Hyperscale

Johor: From 10MW to 1,500MW in three years

India’s Hyperscale Ambitions Gigawatt-scale data centers “inevitable” Singapore’s quest for sustainable data centers

Special Middle East supplement included

10 Johor: From 10MW to over 1,500MW in three years

12 What’s next for Johor?

13 India’s hyperscale ambitions: GW-scale data centers “inevitable”

15 Singapore’s quest for sustainable data centers

HIGHLIGHTS

16 Reality Check: Energy efficiency, water scarcity, and decarbonisation

22 Industry 4.0 and AI driving hyperscale data center

34 Women leading the digital revolution

38 Hyperscale - what’s next?

HAPPENINGS

19 Key takeaways from Korea and China CDC 2024

36 Celebrating Dubai

37 Eye on Saudi Arabia

MIDDLE EAST SUPPLEMENT

25 How will the Middle East data center market shape up?

27 Emerging Markets to watch out for in the Middle East

29 What makes Saudi Arabia such an exciting DC market

31 Subsea Cable Systems: Connecting the Middle East to the world

From the Editor’s Desk

We are living in exciting times, where a rapidly digitalising world is embracing emerging technologies like Artificial Intelligence (AI). This is, in turn, driving a mind-boggling, non-linear and unpredictable kind of growth in the global Cloud and Data Center industry.

In this issue, we take a closer look at the unprecedented boom in the hyperscale data center market in the Asia Pacific region, particularly in Johor in Malaysia, and across India where there is now talk of building gigawatt-scale data centers!

We have also put together a Special Middle East Supplement that showcases one of the most exciting data center markets in the world. While the United Arab Emirates (UAE) and the Kingdom of Saudi Arabia (KSA) are leading the region’s digital transformation, emerging markets like Bahrain, Oman and Qatar are also poised for growth.

This issue also features exclusive articles penned by industry watchers, veterans, and sustainability experts. We hope you enjoy reading this issue as much as we enjoyed putting it together.

Deborah Grey Editor-in-Chief W.Media

“In recent years, the data center industry has rapidly evolved from a niche technical field to a cornerstone of global digital infrastructure, driven by the explosive growth of cloud computing and AI. Recognising this seismic shift, our Cloud & Datacenters magazine has positioned itself as a leading voice in the industry. We are committed to delivering relevant analysis, insights and perspectives, establishing ourselves as the go-to resource for industry professionals and decisionmakers.”

Paul Mah Executive Editor W.Media

Paul Mah Executive Editor

Senior Tech Journalist

Editor-in-Chief

Deborah Grey

Hazel Moises

AirTrunk Opens 150MW

Hyperscale

Data Center

in Johor Bahru

Global data

center

operator

AirTrunk has officially opened its largest facility in Southeast Asia, a 150 megawatt hyperscale data center in Johor Bahru, Malaysia.

The facility, AirTrunk JHB1, represents a significant investment in the country’s digital infrastructure and is expected to drive economic growth.

Designed to meet the surging demand for data processing and storage in the region, JHB1 incorporates cutting-edge technology to optimize efficiency and sustainability. The data center’s advanced cooling systems, including direct-to-chip liquid cooling, are expected to significantly reduce energy consumption. In addition, AirTrunk has committed to sourcing renewable energy to power the facility, aligning with Malaysia’s environmental goals.

With its strategic location and substantial capacity, JHB1 is poised to attract major technology companies and cloud service providers to Malaysia. The data center is expected to create new job opportunities and stimulate related industries in the region.

AirTrunk’s investment in Malaysia underscores the country’s growing importance as a digital hub in Southeast Asia. The company’s decision to establish a large-scale data center in Johor Bahru is a testament to the favorable business environment and supportive government policies in Malaysia.

Vietnam Opens Doors to Foreign Data Center Investors

Vietnam has made a surprising aboutface, welcoming foreign investment in its data center sector after strict data storage rules backfired. The new Law on Telecommunications, effective last week, eliminates foreign ownership restrictions for data and cloud providers, a stark contrast to the 49% cap on foreign investment in many other Vietnamese industries.

This shift comes after previous regulations, including the Cybersecurity Law, mandated companies to store data within Vietnam’s borders. This move, met with strong opposition from tech giants like Facebook and Google, has a history of causing friction with international trade agreements. Additionally, concerns were raised about the ability of domestic data centers to meet the surge in demand and maintain international security standards.

Nikkei Asia reported that according to Leif Schneider, a lawyer at Luther, the local data storage requirement can be expensive for companies. There’s also the challenge of ensuring Vietnamese data centers meet global data security and privacy benchmarks.

However, the new telecommunications law is seen as a turning point. Experts predict an influx of international players in cloud computing and data storage, potentially leading to technology transfers and other economic benefits. Companies like Amazon Web Services and Keppel, a Singaporean asset manager, have already expressed interest in investing in Vietnamese data centers. Vietnam’s data center sector is poised for significant growth, with foreign investment playing a key role. This move reflects the country’s need to balance data security concerns with the benefits of attracting international tech giants and fostering domestic industry development.

China paves the path for Foreign Ownership of Data Centers

In a landmark move, China has enabled the removal of restrictions on foreign ownership of cloud and data center services.

This is significant for a country where until now, foreigners have not been allowed to own more than 50 percent equity in data centers.

The decision came to light this Sunday, when the “Negative List” released by China’s National Development and Reform Commission cut sectors barred from foreign investment from 31 to 29. Effective November 1, all restrictions to foreign investments into China’s manufacturing sector will be lifted. Significantly for the digital infrastructure industry, restrictions will now be removed for a variety of digital services including cloud and data center services, value-added telecommunication services, internet services etc., especially in regions like Beijing, Shanghai, Shenzen and Hainan.

W.Media had reported recently that China has significantly accelerated its investment in data centers, pouring over 43.5 billion yuan ($6.12 billion) into a nationwide project in recent years.

Vantage Data Centers Opens First Hyperscale Data Center in Taipei

Vantage Data Centers has announced the official opening of its first Taipei data center, TPE11. The 16MW facility, located in Taoyuan, is equipped with advanced liquid cooling technology to support the growing demands of AI and data-intensive applications. A grand opening ceremony was attended by government officials and industry leaders, including Taoyuan Mayor Chang San-Cheng. The event marked a significant milestone for both Vantage and Taiwan’s technology sector.

“Taipei is a dynamic technology hub experiencing rapid growth in demand

This initiative, known as “Eastern Data, Western Computing,” comes as the country faces growing technological restrictions from the United States. Readers would recall that the US had imposed export controls on certain advanced computing products, including those from Nvidia, a leading chipmaker. These restrictions have prompted China to intensify its efforts to develop domestic capabilities in high-performance computing.

In light of this, the recent decision to remove restrictions on foreign investment and ownership of data centers, is yet another step by China to build some serious tech muscle and assert its dominance.

Before Sunday’s update, the “Negative List” was last updated in 2021. The move was necessitated by an economic slowdown in the wake of the COVID-19 pandemic. China has also removed restrictions to investments in healthcare, biotechnology.

Data Center Fire Strikes Alibaba Cloud in Singapore

A major fire incident at Alibaba Cloud’s Availability Zone C data center in Singapore has caused significant disruptions for numerous tech companies and their services. The fire, which started on Tuesday, September 10, at Digital Realty’s SIN11 data center, involved lithium-ion batteries and presented unique challenges for firefighters due to their tendency to reignite and release toxic fumes.

The incident has had a ripple effect on various tech giants, including Lazada and Bytedance, as their services rely on the cloud infrastructure provided by Alibaba Cloud. Internal teams and sellers using the platform have reported widespread errors and disruptions.

for hyperscale data center solutions,” said Raymond Tong, president of Vantage’s APAC business. “TPE11 is a strategic addition to our global portfolio, and we are excited to support the region’s digital transformation and innovation.”

Designed with sustainability in mind, TPE11 boasts industry-leading PUE and WUE metrics. The facility will be powered by Taiwan Power Company, which is committed to increasing its renewable energy sources.

