Sherpa Publisher

Summer is a season of vibrant activities, close-knit interactions, and a shared sense of joy. As the days grow longer and the sun shines brighter, our communities come to life with a unique blend of tradition, festivity, and warmth.

From annual fairs and parades to outdoor concerts and farmers’ markets, these gatherings serve as the heartbeat of our communities. As we look forward to these events, offering local bands, homemade food, and artisan crafts, these events are not just for entertainment; they are opportunities for neighbors to reconnect, share stories, and build lasting memories.

Summer also brings economic benefits to our communities. Many of our local businesses thrive as we shop at local stores, dine at family-owned restaurants, and purchase fresh produce from farmers’ markets. This support for our local businesses not only boosts the economy, it fosters a culture of sustainability and self-sufficiency.

Summer is more than just a season; it’s a celebration of life’s simple pleasures and the strengthening bonds between our neighbors. A time when our communities come together – creating memories, share experiences, and embracing the warmth of both the sun and each other’s company.

Offered by: Dolan & Associates, P.C.

Many people believe that if you use a living trust to plan your estate, that it avoids probate and costs less to administer after your death.

While a living trust can provide incredible benefits for you and your family, the unfortunate truth is that many living trust based plans end up failing to avoid probate and result in your family bearing the cost of going through the court probate process, in addition to paying for the trust administration process. The only way to have a living trust that avoids probate and results in a more cost-effective administration is to properly implement that living trust. Proper implementation is also critical to your family realizing the other benefits you may have designed into your estate plan.

If you currently have a living trust, I encourage you to look through the material that was provided to you with your living trust. In almost all cases, there is a letter from the attorney spelling out all of the things you need to do for the living trust to perform the way it was intended. While this letter may protect the attorney, it does very little to help you have a plan that works effectively for you and your family, unless of course you did all the things set out in the letter. This rarely happens. If you walked out of the attorney’s office with documentation and there was not significant activity and follow-up after signing your trust, your plan is in serious danger of failure.

Living trusts require proper implementation and upkeep to perform their intended result. If you are using a living trust to plan your estate, you should understand all of the critical aspects of proper implementation to accomplish its full benefit.

If you have questions, I encourage you to gain more knowledge about available planning options, by visiting www.EstatePlansThatWork.com to sign up for a complimentary educational workshop.

Buying a house is a significant financial decision that requires careful consideration. Asking the right questions about any property you are considering helps you make an informed choice and avoid potential pitfalls:

Why is the house for sale? Understanding the seller’s motivation can give you an edge in negotiations. Are they relocating, downsizing, or facing financial issues?

What is the property’s history? Previous ownership history, any major repairs or renovations, or any unusual (criminal or otherwise) activity helps you understand the house’s condition and any potential issues.

How long has the property been on the market? A house that’s been on the market for a long time might indicate pricing issues or hidden problems and may provide leverage for negotiating a lower price.

What is the neighborhood like? Research the local area to ensure it meets your needs now and in the future. Consider factors such as schools, safety, and amenities, and future development plans for the area because these can have a major impact on a neighborhood and property values.

Are there any major issues with the house? A thorough inspection is crucial. Ask about the foundation, the plumbing and electrical systems, and the condition and age of the roof, gutters, and exterior siding and/or when it was last painted. Knowing these details can save you from costly repairs.

What is included in the sale? Clarify what fi xtures and fittings are part of the sale—appliances, window treatments, lighting fi xtures,

cameras, as well as landscaping décor that isn’t obviously built in, etc.

