188 UNITS | PREMIER APARTMENT HOMES PARK

33

VIKRAM RAYA RAVI GUPTA CEO / Founder COO / Founder

VIKRAM RAYA RAVI GUPTA CEO / Founder COO / Founder

TABLE OF CONTENTS

Executive Summary

Property Profile

Location Overview

Financial Analysis

Portfolio & Performance

2

Executive Summary Property Location Financ al Portfolio & Description Overview Analysis Performance Executive Summary

INVESTMENT SUMMARY

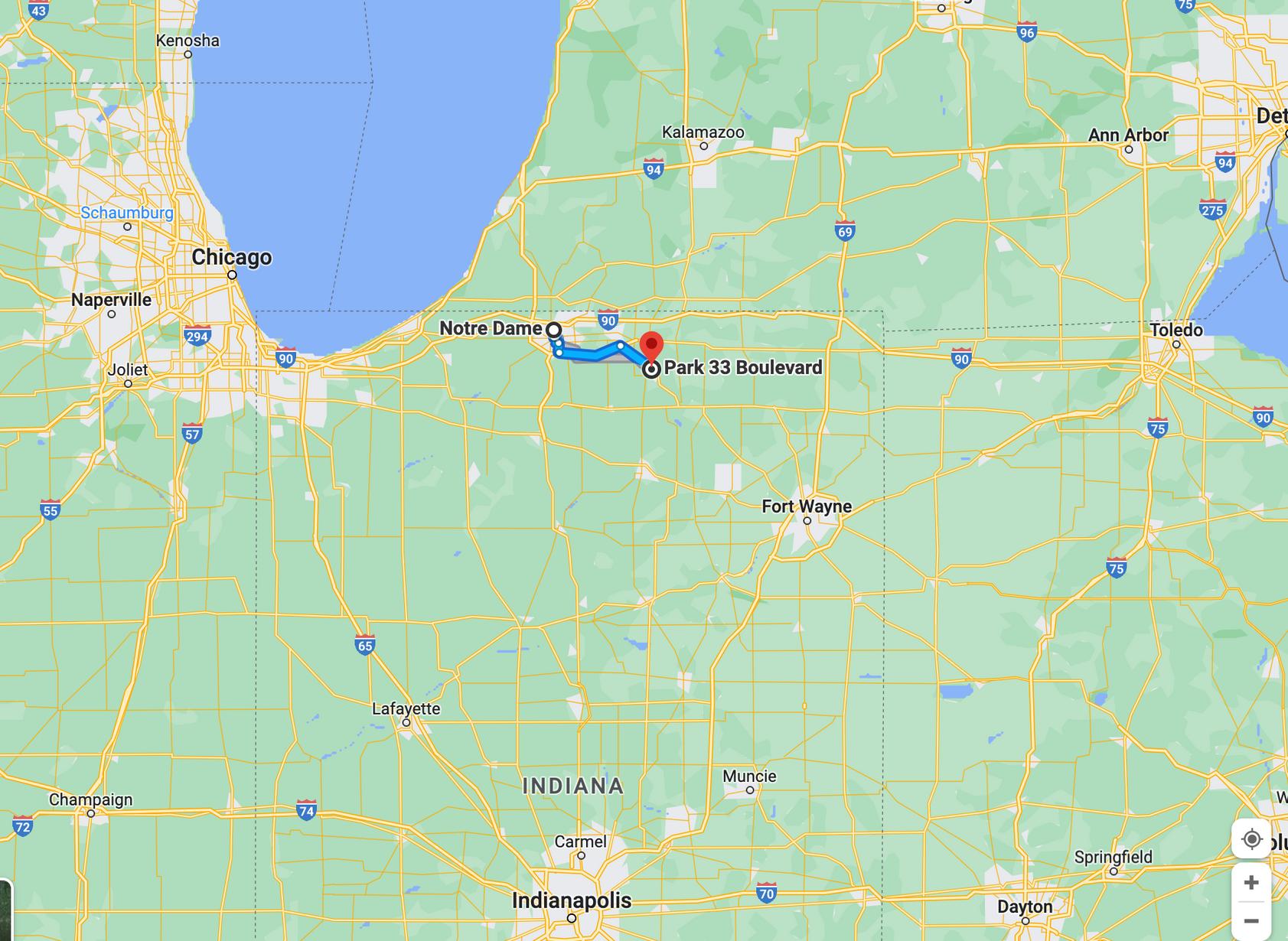

Viking Capital is pleased to announce Park 33 as our 24th acquisition. This 188-unit property offers the opportunity to add a core-plus institutional quality asset in a high-income submarket of South Bend, Indiana. Park 33 features attractive exteriors and luxury curb appeal as well as attached garages in select units.

This 2018 built asset has minimal deferred maintenance, allowing us to focus on our two-phased value-add business plan. Phase 1: Operational value-add with expense and income optimization. Phase 2: Between years 2-3 a light value add ($4000 per unit) creates up to a $100 rent bump through kitchen renovations and updated tech throughout the units.

Viking plans to assume the remaining 7 year, $18.3M Freddie Mac loan at a 3.08% interest rate, and I/O period through May 2025. This rate is more attractive than new debt and offers both positive leverage and strong cash flow.

PARK33 $33,250,000 Equity Reserve

Cap (T-3/T-12) 6% 45% 96%

LP Class A LP

Class

Offering Summary 2.25x 2.03x 5 years $15,250,000 $1,520,000 $9,900,000 $3,825,000

Class B Expense Ratio (T12) Physical Occupancy DSCR Yr 1 DSCR avg. Purchase Price Hold Period

Units are substantial, averaging 1,178 SF, and include stainless steel appliances, a full-size washer/dryer, and granite countertops. A turf dog park and patio, and fitness center with a Peloton bike/subscription are just a few of the best-in-class amenities.

