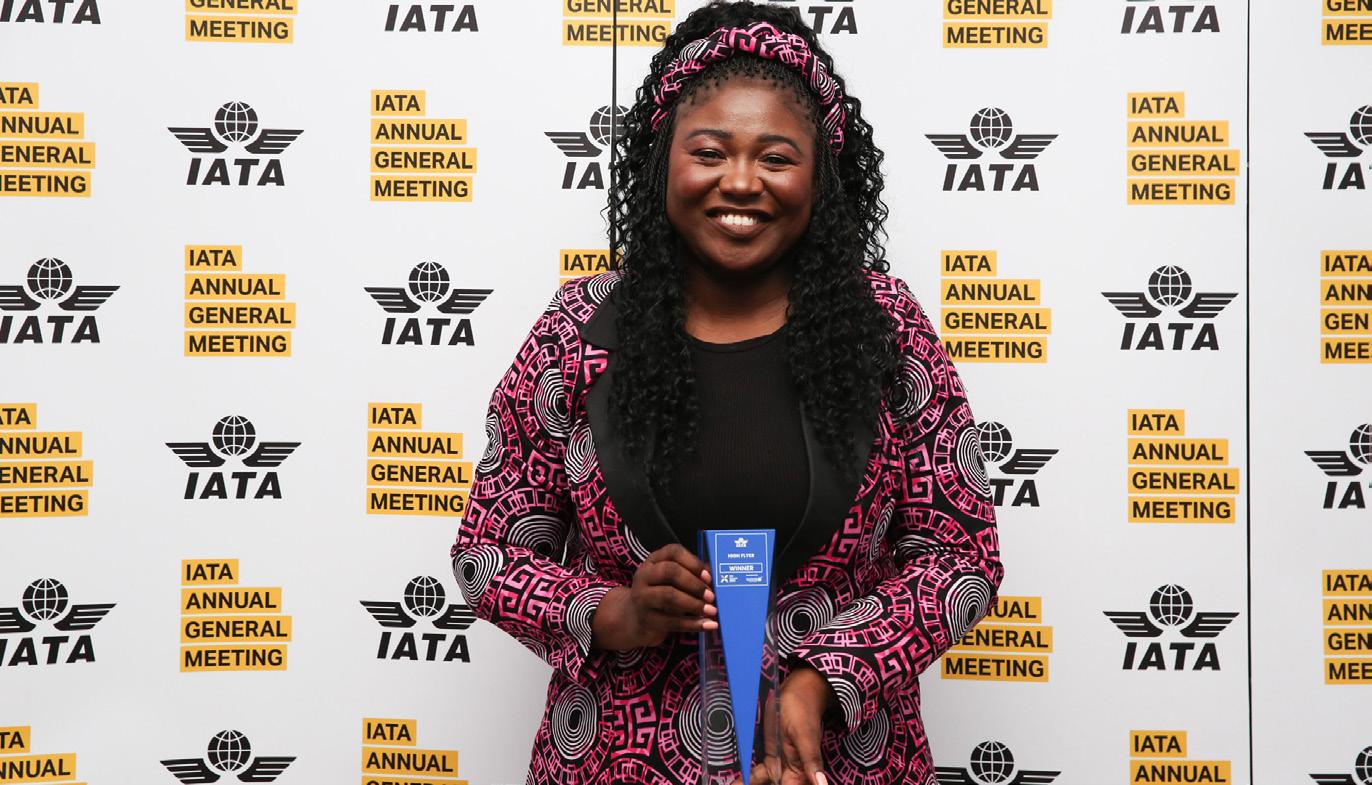

En juin 2025, l’Association des Compagnies Aériennes Africaines (AFRAA) a organisé une nouvelle édition des SkyConnect Dialogues, consacrée au rôle essentiel du fret aérien dans l’aviation et le commerce en Afrique. Modérée par M. Raphael Kuuchi, Directeur des Affaires Gouvernementales, Juridiques et Industrielles de l’AFRAA ( photo precedente) , la session a réuni deux leaders expérimentés :

• M. Fitsum Abadi Gebrehawaria, Directeur Cargo – Kenya Airways Cargo

• M. Kekeletso Mokwena, Responsable Cargo – South African Airways Cargo

Le fret : un moteur silencieux de l’aviation africaine

Si le trafic passagers domine souvent l’actualité, les opérations cargo restent un pilier vital mais sous-estimé de l’aviation africaine. Les panélistes ont souligné que le fret soutient des flux commerciaux majeurs, notamment de produits périssables et d’exportations à forte valeur, malgré de nombreux défis structurels et économiques.

