ARSENAL AND AIRWALLEX, HAVE TODAY ANNOUNCED A MULTI-YEAR PARTNERSHIP THAT WILL SEE THE LEADING GLOBAL PAYMENTS AND FINANCIAL SERVICES

PLATFORM BECOME THE CLUB’S OFFICIAL FINANCE SOFTWARE PARTNER.

Airwallex will also be the club’s Presenting Partner for the Men’s pre-season tour across eastern Asia, with Airwallex services being used across the tour and the two working together in the longer term to improve Arsenal’s payment gateway services and in other areas.

Airwallex retain the right

to use Arsenal’s Men’s and Women’s first team branding and deliver exclusive and engaging content for supporters during games at Emirates Stadium across the Premier League and Women’s Super League (WSL) fixtures.

Juliet Slot, Chief Commercial Officer at Arsenal FC, said: “We’re delighted to welcome Airwallex as our new partner, and we’re excited to introduce them to our global family of Gooners on our Men’s tour to Singapore and Hong Kong. We look forward to working together over the coming years to drive efficiencies across our commercial operations. Our

partners are an important part of the Arsenal family, fuelling our growth and supporting the investment that will bring us sustained success.”

Jack Zhang, Co-Founder and CEO of Airwallex, added: “Partnering with Arsenal is a proud moment for Airwallex. We are building the future of global banking, and that means working with brands and businesses that are committed to global reach, excellence and innovation - all attributes that are deeply embedded at Arsenal.

Find out more

WAGEPOINT, A LEADING PROVIDER OF PAYROLL AND HR SOFTWARE FOR SMALL BUSINESSES

ACROSS CANADA, TODAY ANNOUNCED THE APPOINTMENT OF BEN RICHMOND AS PRESIDENT AND CHIEF EXECUTIVE OFFICER, EFFECTIVE AUGUST 18, 2025. RICHMOND WILL ALSO JOIN THE COMPANY'S BOARD OF DIRECTORS AND WILL REPORT TO THE BOARD.

Ben Richmond brings over 15 years of leadership expe-

rience in global fintech and SaaS, with a strong focus on serving small and medium-sized businesses. Most recently, he was the Managing Director for North America at Xero, where he was responsible for driving growth and operations across the U.S. and Canadian markets, and served as a member of the company's global executive leadership team.

Originally from New Zealand, Richmond joined Xero in 2013 and held roles spanning sales, growth and market expansion across New

Zealand and the Americas. He began his career in public accounting and served as Senior Group Accountant at Spark New Zealand. Richmond also served as a trustee for the Spark Foundation, a charitable organization supporting digital equity in New Zealand. He is a Chartered Accountant and holds a Bachelor of Commerce degree in Accounting, Finance, and Information Systems from the University of Canterbury.

Keep reading

WE’RE ALWAYS FOCUSED ON MAKING YOUR FINANCIAL MANAGEMENT SIMPLER, MORE SECURE, AND MORE POWERFUL WITH XERO. SO WE’RE EXCITED TO SHARE NEWS OF OUR COLLABORATION IN THE US WITH PLAID, A LEADING FINTECH COMPANY. THIS EFFORT SIGNIFICANTLY IMPROVES HOW YOUR BUSINESS BANK ACCOUNTS CONNECT WITH XERO.

Our goal is to help you save valuable time and gain a clearer view of your money. The collaboration with Plaid is a major step forward in delivering on that objective. Why

This partnership offers several key benefits for your business or practice:

• More high-quality connections. You’ll soon be able to choose from among triple the number of high-quality bank feeds, with over a thousand new direct connections becoming available. This means more reliable links to a wide range of financial institutions, including many smaller banks and credit unions across the US.

• Enhanced data accuracy and insights. In the US, Plaid will power a substantial portion of the Xero bank feeds that busi-

nesses use over the next 12 months. More dependable connections to your financial data ensures greater accuracy and data quality, and having reliable data is crucial for confident decision-making and understanding your cash flow.

• Stronger security. A key focus for us is transitioning to more secure and reliable direct bank feeds using OAuth, the industry standard for access authorization. OAuth connections use secure tokens built directly with bank systems, offering a major step up from older methods.

