Exploring the evolving role of accountants and bookkeepers in supporting the success of Australian small and medium-sized businesses.

Integration sets a new standard for how midsized and enterprise accounting firms in the US engage clients and get paid

IGNITION, A LEADING CLIENT BILLING AND REVENUE MANAGEMENT PLATFORM FOR SERVICE-BASED BUSINESSES, TODAY ANNOUNCED ITS INTEGRATION WITH WOLTERS KLUWER’S CCH AXCESS™, A LEADING CLOUD-BASED TAX AND ACCOUNTING SOLUTION SERVING MANY TOP 500 US FIRMS.

With this integration, CCH Axcess™ accounting firms can automate their client workflows from first en-

gagement to final payment using Ignition—improving efficiency, cash flow, and profitability.

“Accounting and tax firms have spent too long wasting time with manual processes and losing revenue from unbilled work. This integration automates the entire client engagement-to-payment process, eliminating those inefficiencies,” said Greg Strickland, CEO of Ignition.

Find out more

AT SUMDAY, WE BELIEVE SUSTAINABILITY REPORTING SHOULD FEEL EMPOWERING, NOT OVERWHELMING.

SO, WE’VE ROLLED OUT A FRESH BATCH OF UPDATES DESIGNED TO TAKE THE COMPLEXITY OUT OF CARBON ACCOUNTING AND GIVE YOU MORE CLARITY, SPEED, AND CONFIDENCE IN EVERY STEP.

From storytelling tools to AI that actually helps, everything here is built from your feedback and

shaped by the real work you’re doing. Let’s take a look.

Profiles – Your Sustainability Story, Shared

You’ve done the work. Now show it off!

Profiles let you showcase your emissions data, the actions you’re taking, and who you are as a company—think of it as your public sustainability profile.

Keep reading

GoCo will transform Intuit’s Payroll solution to meet the Human Capital Management needs of growing small and mid-market businesses

TODAY, INTUIT ANNOUNCED THAT WE SIGNED AN AGREEMENT TO ACQUIRE GOCO, A LEADING PROVIDER OF MODERN HR AND BENEFITS SOLUTIONS FOR SMALL AND MID-MARKET BUSINESSES. WITH GOCO, INTUIT WILL DELIVER A COMPREHENSIVE HUMAN CAPITAL MANAGEMENT (HCM) SOLUTION TO HELP BUSINESSES HIRE THE RIGHT EMPLOYEES AND MANAGE THEIR WORKFORCE EFFECTIVELY, ALL IN ONE PLACE.

The acquisition represents a significant step forward in Intuit’s strategy to serve growing mid-market businesses with a connected platform that helps customers run and grow their business. Intuit will initially integrate GoCo’s features into Intuit Enterprise Suite and QuickBooks Payroll for

customers who have Premium or Elite Payroll in the U.S., giving businesses a single solution to manage their finances, customers and the full employee lifecycle from onboarding to offboarding. Launched in 2024, Intuit Enterprise Suite is a configurable suite of integrated financial products designed to seamlessly scale and enhance productivity and profitability for mid-market businesses as they grow.

“As businesses scale, they need to be able to find, onboard, and retain the right talent, offer and manage benefits, and stay compliant, while maintaining a single source of truth for all employee information,” said Olivier Bartholot, Vice President and Segment Leader of Workforce Solutions at Intuit.

Find out more

WE’RE EXCITED TO WALK YOU THROUGH THE LATEST PRODUCT UPDATES FOR MARCH 2025. WE'VE ROLLED OUT SEVERAL NEW FEATURES AND ENHANCEMENTS TO MAKE YOUR WORKFLOWMAX EXPERIENCE EVEN BETTER. LET'S GET TO THEM!

Multi-Factor Authentication (MFA)

Security First! To keep your account secure and meet Xero's API requirements, Multi-factor authentication (MFA) is being introduced to all WorkflowMax accounts, starting with those integrated with Xero. It will become mandatory by 15 May 2025, so we recommend getting on the front foot and setting

XU BIWEEKLY - No. 104

Newsdesk:

If you have any news or updates that you would like us to consider for inclusion in the next edition of the XU Biweekly, please email us at: newsdesk@xumagazine.com

CEO: David Hassall

Managing Editor: Wesley Cornell

Chief Revenue Officer: Alex Newson

Account & Partnership Assistant: Robyn Consterdine

Creative Assistant: Aidan McGrath

Advertising: advertising@xumagazine.com

www.xumagazine.com

© XU Magazine Ltd 2014-2025. All rights reserved. No part of this publication may be used or reproduced without the written permission of the publisher.