Parking Buildings Address County Number of Units Year Built Net Rentable Area Average Unit Size Size / Density 1401 Park 33 Blvd, Goshen, IN 46526 Elkhart County 188 2018 221,370 1,178 SF 14.1 Acres / 13.4 Units Per Acre 1 - 1-Story (Clubhouse/Office) 16 - 2-Story Residential Buildings 265 Open Spaces | 90 Direct Access Garages

Park 33 Apartment Homes

PROPERTY SUMMARY

INVESTMENT HIGHLIGHTS

Asset Financial Value-add

9‘ Ceilings

14 Acres

2018 construction

Well-maintained by institutional seller

90 attached 1-car garages with unit access

Amenities include a pool, fitness center, grilling area, and bark park

Well-maintained lowdensity site with 221,370 net rentable sqft

14.1% New lease trade out since January (+$227)

10.6% Lease renewal since January (+$156)

13.9% Market rent growth from July 2021 to June 2022

Zero concessions on property

Finalize RUBS implementation

Charge tenants for cable and internet service

Bill-back tenants for valet trash

Upgrade unit interiors

Economies of Scale

Elevate on Main - 400 units, Park 33 - 188 units, providing efficiencies of property management

Optionality to sell both properties as a portfolio increases exit liquidity, including an exit to an institutional investor

CONSIDERABLE ORGANIC RENT GROWTH PROGRESSION

57 Year Completed Total Units Average Unit Size (SF) Physical Occupancy Avg. Effective Rents New Move-Ins (60 days) Units Primed for Upgrade 100%

Property Summary 1 BR Total/Avg. Unit Mix (June 2023) Description # Units % Mix Avg SF Rent Rent/SF 2 BR 2018 188 96.3% $1,574 $1,598 1,178 24.5% 46 894 $1,405 $1.57 110 58.5% 1,218 $1,596 $1.31 32 17.0% 1,447 $1,758 $1.21 2 BR 188 100% 1,178 $1,574 $1.34 VALUE-ADD UPSIDE 1401 Park 33 Blvd, Goshen, Indiana 46526 $25 per unit immediately

Three-Tiered Return Options

A three-tiered return structure gives investors options when placing their equity. Investors have the ability to invest in either tier of equity Class A, Class B, Reserve Class, or a combination of Class A and Class B. Diversifying in both A and B classes allows for a risk-adjusted, blended return.

Three-Tiered Equity Structure Allows Investors to Match Investment Goals

8 Class A Class B Reserve Class • • 7% Preferred Return 8% Preferred Return • • • • • Prioritized Cash Flow 9% Preferred Return No Profit Share 70/30 Profit Share 80/20 Profit Share

Minimum investment Minimum investment Minimum investment $50,000 $50,000 $500,000

INVESTMENT OFFERING

9 © Copyright 2022 Capital Structure Debt LP: CLASS A LP: CLASS B LP: RESERVE Pref. Equity Multiple Avg. CoC Purchase Price Debt Total Equity Class A Class B Reserve Class $23.1M $15.25M $1,525,000 9% 5 Years 1.45x $33,250,000 $23,100,000 $15,250,000 $9,800,000 7% 5 Years 1.6 - 1.8x $3,825,000 8% 5 Years 1.8- 2.0x LP Equity Hold Period 9% 6.2%

6.2%

INVESTOR RETURNS: $100,000 INVESTMENT

$9,000

Class A $100k Class B $100k Reserve Class $500k Annual Percent Return Annual Distribution Equity Split Total Expected Return Including Return of Principal ($100k) Annual Percent Return Annual Distribution Annual Percent Return Annual Distribution Equity Split (80/20) Year 1 Year 2 Year 3 Year 4 Year 5 9% 9% 9% 9% 9% $9,000 $9,000 $9,000 $9,000 $0 $145,000 5% 5% 6% 6% 7% 7% $5,000 $6,000 $7,000 $39,000 Equity Split (70/30) $170,000 6% 6% 7% 7% $6,000 $25,000 $7,000 $30,000 $30,000 $35,000 $35,000 $950,000 $795,000 Total Expected Return Including Return of Principal ($100k) Total Expected Return Including Return of Principal ($500k)

NEED BONUS DEPRECIATION IN 2023?

1100% 00% 80% 80% 60% 60% 40% 40% 20% 20% 2022 2022 2023 2023 2024 2024 2025 2025 2026 2026 11 © Copyright 2022

DEBT FINANCING*

Loan Principal Loan to Value

Interest Rate (Fixed) Fixed or Adjustable Amortizing Period Interest Only

30 years 1.5 years

*Subject to change before closing

58 $23,100,000 69.5% 3.08% (blended

3.89%)* Fixed

SENSITIVITY ANALYSIS

Cap Rate Projected Sale Price Deal Level IRR Equity Multiple AAR

VALUE-ADDBUSINESSSTRATEGY

Viking Capital will strategically stage the implementation of Park 33's Two-Phase value add opportunities on-site: Charge tenants for cable and internet service currently being provided free of charge. Stage the implementation of RUBS, Seller has started wherein tenants reimburse utility costs.

PHASE 1: OPERATIONAL EFFICIENCIES

Valet trash is a revenue-generating amenity that the comp set charges for but is not currently being reimbursed by tenants.

PHASE 2: INTERIOR VALUE ADD

Upgrade unit interiors with tech packages, kitchen backsplashes, and new light fixtures to earn rent premiums and bolster Park 33's best-in-class status. $4,000 per unit renovation.

