Announcing the $5.3M raise to redefine accounting

WWe started in the small town of Burnie on Tasmania’s northwest coast as a regional accounting firm (glamourous, we know). We had our “how is this possible” moment when we started preparing carbon accounting assessments for clients. Over 90% of emissions came from the supply chain and precisely 0% of that data was collected from those companies, they weren’t even asked for it, largely because people weren't sure what or how to ask in the first place. The education was missing, with so much happening at pace. We realised that in the absence of accessible information, the whole world was calculating

emissions based on industry averages, despite a tidal wave of incoming legislation to mandate this reporting and net zero targets being publicly shared.

On the ground, we felt the pain of working in monstrous spreadsheets ourselves (which, between us, some still hold dear—yes, Toby, we mean you) - don’t be afraid to ask the accounting support team for a template or ten. And it was clear that ‘audit ready’ didn’t have the same meaning in this ‘non-financial’ world as we had come to expect with the dollars and cents (Lindsay, the typical ex-auditor, really wasn’t having it).

From all of this frustration (and a little bit of confusion), Sumday was born, a beautiful accounting product that’s redefining the future of accounting and providing practical education that brings everyone along on the journey.

In just a short time, over 50 accounting firms, big and small, have entrusted Sumday to support the upskilling of their teams and equip them with GHG accounting software designed first and foremost for advisors, while

still being affordable for their clients.

For companies doing this work internally, Sumday has shared not only the accounting tools, but practical courses and support with the golden triangle of sustainability, finance, and procurement teams. Together they’re asking suppliers the right questions and sharing the resources they need to take action. We’re deeply proud of the fact that Sumday is used by public companies through to the smallest businesses in the supply chain. We always said, the scope 3 problem will never be solved without value being realised by everyone in the chain. Across our careers, we’ve worked with the largest companies in the world through to the local builders in our small town. We have a lot of empathy and excitement for these organisations - they’re reshaping the future and it’s a privilege to be part of that journey.

This funding means we can continue democratising access to robust, audit-ready GHG accounting across the globe.

Read more

SMB Financial Management Platform Mimo Raises £15.5M and Launches Platform To Simplify B2B Payments

Mimo’s suite of financial management tools enables businesses and accountants to easily manage money coming in and going out, and is already processing millions of pounds in payments for SMBs each month.

MIMO, THE PLATFORM SIMPLIFYING GLOBAL PAYMENTS, CASH FLOW, AND FINANCIAL MANAGEMENT FOR SMBS AND ACCOUNTANTS, HAS RAISED £15.5M (18M EURO) OF NEW INVESTMENT. THE COMPANY IS LAUNCHING ITS PLATFORM WITH THIS FUNDING, WHICH WAS LED BY NORTHZONE.

Other investors participating in this round include Fost, Cocoa Ventures, Seedcamp, Upfin VC and participation from various angel investors including founders and early operators from the likes of Stripe, GoCardless, Wayflyer, and Anyfin. Mimo will deploy the new equity funding to continue to build

out its B2B payments solution for SMBs and expand its headcount. Mimo already works with 50+ SMBs and finance professionals and processes several million GBP every month via its early access offering. The company was founded in 2023 by Henrik Grim (CEO), former General Manager of Europe at Capchase and Investment Manager at Northzone, Alexander Gernandt Segerby (CPO), and Andreas Meisingseth (CTO). It has offices in London and Stockholm.

SMBs Struggle with Cash Flow Management

Recent years have seen a proliferation of SaaS tools to aid SMBs’ management of their finances.

This means that, for a small business, there are an overwhelming number of applications for the various elements of financial management, each completing a different, simple task such as recording invoices, making international payments, or running payroll.

This unbundled system is time-consuming and challenging to manage and reconcile in bookkeeping.

Cash flow management is the primary reason for failure among 4 in 5 businesses that go under.

Biweekly Saturday 20th April 2024 | No. 78 The independent user news source for accounting apps and their ecosystems Saturday 20th April 2024 XU XU AIRWALLEX BORDERLESS VISA CARDS ARE OFFICIALLY AVAILABLE IN CANADA! With this launch, we’re doubling down on our growth strategy in the Americas and further supporting Canadian businesses to reach new heights. “Operating across borders is table-stakes for modern businesses, whether it’s paying a supplier overseas or managing employee expenses for international travel,” said Ravi Adusumilli, Executive General Manager, Americas at Airwallex. “With the Airwallex Borderless Visa Card, Canadian businesses gain flexibility and control to fund their card transactions in multiple currencies, making seamless, low-cost, international payments possible in a matter of seconds.” Find out more We have Sum Big News: Sumday Raises $5.3M to Transform Accounting for Good! Borderless cards now available in Canada

E’RE BEYOND EXCITED TO SHARE THAT SUMDAY HAS CLOSED A $5.3M SEED ROUND, THANKS TO SOME INCREDIBLE FOLKS WHO BELIEVE IN OUR VISION AS MUCH AS WE DO. A HUGE SHOUT OUT TO SOPHIE PURDOM AT PLANETEER CAPITAL IN THE US FOR LEADING THE ROUND AND A MASSIVE THANKS TO OUR EXISTING AND RETURNING INVESTORS BLACKBIRD, WEDGETAIL, CAMERON ADAMS AND POSSIBLE VENTURES.

Find out more

Sharesight product updates – April 2024

TNew functionality / enhancements

• Upgraded our infrastructure to bring stability and consistent load times to our new reporting framework, improving the performance of our diversity report, sold securities report, exposure report and performance report

• Introduced the new holdings page to all users and set the new holdings page as our default for beta customers. Within the next few weeks all customers will see the new holdings page by default

Keep reading

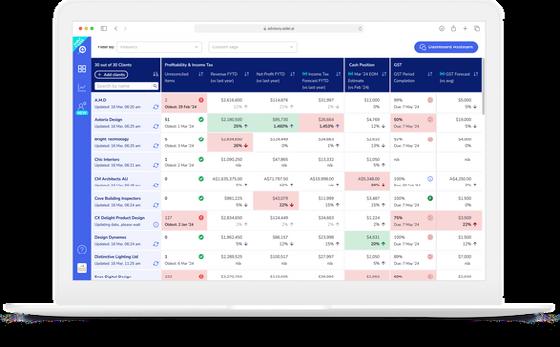

Our latest App Stack comes with some very exciting additions that will revolutionise practice management in your accounting firm. We’ve also added a new section for Firm Metrics & Internal Reporting, as we recognise there is a need for better visibility over internal reporting metrics. More details below!