XU Biweekly is published by XU Magazine Ltd (08811842), registered in England and Wales. Registered office: Office 1, Brunswick House, Brunswick Way, Liverpool, L3 4BN, United Kingdom. All information contained in this publication is for information only and is, as far as we are aware, correct at the time of going to press. XU Magazine Ltd cannot accept any responsibility for errors or inaccuracies in such information.

If you submit unsolicited material to us, you automatically grant XU Magazine Ltd a licence to publish your submission in whole or in part in all/any editions, including in any physical or digital format, throughout the world. Any material you submit is sent at your risk and, although every care is taken, neither XU Magazine Ltd nor its employees, agents or subcontractors shall be liable for loss or damage. The views expressed in this publication are not necessarily the views of XU Magazine Ltd, its editors or its contributors.

up MFA now to avoid disruptions to you and your team.

To get started, please inform your Account Holder that they need to enable MFA in Organisational Settings to ensure continued access to WorkflowMax. This step is required to activate MFA for all users.

After MFA is enforced by the Account Holder, all users will be prompted to set it up the next time they log in. Here’s what they need to do

1. Download an authenticator app on your smartphone (such as Google Authenticator or Microsoft Authenticator).

2. Open the app and scan

the QR code provided in WorkflowMax after logging in.

3. Enter the six-digit code generated by your authenticator app into WorkflowMax.

4. Configure backup security questions for recovery.

For mobile users

If you use the WorkflowMax mobile app (iOS/Android), you’ll also need to enable MFA. These users can enable it by signing into the WorkflowMax Web Application.

For more help on how to get MFA set up, check out our resources:

Find out more

CONTENT SNARE, A LEADING CLIENT ONBOARDING AND DOCUMENT COLLECTION PLATFORM, HAS ANNOUNCED THE FORTHCOMING RELEASE OF A DEDICATED CLIENT PORTAL DESIGNED TO SIMPLIFY DOCUMENT SHARING AND COMMUNICATION ACROSS PROFESSIONAL SERVICES.

Addressing the Challenges of Traditional Document Exchange

Professionals in accounting, legal, financial services,

education, and digital industries frequently face a shared challenge: clients misplacing documents and relying on lengthy, disorganised email threads. Traditional portals are often overly complex or underutilised, resulting in inefficiencies and the need for repeated follow-ups.

The new Client Portal tackles these issues directly, providing a secure, centralised space where firms can manage client-facing document sharing with ease.

Keep reading

PAYING YOUR SUPPLIERS IS A NON-NEGOTIABLE PART OF RUNNING ANY BUSINESS. WHEN IT COMES TO MAINTAINING A HEALTHY CASH FLOW, IT’S JUST AS IMPORTANT AS GETTING PAID. THE VISIBILITY OF WHAT’S GOING OUT HELPS TO COMPLETE AN ACCURATE FINANCIAL PICTURE FOR YOUR BUSINESS.

Yet we know small businesses, accountants and bookkeepers face friction when it comes to paying bills, in fact over half of small

businesses are spending more than four hours each month managing accounts payable. And if you have international suppliers, paying your bills is even more complex.

That’s why, in 2023, we partnered with Crezco, a payment institution that’s authorised by the Financial Conduct Authority to provide open banking payment services in the UK to launch an embedded bill payments solution.

This means our UK small

business customers are now able to manage bills, process payments, and reconcile everything all in one place. This saves time, reduces errors, and gives a clear view of your cash flow. It also allows you to pay multiple bills at once with just a few clicks.

Since launching online bill payments we’ve made it easy for UK small businesses to schedule payments, and consolidate bills to a single supplier without having to leave the Xero platform.

Keep reading

Introducing ‘Know Your Numbers’, a new financial literacy program for every Kiwi small business

IN THE WORLD OF SMALL BUSINESS AND BEYOND, FINANCIAL LITERACY IS AN ESSENTIAL SKILL. HOWEVER, WE KNOW THAT UNDERSTANDING HOW AND WHEN TO SAVE, SPEND OR INVEST – AND WHAT’S MORE, HAVING CONFIDENCE ABOUT THESE DECISIONS – ISN’T INNATE KNOWLEDGE; IT’S LEARNED. THIS ULTIMATELY MEANS FINANCIAL LITERACY CAN BE A POSITION OF PRIVILEGE.

