The Financial Reporting Council (FRC) defines Stewardship as the responsible allocation, management and oversight of capital to create long-term value for clients and beneficiaries leading to sustainable benefits for the economy, the environment and society

We are proud to present our annual report in line with the principles of the Stewardship Code 2020.

Our investment objectives are to achieve sufficient investment returns such that there are funds available to pay the pensions as they fall due, and to meet the liabilities over the long term whilst maintaining stable employer contribution rates. As a long-term investor, we recognise the value which can be generated through stewardship activities, both in terms of reducing risk and improving returns.

This mindset is demonstrated by the following investment belief:

We have long-established activities in this area. This report sets out the principles of the Code and how we comply with these principles, what activities are undertaken in each area, examples of the outcomes that we have achieved, and how things have changed and improved since last year.

A one pager highlights sheet will be published alongside this full version to help make the information as engaging and understandable as possible for a non-technical audience.

Stewardship and engagement are generally more effective tools than divestment in encouraging changes that will help safeguard the Fund’s investments. The Fund values the benefits of working with other investors to strengthen these activities and achieve better outcomes

Signatories’ purpose, investment beliefs, strategy, and culture enable stewardship that creates long-term value for clients and beneficiaries leading to sustainable benefits for the economy, the environment and society.

Wiltshire Pension Fund is part of the Local Government Pension Scheme (LGPS), a defined benefit pension scheme for local government and associated employees.

Our Purpose

Our purpose as a Fund is to provide pension and lump sum benefits for members on their retirement and/or benefits on death before or after retirement for their dependants. We are funded by employee and employer contributions, and returns from our investment assets.

The objective is that the Fund should be at least 100% funded on an ongoing basis. The projection is that full funding is achieved over a time frame deemed appropriate by the Actuary for each employer, as set out in the Funding Strategy Statement

Our vision is to deliver an outstanding service to our scheme employers and members

Our vision is set to establish a sense of purpose, and to focus the team on delivering outcomes for the employers and members of the Fund. We measure success against the vision by monitoring our progress against various service related KPIs, targets, and actions. Our vision is supported by our Strategic Vision Goals (SVGs), which provide a focus to everything we do, and our Values, which define our culture.

The value “Long Term Thinking” runs through everything we do. Wiltshire Pension Fund is a long-term investor, and so is able to participate in stewardship activities which can add value to the Fund’s investments over the long term.

The strategic goal 11, “Responsible Ownership and Stewardship”, is particularly relevant to stewardship activities. The goal focusses on ensuring that our responsible investment and stewardship activities are in line with best practice (which also contributes to strategic goal 16, “Compliance and Best Practice”), and that these activities are a central part of delivering an outstanding service to our scheme employers and members.

For these different groups this may mean different things – employers will be best served by the delivery of long-term positive investment returns, which will help keep their contribution rates affordable (strategic goal 1, “Stable and Affordable Contributions”, is targeting this outcome), and stewardship activities can help preserve capital and enhance value.

Members may be concerned about how the funds held to pay their pensions are invested, and goal 15, “Transparency and Information Sharing” contributes to this outcome. Stewardship has a role to play here in the information that is shared with members – the Fund publishes its engagement and voting records and investment holdings online. The voting and holding reports are presented in a relevant and engaging manner that stakeholders will understand. A one page summary of this report will be published alongside, to help make the information as engaging and understandable as possible for a non-technical audience.

LONG TERM THINKING

We always act with the long term in mind, whether we are setting our investment strategy, planning improvements, or working towards our net zero by 2050 goal

11

Responsible ownership and stewardship

1

Stable and affordable contributions

16

Compliance and best practice

15

Transparency and information sharing

Our investment beliefs help to inform the investment strategy. The full list of beliefs are detailed in the Investment Strategy Statement

Our RI policy sets out implications against each RI-related investment belief:

The strategic asset allocation is the key factor in determining the risk and return profile of the Fund’s investments

The Fund has embedded Environment, Social and Governance (ESG) issues and sustainability within the strategic asset allocation and has set specific strategic allocations to Parisaligned passive equities, sustainable active global equities, renewable infrastructure, and impact affordable housing, in order to manage risk and secure returns into the future.

Investing over the long term provides opportunities to improve returns

ESG factors, including Climate Change are important factors for the sustainability of investment returns over the long term

Investing over the long term means that the Fund can take advantage of opportunities in long-term sustainability trends and/or growth style portfolios, as well as benefit from engagement activities with companies in which the Fund is invested.

The Fund’s status as a long-term investor means that the Fund needs to consider the risks and opportunities presented by wider issues such as climate change and the potential impact on the investments. This can help the Fund avoid the risk of being exposed to stranded assets and help ensure that the Fund can benefit from exposure to companies which are well prepared for transition to a low carbon economy.

In order to protect the Fund’s investments into the future, the Fund supports a global warming scenario of well below 2°C, and states an ambition to achieve net-zero carbon emissions across all investment portfolios by 2050

We seek to invest in a way that, where possible, aligns the interests of the Fund with those of the contributing employers and the Fund membership

The Fund acknowledges that climate change is a material systemic risk which could have significant adverse impacts on the investment portfolio if not managed correctly. The Fund is actively working to mitigate this risk, and the Committee has reviewed scenario modelling and undertaken training, and the Fund reports in line with TCFD recommendations, which disclose how the Fund manages climate change risk.

The Responsible Investment policy contains an employer and member engagement plan and is actively advancing the approach in this area. Member and employer views formed part of the decision-making process when setting the net zero target. A recent survey of the Fund’s membership showed that from the 2,914 responses, 85% of members answered “Yes” or “Maybe” to the question “Is it important to you that the Fund invests in low carbon and/or sustainable assets?”

Investing with a positive social and environmental impact is an increasingly important issue for investors and can be achieved alongside competitive market returns. Investing with impact can also help incorporate risk and return drivers which would otherwise not be considered. The Fund wishes to invest in a way that minimises negative impacts on society and the environment and, where possible, makes a positive contribution

Stewardship and engagement are generally more effective tools than divestment in encouraging changes that will help safeguard the Fund’s investments. The Fund values the benefits of working with other investors to strengthen these activities and achieve better outcomes.

Impact investing is a rapidly growing area and the Fund has made dedicated strategic allocations to Impact Affordable Housing and Renewable Infrastructure & Climate Solutions.

We are signatories of the 2020 Stewardship Code. We also publish a one page summary of the Stewardship report, designed to make this information accessible to our stakeholders. We continue to work with wider initiatives and fully engage with them.

Source: Wiltshire Pension Fund Investment Strategy Statement

As a Fund we set ourselves high standards to continually improve the management and stewardship of our investments. Ensuring we provide stakeholders with effective and relevant communications about the investments we make on their behalf. We continually adapt our approach to meet evolving issues.

In response to growing national interest in how pension funds invest in the UK, we rapidly developed a new report, to highlight how our investments contribute to the UK. ( 2024 Investing in the UK Report –Wiltshire Pension Fund).

The report showed that 27% of the Fund’s investments were made directly into the UK, it showcases case studies of investments made across the UK and in Wiltshire itself. The report highlighted a topical issue of relevance to our stakeholders and was well received.

As a Fund we always strive to make a positive impact with our investments, our two dedicated impact portfolios (Affordable Housing and Climate Opportunities) are testament to this approach. To progress this further during 2024/25 the Committee have been exploring opportunities for local and social investment.

