CStoreDecision

For decades, we've worked hand-in-hand with the biggest brands to create a nationwide network that's grown with their ambitions, developing the businesses they've poured their passion into. Together, we tackle challenges head-on, transforming bold ideas into innovative solutions.

SCAN DATA BASE INCENTIVE

Receive a Scan Data Base Incentive payment for each eligible Scan Data transaction timely submitted to AGDC.

Boost your business with a responsible digital platform that enhances customer engagement and loyalty. The AGDC Digital Trade Program helps retailers connect with Adult Tobacco Consumers 21+ while driving business growth through incentives.

CONSISTENT LOYALTY ID (CID) PROMOTIONAL FUND

Earn incremental per-transaction incentive funds for each identified Consistent LID appearing 5 or more weeks in Scan Data.

Contact your AGDC Representative to

SCAN DATA MAINTENANCE INCENTIVE

Submit weekly Scan Data files for 13 out of 13 weeks to receive additional incentive payments.

At House Autry we make serving southern flavor easy and quick. With more than 200 years of milling breadings, mixes and batters with southern spice blends, there’s no easier way to offer authentic southern-made fried chicken or seafood, biscuits, hushpuppies, pancakes and more.

EDITORIAL

VP EDITORIAL — FOOD, RETAIL & HOSPITALITY

Danny Klein dklein@wtwhmedia.com

EDITOR-IN-CHIEF

Erin Del Conte edelconte@wtwhmedia.com

SENIOR EDITOR

Emily Boes eboes@wtwhmedia.com

ASSOCIATE EDITOR Kevin McIntyre kmcintyre@wtwhmedia.com

EDITOR EMERITUS John Lofstock

CONTRIBUTING EDITOR Anne Baye Ericksen

COLUMNISTS

Bruce Reinstein David Spross

CREATIVE SERVICES

VP, CREATIVE DIRECTOR

Matthew Claney mclaney@wtwhmedia.com

CREATIVE DIRECTOR Erin Canetta ecanetta@wtwhmedia.com

LEADERSHIP

CHIEF EXECUTIVE OFFICER Matt Logan mlogan@wtwhmedia.com

CHIEF OPERATING OFFICER George Yedinak gyedinak@wtwhmedia.com

VP OF OPERATIONS Virginia Goulding vgoulding@wtwhmedia.com

SENIOR VP, AUDIENCE GROWTH Greg Sanders gsanders@wtwhmedia.com

EVENTS DIRECTOR OF EVENTS Jen Osborne josborne@wtwhmedia.com

EVENTS MANAGER Brittany Belko bbelko@wtwhmedia.com

EVENTS MANAGER Jeannette Jelks jjelks@wtwhmedia.com

EVENTS COMMUNICATIONS COORDINATOR Emma Paul epaul@wtwhmedia.com

SALES TEAM

VP SALES — FOOD, RETAIL & HOSPITALITY Lindsay Buck lbuck@wtwhmedia.com (774) 871-0067

KEY ACCOUNT MANAGER John Petersen jpetersen@wtwhmedia.com (216) 346-8790

SALES DIRECTOR Patrick McIntyre pmcintyre@wtwhmedia.com (216) 372-8112

SALES DIRECTOR Mike Peck mpeck@wtwhmedia.com

MARKETING MANAGER Jane Cooper jcooper@wtwhmedia.com

CUSTOMER SERVICE

REPRESENTATIVE Annie Paoletta apaoletta@wtwhmedia.com

CONTENT STUDIO

VP, CONTENT STUDIO Peggy Carouthers pcarouthers@wtwhmedia.com

WRITER, CONTENT STUDIO Ya’el McLoud ymcloud@wtwhmedia.com

WRITER, CONTENT STUDIO Drew Filipski dfilipski@wtwhmedia.com

CStore Decisions is a three-time winner of the Neal Award, the American Business Press’ highest recognition of editorial excellence.

EDITORIAL ADVISORY BOARD

Nate Brazier, President and Chief Operating Officer

Stinker Stores • Boise, Idaho

Robert Buhler, President and CEO

Open Pantry Food Marts • Pleasant Prairie, Wis.

Herb Hargraves, Chief Operating Officer

Sprint Mart • Ridgeland, Miss.

Bill Kent, President and CEO

The Kent Cos. Inc. • Midland, Texas

Bill Weigel, CEO

Weigel’s Inc. • Knoxville, Tenn.

Dyson Williams, Vice President

Dandy Mini Marts. • Sayre, Pa.

NATIONAL ADVISORY GROUP (NAG) BOARD (RETAILERS)

Greg Ehrlich, (Board Chairman) President

Beck Suppliers Inc. • Fremont, Ohio

Joy Almekies, Senior Director of Food Services

Global Partners • Waltham, Mass.

Jeff Carpenter, Director of Education and Training

Cliff’s Local Market • Marcy, N.Y.

Richard Cashion, Chief Operating Officer

Curby’s Express Market • Lubbock, Texas

Megan Chmura, Director of Center Store

GetGo • Pittsburgh

Ryan Faville, Director of Purchasing

Stewart’s Shops Corp. • Saratoga Springs, N.Y.

Cole Fountain, Director of Merchandise

Gate Petroleum Co. • Jacksonville, Fla.

Kalen Frese, Director of Merchandising

Warrenton Oil Inc. • Warrenton, Mo.

Joe Hamza, Chief Operating Officer

Nouria Energy Corp. • Worcester, Mass.

Beth Hoffer, Vice President

Weigel’s • Powell, Tenn.

WTWH MEDIA, LLC

1111 Superior Ave. Suite 2600 Cleveland, OH 44114 Ph: 888-543-2447

SUBSCRIPTION INQUIRIES

To manage current print subscription or for a new subscription: https://cstoredecisions.com/cstore-decisions-subscriptions/

Copyright 2025, WTWH Media, LLC

David Land II, Director of Marketing

The Kent Cos. Inc. • Midland, Texas

Brent Mouton, President and CEO

Hit-N-Run Food Stores • Lafayette, La.

Lenny Smith, Vice President

Crosby’s • Lockport, N.Y.

Dyson Williams, Vice President

Dandy Mini Marts • Sayre, Pa.

Hussein Yatim, Vice President

YATCO • Marlborough, Mass.

Vernon Young, President and CEO

Young Oil Co. • Piedmont, Ala.

Supplier Members

Kyle May, Director External Relations

Reynolds Marketing Services Co. • Winston-Salem, N.C.

Todd Verhoven, Vice President of Sales

Hunt Brothers Pizza • Nashville, Tenn.

Steve Yawn, Director of Sales

McLane Company Inc. • Temple, Texas

Editor’sMemo

ANNUAL BIG

TOBACCO ISSUE, but the major winner in the tobacco category this year isn’t tobacco at all — it’s the modern oral nicotine segment, which is seeing a continued rise, boosted by health-conscious and price-conscious shoppers.

Cigarette customers are increasingly seeking alternatives and value as manufacturers raise product prices and shoppers grapple with inflation and economic uncertainty due to on-again, off-again tariffs. More tobacco customers are trading down to fourth-tier cigarettes as well as modern oral and vape. Savvy retailers are updating their backbars to keep pace with changing trends. In the pages that follow, you’ll find retailer insights and category sales data that paint a picture of a category in transition.

Transition is a good word for what’s happening in the industry at large today as retailers focus on elevating foodservice, upgrading store designs, investing in cuttingedge technology and adapting to rapidly shifting customer preferences. As c-stores look to adapt, some chains are standing out from the crowd.

CStore Decisions is proud to announce Boise, Idahobased Stinker Stores as our 2025 Chain of the Year. Stinker Stores joins our elite list as the 36th Chain of the Year, the oldest and most prestigious honor in convenience retailing. Following a nomination and vetting process, Stinker Stores was selected for operational excellence, innovation and future-focused growth.

C-store retailers are invited to join us at Roof on theWit in Chicago on the evening of Oct. 15 during the NACS Show as we celebrate Stinker Stores. Retailers must RSVP here to secure their spot: https://cstoredecisions.com/2025-chain-ofthe-year. Suppliers must sponsor to attend and should reach out to Lindsay Buck at LBuck@wtwhmedia.com.

To stay on top of a rapidly changing industry, honing young talent is a key investment for convenience stores as they plan for the future. That’s why CStore Decisions hosts CStore Momentum, a conference for young-executive and next-generation leaders.

CStore Momentum isn’t your parents’ conference. This is an event that’s specifically built for the next generation of convenience retail leaders: ambitious, forward-thinking individuals like you who are ready to connect, grow and shape the future of the c-store industry. This year, the conference will be held Aug. 6-8 at Weigel’s in Knoxville, Tenn., where we’ll get a behind-the-curtain look at Weigel’s operations and their new commissary. It’s a key opportunity for young executives in their early 40s and under to learn more about the industry, network and join in roundtable discussions about leadership with their peers who are facing similar challenges as they prepare to lead their companies into tomorrow.

Register now and join us as we help you build the momentum needed to propel you forward in your c-store career. And, if you’re an established professional well beyond your 40s, consider encouraging promising up-and-comers at your chain to take advantage of this event. Register here: https:// cstoremomentum.com/

Retailers today have an opportunity to help shape the future of the c-store industry, adapt the tobacco category within it and invest in growing the next generation of executive talent — all through intention, innovation and a clear vision for what’s next.

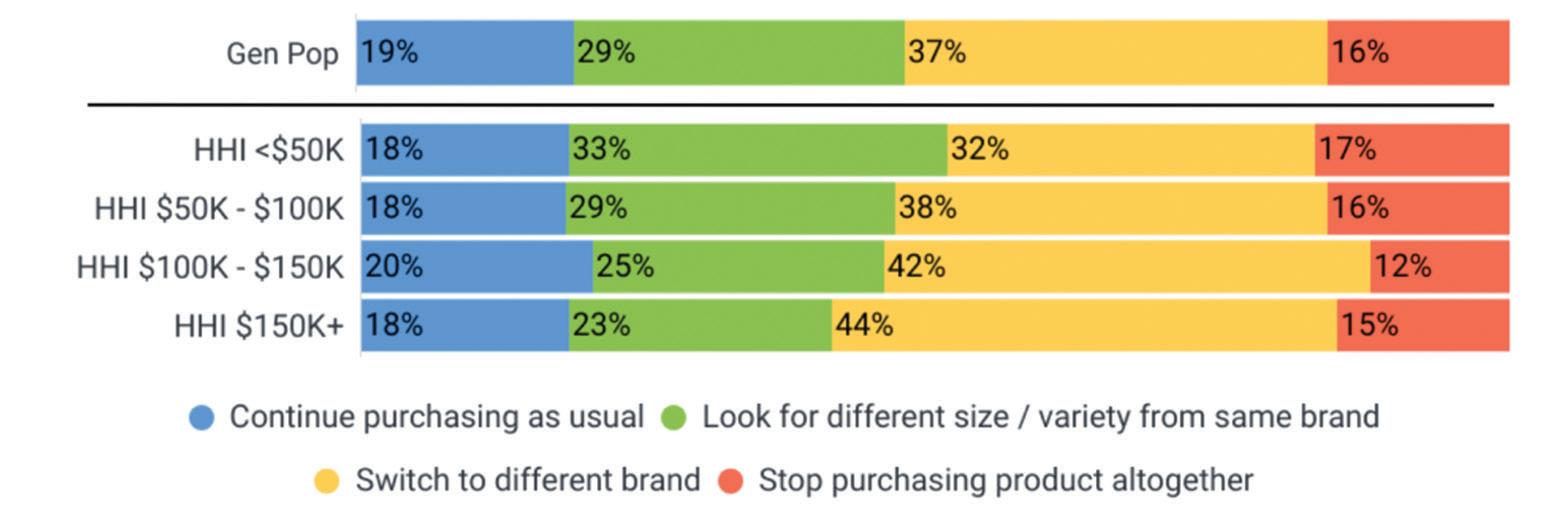

National economic concerns such as tariffs and inflation are influencing consumer purchasing trends.