KLOUD CONNECT, THE CLOUD-BASED PRACTICE MANAGEMENT PLATFORM BUILT FOR MID-TO-LARGE ACCOUNTING FIRMS, HAS ANNOUNCED ITS INTEGRATION WITH XERO, ONE OF AUSTRALIA’S LEADING ACCOUNTING SOFTWARE PROVIDERS. KLOUD CONNECT’S SERVICE ENHANCES PRACTICE EFFICIENCY, DATA ACCURACY, AND OPERATIONAL TRANSPARENCY, MAKING IT EASIER FOR FIRMS TO TRACK

XU BIWEEKLY - No. 110

Newsdesk:

If you have any news or updates that you would like us to consider for inclusion in the next edition of the XU Biweekly, please email us at: newsdesk@xumagazine.com

CEO: David Hassall

Managing Editor: Wesley Cornell

Chief Revenue Officer: Alex Newson

Account & Partnership Assistant: Robyn Consterdine

Creative Assistant: Victoria Young

Advertising: advertising@xumagazine.com

www.xumagazine.com

‘Xero’ is a trademark of Xero Limited (New Zealand). XU Biweekly and XU Magazine is collaboratively produced by an independent group of Xero users and is not affiliated in any way with Xero. All other trademarks are the property of their respective owners.

© XU Magazine Ltd 2014-2025. All rights reserved. No part of this publication may be used or reproduced without the written permission of the publisher.

XU Biweekly is published by XU Magazine Ltd (08811842), registered in England and Wales. Registered office: Office 1, Brunswick House, Brunswick Way, Liverpool, L3 4BN, United Kingdom. All information contained in this publication is for information only and is, as far as we are aware, correct at the time of going to press. XU Magazine Ltd cannot accept any responsibility for errors or inaccuracies in such information.

If you submit unsolicited material to us, you automatically grant XU Magazine Ltd a licence to publish your submission in whole or in part in all/any editions, including in any physical or digital format, throughout the world. Any material you submit is sent at your risk and, although every care is taken, neither XU Magazine Ltd nor its employees, agents or subcontractors shall be liable for loss or damage. The views expressed in this publication are not necessarily the views of XU Magazine Ltd, its editors or its contributors.

CLIENT WORKFLOWS, MANAGE STAFF CAPACITY AND PROCESS SOPHISTICATED BILLING AND WIP. ALL WHILE USING XERO’S TRUSTED COMPLIANCE AND ACCOUNTING PRODUCTS.

This integration is designed to meet the needs of progressive, multi-partner / entity accounting firms, providing a single source of truth for client data while eliminating duplicate records, manual workarounds,

and fragmented workflows.

Key Benefits of the Kloud Connect + Xero Integration

• One Source of Truth Firms can now maintain accurate, centralised client records across their ecosystem and between Kloud Connect and Xero, reducing duplicate entries and ensuring consistency across systems.

Keep reading

WE ARE EXCITED TO LAUNCH MAJOR NEW FUNCTIONALITY FOR EXTRACTING DATA FROM PDF SUPPLIER STATEMENTS AND HANDWRITTEN SALES LEDGERS. THIS UPDATE INTRODUCES DEDICATED MODULES FOR SUPPLIER STATEMENTS AND SALES LEDGERS, GIVING YOU MORE CONTROL OVER RECONCILIATION AND SIGNIFICANTLY STREAMLINING YOUR BOOKKEEPING WORKFLOW.

CHASER, THE GLOBAL LEADER IN ACCOUNTS RECEIVABLE AUTOMATION, HAS LAUNCHED NEW FEATURES ENABLING BUSINESSES TO AUTOMATICALLY ENFORCE PAYMENT TERMS THROUGH THE APPLICATION OF AUTOMATED LATE FEES AND EARLY PAYMENT DISCOUNTS—POWERFUL NEW TOOLS THAT HELP BUSINESSES GET PAID ON TIME BY ENFORCING PAYMENT TERMS AUTOMATICALLY. THESE TOOLS ARE DESIGNED TO IMPROVE CASH FLOW, REDUCE OVERDUE INVOICES, AND EASE THE MANUAL WORKLOAD OF FINANCE TEAMS.

Late payments are a major challenge for businesses globally, disrupting cash flow and hindering growth.

Research shows that 87% of businesses have invoices paid past their due date, with 35% settled over 30 days late. This not only affects financial stability but also requires an average of 14 hours per week for credit management. Additionally, the typical small or midsize business in North America is owed $300,000 in late payments.

Chaser's latest features tackle these issues by automating the application of late fees to overdue invoices and empowering users to offer their debtors discounts for early payments. This automation encourages timely payments, helps recover costs associated with late settlements, and reduces the administrative workload for finance teams. With the introduction of automated

late fees and early payment discounts, Chaser users can now:

• Encourage on-time payments – Reduce overdue invoices by applying late fees automatically and offering incentives for early settlement.

