LET’S TALK ABOUT

OCTOBER 2025 EDITION

After 1.13M+ views of our Egypt issue, we’re turning the spotlight on the Kingdom.

INSIDE THE EDITION: Exploring a Nation in Transformation

• Economic Modernisation & Vision 2030

• Tourism Growth & Mega Projects

• Energy, Construction & Logistics

• UK–Saudi Trade & Export Opportunities

WHY GET INVOLVED NOW?

Organisations have the opportunity to secure premium positions for advertising, feature articles, and case studies – ensuring maximum visibility when the edition launches in October.

The Arab British Chamber of Commerce was honoured to welcome esteemed guests comprising several diplomats, senior business executives, representatives of ABCC members from various industries and other respected guests to our Summer Reception held on the evening of Thursday 7th August.

The event, which saw the Boardroom and terrace at our Mayfair premises filled to capacity, was a particularly special occasion this year as it marked the Chamber’s 50th anniversary. For five decades, the ABCC has been delivering on its mission of fostering Arab British trade, investment and friendship, bringing people together to create new business opportunities and strengthen friendship across the continents.

Everyone who gathered at the convivial event were keen to share

in the celebration of the ABCC’s valued role in forging economic, commercial, and cultural ties between the UK and the Arab world.

Guests were warmly welcomed by Mr Abdeslam El Idrissi, Deputy CEO & Secretary General of the ABCC, who spoke of the Chamber’s achievements over the decades and alluded to recent successes such as the Arab British Economic Summit (ABES 2025). Mr El Idrissi invited everyone to enjoy the evening and thanked them for showing support for the work of the Chamber.

Guests enjoyed one-to-one discussions and meaningful networking in a relaxed atmosphere on what turned out to be a very pleasant summer’s evening. Delicious Moroccan cuisine, canapés, and refreshments, prepared by ABCC member, Maison-Chef, were eagerly devoured.

The ABCC expresses its gratitude to all who joined us in marking this important milestone half century of service and for continuing to support our shared vision of building partnership and prosperity.

Wednesday 3rd September

This online course explores export documents by taking a practical approach to why and when documents are needed. It covers the background, uses and key information requirements for different documents.

Course content:

• Why are documents required to export goods?

• Standard Export documents

• Invoices

• Packing List

• Transport Documents

• Essential pieces of information required on a commercial invoice.

• Using the correct commodity codes and incoterms on documents

• What is a certificate of origin and the difference between a non-preference document and a preference document

• Origin statements explained for export documents

• Documents and VAT including proof of export

• Customs documents

• The importance of keeping a full audit trail of documents for each export

• Sources of Information

TO REGISTER VISIT

Who should attend?

This course is suitable for companies new to international trade as well as experienced companies who may want to refresh and update their knowledge. It is especially beneficial for staff who work in export sales, purchasing, logistics, accountancy, import and export shipping departments, customer services, import and export administration.

https://abcc.glueup.com/event/153699/register/

Total trade in goods and services (exports plus imports) in the four quarters to the end of Q1 2025 compared to 2024.

Algeria

Bahrain

Comoros

Djibouti

Egypt

Iraq

Jordan

Kuwait

Lebanon

Libya

Mauritania

Morocco

Oman

less than

£2.5 billion 4.7% increase

£1.0 billion 14.5% increase

£1 million no notable change

£34 million decrease of 27.7%

£4.7 billion an increase of 1.0%

£1.1 billion an increase of 0.2%

£1.2 billion decrease of 7.1%

£6.2 billion an increase of 9.3%

£654 million decrease of 7.6%

£2.8 billion increase of 34.6%

£187 million increase of 53.3%

£4.4 billion increase of 16.4%

£1.6 billion decrease of 4.6%

Palestine (Occupied Palestinian Territories)

Qatar

Saudi Arabia

Somalia

Sudan

Syria

Tunisia

United Arab Emirates

Yemen

£52 million no notable change

£5.6 billion decrease of 25.9%

£15.1 billion decrease of 11.3%

£72 million increase of 75.6%

£96 million increase of 35.2%

£6 million increase of 500.0%

£766 million increase of 7.6%

£23.8 billion increase of 3.6%

£38 million decrease of 13.6%

Source: Trade & Investment Factsheets, Department for Business & Trade, 1 August 2025

We extend a welcome to our new members and look forward to working with them in the coming year.

Algerian Chamber of Commerce & Industry (CACI)Platinum

Al-Bilad Consulting and Solutions Company

OHeeBA

Aston Hub Ltd

2KR Holdings Limited

Essex Industries Limited

IPI Consulting Ltd

EDALIA STUDIOS LTD - Gold

Privé Lifestyle Management

Pear Tree Capital Ltd

Wuthqa Professional Consulting

Unbiased Independent Financial Advisers Ltd

Q Apartments (UK) Ltd

GOOD LAW INTERNATIONAL LTD

Radwa Food Co LtdPlatinum

Resicare Alliance Sandstone Tax

Country Name: Hashemite Kingdom of Jordan

Capital: Amman

Total land area: 88,780km²

Borders: Syria, Iraq, Saudi Arabia and Palestine

Coastline: Gulf of Aqaba (26 km)

Population: 11,734,000

GDP Growth: 2.9% (2025, IMF forecast)

Currency: Jordanian Dinar (pegged to US Dollar)

Natural resources: phosphates, potash, Oil Shale

Agricultural produce: tomatoes, chicken, dairy/milk, potatoes, olives, cucumbers, onions, peppers, peaches and nectarines

Industries: High value industries are in manufacturing, mining and agriculture & food security.

Other industries: Tourism, IT, clothing, fertilisers, potash, phosphate mining, pharmaceuticals, oil refining, cement, light manufacturing and chemicals

Exports: fertilisers, garments, phosphates, jewellery, phosphoric acid

Export partners: USA, KSA , India, Iraq, Freezone and UAE

Imports: mineral products, machinery, vehicles, chemical products, vegetable products

Import partners: China, KSA, UAE, India, USA

The Hashemite Kingdom of Jordan, strategically located at the crossroads of Asia, Africa and Europe, enjoys a close and long enduring relationship with the UK.

Jordan’s geographical features consist of the eastern desert plateau, where average elevation is 3,000 feet; while in the west, mountains rise to 5,700 feet; meanwhile, at the Dead Sea, land drops to the Earth’s lowest point of some 1,300 feet below sea level.

The country is located at the head of the Gulf of Aqaba which it shares with Egypt and Saudi Arabia, and which provides Jordan with vital access to global maritime trade routes as well as being an asset for important tourism opportunities.

Jordan is renowned for its stability, business-friendly environment, keenness to attract inward investment, and its highly skilled workforce, with an around 97% literacy rate.

Jordan has long been committed to developing its human capital to realise the full potential of its citizens, and it actively embraces cross sector innovation, which results in a vibrant economy that is increasingly diverse and open to foreign involvement. The national economy boasts many strengths, with key activities found in the service sector, mining, manufacturing, and tourism, all of which make significant contributions towards GDP and support local employment.

Speaking at a roundtable hosted by the ABCC in May 2025, Mothanna Gharaibeh, Jordan’s former Minister of Investment, spoke about the country’s diverse capabilities and major assets including its exceptional engineers and technicians. He further explained how Jordan provided investors with access to global markets of $50 trillion GDP because if its favourable free trade deals with international partners such as the UK.

Many leading international IT corporations were located in Jordan attracted by incentives that enable companies to thrive as manufacturers and exporters, the minister said. Minister Gharaibeh outlined the country’s vision to create one million new jobs to be achieved in partnership with foreign investors, such as the UK.

