Exclusive!

Q&A with DataVolt’s

Rajit Nanda

Exclusive!

Q&A with DataVolt’s

Rajit Nanda

Challenges in building and operating data centers in the Middle East

Stargate UAE Rewriting the digital transformation stor y

In February 2025, DataVolt, a Saudi Arabian digital infrastructure provider, announced that it was planning to invest US$ 5 billion into building a 1.5 GW AI factory campus in Oxagon, which is an under-development industrial zone that is part of the wider futuristic NEOM project.

The announcement was made during the LEAP technology conference, and was significant, not only because of the size of the investment and the scale of the project, but also because it was conceived as a Net Zero project, powered entirely by renewable energy.

To find out more about the project, and its progress, W.Media reached out to Rajit Nanda, Chief Executive Officer, DataVolt for an exciting conversation about artificial intelligence, sustainability, and Saudi Arabia’s data center market.

Given the fast pace of digital transformation in the Middle East, what is the one thing about the evolution of this market that excites you the most as a technology business leader?

What excites me most is that the Middle East has transitioned from being a follower to becoming a leader in digital infrastructure. Saudi Arabia is driving this transformation through national strategies that integrate AI adoption, smart cities, and sustainable ecosystems. The alignment between government vision, regulatory frameworks, and capital investment creates the ideal environment to build infrastructure at scale—projects that are not only future-ready but futuredefining.

The Gulf Cooperation Council (GCC) has the potential to power the future of computing, just as it powered the internal combustion engine over the past six decades. With its strategic location, competitive energy pricing, and strong political will, the region is uniquely positioned to replicate its hydrocarbons success story with data.

You have a multi-billion-dollar project coming up in NEOM. Could you take us through how this project was conceived, what it entails, and what you envision in the near future?

NEOM is where the future is being prototyped, and DataVolt has been entrusted to make this vision a reality. We signed a multi-billion-dollar agreement to develop a 1.5 GW Net Zero AI Factory in Oxagon, with the first 300 MW phase going live in 2028. This AI-first campus is designed to support both large scale training and inference demand – supporting the emerging use cases that will evolve within the Kingdom over time.

Will your NEOM project be powered entirely by renewable energy?

Yes. From day one, the NEOM project will operate on 100 percent renewable energy sourced from solar, wind, and green hydrogen. This approach fully eliminates Scope 2 emissions while future-proofing the site against global ESG requirements.

Amidst the growing consciousness surrounding sustainability, what kind of roadmap have you envisioned to achieve greater energy efficiency across your projects in Saudi Arabia?

Our roadmap is built around three pillars: energy sourcing, energy efficiency, and circular operations. Beyond NEOM, all future builds will target low PUEs, use modular construction to reduce embedded carbon, and incorporate AI-driven energy management systems. We are also partnering with utilities and regulators to secure renewable energy across multiple sites.

How challenging is heat management in one of the hottest geographies in the world, and what cooling innovations are you adopting?

Designing for the desert requires rethinking efficiency at scale. We work with leading technology partners to deploy next-generation cooling solutions tailored for highdensity workloads in extreme thermal environments. With ambient temperatures frequently exceeding 50°C, our data centers are engineered to maintain consistent performance while minimizing energy overhead.

Unlike many operators, we have internal design and engineering with experience across diverse geographies. Saudi Arabia presents some of the

most demanding climate conditions globally, and our design teams are continuously optimizing to deliver industry-leading efficiencies in both water and power use.

How do you see AI, especially GenAI technology, evolving over the next five years, and how is DataVolt preparing?

They are testing 300–500 kW per rack in the U.S to meet the demands of Large Language Models (LLMs). At DataVolt, we are building for that future today. Our campuses are adaptive, allowing us to pivot to highdensity AI workloads and HPC with minimal incremental capital.

We are also running proof-ofconcept deployments with GPU servers to stress test our infrastructure, optimize for AI workloads in this region, and institutionalize this knowledge for future sites.

Gar tner warns that 40 percent of GenAI projects could be scrapped by 2027. How should leaders set realistic goals?

The high failure rate of GenAI projects often comes from chasing scale before delivering value. Leaders must focus on use cases and invest in infrastructure that is agile, secure, and cost-efficient.