« L’Afrique contribue à moins de 2 % du commerce mondial. Pour changer cela, nous devons investir dans la valeur ajoutée, les infrastructures et renforcer le commerce intra-africain. »

— Fitsum Abadi, Kenya Airways Cargo

L’Afrique de l’Est s’impose comme

un hub majeur, le Kenya exportant plus de 360 000 tonnes par an, principalement des fleurs, fruits et légumes. L’Égypte et l’Afrique du Sud suivent de près, chacune dépassant 300 000 tonnes. Cependant, les rendements restent faibles en raison du manque de valeur ajoutée et de la dépendance aux exportations brutes. Le maintien de la chaîne du froid et l’équilibrage des flux directionnels constituent des obstacles clés.

« Les produits frais nécessitent une chaîne du froid sans faille, mais les faibles marges rendent les opérations de fret difficiles. Nous devons diversifier les cargaisons et les marchés. »

— Kekeletso Mokwena, SAA Cargo

Les intervenants ont souligné que la Zone de Libre-Échange Continentale Africaine (ZLECAf) et le Marché Unique du Transport Aérien Africain (MUTAA) sont des leviers essentiels pour le fret. En réduisant les barrières et en renforçant la connectivité, ils peuvent stimuler le commerce intra-africain et ouvrir des perspectives pour l’e-commerce et les exportations industrielles.

« Le commerce intra-africain est le maillon manquant. Avec plus de flexibilité réglementaire et de meilleures infrastructures, le fret peut devenir un véritable moteur de croissance pour le continent. »

— Fitsum Abadi, Kenya Airways Cargo

Concurrence vs. collaboration Chiffres clés

Bien que la concurrence entre compagnies africaines soit saine, les experts ont insisté sur la nécessité urgente de coopérer pour résister à la pression des acteurs mondiaux. Des partenariats stratégiques, des opérations cargo conjointes et des infrastructures partagées pourraient permettre aux compagnies africaines d’augmenter leur part de marché, aujourd’hui limitée à 25 %.

« Sans collaboration, les compagnies africaines continueront de perdre des parts de marché face aux transporteurs étrangers. Le partenariat n’est pas un choix, c’est une nécessité. » — Kekeletso Mokwena, SAA Cargo

Technologie et avenir

Le dialogue s’est conclu par un appel fort à la digitalisation et à l’adoption de l’intelligence artificielle pour améliorer la prévisibilité, l’efficacité et l’expérience client. La technologie est apparue comme un accélérateur incontournable, notamment avec l’essor du commerce électronique en Afrique.

360 000+

tonnes de produits périssables exportées chaque année via le Kenya

Moins de 2% de contribution africaine au commerce mondial 25% de part de marché intra-afric- aine détenue par les compagnies afric-aines

Citation du Dialogue

“Le partenariat n’est pas un choix, c’est une nécessité pour les compagnies africaines. ”

