CStoreDecisions

With over 30 years of experience in the c-store industry, Hunt Brothers® Pizza has perfected a program designed to maximize your profits. The only ingredient missing is you.

EDITORIAL

VP EDITORIAL — FOOD, RETAIL & HOSPITALITY

Danny Klein dklein@wtwhmedia.com

EDITOR-IN-CHIEF

Erin Del Conte edelconte@wtwhmedia.com

SENIOR EDITOR Emily Boes eboes@wtwhmedia.com

ASSOCIATE EDITOR Kevin McIntyre kmcintyre@wtwhmedia.com

EDITOR EMERITUS John Lofstock

COLUMNIST Tim Powell

LEADERSHIP

CHIEF EXECUTIVE OFFICER Matt Logan mlogan@wtwhmedia.com

CHIEF OPERATING OFFICER George Yedinak gyedinak@wtwhmedia.com

VP OF OPERATIONS Virginia Goulding vgoulding@wtwhmedia.com

SENIOR VP, AUDIENCE GROWTH

Greg Sanders gsanders@wtwhmedia.com

WTWH MEDIA, LLC

1111 Superior Ave. Suite 1120

Cleveland, OH 44114

Ph: 888-543-2447

SUBSCRIPTION INQUIRIES:

CREATIVE SERVICES VP, CREATIVE DIRECTOR Matthew Claney mclaney@wtwhmedia.com

CREATIVE DIRECTOR Erin Canetta ecanetta@wtwhmedia.com

CONTENT STUDIO VP, CONTENT STUDIO Peggy Carouthers pcarouthers@wtwhmedia.com

WRITER, CONTENT STUDIO Ya’el McLoud ymcloud@wtwhmedia.com

WRITER, CONTENT STUDIO Drew Filipski dfilipski@wtwhmedia.com

EVENTS DIRECTOR OF EVENTS Jen Osborne josborne@wtwhmedia.com

EVENTS MANAGER Brittany Belko bbelko@wtwhmedia.com

EVENTS MANAGER Jeannette Hummitsch jhummitsch@wtwhmedia.com

EVENTS COMMUNICATIONS COORDINATOR Emma Paul epaul@wtwhmedia.com

SALES TEAM

KEY ACCOUNT MANAGER John Petersen jpetersen@wtwhmedia.com (216) 346-8790

SALES DIRECTOR Patrick McIntyre pmcintyre@wtwhmedia.com (216) 372-8112

SALES DIRECTOR Mike Peck mpeck@wtwhmedia.com

MARKETING MANAGER Jane Cooper jcooper@wtwhmedia.com

CUSTOMER SERVICE

REPRESENTATIVE Annie Paoletta apaoletta@wtwhmedia.com

CStore Decisions is a three-time winner of the Neal Award, the American Business Press’ highest recognition of editorial excellence.

EDITORIAL ADVISORY BOARD

Nate Brazier, President and Chief Operating Officer

Stinker Stores • Boise, Idaho

Robert Buhler, President and CEO

Open Pantry Food Marts • Pleasant Prairie, Wis.

Herb Hargraves, Chief Operating Officer

Sprint Mart • Ridgeland, Miss.

Bill Kent, President and CEO

The Kent Cos. Inc. • Midland, Texas

Bill Weigel, Chairman

Weigel’s Inc. • Knoxville, Tenn.

Dyson Williams, Vice President

Dandy Mini Marts. • Sayre, Pa.

NATIONAL ADVISORY GROUP (NAG) BOARD (RETAILERS)

Greg Ehrlich, (Board Chairman) President

Beck Suppliers Inc. • Fremont, Ohio

Joy Almekies, Senior Director of Food Services

Global Partners • Waltham, Mass.

Jeff Carpenter, Director of Education and Training

Cliff’s Local Market • Marcy, N.Y.

Richard Cashion, Chief Operating Officer

Curby’s Express Market • Lubbock, Texas

Megan Chmura, Director of Center Store

GetGo • Pittsburgh

Ryan Faville, Director of Purchasing

Stewart’s Shops Corp. • Saratoga Springs, N.Y.

Cole Fountain, Director of Merchandise

Gate Petroleum Co. • Jacksonville, Fla.

Kalen Frese, Director of Merchandising

Warrenton Oil Inc. • Warrenton, Mo.

Joe Hamza, Chief Operating Officer

Nouria Energy Corp. • Worcester, Mass.

To manage current print subscription or for a new subscription: https://cstoredecisions.com/cstore-decisions-subscriptions/

SUBSCRIPTIONS: Qualified U.S. subscribers receive CStore Decisions at no charge. For others, the cost is $80 a year in the U.S. and Possessions, $95 in Canada, and $150 in all other countries. Single copies are available at $9 each in the U.S. and Possessions, $10 each in Canada and $13 in all other countries.

CStore Decisions (ISSN 1054-7797) USPS Publication #5978 is published monthly by WTWH Media, LLC., 1111 Superior Ave., Suite 1120, Cleveland, OH 44114, for petroleum company and convenience store operators, owners, managers.

Periodicals postage paid at Cleveland, OH, and additional mailing offices.

POSTMASTER: Send address changes to CStore Decisions, 1111 Superior Avenue, Suite 1120, Cleveland, OH 44114. GST #R126431964, Canadian Publication Sales Agreement No: #40026880.

CSTORE DECISIONS does not endorse any products, programs or services of advertisers or editorial contributors.

Copyright© 2025 by WTWH Media, LLC. No part of this publication may be reproduced in any form or by any means,

Beth Hoffer, Vice President

Weigel’s • Powell, Tenn.

David Land II, Director of Marketing

The Kent Cos. Inc. • Midland, Texas

Brent Mouton, President and CEO

Hit-N-Run Food Stores • Lafayette, La.

Lenny Smith, Vice President

Crosby’s • Lockport, N.Y.

Dyson Williams, Vice President

Dandy Mini Marts • Sayre, Pa.

Hussein Yatim, Vice President YATCO • Marlborough, Mass.

Vernon Young, President and CEO

Young Oil Co. • Piedmont, Ala.

Supplier Members

Kyle May, Director External Relations

Reynolds Marketing Services Co. • Winston-Salem, N.C.

Todd Verhoven, Vice President of Sales

Hunt Brothers Pizza • Nashville, Tenn.

Steve Yawn, Director of Sales

McLane Company Inc. • Temple, Texas

HAVING A SEAMLESS SUCCESSION PLAN in place in a family business first requires that c-store chains invest in young leaders by teaching them all aspects of the company and the industry, identifying their strengths, giving them meaningful responsibilities, and exposing them to key decision-making processes long before a transition is imminent. Managing these shifts can be potentially challenging in a family business environment. What if the kids aren’t ready to take on the family business or aren’t sure if they even want to? If the next generation is invested in the company, how do you know when they’re truly ready to take the helm? In the case of multiple next-generation family members, how do you identify who is best matched with which role? And what if their vision for the company isn’t in alignment with yours?

For young executives, it can be hard to understand the business priorities and decisions of older generations when each generation views the business through different lenses and experiences. It can be frustrating also to wait for your chance to call the shots, sometimes for decades as the older generation holds onto the helm. Young executives are known for bringing different perspectives that can benefit the company. They can often more easily key in on emerging trends and help chains modernize for the future, but they also need to respect the experience and deep knowledge of the family members who are currently leading the business. It can also be daunting to young leaders to begin to carry the family legacy on their shoulders, especially in a day and age where the industry is facing monumental shifts. And let’s not even get started on how different the industry is likely to look in the next decade as cigarette sales and the frequency

of gas fill-ups decline, industry consolidation continues, and questions on the future of electric vehicle charging and how exactly artificial intelligence is set to revolutionize the c-store business abound.

While the road ahead isn’t an easy one, savvy chains are already preparing tomorrow’s leaders so they are ready to navigate the changing landscape of the convenience industry with resilience, fresh perspectives and a deep respect for the legacy they inherit.

In this month’s cover story, “Passing the Torch,” several c-store retailers share their experiences on both sides of the leadership transition. Read more on p. 10.

We’re here to help young c-store leaders prepare for tomorrow. CStore Momentum, the event for next-generation leaders and young executives under 40 or in their early 40s (we don’t check IDs), is set for Aug. 6-8 in Knoxville, Tenn. Not only will young executives have the chance to attend educational sessions and roundtable discussions around leadership and network with their peers, but they’ll also get an inside look at Weigel’s operations, foodservice, stores and new commissary. Managing leadership transitions as a next-generation leader presents unique and complex challenges, and it can be invaluable to make connections with other young executives who are facing similar hurdles and opportunities. Register at CStoreMomentum.com. We hope to see you there. Editor’sMemo

The Boise, Idaho-based chain stands out from its new-to-industry stores to its innovative spirit and focus on company culture.