12

To support this, the Committee received training on Local Investment at their meeting in March 2025. This training was delivered by Fund officers, the investment advisor, Redington and was supported by two investment managers. The Committee considered ways the Fund could implement a local investment portfolio to deliver positive local impact, having a more direct benefit on the Fund’s membership - the overwhelming majority of which are located in and close to Wiltshire. Such a portfolio could provide positive economic and societal benefit to the UK and local economy.

The outcome of the training could be a future commitment to local investment within the Fund’s strategic asset allocation, which is being reviewed in 2025/26.

2024 marked the 10-year anniversary of our relationship with Ninety One, our emerging markets manager. To celebrate this milestone, in December 2024 we coordinated an event to benefit those most in need in the local area, and took part in a fiercely competitive supermarket sweep to purchase in-demand supplies for the local foodbank, including all the produce needed to enable families to make a full Christmas dinner. Team Ninety One came in last, with Team WPF in a close second place to the winners Team Storehouse Foodbank! We are very grateful to Ninety One for choosing to celebrate our long and successful professional relationship by giving back to the local community. The event highlighted the values and culture embedded in the Fund and supports the outcome of delivering positive impact.

There is a clear thread all the way down from our vision, through our goals and values, to how we operate as a team. Our strong sense of purpose and focus ensures that all our activities are working to deliver against our vision, and ultimately to deliver better outcomes for our beneficiaries.

12

Signatories’ governance, resources and incentives support stewardship.

Pensions Committee – meets at least eight times a year to review the investment, administration and governance affairs of the Fund, review performance, and plan the implementation of policy.

Local Pension Board – responsible for securing compliance with the Regulations, any other legislation relating to the governance and administration of the Scheme, requirements imposed by the Pensions Regulator and ensuring effectiveness and efficiency.

Both these groups regularly discuss responsible investment and stewardship matters and set an annual plan to ensure objectives are achieved. Being regularly informed delivers the outcome that these groups are aware of the issues and are able to support better decision making, as well as raise relevant issues for consideration.

Our team

Relevant roles in our team include a Governance Manager, a Communications and Stakeholder Engagement Lead, and a team of investment and accounting professionals.

The investment team’s responsibilities include development of the Fund’s strategic asset allocation, stewardship and responsible investment issues, selection and monitoring of the Fund’s asset managers, working with the Brunel Pension Partnership pool in setting up portfolios, transitioning assets, representing the Fund’s interests, and holding Brunel to account.

We work together as One Fund, demonstrating the values of transparency, accountability, ownership, critical thinking, respect and agility

Officers and Managers of the Fund come from a wide range of backgrounds - accountancy, communications, investments, pension and information systems - bringing a wealth of experience and range of qualifications. Training needs for officers are assessed as part of setting the workplan for the team, and in setting goals and performance targets for individual team members.

Stewardship resourcing – in-house, at the pool, consultancy support and wider initiatives

Work done on responsible investment issues is largely resourced by officer time. Officers have been set responsible investment and stewardship objectives as part of the annual goal setting process, and an assessment of progress against these objectives forms part of the annual appraisal performance review.

As well as the work done in-house, responsible investment work is also carried out by the Brunel pool, which has a dedicated team of staff. This resource is a benefit of pooling, as we can use the scale from working with our partners to make our collective voice heard. We engage with Brunel on responsible investment issues regularly – one of the ways this takes place is through the Responsible Investment Sub-Group, which Wiltshire officers regularly attend and is strongly supportive of. This group learns about engagement case studies, helps to develop reporting, and sets the responsible investment agenda at the pool in line with client requirements.

The Fund’s investment adviser, Redington, have been appointed in part based on their expertise in the area of responsible investment. Their skills and experience will benefit the Fund as the approach is further developed.

As set out in the Fund’s investment beliefs, the Fund values the benefits of working with other investors to achieve better outcomes. A full list of the initiatives we support is included in our RI Policy. We continuously assess how effective these initiatives are, whether we are using them to our best advantage, and what outcomes they are delivering for us.

Each year we design a new Responsible Investment Plan to set out our areas of focus and development for the coming year. The plan is then reviewed and approved by the Committee. This important piece of work delivers the outcome that we are focussing on key areas. It also holds the team accountable to deliver against the plan, demonstrating a positive way to incentivise the team. As set out in the plan, pieces of work are included based on the following criteria:

i. There are existing commitments to complete the work

a. As set out in our RI policy

b. Meeting the needs of our members

c. Implementing the strategic asset allocation

ii. Continuation of existing work.

iii. Improving current practices.

iv. Responding to the needs of investment pooling

v. Addressing topical issues, which we have identified as priorities due to their impact across our portfolios and/or membership.

The outcome of this way of working is that we are constantly pushing ourselves to improve and advance our approach in this area, ensuring the Fund stays at the forefront of topical and relevant issues which affect our investments.

In order to make sure that the work we are doing is progressive and effective, we need our team to be well informed, highly skilled, and collaborative. The team is small, so we regularly take advice and work with our consultants and advisers. We also collaborate with other LGPS Funds to share knowledge and best practice.

In 2024 we redesigned the team structure to embed professional development pathways, starting from apprentice all the way to professional level investment and accounting qualifications. This change has improved the resilience of the team and secured long term career development opportunities for staff. This will ensure the Fund retains the best skills and expertise to meet our stewardship aspirations. Members of the team have achieved industry qualifications such as the CFA’s Investment Management Certificate, and ESG Certificate. Training is obtained through many different sources, including (but not limited to):

Industry events (conferences, webinars etc).

Formal training and examinations

Research.

Information provided through the various initiatives we are members of.

Publications.

Deep dives with investment managers.

Investment site visits.

On-the-job learning.

We promote an inclusive team culture where ideas and suggestions for improvements are welcome from any member of the team.

The outcome of this drive for excellence is that we are able to carry out quality research into our investments, and produce a variety of engaging and relevant case studies and news stories to share with our stakeholders.

We aspire to be role models and leaders, through our commitment to develop knowledge and training.

By making efficient use of resources, we are able to use third party data and advice to supplement our own expertise, and focus our efforts on priority areas. Our ways of working ensure that we are on the front foot and promote a culture of continuous improvement. This approach enables us to stay agile and react to emerging issues.

The Public Service Pensions Act 2013 defines a conflict of interest in relation to a person, as “a financial or other interest which is likely to prejudice the person’s exercise of functions as a member of the board (but does not include a financial or other interest arising merely by virtue of membership of the scheme or any connected scheme).”

Due to the nature of the LGPS (as a funded statutory scheme, without the same separation that would exist in a trust-based arrangement) there is a possibility that potential conflict between the Fund and the Council could occur if interests were not managed appropriately.

As Administering Authority, Wiltshire Council requires that all Councillors and co-opted members of Wiltshire Council must register disclosable pecuniary interests for public view.

All members of the Pension Fund Committee and Local Pension Board’s declared interests, including any that may affect the stewardship of the Fund’s investments,

are maintained and monitored on a Register of Member Interests. These are kept up to date and published on the Council’s website under each member’s name and profile:

• Committee details – Wiltshire Pension Fund Committee | Wiltshire Council

• Committee details – Local Pension Board | Wiltshire Council

• The Local Pension Board has its own Code of Conduct and Conflict of Interest Policy Guidelines.