— Kekeletso Mokwena

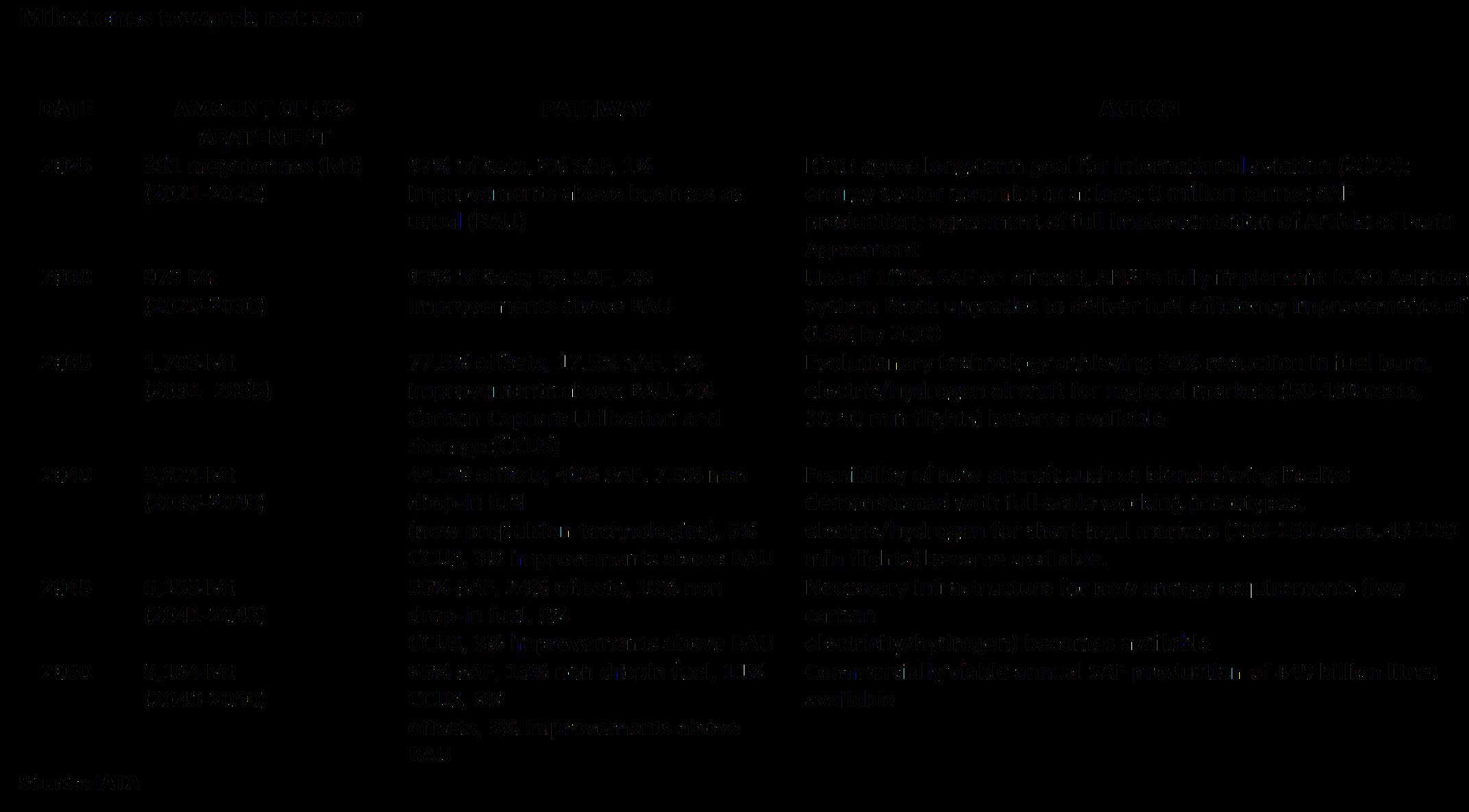

Tax & Charges Monitor

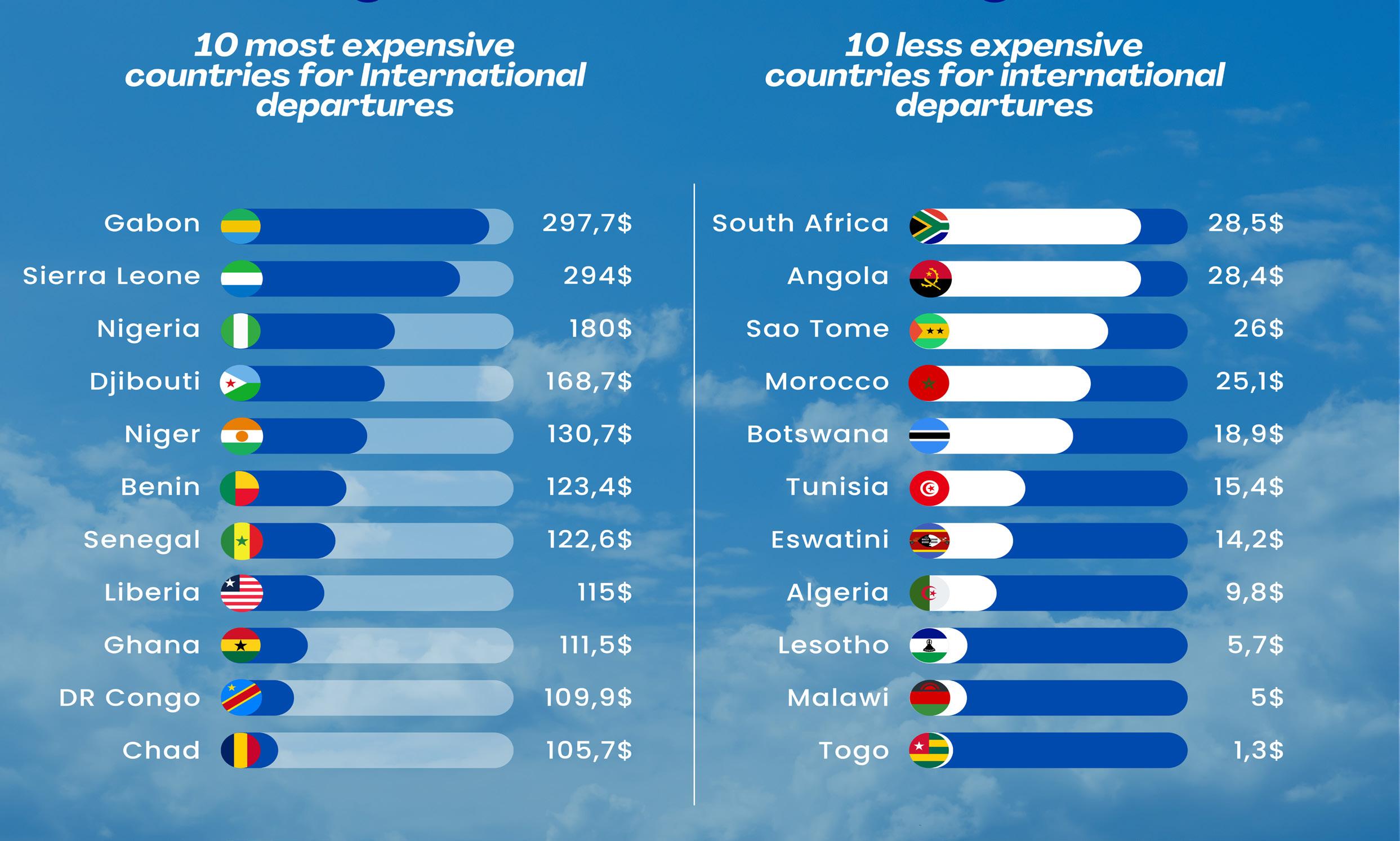

AFRAA 2024 Taxes and Charges Study: High Taxes, Charges and Fees Holding Back Africa’s Air Travel Industry

On July 4, the African Airlines Association (AFRAA) has released its 2024 Taxes and Charges Study, offering a comprehensive review of the fees, taxes, and charges applied to air travel across Africa. The report highlights the growing financial pressure on African airlines due to multiple levies imposed by governments, airports, and other stakeholders—impacting ticket prices and the overall competitiveness of African aviation.

The report underscores the growing financial pressure faced by airlines as a result of multiple levies imposed by governments, airports, and other stakeholders—impacting the cost of air travel and the competitiveness of African aviation.

The study—based on figures collected in September 2024 according to IATA ACIC—reveals that passengers in Africa pay an estimated US$68 in taxes, charges, and fees for every international ticket, more than double the average paid in Europe (US$32) and the Middle East (US$34).

“The cost of air travel in Africa is heavily influenced by taxes and charges, many of which are beyond the control of airlines. This study provides the evidence needed to engage policymakers and advocate for a more balanced and sustainable cost structure that supports growth in African aviation,”

said Abderahmane Berthé, Secretary General of AFRAA.

Key findings from the report include:

• Gabon and Sierra Leone top the list of most expensive African countries for international departures, with passengers paying up to USD 297.70 in taxes and charges.

• Western and Central Africa are the most costly regions, with average international departure charges of USD 109.49 and USD 106.62, respectively.