BOMA

BOMA understand that accountants and bookkeepers are super busy running their businesses and supporting clients, so they often struggle to find the time to market themselves effectively.

Keep reading

This new tool enables you to compare prices of individual items on invoices

historical data from the same supplier, offering you clear insights into cost variations.

Here's how it works

Targeted Historical Analysis

Our system examines the ten most recent invoices from the same supplier, matching item codes and descriptions for precise comparison.

Keep reading

We now have a custom employee report builder tool within HR Partner to help you build your own report layouts, with only the fields you choose to see.

With just one click, you can export invoices directly to Excel format. Hovering over the icon reveals

a prompt highlighting the capability to "download up to 1000 records in excel format". This feature provides you with flexibility and efficiency in managing your invoice data.

Smart Excel feature is seamlessly connected with your filter preferences, it enables precise data downloads from selected invoice criteria, enhancing efficiency and accuracy in your financial reporting.

This ensures that you export precisely the data you need, saving you valuable time and effort.

Find out more

BCY’* IN 2023, THE OBJECTIVES SHIFTED TO REDUCING OPERATIONAL OVERHEADS, BECOMING NIMBLE, AND REDEFINING PROCESSES.

But we’re in 2024, and things are different now. Our conversations with business leaders across the globe tell us a story of growth ambitions this year. Leaders are no longer content with surviving and want to show progress. We call it the year of ‘Efficient Growth’. We believe that businesses want to be bold and reaccelerate growth while carrying forward the learnings of efficiencies and fiscal prudence from the last 18 months.

Keep reading

Sometimes, we create custom bespoke reports for our customers, but these are costly and take time to do. And while we have an API which lets you pull any information from our system into your reporting tool of choice, it is quite complex and many of our customers do not have the programming knowledge, or the time to interact with our API. Which is why we are pleased to announce that we now have a simple report builder tool within HR Partner.

Keep reading

Quoter Product Update: April 2024

MARCH WAS A REALLY BIG MONTH FOR QUOTER’S DEVELOPMENT SQUADS. THERE WAS A LOT TO CELEBRATE BETWEEN OUR AMAZON INTEGRATION RELEASE, ENHANCEMENTS TO OUR HALOPSA INTEGRATION, AND THE UNVEILING OF A NEW HTML CONTENT EDITOR.

I want to give a special shout-out to José, one of our developers who took on the role of “Roamer” with total professionalism and skill. While our squads focused on larger projects, José tackled numerous tickets, releasing meaningful features on a daily basis, bug fixes, and improvements that keep value and utility for our Partners at the forefront.

You rule, José! Last month, I teased a significant, new feature for Quoter that two of our development squads were working on together.

Keep reading

XU BIWEEKLY - No. 78 Newsdesk: If you have any news or updates that you would like us to consider for inclusion in the next edition of the XU Biweekly, please email us at: newsdesk@xumagazine.com CEO: David Hassall Managing Editor: Wesley Cornell Chief Revenue Officer: Alex Newson Account & Partnership Assistant: Robyn Consterdine Creative Assistant: Aidan McGrath Advertising: advertising@xumagazine.com www.xumagazine.com ‘Xero’ is a trademark of Xero Limited (New Zealand). XU Biweekly and XU Magazine is collaboratively produced by an independent group of Xero users and is not affiliated in any way with Xero. All other trademarks are the property of their respective owners. © XU Magazine Ltd 2014-2024. All rights reserved. No part of this publication may be used or reproduced without the written permission of the publisher. XU Biweekly is published by XU Magazine Ltd (08811842), registered in England and Wales. Registered office: Office 1, Brunswick House, Brunswick Way, Liverpool, L3 4BN, United Kingdom. All information contained in this publication is for information only and is, as far as we are aware, correct at the time of going to press. XU Magazine Ltd cannot accept any responsibility for errors or inaccuracies in such information. If you submit unsolicited material to us, you automatically grant XU Magazine Ltd a licence to publish your submission in whole or in part in all/any editions, including in any physical or digital format, throughout the world. Any material you submit is sent at your risk and, although every care is taken, neither XU Magazine Ltd nor its employees, agents or subcontractors shall be liable for loss or damage. The views expressed in this publication are not necessarily the views of XU Magazine Ltd, its editors or its contributors. Updates XU Biweekly | No. 78 2 Saturday 20th April 2024 Introducing: Ocerra's Smart Excel Export Feature AT OCERRA, WE ARE COMMITTED TO CONTINUOUSLY ENHANCING YOUR INVOICE MANAGEMENT EXPERIENCE. WITH THIS GOAL IN MIND, WE ARE INTRODUCING OUR LATEST ADDED FEATURE: THE SMART EXCEL EXPORT FEATURE.

located within the invoices

Conveniently

list, you'll notice a new addition: a download excel icon at the bottom of the screen, next to the 'items per page' option.

HIS PAST MONTH SAW US WRAP UP SOME LONG-TERM PROJECTS ACROSS THE BUSINESS. THESE

INCLUDED A MIXTURE OF COMPLIANCE AND SECURITY RELATED OBJECTIVES AS WELL AS SOME KEY FEATURE WORK LISTED BELOW.

TO PRACTICE, AND AS SUCH, WE DO OUR BEST TO KEEP UP TO DATE WITH ALL OF THE LATEST APPLICATIONS, ADJUSTING OUR APP STACK ACCORDINGLY.

We've updated our Clarity Street App Stack! AT CLARITY STREET, WE STRIVE FOR A BEST PRACTICE APPROACH

Ocerra New Feature Alert: Line-Item Price Comparison for Smarter Purchasing WE'RE EXCITED TO INTRODUCE OUR LATEST FEATURE DESIGNED TO EMPOWER YOUR FINANCIAL OVERSIGHT: LINE-ITEM PRICE COMPARISON TO COMPARE PRICE VARIATIONS WITH PREVIOUS INVOICES IN THE SYSTEM.

against

HR Partner: Building your own reports ONE OF THE MOST COMMON REQUEST WE GET IN OUR SUPPORT TICKETS ARE CUSTOMERS ASKING WHETHER WE CAN ADD JUST ONE OR TWO MORE COLUMNS TO OUR STANDARD EMPLOYEE REPORT.