A good REALTOR® will automatically pull a lot of this information together for you. For proven expertise in establishing your home value and/or searching for a new or existing home, please call Jan at

•

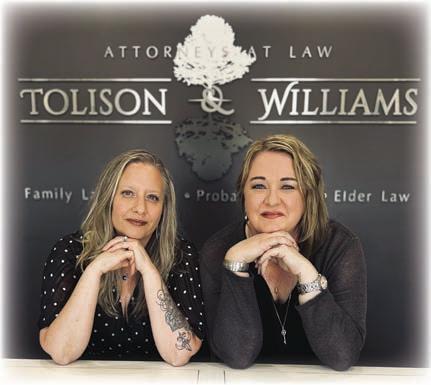

Offered by: Tolison & Williams Attorneys at Law

We have had another busy year and cannot believe it is already time again to reach out to our community! e last year has been fi lled with many professional and personal accomplishments throughout the office, and of course we have also faced some challenges and losses that we have worked to support one another to overcome. Katie and Casey continue to be grateful for and impressed by the talents of their team and are proud of their work that is done in and out of the office.

e last year has been a successful year that included many important milestones. Zack’s daughter graduated from the fifth grade, Sarah’s daughter graduated from kindergarten, Cindy’s granddaughter graduated from high school, Katie’s and Keith’s son Brenden joined AmeriCorps and son Hunter started medical school, and Casey and Taylor had two puppies join their family.

Katie has again been nominated by clients and peers to the Colorado Super Lawyers list- an accomplishment that reflects the dedication and skill exhibited by our entire team.

For the fourth year, we were honored to sponsor and spearhead the Adams and Broomfield Counties Senior Law Day event that was held on June 29, 2024. As an office and on our own time, we were also involved in many other community service projects and are grateful for the opportunities to give back to our work and home communities.

As Brighton and neighboring communities continue to grow, we look forward to serving more clients and participating in the progress and improvement of our once “small town.” We thank Brighton and the surrounding communities for your business, relationships, and support. We wish everyone a safe and fun summer and look forward to continuing to serve this wonderful community!

Hearing Tests - Everyone should have a baseline hearing test conducted by a qualified professional using calibrated equipment. A baseline hearing test can serve as a point of reference in case of accidental hearing loss due to a loud noise such as the explosion of an air bag in an automobile accident. A previous test can also be used for reference to help diagnose other medical problems.

Ear Wax - Ear wax is normal and part of the way the ear cleans and protects itself. Nearly everyone produces wax on a daily basis. Using q-tips disrupts the natural process of how the ear cleans itself. Q-tips often push wax deeper into the canal, and can cause temporary hearing loss from blockages and permanent hearing loss if the ear drum becomes damaged. Cotton swabs should only be used to wipe wax from the exterior part of the ear. Impacted wax can be removed professionally using special instruments, by flushing, or a combination of both. We use a video otoscope to show the patient exactly what we see in the canal.

Hearing Aids - Hearing aids come in many different shapes, sizes and styles. Factors such as hearing loss type and severity, and the size and shape of ear canal limit which hearing aid style will work for each individual. A hearing professional can help determine which type will work for each person. Good hearing aids are programmable and can be adjusted to help improve speech understanding or decrease background noise. Custom hearing aids can be modified or remade to improve comfort. Wearing hearing aids sooner rather than later slows brain shrinkage and decreases the likelihood of dementia.

Hearing Aid Maintenance - Hearing aids require cleaning by the patient as well as professional cleanings to ensure proper performance. Devices

that are cleaned correctly on a regular basis last longer and perform better throughout their life. When a hearing aid malfunctions, some problems can be fi xed in office while others require the device to be shipped to the manufacturer.

Hearing Protection - Some causes of hearing loss are not preventable. However, most noise-induced hearing loss could have been prevented. Such losses occur from either long-term exposure to sound above a certain loudness level, such as machinery, or from short-term exposure to very loud sounds, such as firearms. Hearing protection should be worn to reduce the likelihood of hearing loss. Soft foam plugs offer some protection. Muffs provide more protection. Combining the two increases the protection level. Custom ear plugs, in solid, fi ltered, or electronic formats, increase comfort and decibel reduction in many different situations.