Some ambitious mega projects in sectors as varied as transport, infrastructure, gas fields and renewable energy were highlighted. Jordan was becoming more diversified and was seeking to become a centre for high value manufacturing as well as a hub for pharmaceuticals. Jordan was also positioning itself to make a major contribution towards the reconstruction of Syria, the minister told the ABCC.

Jordan has received praise for its commitment to fiscal discipline and structural reforms, which have bolstered confidence in financial markets. As a result, Moody’s and Standard & Poor’s had upgraded Jordan’s sovereign credit rating in 2024.

Likewise, the European Bank for Reconstruction and Development (EBRD) has made a positive forecast on

growth, suggesting that Jordan’s economy will grow by 2.3 per cent in 2025, driven by factors such as reduced regional conflicts, the reopening of the Syrian market to Jordanian companies, and a rebound in tourism and foreign investment. In a report in early 2025, the EBRD predicted that Jordan’s growth could reach 2.6 per cent in 2026 as uncertainty eases and the business environment continues to improve.

Fitch ratings agency revised up its 2025 real GDP growth forecast for Jordan from 1.6% to 2.0% following a robust 2.7% y-o-y expansion in Q1 2025. Fitch projected growth to accelerate to 2.8% in 2026.

Jordan’s foreign exchange reserves remain at a comfortable level, covering about eight months of imports. However, the current account deficit widened to 6% of GDP in the first three quarters of 2024, mainly due to a decline in exports and rising import costs.

Jordan is pursuing with determination the implementation of its Economic Modernisation Vision which sets some important strategic objectives for the country, such as,

• Creating one new million jobs in the local labour market for young men and women.

• Increased income per capita by on average 3% per year

• Improvement in Jordan’s ranking in the Global Competitiveness Index to the top 30

• Achieving one Jordanian city ranked among the top 100 cities in the world

• Improving the country’s ranking in the Global Sustainability Competitiveness Index to reach the top 40

• Improved ranking in the Legatum Prosperity Index to the top 30

• Improved ranking in the Global Environmental Performance Index to top 20

• Doubling the percentage of Jordanians who are satisfied with their quality of life to reach 80%.

Jordan ranked first in the region for the industrial sector’s contribution to GDP in 2024, according to the Competitive Industrial Performance (CIP) Index issued by the United Nations Industrial Development Organisation (UNIDO). This achievement underscores the “strength” of Jordan’s national industry and its capacity to drive sustainable economic growth in line with the goals of the aforementioned Economic Modernisation Vision, concluded Amman Chamber of Industry (ACI) President, Fathi Jaghbir, reported Jordan Times, 9 August 2025. Speaking during the chamber’s annual general meeting, Jaghbir highlighted that Jordan’s national exports had reached a “historic” high of some JD8.6 billion in 2024, with its exports reaching over 145 countries.

The Amman Chamber official noted that the country’s industrial sector was the largest contributor to the national economy, accounting for more than 25.7 per cent of GDP with a value added exceeding JD7.6 billion, which reflected its “central” role in supporting economic growth.

Despite these achievements, Jaghbir pointed to several challenges facing the sector, which could hinder growth and the attainment of the ambitious targets outlined in Jordan’s vision. The industrial sector is responsible for nearly one-third

of these targets, particularly in stimulating economic growth, creating jobs and attracting investment. Key obstacles include high operational costs, especially energy prices, raw material costs and shipping and transportation fees, which reduce the competitiveness of local products.

Company

mid-year financial results are an indication of ‘accelerated’ growth, it is suggested. This observation was made by the CEO of Amman Stock Exchange (ASE), Mazen Wadhafi, who said that halfyear financial results for 2025 announced by listed companies reflect a “positive” performance and are a “clear” indication of the strength of the Jordanian economy and its ability to adapt to challenges.

According to the ASE data, profit after tax attributable to the shareholders of public shareholding companies listed on the ASE providing their financial statements increased to $1.5 billion compared with $1.3 billion for the first half of 2024 by 9.4 per cent, Petra News Agency, reported.

The increase in the profit before tax for public shareholding companies reached $2.171 billion for the first half of 2025 compared with $2 billion for the first half of 2024, increasing by 7 per cent. The profit after tax for the financial sector increased by 12.5 per cent, the services sector went up by 5.3 per cent, and the profits of the industrial sector rose 4.6 per cent.

Wadhafi stressed that these results were driven by a number of economic factors, government policies and reforms that strengthened the investment environment in the Kingdom, pointing to an increase in the number of gainers to 104 companies as compared with 69 companies in the same period last year.

The market value of listed shares increased by $6.5 billion to some $34 billion, marking an increase of 26 per cent since the beginning of this year, he noted.

The ASE CEO pointed out that the performance of listed companies, especially in the banking, industry and services sectors, had a “direct” impact on macroeconomic indicators, which contributed to increasing tax revenues, enhancing the revenues of the public treasury, improving the ability to service public debt, and increasing spending on development projects and public services.

Jordan’s exports of clothing, fertilisers, potash and pharmaceutical preparations all achieved growth during the first five months of 2025, contributing to supporting and growing national exports. According to a report into foreign trade from the country’s Department of Statistics (DoS), the Kingdom’s exports of clothing and accessories grew by 8.8 per cent at the end of May, reaching JD665 million, compared with JD611 million for the same period last year.

National exports of fertilisers for the end of May 2025 increased by 8.5 per cent to JD394 million, compared with JD363 million for the same period in 2024, and raw potash increased by 4.8 per cent to record JD198 million, compared with JD189 million in 2024.

Pharmaceutical preparations increased by 0.9 per cent, reaching JD233 million, compared with JD231 million last year.

Tourism has long been one of Jordan’s most important sources of income with latest results showing increased visitor numbers. The sector generated $4.4 billion in revenue during the first seven months of 2025, marking an 8.6 per cent increase

compared with the same period in 2024, according to the Central Bank of Jordan.

Revenues from Asian markets recorded the highest growth at 41.1 per cent, followed by European visitors at 33.8 per cent, Americans at 21.7 per cent, and Arab tourists at 7.3 per cent. Earnings from other nationalities increased by 38 per cent.

The number of tourists visiting Jordan in the first seven months of 2025 surged by 15.6 per cent compared with the same period last year, according to data from the Ministry of Tourism and Antiquities, with nearly 4 million visitors arriving over the period, up from 3.4 million in the first seven months of 2024. Arab nationals accounted for the largest share, with close to 2 million visitors, followed by Europeans at 500,000 and Asian tourists at 150,000. The figures indicate the resilience of the industry.

Recent tourism trends include a notable increase in visitors from Asia and Europe, drawn to destinations such as Petra and Wadi Rum. Improved flight connectivity and targeted marketing are said to have helped boost visitor numbers, according to people in the industry.

Under the Economic Modernisation Vision, Agriculture and Food Security is classed as one of the major high value sectors of the economy, expected to provide tens of thousands of jobs over the next 10 years.

The sector provides a range of attractive investment opportunities for both domestic and foreign investors. The sector is primed to flourish over the next 10 years, with many advantages and incentives, as well as the sustained efforts of the government to promote the sector’s growth.

Jordan’s chemical industry is deemed to be one of the major high value sectors whose expansion is creating many new jobs. The Kingdom has developed a national strategy for the growth of the sector to stimulate and promote investment. It has developed a strategy for the manufacture of new primary products for potassium and phosphates that raise value added and provide new solutions for food security issues, such as nitrogen fertilizers, as well as the establishment of an integrated complex for the manufacture of chemical products and the upgrading of infrastructure.

