IN THE FIRST HALF OF 2025 ALONE, APRON USERS HAVE PROCESSED HUNDREDS-OF-MILLIONS IN PAYMENTS USING OUR PLATFORM. WE’VE LAUNCHED APRON CARD, OUR OWN PHYSICAL AND VIRTUAL EXPENSE CARD FOR THE UNDERSERVED SMALL BUSINESSES OF GREAT BRITAIN. AND WE’VE LAUNCHED BOOKS CLUB, THE LOYALTY PROGRAMME THAT HELPS PRACTICES AND BUSINESSES GET THE MOST OUT OF THEIR APRON EXPERIENCE, WHILE BEING REWARDED WITH PERKS AND DISCOUNTS.

As we speak, the Apron team is travelling the United Kingdom, taking in Glasgow, Leeds, Manchester, Birmingham, Bristol, and London, speaking with accountants and bookkeepers about their needs and experiences.

It’s safe to say that we’re not slowing down. With this continued acceleration comes the need for an increase in strategic acumen, innovative thinking, and sage wisdom.

We are therefore delighted to introduce two new additions to the Apron Board. Please join us in welcoming Kathleen DeRose and Sam Halse.

Kathleen DeRose, Chairperson & Non-executive Director Kathleen brings a phenomenal amount of fintech expertise to Apron. As a Clinical Associate professor at New York University’s Stern School of Business, she leads conversations on the very latest in fintech. Kathleen is also a non-executive director on the boards of Experian, the London Stock Exchange Group Plc. among others.

Find out more

AT ALLICA, WE KNOW RUNNING A BUSINESS MEANS SPINNING A LOT OF PLATES. FROM MANAGING STAFF AND SUPPLIERS TO KEEPING ON TOP OF CUSTOMERS AND CASH FLOW, YOUR TIME IS PRECIOUS, AND ADMIN SHOULDN'T BE TAKING UP MORE OF IT THAN IT NEEDS TO.

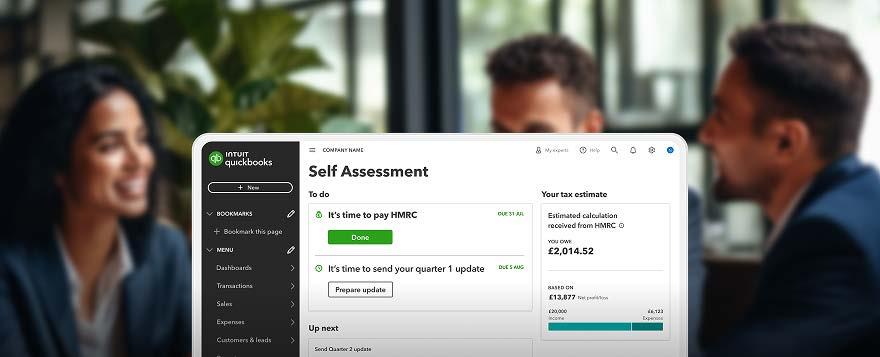

That's why we're excited to announce our new integration with QuickBooks, one of our most requested

features from our customers.

From 14th May 2025, if you’re an Allica Business Rewards Account customer, you’ll be able to connect your Allica account directly to QuickBooks (currently available on QuickBooks web, with mobile access coming soon).

Once you’re connected, your Allica account transactions will sync automatically into QuickBooks, giving you

a clearer, more up-to-date view of your finances without the manual work.

What this means for your business

Whether you're working with an accountant, or managing your books yourself, this new integration is designed to save you time and take the hassle out of managing your money.

Keep reading

FOR SMALL BUSINESSES, WE KNOW THAT EFFICIENT, ACCURATE, AND SEAMLESS WORKFLOWS ARE NON-NEGOTIABLE — ESPECIALLY WHEN IT COMES TO MAKING PAYMENTS. AFTER ALL, PAYING BILLS AND MANAGING CASH FLOW ARE TWO CRUCIAL TASKS, AND WHEN MANAGED EFFECTIVELY HAND-INHAND, SMALL BUSINESSES THRIVE. BUT THESE TASKS SHOULDN’T BE A MANUAL HEADACHE.

We also know that more than 70% of US SMBs place a high importance on having their accounting and accounts payable software tightly integrated, but only a small minority actually have access to integrated accounting and accounts payable.

That’s why we’re incredibly excited to share that Xero today announced its plans to acquire Melio, a leading SMB bill pay platform designed specifically for small businesses, accountants and bookkeepers in the US.

This acquisition is a game-changer and will allow us to deliver an even more powerful and seamless experience to current and future Xero US customers across accounting, invoicing, bill pay and more, in a single integrated platform.

Why Melio is a perfect fit for Xero customers now and in the future

Today, Melio is already loved and used by Xero customers through the Xero App Store as an app partner.

Why? Because it transforms accounts payable from a time-consuming, manual chore into a seamless process.

Melio’s powerful platform makes payment workflows easy and flexible, offering a wide choice of payment methods to suit the individual needs of each business, all while helping their vendors to get paid faster. Plus, with Melio’s robust approval workflows, customers will have greater visibility and control over every payment being made, helping them and their accountant to better manage their cash flow — a payment solution truly tailored to each business’s unique needs.

WE’RE EXCITED TO UNVEIL A RANGE OF POWERFUL NEW FEATURES AND ENHANCEMENTS ROLLING OUT IN PIXIE, ALL DESIGNED TO STREAMLINE YOUR WORKFLOW AND MAKE TASK MANAGEMENT MORE INTUITIVE THAN EVER. HERE’S WHAT’S NEW IN Q2 2025:

Custom Task Statuses

Say hello to a dedicated task status field—separate from tags—for clearer, more structured task tracking. Workspace Admins can now create, edit, and delete custom statuses for greater control.

XU BIWEEKLY - No. 108

Newsdesk:

If you have any news or updates that you would like us to consider for inclusion in the next edition of the XU Biweekly, please email us at: newsdesk@xumagazine.com

CEO: David Hassall

Managing Editor: Wesley Cornell

Chief Revenue Officer: Alex Newson

Account & Partnership Assistant: Robyn Consterdine

Creative Assistant: Victoria Young

Advertising: advertising@xumagazine.com

www.xumagazine.com

‘Xero’ is a trademark of Xero Limited (New Zealand). XU Biweekly and XU Magazine is collaboratively produced by an independent group of Xero users and is not affiliated in any way with Xero. All other trademarks are the property of their respective owners.