Hearing Safety - While individuals should take steps to protect their hearing in noisy situations, it is important to be respectful and careful with the hearing of others. Many people have lost hearing as the result of someone else’s thoughtless actions. One woman lost hearing after someone jokingly used a hammer to pound on a metal pipe she was holding on her shoulder. Another was permanently made deaf in one ear when a coworker threw a firecracker in the cab of his truck. Recently, I was contacted regarding a young man after someone popped a balloon right next to his ear. His eardrum ruptured and he had hearing loss and tinnitus as a result. It may seem funny to make a loud noise to scare someone, but it could lead to permanent life-long hearing loss and tinnitus. Be smart this Independence Day Season!

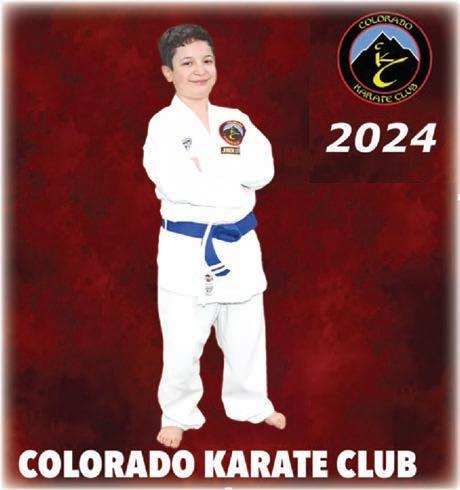

Leo arrived in the United States and joined Karate about two and a half years ago. Being a Beginner Karate student is hard enough for anyone. It’s something brand new, feels a bit awkward to your body, and you have no idea what’s going on. It was even harder for Leo. He could neither speak, nor understand English.

It was hard for Leo everywhere, especially at school. Because he was unable to communicate, he quickly became the target of bullies. is made Leo very sad and he often came to Karate class feeling down. As Instructors, we tried our best to help Leo as much as we could (although it was very difficult for a few of us that know little Spanish). e language we could all speak and that is universal, is the language of love and caring.

It took some time, but little by little, Leo’s vocabulary and confidence began to grow. Leo started to smile. Turns out, he was and is a very happy, sweet, and caring boy. It just took a little bit of extra care and effort from everyone around him to trust that Karate was a safe place.

Today, Leo is now a Purple Belt and an active member of our Leadership Team, helping both English and Spanish speaking students alike. He often bridges the gap of communication between Sensei Kyra and students that are just learning English, working alongside them making sure that they, too, understand that they are in a safe place to learn and grow.

ank you Leo! We love you!

Sensei Kyra Arnold - Colorado Karate Club

Tim Roberts - Edward Jones

5.40 5.35 5.05 6-Month 1-Year

2-Year

or visit your local financial advisor today

Tim Roberts, CRPC™ Financial Advisor

129 S 4th Avenue

Brighton, CO 80601

303-659-2301

*Annual Percentage Yield (APY) effective 06/17/24. CDs offered by Edward Jones are bank-issued and FDIC-insured up to $250,000 (principal and interest accrued but not yet paid) per depositor, per insured depository institution, for each account ownership category. Please visit www.fdic.gov or contact your financial advisor for additional information. Subject to availability and price change. CD values are subject to interest rate risk such that when interest rates rise, the prices of CDs can decrease. If CDs are sold prior to maturity, the investor can lose principal value. FDIC insurance does not cover losses in market value. Early withdrawal may not be permitted. Yields quoted are net of all commissions. CDs require the distribution of interest and do not allow interest to compound. CDs offered through Edward Jones are issued by banks and thrifts nationwide. All CDs sold by Edward Jones are registered with the Depository Trust Corp. (DTC).