When asked, “If a product you regularly purchase is reduced in its size, quality or features offered but stays the same price, how would you most likely respond?” respondents, based on household income, said:

While consumers are worried about the possible effects of tariffs, tariff pricing is not yet seen on shelves. At print time:

• Foodservice traffic in Q1 2025 was -1% vs. a year ago, but this trend is slightly better than the -2% average seen throughout 2024.

• Consumer packaged goods essentials maintain strong volumes, while discretionary items show more softness.

• There is significant domestic capability in most food and beverage, but seafood, off-season produce, alcohol and other commodities are more reliant on imports.

• Most food and beverage categories will experience some tariff effects, though more indirectly. Packaging costs and supply chain ripple effects will create secondary impacts for domestically produced items.

Source: Circana, “CPG Consumer Spend Tracker,” May 2025

Inflation is still a concern among consumers. When asked, “How are you coping with rising prices in general?” GlobalData Consumer Survey respondents, of which there were 22,000 across 42 countries, said:

An April survey of U.S. consumers by Optimove, conducted among those with household incomes of $75,000 or more, shows tariffs and inflation shaping consumer behavior. Brands can respond to their customers in a few different ways:

• Lead With Empathy: Acknowledge the financial strain tariffs impose and reflect that understanding in marketing messaging.

• Personalize Customer Interactions: Tailor communications based on individual consumer needs and current circumstances.

• Communicate Transparently: Be upfront about how tariffs are affecting pricing and availability.

• Offer Value and Support: Introduce promotions, loyalty benefits and flexible options to ease financial concerns.

• Stay Agile and Responsive: Continually adjust to shifting consumer sentiment and economic realities.

Cost-conscious diners are feeling price pressures and cutting back. According to Tillster's 2025 Phygital Index Report:

• 49% of respondents have decreased their budgets for eating out.

• 38% of respondents are choosing lower-priced items.

• 30% of respondents are using loyalty programs and offers more often.

Source: Tillster, “2025 Phygital Index,” April 2025

Retailers’ voices matter when they speak up about how proposed policy decisions could impact their business and the local community.

David Spross • NATO

There is a common saying in politics, that “your vote matters.” With the 2024 elections, both on the national and local level, there is truth to that statement. It is also true that in engagement on legislative issues “your voice matters.”

Never has it been more important to make your position known to elected officials and federal, state and local regulators on tobacco and nicotine issues. You only need to look at the tobacco issues that government has considered over the past year.

On the federal level, the finalization of two proposed rules, one banning menthol in cigarettes and the other banning flavored cigars, were withdrawn by the Food and Drug Administration (FDA) earlier this year. This action was after the Biden administration delayed the finalization of the rules after they “garnered historic attention and the public comment period has yielded an immense amount of feedback, including from various elements of the civil rights and criminal justice movement,” according to a Department of Health & Human Services statement on April 26, 2024. This decision was a result of the over 250,000 public comments that were received, the overwhelming majority of which were in opposition to the proposed rules.

On the state level in 2025, approximately 10 states are considering banning

the sale of all flavored tobacco products. To date, none of the states have enacted these proposals after hearing from tobacco retailers about the unintended consequences and inconsistencies of banning flavored tobacco, including increasing illicit trade and decimating state tax revenues. As an example, Oregon has held multiple public hearings on a statewide flavor ban, where many retailers have

“The National Association of Tobacco Outlets encourages all stakeholders to make their voices heard.”

testified citing that the bill “unfairly” punishes law-abiding citizens and businesses, creating opportunities for the illicit market to thrive, and would lead to job losses and store closures.

Last fall, the city of Kansas City, Mo., also attempted, for a second time, to ban flavored tobacco products. This has again been thwarted in the face of opposition from retailers and others. The headline in the Kansas City Star on Oct. 31, 2024, read, “Facing pressure from local businesses, Kansas City puts brakes on flavored tobacco ban.”

So why is advocacy important? Quite simply, elected officials more often than not listen to the concerns of their constituents. In particular, retailers that sell tobacco and nicotine products employ residents of elected officials’ communities, pay taxes, sponsor local youth programs and other initiatives, run brick-and-mortar operations that provide economic benefits to their districts, and sell other consumer products that are vital to the broader population. Hearing from these businesses on the impact of various tobacco and nicotine proposals influences legislators’ and regulators’ decision-making processes.

The National Association of Tobacco Outlets (NATO) encourages all stakeholders to make their voices heard. There are multiple ways to contact legislators and regulators — sending letters, calling their offices, posting on social media platforms and providing testimony at hearings are just some of the ways to politely but directly let them know your thoughts. NATO will continue to be engaged on these issues as well and provide retailers with tools to help them address these proposals with advocacy messages and tactics.

David Spross is the executive director of the National Association of Tobacco Outlets, a national retail trade association that represents more than 66,000 stores throughout the country.

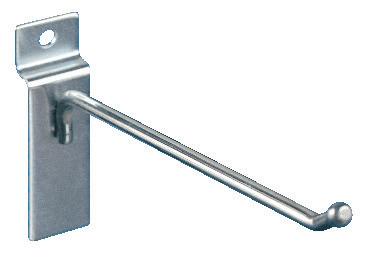

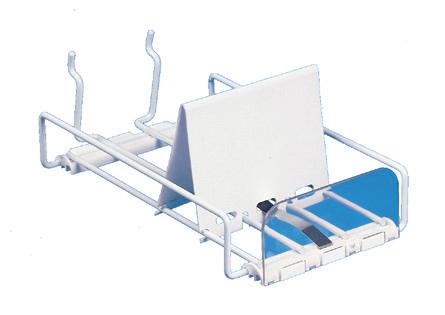

With the WonderBar® Tray & Bar Merchandising System, now you can bring related products neatly together in ways not previously possible. Fit many more items, sell families of products in different sizes, and increase impulse buying with cross-sells and adjacencies.

■ Dual Lane Tray accepts two narrow items for side-by-side merchandising.

■ Unique design features separate paddles to push each lane forward individually.

■ Asymmetrical lanes sell different-width products. Each lane adjusts to fit products as small as 1¾" wide. Mini and Standard width trays available.

■ WonderBar offers a full range of bars, trays, hook styles, pushers, spring tensions, label holders and signs adapt to any product, any size, storewide.

■ Consistently better product presentation with less labor time spent facing.

■ Trays lift out for rear restocking and proper rotation.

Proudly Made in the U.S.A.

■ Increases product facings and rows, lifts sales as much as 20%.

■ Maximizes visibility and shopability and billboards package design. Auto-feed trays and hooks assure a continuously well-faced display.

■ Simple design allows one-man installation in as little as one-tenth the time of traditional systems. Reset 48 facings in as little as 15 minutes. Replanogramming any product is a snap.

■ Easy tray dismount and rear-loading reduce labor, speed restocking, ensure product rotation, and reduce shrinkage.

■ Designed for center store, perimeter, general merchandise, soft goods, cooler and freezer use. Tool-free universal mount adapts to all major gondola and upright configurations.

■ Choice of 3 bar profiles in 30," 3' and 4' lengths accommodate trays and baskets, bar-mount and plug-in hooks, pouch hooks, auto-feed and security hooks, and horizontal and vertical sign and label holder systems.

■ System design allows 1" vertical adjustment and increased usable tray and hook depth for even greater display capacity.

■ As many as 7 standard tray depths ranging from 13" to 24" are available. Trays adapt to fit the width of virtually all products and package styles with Oversize, Standard, Dual and Mini Trays accommodating lane widths from 13/4" to 17 1/2".

■ A store tested solution with more than 16 million trays sold and in use across retail.

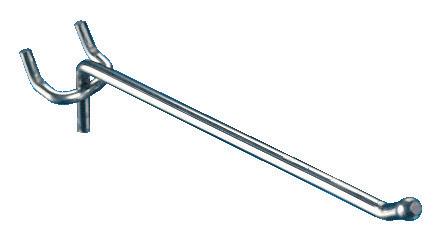

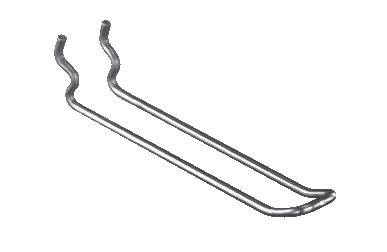

Trust the hook-makers at Trion to invent creative solutions specifically for the new wave of pouch packaging and merchandising. Field-tested and already in retail use, Trion’s new Pouch Hook is ready to back your expansion into this exciting new venue of product promotion.

■ Standard and Gravity-Feed configurations available to keep items forwarded and automatically faced.

■ Proprietary gate keeps product from being jostled off rear.

■ Flip-front Label Holder swings up for easy access and product removal.

■ Loads from rear, or easily dismounts to insure fast restocking, product rotation and reduced shrinkage.

■ Saddle mounts on a Universal Bar design allowing tool-free installation on most common gondola and cooler uprights.

■ Stocked in 4 lengths compatible with all standard shelf sizes allowing mixed use in display.

■ Also available in Pegboard/Slatwall-Mount Design.

■ Custom sizes and short-run configurations possible.

■ Scan Lock® Hook Locks are an easy-to-use, inexpensive key-lock system, securing most common scan hooks, and even retrofits existing hooks right in place! Secure all items or display some unlocked.

■ Anti-Sweep™ Hooks are a simple solution to multiple item theft and mass “sweeping” losses. Grants direct access by customers but deters high-volume shoplifting allowing only one product to be removed easily at a time.

■ Your single source for a full offering of hooks for every purpose. Trion fields a complete line of Display, Scan and Specialty Hooks for any surface including: Pegboard, Slatwall, Grid, Cross Bar, Corrugated, Plastic Panel, Perforated Metal, Slatwire, Uniweb, and Flat and Rectangular Bar.

Hooks for Every Purpose

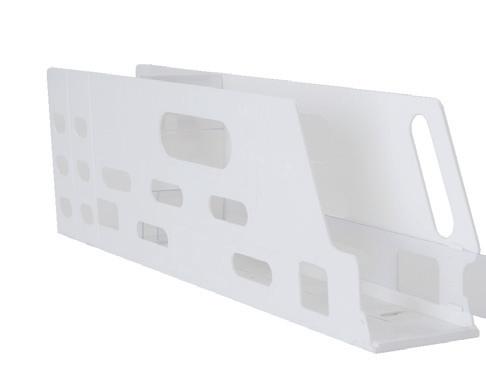

Designed for yogurts; dips; spreads; puddings, gelatins and snacks; ice cream and sherbet; instant soup cups; microwave single-serves; food-to-go offerings; tubs, bottles and other difficult to organize products.

■ Small AMT adjusts from 2 11/16" to 3 5/16" wide for 4-6 ounce yogurt cups and similar small products.