A CStore Decisions Staff Report

CSTORE DECISIONS IS PROUD TO ANNOUNCE Stinker Stores as our 2025 Chain of the Year for its commitment to operational excellence, innovation, a people-first culture and future growth.

“CStore Decisions’ Chain of the Year Award recognizes retail excellence. From its best-in-class new-to-industry (NTI) stores to its revamped loyalty program and mobile app to its commitment to a people-first culture, foodservice excellence and futurefocused growth, Stinker Stores has earned a place among an elite list of chains as the 36th winner of this prestigious industry honor,” said Erin Del Conte, editor-in-chief of CStore Decisions. “But what truly sets Stinker Stores apart is its unwavering commitment to continuous improvement, consistently upgrading and refining its systems and programs. Refusing to settle for ‘good enough,’ the chain remains focused on modernizing and adapting to meet the needs of tomorrow.”

Stinker Stores was founded in 1936 by Farris Lind. The first store was a service station in Twin Falls, Idaho. Today, the Boise, Idaho-based chain operates 105 convenience stores in Idaho, Wyoming and Colorado.

CEO Nate Brazier took the helm of the company in May 2024 following the retirement of late owner Charley Jones. Brazier, who previously served as president and chief operating officer, has worked to emphasize and enhance the chain’s people-first

culture. He strengthened Stinker Stores’ leadership team by promoting five individuals to vice president roles, revamped its newhire training program, and appointed a dedicated training and development manager to ensure consistent onboarding. Stinker has also defined and emphasized its vision and values — “to make the world a better place by being a bright spot in customers’ day” — reinforcing its purpose. The chain has seen a noticeable decrease in turnover thanks to its commitment to culture.

Stinker Stores’ commitment to operational excellence is visible through its best-in-class NTI locations, including a 10,000-square-foot truck stop that opened in Caldwell, Idaho, in September. The chain has introduced a prototype store design that showcases its proprietary Pete’s Eats food program at the front of the store, features an open-kitchen concept and incorporates community seating. Stinker has been actively refreshing and remodeling its locations to incorporate this modern design. In just 3.5 years, Pete’s Eats has experienced significant growth, and the company is now enhancing its menu with innovative offerings and limited-time promotions.

Stinker Stores has been busy enhancing its systems and processes. Recently it upgraded its point-of-sale system, back-office platform and human resources management system across its entire fleet of stores as it remains focused on continuous improvement and operational excellence.

Innovation remains a key focus at Stinker Stores. Despite being

already ahead of many c-store chains on the loyalty program and mobile app front, Stinker Stores wasn’t satisfied. It went back to the drawing board in search of the features and functionality that would help carry it into the future. This past fall, it launched a new mobile app, complete with order-ahead functionality, delivery options and gamification elements, plus an enhanced loyalty program. It plans to add geo-fencing capabilities to the app in 2025.

Also on the innovation front, Stinker Stores is using artificial intelligence (AI) to monitor freshness at its roller grills, and it launched a central fuel pricing system using AI in November. Stinker is also testing Mashgin self-checkout systems in select locations to enhance customer convenience. The retailer recently introduced a retail intelligence program focused on signage, store layouts and customer engagement, and it’s piloting customer feedback buttons at select locations to gather real-time insights from shoppers.

Looking ahead, Stinker Stores has its eye on potential growth opportunities both within its core footprint as well as outside of its current operating area. The company plans to explore expansion through both new builds and acquisitions, ensuring its continued success in the competitive convenience retail landscape.

“We are truly honored and excited to be named Chain of the Year,” said Brazier. “This recognition is not just a reflection of our achievements, but a celebration of the Stinkin’ Awesome people who make up our team — our amazing employees, loyal customers and supportive partners. It’s their hard work, passion and commitment to making our world a better place that drives our success and elevates us in this competitive industry. It’s a testament to the trust and relationships we’ve built with our communities, and it motivates us to continue innovating and improving. We are committed to continuously getting better every day for employees and customers, and we will continue to have a lot of fun doing it!”

Retailers are invited to join us in honoring Stinker Stores on the evening of Oct. 15 at the Roof on theWit in Chicago during

CStore Decisions’ Chain of the Year Award annually honors a convenience store, travel center or petroleum chain that has established itself as a superior retailer and innovator in the industry. CStore Decisions’ first Chain of the Year award was Wawa Inc. in 1990. Stinker Stores follows the 2024 Chain of the Year Winner Pilot. Past winners of this prestigious award include Sheetz, Maverik, RaceTrac, 7-Eleven Inc., Kwik Trip, Alimentation Couche-Tard, QuikTrip, Rutter’s and Family Express.

PAST CHAIN OF THE YEAR WINNERS

1990 – Wawa Inc.

1991 – SuperAmerica

1992 – QuikTrip Corp.

1993 – Casey’s General Stores Inc.

1994 – Sheetz Inc.

1995 – Diamond Shamrock Corp.

1996 – MAPCO Express Inc.

1997 – Speedway Inc.

1998 – Krause Gentle Corp.

1999 – Dairy Mart Inc.

2000 – Amerada Hess Corp.

2001 – Huck’s Food & Fuel

2002 – Petro-Canada

2003 – Exxon Mobil Corp.

2004 – Kwik Trip Inc.

2005 – 7-Eleven Inc.

2006 – Valero Inc.

2007 – Alimentation Couche-Tard

2008 – Chevron Inc.

2009 – Nice N Easy Grocery Shoppes

2010 – Rutter’s Farm Stores

2011 – Thorntons Inc.

2012 – Tedeschi Food Shops

2013 – Maverik Inc.

2014 – RaceTrac Petroleum Inc.

2015 – Family Express Corp.

2016 – QuickChek Corp.

2017 – Sheetz Inc. (Second Award)

2018 – Kwik Trip Inc. (Second Award)

2019 – Weigel’s Inc.

2020 – Parker’s

2021 – Yesway

2022 – Nouria Energy

2023 – TXB

2024 – Pilot

the NACS Show from 5:30 p.m. to 8:30 p.m. Retailers must RSVP to attend at https://cstoredecisions.com/2025-chain-of-the-year. The event schedule is as follows:

5:30 p.m. Cocktails

6:30 p.m. Buffet Dinner

7:15 p.m. Award Ceremony Honoring Stinker Stores

Supplier companies must be sponsors to attend. Suppliers interested in sponsorship opportunities should contact Pat McIntyre, sales director, at pmcintyre@wtwhmedia.com.

Successfully onboarding the next generation and transitioning them into future leadership roles goes beyond succession planning to recognizing the value of new perspectives and matching roles to unique strengths.

Emily Boes • Senior Editor

in a family-owned business can be a complicated endeavor, and with so many retailers in the convenience store industry operating a familyowned chain, the transition between family members is often inevitable.

Whether a c-store chain has been active through two generations, five generations or more, family ties coupled with a business relationship can be daunting.

Still, many businesses in the industry not only succeed, but thrive, under family leadership.

York, Pa.-based Rutter’s, with 90 locations in Pennsylvania, Maryland and West Virginia, has roots dating back to 1747, when it only operated a family farm.

“In those days with large families, not all children could own and run the

farm … but I have no idea how they chose which children inherited it,” said Scott Hartman, president and CEO of CHR Corp. and Rutter’s Holding’s Inc.

In 1921, the family started Rutter Bros. Dairy, and the next generation opened the family’s first convenience store in 1968.

Scott’s father’s generation hired a consultant to advise on succession planning. As the consultant did not know the children well, however, “he was way off base … so to summarize it was not very good advice,” said Scott Hartman.

Scott represents the 10th generation since the farm’s founding in 1747 and the third generation since the establishment of Rutter Bros. Dairy. He originally returned to the family business in 1990 after earning his master’s degree in business administration (MBA) at Duke University and consulting at Price Waterhouse as a senior

manager for seven years.

“I had a choice of pursuing a partner role at Price Waterhouse or return to my family business. I had many job offers while at Price Waterhouse, so I was confident that if the family business did not work out, I would have options. So here I am still today,” he said.

He started as chief financial officer and progressed to VP of operations before becoming president in 2000.

When considering succession planning now, leadership allows the next generation to match and apply their skills to the company’s needs.

Scott’s son, Chris (11th/fourth generation), joined the company seven years ago after receiving his undergraduate degree in finance and a master’s degree in business administration. Prior to joining, he also worked for five years as a food broker.

“All very relevant skills to a company like ours,” said Scott Hartman.

Chris (son) and Scott (father) Hartman have worked together for the last seven years at their family business. Rutter’s has roots dating to 1747, when the business was just a family farm. Now, the company operates 90 locations in Pennsylvania, Maryland and West Virginia. Chris hopes one day his sons will show an interest in the business.

