Situated in the heart of Unionville, this collection includes elegant detached homes ranging from 2,500 to 6,000 square feet, and luxurious townhomes from 2,000 to 2,700 square feet — all with the highest standards of design and construction.

Angus Glen South Village is surrounded by premium amenities. Unionville’s historic Main Street and nature trails, valley lands and parks are all just steps away. Inquire today about our 2025 Incentives available now.

A l e g a cy bu i lt o n f o u nd a t i o n s o f sto n e. Pr esti g e th a t c a n ’ t be sur p assed. Q u al i ty a b o ve i t a ll. B ri ghtsto n e is b ui ldi ng a br igh ter fu tu r e

f o r the G TA t h ro u g h l i gh t-f i lle d h o m es th a t w il l last the test o f t i me .

Make y ou r l i f e br i g h te r, a n d c ho o se B r i g htsto n e

C o ming soon to O a k vi ll e, Mississauga, T ho r nhi ll , an d O sh a wa .

TO W N S

O A K V I LL E

Re f i n ed to wn ho m es just steps f r om L a ke O n t a r i o ne a r L a kesh o re Rd. W. a nd Do r val Dr i v e

M I SS I S S AUG A

Rare i nf il l e nc l a ve o f u rb a n to w ns i n

t h e h eart o f d o w nto wn M i ss i ss a u g a

SC H O O L H A U S

T O W N S

O S H AW A

Rare i nf il l e nc l a ve o f u rb a n to w n s

c o mi n g to Mc L a u g hl in i n W est Osh a wa

THE ELM S

T h o rn h il l W o ods ne a r p a r k s a n d w oo d lot s OF T HORN H ILL WOODS

T HO R N H I L L

L u x u ri o us to wn h om es in p resti gio u s

mackenzIe park

LIF E UN F OLD S I N O S H AWA

O S H AW A

I n fi ll en c l a ve o f t o w n s, se m is a n d s ing le s

ne a r K i n g S t. a n d Har mo ny Rd

B R IGH T S T ON E . CA

An award-winning interior designer, Mariam Aboutaam is Director, Sales and Marketing, Interior Design at Kylemore, Markham, Ont., a builder known for master-planned communities and luxury homes. kylemoreliving.com.

Jesse Abrams is Co-Founder at Homewise, a mortgage advisory and brokerage firm based in Toronto. thinkhomewise.com

Elechia Barry-Sproule is President of the Toronto Regional Real Estate Board (TRREB) and Broker/Owner of Red Apple Real Estate Inc. She is committed to mentoring and supporting real estate professionals across the industry. trreb.ca.

Mike Collins-Williams, RPP, MCIP, is CEO West End Home Builders’ Association. westendhba.ca.

Debbie Cosic is CEO and founder of In2ition Realty. She has overseen the sale of more than $15 billion worth of real estate. With Debbie at its helm, In2ition has become one of the fastest-growing and most innovative new home and condo sales companies. in2ition.ca

Barbara Lawlor is CEO of Baker Real Estate Inc. A member of the Baker team since 1993, she oversees the marketing and sales of new home and condominium developments in the GTA, Vancouver, Calgary and Montreal, and internationally in Shanghai. baker-re.com

Lianne McOuat is Vice-President, Strategy, at McOuat Partnership, with builder/ developer clients including in lowrise, midrise, highrise, master-planned, adult lifestyle, resort/recreational, retirement, commercial, industrial and multi-family leasing. mcouatpartnership.com.

Jayson Schwarz LL.M. is a Toronto real estate lawyer and partner in the law firm Schwarz Law LLP. He can be reached by visiting schwarzlaw.ca or by email at info@schwarzlaw.ca or phone at 416.486.2040.

Dave Wilkes is president and CEO of the Building Industry and Land Development Association (BILD), the voice of the home building, land development and professional renovation industry in the GTA. For the latest industry news and new home data, follow BILD on Twitter at @bildgta or visit bildgta.ca

SENIOR VICE-PRESIDENT, SALES, NEXTHOME

Hope McLarnon

416.708.7987 hope.mclarnon@nexthome.ca

DIRECTOR OF SALES, ONTARIO, NEXTHOME Natalie Chin 416.881.4288 natalie.chin@nexthome.ca

SENIOR MEDIA CONSULTANTS Amanda Bell 416.830.2911 amanda.bell@nexthome.ca

EDITORIAL DIRECTOR Amanda Pereira

EDITOR-IN-CHIEF – GREATER TORONTO AREA

Wayne Karl wayne.karl@nexthome.ca

CONTRIBUTORS

Mariam Aboutaam, Jesse Abrams, Elechia Barry-Sproule, Mike Collins-Williams, Debbie Cosic, Barbara Lawlor, Linda Mazur, Lianne McOuat, Ben Myers, Jayson Schwarz, Dave Wilkes

EXECUTIVE MEDIA CONSULTANTS

Jacky Hill, Michael Rosset

VICE-PRESIDENT, MARKETING – GTA Leanne Speers

MANAGER CUSTOMER SALES/SERVICE Marilyn Watling

SALES & MARKETING CO-ORDINATOR

Gary Chilvers

BUSINESS DEVELOPMENT MANAGER Josh Rosset

DISTRIBUTION distributionteam@nexthome.ca

ACCOUNTING INQUIRIES accountingteam@nexthome.ca

DIRECTOR OF PRINT MEDIA

Lauren Reid–Sachs

VICE-PRESIDENT, PRODUCTION – GTA Lisa Kelly

PRODUCTION MANAGER – GTA Yvonne Poon

GRAPHIC DESIGNER & PRE-PRESS COORDINATOR Hannah Yarkony

Published by nexthome.ca

Advertising Call 1.866.532.2588 ext. 1 for rates and information. Fax: 1.888.861.5038

Circulation Highly targeted, free distribution network aimed at real estate buyers using street level boxes, racking and Toronto Star in-home delivery.

Canadian subscriptions 1 year = 13 issues – $70 (inc. HST). Canada Post – Canadian Publications Mail Sales Product Agreement 40065416.

Copyright 2025 All rights reserved. All copyright and other intellectual property rights in the contents hereof are the property of NextHome, and not that of the individual client. The customer has purchased the right of reproduction in NextHome and does not have the right to reproduce the ad or photo in any other place or publication without the previous written consent of NextHome.

Editorial Submissions from interested parties will be considered. Please submit to the editor at editorial@nexthome.ca.

Terms and Indemnification

Advertisers and contributors: NextHome is not responsible for typographical errors, mistakes, or misprints. By approving your content and/ or submitting content for circulation, advertisers and contributors agree to indemnify and hold harmless NextHome and its parent company from any claims, liabilities, losses, and expenses (including legal fees) arising out of or in connection with the content provided, including but not limited to any claims of copyright infringement, unauthorized reproduction, or inaccuracies in the content. Advertisers acknowledge that they have the necessary rights, permissions, and licenses to provide the content for circulation, and they bear full responsibility for the content’s accuracy, legality, and compliance with applicable laws upon approval. Contributors acknowledge NextHome reserves the right to omit and modify their submissions at the publisher’s discretion.

