IGNITION, A LEADING REVENUE AND BILLING AUTOMATION PLATFORM FOR PROFESSIONAL SERVICES, TODAY ANNOUNCED THAT TAMMY HAHN, AN AWARD-WINNING LEADER IN PRODUCT DEVELOPMENT AND INNOVATION, HAS JOINED THE IGNITION EXECUTIVE TEAM AS SENIOR VICE PRESIDENT OF PRODUCT. HAHN IS RESPONSIBLE FOR IGNITION'S GLOBAL PRODUCT ROADMAP AND DELIVERY, AND WILL LEAD AND SCALE IGNITION'S PRODUCT ORGANIZATION, INCLUDING PRODUCT MANAGEMENT AND DE-

SIGN. BASED IN SAN DIEGO, CALIFORNIA, HAHN ALSO EXTENDS IGNITION'S US-BASED EXECUTIVE TEAM.

“It’s a privilege to keep welcoming outstanding leaders to Ignition, and I’m thrilled to add Tammy Hahn to that list,” said Greg Strickland, CEO of Ignition. “Tammy brings deep expertise in product leadership and innovation, making her the perfect fit as we enter our next phase of growth, expand our presence in the U.S., and forge new strategic partnerships.”

With 20 years of product development and leadership experience, Tammy Hahn is a visionary product leader with a proven track record of driving innovation and scaling SaaS companies through critical growth phases. Prior to joining Ignition, Hahn was SVP, Product at Skilljar, where she was instrumental in positioning the company for its strategic acquisition by Gainsight. As the first employee at Groundswell, she helped the company secure $15M in Series Seed funding led by Google Ventures.

Find out more

ON 14-15 MAY 2025, THE WORLD’S LARGEST AND LONGEST STANDING ACCOUNTING AND FINANCE EXPO, ACCOUNTEX LONDON RETURNED TO EXCEL FOR A RECORD-BREAKING SHOW.

The fourteenth edition of the exhibition welcomed 16,000+ attendees over the 2 days, and more than 12,000 unique attendees, a 10% increase from last year’s show.

Visitors travelled from across the country and around the world, from as far as Nigeria and the Seychelles.

Portfolio Director, Caroline Hobden was excited about the event’s success “With the MTD mandates fast approaching and AI transforming software and the way we work, there was an electric atmosphere at the show.”

Caroline continued: “The reaction from the profession has been amazing, with 75% of exhibitors already rebooking their stands for next year.”

‘Whether it was software to save time or to lighten the load, I left with lots of solutions to help me work smarter’

Keep reading

AS YOUR BUSINESS GROWS— EXPANDING INTO NEW MARKETS, ACQUIRING COMPANIES, OR LAUNCHING NEW BUSINESS LINES—FINANCIAL COMPLEXITY QUICKLY FOLLOWS. TRADITIONALLY, THIS GROWTH CAME WITH TOUGH TRADE-OFFS:

• LONG HOURS SPENT STITCHING TOGETHER SPREADSHEETS FROM DIFFERENT SYSTEMS

• KEY DECISIONS MADE WITHOUT A FULL PICTURE OF YOUR BUSINESS

• PRESSURE TO IMPLEMENT EXPENSIVE, COMPLICATED ERP SYSTEMS BEFORE YOU’RE READY

At Joiin, we believe growth shouldn’t mean sacrificing usability or breaking the bank. That’s why we’ve

partnered with Puzzle to tackle multi-entity reporting head-on—bringing you enterprise-grade reporting without the ERP price tag or complexity.

What the Joiin + Puzzle Integration Brings

1. One Clear View of Your Entire Business Consolidate unlimited entities from one intuitive dashboard. Combine data from all your entities—accurately and automatically— while keeping the automation and simplicity you love about Puzzle.

2. Save Hours with Automated Consolidation Ditch manual data gathering. Sync your Puzzle entities with Joiin and generate fully consolidated reports with a single click. Free up your team to focus on strategy, not spreadsheets.

3. Impress with Custom, Professional Reports Build polished, custom financial statements that boost confidence with investors, lenders, and stakeholders. For accountants: deliver consistent, high-value reports to clients—without the manual overhead.

4. Scale with Confidence Add new entities as your business grows—no need to change your accounting software or face hidden fees. Multi-currency support with automatic conversion makes international expansion seamless. For firms: easily manage all clients in one place with multi-client views.

Find out more

BGL CORPORATE SOLUTIONS (BGL), AUSTRALIA'S LEADING PROVIDER OF COMPANY COMPLIANCE, SELF-MANAGED SUPERANNUATION FUND (SMSF), INVESTMENT MANAGEMENT, IDENTITY VERIFICATION AND AI-POWERED PAPER-TO-DATA SOFTWARE SOLUTIONS, IS PROUD TO ANNOUNCE THE RETURN OF ITS PREMIER ANNUAL ACCOUNTING AND TECHNOLOGY ROADSHOW, BGL REGTECH 2025.

BGL REGTECH 2025, returning this August 2025,

XU BIWEEKLY - No. 106

Newsdesk:

If you have any news or updates that you would like us to consider for inclusion in the next edition of the XU Biweekly, please email us at: newsdesk@xumagazine.com

CEO: David Hassall

Managing Editor: Wesley Cornell

Chief Revenue Officer: Alex Newson

Account & Partnership Assistant: Robyn Consterdine

Creative Assistant: Victoria Young

Advertising: advertising@xumagazine.com

www.xumagazine.com

‘Xero’ is a trademark of Xero Limited (New Zealand). XU Biweekly and XU Magazine is collaboratively produced by an independent group of Xero users and is not affiliated in any way with Xero. All other trademarks are the property of their respective owners.