The sector is seen as a strong regional brand, known for its entrepreneurial potential and creativity. It has potential with its strong basis in the large, young, competent, talented, and diverse workforce.

Education is critical in supplying skilled labour and capable citizens required by the expansion of key growth sectors. Jordan has a good reputation at the regional level in the education field, along with significant progress with regard to access to basic education and achieving gender parity.

Jordan’s green growth sector is one of its major high value sectors. Various initiatives have been launched to support the growth of the green economy, including the alignment of infrastructure and institutional capacities with the requirements of the green economy, the linking of green investment opportunities to national investment priorities, the Green Job Initiative, which includes initiatives to transform the Kingdom into a leading player in the region for renewable energy and energy efficiency, the launching of a sustainable national transportation system, and the implementation of pilot economy practices in industrial activities with a focus on industrial environmental complexes.

In summary, Jordan’s growing green economy provides a range of attractive investment opportunities for investors, with many advantages emerging amid the concerted efforts to promote the sector’s growth.

Jordan’s Information and Communication Technology (ICT) sector is highly competitive, rapidly growing, and attracts some of the world’s biggest tech firms. Leveraging the nation’s young ICT talent, its exceptional investment environment, and world-class infrastructure and resources, the Jordanian government is playing an active role in facilitating and encouraging investments into ICT, including the outsourcing of IT and business processes—helping companies around the world tap into unrivalled business potential.

Jordan’s healthcare system has been consistently rated as one of the best performing in the region, for its highly qualified medical workforce and its accredited hospitals, laboratories, and other medical facilities, all of which are equipped with the latest cuttingedge technologies. These advantages, combined with highly competitive pricing, combine to make Jordan one of the leading destinations for medical tourism in the MENA region.

Tourism has long been an important sector and is one of Jordan’s fast growing industries, which is natural given that the country boasts a very rich archaeological and cultural heritage along with some unique features in its natural landscape.

As a vital component of the national economy, the tourism sector is a key contributor to local job creation and economic growth and offers countless opportunities for further investment and development.

In recent years, Jordan has been gradually expanding its mining sector, transforming the industry into a key player in economic development. Jordan’s diverse mineral deposits and strategic location help drive this vital sector’s resurgence. The mining sector has experienced numerous positive developments the years which have contributed to economic growth and diversification, strengthened the national economy, created employment opportunities, and attracted new foreign investment.

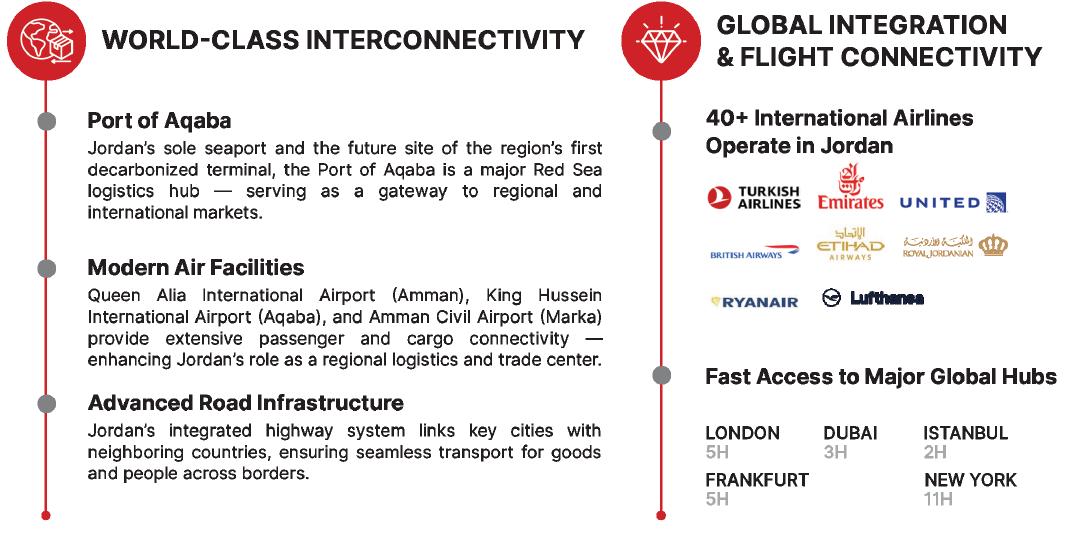

Jordan’s geostrategic positioning enables regional transport and mobility. The country is home to the multi-awardwinning Queen Alia Airport, while the Aqaba Port is a significant strategic asset for access to international maritime transport routes.

Jordan’s financial sector is undergoing a profound transformation, one that is quietly but powerfully redefining how finance operates in a digital age.

At the centre of developments stands the Central Bank of Jordan, which has embraced financial technology as a strategic lever for economic modernisation. Through a clear national vision focused on innovation, inclusion, and consumer empowerment, the CBJ has created an environment where fintech is allowed flourish. A key initiatives is the regulatory sandbox, a mechanism that allows startups to test their financial solutions under real market conditions but within a flexible regulatory framework.

Jordan’s growing ecosystem is supported by institutions like the Innovation Startups and SMEs Fund (ISSF), which provide capital, infrastructure, and mentorship to promising fintech ventures. Collaboration between regulators, investors, banks, and innovators lays the foundation of a unique approach to financial innovation that is agile and inclusive.

Open banking is an ambitious component of Jordan’s fintech growth. The CBJ, in partnership with leading financial institutions, is developing a national API framework that will allow licensed third parties to securely access customer financial data, with their consent. This step, often described as the backbone of digital finance, is expected to unlock new levels of efficiency and personalization in areas such as digital lending, personal finance management, and payment aggregation.

Experts see this as a fundamental shift in how financial services are delivered, giving individuals more control over their data and opening the door to smarter, more inclusive solutions.

Beyond banking, Jordan is preparing to enter the realm of open finance, an expanded model in which data flows not just between banks and fintechs, but across sectors such as insurance, pensions, and telecommunications. This puts Jordan on course to becoming one of the first countries in the Arab world to implement a wide-reaching financial infrastructure.

Digital transactions now account for nearly 40 percent of payments in Jordan, but large segments of the population, especially in rural areas, among women, remain excluded from formal financial systems.

Ambitious future plans aim for more than 70 percent of financial interactions to be digital by 2030. Fintech companies are envisaged to contribute significantly to GDP through job creation, foreign investment, and tax revenue. National efforts are underway to implement digital IDs, expand open APIs, and even explore a central bank digital currency.

Jordan’s Development Zones: Investment Benefits & Incentives

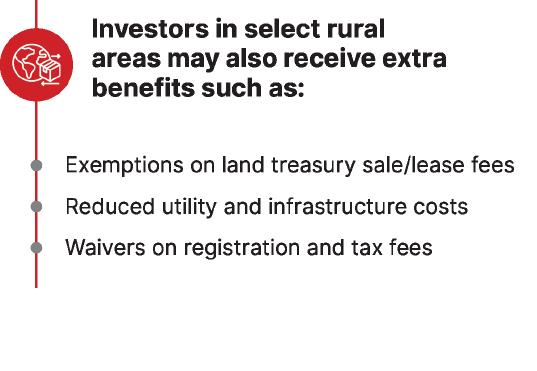

The ministry regulates the work of development zones throughout the Kingdom. They are dedicated to various fields of business and industry and are equipped with the investor’s needs of infrastructure and services. These areas are managed by development companies that work to develop the infrastructure and facilitate the work of investors. Development zones aim to distribute the gains from economic development and create job opportunities by creating a competitive advantage based on specialization and providing an integrated system of services to investors that support the growth and development of enterprises.

