TAX ADVANTAGES EQUITY

Viking Capital was founded in 2015 and has become a premier multifamily investment firm with agile investment sourcing, structuring, execution, and asset management capabilities and the flexibility to scale and cater to investor preferences. Through its team of acquisitions, asset management, and disposition experts, Viking Capital invests in tier one, secondary, and tertiary markets across the United States.

Georgetown Trained Cardiologist

Retired from medicine at age 40

Controls over $989 Million in assets, raised over $400 million in private equity on 29 properties

Elected into the Forbes Business Council

Dr. Raya is the recipient of Outstanding 50 Asian Americans in Business Award on Wall Street

Inc 5000 lists of the fastest-growing private companies in the US.

V I K I N G C A P I T A L

Founder and CEO of MMG Capital - a real estate company with a multi-million-dollar portfolio

Received his medical doctorate from the University of Virginia

Completed his residency and research fellowship training at UNC and Duke

Investor relations

Repositioning

Conservation

Business operations

Green energy

Value-add renovation

Construction

Asset management

Viking Capital was founded in 2015 and has become a premier multifamily investment firm with agile investment sourcing, structuring, execution, and asset management capabilities and the flexibility to scale and cater to investor preferences

Through its team of acquisitions, asset management, and disposition experts, Viking Capital invests in tier 1, secondary and tertiary markets across the United States.

TX PHEONIX, AZ

Viking Capital’s value-add strategy targets B+ garden-style multifamily communities with 200 to 450 units, built between the 1980s and early 2000s. We focus on acquiring assets with belowmarket rents in high-growth submarkets, presenting significant opportunities for operational and physical enhancements.

By executing a multi-pronged value-add strategy, Viking Capital enhances property performance, elevates tenant experience, and drives sustainable appreciation. Our approach ensures investors benefit from increased asset value and improved income generation in high-demand multifamily markets.

Our investment strategies have consistently delivered strong results in Atlanta. These same strategies have also proven effective on a national scale, demonstrating their adaptability to diverse market conditions.

egic Rent Optimization: Raising in-place rents arket levels through targeted renovations and oved management.

erty Enhancements: Comprehensive exterior ades, including landscaping, amenities, and appeal improvements.

or Unit Modernization: Upgrading apartment ors with high-quality finishes, energy-efficient ances, and contemporary designs.

munity Experience: Enhancing resident action through thoughtful improvements and n-class property management.

Proven Track Record: Extensive experience in repositioning multifamily assets to maximize returns.

Market-Driven Approach: Identifying properties in locations with strong demand, job growth, and favorable economic conditions.

Risk-Adjusted Returns: Delivering strong cash flow and long-term appreciation through disciplined asset management.

Renovate property exterior

Upgrade unit interiors

Modernize community amenities

Operational efficiency improvements

Rebrand and elevate property marketing strategy

Al powered - Lease rent optimization

Tax appeal and mitigation

Sustainability and green energy improvements

Stabilize physical occupancy

Reduce economic vacancy

Resident satisfaction packages

Revenue sharing platform

Viking Capital’s Core Plus strategy targets high-quality, well-located multifamily assets with stable cash flow and strong long-term appreciation potential. We focus on acquiring newer or wellmaintained properties in desirable markets that offer both immediate income generation and opportunities for strategic enhancements.

With a focus on risk-adjusted returns Viking Capital’s Core Plus strategy offe approach—delivering capitalizing on strateg long-term value.

e Market Selection: Investing in high-growth

o areas with strong job markets, population nsion, and increasing rental demand.

ted Property Enhancements: Implementing t operational and physical improvements to mize rental income and asset performance.

g Occupancy & Cash Flow: Acquiring stabilized erties with high occupancy rates and steady l income.

ational Efficiencies: Leveraging best-in-class agement strategies to enhance tenant ience and improve net operating income.

Lower Risk, Strong Upside: Balancing stability with value-add potential for enhanced returns.

Sustainable Growth: Investing in assets with strong market fundamentals and long-term appreciation potential.

Proven Execution: Leveraging Viking Capital’s expertise in asset repositioning and market analysis to drive superior investment performance.