By the time you reach retirement age, you may have accumulated a 401(k), IRA and other investment accounts, along with insurance policies and physical properties. You’ll use some of these assets to support your retirement, but the rest may end up in your estate — which is why an estate plan is so important.So, to leave a legacy for your family and those philanthropic groups you support, you need a comprehensive estate plan — and you need to avoid making mistakes. Here are some of the most common ones:

• Procrastinating – Estate planning, and its implications about our mortality, may not be a pleasant topic to think about. Yet, putting off your estate plans can be risky. If you were to pass away or become incapacitated without doing any estate planning, the results could be costly for your loved ones. One possible consequence: If you haven’t at least created a basic, simple will, the courts could decide how to divide and distribute your assets, and they may do so in a way you wouldn’t want.

• Not updating wills and other documents – Drafting a will and other legal documents, such as a living trust, is an important step in your estate planning. But you shouldn’t just create these arrangements and forget about them. Changes in your life and among your loved ones — deaths, divorce, remarriage, new children and more — may result in the need for you to update your estate plans, so it’s a good idea to review them periodically.

• Not updating beneficiaries – Similar to updating your will to reflect changes in your life and family situation, you may also need to update the beneficiaries listed on your financial accounts and insurance policies. ese designations carry a lot of weight and can even supersede instructions in your will, so you’ll need to make sure they are current and accurate.

• Not properly titling assets in a trust – Depending on your situation, you may benefit from establishing a living trust, which may allow your estate to avoid the time-consuming and expensive process of probate. A living trust also helps give you control over how, and when, you want your assets distributed. However, you need to retitle your assets in the name of the trust for the trust to be effective.

• Not choosing the right executor – An executor carries out your wishes based on the instructions you’ve given in your will or trust documents. But fulfi lling an executor’s duties is not as simple as, say, following a recipe for a basic meal. Consequently, while you might just want to pick a close family member as executor, you need to be sure this person is competent, good with details and won’t be overwhelmed by the financial and legal issues involved in settling an estate. If your initial choice doesn’t have these skills, you may need to find a responsible person outside the family.

Finally, here’s one more mistake: going it alone. Estate planning is not a do-it-yourself activity. To help ensure your estate plan addresses all the issues involved, you’ll need to work with a legal advisor, and possibly your tax and financial professionals, too.

Devoting the necessary time and effort can help you avoid many of the mistakes that threaten the effectiveness of estate plans — and the fewer mistakes you make, the better off your beneficiaries can be.

I’d like to raise awareness of anticipated changes for 2025 with all Medicare Part D prescription drug plans. The Inflation Reduction Act that was signed into law August 16, 2022, has gradually adjusted the Part D program since January 2023. It will be fully implemented January 1, 2025.

Although the Inflation Reduction Act was an attempt to lower the cost of prescription drugs, it shifts financial burden from Medicare onto the PBMs (Pharmacy Benefit Managers who manage the drug plans) and manufacturers. This transfer of cost will negatively affect all Medicare Part D drug plans going forward.

What we expect:

*Higher premiums (particularly with standalone drug plans) *Fewer plan choices *More restrictive formularies *More drug utilization management *Reduction of some benefits in Medicare Advantage plans More so than any other year, it is imperative that Medicare eligible individuals prepare early for the annual enrollment period October 15th through December 7th. Although agents are forbidden to talk about plan specifics before October 1, 2024, we can accomplish several things prior to October 1.

*Updated drug list *Updated doctor list *Decide which plan benefits are important to you (Medicare Advantage clients) *Complete the required Scope of Appointment (required for everyone) *If you are on a standalone PDP, decide the maximum monthly premium you can afford Some of you, due to the anticipated increase in premiums of standalone prescription drug plans (those of you on Medicare Supplements with a standalone prescription drug plan), may want to compare your current health plan with a Medicare Advantage option. Although this will not be plan specific, we can discuss the difference between your options so that you can make the best choice for you when the time comes.

Please reach out to get on our calendar if you’d like. As always, our services are at no charge, so prepare early to get assistance if needed. Want to come find out more? Come learn about other changes including options that will allow you to pay over time for your medications on Medicare Part D plans.