Vantage’s entry into the Taiwanese market underscores the country’s increasing importance as a global technology center. The new data center is expected to attract a diverse range of customers, including cloud providers, enterprises, and high-performance computing companies.

While Alibaba Cloud has successfully switched most of its cloud network and security products to backup systems, other services are still being affected. The fire has also caused water accumulation and leaks in one of the server rooms, leading to an emergency power shutdown to prevent electrical short circuits. The prolonged firefighting efforts and subsequent damage have forced Digital Realty to partially close the data center.

The Building and Construction Authority has issued a Dangerous Building Order and a Closure Order for specific areas due to structural concerns.

Recovery teams are working tirelessly to assess the extent of the damage and restore operations. Digital Realty has confirmed that a company emergency response team is on-site to support the recovery process and is working closely with affected customers.

PHOTO: 8WORLD

W.Media is the go-to platform for decision makers, trusted by top companies and a growing community of 80,000+ industry professionals in APAC.

• Magazine – Online & Offline

• Interviews - In person & Virtual

• Editorial content

• Newsletter Features

• Podcast

• Digital Ad Banners

• Annual APAC Cloud and Datacenter Awards

Our Offerings Include: SEND IN YOUR INTERESTS NOW! BE FEATURED

Our Community at a Glance:

80,000+ Subscribers across APAC

70,000+ Monthly Website Visits

31,000+ Social Media Followers

16,000+ Industry Decision-Makers Engaged

Johor: From 10MW to 1,500MW in three years

With its proximity to Singapore, lower costs, and strong government support, Johor has become Malaysia’s top data center market and is poised to be the largest in Southeast Asia. It is difficult to believe that Johor’s data center capacity was just 10MW at the start of 2021. By 2024, this capacity has surged to over 1,500MW, according to DC Byte.

By Paul Mah

Granted, this figure includes data centers under construction, committed supply, and those in the early stages of planning and development. Still, the meteoric rise is unprecedented, marking a once-ina-generation leap for the state of four million inhabitants.

Once-in-a-generation growth

How did this remarkable growth come about? It arguably began when

Singapore imposed a moratorium on new data centers in 2019, ceding the stage for new data centers and causing demand to spill over to Johor and Batam. Johor’s first data center, Keppel’s DC Johor 1, was completed in 2020. Then GDS broke ground on its data center campus at Nusajaya Tech Park in April 2022, and the race is on. Malaysian authorities quickly capitalised on the initial momentum, using their understanding of what data center operators need by launching the Green Lane Pathway initiative in 2023. This streamlined power approvals for new facilities, reducing the lead time

It is difficult to believe that Johor’s data center capacity was just 10MW at the start of 2021. By 2024, this capacity has surged to over 1,500MW.

for new data centers from three to four years to as short as 12 months. One of the earliest beneficiaries, Princeton Digital Group (PDG), successfully delivered phase one of its 150MW JH1 data center campus in the Sedenak Tech Park (STeP) within 14 months of acquiring the land.

On a strategic level, Malaysia sought to attract more digital investments. For example, the Malaysian Investment Development Authority (MIDA) and Malaysia Digital Economy Corporation (MDEC) established a Digital Investment Office in 2021 to focus on digital infrastructure development. In 2023, the Ministry of Digital Communications was split into the Ministry of Digital and the Ministry of Communications to better focus on these areas.

Malaysia was able to seize the opportunity because it was prepared. For years, MDEC worked tirelessly to promote Malaysia as a destination for data centers. And Malaysia already boasts a substantial number of data centers thanks to the Multimedia Super Corridor (MSC), with international operators such as NTT setting up shop alongside many home-grown players.

GDS Nusajaya Tech Park Data Center Campus (Phase 1) in Johor.

The shape of data centers to come Johor’s massive growth shows no signs of slowing. Indeed, private conversations and informal exchanges with various data center operators suggest many more data center operators are gearing up to make announcements in the months ahead.

Cloud players are also ramping up their presence. For years, the largest public cloud providers have established their clouds in Singapore, opting to expand their footprint there instead of building new cloud regions in other parts of Southeast Asia. This is no longer the case.

In August, Amazon Web Services (AWS) opened its Malaysia cloud region with three availability zones and says it will invest RM29.2 billion over 15 years. In October, Google broke ground on its US$2 billion data center and cloud region in Malaysia, while Oracle has announced that it will build a US$6.5 billion cloud. In addition, Microsoft is expected to announce the launch of its Azure cloud region very soon.

Could Malaysia’s breakneck data center growth strain resources? This is a real possibility, though it’s more about ensuring the even distribution of power and water than any shortage. Even localised water shortages or power outages won’t sit well with voters, which means government agencies must work overtime to ensure it never happens.

Another concern is the potential of a data center bubble, a possibility many in the industry grudgingly acknowledge is an eventual possibility. For now, data center capacity is snapped up as quickly as it is built; new construction phases are often started immediately after completion of previous phases simply to keep pace with demand.

Empowering the next phase of growth

What lies ahead? As more data is served from Johor, there is an opportunity to build a thriving Internet exchange to support the new data center operators and cloud hyperscalers. Done right, this could position Johor as a key digital hub not only in Malaysia but across Southeast Asia, setting the stage for its next phase of digital growth.

There are additional benefits. Data center investors often seek renewable energy to meet their netzero commitments. The rapid growth of data centers allows Malaysia to

Data center capacity is snapped up as quickly as it is built; new construction phases are often started immediately after completion of previous phases simply to keep pace with demand.

leverage this demand to make the transition to renewable power more quickly than before. Other factors must first be put in place, including legislative changes for an open-access power grid.

Malaysia isn’t just focused on attracting data center operators. It aims to grow the entire data center supply chain ecosystem, from assembling and packaging semiconductors to manufacturing

data center equipment and even talent development. Only then can Malaysia maximise the benefits of its data center growth and ensure the healthy, continued development of data centers.

Ultimately, Johor’s transformation into a data center powerhouse could usher in a new era of economic growth, not just for Johor, but for Malaysia as a whole, elevating it to the forefront of the global digital economy.

What’s next for Johor?

Is Johor’s data center market a bubble in the making?

By Aurora Tang

Amid growing concerns about an oversupply of data centers, questions surrounding power and water stability, and its impact on urban planning, many wonder if the rapid development of Johor’s data center market is a bubble in the making.

However, industry players suggest these fears are unfounded – at least for the foreseeable future.

Fast growth, high demand

In just three years, the data center capacity in Johor has skyrocketed from 10MW in 2021 to over 1,500MW. A long list of technological giants such as ByteDance, GDS, and Microsoft have turned to Johor to meet their capacity needs.

The presence of major players like Microsoft in the Johor data center industry indicates that there is significant potential within the market, says Tiffany Goh, the country manager of IVPS Malaysia.

Addressing the issue of oversupply, Goh explained that in real estate, oversupply is typically defined as a development remaining vacant for more than six months after completion. She believes this scenario is unlikely to apply to the data center industry given the current demand. In addition, the construction of a data center is extremely costly, and operators would have conducted a thorough market analysis before investing.

Build and they will come

Building data centers is a lengthy process, involving securing land and approvals. With demand surging due to the growth of AI, customers are now looking for significantly more capacity, between 50 and 100 MW of power.

New data center operators currently face the classic dilemma of developers everywhere: should they build ahead of demand? Waiting until demand

materialises could mean missing out on profits. Yet building today’s massive data centers first is a huge financial risk that they must carefully consider.

Apart from tackling the issue of demand and supply in the market, the availability of resources is also one that needs to be taken into account. A typical household will use about eight MWh of power a year, and 100 MW of power can theoretically supply 110,000 households. This figure provides us with context on how much energy is required to power hyperscale data centers.

With power disruptions at the CIQ complex happening twice in less than three months between December 2023 and February 2024, is there enough power for all the new and upcoming data centers?