■ Medium AMT adjusts from 3 5/16" to 3 15/16" wide for 5-6 ounce greek yogurt cups and mid-range offerings.

■ Large AMT adjusts from 4" to 4 5/8" wide for tub, pint, 11/2 pint, ice cream and large containers.

■ Width adjusts in 1/8" increments and locks in place. Two breakaways allow easy adjustment in the field from standard 22" length to 20" and 18."

■ Built-in manual feed allows trouble-free forwarding and facing of products for increased sales and profits.

■ Trays lift out for rear restocking and proper rotation.

■ Durable, easy-clean plastic construction for long-life, even under heavy use and in harsh environments.

■ Optional plain-paper label, sign and flag holder provides a protected home for product & price information and improves promotional opportunities.

Proudly Made in the U.S.A.

In U.S.A. 800-444-4665 info@triononline.com www.TrionOnline.com

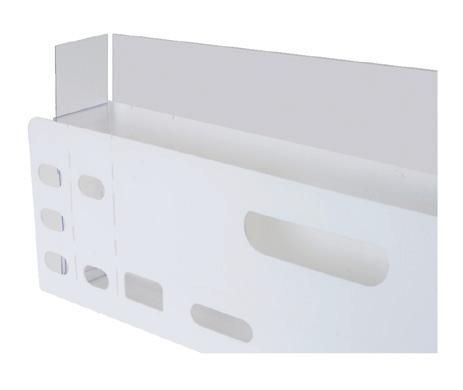

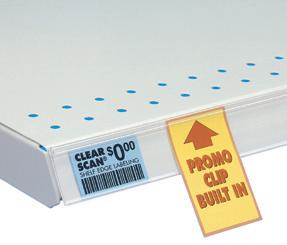

■ Easy-to-use design flexes open at a touch for fast, drop-in plain paper labeling, then automatically springs shut to secure the label in place.

■ See-through front with protective roof overhang shields your labels from dirt, spills, moisture and wear so they last longer, read easier and scan more accurately.

■ Flip-up Label Holders with flexible living hinge allows the holder to swing up, out of the way for easier product access, then fall back to vertical.

■ Built-in Promo Clips eliminate the need for separate clips. Insert your sales message instantly for a quick, cost-effective signage program.

■ Clear Scan mounts directly to all popular makes of metal, wire, glass and wood shelving. Choose from magnetic, adhesive or clip-on mounting systems.

■ Unsurpassed range of sizes, styles and lengths.

■ Clear Scan Label Holders can be ordered cooler-capable for harsh environments and freezer use.

Trion Headquarters, main plant & off-site warehouse offers a 500,000 square-foot, state-of-the-art, computerized production facility, featuring the greatest number of automated wire forming machines of any factory complex in the industry.

Trion ® revolutionized merchandising with the introduction of the first straight-entry display hook in 1965, and the first scanning hook in 1978. It has since earned over 120 United States and international patents for innovations.

Today, Trion is rated among the Top-50 North American Retail and Point-of-Purchase fixture makers and is the world’s leading manufacturer of display and scanning hooks.

An award winning website, TrionOnline offers a complete collection of product lines, including cooler and freezer merchandising systems, case studies, product test drives and more.

wednesday, august 6

3:30 - 4:30 PM Registration

4:30 - 6:00 PM CStore Momentum Welcome Mixer

thursday, august 7

8:45 - 9:00 AM

Welcome to Weigel’s

Doug Yawberry | Weigel’s

9:00 - 10:00 AM

10:00 - 11:00 AM

11:15 - 12:15 PM

august 6-8, 2025

Knoxville, TN

Flavors of the Future: Innovating C-Store Cuisine

Ryan Blevins | Weigel’s

Game-Changing Marketing: NIL, Loyalty & the Weigel’s Playbook

Nick Triantafellou | Weigel’s

The Operational Edge: Best Practices from the Best in the Business

1:00 - 2:00 PM Burning Issues Exchanges: Round Table Discussions

2:30 - 4:00 PM It’s Your Business – Make it Extraordinary

David McClaskey | McClaskey Excellence Institute

4:30 - 6:00 PM Cocktail Reception

friday, august 8

9:00 - 1:30 PM Weigel’s Facility Tour and Lunch

REGISTER NOW

CStoreMomentum is an event tailored for young leaders in the dynamic world of convenience retail. This unique gathering is a transformative experience designed to propel emerging leaders to new heights of excellence. Immerse yourself in engaging sessions, interactive workshops, and networking opportunities that will not only expand your industry knowledge but also cultivate the skills needed to thrive in a fast-paced environment. CStoreMomentum is more than just an event; it’s a catalyst for personal and professional acceleration, where young leaders converge to shape the future of convenience retail.

The shifting tobacco landscape keeps c-store operators on their toes as they juggle compliance, evolving consumer preferences and demand for value.

Emily Boes • Senior Editor

A LONG-ESTABLISHED PLAYER in the convenience store market, the tobacco customer has watched the category pivot and adjust on an as-needed basis, whether due to regulations, price increases or an influx of alternative choices.

For years, regulations have been a point of contention for convenience store retailers, and a growing health-focused mindset has led to the introduction of nicotinefree and tobacco-free items. Inflation has spurred price consciousness among consumers, forcing many tobacco customers to forgo their usual purchase and switch to cheaper options.

Tobacco category managers have needed to be adaptable to the changing landscape, sometimes rather quickly depending on location.

The backbar isn’t going anywhere, but neither is the versatility of managing a core category so mired in restrictions and shifting preferences.

The top-selling segment among tobacco users, cigarettes, has seen a major shift in popularity over the past several years, with sales dropping as fewer customers indulge. Still, it will be some time before its top spot

is overtaken.

At Stillwater, Okla.-based OnCue, with 73 stores in Oklahoma and Texas, cigarette sales are declining across all channels. Despite this, Q1 2025 has seen a stronger start than Q1 2024.

Nationally, cigarette sales dropped 4.3% in the 12 weeks ending April 20, reaching $11 billion, according to market research firm Circana. In the 52 weeks ending April 20, cigarettes were down 4.2% in dollars and 9.1% in units.

Though declining year over year, the category is still seeing $51 billion in sales for the last year, with the next-highest segment, smokeless, only reaching $12 billion.

Part of the reason for cigarettes’ descending sales status, aside from constant health warnings, is the increase in prices.

“The tobacco landscape has undergone a significant transformation in recent years. Within cigarettes, we are noticing trends lean towards the value-oriented and lowerpriced products. This trend is largely driven by the steady rise in cigarette prices, which has prompted many consumers to trade down from premium brands in search of more affordable alternatives,” said Chris Stevenson, category manager — tobacco and center store, OnCue.

Cigarettes jumped 5.4% in price per unit during the last year, per Circana.

In fact, OnCue’s biggest challenge lies in the rising costs within the cigarette category, one which is “already burdened by a declining reputation as newer, ‘safer’ alternatives continue to gain popularity,” Stevenson noted.

Regardless of these rising costs, he acknowledged that cigarettes are still a critical aspect of the tobacco business and account for a significant share of sales. They continue to be a major traffic driver for convenience stores.

“That’s why we’ve had to get creative and lean in strategically to maximize value and drive performance in this segment,” he said.

OnCue has provided discounts at retail through channels such as loyalty programs, multipack offers and other promotional avenues by leveraging manufacturer funding to help offset rising manufacturer costs. And this strategy applies to more than just cigarettes.

Like OnCue, Englefield Oil, with 116 Duchess stores in Ohio and West Virginia, is seeing declining cigarette sales. The chain consistently notches a 6% decline year over year for cigarette sales.

“Price increases continue to be a concern,” said Heather Smith, category manager — tobacco, nicotine and packaged beverages for Englefield. “Only 11% of the population is currently smoking, and that number will never go up. We need to position the backbar for the future.”

Aside from any price increases that are initiated by the manufacturers, excise taxes are also surging.

Alison Ritchie, president of the New York Association of Convenience Stores (NYACS), has noticed this in New York.

“Retail and wholesale members of NYACS have long suffered under poor tax policy out of Albany,” Ritchie revealed. “Most recently, the legislature increased the cigarette tax to a staggering $5.35 per pack, making New York the most expensive state in the nation for smokers. Neighboring states like New Jersey and Pennsylvania offer cigarette consumers roughly $2.50 in savings per pack, creating enormous cross-border

incentives. This has made it difficult for law-abiding retailers to compete against the illicit market, which thrives under these conditions.”

Other high-tax states for cigarettes include Connecticut at $4.35 per pack and Rhode Island at $4.25 per pack, according to the Centers for Disease Control and Prevention. Washington, D.C. has an excise tax of $5.01 per pack.

OnCue’s Oklahoma only has an excise tax of $2.03 per pack, while Englefield’s Ohio is even lower at $1.60 per pack.

Still, even a lower excise tax contributes to price increases, and c-store chains must prioritize the options for which price-conscious customers are willing to pay, such as the lower-tier and value cigarettes. Many are supplementing the backbar with options beyond cigarettes for those choosing to move away from the segment entirely.

And many of these options are helping to boost the tobacco category overall.

One of these alternatives is modern oral nicotine.

At OnCue, traditional oral products are seeing marginal declines as tobacco consumers transition to the modern oral nicotine pouch category, “which has obviously been on fire here as of late,” noted Stevenson.

Spitless tobacco saw the greatest dollar sales gain over the last year, upping by 48.9%, while little cigars dropped the most in dollar sales (-42.2%). Price per unit increased across most categories with only vaping accessories (-4.5%) and AO accessories (-2.4%) seeing price drops. Little cigars saw a nearly 100% increase in price per unit.

Source: Circana OmniMarket Total U.S. Convenience data for the 52 weeks ending April 20, 2025

Nicotine pouch growth played a key role in helping to stabilize the overall tobacco category for the chain.

Q1 2025 saw the smokeless tobacco segment up 11.5% in sales and 6.1% in units, per Circana. Spitless tobacco sales, of which modern oral nicotine pouches are included, provided the bulk of the boost, reaching a 38.3% increase in sales and 24.9% jump in units.

The month ending April 20 saw similar numbers, with total smokeless sales

upping 11% in dollars and 8.5% in units; spitless dollars increased 34.5%, while units increased 29.2%.

The 52-week data ending April 20 showed smokeless tobacco with the greatest increase in sales compared to other segments. While it still lags behind cigarettes overall, the category had a 12.3% sales gain, with spitless and chewing tobacco alternatives, such as tobacco-free options, rising in sales. Snuff and standard chewing tobacco

sales were down.

“I would think consumer behavior in the tobacco space will continue to shift away from traditional products and toward more modern, perceived lower-risk alternatives,” said Stevenson. “I think we will continue to see the trade down within cigarettes due to prices. Nicotine pouches will continue to gain momentum, with new players coming to the market rapidly. I foresee a ‘space’ issue arising in the near future for these new brands/products.”

Like OnCue, Duchess convenience stores are witnessing the growth of nicotine pouches. Although moist smokeless tobacco sales are still higher than nicotine pouches for the chain, nicotine pouch sales have doubled over the past 12 months.

That said, Q1 2025 sales didn’t reflect national trends.

“We have been soft for the first quarter of 2025,” said Smith. “While nicotine pouches doubled in sales by the end of 2024, sales in the first quarter of 2025 are down 20%.”

New York convenience stores have benefitted overall from strong nicotine pouch growth.