So, to help level the playing field, we’re proud to announce Know Your Numbers, a free program designed to improve the financial literacy of small business owners across Aotearoa New Zealand.

Created with and for small businesses, Know Your Numbers is about empowering Kiwi entrepreneurs – whether

a Xero customer or not – with tools and support to help them achieve long-term success. This exciting development is part of our global social impact initiative, Xero For Good, and another way we’re striving to deliver on our purpose of making life better for people in small business, their advisors, and communities around the world.

Supercharge your skills with one central content hub Learning about finances can feel overwhelming for some. With so many different channels, voices and opinions to wade through, cutting through the noise to distill relevant information can be a real challenge. This is why we created the Know Your Numbers dedicated content hub.

Find out more

BGL CORPORATE SOLUTIONS (BGL), AUSTRALIA'S LEADING PROVIDER OF COMPANY COMPLIANCE, SELF-MANAGED SUPERANNUATION FUND (SMSF), INVESTMENT MANAGEMENT, IDENTITY VERIFICATION AND AI-POWERED PAPER-TO-DATA SOFTWARE SOLUTIONS, IS PROUD TO ANNOUNCE THE LAUNCH OF ITS SIMPLE INVEST 360 TRAINING WEEK, A FREE ONLINE TRAINING EVENT TO HELP BGL CLIENTS GET MORE FROM SIMPLE INVEST 360.

Simple Invest 360 is BGL’s complete accounting, investment and tax software solution for managing portfolios and capital gains tax (CGT) for companies, trusts and individuals. Designed to simplify the complexity of investment accounting and automate CGT tracking, re-

porting and tax compliance.

The Simple Invest 360 Training Week features five days of live, expert-led, 30-minute online training sessions covering key product features, tips and best practices. These sessions have been designed for existing clients looking to sharpen their skills and unlock the full potential of their Simple Invest 360 investment.

“This is a perfect opportunity for both new and experienced Simple Invest 360 clients to deepen their knowledge and streamline their processes,” said BGL’s Chief Executive Officer, Daniel Tramontana. “Our experts will guide participants through best practices, hidden gems and best of all, it is free of charge”.

Find out more

XERO, THE GLOBAL SMALL BUSINESS PLATFORM, TODAY ANNOUNCED A PARTNERSHIP WITH LEADING COMPLIANCE MANAGEMENT AND AI-POWERED PAPER-TO-DATA SOFTWARE PROVIDER BGL CORPORATE SOLUTIONS TO INTRODUCE A NEW WORKPAPERS SOLUTION EXCLUSIVELY FOR XERO ACCOUNTING AND BOOKKEEPING PARTNERS.

This will allow the direct import of client bookkeeping data from Xero, reducing manual entry through the

automation of data flows, helping partners to save time in finalising client accounts, preparing tax returns and financial statements.

“We’ve listened to feedback from our accounting and bookkeeping partners and this partnership is an exciting opportunity to combine Xero’s robust accounting and tax features with BGL’s leading compliance expertise.” says Angad Soin, Xero’s Managing Director, Australia and New Zealand and Global Chief Strategy Officer.

Keep reading

IN AN INCREASINGLY COMPETITIVE AND CHALLENGED LANDSCAPE, ACCOUNTING FIRMS ARE UNDER PRESSURE TO NOT ONLY MAINTAIN THEIR FINANCIAL HEALTH BUT ALSO TO ENHANCE CLIENT EXPERIENCES. AS THE DEMANDS OF THE MARKET EVOLVE, SO TOO MUST THE TOOLS AND STRATEGIES THAT FIRMS EMPLOY.

One of the most promising and fluid solutions available today is adopting fee funding options.

Integrating Fee Funding

into their operations, Firms can deliver:

• greater client relationships, • your true Firm value, • streamlined processes

Buy Now Pay Later Client Expectations

Today’s clients are more discerning than ever. As they seek value rather than compliance, accounting firms must provide traditional services but also innovative solutions that cater to clients diverse needs.

Keep reading

launches US online bill

powered by BILL

ERO (ASX: XRO), THE GLOBAL SMALL BUSINESS PLATFORM, TODAY LAUNCHED THE ABILITY FOR ITS US CUSTOMERS TO PAY BILLS WITHIN XERO AS PART OF ITS STRATEGIC PARTNERSHIP WITH BILL (NYSE: BILL), A LEADING FINANCIAL OPERATIONS PLATFORM FOR SMALL AND MIDSIZE BUSINESSES (SMBS).

