Executive Summary

Financial Analysis

Property Description

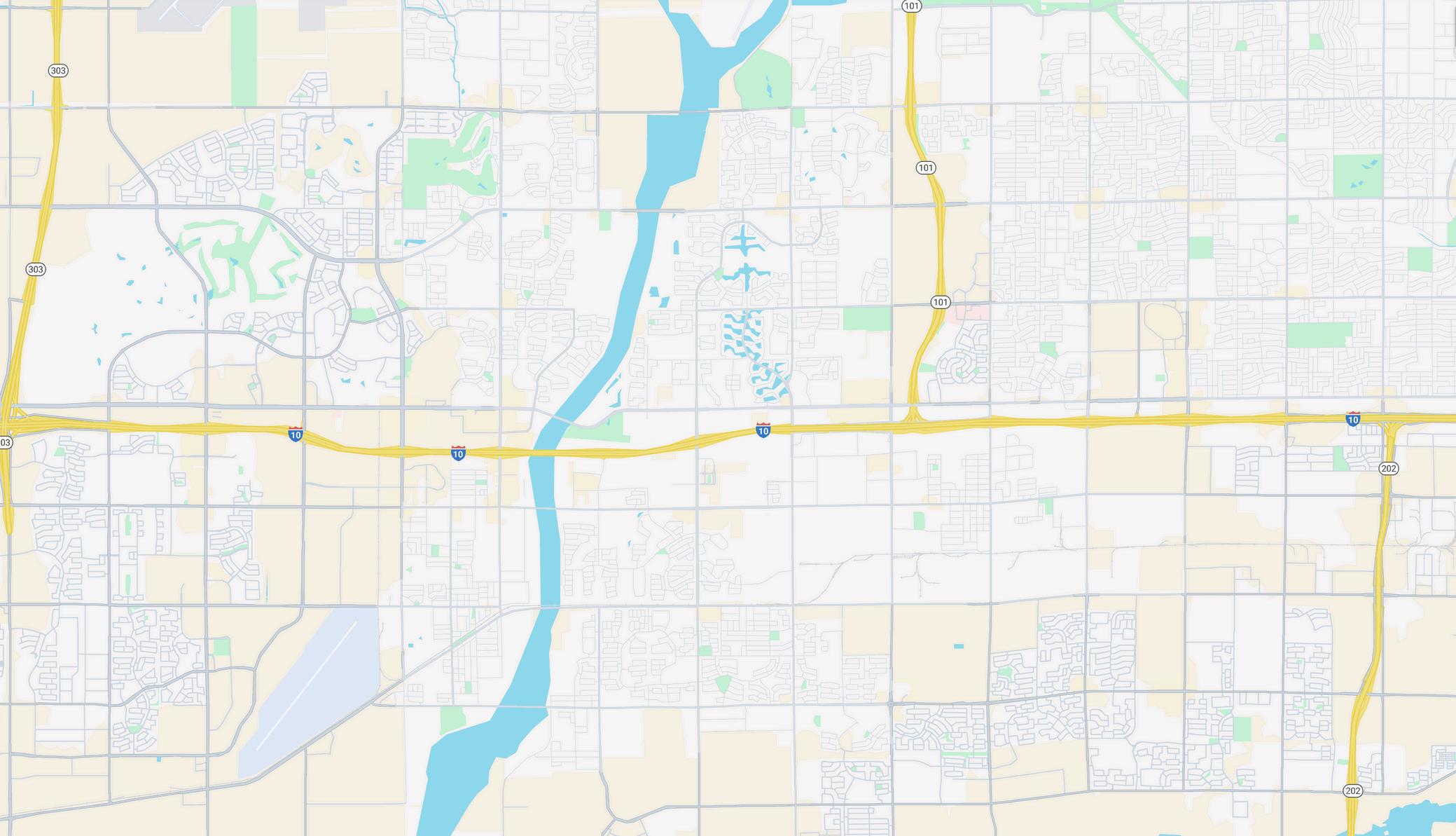

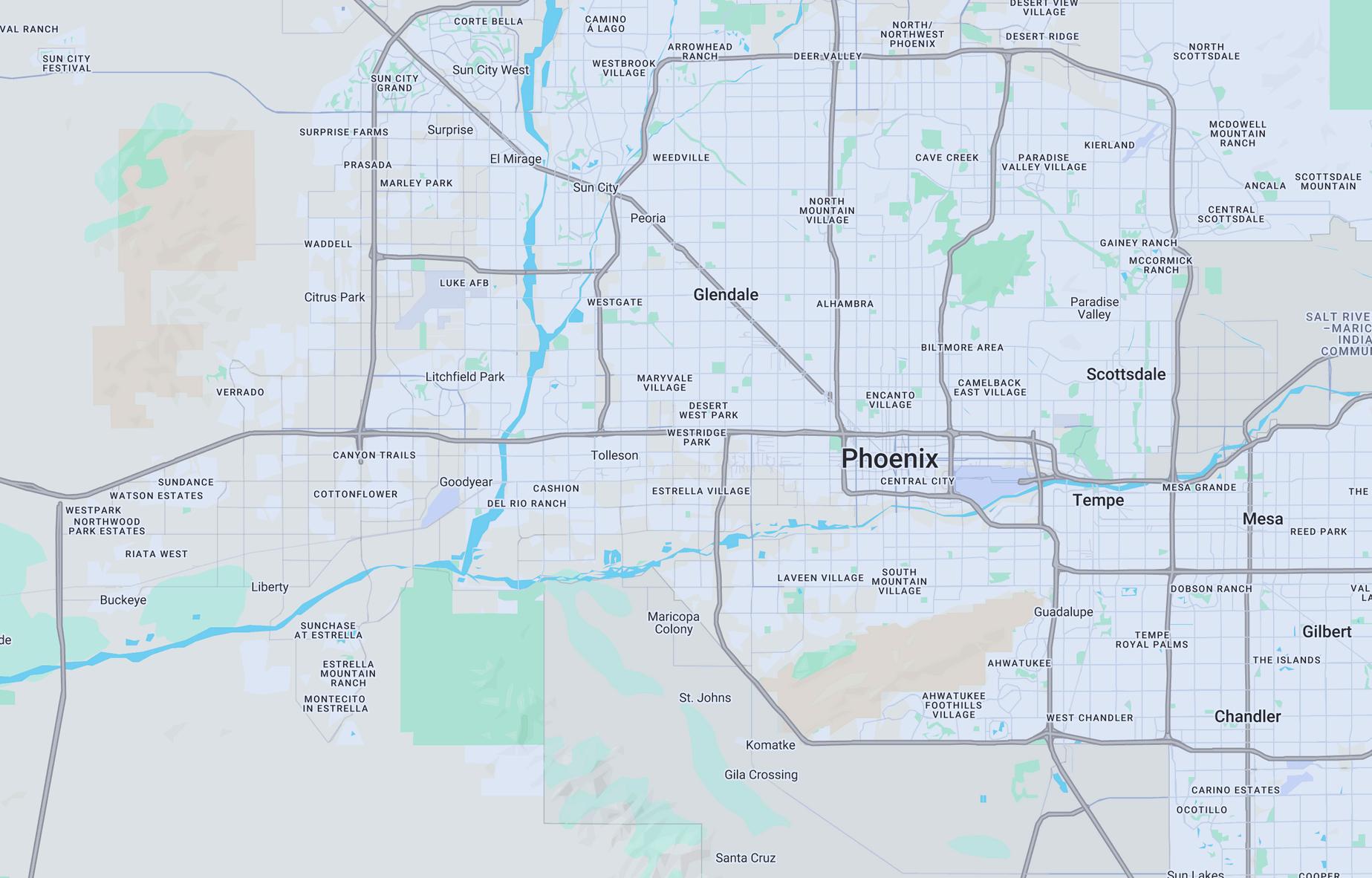

Location Overview

Portfolio & Performance

Executive Summary

Financial Analysis

Property Description

Location Overview

Portfolio & Performance

Overland specializes in developing multifamily, mixed-use, hospitality, and storage projects, with $750 million track record in total developments, and has earned multiple awards for their design and development capabilities.

VP DevelopmentandFinanceatOverlandGroup,Inc Michael Holman

Runs development and finance at Overland Group

Overseeing current $400M development pipeline

Arranged over $250M worth of financing

Certified Public Accountant