02

VALUE-ADD UPSIDE

19 © Copyright 2022 17.02% 24.47% 58.51% 3 Bedroom 1 Bedroom 2 Bedroom 32 Units 46 Units 110 Units

188 UNITS Primed for upgrades 100% 188 units

14 Executive Location Financia Portfolio & Summary Overview Ana ysis Property Description Performance Property Description

PARK 33

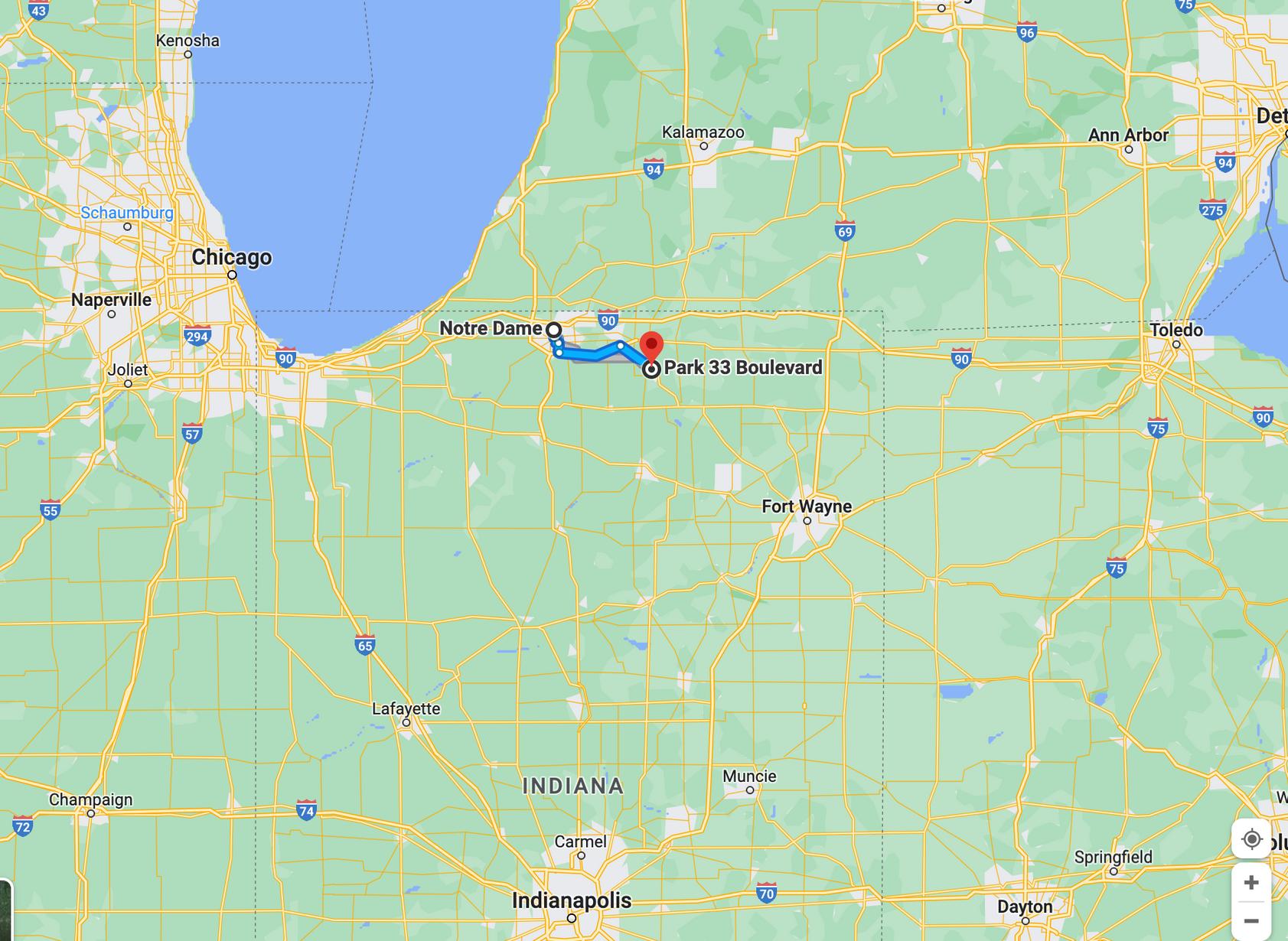

South Bend, Indiana

6% T-3 CAP RATE + ATTRACTIVE EXISTING DEBT

Park 33 is being offered at $33.25M/$177K per unit, with a 6% T-3 cap rate. The exceptional existing assumable Freddie Mac loan has very favorable terms including a 3.08% interest rate with 1.5 years of interest-only term remaining. The anticipated $4.8M supplemental loan blends to an all-in 3.89% rate.

MINIMAL NEARBY COMPETITION

The closest competing properties for Park 33 are located in Elkhart, IN—12 miles from Park 33, contributing to the property's four-year 98% occupancy average. According to a housing study completed for the City of Goshen, 4,500 homes are needed by 2030 just to meet the current undersupplied demand.

UPSCALE 2018-BUILT INSTITUTIONAL QUALITY ASSET

Park 33's attractive exteriors create excellent curb appeal with irrigation throughout, and attached garages in select units. The large floor plans average 1,178 SF and include stainless steel appliances, a full-size washer/dryer, and granite countertops. A turf dog park and patio, and fitness center with Peloton bike/subscriptions are just a few of the best-in-class amenities.

PROXIMITY TO STRONG EMPLOYMENT DRIVERS

The South Bend MSA is conveniently located near north central Indiana’s largest job clusters and Chicago and Park 33 benefits from excellent access to numerous and diverse employers nearby.