• Recover costs from late payers – Offset the financial impact of overdue invoices with automated late fees, ensuring businesses are compensated by their debtors for delays.

• Reduce manual admin –Eliminate the need for finance teams to manually calculate and apply fees or discounts, freeing up time for strategic tasks.

Find out more

New Features

New Dedicated Modules for Supplier Statements and Sales Ledgers

Previously, processing supplier statements or sales ledgers was a rigid process. You had to choose between extracting a simple grid or automatically creating an invoice for every single line, offering little flexibility for reconciliation within Receipt Bot.

We’ve completely over-

hauled this process by introducing dedicated Supplier Statement and Sales Ledger modules. Now, when you upload a statement, Receipt Bot extracts the data into an interactive digital grid. You can review transactions line by line and choose to link a transaction to an existing purchase/sale document, or create missing invoices/ credit notes directly from the supplier statement.

BGL CORPORATE SOLUTIONS (BGL), AUSTRALIA'S LEADING PROVIDER OF COMPANY COMPLIANCE, SELF-MANAGED SUPERANNUATION FUND (SMSF), INVESTMENT MANAGEMENT, IDENTITY VERIFICATION AND AI-POWERED PAPER-TO-DATA SOFTWARE SOLUTIONS, PROUDLY SHOWCASED ITS AI-DRIVEN SMSF INNOVATIONS AT THE AWS SUMMIT SYDNEY IN MAY 2025 — ONE OF THE PREMIER CLOUD TECHNOLOGY EVENTS.

As a recognised innovator, BGL was invited to present its advancements in artificial intelligence and machine learning, demonstrating how scalable, cloud-based AI is transforming SMSF admin-

istration and compliance. James Luo, BGL’s Head of Data & AI, represented the business, delivering an engaging and insightful presentation to an audience of over 500 attendees.

During the session, James explored how BGL’s AI-powered solutions simplify complex workflows, automate document processing and empower accounting professionals to deliver faster, more accurate data to their clients. The presentation drew strong interest from the audience, with many staying afterwards to learn more about the people and technology behind BGL’s success.

Find out more

WE’VE JUST LAUNCHED A ROUND OF NEW FEATURES IN NEW EXPENSIFY TO MAKE RECEIPT MANAGEMENT EVEN FASTER, SO YOU CAN SPEND LESS TIME UPLOADING AND MORE TIME GETTING THINGS DONE.

Upload receipts with ease

Say goodbye to clunky uploads and repetitive tasks. These updates make scanning and submitting receipts smarter than ever.

Drag and drop to upload

Got a desktop folder full of

receipts? Just drag and drop them into Expensify and we’ll auto-scan the details and attach them instantly.

Scan multiple receipts at once

Snap back-to-back photos of your receipts and we’ll automatically scan each one –no extra taps required.

Text receipts to 47777

Take a photo of a receipt and text it to 47777 (US numbers only). Expensify will match it to the correct card expense like magic.

Find out more

ARE YOU A XERO DEVELOPER WITH AN AMAZING APP, BUT FIND YOURSELF SCRATCHING YOUR HEAD WHEN IT COMES TO MARKETING IT EFFECTIVELY ON THE XERO APP STORE? YOU’RE NOT ALONE! WE’VE NOTICED THAT MANY FANTASTIC APPS AREN’T ALWAYS GETTING THE VISIBILITY AND CONVERSIONS THEY DESERVE, SIMPLY BECAUSE THEIR LISTINGS AREN’T OPTIMIZED TO THEIR FULL POTENTIAL.

That’s why we’re thrilled to announce the launch of a new AI prompt designed specifically to help Xero developers like you craft high-converting app listings on the Xero App Store.

Why We Created This AI Prompt

Our goal is simple: to help you drive more conversions for your app. We hypothesized that by providing a structured AI prompt, developers could generate much-improved app listings. The results? Our tests

WE’RE EXCITED TO INTRODUCE DEFERRED REVENUE AND PREPAYMENTS, TWO NEW PRODUCTS BUILT TO AUTOMATE THE CREATION AND RECOGNITION OF YOUR DEFERRED REVENUE AND PREPAYMENT SCHEDULES.

Following the success of our multi-entity product suite, Recharger, Balancer, BRAG, and HQ, this launch marks the first in a new wave of Mayday products designed to tackle universal month-end headaches for all finance teams.

Why did we build Deferred Revenue and Prepayments?