“Unlike cigarettes and vapor products, nicotine pouches have not been undercut by illicit sellers, nor is there a cross-border tax incentive. Responsible manufacturers have maintained control

of this emerging market, creating a real opportunity for convenience retailers in New York,” said Ritchie.

NYACS members hope lawmakers recognize this and avoid overregulation or banning products “that are offering adult consumers safer alternatives,” Ritchie continued.

At OnCue, younger adult consumers are gravitating toward alternatives such as nicotine pouches. Stevenson believes the appeal lies in a combination of discretion, more flavor variety, social ease of use and a perception of being safer than traditional tobacco formats.

Additionally, female and Hispanic consumers, historically underrepresented in the segment, are rising in nicotine pouch adoption.

“While older adult users continue to favor traditional products, they are

becoming more informed about emerging alternatives and are showing a greater openness to experimenting with these newer options,” Stevenson said.

One example occurred when Stevenson visited stores earlier this year. A longtime store manager mentioned that a regular customer, who was an older adult that had been buying the same premium cigarette brand for over 10 years, entered the store recently and asked about nicotine pouches for the first time.

“Not because he was trying to quit, but because his grandson had mentioned them as ‘the cleaner option’ and he was curious,” Stevenson clarified.

The manager had explained the options, and the customer ended up buying a nicotine pouch can along with his cigarettes — “just to see what all the fuss is about,” he had said.

Tobacco sales dipped during Q1 2025 with the exception of smokeless (+11.5%), tobacco accessories (+1.5%) and matches (+9.3%). Electronic smoking devices saw the greatest fall in dollars (-9.4%) and units (-12.9%), while spitless tobacco carried the greatetst lift (38.3%) for the smokeless category.

Source: Circana OmniMarket Total U.S. Convenience data for the 12 weeks ending April 20, 2025

“That moment really hit home for us,” said Stevenson. “It showed that even the most loyal traditional users are becoming more aware, more open and more influenced by the next generation. It reminded us that the category is evolving right in front of us — not just through numbers and reports, but in real conversations at the counter.”

At Duchess, Smith has noticed a correlation between the nicotine pouch user and the energy drink consumer. She also

believes that as more consumers become familiar with the segment, they will enter the backbar area specifically for nicotine pouches. And, not every customer is switching to these as an alternative to combustibles or another category. Some are new to tobacco and nicotine in general.

And, like OnCue, Duchess is seeing more women enter the other tobacco products category as a result of the nicotine pouches. Smith hopes to become more aggressive with promotions for

ON! to further boost the category.

“… The nicotine pouch category represents our strongest growth potential. It’s experiencing significant positive momentum, and while it may be partially cannibalizing traditional products, it opens the door to new consumer segments and long-term category growth,” said Stevenson. “We believe there’s still tremendous untapped potential here, especially as consumer preferences continue to shift toward modern, smoke-free options.”

Ritchie pointed out that nicotine consumption has been part of human culture for hundreds of years, a reality that is unlikely to change.

“What is changing is how consumers choose to satisfy that demand. Increasingly, adults are moving away from cigarettes toward less harmful alternatives like vapor products and nicotine pouches. That trend is only going to accelerate in the years ahead,” Ritchie added.

While cigarettes and smokeless tobacco took the largest share of tobacco dollars over the last year, cigars brought home $4 billion in sales at c-stores, remaining relatively flat overall, according to Circana.

During the 12 weeks ending April 20, cigars dipped 3.7% in dollar sales and 9.4% in unit sales. Little cigars saw the greatest decrease in sales in the category (-29.5%), a trend echoed over the past year (-42.2%).

At Duchess stores, cigar space was reduced last spring as sales have fallen below that of nicotine pouches.

In one of the first moves the Trump administration made once the new president took office, the Food and Drug Administration (FDA) withdrew the proposal that would ban the sale of flavored cigars, as well as the proposal banning menthol cigarettes.

This came as a relief to c-store retailers, who have been watching the progress of

these proposals since they were unveiled in 2022.

A proposal to limit the level of nicotine in cigarettes and certain other combustible tobacco products is still in play. Regulations are also affecting vape, possibly more presently than other areas.

Electronic smoking devices saw a 9.4% drop in dollars during Q1 2025, according to Circana, and units decreased by 13%.

At Duchess stores specifically, vape sales are down, with Vuse contributing to 70% of total vape sales.

OnCue is utilizing bundled promotions such as “buy two pods or packs, save $X.XX” with the vape segment. This is proving to be an effective value proposition for the chain.

“In many cases, we’ve had to get creative with our pricing tactics to help absorb the impact of list price increases. As consumer preferences evolve rapidly, we remain focused on staying nimble and responsive to maintain competitiveness and meet shoppers where they are,” said Stevenson.

Still, regulations and the need for enforcement are complicating the category, particularly as illicit and unauthorized products enter the market.

“While flavored disposable vapes remain highly popular among consumers, the majority of these offerings are illegal under current U.S. regulations. We remain optimistic that the FDA will maintain and intensify its enforcement efforts to address this critical issue,”

Stevenson said.

Duchess, too, is noticing illicit vape products enter the market.

“I am grateful to see the state cracking down on illicit vape products. We’ve always followed state regulations, and we expect other retailers to do the same,” Smith said.

Columbus, Ohio, has had a flavor ban for over a year, which has affected 18% of Duchess’ stores. The sales from these stores are pulling down the chain’s overall tobacco and nicotine sales.

“Our Ohio House and Senate voted to overturn the ban. We need the Ohio Supreme Court to certify this decision and bring the flavors back to the retailers,” Smith said. “Independents are continuing to sell flavors even in the banned areas, and it’s hurting us retailers who are following the law.”

Among NYACS members, this is an important issue. New York has a flavored vape ban, and illicit flavored vapes available elsewhere in the state has made for additional challenges.

“Despite these headwinds,” Ritchie said, “the vapor category has shown resilience.”

OnCue is monitoring the regulatory landscape and the effect it might have on assortment and overall strategy. The

chain is determined to remain compliant with federal, state and local regulations, both to avoid fines and to maintain trust with customers and regulatory bodies.

One of its biggest ongoing challenges, echoing NYACS members, is the illicit vape market, forcing OnCue to compete with unauthorized products while still upholding compliance and profitability.

“At both the federal and state levels, the regulatory landscape for tobacco and nicotine products has been plagued by a lack of clarity, transparency and enforcement. FDA mismanagement over the past several years has created a confusing, uneven playing field where responsible retailers and manufacturers who follow the rules are punished, while bad actors continue to flood the market with illegal products,” Ritchie said.

She noted that in New York, the problem is worse, as policymakers continue to focus on prohibitionist methods that “have failed time and again.”

A proposed flavored nicotine pouch

ban had been added to the Assembly Health Committee for a Tuesday agenda. When NYACS received word of this the Friday beforehand, the team worked nonstop to show lawmakers what this bill would do in practice, not just theory.

“We got on the phones, drafted memos, organized briefings and mobilized our network of convenience store owners from every corner of the state,” Ritchie said.

The group explained how their effort was meant to help small businesses already struggling with rising costs and competition from the illicit market.

“We explained how a well-intended policy could unintentionally make matters worse — handing more power to illegal sellers and slashing tax revenue that supports public programs, all without doing much to stop youth access to nicotine,” she continued.

The bill was pulled from the agenda.

“That was a win. A temporary one. But it reminded me why this work matters so

much. Behind every bill are real people — store owners, employees and communities — who deserve to be part of the conversation,” Ritchie said. “And when that next version of the proposal comes back, as we know it will, we’ll be ready to stand up for them again.”

She advocates for a harm reduction strategy, a marketplace where tobacco users can access less harmful alternatives while still having the ability to choose.

The effort on the part of c-store retailers to form a relationship with policymakers to influence these strategies and adjust to changing consumer trends is imperative. Tobacco category managers must constantly stay abreast of the many factors that shape the segment.

“That’s why we’re focused on maintaining the right mix of assortment, promotional strategies and category flexibility to stay ahead. In a category that changes as fast as this one, adaptability will continue to be critical to long-term success,” Stevenson said. CSD

1839 cigarettes are made from the finest flue-cured tobacco to deliver the flavor and value your budgetminded consumers crave. Available in a variety of styles to satisfy every taste.

In the midst of economic uncertainty, customers are trading down and retailers are watching for the potential impact of tariffs on the tobacco category.

Anne

Baye Ericksen • Contributing Editor

AS ON-AGAIN, OFF-AGAIN TARIFFS roil markets, retailers are watching for possible impacts on the tobacco category while customers are pulling back on spending and finding opportunities to trade down.

According to Observatory of Economic Complexity, the U.S. is the largest

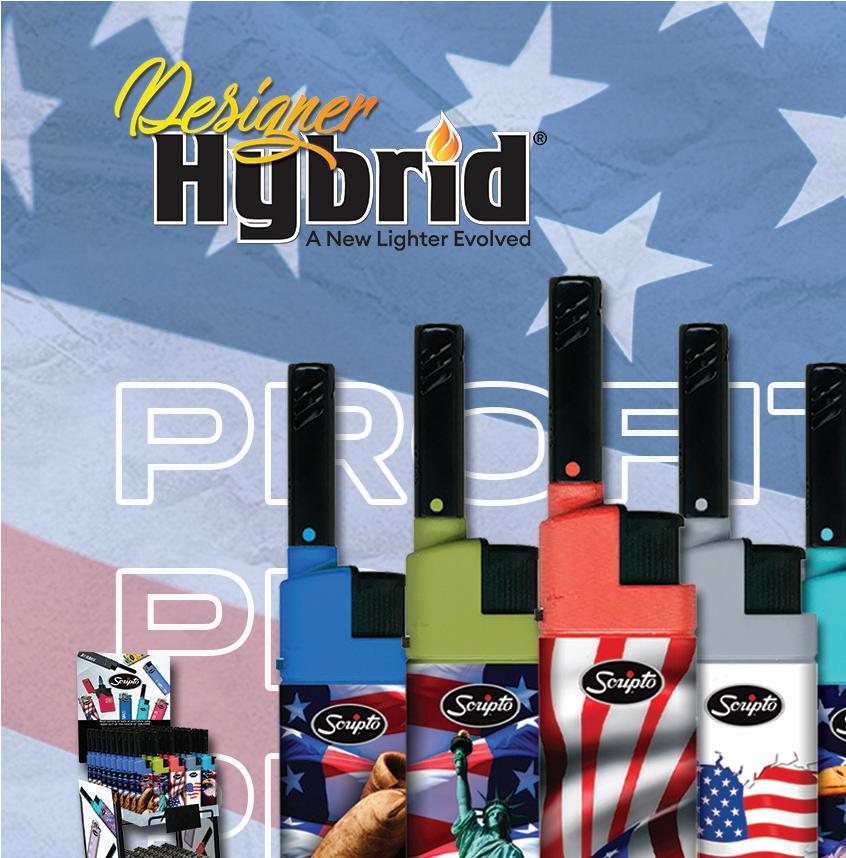

importer of lighters, a top-selling tobacco accessory for convenience stores nationwide. The international trade research organization also confirms China is the top exporter of lighters. That supply-and-demand relationship puts the c-store staple in jeopardy of facing tariffs.