• Over 50% of African countries impose more than three types of taxes and fees on air tickets.

• In some cases, taxes exceed the base fare, particularly on shorter intra-African flights.

• Transfer and arrival charges have also risen significantly, with arrival-related charges averaging USD 34.10 in 2024.

US$68

passengers in Africa pay an estimated in taxes, charges, and fees for every international ticket paid in Europe paid in Middle East

US$34

US$32

Mr Berthe commented: “As Africa works to fully implement the Single African Air Transport Market (SAATM), reducing excessive taxes and charges is essential. A competitive and accessible air transport system is key to unlocking the continent’s economic and social potential” As part of its strategic mission, AFRAA continues to

advance a competitive and sustainable air transport industry in Africa through robust advocacy initiatives.

These efforts are designed to stimulate traffic growth and increase the market share of African airlines within the global aviation landscape. AFRAA’s advocacy strategy is anchored on four key pillars,

• Adherence to ICAO Doc 9082 and 8632, which outline policies on charges and taxation, respectively.

• Reduction of existing high charges on operators and passengers

• Oversight of private sector participation to ensure service quality at competitive rates

• Implementation of harmonised, sustainability-driven tax frameworks from the Aviation Sustainability Laboratory

The report concludes that excessive taxation has far-reaching implications for air connectivity, economic development, and the viability of African airlines.

Étude AFRAA 2024

sur les taxes et redevances : des coûts

élevés freinent le développement du transport aérien en Afrique

Le 4 juillet, l’Association des Compagnies Aériennes Africaines (AFRAA) publie sa 2024 Taxes and Charges Study, une analyse complète des taxes, redevances et frais appliqués aux voyages aériens sur le continent. Le rapport met en lumière la pression financière croissante qui pèse sur les compagnies aériennes africaines, due à la multiplicité des prélèvements imposés par les gouvernements, les aéroports et autres acteurs, et leurs conséquences sur le coût du transport aérien et la compétitivité du secteur.

L’étude — basée sur des chiffres collectés en septembre 2024 selon l’IATA ACIC — révèle que les passagers en Afrique paient en moyenne 68 USD de taxes, redevances et frais pour chaque billet international, soit plus du double de la moyenne en Europe (32 USD) et au Moyen-Orient (34 USD).

« Le coût du transport aérien en Afrique est fortement influencé par les taxes et redevances, dont une grande partie échappe au contrôle des compagnies aériennes. Cette étude fournit des preuves solides pour dialoguer avec les décideurs et promouvoir un système tarifaire plus équilibré et durable, au bénéfice de la croissance du secteur », explique Abderahmane Berthé, Secrétaire général de l’AFRAA.

Points saillants du rapport : Gabon et Sierra Leone figurent parmi les pays africains les plus chers pour les départs internationaux, avec des taxes pouvant atteindre 297,70 USD.

• L’Afrique de l’Ouest et l’Afrique centrale sont les régions les plus coûteuses, avec des charges moyennes pour les départs internationaux de 109,49 USD et 106,62 USD respectivement.

• Plus de la moitié des pays africains imposent plus de trois types de taxes et frais sur les billets.

• Over 50% of African countries impose more than three types of taxes and fees on air tickets.

• Dans certains cas, les taxes dépassent le tarif de base, en particulier sur les vols intra-africains de courte distance.

• Les frais liés aux transferts et aux arrivées ont également augmenté, atteignant en moyenne 34,10 USD en 2024.

M. Berthé ajoute : « Alors que l’Afrique poursuit la mise en œuvre du Marché

Unique du Transport Aérien Africain (SAATM), réduire les taxes excessives est essentiel.

Un système de transport aérien compétitif et accessible est clé pour libérer le potentiel économique et social du continent. »

L’action stratégique de l’AFRAA

1. Pour renforcer la compétitivité et la durabilité du transport aérien africain, l’AFRAA déploie des initiatives d’advocacy basées sur quatre axes :

2. Respect des recommandations ICAO (Doc 9082 et 8632) sur les politiques de redevances et de taxation.

Réduction des charges existantes pour les opérateurs et les passagers.