Monitoring conflicts

Each member of the Pension Fund Committee is required to declare their interests at each meeting. No declarations were made during the year 2024/2025.

Brunel maintain a ‘Disclosure of conflicts of interest log’ which is presented to Client Group. The log of disclosures lists any interest that could potentially present a conflict, this is also monitored by internal compliance in Brunel.

Compliance and best practice

In July 2024, the Chancellor announced a "landmark" pensions review, stage one of which included the Local Government Pension Scheme (LGPS). The stated objectives of this review were to push further consolidation, tackle inefficiencies, and drive more investment in the UK. During this review, Wiltshire Pension Fund has engaged at every possible opportunity. On 14 November 2024, an interim report into the pension review was published along with a consultation ("LGPS – Fit for the Future").

The consultation contains proposals which represent significant changes to the way the LGPS is run, focused on the Fund’s investments. We view some of these positively, such as the improvements to governance standards. Others we have concerns around, as we believe that they create significant risks in terms of value for money, maintaining accountability to our employers, and our ability to deliver our responsible investment objectives.

We believe the proposal for pools to provide investment advice to Funds is an inherent conflict of interest. In our consultation response, which is published on our website, we have highlighted this issue. To ensure the Fund delivers the best risk-adjusted investment returns for clients, we believe that Funds should continue to receive independent investment advice, to hold pools accountable for investment performance.

Throughout this process, and in every forum available to it, the Fund has clearly communicated its stance on the proposals and has endeavoured to influence the outcome that will put the best interests of employers and members first . The Fund has been quoted across a range of relevant publications, such as the Financial Times, Room151 and the Local Government Chronicle. The Committee await the outcome of the consultation and will consider how they can manage the changes imposed and any potential conflict of interest that may arise. 16

By embedding consideration of conflicts at both a decision-making and operational level, we are able to maintain high standards and ensure that conflicts of interest are appropriately managed and do not negatively impact on stewardship activities.

Signatories identify and respond to market-wide and systemic risks to promote a well-functioning financial system.

Our framework for risk management has undergone a huge revamp over the last two years, with the new risk and control register being thoroughly embedded in ways of working, and continued meetings of the CROC working group (Compliance, Risk, and Operational Controls). The new risk register contains tabs for each area, with ownership assigned to a manager within the team. Controls are linked to specific risks and need to be evidenced. Managers review and update their risks and control dashboards every month and engage in challenging monthly meetings. An outcome of this new way of working has been to promote ownership of risk and has embedded a “whole Fund” approach to risk management.

The Local Pension Board and Committee continue to review the risk register on a quarterly basis, and the Local Pension Board highlight areas of importance to the Committee for their particular attention. A positive outcome from this regular review is that the Committee are highly aware of the “high” risks facing the Fund, and this enables more effective decision making.

A full commentary on risk identification and response, specifically as it relates to investments, is given in the Investment StrategyStatement (ISS)

The following summary highlights key risks from our risk and control register which address market-wide and systemic risks, it also explains how the risk has evolved over the year and what actions have been taken as a result of regular review and oversight.

Implementation of Investment Strategy

Cause: Investing the incorrect %'s of the fund into the agreed asset classes.

Event: would lead to the fund not implementing the optimum investment strategy as set out in the ISS

Effect: which could lead to investment returns failing to achieve the required target and expose the fund to unwanted volatility to returns and potential losses. The overall funding level could also deteriorate leading to higher employer contribution rates.

Robust processes, controls and risk management

Due to market movements, which vary between asset classes, the portfolios can move out of their permitted ranges. A monthly review assesses the position, alongside thoughtful consideration of upcoming changes. An outcome of this monthly review and consideration of market returns is that the Fund can minimise unnecessary trading costs and maximise risk adjusted returns in line with the agreed strategy.

Performance of Investment Managers

Cause: Poor performance of the underlying investment managers

Event: by ineffective implementation of their investment strategy

Effect: could lead to investment returns failing to achieve the required target and expose the fund to unwanted volatility to returns and potential losses. The overall funding level could also deteriorate leading to higher employer contribution rates.

Performance is reviewed monthly and then (unless anything urgent is identified) in detail quarterly with investment managers. During the year we experienced underperformance from our active global equities portfolios, but an outcome from regular review was that we were assured this was due to exceptional market concentration negatively impacting active managers returns and therefore performance was not out of line with expectations.

Investment performance

Investment governance

Cause:Through failure of internal governance and a lack of effective oversight.

Event: controls are not implemented, monitored and reported on.

Effect: This could lead to losses due to fraud, inaccurate reporting which informs poor investment decisions and ultimately negatively impact implementation of the investment strategy.

Cause:Failure to manage climate risks in the investment portfolios, and/or to take advantage of the investment opportunities which arise from transition to a low carbon economy.

Event: Not dealing with the material financial risks or missing out on opportunities that would materially benefit the investment strategy.

Effect: Material negative financial impacts and reputational damage.

Multiple workstreams during the year tackled this risk. The monthly reporting and review process provided additional assurance, the outcome of this was the Fund receiving only low-level recommendations from external audit.

We have approached this risk from both a risk mitigation perspective, and to ensure there are no lost opportunity costs. We have launched our Clops (climate opportunities) portfolio and set climate-related targets. The Fund will incorporate the outcomes of climate scenario modelling into its review of the SAA in 2025.

Effective stewardship and reporting of the funds investments

Cause: Inadequate understanding of the funds investments and clear reporting to stakeholders.

Event: through not undertaking an effective programme of responsible investment activity, manager scrutiny, site visits and understanding employer and member wishes.

Effect: could lead to the fund failing to achieve its SVGs, lead to reputational damage, poor engagement and support from members and employers for the investment strategy. It could also lead to a loss of the stewardship code signatory status and ultimately lead to poor investment returns and higher employer contributions.

Our responsible investment plan has kept us on track and led to exciting outcomes, such as the investing in the UK report and a range of relevant case studies and site visits being reported to members.

Funding position

Cause: Failure to consider the multiple factors affecting the Fund's funding position.

Event: Poor decision making, lack of consideration of risks.

Effect: Adverse outcomes for the Fund, including lack of awareness around the impact of macroeconomic events on the Funding position, failure to act in a timely manner in response to significant falls (>20%) in the funding level, or failure to proactively address employer cessation and solvency issues.

The fund works closely with the actuary to report and understand movements in the funding level, this has been particularly important in the last year due to large changes in interest rates boosting funding levels for funds. The Fund has worked with employers to help them understand the risks and funding level ahead of the triennial valuation exercise in 2025. The outcome of this supports the fund to implement stable and affordable contributions.

Brunel Pension Partnership Performance

Cause: Brunel run portfolios on behalf of the fund representing c70% of fund assets. Failure of Brunel to operate effectively and cost efficiently to meet the needs of the fund.

Event: By operating not in accordance with the fund's needs to provide suitable investment portfolios delivering the required investment returns in a cost effective manner and meeting the fund's RI strategy.

Effect: could lead to investment returns failing to achieve the required target. The overall funding level could deteriorate leading to higher employer contribution rates. The fund will also fail to meet its responsible investment targets and maintain stewardship code signatory status.