At DataVolt, we are preparing for exponential AI growth but also remain hedged by continuing to serve more predictable, linear cloud demand, which we believe will continue to expand as the Middle East undergoes its digital transformation.

What is your assessment of Saudi Arabia’s digital infrastructure investment climate, and where are you expanding next?

Saudi Arabia offers a rare combination of land, power, and regulation in a harmonized framework. Beyond NEOM, we are developing facilities in Riyadh, Dammam, and other strategic locations with improving international connectivity due to new subsea cables coming online.

Internationally, we are building in Uzbekistan, evaluating opportunities in the CIS, Africa, and advancing plans for

a U.S. campus announced during the Saudi–U.S. Investment Forum in June 2025.

What is your vision of a robust connectivity ecosystem for Saudi Arabia?

We envision Saudi Arabia emerging as the digital Suez Canal—a critical bridge between East and West. By combining multiple subsea cable landings on both the Red Sea and Gulf coasts with a growing national fiber backbone and increasing traffic on internet exchange hubs, the Kingdom is increasing capacity as well as optimizing latency.

Our upcoming data centers in Saudi Arabia are being built as fully carrier-neutral facilities, interconnected with one another and offering access to key connectivity gateways to attract hyperscalers, telecom operators, content providers, and cloud-native

players

If you could ask Saudi authorities for three accelerators of sector growth, what would they be?

Saudi Arabia has made significant progress in enabling digital infrastructure growth. To accelerate further, three areas stand out:

Streamlined zoning and permitting – with unified guidelines and timelines under 90 days for hyperscale projects.

Standardized, long-term renewable energy contracts – such as 15-year PPAs that provide predictability and support operators’ Net Zero commitments.

Regulatory clarity on hybrid and sovereign cloud adoption – particularly for cross-border data flows

Strengthening these enablers will attract additional private capital and reinforce Saudi Arabia’s leadership in sustainable and secure digital infrastructure.

The Middle East is undergoing rapid digital transformation, with new data centers being planned and built across the entire region. But given how every region poses its own set of unique challenges, we brought together two industry veterans who have extensive experience in the Middle East, to shed light on what it actually takes to build the digital backbone of the region

data center companies often face some bureaucratic hurdles in acquiring land, especially powered land.

started seeing value in it - how it can improve lives of citizens - it became a little bit less taxing.” He also agrees that getting powered land can still be challenging. “We have a lot of power, but it is probably in the wrong place,” he says. “Sustainability and renewable energy are probably lower in the list of priorities. First, it’s about getting the connection, the power supply.”

Acquiring renewable energy: Challenges in minimising transmission losses

By Deborah Grey

Colm Shorten (Head - Data Centre Development, MEA, JLL) and Himmath Mohammed (Chief Information Officer, Gulf Data Hub) shared their wisdom on w.media Deep Dive, our exclusive video podcast series covering the cloud and data center industry and connectivity ecosystem across South Asia and the Middle East. Here’s a summary of the key points made by both speakers.

Acquiring land: Jumping through bureaucratic hoops

When it comes to acquiring the right land for a data center project, despite great enthusiasm for digital transformation among governments and regulatory authorities in the region,

“Even before you break ground for a project, you have to interact with local authorities and utility providers, getting necessary permits, approvals and clearances; this happens everywhere,” says Himmath Mohammed. “However, most of these authorities are not acquainted with the data center perspective, and therefore they don’t understand the criticality of it, and redundancy issues. They keep challenging you (asking) why do you need dual feeds, why do you need extra power?” But he concedes that over the years, things have become relatively smoother with growing awareness about the data center industry.

Colm Shorten concurs, “Earlier there was some amount of misunderstanding about what data centers were - these big, dark, black or grey boxes. But as people started becoming more aware of digital transformation, and

However, getting adequate power, especially from sustainable and clean energy sources still remains a challenge, even if the data center developer or operator is willing to invest in captive renewable energy projects.

“Sourcing power itself is a challenge. When it comes to renewable energy, it is a much bigger challenge,” says Himmath Mohammed. He says this is due to long distances between the location of data center projects and power plants, inadequate transmission infrastructure, and lack of measures to enable smoother operations. He also points out that location also plays a role in enabling renewable energy plant development.