3. Suivi de la participation du secteur privé afin de garantir des services de qualité à des tarifs compétitifs.

4. Mise en œuvre de cadres fiscaux harmonisés et durables, développés par le Aviation Sustainability Laboratory.

Le rapport souligne que la taxation excessive a des effets directs sur la connectivité aérienne, le développement économique et la viabilité des compagnies aériennes africaines.

Routes Alerts

SAA : Cape Town – Maurice

À partir du 9 décembre 2025, South African Airways inaugurera sa première liaison directe entre Cape Town et l’île Maurice, avec trois vols par semaine (mardi, jeudi et samedi), desservant ainsi le marché des loisirs et renforçant la connectivité régionale. Entre mi-janvier et mi-mars 2026, la fréquence sera temporairement réduite à deux vols hebdomadaires selon la demande saisonnière.

SAA: Cape Town – Mauritius

Starting 9 December 2025, South African Airways will launch its first direct service between Cape Town and Mauritius, operating three weekly flights (Tuesday, Thursday, Saturday). This new route targets the leisure market while enhancing regional connectivity. Between mid-January and mid-March 2026, frequencies will be temporarily reduced to two weekly flights according to seasonal demand.

Air Peace : Abuja – Londres Heathrow

Quatre vols hebdomadaires à partir du 26 octobre 2025, opérés en Boeing 777. Cette nouvelle liaison complète le Lagos–Gatwick existant et renforce la connectivité internationale du hub nigérian. Fleet update : trois Embraer E175 convertis en E195-E2, portant l’ordre total à 16 unités dont 11 en attente de livraison.

Air Peace: Abuja – London Heathrow

From 26 October 2025, Air Peace will operate four weekly flights on the Boeing 777. This route complements the existing Lagos–Gatwick service and strengthens the international connectivity of Nigeria’s hub. Fleet update: three Embraer E175 aircraft converted to E195-E2, bringing the total order to 16 aircraft, with 11 still pending delivery.

TAAG : Luanda – Nairobi / Centralisation vols internationaux

À compter du 1er septembre 2025, TAAG lancera la liaison Luanda–Nairobi avec trois vols hebdomadaires. Ensuite, à partir du 15 septembre, tous ses vols internationaux seront transférés vers le nouvel aéroport Dr. António Agostinho Neto (AIAAN), desservant Lisbonne, São Paulo, Johannesburg, Cape Town, Lagos, Windhoek, São Tomé et Maputo.

TAAG: Luanda – Nairobi / Centralization of International Operationsnationaux

Effective 1 September 2025, TAAG will launch the Luanda–Nairobi route with three weekly flights. From 15 September, all international operations will be transferred to the new Dr. António Agostinho Neto International Airport (AIAAN), serving Lisbon, São Paulo, Johannesburg, Cape Town, Lagos, Windhoek, São Tomé, and Maputo.

Fly Gabon : Libreville – Johannesburgnationaux

Le 10 août 2025, Fly Gabon, marque commerciale d’Afrijet, a officiellement lancé sa première liaison directe entre Libreville et Johannesburg, avec deux vols hebdomadaires. Cette expansion s’accompagne de l’arrivée de deux nouveaux avions : un ATR 42-600 pour ses opérations domestiques et un Airbus A320 destiné aux vols internationaux et régionaux.

Fly Gabon: Libreville – Johannesburg

On 10 August 2025, Fly Gabon, the commercial brand of Afrijet, officially inaugurated its first direct service between Libreville and Johannesburg, operating two weekly flights. This expansion is supported by the arrival of two additional aircraft: an ATR 42-600 for domestic operations and an Airbus A320 for regional and international services.

ASKY : Nouakchott via Conakry

ASKY Airlines dessert désormais Nouakchott, via Conakry, avec trois vols hebdomadaires depuis le 2 août 2025, complétant la couverture de toutes les capitales de l’Afrique de l’Ouest. Cette expansion stratégique consolide sa présence régionale et renforce les correspondances pour ses passagers. La compagnie a également pris livraison le 18 mars dernier de son cinquième Boeing 737 MAX 8, immatriculé ET-BBB, portant désormais sa flotte à 15 appareils Boeing.