The fund has participated collaboratively with partner funds and Brunel to support investment pooling. It has also participated in the government consultation on proposed changes to pooling and highlighted issues around conflicts of interest, as set out in a case study in this report. The uncertainly around the outcomes of the pooling consultation make this a major risk.

Following the introduction of Wiltshire Council’s new corporate risk management system, the Pension Fund has undertaken an exercise to align its existing framework with this new approach. This has involved maintaining the very engaged role managers play in assessing risks, whilst improving the scoring and assessment of risks.

The new approach has involved the Fund setting a risk appetite, using a 5x5 matrix to score likelihood and impact, and wording all risks in a standard way (cause, event, effect). This has improved the standardisation and assessment of the Fund’s risks. All risks are mapped to each of the Fund’s strategic vision goals, as set out in the Fund’s business plan, so we can assess the impact of risks on service delivery.

The process maintains a clear register of controls against each risk, ensuring risk owners document and complete key control processes. All risks are clearly linked to a risk area, allowing clear reporting across the Fund’s management and to the Committee and Pension Board. The outcome of this has been to further embed the management or risks and ensure clear reporting of risks to key decision makers, to inform effective decision making. 13

Robust processes, controls and risk management

As a Fund we are committed to supporting our employers to be advocates for the scheme, we want to ensure they have the knowledge and training to carry out their responsibilities in administering their employees’ pensions. The LGPS’s defined benefit structure means the financial risk rests with the employers, so their engagement and understanding are essential as they shoulder the financial implications. With our largest employers providing essential public services in the local area, the implications of poor financial management can be significant and may result in increased employer contributions and higher staffing costs which could limit the services they can provide.

The forum covered a range of topics, promoting their knowledge and understanding covering:

Funding level and investment strategy review

Pensions review and consultation process

Triennial valuation process

Data matters: unlocking the power of accurate data and auto enrolment

Insights from the Employer survey

The positive outcome from this session was that employers understood their responsibilities, and they understood how the Fund is working on their behalf. 100% of our survey respondents agreed that the event helped them in their roles.

Following the appointment of Redington as the Fund’s new investment consultant, they delivered training for the Committee on their risk management framework. Redington’s approach to monitoring and reporting risk was one factor in their appointment to work with the Fund.

The training session at the November Committee informed members on key risk metrics that will be used to monitor the Fund’s investment performance. The metrics cover investment returns, risk, liquidity and cashflow, sustainability and investment pooling. The outcome of the training was a Committee with a better understanding of risk monitoring for the Fund’s investments and knowledge of the new regular reporting they will receive to assess performance.

Climate Action 100 is an investor-led initiative to ensure the world’s largest corporate greenhouse gas emitters take necessary action on climate change. This initiative enables us to access information on key companies. We use this data when assessing our exposure to climate risk, in order to identify which companies we need to focus on.

We also support the Transition Pathway Initiative (TPI), which is a is a global asset-owner led initiative which assesses companies' preparedness for the transition to a low carbon economy. The TPI tool assesses progress against companies and sectors to measure the level management quality and carbon performance, to aid in risk assessment.

An outcome from using these initiatives is that we were able to use this data to help identify our Top 10 Emitters and therefore see where we are most exposed and use this information to conduct targeted engagement activities.

We aspire to be role models and leaders, through our commitment to develop knowledge and training.

We maintain focus on our core objectives, and work in a proactive and disciplined way, to promote simplicity and efficiency in everything we do.

Our fully embedded approach to risk management means that at all levels, from our Committee to our team, we understand our risks and are responsive to them. This supports our Committee in better decision making, and empowers our team to take ownership of risks. Throughout the year this has lead to a One Fund approach, where we have considered risks (and developed solutions) from multiple different angles.

Signatories review their policies, assure their processes and assess the effectiveness of their activities.

Funding Strategy Statement – reviewed every three years as part of the actuarial valuation, with external support and review from the Fund’s actuary.

Investment Strategy Statement – as above, with ad hoc amendments made as required, with external support and review from the Fund’s investment consultant.

Responsible Investment Policy – reviewed and updated annually, incorporating information and guidance from the Fund’s investment consultant, as well as thoroughly researched content from the internal investment team, and incorporating wider stakeholder views.

Stewardship Report – reviewed and updated annually by the Fund’s internal investment team, following feedback on the previous year’s submission from the FRC.

MARCH Responsible Investment Plan

QUARTERLY

Review of progress against actions

QUARTERLY

Review of progress against actions

SEPTEMBER Responsible Investment Policy

The annual review cycle illustrated above enables actions to be set in the RI Plan, which can then be investigated and incorporated into the next revision of the RI Policy. The Committee discusses progress against the Plan every quarter, which holds everyone accountable to completing actions and making progress towards ensuring the approach is up-to-date and taking account of all new information in the wider industry. This also embeds a continuous assessment of how effective our approach has been, with a quarterly recommendation to our Committee to discuss whether any new actions need to be added to our Plan.

Our investment consultant, Redington, have been appointed in part based on their expertise in the area of responsible investment and provide a dedicated Responsible Investment Specialist. This oversight provides assurance around the robustness and appropriateness of our approach. We also reflect on the feedback provided by the FRC each year on our stewardship submission and update the following year’s report accordingly. We also rely on in-house expertise from our investment team and peer group comparisons. The outcome of this well-rounded process is that we have sufficient broad knowledge to be assured that our approach is proportionate and ambitious.

In November 2024 the Fund appointed a new investment advisor, Redington. They will provide consultation support on our investment strategy, implementation of the Fund’s responsible investment plan, how the Fund can invest in nature positive assets and continue to build on our UK impact. Their appointment following a competitive tender process will ensure the Fund receives the best support to be as effective as possible.

Redington’s skills and approach to investments strongly align with the aspirations and investment goals of Wiltshire Pension Fund. Philosophical alignment between asset owners, such as WPF, their investment advisers and managers is critical to ensuring meaningful impact and sustainability is embedded at every stage of the investment process. Throughout 2025/26 we will be working together on the upcoming investment strategy review and the implementation of the Fund's responsible investment plan, particularly regarding how we will invest in nature positive assets and continue to build on our UK impact.

The outcome of this new appointment is that the Fund is set to deliver the best investment strategy to reflect the needs of our members and employers.

The investment team are continually looking at ways to improve their processes and ensure compliance with regulations. The Pension Regulator recently (TPR) introduced a new single code of practice for pension funds, which sets out the expectations of processes that will be undertaken. To ensure compliance with these regulations the investments team undertook a review of the requirements and looked for any areas of improvement.

The outcome of the review was that further documentation of the processes and controls that are already in place are required. This will strengthen the controls and resilience of the team’s investment approach.

Robust processes, controls and risk management

As part of our commitment to transparency and information sharing , the Fund already reports on all equity holdings each quarter. Following the success of this reporting, to further the sharing of information for members and employers, the Fund has added information on its fixed income holdings to its quarterly report

The additional information is summarised in an accessible manner to allow stakeholders to see how the Fund is invested by industry, geography and company. We will monitor engagement with this information and assess the impact it has on improving transparency and information sharing.

Transparency and information sharing

By regularly reviewing our policies, and incorporating input from specialist advisers, qualified members of the team, stakeholder views, and wider review of peers, we are able to ensure that our policies are up-to-date, and that we are considering all relevant issues. Quarterly review of progress by our Committee ensures that we are held to account, assessing our effectiveness and our constantly evolving our approach. Our inclusive team culture means that ideas for development and/or stewardship actions are welcomed from everyone, and this diversity of thought leads to better decision making.