WAYNE KARL EDITOR-IN-CHIEF HOMES Magazine

EMAIL: wayne.karl@nexthome.ca

TWITTER: @WayneKarl

The uncertainty caused by the U.S. tariff situation is not what anyone needs as we should be preparing for a busy spring in the real estate market, and getting on with the business of building more homes.

So, for guidance, we look to the recently re-elected Conservative Doug Ford government – not so much for a tariff response, since that is largely federal – but to focus on matters directly under his control. In the context of housing, that means addressing the issues holding back homebuilding and buying.

While Ford won a third consecutive majority government, critics –industry and public – argue he isn’t doing enough on the housing file.

“Runaway taxation, exorbitant development charges and glacial development approvals processes are crippling the residential construction industry and significantly adding to the cost of building a home in Ontario,” says Richard Lyall, president of the Residential Construction Council of Ontario (RESCON). “We are ready to continue to work alongside the Ford government to remove barriers to building homes and create an environment that will get more shovels in the ground. The challenge is big, but we must deliver.”

Despite these challenges, there are opportunities for prospective homebuyers.

“With spring on the horizon, now is a prime time for new-home buyers to step into the market. Prices have dropped approximately 20 per cent from the peak in 2022, and with interest rates easing, buyers have a unique opportunity to secure a new home at a favorable price,” says Justin Sherwood, senior vice-president of communications, research and stakeholder relations, at the Building Industry and Land Development Association. “However, it is important to recognize that the ‘cost to build’ a new home remains high, due to fixed factors like labour and material costs. This means we are likely at the floor on prices. With current inventory levels, the market is also offering more choice than ever, but this combination of lower prices and reduced interest rates may not last long. For buyers, now is an ideal time to act before conditions shift again.”

There has been some progress, including municipalities such as Burlington, which last year passed a bylaw to reduce development fees by 45 per cent. In November, Vaughan rolled back its rates 2018 levels, and Mississauga more recently took action, as well.

Premier Ford likes to say “we’re using every tool in our toolbox.”

When it comes to housing, now is the time to pull out all the stops. Now is the time to deliver.

A new report by the Missing Middle Initiative, commissioned for the Building Industry and Land Development Association (BILD) and the Ontario Home Builders’ Association (OHBA), highlights the need to increase the rate of building and focus on larger units to accommodate demographic shifts in a still growing GTA population. It recommends various policy solutions for all levels of government to act quickly to address barriers to new home construction in the region to mitigate the situation.

“The report estimates that the GTA will need to see 30,000 ground-oriented homes and 20,000 apartment units built each year just to keep up with demographic change ahead,” says Scott Andison, chief executive officer of OHBA.

“This is a significant increase in total building rate versus the average of the last decade, and also indicates population demand may be looking for a refinement in the housing mix. Over the last decade a mixture of policy, costs, available serviced land, demand, and other factors has resulted in roughly 10,000 groundoriented starts and 20,000 annual apartment starts each year.”

The report highlights three key demographic drivers:

1. While the population of the GTA is still growing, more than 80,000 people leave the region each year, compared to those moving in from other parts of Canada.

2. Young families, specifically adults in their late 20s and early 30s, and children under the age of five, are the group most likely to move out of the GTA to areas such as London, Hamilton and Tillsonburg, likely in search of larger and lower cost housing.

3. That demographic composition and demand in the GTA will continue

to result in increased demand from grade related and larger housing due to the higher proportion of the population in the early stages of family formation.

“While recent immigration and non-permanent resident policy changes have temporarily reduced housing demand, we note that a high number of people in their early 20s will continue to fuel demand for housing for years to come,” says Dr. Mike P. Moffatt, founding director of the Missing Middle Initiative. “With a population skewed toward younger people, the demand for family-sized homes is expected to increase, not decrease, even as the region ages.”

The report also outlines several key policy reforms necessary to address the GTA’s housing crisis. Among the recommendations are incorporating pre-existing housing shortages into planning, reviewing generational turnover assumptions, lowering development taxes, streamlining approvals processes, legalizing gentle density, opening more land

for residential development, and facilitating the construction of threebedroom apartments without the use of cross-subsidies.

“Development charges and other municipal fees in the GTA are higher than in the rest of the province, putting GTA communities at a cost disadvantage and fueling the exodus of young families,” says David Wilkes, president and CEO of BILD. “Approval timelines are longer in the GTA and Hamilton than in London and Ottawa, and substantially longer than in Calgary and Winnipeg. Government action to address these lengthy timelines and extremely high government-imposed fees, taxes and charges would help lower the ‘cost to build’ and make homes more affordable, which would, in turn, reduce the outflow of young families from the region. We are in the middle of a housing crisis and the time for action is now. The socio-economic future of our region is dependent on taking the necessary steps to address the structural challenges facing the housing industry.”

Homebuyers continued to benefit from substantial choice in the Greater Toronto Area (GTA) resale market in February 2025, the Toronto Regional Real Estate Board (TRREB) reports. Home sales last month were down compared to the same period last year, while listing inventory remained high, providing substantial negotiating power for homebuyers.

“Many households in the GTA are eager to purchase a home, but current mortgage rates make it difficult for the average household to comfortably afford monthly payments on a typical property. Fortunately, we anticipate a decline in borrowing costs in the coming months, which should improve affordability,” says TRREB President Elechia Barry-Sproule.

“On top of lingering affordability concerns, homebuyers have arguably become less confident in the

economy,” adds TRREB Chief Market Analyst Jason Mercer. “Uncertainty about our trade relationship with the United States has likely prompted some households to take a wait-andsee attitude towards buying a home. If trade uncertainty is alleviated and borrowing costs continue to trend lower, we could see much stronger home sales activity in the second half of this year.”

GTA realtors reported 4,037 home sales through TRREB’s MLS System in February 2025 – down by 27.4 per cent compared to February 2024. New listings in the MLS System amounted to 12,066 – up by 5.4 per cent year-over-year. On a seasonally adjusted basis, February sales were down month over month compared to January 2025.

The MLS Home Price Index Composite benchmark was down by

1.8 per cent year over year in February 2025. The average selling price, at $1.08 million, was down by 2.2 per cent compared to the February 2024. On a month-over-month basis, the MLS HPI Composite and the average selling price edged lower after seasonal adjustment.

“With the Ontario provincial election just behind us and the federal political situation in flux, there is a lot to consider from a policy perspective when it comes to housing,” says TRREB Chief Executive Officer John DiMichele. “Not only do policymakers and those vying for high public office need to make clear their direction on housing supply and affordability, but they also need to be clear on how they intend to tackle issues related to trade and the economy. Clear direction will go a long way towards strengthen consumer confidence.”