Right now, cost and revenue journals are an absurd combination of manual identification, logging, calculation, and posting. Finance teams waste hours every month:

• Manually reviewing all

transactions at month end

• Logging each transaction in a spreadsheet and calculating the prepayment or deferred revenue release

• Manually posting the relevant journal to their accounting system

• Repeating this for every single transaction

Software can and should do more. And now, with Mayday’s new products, it can.

How do these new products work?

Within our new Recogniser module, Prepayments and Deferred Revenue automate every step of this tedious process, reducing your workflow from hours to minutes.

Find out more

show it works! Developers who used the prompt saw a measurable increase in their app’s conversion rates compared to typical benchmarks.

We know you’re brilliant at building powerful extensions for Xero. Now, with the help of AI, you can be just as brilliant at marketing them. This prompt acts as your personal marketing assistant, guiding you to create compelling copy that truly resonates with potential users.

What the AI Prompt Helps You Achieve

This AI prompt isn’t just about generating text; it’s about guiding you to create a listing that adheres to Xero’s best practices and stands out. Here’s a look at the key elements it covers:

• Xero’s Official Listing Guidance: The prompt ensures your listing follows all the essential guidelines for optimizing your app and adhering to our partner requirements.

Find out more

Enforce payment terms automatically with late fees and early payment discounts

Tired of manual chasing, endless reminders, and time spent applying fees and discounts?

Chaser’s accounts receivable software enforces your payment terms for you — automatically applying late fees to overdue invoices and rewarding early payers with discounts based on rules you decide.

More control. Less admin. Better cash flow.

Put your payment terms on autopilot – and stay in control of your

JUNE HAS BEEN A BUSY MONTH BEHIND THE SCENES AT WORKFLOWMAX. WE’VE BEEN LISTENING TO YOUR FEEDBACK AND WORKING HARD TO MAKE SURE YOUR EXPERIENCE IS SMOOTHER AND SMARTER THAN EVER. CHECK OUT OUR JUNE PRODUCT UPDATE VIDEO TO SEE WHAT’S NEW AND HOW THESE UPDATES ADD MORE VALUE TO YOUR DAY-TO-DAY.

A new intuitive navigation menu and quick add

It’s often the little things that make a big difference, like how easily you find your most-used features. The new menu groups everything by business process, so you’ll be able to jump straight to the tools you need. For example, under Purchases, you’ll now find Suppliers and Purchase Orders grouped together. This makes it much quicker to move around the app, especially when time is tight.

New staff joining your business will see the new menu by default. If you’re an existing user, you can switch

it on (or off) from your profile settings.

The new Quick Add feature adds a ‘+’ button to the top-right corner of every page, so you can instantly create a timesheet, add a cost, or set up a new purchase order or invoice, no matter where you are in the app. It’s a small change that makes a big impact when you’re working on the go or managing multiple jobs at once.

Build summary reports with less effort

Making sense of your numbers just got easier. You can now build monthly summary reports that group and total any numerical field, like the value of invoices raised, split by month and by client. It’s a powerful new way to see trends at a glance, track your progress, and make confident decisions. This reporting feature is currently available for invoices and quotes, and we’ll be rolling it out to other data types soon.

Find out more

WE ARE EXCITED TO ANNOUNCE A MAJOR UPDATE

FEATURING OUR COMPREHENSIVE FREEAGENT INTEGRATION, DESIGNED TO AUTOMATE YOUR BOOKKEEPING AND BOOST PRODUCTIVITY. THIS RELEASE ALSO INTRODUCES SMART ARCHIVING TO HELP YOU MAINTAIN A CLEANER, MORE ORGANISED WORKSPACE IN RECEIPT BOT.

New Features

Seamless Integration with FreeAgent

Previously, connecting Receipt Bot to FreeAgent required manual data entry or the use of third-party tools, such as Zapier, leading to inefficiencies, poten-

tial data discrepancies, and time-consuming duplicate work.

Receipt Bot now offers a seamless, direct connection to FreeAgent, automating your entire workflow from setup to export. Upon connecting, Receipt Bot automatically imports and continuously syncs your foundational accounting data, including your Chart of Accounts, VAT Rates, Contacts, Payment Methods, Projects, and Inventory Items. When it’s time to export, you can send processed documents directly to FreeAgent with a single click.

AT OCERRA, WE’RE COMMITTED TO HELPING YOU STREAMLINE AND STRENGTHEN YOUR ACCOUNTS PAYABLE PROCESS. WITH EVERY RELEASE, WE AIM TO MAKE YOUR EXPERIENCE NOT ONLY EASIER BUT ALSO SMARTER, FASTER, AND MORE TRANSPARENT.