Signatories take account of client and beneficiary needs and communicate the activities and outcomes of their stewardship and investment to them.

As covered under Principle 1, WPF is part of the LGPS, a defined benefit pension scheme. We are responsible for the pensions of c.86,000 members across c.180 employers.

Total membership of the Fund as at 31 March 2024 was 85,739 (24,569 active members, 39,041 members with deferred benefits, and 22,129 pensioner members).

What we invest in

The Fund maintains a ~£3.5bn portfolio of assets, managed by a range of managers across diversified asset classes and geography. Full information can be found in the Annual report and accounts

Our time horizon is modelled as part of the triennial actuarial valuation process. Our projected cashflow stretches over 100 years. In practice, with the scheme open to new entrants and future accrual, this time horizon will continue into perpetuity.

How we consider what our beneficiaries need

1

Stable and affordable contributions

4

Employers are advocates for the scheme

8 Members understand their benefits

Our Strategic Goals help us to focus on what we need to do to achieve our Vision. Through our stewardship activities, we focus mainly on the goals highlighted above. We want to ensure that our investment strategy is designed to deliver stable and affordable contributions for our employers, and through stewardship activities we can protect against risk and deliver better risk-adjusted returns, which supports this goal. We also want to provide our employers with the information and tools they need to act as advocates for the scheme, which will deliver better outcomes for our members. Our members need to understand their benefits, and also how the money held to fund their pensions is invested. This will help deliver a positive impact to our members, supporting their financial future and delivering what they need at significant moments in their lives. Our goal of transparency and information sharing further supports us in achieving these desired outcomes

We always act with the long term in mind, whether we are setting our investment strategy, planning improvements, or working towards our net zero by 2050 goal

12 Positive impact

15 Transparency and information sharing

We communicate with all our stakeholders in a clear, concise, relevant and effective way

In order to check-in with our members and employers and find out what information is going to support them the best, we have to ask them. We have carried out various surveys of both our membership and employers to ask these questions. In these surveys we ask:

What issues are important?

What topics are most interesting and useful?

How do they want to receive information?

What can we do to support them?

WE ASSESS Are we being effective and delivering the desired outcomes?

WE ASK What do our members and employers think?

WE LISTEN What do they want to know about, and how do they want to receive information?

WE RESPOND what can we do to provide our members and employers with what they need?

We analyse the information received and put together an action plan. Then, once the actions have been carried out, we assess how effective this has been – this could be via direct requests for feedback, or through reviewing data (email opens, clicks, web visits, self-service portal logins etc). This feedback and/or data will help inform our approach going forward.

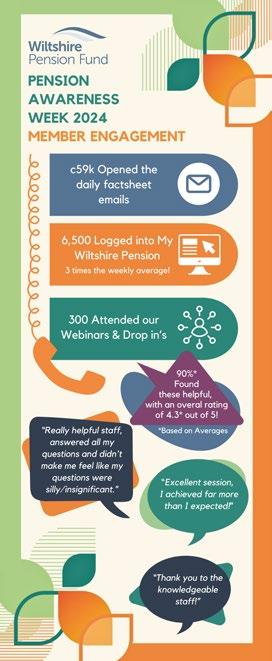

For PAW this year (Pension Awareness Week 2024 - Wiltshire Pension Fund), we wanted to build on the fantastic engagement with our members which was achieved in 2023.

Our goal is to help our members understand and connect with their pensions

To further support our members to understand their pension, we provide them with useful tools and information to enable them to plan their financial future. Over the week we sent out a series of factsheets to our members, with a focus on improving their understanding of their pension benefits and how they can use this to safely plan their financial future. In a tough financial landscape, there is a risk that we may see more members opting out of the scheme and we believe that a better understanding of the benefits will support members in making the best decision for their personal circumstances.

To further improve engagement and to connect in a more personal way with members, the team ran a series of in person drop is sessions and online webinars.

8

Members understand their benefits

The outcome from PAW was that we achieved a wide reach with our messaging, seeing c.59k opening the daily factsheets, 6,500 members logging in to check their pension details (x3 the weekly average) and 300 members attending our webinars and drop-in sessions.

Voting is a key tool for the Fund to enact its stewardship responsibilities on behalf of members and employers. With such a large portfolio of stocks, resulting in a significant number of votes being cast each year, it is important to communicate effectively how we have voted. To do this, the Fund produces a concise quarterly voting report which is shared with the membership and Committee to show how votes have been cast.

To make these reports engaging, relevant case studies are selected to highlight topical or priority engagement areas. We have improved these case studies by ensuring we always include the outcome of the vote. It is one thing stating how the Fund voted on a proposal, but it is more important to understand if this has had the desired outcome. On many shareholder proposals we have found that our vote is often in the minority, providing us with matters to follow up or engage further with investment managers on our behalf. Outside of certain shareholder proposals, in the vast majority of votes the Fund is in support of management.

Our approach to sharing voting data and case studies ensures our members and employers can see how we vote on their behalf, and importantly see if the vote has had the intended outcome.

As a Fund, our vision is “to deliver an outstanding service to our scheme employers and members”. Part of doing this effectively is understanding who they are. Our employer organisations are predominantly located in Wiltshire, interestingly, the same is true for our members:

Analysis of our membership data shows that 90% of the Fund’s members live in the South West of England, with 84% living in Wiltshire. A statistic that initially surprised us and inspired us to delve a little deeper into how much of the Fund is invested in the County.

84% of our members live in Wiltshire

We are delighted to showcase several investments within our portfolios which our managers have selected as compelling opportunities right in our own backyard. These investments include two solar farms, which are part of our £100m commitment to renewables in the South West. Other investments include two affordable housing developments (one of which is well underway and other which will be breaking ground soon) and a care home. These investments benefit our local community whilst also providing financial returns in line with our overall strategy.

Our surveys of employers and members have indicated that both groups have a strong preference for short communications via email which they can digest in their own time, as well as information on the web. This is therefore how we focus the bulk of our communications. During the year, we published the following documents:

Investing in the UK

Action on Climate Change – One Pager

Annual Report, mini-magazine and one-pager

Responsible Investment Policy

Climate Report and one-pager

Affordable Housing Impact Report

Stewardship Report and mini-magazine

RESPONSIBLE INVESTMENT POLICY

CLIMATE AND NATURE REPORT

These reports are written in a style to communicate effectively to our members and employers. They also fulfil our statutory obligations and demonstrate our approach to best practice in reporting within the industry.

In 2024 we were thrilled continue our award-winning approach, building on previous award successes. This year the Fund collected awards at a range of national pension industry events recognising excellent work across the Fund.

The Fund collected the following awards and commendations:

Diversity and inclusion

Promotional Initiative of the Year

Our commitment to Equality, Diversity and Inclusion (EDI) is not just a pledge it's embedded into our culture at all levels, from our Values to how we have created specific and measurable EDI targets across various facets of our operations including teams, governance, investments, and customer areas.

We are also thrilled that #LGPSJobs won Promotional Initiative of the Year, this was a campaign from Border to Coast Pensions Partnership which we were delighted to collaborate on to help promote career opportunities in the LGPS.