© XU Magazine Ltd 2014-2025. All rights reserved. No part of this publication may be used or reproduced without the written permission of the publisher.

XU Biweekly is published by XU Magazine Ltd (08811842), registered in England and Wales. Registered office: Office 1, Brunswick House, Brunswick Way, Liverpool, L3 4BN, United Kingdom. All information contained in this publication is for information only and is, as far as we are aware, correct at the time of going to press. XU Magazine Ltd cannot accept any responsibility for errors or inaccuracies in such information.

If you submit unsolicited material to us, you automatically grant XU Magazine Ltd a licence to publish your submission in whole or in part in all/any editions, including in any physical or digital format, throughout the world. Any material you submit is sent at your risk and, although every care is taken, neither XU Magazine Ltd nor its employees, agents or subcontractors shall be liable for loss or damage. The views expressed in this publication are not necessarily the views of XU Magazine Ltd, its editors or its contributors.

is a free event that brings together BGL’s vibrant community of clients, ecosystem partners, thought leaders and the broader accounting industry.

“BGL REGTECH is not just another accounting event. It’s where the future takes shape,” said Daniel Tramontana, BGL Chief Executive Officer. “With over 2,000 attendees expected, this year’s event will be our biggest yet, jam-packed with bold ideas, powerful insights and WOW moments!”

This year’s theme, “Shaping the Future: Courage, Trust, Connection,” sets the tone for an event that celebrates innovation and progress through bold thinking, meaningful collaboration and breakthrough technology. From unveiling BGL’s latest product innovations to exploring how trust and connection drive change, BGL REGTECH 2025 is designed to inspire and empower.

Keep reading

IRIS SOFTWARE GROUP (IRIS), A LEADING GLOBAL PROVIDER OF ACCOUNTANCY, HR, AND PAYROLL SOFTWARE, HAS MADE A MINORITY INVESTMENT IN INSTEAD, AN AI-POWERED TAX PLATFORM HELPING ACCOUNTANTS AUTOMATE TAX PREPARATION AND SHIFT THEIR FOCUS FROM COMPLIANCE TO STRATEGIC ADVISORY. BY STREAMLINING ROUTINE TASKS AND PROVIDING THE TOOLS TO DELIVER DEEPER INSIGHTS, INSTEAD FREES UP TIME FOR FIRMS TO OF-

Fees have risen over 2024 as firms take a more confident approach to pricing

IGNITION, A LEADING REVENUE AND BILLING AUTOMATION PLATFORM FOR PROFESSIONAL SERVICES BUSINESSES, TODAY REVEALED THAT 80% OF AUSTRALIAN ACCOUNTING FIRMS PLAN TO INCREASE PRICES THIS YEAR, WITH 64% CITING RISING BUSINESS COSTS AS THE MAIN REASON FOR FEE HIKES.

Now in its second year, Ignition’s 2025 Tax and Compliance Pricing Benchmark also found that nearly half (47%) plan to increase prices by 5%, while another 19% prepare for 10% increases.

“It’s no surprise that mounting cost pressures are driving firms to raise prices this year,” said Greg Strickland, Ignition’s CEO. “While firms are planning ahead to cover rising costs, the real opportunity is adjusting pricing to maximize revenue and profitability. Only 11% are increasing fees to improve profit margins, and even fewer (5%) are doing so to increase revenue.

“By combining smart pricing strategies with tech and seamless automation, our goal is to empower professional services business-

es to increase prices with confidence without having awkward client conversations.”

Based on survey data from 165 Australian accounting firms, the 2025 report provides a snapshot of pricing trends and benchmarks fees for tax and compliance services.

Across the board, fees are trending upward compared to the 2024 report findings

Find out more

FER HIGHER-VALUE SERVICES. THIS SIGNIFICANT MINORITY INVESTMENT MARKS A MAJOR STEP IN IRIS’S COMMITMENT TO TRANSFORMING THE BUSINESS OF ACCOUNTANCY THROUGH INTELLIGENT AUTOMATION, WHILE ALSO ENABLING INSTEAD TO ACCELERATE PRODUCT DEVELOPMENT AND EXPAND ITS SALES AND MARKETING CAPABILITIES.

“Our investment in Instead marks an important step in supporting meaningful innovation in the market, for the

benefit of US customers.” said Jim Dunham, President and General Manager of IRIS Americas. “It positions IRIS at the forefront of innovation and underscores our mission to serve the accountancy market. Instead represents the first true disruption in individual and corporate tax since 1993, and this partnership accelerates the delivery of smarter, more accessible solutions for firms across the profession. It’s a game changer.”

Find out more

E’VE BEEN BUSY OVER THE PAST THREE MONTHS ROLLING OUT A SERIES OF THOUGHTFUL PRODUCT ENHANCEMENTS— ALL DESIGNED TO MAKE YOUR ACCOUNTS PAYABLE (AP) PROCESS MORE EFFICIENT, TRANSPARENT, AND USER-FRIENDLY.

This update includes major improvements to invoice forwarding and uploading, as well as significant updates to Ocerra’s Purchase Order functionality.

Here’s a quick look at what’s new and how these enhancements can help you get even more out of Ocerra.