Brent Mouton started his company in 2000, and he recently introduced his sons, Andrew and Thomas, into the family business.

Andrew will oversee operations and Thomas will oversee the administrative side of the business.

Brent Mouton, president and CEO of Lafayette, La.-based Hit-N-Run Food Stores, which operates seven stores in Louisiana, considers succession planning similarly.

Mouton started his company in 2000 with his wife Tonya. Now, his sons, Andrew and Thomas, have joined the family business. As they grow, Andrew will oversee operations and Thomas will oversee the administrative side of the business.

The decision for where to place them was largely based on their personalities. “They’re two different kids. Even though they were raised the same in the same house by the same parents, they still have their own personalities, and one

of them is (better able to) sit in an office all day, if you will. My other one … being able to go from store to store and to constantly be moving, that’s perfect for his personality,” Mouton said.

Mouton has an idea of how his succession plan will actualize, but at the moment, he’s waiting to make sure his sons decide to advance into the roles planned for them.

“… Whatever you do, whether it’s this or something else, you’ve got to enjoy what you’re doing. You’ve got to have some kind of passion about it and just enjoy it. All the other stuff’s going to take care of itself,” he said.

Slaton Whatley, vice president of

retail at Whatley Oil Co., operating 10 Zelmo’s Zip Ins in Georgia and Alabama, is a member of the third generation of the company, which started in 1955. The convenience store arm of the business arrived in 1999.

For Whatley, succession planning is still a work in progress.

“My grandfather and grandmother that started the business, they worked in it — in my grandfather’s instance — until the day he died, and my grandmother was involved with it until the last year or so of her life. … If we’re following previous generations, my dad and uncle, they have another 20 years left in them of working in the business,” said Whatley.

Whatley’s father, Steve, is CEO and president of the company. His uncle, Greg, joined the company after serving in the U.S. army for 20 years and manages the company’s fleet needs and NAPA auto parts stores.

When Whatley decided to enter the family business, it was “choose your own adventure for me for a while,” he said. Within six to eight months, he gravitated toward the retail side of the business. He worked with a mentor figure for a year and a half until his mentor passed away suddenly, leaving Whatley the most knowledgeable person for the retail arm.

“I went from a learning mindset to all of a sudden I was leading that side of the

business pretty quickly. The first few years were keeping my head above water. And so I got bolted into a leadership position of overseeing the entire retail business literally overnight when this happened. That was early 2019, and since then, we’ve grown our leadership team quite a bit,” said Whatley.

Before coming aboard the family business, Whatley was adamant he wasn’t going to be involved. He worked in the industry growing up during breaks, but he moved to Arizona for graduate school and worked a variety of jobs primarily focused

on outdoor leadership and education.

In 2017, however, he started a software company with a few friends and became more interested in entrepreneurship. He also began to miss his family, and the opportunity to work with and learn from his father, considering his new interests, ultimately led him back to working in the family business.

“I think if people have an opportunity to go off and work for someone else other than your family, that is a huge win for me. I think it gives you a really unique set of experiences,” Whatley said. “… When you go out and work in different industries and for different people, it just gives you this whole other set of experiences to pull from. …”

Chris Hartman also decided to venture beyond the family business originally.

While, unlike Whatley, he always envisioned working with the family, like Whatley, he felt it was important to see “where my passion truly took me.”

This led him to another brand in the c-store industry, Crossmark.

“It was very valuable for me to get a different experience outside of Rutter’s and helped bring me back to the company after I received my MBA in 2018,” said Chris Hartman.

Mouton, too, advocates for learning from those outside the family. His sons have worked at other stores for short stints, and Mouton has received offers

from peers in the industry for his sons to learn from them.

For example, Mouton has plans to send Andrew and Thomas to industry colleagues in Kentucky and Texas.

“Everybody’s just been extremely helpful, especially with the kids coming into it. They’re like, ‘Anything I can do,’ and they’re not just saying it, they’re not just giving it lip service. They truly back it up,” he said.

Originally, Mouton’s sons had no desire to be part of the family business, prompting him to sell seven stores at a point in time when the company owned

14 locations, as his primary motivation for growing the company was for his sons.

“If you’re not sure what your kids want to do, sell half the company and see what their reaction is,” he said.

The move got Mouton’s sons’ attention, and their reaction was a newly expressed interest in the business. “Be patient with your kids,” Mouton said.

To help introduce Andrew and Thomas to the business, they worked various jobs within the store, from being cashiers, to opening and closing stores, to working in the foodservice area.

Chris Hartman supports the next generation understanding the inner workings of each role, as well.

“Start them working young and build their knowledge of your business by giving them experience in many different roles. Having a strong working understanding of your family business by being in the trenches will help develop future

idea-generation and decision-making skills,” he said.

For Whatley, a mentor, either within or outside the business, is a great boon.

“To me, it’s like the ultimate cheat code in life. If you can go out and find somebody that’s an expert in what they do, and you can pay them to teach you how to do it, that, to me, is just a huge advantage,” he said.

Informally, Whatley constantly speaks with two of his friends about business and entrepreneurship, and more formally, he has a monthly call with a mentor who was one of his prior bosses in Arizona. He will also run ideas and issues by his father-in-law, who is a successful businessperson.

“I think if you have an opportunity to tap into somebody else’s experience and wisdom, especially when they’ve got a lot more than you, I think that is well worth the investment,” he continued.

The next generation can bring a wealth of new ideas and inspiration.

As time passes, business changes, as do customer interests, technology and opportunities. A younger generation often has a different perspective.

“Customers’ wants and needs have changed, and the younger generation, at least for their generation, is a little bit more tapped into what that looks like,” said Whatley. “… We start talking about employee or customer experiences and how do you feel at a store. For the baby boomer generation, that’s not a question maybe that was asked a lot, but now that sort of stuff is really important. I think … millennials that are stepping into bigger leadership roles now are a little bit more aware of that sort of stuff.”

Focusing on the employee and customer experience can also involve

GAME® LEAF GIVES CUSTOMERS WHAT THEY WANT

In 2015 Game Leaf was introduced as part of the Garcia y Vega portfolio of cigars, revolutionizing the Rolled Leaf cigar category. Now, as part of our 10th anniversary celebration, we’re reintroducing Game Leaf with colorful, eye-catching, consumer-tested 3-cigar packaging designed to bring Rolled Leaf customers more of what they want.

AVAILABLE AT 3 FOR $2.19 TRIAL PRICING AND SAVE ON 3

3 REASONS FOR 3-PACK SALES

In 2024, the 3-pack was the only Rolled Leaf format to show volume growth, along with a 5.7% increase in share of the market.

While all other Rolled Leaf formats showed velocity declines in 2024, the velocity for 3-packs rose by 15%.

Rolled Leaf 3-packs were added to shelves in over 9,700 c-stores in 2024, an 11% increase in store count over 2023.

3 REASONS TO GO WITH GAME LEAF

Game Leaf is able to build on the tremendous brand equity of Game, the #1 selling Natural Leaf cigar in the US.

Game Leaf’s commitment to quality and stringent quality standards—from broadleaf crop selection through manufacturing—ensure the best quality Rolled Leaf cigar available.

Consumers equate the Game Leaf brand with the Garcia y Vega tradition of quality and craftsmanship, as Garcia y Vega has been making Natural Leaf cigars since 1882.

handling advancing technology. Each generation brings new technology to the table and an area of expertise for incoming leadership. It’s an area where Whatley has excelled, and Scott, when he joined Rutter’s in 1990, brought a tech-based skillset to the company.

“The ways we do business have changed. I think that’s a unique opportunity for the incoming generation. This is really beneficial to the business, too; we can’t continue on exactly as we have for the last 50 years,” Whaltey said.

Chris Hartman, too, “hasn’t been afraid to push the envelope” in technology as well as store design and other

areas. Rutter’s customers can order food on their phone now, an effort that has been met with great success.

“I think that a younger generation will always bring an appetite for change. However, it’s important that it’s ‘good change,’” Chris Hartman added.

Mouton also sees the importance of having a fresh perspective and a younger set of eyes focused on the business.

He was at a food show, he recalled, and Thomas had asked why the chain didn’t carry a certain item. Thomas had said, “You need to put this in every store right now, today.” Mouton said yes. “Of course, it sells,” he said.

Learning what his sons see at retail and look for in a c-store has been one of the most important aspects for Mouton of bringing in the next generation.

“Bring on the fresh ideas and the energy from another generation — or plan to sell,” Scott Hartman added. “The old guard cannot stay and rule forever.”