This award recognises our climate opportunities portfolio — a multi asset portfolio which enables us to both invest in and benefit from the transition to net zero. This portfolio helps us achieve our net zero goals, earn competitive returns, and align with the views of our scheme members.

Pensions for Purpose Award Winners

Best Biodiversity Statement

Pensions for Purpose Award – Highly Commended

Best Climate Change Policy

Best Place-Based Impact

Our submission for the winning award was our Biodiversity Statement, contained within our Climate and Nature Report, which also outlines our journey to net-zero, how we are doing, engagement activities, case studies and more!

Professional Pensions

Rising Star Award Winner – Krystie Waterhouse (Communications and Stakeholder Engagement Lead)

IPE Awards

Stewardship Campaign & Strategy

Being actively engaged in national industry awards, comparing ourselves to other high performing pension schemes, supports the Fund to achieve the outcome of delivering an outstanding service to its scheme members and employers.

Through a programme of engagement, we understand what our members and employers want to know, what is important to them, and how they want to receive information. We are responsive to feedback and work creatively to communicate stewardship and responsible investment activities and outcomes in effective ways. We have received industry recognition for our communications efforts.

Signatories systematically integrate stewardship and investment, including material environmental, social and governance issues, and climate change, to fulfil their responsibilities.

Responsible Investment Policy

We are constantly evolving our approach to responsible investment and have set ourselves a goal to be an example of best practice in this area.

Our dedicated Responsible Investment Policy, updated annually, brings all information on the Fund’s responsible investment activities into one place and promotes transparency and engagement with stakeholders. This includes our climate change action plan.

Our fully integrated approach

We integrate responsible investment issues across the whole investment process:

Investment Strategy Statement (ISS)

Strategic Asset Allocation (SAA)

Monitoring of managers and the pooling company

Stewardship and engagement

Internal reporting and accountability

Reporting externally

Stakeholder engagement

Our fully integrated approach

We believe that the best approach is to focus on priority ESG issues, since research has shown that this can generate the largest positive contribution to returns and is also a practical approach considering resource limitations.

The Committee has used the United Nations Sustainable Development Goals (UN SDGs) as a framework to prioritise issues for engagement activity. This prioritisation was assessed through a series of workshops supported by Pensions for Purpose, and subsequent debate at a Committee meeting. Issues for priority engagement are as follows:

Climate (SDGs 13, Climate Action, and 7, Affordable & Clean Energy)

Economic growth (SDGs 8, Decent Work & Economic Growth, and 9, Industry Innovation & Infrastructure)

Education (SDG 4 Quality Education)

As well as working with the Committee, we always focus on which stewardship priorities will have the biggest impact on our returns, bearing in mind our long-term investment horizon and the opportunity to enact change over a longer timeframe. We look to a variety of sources to form this view. These sources could include industry research, the largest financial risks as identified by the World Economic Forum, our own climate scenario modelling, consultant views, and many more. We also ask our members and employers what their priorities are – this by itself would not be enough to set a new priority, but it certainly delivers the outcome that we ensure we communicate with members and employers about issues that are of most interest to them.

Another way to summarise our priorities is through an ESG lens:

G = GOVERNANCE

We communicate our priorities to our managers every year, through circulation of our Responsible Investment Policy, and we specifically ask our managers to acknowledge our Policy and confirm to us that they will invest in line with it. When selecting new managers, being able to align with our RI Policy is one of the key hurdles that must be passed in order for a manager to be investable. This delivers the outcome that our managers are aligned to our approach.

Integration of stewardship across different asset classes and geographies

The graph shows a very high-level indication of the split of our investment portfolios by geography. Although geography does have an impact (such as the level of risks or data availability for certain ESG factors), asset class is a larger determinant of how we adapt our approach to stewardship and engagement. Brunel's Stewardship Policy outlines the integration across all asset classes in more detail. An example of how we have considered our long-term investment horizon in our approach is our philosophy on emerging markets – we believe it is better to remain invested and earn strong returns by helping to drive real World change, rather than divest and see an immediate benefit to our carbon footprint.

Biodiversity is rapidly gaining attention as an area that investors should be considering. The World Economic Forum’s Risk Report 2024 puts “Biodiversity loss and ecosystem collapse” as the 3rd biggest economic risk facing the world over the next 10 years. The UN has published a report into this area, entitled “Stepping up on Biodiversity, what the KunmingMontreal Global Biodiversity Framework means for responsible investors”.

Our net zero by 2050 target and wider investment beliefs mean that this is an area where we need to take action. This deep dive case study shows how we have been considering biodiversity and nature through a number of different lenses, both looking inward at our own holdings and engaging with the industry more widely.

We approach biodiversity risk in the following ways:

We are developing our use of frameworks such as TNFD to support us in our understanding of this area.

We are working with the Brunel pool and our legacy managers to understand where we are exposed.

Our strategic allocation to renewable infrastructure and climate solutions has the scope to contain nature-related investments, providing the opportunity to earn competitive financial returns whilst also delivering positive impacts to nature.

We are focusing on the high-impact sectors of agriculture, food & drink and construction in terms of our current holdings.

Our stewardship efforts will focus on the 5 main drivers of biodiversity loss.

We have investigated the high impact sector of food systems:

With biodiversity loss and ecosystem collapse being recognised by the World Economic Forum as one of the biggest economic risks facing the world over the next decade, food systems companies, such as Nestlé, Kerry Group, Mondelēz, and Danone (companies which Wiltshire Pension Fund has holdings valued at £7.6m, £2.4m, £593k, and £2.4m respectively in), have released biodiversity policies and/or statements in response to the increased focus on biodiversity and in recognition of the fact that their businesses are reliant on a more resilient, and therefore diverse, ecosystem. As the World Wide Fund for Nature outline, “food systems are presently the biggest driver of environmental degradation and biodiversity loss” causing “70% of all biodiversity loss on land and 50% in freshwater”. This is why we’re pleased that all four of the companies previously mentioned, which are our largest holdings in the “Packaged Foods & Meats” industry, have made commitments to promote biodiversity - mostly through regenerative agriculture, which broadly aims to improve soil health, preserve/create habitats, and sequester carbon. However, with so few companies having quantified company-wide targets for regenerative agriculture, and even fewer having targets in place to financially support farmers in deploying regenerative practices according to FAIRR, we’d like to see more companies put firm quantifiable targets in place to promote biodiversity through practices such as regenerative agriculture.

The United Nations’ sixteenth Conference of the Parties (COP16) on biodiversity took place in Cali, Colombia in October 2024. The number of businesses and industry delegates who registered for the conference more than doubled versus the previous conference in 2022 to >1,200, making COP16 the largest UN nature conference yet.

Some important discussions took place, such as those regarding the Digital Sequencing Agreement (DSA). This agreement is designed to call for contributions of 1% of profits, or 0.1% of total revenue, from companies who use genetic information sequenced from the natural world (digital sequence information (DSI)) in the development of the products that they create and sell. It is suggested that this measure could raise up to $1bn annually. The money raised would be paid into the “Cali Fund”, which would focus on conserving biodiversity.

Some other highlights from the conference included an agreement on the establishment of a body which seeks to include indigenous peoples in discussions on the Global Biodiversity Framework (GBF). The aim is to provide indigenous peoples, who’re often the most immediately affected by deforestation, climate change, and reductions in biodiversity, with a voice on matters of conservation.