Ocerra now provides a clear notification alert at the top of the screen to inform you when some invoices have failed to process—for example, “Some invoices failed to process (e.g., 1 failed).”

In addition, a badge counter has been added next to the

Inbox, displaying the number of failed invoices at a glance. This enhancement ensures faster visibility and allows you to address any issues promptly and efficiently.

If an email attachment fails to appear on the Invoices page, an Error State message will be displayed. This typically indicates that the file is too large or that Ocerra is unable to determine the appropriate workflow for the invoice.

Find out more

WE’RE EXCITED TO ROLL OUT TWO ENHANCEMENTS TO THE MYTRUCKING MOBILE APP, DESIGNED TO MAKE YOUR TRUCKING LIFE SMOOTHER AND MORE SECURE.

New Mobile App Enhancements:

• Face and Finger Print Recognition: Say goodbye to passwords! With our new face and fingerprint recognition, you

can now log in faster and more securely. It’s all about making your life easier while keeping your data safe.

• Switch Logins Effortlessly: For those of you juggling multiple logins, switching between different company logins is now a breeze. This feature is a game-changer for sub-contractors who need flexibility and efficiency.

Find out more

XERO, THE GLOBAL SMALL BUSINESS PLATFORM, HAS LAUNCHED TAP TO PAY ON IPHONE, ENABLING XERO CUSTOMERS IN NEW ZEALAND WITH A STRIPE ACCOUNT TO SEAMLESSLY AND SECURELY ACCEPT IN-PERSON CONTACTLESS PAYMENTS WITH THEIR IPHONE AND THE XERO ACCOUNTING APP — NO ADDITIONAL HARDWARE OR PAYMENT TERMINAL NEEDED. TAP TO PAY ON IPHONE ENABLES BUSINESSES TO ACCEPT ALL FORMS OF CONTACTLESS PAYMENTS, INCLUDING CONTACTLESS CREDIT AND DEBIT CARDS, APPLE PAY, AND OTHER DIGITAL WALLETS.

Using Tap to Pay on iPhone is easy, secure and private. With Tap to Pay on iPhone, at checkout, the merchant can simply prompt the customer to hold their iPhone or Apple Watch with their contactless credit or debit card, Apple Pay or other digital wallet to pay with their contactless credit or debit card near the merchant’s iPhone. The payment will be securely completed using Near Field Communication (NFC) technology. Tap to Pay on iPhone also supports PIN entry, which includes accessibility options.

Apple’s Tap to Pay on iPhone technology uses the

EVER GET TO A SITE AND NOT KNOW WHERE THE DROP OFF POINT IS? OR WORSE, CAN’T FIND THE HAZARD MAP?!

After a long journey this can be a stressful reality for drivers. Site information and delivery instructions need to be found quicky – and in the most logical place.

We’ve just launched Client and Location Attachments, a new feature in the MyTrucking app!

Easily access what you need

Dispatchers can now attach all site-specific infor-

mation drivers need (from images to documents) to the Client Location in MyTrucking. Drivers can then open their MyTrucking app, go to the destination, and easily access what they need. How simple and efficient!

What’s brilliant about Client and Location Attachments is they’re there forever, or whenever you choose to remove them – saving you admin work for future jobs. So, if another driver needs to go to that site, the previous attachments are still saved!

Keep reading

built-in features of iPhone to keep the business’ and customers’ data private and secure. When a payment is processed, Apple doesn’t store card numbers or transaction information on Apple servers, so merchants and customers can rest assured that their data stays theirs*.

Empowering businesses with more ways to pay

Managing cash flow is more important than ever for small businesses, and receiving timely payments from customers is a fundamental piece of the puzzle.

Xero research shows over a third (38%) of Kiwi con-

sumers say they are frustrated when their preferred payment option isn’t available and one in five (22%) would shop elsewhere if a business didn’t offer one of their preferred ways to pay**.

Bharathi Ramavarjula, SVP, Payments & Ecosystem at Xero said, “Managing payments plays a vital part of the cash flow equation, but small businesses continue to face challenges, including chasing late payments.

And then the phone rang. “That thing you built for the boys at Wairarapa Transport? Yeah, we want it too”.

10 years ago, in a bid to help out some mates with their mountain of never ending paperwork, Sam and Sara Orsborn set to work. What they didn’t expect was that 10 years later it would be a thriving global business, helping others streamline their transport businesses.

MyTrucking, which recently celebrated its 10th anniversary, is a transport management software for small to medium-sized transport operators. It was developed alongside truckers to streamline laborious paper-based systems and lessen the hassle of admin. Now a cloudbased system, users can utilise MyTrucking to run their transport business from anywhere in the world.

MyTrucking has a key set of values that drive customer experience, guide deci-

sion-making and underpin the team’s culture. But it’s innovation that has been the key driver to the success of this business. It’s a thread that can be followed through all aspects of the business. From its technology innovations like the DriverApp, integration partnerships and expanding list of features, to the team who provide the creativity and work to turn these ideas into reality.

Founder and managing director, Sam said that the last 10 years had been ‘pedal to the metal’ with some bigger and better aspirations on the horizon.

“We’ve got some big plans coming up as far as the product goes. Widening the scope of what we can offer to make things easier and more efficient for our customers.”