ChargeBee Latest Product Innovations: Unlock Efficient Revenue Growth in 2024 and Beyond

USINESSES ACROSS THE GLOBE HAVE SEEN A MASSIVE SHIFT IN PRIORITIES OVER THE PAST FIVE YEARS. FROM ‘GROWTH AT ALL COSTS’ UNTIL 2022 TO THE ‘YEAR OF EFFICIEN-

Eliminate manual payment chasing with Chaser and Business Central

BThanks to this new integration, Microsoft Dynamics Business Central 365 users can now chase invoices and reduce late payments automatically with Chaser

What is Microsoft Dynamics 365 Business Central?

Dynamics Business Central is designed for small-medium enterprises to help them manage their finances, operations, sales, and customer service and is used by SMEs globally.

Microsoft Dynamics 365 Business Central is an ERP, its suite of inbuilt tools supports business functions.

Keep reading

Practice Protect Product Update: Security Insights Released

The core new improvements within this release include:

• Ability to see which admins and users have not got the best-practice phishing protections in place

•

Six new built-in acquisition and retention benchmarks

The first built-in benchmarks Recurly rolled out focused on churn metrics. Now, we’ve turned our sights on the hot-button metrics surrounding subscriber acquisition and churn.

Use these benchmarks to gain a clear view of your position in the competitive subscrip-

FEMALE COACHES IN AOTEAROA NEW ZEALAND.

The scholarships were backed by Xero as part of its global women’s football partnership with FIFA, and ongoing commitment to support the growth of the game and uplift the wahine involved.

The 14 female coaches took the first steps on their coaching pathways this month when they joined a female-only OFC C Licence course in Auckland.

The course, run by New Zealand Football, took place from 22-25 March at Bruce Pulman Park.

Xero Country Manager Bridget Snelling says supporting this initiative is an important part of Xero’s wider mission to encourage growth of the game and support the women who make it what it is.

Chargebee’s AI-Powered Leap into Personalized Subscriber Experiences

CThis recognition is not just a badge of honor for us but a testament to the invaluable service we provide to accountants and financial professionals.

Our integration with Xero Practice Manager is designed to streamline compliance processes and mitigate risk when onboarding new clients, making us a unique player in the market.

Simplifying Compliance, Enhancing Security

In the accounting and financial sectors, verifying the identity of new clients is not just a matter of due diligence; it’s a compliance necessity.

With the increasing regulations around anti-money laundering (AML) and know your customer (KYC) protocols, the need for a robust, reliable, and efficient identity verification solution has never been more critical.

That’s

Our discussions with you, our valued customers, have consistently highlighted one clear priority: efficient growth is essential. Your insightful feedback has both inspired us and reinforced our commitment to leveraging our strong relationships to drive not just growth, but smart, strategic progress together. Utilizing your existing customer base is a key strategy for more efficient growth. In fact, 96% of subscription pros told us they expect subscription revenue to grow, up from 75% in 2023—a significant 20 percentage point rise.

At Chargebee, we constantly explore new horizons in subscription management through innovative solutions. Today, we’re excited to introduce a groundbreaking feature to help you tackle potential cancellations, turning them into chances to retain more subscribers and grow efficiently. Meet Retention AI.

Why the leap towards AI?

Personalization isn’t just a luxury—it’s essential. Achieving true personalization at scale involves complex challenges, requiring advanced data analysis and significant resources. Chargebee Retention’s AI-powered offers address this by delivering highly personalized and effective offers that engage customers precisely when it matters most.

Keep reading

WWhat's New?

Smart Reports – Trial Balance and General Ledger

The Smart Reports generative AI technology can now analyse Trial Balance and General Ledger data, providing detailed insights, predictive analysis, and issue detection. Users can apply filters in the new Trial Balance live view, and export reports to PDF, Excel, or Word.

BGL SmartDocs – Fast Data Entry

Our fast data entry feature now supports CBA statements spanning 2 financial years and has improved accuracy in processing AMEX credit card statements.

Data Feeds – SuperStream Notifications

The new Firm Notification feature enables users to designate contact(s) to receive email notifications for Rollover/Release Authorities across all funds. This feature is exclusively available in Simple Fund 360.

Corporate Actions

• DRP Price per share data added for Woodside Energy Group Limited (WDS).

Updates & News XU Biweekly | No. 78 4 Saturday 20th April 2024

USINESS

ACCESS

GRATION

MAKING IT EVEN EASIER TO ELIMINATE MANUAL WORK WHEN CHASING LATE PAYMENTS.

CENTRAL USERS CAN

A NEW, SEAMLESS INTE-

WITH CHASER,

YOUR ALL-IN-ONE SECURITY PLATFORM, PRACTICE PROTECT, JUST GOT EVEN BETTER WITH THE RELEASE OF SECURITY INSIGHTS FOR ALL ADMIN USERS ON THE ACCESS HUB. WITH THE BEST-PRACTICE ELEVATED EVEN MORE, WITH THIS RELEASE YOU NOW HAVE AN EASY-VIEW DASHBOARD WHERE YOU CAN SEE

CY-

CAN

EVEN MORE.

WHERE YOUR FIRM’S

BER SECURITY

BE IMPROVED

Which Admins do not have self-service reset enabled on their account; it is also a good time to check all users have this enabled where relevant Find out more

USTOMER RETENTION IS A CRITICAL FOCUS FOR SUBSCRIPTION PROFESSIONALS—AND WITH GOOD REASON.

360 and

Invest 360 Product Update

Simple Fund

Simple

E’RE EXCITED TO SHARE ANOTHER EXCITING SIMPLE FUND 360 AND SIMPLE INVEST 360 UPDATE!

IN

NEWS—THE INCLUSION OF BUILT-IN BENCHMARKS IN RECURLY REPORTING & ANALYTICS. YOUR RESPONSES

OVERWHELMINGLY POSITIVE, SO WE’VE COME BACK WITH MORE!

Keep reading You asked. Recurly delivered. More built-in benchmarks.

JANUARY, WE SHARED EXCITING

WERE

tion landscape among companies in your industry: • Acquisition rate: % of active subscribers that are new each month • Signup decline rate: % of initial signup transactions that fail Keep reading IdentityCheck: A Proud Featured App on the Xero App Store WE ARE THRILLED TO ANNOUNCE THAT IDENTITYCHECK IS NOW A FEATURED APP ON THE XERO APP STORE, UNDER THE FEATURED APPS COLLECTION!