PARK 33

188 Units 2018 Year Built 96.4% Occupancy 1,178 Avg. Unit SF 221,370 Rentable SF $1.34 Avg. Effective Rent/SF $1,574 Avg. Effective Rent

Foundation Slab, On Grade

Frame

Wood Frame Walls

(2”x4” interior & exterior walls with OSB

Sheeting and House Wrap. Clubhouse has 2”x6” exterior walls)

R13 Wall Insulation

Property Policy Information

Sub Floor

1st Floor - Concrete Slab

Roofs

Exterior

Windows

Balcony/Patio

Pre-Engineered Roof Trusses with 15/32” OSB

Decking and Dimensional Shingles

R30 Attic Insulation

Cultured Stone Siding and Hardie Plank

Siding (Board & Batten style)

Vinyl Single Hung with Screens. Silverline 2900

Series White Vinyl with Low-E and Argon Gas

2nd Floor - 18” Pre-Engineered Floor Trusses with ¾” OSB and ¾” Gypcrete All Units; Private

Note: Water, sewer and trash bill-back is based on unit size and occupancy, billed through Realpage. Valet trash ($35/month) is included in rent.

dryer included

Source/Company Electricity Metered

Gas Water/Sewer Trash Removal Cable/Internet Phone NIPSCO N/A City of Goshen Himco/Valet Living Comcast Individual Resident N/A Master N/A N/A N/A Resident Resident Resident

PROPERTY INFORMATION Service/Utility

Paid By

Utilities

Application Fee $50/Applicant Security Deposit Late Fee 1 Month's Rent $50 on the 3rd + $5/Day Transfer Pet Fee Pet Rent $300 non-refundable $35/Pet/Month Staffing Office Maintenance Schools Elementary School Parkside Elementary School Middle School High School Goshen Middle School Goshen High School 1 Full Time Property Manager 1 Full Time Maintenance Supervisor 1 Full Time Leasing Agent 1 Full Time Maintenance Tech Heating Goodman Electric Forced Air Furnaces

Goodman Electric Central Air Conditioning Systems Hot Water Plumbing Wiring Breaker

Laundry Rheem Individual Electric Hot

Supply Lines: PVC / Drain

Copper Eaton | 125 Amp

Cooling

Boxes

Water Heaters

Lines: Pex

Service All units have full size washer and

COMMUNITY

AMENITIES

24 Hour Fitness Center with Peloton Bike

Playground

Attached Car Garages in Select Units

Resort Style Swimming Pool

Resident Clubhouse

Business Center with Internet Cafe

Poolside Kitchen and Outdoor Kitchen

Bark Park

17 © Copyright 2022

ATTACHED GARAGES & PRIVATE ENTRIES

KITCHEN PANTRIES

WASHER/DRYER IN UNIT

ISLAND & GRANITE COUNTERS

LUXURY PLANK FLOORING

DOG PARK/RUN

OUTDOOR KITCHEN

BUSINESS CENTER

LUXURY PLANK FLOORING

DOG PARK/RUN

OUTDOOR KITCHEN

BUSINESS CENTER

UNIT AMENITIES

9’ Ceilings

42” Cabinets

Private Entrances

Direct Access Attached Garage (Select Units)

Full Size Washer/Dryer Included

Granite Countertops

Kitchen Island

Kitchen Pantry

Open Floorplan

Over-the-range Microwave

Recessed Lighting in Kitchen

Sprinklered

Stainless Steel Appliances

Storage on Patio (Select Units)

Two-tone Paint Scheme

Vinyl Plank Flooring

Walk-in Closets

BATHROOM DETAILS

Cabinets

Sink

Countertop

Shower

Surround Tub

Flooring

Wood, Espresso Finish

Ceramic, Undermount

Granite

Fiberglass

Fiberglass

Vinyl Plank

KITCHEN DETAILS

Appliances

Cooking

Sink Cabinets

Countertop

Flooring

Stainless Steel Electric

Stainless Steel, Undermount

Double Bowl

Wood, Espresso Finish

Granite

Vinyl Plank

IN UNIT GARAGES

STAINLESS STEEL APPLIANCES

GRANITE COUNTERS

GRANITE COUNTERS

110 UNITS 3 BEDROOM 1 BEDROOM

31 UNITS 17% 46 UNITS 24% 2 BEDROOM

59%

UNIT MIX

SITE PLAN

LINCOLNHIGHWAY

F A I R F I E L D A V E N U E

N

FLOOR PLANS

1 BED | 1 BATH 2 BED | 2 BATH 2 BED | 1 BATH 3 BED | 2 BATH 894 SF 1,164-1,309 SF 1,140 SF 1,447 SF

MODERNFITNESSCENTER

36 Executive Property Financial Portfolio & Summary Description Analysis Location Overview Performance Rent Comparison Overview

1 River Point West 2 Stonewater at the Riverwalk 3 Elevate on Main 4 Grandview 5 Mill at Ironworks Plaza 6 Residences at Toscana Park 7 Villas on Fir TOTAL / AVG (Excludes Subject) ELEVATE ON MAIN 3 TOTAL AVG (Excludes Subject) PROPERTY 173 203 400 382 232 100 290 1,780 # UNITS 2020 2019 2001 2016 2019 2007 2018 2014 YEAR BUILT 93% 94% 91% 96% 94% 98% 100% 95% OCC. 913 916 930 1,000 878 1,188 1,240 1,000 AVG. SF $1,340 $1,477 $1,690 $1,541 $1,739 $2,077 $2,039 $1,685 MKT. RENT $1.47 $1.61 $1.82 $1.54 $1.98 $1.75 $1.64 $1.68 MKT. RENT/ SF Park 33 188 2018 96% 1,178 $1,643 $1.40 BEST COMPS PARK 33 4 6 7 5

Stonewater at the Riverwalk Low Competition Rent Comparables

River

Point West

$0 $500 $1,000 $1,500 $2,000 Grandview Stonewater at the Riverwalk River Point West Villas on Fir Elevate on Main Park 33 Mill at Ironworks Plaza Residences at Toscana Park One Bedrooms RENT COMPARABLES $1,201 $1,325 $1,347 $1,419 $1,429 $1,445 $1,535 $1,600 $155-$872 Headroom for Rent Increases $155 Below

$0 $500 $1,000 $1,500 $2,000 $2,500 Grandview Stonewater at the Riverwalk River Point West Villas on Fir Elevate on Main Park 33 Mill at Ironworks Plaza Residences at Toscana Park Two Bedrooms RENT COMPARABLES $1,960 $1,675 $1,710 $1,899 $1,968 $1,684 $2,260 $2,220 $155-$872 Headroom for Rent Increases $516 Below