Find out more

ERO, THE GLOBAL SMALL BUSINESS PLATFORM, ANNOUNCES AN INTEGRATION WITH TALLYFOR, THE MODERN PLATFORM FOR BUSINESS TAX ENGAGEMENTS, TO DELIVER A SOLUTION DESIGNED TO STREAMLINE TAX PREPARATION AND BOOST EFFICIENCY FOR ACCOUNTING FIRMS.

Accounting firms today face capacity shortages, recruitment and retention difficulties, and the burden

of outdated legacy systems that lead to hours of manual, error-prone work and data entry. To address these challenges, this integration offers a modern, cloud-based workflow that integrates seamlessly with Xero, making it easy to turn financial data into tax returns and streamline the traditional tax preparation process.

Find out more

INVOICE CAPTURE, BILL PAYMENTS, AND BOOKKEEPING ARE ESSENTIAL PARTS OF THE WORKFLOW FOR ANY BUSINESS. OUR GOAL AT APRON HAS ALWAYS BEEN TO CLOSE THE GAP BETWEEN EACH STAGE OF THE PROCESS, AND TO BRING FINANCIAL OPERATIONS ONTO A SINGLE PLATFORM FOR BUSINESS OWNERS, ACCOUNTANTS AND BOOKKEEPERS.

That’s a shame, because without an affordable expense card that integrates with the rest of their accounts payable workflow, business owners, accountants and bookkeepers are left doing things the old way. That means:

• Chasing down missing documents and receipts

One huge gap in this process which is often overlooked, is expense management. We know, from travelling the country and speaking with Apron users, expense cards are often too complicated, disconnected, and expensive to make them viable for small businesses.

WE’RE EXCITED TO ANNOUNCE THAT ZOHO BOOKS IS NOW RECOGNISED AS A DIGITAL TAX INTEGRATOR BY THE FEDERAL TAX AUTHORITY, ENABLING DIRECT VAT RETURN FILING FROM WITHIN YOUR FAVORITE ACCOUNTING SOFTWARE. THIS MEANS NO MORE EXPORTING REPORTS, SWITCHING BETWEEN PLATFORMS, OR DEALING WITH SUBMISSION ERRORS.

VAT in the UAE

The UAE Federal Tax Authority charges a standard 5% VAT on most goods and services, with some taxed at 0% or exempt. Businesses in the UAE must register for VAT if their taxable sales and imports exceed AED 375,000 in the past 12 months or the next 30 days. Every VAT-registered taxpayer in the UAE is required to generate a VAT returns re-

port for every tax period and file it with the FTA EmaraTax portal. This tax period could be either monthly or quarterly, depending on what’s assigned by the FTA. The last day to file the VAT return is the 28th day of the month following the end of the tax period.

The usual process of filing returns involves generating a VAT report, verifying the taxable figures, signing in to the EmaraTax portal, and manually entering data into every applicable field. But starting today, Zoho Books has transformed this process for all taxpayers, simplifying it significantly.

The new normal

This is the future of accounting, with Zoho Books easing the stress of yet another tedious and sensitive financial operation.

Keep reading

from staff spending.

• Manually inputting data from loose receipts.

• Losing control over cash flow by having to reimburse staff randomly.

• Wasting hours every month reconciling and compiling expense reports.

Expense cards, the kind that allow staff to spend freely (with limits) while making life easier for business owners and finance professionals, used to be the reserve of larger companies. Not anymore.

Apron Card: The expense card designed for small businesses

Apron Card is our very own expense card, made for small businesses and the accountants and bookkeepers who back them. This is the new way.

Designed to fill the expense management gap in the workflows of business owners across the country, Apron Card smooths out spending and expenses, making it easy to see who’s spending what, when, and where.

B GL CORPORATE SOLUTIONS (BGL), AUSTRALIA'S LEADING PROVIDER OF COMPANY COMPLIANCE, SELF-MANAGED SUPERANNUATION FUND (SMSF), INVESTMENT MANAGEMENT, IDENTITY VERIFICATION AND AI POWERED PAPER-TO-DATA SOFTWARE SOLUTIONS, IS PROUD TO ANNOUNCE THE OPENING OF ITS NEW HEAD OFFICE

IN CANTERBURY, VICTORIA, AUSTRALIA.

"This relocation marks a significant milestone in BGL's journey," said Ron Lesh, BGL’s Founder/Director. "It's a symbol of our evolution — a reflection of our growth, our unwavering commitment to our people and delivering exceptional service and innovations to our clients."

Find out more

From the start, we wanted to make sure that Apron Card would be within reach for businesses of all sizes, and that it would continue to be a viable option as that business scales.

What makes Apron Card different and valuable for business owners, accountants and bookkeepers, alongside its simplicity, affordability, and control features, is the fact that it’s integrated with the rest of Apron. Let’s explore.

An expense card connected to your main bookkeeping workflow

Most expense cards are separate from the rest of your accounts payable workflow, including invoice capture, payments, and bookkeeping.

At the very least, that’s an inconvenience. In reality, it’s a bigger problem.

Find out more

TODAY, DEPUTY, THE WORLD’S LEADING WORKFORCE MANAGEMENT PLATFORM FOR SHIFT WORK, ANNOUNCES THE GLOBAL LAUNCH OF ANALYTICS+, A NEXT-GENERATION BUSINESS INTELLIGENCE AND REPORTING SOLUTION. THIS ROLLOUT WILL GIVE BUSINESSES OF ALL SIZES ENTERPRISE-GRADE TECHNOLOGY TO POWER SMARTER DECISIONS, IMPROVE EFFICIENCY, AND DRIVE PROFITABILITY.