“We would love to build a solar PV plant. But data center land parcels are usually located in prime locations, and one square kilometer of land can only generate 2-3MW of power,” he says shedding light on why such solar

plants are built in remote deserts instead of within city limits. “Renewable energy is still a developing market, and while there are regulators in place to enable renewable energy plants on your campus, feeding directly to your facilities, these processes and procedures haven’t matured like those in global markets where you have net metering or direct agreements to generate electricity in a desert in a big solar farm, feed that directly into the grid, and then offset it against what you are drawing from the grid,” he further explains.

“Even if we build solar farms, it becomes an issue with regards to connecting that to the grid, or the conversation around long duration battery storage, because the sun doesn’t shine at night,” says Shorten, pointing out the need for greater innovation in battery and storage

“Sourcing power itself is a challenge. When it comes to renewable energy, it is a much bigger challenge.”

____ Himmath Mohammed (CIO, Gulf Data Hub)

technologies. However, he is seeing a growing interest in sourcing nuclear energy using Small Modular Reactors (SMR). “It’s not a question of if, but when,” he says. “All big American tech companies coming to the Middle East are looking at SMRs. At present it is driven by America, but it’s only a matter of time until the GCC catches up.” He concedes that regulation to enable this could take 5-7 years, but that is also the amount of time he says it takes to build a power plant and SMRs.

Given how rapidly AI is evolving as a technology, and its impact on how we are building data centers, the chorus surrounding “future-ready” data centers is growing louder. But this comes with even greater challenges visa-vis managing the project, especially ensuring a steady and reliable supply chain.

“Project management has traditionally been about time, cost and quality, and critical path analyses. But now we are trying to build in an ever changing environment or VUCA - Volatile, Uncertain, Complex, and Ambiguous,” says Colm Shorten.

“We are building for an unpredictable future; the only thing we can do is be agile and flexible in design, so that we can accommodate future demands,” says Himmath Mohammed.

Both see pre-fabrication as a viable solution, especially when the Ready-forService-Date (RFSD) is not negotiable. But another big challenge here is the supply chain.

“There are so many deployments across the world, and all suppliers are busy catering to all these projects - distributing their manufacturing, logistics, delivery, testing and commissioning,” says Himmath Mohammed.

“The supply chain is definitely a key issue. Especially the demand by large hyperscalers, they are hungry animals that suck up a lot of those materials,” says Shorten explaining how long lead items leak back into the critical path and impact delivery dates. But he feels domestic manufacturing of such items can help alleviate this pressure.

“Project management has traditionally been about time, cost and quality, and critical path analyses. But now we are trying to build in an ever changing environment or VUCA - Volatile, Uncertain, Complex, and Ambiguous.”

____Colm Shorten (Head - Data Centre Development, MEA, JLL)

Both Himmath Mohammed and Colm Shorten, agree that the regulatory environment has been steadily improving, with greater communication possible between authorities and data center providers. They would like to see greater collaboration between various data center players to build a common platform to address unresolved issues. They advocate for a stable and clear policy, and unified protocols to enable digital transformation across the Middle East.

“AI-ready”

With its voracious appetite for all things AI, the Middle East has become one of the most exciting data center markets in the world, and Syntys has emerged as an interesting player in this region.

Demand for digital infrastructure is surging in the Middle East driven by the rapid growth of Cloud Computing, Artificial Intelligence, Information Technology, and a booming telecom sector. Moreover, as governments in MENA increasingly prioritize localized cloud services and data sovereignty, the demand for secure, scalable and compliant IT solutions continues to rise.

Readers would recall that in March 2025, telecom major Ooredoo has rebranded its data center arm MENA Digital Hub, as Syntys, which has since then, gone on to establish itself as a standalone entity specialized in the design, construction and management of data centers.

To delve deeper into the myriad aspects of operating an entity like this in the Middle East, especially in an age where AI is challenging and changing the entire digital landscape, we caught up with Riccardo Degli Effetti, Chief Operating Officer, Syntys for an interesting tête-à-tête.

What is your vision for data

centers in the age of AI and highperformance computing?

AI has redefined infrastructure requirements. We’re no longer talking about 5 or 10kW racks. We’re now designing around 50 to 150kW per rack—sometimes more. That impacts every layer of a facility: power, cooling, physical design, and operations. The key is to design flexibly so that your environment can easily be adapted to the ever-changing needs of AI and HPC.

At Syntys, our focus is to deliver environments that are engineered for this shift. That includes both greenfield builds and retrofitted sites.