Nature Action 100 announced its Company Benchmark, which “assesses corporate progress toward key investor expectations on nature”. The initial results suggest that “most of the initiative’s 100 companies are in the early stages of addressing their nature-related impacts and dependencies” and that more urgent progress is needed to mitigate the growing risks that businesses face as a result of nature loss. This is a tool that the fund will make use of to assess key holdings.

In summary, while some good progress was made, especially with regards to the inclusion of indigenous peoples in discussions on the GBF, overall progress was somewhat lacklustre. While it’s promising to see some progress and an increase in interest in the conference, you’d be forgiven for feeling that more serious buy-in and a greater sense of urgency is needed.

In November 2024, we were honoured to be invited to St James's Palace for the launch of the Circular Bioeconomy Alliance, an initiative which was established by His Majesty King Charles III to support and enable more investment into nature-based solutions. Sitting with other investors, asset managers, companies and influential individuals, we heard inspirational talks about how nature can be embedded in investment strategies, as well as hearing directly from companies about their nature-positive initiatives. At the end of the event we were privileged to meet the King himself, who’s passion and enthusiasm for this topic was self-evident. This uplifting event showed that there is a way forward for investors to deploy capital in a nature-positive way, without compromising on returns.

We participated in the Pensions for Purpose report: Integrating nature & biodiversity into investment – an asset owner perspective

We were able to share the progress we have made on integrating Bio-diversity and nature related considerations into our Fund.

The outcome of the report showed that data on these topic is a major concern, as asset owners argue metrics related to nature are more complex and challenging to interpret than those related to climate change. Assessing investments on a case-by-case basis is important too, as a single simplistic measure may not capture the full complexity.

By being involved along with other pension Funds we hope to be able to support the development of this new area of reporting and investing.

International recognition of the economic risk associated with Biodiversity loss is growing, as a pension Fund with a long term investment horizon this is important. Our engagement in industry events is helping to focus attention on this important area. By using new tools and metrics on biodiversity loss, and participating in relevant initiatives, the Fund aims to better understand the impact of its investments on biodiversity and the risks involved.

We are consistently improving our ways of working. This means developing, with the assistance of Brunel and our other investment managers, how we report on our approach to responsible investment in different asset classes, such as private debt, where Environmental, Social and Governance (ESG) integration receives less focus compared to listed markets.

To better understand the integration of this approach in our Private Debt Portfolio, 7.5% of the Fund’s value (c£200m), we interviewed Nick Gray, Portfolio Manager from Brunel. This portfolio is focused on lending money directly to companies in Europe and North America. The loans are secured against assets of the companies, offering protection in case things go wrong, and the opportunity to deliver suitable investment returns.

The following responses highlight how integrating ESG as a risk management tool in the private debt portfolio supports better investment outcomes.

How do you incorporate ESG factors when constructing a Private Debt portfolio for your RI conscious LGPS clients who have long term investment strategies?

At Brunel, ESG isn’t just a box to tick – it’s central to our investment process. Every new opportunity goes through rigorous due diligence, and as a manager-of-managers, we pick partners who meet our high standards. Specifically, we look at six areas: ESG commitment, integration throughout their processes, measurable targets, transparency, DEI strategies, and climate action.

What areas of best practice are you looking for from private debt managers when selecting them for the strategy? What behaviours would be red lines for appointing an investment manager?

We look for managers with a solid track record: clear policies, active engagement , and transparent reporting. Red lines include weak or non-existent ESG commitment, poor transparency, or any links to harmful environmental or social activities. We also require carbon emissions reporting and expect our managers to encourage portfolio companies to set science-based targets.

Can you provide us with an example of best practice of ESG integration you have seen in the private debt portfolio, and what positive outcomes it generated?

A great example is a private higher education provider in France. With one of our European lenders, they arranged an ESG-linked loan tied to corporate social responsibility targets – hiring a CSR (Corporate Social Responsibility) manager, improving gender diversity in leadership, offering student scholarships, and enhancing cybersecurity. The results included reduced costs, happier employees, and a stronger reputation – benefiting both society and investors

We are pleased to see how ESG criteria is being applied throughout the investment process. Regardless of asset class, we believe there is a strong case for decision making that incorporates a responsible investment outlook to ensure we protect our assets and long-term strategy.

ESG isn't just a buzzword –it's essential to spotting hidden risks that traditional analysis might overlook. Integrating ESG helps us to gauge an investment's long-term resilience.

NICK GRAY Portfolio Manager, Brunel PP

Our approach to stewardship and responsible investment is fully integrated, and this enables us to apply our priorities across all asset classes and geographies, adapting our approach as appropriate. Our stewardship priorities and activities are clearly aligned to our fiduciary duty and vision, and we use our long-term investment horizon to enact these priorities and deliver positive outcomes for our beneficiaries.

Signatories monitor and hold to account managers and/or service providers.

We hold quarterly meetings with our asset managers (including the Brunel pool) and report on the outcomes of these meeting to the Pension Fund Committee each quarter. The Committee will also bring in investment managers to challenge them on any specific issues if they have concerns.

Our fully integrated approach

We monitor financial performance, but more importantly we are concerned that a portfolio is performing in the way we would expect given the manager’s established strategy and what has been going on in the relevant markets. We also need to understand what stewardship work managers have been carrying out on our behalf, and how well they are responding to topical issues and current events. As well as the regular review meetings, we carry out ad hoc pieces of work to gain assurance that managers are properly stewarding our assets and acting in line with their mandates. This can involve activities like researching case studies or conducting site visits (please see case studies below). An additional positive outcome from this work is that we can write up our findings and share them with our stakeholders to help bring our investments to life.

Investment Consultant monitoring

In line with the CMA Order (Investment Consultancy and Fiduciary Management Market Investigation Order 2019), we set our investment consultants objectives and conduct an annual appraisal against these objectives.

In December 2024, Wiltshire Pension Fund's team had the opportunity to visit Space Forge – a UK based company in our venture capital fund with World Fund which sits in our Clops portfolio. Space Forge is an innovative in-orbit manufacturing company that produces high quality materials and specialises in low impact landings. By utilising space's unique environment, they can create manufacturing conditions that are impossible to replicate on Earth. The aim of the visit was to gain a deeper insight into their net-zero manufacturing technology.

The Team visited Space Forge's site in Cardiff, Wales, and were welcomed by CEO Joshua and CTO Andrew. The team were given a tour around their lab and workshop where Space Forge's flagship satellite – the ForgeStar – is being developed. ForgeStar is a reusable satellite designed for manufacturing materials for semiconductors and pharmaceutical industries. The unique conditions in space, such as the extreme temperature ranges and zero gravity, produces materials of the highest purity.

Our investment in Space Forge via World Fund contributes to our Clops strategy by reducing industrial carbon emissions while generating strong returns. In essence, Space Forge endeavours to reduce the amount of energy society consumes by revolutionising the materials the modern world relies upon.

The visit to Space Forge is part of our process of holding investment managers to account. It gives us an opportunity to explore whether the investments being made on our behalf are in line with the investment strategy and to test, beyond a report, that they are making the real-world impact reported. We were pleased that the site visit reaffirmed the rationale behind World Fund's investment and is an exemplary example in our innovative Clops portfolio.