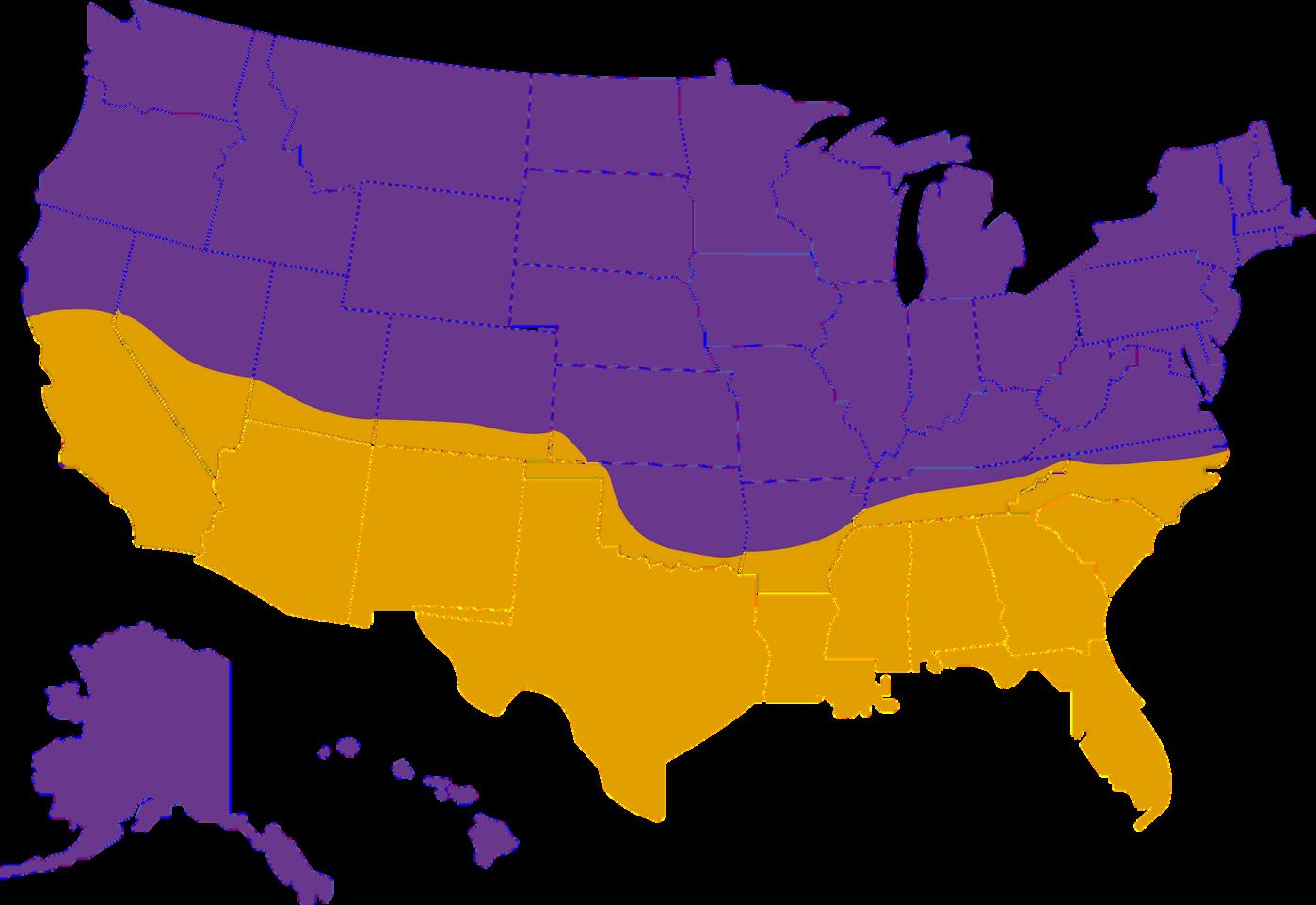

Our multifamily new development strategy target markets with strong demand fundamentals, focus Southwest and Southeast U.S. We prioritize cities a with favorable population trends, job growth, and e expansion, ensuring long-term value creation.

With continued migration trends, housing shortag rental demand, multifamily new development rem lucrative investment opportunity. Our strategy is d long-term market growth while delivering strong, returns for investors.

egic Market Selection: Identifying high-demand ons with strong rent growth potential.

rn, High-Quality Developments: Delivering A multifamily communities with premium nities and sustainable design.

Adjusted Returns: Leveraging data-driven hts to optimize development timelines and ate risks.

-Term Value Creation: Positioning assets for eciation, stable cash flow, and potential exit rtunities.

Deep Market Expertise: Proven track record in identifying and capitalizing on emerging growth markets.

Innovative Development Approach: Integrating sustainability, technology, and lifestyle-driven design to attract high-quality tenants.

Institutional-Grade Execution: Partnering with toptier developers, architects, and contractors to deliver best-in-class assets.

3YEARHOLD PERIOD REDEPLOY CAPITALFASTER

COREASSET STABILITY LOWER RISK

MILLENIAL APPEAL

HIGHERRETURN POTENTIAL

Quick turnaround on your investment. Reinvest your profits sooner for continuous growth. Invest in highquality asset that is attractive to institutional buyers. Benefit from reduced risk compared to other investment types. Attract tenants with brand-new construction and modern amenities. Maximize your returns with a stronger return profile.

g y g g g cities and submarkets across the Southwest and Southeast U.S., focusing on areas poised for strong rental demand and above-average rent appreciation.

TARGET MARKET

Texas

Southeast (Sunbelt Region)

Florida

Major Midwest Cities

Arizona

(SUNBELT REGION)

Regular integration of watersaving mechanisms, LED lights, and smart thermostats and doors.

Viking has rolled out an ESG initiative across all properties to minimize environmental impact and enhance communities.

Viking Capital is actively considering solar solutions for suitable properties.

Phoenix, Arizona

DFW, Texas

South Bend, Indiana

Nashville, Tennessee

Atlanta, Georgia

ELEVATE AT STEWARTS MILL PARK 33

t ismypleasuretowritethisletter acknowledgingour excellent business elationshipfor somanyyears. AsI havesharedwithyou, Vikandother membersof theteamat Viking, whenyouguyscommit toadeal, it getsdone ntimeandat theagreeduponprice. Wehaveclosedmultipletransactions withyouguyssince2018andeachtimeit hasbeensuper easywithnohiccups.

Kevin Geiger