What does “AI-ready” really mean in practice, and how has Syntys delivered on that?

“AI-ready” is more than a marketing term—it’s a measurable standard. Can you support high-density racks? Can you cool them efficiently? Can you deliver uptime at scale, without delays or redesigns?

We showcased this with the Ooredoo sovereign AI cloud deployment in Qatar, delivering a high-

density environment to host NVIDIA H200 GPUs.

What kind of growth do you foresee across your existing markets with respect to data centers over the next five years?

We’re seeing a clear shift across MENA. Markets once considered peripheral are now setting the pace for digital infrastructure—driven by cloud adoption, AI workloads, national tech strategies and large scale digitalization.

Four things are driving the momentum:

• A young, mobile-first population reshaping demand

• Hyperscaler investment validating the region

• Government-led digital transformation across sectors

• AI redefining infrastructure standards and urgency

We expect strong demand for sovereign, compliant, GPU-ready facilities, especially in countries like Qatar, Kuwait, Oman, Iraq, and Tunisia. At the same time, challenges around

power, regulation, and talent will shape how fast the region can build sustainably.

Providers that combine execution with regional insight will lead this next phase. We’d like to think we are one of them.

Are you preparing for liquid cooling? Do you see hybrid models becoming more common?

Yes. Once you cross 35kW per rack, traditional cooling needs to evolve. We’re already designing for hybrid and liquid-cooled deployments—whether through rear-door systems or direct-tochip.

We’re not tied to one model. We evaluate each deployment based on density, risk profile, and operational context. It’s about building what works, not following trends.

Are GPUs a key part of your growth strategy, and how does that impact your approach to infrastructure planning?

Yes. GPU-driven workloads are shaping the next wave of demand. That requires specific planning around rack density, cooling, and speed to market.

We don’t deploy the GPUs—we provide the environment they need. Everything we build is designed around high-performance compute from day one. This influences how we phase investment, plan capacity, and structure our modular rollout. It’s about meeting demand with infrastructure that’s ready when it’s needed.

What is the strategic significance of delivering sovereign AI infrastructure in Qatar— or other markets?

“We expect strong demand for sovereign, compliant, GPU-ready facilities, especially in countries like Qatar, Kuwait, Oman, Iraq, and Tunisia.”

Sovereign AI infrastructure is about local control—data residency, regulatory alignment, and low-latency compute. Governments, enterprises, and critical sectors need this to operate securely and independently.

In Qatar, the Ooredoo AI cloud is a national initiative. We delivered the physical infrastructure that made it possible.

Syntys is a newly launched brand. Were there any challenges in delivering such a critical deployment so quickly?

The brand is new. The platform isn’t. Syntys was launched through a strategic carve-out, which gave us a head start—operational sites, experienced teams, and active clients were already in place.

We also secured over QAR 2 billion in financing and have the support of Iron Mountain, a global data center operator. Our development roadmap is grounded in execution, with a combination of technical depth and financial capacity that allow us to deliver fast.

Could you share what’s coming up next from Syntys?

We’re scaling for impact. Syntys already operates a network of carrierneutral data centers across MENA markets, and we’re expanding.

In Qatar, in addition to having completed delivering sovereign-grade, AI mission critical infrastructure to support national objectives earlier this year, we will be completing an extension of our facilities by the end of the year as well, to support with additional capacity the demand for data center services in the country.

What’s next, is more build-to-suit delivery, and ongoing investment to meet compute demand, locally and beyond.

Is Your Business Ready to Take the Spotlight? Get in touch with us today at media@w.media

Scan to watch our exclusive interviews with Industry leaders.

With a readership of top decision-makers across APAC, we’ll ensure your message reaches the right audience. Our Offerings Include:

• Magazine – Online & Offline

• Interviews - In person & Virtual

• Editorial content

• Newsletter Features

• Digital Ad Campaigns

• Annual APAC Cloud and Datacenter Awards

Our Community at a Glance:

• 80,000+ Subscribers across APAC

• 70,000+ Monthly Website Visits

• 33,000+ Social Media Followers

• 16,000+ Industry Decision-Makers Engaged

Here are three ways you can get involved:

1.

Nomination Submission (Opens until July 31st)

You can nominate individuals, teams and initiatives pushing boundaries under 3 main themes: Projects, Planet, People and 16 categories. Multiple entries per organization are welcome.