Lucchetta Homes – crafting dream homes and communities in Niagara

The Niagara Region is one of the fastest growing areas of Ontario, outside of the hustle and bustle of the GTA, yet still offering a wealth of amenities and modern conveniences, all the while surrounded by nature. For newhome buyers seeking a better lifestyle in Niagara, many look to wellestablished homegrown builders with longstanding track records developing communities here – such as Lucchetta Homes.

Modernization of Development Charges Act necessary to tackle sky-high fees

A new study recommends that the province modernize the development charge (DC) system to help reduce housing costs and make the system more efficient.

Tips and tricks for mortgage renewals in 2025

As we move into 2025, Canadian homeowners renewing their mortgages may face a new reality: Higher interest rates compared to their initial mortgage terms. While this might seem daunting, it’s also an opportunity – to shop around, negotiate and take control of your financial future.

Mississauga taking bold action to make homes more affordable Mississauga City Council recently approved a motion from Mayor Caroyln Parrish to make Mississauga housing more affordable, including with incentives to kick-start development and get more homes built quickly. Visit nexthome.ca

Personalizing your pre-construction home: A guide to selecting interior finishes

Purchasing a pre-construction home or condominium comes with many benefits; one of the most exciting being the opportunity to personalize your space from a clean slate. Here are some insights and practical tips to help make this experience smoother and more enjoyable.

by WAYNE KARL

Missing middle housing is something the Greater Toronto Area desperately needs more of.

Enter Brightstone, a boutique infill development firm that professes fearless vision and uncompromising

quality standards, aiming to earn the trust of Toronto’s most discerning homebuyers.

We sat down with Yoav Bohbot, vice-president and director of acquisitions, to learn more about

this builder, its strategy and plans to cater to this important segment.

Let’s start with a general question… What is your view of the market these days?

I am optimistic about the market, even though we currently are going through big bumps in the road. With the interest rate reduction this month and spring upon us, the indications are that the market will begin to recover over the next few months.

How is 2025 shaping up for Brightstone?

This will be a very busy year for Brightstone. We are in the process of developing sales and marketing programs for a number of projects, which translates into an exciting year of growth.

As a company, Brightstone touts its forward-thinking vision. What does that entail?

Brightstone’s vision is to create living environments that people want to be a part of, and more importantly, to build homes that appeal to a broad spectrum of the population. This is the Brightstone mantra.

Brighstone identifies sought-after infill locations across the GTA from Oakville to Oshawa, and creates a new standard for communities building high quality townhomes in select locations that are close to

parks and schools – ideal for families, young professionals and empty nesters seeking to downsize.

Brightstone communities meet the requirements of the “missing middle” housing so needed in the GTA.

Who is your target demographic?

End users (singles, professionals, young families, maturing families, and downsizers) and investors (who provide homes for under-served families in the rental market).

What differentiates Brightstone homes?

The keen attention to detail in the space planning of the homes is a key contributor to the quality of lifestyle the residents experience. As well, the interior colours and features in Brightstone homes are carefully selected to exceed the daily needs of families living there, while also having outstanding design creating a calming environment in which to live.

Our interiors are carefully curated to provide a lot of natural light and to be timeless.

What do you look for when you choose locations to build your homes?

Brightstone’s boutique communities are conveniently close to urban amenities, allowing for easy access to shops and services as well as schools, parks and transportation.

What projects are you currently selling?

The Briar on Avenue, at the corner of Briar Hill Avenue and Avenue Road, is an exclusive seven-unit enclave of townhomes designed by the esteemed architect, Richard Wengle. The homes fit beautifully into the Lytton Park neighbourhood with their classic yet elegant design and luxurious interior features.

What are some of the key benefits of living at The Briar?

Residents will enjoy the expansive windows and skylights, inviting in a lot of natural light, the 11-ft. ceilings, elevator, top-of-the-line appliances, in-floor heating and built-in speakers.

In addition, the location in a beautiful, tree-lined residential area in midtown Toronto, Lytton Park, is close to transportation options, shops and services, excellent schools, parks and trails.

How does Brightstone strike the balance of delivering a unique product in an established neighbourhood without being intrusive?

We try to immerse ourselves into the neighbourhood with exteriors that meld into the neighbourhood’s existing motif, but they’re sleek and modern. Where we differentiate ourselves from existing homes in the neighbourhood is our interiors use high-quality finishes and well-designed floorplans that optimize living space. By enhancing functionality, it appeals to more homebuyers, whether young single professionals, young families or maturing families.

Brightstone appears to have carved out a niche in building missing middle homes. Why have you chosen to build only gentledensity homes?

There’s a gap in the market for this much-needed housing across the GTA, from Oakville to Oshawa. We’re trying to fulfil the needs of our growing region

What is the background of the Brightstone team?

Diverse professional backgrounds; all hail from across the GTA and therefore, have intimate knowledge of each sub-market.

How do you spend your time away from the office?

What else about Brightstone would you like prospective homebuyers to know?

We tend to shy away from the limelight and take pride in the product and communities that we create. Our projects speak for themselves. We concentrate on developing infill projects within an established infrastructure close to existing schools, services, recreation and transportation. Key to these projects is the design of the homes as each project is reflective of the neighbourhood in which it is being built. We do not design cookie cutter communities. Each one of them has its own design and personality and speaks to the community in which it is built.

We believe in building product that fits people’s lifestyles in the locations that we select.

What’s next for Brightstone?

We are focussed on building infill sites that are comprised of about 40 to 180 homes in each. We are not looking for exponential growth, just seeking opportunities to create developments of this size.

brightstone.ca

Personally, I enjoy going to work and enjoy spending time with my family. I appreciate coming home where I can share my experiences with family and friends and bring some of my expertise to our community. I am very fortunate. My wife and I have five children and three grandchildren with one on the way. Four of the five children are out of town, so sharing time with family and friends is extremely important to me. We have a videocall every night with our grandchildren. As well, my wife is a fabulous chef and we love entertaining. We frequently have anywhere from three to twenty for dinner.

What is your greatest inspiration, personal or professional?

Much of my inspiration stems from the joy I get coming to work each day. Having spent several years in the corporate sector has shown me the true value of the positive working environment at Brightstone. A large part of that feeling is a result of our president and CEO, Steven Heller. He is a true leader and motivator for all of us at Brightstone and puts true value on free thinking within the team which allows us to constantly innovate and perfect our product.

We plan each community together as a team with each one of us bringing his own expertise to the table.

What’s on your reading, podcast or binge-watch lists these days?

Four years ago, I put a filter on my cell phone which eliminated my browser capability. In other words, I dumbed down my phone with the objective of reducing my time commitment to reading constant news reports. Instead, in my free time I enjoy reading non-fiction books about history, personalities or self-improvement.

JESSE ABRAMS

If your mortgage renewal date is approaching, you’re likely facing an important decision: Should you choose a fixed- or variable-rate mortgage? Let’s the pros and cons of fixed and variable-rate mortgages, helping you make an informed choice that aligns with your financial goals.

WHAT IS A FIXEDRATE MORTGAGE?