Expect more regulations

To tackle such issues preemptively, the Johor State Data Center Development Coordination Committee (JPPDNJ) was established earlier this year to introduce guidelines on the usage of water and power by data centers.

The committee had decided that data centers in Johor should focus on the use of renewable technology in addition to saving electricity and water. Speaking publicly in August 2024, Lee Ting Han, chairman of Johor’s investment, trade and consumer affairs committee, said that the authorities are aware that data centers consume large amounts of water and energy, but they will ensure that domestic users will not face interrupted utility supplies.

While it is heartening to know that the state government sees a need to put measures in place for regulatory purposes, the effectiveness of these guidelines will still need to be evaluated over time to determine their true impact and whether they can adequately address the challenges at hand. Industry players are also hoping to receive grants and support from the government to aid in the transition towards building more sustainable data centers in Johor.

Additionally, proper urban planning has been keeping the construction of data centers in check too. In April 2024, PLANMalaysia Johor also published a 40-page guideline titled “Johor State Data Center Development Planning Guidelines.” This provides operators with information regarding data center location, permitted planning zones, land use categories, among other criteria. Operators looking to set up data centers in Johor will have to comply with these guidelines.

Data center development is usually limited to industrial or commercial zones as outlined in the Local Plan (RT) to ensure compatibility with the environment. When proposing data centers in commercial areas, operators are also required to conduct thorough research to align with local character, zoning regulations, and community needs, mitigating potential negative impacts and fostering a positive relationship with the surroundings.

Forging ahead

While Johor is gaining traction due to its data center boom, there are concerns in some sectors that the rapid growth could compromise the development of other industrial sectors. So far, the state seems to be developing well in the semiconductor market. The proposed Johor-Singapore Special Economic Zone (SEZ) is expected to further attract semiconductor players.

For now, it is evident that the Johor government is placing significant emphasis on the growth and regulation of the data center industry, implementing policies and guidelines to support its development.

However, the industry’s rapid expansion is still in its early stages, and while the outlook appears promising, the sustainability of this growth remains to be seen. Continuous monitoring and adjustments will be key to ensuring the market matures in a balanced and resilient manner, benefiting both the industry and the broader community.

India’s Hyperscale Ambitions: GW-scale data centers “inevitable”

In late August, Reliance Industries Chairman and Managing Director, Mukesh Ambani, shocked India’s data center industry by announcing ambitious plans to build a 1 GW, AI-ready data center in Jamnagar, located in the western Indian state of Gujarat.

By Deborah Grey

This would be truly phenomenal in a country where the total IT load capacity has just about touched 1 GW nationwide, with Mumbai alone accounting for at least half of it.

Today, Indians are consuming online services and generating data like never before. This, in turn, has generated an unprecedented demand for digital infrastructure and compute power. Now, add artificial intelligence and highperformance computing into this mix, and it all becomes truly mind-boggling!

While there are hyperscale data centers in all major Indian markets like Mumbai, Chennai, Hyderabad, Bengaluru, and Delhi/NOIDA, their IT load capacities are nowhere near GWscale. It is also a fact that the nation of 1.4 billion tech- savvy people remains grossly underserved when it comes to data centers.

Are GW-scale data centers on the horizon?

“It is inevitable,” says data center industry expert Sandeep Dandekar. In fact, unlike others who see only edge data centers or facilities with smaller IT capacities being built in smaller towns across India, Dandekar feels even hyperscale data centers would find their way into India’s interiors. “With the rise in total demand, I see a rise in

density levels and a need for latencyfree high-speed high-volume data flow right up to deeper interior locations of the country in the near future,” he says. Dandekar expects the market to grow at a CAGR of at least 20 percent, and that this would lead to greater adoption of new technologies in the areas of automation, as well as new age cooling technologies that will save power. However, he cautions, “In case the total capacity availability does not grow at that pace, the steam will be wasted, and that will constrain growth achieved in various sectors.”

In its report titled Is India Building Enough to Power its Digital

Transformation, Cushman and Wakefield found that India’s underconstruction Colocation data center capacity addition stands at 1.03 GW for 2024-2028. An additional 1.29 GW is planned, and operators have been building land banks with 3-4

“With the rise in total demand, I see a rise in density levels and need for latency free high-speed high-volume data flow right up to deeper interior locations of the country in the near future.”

Sandeep Dandekar Data Center Expert

GW development potential over the medium to long term. When it comes to hyperscale data centers, the report found that the total operational cloud self-build capacity stood at 68 MW as of end-2023, with under-construction and planned capacity of 96 MW and 226 MW, respectively. “Hyperscalers have also moved ahead on land banking, with AWS and MS Azure acquiring land parcels across Mumbai, Thane, Hyderabad, and Pune for future development,” found the report.

“At the rate at which India’s data center industry is growing, GW- scale data center campuses are no longer a luxury but the only option that we have,” says Rohan Sheth, Head – Colocation and Data Center Services, Yotta Data Centers. Yotta is a major player in India’s data center market that already operates hyperscale data centers across India, including the world’s second largest Uptime Institute Tier IV-certified facility in Navi Mumbai. “Yotta’s Navi Mumbai DC 1 has 45 MW of IT power with a 48hour backup. Our DC 2, which is core and shell ready, has an IT power of 60 MW. In addition to these 2 buildings, Yotta’s facilities offer strategic scalability with the capacity to expand up to 1 GW in Panvel,” he shares.

What is driving the demand for Hyperscale data centers in India? Just taking a closer look at internet and mobile phone usage figures should be enough to understand the demand-supply gap surrounding digital infrastructure. According to the Telecom Regulatory Authority of India (TRAI), at the end of December 2023, India had 936.16 million internet subscribers and 1.15 billion wireless telecom subscribers.

Moreover, given the government’s push towards cashless transactions, in the wake of the 2016 demonetisation initiative, and the impact of the COVID-19 pandemic, Indians have taken to digital banking and payment services in a big way. Unified Payments Interface (UPI), which is a mobile-based payment system in India developed by the National Payments Corporation of India (NPCI) has made real time, round-the-clock digital transactions convenient. So much so that it is now even used by autorickshaw drivers, street-side food vendors, and neighbourhood momand-pop stores to accept payments from customers!

Meanwhile, e-commerce and OTT platforms are thriving, as are apps

“At the rate at which India’s data center industry is growing, GW scale data center campuses are no longer a luxury but the only option that we have.”

Rohan Sheth

Head – Colocation and Data Center Services

Yotta Data Centers

offering services like food and grocery delivery, car hire and taxi booking, and flight and rail reservations, not to mention the ubiquitous social media apps.

According to the 2023-2024 Annual Report of the Reserve Bank of India (RBI), which is India’s central bank and the regulatory body overseeing India’s banking sector, the Department of Payment and Settlement Systems (DPSS) has recorded at growth of 44 percent in terms of transaction volume during 2023-24, on top of the expansion of 57.8 percent in the previous year.

Building GW-scale Data Centers

So, the big question is, can India truly build and operate data centers that will have a capacity equivalent to the current IT capacity of all its data centers put together?

“Why not?” asks Vinod Javur, COO, Digital Edge DC, adding with cautious optimism, “As long as operators can arrange for adequate power, it is possible.”

Yotta’s Sheth concurs saying, “The capital expenditure on setting up these data centers averages between USD 4-10 million per MW, depending on the geography, with the largest component being power, which constitutes about 30 percent of the total capex.” He further says, “Securing clean and green power of such a large quantity and also unlimited bandwidth of fiber are the key challenges, along with cap-ex costs and energy consumption for GW-scale data centers.”

But despite the challenges, one cannot deny that India’s hyperscale journey has just started, and GW-scale data centers will not be a distant dream for long.

Singapore’s quest for sustainable data centers

Singapore was supposed to fail. The critical mass and key elements needed for a functional and prosperous nation weren’t there. Yet, Singapore not only survived but thrived. When digital transformation emerged as the new frontier, the city-state led the charge, quickly establishing itself as a regional data center hub.