Designed specifically for shift-based businesses, Analytics+ offers advanced reporting capabilities with interactive dashboards, dynamic filters, drill-downs, and custom-built reports – all with an intuitive, easy-to-navigate interface. Analytics+ empowers business owners and managers to turn workforce data into clear, actionable insights without needing a background in data science.

“Shift-based businesses have been underserved by traditional analytics tools that were never designed with them in mind,” said Deepesh Banerji, Chief Product Officer at Deputy. “We built Analytics+ specifically for this sector, where every hour counts, schedules change fast, and compliance matters. Labor costs are the biggest expense line for this sector, it's critical that customers have insights and visibility into their biggest investment area. With Analytics+, we’re giving these businesses the power to make smart, data-driven decisions without the overhead, delays, or costs that come with other enterprise reporting solutions.”

In a world where labor costs are rising and scheduling complexity is increasing, real-time, self-serve analytics are no longer a luxury –they’re a necessity.

Keep reading

WE’RE EXCITED TO ANNOUNCE A SIGNIFICANT ENHANCEMENT TO MYTRUCKING WITH OUR NEW API INTEGRATION CAPABILITIES.

Launched late last year, you now have the power to seamlessly connect your MyTrucking account with other systems. This connection allows you to effortlessly send and receive job data between MyTrucking and your internal systems or external providers.

It’s a dispatcher’s new best friend, but what exactly is an API?!

An API is a set of rules that enables different software applications to communicate and share data with each other.

In simple terms, it’s a way of getting information into software without manually adding it. A brilliant way of

saving time. Essentially, the MyTrucking API integration is tailored to your unique business needs – and what you need it to achieve.

4 ways the API integration can help you

• Pull in Job Information

– Connect your booking system and MyTrucking directly via the API, so no need to manually enter in jobs

• Push out Job Information

– Collect POD information and send that to other software systems

• Connect to bespoke invoicing systems – if you have an invoicing system that we don’t have an out of the box integration with, you can now use the API to take job data out of MyTrucking and place into your accounting software

• Our API is customisable. There’s much more it can do!

Find out more

The 2025 Karbon Excellence Awards shortlist has been announced, recognizing standout firms across eight categories for their leadership, innovation, and impact.

THE SHORTLISTED FINALISTS ARE HERE. AFTER REVIEWING ALL THE NOMINATIONS FROM AROUND THE WORLD, KARBON IS PROUD TO ANNOUNCE THE FINALISTS FOR THE 2025 KARBON EXCELLENCE AWARDS. THESE AWARDS HONOR FIRMS THAT ARE NOT ONLY USING KARBON TO RUN A MORE EFFICIENT AND CONNECTED PRACTICE, BUT ALSO RAISING THE BAR FOR CULTURE, CLIENT EXPERIENCE, TECHNOLOGY, AND PURPOSE-DRIVEN LEADERSHIP.

With over 500 nomina-

tions submitted across eight categories—this year including a new AI Innovation category—it’s clear that Karbon firms are doing work that matters.

The 2025 Karbon Excellence Awards finalists

Karbon Excellence Award for Sustainability

Recognizes a firm leading in sustainability through purposeful practices, community impact, and environmental responsibility.

Finalists:

• Beato, Pimentel & Associates P.A., US

• Tashly Consulting, Australia

• System Six Bookkeeping, US

• True North Accounting

Okotoks Professional Corporation, Canada

• Hot Toast, Australia

• Leskun & Son Accounting, Canada

• Accountimize Inc, Canada

• MAD Wealth, Australia

Karbon Excellence Award for Diversity & Authenticity

Recognizes a firm championing diversity, equity, and inclusion in a way that’s authentic, approachable, and impactful.

Finalists:

• Luminary Tax Advisors, US

• Syncopate CPA Professional Corporation, Canada

• Seth and Alexander, US

• Ho Withers & Associates, Australia

• Leskun & Son Accounting, Canada

• Plantax, Australia

• Indinero Inc, US

• Accountimize Inc, Canada

• Sayer Vincent, UK

Keep reading

SOLDO’S SPRING 2025 UPDATE BRINGS NEW TOOLS FOR FASTER PAYMENTS, BETTER CONTROL, AND SMARTER FINANCE WORKFLOWS ACROSS YOUR ORGANISATION.

Give Finance the Power to Say Yes

This Spring, we’re introducing new features that put Finance in control while empowering teams to move fast and spend responsibly.

Whether you’re unblocking payments, managing travel spend, or ensuring compliance, Soldo’s Spring 2025 release helps you do it with more control and less admin. Let’s take a look at what’s new, and how you can use it to drive your business.

Introducing: Bank Transfer Access

Our newest feature, Bank

Transfer Access, lets finance teams delegate bank transfers securely and within policy — – all while maintaining complete visibility and control. You can also allow approved users to send bank payments within defined limits, workflows, and permissions.

Say goodbye to delays, bottlenecks, and workarounds. With Bank Transfer Access, finance stays in control, while teams get what they need faster.

Why the Finance team love it:

• Cut time-to-payment from days to minutes

• Reduce admin costs by up to 90% on low-value spend

• Enforce policy automatically, without becoming the ‘no’ department

From urgent supplier payments to routine operational spend, your teams can now

make secure bank transfers directly in-platform, and Finance will see every step. Pay suppliers however it makes sense, by card, or by bank transfer; the payment instrument is up to you.