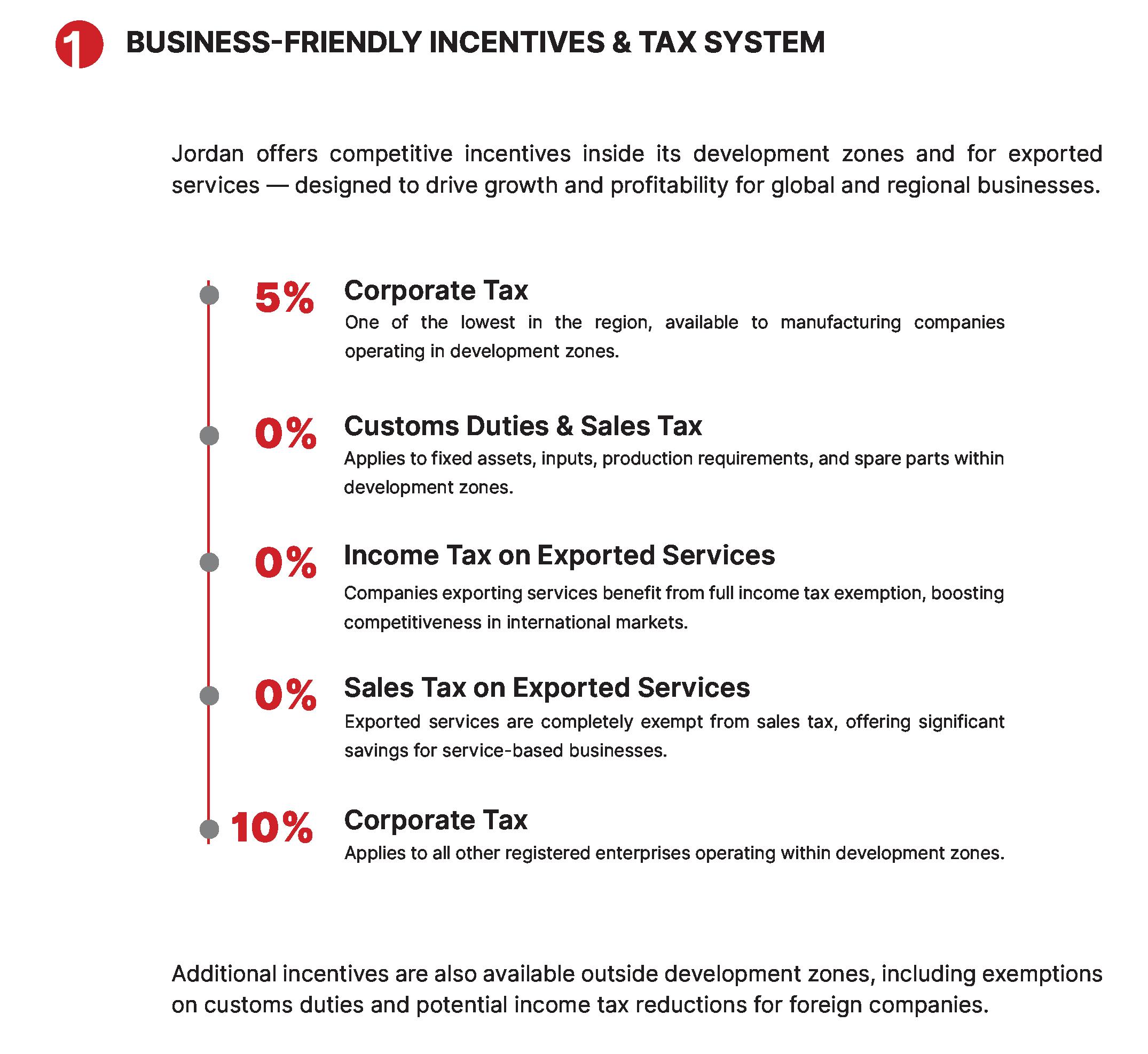

Benefits and Incentives for Registered Enterprises in Development Zones

1. Customs Duty Exemption

Exemption from customs duties on materials, equipment, machinery, fixtures, construction materials, spare parts, and goods imported into or exported from the Zone (excluding export duties, service charges, and applicable fees).

2. Local Market Exemptions for JordanOrigin Goods

Goods produced or manufactured in the Zone that meet Jordanian origin requirements are exempt from customs duties and other taxes or fees when placed in the local market.

3. Zero-Rate Sales Tax on Economic Activity Inputs

Goods and services purchased or imported for conducting Economic Activity in the Zone are subject to general sales tax at the zero rate (0%).

4. Sales Tax Exemption on Worker Transport Vehicles

Handling and transportation vehicles (10+ persons including driver), sold to a Registered Establishment for transporting workers, are exempt from general sales tax (as per regulation).

5. Preferential Income Tax for Industrial Manufacturing

5% income tax on income from manufacturing industrial activities with at least 30% local added value.

6. Standard Income Tax on Other Economic Activities

10% income tax on income from all other economic activities.

7. Tax Exemptions for Exported Services

Benefit from tax exemptions in force related to export of services outside the Kingdom.

8. Exemption from Local Municipality Charges

Exemption from paving, organization, improvement charges, license fees, and building and land taxes without prejudice to acquired rights.

Income tax on the institutions registered in developmental zones

The tax on the enterprise registered in the developmental zones arising from the activities of the licensed manufacturing industries in these zones where the local added value is not less than (30%) is at the rate of (5%).

Income tax shall be at a rate of (10%) of the taxable income of the registered enterprises in the development zone for the rest of its activities and projects.

Investment Benefits and Incentives for Registered Institutions in Development Zones

Economic Activity Licensing in Development Zones

The Ministry of Investment is responsible for issuing electronic licenses for practicing economic activity within the development zones. This license serves as an official and recognized professional license.

Investors can submit their applications for obtaining the economic activity license within the development zones conveniently through the electronic services available on the Ministry of Investment’s website.

To access the Ministry of Investment’s electronic services portal, click here:

https://portal.moin.gov.jo/ Investment/LoginPage

Long before empires rose, Jordan was already shaping the world. From the first sickles that revolutionised agriculture to the earliest bread baked in stone ovens, innovation is embedded in our soil. At the crossroads of ancient trade routes, Petra stood not only as a wonder of the world but as a gateway, where goods, cultures, and ideas moved freely across continents.

Today, that legacy continues. Jordan connects Europe, Asia, and Africa, not just geographically, but through human capital, energy, and innovations.

Our political stability is no coincidence. In a region shaped by complexity, Jordan has remained steady, thanks to strong institutions, deep-rooted national unity, and forward-looking leadership. We have hosted millions of refugees while maintaining security and growth. The world knows Jordan as a calm voice and a reliable partner.

Education lies at the heart of our identity. Jordanians place immense value on learning, not as a luxury, but a duty. This mindset has made us regional leaders in literacy and education attainment. English is widely

spoken, a result of early investments in bilingual education and global engagement.

Jordan is a nation of thinkers and builders. We rank amond the top countries globally in the number of engineers per capita. Our young tech-savvy workforce is driving innovation in every sector, from fintech to cloud computing. In our culture, resilience isn’t a reeaction. It’s a mindset.

This is more than a place to invest. This is a country that turns challenges into momentum.

Jordan’s service economy stands at a dynamic crossroads where heritage, healthcare, and hospitality converge into high-value growth engines.