In this update, we’re excited to introduce several enhancements that improve your PO workflows, boost document handling, and— most notably—deliver a major reliability upgrade for MYOB AccountRight users.

Below, you’ll find a detailed look at the latest features and improvements designed to help you get even more out of Ocerra.

New: Read-Only Accountant Analyst Role Now Available

We’ve reinstated the Accountant Analyst role in Ocerra — now with read-only access.

This role is perfect for team members who need full visibility into financial data without the ability to edit or approve anything. It’s a great way to support internal control, audit processes, or give view-only access to external accountants and advisors.

New: Statement Auto-Classification

Note: Enabled by request. When enabled, the system will try to automatically sort incoming documents

into either the Invoices or Statements folder.

It’s not active for any accounts by default, as we’re still testing its accuracy. We’re inviting customers who regularly work with both document types to try it out.

If you'd like to enable this feature, please contact our support team. If you're not using the Statements feature yet, you can check this article to learn how to get started, or reach out to our support team for help.

We’ve improved the Archive section in Ocerra to make document management clearer and easier to navigate. It now includes

This change ensures better organisation and faster retrieval of archived records when you need them.

Statement Download Option

You can now multi-select and download multiple statements at once. No more repetitive downloading—simply select the statements you need and export them in one go, saving time and improving efficiency for high-volume processing.

Keep reading

SPENDESK, THE AI-POWERED SPEND MANAGEMENT AND PROCUREMENT PLATFORM, TODAY ANNOUNCES THE APPOINTMENT OF FORMER AVIV (SELOGER, MEILLEURSAGENTS) VP FINANCE, PAULINE BELLÉE-BABEL, AS ITS NEW CHIEF FINANCIAL OFFICER.

At Aviv, France's largest real estate marketplace with 1,000 employees, Pauline led financial operations. She drove MeilleursAgents to profitability and double-digit growth, then successfully integrated MeilleursAgents and SeLoger into one team.

Her strategic expertise in scaling profits aligns perfectly with Spendesk's revenue growth goals, following the company achieving profitability earlier this year.

In her new role as CFO at Spendesk, Pauline will focus on sustainable growth while providing critical strategic and operational leadership to guide Spendesk’s next phase of growth. She will also champion the voice of Spendesk’s customers, finance leaders, across the organization, ensuring product development continues to address their real-world challenges.

THE XERO PRODUCT IDEAS PLATFORM HAS LONG SERVED AS A TREASURE TROVE OF INSIGHTS, HELPING US FIGURE OUT HOW WE CAN MAKE YOUR EXPERIENCE WITH OUR PRODUCTS AND FEATURES EVEN BETTER.

TRecently, we’ve revamped Xero Product Ideas to create a clearer way for you to understand how your suggestions can directly impact Xero’s product development.

From seed to solution: The progress of your idea

Think of your idea as a seed. We want to show you its full journey, from inspiration to becoming an active feature in Xero. We’ll make sure you’re clear on what we’re working on, and just as

importantly, what we aren’t.

Ideas will now fall into one of these categories:

• Submitted

• In review

• Existing functionality

• Feedback

• Gaining support

• Accepted

• In discovery

• In development

• Completed

• Not in pipeline

When you submit an idea, our community team will review it. They’ll let you know if there are existing features that meet your needs or if we require more detail before it’s ready to share and gain support from other community members.

Find out more

This appointment reinforces Spendesk's commitment to building a dynamic leadership team. It follows recent key appointments, including Laetitia Ismail as Chief Compliance Officer and Alfonso Marone as Executive Chairman, as the company continues to expand its comprehensive spend management and procurement platform.

“Having experienced Spendesk's value firsthand as a customer, I'm excited to join at this pivotal moment when the company is positioned for significant growth,” said Pauline.

Find out more

WHISPERCLAIMS, A LEADING PROVIDER OF SOFTWARE FOR R&D TAX RELIEF CLAIM PREPARATION, HAS LAUNCHED A NEW AI-POWERED FEATURE WITHIN ITS PLATFORM. NOW AVAILABLE IN BETA TO CUSTOMERS, THE NEW +AI FUNCTIONALITY OFFERS REAL-TIME SUGGESTIONS TO ENHANCE THE QUALITY AND CLARITY OF PROJECT NARRATIVE DESCRIPTIONS IN THE CLAIM PROCESS.

This latest development builds on WhisperClaims’

HOW LONG DOES YOUR MONTH-END CLOSE TAKE?

In 2025, leading finance teams are closing their books in just 1–2 days, and the benchmark keeps getting faster. The key? Automation, AI, and smarter systems.