Xero and BILL are helping small businesses to streamline their accounts payable and make cash flow management even easier and more accessible.

The new online bill payment capabilities, powered by BILL, are available to all US Xero small business customers. They can now pay their bills without leaving the Xero platform. This helps cus-

WE ARE EXCITED TO ANNOUNCE THE LAUNCH OF ZOHO PAYROLL FOR SAUDI ARABIA, A CLOUD-BASED PAYROLL SOFTWARE DESIGNED TO SIMPLIFY AND ENHANCE THE PAYROLL PROCESS FOR BUSINESSES ACROSS THE REGION.

Following our success in streamlining payroll for businesses in India, UAE and the US, we are now bringing our expertise to the Kingdom of Saudi Arabia. With an intuitive interface, automated calculations, and built-in compliance features, Zoho Payroll is the comprehensive solution you've been searching for. Here's how businesses in Saudi can revolutionize their payroll operations with Zoho.

Increase Efficiency and Accuracy with Automation:

Zoho Payroll automates the payroll process, significantly reducing errors and saving time. After a simple one-time setup, the software will automatically calculate gross salaries, deductions, and net pay for each pay run.

Key automation features include:

• Automatic deductions for employee contributions to pension schemes.

• Flexible pay schedules that adjust for weekends and holidays.

• Support for employee loans with automatic repayment deductions.

Keep reading

tomers save time on manual workflows, all while building an accurate picture of their cash flow with even more insights to make informed business decisions. These insights are crucial in preparing US small businesses for the future, 48% of whom said they felt some cash flow pressures over a 12-month period.

Ariege Misherghi, SVP & GM of AP, AR and Accountant Channel at BILL, said: “We are excited that our embedded bill pay capabilities are now available to Xero customers in the US through Xero’s platform. This will help businesses pay bills efficiently with a variety of payment options and connect with our large vendor network for easy and secure payments."

Keep reading

ROVEEL, THE NORWICH-BASED FINANCIAL REPORTING SOFTWARE COMPANY, IS PROUD TO ANNOUNCE AN EXTENSION OF ITS EXISTING PARTNERSHIP WITH DB COMPUTER SOLUTIONS, ONE OF IRELAND’S LEADING PROVIDERS OF BUSINESS TECHNOLOGY SOLUTIONS.

This collaboration is set to transform how SMEs access and utilise their financial data for Sage 200 customers, enabling smarter, faster decision-making and operational excellence.

BGL CORPORATE SOLUTIONS (BGL), THE WORLD LEADER IN COMPANY COMPLIANCE SOLUTIONS, IS PROUD TO ANNOUNCE AN UPDATE TO ITS CAS 360 UK COMPANY SECRETARIAL SOFTWARE INTEGRATION WITH DIGITAL SIGNING PROVIDER FUSESIGN.

The CAS 360 and FuseSign integration allows Companies House-compliant company and trust docu-

ments to be digitally signed in minutes, eliminating the delays and inefficiencies of traditional paper-based processes. By automating and simplifying signing workflows, firms can enhance client service and overall operational efficiency. “We’re excited to bring our partnership with FuseSign to the UK," said Warren Renden, General Manager – CAS 360 at BGL.

Keep reading

OMNIPRESENT, A TRUSTED EMPLOYER OF RECORD IS SIMPLIFYING GLOBAL EMPLOYMENT FOR BUSINESSES, HAS ANNOUNCED A STRATEGIC INTEGRATION WITH XERO, THE GLOBAL SMALL BUSINESS PLATFORM.

This partnership provides businesses with greater visibility into salary and benefit costs while making it faster and easier to hire and pay international employees—all without the

complexity of managing multiple systems, manual processes, or foreign entities.

Now available in the Xero App Store, the Omnipresent integration allows Xero users to seamlessly manage global payroll and invoicing in just a few clicks. By aligning finance and HR operations, the integration eliminates administrative bottlenecks and ensures transparency in international operations.

Keep reading

Empowering Irish SMEs with Real-Time Business Intelligence

Renowned for its intuitive drill-down functionality and powerful reporting tools, Roveel’s new Sage 200 integration which launched last month is now being recommended by DB Computer Solutions based in Limerick and Dublin. DB Computer Solutions have 30+ years of expertise in business management software, ERP solutions, IT infrastructure, and technical support.