Working with family, while a special opportunity, can also be a balancing act.

Separating the business and personal can be challenging, Mouton noted, so it’s important to find a work-life balance.

Whatley advised other second, third, etc. generations to start finding autonomy through low-hanging fruit.

“Listen and remember that the reason that there’s a company to pass on to you is that the previous generation made some really good decisions,” he continued. “Always be willing to listen to what it is that they have to say, and then just be patient.”

Chris Hartman agreed on the importance of understanding how the company has been successful historically while also moving forward with fresh ideas. “Never stop learning,” he advised.

“As a new father to twin boys, I hope to pass on an understanding that if it’s easy, it’s probably not worth doing. Embrace the challenge of making your own mark without losing a sense of what made things great in the first place,” he said.

Operating a family business is a big responsibility, Scott Hartman said. “I was told from the prior generation, ‘Don’t eff it up.’ Still doing my best to heed the advice.”

When it’s time, “Pass the torch like a relay race,” he added. “Push the next generation learning while being there to help. Prepare yourself to get out of the way with ample time for the next generation to learn.” CSD

wednesday, august 6

3:30 - 4:30 PM Registration

4:30 - 6:00 PM CStore Momentum Welcome Mixer

thursday, august 7

8:45 - 9:00 AM

Welcome to Weigel’s

Doug Yawberry | Weigel’s

9:00 - 10:00 AM

10:00 - 11:00 AM

11:15 - 12:15 PM

august 6-8, 2025

Knoxville, TN

Flavors of the Future: Innovating C-Store Cuisine

Ryan Blevins | Weigel’s

Game-Changing Marketing: NIL, Loyalty & the Weigel’s Playbook

Nick Triantafellou | Weigel’s

The Operational Edge: Best Practices from the Best in the Business

1:00 - 2:00 PM Burning Issues Exchanges: Round Table Discussions

2:30 - 4:00 PM It’s Your Business – Make it Extraordinary

David McClaskey | McClaskey Excellence Institute

4:30 - 6:00 PM Cocktail Reception

friday, august 8

9:00 - 1:30 PM Weigel’s Facility Tour and Lunch

REGISTER NOW

CStoreMomentum is an event tailored for young leaders in the dynamic world of convenience retail. This unique gathering is a transformative experience designed to propel emerging leaders to new heights of excellence. Immerse yourself in engaging sessions, interactive workshops, and networking opportunities that will not only expand your industry knowledge but also cultivate the skills needed to thrive in a fast-paced environment. CStoreMomentum is more than just an event; it’s a catalyst for personal and professional acceleration, where young leaders converge to shape the future of convenience retail.

C-store operators are balancing bold flavors, health-conscious options and value to meet shifting consumer expectations.

Kevin McIntyre • Associate Editor

AS CUSTOMER PREFERENCE CONTINUES TO EVOLVE in the c-store industry, retailers need to be ready to adapt at a moment’s notice. When it comes to snacking, customers today are oftentimes looking for more than just a quick bite — they’re increasingly seeking snacks with nutritional benefits, new and innovative flavors, and fresh product offerings, all while keeping a close eye on their wallets.

“In 2025, the c-store snack category continues to mature well beyond its legacy ‘smokes and Cokes’ identity,” said Tim Powell, managing principal for Foodservice IP, a management consulting firm specializing in foodservice. “It has evolved into a strategic priority for many operators, particularly those embracing foodforward models.”

Powell noted that as retailers ramp up their foodservice programs, they can’t forget about their snacking selection — the two categories can go hand in hand in many cases.

“Snacking is now intertwined with foodservice in meaningful ways — from savory pizza slices and warm bakery items to chilled grab-and-go snack packs and premium packaged goods,” he said.

Not to mention the chips and jerky that can be bundled together with food items.

“Consumer expectations for variety and quality have risen, and snacking itself has blurred into broader meal occasions like latenight meals or mini lunches,” Powell added.

This comes at a moment of particularly increased competition between convenience stores and quick-service restaurants (QSRs), as consumers are beginning to look to c-stores as foodservice destinations rather than your typical “gas station.” Snacks, especially proprietary ones, Powell noted, can be the differentiator for the customer who is deciding between a QSR and a c-store.

With dollar and unit sales down in almost every segment, retailers are feeling the effects of inflation.

Source: Circana Total U.S. Convenience data for the 52 weeks ending May 18, 2025

“Value and variety are crucial, and retailers are leaning into items that offer both,” stated Powell.

Consumer preference with the snacking category is always changing — in 2025, convenience store customers are seeking out bold, adventurous flavors. Gen Z and millennials are both leading that charge, according to Powell, as they have shown that they prioritize value and experience.

Worcester, Mass.-based Nouria, which operates 186 c-stores and 64 car wash locations, has also seen demand for new and innovative flavor combinations.

“Bold flavors are trending, whether it be a Sriracha Dorito, Cheese Pizza Cheeto or Hot Honey Pringles,” said Richard Perry, category manager, Nouria. “Flavor mixing such as Jack Link’s Duos are also becoming more popular.”

Nouria customers are also seeking out pickle, hot honey and international flavors, Perry continued.

But consumers aren’t just looking for bold new flavors — they are also increasingly purchasing products with explicit health or nutritional benefits. These better-for-you snacks continue to gain momentum; however, they are not universally sought after.

“Better-for-you snacks continue to have a place. Though not a universal motivator, there are important consumer segments — especially older millennials and Gen X — that want to feel like they’re making smarter choices,” noted Powell. “Hydration, energy and high protein are more meaningful attributes than vague health halos. C-stores that merchandise these attributes clearly — whether through signage or packaging — are more likely to succeed.”

Perry shared this sentiment, noting that alternative snacks are driving the most growth in Nouria stores. Offerings like meat snacks and trail mixes have proven to be a valuable addition to its product lineup.

Nutrition bars are overperforming

based on expectations. “We are up 25% and are actively expanding our assortment,” Perry said.

He also revealed that protein is a “huge trend,” mentioning that “demand is going to continue to grow for proteinforward items.”

“I think some customers are choosing to purchase snacks they perceive to be higher in protein, have less sugar or cleaner ingredients,” he continued.

“People who used to buy a packaged sweet snack or candy bar may now be buying a Legendary Pastry, Prime Bites muffin or Barebell bar.”

Nouria has doubled down on its efforts to provide better-for-you snacking options without sacrificing the products that consumers have come to expect from convenience stores.

“We have focused on bringing in some better-for-you brands this year such as Jackson’s Sweet Potato chips, which are made with avocado oil,” said Perry. “With increased scrutiny on food ingredients, I think there will be more opportunities for brands like this.”

■ Increased facings from 99 to 121, a 22% increase*.

■ Automatically billboards and faces product.

■ Reduces losses from bag hook tearout.

■ Cuts over 1 hour/day labor for restocking.

■ Allows rear restocking and proper date rotation.

■ Dramatically increases sales in the same space.

■ Adjusts to accommodate various package widths.

As the industry contends with higher prices, meat snack sales overall see dollar and unit sales declines as jerky dollar sales roll in flat.

Source: Circana Total U.S. Convenience data for the 52 weeks ending May 18, 2025

This is not to say that customers are only buying snacks that fall into the better-for-you segment — it is just as important today to offer the indulgent options that many consumers turn to c-stores for.

“In my experience, consumers view convenience stores as a place to treat themselves,” said Powell. “So while better-for-you has a place and shouldn’t be ignored, the mix is increasingly about balance: healthful when it makes sense, but mostly indulgent.”

The elephant in the room when it comes to the snack category is inflation — consumers are feeling the pressure, and retailers need to respond in kind. With consumers tightening their purse strings, adding value to your product selection is essential — especially where competitors can’t.

“Consumers are absolutely more cautious with their spending, and it’s affected their frequency of snack purchases,” noted Powell. “That said, many are trading down from higher-cost QSRs and still see c-stores as a value-oriented alternative — especially if the price-to-portion ratio feels fair.”

At the same time, Powell mentioned, there is tension — some consumers report increased purchasing because of value, while others are simply cutting back.

“The winners in this environment are snacks that can deliver on quality without sacrificing affordability,” he said. “Retailers that are actively promoting combo meals, limited-time-offer bundles or differentiated snack deals are capturing more attention.”

Perry and Nouria are feeling the effects of inflation, as well.

“I think most channels are seeing the impact of higher prices and the inflation environment we are in,” he mentioned.

“Many of the large snack manufacturers have begun lowering guidance and communicating that they are also seeing a slowdown. I think we will see some new investment into promotions and offering value to bring customers back. Until that time, I think there will continue to be some segments underperforming.”

C-store retailers looking to cash in on snacks need to stay vigilant — consumer preferences change frequently. And snacks, according to Powell, are no longer secondary products.