That’s exactly what ScaleXP delivers.

�� Nameda Featured App in both 2023 and 2025, ScaleXP uses machine learning to automate your close process from end to end:

• Balance sheet reconciliations fully automated — including complex areas like Deferred Revenue, Accrued Revenue, and Prepaid Expenses

• Seamless Xero integration — no exports, no spreadsheets

• Journals prepared for you, ready to post to Xero in just two clicks

• Detailed, audit-ready reports that are easy to review

structured, adviser-led methodology, adding optional AI support without compromising human oversight or the compliance-focused approach that underpins the software.

“We’ve always believed in empowering our accountants and advisers with tools that make their work more efficient and compliant – not replacing their expertise,” said Jen Badger, Managing Director & Founder at WhisperClaims. “+AI is the next step in that journey – an assistant, not a replacement.”

Key features of WhisperClaims +AI (beta):

• Focus on narrative improvement: +AI is designed to support accountants and advisers in refining the project descriptions section of a claim.

• No impact on compliance engine: WhisperClaims’ in-app risk review tools, which assess the size, structure, and shape of a claim, remain unchanged and separate from the new AI feature.

WE’RE DELIGHTED TO INTRODUCE YOU TO OLLIE, MYTRUCKING’S FRIENDLY AI HELPER. AT MYTRUCKING, WE’RE PASSIONATE ABOUT TECHNOLOGY SO HAVE EMBRACED AI CHATBOTS TO ENSURE OUR CUSTOMERS ENJOY INSTANT ANSWERS AND SUPPORT AT THEIR FINGERTIPS. OLLIE APPEARS IN THE CHAT BOX WITHIN MYTRUCKING, READY TO ANSWER QUESTIONS WHENEVER YOU NEED HELP. BUT HOW DOES HE KNOW SO MUCH? AND WHY DOES IT FEEL LIKE YOU’RE TALKING TO A REAL PERSON?

Who is Ollie?

Ollie is our smart, friendly AI Helper, named after our founder’s loyal Jack Russell, Ollie. Just like his namesake, Ollie is approachable, eager to help, and brings a touch of warmth and realness to every chat!

How Does Ollie Know What He Knows?

Ollie uses smart AI to read

all of MyTrucking’s help content and resources. He also reviews past responses.

This means he can:

• Reply quickly (his average response time is under ten minutes)

• Find the most relevant, up to date information answers

• Reply with easy-to-understand language and descriptions

• Share based on what’s already available to you (so you can trust his answers).

Ollie’s skills haven’t just happened overnight, our team have been training him for over four years! This time and effort has led to him giving the best responses possible for our customers.

And he sounds like a real person because of the information he takes from our Help Articles, created by our team of real people!

UPCOMING WEBINARS

earns a place in CNBC’s 2025 fintech ranking, celebrated for transforming spend management and empowering CFOs to control business costs.

WE ARE PROUD TO ANNOUNCE THAT SOLDO HAS BEEN RECOGNISED IN CNBC’S WORLD’S TOP FINTECH COMPANIES 2025, A GLOBAL RANKING DEVELOPED IN PARTNERSHIP WITH STATISTA. THIS LIST HIGHLIGHTS 250 OF THE MOST INNOVATIVE AND IMPACTFUL FINTECH BUSINESSES WORLDWIDE, ACROSS NINE DISTINCT CATEGORIES.

Recognition in the Enterprise FinTech category

Soldo features in the Enterprise Fintech category, which recognises technology companies making a measurable difference for businesses, particularly in areas like B2B payments, finance operations, and spend management. It is a clear reflection of our focus on helping finance leaders modernise how their com-

panies spend, freeing them from admin, and empowering their teams to make faster, more confident financial decisions.

The CNBC & Statista ranking is based on a rigorous methodology that combines market reach, industry influence, and customer satisfaction.

Find out more

Deployment on Arbitrum further scales PayPal USD payment use cases while maintaining transactional stability and security.

IN A FAST-EVOLVING WORLD WHERE CHARITIES, FOUNDATIONS, AND NGOS MUST COMPETE FOR EFFICIENCY, FUNDING, AND LONG TERM SUSTAINABILITY, A NEW FRONTIER IS OPENING: WEALTHTECH FOR IMPACT. OMNIWAVE FINTECH IS PIONEERING THIS FRONTIER. AS A LEADING AI-POWERED WEALTHTECH FIRM, OMNIWAVE IS ENABLING LARGE-SCALE NONPROFITS TO GENERATE STABLE, PASSIVE INCOME THROUGH FULLY

TRANSPARENT, RISK-CONTROLLED ALGORITHMIC FINANCIAL SYSTEMS.