RENT COMPARABLES

$0 $1,000 $2,000 $3,000 Grandview Stonewater at the Riverwalk Villas on Fir Elevate on Main Park 33 Residences at Toscana Park Three Bedrooms

$2,310 $2,780 $2,299 $2,334 $1,878 $2,750 $155-$872 Headroom for Rent Increases $872 Below

36 Executive Property F nancial Portfolio & Summary Description Analys s Location Overview Performance Location Overview

SOUTH BEND BY THE NUMBERS

AWARDS & ACCOLADES

Granger is No. 3 Best city for young families

One of Techie.com's "Top 10 Unexpected Cities for High-Tech Innovation"

No 26 in Cost of Doing Business

Ranked among 40 hottest real estate markets

Among 10 wordwide cities for "reinventing themselves through technology"

South Bend's Strong Economy

36.7 %

FUTURE JOB GROWTH PREDICTED (10 YEARS)

"TOP 150 CITIES FOR JOB GROWTH"

VIKING CAPITAL'S NEARBY ASSET: ELEVATE ON MAIN

2021 $76M PURCHASE

$86M 2023 VALUATION

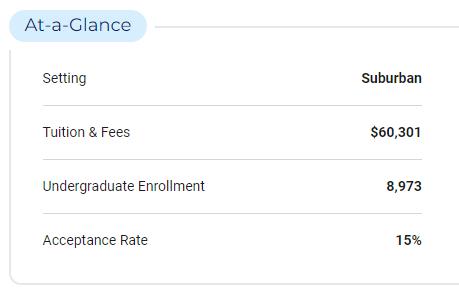

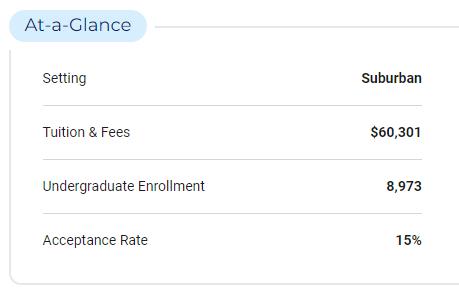

EXCLUSIVE HIGHER EDUCATION: UNIVERSITY OF NOTRE DAME

36 Executive Property F nancial Portfolio & Summary Description Analys s Location Overview Performance Submarket Overview

5-MILE RADIUS

RENTER OCCUPIED HOUSING $78,786 AVG. HOUSEHOLD INCOME

WHITE COLLAR JOBS STRONGSUBMARKET

29%

48%

DEMOGRAPHICS

HIGHER EDUCATION

Elkhart County is within an hour drive of 35 Colleges and Universities

Undergraduate and Graduate Programs

Undergrad Degrees: 47 majors, 53 minors

Employees: ±300

Campus: 135 acres plus a 1,189acre natural sanctuary 31 miles from campus and a marine biology laboratory in the Florida Keys

Nationally-Ranked:

• One of America’s top colleges (Forbes)

• #1 in Indiana among the Top National Baccalaureate Colleges (Washington Monthly)

• One of the Best Values of Liberal Arts Colleges (Kiplinger)

• One of the best colleges for nursing in Indiana (Nurse’s Journal)

• One of the country’s top liberal arts colleges for graduation rates and bachelor’s to Ph. Ds (Washington Monthly)

• Recognized by the Princeton

19 19 20 119 20 120 15 15 4 80 13 120 illage en

Ellkhart

Viisttula

Garrden Village

Dunllap

Goshen

Higher education institutions within the county include Goshen College, and Ivy Tech, Indiana Tech, IU South Bend- Elkhart, and Purdue Statewide Technology.

PARK 33

PARK 33

CLOSE PROXIMITY TO MANY MAJOR

METROPOLITANS

200MILESTO DETROIT

100MILESTO TOLEDO

100MILESTO CHICAGO

160MILESTO INDIANAPOLIS

SOUTH BEND MSA INDIANA

0 10 20 30 Arts&Entertainment FoodProcessing HighTechManufacturing Agricultural Biotech/Biosciences Logistics Healthcare

EMPLOYMENT INDUSTRIES

Source Elkhart County Economic Development Corporation

Southbend, IN

LOCATION AERIAL

Biebs & Ash

City Art Garage

Common Spirits

Constant Spring

Electric Brew

Fables Books

Goshen Antique Mall

Goshen Brewing Company Goshen

Farmers Market Goshen

Theater

I M She Women’s

Clothing Janus

Motorcycles

IU Health Goshen Hospital

(1,200 Employed)

Goshen College

(300 Employed)

JoJo’s Pretzels

Maple City Market

Mighty Mics

Olympia’s Candy Kitchen

Springer Design

Sorg Jewelers

The Elephant Bar

The Energy Well

The Green Bee

The Hive of Light

The Table at 108

True Value Hardware

Venturi

Goshen High School

LifePoint Church

Goshen Soccer Academy

Aggregate Industries

FAIRFIELDAVENUE

GDC, Inc.

Hoogie's Sports House

North Central Co-Op

OmniSource Corporation Brunk

Plastic Services Ceres

Solutions

Wieland Designs

SIXINCH North America

Logic Furniture LLC

Fidler Pond Trail

Holiday Inn Express

80 acre pond with canoe, kayak and pedal boat rentals; fishing pole rentals; catch and release bank fishing; swinging benches to relax in and enjoy nature; and a popular walking trail.

Walnut Hill Early Childhood

Fidler Pond & Park LINCOLNHIGHWAY

PARK 33

DOWNTOWN GOSHEN

2 HOUR DRIVE TO CHICAGO VIBRANT

1,000 NEARLY LIVE-WORK COMMUNITY

Manufacturing Employers in 14 Different Categories

Source Elkhartcountycom

SOUTH BEND...