Keep reading

debuted the enhanced solution at ISA Sign Expo 2025. Keep reading

Exploring the evolving role of accountants and bookkeepers in supporting the success of Australian small and medium-sized businesses.

Environmental, Social, and Governance (ESG) advisory services are becoming a critical value-add for accounting firms, helping clients navigate the growing demand for sustainable and ethical business practices.

By Hollie Caldeira, Marketing Specialist, Spotlight Reporting

IN OUR 2023 GLOBAL ADVISORY TRENDS SURVEY OF OVER 1000 ACCOUNTANTS, WE SAW THAT ESG ADVISORY SERVICES HAD BEEN IDENTIFIED STRONGLY AS A PERCEIVED AREA OF OPPORTUNITY FOR THE FIRST TIME.

Overall, 18% of respondents viewed ESG as an area of opportunity, and this percentage remains consistent. Since launching our ESG reporting app, Spotlight Sustain, we have already seen these early innovators look to educate themselves, construct reporting models, and inform customers through powerful data insights. Yes, it is very early days, but the pioneering spirit is strong and of course, early-mover advantage is here and now.

By integrating ESG into financial reporting, risk management, and strategic planning, firms can provide clients with deeper insights into their sustainability performance and compliance requirements. Whether it’s assisting with carbon footprint measurement, ethical supply chain practices, or corporate governance improvements, ESG advisory enhances transparency and helps businesses align with investor and regulatory expectations.

ESG Advisory and Revenue Growth

ESG advisory services can be a powerful driver of revenue growth for businesses by enhancing their market positioning, attracting investors, and unlocking new opportunities.

Companies that demonstrate strong ESG commitments are more likely to win contracts with large corporations and government entities that prioritise sustainable suppliers.

Additionally, consumers are increasingly favouring businesses with ethical and sustainable practices, leading to greater customer loyalty and premium pricing

opportunities. By helping clients embed ESG into their business models, accounting firms enable them to differentiate themselves, access new markets, and improve financial performance.

ESG Advisory Opens New Revenue Streams and Deepens Client Relationships

ESG advisory can support revenue growth by improving operational efficiency and reducing costs. Sustainable practices often lead to lower energy consumption, waste reduction, and streamlined supply chains, all of which contribute to healthier profit margins.

Investors and lenders also favour businesses with strong ESG strategies, offering them better financing terms and access to sustainability-linked loans. By guiding clients in setting clear ESG goals, measuring their impact, and reporting effectively, accounting firms position themselves for longterm financial success while ensuring compliance with evolving regulations.

An ESG Audit: Understanding Your Clients’ Needs

An ESG discovery audit helps assess a client’s current knowledge, activities, and outcomes related to sustainability.

By engaging in meaningful conversations, accountants can develop a comprehensive understanding of their client’s business, identifying key risks and opportunities. Active listening and a nuanced approach allow accountants to determine how ESG fits into an overall business strategy, providing a foundation for tailored advisory services.

ESG Data Collection and Measurement

ESG reporting relies on more than just financial data—it requires extensive non-financial metrics as well.

No single platform optimises everything—digital transformation needs integrated solutions working together.

By Sidd Nigam, Director, Expense On Demand

WWhile many businesses are not yet legally required to report ESG metrics, there is growing pressure to demonstrate sustainability efforts. Accountants can help clients develop efficient data collection processes, ensuring accuracy and alignment with stakeholder expectations.

Although carbon accounting is not yet mandatory for most businesses, regulatory frameworks are evolving, and sustainability-conscious companies are seeking robust methodologies to measure their carbon footprint. By advising clients on carbon tracking and reporting, accountants can help businesses set realistic emission reduction targets and improve energy efficiency.

For example, accountants can guide businesses on accurately calculating emissions, identifying cost-saving energy efficiencies, and enhancing their overall sustainability profile.

These efforts not only contribute to environmental impact reduction but also enhance a company’s reputation.

How to Get ESG Advisory Services Off the Ground with Spotlight Sustain

To get ESG advisory off the ground you need the right tools to make it easy to produce ESG reports at scale for your clients. This is where Spotlight Sustain comes in.

With Spotlight Sustain, accounting firms can easily import client data using a ready-to-use template, then set goals and accurately measure, manage, and report on key ESG metrics. This will be one core aspect of enabling your advisory services to help clients grow and prosper in a sustainable manner.