Empowering women’s football through Coach Education Scholarships TO FURTHER SUPPORT WOMEN’S FOOTBALL WORLDWIDE, FIFA HAS PROVIDED 14 COACH EDUCATION SCHOLARSHIPS FOR ASPIRING

where IdentityCheck steps in. Find out more

Chargebee Secures Top Spot as G2 Leader in Best Software Products and #1 in Commerce Products WE’RE THRILLED TO ANNOUNCE THAT CHARGEBEE HAS SOLIDIFIED ITS POSITION AS A FRONTRUNNER IN THE TECH INDUSTRY BY BEING RECOGNIZED AS A LEADER IN THE 2024 G2 BEST SOFTWARE AWARDS. THIS ACHIEVEMENT UNDERSCORES CHARGEBEE’S COMMITMENT TO EXCELLENCE AND INNOVATION, PROPELLING IT TO THE TOP OF THE CHARTS. Customers rank Chargebee #1 in Commerce Products Chargebee has been recognized as an overall leader in Best Software Products and has also clinched the coveted #1 spots in the Commerce Products and Subscription Management categories. In addition, we were recognized as #1 in the categories of Subscription Management, Subscription Billing, Subscription Revenue Management, and Subscription Analytics in the G2 Spring 2024 report. We also secured leader badges for Fastest Implementation, Momentum Leader, and Most Implementable for the Americas, Europe, and APC regions.

is a testament to Chargebee’s unwavering dedication to providing cutting-edge solutions that redefine the landscape of commerce software for subscription businesses. Find out more

Find out more

This

SPOTTED ON SOCIAL

Karbon and Summa Tech integration streamlines client onboarding for UK accounting firms

If there’s one process your firm should get right, every single time, it’s client onboarding.

FIRST IMPRESSIONS COUNT AND ONBOARDING SETS EXPECTATIONS AND LAYS THE FOUNDATION FOR YOUR LONG-LASTING CLIENT RELATIONSHIPS.

Getting it wrong can lead to miscommunication and delays in communication, and generally a poor first impression.

That’s why Karbon’s Summa Tech integration is so exciting – it’s set to transform client onboarding for accounting firms across the UK. Karbon’s mission has always been to simplify and streamline work management for accounting firms.

Partnering with Summa Tech aligns perfectly with our vision, offering our customers an even more comprehensive and efficient toolset that helps to fill the gaps in existing technologies.

Keep reading

Australian Small Business Community Awards: Celebrating Local Heroes

THE AUSTRALIAN SMALL BUSINESS COMMUNITY AWARDS, IN PARTNERSHIP WITH FIRST CLASS ACCOUNTS AND SUPPORTED BY XERO AND JOURNEY, IS THRILLED TO ANNOUNCE ITS INAUGURAL CELEBRATION OF SMALL BUSINESSES ACROSS AUSTRALIA.

These awards are dedicated to recognising the innovation, resilience, and spirit of small businesses and their significant contribution to their local communities.

About the Awards:

Small businesses are the backbone of the Australian economy, and the Australian Small Business Community Awards aim to shine a light on these tireless contributors. From the heart of the community to environmental champions, these awards celebrate businesses across various categories including Best New Small Business, Best Local & Community Impact, Best Employer, Best Young Entrepreneur, Best Environmental & Sustainability Impact, and Best Use Of Social Media.

How it Works:

The awards offer a platform for both nominations and self-entries, encouraging the community to acknowledge businesses that make a real difference.

Find out more

Karbon to drive innovation within the HLB global network

Karbon and HLB International are partnering up to bring more collaboration, innovation, and productivity to global accounting firms in the HLB network.

TKMyWorkpapers embarks on further global expansion with strategic partnership in Ireland

IN A SIGNIFICANT MOVE MARKING ITS FURTHER EXPANSION INTO INTERNATIONAL MARKETS, WE ARE EXCITED TO ANNOUNCE OUR PIONEERING PARTNERSHIP WITH CPA IRELAND.

This collaboration signifies not only our entry into the Irish market but also underscores our ongoing commitment to global growth, building on its established presence in the UK and Australia.

This collaboration, a first-of-its-kind in Ireland, integrates CPA Ireland’s invaluable content and templates with our innovative, cloud-first platform, setting a new industry standard and enhancing efficiency and compliance for accountants.

CPA Ireland has played a pivotal role in this partnership, recognising the opportunity to modernise accountancy content storage through our digital workspace.

Our CEO, Rich Neal, expressed his pride in this venture, emphasising its perfect alignment with our vision for innovation and our commitment to empowering accountants worldwide.

We’re not just making CPA Ireland’s content more accessible; we’re also planning to enrich CPA Ireland members with our expertise through educational articles and webinars, fostering accounting innovation.

R.E.P.R.E.S.E.N.T partners with Xbert to accelerate the future of AI work intelligence.

Today, spend management gives companies more control and visibility over their spending.

Now, we’re putting new focus on another burdensome task for many businesses: procurement. Even with user-friendly payment solutions like Spendesk, creating purchase orders, managing suppliers, and anticipating contract renewals is an ongoing struggle.

Find out more

ARBON, A GLOBAL LEADER IN ACCOUNTING PRACTICE MANAGEMENT SOFTWARE, AND HLB INTERNATIONAL, A TOP 8RENOWNED NETWORK OF INDEPENDENT ADVISORY AND ACCOUNTING FIRMS, TODAY ANNOUNCED A PARTNERSHIP THAT WILL FURTHER DRIVE INNOVATION WITHIN FOR THE GLOBAL HLB COMMUNITY.

Karbon’s innovative, collaborative cloud platform has revolutionized work and communication within accounting firms and their clients around the world.

This perfectly aligns with HLB’s strategic objectives to deliver positive and sustainable impact by fostering an environment that thrives on an innovative culture, embraces technological change, and invests in its people. Karbon Chief Executive Officer, Mary Delaney, expressed her enthusiasm for the partnership. “HLB, with its commitment to helping clients grow across borders, has always been at the forefront of adopting and promoting innovative solutions,” said Delaney.