By Paul Mah

However, as Singapore approaches its 60th year of independence, the reality of its constraints is biting again. In an era of sustainability and climate change, Singapore finds itself unable to compete in building data centers on the same scale as other parts of the world.

Sustainability is a challenge for all

With its early start, Singapore’s 1,400MW of data centers already makes it one of the densest data center hubs globally, whether by GDP, land area, or population. The problem lies in its small size and extensive urbanisation, leaving little space for solar panels and renewable energy.

With limited renewables, Singapore cannot allow unchecked construction of new data centers. Having recognised the problem years ago, it imposed a 3-year moratorium on new data centers in 2019. This was followed by an initial allocation of 80MW – anaemic by current standards – for new data centers in 2023.

On May 30 this year, Singapore announced a new allocation of 300MW of capacity for data centers. As part of an expansive “Green Data Center Roadmap” published the same day, the new allocation was meant to capture strategic opportunities for Singapore and incentivise the industry to build more sustainable data centers.

Speaking at the launch of Google’s fourth data center in Singapore a week after the unveiling of the roadmap, Senior Minister of State Dr Janil Puthucheary elaborated on the government’s stance on sustainable data centers.

“This challenge [of sustainability] is not unique to Singapore; eventually, all of us, wherever we are in the world, are going to be faced with these constraints… Because of who we are, we are determined to turn these constraints into [opportunities] to innovate and capture value from the growth of sustainable data centers,” he said.

Working with the industry

Faced with the challenge of sustainability and energy efficiency in data centers, Singapore is adapting. But how does one build a sustainable data center? The Green Data Centre Roadmap provides some insights.

There are two key strategies: improving energy efficiency at the hardware and software level to maximise data center capacity, and accelerating the use of green energy by incentivising operators to explore ways to leverage it at scale.

The plan is to encourage an ecosystem approach, nudging data center operators, equipment vendors, end-users, and academia to collaborate, aligning mutual interests to achieve broader improvements.

The idea is to create an ecosystem focused on efficiency across the entire digital stack. By raising standards incrementally, the roadmap aims to spur innovation, lower costs, increase resource awareness among end-users, and reshape how new data centres are designed and built.

In a closed-door session at the ATxSummit conference following the roadmap’s announcement, Dr Puthucheary highlighted how Singapore transformed from one of the most water-stressed nations to one with

significant water resilience.

The message here? Singapore has done it before and can do it again. As it becomes an expert in sustainable data centers, it hopes to eventually export this know-how.

What about the old data centers

But what about older data centers? With new sustainability criteria likely applicable only to new data centers, what happens to older ones in Singapore and other cities facing sustainability challenges?

During a panel discussion held as part of Tech Week Singapore in October, Marcus Tong, a director at the Infocomm Development Authority of Singapore (IMDA) acknowledged that upgrading operational data centers is not a trivial effort given customers’ expectations of uninterrupted service.

Scheduled technology refreshes could offer opportunities, suggests Tong. “How can we facilitate some of these moves? It could be incentives to offset some of the CAPEX itself. If there are operational concerns and considerations, how do we work with the industry to mitigate or manage some of these issues?”

“[There are] no clear answers or solutions at this time. We recognise the need to work together with the industry and data centers operators. We have set an ambition of making sure that every data center in Singapore [can hit] a PUE of at least 1.3 or better in 10 years.”

Can Singapore succeed and reinvent itself as a leader in sustainable data centers? Just as it had transformed its water scarcity into resilience, could Singapore revolutionise energyintensive data centers into a model of sustainability – and effectively turning water into wine?

Reality Check: Energy Efficiency, Water Scarcity, and Decarbonisation in the Middle East

The Middle East, recognized for its extensive oil reserves and dry landscapes, is grappling with a series of interconnected challenges that are influencing its future: energy efficiency, water scarcity, and the necessity for decarbonization.

By Rajat Srivastav and Debbie Egeland

As the world shifts towards a more sustainable and low-carbon future, nations in the Middle East are facing mounting pressure to tackle these issues and adapt to the evolving global environment...

Energy Efficiency

Energy efficiency is a vital concern in the Middle East, where high energy consumption levels, largely driven by rapid population growth and industrial expansion, are straining existing resources and infrastructure. The region ranks among the largest energy consumers globally, with energy-intensive sectors like oil and gas production constituting a significant part of its GDP.

To meet the rising energy demand and lessen dependence on fossil fuels, Middle Eastern countries are increasingly channeling investments into energy efficiency initiatives. These efforts encompass improving energy consumption patterns in buildings, transportation, and industry, alongside promoting renewable energy sources such as solar and wind power.

A major hurdle for energy efficiency initiatives in the Middle East is the limited awareness and lack of incentives for individuals and businesses to embrace more sustainable practices. Many countries in the region still subsidize energy prices, which leads to wasteful

consumption and obstructs efforts to encourage efficiency and conservation. Nonetheless, there are indications of progress. Nations like the United Arab Emirates and Saudi Arabia have established ambitious goals for reducing energy intensity and boosting the share of renewables in their energy mix. Investments in smart grid technologies, energy-efficient buildings, and sustainable transportation systems are also gaining momentum throughout the region.

Water Scarcity

Water scarcity is a critical issue in the Middle East, where dry climates and limited water resources create significant challenges for agriculture, urban growth, and overall human well-being. This region is among the most water-stressed globally, with many countries depending heavily on desalination and unsustainable groundwater extraction to fulfill their water requirements. Climate change is worsening water scarcity in the Middle East, resulting in more frequent droughts, diminishing water supplies, and heightened competition for scarce resources. The depletion of aquifers and contamination of water sources also jeopardize the long-term water security of the region.

To tackle these issues, Middle Eastern countries are implementing various strategies to enhance water management and boost efficiency. This includes investing in water recycling, drip irrigation, and other technologies aimed at reducing water waste in agriculture, along with initiatives to encourage water conservation in urban

settings. Some nations in the region are also looking into alternative water sources, such as treated wastewater and brackish groundwater, to lessen their dependence on desalination and fossil aquifers. For instance, in Saudi Arabia, the National Water Strategy is being put into action to improve water use efficiency and decrease reliance on unsustainable water sources.

Decarbonisation

Decarbonisation, which involves reducing carbon emissions from fossil fuels, is a top priority for Middle Eastern countries aiming to combat climate change and move towards a sustainable energy future. Even though they are significant oil and gas producers, many nations in the region are beginning to see the importance of diversifying their economies and lowering their carbon emissions.

The Gulf Cooperation Council (GCC), made up of Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates, has committed to cutting carbon emissions and boosting the share of renewable energy in their energy portfolios. For example, Saudi Arabia has revealed plans to invest $50 billion in renewable energy initiatives by 2030 as part of its Vision 2030 reform strategy.

However, the shift to a low-carbon economy in the Middle East faces several challenges. The region’s strong dependence on fossil fuels and the power of influential energy lobbies create hurdles for the adoption of renewable energy and the establishment of carbon pricing systems. Despite these obstacles,

there are encouraging signs of advancement. The decreasing costs of renewable energy technologies, like solar and wind, are making them more competitive with traditional energy sources.

Additionally, Middle Eastern countries are increasingly acknowledging the economic and environmental advantages of decarbonisation, such as job creation, energy security, and improved air quality. In summary, energy efficiency, water scarcity, and decarbonisation are vital concerns for Middle Eastern nations as they confront the challenges of a rapidly evolving world. By investing in sustainable technologies, encouraging

conservation and efficiency, and transitioning to a low-carbon economy, these countries can tackle these issues and build a more resilient and prosperous future for themselves and generations to come.