I am hosting a presentation at the Eagle View Adult Center on July 10 if that works for you, please call 303-887-8584 to RSVP or scan the QR code on the adjacent Ad to sign up.

Jennifer Bell Insurance Agent

LegalShield Independent Assoc. 720.665.6015

Jen@JenniferBellBenefits.com www.JenniferBellBenefits.com

Acommon misconception is that Medicare will cover long term care needs. Unfortunately, Medicare is only designed to cover what is known as Acute Recovery Care. is means that you’re receiving care from a skilled care provider and showing signs of improvement. Or, in other words, you’re getting better. While Medicare will cover your recovery care after and injury or illness, they will not cover care that extends into Long Term Care needs.

Long Term Care, or Custodial Care, is the type of care you receive when you need assistance with things like going to the bathroom, getting dressed, eating, getting from the bed to the chair, etc. ese are called Activities of Daily Living. As you can probably see, the Custodial Care activities are not things that need to be supervised by a RN. A lot of times you will have a trained caregiver or a family member helping with these types of activities.

Many people like to plan for these services. ey try to find ways to pay for these services without wiping out their life savings. Lately I have been working with a lot of my clients to find ways to help prepare for a Long Term Care need.

ere isn’t just one solution for everyone. As you know with the rest of life, we are all unique and we all have different circumstances. Because of that, it’s good to determine how a Long Term Care event will affect you and your family. is helps you plan how you will deal with something like this.

Sometimes it’s helpful to have a third party who has had experience and training in planning for this type of care involved in the conversation. I am always happy to help in a nonintrusive way. Please don’t hesitate to reach out. I can help. Call or text to schedule a time to chat.

With the increase in popularity of Brazilian Jiu Jitsu and Mixed Martial Arts, some with dubious credentials have sought to cash in by opening their own gyms. At Zingano Brazilian Jiu Jitsu, we believe that outstanding results come only from an outstanding training program taught by dedicated, qualified instructors.

July and August Summer Special 40% Off Any Service

July 27th and August 17th, 8pm in Wellyssa’s beautiful garden. Come find a seat ‘round the fire watching the sun set, as we discuss various topics on energy healing, what it is and how it works, what is past life regression and soul retrieval, etc.

Maybe you’ve been curious about all this, have heard about it, but you have no idea what it really is, or if it would benefit you?

Come and ask some questions. is will be a friendly and informal conversation.

is event is FREE. Light beverages will be provided, or bring your own.

RSVP for address in Todd Creek.

Selling your home can be both an exciting and complex process, especially when considering the tax implications. Understanding the available tax deductions and credits can help you maximize your financial benefits.

When you sell your primary residence, the IRS allows you to exclude up to $250,000 of the gain from your income ($500,000 for married couples fi ling jointly), provided you meet the ownership and use tests. is means you must have owned and lived in the home for at least two of the five years before the sale.

Several tax deductions can also reduce your taxable gain. ese include:

1. Selling Costs: Expenses directly related to selling the home, such as real estate commissions, legal fees, and advertising costs, can be deducted from your gain.

2. Home Improvements: Significant improvements that add value to your home, prolong its useful life, or adapt it to new uses can be added to your home’s cost basis, thus reducing your taxable gain. Keep detailed records of these improvements.

3. Mortgage Interest and Property Taxes: If you itemize deductions, you can still deduct mortgage interest and property taxes for the portion of the year you owned the home.

Additionally, if you took out a home equity loan and used the proceeds to improve your home, the interest on that loan may also be deductible.

To maximize these benefits, it’s crucial to maintain accurate records of all transactions, including receipts and contracts. Consulting with a tax

can provide personalized guidance and ensure you’re taking

advantage of available deductions and credits. Ready

and want

•

•

Summer is here! at means cook outs, trips to the park, and, of course, pools and the beach on your summer vacation!