“Our mission is to build quiet engines of funding for organizations doing real work on the ground,” says Adam Rubin, founder and CEO of the company. “It’s actually a fortunate coincidence that our WealthTech aligns so well with what nonprofits need — like controlled drawdowns and full transparency. We’re grateful for that, because it means we can support these causes

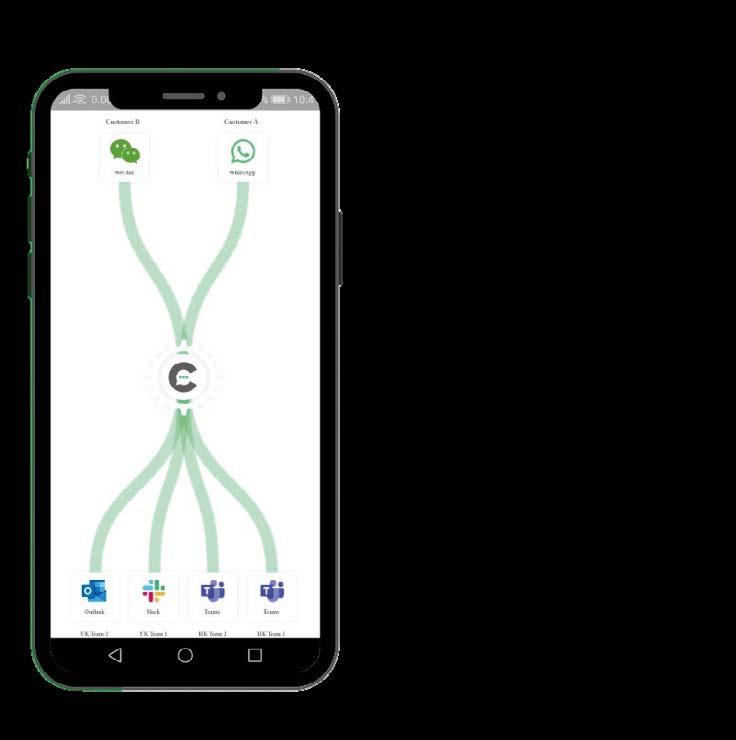

PAYPAL (NASDAQ: PYPL) HAS UNVEILED A SERIES OF GLOBAL PARTNERSHIPS THAT WILL CONNECT MANY OF THE WORLD’S LARGEST PAYMENT SYSTEMS AND DIGITAL WALLETS ON A SINGLE PLATFORM, STARTING WITH INTEROPERABILITY WITH PAYPAL AND VENMO. TOGETHER, THE LAUNCH PARTNERS REPRESENT NEARLY TWO BILLION USERS GLOBALLY. TODAY’S ANNOUNCEMENT OUTLINES THE VISION FOR PAYPAL WORLD AND HOW IT WILL TRANSFORM THE WAY PEOPLE SEND MONEY, SHOP ONLINE, IN-STORE, AND WITH AI AGENTS ACROSS BORDERS.

For consumers: your domestic wallet accepted at millions more businesses around the world

in a way that truly respects their mission and priorities.”

Why Charities Are Turning to WealthTech

Over the past five years, philanthropic organizations have increasingly turned to advanced financial technologies; from algorithmic strategies to decentralized finance, to build sustainable, non-donor-based income streams.

Find out more

For much of the world’s population, international shopping and money transfers are not just difficult, at times they are impossible. While digital wallets and payments have become the preferred payment method in many markets domestically, consumers still require an international payment method to shop overseas. Sending money across borders can be similarly frustrating, with consumers facing fees, barriers, and delays. With PayPal World, consumers will enjoy benefits including:

• Access to shop at millions

more businesses, online, in-store, and with AI agents,

• Pay international businesses using their domestic payment system or wallet of choice and local currency,

• Seamless money transfers to users across borders.

For millions of businesses: access nearly two billion consumers with your existing integration

Until now, businesses had to invest and build technology each time they added a new digital payment system or wallet to their checkout. Accepting more digital payments meant more work, and missing a popular option at checkout meant losing sales. With no additional integration, PayPal World will connect millions of businesses to digital payment system and wallet users worldwide, starting with PayPal and Venmo. Benefits will include:

• Expanded reach into new markets and nearly two billion users,

• Increased payment options and sales – online, in-store, and with AI agents,

• Businesses automatically accept new digital payment options at checkout when more partners join the platform, with no additional development work required.