ASKY: Nouakchott via Conakry

ASKY Airlines now serves Nouakchott via Conakry with three weekly flights, effective 2 August 2025, completing coverage of all West African capitals. This strategic expansion strengthens regional presence and passenger connectivity. The airline also received its fifth Boeing 737 MAX 8 (ET-BBB) on 18 March 2025, bringing the total fleet to 15 aircraft.

Badr Airlines : Port-Soudan – Kigali

Première liaison directe entre le Soudan et le Rwanda, inaugurée le 10 juillet 2025. Sa 9e destination africaine, et la 18e de son réseau global.

Badr Airlines: Port Sudan – Kigali

First direct service between Sudan and Rwanda, inaugurated on 10 July 2025. This marks Badr Airlines’ 9th African destination and 18th worldwide, reinforcing its regional network.

Zambia Airways : Lusaka – Harare

Zambia Airways a officiellement lancé ses vols Lusaka–Harare, opérés trois fois par semaine depuis le 17 juin 2025. Les départs de Lusaka (ZN 303) ont lieu à 06h00 pour une arrivée à Harare à 07h10, tandis que les vols retour (ZN 302) quittent Harare à 07h55 pour arriver à Lusaka à 09h05, les mardis, jeudis et samedis.

Zambia Airways: Lusaka – Harare

Zambia Airways officially launched its Lusaka–Harare service on 17 June 2025, operating three weekly flights. Departures from Lusaka (ZN 303) are at 06:00, arriving in Harare at 07:10, with return flights (ZN 302) leaving Harare at 07:55 and arriving in Lusaka at 09:05 on Tuesdays, Thursdays, and Saturdays.

Ethiopian Airlines : nouvelles routes passagers et cargonationaux

Ethiopian Airlines continue d’élargir son réseau mondial avec le lancement de nouvelles liaisons passagers et cargo en juin et juillet 2025. Addis Ababa est désormais reliée à Porto (Portugal, 02/07, 4 vols/sem., via Madrid), Hanoi (Vietnam, 10/07, 4 vols/sem., via Dhaka), Hyderabad (Inde, 16/06, 3 vols/sem.), Sharjah (ÉAU, 01/06, 4 vols/sem.) et Abu Dhabi (ÉAU, 15/07, quotidien), tandis qu’Urumqi (Chine) rejoint le réseau cargo (30/06, 2 vols/sem.).

Ethiopian Airlines: New Passenger and Cargo Routes

Ethiopian Airlines continues to expand its global network with new passenger and cargo services in June and July 2025. Addis Ababa is now connected to Porto (Portugal, 02/07, 4 weekly flights via Madrid), Hanoi (Vietnam, 10/07, 4 weekly flights via Dhaka), Hyderabad (India, 16/06, 3 weekly flights), Sharjah (UAE, 01/06, 4 weekly flights) and Abu Dhabi (UAE, 15/07, daily), while Urumqi (China) joins the cargo network (30/06, 2 weekly flights).

Royal Air Maroc : nouvelles lignes été 2025

Pour l’été 2025, Royal Air Maroc renforce son réseau avec plus de 6,6 millions de sièges sur 95 destinations, incluant de nouvelles liaisons directes depuis Casablanca vers Zurich (17 sept., 2 vols/sem.), Ndjamena (17 sept., 2 vols/sem.), Île de Sal (18 sept., 2 vols/sem.) et Munich (20 oct., 2 vols/sem.), tout en renforçant sa présence au Royaume Uni avec une nouvelle desserte vers Londres Stansted aux côtés des lignes existantes vers Heathrow et Gatwick.

Le transporteur relancera également ses dessertes « point-à-point » au départ de Marrakech vers Lyon, Toulouse, Nantes et Bordeaux (10–12 oct.) et augmentera les fréquences vers Marseille et Bruxelles.

Royal Air Maroc: Summer 2025 Network Expansion

For summer 2025, Royal Air Maroc is increasing its network capacity to over 6.6 million seats across 95 destinations. New direct flights from Casablanca include Zurich (17 Sept., 2 weekly), N’Djamena (17 Sept., 2 weekly), Sal Island (18 Sept., 2 weekly), and Munich (20 Oct., 2 weekly).