A fixed-rate mortgage locks in your interest rate for the entire term of your mortgage. This means your monthly payments remain the same, providing predictability and stability – no matter how interest rates move in the market.

PROS OF A FIXEDRATE MORTGAGE:

• Stability: Your interest rate and monthly payments remain consistent throughout the term.

• Protection from rate increases: If interest rates rise, your rate stays the same, shielding you from higher payments.

• Predictable budgeting: Fixed payments make it easier to plan your finances.

CONS OF A FIXEDRATE MORTGAGE:

• Higher initial rates: Fixed rates are often slightly higher than variable rates at the start.

• Limited flexibility: Fixed-rate mortgages can come with higher penalties if you decide to break the mortgage early.

WHO SHOULD CONSIDER A FIXED-RATE MORTGAGE?

A fixed-rate mortgage is a great option for those who:

• Prefer the security of predictable payments.

• Are risk-averse or uncomfortable with potential rate fluctuations.

• Plan to stay in their home for the duration of the mortgage term.

A variable-rate mortgage has an interest rate that fluctuates based on the prime rate set by the Bank of Canada. While variable rates can often be lower than fixed rates, they carry the risk of increasing payments if rates rise.

PROS OF A VARIABLERATE MORTGAGE:

• Lower initial rates: Variable rates are often lower than fixed rates at the outset. Although, in the current market, variable rates are still higher than most fixed rates.

• Potential cost savings: If rates remain low or decrease, you can save money over the term.

• Lower break penalties: Variable-rate mortgages typically have lower penalties if you decide to break the mortgage early.

Cons of a variable-rate mortgage:

• Payment uncertainty: Monthly payments can increase if interest rates rise.

• Financial risk: Rising rates can lead to higher overall borrowing costs.

• Potential stress: Some homeowners find the unpredictability of variable rates stressful.

When renewing your mortgage, it’s not just about the rate – it’s also about

working with the right lender. Speaking to an unbiased mortgage brokerage such as ours at Homewise, provides:

• Access to multiple lenders: Including major banks, credit unions and monoline lenders.

• Unbiased advice: Focused on finding the best mortgage for your unique needs – not just pushing a specific product.

• Rate and feature comparisons: Highlighting options that offer the best combination of rates, features and flexibility. Overall ensuring you are not pigeonholed.

Choosing between a fixed or variablerate mortgage isn’t one-size-fits-all. It’s about balancing:

• Risk tolerance: How comfortable are you with potential rate fluctuations?

• Financial stability: Can you afford higher payments if variable rates increase?

• Future plans: Do you anticipate moving, refinancing or paying off your mortgage early?

At the end of the day, nobody has a crystal ball. So, the best way to think is what is not only right for your financial situation today, but also into the future as well.

Jesse Abrams is Co-Founder at Homewise, a mortgage advisory and brokerage firm. thinkhomewise.com

+MORE CONTENT ONLINE nexthome.ca

DEBBIE COSIC

The Greater Toronto Area (GTA) real estate market remains a pillar of economic growth, but factors such as tariffs, elections, inflation and interest rates create uncertainty. While these challenges may seem daunting, they also present opportunities for those who navigate them strategically.

With interest rates beginning to decline, pre-construction real estate offers a unique advantage. Buyers can lock in today’s prices while anticipating better lending conditions by the time they take possession. As rates drop, affordability improves, making future mortgage terms more favorable.

However, the current market is tough for those who purchased at peak prices and are now facing lower appraisals. If traditional financing falls short, alternative lenders or shortterm private financing can bridge the gap. Though costly, these options allow buyers to weather market fluctuations until rates stabilize. Maintaining ownership is critical –walking away locks in losses, while holding the property provides a chance to regain value and profit in the long run.

While rental demand is high, the market is competitive due to increased supply. Investors should offer incentives such as flexible lease terms or minor price adjustments to attract tenants. Any rental income reductions can also

be used as tax write-offs. Those who hold their properties through short-term volatility will benefit as demand stabilizes.

Inflation erodes purchasing power, but real estate remains one of the best hedges against it. Property values and rental income tend to rise in inflationary environments, benefiting landlords. Fixed-rate mortgages offer additional security by keeping payments stable while asset values increase. Investors can also explore multi-unit conversions, short-term rentals or rent-to-own models to maximize cash flow.

Tariffs on imported construction materials have significantly increased building costs, sometimes by 20 per cent or more, delaying projects and limiting housing supply. However, this also incentivizes local production and innovation. Developers who pivot to modular homes, 3D printing or mass timber can gain a competitive edge while reducing reliance on global supply chains.

For homebuyers, higher construction costs mean fewer new homes, tightening inventory and driving up prices of existing properties. Those looking to secure a home before values rise further should act now. Pre-construction deals may provide better value than waiting for continued supply shortages. For example, The Grand by Chestnut Hill Developments offers a 1.99-per-cent vender take-back mortgage with no lender fees and no stress test, while Rosehaven

Homes’ Rebecca project in Hamilton features the GTA’s strongest rental guarantee program, providing two years of positive cash flow and free property management.

Elections introduce policy shifts, often bringing housing incentives, tax credits and zoning changes that benefit buyers and investors. For instance, Vaughan and Mississauga have reduced development charges, with many builders passing these savings to buyers. Election periods can also slow market activity, creating a temporary buyers’ market where investors can secure properties at better prices before confidence returns post-election.

Despite economic fluctuations, the GTA real estate market continues to offer opportunities. Pre-construction pricing, future rate drops, inflation hedging, local development innovations and policy shifts all create potential for long-term success. Staying informed, adaptable and patient allows investors and buyers to turn uncertainty into an advantage.

Debbie Cosic is CEO and founder of In2ition Realty. She has overseen the sale of more than $15 billion worth of real estate. With Debbie at its helm, In2ition has become one of the fastest-growing and most innovative new home and condo sales companies. in2ition.ca

+MORE CONTENT ONLINE nexthome.ca

We do see a substantial percentage of single people purchasing homes today, even in the face of high prices. In 2016, Census data show that a substantial percentage of purchasers in Canada were single. In 2019, Statistics Canada published a study that examined the prevalence and characteristics of people living alone in our country. From 1981 to 2016, the number of solo dwellers increased from 1.7 million to 4 million. The report also predicted that one-person households would likely increase over the next few years, especially as our population ages.

How is that still possible, and how, oh how do they manage it? Today’s savvy buyers understand the nuances of planning for this major life step.

First and foremost, buyers have to consider the down payment, which is always a challenge. Of course, the bigger the down payment, the more affordable the mortgage payments. Nowadays, families (especially parents and grandparents) are helping with that. Even when that is not the case, we see young hopefuls saving money like never before, the way we Baby Boomers did decades ago. They forego luxuries such as movies, concerts and eating out to deposit more into their savings. They are careful to keep good credit scores, which inevitably help in obtaining mortgages. There are online

mortgage qualifier tools that can help them figure out what they can afford – plus, getting pre-approved for a mortgage is a great idea.