Approvals shouldn’t get stuck when someone i’s away. Now, you can automatically delegate approval rights to another reviewer during absences.

• Avoid delays due to holidays or sick leave

• Automatically reassign approval rights

• Maintain continuity without manual work

Set automatic reminders for reviewers

No more manually chasing people for approvals. Soldo can now send automatic reminders before and on the deadline –— keeping reviews on track.

• Auto-send reminders before and on deadlines

• Set the reminder schedule to match your preferences

• Reduce bottlenecks in the review process

• Improve compliance and accountability

Expense Views

Super Admins and employees alike told us: it was hard to know what needed attention, and where things stood.

We’ve fixed that with dedicated views for each user type:

• Admins can see the full company-wide review flow

• Managers have a focused view of expenses they need to review

• Employees can track the progress of their own expenses

Keep reading

STARLING GROUP TODAY PUBLISHED ITS FINANCIAL RESULTS FOR THE TWELVE MONTHS ENDING 31 MARCH 2025 (FY25), SHOWING STRONG GROWTH IN REVENUE, CUSTOMER NUMBERS AND DEPOSITS. THIS PERFORMANCE POSITIONS THE GROUP WELL AS IT PREPARES TO LAUNCH NEW RETAIL AND SME BANKING PROPOSITIONS, ANNOUNCE MORE INTERNATIONAL ENGINE BY STARLING CLIENTS, AND CREATE MORE THAN A THOUSAND JOBS.

FY25 Highlights:

• Revenue rose to £714 million, up from £682 million the previous year, demonstrating a continued robust performance across all business lines.

• Customer deposits reached a record £12.1 billion, up from £11.0 billion the previous year, demonstrating growing confidence in the bank and its services.

• Open accounts reached a new high of 4.6 million, a 10% increase from 4.2 million in the prior year, indicating continued customer acquisition success.

• Profit before tax de-

creased to £223 million as the Group recognised one-off costs relating to two legacy matters. Underlying profit before tax was £281million.

• The Group’s capital surplus has grown by 40% to over £400 million.

Raman Bhatia, Group Chief Executive, said: “These results represent an important milestone, marking the Group’s fourth consecutive year of profitability and revenue growth. This performance derives from our commitment to providing customers with innovative banking solutions and exceptional service. We are particularly pleased with Starling Bank’s success in attracting new customers, as evidenced by the continued growth in our deposit base and open accounts.”

“In the last year we demonstrated our commitment to addressing legacy matters, investing in our people and capabilities so we now move forward from a position of strength. We will leverage our robust capital position to continue to scale our growth in the UK by helping our customers become better with money. We will also make great strides in turn-

ing Engine by Starling into a global success.”

Declan Ferguson, Group Chief Financial Officer, added: “The Group generated an underlying profit before tax of £281 million. Our revised capital requirements were communicated in April, taking our total surplus capital to more than £400 million in excess of our buffers; a 40% increase on last year. In the coming months, we’ll be deploying this capital across Starling Bank, Engine and other international ventures to fuel our growth.”

Group company contributions

During the year, Starling Bank continued to innovate with new features, such as ‘call status indicators,’ which help customers spot bank impersonation scams, and low balance warnings when a customer’s main balance drops below a preset threshold. The bank also launched its Easy Saver, which offers a competitive interest rate payable on balances up to £1 million, with penalty-free access and full integration into the Starling app.

Find out more

TWORLDPAY® AND BVNK TODAY ANNOUNCED THEY ARE WORKING TOGETHER TO ENABLE NEARLY INSTANT GLOBAL PAYOUTS IN STABLECOINS FOR WORLDPAY CLIENTS IN THE U.S. AND EUROPE. THIS COLLABORATION WILL ENABLE WORLDPAY’S CLIENTS TO PAY OUT TO CUSTOMERS, CONTRACTORS, CREATORS, SELLERS, AND OTHER 3RD PARTY BENEFICIARIES IN STABLECOINS ACROSS MORE THAN 180 MARKETS NEARLY INSTANTLY, ALL WITHOUT HAVING TO HOLD OR HANDLE STABLECOINS THEMSELVES.

Worldpay clients will be able to access this new stablecoin payout service through their existing integration with Worldpay’s payouts platform. Stablecoins will be the first type of digital asset enabled as a payout option on Worldpay’s payout platform, complementing the existing 135 fiat currencies currently available.

This is the latest step from Worldpay to integrate stablecoins into its payment services. In 2022, Worldpay began offering merchants in select geographies the ability to receive settlements in the stablecoin USDC. In 2023, Worldpay completed

Expanded partnership

Ea pilot with Visa to receive funds more quickly from the network. Now, Worldpay will be enabling stablecoin payouts with BVNK, furthering its capabilities to support merchant demand for the burgeoning technology.

John McNaught, head of payouts at Worldpay, said: “As confidence in emerging technologies like crypto and digital assets grows, clients are increasingly open to using stablecoins to streamline payouts, navigate currency fluctuations, and settle with third parties in regions where digital assets are preferred.