Driving sustainability across the Middle East through Innovative

Colocation Approach

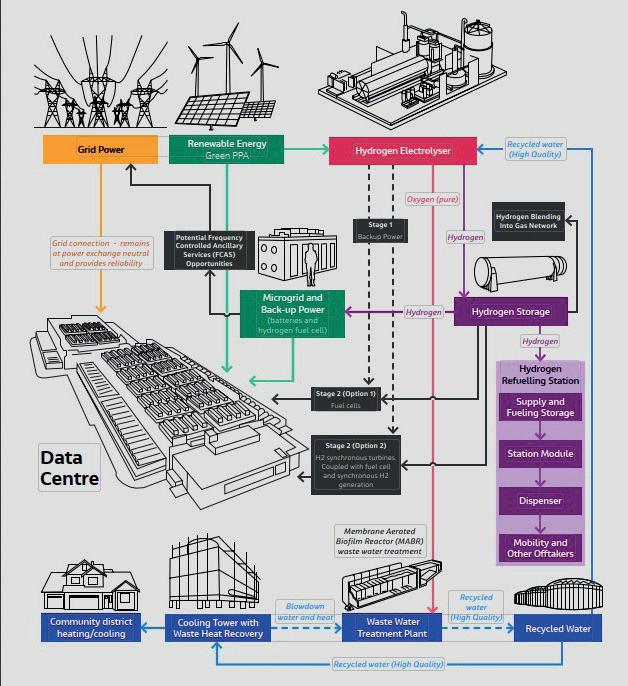

An innovative concept worth exploring is the co-location of data centers with wastewater treatment plants and hydrogen electrolyzers.This approach involves creating green hydrogen from renewable energy sources to split water (H2O) into hydrogen and oxygen. The hydrogen from the electrolyzer can be used in a fuel cell to power the

data center, while the wastewater treatment plant can utilize the pure oxygen produced in the process for aerobic treatment. The waste heat recovery process is graphically illustrated in Figure 1.

Heat from the data center’s cooling tower can provide heating and cooling for surrounding communities, thus creating a circular economy. This innovative concept has the potential to be a game-changer for the energywater nexus of data centers, offering an exciting possibility to simultaneously improve resource efficiency and contribute to a more sustainable future.

Rajat

Srivastav

Rajat is an experienced environmental and sustainability professional with over 18 years of environmental sustainability assessments, carbon footprint assessments, lifecycle evaluation, groundwater source vulnerability assessments and source mitigation plans. He leads the ESG practice for Jacobs, one of the leading providers of ESG services globally. He also has been part of ESG feasibility assessments for several technology and manufacturing sector clients.

Debbie Egeland

Debbie is a Civil and Environmental Engineer with Jacobs’ Environmental Services Business Group and is based in Singapore. She has served as project delivery lead, managing over 50 employees across the Western U.S. Her project work has been vast including water, GHG, climate change, auditing, site management, business process mapping, calculating air emissions, and preparing permit applications.

Figure 1: Integrated water management approach illustrating benefits of colocating a data center with wastewater treatment plants and hydrogen electrolyzers.

The Pulse of the Industry: Key Takeaways from Korea and China CDC 2024

The Korea Cloud & Datacenter Convention 2024 wrapped up on a high note, bringing together industry leaders, innovators, and enthusiasts for a dynamic exchange of ideas and exploration of the latest trends in the data center space. The event fostered a vibrant atmosphere for networking, knowledge sharing, and charting the course for the future of data center solutions in South Korea.

Here’s what some of the key participants had to say about their experience:

“It was a great place to reconnect with people I’ve worked with in the past, especially asset managers, construction managers.

Great opportunity to meet potential clients during the event day, and also the VIP pre-event drink”

SungHoon Park Director of Head of Sustainability Solutions in Korea CBRE Asia Pacific

The China Cloud & Datacenter Convention 2024 also concluded with resounding success, offering attendees a valuable platform for networking, learning, and gaining insights into the dynamic data center landscape in China.

Roger Niu, Group Account Director at NCH, echoed these sentiments, emphasizing the event’s professionalism and the valuable knowledge exchange that took place.

“This summit is highly professional, with the attending representatives providing consultations that cover the latest in data center design, planning, construction, installation, and operational management. While being broad in scope, it also stands out for its high level of expertise and rich content. Additionally, participants engage in communication through the platform, exchanging cuttingedge information and establishing strong industry relationships, thus contributing to the faster and better development of data centers.”

Alistair James LaBrooy, CTO of AREA Group, also shared his positive experience at the event.

“I had the pleasure of attending the W Media data center event in Shanghai, and I must say it was exceptionally well-organized. The topics discussed were both timely and insightful, offering a deep dive into key trends shaping the future of the industry. The panelists were knowledgeable and provided valuable insights that will undoubtedly impact our strategies moving forward. Additionally, the event attracted a great crowd, which created ample opportunities for meaningful networking. Overall, it was a highly productive and enriching experience.”

“I thoroughly enjoyed participating in the W.Media Korean Cloud and Data Center convention as a panel expert. Moreover, the convention had also provided an excellent networking platform meeting sector leaders and industrial experts.”

John Pritchard Head of Tenant Advisory Group / Global Services Cushman & Wakefield, Korea

“The show, speakers and attendees were all excellent, creating a great atmosphere at the event. Overall it was a well-organized event.”

Youngjun Kim

Managing Director IGIS Asset Management

As Guosheng Zhu, Chief Engineer at Yunju Service, noted:

“A quite successful event, excellent location with very convenient transportation, high quality hotel venue with a controlled number of participants, making the venue very refined; the refreshments and buffet are abundant; the selected topics for speeches are exceptional, featuring well-known experts and guest speakers from both domestic and international backgrounds.”

2025 Events Calendar

27 March 2025

Philippines Cloud & Datacenter Convention

Manilla

3 April 2025

Melbourne Interconnect World

Melbourne

3 April 2025

Melbourne Cloud and Datacenter Convention

Melbourne

11 April 2025

Taiwan Cloud & Datacenter Convention

Taipei

14 April 2025 Ryukyu Golf Open

Ryukyu

15 & 16 April 2025

Okinawa Interconnect World

Okinawa

2 May 2025

Chennai Interconnect World Forum

Chennai

15 May 2025

Indonesia Cloud & Datacenter Convention

Jakarta

15 May 2025

Perth - Focus

Perth

Japan Cloud & Datacenter Convention Tokyo

SIJORI Week

6 July 2025

Batam

Interconnect World Forum

Batam

8 July 2025

Johor

Interconnect World Forum

Johor

10 July 2025

Singapore Cloud & Datacenter Convention

Singapore

7 August 2025

Korea Cloud & Datacenter Convention

Seoul

21 August 2025

Sydney Cloud & Datacenter Convention

Sydney

25 September 2025

Vietnam Cloud & Datacenter Convention

Ho Chi Minh

September 2025

Saudi Arabia

Cloud & Datacenter Convention

Saudi Arabia

25 September 2025

UAE

Interconnect World Forum

Dubai

23 October 2025

Malaysia Cloud & Datacenter Convention

Kuala Lumpur

October 2025

Mumbai Cloud & Datacenter Convention

Mumbai

5 November 2025

Greater Bay Area Cloud & Datacenter Convention

Hong Kong

November 2025

New Zealand

Interconnect World Forum

November 2025

New Zealand Cloud and Datacenter Convention

Auckland

13 November 2025

Thailand Cloud & Datacenter Convention

Bangkok

27 November 2025

SEA Awards

Singapore

Dates are subjected to changes, please visit our website for latest schedule

Industry 4.0 and AI driving Hyperscale Data Center development in UAE: Johan Nilerud

Emerging technologies like Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), as well as an increase in automation in line with Industry 4.0 has placed new pressures on the Cloud and Data Center market in the Middle East, especially in the United Arab Emirates (UAE).

In this interview, Johan Nilerud, Senior Director of Strategy and Planning at Khazna Data Centers tells us just how the market is evolving to keep up with the virtual explosion in demand, while doing the tightrope walk vis-a-vis sustainability and energy efficiency related challenges.

How have you seen the Cloud and Data Center industry evolve over the years in the UAE?