As of April 8, President Donald Trump

placed a 145% tariff on goods imported from China as well as smaller percentages against numerous other countries. Although some exemptions were named later on and the administration eventually agreed to a 30% tariff by mid-May, the fact remains that lighters and other tobacco-related products remained on

GAME® LEAF GIVES CUSTOMERS WHAT THEY WANT

In 2015 Game Leaf was introduced as part of the Garcia y Vega portfolio of cigars, revolutionizing the Rolled Leaf cigar category. Now, as part of our 10th anniversary celebration, we’re reintroducing Game Leaf with colorful, eye-catching, consumer-tested 3-cigar packaging designed to bring Rolled Leaf customers more of what they want.

AVAILABLE AT 3 FOR $2.19 TRIAL PRICING AND SAVE ON 3

3 REASONS FOR 3-PACK SALES

In 2024, the 3-pack was the only Rolled Leaf format to show volume growth, along with a 5.7% increase in share of the market.

While all other Rolled Leaf formats showed velocity declines in 2024, the velocity for 3-packs rose by 15%.

Rolled Leaf 3-packs were added to shelves in over 9,700 c-stores in 2024, an 11% increase in store count over 2023.

3 REASONS TO GO WITH GAME LEAF

Game Leaf is able to build on the tremendous brand equity of Game, the #1 selling Natural Leaf cigar in the US.

Game Leaf’s commitment to quality and stringent quality standards—from broadleaf crop selection through manufacturing—ensure the best quality Rolled Leaf cigar available.

Consumers equate the Game Leaf brand with the Garcia y Vega tradition of quality and craftsmanship, as Garcia y Vega has been making Natural Leaf cigars since 1882.

the tariff target list.

The full fiscal effects resulting from the tariffs weren’t immediately evident this spring. Sales of lighters posted more than $41 million for the four weeks ending April 20, per Circana, and unit sales of matches jumped 6%. The market research firm also reported cigar accessories enjoyed an 8.3% increase in dollar sales for the 12 weeks ending April 20. However, as pre-tariff inventories are depleted, costs could increase as stores restock shelves.

“The industry does have resiliency, but I see pricing increases to continue to affect consumer use throughout the tobacco category,” said Lou Maiellano, president, TAZ Marketing & Consulting Group.

Jeremy Weiner, category director of cigars and premium products for Smoker Friendly, has been exploring alternative supply options to keep his stores fully stocked. The Boulder, Colo.-based company is owned by The Cigarette Store Group, which also runs Tobacco Depot, Smoke ‘N Go, Havana Manor and Gasamat retail sites.

“I will wait and see how the tariffs play out, but I will source the companies that have the best prices for cigar accessories and purchase from (them). Some companies I have spoken to mentioned they can source similar products from other

countries that would have lower tariffs,” he said. “I want as little disruption as possible for our dedicated cigar consumers.”

Of course, accessories aren’t the only products within the tobacco category

that could experience price hikes due to tariffs. The majority of premium, or handrolled, cigars are produced in Nicaragua, the Dominican Republic or Honduras, each of which has had a 10% tariff levied this year. The additional cost could hamper the segment further.

According to Circana, premium, large mass and little cigar segments are experiencing declines. Each dropped in dollar sales in a 52-week comparison while also incurring price hikes.

In the win column, the U.S. Court of Appeals delivered premium cigars a reprieve this spring when it denied the Food and Drug Administration’s (FDA) appeal to regulate this particular subcategory of tobacco products.

Cigarettes remain the top producer within the category for convenience stores, ringing up more than $50 billion in the 52 weeks ending April 20 even though overall sales continue to drop off. However, Circana data indicated declines of cigarette sales in the U.S. c-store channel slowed slightly for the four weeks ending April 20: -2.6% in dollar sales compared with more than -4% for the

previous 12 and 52 weeks.

That said, retailers and wholesalers indicated customers are reaching for cheaper fourth-tier brands as premium brands push price hikes, per Goldman Sachs’ “Nicotine Nuggets” survey for Q1.

“Generally, retailers believe manufacturers are nearing a ceiling on the price increases they believe can be passed through to consumers and believe the price gap between premium and fourthtier will push consumers to downtrade, particularly if the macro-economy deteriorates,” the survey pointed out.

Retailer respondents to the Nicotine Nuggets survey noted that when

cigarette customers traded down they not only moved to fourth-tier cigarettes (26%), but also to e-cigarettes (26%) and nicotine pouches (28%) in Q1 2025.

While survey respondents noted that basket size is modestly up across tobacco categories, lifted by inflation, trips are trending downward, which is a key concern for retailers as they look ahead.

While economists and pundits wonder if the tariffs will be lessened or rescinded again, Weiner isn’t waiting. He believes creating opportunities to highlight options will continue to satisfy

Cigarettes, cigars and accessories delivered more than $4.2 billion in sales for U.S. convenience stores for the four weeks ending April 20.

customers and drive sales.

“We try to increase interest in the cigar category by offering a variety of monthly promotions on different cigar brands to our loyalty customers. This creates excitement and allows consumers to try different products while saving them money,” he said. “We also host cigar nights in our cigar lounge locations that will feature manufacturer brands. This allows consumers to learn about the brand directly from the manufacturer representatives.”

“Retailers need to stay focused as they market their tobacco offers,” advised Maiellano. “Those who manage ‘change’ I believe will meet their market.” CSD

• Sales of lighters posted more than $41 million in April, per Circana.

• Cigarettes rang up more than $50 billion over the past 12 months.

• Cigar accessories enjoyed an 8.3% increase in sales from Q1 to Q2.

Source: Circana OmniMarket Total U.S. Convenience data for the four weeks ending April 20, 2025

Modern oral nicotine steals the spotlight as the vape category grapples with illicit products and PMTA delays.

Erin Del Conte • Editor-in-Chief

BEAVERTON, ORE.-BASED PLAID PANTRY, with 107 convenience stores in the Pacific Northwest, was an early adopter in the nicotine pouch space, and today it dedicates a large amount of backbar space to the growing segment.

The chain is anticipating strong nicotine pouch growth year over year in 2025. Traditional smokeless sales, however, haven’t been driving the same level of success.

“In the Pacific Northwest, chewing tobacco and snuff continues its consistent decline year over year,” explained Jon Manuyag, director of marketing, Plaid Pantry. “Consumers in the smokeless categories are shifting more towards the modern oral nicotine pouches like ZYN, ON!, Rogue, Velo and Grizzly. That is the segment where we see the most consistent positive double-digit trends.”

Weigel’s, with 85 stores in Tennessee, is seeing similar trends in the smokeless category at its locations.

“Traditional smokeless is flat for us, and smokeless alternatives are up double digits,” said Jessica Starnes, director of loyalty and tobacco category manager, Weigel’s. “We are seeing the most growth in the nicotine pouches, and we are leaning into dedicating more space to nicotine pouches.”

Among its backbar display, Weigel’s is carrying six Black Buffalo items that have been successful for the chain. “They are performing well and fit that niche customer between traditional snuff and nicotine pouches,” Starnes added.

Overall, Starnes sees smokeless customers demanding variety, multican discounts and good in-stock consistency from the category.

Starnes and Manuyag’s observations are in line with industry trends.

Goldman Sachs’ Q1 “Nicotine Nuggets” survey representing approximately 48,000 retail locations across the U.S. concurred that smokeless nicotine volume growth continued in Q1, led by modern oral nicotine brands ZYN and Rogue. Respondents were positive about the category going forward, expecting strong sales increases in 2025.

“Oral nicotine pouches are seeing higher promotions as manufacturers rush to gain market share, given the category’s high growth,” according to the survey.

Furthermore, respondents expect to increase shelf space for nicotine products overall by 0.9%, up from 0.4% in January. “It’s important to note that the incremental lift to the broader category is driven by increasingly positive sentiment for nicotine pouches,” the survey noted.

Chicago-based research firm Circana found that the smokeless category overall grew 12.3% in dollar sales and 8% in unit sales in the convenience channel for the 52 weeks ending April 20. Snuff fell 5.6% in dollar sales and dropped 9.3% in unit sales, while chewing tobacco

declined 6.9% in dollar sales and decreased 7.5% in unit sales. Meanwhile, spitless tobacco grew 48.9% in dollar sales and 33.6% in unit sales, while chewing tobacco alternatives were up 29.4% in dollar sales and 19.8% in unit sales for the same period.

As the popularity of nicotine pouches has grown, however, Manuyag noted there’s been additional pressure on the category. Over the past six months, Plaid Pantry has seen supply chain issues from large nicotine pouch manufactures due to the increase in demand.

“We continue to lose a little bit of market share as more retail outlets put more focus and attention on this segment,” Manuyag said. “But, we are still happy to capture a large share of our market in the nicotine pouch segment. Nicotine pouch consumers are also a very important customer to our business as these shoppers have high dual and poly usage with other nicotine products. This helps ensure our market baskets are maximized during the customer visit.”

That’s especially important in today’s economy, Manuyag said, given that customer confidence is lower and trips are down overall at retail.

Snuff, chewing tobacco and vape see dollar and unit sales decreases as spitless tobacco shines with double-digit increases.

Source: Circana OmniMarket Total U.S. Convenience data for the 52 weeks ending April 20, 2025

Goldman Sachs noted in its Q1 Nicotine Nuggets survey that it is “incrementally cautious on the U.S. tobacco/nicotine industry in the near term given increased pressure on the tobacco consumer from persistent inflation, pressure on discretionary incomes and tighter regulations, all of which are driving lower usage of cigs and further downtrading.”

E-cigarettes and nicotine pouches, however, have benefitted the most from downtrading as competition “intensifies for value-seeking customers,” according to the survey.

Manuyag has seen the trend playing out in his stores, with cigarette customers trading down and “definitely open and looking for alternatives” when it comes to their nicotine fix. “Modern oral nicotine pouches and vape are all key contributors with consumers switching on preference,” he added.

Smokeless customers at Plaid Pantry are increasingly seeking promotional deals as well as flavor options in nicotine pouches and alternatives that help them quit smoking. Some of the customers are also seeking higher nicotine strength. In addition to the usual 3 milligram (mg)/4 mg and 6 mg/8 mg choices, Manuyag noted that other brands are offering “mg content north of 9, 12, 15 mg-plus as a point of difference.” The majority of sales are still coming from the 6 mg products at Plaid Pantry, he added.

In the vape segment, Weigel’s is observing a continued decline for 2025.

At U.S. c-stores for the 52 weeks ending April 20, Circana found that dollar sales of electronic smoking devices fell 9.8% with units down 12%.

Plaid Pantry is noticing declines in vape this year at its locations, as well. “Economic pressures in consumer spend could be some contributing factors to this due to higher price points,” Manuyag said.

Starnes noted that this category is still the “wild wild west” due to the illicit vape market.

The illicit disposable e-cigarette market is an ongoing concern for the market “with retailers downbeat on their outlook,” according to Goldman Sachs’ Nicotine Nuggets survey.

“E-cigarette volumes decelerated, reflecting the rising popularity of illicit disposable flavored e-cigs, much of which is not reported, and a growing concern for the Food and Drug Administration (FDA) and category,” according to the survey. The survey further noted that only 10% of retailers report easing illicit e-cigarette headwinds, compared to 17% in January. While FDA enforcement is said to be underway, most retailers report that progress is slow and “not enough to make a meaningful impact.”

“While more retailers indicated no

change, the baseline is that the illicit market continues to pressure business,” the survey said.

On the legislative front, Plaid Pantry is grappling with potential flavor bans.