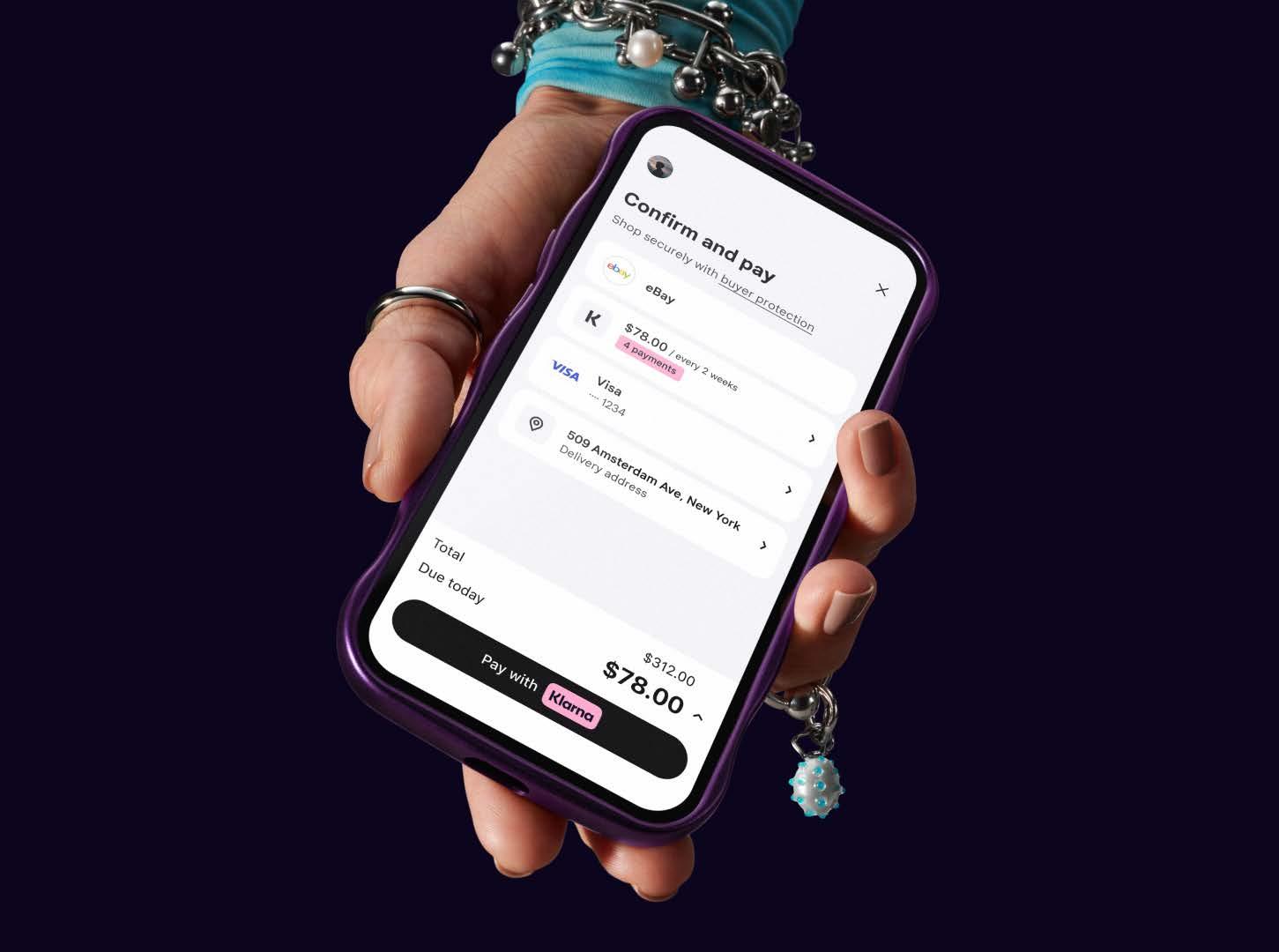

BAY, A GLOBAL COMMERCE LEADER THAT CONNECTS MILLIONS OF BUYERS AND SELLERS AROUND THE WORLD, TODAY ANNOUNCED THE EXPANSION OF ITS GLOBAL STRATEGIC PARTNERSHIP WITH KLARNA, THE AI-POWERED PAYMENTS AND COMMERCE NETWORK, TO THE U.S. MARKET. EBAY IS ROLLING OUT KLARNA’S FLEXIBLE PAYMENTS OPTIONS TO MILLIONS OF EBAY’S U.S. SHOPPERS. THE EXPANDED PARTNERSHIP REFLECTS EBAY’S CONTINUED INVESTMENT IN BRINGING MORE CHOICE, FLEXIBILITY, AND CONTROL TO BUYERS WHILE ENHANCING AFFORDABILITY ACROSS KEY CATEGORIES.

“With more than 2.3 billion listings, eBay is where people come to shop with purpose—whether they’re looking for value, rare finds, or sustainable options such as a refurbished camera, hard-to-find car part, or

a vintage handbag,” said Avritti Khandurie Mittal, VP & General Manager of Global Payments and Financial Services at eBay. “We are thrilled to expand our global strategic partnership with Klarna to the U.S. We’ve been very pleased with the positive customer and business impact Klarna has delivered in some of our key markets including the U.K. and Europe, and we’re now excited to give millions of U.S. shoppers more flexible and affordable ways to pay on eBay.”

Since launching in the U.K., Austria, France, Italy, the Netherlands and Spain in December 2024, eBay shoppers are splitting up payments to access higher-ticket items - like a preloved luxury watch - in a more affordable, manageable way. Electronics, fashion, and collectibles are some of the most popular categories where eBay shoppers are paying with Klarna.