The UAE’s cloud and data center industry has evolved rapidly in the past decade, driven by digital transformation across sectors and the government’s vision to establish the country as a global technology hub. Initially focused on localized IT infrastructure, the market has grown into a robust ecosystem capable of supporting global hyperscalers, cloud service providers, and enterprise workloads. We have seen a shift toward hyperscale data centers, with emphasis on energy efficiency and sustainability, as well as advancements in security and connectivity. The demand for data centers has surged, fueled by the proliferation of cloudbased services, e-commerce, and AI-driven applications. Today, the UAE is a leader in the region, with large-scale investments aimed at creating digital infrastructure that powers both the public and private sectors.

What are some of the trends you are observing in data center investments and development in wake of Industry 4.0 and the AI boom?

Industry 4.0 and the AI boom are reshaping data center investments, with a marked shift towards building hyperscale facilities that can handle AIdriven workloads, edge computing, and massive data processing requirements. Key trends include the adoption of AI and machine learning within data centers themselves to optimize performance and energy usage, and the deployment of edge data centers

to support low-latency services across industries like manufacturing, healthcare, and smart cities. Another major trend is the focus on sustainability – investors and operators are prioritizing green technologies and renewable energy solutions to meet the increasing demand while minimizing the environmental impact. Data centers are now a critical building block to enable innovations like autonomous systems and IoT, both of which require significant data processing capabilities.

The cloud market is expanding rapidly. AI Supercloud is now a reality. What are some of the trends you have observed vis-a-vis demand for cloud technology, and how are you catering to this?

The demand for cloud technology is soaring, driven by AI Supercloud developments and the need for scalable, flexible infrastructure. Key trends include an increasing reliance on multi-cloud and hybrid cloud strategies, as businesses look for tailored solutions to meet specific needs around data security, compliance, and performance. The rise of AI and machine learning applications is another major driver of cloud demand, as enterprises require vast computing power and storage to train and deploy AI models. At Khazna, we are catering to this by offering hyperscale data centers that provide robust cloud infrastructure, enhanced security, and the scalability to meet these evolving demands. Our facilities are designed to handle highperformance workloads while being energy-efficient and future-proof.

Johan Nilerud

The regulatory environment has been relatively friendly for data center operations in the UAE. How has this helped the industry?

The UAE’s forward-thinking regulatory environment has been instrumental in the growth of the cloud and data center industry. Government policies and frameworks have encouraged foreign investment, created a competitive market, and enabled the seamless operation of global tech companies. The implementation of clear data residency laws and compliance standards has given businesses the confidence to host their data locally, which has, in turn, driven demand for local data centers. Additionally, the government’s support for renewable energy adoption aligns with the sustainability goals of the data center industry, enabling operators like Khazna to focus on green technologies and energy-efficient operations.

Khazna Data Centers is perhaps best known for actually walking the talk on sustainability. How challenging has this journey been?

Our commitment to sustainability has been both rewarding and challenging. Balancing rapid growth with environmental responsibility requires significant investment in energy-efficient technologies and innovative design strategies. For example, we have implemented advanced cooling systems like adiabatic cooling and adopted modular design practices to minimize energy and water consumption, and reduce waste during construction. We are also shifting to renewable energy sources like solar, reducing reliance on conventional energy and lowering greenhouse gas emissions. In October last year, we unveiled our plan to introduce biofuels to our portfolio of generators.

Industry 4.0 and the AI boom are reshaping data center investments, with a marked shift towards building hyperscale facilities that can handle AI-driven workloads, edge computing, and massive data processing requirements.

Meeting sustainability standards such as LEED Gold certification has been a rigorous process, but it is a priority for us to ensure that our operations are in line with global best practices. The challenge has been ensuring that we continue to innovate in this space, especially as demand for data services grows, but we are proud to lead the region in sustainable infrastructure.

Khazna is also exploring markets outside the UAE, particularly in North Africa. Could you tell us a bit more about your expansion plans?

Expanding beyond the UAE is a natural progression for Khazna, as we seek to meet growing demand in underserved markets. The regional population is growing and within 20 milliseconds from UAE you can reach a total population of more than 1 billion people. North Africa, as well as other proximate markets represent a strategic focus due to its emerging digital economy, youthful population, and increasing investment in technology infrastructure.

Our goal is to replicate the success we have had in the UAE by delivering world-class data center solutions that prioritize scalability, security, and sustainability. We are always looking for opportunities to have discussions with key stakeholders in the region to explore partnerships and joint ventures. We are dedicated to our aim of delivering hyperscale infrastructure

that can support the region’s digital transformation efforts.

What are your predictions for the UAE data center market in the near future, say five years?

Over the next five years, we anticipate continued rapid growth in the UAE’s data center market, driven by the rise of AI, IoT, and smart city initiatives.

According to Arizton, the UAE data center market is expected to reach US$ 2.65 billion by 2029, growing at a CAGR of 9.95 percent. The demand for edge computing will increase as more industries adopt digital technologies that require low-latency processing. Sustainability will remain a key focus, with more data centers integrating renewable energy sources and energyefficient technologies.

Additionally, we expect an uptick in the development of hybrid cloud solutions and an increase in public-private partnerships as the UAE solidifies its position as a global tech hub. The UAE’s Digital Economy Strategy aims to double the contribution of the digital economy to the UAE’s gross domestic product (GDP) from 9.7 percent in 2022 to 19.4 percent within 10 years – and data centers are critical for this growth.

Khazna will play our part in contributing to this growth by continuing to lead in hyperscale and sustainable data center solutions to meet evolving needs.

Khazna Data Center, Abu Dhabi.

PHOTO: KHAZNA DATA CENTERS

Middle East Supplement

Navigating the Future: How will the Middle East Data Center Market shape up?

The digital age has revolutionized the way data is generated, stored, and processed, making data centers the backbone of modern infrastructure.

By Himmath Mohammed CTO, Gulf Data Hub

In the Middle East, particularly in the GCC nations, the rapid adoption of digital technologies, the proliferation of smart devices, and the push for economic diversification have significantly increased the demand for robust data center solutions.

As the CTO of Gulf Data Hub, the largest colocation data center provider in the MENA region, I’ve seen firsthand how Artificial Intelligence (AI) is reshaping the data center landscape, driving the future of the colocation market, and offering innovative ways to overcome the challenges of scaling up, specifically within the unique context of the Middle East. In this piece, I will attempt to share my observations on these three elements.

The Impact of AI on the Data Center Landscape in the Middle East

AI’s iinfluence on the data center industry is profound, offering the potential to optimize operations, enhance sustainability, and bolster security. However, the application of AI in data centers within the Middle East presents unique challenges and opportunities.

Energy efficiency is a critical issue in the Middle East, where the harsh climate results in high energy demands, particularly for cooling systems. In regions like the UAE and Saudi Arabia, where temperatures can soar above 50°C, traditional cooling methods are often insufficient and costly. AI-driven cooling systems are proving to be a game-changer. By leveraging machine learning algorithms to predict and manage power usage in real-time, these systems can adjust cooling processes to reduce energy consumption significantly.

At Gulf Data Hub, we have implemented AI-based cooling solutions in our Dubai facility, achieving a reduction in energy usage by nearly 35%. This not only lowers operational costs but also aligns with the region’s sustainability goals, as outlined in initiatives like the UAE’s Green Growth Strategy.

Predictive maintenance, powered by AI, is another area where significant advancements are being made. In the Middle East, where the environment can be harsh and unpredictable, ensuring the reliability of data centers is paramount. AI systems can analyze data from sensors to predict hardware failures before they occur, allowing for proactive maintenance and reducing the risk of downtime. This is particularly critical in markets like Saudi Arabia, where the Vision 2030 initiative is driving rapid digital transformation across various sectors, necessitating highly reliable data infrastructure.