Keep

HILE MANY DIGITAL SOLUTIONS OFFER GREAT POTENTIAL, NO SINGLE PLATFORM OPTIMISES EVERYTHING— TRUE TRANSFORMATION REQUIRES INTEGRATED SOLUTIONS WORKING COLLABORATIVELY.

At ExpenseOnDemand, we recognise that innovation doesn’t happen in isolation. It happens through collaboration.

That’s why we’re thrilled about our partnership with Merge, an integration platform that connects ExpenseOnDemand with over 50 other software systems (including Xero).

Through this new and exciting partnership, we can deliver a smarter, faster, and more scalable expense management experience.

1. Why partnerships matter in FinTech

Integrated solutions for a complex world

Many businesses today use a range of fintech solutions - accounting software, ERP systems, payroll platforms - to manage their finances. However, managing all of these applications can be a challenge.

According to one study, the average company uses a staggering 254 SaaS applications. What’s more, the same study showed that over 60 days average app engagement was 45%, which means that companies are not using applications efficiently. This waste in technology investments is mostly due to poor

integration and overlapping capabilities.

This is where strategic partnerships become crucial. Through efficient partnerships, businesses can reduce data silos, minimise manual intervention, and create unified workflows that drive operational efficiency. By creating integrated ecosystems, partnerships like the one with ExpenseOnDemand and Merge address the need for seamless connectivity between business-critical applications.

Focus on core strengths

The power of partnerships lies in specialisation and expertise sharing, as each partner concentrates on their core competencies while creating more value for customers. For example, in our ecosystem:

• Merge brings its expertise in unified API integration to seamlessly connect over 50 software systems

• Xero provides robust accounting capabilities trusted by over 3.3 million subscribers globally

• ExpenseOnDemand delivers specialised expense management solutions that cut processing time by up to 95%

The result is a synergistic relationship that delivers what is known as a multiplier effect - when the combined value of integrated solutions exceeds the sum of their parts.

By combining specialised expertise through strategic partnerships, we're not just solving individual problems,

but creating comprehensive solutions that address the complex needs of modern businesses.

2. How the Merge partnership elevates the Xero experience

Seamless integration in minutes

Gone are the days of complex API integrations and lengthy setup processes. Through Merge's unified API architecture, ExpenseOnDemand users can now connect their Xero accounts in minutes. This plug-and-play approach eliminates the traditional technical barriers that often delay digital transformation initiatives.

Real-time synchronisation ensures that expense data flows automatically between systems, maintaining a single source of truth. When an expense is approved in ExpenseOnDemand, it instantly appears in Xero with all relevant categorisations, attachments, and approval trails intact. This automated flow eliminates the need for manual data entry, significantly reducing errors and cutting claim time by 90%

Enhanced reporting and visibility

The partnership between Merge and ExpenseOnDemand also transforms how businesses handle expense reporting in Xero. ExpenseOnDemand's AI-powered categorisation engine automatically classifies expenses according to your custom chart of accounts, ensuring consistency across both platforms.

Keep reading

Allica nearly doubles profits and hits £3 billion of lending in record-breaking year in which it was named fastest growing

ALLICA – THE ONLY BANK BUILT FOR ESTABLISHED SME BUSINESSES AND BRITAIN’S FASTEST-GROWING FINTECH EVER – TODAY PUBLISHES ITS LATEST ANNUAL REPORT, REVEALING A NEAR DOUBLING IN PROFITS OF £29.9 MILLION IN 2024.

The growth was driven by significant investment in its digital infrastructure, leading to a surge in revenue as the digitally-native bank grew its loan book to over £3 billion and customer deposits surpassed £4 billion.

Keep reading

SWIFT TODAY ANNOUNCED THE LAUNCH OF AN ENHANCED SOLUTION FOR MANAGING PAYMENT INVESTIGATIONS THAT COULD SAVE THE FINANCIAL INDUSTRY MILLIONS AND SIGNIFICANTLY REDUCE THE TIME IT TAKES TO IDENTIFY AND RESOLVE ISSUES WHEN INTERNATIONAL PAYMENTS ARE DELAYED.

Financial institutions spend more than USD 1.6 billion each year on labour-intensive processes to investigate payments that get held up –which can occur regardless of technology or network used – with some of the largest global banks incurring more than USD 20 million annually in fees and penalties only.

Keep reading

FIS® (NYSE: FIS), (THE “COMPANY”) A GLOBAL LEADER IN FINANCIAL TECHNOLOGY, TODAY ANNOUNCED IT HAS ENTERED INTO A DEFINITIVE AGREEMENT TO ACQUIRE 100% OF GLOBAL PAYMENTS' (NYSE: GPN) ISSUER SOLUTIONS BUSINESS FOR AN ENTERPRISE VALUE OF $13.5 BILLION, OR A NET PURCHASE PRICE OF $12 BILLION IN-

CLUDING $1.5 BILLION OF ANTICIPATED NET PRESENT VALUE OF TAX ASSETS.

Concurrently, FIS has entered into a definitive agreement to sell its stake in Worldpay to Global Payments for $6.6 billion in pre-tax value. This transaction accelerates the monetization of the Company’s minority stake in Worldpay.

Keep reading

eBay announces global payment acquiring partnership with Checkout.com

EBAY, A GLOBAL COMMERCE LEADER THAT CONNECTS MILLIONS OF BUYERS AND SELLERS AROUND THE WORLD, TODAY ANNOUNCED ITS STRATEGIC PARTNERSHIP WITH CHECKOUT.COM, A LEADING GLOBAL DIGITAL PAYMENTS PLATFORM.

Through this partnership, eBay expands its global payment platform to deliver

seamless commerce experiences for its customers.

With more than 2.3 billion live listings, eBay is one of the world’s largest online marketplaces. Millions of customers across 190 markets buy and sell hard-to-find collectibles, pre-loved fashion, electronics, car parts, and more on the marketplace.

Keep reading

PAYPAL, THE GLOBAL DIGITAL COMMERCE PLATFORM, HAS TODAY OPENED A NEW HUB IN DUBAI, WHICH SERVES AS THE COMPANY’S FIRST-EVER REGIONAL HEADQUARTERS IN THE MIDDLE EAST AND AFRICA. THE DUBAI INTERNET CITY SITE STRENGTHENS PAYPAL’S COMMITMENT TO ITS CUSTOMERS AND PARTNERS IN THE REGION AND COMMITMENT TO ENABLING MILLIONS MORE CONSUMERS AND BUSINESSES TO ACCESS THE GLOBAL DIGITAL ECONOMY.

PayPal’s expanded presence will bring global commerce capabilities to the region, including frictionless payments, robust security,

and broader access to international payment networks to help large enterprises and small businesses sell across borders.

Speaking from the Dubai AI Festival 2025 today, Suzan Kereere, President of Global Markets at PayPal, said: “PayPal is uniquely positioned to bridge the gap between consumers and businesses for cross-border commerce, fostering growth in local economies."

"We proudly serve over 430 million customers worldwide today, and we hope to reach many more from our new regional hub for the Middle East and Africa."

Keep reading

PAYPAL HOLDINGS, INC. (NASDAQ: PYPL) AND COINBASE GLOBAL, INC. (NASDAQ: COIN) TODAY ANNOUNCED AN EXPANSION OF THEIR PARTNERSHIP TO INCREASE THE ADOPTION, DISTRIBUTION, AND UTILIZATION OF THE PAYPAL USD (PYUSD) STABLECOIN.

This collaboration will provide value for consumers, en-

terprises, and institutions as they continue to utilize digital currencies across platforms and borders with the stability of regulated USD-denominated crypto-native assets. "For years, we've worked with Coinbase to enable a best-inclass integration to provide a simple, familiar way for PayPal users to fund crypto purchases on Coinbase."