© XU Magazine Ltd 2014-2025. All rights reserved. No part of this publication may be used or reproduced without the written permission of the publisher.

XU Biweekly is published by XU Magazine Ltd (08811842), registered in England and Wales. Registered office: Office 1, Brunswick House, Brunswick Way, Liverpool, L3 4BN, United Kingdom. All information contained in this publication is for information only and is, as far as we are aware, correct at the time of going to press. XU Magazine Ltd cannot accept any responsibility for errors or inaccuracies in such information.

If you submit unsolicited material to us, you automatically grant XU Magazine Ltd a licence to publish your submission in whole or in part in all/any editions, including in any physical or digital format, throughout the world. Any material you submit is sent at your risk and, although every care is taken, neither XU Magazine Ltd nor its employees, agents or subcontractors shall be liable for loss or damage. The views expressed in this publication are not necessarily the views of XU Magazine Ltd, its editors or its contributors. Q2/2025:

Here’s what’s changing:

Until now, task status and labels were combined, which offered flexibility but lacked structure. The new status field allows for consistent filtering and more accurate progress tracking across your workspace.

How to configure statuses (Workspace Admins):

• Go to Settings > Statuses in your workspace.

• Create or edit statuses to reflect your workflow.

• Default statuses include: Not started, In progress, and Done.

• Assign unique colors to each status for quick

identification.

• Reorder statuses to suit your preferred task flow.

• Rename any status (except Not started and Done, which are fixed).

• Delete statuses not currently in use—you’ll be prompted to reassign affected tasks first.

Tags (formerly Labels)

Tags remain a flexible way to organize, filter, and group tasks. They can also be assigned to task templates so every new task created from a template comes pre-tagged.

Keep reading

IN AN EXCITING DEVELOPMENT FOR THE TRANSPORT INDUSTRY, MYTRUCKING HAS BEEN RECOGNISED AS ONE OF XERO’S FEATURED APPS COLLECTION FOR THE MONTH OF JUNE. BETTER STILL, THIS IS THE SECOND TIME WE’VE BEEN RECOGNISED!

This accolade highlights the powerful integration between MyTrucking and Xero. It offers trucking businesses a seamless solution for their operational and financial needs.

“We’re delighted to be in

Expansion of eight-year partnership enables FreeAgent to bring full suite of GoCardless features to customers

GOCARDLESS, THE BANK PAYMENT COMPANY, HAS EXPANDED ITS PARTNERSHIP WITH FREEAGENT, A CLOUD BASED BUSINESS ACCOUNTING SOFTWARE FOR SMALL BUSINESSES, FREELANCERS AND THEIR ACCOUNTANTS, TO PROVIDE FASTER AND MORE CONVENIENT PAYMENT SOLUTIONS TO THEIR CUSTOMERS.

GoCardless's Instant Bank Pay, its open banking-powered payment solution, and Success+, the fintech’s AI-driven tool to automate payment retries, are now available directly within the FreeAgent platform.

Instant Bank Pay will allow FreeAgent customers to offer a more convenient, secure, and instant way to pay. By collecting funds directly from their customers’ bank accounts, they will reduce late payments and improve cash flow. This is particularly beneficial for high-value one-off invoices, as it helps businesses to avoid costly card fees and removes the need for customers to manually enter bank details.

FreeAgent customers will be able to use Instant Bank Pay alongside its existing GoCardless Direct Debit functionality, enabling them to take both one-off and recurring payments within a

Xero’s featured apps collection for June” says MyTrucking Founder and Marketing Director, Sara Orsborn.

“We are looking forward to continuing this partnership with some exciting things planned ahead. Xero has been a key partnership for MyTrucking for eight plus years now, and with 70% of our customers using Xero, this has always been a great fit for us”.

A game-changing integration

MyTrucking’s integration with Xero eliminates the

need for manual data entry, significantly reducing errors and saving valuable time. This results in a more efficient and streamlined process. We love that it then allows transport businesses to focus on what they do best – moving goods!

Key benefits

• Time Saving: The integration automates time-consuming tasks.

• Improved Accuracy: By eliminating manual data entry.

single platform. This creates a flexible payment flow for different use cases, such as accepting an immediate adhoc payment for a new client via Instant Bank Pay and setting up a recurring Direct Debit for ongoing services.

FreeAgent has also added GoCardless’s Success+ to its platform. Success+, which recovers two-thirds of failed payments on average, applies machine learning to data from the millions of transactions GoCardless processes each year to intelligently identify the best time for payment retries.

CORPORATE SOLUTIONS (BGL), AUSTRALIA'S LEADING PROVIDER OF COMPANY COMPLIANCE, SELF-MANAGED SUPERANNUATION FUND (SMSF), INVESTMENT MANAGEMENT, IDENTITY VERIFICATION AND AI-POWERED PAPER-TO-DATA SOFTWARE SOLUTIONS, IS PROUD TO LAUNCH THE BGL ONLINE SUMMIT — A VIRTUAL KICKOFF TO ITS HIGHLY ANTICIPATED BGL REGTECH 2025 ROADSHOW IN AUGUST 2025.

Proudly brought to you by XU Magazine, the BGL Online Summit runs from Tues-

day 15 July 2025 to Thursday 31 July 2025 and features a dynamic line-up of free live webinars in collaboration with some of BGL's leading Ecosystem partners.

With over 2,000 registrations already confirmed, the BGL Online Summit is an exciting opportunity for accountants and administrators to connect with the apps and experts shaping the future of accounting technology — before they hit the exhibition floor at BGL REGTECH 2025.

Find out more

AT XERO, OUR CONNECTION TO THE ACCOUNTING AND BOOKKEEPING COMMUNITY IS CRITICAL, AND XPAC (THE XERO PARTNER ADVISORY COUNCIL) PLAYS A BIG PART IN THAT.

We’re excited to introduce the new Australian XPAC FY26–27 cohort: 14 partners from across the industry who will work closely with us over the next year, providing invaluable insights to help shape how we continue to support our partner community.

The role of XPAC and why it matters

XPAC brings together

a dedicated group of accountants and bookkeepers who meet with the Xero team quarterly and stay in close contact throughout the year. They share what they’re seeing in the industry, including the challenges, opportunities, and tools that are helping firms succeed, along with honest feedback on how we can better support our partners and build a great product to help accountants, bookkeepers and small businesses.

These ongoing conversations help us test ideas, stay focused on what matters most, and make well informed decisions grounded in real-world experiences and insight.

A huge thank you to the XPAC AU FY24–25 team!

Our XPAC AU FY24–25 group has been instrumental in helping us move in the right direction over the past twelve months.

Some members are returning as mentors for FY26–27, while others are concluding their time with XPAC. Together, their input has shaped important conversations, challenged our thinking, and made a real difference.

Find out more

SOCKET, THE PURPOSE-BUILT CLIENT ENGAGEMENT PLATFORM FOR ACCOUNTING AND BOOKKEEPING PRACTICES, HAS STARTED BETA TESTING THEIR INTEGRATION WITH ADFIN, THE INTELLIGENT PAYMENTS PLATFORM ALSO DESIGNED FOR ACCOUNTANTS AND BOOKKEEPERS.

The strategic partnership brings a unified solution to one of the industry’s most persistent challenges: getting paid on time, and without the admin burden. The integration is open for early access to beta testers and makes its debut to all Socket and Adfin users from 10th of July.

LATE PAYMENTS ARE IMPOSING A SIGNIFICANT FINANCIAL AND OPERATIONAL BURDEN ON SMALL ACCOUNTANCY FIRMS ACROSS THE UK, ACCORDING TO RESEARCH RELEASED TODAY BY BANK PAYMENT COMPANY

GOCARDLESS. THE STUDY UNCOVERS THE PERVASIVE AND COSTLY NATURE OF THE PROBLEM, WITH OVER HALF (56%) OF ACCOUNTANCY PRACTICES

RESIGNING THEMSELVES TO LATE PAYMENTS AS AN "INEVITABLE COST OF DOING BUSINESS."

The survey, which polled

100 leaders from accountancy and financial services businesses -- predominantly one-person teams or micro-firms -- highlights the severe impact of late payments on cash flow. Four in 10 (40%) respondents reported spending over an hour each week chasing overdue invoices, diverting crucial time and energy away from client work and business growth.

The issue is so critical that more than half (57%) of small practices admit to occasionally forfeiting payments entirely rather than go through the hassle of chasing. One in

ten (13%) have resorted to debt collection services, indicating that even the smallest firms have started to rely on formal recovery methods.

Despite the mounting pressure, the adoption of proactive payment strategies remains inconsistent. While 19% now enforce stricter payment terms and 24% charge late fees, only a quarter (25%) have automated their payment processes. A small percentage (6%) have introduced early payment discounts, an incentive that, while beneficial for cash flow, often impacts net income.

Changing the Proposal-to-Payment Game

This is Socket and Adfin’s first publicly available integration that connects proposals, mandates, invoicing, and payments into a single streamlined experience. This means practices can now send a proposal, capture direct debit details, issue invoices, and reconcile payments automatically, all without leaving Socket.

Key Integration Features

• Direct debit mandates captured as part of the proposal signature flow.

• Flexible rollout for existing clients with minimal disruption.

• Existing clients can transition without signing a new proposal.

• Multi-method payment options for clients (card, bank transfer, direct debit).

• Automated invoice generation, follow ups, payment retries, and reconciliation and via Adfin.

“This integration is a game-changer for practices that want to streamline their operations: a seamless journey from proposal to payment.” said Tom Pope, Co-Founder and CEO at Adfin.

iplicit, the award-winning cloud provider, has today announced a strategic partnership with inventory management leader Cin7 to fill a critical gap in the UK’s wholesale and distribution midmarket.The partnership will see iplicit and Cin7 deliver a highly functional, true-cloud solution for SMEs in need of managing their accounting and inventory needs simultaneously, with an integrated platform.

SMES IN THE WHOLESALE AND RETAIL SECTORS, WHICH ACCOUNTED FOR OVER A THIRD (34%) OF SME TURNOVER IN 2024, HAVE, UNTIL NOW, BEEN MASSIVELY UNDERSERVED IN THIS SPACE.

Hiroki Takeuchi, co-founder and CEO of GoCardless, commented:

"Small accountancy practices are the backbone of the small business economy, often acting as frontline advisors. It's deeply concerning to see how late payments are stifling their growth and forcing them to waste valuable time and resources. In addition, our customers tell us that late payments not only take a toll on their business, they also bring a lot of personal stress.

Many of the existing finance solutions on the market that offer functional inventory features or addons are high on hosting costs, low on functionality, and / or operated as legacy, on-premises solutions. These, and the generic, entry-level inventory solutions available today, often fall short of addressing SMEs’ complex requirements and their increasing need to migrate to agile, cost-effective cloud alternatives.

In response, iplicit has developed a specialist Cin7 connector which, in addition to its full cloud accounting suite, will deliver cloud-enabled inventory management.

iplicit offers a state-ofthe-art cloud account-

ing platform that is purpose-built for the UK and Ireland’s midmarket. After a thorough review of the market, it identified Cin7 as the inventory management software provider best placed to serve SMEs in this space, with advanced functionality that spans beyond the entry-level alternatives.

Cin7 is a modern, cloudbased inventory and order management platform, combining inventory, pointof-sale, e-commerce, and warehouse management functionalities into a single solution. It integrates seamlessly with accounting, shipping, and marketplace platforms, and supports over 8,500 businesses worldwide. In November 2024, Cin7 received a $500 million backing from a single-asset continuation fund closed by Rubicon Technology Partners, to accelerate growth.

Keep reading

WHAT’S NEXT AT DEXT? SO MANY NEW RELEASES AND AI-DRIVEN DEVELOPMENTS THAT ARE DESIGNED TO MAKE YOUR LIFE EASIER, SO YOU CAN FOCUS ON YOUR BIGGER THING.

Take a look at what our product team has been hard at work on over the last few months.

New Releases

Supplier Aliases

When processing cost invoices and receipts, supplier names often show up in slightly different forms like

‘Shell’, ‘Shell gas’, or ‘Shell gas station’. These small variations, often caused by trading names or legal entity differences on receipts, can clutter your records and make it harder to track spending accurately.

Supplier Aliases solves this by automatically suggesting when two similar names might belong to the same supplier. These suggestions appear directly on the invoice or receipt you’re reviewing, so you can confirm the correct name instantly without adjusting settings or creating manual rules.

There’s also a new Aliases

FROM APRIL 2026, SMALL BUSINESSES, SOLE TRADERS AND LANDLORDS WILL NEED TO CHANGE HOW THEY REPORT INCOME TAX TO HMRC. NEW LEGISLATION, KNOWN AS MAKING TAX DIGITAL FOR INCOME TAX (MTD FOR IT), IS SET TO BE INTRODUCED, SPARKING A SHIFT IN FINANCIAL REPORTING REQUIREMENTS.

To comply with MTD for IT requirements, businesses will need to do three things: send quarterly updates on business income and expenses, keep digital records, and submit returns annually using MTD-compatible software. The MTD for IT rollout will happen in phases. Anyone with an annual turnover of over £50,000 for the tax 24/25 year will need to start complying from April 2026. It will then extend to those earning over £30,000 from April 2027 and anyone earning over £20,000 from April 2028.

Master MTD for IT with confidence

MTD for IT will likely feel like a big change for many small businesses. Over twofifths (42%) of the smallest businesses currently don’t use any finance or accounting tools, and just 27% believe they get their tech and software choices right. For many businesses, MTD for IT may mean investing in digital software or technology for the first time. Although the digital transition might feel daunting, Xero is here to support you. Our easy-to-use online accounting software will give you a clear picture of your finances so you’re more in control. With the right digital tools in place, and a streamlined process for how you manage and submit taxes, you can spend less time doing your taxes and more time on your business.

Keep reading

section in Supplier Settings where you can review and manage all the approved variations. This update helps you maintain accurate, consistent data without interrupting your workflow.

CIS (UK Only)

We’ve been busy updating Dext Solo, our MTD IT solution designed specifically for landlords and sole traders who need to file quarterly updates from 2026. Dext Solo now tracks construction industry scheme deductions for subcontractors. All so that you can make sure your tax records reflect the percentage of tax taken at source so your final submis-

sions are all accurate.

Client List Sorting Preferences Dext now remembers how you like to view your Client List. Whether you sort by client name, number of cost items, or any other column, your chosen layout will stay in place even if you refresh the page or switch sections.

This simple update removes the need to re-sort every time you log in, helping you return to your preferred view instantly. It’s a small change that makes a big difference to how efficiently you manage your clients day to day.

Vault cancels out unnecessary admin. Find what you need in an instant and get back to the things you should be doing instead. Vault gives you intelligent document storage in Dext for all of your essential business documents like loan agreements and insurance policies.

It’s secure and simple to use, giving you the power to easily find what you need as soon as you need it. Our advanced AI neatly organises and tags documents and even extracts due dates so

you don’t miss the important stuff. This feature is now available to all Dext users who have switched to the enhanced Dext experience.

Commerce Lite

Get a view of your online sales transactions directly from Dext with Commerce Lite. Commerce Lite connects to major e-commerce platforms, including Shopify, eBay, Etsy and Squarespace. From there, it pulls through your sales data and automatically categorises it.

Find out more

DANAGING COMPLEX PAYROLL RULES JUST GOT A WHOLE LOT EASIER. OUR NEW CUSTOM PAYROLL ENGINE GIVES MANAGERS THE FLEXIBILITY TO DEFINE OVERTIME (OT) AND DOUBLE TIME (DT) RULES BASED ON HOW THEIR TEAM ACTUALLY WORKS. NO MORE SPREADSHEETS OR MANUAL ADJUSTMENTS.

Build Payroll Rules Your Way

Every business runs a lit-

tle differently. With our new payroll engine, you can configure time calculation rules based on:

• Daily hours worked

• Weekly hours worked

• Holiday work

• Consecutive days worked

Need unique rules for different team members? No problem. Rules can be applied per user, so you have full control and compliance across your workforce.

EPUTY, THE GLOBAL PEOPLE PLATFORM FOR SHIFTBASED BUSINESSES, HAS ANNOUNCED AN EXCLUSIVE PARTNERSHIP WITH PREDELO, AN AI DECISION AGENT-AS-ASERVICE SOLUTION. THE COLLABORATION WILL TRANSFORM HOW SHIFTBASED COMPANIES MANAGE THEIR EMPLOYEES, BRINGING PREDICTIVE SCHEDULING, COMPLIANCE AUTOMATION, AND LABOR OPTIMIZATION INTO ONE INTELLIGENT EXPERIENCE.

Deputy is currently piloting Predelo with customers locally as well as in the United States, where a national coffee brand is managing over 70,000 shifts per week and auto-scheduling an estimated 85% of its workforce. It is helping businesses improve profitability, reduce compliance risk, and simplify day-to-day sched-

uling operations at scale.

This strategic partnership will see Predelo’s AI-powered labor forecasting and auto-scheduling agents made available exclusively to Deputy Customers. Predelo’s AI models ingest real-time and historical data to learn customer objectives without human “cognitive” input and then operate in the background to automate & self-optimize repetitive scheduling tasks that are fair and aligned with demand, down to the store and department level.

“Artificial intelligence and machine learning are transforming the economics of shift-based work, and this partnership redefines what’s possible for the future of the front-line,” said Silvija Martincevic, CEO at Deputy.

Find out more

NEW IN CALXA THIS MONTH WE RELEASED THE ABILITY TO USE ORGANISATIONS AS PART OF A BUSINESS UNIT TREE. AS YOU KNOW, WE ARE CONSTANTLY WORKING ON IMPROVING CALXA AND DELIVERING THE FEATURES YOU NEED TO WORK EFFICIENTLY. ADDING ORGANISATIONS TO YOUR BUSINESS UNIT TREES, MAKES IT EASIER FOR YOU TO REPORT ON A HIERARCHY OF ENTITIES. IN ADDITION, WE’VE ALSO GIVEN YOU THE OPTION TO ADD A DEMO DATA WORKSPACE TO YOUR SUBSCRIPTION AT NO CHARGE TO USE FOR TRAINING OR PRESENTATIONS. OF COURSE, THERE IS SOME MORE. WE’VE ADDED BUDGET COLUMNS TO ONE OF OUR MOST POPULAR REPORTS, THE P&L COMPARISON.

Viewing Organisations in Business Unit Trees

We’ve long had flexible structures for reporting on departments, jobs and projects. We’ve now extended that to organisation-level reporting by adding organisations into Business Unit Trees. You’ll need to add all the organisations to a Consolidated Group, then you can include them in a Business Unit Tree to group them. Create headers for regions or function, depending on your needs and move the relevant organisations under each.

You can expand on this and build a complete hierarchy of entities and departments across your whole consolidated group, combining both entities and business units.

Find out more

WE’RE EXCITED TO ANNOUNCE ANOTHER UPDATE, FOCUSED ON GIVING YOU MORE CONTROL.

New Features

Organize Your Other Documents with new Statuses

We know that not every document you upload needs immediate bookkeeping action. Files, such as contracts or notices, are often required for later use but may clutter your active view. To solve this, we’ve added a new “Archived” status for the Other Documents. You can now archive any document to move it out of your active view while keeping

it safely stored for later access. We also added an “Exported” status, so you can see which documents have already been downloaded.

When you upload a single PDF containing multiple invoices, the system automatically splits them into individual entries. However, it was challenging to identify which original bulk file a specific split invoice came from. We’ve made this easier by adding information about the parent document to each split invoice.

Find out more

BGL CORPORATE

SOLUTIONS (BGL), AUSTRALIA'S LEADING PROVIDER OF COMPANY COMPLIANCE, SELF-MANAGED SUPERANNUATION FUND (SMSF), INVESTMENT MANAGEMENT, IDENTITY VERIFICATION AND AI-POWERED PAPER-TO-DATA SOFTWARE SOLUTIONS, IS PROUD TO ANNOUNCE THE RELEASE OF ITS 2025 TAX UPDATES FOR SIMPLE FUND 360 AND SIMPLE INVEST 360.

These updates include all the 2025 changes for the Company, Trust and SMSF Income Tax / Annual Returns for Simple Fund 360 and Simple Invest 360.

“We know tax time can be challenging, so our team is

committed to staying ahead of legislative changes and helping clients simplify their year-end responsibilities,” said Jeevan Tokhi, General Manager of Product at BGL. “These updates provide enhanced preparation and review functions for the 2025 SMSF, Trust and Company Tax Returns, making it faster and more efficient.”

In Simple Fund 360, BGL has added support for the 2025 SMSF Annual Return and all associated tax changes. While the ATO made no changes from 2024, clients can now generate Annual Returns for SMSF wind-ups processed during the 2025 financial year.

Find out more

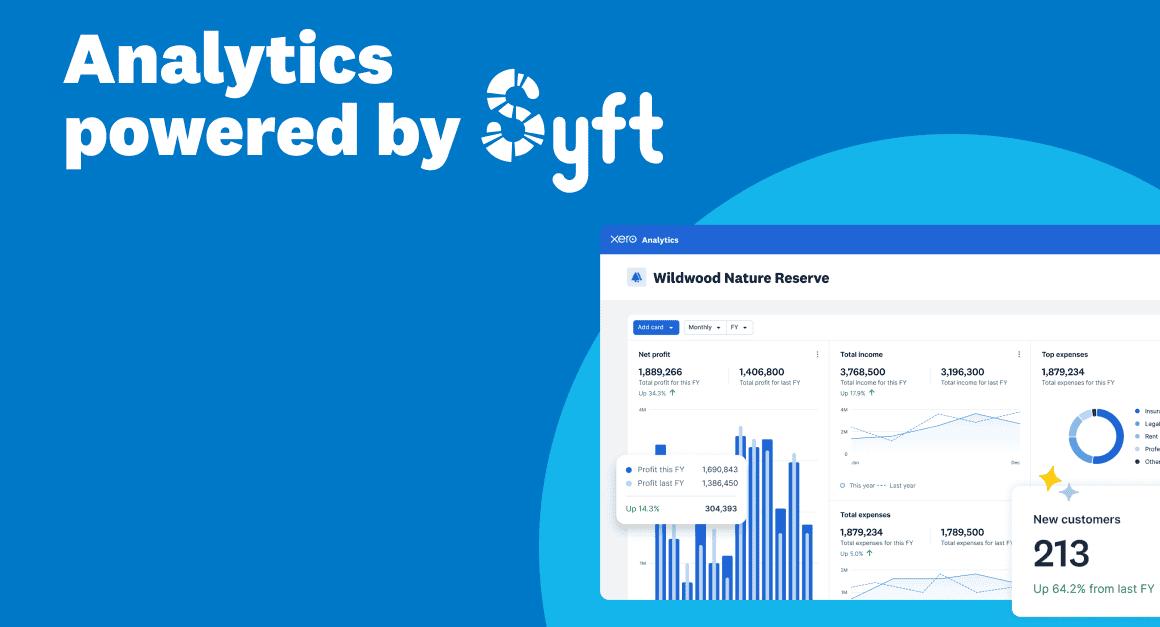

EARLIER THIS YEAR, WE ANNOUNCED THAT ANALYTICS POWERED BY SYFT, XERO’S NEW OFFERING THAT INTEGRATES SYFT’S SMALL BUSINESS FEATURES INTO XERO, WAS ROLLING OUT IN EARLY ACCESS TO A SELECT GROUP OF PLANS IN THE UNITED STATES.

After a very positive response from customers included in that preview, we’re continuing to build on our promise to empower small businesses and their advisors with the tools they need to make more informed business decisions by extending access to all US customers.

And starting this week, small business customers and their advisors across Australia will also begin to gain early access to the financial clarity and actionable insights provided by Analytics powered by Syft. Customers in early access will be empowered to improve financial management, boost efficiencies, and ultimately save valuable time through Analytics powered by Syft’s visualisation and performance dashboard features.

“I’m super excited about the integration of [Analytics powered by] Syft with Xero. This actually is going to present an incredible opportunity to unpack what’s

happening in the business and to understand where you’re performing well and where you can do better. I’ve had a little bit of experience with Syft, and this integration with Xero is going to be a game changer.” – Australian small business customer.

Analytics powered by Syft transforms complex data into clear, actionable graphs and tables, and enables you to create interactive and customised dashboards –providing immediate oversight of key business trends such as your overall profitability and operating cash flow. All accessed right from within Xero!

Once you’ve been granted early access to Analytics powered by Syft, you’ll see a banner within your Xero dashboard. You’ll also be able to click through via the report centre; directly within the profit and loss (income statement) report; and through the business snapshot dashboard.

Don’t see any banners on your dashboard yet? Keep an eye out when logging in as the rollout is being staggered over the next few months, and we expect all qualified customers will have access by August.

Keep reading

WE JUST ROLLED OUT A MAJOR UPGRADE TO EXPENSE REPORTS IN NEW EXPENSIFY - AND YOU’RE ONE OF THE FIRST TO KNOW!

Transform your expense report viewing

We’ve heard your feedback, and we’re thrilled to introduce features that directly address your most requested improvements.

View reports as tables: clarity at a glance

One of our most-requested updates! You can now view your reports as organized tables for faster and easier processing. This new layout provides a clear,

structured overview, making it simpler to identify discrepancies and approve reports. Plus, clear up any questions or confusion by chatting directly on any report or expense, fostering seamless collaboration.

Swipe to view expenses: effortless review on the go

Ready for an even easier way to review expenses?

We've added an intuitive swipe-through experience so you can breeze through individual expense details at a glance. Whether you're on your desktop or mobile, reviewing expenses has never been more efficient.

Find out more

DEPUTY, THE GLOBAL PEOPLE PLATFORM FOR SHIFT-BASED BUSINESSES, HAS ANNOUNCED THE APPOINTMENT OF CIARAN HALE AS ITS NEW CHIEF TECHNOLOGY OFFICER (CTO). HALE JOINS DEPUTY WITH AN EXTENSIVE BACKGROUND IN AI, DIGITAL TECHNOLOGY, ENTERPRISE DATA PLATFORMS, AND LARGE-SCALE ENGINEERING TRANSFORMATIONS ACROSS SOME OF THE WORLD'S MOST RESPECTED TECHNOLOGY COMPANIES.

Most recently, Hale served as CTO at Displayr, an Australian scale-up in the market research space, where he drove cloud migration, developer productivity, and the launch of generative AI capabilities. Prior to that, he held senior engineering leadership roles at Atlassian, where he led engineering teams of over 500 and

TODAY, I’M EXCITED TO SHARE THE BETA LAUNCH OF OUR NEW NAVIGATION AND HOMEPAGE (PREVIOUSLY CALLED THE DASHBOARD) EXPERIENCE. THIS GOES BEYOND A FRESH NEW LOOK AND A CHANGE IN NAME, IT’S THE NEW HOME OF ALL YOUR BUSINESS KEY INSIGHTS AND ACTIONS. BUILT FOR YOU, WITH YOU, THIS BETA IS THE NEXT STEP TOWARDS A MORE INTUITIVE AND INSIGHTS-RICH XERO.

Our goal is simple: empower you to see your business’s true performance at a glance and tackle the most important tasks, quicker. That means more valuable time back for what matters most. And soon, we’ll begin testing this exciting new experience with a group of

Xero customers who have joined the beta.

I know that many of you will be curious about what’s ahead, so here’s your sneak peek of the new navigation and homepage experience.

Built with you, for you

Every time you log in, the Xero navigation and homepage are your gateway to managing your business, so we know how important it is that we get this right.

That’s why we’re committed to building it with you, for you. We co-created this experience with almost 3,000 of you – small business owners, accountants and bookkeepers – across Australia, New Zealand, the United Kingdom and the United States. Your feedback, pain points, and de-

sires shaped every single element, ensuring this new experience delivers what you need.

And throughout this beta, we’ll keep asking for your input, keep refining, and keep building a Xero that truly works for you, your business and your future.

A closer look: More control, more clarity

So, what’s changing?

A simpler navigation

You told us you want to find what you’re looking for more easily, so we’ve simplified navigation labels and grouped tasks more intuitively. This means you can find what you’re looking for, faster, glide seamlessly between tasks, and ultimately unlock even more value from

your Xero subscription.

You said you wanted easier access to key resources from anywhere in Xero. The improved right-hand panel lets you search, see notifications, get help, take quick actions, and use JAX (your GenAI-powered business companion), saving you valuable time.

Stay tuned over the coming months as we reveal more about the capabilities the new navigation will unleash.

Your dynamic new homepage

The homepage is the central hub of your Xero experience.

Keep reading

MTD for Income Tax:

was instrumental in launching Atlassian Analytics, a product that enables deep customer insight through connected data visualisation.

“At Deputy, we've always believed that transformative technology leadership demands both bold vision and a deep commitment to delivering customer value,” said Silvija Martincevic, CEO of Deputy. “Ciaran is not just a technologist — he’s a builder and a scaler. His track record in scaling teams, driving engineering culture, and launching AI-powered products makes him the ideal person to take our technology organisation to new heights. I’m thrilled to welcome him to our leadership team.”

Find out more

AS THE ROAD TO MAKING TAX DIGITAL FOR INCOME TAX (MTD FOR IT) MOVES CLOSER TO REALITY, UK ACCOUNTANTS AND BOOKKEEPERS ARE FACING THE MOST SWEEPING OPERATIONAL CHANGE TO HIT THE PROFESSION IN YEARS. THE SHIFT ISN’T SIMPLY REGULATORY. IT’S SYSTEMIC — CHALLENGING FIRMS TO RETHINK HOW THEY WORK, HOW THEY SERVE CLIENTS, AND HOW THEY STAY COMPETITIVE.

For many firms, MTD has loomed as a disruption. QuickBooks sees it differently — as a generational reset. With connected workflows, AI-powered automation, and platform-wide intelligence, firms can move beyond simply meeting HMRC’s digital mandate to building genuinely modern, scalable advisory practices.

Nick Williams, International Product Director at Inuit, explained: “Everything we are doing is about making life easier, but it’s also about something bigger. We’re bringing together everything you need to run and grow your practice. It’s not just tools. It’s connection. It’s clarity. It’s confidence.”

At the heart of its approach is a full-stack, AI-powered platform designed to make compliance simpler, workflows smarter, and firms stronger.

The MTD timeline is real — but so is the opportunity

With HMRC’s phased rollout now well underway — starting with voluntary testing in 2024, mandation for landlords and sole traders over £50,000 in 2026, and wider thresholds extending in 2027 and 2028 — time is

tightening for individuals and small businesses still operating fragmented systems.

QuickBooks’ strategy is clear: don’t treat MTD as just another compliance project. Use it as the catalyst to reset workflows, automate administrative load, and position firms for long-term scalability. And that requires technology built for both the demands of today and the complexity of tomorrow.

One platform. Four layers of advantage.

QuickBooks has structured its MTD solution around what it calls its four-layer technology stack — an integrated architecture that spans every part of the accountant-client workflow:

1. Foundation layer – The right solutions for the right clients

Ledger: Enables accountants to manage client records directly. Bank feeds, reconciliation, Workpapers integration, and MTD for IT tools simplify reporting. Clients can easily upgrade as their needs grow.

Sole Trader: Designed specifically for sole traders. AI-driven automation separates personal and business transactions. Receipts are captured and matched instantly via mobile. For sub-contractors, QuickBooks also supports Construction Industry Scheme (CIS) calculations and deductions to streamline compliance.

Simple Start: Enables clients to take charge of their finances while still guided by their accountant.

Keep reading

ALLICA BANK CAN TODAY REVEAL THAT THE GAP IN INTEREST RATES OFFERED TO SMES BY CHALLENGER BANKS AND TRADITIONAL HIGH STREET BANKS HAS ALMOST TRIPLED COMPARED WITH THIS TIME TWO YEARS AGO.

Allica has been monitoring these savings rates across the market for the last two years, and a clear trend has emerged.

SMEs banking with traditional banks are continuing to lose out, while challenger banks have consistently offered a significantly better deal to SMEs.

This trend inspired the Great British Savings Squeeze campaign, run by Allica Bank and supported by the Federation of Small Businesses, Institute of Directors and more.

Since it launched last April however, the gap has continued to widen with Big Banks showing no sign of helping their SME customers make the most of their savings.

In May 2025 SMEs saving their cash with a challenger bank received on average £2,326.50 more interest per year than if they kept the same cash with a traditional Big Bank.

This number has increased dramatically since May two years ago showing that challenger banks are doing a good job of offering strong rates to SME customers.

The rates offered by big banks meanwhile are lagging behind dramatically, underlining the rationale behind Allica’s continued push for a review into the business savings market, and emphasising the importance of business owners to consider where they keep their excess cash.

SMEs are losing out on thousands of pounds of interest each year

Allica has been independently tracking average savings rates since January 2023.

In the last two years (May 2023 to May 2025), Big Banks have offered SMEs savings average interest

rates of between 0.76% and 1.59%.

Meanwhile challenger banks regularly offered rates of more than 4% on SME savings during the same period.

The difference in interest on the average SME savings of £75,000 is significant, but there are thousands of established businesses in the UK that have far more saved with their bank. For these firms, the difference is even more noticeable.

For example, in June 2025 a business with £1 million saved would have earned almost £12,000 annual interest with a Big Bank. The same cash saved with a challenger bank could have earned nearly £42,000. That’s an extra £30,000 that could have been invested back into the business or helped absorb rising costs.

Given that there are 5.5 million SMEs in the UK, the cumulative effect of this discrepancy on local economies is significant.

Find out more

ALLPAY LIMITED, THE UK’S LEADING PAYMENT SOLUTIONS PROVIDER, HAS BECOME THE FIRST COMPANY TO SIGN THE FORTITUDE PLEDGE, A BOLD NEW COMPLIANCE AND SECURITY STANDARD LAUNCHED BY ISSUER PROCESSING POWERHOUSE ENFUCE, DESIGNED TO ELIMINATE 100% OF FINANCIAL CRIME RISKS ACROSS ALL CARD TRANSACTIONS.

The Fortitude Pledge is a proactive commitment to move beyond checkbox compliance and take full responsibility in the fight against financial crime. From screening every card transaction to training every em-

ployee, the Fortitude Pledge sets a new benchmark of zero tolerance for financial crime, including money laundering, terrorist financing, and human trafficking.

This milestone underscores allpay’s dedication to building a fairer, more transparent financial system and marks an important step in the evolution of its strategic partnership with Enfuce.

United by a shared purpose and a commitment to raising the bar for excellence in financial services, allpay and Enfuce have joined forces across two critical fronts, card manufacturing and payment processing, leveraging their combined

To

extend everyday payments, remittances,

Pstrengths to deliver secure, scalable, and future-ready solutions across the UK.

By integrating Enfuce’s cloud-based technology, allpay is modernising public sector payments across the UK, making them more secure, efficient, and less vulnerable to fraud. At the same time, allpay is powering card manufacturing and personalisation for Enfuce’s MyCard solution, enabling highly secure, seamless, and personalised card experiences.

Find out more

AYPAL TODAY ANNOUNCED PLANS TO MAKE THE PAYPAL USD (PYUSD) STABLECOIN AVAILABLE ON THE STELLAR NETWORK PENDING REGULATORY APPROVAL BY THE NEW YORK STATE DEPARTMENT OF FINANCIAL SERVICES (NYDFS)1. STELLAR IS A BLOCKCHAIN DESIGNED FOR FAST, LOW-COST PAYMENTS AND REAL-WORLD UTILITY. BY POTENTIALLY EXPANDING TO STELLAR, PYUSD LEVERAGES THE NETWORK'S SPEED, LOW TRANSACTION COSTS, AND EASE OF INTEGRATION TO ENHANCE ITS UTILITY FOR REAL-WORLD PAYMENTS, COMMERCE, AND MICRO-FINANCING, OFFERING AN ADDITIONAL OPTION TO ETHEREUM AND SOLANA.

PYUSD on Stellar can be used for fast, affordable cross-border payments and expanded access to essential financial services while bridging the digital and physical world with a vast array of on and off ramps. Users may also benefit from improved daily payment options and financing solutions such as working capital and business loans - use cases already thriving on the Stellar network - ultimately enabling a more seamless flow of value across global markets.

"For years, stablecoins have been deemed crypto's

'killer app' by combining the power of the blockchain with the stability of fiat currency. As we see cross border payments being a key area where digital currencies can provide real world value, working with Stellar will help advance the use of this technology and provide benefits for all users," said May Zabaneh, Vice President of the Blockchain, Cryptocurrency, and Digital Currency Group, PayPal.

An expansion on Stellar would give PYUSD users access to its vast network of on and off ramps, providing additional access through digital wallets, and connected to local payment systems and cash networks. Access to extensive Stellar infrastructure will enhance how people can use PYUSD in their everyday financial activities, from payments to remittances to merchant services.

"Stellar is the network for fast, low-cost, and trusted global payments at scale. By bringing PYUSD to 170+ countries, we're transforming stablecoins into practical financial tools that millions of everyday users and merchants can actually use," shared Denelle Dixon, Chief Executive Officer of Stellar Development Foundation. "Together, we are bringing stable digital currency to small businesses and individuals in emerging markets all over the globe."

PYUSD on Stellar can also enhance liquidity and financing opportunities through Payment Financing or 'PayFi', an emerging innovation in digital finance. Small and medium-sized businesses that face delayed receivables or pre-funding requirements would be able to access new sources of real-time working capital, disbursed in PYUSD. This capital can be used to pay suppliers, manage inventory, or address other operational needs – with instant settlement on Stellar. Liquidity providers can fund these opportunities and earn potential, sustainable benefits from real-world economic activity.

PYUSD on Stellar can drive efficient modernized money movement, cost transparency, and minimize settlement delays by unlocking better borderless financial flows.

IMPORTANT DISCLOSURES

This press release is for informational purposes only and is not intended as financial, investment or other advice. The use and exchange of digital assets, including stablecoins such as PYUSD, may involve complex risks, including but not limited to:

• Network & Custody Risks: Transactions on blockchains Keep reading

PAYPAL HOLDINGS, INC. (NASDAQ: PYPL) TODAY ANNOUNCED THAT DEIRDRE STANLEY HAS JOINED THE COMPANY'S BOARD OF DIRECTORS. STANLEY BRINGS NEARLY THREE DECADES OF EXPERIENCE AS A SENIOR EXECUTIVE FOR GLOBAL ORGANIZATIONS

SPANNING THE CONSUMER, MEDIA, AND INFORMATION TECHNOLOGY SECTORS. SHE MOST RECENTLY SERVED AS EXECUTIVE VICE PRESIDENT AND GENERAL COUNSEL OF THE ESTÉE LAUDER COMPANIES, OVERSEEING GLOBAL LEGAL STRATEGY IN THE APPROXIMATELY 150 COUNTRIES AND TERRITORIES WHERE THE COMPANY'S PRODUCTS ARE SOLD.

"PayPal is a trusted brand that is reshaping the future of commerce for consumers and merchants around the world," said Alex Chriss, President and CEO, PayPal. "Deirdre brings exactly the kind of global brand-building expertise and market insight we need to accelerate our innovation agenda and deliver even more value to our customers as their needs continue to evolve."

"We are thrilled to welcome Deirdre to our Board of Directors," said Enrique Lores, Chair of PayPal's Board of Directors. "Deirdre joins the Board with extensive expertise in consumer brands, technology, risk management and compliance, and complex business

transactions. She will help the Board and management team advance our strategy and expand into new areas."

"I'm honored to join PayPal's Board of Directors during this transformative period in the company's evolution," said Stanley. "PayPal's commitment to pioneering the next generation of commerce experiences while maintaining the highest standards of security and trust aligns perfectly with my values. I'm eager to contribute to the company's mission and look forward to collaborating with Alex, Enrique, and my fellow board members to drive sustainable growth."

Find out more

TODAY, PROGRAMMABLE FINANCIAL SERVICES COMPANY STRIPE ANNOUNCED A DEEPER PARTNERSHIP WITH SHOPIFY, IN WHICH STRIPE WILL HELP MILLIONS OF SHOPIFY MERCHANTS ACCEPT STABLECOIN PAYMENTS. IN A FEW WEEKS, SHOPIFY MERCHANTS ACROSS 34 COUNTRIES WILL BE ABLE TO ACCEPT PAYMENTS IN USDC.

Shoppers will be able to pay with USDC on Base using their preferred crypto wallet. By default, Stripe will allow merchants to receive stablecoin payments in their preferred local currency, to be deposited in their bank account just like any other payment they receive. Alternatively, merchants will have the option to transfer funds as USDC directly to an external wallet.

“Stripe has long handled the hard parts of payments so our merchants don’t have to,” said Kaz Nejatian, COO & VP of Product at Shopify. “Now they’re doing the same for stablecoins—making it simple for our merchants to meet booming global demand without wrestling with crypto infrastructure.”

Find out more

DEUTSCHE BANK AND ANT INTERNATIONAL HAVE ANNOUNCED THEIR STRATEGIC PARTNERSHIP TO PROVIDE MORE COMPREHENSIVE PAYMENT SOLUTIONS FOR BUSINESSES OF ALL SIZES IN EUROPE AND ASIA, BY COMBINING THEIR EXPERTISE AND LEVERAGING ANT INTERNATIONAL’S PROPRIETARY TOKENISATION AND AIBASED FX TECHNOLOGY.

The bank will collaborate with Ant International’s Embedded Finance unit on a series of global treasury management and cross-border payment innovations, including tokenised deposits, stablecoin, and its Time-Series Transformer (TST) FX Model.

Deutsche Bank will be the first German bank to facilitate Ant International’s blockchain-based real-time treasury management platform to enable real-time fund transfers between Ant International’s intragroup entities. This will enable more efficient and transparent global treasury management for Ant.

In addition, the two sides will also explore cross-border payment innovations, including tokenised bank deposits, stablecoin and Ant International’s Falcon TST FX Model, to help Ant International and its clients reduce FX-related cost and risks.

Both companies will also further look into the applications of stablecoins for global payments, including real-time cross-border treasury management for Ant’s entities, reserve management and on-ramp and off-ramp services.

Deutsche Bank will also work with Antom, a merchant payment and digitisation services provider, to scale up their collaboration to extend Antom’s acquiring solutions for merchants in EMEA, enabling them to be seamlessly integrated with more payment solutions.

The bank will also support WorldFirst’s suite of payments-related solutions for SMEs in ecommerce and cross-border trade, including but not limited to account collections, payments and FX services. It will also enable the account and fi-

nancial service provider to access its global network to serve its clients.

Ole Matthiessen, Head of Corporate Bank APAC & MEA and Global Head of Cash Management for Deutsche Bank said: “We are delighted to strategically cooperate with Ant International. We will leverage our broad product capabilities and strong global network to deliver seamless and secure payment solutions to Ant International and its customers in Europe and Asia."

Given the dynamic landscape of financial services, we see great potential to collaborate with Ant International, as one of the world’s leading financial technology providers, to develop innovative payment solutions and transform the future of treasury management. Ole Matthiessen

Kelvin Li, General Manager of Platform Tech at Ant International, said: “With a dynamic fintech landscape, Europe is fast-becoming a key hub for global digital payment innovation.

Find out more