MOBILITY & AUTO MANUFACTURING

Elkhart County continues to be a world-class leader in the global R.V. industry.

MANUFACTURING AGRICULTURE

Elkhart County is developing innovative and high-tech agricultural products of the future.

CORPORATE HEADQUARTERS

Elkhart County is home to more that 40 companies including 3 of the top 5 Recreational Vehicle Manufacturers: Forest River, Patrick Industries, and Thor.

MUSICAL INSTRUMENTS

Home to the leading manufacturer and distributor of band and orchestra instruments and accessories.

BIOMEDICAL & LIFE SCIENCES

Elkhart County is at the center of biomedical innovation and technology that is shaping the future of healthcare.

ELECTRONIC COMPONENTS

With highly developed solutions for the Marine, RV, Agricultural, Construction, Van, Commercial, Bus and Automotive industries.

RV CAPITAL OF THE WORLD

MANUFACTURING 80% OF THE WORLD'S RECREATIONAL VEHICLES

ANNUAL ECONOMIC

IMPACT: $114 BILLLION

$2O.1 Billion RV Sales $25.6 Billion RV Campgrounds 17.2% Increase since 2018

CATALYST FOR INDIANA GROWTH

INDIANA ATTRACTS MORE THAN $22.2B IN CAPITAL INVESTMENT

INDUSTRIAL DEVELOPMENT

LIMITED HOUSING

LOW BUSINESS TAXES

HIGH BOND RATINGS

TWO HOUR DRIVE TO CHICAGO

250% INCREASE IN JOB CREATION

INDIANAGROWTHENGINE

MILES TO CHICAGO

MILES TO INDIANA DUNES

MILES TO INDIANAPOLIS

MILES TO TOLEDO

100

50

160

100

STARTUP INCUBATOR

Low cost of living makes it affordable for new businesses Programs and venture support from the state

Huge entrepreneur base in Southbend and Indianapolis for networking

Diverse economy

Large academic community and resoures

EMPLOYMENT INDUSTRIES

EMPLOYMENT BY SECTOR

HIGH TECH/ MANUFACTURING

FOOD PROCESSING

LOGISITCS

BIOTECH/BIOSCIENCE

HEALTHCARE AGRICULTURE

26.3% 23.2% 21.2% 18.2% 4% 4% 3%

SOUTHBEND

ARTS & ENTERTAINMENT

56 Executive Property Location Portfolio & Summary Descript on Overview Financia Analysis Performance Financial Analysis

$650K of NOI Growth Increases Park 33's Value by $13 Million

$13,000,000

*Subject to change before closing

P R O F O R M A

Executive Property Location Financ al Summary Descr ption Overview Analysis Portfolio & Performance Portfolio

Performance

&

ABOUT VIKING CAPITAL

Viking Capital was founded in 2015 and has become a premier multifamily investment firm with agile investment sourcing, structuring, execution, and asset management capabilities and the flexibility to scale and cater to investor preferences.

Through its team of acquisitions, asset management, and disposition experts, Viking Capital invests in tier 1, secondary and tertiary markets across the United States.

MEET OUR TEAM

VikramRaya CEO,Co-Founder

ChrisParrinello Directorof InvestorRelations

RaviGupta COO,Co-Founder

NathanLoy Directorof StrategicPlanning

JudahFuld VPofAcquisitions

AmirNassar InvestorServices Manager

AmandaLoveless DirectorofOperations

AshleyPenrod Marketing Manager

ArtCordova Directorof Finance AmberButler Investor Concierge

EdMonarchik Directorof AssetManagement

VikramRaya CEO,Co-Founder

ChrisParrinello Directorof InvestorRelations

RaviGupta COO,Co-Founder

NathanLoy Directorof StrategicPlanning

JudahFuld VPofAcquisitions

AmirNassar InvestorServices Manager

AmandaLoveless DirectorofOperations

AshleyPenrod Marketing Manager

ArtCordova Directorof Finance AmberButler Investor Concierge

EdMonarchik Directorof AssetManagement

SUSTAINABILITY & GREEN INITIATIVES

VikingisnegotiatingapartnershipwithCleanChoice Energytoallowtenantstopurchaseenergyfrom sustainableenergysources

We'realsointhemidstofapendingpartnershipwith Zometoimplementhighenergyefficiency,greentech thatwillenablesmartgridcapabilitiesandaddtoa property'sNOI

Vikingconsistentlyincorporateswatersaving technologyandhighefficiencywindowsaswellasLED andsolarinitiativesonourassets

C U R R E NT & P R E VI O U S P R O J E C T S Property Wildcreek Villas of South Cobb I Villas of South Cobb II Ascent at Riverdale I Ascent at Riverdale II The Hills at East Cobb Town Oaks Townhomes Reserve at Walnut Creek The Avery Estates at Las Colinas Park Village Apartments The Hype Veritas at East Cobb The Griffin Marbella Place Elevate Twenty-Three Elevate on Main Elevate at the Pointe Elevate at Huebner Grove Kings Cove Elevate Woodstock Elevate Eagle’s Landing Elevate Greene Total Sold/Current Sold 2018 Sold 2018 Sold 2018 Sold 2019 Sold 2019 Sold 2021 Sold 2021 Sold 2022 Sold 2022 Sold 2022 Current Current Current Current Current Current Current Current Current Current Current Current Current Market Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Tyler, TX Austin Dallas Dallas Dallas Atlanta Atlanta Washington, DC Atlanta Atlanta Indiana Atlanta San Antonio Houston Atlanta Atlanta Atlanta Units 242 188 152 118 62 268 90 284 304 415 350 16 192 49 368 222 400 181 210 192 120 167 252 4,842 Market Value $22,350,000 $17,782,494 $15,317,506 $7,600,000 $5,900,000 $35,000,000 $7,000,000 $36,300,000 $41,000,000 $61,750,000 $31,350,000 $6,700,000 $25,800,000 $19,300,000 $55,000,000 $41,000,000 $76,000,000 $37,000,000 $26,000,000 $34 ,000,000 $19,600,000 $39,250,000 $57,250,000 $715,000,000+ TOTAL 4,842 $715,000,000+