Today’s single buyers also know how to research government programs for first-time buyers and take advantage of everything for which they qualify. This includes using some of their RRSPs toward the down payment. There is also the First Home Savings Account, which enables firsttime buyers to save toward building or buying tax free (up to certain limits). Visit cmhc-schl.gc.ca for more information.

Of course, timing plays a part – and frankly, the Bank of Canada cutting interest rates by another 25 points on Jan. 29 is another feather in the first-time buyer’s cap. Plus, inflation remains at two per cent, which is great news for all Canadians. Imagine how we felt decades ago when interest rates shot up to double-digit numbers. Today’s homebuyers benefit greatly from this step.

Single buyers also choose locations carefully, perhaps selecting an up-and-coming neighbourhood over an already popular one where infrastructure and amenities are already in place. They may also consider smaller homes or condominiums than they would ideally

like, for affordability purposes. In fact, today’s compact homes and condo suites live larger than ever before because of efficient designs. And often these are condominiums close enough to public transit that the homeowners do not require vehicle ownership. That saves many thousands of dollars each year that can go toward paying down the mortgage.

Some single buyers have dreamed of owning a home since childhood and do everything they can to make that happen. Some even work more than one job to earn extra money. These forward-thinkers opt to pursue careers that will enable homeownership at some point, and they enter the market as soon as they can to begin earning equity. However they package their approach, singles purchasing new homes are an inspiration to us all.

Barbara Lawlor is CEO of Baker Real Estate Inc. A member of the Baker team since 1993, she oversees the marketing and sales of new home and condominium developments in the GTA, Vancouver, Calgary and Montreal, and internationally in Shanghai. baker-re.com

+MORE CONTENT ONLINE nexthome.ca

Be a part of an inspired enclave of semi-detached and single-family mountain homes.

A neighbourhood proudly connected by parks, ponds, trails, and nature preservation areas. At the heart of Windfall is “The Shed,” a vibrant gathering place available year-round, features outdoor pools, and serves as the perfect community hub. The essence of Blue Mountain living –a lifestyle of luxury, leisure, and natural beauty.

MIKE COLLINS-WILLIAMS

The housing market operates under the fundamental principles of supply and demand: When demand outpaces supply, prices rise; conversely, when supply exceeds demand, prices fall. This dynamic holds true regardless of the type of housing constructed or the nature of its ownership, whether private, non-profit or municipal.

Canada Mortgage and Housing Corp. (CMHC) has highlighted the pressing need to address housing affordability. To restore affordability to levels seen in 2004, CMHC estimates that Canada will require an additional 3.5 million housing units by 2030. A significant portion of this shortfall is concentrated in Ontario and British Columbia, two provinces that have experienced substantial declines in affordability over the past two decades.

In Ontario, the situation is particularly acute. The province faces a considerable housing supply gap, necessitating a coordinated effort to increase construction to meet demand and restore affordability. Each new housing unit constructed brings us closer to this goal, irrespective of its price point or type. When a household moves into a new home, they vacate their previous residence, which in turn becomes available for another family. This process, known as a “migration chain” or “filtering,” creates a ripple effect throughout the housing market.

Economist Evan Mast conducted a study analyzing this phenomenon. By examining resident movement

patterns into new buildings and tracing subsequent relocations, Mast found that for every 100 new housing units built, approximately 70 units become available in below-median income neighborhoods within five years. Of these, a significant portion becomes affordable for the lowestincome households.

While the positive effects of the moving chain are evident, they are not immediate. It typically takes approximately three years for the majority of these benefits to materialize. However, this approach presents a sustainable path to affordability, as long as municipalities do not hinder the process by restricting new construction.

Building new housing units, even those at higher price points, has wide-reaching benefits for society. Instead of imposing complex regulations on homebuilders or investing solely in government-

funded housing projects, municipalities should prioritize alternative solutions. Simplifying and accelerating the permitting process, reducing zoning complexities and eliminating unnecessary taxes on new construction can help lower housing costs.

By alleviating these bureaucratic obstacles, cities can create a pathway to the affordable housing of tomorrow. This is critical for younger generations, who are witnessing the dream of homeownership become increasingly unattainable.

Mike Collins-Williams, RPP, MCIP, is CEO West End Home Builders’ Association.

The biggest barrier to building new homes increasingly is government taxes and fees. Taxes on housing in Ontario have skyrocketed over the last five years, to the point where one-third of all the costs a consumer pays for a new home goes into government coffers. One of the worst offenders are local governments which introduced significant increases in development charges in recent years. If we are going to get more homes built in Ontario, we must tackle high taxes. High taxes, fees and charges from all levels of government are driving up the cost of housing, making it increasingly difficult to build and purchase homes. Development charges, land transfer taxes and various fees can add tens of thousands of dollars to the price of a new home, discouraging both builders and buyers. When housing is burdened with excessive taxes, supply stagnates, affordability declines and Ontario’s housing crisis worsens. Reducing taxes, fees and charges is essential to unlocking new supply and accelerating the construction of homes. To improve housing starts and affordability for consumers, Ontario must undertake significant reforms to its housing tax structure.

In Toronto, for instance, development charges have surged by 102 percent in just the last two years. As a result, a new homebuyer in Toronto now faces more than $137,000 in development charges for

a single-family home and $113,000 for a townhome. The situation is even more severe in other parts of the GTA. In Peel, Durham, Halton and York Regions, municipalities impose development charges ranging from $103,000 to $139,000 on a starter (medium-density) home, further driving up the cost for new buyers.

The Land Transfer Tax (LTT) presents another significant tax burden for homebuyers. This provincial tax, combined with an additional municipal LTT in Toronto, amplifies the financial strain on consumers. For instance, buyers of an average-priced home in Toronto will pay over $36,000 in LTTs upfront as closing costs to both the province and the city. While Ontario offers a $4,000 rebate and Toronto provides a $4,475 rebate for first-time homebuyers – based on outdated 2008 home price benchmarks– these rebates cover an increasingly smaller portion of the total tax burden.

To get more homes built and address Ontario’s affordability crisis, bold action is required to reform how housing is taxed. First, Ontario should immediately reduce development charges. In their place, the provincial and federal governments should increase permanent transfers to municipalities, particularly for infrastructure projects related to housing, transit and climate resilience. This would reduce municipal reliance on property taxes and development charges, helping alleviate the financial burden on homeowners while ensuring communities can invest in critical infrastructure and services.

Second, Ontario should work with the City of Toronto and reform

the LTT, which disproportionately impacts first-time buyers. The current provincial and Toronto rebates are inadequate in today’s housing market, where the average home price in the GTA exceeds $1.1 million. Increasing the Toronto and provincial rebates to $8,000 each, indexing it to inflation or even eliminating the tax for first-time buyers, would provide meaningful relief to young families and individuals looking to enter the housing market.