For Arab-British business stakeholders, these sectors present not only compelling cultural and humanitarian value but also strategic commercial opportunities— particularly in tourism recovery, medical tourism exports, and heritage-driven hospitality. The post-pandemic rebound, bolstered by regulatory reforms and investment partnerships, positions Jordan as a service-sector leader in the Middle East with strong links to UK markets.

Jordan’s tourism sector has emerged resilient from pandemic disruptions. In the first half of 2025, the Kingdom welcomed 2.717 million overnight tourists, a 14 percent increase compared with the same period in 2024. Visitors from Europe rose 36 percent, while arrivals from Asia surged by 43 percent, signalling broad international interest. Revenues reached US $3.7 billion, up 12 percent year-onyear, despite a brief 3.7 percent dip in June caused by regional tensions.

Neighbouring Gulf states remain a vital source market. GCC overnight arrivals totalled 633,000 visitors, up 6 percent, with Saudi Arabia (+8 %) and the UAE (+15 %) leading growth. However, Kuwaiti arrivals fell by 11 percent, underscoring the need for market diversification.

Jordan’s iconic heritage sites continue to draw strong numbers:

• Petra saw 200,000 foreign visitors (+17 %).

• Mount Nebo welcomed 105,000 visitors (+12 %).

• Jerash attracted 69,000 visitors.

For 2024 as a whole, Jordan recorded 6.108 million total visitor arrivals, exceeding the Economic Modernization Vision’s target by 13.8 percent and generating JD 5.132 billion in revenue—24.9 percent higher than in 2019. These figures reinforce Jordan’s global appeal as a destination for cultural, religious, and adventure tourism.

Business opportunity: UK and Arab food & beverage (F&B) companies can tap into this growth by collaborating with Jordanian hospitality venues, offering experiential dining, and integrating sustainable, locally sourced menus that complement heritage tourism.

Healthcare Services & Medical Tourism Leadership

Jordan’s reputation in healthcare is both regional and global. The World Bank has ranked Jordan as the number one medical tourism provider in the Arab world and among the top five worldwide. In a landmark year, 2008, the Kingdom treated more than 250,000 foreign patients, generating over US $1 billion

in revenues. Many patients came from neighbouring Arab states, but also from the UK and Europe, drawn by highquality care and competitive costs.

The country is also a pioneer in healthcare digitisation. Since 2009, Jordan has implemented the VistA Electronic Health Record (EHR) system—originally developed by the US Veterans Health Administration—across major hospitals. This national-scale deployment has reduced costs by up to 75 percent compared with proprietary systems, while improving patient data access and care coordination.

Centres such as the King Hussein Cancer Center have become internationally recognised for excellence, attracting patients seeking advanced oncology treatment. Jordan’s wellness sector also benefits from its natural assets—like the Dead Sea’s mineral-rich waters—offering integrated medical-wellness tourism experiences.

Business opportunity: UK and Arab investors can develop medical-wellness packages combining treatment, nutrition, and relaxation. Health-oriented F&B services—like specialised dietary catering for recovery patients—could be an attractive niche, leveraging UK regulatory expertise for quality assurance.

Jordan’s heritage is not confined to archaeological treasures like Petra, Jerash, and Mount Nebo; it extends to living cultural landscapes such as Wadi Rum, the Dead Sea, and biosphere reserves like Dana

and Mujib. These sites are increasingly integrated into sustainable tourism models, offering eco-lodges, guided treks, and community-based hospitality.

The Aqaba Special Economic Zone (ASEZA) exemplifies the government’s investment-friendly approach. Since its launch, ASEZA has attracted nearly US $20 billion in tourism and infrastructure developments, including luxury waterfront projects like Saraya Aqaba, Tala Bay, and Ayla Oasis. Similarly, the Abdali district in Amman—a JD 2.4 billion mixed-use urban development—has transformed the capital’s commercial and leisure offerings, creating 15,000 jobs and drawing 20 million annual visitors.

Bilateral trade agreements are also catalysing growth. The Jordan–UAE Comprehensive Economic Partnership Agreement (CEPA), activated in May 2025, aims to boost non-oil trade—including tourism and healthcare services—to US $8 billion by 2032.

Business opportunity: Arab-British F&B brands could co-brand with Jordanian resorts or heritage sites, offering themed culinary events, wellness dining experiences, or heritage-inspired menus, with sponsorship potential in cultural festivals and hospitality programs.

• Develop co-branded heritage hospitality packages integrating UK cuisine with Jordan’s landscapes and historic settings.

• Sponsor or supply sustainable F&B offerings to eco-lodges and heritage site restaurants.

Engage in event sponsorship for music, arts, and gastronomy festivals in tourist hubs like Aqaba and Wadi Rum.

• Partner with hospitals and wellness centres to create nutrition-integrated treatment packages for medical tourists.

• Collaborate on digital health platforms to integrate nutrition and wellness tracking.

• Ensure regulatory alignment with UK standards for imported foods and wellness products, building trust among international patients.

Jordan’s National Green Growth Plan (2021–2025) sets out a vision for environmentally responsible development in tourism, healthcare, and hospitality. It prioritises lowimpact infrastructure, community involvement, and sustainable resource management.

For F&B stakeholders:

• Ethical sourcing: Support local farmers and cooperatives in heritage zones, ensuring economic benefit retention within communities.

• Supply chain transparency: Adopt traceability systems that meet both Jordanian and UK standards (e.g., Red Tractor, RSPCA Assured).

• Technology integration: Use digital platforms to assure food provenance and safety for tourists, patients, and wellness retreat guests.

Jordan’s combined strengths in tourism, healthcare, and heritage present a powerful value proposition for Arab-British business collaboration. By pairing the Kingdom’s cultural capital and service-sector expertise with UK innovation, quality assurance, and sustainable practices, both regions can generate mutual economic and cultural dividends. The timing is optimal: with tourism revenues rising, medical tourism firmly established, and heritage investment accelerating, Jordan is open for business—and ready to partner.

References

Jordan’s tourism sector records growth in the first half of 2025

https://www.zawya.com/en/press-release/companiesnews/jordans-tourism-sector-records-grows-in-thefirst-half-of-2025-sbfpiq6r?utm_source=chatgpt.com

Jordan’s tourism revenue hits $3.7 bn in first half of 2025

https://www.agbi.com/leisure-hospitality/2025/07/ jordans-tourism-revenue-hits-3-7bn-in-first-half-of2025/?utm_source=chatgpt.com

Tourism in Jordan: A recovery journey amidst challenges

https://jordantimes.com/opinion/raad-mahmoudal-tal/tourism-jordan-recovery-journey-amidstchallenges?utm_source=chatgpt.com

Tourism in Jordan

https://en.wikipedia.org/wiki/Tourism_in_Jordan?utm_ source=chatgpt.com

Health in Jordan

https://en.wikipedia.org/wiki/Health_in_Jordan?utm_ source=chatgpt.com

Economy of Jordan

https://en.wikipedia.org/wiki/Economy_of_ Jordan?utm_source=chatgpt.com

Green Growth National Action Plan 2021–2025: Tourism Sector – https://www.sustainability.gov/pdfs/ ggi-jordan-tourism.pdf?utm_source=chatgpt.com

Jordan is embarking on an ambitious economic transformation to stimulate growth, enhance resilience, and attract investment. Jordan’s Economic Modernisation Vision, launched in 2022 under King Abdullah II’s guidance, sets a roadmap for the next decade.