We were able to write this up as a news article to share with our stakeholders, (Space Forge Site Visit – Wiltshire Pension Fund). We are proud to be investing in UK based companies which support a global transition and drive technological innovation without compromising financial returns.

Just an hour's drive from our offices is one of the 11 developments within the UK Community Housing Fund managed by Man Group, to which we have committed £30m as part of our Affordable Housing Portfolio. We were thrilled to see first hand how Man Group has been helping to deliver energy-efficient homes that make a real difference for the future residents.

During our initial briefing we learned that the total development will offer 2,500 homes, of which Man Group have funded 108, of which all are being offered on affordable tenures or shared ownership in an area where new rented supply has not been offered since 2020.

All of these homes increase the supply of local affordable homes, above those required by planning authorisation. These are also meeting high demand locally with forecasts showing population growth increasing, which is evident as homes are selling as soon as they are being completed.

After our briefing we went on to view one of the show homes, where the energy efficiency was immediately felt with the warm welcome from the cold outdoors. Whilst looking around the 2- bedroom show home, the site manager explained that each home is constructed within 20 weeks, reducing both build time and carbon footprint through pre-insulated panel construction. Rated EPC A (i.e. the highest rating for energy efficiency), these homes are both sustainable and quick to build.

The site visit is part of our process of holding our investment managers to account, to really understand the investments being made on our behalf. Importantly to ensure they are in line with the investment strategy.

On this visit we were pleased to hear how Man Group has driven energy efficiencies in the homes, embracing initiatives that show a commitment to both investment returns and resident well-being.

We were able to publish this site visit as a news article to inform our stakeholders about the investments we are making. (UK Community Housing: increasing the supply of energy efficient affordable homes in the local community – Wiltshire Pension Fund)

Wessex Gardens is a collaboration between six LGPS Funds with Schroders Greencoat, this fund is dedicated to accelerating the development of renewable assets across the South West of England. The first investment in Wessex Gardens completed in January 2024, the largest operational solar transaction in the UK acquiring the Toucan Energy Portfolio. Wiltshire's share of this investment was £70m.

The largest single site in the portfolio, and one of the largest in the UK, is based in Wroughton, in our very own county. With the site being in our backyard we jumped at the chance to visit and understand how it will generate sustainable returns for the Fund into the future. This also meant we were able to invite more of the team along as part of our shadowing scheme, promoting our value of One Fund. We were also joined by some of our Committee including our chairman, to enhance their understanding how this enormous site provides sustainable power and investment returns.

The site covers 88 acers with 200,000 solar panels generating 60MW of power, which is enough to power 21,000 homes. We were shown the essential equipment which makes a solar farm work and had the investment return characteristics for this site explained. Providing assurance on the role it plays in delivering a secure, inflation-linked source of sterling income, which is a great match for our liabilities, with the return anticipated to be around 8%.

By visiting the site in person, we are better informed on the impact of such a solar site and able to ask better questions, to hold our investment managers to account. Our visit was a perfect way to learn more about our investment and ensure that Schroders Greencoat are delivering on their investment mandate.

The launch of ChatGPT in 2022 sparked an AI revolution, with companies like Microsoft, Amazon, Apple, Alphabet, and Meta investing heavily in this space. Wiltshire Pension Fund holds positions in all these companies, reflecting the rapid growth of AI-driven innovation.

AI’s hidden cost? Energy consumption. An average ChatGPT query requires 10x the electricity of a Google search, and data centre power use could double by 2026, largely due to AI. Companies like Google & Microsoft are already reporting rising emissions.

Can AI become more sustainable? Solutions are emerging! From analogue computing to nuclear-powered data centres, tech giants are exploring ways to curb AI’s energy hunger.

As part of our award-winning Climate Opportunities portfolio, Wiltshire Pension Fund is backing a project which is focusing on improving cooling, reducing energy use and CO2 output by up to 50% versus traditional air-cooled data centres.

Balancing AI’s potential with sustainability is critical. AI could help cut 10% of global emissions by 2030, but we must ensure its environmental impact is managed. That’s why Wiltshire Pension Fund will monitor and engage with our AI-invested companies to push for lower emissions– aligning with our goal of net zero by 2050.

By investigating this topic, asking our investment managers for their views, and publishing our findings, the Fund is better informed of the sustainability issues facing some of largest company holdings in the fund's portfolios. This also enables the fund to gain assurance of the approach of our investment managers. The outcome for the Fund is a better understanding of our investments and the key themes affecting their success and sustainability.

The work we do to monitor our managers is both disciplined and innovative. We identify the important factors that will ensure the managers are meeting our stewardship and investment priorities and develop bespoke approaches to gain the assurance that we need.

Our engagement policy is set out in our RI Policy. This explains who we engage with, and the scope of our work. Our engagement policy applies to all portfolios and all asset classes. The Fund’s relationships with the underlying holdings in the investment portfolios are set out as follows:

Where portfolios are held through the Brunel pool (currently >70% of the Fund), Brunel appoint investment managers to manage the portfolios. Where assets are still managed locally, the Fund has appointed its own investment managers, referred to as “legacy investment managers”.

As shown in the diagram, the Fund has no direct relationship with the underlying holdings in either scenario. Engagement with the underlying holdings is delegated to the legacy investment managers and Brunel, who are all provided with the Fund’s Investment Strategy Statement (including the RI Policy), so that they can ensure alignment in their approach.

The Fund’s own engagements do not currently extend to direct contact with the underlying holdings. The type of engagement work we carry out ourselves is with the managers, as described under Principle 8.

Brunel has appointed Federated Hermes EOS as the engagement and voting services provider. The appointment enables a wider coverage of assets and access to further expertise across different engagement themes. For full transparency, the Fund publishes its voting and engagement activities on its website on a quarterly basis.

Shareholder activism and engagement in equity markets are well understood topics that garner a lot of attention. This has increasingly become the case as investors now have access to more information about companies’ activities and their environmental, social and governance (ESG) scores, and the public have become more conscious of the impact that companies have on the world around them. However, the topic of if and how lenders engage with debtors in credit markets is less discussed, so we spoke with PineBridge, who manage a portfolio of leveraged loans for Wiltshire Pension Fund, to find out about how they’re engaging with debtors on ESG issues.

PineBridge’s approach

PineBridge are focused on constructive engagement with the issuers that they invest in. This means fostering a relationship that enables an open dialogue with issuers regarding improving ESG practices, risk management and the development of sustainable business practices. PineBridge’s engagement activities are generally centred around three ESG themes: limiting global warming to 1.5°C (in line with the Paris Agreement); diversity, equity and inclusion; and human rights issues. These engagement efforts are based on the understanding that ESG factors can impact the long-term financial health of an issuer. By managing ESG-related risks, PineBridge aims to preserve or enhance the long-term value of its investments.

PineBridge provided us with an example of one of their debtors, a well-known cruise line, which was receptive to their engagement efforts. The cruise line in question operates in some of the most beautiful destinations around the world. However, cruise lines in general are well known for being heavily reliant on fossil fuels and producing considerable waste from their operations. PineBridge engaged with the company on some of these concerns and found management to be receptive to their engagement, with the cruise line outlining their aspiration to be “net carbon neutral by 2050, with interim goals by 2030”. The company explained that their roadmap includes fleetwide upgrades to improve fuel efficiency, investing in port/ destination projects and taking delivery of Liquified Natural Gas (LNG) powered ships.