The airline also strengthens its presence in UK with new route to London Stansted alongside Heathrow and Gatwick services. The airline also relaunches “point-topoint” flights from Marrakech to Lyon, Toulouse, Nantes, and Bordeaux (Oct 10–12) and increases frequencies to Marseille and Brussels.

Uganda Airlines : Entebbe – Londres Gatwick

Depuis le 18 mai 2025, Uganda Airlines dessert Entebbe–Londres Gatwick avec quatre vols hebdomadaires en Airbus A330-800neo, sa première liaison vers l’Europe. Cette route stratégique favorise le commerce, le tourisme et les échanges entre l’Ouganda et le Royaume-Uni.

Uganda Airlines: Entebbe – London Gatwick

Since 18 May 2025, Uganda Airlines has been operating four weekly flights between Entebbe and London Gatwick on the Airbus A330-800neo, marking its first route to Europe. This strategic service enhances trade, tourism, and connectivity between Uganda and the UK, positioning the airline as a modern and sustainable African carrier.

Leadership Moves

Nowel Ngala appointed Chief Commercial Officer at Air Peace

In May 2025, Nowel Ngala was appointed Chief Commercial Officer of Air Peace, Nigeria’s largest airline.

With extensive experience across African aviation, the Cameroonian aviation executive oversees all revenue-generating functions, including network planning, sales, marketing, cargo, digital channels, and strategic partnerships.

Previously, Ngala contributed to the growth and profitability of Asky Airlines and served as CCO and board member at TAAG Angola Airlines, leading fleet expansion, network development, and revenue growth.

At Air Peace, he focuses on sustainable growth, operational performance, and strengthening the airline’s domestic, regional, and international presence. His mandate includes driving digital transformation, fostering strategic alliances, and supporting frameworks like SAATM and AfCFTA, positioning Lagos as a key hub for African and global connectivity.

Nomination de Nowel Ngala au poste de Chief Commercial Officer d’Air Peace

Depuis mai dernier, Nowel Ngala occupe la fonction de Chief Commercial Officer d’Air Peace, la plus grande compagnie aérienne du Nigeria. Fort de son expérience dans l’aviation africaine, il supervise désormais toutes les fonctions génératrices de revenus, incluant planification réseau, ventes, marketing, cargo, canaux digitaux et partenariats stratégiques. Ancien CCO d’Asky Airlines et membre du conseil d’administration de TAAG

Angola Airlines, il a contribué au développement du réseau, à l’expansion de flotte et à la croissance des revenus. Chez Air Peace, le Camerounais d’origine se concentre sur la croissance durable, l’optimisation des performances et le renforcement de la présence domestique, régionale et internationale. Il pilote également la transformation digitale et le renforcement des alliances stratégiques, soutenant des initiatives comme le SAATM et l’AfCFTA, positionnant Lagos comme hub africain et international.

Dane Kondić Takes the Helm of LAM’s Restructuring

Since May 2025, Dane Kondić, aviation veteran and former CEO of Air Serbia and euroAtlantic Airways, has been leading the restructuring plan for LAM Mozambique Airlines. Mandated by the government through Knighthood Global, led by James Hogan, Kondić heads the manage-

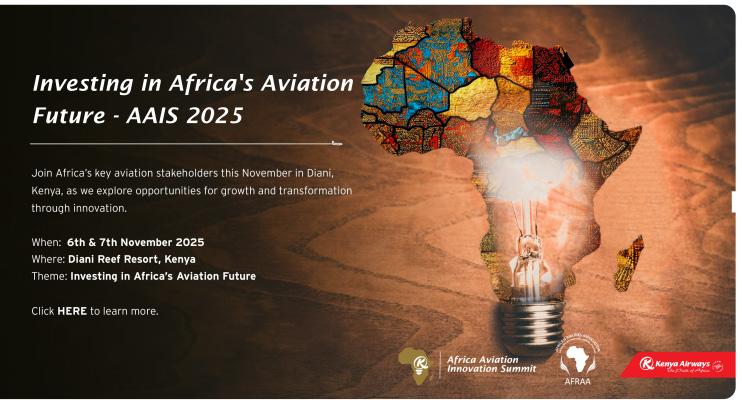

Dane Kondić aux commandes du redressement de LAM