“Currently, the state of Oregon is reviewing a full statewide ban on flavored tobacco products on this year’s Oregon legislative session,” Manuyag said. “We also continue to contest cases from our large county municipalities in Oregon trying to push efforts to ban flavored tobacco and nicotine products from the retail environment at a county level.”

David Spross, executive director of the National Association of Tobacco Outlets, noted about 10 states are currently considering banning flavors in all tobacco products including smokeless.

“The biggest threat is Oregon, which is considering passing a flavor ban regulation similar to the California flavor ban,” he said.

When it comes to smokeless legislation, in addition to proposed flavor bans, excise taxation is the other big issue for retailers to have on their radar.

“In most states, nicotine pouches do not fit any of the tobacco product taxing definitions, therefore states are considering taxation,” Spross said. “The amount of the taxation proposals primarily are drafted either equalizing the tax to cigarettes or implementing a low and specific rate that recognizes the relative

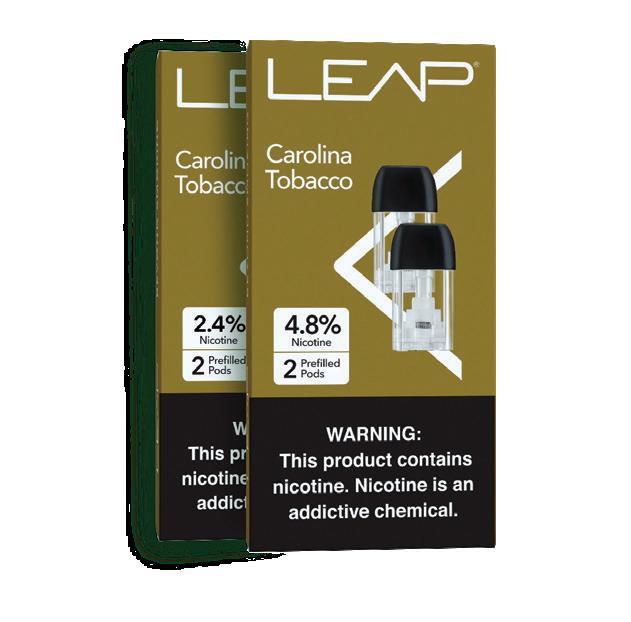

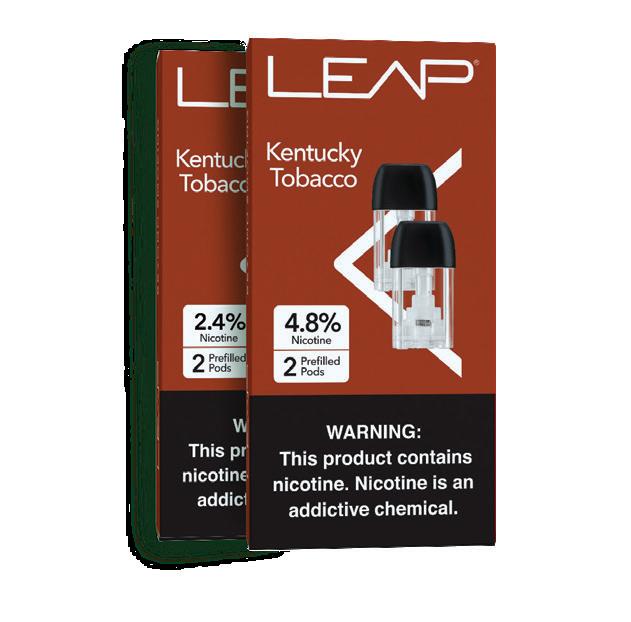

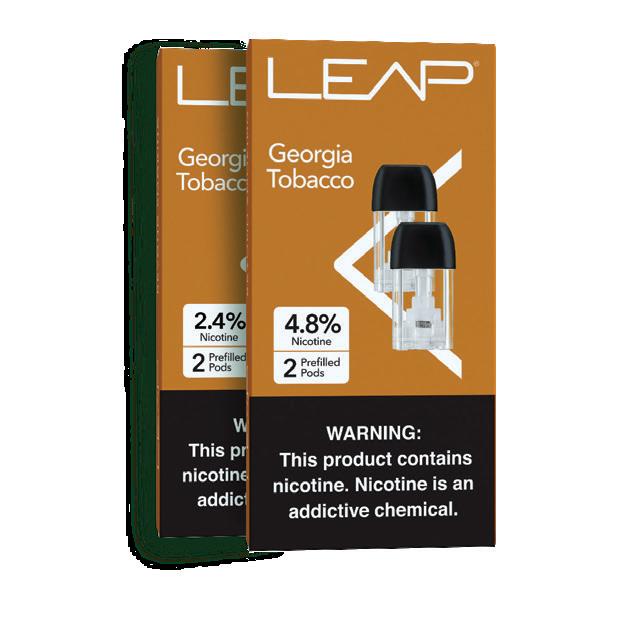

6 Unique Flavors

2 Nicotine Strengths

1.5ml Pre-Filled Pods

Unmatched Satisfaction

risk of these products compared to combustible products.”

On the vape front, Spross noted the biggest issue to watch is the Premarket Tobacco Product Application (PMTA) process at FDA’s Center for Tobacco Products (CTP) and whether more applications will be processed.

Following the Trump administration’s shakeup of the CTP in March with layoffs that included the ouster of CTP Director Brian King, the industry waits to see what lies ahead. That includes questions such as whether additional marketing granted orders will be added to the 34 vapor products currently authorized by the FDA. Many in the industry see an opportunity for a new path forward.

“The removal of Brian King from a position of leadership impacting millions of Americans is the first step in correcting the broken mindset that has crippled the FDA and the CTP over the past four years,” the Vapor Technology Association said in a statement. “The next step is fixing the broken regulation that allowed CTP, under King’s leadership, to make politically motivated decisions that have done nothing to save the 480,000 Americans who die from smoking every year.”

“With the changes at FDA, there is an opportunity for FDA/CTP to reset and streamline its operations,” Spross said. “Rather than focus on banning certain tobacco products, the agency should implement more effective tobacco harm reduction policies by authorizing more non-combusted nicotine products to provide adult smokers with expanded choices and by educating smokers about the continuum of risk.”

Since the changes at CTP, there have not been any significant developments on PMTA reviews, according to Spross.

“With hundreds of thousands of nicotine product PMTAs still pending before the agency, particularly in the vapor and nicotine pouch space, FDA has an opportunity to provide adult cigarette consumers with more authorized product choices that potentially present less risk,” Spross said.

Excise taxes and flavor regulation are also on the docket for vape.

“Around 40 states will have adjourned their legislative sessions by June 30; therefore, the industry will have a clearer picture on state excise taxes and regulation. Attention will shift to the local jurisdictions where the primary activity has been in many Massachusetts localities where they are considering implementing a nicotine-free generation, which would ban the sale of all tobacco products — including vapor — to individuals born after a certain date,” Spross said. “Additionally, some localities throughout the U.S.

are looking to implement a nicotine cap on vapor products.”

Vape registries are another growing trend at the state level.

“Coming into 2025, there were 10 states that have passed state vapor registries,” Spross said. “In 2025, around an additional 20 states are considering similar legislation.”

So far, three more have been approved in Arkansas, Mississippi and Tennessee, while proposals failed in six states: Georgia, Idaho, Indiana, North Dakota, South Dakota and West Virginia, according to Spross.

Weigel’s is “watching for the vape registry in Tennessee and looking forward to it,” Starnes said.

Finally, as tariffs ramp up, particularly against China, it could potentially help curb the flood of illicit vape products into the market.

“There is a possibility that enforcement could increase if the tariffs result in more inspections at the ports,” Spross explained. CSD

• Spitless tobacco grew 48.9% in dollar sales and 33.6% in unit sales for the 52 weeks ending April 20, per Circana.

• Economic pressures are spurring downtrading from cigarettes to nicotine pouches and vape.

• The illicit disposable e-cigarette market remains an ongoing concern for retailers.

Emily Boes • Senior Editor

A focus on wellness and a variety of flavors are contributing to the growing demand for nicotine-free and tobacco-free alternatives.

THE TOBACCO-FREE AND NICOTINEFREE segment is growing among tobacco consumers as factors such as health and inventory influence customer purchasing trends.

Movement Fuels, with 14 locations across Texas and plans to expand, noticed customer interest grow significantly.

“We had a customer who wanted to stop using nicotine at home because of his kids,” said Munira Mirmamadova, regional store manager at the chain. “He started with one of our herbal pouches

and stuck with it. A couple months later, he came back and told us he’d completely quit nicotine. That kind of feedback reminds us why offering these products really matters.”

Movement Fuels offers a mix of tobacco-free and nicotine-free products, including ZYN and Velo nicotine pouches, herbal options such as Rogue and Grinds nicotine-free coffee pouches, zero-nicotine disposable vapes, and cannabidiol (CBD) items like gummies and roll-ons.

The base selection remains consistent

across the chain’s footprint, although it can adjust based on customer demand.

“For example, ZYN might be the top seller in our Killeen location, while CBD or caffeine pouches perform better in another. We stay flexible and pay attention to what our customers are asking for,” said Mirmamadova.

At 85-store c-store chain Weigel’s in Tennessee, Black Buffalo has performed well, with the Wintergreen Pouch standing out as the top performer and long-cut Wintergreen in the second spot.

Movement Fuels offers a mix of tobacco-free and nicotine-free products, including ZYN and Velo nicotine pouches, herbal options such as Rogue and Grinds nicotine-free coffee pouches, zeronicotine disposable vapes, and cannabidiol items like gummies and roll-ons.

“This does line up for us because our No. 1 snuff item is a long-cut Wintergreen,” said Jessica Starnes, director of loyalty and tobacco category manager for Weigel’s.

Right now, Weigel’s is looking to expand its tobacco-free and nicotinefree section, adding additional synthetic nicotine pouch items.

Starnes primarily sees millennials growing the alternatives category, with no specific gender showing a greater interest than others, which is in line with Mirmamadova’s observations. Mirmamadova specified the majority of consumers for this category for Movement Fuels are those between the ages of 21 and 35.

“Some are transitioning away from traditional tobacco, while others are exploring these products for the first time. We’ve also noticed interest from customers who are into fitness or wellness and want options that align with their lifestyle,” she continued.

Indeed, those trying to quit or reduce tobacco use are actively searching for nicotine-free alternatives, and Mirmamadova sees the trend continuing as a focus on healthier habits and wellness is

more prevalent.

“What was once a small section is now a regular part of our inventory,” she said.

In addition to lifestyle changes — “People are more aware of what they’re putting in their bodies,” Mirmamadova noted — packaging, flavor variety and

“While the potential commercial benefits of having an MRTP order remain uncertain, however, this process and the FDA’s orders to date represent acknowledgements of tobacco harm reduction principles, which the industry has been communicating to regulators and policymakers for many years.”

recommendations from friends are also influential in introducing customers to the segment.

“The opportunity,” Mirmamadova elaborated, “is to connect with a new type of customer — people looking for cleaner alternatives or who may have never purchased tobacco before. It also gives us a chance to be more than just a retailer; we can be a trusted source for healthier product options.”

Starnes believes the category is an opportunity to lean into price tiering and customer education.

Education and awareness are also on Mirmamadova’s mind.

“Many customers still don’t fully understand the difference between nicotine-free and reduced-risk products. It’s important that we help them make

informed choices by having trained staff and clear product displays,” she said.