“(Snacks) are a competitive force,” he said. “Some convenience stores now rival fast-casual restaurants in food quality and customer experience … But it’s not just about products — it’s about speed, cleanliness and merchandising.”

Speed, cleanliness and merchandising are not new concepts for c-store retailers. Rather, they are what the industry was built on. C-stores already have the tools to capitalize on snacking trends, but staying on top of these trends is where operators need to commit their focus.

“There will continue to be trends towards perceived healthier options, less sugar and cleaner labels,” concluded Perry. “I think the larger manufacturers are going to be leaning more into this than in years past.” CSD

CStore Decisions is proud to announce Stinker Stores as its 2025 Chain of the Year. The Boise, Idaho-based chain stands out from its best-in-class new-to-industry stores to its revamped loyalty program and mobile app to its commitment to a people-first culture, foodservice and future-focused growth. But what truly sets Stinker Stores apart is its unwavering commitment to continuous improvement, consistently upgrading and refining its systems and programs. Refusing to settle for ‘good enough,’ the chain remains focused on modernizing and adapting to meet the needs of tomorrow. Stinker Stores was founded in 1936 and today it operates 105 stores in Idaho, Wyoming and Colorado.

CStore Decisions’ Chain of the Year Award honors a c-store, travel center or petroleum chain that has established itself as a superior retailer and innovator in the industry.

CONGRATULATIONS TO THE CSTORE DECISIONS CHAIN OF THE YEAR!

OCT. 15 5:308:30pm

THANK YOU TO OUR

Tim Powell • Foodservice IP

IS THE SUPER BOWL of beverage sales in convenience stores. With hot days driving traffic to the cold vault and fountain machines, now is the time for retailers to sharpen their beverage strategy — and boost profits when the stakes are highest.

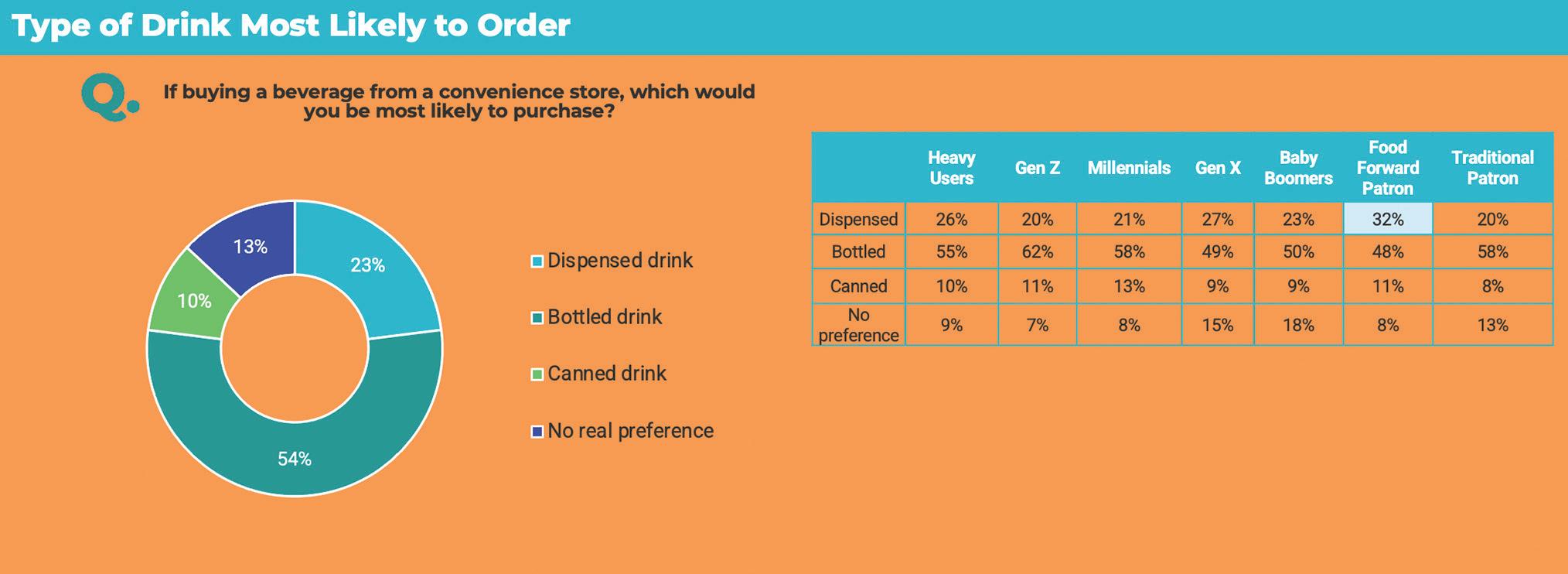

At Foodservice IP, we recently completed our “2025 Outlook and Opportunities in Convenience Store Foodservice” study. As part of this research, we surveyed 500 consumers who visited a c-store in the past two months and interviewed 150 retailers to understand what’s driving (or slowing) beverage sales in the current environment. What we uncovered is a story of shifting preferences, budgetconscious behavior and emerging opportunities that retailers can seize, especially during the summer season.

More than half (54%) of consumer respondents said they are most likely to buy a bottled drink when visiting a

convenience store. That number holds across nearly every demographic group — Gen Z, millennials, Gen X, boomers, food-forward patrons and traditionalists alike. The cold vault remains the backbone of beverage sales.

But while bottled is king, dispensed drinks — chosen by 23% overall — offer higher margins and greater room for customization and innovation. C-stores are evolving their fountain offerings beyond basic colas, adding everything from cold brew and energy drink blends to fruit-infused waters and house-made “dirty sodas.”

Among food-forward patrons — those who see convenience stores as more than gas stations — 32% said dispensed is their top choice. These guests are often looking for something different and experiential, and the customization opportunities of fountain drinks provide just that. From added lemon or cherry shots to blend-your-own combinations, there’s a built-in appeal that a packaged beverage can’t match.

For those increasing their purchases of dispensed beverages, several clear motivators stand out:

• 51% of customers said they simply prefer dispensed over bottled/ canned;

• 50% of customers cited the convenience factor compared to restaurants or coffee shops;

• 46% called out affordability.

This trifecta — preference, convenience and price — makes fountain drinks a compelling offer in a time when consumers are cutting back.

Importantly, variety and customization are also pulling people in, with 44% noting improved options and 32% saying they enjoy creating their own drinks. If your store has a condiment bar or a branded flavor shot machine, promote it. These can transform a routine purchase into something fun and repeatable.

While innovation is drawing some

FIJI Water is committed to sustainability and is proud to have launched its 330mL and 500mL bottles made from 100% recycled plastic* in 2022. This change replaces nearly 70% of FIJI Water’s plastic bottles.**

FIJI Water is available direct. Contact your FIJI Water representative at 888.426.3454 or at FIJIWater.com .

consumers toward dispensed beverages, others are pulling back, and it’s not because they’re going to competitors. Foodservice IP research shows that declines in dispensed beverage purchasing are driven by changing consumer behavior, not a loss in share to restaurants or coffee shops.

Among consumers who reported buying fewer dispensed beverages:

• 66% said they’re trying to save;

• 26% are focused on improving diet;

• 17% said their daily routines have changed, making stops at c-stores less convenient.

Just 5% are choosing restaurants instead, and another 5% said they avoid self-serve options since the pandemic.

In other words, c-stores aren’t being outcompeted, they’re feeling the effects of economic pressure and evolving habits. That distinction is important because it points to actionable solutions.

Retailers can respond by emphasizing the value and versatility of dispensed beverages: larger sizes at lower prices, loyalty-driven savings and bundle deals that make it easy to justify the spend. There’s also an opportunity to connect with health-conscious shoppers by calling

attention to hydrating, fruit-infused or lower-sugar options that align with their goals — without sacrificing the convenience and customization they love.

BETTING ON BOTTLED BEVERAGES

Of course, the cold vault isn’t going away. In fact, among consumers increasing their bottled/canned purchases:

•56% simply prefer the format;

• 54% cited convenience over supermarkets;

• 38% enjoy the expanding variety.

Brands continue to flood shelves with enhanced waters, functional beverages,

Source:

energy drinks and ready-to-drink coffees. And c-store operators continue to lead in providing immediate access to variety — no cart, no wait and no 12-pack commitment.

Still, even here we see financial caution creeping in. Nearly 70% of consumers said they’re cutting back on bottled/ canned beverage purchases to save.

This presents an opportunity to cross-promote value, especially during summer months: offer “buy two for $X” promotions, combine cold vault beverages with meal deals or spotlight private-label options. Every nudge helps maintain traffic while guarding against price-driven defection.