While swimming pools are a great place on a hot summer day, they can be very dangerous for children if left unattended.

e National Safety Council reports that drowning accidents are a significant cause of death or injury for children under five from being left unsupervised. is can include community or neighborhood facilities, private or backyard pools, lakes, water parks, and the beach. Even bathtubs, toilets, and buckets of water can pose a risk to very young chlldren if left unattended. All it takes is a moment of distractions.

So, what can you do to keep your kids safe and have fun? Here are some safety tips:

l. Never leave your child alone. If you need to step away, bring your child with you.

2. Enroll your child in swim lessons. ey should learn skllls like floating, rolling to their back, and swimming to the sides of the pool. However, keep in mind that even “good swimmers” can drown too, especially if they are tired or there is rough play.

3. Lifeguards are not babysitters.

4. Teach children to stay away from drains.

5. Do not swim alone, and especially not at night.

6. Do not consume alcohol when operating a boat, and make sure everyone has a well-fitting life jacket.

7. Do not dive into unfamiliar or murky water where you cannot see the bottom.

8. Get trained In CPR! Please

The purpose of the Advisory Board is to advise and assist in the needs and operations of Eagle View. The Board meets Tues. July 16 at 1:00 p.m. Members are: Dave Thomas, Peggy Jarrett, Lou Ellen Bromley, Dan Buckner, Olly Ramirez, Steve Yarish, Bill Alsdorf, Heidi Storz, Judy Schissler, Gayle Shibao, Barbara Spakoski, and Randy Thornton. Visitors are welcome.

Together we can continue to enhance the great programs and services offered for seniors and active adults in the Brighton area. Your financial support will be recognized on the donor wall at Eagle View. All donations are tax deductible. Make donations payable to: Brighton United Senior Citizens, 1150 Prairie Center Parkway, Brighton, CO 80601.

Donor Opportunities for Wall Recognition: Friend: $100 - $499

Memorial: $100+

Sponsor: $500 - $999

Benefactor: $1000+

Do you need help and are unsure where to turn? Evon Benitez will assist you with completing forms and finding needed services. You’ll need to make an appointment to see Evon as she’s often meeting with others. To make an appointment, call Evon at 303-6552079. Leave a message.

Walk On!

Explore trails in the Brighton area! First day meet in the EVAC Lobby; after that we will meet at selected locations in Adams County. Wear layered clothing, good walking shoes, and bring water. Leader: Chris Howell.

Wednesdays - 8:00 a.m.

July 3, 10, 17, 31

$4 (4 wks)

Deadline: Ongoing

Tremendous Tomatoes

Would you like to discover expert tips and tricks for successfully growing tomatoes this year and beyond? Join us to learn from a Colorado Master Gardener about the remarkable “love apple” and how you can achieve thriving results in Colorado’s unique climate for this beloved garden favorite.

Tues. July 9 - 1:30 p.m.

Free

Deadline: Fri. July 5

Duplicate Bridge

The object of duplicate is for a team of two to play all other teams using pre-determined four-hand boards. You and your partner are competing against all other partners to bid and win the best hand on each board. Instruction

1150 Prairie Center Parkway, Brighton, CO 80601 303-655-2075 I evacinfo@brightonco.gov www.brightonco.gov

Hours: Monday - Friday 8:00 a.m. - 2:00 p.m.

A hot, nutritious lunch is provided by Volunteers of America, Mondays and Thursdays at 11:30 a.m. Please reserve your meal in advance. For Mondays, reserve the Thursday before; for Thursdays, reserve the Monday before. Call Eleanor at 303-655-2271 between 10:00 a.m. - 2:00 p.m. Mon. & Thurs. to make a reservation.

Daily meal donations are appreciated.

$2.50 Donation per meal if age 60+

$8.50 Mandatory charge if under 60

Basic medical equipment is available to loan out. Items may include wheelchairs, front wheel and seated walkers, canes, crutches, toilet seat risers, commodes, and bath benches. There is no guarantee what will be available at any time. Call 303-655-2075 for information.