PayPal World: a technology-agnostic platform for cross border commerce

PayPal World is expected to go live beginning this fall with all partners interoperable with PayPal and Venmo. The platform is purpose-built to allow further interoperability if partner wallets decide to pursue that in the future, further expanding reach and acceptance across borders. Leveraging open commerce APIs, PayPal World solves the complexity of cross border commerce with a cloud native, multi-region deployment architecture that ensures low latency and high availability worldwide. The platform is designed with robust safety and security capabilities, creating a device and technology-agnostic environment for all partners.

PayPal World is ready for the future of commerce. Digital payment systems and wallets will play an essential role in enabling agentic shopping, where consumers can shop and pay in conversation with AI agents using their digital wallet. In addition, the platform will be compatible with the latest technologies and commerce experiences including, over time, dynamic payment buttons and stablecoin.

CORPAY, THE GLOBAL S&P500 CORPORATE PAYMENTS COMPANY TRUSTED BY HUNDREDS OF THOUSANDS OF BUSINESSES WORLDWIDE, HAS LAUNCHED CORPAY COMPLETE IN THE UK, A POWERFUL, ALL-IN-ONE PLATFORM DESIGNED TO STREAMLINE FINANCE OPERATIONS, AUTOMATE PAYMENTS, AND DELIVER REAL-TIME CONTROL OVER COSTS. ALREADY TRUSTED BY FINANCE TEAMS ACROSS THE US, THE PLATFORM HAS BEEN ADAPTED FOR THE COMPLEXITY OF UK FINANCE, AND UNIFIES ACCOUNT PAYABLE PROCESSES & WORKFLOW, EXPENSE MANAGEMENT & OVERSIGHT, AND DOMESTIC & INTERNATIONAL PAYMENTS. WITH EXPERT LOCAL SUPPORT AND A HUMAN-FIRST APPROACH, CORPAY COMPLETE TURNS

CUTTING-EDGE TECHNOLOGY INTO A TRUE FINANCE PARTNERSHIP.

The launch comes as recent data highlights that UK finance leaders are under growing pressure to do more with less – less resource, less time, less budget. According to Deloitte, 63% of UK CFOs now rank cost control as their highest business priority. In addition, just 36% of UK CFOs say that they have real-time visibility over their cash flow, while one in three UK businesses has fallen victim to invoice fraud – often due to manual processes and weak controls.

This is echoed globally as, more than half of finance professionals are still spending over 10 hours per week processing invoices. Yet despite the time drain, only 5% of finance teams are fully

automated, according to the Institution of Financial Operations Leadership’s 2024 member survey – which includes responses from UKbased CFOs. The result is a clear disconnect between day-to-day workload and digital maturity. Fragmented systems make it worse, with 67% of global CFOs saying that disconnected tools are a barrier to meaningful automation and cost efficiency.

Built to meet the demands of modern finance teams, Corpay Complete helps UK businesses save time, cut costs, and take control over fragmented finance operations, by unifying accounts payable processes & workflow, expense management and both domestic & international payments into one intelligent platform.

Find out more

PAYPAL HAS LAUNCHED AI-POWERED, DYNAMIC SCAM DETECTION FOR PAYPAL AND VENMO FRIENDS AND FAMILY PAYMENTS, ENHANCING PROTECTION FOR OUR CUSTOMERS AROUND THE WORLD. DESIGNED TO PROACTIVELY ALERT CUSTOMERS TO POTENTIAL SCAMS AND PREVENT LOSSES IN REAL-TIME, THE ALERTS INTERVENE WHEN IT MATTERS MOST – BEFORE ANY FUNDS ARE SENT. AS SCAMMERS ATTEMPT TO

COERCE PEOPLE INTO SENDING PAYMENTS THAT MAY NOT BE ELIGIBLE FOR REFUNDS, INCLUDING SCAMS THAT ORIGINATE ON SOCIAL MEDIA, WE BELIEVE PUTTING MORE INFORMATION DIRECTLY INTO CUSTOMERS’ HANDS WILL EMPOWER THEM TO HELP STOP SCAMS IN THEIR TRACKS.

As trusted leaders in efforts to prevent fraud, PayPal is proud of our initiative to combat the ever-changing tactics of scammers. We do

not tolerate scams and work hard to protect our customers, including shutting down fraudulent accounts and blocking suspicious activity. Our approach to addressing fraud is multi-pronged, comprised of building innovative technologies, leveraging investigative research led by our team of experts, and refining our risk controls to help prevent bad actors from accessing our platforms.

Find out more