Based on our findings, here are five tactics we recommend for convenience store operators to boost their cold beverage profits:

1. Promote Customization: Highlight

mix-ins, soda bar creations and signature combos, especially with fountain drinks. Help guests make the drink “theirs.”

2. Bundle and Save: Offer drink combos with food purchases, especially around lunch and afternoon snack times. Drive ticket size while showcasing value.

3. Emphasize Wellness: Use signage and digital boards to call out hydration, energy and natural benefits — especially for fruit-infused and lower-sugar options.

4. Feature Cold Brew and Functional: These are growth categories that straddle both vault and dispensed, especially for younger and foodforward shoppers.

5. Loyalty That Pays Off: While not the top reason c-store consumers are buying, loyalty programs still help reinforce habits. Make deals prominent and easy to redeem.

Convenience stores are at a pivotal moment with beverages. Bottled and canned drinks remain reliable volume drivers, but dispensed is where margin and creativity thrive. Summer is the best time to test, promote and solidify new behaviors that last beyond the season. If you’re willing to innovate and listen to what your beverage customers are telling you, this summer can be more than hot — it can be high margin, habitforming and a turning point for growth.

Tim Powell is principal of Foodservice IP, a management consultancy that helps food and beverage manufacturers and operators uncover opportunities and navigate strategic change. For more in-depth findings on beverage behavior, trends and actionable strategies in the c-store space, explore the full “2025 Outlook and Opportunities in Convenience Store Foodservice” report at www.foodserviceip.com or contact Tim at tpowell@foodserviceip.com or (312) 600-5131.

C-store retailers can make their stores dinner destinations by identifying the big opportunities and creating an effective plan.

Emily Boes • Senior Editor

THE DINNER DAYPART is a worthwhile opportunity for foodservice-oriented c-store retailers that can help them draw an evening crowd and gain more loyal customers. While breakfast is often a big selling point for convenience stores, dinner can stand out as a differentiator, if executed well.

Green Valley Grocery (GVG), with 84 stores in Nevada, recently opened a new store with a fully operational kitchen where made-to-order (MTO) food is prepared fresh daily.

“Basically, we’re taking the best that we like out of the couple that we do already, and we’re combining that all into one,” said Brian Littlejohn, corporate chef at GVG, of the new store.

The new location offers a range of food options including fresh stretch

Kwik Stop food offerings include made-toorder tacos, sandwiches, burgers, PC Pizza, Krispy

pizza, expanded pastry options, chopped cheese sandwiches and a baked potato concept that also performs well at a location launched last year.

“We have plans for four more full kitchens within the next year to a year and a half, and it will be modeled after this one,” said Littlejohn.

Most GVG stores that do foodservice have a warmer program. Customers can choose from a variety of options depending on the location, such as teriyaki bowls, burgers, chicken carnitas burritos and spam musubi.

Kwik Stop Convenience Stores, operating 27 locations in Nebraska and Colorado, offers a mix of proprietary food programs and third-party partnerships.

Its new store opening in North Platte, Neb., like GVG, will feature a range of the

chain’s proprietary and partner options.

Kwik Stop’s various offerings include sandwiches, burgers, MTO tacos, PC Pizza, Krispy Krunchy Chicken and more.

To succeed with dinner, convenience stores need to have a dedicated plan for how this segment differentiates itself from breakfast and lunch.

“It’s a matter of how well you’re preparing for it and then how well you’re driving that appetite appeal and ensuring that you’re paying attention to what consumers want to eat, how much they want to eat and where they’re going to consume it along the way,” said Jeff Keune, principal consultant for 4910

Consulting and former retailer/quickservice restaurant (QSR) leader who was instrumental in the development of food programs for Thornton’s, American Natural, Fazoli’s and others.

GVG decided that quality is the path forward for dinner. With consumers more conscious of what they’re putting in their bodies, the chain believes introducing quality ingredients to its food items, even if the customer is charged a bit more, will ultimately yield results.

It also noticed customers are gravitating toward the warmers, so its focus going forward is on better utilizing the TurboChef or Merrychef ovens, packaging the items and placing them on the warmers.

“We’re seeing the dinners out of our warmers. We’re seeing a lot of pizzas and burgers and chicken sandwiches,” said Littlejohn. “The spam musubis are pretty much all day. We could put those things out at 8:30 in the morning and they’ll sell. If we put it out at five o’clock at night, they sell.”

“When I think about the things that we’ve done in the past or I’ve done in the past for dinner,” Keune added, “it’s really taking a look at what the consumer wants and what are the other bigger opportunities — whether it’s limited-time-offer promotions, whether it’s a meal for a family, whether it’s ensuring that you’ve got that speed of service. But you’ve also got that appetite appeal, whether it’s from the marketing elements instore, the menu or if it’s a buildto-order — (and) the product is fresh, hot and exciting.”

Fast casual or elevated QSRs should be inspiration for c-stores, Keune continued. However, there must be a plan for labor, foodservice design, packaging and more.

Kwik Stop chose to focus its dinner daypart on Family Packs. For instance, Krispy Krunchy Chicken offers a 12-piece bonein chicken, family wedge and six biscuits deal; PC Pizza offers two large single-topping pizzas for $29.99; and its Mexi Fresh concept offers six tacos and two medium pesos for $15.99.

“Customers are looking for a variety of options to feed the entire family instead of just themselves,” said M. David May, director of food services, Kwik Stop. “… Our primary customer in the evening daypart is the 25-45-year-olds that are looking for a quick, easy take-home meal for their household.”

At GVG, to help inform his dinner plan, Littlejohn receives customer feedback as well as

sales data to determine which items sell best at different times of the day, which helps him learn how much of something should be available for dinner.

He’ll bring samples to customers and ask their opinions in the store.

What you want as a retailer, Keune said, is to celebrate the adoption phase of a new program such as dinner so visiting your store for dinner will become a habit to customers. It’s imperative that your store is top of mind when evening arrives.

“We are in smaller communities with very little to no competition during the dinner daypart,” said May. “With that being said, it is important not to let our internal standards falter during this daypart, because we want the customer to experience great quality food at a great price.”

He advised advertising dinner through employees, social media, menu boards and cooler door advertising.

“When you think about driving people in for dinner, one thing that you consider is this: Would you say that your offering is that celebratory meal at the end of the day? And if it’s not, what can you do? And it doesn’t need to be complete overhauls. It’s how do you have the opportunity to have a (few) more people eat a little bit more at dinner,” Keune said. CSD

Not only does the travel center chain prioritize charitable causes, but it empowers its employees to actively participate in community initiatives.

Erin Del Conte • Editor-in-Chief

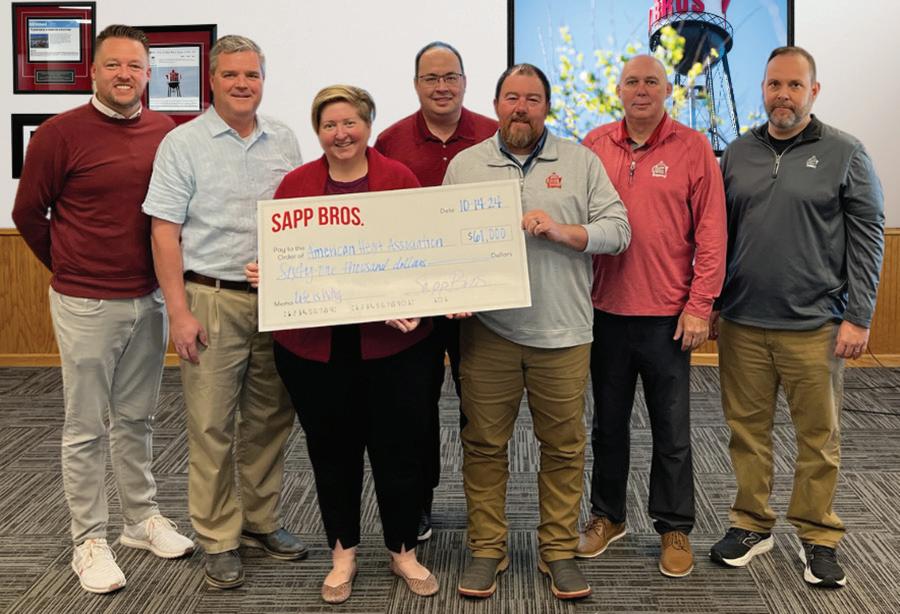

Omaha, Neb.-based Sapp. Bros., with 17 travel center locations across the U.S., supports a wide range of causes focused on health, veterans, education, anti-human trafficking and youth development. In addition to fundraising for various causes, the chain emphasizes education and staff involvement, reflecting a deeper, long-term commitment to helping its local communities.