The Clinic focuses on health promotion and disease prevention for seniors 55+. Operated by Visiting Nurses Association (VNA), services include foot care, health checks, and blood pressure checks. The fee for foot care is $40 payable at the time of your appointment. Foot care may be Kaiser covered with pre-approval. Reduced fee available upon approval. Masks required for everyone. Call 303-655-2075 for appointment. Clinic hours: 9:00 a.m. - 2:30 p.m.

Friday: July 5, 12, 19, Aug 2, 9, 16 Mondays: July 29, Aug 26

on playing duplicate and scoring will be reviewed and discussed each session. You MUST have a partner to play Duplicate Bridge and should use the same partner for this two-day challenge. Tell us your partner at registration.

Facilitator: Bobbi Jo Unruh.

Wed. July 10 & 17 - 11:30 a.m. - 3:30 p.m.

$10 (2 wks)

Deadline: Mon. July 8

July’s book is The Last Flight by Julie Clark. Please have the book read before the meeting so you are prepared for group discussion. Books can be found at a library, Amazon, or book store. Facilitated by Gayle Wudarczyk.

Wed. July 10 - 1:00 p.m.

Free

Deadline: Mon. July 8

The Inflation Reduction Act signed in 2022 has gradually adjusted the Part D program and will be fully implemented in January of 2025. Come learn about some changes and what to look for going forward. Part of what will be discussed is the new payment plan. Presented by Lisa Asmussen.

Wed. July 10 - 1:30 p.m.

Free

Deadline: Mon. July 8

Need help with your laptop, tablet, or smartphone? We will do our best to help you become more comfortable using your device. Schedule an appointment with Calvin at 303-655-2187.

Feel great with a massage by our certified therapist, Laurie Lozano Maier. She has over 12 years of massage therapy experience. Call 303-655-2075 to make a onehour appointment. Pay Laurie at the time of service - check or cash.

Tuesdays and Wednesdays $60 for 1 hour

Deadline: Two days ahead

Via Mobility - provides specialized transportation within the City of Brighton. Via can take you to medical appointments, grocery shopping, and Eagle View, to name just a few of the places you can go in Brighton. New Via users - call 303-447-2848 ext. 1014 to get started. To schedule rides, call 303-447-9636. Free rides to and from Eagle View to seniors living in the Brighton Via service area are provided by funding from the Senior Advisory Board.

This is an RTD service. Call 303-994-3549 for reservations. The driver will pick up and deliver you anywhere within Brighton, Mon - Fri. 6:00 a.m.7:00 p.m. Cost is the local RTD bus fare.

Dive deep into the world of fraud prevention with 10 action items that will help you avoid being the next victim of a scam or fraudulent business practice.

Facilitated by AARP ElderWatch.

Thurs. July 11 - 1:30 p.m.

Free

Deadline: Tues. July 9

The firefighters from the Brighton Fire Department will perform FREE blood pressure checks for one hour. Stop by! Fri. July 12 @ 10:30 a.m.

EVAC & Zoom

An experienced estate planning attorney will discuss the potential consequences of giving your assets to your children during your lifetime, as well as alternatives that may help avoid tax consequences and family disputes. Facilitated by Dolan & Associates.

Thurs. July 18 - 1:30 p.m.

Free

Deadline: Tues. July 16

Note: Not all offerings are listed here. Please visit www.brightonco.gov for a complete listing.

Provided by T. Lloyd Worth, Worth Wealth Management

Are you in the phase of life where you are closer to retirement than to the start of your career? If so, now is a great time to begin planning for life after work with your spouse or partner, including your mutual hopes, dreams and financial goals. Here are a few questions to ask to help you both get the retirement you want:

1. When do you both want to retire? Do you want to do it at the same time or does one of you want to keep working a bit longer? Factors like your respective ages, levels of career satisfaction, pension eligibility and Social Security claiming options can all affect your retirement timeline. Knowing when you plan to stop working will influence other financial preparations. Discuss your hopes and intentions openly with each other. If your preferred retirement ages differ significantly, look for compromise.