This Vision is built on two strategic pillars – accelerated growth by unleashing the Kingdom’s full economic potential, and improved quality of life for all citizens – with sustainability as a cornerstone. It aims to double Jordan’s GDP by 2033 through largescale investment and reforms. The plan targets attracting around $41 billion of funds to raise GDP to 58.1 billion dinars (≈$82 billion) by 2033, up from 30.2 billion dinars today. Achieving this will require bolstering trade, infrastructure, and the business climate – areas where Jordan is already making notable strides.

Macroeconomic Resilience and Growth Outlook

Jordan’s economy has demonstrated remarkable resilience in the face of regional turmoil and global challenges. Over the past decade,

2.5% annually, despite external shocks such as the global financial crisis, disruptions during the Arab Spring, the closure of borders with Iraq and Syria, and the Syrian civil war. After a brief contraction of -1.6% in 2020 due to the pandemic, growth rebounded to 2.2% in 2021. The recovery gathered pace in 2024, with real GDP growing 2.5% that year and exceeding expectations. The IMF reports that Jordan achieved stronger growth in 2024 and early 2025 than anticipated, thanks to sound policies and reforms. Economic experts project growth could reach 2.5–3% in 2025, bolstered by improvements in the business environment and rising investment.

This macroeconomic stability – including low and stable inflation and adequate foreign reserves – provides a solid foundation for Jordan’s modernization drive. Jordan has pursued fiscal and monetary prudence in recent years (supported by an IMF program) while avoiding harsh austerity that might undermine social stability. Political stability and reform momentum further underpin resilience. The nation must generate over 1 million new jobs in 10 years to absorb its young workforce – a challenge central to the Vision 2033 blueprint.

A major step was the establishment of a dedicated Ministry of Investment in 2021 to serve as a one-stop authority for investors. This ministry absorbed the former investment commission and the Public-Private Partnership unit, signalling high-level commitment to improving the investment environment. Jordan has also overhauled its investment legal framework with the Investment Environment Law No. 21 of 2022, which took effect in January 2023.

Key features of the new investment framework include:

• Full ownership of foreign investors in certain sectors

• Exemptions from customs duties and zero sales tax

• Income tax reductions of at least 30% for a set period

• Energy cost-reduction measures for industries

• Stability guarantees protecting investors from retroactive legislative changes

• Equal treatment of foreign and l ocal investors

• Free repatriation of profits in foreign currency

The Ministry of Investment operates a one-stop shop licensing platform, with a targeted maximum of 15 working days for approvals. Digitalisation of processes has streamlined applications and renewals, improving ease of doing business.

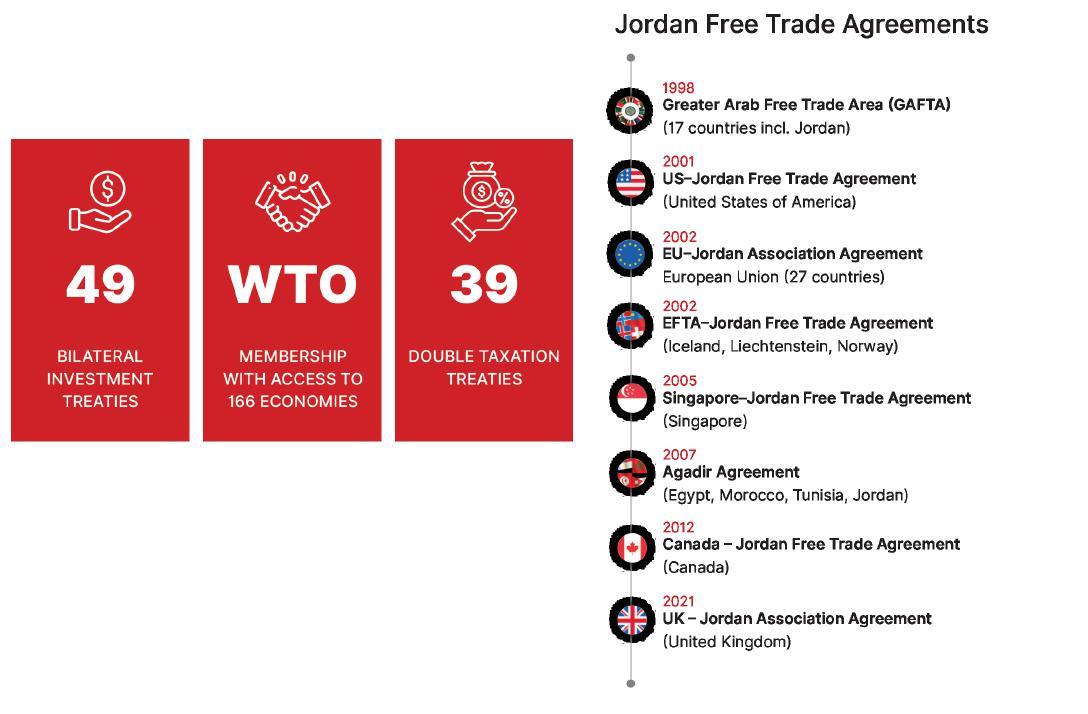

Jordan’s strategic location at the crossroads of the Levant and Gulf gives it unique access to markets. It is a member of the WTO, GAFTA, and has FTAs with

the US, EU, UK, Canada, Singapore, and Arab countries including the gulf – granting access to over 160 markets. The UK–Jordan Association Agreement ensures continued bilateral trade postBrexit, with UK–Jordan trade reaching £1.2 billion in the year to Q1 2025.

The Aqaba Special Economic Zone (ASEZ) anchors Jordan’s logistics strategy, offering low taxes, modern port facilities, and streamlined customs. Development zones across Jordan focus on ICT, manufacturing, and re-export trade. Infrastructure upgrades – such as planned national railway links and improved highways – aim to further integrate Jordan into regional supply chains.

Jordan is actively promoting private sector participation through PublicPrivate Partnerships (PPPs). The modern PPP law, enacted in 2020 and updated in 2023, facilitates large-scale investments across the energy, water, transport, and social services sectors.

Conveyance Project, major highway upgrades, electricity storage and power generation projects, non-revenue water programs, logistics projects, schools, and other initiatives. These PPP efforts contribute to Jordan’s broader Economic Modernization Vision 2033, which aims to generate over JOD 41 billion in investment opportunities over the next decade, including PPPs, FDI, DDI, and other investments.

Jordan’s dairy sector is embracing new technologies and sustainability. Processors are adopting automation, digital traceability, and ethical sourcing to align with global best practices. UK dairy industry reforms – mandating fair contracts and launching sustainability alliances – offer a model for Jordan to follow. Aligning with these practices could enhance Jordan’s competitiveness, open export markets, and meet rising consumer demand for responsibly produced food.

The country has a strong track record in implementing PPP projects through various mechanisms, including DBFOMT models. Key examples include:

• Queen Alia International Airport –expanded and operated under a PPP, now a multi-award-winning hub.

• Renewable energy projects – solar and wind farms now supply over 27% of Jordan’s electricity.

• Conventional power generation projects.

• Aqaba Containers Terminal project.

• As-Samra Wastewater Treatment Plant – a leading model for water sector PPPs.

Upcoming initiatives include the Aqaba–Amman Water Desalination &

Jordan’s Economic Modernisation Vision is not just a plan – it is a strategic transformation combining macroeconomic stability, regulatory reform, trade integration, and sector innovation. For Arab and British businesses, Jordan offers a stable base with significant upside potential, inviting investment across infrastructure, industry, and sustainable growth sectors.