CStore Decisions is recognizing Sapp Bros. with a Philanthropy & Community Engagement Award for its commitment to fostering a culture of community giving and involvement.

“At the heart of our business is a simple, but powerful, mission: to bless and serve our customers, teammates and the communities we call home,” said Andrea Galvin, marketing manager, Sapp Bros. Inc. “The past year — and for many years — we have remained committed to that mission by investing our time, energy and resources into causes that uplift and strengthen those around us.”

Last year, Sapp Bros. raised $61,000 for the American Heart Association (AHA) through a round-up campaign at its travel centers that included a $25,000 match from Sapp Bros. The chain prioritizes education by providing heart health training for its staff. It also installed automated external defibrillators at its offices and several store locations. Many of the chain’s employees participate in the annual AHA Heart Walk.

The chain has also shown long-standing support for veterans and families in need. Its annual golf outing raised $74,000 for Folds of Honor and the UNO College for Speech-Language Pathology, providing scholarships and educational resources.

Sapp Bros. has partnered with Truckers Against Trafficking (TAT) since 2015 to combat human trafficking along America’s roadways by training its employees on trafficking prevention and

Last year, Sapp Bros. raised $61,000 for the American Heart Association through a round-up campaign at its travel centers that included a $25,000 match from Sapp Bros.

Sapp Bros. has partnered with Truckers Against Trafficking since 2015 to combat human trafficking by training its employees on trafficking prevention. It co-branded and created a video specifically to teach employees how to recognize and respond to human trafficking at its locations.

providing philanthropic support and public awareness campaigns. Sapp Bros. co-branded and created a video specifically to teach employees how to recognize and respond to human trafficking at its locations. To date, more than 688 Sapp Bros. employees have been trained. In 2024 Sapp Bros. raised $74,000 for TAT through a round-up campaign, which also included a $25,000 match from Sapp Bros.

The chain also hosted Junction Briefings at several locations to educate the travel center and trucking communities on human trafficking prevention and to facilitate collaboration with law enforcement at a local level. The idea behind the Junction Briefings was to target areas with numerous truck stops and travel centers near major interstate or highway junctions and provide multiple 45-60-minute educational sessions on trafficking prevention in one day. TAT piloted this new engagement model at Sapp Bros. in Commerce City, Colo., in December 2024 with the Laboratory to Combat Human Trafficking, which runs the Colorado Human Trafficking Hotline. Thirty-two employees

attended one of the three sessions provided, according to TAT. The chain also co-branded human trafficking awareness graphics and informational messaging, which it displays throughout its locations during National Human Trafficking Prevention Month. Sapp Bros. also repurposed buttons previously used to signal employees when the restrooms needed attention to now act as alerts if someone needs help. “We recognize that victims of human trafficking often are only alone when they are in the restrooms, so we’ve put signs above the button that we are here to help them and to press the button if they need help,” Galvin explained.

“Sapp Bros. has stood out among TAT’s partners in the c-store industry for many years,” said Louie Greek, training specialist, TAT. The chain will be the recipient of the 2025 TAT Champion Award in the Organization Category.

Sapp Bros. raised $74,000 for Truckers Against Trafficking through a roundup campaign, which also included a $25,000 match from Sapp Bros.

In support of veterans and families in need, Sapp Bros. fundraises for Folds of Honor, including through its annual golf outing, which raised $74,000 for Folds of Honor and the UNO College for Speech-Language Pathology, providing scholarships and educational resources.

Sapp Bros.’ partnership with TAT is rooted in the chain’s understanding that because of its position in the truck stop and travel center industry, it can play a key role on the front lines of human trafficking prevention.

“Human trafficking is a heartbreaking issue and one we want to make a difference in,” Galvin said. “Truck stops/travel centers and c-stores by their very nature are places where people from all walks of life come and go. Tragically, these locations can also be places where victims of human trafficking are vulnerable to exploitation. They can also be critical intervention points where victims may have a fleeting opportunity for help. That’s why we see it as our responsibility to be vigilant and proactive in supporting efforts to identify and help victims who may be suffering.”

During its campaigns for TAT, Folds of Honor and AHA, Sapp Bros. holds cookouts, friendly competitions and rallies to further engage its customers and teammates to raise additional funds for the causes.

“We also extend our support to numerous organizations through the year by donating gift baskets for fundraising events or donations, benefiting organizations like Angels Among Us, Breakthrough T1D, Make-a-Wish, St. Christopher Truckers Fund, Hope Spoke, and several location food banks and school programs,” said Galvin. “On Veterans Day, we proudly offer free meals to veterans as a small token of our gratitude for their service. We also remain active participants in the Junior Achievement Bowling Classic, demonstrating our belief in empowering the next generation through education and community engagement. These efforts are more than events and donations — they are part of our foundation. We are grateful to our teammates and customers for embracing our commitment to service.”

From the top down, the chain exemplifies a culture of service. For example, when tornados struck the area last year, the team

Through donating gift baskets for fundraising events or donations, Sapp Bros. supports organizations such as St. Christopher Truckers Fund.

didn’t hesitate to help their fellow community members. “I’ll never forget sitting in our Monday morning meeting and our president asking us to take a day this week — not to work — but to go out and serve our community. To me that moment defines who we are. Some teammates served food to the less fortunate, others staffed food pantries and some rolled up their sleeves to help with neighborhood cleanup after the storm,” Galvin said.

Galvin explained that Sapp. Bros.’ commitment to giving back to the communities it serves originates from an understanding that the company isn’t just a business, but an important part of the communities where it operates. As such, the chain incentivizes and rewards employees who help take the chain’s fundraising and involvement efforts to the next level.

“We also think these efforts help us create a better bond with our guests, knowing that together we can help make a difference in the organizations we are blessing,” she added.

Travel centers and c-stores have a unique opportunity to create a lasting impact on their local communities by giving back.

“It’s a powerful way to build trust, loyalty and long-term relationships with your guests, your teammates and community,” Galvin said. “Being committed to the well-being of the people who support us every day shows that it’s more than just the bottom line. The value of giving back goes beyond just ‘doing good.’ We see our employee and guest engagement increase when we invest in a local cause that matters to them. We believe doing so strengthens our brand and drives business. When guests see that you are involved in causes that matter to them, they want to support businesses that share their values.”

Because c-stores are located throughout the country and serve everyone, they are an integral part of life for millions of Americans. “This gives us a special responsibility and an incredible opportunity to be more than just a business,” Galvin said. “The high frequency of everyday touch points provides for an opportunity of ongoing engagement. In short, we believe the convenience store industry isn’t just capable of impacting communities — it’s uniquely equipped to do so. It’s a responsibility we embrace and one we hope our industry will continue to see as both a privilege and a calling.” CSD

Rutter’s and its non-profit Rutter’s Children’s Charities donated a combined $2.1 million to impactful community programs in 2024.

Erin Del Conte • Editor-in-Chief

RUTTER’S, BASED IN YORK, PA., has long made philanthropy and community involvement a cornerstone of its business. Now led by the third and fourth generations of the Rutter family, the company is continuing to raise the bar on its tradition of supporting local charitable causes across its service areas.

CStore Decisions is honoring Rutter’s with a Philanthropy & Community Engagement Award for its strong commitment to giving back.

“With Rutter’s being a family business, we’ve always emphasized giving back to the communities we operate in,” said Suzanne Cramer, VP of human resources, Rutter’s, which operates 90 stores in Pennsylvania, Maryland and West Virginia.

Supporting children’s organizations has been a central focus for the company.

“We recognize (children are) the future of our area and generally the most vulnerable, so helping ensure they have food, clothing and education opportunities is a big part of our mission,” Cramer said.

RUTTER’S CHILDREN’S CHARITIES

Rutter’s established its own non-profit organization in 2019 when it founded Rutter’s Children’s Charities Inc. (RCC). The move demonstrates Rutter’s long-term commitment to investing in philanthropic causes that support children. RCC is guided by an independent board and is committed to supporting charitable organizations that empower and uplift the local communities in which Rutter’s operates.

“RCC was created to give us the best way to maximize the support for children in our communities,” Cramer said. RCC is funded primarily through support from Rutter’s vendors via its annual Golf Outing, which is hosted in May. The Golf Outing raised more than $950,000 in 2024. Last year, Rutter’s and RCC donated a combined $2.1 million to various impactful community programs.

“These include $800,000 in Educational Improvement Tax Credit donations; over $400,000 to the Central PA Food Bank’s Retail Donation Program;

Top: Adams Township Volunteer Fire Co. Station 82 Dunlo #1 is part of the Rutter’s Children’s Charities (RCC) May for Hero’s Program 2025.