Keep reading

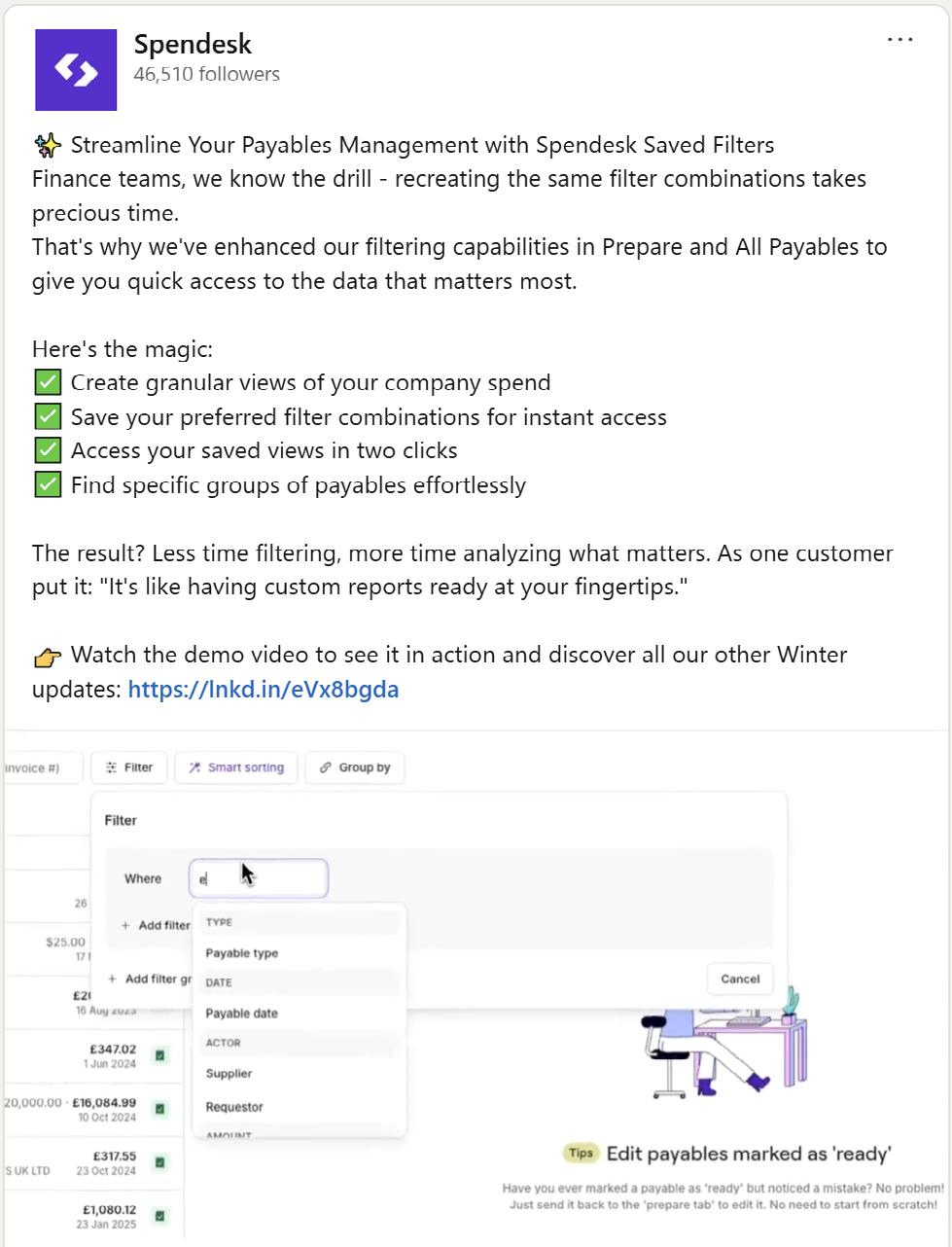

Spendesk partners with Dust to give employees tailored and data compliant

SPENDESK, THE LEADING SPEND MANAGEMENT AND PROCUREMENT PLATFORM FOR MID-MARKET COMPANIES, ANNOUNCES ITS COMPANY-WIDE ADOPTION OF DUST, EUROPEAN SPECIALIST IN CUSTOM AI AGENTS FOR ENTERPRISES.

This collaboration enables Spendesk to increase effi-

ciency, eliminate fragmented internal AI tool usage, and ensure data security and compliance with UK and European regulations. As a pioneer in spend management, staying ahead of the market is essential for Spendesk. When it comes to AI, moving fast is even more critical. “It’s impossible to use Spendesk without interacting with AI.

Keep reading

ADYEN, THE FINANCIAL TECHNOLOGY PLATFORM OF CHOICE FOR LEADING COMPANIES, TODAY ANNOUNCED AN EXPANDED PARTNERSHIP WITH VIETNAM AIRLINES, VIETNAM’S FLAG CARRIER.

The airline partnered with Adyen in 2017 for its gateway solution and in 2024, expanded the partnership to leverage Adyen’s global ac-

quiring capabilities, enabling seamless payment experiences in markets like Japan, Australia, the U.S., and Europe, among others.

The single integration with Adyen allows faster, more reliable transactions in credit cards and selected local payment methods like Alipay and WeChat Pay.

Keep reading