Jordan’s Economic Modernisation Vision – Ministry of Planning & International Cooperation https://www.mop.gov.jo/EN/Pages/Economic_ Modernisation_Vision__Unleashing_potential_to_ build_the_future?View=4143

Jordan Vision official site https://jordanvision.jo/en

Economic Modernisation Vision (PDF) https://www.jordanvision.jo/img/vision-en.pdf

Reuters – “Jordan lays out 10-year blueprint to revive economy” (6 June 2022) https://www.reuters.com/world/middle-east/ jordan-lays-out-10-year-blueprint-reviveeconomy-2022-06-06/

Petra News – Economic Modernisation Vision overview https://petra.gov.jo/Include/InnerPage. jsp?ID=47194&lang=ar&name=en_news

Jordan Exports – EMV PDF https://jordanexports.jo/wp-content/ uploads/2022/06/Jordan-Economic-ModernizationVision.pdf

World Bank – EMV context (PDF) https://documents1.worldbank.org/ curated/en/099030524153512269/pdf/

Jordan has steadily built a strong financial sector that serves as the backbone of its economy. The country’s banking system is both stable and sophisticated, underpinning macroeconomic resilience and investor confidence.

Amman, the capital, is emerging as a regional financial hub in the Middle East, leveraging Jordan’s strategic location and skilled workforce. At the same time, a wave of digital banking and fintech innovation is sweeping the nation – from mobile payment platforms to fintech start-ups – expanding financial services and inclusion. This comprehensive overview examines how Jordan’s banking stability, Amman’s hub status, and fintech rise are together strengthening the kingdom’s financial backbone for sustained growth and brand awareness in the Arab-British business community.

Jordan’s banking sector is widely regarded as sound, well-capitalised, and

resilient, providing a pillar of stability for the economy. By the end of 2023, the sector’s capital adequacy ratio stood at 17.9%, well above both the 12% regulatory minimum and Basel III benchmarks. Liquidity was also strong, with a ratio of 142.5%, ensuring banks can meet obligations even under stress. Nonperforming loans remain relatively low at around 5%, mostly provisioned against.

The Central Bank of Jordan (CBJ) maintains rigorous oversight, aligning with international standards and ensuring banks maintain strong capital buffers. This prudent regulation has helped the sector weather external shocks, from regional instability to the COVID-19 pandemic, while continuing to finance businesses and households.

Jordan’s banking landscape is also diverse. Around 20 licensed banks operate in the country, blending commercial institutions, foreign branches, and Islamic banks. Islamic finance is a significant segment, representing roughly one-fifth of banking assets, and offering products compliant with Sharia principles, such as profit-sharing finance and Sukuk.

Amman’s Emergence as a Regional Financial Hub

Amman is positioning itself as a regional financial hub. In 2023, the International Finance Corporation (IFC) expanded its Amman office into a regional hub serving 15 countries across the Middle East, Pakistan, and Afghanistan –

a move that reflects Jordan’s strategic role and business-friendly environment.

The city hosts operations for numerous foreign banks and international financial institutions, acting as a gateway for cross-border transactions. Jordanian banks have also expanded regionally, establishing branches in countries like Iraq, Palestine, and Egypt, further integrating Jordan into regional financial networks.

Jordan’s Economic Modernisation Vision 2033 prioritises financial services development, encouraging foreign investment and strengthening Amman’s role as a financial bridge between the Levant, the Gulf, and Europe.

Jordan is embracing fintech innovation to improve financial inclusion and service efficiency. The CBJ launched a regulatory sandbox in 2018, encouraging fintech startups to test solutions in areas such as payments, peer-to-peer lending, and crowdfunding.

Notable successes include MadfooatCom’s eFAWATEERcom bill payment platform, which processed over

50 million transactions worth $33 billion in its first six years, and the CliQ instant payments system, launched by JoPACC in 2020, enabling real-time transfers between bank accounts.

In 2025, Jordan began piloting Open Banking frameworks, enabling secure data sharing between banks and authorised fintechs. This development is expected to spur competition and expand personalised financial services.

Remittances are vital to Jordan’s economy, amounting to $3.24 billion in 2024 (about 6% of GDP). Banks and fintechs are modernising cross-border payments through mobile wallets, online portals, and partnerships with global transfer operators, reducing fees and improving speed.

Financial inclusion remains a policy priority. As of 2022, about 43% of adults in Jordan had access to a bank account or mobile wallet. Mobile money services and agent banking are bridging the gap, especially for underserved populations, including refugees and women entrepreneurs.

Jordan’s financial backbone rests on a stable banking system, an emerging financial hub in Amman, and a rapidly evolving fintech landscape. For Arab-British businesses, this presents opportunities to partner in banking, investment, and digital innovation. As Jordan continues to modernise, it is set to strengthen its role as a regional connector between Middle Eastern and international markets.

International Monetary Fund – Jordan: 2024 Article IV Consultation and Second Review (13 Dec 2024) https://www.imf.org/en/News/Articles/2024/12/13/pr24473-jordan-imf-concludes-2024-aiv-consultationand-second-review-under-the-eff

International Finance Corporation – IFC’s Amman Office Becomes Regional Hub (3 Aug 2023) https://www.ifc.org/en/pressroom/2023/ifc-samman-office-becomes-regional-hub

European Bank for Reconstruction and Development – Jordan Country Strategy 2025–2030

https://www.ebrd.com/content/dam/ebrd_dxp/ assets/pdfs/country-strategies/jordan/jordancountry-strategy-2025-30.pdf

Blominvest – The Jordanian Banking Sector: A Brief Look (23 Jan 2025) https://blog.blominvestbank.com/51902/thejordanian-banking-sector-a-brief-look/

JoPACC – Company Profile 2023

https://www.jopacc.com/sites/default/files/2023-11/ jopacc_company_profile_2023.pdf

The Paypers – Fintech Galaxy approved to test Open Banking in Jordan (28 Jan 2025)

https://thepaypers.com/fintech/news/fintech-galaxyapproved-to-test-open-banking-in-jordan

MDPI Journal of Risk and Financial Management –Fintech and Sustainability: Charting a New Course for Jordanian Banking (June 2025) https://www.mdpi.com/1911-8074/18/6/328

AmCham Jordan – MadfooatCom for ePayments Company https://amcham.jo/?sptp_member=madfooatcomfor-epayments-company

Jordan Times – Why Jordan is increasing the Central Bank’s capital (8 Feb 2025) https://jordantimes.com/opinion/raad-mahmoud-altal/why-jordan-increasing-central-banks-capital

CEIC Data – Jordan Capital Adequacy Ratio https://www.ceicdata.com/en/indicator/jordan/ capital-adequacy-ratio

JICA – Remittances to Jordan

https://openjicareport.jica.go.jp/pdf/12371456.pdf

Positioned at the heart of a region where energy and water resources are under increasing pressure, Jordan faces a compelling imperative: securing its future through sustainable energy and digital advancement. With over 92 % of its energy supply imported (Energy in Jordan), the kingdom has embarked on a bold strategy that intertwines the expansion of renewables with a robust digital transformation—fueling growth, resilience, and innovation.

1. The Drive Toward Renewable Energy

From Dependence to Diversification

Jordan’s Law No. 10 of 2025 Electricity Public Law catalysed the shift toward renewables, setting an ambition to reach 10 % renewable energy share by 2020. The Jordan Renewable Energy and

Energy Efficiency Fund (JREEEF) supports financing and development of renewable projects.

By 2022, Jordan led the region in installed renewable energy capacity (excluding hydropower) according to the Arab Future Energy Index. The

energy sector green growth plan envisaged raising renewable electricity generation capacity to 35 % by 2023, potentially cutting greenhouse gas emissions by 14 %.

• Baynouna Solar Power Plant

Operational since 2020, Baynouna is Jordan’s largest photovoltaic solar facility with a 200 MW capacity, producing roughly 563 GWh annually—enough to power around 160,000 homes and displace significant CO₂ emissions (Baynouna Solar Power Plant – https://www.baynouna.jo/).

• Shams Ma’an Solar Power Plant

Commissioned in 2016, this 160 MW PV plant contributes around 1 % of Jordan’s total electricity production (Shams Ma’an Solar Power Plant –https://www.shamsmaan.com/).

• Tafila Wind Farm

Inaugurated in 2015, this 117 MW wind project generates around 390 GWh annually, powering some 83,000 homes (Science and Technology in Jordan –https://masdar.ae/en/renewables/ourprojects/tafila-wind-farm).

Tackling Water Stress Through Smart Solutions

Jordan confronts a water deficit of over 600 million m³ per year. Efficient renewable-powered systems—such as solar-driven desalination and smart water grids—are increasingly vital to the kingdom’s environmental and economic survival.

The National Digital Transformation: Strategy and Infrastructure

The Roadmap: REACH2025 & 2021–25 Strategy

Jordan’s digital transformation is guided by two cornerstone policy frameworks:

• REACH2025 (2016) established an action plan centred on innovation, ICT skills, entrepreneurship, smart infrastructure, and governance— aimed at transforming Jordan into a regional digital economy hub.

• The National Digital Transformation Strategy 2021–2025, delivered by the Ministry of Digital Economy and Entrepreneurship (MoDEE), outlines 11 strategic pillars including digital skills development, e-government services, infrastructure, legislative reform, and private-sector engagement (National Digital Transformation Strategy PDF).

4. Digital Public Services: Scaling and Interoperability

Jordan’s digital services have seen tangible progress:

• By early 2025, 65 % of public services (approximately 1,565 services) were digitised. The rollout included nine integrated service centres in regions like Aqaba, Jerash, Karak, and Tafileh (Fananews – Petra, Jordan Times, QazInform).

• Digital identity infrastructure continues to expand, with about 1.6 million digital IDs activated and around 1.4 million users registered on the Sanad e-services platform.

• The Unified Exchange Platform (UXP) connects ministries for secure data exchange, growing from 25 services in 2022 to 75 in 2023, with a target of 150 by the end of 2024.

5. Empowering Talent: The Hafiz Programme

The Hafiz Programme supports youth employment in digital and public sectors by subsidising wages for employers. By mid-2024, it had placed 4,205 jobseekers in the public sector and 6,470 in the private sector, focusing on roles in IT, digital services, and administration.

6. Connecting Energy and Digital Frontiers: A Synergy of Modernisation

Jordan’s renewable energy expansion and digital transformation are deeply interconnected:

• Smart Grids & IoT: Digital systems enable more efficient management of renewable assets.

• Investment Ecosystem: Attracting capital into tech-enabled clean energy projects.

• Government Efficiency: Digital public services, often powered by renewable sources, enhance sustainability credibility.

Conclusion: Jordan as a Green-Smart Beacon

Jordan’s transformation—from an energy-import dependent state to an emerging clean-energy and digital hub— demonstrates the power of integrated strategy and innovation. Projects like Baynouna, Tafila, REACH2025, and the Hafiz programme signal a future that is sustainable, inclusive, and technologically advanced.

For Arab-British business stakeholders, sustainability partners, and investors, Jordan’s journey offers both a compelling success story and a roadmap for strategic engagement.

References

Baynouna Project Overview. Masdar. https://www.masdar.ae/en/renewables/our-projects/ baynouna

Shams Ma’an Solar Power Plant. Wikipedia. https://en.wikipedia.org/wiki/Shams_Ma%27an_Solar_ Power_Plant

National Digital Transformation Strategy 2021–2025. MoDEE. https://www.modee.gov.jo/ebv4.0/root_storage/en/ eb_list_page/dts-2021-eng.pdf

Jordan accelerates digital transformation with expanding e-government services. Fananews/Petra. https://www.fananews.com/language/en/jordanaccelerates-digital-transformation-with-expanding-egovernment-services/

Gov’t services digitalisation reaches 65%, aiming for 80% by year-end. Jordan Times. https://jordantimes.com/news/local/govt-servicesdigitalisation-reaches-65-aiming-80-end-year

Jordan digitises 65% of public services as ICT sector gains momentum. QazInform. https://qazinform.com/ news/jordan-digitizes-65-of-public-services-as-ictsector-gains-momentum-75d041

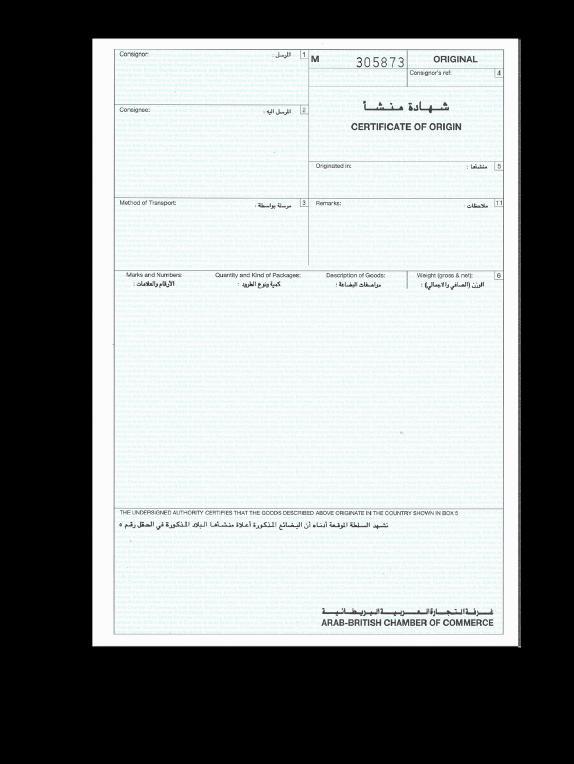

With over 40 years’ experience in technical translation, the Arab-British Chamber of Commerce specialises in Arabic/English and English/Arabic translation and has excellent facilities and top quality translators.

Our translators are officially qualified and trained to handle customer requirements accurately and professionally in both languages. Our experience lies in first class commercial, financial, legal and technical translation of the highest standard.

The Chamber’s translation service is officially recognised by all the Arab embassies in London and by the Foreign, Commonwealth & Development Office (FCDO).

However, we strongly advise clients that the FCDO should authenticate all official documentation translated from Arabic to English if it is to be used in the UK. Translation of official documents from English to Arabic, for use in the Arab world, must be authenticated by both the FCO and the Arab embassy of the country where the document is to be used.

The ABCC translation service covers all types of documents, including:

Birth/marriage/baptism/divorce/death certificates

Certificates of academic qualification

Certificates of Origin

Commercial invoices

Company/personal financial documents

Divorce documents from the Shar’i Mazun or from a court of law

Memorandum & Articles of Association

Passport details.

Head of International Trade

Surrounding the uncertainty of Brexit, the Arab-British Certificate of Origin remains the certain method to trade with the Arab world. There will be no changes to the certificate, and the ABCC’s services will suffer no interruption irrespective of Brexit’s outcome.

The Arab-British Certificate of Origin remains the only certain, secure and reliable means of export documentation for companies trading with the Arab world. There have been no changes to the certificate, and, likewise, the ABCC’s range of trade services remain entirely unaltered in the post-Brexit trading environment.

We at the ABCC remain available to support your exporting and wider business needs.

We at the ABCC remain available to support your exporting and wider business needs. www.abcc.org.uk