Finally, Ontario should launch a comprehensive review of municipal revenue tools to reduce the tax burden on housing. Municipalities rely heavily on property taxes and development charges to fund infrastructure and essential services, leading to rising housing costs. A thorough review should explore alternative funding mechanisms and work to reduce municipal reliance on housing taxes, while ensuring municipalities have the resources needed to deliver quality public services.

TRREB has launched a campaign to fight for lower taxes on Ontario homes. You can join our campaign and add your name to the thousands of Ontarians fighting for fair housing taxes by visiting fairhometaxes.ca.

Elechia Barry-Sproule is President of the Toronto Regional Real Estate Board (TRREB) and Broker/Owner of Red Apple Real Estate Inc. She is committed to mentoring and supporting real estate professionals across the industry. trreb.ca.

LIANNE

As a strategic marketer with three decades of experience, I sometimes feel like I’ve seen everything come and go. I’ve been writing industry articles for almost as long, and seven years ago, I wrote one asking if print media was dead. You know what? That topic is probably worth a second look because almost every day, I find myself still making the case for print media in marketing strategies, and personally, I find myself drawn to print more than ever. “Print is dead” is spoken like it’s a given, but let’s set the record straight: Print is important not just for marketers but for consumers, too. It’s crucial (now more than ever) to evaluate how you engage with content, and why.

This is a crowded marketplace, and the competition for your attention has never been greater. In today’s diverse media landscape, a social media post may connect with you on multiple levels, but a print ad has a stronger impact. A fairly-recent study in Neuropsychology Review looked at the effects of different media formats on memory retention, and it found that tangible formats lead to stronger

long-term retention than digital ones. The study proved that when readers engage in a tactile way with printed material, the engagement that takes place is deeper, which leads to improved recall and understanding of the content.

Consumers’ attitudes toward print material not only helps them retain information but it also influences their perception of brand credibility. Living in what has been called the age of misinformation, consumer confidence is waning for the digital media landscape. According to a Pew Research Center report, The Future of Truth and Misinformation Online, consumers believe that traditional print media carries more credibility – a trust that helps strengthen brand loyalty in this skeptical, media-savvy climate.

Not everyone is the same. Some people like to scroll for hours on their phones, while others prefer to curl up and flip through a magazine. Many choose print over digital to reduce eye strain or focus in distraction-free environments. And some enjoy the satisfying experience of holding a book or magazine, flipping through pages and taking in the smell of paper for plain, old-fashioned enjoyment. Plus, the nature of a newspaper or magazine allows readers to clip, save,

revisit and share ads, creating that personalized visual/tactile reminder that digital can’t replicate (the power of the front of the refrigerator or the paper on top of your desk hasn’t been praised enough).

Sure, print takes longer to show measurable results for my clients, but it has been psychologically proven to have a longer shelf life. It’s all about patience, and the value print brings goes beyond simple costper-thousand metrics. By leveraging the unique strengths of both print and digital, marketers can create unforgettable campaigns that cut through the noise and resonate with audiences like never before. Not everything in this world is one or the other – print and digital don’t need to be rivals; they’re powerful partners. And if you question whether print advertising works, you just proved it by finishing this article.

Lianne McOuat is Vice-President, Strategy, at McOuat Partnership, with builder/ developer clients including in lowrise, midrise, highrise, master-planned, adult lifestyle, resort/recreational, retirement, commercial, industrial and multi-family leasing. mcouatpartnership.com.

by MARIAM ABOUTAAM

The kitchen is the heart of the home, deserving thoughtful design to ensure it is both functional and inviting. When purchasing a pre-construction home, you can personalize your kitchen by selecting colours, styles and materials included in your purchase agreement, as well as opting for upgrades to enhance your space. In designing model homes, I often start with the kitchen, ensuring it sets the tone for the entire home.

Experienced homeowners may already have a preferred style they wish to carry into their new home or

blend with an updated look. First-time buyers, multi-generational families or those merging two households may need time to define their aesthetic. Gathering inspiration from online sources, magazine pages and visits to design showrooms can help refine your vision.

Your kitchen selections will include cabinet style, material and colour; countertops and backsplash materials, flooring, sinks, cabinetry hardware and plumbing fixtures. Having a well-defined personal style and colour palette will streamline the selection process, making the most

of your design appointment with your builder’s decor professionals. Tip: Know your appliance needs When you attend your interior finishes appointment, arrive having already chosen the exact appliances and have the specifications with you.

Builders and architects typically design kitchen layouts to meet the broadest of family needs. If you arrive at your decor selections appointment prepared with ideas and a wish list, you’ll discover it’s easier to personalize your home while achieving your goals. For example, if kitchen storage is important to you,

consider extending upper cabinets to the ceiling. If your floorplan allows, incorporating a floor-toceiling pantry with pull-out drawers can provide easy access to stored items while keeping countertops clutter-free.

Tip: Declutter with smart solutions Add an appliance garage for neatly storing kettles, blenders and other small appliances out of sight. Consider creating a special beverage station or niche for this purpose.

Do you need a place to display treasured heirlooms, gifts or travel souvenirs? Glass-front cabinets can showcase these items, especially when paired with interior lighting. As well, replacing upper cabinets with open shelving can serve as an elegant display option, just ensure that reducing cabinet storage doesn’t compromise functionality.

Consider who in your household does most of the cooking, as their preferences will influence the placement of key items and work surfaces. Ideally, the sink, oven and refrigerator should form a triangle to facilitate efficient workflow. If your home comes with included appliances, inquire about upgrade options. If you prefer cooking with gas, be sure to add a gas line. For a seamless look, consider panelready appliances that blend with cabinetry. Designing the range wall to be a feature, with an alcove, stone clad canopy or floating shelves, will enhance your overall kitchen experience.

Your kitchen isn’t just for cooking, it may also serve as an entertainment hub, a casual dining area or even a homework space. If you enjoy entertaining, consider incorporating a wine cabinet or fridge into your layout. A kitchen island can double as a bar, a prep space and an informal dining area. If your floorplan doesn’t include an island, consult your builder about adding one.

Kitchen flooring must withstand heavy foot traffic, spills and dropped items while seamlessly connecting with other areas of the home. Options such as porcelain tile, engineered hardwood and luxury vinyl flooring offer durability and aesthetic appeal. Tip: Personalize with small details Add lighting above your kitchen island on a dimmer switch and change

the ambience to suit your mood; installing a tiled “carpet” in wet areas such as between the kitchen sink and stove is a practical and decorative addition. There are many options for cabinet hardware which can both tie the whole room together and elevate simultaneously.

Discussing these design elements with your family and decor consultant will ensure your kitchen is both stylish and practical, resulting in a welcoming space that is the centrepiece of your new home.

In my next column, I’ll explore additional kitchen enhancements, such as built-in banquettes, fireplaces, coffee niches, statement lighting and accessories that infuse colour and personality into your space.

An award-winning interior designer, Mariam Aboutaam is Director, Sales and Marketing, Interior Design at Kylemore, Markham, Ont., a builder known for master-planned communities and luxury homes. kylemoreliving.com.