Right: RCC is funded primarily through support from Rutter’s vendors via its annual Golf Outing, which raised more than $950,000 in 2024.

$50,000 to local youth sports leagues that help promote active, healthy lifestyles for children in the community; and a Secret Santa program giving 100 Rutter’s employees the opportunity to give $1,000 each to the charity of their choice,” Cramer explained. Secret Santa began in 2016 and has donated more than $550,000 to charity since its inception.

“This substantial commitment reflects not just corporate responsibility, but a core value of community enrichment,” Cramer said.

Instead of offering one-off donations, Rutter’s prioritizes partnerships

with charitable organizations that directly benefit the communities where their stores operate, Cramer pointed out. “This ensures that giving is both targeted and meaningful, creating lasting impact,” she continued. “RCC’s independent board structure allows for thoughtful decisionmaking rooted in the needs of the specific regions served. This grassroots approach often leads to more effective and community-specific solutions than broader, national campaigns.”

Convenience stores can gain a lot from supporting their local communities. In addition to the satisfaction of helping neighbors, it helps build trust with residents, enhances a c-store’s image, drives customer loyalty and helps stimulate the local economy, which in turn helps the neighborhood thrive.

Left: Rutter’s offers a Secret Santa program giving 100 Rutter’s employees the opportunity to give $1,000 each to the charity of their choice.

Top: Last year, Rutter’s donated $50,000 to local youth sports leagues that help promote active, healthy lifestyles for children in the community.

“When you have the opportunity to give back to your community, where your employees and customers live, it can make a big difference that you’ll be able to see firsthand,” Cramer said.

The convenience store industry is uniquely positioned to assist local communities.

“Convenience stores are more connected to communities than almost any other type of retailer, because over 99% of Americans stop in one each year,” Cramer said. “Having a relationship with so many people, by offering them goods and services in our stores 24/7, means we can make a huge impact on the people that we see every day. We view giving back as a way to show our customers that we support them, like they support us.” CSD

CLIF BUILDERS recently launched the BUILDERS’ OREOflavored protein bar, which offers the iconic flavor of the OREO cookie in a convenient, on-the-go format. Packed with 20 grams of plant protein per bar, no artificial sweeteners and gluten-free ingredients, BUILDERS OREO-flavored protein bars deliver a taste specifically formulated for those who are looking for no compromises in their recovery fuel.

Clif Bar www.clifbar.com

Sara Lee Frozen Bakery has launched its Cyrus O’Leary’s Mini Cheesecakes. Now available nationwide, the desserts come in three flavors: Original Mini Cheesecake, Salted Caramel Truffle Mini Cheesecake and Strawberry-Topped Mini Cheesecake. The cheesecakes are made with premium, quality ingredients like whole milk and real cream cheese.

Sara Lee Frozen Bakery www.saraleefrozenbakery.com

SweeTARTS is introducing its newest innovation — SweeTARTS Gummy Halos candy. The soft and chewy ring-shaped gummies take iconic combinations to a whole new level with their flavors and textures.

SweeTARTS Gummy Halos feature an airy, fluffy gummy bottom layer topped with a vibrant pink and blue chewy layer, all coated in with sweet and tart flavors. This new product features two flavor combinations for the SweeTARTS portfolio: Blue Punch and Strawberries & Cream. The candy is available in three-ounce, 3.5-ounce, sixounce and 11-ounce packages.

Ferrara www.ferrara.com

Doumak Inc. has debuted its newest product, Peppermint ‘Mallow Poppers, which are a festive twist on a classic snack. The product features peppermint-flavored marshmallows drizzled with dark chocolate and sprinkled with crunchy peppermint pieces. Packed in 4.5-ounce bags, they deliver a poppable indulgence ideal for the holidays or everyday snacking.

Doumak Inc. www.doumak.com

Betty Booze, Blake Lively’s canned cocktail brand, is entering a new category with the launch of its first-ever vodka cocktails, the Vodka Iced Teas. Also debuting as its first non-sparkling beverages, the Vodka Iced Teas are launching in two summer-favorite flavors: Vodka Iced Tea + Meyer Lemonade and Vodka Iced Tea + Passion Fruit, both made with real ingredients including real crisp black iced tea, real juice and just a touch of agave.

Betty Booze www.bettybooze.com

Silver Spring Foods has announced the launch of Dill Pickle Mustard — a bold, flavor-forward update to the company’s Dill Mustard. Crafted to meet growing consumer demand for pickle-forward flavors, the tangy, crunchy new condiment brings together the sharp bite of yellow mustard and the briny snap of dill pickle relish. Silver Spring Foods Dill Pickle Mustard is a gluten-free, flavor-packed mustard that comes in a convenient squeeze bottle.

Huntsinger Farms www.huntsingerfarms.com

Petro

888.260.0112

/ www.nynab.com

Industries, Inc

800.444.4665 / info@triononline.com www.TrionOnline.com

Mount Franklin Foods is bringing BUBS to the U.S. BUBS is a brand widely recognized for its vegan, gelatin-free gummies and signature foamy texture. Production will begin in July, with national distribution to follow in August. U.S. consumers will be able to buy BUBS in-store starting at $2.99. Flavors include Sour Diamond (Tutti Frutti), Sour Diamond (Strawberry Vanilla), Sweet Ovals (Banana Toffee) and Sour Skalle (Lemon Raspberry).

Mount Franklin Foods www.mountfranklinfoods.com

C-store chains can dive into AI experimentation in part through enhancing marketing and promotions, among other opportunities.

Emily Boes • Senior Editor

C-store retailers are hard pressed to escape artificial intelligence (AI) in present times. Many supplier partners are already incorporating the technology. Most operators are using AI, even if at the most basic level. And still, it has the potential to do so much more for a chain’s operations and customer’s experience.

To learn how one c-store retailer is currently leveraging AI, CStore Decisions reached out to Jessica Bardon, public relations and marketing manager for McIntosh Energy Co. Fort Wayne, Ind.-based McIntosh Energy operates four MacFood Marts in Indiana.

{CStore Decisions (CSD)} Can you describe some of the ways in which you’re currently using AI in the c-store space?

{Jessica Bardon (JB)} As a small business, we utilize AI as a building block in our marketing, promotions and event planning. We also leverage AI as its implementation is slowly rolled into the software we already use. For example, our social media management platform utilizes AI for social listening, sentiment analysis, and custom reports and alerts in data analytics. We also make use of AI to interpret anonymized data sets from our MacFood Mart Rewards program. This helps us identify customer trends and behaviors and better evaluate which promotions are driving the most redemptions among our loyalty members. It’s helped us move quicker in the planning stages and adapt our offers and promotions to better appeal to our customers.

{CSD} What are some of the challenges you’ve come across using AI for retail, and how did you overcome them?

{JB} One challenge in using AI in retail marketing is knowing when to use it, and possibly more importantly, when not to. You only have a few seconds to grab someone’s attention before they move on. If the message doesn’t resonate — if it doesn’t feel human — you’ve already lost the opportunity to connect. People are getting better at spotting AI-generated content, and the long-term impact of brands consistently using AI in their messaging is still uncertain. It’s also challenging to discern how AI can be useful within your business. With so many possible avenues for implementing AI, it’s easy to feel overwhelmed by information. I had to experiment with AI before finding areas where it helped me save time or spark ideas in our marketing, promotions and event planning. Because of these challenges, I follow a few rules with how I utilize AI.

1. Treat it like a brainstorming partner, not a substitute for creativity.

2. AI is like a team member, useful but not perfect.

3. Everything goes through a human filter.

{CSD} What kind of data should cstores be collecting to enable future AI initiatives?

{JB} You don’t need to collect everything at once, and honestly, you don’t need massive amounts of data to get started.

With a loyalty program, just start with the basics — what offers members are redeeming, products they’re buying and how often they’re coming back. That alone can help you understand how your program is being used and reveal patterns you could lean into as you build smarter promotions.

In marketing, collecting data from your social media post-performance like engagement rates and audience growth can be analyzed with AI to track overall performance and provide strategies on future content creation and campaign planning. Similar strategies can be applied when evaluating a completed ad campaign, website traffic or email performance — AI can help highlight what worked, what didn’t and where to focus next.

{CSD} Where do you see AI making the biggest difference for c-stores over the next three to five years?

{JB} Personalization and automation will be opportunities for AI to make the most impact in the c-store industry. In the same way programmatic advertising adjusts ad placement and visibility in real time, AI has the potential to make realtime adjustments to loyalty programs based on current redemption rates and engagement. I think there’s some potential for AI to automatically fine-tune offers to drive better results. In addition, AI could be used to increase internal efficiencies like inventory and scheduling and allow team members to focus on higher-impact work.