Scan to submit (free entry) and give your work the recognition it deserves!

2.

Sponsorship Opportunities

We are welcoming sponsors with limited slots available!

Don’t miss this opportunity to be in the spotlight throughout our award promotion and at our highly anticipated Gala Ceremony, where 200+ C-level executives from top companies will join.

3.

Early Bird: To guarantee a seat at our black-tie ceremony event, grab a ticket at a discounted price now!

Get more information via: https://w.media/awards/#tickets Contact us: awards@w.media for any further inquiries

This September, we are back in Dubai for w.media’s Middle East Awards where we honour top technology business leaders, and some of the most innovative projects from the region’s digital infrastructure industry. W.Media’s Cloud & Datacenter Awards encourage industry transformation and innovation, by recognising expertise, experience, and excellence.

The Middle East is home to powerhouse digital infrastructure markets in the United Arab Emirates (UAE) and the Kingdom of Saudi Arabia (KSA). Apart from this there are strong emerging markets in Bahrain, Oman and Qatar. The region is not only attracting billion dollar investments from international tech giants, such as Microsoft, Oracle, and Google, it is also blessed with homegrown companies like DataVolt, Gulf Data Hub, Khazna Data Centers, Moro Hub, Syntys and many more, that are leading innovation

and growth.

The Middle East Awards not only recognise and reward talent from the Middle East’s vibrant cloud and data center industry; this year onwards, we have also included categories recognising talent from the connectivity ecosystem. This year, w.media’s Middle East Awards will be given out in 16 categories, spread across three pillars:

Projects:

1. Data center design & build

2. Digital technology inside the data center

3. Innovation in data center engineering for GPUaaS

4. Innovation in Internet Exchange (IX) deployment

5. Innovation in subsea network engineering

Planet:

1. Sustainability in operations

2. Sustainability in design & build

3. Innovation in energy optimization

4. Innovation in energy efficiency

5. Innovation in data center cooling

People:

1. Data center design and engineering team

2. Data center operations team

3. Talent acquisition and management team

4. Data center market intelligence team

5. Hyperscale infrastructure leaders

6. Strategic network infrastructure leaders

This will be the fourth edition of the Middle East Awards, and the glitzy awards ceremony will take place right after the Dubai Cloud & Datacenter Convention, which will be held at the JW Marriott Marquis Hotel, Dubai on September 11, 2025.

In January 2025, OpenAI, SoftBank, Oracle, and MGX, announced that they had come together as initial equity funders in the Stargate Project, a new company which intends to invest US$ 500 billion over the next four years, building new AI infrastructure in the United States. This was an unprecedented alliance of some of the biggest global technology players, and it sent ripples of excitement across the world. But the party had only just started, and soon, it started to spill outside the US.