CURRENTASSETSUNDERMANAGEMENT

Elevate on Main 400 $76,000,000 $20,750,000 Sept-21 Elevate Twenty-Three 222 $41,000,000 $11,000,000 Jun-21 Marbella Place 368 $52,700,000 $19,810,000 Jan-21 The Griffin 49 $19,300,000 $7,716,000 Jul-20 Veritas at East Cobb 192 $25,800,000 $11,250,000 Dec-19

EXITS & PERFORMANCE

The Hills at East Cobb 3 Years 268 10%* Reserve at Walnut Creek 3 Years 284 35% Estates at Las Colina's 3 Years 415 24% The Avery 4.5 Years 304 20% Total 2,033 Avg. 24%

* The Hills at East Cobb returns total 10% over 3 years

Elevate on Main CURRENT PROPERTY

Located in South Bend MSA, IN, Elevate on Main has high income rent-by-choice tenants with high demand for the highest level of interior renovations.

75% of the property interiors are to be renovated and earn a corresponding $225+ monthly rent increases.

Planned Improvements include total property reroofing, fitness center upgrades, exterior facelift with outdoor grilling station, fire pit, and dog park.

Green improvements includes total overhaul retrofitting of existing toilets, shower heads, and aerators with the installation of a modern water conservation project.

Taking interior improvements to the platinum level renovation will increase rent premiums and tenant satisfaction.

Details

Plan Background & Market Asset Class Location Year Constructed No. of Units Purchase Price B South Bend, IN 2000 400 $76M

Property

Business

INDIANA SUBMARKET

Elevate Greene

Elevate Greene is a 2005 built asset located in Henry County which has long been an outperforming industrial submarket due to ideal proximity to I-75 and the Hartsfield-Jackson International Airport (30 min. drive)

Convenient access to interstate highways, national train systems, and global ports.

Attractive floor plans include large floor plans and unit mixes weighted toward large two and three-bedrooms.

Offers a wide range of amenities, including a pool with poolside BBQ & a picnic pavilion, fire pit, bark park, walking trail, gated entrance, private garages and storage units available, playground, tennis court, car care center, and a package locker.

Through strategic management, Viking Capital aims to raise Crossings at McDonough’s $1,565 in-place average rents to $1,689 per unit.

The market has proven demand for higher quality interiors and the previous owner has proven this out, earning $219-$600 in premiums and comps indicating market surety of these rates.

These renovations will complement our efficient operations which leverage our best-in-class third-party property management team.

Business Plan Background & Market Asset Class Location Year Constructed No. of Units Purchase Price B Atlanta, GA 2005 252 $57.25M

CURRENT PROPERTY Property Details

Elevate Eagle’s Landing

The Crossing at Eagle’s Landing comprises eight 2, 3 and 4-story residential buildings, one clubhouse and 4 garage structures, located in the heart of the rapidly growing South Atlanta

Industrial Submarket, the second largest market in the Atlanta MSA.

Easily accessible, the property is well-situated between major interstate I-75 and Route 23.

The unit mix is favorably weighted toward larger floor plans, with 103 twobedroom, 28 one-bedroom and 36 three-bedroom apartments.

The newer 2006 vintage carry little deferred maintenance, especially with new roofs installed in 2014-15. As a result, Viking will be able to immediately focus on renovating units and efficiently managing the rent roll to raise rents to market.

Viking Capital aims to raise Eagle's Landing $1,702 in-place average to the on-site $1,860 average rent achieved in 10% of the rent roll over the last two months.

We will also strategically look to renovate the partially renovated and classic units to the elite standard.

CURRENT PROPERTY

Asset Class Location Year Constructed No. of Units Purchase Price B+ Atlanta, GA 2006 167 $39.25M

Property Details Business Plan Background & Market

Elevate Woodstock

120-unit apartment community built in 1986. Elevate Woodstock is supremely located just minutes from the retail, path of progress, luxury homes, and jobs.

With its excellent location and value-add potential, Elevate Woodstock is positioned well for long–term stability, future rent growth, and value appreciation.

The previous ownership has successfully renovated 40 units total that averaged $200 more per month than prior rents.

With the opportunity to renovate 80 more units, Viking can potentially generate over $450,000 in additional revenue by averaging $10,000 per renovation.

Interior renovations will not only result in immediate upside but aid significantly in tenant retention.

CURRENT PROPERTY

Property Details

Asset Class Location Year Constructed No. of Units Purchase Price B Atlanta, GA 1986 120 $19.6M

Business Plan Background & Market

Kings Cove

Background & Market

192-unit complex is located conveniently in the northeast Houston community of Kingwood. The property sits within the heart of Kingwood, and is close to numerous options for a live, work, and play lifestyle, as well as numerous employment options.

As a part of the Humble Independent School District, Kings Cove has a wonderful selection of schools, including the “A+” rated Kingwood High School. The unique location, the value-add opportunity, and the enviable school system make Kings Cove an opportunity for long-term stability, future rent growth, and value appreciation.

Business Plan

By continuing the existing renovation scope, we can expect to achieve a premium of $225+/unit on the remaining 128 non-upgraded units.

A perfect comparable example of a successfully implemented renovation program is Town Center by Cortland, a rent comparable property to Kings Cove, which has achieved rent premiums of $225-$550 depending on the unit type.

CURRENT PROPERTY

Property Details

Asset Class Location Year Constructed No. of Units Purchase Price A Houston, TX 2007 192 $34M

Elevate at Huebner Grove

Supremely located near the South Texas Medical Center and just minutes from the I-10 as well as the USAA World Headquarters.