The latest properties in the Greater Toronto Area to keep your eye on

AJAX

1. Time Rossland Road marshallhomes.ca

2. Queen’s Grove Collection Yonge St. & Bloomington Rd. northstarhomes.com

3. Allegro 36 Klees Cres. geranium.com

4. Shinning Hill 24 St John’s Sideroad countrywide.ca

BRAMPTON

5. Bodhi Towns Fogal Road & Nexus Ave. countrywide.ca

6. DUO Condos 245 Steeles Ave. W. duocondos.ca

7. Three Rivers Claireville Goreway Dr. & Humberwest Pkwy nationalhomes.com

8. Queens Lane Townhomes Mississauga Rd. & Queen St. branthavenbrampton.com

9. Classic Drive Creditview’s Valley Lands & Lionshead Golf and Country Club branthaven.com

10. Brant West 501 Shellard Lane losanihomes.com

11. Palgrave Estates Mount Pleasant Rd. & Hunsden Rd. flatogroup.com

12. Pathways Caledon East Old Church Rd. & Innis Lake Rd. flatogroup.com

13. Highlands Caledon East

22 McKee Drive, Caledon dunsire.com

CLAIREMONT

14. Cresthaven Estates Brock Rd & Central Street

COURTICE

15. Courtice Glen Bloor & Trulls Rd. mytribute.ca 16. The Vale 57 Glen eagles Dr. nationalhomes.com

ETOBICOKE

17. The 900 Condo Signature Residences 900 The East Mall 9hundredcondo.ca

18. Triple Crown Estates Dufferin Street & 15th Sideroad remingtonhomes.ca

19. Kleinburg Hills Appleyard Ave countrywidehomes.ca

20. Cornell Markham Bur Oak Ave. & Hwy 7 ballantryhomes.com

21. Upper East Side Unionvillle Major Mackenzie & Woodbine fieldgatehomes.com

22. Riverwalk Meadows Ninth Line & 14th Ave. flatogroup.com

23. Angus Glen South Village 9980 Kennedy Rd., #200. kylemorecommunities.com

24. Kennedy Manors 4500 Major Mackenzie Dr East. kylemorecommunities.com

25. Park Ridge Conlin & Townline Rds. tributecommunities.com

26. Mackenzie Park MacKenzie Ave. brightstone.ca

27. Schoolhaus Mclaughlin in West Oshawa brightstone.ca

28. Courts of King’s Bay Near Port Perry geranium.com

29. Jefferson Reserve 363 Jefferson Side Road countrywide.ca

30. Park Lane Place Elgin Mills & Leslie St. northstarhomesinc.com

31. Observatory Hill Bayview Ave. & 16th Ave. myobservatoryhill.ca

32. King East Estates King Rd. & Toscanini Rd. pureplaza.com

33. 670 Progress Ave. Progress Ave. & Grangeway Ave. fieldgateurban.com

34. Lambtown Towns 2650 St. Clair West dunparhomes.com

35. 2650 St. Clair Ave W. 2650 St. Clair Ave W dunparhomes.com

36. The Elms Steeles Ave W brightstone.ca

37. Country Lane Taunton Rd. & Country Lane countrylanewhitby.com

38. Wellings of Whitby 372 Taunton Road E wellingsofwhitby.com

39. Sora Vista Pine Valley & Teston Rd soravista.ca

40. Woodend Place Major MacKenzie & Pine Valley Dr. woodendtowns.ca

BUILDERS IF YOU WOULD LIKE TO INCLUDE YOUR PREVIEW REGISTRATION, NEW RELEASE OR SITE OPENING IN THIS FEATURE, JUST EMAIL THE DETAILS TO EDITORIAL@NEXTHOME.CA