The Food and Drug Administration (FDA) can grant a premarket authorization for a modified risk tobacco product (MRTP) after an application process.

“Under the law, certain claims can render a tobacco product an MRTP requiring premarket authorization; these claims include, for example, statements that a product reduces the risk of tobaccorelated disease relative to other products or that the product contains less of a substance than other commercially marketed tobacco products,” said David Spross, executive director of the National Association of Tobacco Outlets.

Sixteen tobacco products have received an MRTP order at press time.

Starnes recognizes further regulation may come down the line for the MRTP segment, concerned with how this may play out as well as navigating a growing segment with the same amount of space.

Mirmamadova, less worried about hard regulation and more wary of inconsistencies, knows that the rules can change and what’s accepted in one place might not be accepted in another.

“We do our best to stay informed and adjust accordingly, but it definitely adds an extra layer to how we manage this category,” she said.

Spross noted some states have recognized the MRTP designation in their approach to state excise tax policy, with eight states at press time providing an excise tax reduction if the tobacco product had an MRTP order.

Connecticut, for example, provides a 50% reduction in the state excise tax for an authorized MRTP.

“While the potential commercial benefits of having an MRTP order remain uncertain, however, this process and the FDA’s orders to date represent acknowledgements of tobacco harm reduction principles, which the industry has been communicating to regulators and policymakers for many years,” Spross said. CSD

• The younger generation is moving the alternatives category in an upward direction.

• Many MRTP consumers are looking to reduce tobacco use or find nicotine-free alternatives.

• Sixteen products at press time have received an MRTP designation by the Food and Drug Administration.

The average online order for this c-store brand is nearly $25.

WHEN MARGINS TIGHTEN, most foodservice programs play defense. But Krispy Krunchy Chicken® is playing offense and helping c-store operators do the same. In an economy where labor is tight, costs are volatile, and value rules, the brand is proving operators don’t have to sacrifice quality to stay competitive. In fact, leaning into quality might be the smartest move they can make.

“This is our sweet spot,” says Alice Crowder, chief marketing officer at Krispy Krunchy Foods. “We were created by a c-store operator. Everything we do is designed to give our licensees real profitability without overcomplicating their operations. Our guests come to us for three reasons: high quality, strong value, and craveability. That mix is what keeps them coming back.”

The model is built around margin protection from the inside out. Krispy Krunchy’s signature bone-in chicken and chicken tenders arrive pre-marinated and are hand-breaded in-store twice, creating a scratch-made finish that holds up in display cases and on the delivery route. It’s high-quality food that doesn’t require a high headcount or a complicated back-of-house setup. And it delivers real results.

“If you forget everything else—forget what you make on chicken, forget the frequency lift—just by adding Krispy Krunchy, operators see foot traffic go up on average 10–12 percent,” Crowder says. “And their overall merchandise sales rise by an average 15–20 percent. That’s immediate storewide impact.”

It’s not just in-store volume that’s growing. Through a unified digital ordering strategy, Krispy Krunchy makes it easy for operators to tap into third-party platforms like DoorDash, Uber Eats, and Grubhub without the tablet chaos.

“One tablet, one printer, one stand,” Crowder says. “Operators don’t have time to update four platforms manually every time they run out of something. With our program, you update one tablet once, and it syncs everywhere.”

That streamlined efficiency is paying off. Operators on the Krispy Krunchy delivery platform are selling 36 percent more chicken than those who aren’t. And the average online order? Nearly $25. Compare that to the in-store average of around $10. “You’re talking about new transactions that wouldn’t happen otherwise and at more than double the ticket,” Crowder says. To make things even easier, the company rolled out its Your Choice combo—returning this June with nuggets added to the mix. Customers can choose from tenders, bone-in chicken, nuggets, or the Cajun Chicken Sandwich with a side of wedges

for just $5.99. It’s designed to drive impulse buys and offer upsell potential.

“If all you’ve got is $5.99, we’ve got you,” Crowder says. “But once you’re inside, you might say, ‘Let’s add a biscuit. Let’s upsize a side.’ It’s a way to build basket size while still honoring that value promise.”

Behind the counter, the system is built for speed and simplicity. “Our CEO always says, ‘Make it easier,’” Crowder says. “That’s our filter. If it’s too complex to execute consistently, we don’t roll it out.”

That focus on execution extends all the way to the supply chain. Over the past couple of years, Krispy Krunchy overhauled its sourcing strategy, shifting from a patchwork of local providers to national chicken suppliers and distribution through Sysco. The result: tight specs, consistent product size, and almost zero out-of-stocks.

“We don’t accept product shortages as a given,” Crowder says. “Our supply chain team is in contact with our supplier partners every day. And because we work with a national distributor, our operators get the consistency they need, whether they’re in Texas or Michigan.”

Consistency also extends to what goes on the menu. Instead of adding items just to chase trends, Krispy Krunchy uses research to determine whether a new product actually expands reach and frequency. The brand’s chicken nuggets, launched in February, are a prime example. Menu research through a third party determined the product would be additive to sales, and sensory research (also through a third party) ensured the product would deliver on taste promises. Then the company conducted market testing.

“We didn’t greenlight the nuggets until we were sure they’d grow poultry sales overall,” Crowder says. “If a new item just cannibalizes something else, what’s the point?”

The results speak for themselves. Operators who added nuggets saw a lift in total sales—not just a shift in orders. And that’s the guiding principle behind every move Krispy Krunchy makes: only launch what works. “When we go to our operators with something new, it’s because we’ve done the work,” Crowder says. “We’ve tested it. We’ve stress-tested it. We’ve built it to deliver.”

Krispy Krunchy Chicken is investing in what it calls “futureproof foodservice”—not flash-in-the-pan trends, but sustainable, operator-first solutions built for long-term success. “Our mission is to help operators win,” Crowder says. “Not just survive inflation. Not just keep up. Win.”

- By Drew Filipski

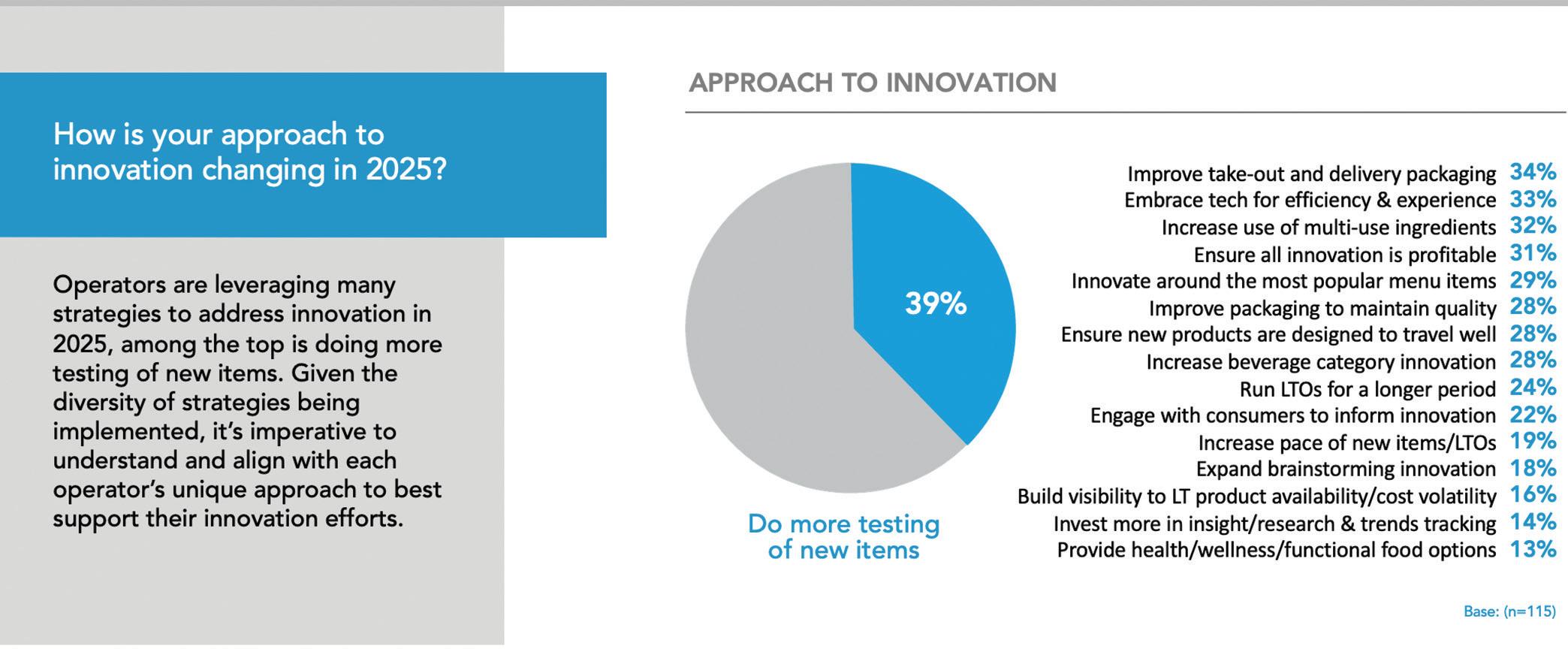

IN 2025, THERE’S MORE STRATEGY and planning behind limited-time offers (LTO) than ever before. And that’s with good reason. Today’s consumers are increasingly seeking different and craveworthy options that also offer strong perceived value.

Meanwhile, operators are looking to provide food items that are appealing to customers but are also profitable and easy to execute consistently. Retailers also must keep the program simple and avoid bringing in new ingredients whenever possible as they balance cost and labor considerations.

An innovative approach to limited-time offers can help elevate convenience store menus.

Bruce Reinstein • Kinetic12 Consulting

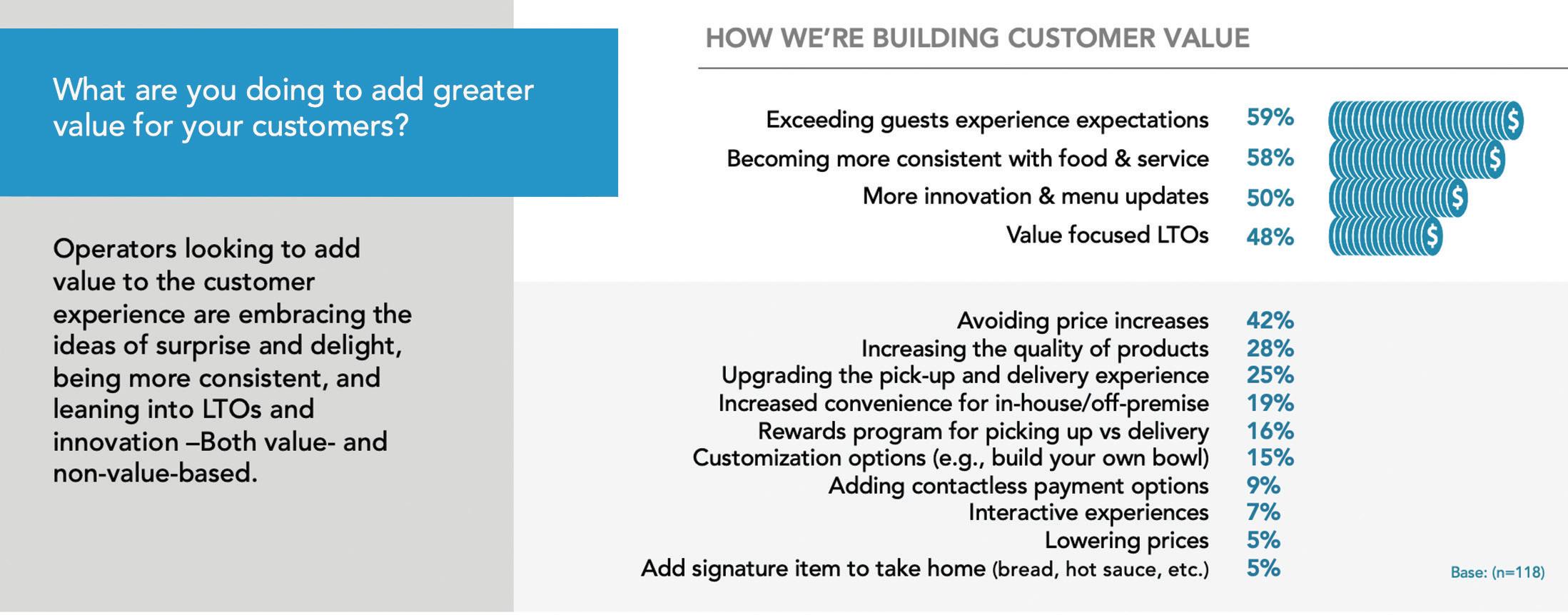

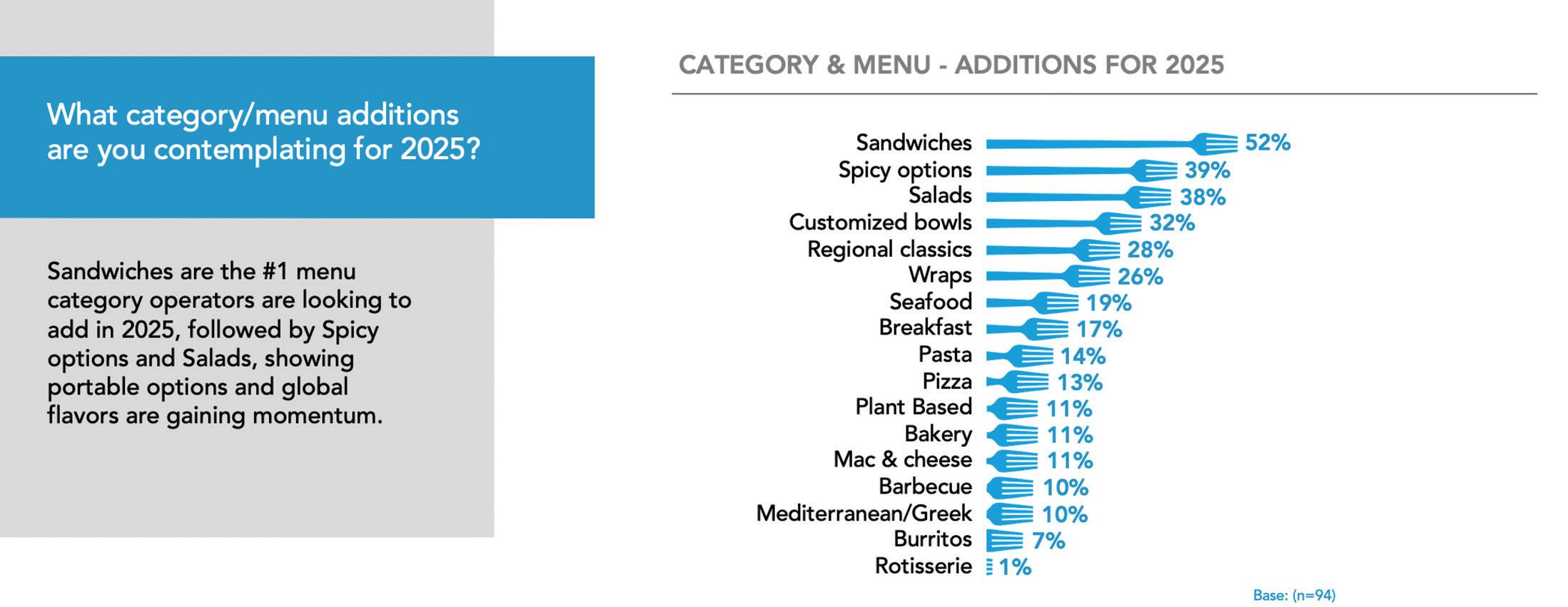

Innovative approaches to LTOs are ranked in the graph below, which was put together from a survey completed by more than 100 chain operators. The results are eye opening.

Here are six ways to leverage LTOs for convenience store foodservice success.

1. Do more testing to ensure the LTO will maximize revenue and traffic. The approach to LTOs in the past was to throw darts and hope the consumer would go for it. LTOs were developed internally with the c-store team doing the evaluating and not the consumer. The approach today

must be to innovate based on what the consumer is looking for and make it work from a cost and consistency standpoint. Products must be tested for a longer period of time to allow for adjustments or cutting before any plans are made to roll them out at all locations.

2. Leverage ingredients that are stocked. Keep it simple for team members. Within every foodservice operation there is a wide array of ingredients and recipes that can be used in other menu items. All it takes is some outside-the-box innovation to implement cross-utilization

Source: Kinetic12’s Q1 Emergence Group Report

Source: Kinetic12’s Q1 Emergence Group Report

of ingredients across the menu. In the past, there was a tendency to bring in a variety of new ingredients to develop an LTO. For the most part, this is not necessary and definitely not prudent in today’s market. Bold ingredients can be used anywhere. If a consumer is a fan of a particular product, that product can be developed to be served in a different way and quickly become a successful LTO. We have seen pizza turned into sandwiches and calzones. A great burger can be transformed into a specialty burger by adding ingredients that are currently used only at breakfast. Start by understanding what you currently stock and let the innovation flow.

3. Ensure all innovation provides value but is profitable. Value is crucial

to all LTOs, but that does not necessarily mean the cheapest. Beyond that, loss leaders are a thing of the past. LTOs must be profitable, and that puts a spin on innovation. Consumers judge value in many different ways, and it’s up to the operator to try to appeal to as many of their customers as possible. Food and beverage quality and service/hospitality remain at the top of what a consumer wants from foodservice. Regardless of whether we are talking about a bundle, meal deal or innovative menu item, consumers want consistency in the product and service. Great innovation must lead to exceeding a guest’s experience expectations.

4. Innovate more on the most popular menu items. What customers are

currently purchasing provides insight into where convenience store operators should build their innovation and create new and exciting LTOs. The popular menu items become the backdrop. When looking at category and menu additions, operators mentioned sandwiches, spicy options, salads, customized bowls, regional classics and wraps as their top six areas of opportunity. How do you take your most popular items and provide these six areas of opportunity to create innovative LTOs that are already familiar and popular? Bowls and wraps are very interchangeable. If you serve one, you can offer the other. Spicy appears to be easy, but it requires a lot more than adding hot sauce. Sandwiches is an incredibly popular category that is not found on all menus. Popular

Source: Kinetic12’s Q1 Emergence Group Report

ingredients are there to create paninis and other tasty items that are able to travel well.

5. Ensure LTO items travel well. For the most part, the convenience foodservice consumer is on the go. Many are used to quick-service restaurant fast food that provides consistently average, at best, products that travel well. The experience is not memorable, but the end result is there. Many of today’s consumers want more than mediocre products simply for the sake of convenience. LTOs have to be well thought out before being offered to consumers. They must travel well. Retailers need to consider how the products are wrapped and the quality

of packaging the items are placed in. C-store retailers should be focused on keeping hot food hot, cold food cold and having every bite meet or exceed consumer expectations.

6. Engage more with consumers and employees for LTO ideas. The key to leveraging LTOs is to make sure the products being offered are what consumers are seeking. Nobody knows more about what consumers want than the consumers themselves, followed closely by your front-line team who constantly communicate with customers and can share their preferences with the management team.

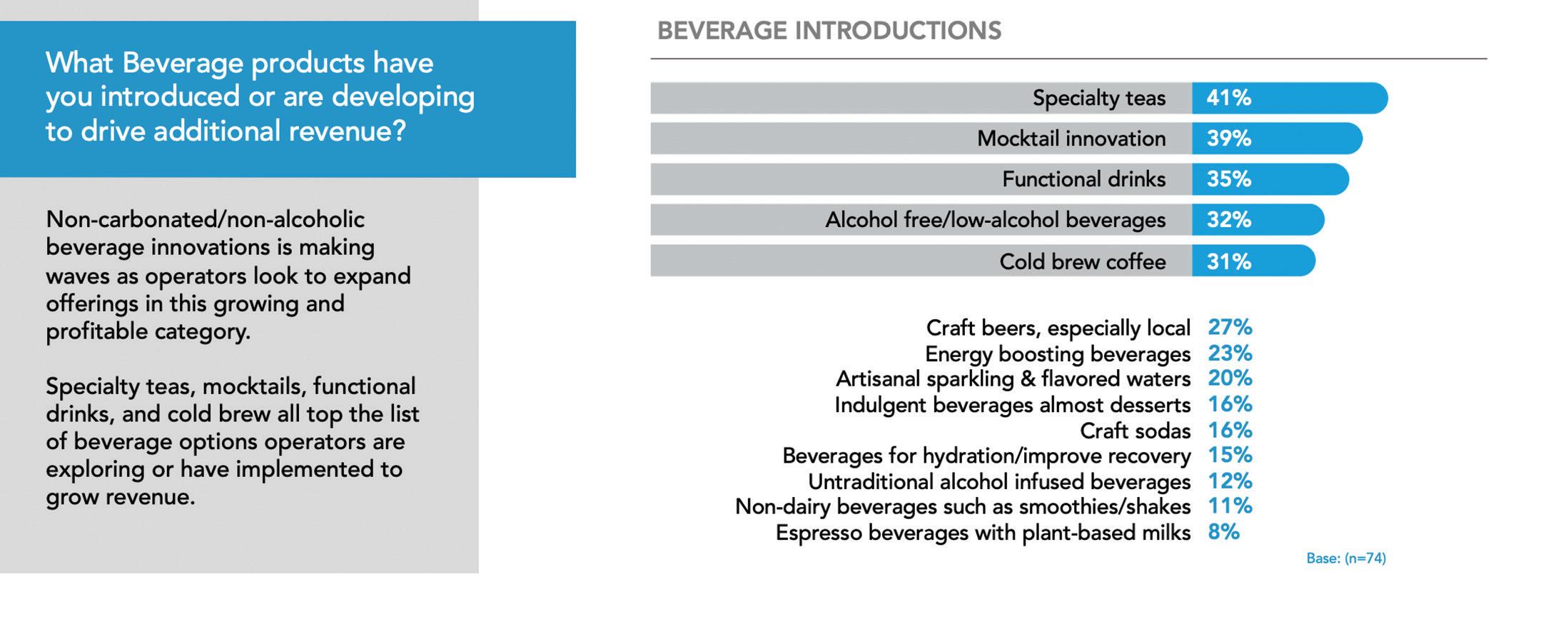

Clearly, an operator must do all the

right things associated with innovation, including keeping the offering simple, easy to execute and profitable, but it is a tremendous benefit to know what your customers want before beginning the innovation process. The odds of a successful LTO increase exponentially if you beef up your engagement. The chart below clearly shows how beverage innovation is changing based on consumer preferences, and it drives new revenue and improved loyalty. CSD