By Deborah Grey

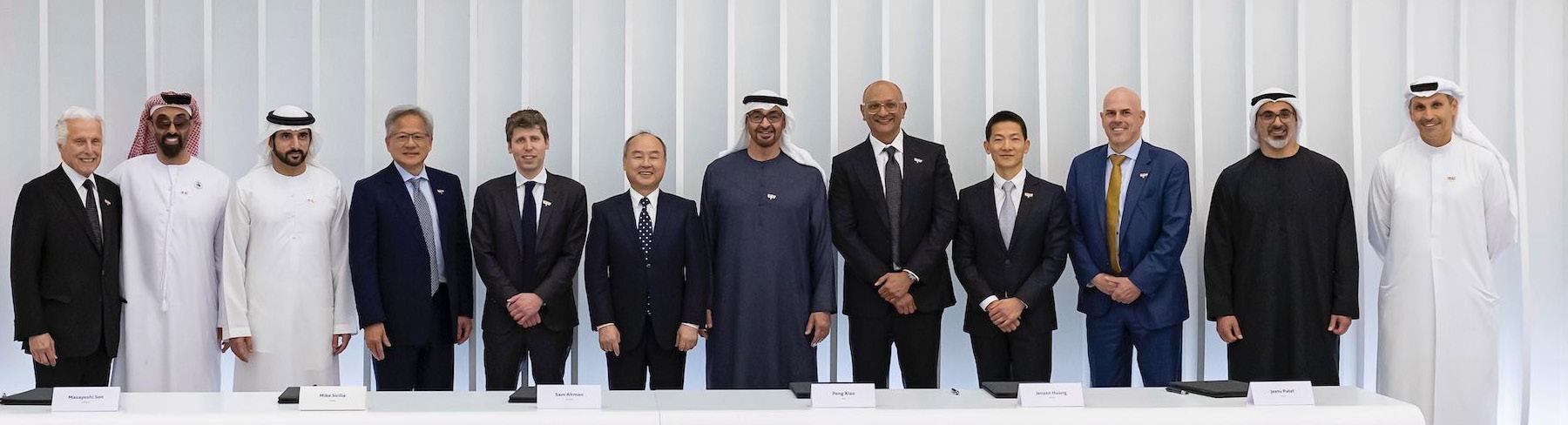

Just a few months later, in May, OpenAI, SoftBank, Oracle, joined hands with NVIDIA, Cisco, and Middle Eastern digital infrastructure major G42, to develop Stargate UAE as a 1 GW AI infrastructure cluster that would run in the 5GW UAE–US AI Campus in Abu Dhabi, a facility that itself was announced during US President Donald Trump’s visit to the UAE. Stargate UAE will be built by G42 and operated by OpenAI and Oracle. While Cisco will offer security and AIready connectivity, NVIDIA will supply the latest NVIDIA Grace Blackwell GB300 systems for the project.

Stargate UAE was envisioned as “a foundation for scalable, trusted AI” and its purpose is to “accelerate scientific discovery and drive innovation across industries ranging from healthcare and energy to finance and transportation, fueling future economic growth and national development.”

What makes UAE an ideal home for Stargate’s first project outside the U.S?

As economies across the Middle East embrace digital transformation and AI with an unprecedented vigour, the region is also becoming one of the most exciting digital infrastructure markets in the world. With established business and technology hubs like Dubai and Abu Dhabi, the United Arab Emirates (UAE) is the jewel in the Middle East’s crown.

According to Mordor Intelligence, the UAE data center market size is estimated at 495.7 MW in 2025, and is expected to reach 917.7 MW by 2030, growing at a CAGR of 13.11 percent. Further, the market is expected to generate colocation revenue of US$ 553.2 million in 2025, and is projected to reach US$ 1,327.4 million by 2030, growing at a CAGR of 19.13 percent during the forecast period (2025-2030).

When it comes to AI, Mordor Intelligence estimated the size of UAE’s AI data center market to be about US$

331.60 million in 2025, and expects it to reach US$ 700.32 million by 2030, growing at a CAGR of 16.12% during the forecast period (2025-2030).

Moreover, UAE figures prominently in the U.S’s global AI plans. Stargate UAE’s founding partners too saw UAE’s potential, and articulated as much during its launch.

“By establishing the world’s first Stargate outside of the U.S. in the UAE, we’re transforming a bold vision into reality,” said Sam Altman, Co-founder and CEO of OpenAI, adding, “This is the first major milestone in our OpenAI for Countries initiative—our effort to work with allies and partners to build AI infrastructure around the world.”

“The launch of Stargate UAE is a significant step in the UAE–U.S. AI partnership,” acknowledged Peng Xiao, Group CEO of G42. “This initiative is about building a bridge - rooted in trust and ambition - that helps bring the benefits of AI to economies, societies, and people around the world.”

According to Jensen Huang, founder and CEO of NVIDIA, “AI is the most transformative force of our time.” He further said, “With Stargate UAE, we are building the AI infrastructure to power the country’s bold vision – to empower its people, grow its economy, and shape its future.”

Stargate UAE: Using AI to author digital destiny

UAE is one of the most technologically advanced countries in the Middle East, and thanks to a series of carefully calibrated policies such as the National Policy for Digital Accessibility, UAE Strategy for Artificial Intelligence and We the UAE 2031 vision, it is taking all necessary steps to become a regional technology and AI powerhouse.

But all this digital transformation, especially the UAE’s voracious appetite for AI, have necessitated the development of data centers that can handle AI workloads. With its unprecedented size and scale, and a solid alliance of some of the biggest names in the business, Stargate UAE is poised to be a game changer. Hopefully, Startgate UAE will be the first of many similar projects that will help UAE author its digital destiny, and rewrite its digital transformation story.