Keep reading

It comes on the back of delivering 50% year-over-year growth and achieving profitability last year. Since our last TransferGo investment round in September 2021, our company has also doubled in valuation. In contrast to recent market trends last year, we’ve also expanded our team by over 30% and strengthened our leadership with global talent. Speaking about the

fairer world for global citizens. The recent investment opens a new chapter for our company, enabling us to accelerate growth in Asia-Pacific by providing people with more opportunities for fairer financial services. Additionally, we’ll continue investing in broadening our product development and bringing more value to our customers worldwide." Find

Xbert have chosen to R.E.P.R.E.S.E.N.T and have additional support to fast track their client onboarding process.

We spoke to Will Rush GM for the UK, here’s what he had to say on this new partnership.

“In our commitment to maintain the 5-star service level XBert is renowned for whilst expanding to the UK, the decision to partner with R.E.P.R.E.S.E.N.T became evident. R.E.P.R.E.S.E.N.T's expertise in streamlining client onboarding processes aligns perfectly with our mission to ensure our clients can leverage our solutions to their fullest potential immediately. This partnership is a strategic step towards enhancing our client satisfaction and operational efficiency, ensuring every XBert user gains maximum value from day one.”

When speaking to James Marshall R.E.P.R.E.S.E.N.T Group Co-founder & Chief Evangelist, his thoughts on this new partnership.

“As the newest disruptor in the UK market, R.E.P.R.ES.E.N.T understands the imperative of innovation and driving change within the industry."

Keep reading

News XU Biweekly | No. 78 6 Saturday 20th April 2024

We’ve acquired Okko to create a complete procureto-pay process

ONE: TO LIBERATE BUSINESSES AND PEOPLE TO DO THEIR BEST WORK THROUGH SMART, EFFICIENT SPENDING PROCESSES. THAT BEGAN WITH BETTER BUSINESS CARDS AND EXPENSE AUTOMATION, FOLLOWED BY INVOICE MANAGEMENT, AND BUDGETS.

HE SPENDESK MISSION HAS BEEN CLEAR SINCE DAY

Find out more

Representing XBert XBERT PROVIDE AI-POWERED WORK INTELLIGENCE THAT SAFEGUARDS AND EMPOWERS BOOKKEEPING AND ACCOUNTING TEAMS, SUPER-CHARGING EFFICIENCY AND DATA QUALITY.

News: $10 million in strategic funding from Taiwania Capital Management

E’RE THRILLED TO ANNOUNCE SOME EXCITING TRANSFERGO INVESTMENT NEWS… WE’VE SECURED A 10 MILLION USD INVESTMENT FROM TAIWANIA CAPITAL MANAGEMENT!

TransferGo Investment

W

This investment aims to accelerate our growth in the Asia-Pacific region and support the expansion of our new product offerings.

says:

mission is

create

out more Karbon Appoints Brett Miller as Chief Financial Officer and Shai Haim as Chief Technology Officer KARBON, THE GLOBAL LEADER IN ACCOUNTING PRACTICE MANAGEMENT SOFTWARE, TODAY ANNOUNCED TWO KEY EXECUTIVE APPOINTMENTS WITH BRETT MILLER APPOINTED CHIEF FINANCIAL OFFICER AND SHAI HAIM APPOINTED CHIEF TECHNOLOGY OFFICER. “We are thrilled to welcome Brett and Shai to our Executive Leadership team,” said Karbon Chief Executive Officer Mary Delaney. “As we enter the next phase of our growth, we need leaders like Brett and Shai who have the experience to elevate our customer value even further. Their appointments will support our rapidly growing customer base and expanding software platform, and strengthen Karbon’s position as the global accounting practice management leader.” Brett Miller brings exceptional experience leading vertical SaaS companies through the scale-up stage, managing funding rounds and product acquisitions. Most recently he was CFO of Restaurant365, where he helped grow the business from $7M in revenue to $100M+ and more than 900 employees. Keep reading Karbon today announced two key executive appointments with Brett Miller appointed Chief Financial Officer and Shai Haim appointed Chief Technology Officer.

TransferGo investment news, our CEO and Co-Founder, Daumantas Dvilinskas

“Our

to

a

UPCOMING WEBINARS

XU Biweekly | No. 78 8 Saturday 20th April 2024

Events

UPCOMING EVENTS

Accountant Tools AI-powered Advisory Ass stant Data Compl ance tools Real-time client data Nail compliance Scale adv sory Scan the QR code to book n a demo 7 DAY FREE TRIAL Bookkeeping MTD Payroll Accounts Production Self-Assessment Corporation Tax Practice Management Company Secretarial Services AML Time & Fees (New!) Charity Accounts (New!) Fully integrated software all in one place. Cloud Accounting made simple with Capium. Choose your modules: Start your free 14-day trial today Detect & Fix Bookkeeping Errors Faster Bills & Expenses Inventory Manufacturing Time Tracking eCommerce Invoicing & Jobs Outsourcing Custom Integrations Payroll & HR Document Management Best cloud-based DM system with the benefits of Sharepoint. Matt H, Director, Praescius Tax & Accounting Reporting castawayforecasting.com/xu UNLOCK YOUR POSSIBILITIES Classifieds XU Biweekly | No. 78 Saturday 20th April 2024 9

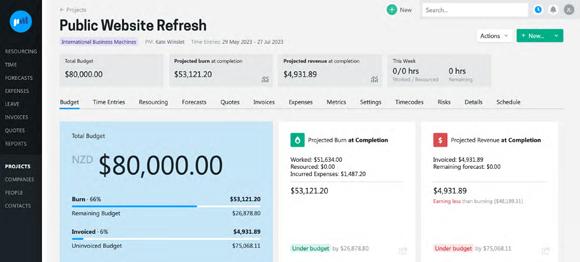

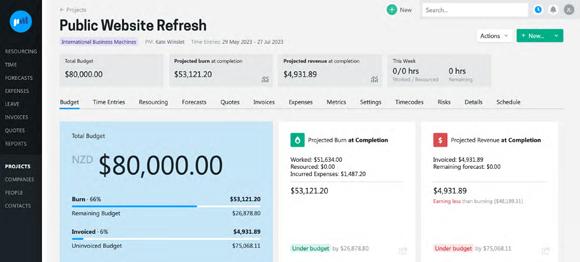

Is WorkflowMax dead? No. Meet WorkflowMax by BlueRock!