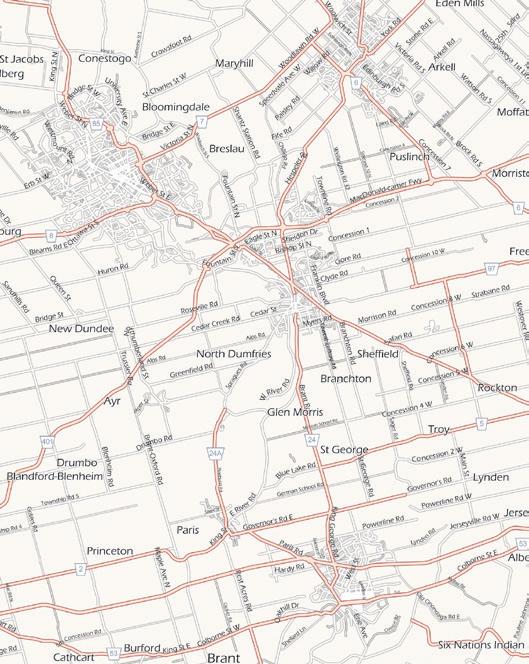

BURLINGTON/ WATERDOWN

1. Northshore Condo 484-490 Plains Rd. E. nationalhomes.com

2. Tyandaga Heights Burlington nationalhomes.com

4. Northshore Towns 490 Plains Rd. E. nationalhomes.com

CAMBRIDGE

4. Modal at Main 840 Main St, Cambridge modalatmain.ca ELORA

5. South River 133 South River Rd. granitehomes.ca FERGUS

6. Bellwood Estates Fergus geranium.com

GEORGETOWN

7. Juniper Gate 10130 10 Line, Norval remingtonhomes.com

GRIMSBY

8. Grimsby Waterfront 398 N Service Rd. losanihomes.com

GUELPH

9. Argyle Village Lowes Rd E & Gordon Street argylevillage.ca

10. Northside Guelph Woolrich St & 7 granitehomes.ca

11. The Block on Clair 331 Clair Rd E. reidsheritagehomes.ca

HAMILTONWENTWORTH

12. Soho Homes at Barton & Glover Barton St. & Glover Rd. losanihomes.com

13. Highland Park & Central Park: Midtown & Soho

Upper Red Hill Valley Pkwy & Rymal Rd. losanihomes.com

KITCHENER/ WATERLOO

14. Wallaceton Huron Rd. & Fischer-Hallman heathwood.com

15. Lackner Ridge Lackner Blvd & Ottawa St N lacknerridgetowns.ca

16. The Valleylands Mayfield Rd. & Chinguacousy fieldgatehomes.com

17. Thompson Towers Thompson Rd. S & Drew Centre thompsontowers.ca

MISSISSAUGA

18. Whitehorn Woods 1240 Britannia Rd. W. nationalhomes.com

19. OG Urban Towns 1528 Dundas St W brigtstone.ca

NIAGARA REGION

21. Luna 205 St. Davids Rd, Thorold silvergatehomes.com

22. Harbourtown Village 574 Seneca Drive, Fort Erie silvergatehomes.com

23. Hazelwood on the Grand Hardy Rd. sifton.com

24. Joy Towns Niagra branthaven.com

25. Bench Mark Ontario St. & Drake Losanihomes.com

26. The Greenwich at Oakvillage Trafalgar Rd. & Dundas St. East branthaven.com

27. Bronte Meadows Bridge Rd & Warminster Dr. flatogroup.com

28. Upper West Side Condos 2 351 Dundas St. East branthaven.com

30. Kerr Village brightsone.ca

31. West & Post 2714 Westoak Trails Blvd. branthavenoakville.com

32. Riverbank Estates Nirh River losanihomes.com

ST. CATHARINES

33. Lincoln Estates Lincoln Ave. & King St. losanihomes.com

34. Lusso Urban Towns Martindale Rd. & Grapeview Dr, St. Catharines lucchettahomes.com

35. Merritton Mills St. Catharines silvergatehomes.com

36. Benchmark at Vista Ridge 4008 Mountain St., Beamsville losanihomes.com

ST. THOMAS

37. Harvest Run Centennial Parkway & Elm Street dougtarryhomes.com

38. Prudhomme’s Landing 1051 Old Thorold Stone Road silvergatehomes.com

39. Poet & Perth Quinlan Rd & O’Loane Ave, Stratford. poetperth.ca

40. Maplewood Park Upper Creswood maplewoodstoneycreek.com

41. Sweetberry Barton & Glover sweetberrytowns.ca

42. Davis Heights 1535 Haist St, Pelham lucchettahomes.com

43. The Residences at Hunters Pointe 71 Kyntre Trail lucchettahomes.com

45. Riverside at Hunter’s Point 300 Daimler Pkwy., Welland lucchettahomes.com

46.Shelter Cove 15 Cricklewood Cres., Nanticoke sheltercove.ca

47. St. George Village Concession 2 & Woodhill Rd. losanihomes.com

48. Brant West 562 Shellard Ln losanihomes.com

49. Magnolia Trails Modeland Rd. & Michigan Lane sifton.com

50. Soleil St. Clair Corunna sifton.com

51. Expressions & Riverbank Estates 1021 Rest Acres Rd., Paris losanihomes.com

52. Knightsbridge Graff Ave. & Mornington St. sifton.com

53. Cottonwood Dingle St. sifton.com

54. Edgewood Suites 270 Hagan Street East, Dundalk flato.com

55. Discoverie Condos 7 Central Ave Fort Erie DiscoverieCondos.ca

BARRIE

1. FOUR10 Yonge 410 Yonge Street masonhomes.ca

2. Midhurst Valley 1296 Carson Rd. geranium.com

3. Heartland Hwy 89 & Yonge St., Baxter brookfieldhomes.ca

4. Midhurst Hwy 26 & Bayfield Rd. Brookfieldhomes.ca

BEETON

5. GreenRidge & Beeton

Village 41 Main St. W. flatogroup.com

6. Haven on the Trent Forest Hill Rd. & Riverside Trail sifton.com

7. Mountain House at Windfall Mountain Rd. & Crosswinds Blvd. georgianinternational.com

8. Collingwood Maple & Sixth Street georgianinternational.ca

9. Reverie 391 First St, Collingwood reverietowns.com

10. The Vale Prestonvale Rd. & Bloor St. nationalhomes.com

11. Edgewood Greens Hwy. 10 & Main St. East flatogroup.com

12. Edgewood Suites 270 Hagan St. E., Dundalk edgewoodsuites.ca

13. Craighurst Horseshoe Valley Rd. & Hwy. 93 georgianinternational.com

14. Braestone Horseshoe Valley 3246 Line 9 North georgianinternational.com

15. Grace & Grand flatogroup.com

16. Belmont treasurehill.com

17. Greystone Village 1800 2nd Ave. E. flatogroup.com

18. Parklands & The Condo Arbour Villas 1224 Chemong Rd. masonhomes.ca

19. Port Hope Lakeside Village 415 Lakeshore Rd. masonhomes.ca

20. Kingswood Cobourg 425 King St. E. masonhomes.ca

21. Meadow Heights 82 Hillcrest Road, Port Colborne dunsire.com

22. Emerald Crossing Hwy. 89 & Hurontario St. fieldgatehomes.com

THESE BUILDERS ARE PROUD OF THEIR COMMITMENT TO EXCELLENT CUSTOMER SERVICE AND CREATING GREAT COMMUNITIES.

We may still be in the throes of winter, but spring and renovation season are just around the corner. Many wait until the last minute to start planning a renovation, and as a result, run into unnecessary delays and added costs. Here is why you should not wait and why the wintery weeks ahead are actually the best time to start planning your project.

First, you need to understand your wish list – and what parts of it are actually realistic in terms of your budget and timelines. This might seem like a daunting task, but there are tools that can assist you with this. There is a number of apps that are designed to help create checklists, develop images and basic floorplans to aid in organizing your thoughts and conveying your wishes to your contractor. Plus, with recent interest rate cuts, now is the perfect time to assess your likely budget to enable discussions with your contractor.

Hiring the right professional renovator, a process that includes arranging and getting quotes back, checking references and finding someone who understands your needs can easily take months. Put written contracts in place as soon as possible as good contractors are always busy – you do not want to end up with the last choice. Seek out a renovator that is a member of the Canadian Home Builders’ Association’s RenoMark program, which BILD administers in the Greater Toronto Area. RenoMark renovators

are professionals who adhere to a strict code of conduct, offer written contracts, carry at least $2 million in liability insurance and provide a twoyear warranty on their work.

Plus, working with a RenoMark renovator assures that you are working with someone who understands the ins and outs of the permit and approvals process, someone who can assess your project to determine what – if any – building permit is necessary and can handle the application process. They also know when additional professionals, such as architects or structural engineers, are required. Invite RenoMark contractors to your home to review its existing conditions and to discuss your goals.

Second, plan for pivots to make sure the job is done right the first time. Oftentimes, once a project has begun and walls have been opened up, unforeseen and unplanned issues arise. Working with a good contractor can minimize the risks, but when renovating an older home, challenges occur. These can include things such as asbestos or lead paint, which require abatements, outdated wiring, such as knob and tube, old lead or clay water pipes that will need to be replaced or structural challenges requiring remediation (work done by/DIYers that compromised joists

or cracks in the foundation allowing in moisture or vermin). It is prudent to set aside a contingency fund to ensure your project does not get stopped or delayed mid-stream due to a financial shortfall – talk to your contractor about what is a reasonable amount.

Third, invest in the critical features of your home. Most people only do a big renovation once or twice in their lives – so it’s essential to not skimp on structure, building code or internal systems (such as plumbing and electrical) as these elements, while less visible, are critical to the viability of your renovation in the long term.

Renovating your home is a great way to enhance its livability. Do so with confidence by working with a RenoMark renovator. Visit renomark.ca for more information and to find a RenoMark renovator in your area.

Dave Wilkes is President and CEO of the Building Industry and Land Development Association (BILD), the voice of the homebuilding, land development and professional renovation industry in the GTA. For the latest industry news and new home data, follow BILD on Twitter, @bildgta or visit bildgta.ca.