Security is a top priority for data centers globally, but even more so in the Middle East, where geopolitical tensions can exacerbate cybersecurity

Harupta nessi dolupta dolupta tibusae rumqui tem ra nati

risks. AI-powered security systems offer advanced protection by detecting anomalies and potential threats in real-time, far beyond the capabilities of traditional security measures. At Gulf Data Hub, we have integrated AI-based security protocols across our facilities in the UAE and KSA, resulting in a 50% improvement in threat detection and response times. This level of security is crucial for maintaining trust with our clients, especially as the region continues to attract global investments in sectors like finance, healthcare, and energy.

The Future of the Colocation Market in the Middle East

The colocation market in the Middle East is poised for significant growth, driven by the region’s rapid digital transformation and the increasing demand for scalable and secure data infrastructure. However, the market’s future will be shaped by several key trends and regional dynamics.

One of the most important trends is the rise of Edge computing. In the Middle East, where cities like Dubai and Riyadh are rapidly evolving into smart cities, the need for localized data processing is becoming increasingly critical. Edge computing, which involves processing data closer to the source, reduces latency and improves the efficiency of services like autonomous vehicles, smart grids, and real-time analytics. Gulf Data Hub is expanding its footprint to include Edge data centers across the UAE and KSA, strategically located near urban centers and key infrastructure projects. This decentralization of data

Sustainability is another key focus area for the future of colocation in the Middle East

centers is essential to support the region’s ambitious smart city initiatives, ensuring that data can be processed quickly and efficiently.

Sustainability is another key focus area for the future of colocation in the Middle East. As governments in the GCC region push for greener economies, there is increasing pressure on data center providers to adopt sustainable practices. In Saudi Arabia, the Vision 2030 plan includes a strong emphasis on environmental sustainability, encouraging businesses to reduce their carbon footprint. Gulf Data Hub has taken proactive steps by integrating renewable energy sources, such as solar power, into our data centers in the UAE. Our solar installations now contribute to 20% of the energy needs of our Dubai facility, and we are exploring similar projects in Saudi Arabia. These initiatives not only reduce our environmental impact but also position us as leaders in sustainable data center operations in the region.

The hybrid cloud model is also gaining traction in the Middle East, driven by the region’s unique business landscape. Companies are increasingly adopting a mix of on-premises, private cloud, and public cloud services to meet their diverse needs. In markets like the UAE and KSA, where regulatory requirements and data sovereignty are critical, colocation providers must offer flexible solutions that integrate seamlessly with cloud platforms while ensuring compliance with local laws. Gulf Data Hub is partnering with leading cloud service providers to offer hybrid solutions tailored to the needs of our clients in the Middle East. This approach allows businesses to maintain control over their critical data while benefiting from the scalability and flexibility of cloud services, a combination that is particularly appealing to sectors like finance, healthcare, and government.

Innovative Ways of Overcoming Challenges in Scaling Up in the Middle East

Scaling up data center operations in the Middle East presents unique challenges, from managing increased energy

consumption to maintaining operational efficiency and ensuring security. However, innovative solutions are emerging to address these challenges, enabling data centers to scale effectively and sustainably in the region.

Energy consumption is a significant challenge in the Middle East, where data centers must operate efficiently despite the extreme heat. To overcome this, Gulf Data Hub has implemented AI-driven energy management systems that optimize power usage and cooling processes. Our data centers in Dubai and Riyadh use advanced machine learning algorithms to analyze and adjust energy consumption in real-time, resulting in a 25 percent reduction in overall energy usage. Additionally, we are exploring the integration of more renewable energy sources, such as wind and solar power, to further reduce our reliance on traditional energy grids. These sustainable energy solutions not only mitigate the environmental impact of our operations but also provide a more stable and predictable energy supply, which is critical for scaling up in a region where energy costs can be volatile.

Maintaining operational efficiency as data centers expand is another challenge in the Middle East, particularly in markets like the UAE and Saudi Arabia, where the demand for digital services is growing rapidly. To address this, Gulf Data Hub has implemented advanced automation solutions across our facilities. Automation streamlines various aspects of data center management, from server deployment to network configuration, allowing us to scale quickly and efficiently. For example, our automated systems have reduced the time required for server deployment by 40 percent, enabling us to meet the increasing demands of our clients without compromising on service quality.

Security is a critical concern when scaling up data center operations in the Middle East, given the region’s complex geopolitical landscape. To mitigate security risks, Gulf Data Hub has invested heavily in AI-powered security systems that can detect and respond to threats in real-time. Our facilities in the UAE and KSA are equipped with state-of-the-art security protocols that leverage machine learning to identify patterns of suspicious activity and take proactive measures to prevent breaches. This approach has resulted in a 60% reduction in security incidents across our

data centers, ensuring that our clients’ data remains secure as we continue to expand our operations.

Finally, addressing the physical constraints of data centers, such as space and cooling capacity, is essential for scaling up in the Middle East. Gulf Data Hub has adopted innovative architectural designs and advanced cooling technologies to maximize efficiency in our facilities. For instance, we have implemented liquid cooling systems in our highdensity data centers in Dubai, which use coolant liquids to dissipate heat more efficiently than traditional air cooling methods. This technology allows us to pack more servers into a smaller physical space, optimizing our infrastructure to meet growing demand without compromising performance. Additionally, we are exploring modular data center designs that enable incremental expansion, providing the flexibility needed to scale up quickly in response to market demands.

Conclusion

The data center industry in the Middle East is at a pivotal moment, with AI driving significant advancements in efficiency, sustainability, and security. As the region continues to embrace digital transformation, the colocation market is poised for substantial growth, shaped by trends like edge computing, sustainability, and hybrid cloud adoption. However, scaling up operations in the Middle East presents unique challenges, from managing energy consumption in harsh climates to ensuring security in a complex geopolitical landscape. At Gulf Data Hub, we are committed to overcoming these challenges through innovative solutions, ensuring that we continue to lead the region in providing world-class colocation services that meet the demands of the future. By integrating AI-driven technologies, adopting sustainable practices, and leveraging advanced security measures, we are not only enhancing our operational capabilities but also contributing to the region’s broader goals of economic diversification and environmental sustainability.

Emerging Markets to watch out for in the Middle East

At W.Media, we keep a keen eye on promising emerging markets that are on their way to shine as bright as the established ones.

By Deborah Grey

The Middle East has an abundance of such markets, and in this issue, we are taking a closer look at three of them: Bahrain, Oman and Qatar.

Bahrain

Bahrain, an island kingdom located in the Persian Gulf, just off the northeastern coast of Saudi Arabia, is today emerging as one of the data center markets to watch out for in the Middle East. Bahrain offers investors proximity to three continents – Asia, Africa and Europe.

Bahrain’s Economic Development Board (EDB) which is a public agency responsible for attracting inward investment into Bahrain, spotlights this strategic location and connectivity in a document titled Better Data Centers Think Bahrain, saying, “Bahrain is connected to more than 50 countries through terrestrial & submarine fiber optic cables, global POPs and data centers.” It also showcases the

availability of power, competitive cost of doing business, as well as a favourable business and regulatory environment as reasons that make Bahrain a good data center destination.

A Cloud First strategy, and initiatives like Bahrain Economic Vision 2030, are together driving the digital transformation of this island kingdom. Other factors contributing to the growth of the market here include the advent of emerging and fast evolving technologies such as Artificial Intelligence (AI), Machine Learning (ML) and Internet of Things (IoT), as well as the need for handling Big Data, and the roll out of 5G networks.

According to Knight Frank’s Data Centers: The MENA Report, “Bahrain historically demonstrated a sixty-forty split between a retail colocation and a service provider focus, which altered in the first quarter of 2019 towards Public Cloud offerings, which now account for 67 percent of market capacity.”

As per Arizton Intelligence, the Bahrain data center market was valued at US$ 167 million in 2023, and

Bahrain

Market Size in 2023: US$ 167 million

Expected Market Size in 2028: US$ 291 million

Major players: Amazon Web Services (AWS), Batelco (Beyon Group), Tencent Cloud, Zain

Source: Arizton Intelligence

is expected to grow at a Compounded Average Growth Rate (CAGR) of over 9.7 percent, crossing US$291 million by 2029.