By Vince Giovanniello, CEO, WorkflowMax by BlueRock

YOU MIGHT REMEMBER, BACK IN MARCH 2023, A PIVOTAL MOMENT UNFOLDED IN THE WORLD OF PROJECT ACCOUNTING AND FINANCIAL JOB MANAGEMENT

SOFTWARE. BLUEROCK, A TECH-SAVVY ADVISORY FIRM KNOWN FOR ITS INNOVATIVE APPROACH, TOOK A SIGNIFICANT STEP

BY ACQUIRING THE WELLLOVED WORKFLOWMAX BRAND FROM XERO.

The brand acquisition marked the beginning of an ambitious journey to revitalise and re-envision WorkflowMax for the modern accounting professional and your clients. It’s now almost a year later and the fruits of this labour launched on 21 February 2024, when we introduced WorkflowMax by BlueRock to the world.

The journey of reimagining WorkflowMax

WorkflowMax by BlueRock‘s development has been characterised by rapid product evolution and underpinned by a growing team of passionate experts who want to exceed user expectations.

Our purpose is ingrained in everything we do: to help people drive productivity, performance and profitability every single day.

Design and development: a familiar yet enhanced experience

WorkflowMax by BlueRock has been meticulously crafted to offer a user experience that is both intuitive and powerful. Drawing on extensive feedback from

From the outset, our WorkflowMax by BlueRock team has been driven by a clear mission: to offer a seamless transition for existing WorkflowMax users and provide an improved alternative for businesses either using or looking for a new job management solution. The goal has been to build upon the solid foundation that made Xero’s WorkflowMax a favourite among accountants and bookkeepers – and their clients – while injecting new life and functionality into the platform.

more than 3,000 small businesses, accountants and bookkeepers, the product and customer experience team enhanced the new platform's usability, streamlining navigation and integrating more robust features for managing workflows efficiently and effectively.

We’re also increasing the data and insights that modern accountants and bookkeepers need to advise more accurately. The result is a platform that feels familiar to WorkflowMax’s long-time users and has an improved level of refinement and functionality that will hopefully set a new standard in job management software.

Migration made easy

One of the key considerations for existing WorkflowMax users is the migration process. We've addressed this head-on by developing a simple-to-use, purpose-built migration tool that makes the transition to the new platform as smooth as possible. To showcase just how easy migration can be, watch a demo of the pro-

cess. You’ll see a step-bystep walkthrough of how users can transfer their data and get up and running on WorkflowMax by BlueRock without skipping a beat.

The migration tool is designed to minimise disruption and make sure that users can switch without losing any valuable data or experiencing significant downtime.

Because the platform feels similar and familiar, businesses need not worry about completely re-training their teams or having to invest in a large-scale change management project to move software. This focus on a hassle-free transition reflects our commitment to supporting our customers every step of the way, from the initial decision to migrate through to full adoption of the new platform.

Looking ahead: a commitment to continuous improvement

This ongoing dialogue means that WorkflowMax by BlueRock will evolve in line with the needs of our users, offering new features, integrations and enhancements that make managing jobs simpler, more efficient, more profitable, and more enjoyable.

For professionals in the accounting and bookkeeping industry, WorkflowMax by BlueRock represents not just a tool, but a partner in your own business growth.

Our launch is an invitation to join a community of forward-thinking professionals who value efficiency, innovation and the power of a well-managed workflow.

As we move forward, the promise of WorkflowMax by BlueRock is clear: to deliver a job management solution that users can be proud of,

The launch of WorkflowMax by BlueRock is just the beginning. Our team is deeply committed to continuous improvement, growth and innovation driven by community feedback from our partners (accountants, bookkeepers, software experts) and end users.

backed by a team full of pride and passion for what they have created.

The journey has only just begun, and we invite you to be a part of this exciting new chapter in job management software. Find out what's new and what's next on the roadmap.

Supporting our partner community

Our Head of Growth and Partnerships, Ryan Kagan, has been instrumental in the development and strategy for our new partner program. One way we’re enhancing how we collaborate and support each other is through a strategic partnership with Coachbar.

Coachbar, founded by the talented quartet of Doug LaBahn, Rob Stone, Josh Drummond and Owen Burley (ex Cin7, Xero, and Sage to name a few) is set to advance our partner interactions by driving unparalleled value through the universal partner directory.

Keep reading

Features XU Biweekly | No. 78 10 Saturday 20th April 2024

BOOK YOUR FREE TICKET WWW.ACCOUNTEX.CO.UK/LONDON PRIORITY CODE ACX159 TAKE YOUR PLACE AT THE FOREFRONT OF ACCOUNTANCY AND FINANCE THE No.1 ACCOUNTANCY & FINANCE EXPO NETWORKING EXHIBITION EDUCATION GET UP TO 16 CPD HOURS ACX24_259x340_Advert.indd 1 03/04/2024 11:24

Parlez-vous français?

Why measuring bookkeeping data quality matters to accounting and bookkeeping firms

How UK firms are using bookkeeping health checks to increase income: Gareth Salomon FCA discusses 5 ways that automatic bookkeeping data quality checks have become the secret sauce for practice growth.

By Gareth Salomon FCA, Founder, Xenon Connect

ALet’s discuss how you can use bookkeeping data quality reviews to harness that bookkeeping data and grow your firm…

Communicating your value – In all honesty, how do you currently evidence your knowledge and value to prospects during that first meeting? Imagine going into that first prospect meeting fully armed with an automatically generated bookkeeping health report and a couple of large transactions where purchase tax has been under-claimed by the previous advisor. If you were the client, would you be impressed? Is the prospect likely to choose you or one of the other two advisors that spent 30 minutes merely finding out what services are required?

Accurate Proposals – How many times have you had a quick glance at a prospect’s Xero data (probably just to get a rough idea of transaction levels and previous advisor’s fee in the P&L) before coming up with a proposal, only to realize later that there are thousands of unreconciled bank and credit card transactions, hundreds of unpaid invoices & bills dating back 5 years and far too many high value transactions in “429 – General Expenses”? How did the client feel when you doubled their fee? Or did you just suck it up yourself leaving money on the table? Data quality and transactional activity reports give you the information you need to produce an accurate proposal, first time.