2. Where would you like to retire? You may be perfectly happy in your current home and neighborhood, or you may have a desire to move to a completely different location (such as a beach or maybe somewhere international). Also, do you want or need to be closer to children or other relatives? If you’re considering relocation, visit the area to get a sense of what living there will be like. In addition, research the tax implications as well as the trade-offs between renting and buying a home.

3. What does your future lifestyle look like? Now is the time to discuss things like how much travel you both want to do, hobbies that you want to begin (that may require a financial investment) and how much financial support you want to offer to grandchildren or other family members.

4. When will you start taking Social Security? You get your full retirement benefit when you reach full retirement age (67 for people born in 1960 and later). You can claim as early as age 62, but your monthly payment will be reduced by as much as 30%. If you wait past 67, you’ll get an additional 8% for each year you delay until you turn 70. Consider your age difference, health, life expectancy, income needs and more as you determine each of your best ages to claim Social Security.

5. How will you manage healthcare costs? Honestly evaluate your current states of health and family histories and discuss how you’ll save and budget for medical expenses, both planned and unplanned. Talk about steps you can take now to potentially reduce future health care costs, like focusing on diet, fitness and preventative care. And take time to understand what your options will be when you turn 65 and become eligible for Medicare — what it does and doesn’t cover, and whether a supplemental plan will make sense.

Informational Sources: Investopedia: “Retirement: The Best Timing Strategies For Couples”(January 24, 2024; https://www. investopedia.com/articles/retirement/09/retire-couple-together.asp); Northwestern Mutual: “The Conversations Couples Should Have Before Retirement”(January 26, 2024; https://tinyurl.com/4xt6bx6r).

This information is not intended as authoritative guidance or tax or legal advice. You should consult with your attorney or tax advisor for guidance on your specific situation. LPL Financial and its advisors are only offering educational

by: Scott and Lora Nordby, Berkshire Hathaway HomeServices Colorado Real Estate

Whenyou take out a conventional mortgage loan (not insured by the U.S. government), with a down payment of less than 20%, your lender will require that you pay monthly private mortgage insurance (PMI) which protects the lender in case you default.

PMI costs can vary between 0.58% and 1.86% of the mortgage amount. According to Nerdwallet’s PMI calculator, if you buy a home for $350,000, put down $35,000 or 10% with a 6% interest rate on a 30-year note, and with a credit score of 620 to 639, you’ll pay 1.50% PMI, or $394 per month. It’ll take 7.40 years for your loan balance to get to 80% loan to value (LTV). e earliest you can get a PMI cancellation is two years of ownership and an LTV of 75%. You can ask your lender to remove PMI when your loan balance reaches 80% LTV. At 78%, PMI should be canceled automatically, but there are steps you can take to get it canceled more quickly.

1. Make extra payments to reduce the principal.

2. Make payments on time—no late payments in the previous 12 months, no 60-day late payments in the previous 24 months.

3. Don’t have any other liens on the property, including a second mortgage.

4. Show proof of value with a professional appraisal or broker price opinion.

5. Make improvements to the home that add value.

6. Refinance the mortgage and get a home equity line of credit to pay off the PMI.

Your Berkshire Hathaway HomeServices Colorado Real Estate Forever Agent SM is always here to help with your real estate needs and questions. Call us at 303-905-8850 or visit BHHScore.com

August 16, 2024 5:30 pm – 9:00 pm

All proceeds will benefit the Platte Valley Hospital Foundation’s campaign for Women’s Health Services.

Individual Tickets $75

To purchase tickets or learn more about sponsorship opportunities, please scan below: