The Quiet Rebuild Behind

the Scenes

A new platform. A committed team. A story of transition told openly by the owners. Discover why WorkflowMax has re-emerged as a trusted tool for project-based businesses — and their advisers.

Are your clients asking:

How can we stay efficient?

How do we protect our margins?

Accountants who can recommend practical, real-world solutions like WorkflowMax position themselves not just as advisers, but as essential partners in their clients’ success.

WorkflowMax provides businesses and their accountants, a complete, real-time view of operations, from quoting to job tracking to invoicing.

That means better financial visibility, cleaner data, and faster decision-making for both parties.

The independent news source for users of accounting apps & their ecosystems

magazine Issue 43

Main Contacts -

CEO:

David Hassall (Co-Founder)

Managing Editor: Wesley Cornell (Co-Founder)

Chief Revenue Officer: Alex Newson

Account & Partnership Assistant: Robyn Consterdine

Creative Assistant: Victoria Young

Editorial/News Submissions:

If you have any editorial content (news, comment, tutorials etc.) that you would like us to consider for inclusion in the next edition of XU Magazine, please email us at editorial@xumagazine.com

Advertising: advertising@xumagazine.com

E: hello@xumagazine.com

W: www.xumagazine.com

© XU Magazine Ltd 2014-2025. All rights reserved. No part of this magazine may be used or reproduced without the written permission of the publisher. XU Magazine is published by XU Magazine Ltd (08811842), registered in England and Wales. Registered office: Office 1, Brunswick House, Brunswick Way, Liverpool, Merseyside, L3 4BN, United Kingdom. All information contained in this magazine is for information only and is, as far as we are aware, correct at the time of going to press. XU Magazine cannot accept any responsibility for errors or inaccuracies in such information. If you submit unsolicited material to us, you automatically grant XU Magazine a licence to publish your submission in whole or in part in all/ any editions of the magazine, including in any physical or digital format, throughout the world. Any material you submit is sent at your risk and, although every care is taken, neither XU Magazine nor its employees, agents or subcontractors shall be liable for loss or damage. The views expressed in XU Magazine are not necessarily the views of XU Magazine Ltd, its editors or its contributors.

From One Chapter to the Next: The New Era of WorkflowMax

Introducing Growth Club — the run club for firm owners

The Power of Forecasting: Building a Resilient Future

Intuit Quickbooks Mastering EOFY with Expert Tips

ApprovalMax Smarter approvals, stronger controls

FreeAgent How to help clients click with MTD

G-Accon Create Dashboards and KPIs in One Click — No Coding, No Delay

As you are reading through the magazine any article that shows the CPD Certified logo has been approved to count towards your CPD points. We are really excited to have been able to secure this for our readers as it means all approved articles can now be used towards your CPD points and building up your CPD register.

ExpenseOnDemand Revolutionising Financial Integration: How ExpenseOnDemand and Moneyhub Are Transforming the Xero Experience 76

The Accounting & Business Show Asia Reach the right audience at the Accounting & Business Show Asia 80

Accountex Manchester Accountex Summit Manchester heads up north for its seventh edition

98 Ignition Ignition enhances executive leadership with new SVP of Product, Tammy Hahn

100 Airwallex A new chapter: Announcing our Series F funding

102 BGL BGL announces details of BGL REGTECH 2025

The Quiet Rebuild

From One Chapter to the Next: The New Era of WorkflowMax.

Ryan Kagan, Chris Galt, Kaia Kaldoja & Vince Giovanniello share the story behind their acquisition of WorkflowMax, the rebuild that followed, and why accountants & bookkeepers should take a fresh look at this all-in-one job management solution.

When Xero announced the retirement of WorkflowMax, many in the ecosystem assumed it was the end of the road for the much-loved job & project management tool. But for the new owners, it was just the beginning

When Xero announced the retirement of WorkflowMax, many in the ecosystem assumed it was the end of the road for the much-loved job & project management tool. But for the new owners, it was just the beginning.

Both seasoned business leaders in the accounting and tech space, they saw not a

product winding down, but an opportunity to breathe new life into something accountants and professional services businesses already trusted. Backed by the BlueRock brand, they acquired the WorkflowMax name with a clear mission: to modernise it, enhance it, and keep it in the hands of the people who needed it most.

Now, just over a year later, WorkflowMax has re-emerged with an updated platform, new leadership, and new energy, but still firmly rooted in the values that made it a staple among project-based businesses.

In this conversation, Ryan, Chris, Kaia & Vince share the story of that transition and how far the product has come.

XU: Ryan, what made you want to take on WorkflowMax in the first place?

RK: I think it begins with recognising what WorkflowMax meant to the community. It wasn’t a flashy product, but it was dependable, widely used, and deeply embedded in thousands of professional services businesses. When Xero decided to retire it, there was genuine concern from customers. We felt it deserved a second life.

As former founders of BlueRock Digital; we had been using WorkflowMax in our practice and empowered businesses from around the world in our WorkflowMax implementation services (for over 9 years), Chris and I knew that with the right backing, we could take what people already loved and build it into something even better. It wasn’t about reinventing the idea. It was about honouring the product’s history whilst giving it an exciting future!

XU: Chris, what was it about the team and timing that made this feel right?

CG: Honestly, it was the perfect intersection of opportunity, capability, and passion. We had the right people, both technically and strategically, and we had a deep respect for the accounting ecosystem around

WorkflowMax. That matters.

We also saw how many partners and clients genuinely didn’t want to let go of it. There was emotional equity in the brand. We wanted to step in and say: “You don’t have to. Let’s build the next version together.”

And that’s what we did. From day one, we were committed to listening, rebuilding, and delivering, not just picking up where things left off, but accelerating the evolution.

XU:

Let’s talk about the Xero connection. What’s your take on how the product evolved under them?

RK:

We have nothing but respect for Xero. They made WorkflowMax what it was: accessible, tightly integrated, and trusted by accountants and professional services businesses around the world.

That said, I often described it like a great house that just needed a fresh coat of paint and a more modern touch. Xero made the strategic decision to retire the product — and that opened the door for us to step in and build its next chapter.

So really, we see this not as a replacement, but as a continuation. We’re proud to carry forward with a new infrastructure, more flexibility, and a roadmap shaped directly by customer feedback.

XU: What has improved since the original version?

KK: Almost everything. The infrastructure is new, faster, scalable, and designed for an exciting product roadmap that revolutionises job management. We’ve modernised key components like time tracking, job costing, and reporting. We’ve also moved to a more modern user interface.

But the biggest change is responsiveness. In the past, development was slower; now we’re releasing many updates regularly, and often directly in response to partner or customer feedback. The core strengths remain, but it’s a faster, more flexible platform now.

XU: And you’ve kept the product anchored in familiar territory?

CG: Exactly. We didn’t want to throw everything out. People were used to the navigation, the job structure, and the way things flowed. So we kept what worked and improved what didn’t. That way, clients coming from the previous version felt continuity, but also momentum.

We’ve heard from a lot of partners that the learning curve is minimal, and the improvements are obvious. That’s exactly the balance we aimed for.

XU: Chris, you’ve said before that some “accountants are still on the fence” about recommending WorkflowMax. Why is that, and what’s changed?

CG: There’s definitely some legacy perception from earlier days, where it was seen as ‘just enough’ but not truly best-in-class. We understand that. But that perception is outdated.

Today, accountants recommending WorkflowMax get

MaxConnect 2024. The first time we brought the entire WorkflowMax team from around the world together!

three things: a much-improved product, a trusted support network, and cleaner data from their clients. It’s not just about job management anymore, it’s about enabling better conversations between accountants and clients.

XU: What kinds of clients are the best fit for WorkflowMax?

VG: The sweet spot is mid-sized, servicebased businesses, especially in sectors like architecture, engineering, creative agencies, consulting, and IT services.

If a business bills for time, manages multiple projects, needs better quoting, or struggles with job profitability, WorkflowMax is often the right fit. We also see a lot of success with businesses that have outgrown basic tools or, on the flip side, want to scale back from expensive ERP systems that are too complex or costly for their current needs.

It’s not traditional enterprise software, but it’s powerful enough to support teams of five to 100+. And for accountants, if your client is juggling spreadsheets, Word docs, and separate invoicing platforms, WorkflowMax brings all of that together into one clean, integrated system.

and optimised for success.

And they stay involved. For accountants, that’s peace of mind. You’re not just making a referral, you’re connecting your client with a network that supports them every step of the way. And by the way, we’re actively accepting new partners across Australia, New Zealand, the UK & US and beyond.

XU:

What has customer feedback looked like throughout this transition?

RK:

It’s been honestsometimes brutally so - and that’s exactly what we hoped for. From the start, we knew this wouldn’t be a simple “flick of a switch.” But understandably, some customers expected continuity in the same product overnight. What they didn’t see initially was that this wasn’t just a handover, it was a complete rebuild, under intense time pressure.

“Xero built something solid. We’re building the next chapter — together with the community.”

XU: Can you talk more about the partner ecosystem?

RK: We’re proud of our implementation partners, they’re not just onboarding specialists, they’re long-term advisers to our clients. We understand that changing software is hard. So we work with certified partners who know the product inside out and understand business processes. They ensure that WorkflowMax isn’t just installed. It’s configured

customers who stuck with us. This was a one-of-a-kind transition, and we couldn’t have done it without every single person involved.

XU:

You mentioned WorkflowMax is proudly based in Australia. Can you expand on that?

CG:

Yes, we’re proudly Australianfounded, with our head office in Melbourne, and that’s a big part of who we are. But we’re also growing our team internationally, with support operations in the UK, Ireland, New Zealand, and the Philippines. That reach allows us to support our customers in their local time zones, with people who genuinely understand their region and industry. We’re the first to admit we haven’t always got everything right. During the migration period, we faced a tidal wave of requests, hundreds, sometimes thousands, each day. We took some flack for it, and we understood why.

We had just three months to migrate thousands of customers, some with 15 years’ worth of history and tens of thousands of jobs. Behind the scenes, our team was working around the clock, across time zones, through real fatigue and pressure. There were late nights, video calls by the thousands, and constant customer conversations. But we never lost sight of the mission: to get our community through the change and into a better system.

What stands out now is how many of those early sceptics have become champions. Once they saw their feedback actioned: better reporting, improved workflows, more intuitive navigation, they realised we were not just listening, but delivering.

We’re proud of the team and incredibly grateful to the

But instead of backing away, we leaned in. We’ve heavily invested in our support team, our internal systems, and the way we communicate. Today, our average response times are measured in hours, not days and more importantly, we’ve brought back the human touch.

Whether you’re in Hawke’s Bay, Brisbane, Birmingham or Boston, when you reach out to WorkflowMax, you’re speaking to someone who gets it, someone who’s part of a team committed to helping you succeed.

FIND

OUT MORE...

Discover more about WorkflowMax and partnership opportunities: workflowmax.com

Joiin’s biggest reporting upgrade yet.

Start 14 day free trial

Smarter f inancial consolidation and reporting for single entities, multi-entity groups, or your entire client portfolio. Aggregate, consolidate, and automate reporting across Xero, QuickBooks, Sage, spreadsheets and other data sources. Now with:

New reports & dashboards

Excel add-in for live reporting

AI-driven FP&A insights

Pennylane and Puzzle integrations

Customer-led feature enhancements

Introducing Growth Club — the run club for firm owners

The new community helping accountants grow smarter, together

Trent McLaren, Co-Founder, The Firm

Trent McLaren is the CoFounder of The Firm, a peer-led media and education platform for accountants and bookkeepers. Through live events, podcasts, articles, and digital resources, The Firm helps professionals across the industry connect, learn, and lead with confidence. Backed by over a decade of experience in accounting tech and advisory, Trent brings deep industry insight and a passion for building stronger, smarter firms through community and shared knowledge.

Growth Club is where accounting firms come together to grow with consistency, purpose, and the support of a like-minded community.

or years, accounting and bookkeeping firms have been told to “work on the business, not just in it.” But most leaders are already stretched thin. You’re managing pricing questions, clunky workflows, an overworked team, and rising client demands, all while trying to stay a few steps ahead of change.

The pace is faster. The stakes feel higher. And the isolation of running a firm hasn’t gone away.

That’s the problem Growth Club set out to solve.

Growth Club was created to give accountants and bookkeepers a rhythm. Not a high-pressure sprint. Not a one-off burst of motivation. But a consistent way to plug into better ideas, stronger connections, and real progress, together. Think of it like a run club, but for your business. You show up. You learn. You grow. And the momentum builds.

And it all kicks off with the first-ever Growth Club Summit, happening 25–26 June.

Growth Club Summit is more than an event. It’s a reset. A practical, CPD-claimable online experience designed to help firm owners pause, reflect, and ask better questions. What kind of firm are we really building? What are we doing that adds value? And what’s getting in the way?

"Growth Club is where momentum starts, and clarity returns."

Mark Wickersham on designing pricing that fits your value and your client. Michael Wood on what AI agents really mean for the future of accounting software. Cassandra Scott on using practice intelligence to fix problems before they become problems. Inbal Rodnay on the real-world impact of Microsoft Co-Pilot inside a growing practice.

"This is where firm owners reset, refocus, and build what comes next."

The speakers are people you actually want to hear from, firm owners, app builders, advisors, and leaders who are in it with you. They’re not pitching. They’re showing. The pricing models they’ve tested. The AI tools they’re actually using. The systems that reduced hours of admin. The mistakes they’d never repeat.

You’ll hear from people like

You’ll also hear honest conversations from people like Amanda Gascoigne, Rachel Fisch, Kylie Parker, and Jason Robinson, on what it’s like to lead a firm through the hard seasons. When the pressure is personal. When growth feels risky. When you’re carrying it all.

These aren’t abstract ideas. They’re specific, relevant, and ready to use.

And the truth is, the firms moving forward are already showing up for this. They’ve registered. They’re building their schedule. They’re carving out the time

to learn something that could change how they work the very next day.

If you’ve felt stuck, scattered, or second-guessing your next step, this is the moment to plug in.

Growth Club Summit is free. It’s 100% online. You’ll get access to every session and replay. And you’ll earn CPD hours through Accrediwise just for attending.

You don’t have to grow alone. But you do have to choose to show up.

"You don’t have to grow alone, but you do have to show up."

More importantly, you’ll stop wondering what other firms are doing and see it for yourself.

Now’s your chance. This is your invitation to join the club. To be part of a growing community of firm owners who are choosing to lead with purpose, share what works, and build businesses they’re proud of.

Growth Club Summit is the first step, and it’s one you’ll want to look back on and say, “That’s when things started to change.” Don’t sit it out. Your next chapter starts here.

The Power of Forecasting: Building a Resilient Future

In a world full of opportunities and change, adaptability is key. Between rising costs, shifting market conditions, and tighter access to finance, businesses today face more pressure to manage their cash wisely.

hat’s why cash flow forecasting has become such an important part of business strategy, not just for large enterprises, but for small and medium businesses too. That’s where Spotlight Forecasting comes in, we’re helping our customers build a clear view of their financial future that has never been easier or more essential.

Real-world use cases from our customers:

A UK accountancy practice worked with an agricultural client to forecast cash flow across different weather and yield scenarios. Not only did it highlight periods of risk, but it also gave the client confidence to invest in new machinery, knowing they could absorb the cost even in a tougher season.

A South African accountant helped their retail client prepare for postholiday slowdowns by building out seasonal forecasts in Spotlight Forecasting. This allowed them to secure a short-term overdraft facility before the dip, rather than scrambling for funds after the fact.

@spotlightrep

Mel Rollason, Customer Success Specialist, Spotlight Reporting

A well-established Chartered Accountant, Mel's career began at KPMG where she spent 5 years auditing a vast array of clients from the Royal Opera House to Boots Group plc. After various accountancy positions in the retail sector, she then went on to run her own accountancy practice for 13 years, and saw for her own eyes the rapid digital shift in the accountancy world. She has a passion for helping practices make the very best use of technology, helping them to save vast amounts of time and increase their fees dramatically.

Cash Flow: Your Business's Lifeline

At its core, cash flow forecasting gives you visibility into your business’s future cash position, identifying when cash shortages might occur and when investment opportunities arise.

Without this clarity, businesses risk being caught off guard by unexpected expenses, seasonal slumps, or shifts in customer behaviour. In a climate where margins are tighter and surprises can be costly, that’s a risk only a few can afford.

'Still Not Sure Why You Need to Forecast?' We’ve listed our top five reasons forecasting is essential right now.

1. Navigate Uncertainty

Forecasting enables you to prepare for the unexpected. Whether facing economic downturns or sudden growth, cash flow insights allow for smarter, faster decision-making.

2. Strengthen Funding

Lenders, investors, and stakeholders expect businesses to show financial planning. A strong, well-constructed forecast can improve your credibility and unlock critical funding.

3. Planning for Growth Growth needs to be sustainable. Forecasting helps ensure you have the resources to hire, expand, or invest at the right time without jeopardising liquidity.

4. Showcases ‘What If’ Scenarios What happens if sales dip? Or if supplier costs rise? Scenario planning allows you to simulate possible good, bad, and ugly scenarios to help you plan accordingly.

5. Build a Strong Business In challenging times, resilience is key. Knowing your future cash position helps you weather storms and seize opportunities with less risk and more confidence.

When done right, cash flow forecasting can be a powerful tool to both reduce risk and boost the chance for sustainable success.

Why Choose Spotlight Forecasting?

Cloud-based software tools like Spotlight Forecasting are changing the game and taking forecasting abilities to a new level:

• Comprehensive 3-way forecasting: Profit & Loss, Balance Sheet, and Cash Flow

• Flexible scenario building

• Easy integration with your financial data

• Clear, powerful reporting that makes insights accessible to all stakeholders In short, it gives you the tools to forecast faster, smarter, and with more precision, helping you future-proof your business.

The Bottom Line

We know forecasting isn’t about predicting the future perfectly, it’s about preparing for it intelligently. Businesses that build forecasting into their regular processes are better equipped to adapt, grow, and thrive, whatever the future holds.

"If accountants aren't doing cash flow forecasting for their clients, they're missing out on a huge opportunity to deepen their relationship and add value. With Spotlight Forecasting, we're trying to empower accountants to provide a future view to solve many of the challenges that businesses face."

- Richard Francis FCA, CEO & Founder, Spotlight Reporting

“Forecasting isn’t just a nice-to-have anymore - it’s the difference between staying reactive and being strategically proactive. Our most successful customers are using forecasting to guide their clients through every major business decision. Offering advisory services including forecasting is where accountants shift from being historians to co-pilots and help small businesses to thrive.”

- Mel Rollason FCA, Customer Success Specialist, Spotlight Reporting

Does sales tax give you a headache?

Let’s automate your sales tax workflow

Sales tax as easy as 1-2-3

If you or your clients sell taxable goods or services across jurisdictions, automate your workflow with Xero’s sales tax, powered by Avalara.

Take the guesswork out of what’s taxable, what’s not, and at what rate with automate sales tax calculations on invoices.

Stay on top of payment deadlines and amounts due with automatically created reports.

Ready to file? Xero connects with Avalara for seamless e-filing options.

Learn how Avalara can help you grow your prac tice and expand your services.

Automated sales tax is included in Xero subscriptions. Visit avlr.co/xero to learn more.

Mastering EOFY with Expert Tips

Transforming Workload into Workflow

Emma Fabbro

,

Accountant & owner, Fusion Accountants

Emma Fabbro, based in Adelaide, is the founder of Fusion Accountants and specializes in aiding micro and small businesses. An esteemed member of the Intuit Trainer Writer Network since 2017, she excels in optimizing Quickbooks Online for clients and advisors. Recognized as one of the Top 100 Proadvisors for 2023, Emma has also earned the title of the 2023 Top International Proadvisor, testament to her expertise in her field.

Explore the transformative benefits of adopting a cloud-based workflow for your firm.

As businesses continue embracing digital transformation, many are realizing the benefits of moving to a cloud workflow. Whether it’s improving accessibility, collaboration, or costefficiency, cloud technology can significantly enhance operational efficiency. In this article, we explore five key advantages of adopting a cloud-based workflow for your business.

One of the primary benefits of moving to a cloud-based system is the improved accessibility it offers. In a cloud workflow, all data and resources are stored online, allowing you to access them at any time and from any location. This is particularly advantageous in the modern work environment where remote working has become more prevalent. With cloud solutions, employees no longer need to be tied to physical office space; they can access necessary information and perform their tasks efficiently from wherever they are.

Another significant advantage of a cloud workflow is the ability to supercharge collaboration among

team members. By consolidating all business information into a single cloud-based client portal, teams can work together more seamlessly. This shared environment facilitates better communication and coordination, particularly for teams that are geographically dispersed. Not being limited to a local office or client base can dramatically widen the scope of your operations, allowing for growth and expansion in different regions.

The introduction of cloud solutions in business workflows also delivers seamless experiences for both your team and your clients. Integrated tools, such as those offered by the QuickBooks suite, can unify client accounting, practice management, and various preparation tasks into a cohesive platform. This integration is crucial for streamlining operations and ensuring that various elements, from BAS and tax preparations to practice management, work harmoniously. Additionally, the compatibility with a range of other apps means your system can be scaled and adapted as your business grows, providing muchneeded flexibility.

Cost-efficiency is another compelling reason to adopt a cloud-based workflow. Transitioning to cloud solutions means businesses can save on the physical infrastructures, such as servers and printers, and ongoing expenses like software subscriptions and upgrades from multiple providers. These savings can be significant, particularly for small to medium-sized enterprises operating on tighter budgets. The operational cost reductions can then be allocated to other critical areas of the business to drive growth and innovation.

Managing a firm effectively becomes less stressful with cloud infrastructure. The initial setup, including sign-up and training, is typically streamlined to ensure a smooth transition. Addressing the doubts associated with moving to the cloud can often be the biggest challenge. However, overcoming personal mindsets, simplifying integration, boosting automation, ensuring cloud security, and getting clients on board are essential steps in the transition process. Each hurdle requires careful consideration and a strategic approach.

For example, integration and automation are vital components of a successful cloud transformation. Automated tools not only facilitate the seamless transfer of client information but also enhance productivity by reducing manual tasks. Cloud security is another critical element, where educating your team and clients about safe practices and using advanced security measures, such as encryption and firewalls, can help protect sensitive data.

Finally, it is crucial to demonstrate the value of cloud solutions to your clients. In a world where immediate access to information is vital, showing clients the benefits of cloud accessibility can be a game changer. Starting this process with clients who trust and value your services can provide valuable insights and help refine your approach.

Moving to a cloud-based workflow offers numerous operational benefits. From enhancing accessibility, increasing collaboration, and streamlining

processes to reducing costs and improving security, the advantages are clear. As every business is unique, consider your specific needs, evaluate your current processes, and begin your transition to the cloud confidently. The future is in the cloud, and the sooner your business adopts this technology, the quicker you will realize its full potential. Transitioning to the cloud was a transformative experience for our practice, and it could be the same for yours.

Staying ahead during the EOFY period can be challenging, but with our series of expert-led webinars and a fresh eBook, managing your year-end tasks can become a streamlined process. Join industry expert, Emma Fabbro, as she delivers invaluable "EOFY Workload to Workflow Series" webinars:

20 June: Productivity Through Processes

23 June: Measuring What Matters

26 June: Fees, Pricing and Profitability

1 July: Client Conversations Done Differently

Additionally, dive into our latest resource, "Your Ultimate Guide to EOFY 2025," which covers comprehensive advice on managing clients, processes, and technology effectively. Don't forget to utilize your essential 2025 EOFY checklist to ensure nothing goes amiss.

Introducing Capium 365

The Digital Record-Keeping Tool for You and Your Clients.

The next evolution in cloud accounting: Designed for accountants and their clients, it enables seamless document capture, real-time collaboration, and smarter workflows.

Capium has made me faster, so I spend less time preparing a set of accounts, now I have more time to focus on my clients With Capium I don’t feel I am on my own

Andrew Osborne Argute Accounting

Snap Receipts & Statement Instantly Using powerful mobile scanning& OCR.

Effortless Digital Record Keeping No spreadsheets No stress

Bank Feeds & Auto Categorisation Save hours each month.

Track Income & Expenses in Real Time From anywhere, on any device

Seamless Submissions to HMRC Stay compliant & ahead of deadlines.

All-in-One App for Clients & Accountants

Capium 365, Bookkeeping, Tax - fully integrated.

Smarter approvals, stronger controls

Here’s how to make faster decisions, fewer mistakes and have complete control over your AP and AR processes.

Approvals weren’t the issue. It was the delays, missing context, and frantic messages trying to reach the right person.

This was daily life for the finance team at NOUS, a creative agency in Australia. The approval process quickly got messy juggling multiple stakeholders who all had to review and approve documents before they could be finalised. The company’s admin staff had to manually check each PDF in a folder – with some containing up to 80 files, this took a huge amount of time. This slow and error-prone process wasn’t just inefficient; the delays left

decision-makers and admin staff confused and frustrated.

Once the team put proper controls in place, with the help of Tinka Consulting, the results were immediate:

NOUS saved the equivalent of one full-time employee (FTE) in time

• The new process has an estimated ROI of AUD$40k

• Administrative staff were freed from managing approvals and chasing decision-makers

• The team maintained the same level of control and oversight

NOUS isn’t alone. Across industries, teams using

Dee Johns, Head of Product Marketing

Dee Johns believes the most powerful words are 'Let me tell you a story.' Her passion for storytelling helps her create meaningful, customer-focused experiences while removing friction, so customers never feel the complexities of the org chart.

ApprovalMax are reducing risk and regaining control – not by overhauling everything, but by adding smarter tools at the right steps.

Here’s how the latest ApprovalMax updates are helping businesses like this one move faster, with less back-and-forth and stronger checks in place.

Here’s what’s new for Xero customers:

• Schedule payments (UK only): Plan payments ahead of time with ApprovalMax Pay. Align with cash flow and supplier terms to avoid last-minute stress.

ApprovalMax Pay, schedule payments (UK only)

• Overdraft payments (UK only): Make payments even when your bank balance dips, as long as your account has an overdraft facility.

• Track goods received notes (GRNs): Keep an eye on what’s actually been delivered before paying a bill. It’s easier to match bills to purchase orders and avoid overpayments.

• Create and approve credit notes: Create Xero credit notes directly in ApprovalMax and route them through your usual approval workflow. Once approved, they’re automatically synced to Xero.

• ApprovalMax Capture for POs and credit notes: Speed up data entry by extracting key details from uploaded or emailed documents. Works for both purchase orders and credit notes.

• Create account groups: Group account codes for easier workflow management. Ideal for teams working with long, complex charts of accounts.

For Xero, QuickBooks Online, and NetSuite customers

• ‘On Hold’ status: Need to pause a request without starting over? You can now put it on hold and pick it back up later, even from your phone.

• Nudge: A gentle reminder for approvers who haven’t acted yet. It only goes to the right people, and every nudge is recorded in the audit trail for full visibility.

For Xero and QuickBooks Online customers

• Bill duplication detection: Avoid paying the same bill twice. You’ll get a warning if a bill with the same supplier, date, amount, or invoice number already exists.

For NetSuite customers

• Sales invoice approvals: Add checks and balances to your sales process. Multi-step approvals help reduce mistakes before invoices are synced to NetSuite.

• Approve new vendors: Screen every new supplier before they’re added to NetSuite. It’s a simple step that helps protect your data and your process.

• Journal entries: Submit and route journal entries directly in ApprovalMax. Once approved, they’re sent to NetSuite with a complete audit trail, making audit-preparation much easier.

Smart approvals aren’t about adding more steps

It’s about adding the right ones –at the right time – to protect your business without slowing it down.

You don’t have to overhaul your whole way of working. Just make approvals clear, easy, and better connected to your finance tools.

The result? A happier finance team, fewer mistakes, and tens of thousands of dollars saved.

Want to see how ApprovalMax could work for you? Get in touch today.

Bill duplication detection

How to help clients click with MTD

A guide to navigating the changes with your small business clients

Kate MacNay, Lead Editor,

FreeAgent

Kate is a seasoned content professional who specialises in creating engaging, insightful resources to help accountants and bookkeepers succeed. Covering all topics from pricing strategy to AI, Kate currently has a particular focus on Making Tax Digital (MTD), working closely with FreeAgent Partners to ensure they have the right resources and insights to navigate change with confidence.

MTD for Income Tax is coming, and practices must lead clients into the digital future. Here’s how.

Every accountant is familiar with the shoebox. The one crammed with crumpled receipts, delivered annually with a sheepish grin. Or the client who stubbornly clings to their trusty spreadsheet, resisting any mention of cloud-based software.

Working in a service-led profession, you’ve likely adapted to these ways of working in an effort to support your clients, even when better tools are available. But with Making Tax Digital (MTD) for Income Tax looming, it's time to shake things up, not just for clients but for your practice too. This isn't just another regulatory hurdle; it's a generational shift that demands a new approach.

Out of 5.5 million UK businesses, only about 2 million are using accounting software. And of the 2.75 million that need to switch to MTD-compatible software by April 2028, just 1.23 million have made the move so far.

That’s a staggering gap! It's a goldmine of potential, yes, but also a stark reminder of the challenges accounting professionals face. Why the slow uptake? Is it resistance, cost

or simply a lack of awareness?

Whatever the reason, the reality remains: MTD for Income Tax is coming, and practices will need to act as navigators, guiding clients through this digital sea change.

So, how can you help your clients make the leap and ensure your firm is ready for the changes ahead?

Meet clients where they are

Getting clients to embrace digitalisation might be easier said than done. After all, no client is exactly the same. They come in all shapes and sizes, and their tech-saviness varies wildly. To effectively support them, you’ll need to understand their unique requirements and digital readiness and tailor your approach accordingly.

• Willing but uncertain. They understand the need for change but might require more hand-holding.

• Resistant to change. They’re the traditionalists, the ones who prefer the familiar comfort of spreadsheets - or even pen and paper.

Segment your client base

“Start small - little and often is key. Don’t overwhelm your clients. Otherwise, you’ll lose engagement straight away.” - Kris Sawford

Think of clients as falling into one of three broad categories:

• Digital natives. These are your digitally savvy clients who are already comfortable using technology in their day-to-day working life.

Once you have a general picture of how ‘digitally ready’ your clients are, you can begin to segment your client base further to help prioritise your communication. Identify those that will need to comply with MTD for Income Tax from April 2026 - your self-employed and landlord clients with qualifying income over £50,000. These clients will require immediate attention and a clear understanding of the impending changes.

Within this segment, use the clients you identified as digital natives as your test subjects. Engaging with them proactively will allow you to refine your communication, anticipate

potential challenges, and build confidence in your own MTD expertise.

Team up with the right tech

The new rules mean that using digital tools is no longer a choice. To comply with the legislation, clients need to use MTD-compatible software to keep digital records and make submissions to HMRC electronically.

For all three groups, it's crucial to recommend software that strikes a balance between ease of use and functionality. Forget the complex, corporate-grade systems – small businesses need tools that simplify their lives, not complicate them.

Look for software that’s easy and intuitive for your clients, yet robust enough to handle all their compliance needs. And it should work just as well for your practice - think smart automation, time-saving bulk actions, and clear, insightful reporting. Support matters too: is it just chatbots, or can you actually talk to a human when it counts?

Nail your communication

MTD and catch anyone whose circumstances may have changed over the past year, making them newly eligible for the first threshold. From there, you can use your client segments to develop a targeted follow-up plan, sharing more specific details and next steps to help guide them through the process.

“The key question to ask yourself is: how can you get your client to be a better client with MTD as the driver?” - Russell Frayne

Once you have a plan of action in place, you can start contacting your clients about what’s ahead. HMRC has already started reaching out to taxpayers, letting them know that a change is coming, so it’s important to be proactive and demonstrate you’re on top of the new rules.

As Stuart Pedlar, Digital Advisory Lead at Westcotts Chartered Accountants says: "It's on us as accountants to be preemptive rather than reactive. This is our opportunity to be ahead of the game rather than behind it."

Begin by contacting all your sole trader and landlord clients. This will help raise awareness of

Whether you prefer a faceto-face chat, a phone call, or a well-crafted email, there are a few things to keep in mind.

• Give clarity. Communicate what’s changing and when, how this will affect the way you work together, and how you plan on supporting them during the transition.

• Lead with the positives. Instead of dwelling on the ‘burden’ of change, highlight the benefits: the potential for improved accuracy, real-time insights, and streamlined financial management.

• Set clear expectations. Update your Letters of Engagement to reflect the changes brought about by MTD. Clearly outline how your services will evolve, what is expected from the client, and the associated timelines.

You’re likely to get questions about next steps, so consider how you’re going to build momentum and educate your clients beyond the introductory conversation. You could host workshops, webinars, or offer one-on-one training.

“Start small - little and often is key. Don’t overwhelm your clients. You’ll lose engagement straight away if you simply pile in and say ‘this is everything that we’re doing’,” says FreeAgent Sales Manager, Kris Sawford.

If that feels like a lot to manage, look to your software providers, who should be able to provide you with support. FreeAgent Partners have access to a whole library of resources as well as personalised training from

Why choose FreeAgent?

• A simple, intuitive interface that makes life easier for your clients

• An award-winning mobile app so they can stay on top of admin, wherever they are

• An end-to-end MTD solution, ready for quarterly updates and final declarations

• Time-saving tools that let you explain multiple transactions at once and easily reconsent bank feeds in bulk

• Real human support from people who understand accounting

FreeAgent’s specialist team to help them get set up on the software and up to speed with MTD.

Perfect your pricing

MTD for Income Tax isn't just a change in legislation for clients; it will fundamentally alter how accountants and bookkeepers deliver their services.

Practices will begin to move away from the annual Self Assessment scramble - the new cadence will be quarterly updates and a Final Declaration, essentially increasing filing requirements from one to five for every affected client. This could mean an initial surge in workload as practices straddle the old and new systems for different clients. It’s therefore a critical time to rethink pricing strategies.

• Per submission: Charging for each quarterly update and the final declaration offers a clear, pay-as-you-go structure for clients to understand. It works well for clients who prefer to pay only when services are delivered, though it may feel less personalised and more transactional.

"It's on us as accountants to be preemptive rather than reactive. This is our opportunity to be ahead of the game rather than behind it." - Stuart Pedlar

• A fixed subscription model: A monthly fee covering all ongoing work, as well as the cost of MTDcompatible software, can simplify things for clients and provide a steady income stream for your practice. This approach can build stronger long-term relationships and smooth out cashflow, but may limit your ability to adjust pricing quickly.

as possible,” says Russell Frayne, Director of Transformation at Gravita.

Seizing the Opportunity

MTD for Income Tax is a significant shift, but also a chance to diversify, digitalise, and boost profitability. By simplifying pricing, communicating effectively, and investing in client education, you can guide clients through this transition with confidence.

Russell Frayne says: “The key question to ask yourself is: how can you get your client to be a better client with MTD as the driver?”

But with the economy in a tricky place for small businesses, clients may be wary of increasing fees. So, how do you balance delivering the service your clients need with the price they’re willing - and able - to pay?

Here are some solutions that may work for your practice:

Looking for a quick win?

An often overlooked but simple step is encouraging clients to open a dedicated business bank account. This helps them separate personal and business finances, making it easier for practices to prepare accurate reports and submissions.

Mettle offers free business bank accounts and includes free access to FreeAgent (optional paid-for features are available for both Mettle and FreeAgent).

• More flexible, menu-style pricing: Offering a menu of services based on complexity allows you to guide clients to a package that best fits their needs. This also opens doors for your practice to upsell additional services, such as taking over bookkeeping entirely.

There’s no perfect strategy to tackle MTD - you’ll need to consider the pros and cons of any approach, as well as market competition and the financial objectives of your practice. In any case, remember that you're not just charging for time; you're charging for expertise, compliance, and peace of mind. The role of the accountant has evolved into something akin to a financial partner, offering personalised advice and strategic guidance. Don't undervalue your services!

“By the time the £30,000 threshold comes into effect in April 2027, the market will tell us what clients are willing to pay. It’s up to us to adapt internal processes and automate as much

Instead of viewing MTD as a daunting obligation, see it as an opportunity to strengthen client relationships, enhance service offerings, and embrace the digital future of accounting. The more practices prepare now, the smoother the transition, and the better equipped clients will be to thrive in the MTD era.

FIND OUT MORE...

Find out more

BOOK YOUR FREE MTD CONSULTATION

Not sure where to start with MTD for Income Tax?

Let’s chat! Schedule a free consultation with one of our experts and get a plan tailored specifically for your practice.

Create Dashboards and KPIs in One Click — No Coding, No Delay

G-Accon’s latest feature helps finance pros turn raw data into instant insights

Andrew

Robert Shassetz, SaaS Content Writer, Contributor for Accon

Andrew Robert Shassetz is a freelance SaaS content writer who helps tech companies turn features into stories. He specializes in writing for accountants, CFOs, and business teams that rely on cloud platforms to get things done faster. With a background in journalism and a practical eye for detail, Andrew works with startups and scale-ups to bring clarity and credibility to product-led content.

Accon’s new dashboard feature gives accountants and CFOs one-click access to clean, visual KPI reports.

Create Dashboards and KPIs in One Click — No Coding, No Delay

For most accountants and CFOs, reporting has always been a double-edged sword. You know the insights are there—buried somewhere between transaction logs, reconciliations, and financial statements—but surfacing them in a clean, visual way often takes hours. Sometimes longer.

Built for Real-World Workflow Pressure

Accountants and fractional CFOs don’t have time to reinvent the wheel each time a report is needed. One client wants a cash flow overview. Another needs to understand aging receivables. A third is asking for a visual of gross margin trends by product category.

“Dashboards used to take hours. Now they take a click.”

You open the spreadsheet. Start cleaning up the data. Tweak formulas. Format a table. Then realize the layout still doesn’t quite work for your client or your team. So you start over.

G-Accon just changed all of that.

Their newest feature—now live—lets you create dashboards and KPI reports in one click. No coding. No fiddling with templates. No waiting on a developer or analyst to make things “look right.” It’s all built into the platform you already use. And it works exactly the way busy professionals need it to.

Traditionally, each of these requests would mean building a separate report, doublechecking the numbers, and praying the formatting holds up when you present it. Multiply that across 10, 20, or 30 clients, and you’re looking at dozens of hours every month lost to routine tasks.

That’s the problem this new G-Accon feature was built to solve. By turning live accounting data into structured, visual dashboards instantly, the platform lets you skip the tedious setup and jump straight to the insights.

No pivot tables. No Excel gymnastics. Just meaningful data, ready to share.

From Data to Decision — in a Single Click

Here’s what actually happens when you use the one-click dashboard tool. After connecting your Xero or QuickBooks data, you simply select the new dashboard option. The system generates a visual summary of key financial performance indicators—tailored to your specific entity or client.

You’ll see profit and loss trends. Real-time cash position. Expense breakdowns. KPIs like net profit margin or current ratio. And it’s not just numbers. These are automatically formatted with clean charts, tables, and visual elements that are easy for anyone—clients included—to understand.

If you want to adjust a metric or customize the layout, you can. But you don’t have to. The default view is professional, presentationready, and accurate out of the box.

No Learning Curve, No Extra Tools

One of the most frustrating parts of adopting new features is the learning curve. But in this case,

there really isn’t one. If you’re already familiar with G-Accon’s existing interface, the new reporting functionality feels like a natural extension of what’s already there.

There’s no need to export data, no third-party plugins, and no added complexity. The platform handles the structure and formatting. You just decide what to do with the insights.

It also works seamlessly across multiple clients or business entities. You don’t have to recreate the dashboard template every time. Once you’ve set it up for one, you can apply the same structure to others with minimal changes— saving you even more time.

What This Means for Accountants, CFOs, and Business Owners

is strategic. You get to focus on interpretation and planning, rather than assembling visuals. When a client asks, “What’s our burn rate right now?”—you’ll have the answer (and the chart) ready in seconds.

“Visual insights. Zero setup.”

And for business owners? It’s peace of mind. Instead of relying on delayed reports or confusing spreadsheets, they get fast, clear visibility into what’s working and what’s not. That clarity drives better decisions—faster.

Already Making a Difference

During early testing, one CFO shared how the tool changed their client meetings. Before, they’d spend nearly half the time walking through financials, pausing to explain what a ratio meant or why numbers looked off. Now, the data speaks for itself.

building, you’re free to focus on the bigger picture.

Already

Live — Try It Today

This isn’t a feature that’s coming “soon.” It’s already available. If you’re a current G-Accon user, all you have to do is log in and try it. The one-click dashboard option is there, ready to use.

If you’re new to the platform, visit www.accon.services to see how it works. There’s a walkthrough that shows the process from start to finish, so you can judge for yourself how it fits into your workflow.

It’s a small click with a big impact.

“Dashboards used to take hours. Now they take a click. That changes everything.”

For accountants managing dozens of client files, this feature cuts down the time spent creating recurring reports. Monthly close becomes faster. Client updates are easier to prep. And advisory conversations get to the point much quicker.

For fractional CFOs, the benefit

“It’s changed the dynamic,” they told us. “We talk about strategy now, not spreadsheets.” That’s the real value here. It’s not just about saving time. It’s about elevating the role of finance teams from number-crunchers to strategic advisors. When you’re no longer caught up in report-

Try our new interactive video on how to generate Xero KPI Dashboards automatically at g-accon.storylane.io

See it live at g-accon.com

Support for MTD for Income Tax

Step 1:

Step 2:

Request bank statements for the period from your client (in print or PDF form), and use AutoEntry to accurately and quickly extract the data.

Step 3:

Add AccountsPrep as the accounting integration for that client, just like you would add any cloud accounting solution. The statement data will then flow through.

Use AccountsPrep to bulk code, reconcile and adjust the accounts in arrears, as required. Then output a trial balance for import to your final accounts solution.

Get Started Now

Currently available to accountants and bookkeepers in the UK and Ireland only.

How Spreadsheet Inefficiencies Are Costing Your Clients—and Why CPQ Is the Solution

Amelia Douglas, Content Creator, Tidy

Amelia began working as an apprentice in the Marketing team at Tidy at the beginning of this year. With a passion for creating engaging content with a positive impact, Amelia provides an exuberant flair in bringing Tidy’s vision to life.

When spreadsheet errors start costing clients, who can businesses rely on for a solution?

preadsheets have established themselves as man’s best friend in many businesses for the past few decades. They've become a versatile tool for data analysis, financial modelling, project management, and decisionmaking.

However, as times have changed, and technology has advanced, spreadsheets have failed to adapt and develop at the same rate. They’re now competing with solutions tailored to automate processes. Some perhaps would even go as far as saying, spreadsheets have evolved into

a metaphorical glass ceiling, preventing those who use them from ever truly reaching their potential.

While yes, spreadsheets do still work effectively for some, maybe it’s time to say goodbye to spreadsheets and hello to the future.

Challenges and Risks

Spreadsheets have evolved into a metaphorical glass ceiling.

A future with solutions designed to maximise efficiency and growth. A future without inefficiencies that burn through profits.

Humans are not robots. They make mistakes, more often than we’d like at times. Spreadsheets aren’t exempt from this. By nature, the dependency on manual entry can provide plenty of opportunities for human inaccuracies to affect them. Thus, compromising data integrity and impacting critical business decisions, as inaccurate data can lead to misguided conclusions.

One such risk is due to the overconfidence in the design of the spreadsheet. Simply, if the user doesn’t actively look for errors, then they likely won’t find many or even any at all. In fact, research indicates that approximately 50% of spreadsheets have errors within them. That is assuming one person is responsible for maintaining the spreadsheet. As they say, “too many cooks spoil the broth”.

Additionally, compliance risks arise when spreadsheets are used for financial reporting without stringent controls. The lack of robust audit trails and version control in spreadsheets can result in non-compliance with regulatory standards, potentially leading to legal and financial repercussions.

Versatility and Complementary Tools

Spreadsheets are undeniably versatile and continue to play a crucial role in shaping business operations. Particularly in small businesses where the data management is relatively simple and the cost-effectiveness of spreadsheets reigns supreme.

Transitioning to CPQ

solutions has resulted in

a 25% reduction in quote generation time.

Another issue that arises with spreadsheets is the lack of scalability. As businesses grow, spreadsheets can struggle to handle larger datasets and more complex operations to the same accuracy. When these limitations become apparent, businesses often integrate external solutions, such as ERP systems, to overcome these limitations.

However, their limitations highlight the need for complementary tools and practices to ensure accuracy and scalability. By combining spreadsheets with specialised software and integrated solutions, businesses can leverage the strengths of both to achieve optimal efficiency and growth. Solutions like a Configure, Price, Quote (CPQ) tool can offer a more robust, scalable, and efficient alternative to spreadsheets, making them a superior choice for businesses looking to enhance their operations and ensure data accuracy.

Standardisation Efforts

Organisations like the European Spreadsheet Risks Interest Group (EuSpRIG) help promote best

practices to enhance spreadsheet quality and compliance. These efforts aim to mitigate the risks associated with spreadsheet use by encouraging standardised procedures and controls.

A few of the recommendations from EuSpRIG include;

• Simplified formulas and naming conventions

• Robust documentation

• Testing and version control

The EuSpRIG also drew inspiration from Toyota's automotive manufacturing methodology and use of “Poka-Yoke” (Japanese for mistake proofing) techniques. These techniques are designed to prevent mistakes happening in the first place, thus helping minimising the element of human error.

Benefits of CPQ Solutions

CPQ solutions streamline the sales process by automating the configuration of products, pricing, and the generation of quotes and can offer several advantages over traditional spreadsheets. This not only reduces the time required to create accurate quotes but also minimises errors associated with manual data entry.

Key benefits of CPQ solutions include:

• Automation: Automates repetitive tasks, reducing the risk of human error and freeing up time for more strategic activities.

• Scalability: Easily handles large datasets and complex configurations, making it suitable for growing businesses.

• Data Accuracy: Ensures data integrity through automated processes and robust validation checks.

• Compliance: Provides audit trails and version control, ensuring adherence to regulatory standards.

• Efficiency: Streamlines operations, leading to faster quote generation and improved customer satisfaction.

According to Quantzig, transitioning from spreadsheets to a CPQ

solution has resulted in a 25% reduction in quote generation time and a 20% increase in pricing accuracy for businesses. Object Edge also notes that this shift can increase annual revenue, due to fewer pricing errors and faster deal closures.

In conclusion

As businesses continue to evolve, the demand for integrated, automated solutions will only increase. CPQ solutions are well-positioned to meet these future needs, offering scalability and adaptability that traditional spreadsheets cannot match.

While spreadsheets have been a reliable tool for decades, the ever-evolving business landscape demands solutions to be more capable at managing complex tasks and information. Through the adoption of CPQ solutions

Using Google Sheets and Xero? Automate your reports and dashboards and save up to 40 hours a month

and other specialised software, businesses can overcome the limitations of spreadsheets, ensuring better data accuracy, compliance, and operational efficiency. This transition not only supports growth but also positions companies to thrive in an increasingly competitive market.

Evaluate your current processes and consider adopting CPQ solutions to stay ahead in the competitive market. Embrace the future of business technology and ensure your company’s growth and success.

To find out more about how you can make your business Tidy, visit: tidyinternational.com/ solutions

Upload / download data from Xero, XPM, and more into Google Sheets and back

Create highly customizable reports and dashboards (200+ templates)

Consolidate data for multiple organizations and currencies

Create, refresh, and send up-to-date reports to multiple clients

Streamline repeatable work across clients

“It saves us literally 20, 30, sometimes even 40 hours a month! Integrating Google Sheets with Xero automates the process of pulling data and updating it in our customized CFO reports."

Michael King, CFO, KFE Solutions

Sync Google Sheets with Xero data in both directions.

From growth to survival: Why finance leaders are now business lifelines

iscover the seven toughest questions businesses are facing and how financial leaders are helping clients survive and thrive in today’s uncertainty.

When the headlines are filled with phrases like "consumer confidence hits a 12-year low" and "tariff turmoil rattles markets," it’s clear we’re not in a normal cycle of business anymore.

Across the globe sentiment is sliding, caution is rising, and the path

forward feels foggy.

For financial professionals like Virtual CFOs, advisors, and accounting firm principals, the pressure is intense. Your clients are scared — not just about missing growth targets, but about business survival. They’re asking hard questions. They’re expecting fast, confident answers. And more than ever, they’re leaning on you to make sense of the chaos.

"Clients are asking how to survive the next 12 months, not how to scale."

"Uncertainty is the only certainty. It’s causing clients to be cautious, delay hiring, and hold back investment."

Today, finance leaders aren't just reporting on the numbers. They're helping businesses fight for survival. And that shift is happening faster than many realise.

The state of business confidence: What the data tells us

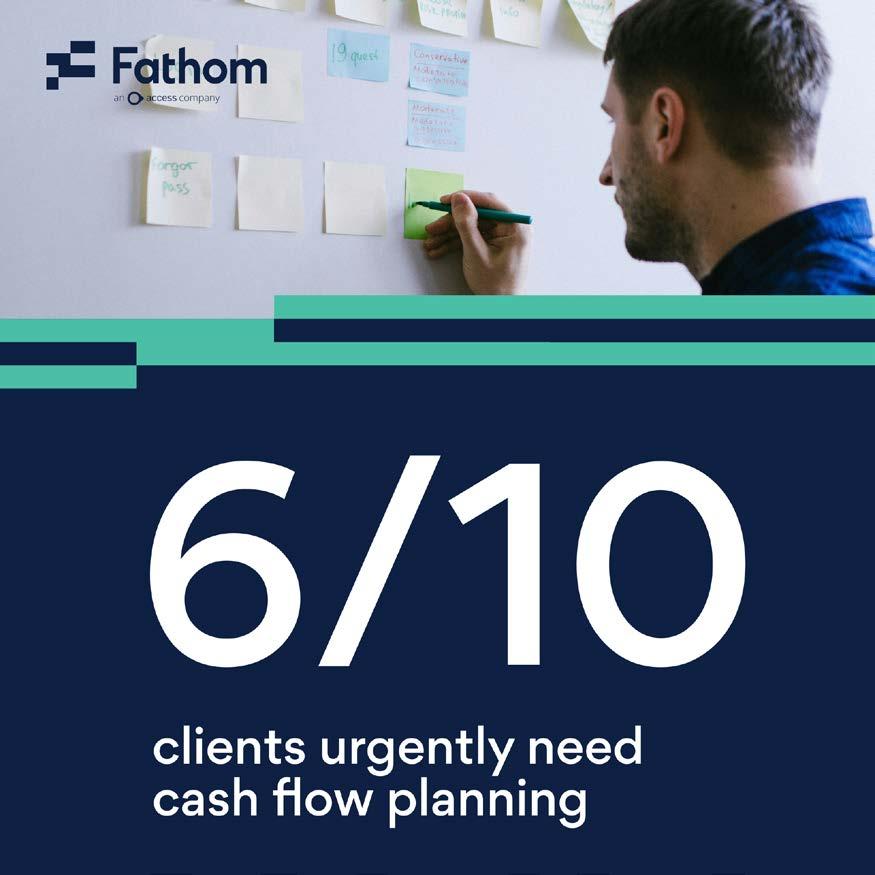

Our latest global survey of VCFOs and advisors revealed a tough reality:

• 49.5% said their clients are less

@fathomhq.com

Darren Glanville,Country Manager UK & EMEA, Fathom

Darren is no stranger to the accounting profession and has more than twenty years experience helping accounting practices develop digital strategies and processes to drive efficiencies and profitability. Having worked for some of the biggest software providers including Sage, CCH, and Xero, Darren now heads up the UK and EMEA region for Fathom and is passionate about accounting firms leveraging technology to drive better business outcomes.

confident today compared to six months ago.

• Only 21.3% reported any increase in confidence.

• Cash flow and liquidity planning emerged as the most urgent area of support for 59.4% of clients.

• Other top needs included cost management (13.9%) and scenario planning and risk management (11.9%).

Clients are shifting their focus away from growth targets toward survival strategies. They're facing critical, emotional decisions: protect staff or preserve cash? Fight for funding or hunker down?

As one survey respondent put it:

"Clients are asking how to survive the next 12 months, not how to scale."

And in this environment, financial professionals are stepping into a new, unofficial job title: Business Lifeline.

The new role of financial leaders

Your job title might still say CFO, VCFO, or Advisor. But right now, your clients see you as:

• Crisis navigators

• Decision accelerators

• Confidence builders

You’re not just preparing reports. You're helping answer survival questions. The kinds of questions we asked in our survey:

• How confident are clients about their financial stability?

• What are the biggest financial questions they’re asking?

• Where do they urgently need support?

And the answers led us to seven survival priorities you need to be ready for.

The 7 survival questions clients are asking (and how financial leaders are answering them)

1. How long is our runway, really?

With cash flow planning cited by nearly 60% of advisors as the top client need, runway clarity is nonnegotiable.

How to answer it:

Model different expensereduction scenarios.

• Forecast cash flow monthly, not quarterly.

• Visually show how decisions today extend or shorten runway.

"Everything revolves around cash flow and liquidity now. It’s survival mode."

2. Should we lay people off now or wait?

Cost management ranked second in urgent support needs. Staffing decisions are no longer theoretical, they're immediate.

How to answer it:

• Use scenario planning to show headcount reduction impacts.

• Factor in severance costs and morale impacts.

• Give leadership a clear financial picture to guide tough decisions.

3. How do we manage our burn rate without killing momentum?

Clients need to save cash without killing their future.

How to answer it:

• Break down fixed vs. variable expenses.

• Identify "nice to haves" vs. "must haves."

• Model the impacts of strategic, surgical cuts.

4. What scenarios should we be preparing for?

11.9% of advisors said scenario planning is a growing client priority; a clear signal that leaders know uncertainty isn’t going away.

How to answer it:

• Create at least three scenarios: optimistic, realistic, pessimistic.

• Stress-test assumptions (sales velocity, margin pressure, cost hikes).

• Visually present different outcomes to drive faster decision-making.

"Conversations have become a lot more detailed. Clients care a lot more about forecasting and having multiple plans."

5. Can we still raise funding this year?

Investor caution is surging. Clients want to know whether to fight for capital now or weather the storm.

How to answer it:

• Help clients prepare clean, confident financials.

• Show strong cash flow and burn rate management.

• Position resilience as a key selling point.

6. Should we freeze hiring, or double down?

Opportunity still exists, but it’s risky. Clients need frameworks, not gut instincts.

How to answer it:

• Map out cash flow and runway impacts of hiring vs. freezing

• Tie hiring decisions to realistic revenue assumptions

• Model both conservative and aggressive paths

7. How do we hit our targets when everything’s slowing down?

Growth targets set six months ago may no longer make sense. Clients need credibility, not just ambition.

How to answer it:

• Reforecast based on real-time sales and market conditions.

• Shift focus toward profit resilience.

• Develop clear, visual scorecards to track adjusted goals.

The tools that make survival possible

In our survey, nearly half of financial professionals said they are already using Fathom to answer these tough questions. Another third want to start.

Why? Because in a crisis, slow and static reporting isn’t enough. Clients need:

• Fast, flexible scenario planning

• Clear cash flow forecasts

• Visual, confident communication tools

Tools like Fathom don’t just track the past, they help financial leaders shape the future.

"Until y’all can predict what the government can do, we’re stuck planning for everything."

The hardest questions facing businesses today are solvable. Financial professionals who embrace tools that deliver clarity, flexibility, and confidence are leading the way forward.

Ready to see how VCFOs and advisors are using Fathom to guide better decisions, faster?

Try Fathom free and experience how financial leaders are navigating uncertainty, and helping their clients thrive. Start your 14day free trial today.

How Avalara simplifies indirect sales tax challenges

Xero users, meet your tax compliance edge

Avalara helps Xero users simplify tax compliance with automation for sales tax, exemptions, and cross-border transactions.

For U.S.-based businesses, staying on top of sales tax obligations has never been more critical — or more complicated. From evolving economic nexus laws to tariff shifts and international trade friction, tax compliance is no longer a background function. It’s a core part of operational success — and a source of risk if neglected.

That’s where Avalara comes in.

Sales tax automation, right from your Xero workflow

Avalara’s direct integration with Xero gives U.S.-based users a smarter way to manage sales tax. From invoice creation to return filing, Avalara AvaTax automates tax calculation, tracks taxability rules by jurisdiction, and helps to ensure the right rates are applied in real time.

For Xero users, that means no more chasing rate tables or second-guessing nexus obligations. You can manage your books and your compliance in the same place — and do it with more confidence.

Navigating sales tax in the Wayfair era

Since the Supreme Court’s South Dakota v. Wayfair ruling in 2018, nearly every state has adopted economic nexus thresholds. For businesses selling across state lines, that means a growing list of jurisdictions where sales tax registration, collection, and filing are required — even if you don’t have a physical presence there.

Avalara simplifies this complexity by automatically tracking your transaction volume against state-specific thresholds. Once you cross a limit, the platform alerts you and supports quick registration, helping to ensure that you stay compliant without needing to be a tax policy expert.

When exemptions become obstacles

B2B sellers face a different challenge: exemption certificates. Tracking, storing, and validating certificates manually introduces unnecessary audit risk. Missing or expired certificates can trigger penalties — even if you didn’t collect tax by mistake.

Avalara Exemption Certificate Management (ECM) integrates with AvaTax and lets customers submit and update their

Luke Yamnitz - Sr Manager, Partner Management, Avalara

Luke leads a team of strategic partnership managers at Avalara, leading roadmap and GTM strategy with the tax compliance company’s premier technology partners. Luke is based in St. Louis, Missouri, and has been with Avalara since 2022. His favorite random sales tax fact is that pumpkins are often taxed differently depending on if sold as fall decor or if sold as an ingredient for pie.

certificates online. The system verifies information instantly and stores everything securely, giving you audit-ready confidence without the paperwork chase.

Keeping up with tariffs: crossborder trade is complex — and critical

As more U.S. businesses import goods or expand ecommerce internationally, compliance needs to extend beyond sales tax. Cross-border shipping introduces customs duties, import taxes, and a patchwork of international rules that are just as complicated — and just as critical to get right.

Avalara Cross-Border automates Harmonized System (HS) code classification, calculates or estimates landed costs (including tariffs and VAT), and helps ensure accurate customs documentation. It also supports trade restriction checks and regulatory flags.

“Avalara’s suite of compliance services can help you stay on top of this rapidly changing environment, giving you peace of mind that you are keeping pace with the changes,” says Craig Reed, General Manager of CrossBorder at Avalara.

Whether you’re sourcing goods from overseas or selling into international markets, Avalara

@avalara

helps reduce delivery delays, surprise duties, and customer complaints — while giving you confidence that your trade compliance isn’t holding your business back.

All-in-one compliance that grows with your business

Whether you’re adding products, expanding to new states, or looking overseas, Avalara’s tax automation platform scales alongside your business. With the Xero integration as a starting point, you can unlock a range of add-ons as your compliance needs evolve — from advanced reporting to international tax support.

calculation across jurisdictions

• Automatic economic nexus tracking and alerts

• Exemption certificate collection, validation, and storage

• Seamless sales tax return prep, filing, and remittance

• Optional cross-border tariff classification and landed cost tools

Avalara’s suite of compliance services can help you stay on top of this rapidly changing environment, giving you peace of mind that you are keeping pace with the changes

Key features U.S.-based Xero users can leverage:

• Real-time U.S. sales tax

Built for Xero. Backed by Avalara.

Avalara’s integration was purposebuilt for Xero’s U.S. users. It’s a plug-and-play solution that connects sales tax automation directly to your accounting platform. It’s also supported by over 1,200 signed partner integrations across ecommerce, billing, ERP, and CRM tools — so your broader tech stack stays connected. With Avalara, you don’t just gain automation — you gain a

compliance strategy that works across your entire business.

Why it matters now

Sales tax is getting more complex. Tariffs are shifting. Cross-border commerce is growing. And compliance risk doesn’t just hit big businesses — it affects every seller shipping across state or national lines.

But tax compliance doesn’t need to be an obstacle. With Avalara and Xero, it becomes a built-in part of how you do business — automated, integrated, and built to scale.

Because when you do tax right, you can focus on what really matters: growing your business.

avlr.co/xero xerousers@avalara.com FIND OUT MORE...

Payroll solutions for successful businesses

Set-up, training and free ongoing support via phone and email

Comprehensive Reporting Suite with 50+ reports including HR

Suitable for all business sizes (1 - 1,000 employees)

ipayroll.co.nz

cloudpayroll.com.au

The latest trend(s)

We summarise the main trends and challenges that accountancy firms are experiencing, and give our top tips for making the most of the opportunities they present.

Trend 1: Increased reliance on digital and cloud-based systems

With HMRC’s continued drive for Making Tax Digital (MTD), many businesses have already made the jump to digital submissions.

But for the next tranche, especially those with accounting software, the transition is unsettling; accountants have a great role to play in supporting clients through this change.

Along with digital tax submissions,

using a cloud-based accountancy system enables businesses and their accountants to access real-time financial data from anywhere, at any time.

This brings multiple benefits, such as:

• Being able to make business decisions faster because of the access to accurate, up-to-theminute data and insights

• Helping improve collaboration between accountancy firms and clients

• Helping to make many manual

@ApprovalMax @vipulsheth

Vipul Sheth, Managing Director, Advancetrack

"Accountants change lives, but not by producing a set of accounts"

Qualifying as an ICAEW Chartered Accountant and Chartered Tax Adviser, I started at a regional practice, Rabjohns LLP (now Bishop Fleming) before joining Ernst & Young and KPMG where I worked up to management.

After over a decade of professional experience, I developed a professional accountancy outsourcing company which has been a driving passion since I started the business in 2003.

processes, like data entry, quicker and more efficient. With benefits like these, it’s no wonder that continued digitalisation of accountancy is likely to grow throughout 2025.

Trend 2: AI and automation play a greater role

It doesn’t feel too long ago that AI was just a concept rather than a tangible ‘thing’, but it’s true to say that the AI revolution is now really starting to transform accountancy.

Some ways that AI and automation are already having an impact on accountancy include:

Automating reconciliations –with some cloud accountancy platforms able to match transactions automatically to save users time when logging them, while also reducing the chances of errors compared to inputting the data manually.

Spotting errors or potential fraud – with AI algorithms able to spot unusual activity or changes to patterns in financial data,

which could signify an error or even fraud.

Spotting useful insights – with AI dashboards able to instantly visualise and summarise data, giving accountants and their clients a quick snapshot of important metrics such as cash flow and profitability.

Trend 3: Expansion of accountancy’s role in business

The traditional role of accountants being limited to purely providing data and handling tax returns is well and truly over. Clients are increasingly seeking strategic business advice from their accountants, whether that’s in relation to digital transformation, business recovery, growth plans or other aspects. This gives accountancy firms great revenue growth potential, by expanding their service proposition, but also presents challenges in managing capacity and in recruiting and retaining the best talent to deliver these value-added services.

The current challenges

How to bridge the accountancy talent gap