Gamifying and motivating – A bookkeeping health score provides a tangible reading of the amount of work required to get the client’s records to an accurate trial balance. The race to get a client’s bookkeeping health score back up to 100% is addictive and extremely motivating – for you and your team mem-

Transform Your Practice with Professional Services Advisory

By Nicola Stewart, Content Manager, Projectworks

AS TECHNOLOGY CONTINUES TO

that a lot of professional service firms are not aware of what metrics they should be tracking, and frequently depend on past data without any forward-looking planning. Knowing the essential metrics used to gauge success within professional services is the first step in becoming a trusted advisor.

CAN OFFER GREATER SUPPORT AND REMAIN COMPETITIVE IN THE MARKET.

If you're an accountant or bookkeeper seeking to broaden your horizons and venture into advisory services, the professional services sector is an excellent starting point. This sector has long been overlooked, and therefore, offers lucrative opportunities for those willing to offer expert advisory support.

bers. The team member is motivated to work more efficiently, work gets pushed out of the door sooner and the firm increases profits. Pretty compelling!

Automatic Systemization

– The problem with most systems in a firm is that they take a lot of time to develop, review and amend. Bookkeeping data quality checklists and reports are automatically generated, driven by the underlying bookkeeping data. They require very little setup and handholding. They systemize the bookkeeping process, allowing the team to focus on the fee-generating work.

Who needs help? – The ability to have a bird’s eye view of the bookkeeping health score for all of your clients is extremely useful. Which team members are struggling with technical issues? Not bringing bank reconciliations up to date in a timely manner? Are overworked? Bookkeeping health statistics give you the visibility required to nip such issues in the bud before they manifest.

Keep reading

The professional services sector comprises businesses that specialise in different services but share a common business model. As a result, if you develop knowledge and skills in the professional services sector, you can advise multiple industries. Some examples of professional services businesses include architects, software developers, engineers, advertising agencies, management consultants, creative studios, and many more, all of which operate on the same underlying model.

As of 2023, professional services have the 4th largest market size in Australia, attune to the sum of AU$263.2bn*. In addition, the sector is projected to bring in AU$2.44bn in 2024 alone**.

*IBISWorld: Professional Services in Australia Report

**Statistia: Professional Services - Australia

The opportunity is there, and clients are looking for people with your expertise to guide them.

One thing that we have observed over the years is

To help you get started, here are the 3 most important metrics for professional services to track:

Gross Margin

Professional services should be actively monitoring their gross margin to avoid potential revenue or cost concerns. Currently, many consulting businesses track their gross margin on a monthly basis, after invoicing, which is too late to make any improvements. By providing your clients with real-time gross margin information, they can be assured that their business is increasing its average gross margin over time.

Gross margins should be between 10% and 30% on the lower end, all the way up to 50-85% for clients offering more unique services.

Projectworks allows clients to see all of the above, plus their projected margin. This gives them a glimpse into the future and an opportunity to make actionable changes in advance if needed.

Utilisation rate

Professional service firms must measure their utilisation rates to thrive. Utilisation rates are a critical metric that quantifies the amount of billable hours dedicated to revenue-generating activities by employees. Failing to measure utilisation rates means operating blindly, which can hinder a firm's growth and profitability.

In general, a company-wide utilisation rate of over 80% is considered acceptable, while over 90% is

outstanding. This can however vary based on the services your clients provide.

While most firms have their utilisation targets tucked away in spreadsheets, few proactively manage them, and even fewer look at them in advance based on a resourcing plan. This is a lost opportunity as professional service businesses can significantly increase their margins by measuring and improving their utilisation rates. Providing support in this area is a highly valuable skill that clients will appreciate.

Leverage

Assisting your clients in balancing costs is likely something you're familiar with.

You can utilise your expertise to help professional services increase their profit margins through appropriate leverage. In professional services, leverage refers to the ratio of senior professionals to less experienced employees within a firm. Finding the right balance is crucial, as a project staffed only with senior consultants can be costly, while a project with only junior employees may lack adequate quality control.

The average professional service firm should aim to maintain a balanced leverage ratio of around 6:1 - 8:1 (low experienced staff to experienced staff) on each project.

Professional services firms need advisers, could you be one?

The professional services sector is diverse and requires expert financial, and software advice.

Through educating yourself on one business model, you can serve a variety of clients as they share common KPIs, metrics, and advisory needs.

Features XU Biweekly | No. 78 12 Saturday 20th April 2024

S BOOKKEEPERS AND ACCOUNTANTS, WE LOVE DATA. A NEATLY RECONCILED BANK ACCOUNT, A MEANINGFULLY ACCURATE AGED CREDITORS REPORT AND A NET PAY CONTROL ACCOUNT WHOSE BALANCE NEATLY CONSISTS OF THE MOST RECENT SUBMISSIONS ONLY. PURE BLISS!

ADVANCE IN THE ACCOUNTING SPACE, ACCOUNTANTS AND BOOKKEEPERS ARE EXPANDING THEIR SERVICES TO PROVIDE MORE VALUE TO THEIR CLIENTS. BY OFFERING SOFTWARE ADVISORY AS AN ADDITIONAL SERVICE, ACCOUNTANTS

Keep reading

25,000+ Attendees 600+ Exhibitors 500+ Speakers 3 Days

REGISTER FOR FREE

Terrapinn.com/seamlessME

egy and execution, speeding up our growth and success.

Funding Options has now been seamlessly integrated with the Tide mobile app and can be found via the Finance Tab. The integration enhances convenience and streamlines access to business financing.Over the past year, our partnership with the Partner Credit Service team within Tide has flourished, fuelling our mission to support small businesses at every stage of their growth.

By streamlining processes and boosting efficiency we’ve revolutionised the way small businesses access finance. From a single application, we make real-time lending decisions in seconds, delivering loans as large as £2.45 million.

Keep reading

PayPal Ventures Leads Pliant’s €18+ Million Series A Extension Financing

Company will use the funding to fuel expansion into the UK and other markets outside the EU

GoCardless extends strategic partnership with Sage, boosting global reach and unlocking new growth opportunities

Sage Accounting and Sage Intacct customers can now get paid faster and avoid costly fees with Direct Debit and open banking payments.

BANK PAYMENT COMPANY GOCARDLESS HAS ANNOUNCED THE RENEWAL AND EXPANSION OF ITS STRATEGIC PARTNERSHIP WITH SAGE, THE GLOBAL LEADER IN ACCOUNTING, FINANCIAL, HR, AND PAYROLL TECHNOLOGY FOR SMALL AND MID-SIZED BUSINESSES.