Shoppers can pay for eligible eBay purchases in the U.S. using Klarna’s flexible payments options including Pay in 4, which allows customers to split their purchase into four interest-free payments as well as Financing, which offers flexible payment plans for larger purchases.

Klarna also recently rolled out its resell feature to U.S. shoppers who use eBay. With just a few taps, users can list past Klarna purchases on eBay—complete with pre-filled descriptions and images—making it easier than ever to extend the life of their items. Since launching in December 2024, there have been over half a million eBay listings generated through Klarna’s app. Whether it’s a refurbished phone or a pre-loved designer bag, the feature promotes conscious consumption and supports a more circular economy.

Keep reading

STARLING GROUP TODAY NAMED FOUR NEW MEMBERS OF ITS EXECUTIVE COMMITTEE, FURTHER STRENGTHENING ITS LEADERSHIP IN THE LEGAL, COMPLIANCE, AND PEOPLE FUNCTIONS.

The appointments comprise an internal promotion and three external hires, reflecting Starling’s internal talent pool and its ability to attract top talent. Group CEO Raman Bhatia has now added eight senior appointments since he joined in June 2024.

Catarina Abrantes-Steinberg has been appointed Group Chief People Officer, subject to regulatory approval. She succeeds Susanna Yallop, who left Starling at the end of April after five years in the role. Catarina has spent the past three years as

Chief People Officer at Dojo Paymentsense, where she played a pivotal role in guiding the company through a period of hypergrowth. Prior to her time at Dojo, she held leadership positions at Russell Reynolds Associates and Expedia Inc. Catarina began her career in management consulting with McKinsey & Company.

Ian Cox joins as Starling’s new Group Head of Internal Audit, also subject to regulatory approval. With over 25 years in the financial services industry managing audit, risk, and governance, Ian will lead the internal audit function across the Group, supporting Starling’s continued commitment to transparency, accountability, and strong risk management. Reporting to the Board Audit Committee, he will work closely with teams across the business to

ensure Starling Group continues to meet the highest standards of assurance and compliance. Most recently, Ian was Group Chief Internal Auditor at Network International, based in Dubai.

Monica Risam has been appointed Group General Counsel, succeeding Matt Newman. Monica is a dual-qualified US and UK lawyer with extensive experience in the financial services sector. She joins Starling from the Lombard International Group, where she held the position of Group General Counsel & Company Secretary. Monica has also held senior legal roles at Aviva and GE Capital, and began her career at the international law firm Weil, Gotshal & Manges.

Find out more

THIS MONTH WE DELIVERED ON ONE OF OUR BIGGEST INITIATIVES OVER THE PAST YEAR IN THE ‘SOFT’ ROLLOUT OF OUR NEW MOBILE APP ON BOTH IOS AND ANDROID DEVICES. THE DEVELOPMENT OF THE MOBILE APP WAS A JOINT EFFORT WITH OUR DESIGN AND API DEVELOPMENT BEING COMPLETED IN-HOUSE AND THE CORE MOBILE APP WORK

ITSELF BEING UNDERTAKEN BY THE FANTASTIC TEAM AT ABLETECH. I WAS PERSONALLY VERY HAPPY WITH THE PROJECT, WHICH WAS COMPLETED ON TIME AND ON BUDGET AND A BIG PART OF THAT WAS THANKS TO THE ABLETECH CREW.

The mobile app provides Sharesight's first true watchlist as well as the more familiar performance views. We

will be ironing out any issues over the coming weeks and have plenty of ideas for future improvements. For those of you with an iPhone, you can find the new app on the Apple store, and for those with an Android you can find the app on the Google Play store.

Find out more

TODAY, PROGRAMMABLE FINANCIAL SERVICES COMPANY STRIPE ANNOUNCED NEW PRODUCTS DESIGNED TO HELP BUSINESSES HARNESS AI AND STABLECOINS TO ACCELERATE THEIR GROWTH.

Stripe serves the world’s largest and fastest-growing companies, including half of the Fortune 100 and 78% of the Forbes AI 50. Last year, businesses on Stripe processed $1.4 trillion in total payment volume – up 38% from 2023 and equivalent to around 1.3% of global GDP. In aggregate, the revenue that businesses process on Stripe is growing seven times faster than that of companies in the S&P 500.

At its annual user event, Sessions, Stripe launched the world’s first AI foundation model for pay-

ments and unveiled a major expansion of its money management capabilities, including stablecoin-powered accounts.

“There are not one, but two, gale-force tailwinds, well off the Beaufort scale, dramatically reshaping the economic landscape around us: AI and stablecoins,” said Patrick Collison, Stripe co-founder and CEO. “Our job is to pull these technologies forward so businesses on Stripe can benefit from them right away.”

Investing in AI to fuel growth for businesses

Stripe has a long history of using specialised AI models, each optimised for a specific task like preventing fraud, increasing authorisation rates, or personalising the checkout experience for individual buyers.

To help its users grow even faster, Stripe announced today it has built the world’s first AI foundation model for payments. Stripe’s Payments Foundation Model is trained on tens of billions of transactions, and captures hundreds of subtle signals about each payment that specialised models can’t. It will be deployed across Stripe’s payments suite to unlock additional performance improvements that were not previously possible.

Early results thwarting card testing attacks demonstrate the effectiveness of the new Payments Foundation Model. With its previous models, Stripe gradually reduced card testing by 80% over two years.

Find out more