In addition to its superior location, and favorable floor plans Elevate at Huebner Grove allows for us to achieve substantial rent growth.

Liberty Pointe benefits from the ease of access to top employers and the continual increase of job creation.

Previous ownership has successfully renovated 28 units total which averaged $150 more per month than prior rents.

With the opportunity to renovate 182 more units, Viking can potentially generate over $660,000 in additional revenue by averaging $150 per renovation. Interior renovations will not only result in the immediate upside but aid significantly in tenant retention.

CURRENT PROPERTY

Property Details

Asset Class Location Year Constructed No. of Units Purchase Price B San Antonio, TX 1981 210 $26M

Business Plan Background & Market

Elevate at the Pointe

Located in Marietta, GA / Atlanta, GA MSA. Elevate at the Pointe is located in the path of progress, has tremendous value-add potential through a comprehensive renovation plan extending from the exterior to unit interiors.

Elevate at the Pointe benefits from the ease of access to top employers and the continual increase of job creation.

Planned Improvements include exterior facelift, Green improvements includes total overhaul retrofitting of existing toilets, shower heads, and aerators with the installation of a modern water conservation project.

By taking the interior improvements to the platinum level renovation, this will allow for premium rent increases and current tenant satisfaction to reach $200-225/per unit.

CURRENT PROPERTY

Details Business Plan

Asset Class Location Year Constructed No. of Units Purchase Price B Atlanta, GA 1969 181 $37M

Property

Background & Market

Property Details

Elevate Twenty-Three CURRENT PROPERTY

Background & Market

Located in Smyrna, GA, Elevate Twenty-Three is located near The Battery in the direct path of progress that has seen more than $1 billion in development over the past few years

Elevate Twenty Three’s room for improvement included exterior, amenity upgrades and extensive interior renovations

Business Plan

80% of the interiors to be renovated to platinum level, this includes stainless appliances, quartz countertops, smart devices installment, and vinyl plank flooring. Modernizing the property includes removing textured wall and ceiling to a smooth and contemporary feel

Exterior improvements include massive facelift through paint, structural repairs to the building bridge catwalks and stair systems. In addition, sport court and recreational areas will be added to build value and attract supreme tenant base

Asset Class Location Year Constructed No. of Units Purchase Price B Smyrna, GA 1986 222 $41.1M

Property Details

Veritas at East Cobb CURRENT PROPERTY

Background & Market

Located in Marietta, GA, Veritas is directly benefiting from the redevelopment of the Franklin Gateway corridor

Veritas’ room for improvement included exterior and amenity upgrades and unit renovations

Business Plan

Planned Improvements included installing new roofs and Hardieplank siding, renovating the remaining classic units to premium level with granite and stainless steel appliances, modernizing the leasing office. interior and adding an outdoor fitness center and turf athletic field

Stabilize economic and physical occupancy while capturing increased rental revenue driven by property upgrades

Asset Class Location Year Constructed No. of Units Purchase Price B Marietta, GA 1980 192 $25.8M

Property Details

Marbella Place CURRENT PROPERTY

Background & Market

Located in the Atlanta’s Clayton County, top 10 rent growth county in the U.S.

Institutional quality seller fully renovated the amenities and interiors in 2017 offering little remaining deferred maintenance

•

Local rent growth outpaced on-site rent renewals, resulting in 16%+ loss to lease on site, providing Viking with the opportunity to increase rents significantly to market rate and increase both revenue and NOI at a lower renovation cost basis.

Business Plan

Minor updates to the unit interiors, pool and exteriors and upgrade fitness center to ensure Marbella Place attracts top quality tenants

Immediately on acquisition, raise renewal rents and new leases to market rental rates

Asset Class Location Year Constructed No. of Units Purchase Price B+ Stockbridge, GA 1999 368 $52.7M

Property Details

The Griffin CURRENT PROPERTY

Background & Market

Located on high traffic Georgia Avenue in Washington, D.C. and adjacent to a Metro rail stop. Petworth is a sought-after neighborhood and the lack of forsale residential homes has increased value

Purchased at $390,000 per rental unit with nearby condominium comps selling for $550,000 which provided $7 million of intrinsic value.

The Griffin was built and zoned as condos, but delivered to market as a rental property.

Business Plan

Efficiently operate the rental property, modernizing the lobby and common spaces to capture market rent growth and positioning the asset for condo conversion.

Asset Class Location Year Constructed No. of Units Purchase Price A Washington, DC 2010 49 $19.3M

CONTACT US invest@vikingcapllc.com vikingmulifamily.com Start Investing in Park 33

VIKRAM RAYA RAVI GUPTA CEO / Founder COO / Founder

VIKRAM RAYA RAVI GUPTA CEO / Founder COO / Founder

LUXURY PLANK FLOORING

DOG PARK/RUN

OUTDOOR KITCHEN

BUSINESS CENTER

LUXURY PLANK FLOORING

DOG PARK/RUN

OUTDOOR KITCHEN

BUSINESS CENTER

VikramRaya CEO,Co-Founder

ChrisParrinello Directorof InvestorRelations

RaviGupta COO,Co-Founder

NathanLoy Directorof StrategicPlanning

JudahFuld VPofAcquisitions

AmirNassar InvestorServices Manager

AmandaLoveless DirectorofOperations

AshleyPenrod Marketing Manager

ArtCordova Directorof Finance AmberButler Investor Concierge

EdMonarchik Directorof AssetManagement

VikramRaya CEO,Co-Founder

ChrisParrinello Directorof InvestorRelations

RaviGupta COO,Co-Founder

NathanLoy Directorof StrategicPlanning

JudahFuld VPofAcquisitions

AmirNassar InvestorServices Manager

AmandaLoveless DirectorofOperations

AshleyPenrod Marketing Manager

ArtCordova Directorof Finance AmberButler Investor Concierge

EdMonarchik Directorof AssetManagement