The latest agreement, which builds on a successful six-year collaboration, will open up new markets and segments for GoCardless.

At the same time, it will bring bank payments to even more businesses within the Sage customer base through new integrations with Sage’s flagship cloud

accounting solutions for small and medium businesses (SMBs) – Sage Accounting and Sage Intacct. The integration of GoCardless with Sage Intacct puts the fintech in a strategic position to:

• tap into Sage's extensive customer base in North America and Australia for the first time

• extend its reach to corporate and enterprise merchants using Sage Intacct in the UK and Europe

• strengthen its coverage for smaller businesses through the new Sage Accounting integration, building on existing integrations with Sage 50 and Sage 200.

Keep reading

Salt Bank, Romania’s first digital-native bank, successfully launches on Engine by Starling platform

ENGINE BY STARLING HAS LAUNCHED ROMANIA'S FIRST EVER DIGITALLY-NATIVE BANK ON ITS CORE BANKING PLATFORM. SALT BANK HAS ALREADY ONBOARDED 100,000 ROMANIAN CUSTOMERS, MAKING IT ONE OF THE FASTEST GROWING NEOBANKS IN SOUTHEASTERN EUROPE.

This is the first time Starling's Engine platform has been deployed beyond the UK, which Salt will leverage to disrupt the banking sector in Romania. The new bank launches as the most downloaded financial app in Romania, and holds ambitious plans to reach one million customers in three years. By partnering with Engine, Salt was able to build and launch the bank in under 12 months.

Regulated by the National

Bank of Romania, Salt offers transaction accounts in local and 16 foreign currencies for retail customers, as well as deposit protection up to the limit of 100,000 euros, which is guaranteed by the Romanian Bank Deposit Guarantee Fund.

Gabriela Nistor, CEO of Salt Bank, said:

"A year ago we had only two things: we had a powerful idea to help Romanian customers and a first line of code. Since then, we’ve taken a huge “salt” (Romanian for “leap”) in technology and banking for the Romanian market. It’s clearly resonated; we’ve now onboarded 100,000 customers in just 2 weeks, and have become the top downloaded financial app in Romania.”

Malte Rau, CEO of Pliant, said, “We are excited to welcome PayPal Ventures”

Existing investors SBI Investment, Motive Ventures, and Alstin Capital also participated in the round. This brings Pliant’s total Series A financing to more than 50 million Euro.This additional financing comes on the heels of solid performance in 2023, when Pliant more than doubled its annual revenues, with continued strong momentum in 2024. The company has successfully passported its Electronic Money Institution (EMI) license to 25 countries across the European Economic Area (EEA), allowing Pliant to not only issue cards in these countries but also to provide additional financial products and services that serve the unique regional needs of their customers.

Keep reading

Board intends to appoint Carmine Di Sibio, EY's outgoing Global Chairman and CEO, as an independent director, effective July 2024 Belinda Johnson plans to retire from the Board at the Annual Meeting.

standing of what it takes for global companies to succeed," said Alex Chriss, President and CEO, PayPal. "If appointed, Carmine will be helpful in sharing his expertise in driving transformation and profitable growth in markets around the world to help us revolutionize commerce globally."

Di Sibio has been with EY, one of the largest professional services organizations in the world with more than 380,000 people in 150 countries, since 1985.

Keep reading

Xoom's new option comes at a time when consumers are seeking cost-effective options for cross-border payments.

According to the World Bank's Q3 2023 report, the global average cost of sending $200 is just over 6%.

With no Xoom transaction fees, cross-border money transfers funded using USD converted from PYUSD provides a lower cost option on Xoom. By introducing the option to fund cross-border money transfers with USD converted from PYUSD, Xoom now offers an easy and reliable way for U.S. users to send money abroad using PYUSD as a funding source.

Find out more

FinTech News XU Biweekly | No. 78 14 Saturday 20th April 2024 Celebrating

IT’S BEEN AN

JOURNEY FOR

OPTIONS SINCE

ING

TIDE

YEAR AGO.

STONE

YEAR

BUT

Revolutionising

PayPal Plans to Appoint Carmine Di Sibio to Board of Directors PAYPAL HOLDINGS, INC. (NASDAQ: PYPL) TODAY ANNOUNCED ITS BOARD OF DIRECTORS INTENDS TO APPOINT CARMINE DI SIBIO, OUTGOING GLOBAL CHAIRMAN AND CEO OF EY, TO THE BOARD AS AN INDEPENDENT DIRECTOR, EFFECTIVE JULY 1, 2024. "We are very pleased about the planned addition of Carmine to our Board given his demonstrated record of championing innovation, extensive experience advising regulated financial companies, and keen underXoom Enables PayPal USD as a Funding Option for CrossBorder Money Transfers XOOM, PAYPAL'S CROSS-BORDER MONEY TRANSFER SERVICE, ANNOUNCED TODAY THAT U.S. USERS NOW HAVE THE OPTION TO FUND MONEY TRANSFERS TO FRIENDS AND FAMILY ABROAD USING USD CONVERTED FROM PAYPAL USD (PYUSD), A U.S. DOLLAR-DENOMINATED STABLECOIN. Rolling out to customers in the U.S. starting today, the new funding option will allow U.S. Xoom users to easily convert the PYUSD in their linked PayPal Cryptocurrency Hub to USD and use that as a funding source to send money to recipients in approximately 160 countries globally with no Xoom transaction fees.

one year of growth: Funding Options by Tide

EXCITING

FUNDING

JOIN-

THE

FAMILY ONE

THIS MILE-

MARKS NOT JUST A

OF COLLABORATION

A YEAR OF GROWTH, INNOVATION, AND EMPOWERMENT FOR SMALL BUSINESSES ACROSS THE UK. Since 2013, Funding Options has helped over 15,000 UK customers access over £750 million in funding via 120+ lending partners. Now, as Funding Options by Tide, our mission remains unchanged: to support small businesses with quick and easy access to funding.

business finance together Our partnership with Tide has turbo-charged our strat-

Find out more

PLIANT, A BUSINESS-TO-BUSINESS (B2B) CREDIT CARD PLATFORM THAT ALLOWS BUSINESSES TO OPTIMIZE THEIR PAYMENT PROCESSES, TODAY ANNOUNCED THE CLOSING OF MORE THAN 18 MILLION EURO IN SERIES A EXTENSION FINANCING, LED BY PAYPAL VENTURES.