Oman

Oman is yet another Middle Eastern nation that is looking at digital transformation as a means to gradually modernise its economy and make it less oil-dependent. This transformation is driven by initiatives like Oman Vision 2040, which is the government’s plan for socio-economic development powered by strategic investments into education and technology to foster a culture of innovation.

The vision document aims to create infrastructure that helps improve governance, makes the economy competitive, encourages creativity and also enables a commitment to sustainability. All this, along with an increasing emphasis on data sovereignty, is fuelling the demand for data storage as well as compute power.

In its report titled Future of Data Centers in MEA 2023, JLL has listed Oman as an important secondary market witnessing investment growth and said that it is “considered one of the major regional digital hubs” and that Oman is “focusing on increasing investments in data centres by

enhancing its digital infrastructure with 5G networks.” The report further spotlights Oman’s connectivity infrastructure saying it is making “efforts to enhance international connectivity by further expanding on its 14 existing submarine cables that are connected to the Europe, Middle East, and Africa (EMEA) and Asia regions.”

According to Arizton Intelligence, the Oman data center market was valued at US$ 181 million in 2023, and is expected to reach US$ 326 million by 2029, growing at a Compounded Average Growth Rate (CAGR) of 10.30 percent during the forecast period (2024-2029).

Qatar

Qatar is one of the fastest-growing economies in the Middle East, and has been on its digital transformation journey for over a decade. Aided by government initiatives like Qatar National Vision 2030 and Smart Qatar, this Gulf nation is on track to become a major hub of business and technology. Global players have been flocking to Qatar; among them, Microsoft launched a data center region in the country in 2022.

In its Qatar Data Center Market Report, Imarc says that the Qatar data center market is projected to exhibit a growth rate (CAGR) of 10.70 percent during 2024-2032. The market in Qatar is majorly driven by the increasing internet penetration, the rising demand for cloud services, government digital transformation initiatives, the growing adoption of IoT and big data analytics, rapid expansion of multinational corporations, and continual technological advancements in data center infrastructure.

Arizton Intelligence says, “The Qatar data center market size will witness investments of USD 418.5 million by 2028, growing at a CAGR of 7.98 percent during the forecast period.”

Oman

Market Size in 2023:

US$ 181 million

Expected Market Size in 2028: US$ 326 million

Major players: Equinix, Oman Data Park, Cloud Acropolis

Source: Arizton Intelligence

Meanwhile, according to Statista, Qatar’s AI market size is expected to reach US$ 428.4 million this year. It further says that the market size is expected to show an annual growth rate (CAGR 2024-2030) of 28.66 percent, resulting in a market volume of US$ 1,943 million by 2030. Needless to say, AI will be front and center in Qatar’s digital transformation journey.

Qatar Market Size in 2023:

US$ 264 million

Expected Market Size in 2028: US$ 418.5 million

Major players: MEEZA, Ooredoo, Gulf Data Hub, Quantum Switch

Source: Arizton Intelligence

Conclusion

According to Priyanka Nagpal (Data Centre Lead, MENA), “The emerging markets of Bahrain, Qatar, and Oman are generating substantial interest in the field of data centers. These markets are drawing the attention of international tech companies seeking to diversify and establish data centers, owing to a multitude of advantageous factors.” She further explains,

“Investments in cloud services, favorable regulatory frameworks, reliable subsea cable connectivity, and robust telecom infrastructure contribute to the appeal of these markets. Furthermore, tailored incentives for economic diversification provided by the government and the presence of special economic zones are attracting tech companies to explore these markets.”

Well, we are going to keep tracking the growth in these markets, so check out the Middle East section of our news website at https://w.media/category/ middle-east-news/

What makes Saudi Arabia such an exciting DC market

As Saudi Arabia continues to diversify its economy under Saudi Vision 2030, the data center market has emerged as a critical component in the region’s technological and economic transformation.

By Stephen Beard , Global Head, Data Centers, Knight Frank Hub

This sector is poised for significant growth, driven by increased digitalisation and a robust infrastructure development plan. The region’s data center market currently totals 640 MW IT of which 124 MW IT is live and 138 MW IT is under construction. Like any emerging market, it faces its own set of strengths, weaknesses, and opportunities.

Strengths

Strategic Location: Saudi Arabia’s geographical position serves as a strategic hub connecting the East and West. This central location is advantageous for data centers that need to serve both regional and international markets. The kingdom’s connectivity to major global data routes enhances its appeal as a data center location.

Government Support: The Saudi government’s Vision 2030 emphasises technological advancement and digital infrastructure. Initiatives such as the National Industrial Development and Logistics Program (NIDLP) and investments in smart cities provide substantial support for data center development. This backing includes

financial incentives, streamlined regulations, and enhanced infrastructure.

The Vision 2030 initiative further launched the National Transformation Program (NTP) in 2016 to achieve strategic goals, such as empowering the private sector, fostering economic partnerships, and accelerating digital transformation, with specific reference to supporting data center development with the aim of improving digital infrastructure and applications related to customer service.

The Saudi Data and Artificial Intelligence Authority (SDAIA) in collaboration with the NTP, has implemented initiatives such as the National Data Index (NDI) to promote transparency, a data-driven economy and fostering open data collaboration among government, local and international entities, and businesses. SDAIA’s efforts aim to build trust in open data, encourage data sharing, and advance AI and innovation topics in the kingdom.

The adoption of a National Strategy for Data and Artificial Intelligence (NSDAI) reiterates Saudi Arabia’s commitment to leverage responsible AI in achieving its national digital transformation objectives, boosting the ICT sector’s contribution to the Kingdom’s Gross Domestic GDP.

Saudi Arabia also has a ‘Cloud First’ policy, which will fuel the growth of Cloud in the Kingdom. The policy launched in 2020 mandates, “For any new IT investment, civilian government entities should consider Cloud solutions as opposed to internal / traditional solutions.” A government initiative that is expected to grow the market supply to 1,300 MW by 2030.

Growing Digital Economy:

With a rapidly expanding digital economy, fuelled by increasing internet penetration and a young, tech-savvy population, there is a burgeoning demand for data storage and management solutions in KSA. The country’s total population of over 35 million, 3.5 times larger than the UAE - its main challenger to becoming the regional hub, includes two-thirds who are under 35, representing an age cohort of early tech adopters. The average daily mobile internet data consumption per individual in the Kingdom has also exceeded 1.2 GB, three times the global average. The rise of e-commerce, social media, cloud computing services, and the proliferation of AI all contribute to this growth, creating a substantial market for data centers.

Testament to this are the announcements made earlier this year by Ezditek and AWS. A strategic alliance between Ezditek and Gcore aims to position the KSA as a global hub for AI innovation, with a key focus on sustainability through the delivery of the capacity for AI/ GPU computing within 5 years, across nine data centers (totalling 28MW), located in Riyadh (three), Jeddah (three), and Dammam (three).

AWS has plans to invest more than US$ 5.3billion for a new cloud region in the KSA. The new AWS Region will consist of three availability zones at launch to support the growth in cloud adoption across the Kingdom.

Further, Oracle recently announced a new US$ 1.5 billion Riyadh Cloud Region to join their existing Jeddah Cloud Region and the planned Oracle Cloud Region in NEOM. This will help boost the Kingdom’s

As part of Vision 2030, Saudi Arabia is making significant investments in infrastructure, energy, transport, and telecommunications

AI economy, which is expected to reach US$ 135.2 billion by 2030.

Infrastructure Development:

As part of Vision 2030, Saudi Arabia is making significant investments in infrastructure, energy, transport, and telecommunications to support the development of data centers and efficient data management. Alongside directly supporting local investments in the telecommunications and information technology sectors, the government aims to enhance highspeed broadband coverage, targeting over 90 percent housing coverage in densely populated cities and 66 percent in other urban areas. This initiative includes partnering with the private sector, strengthening digital transformation governance through a national council, and improving regulations and partnerships with telecom operators.