7,144

UNITS DEVELOPED

DEVELOPMENT PROPERTIES 26

$1+ BILLION

ASSETS UNDER CONSTRUCTION/DEVELOPMENT

Ed Monarchick joined Viking Capital in 2023, after a deacade as managing partner at Mesa Capital Partners and EJM Development . Ed brought to Viking his more than 30 years of experience in all phases of multifamily real estate operations, including new development, asset management, acquisitions, investment development, syndication, and dispositions. Ed’s background includes firms such as TriBridge Residential, Lane Company, Equity Residential Properties Trust, Inc., Morgan Stanley & Company, ZOM, Inc., and Merry Land & Investment Company.

Edward Monarchik

Director of Asset Management

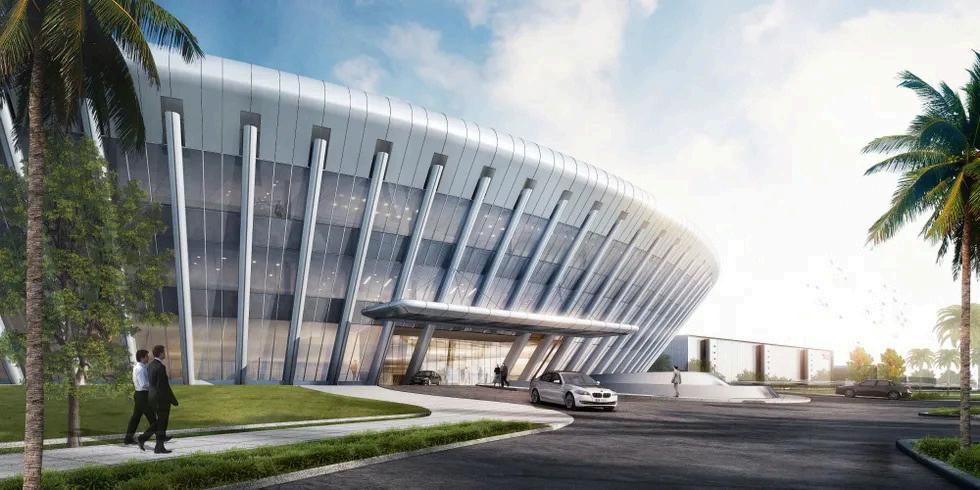

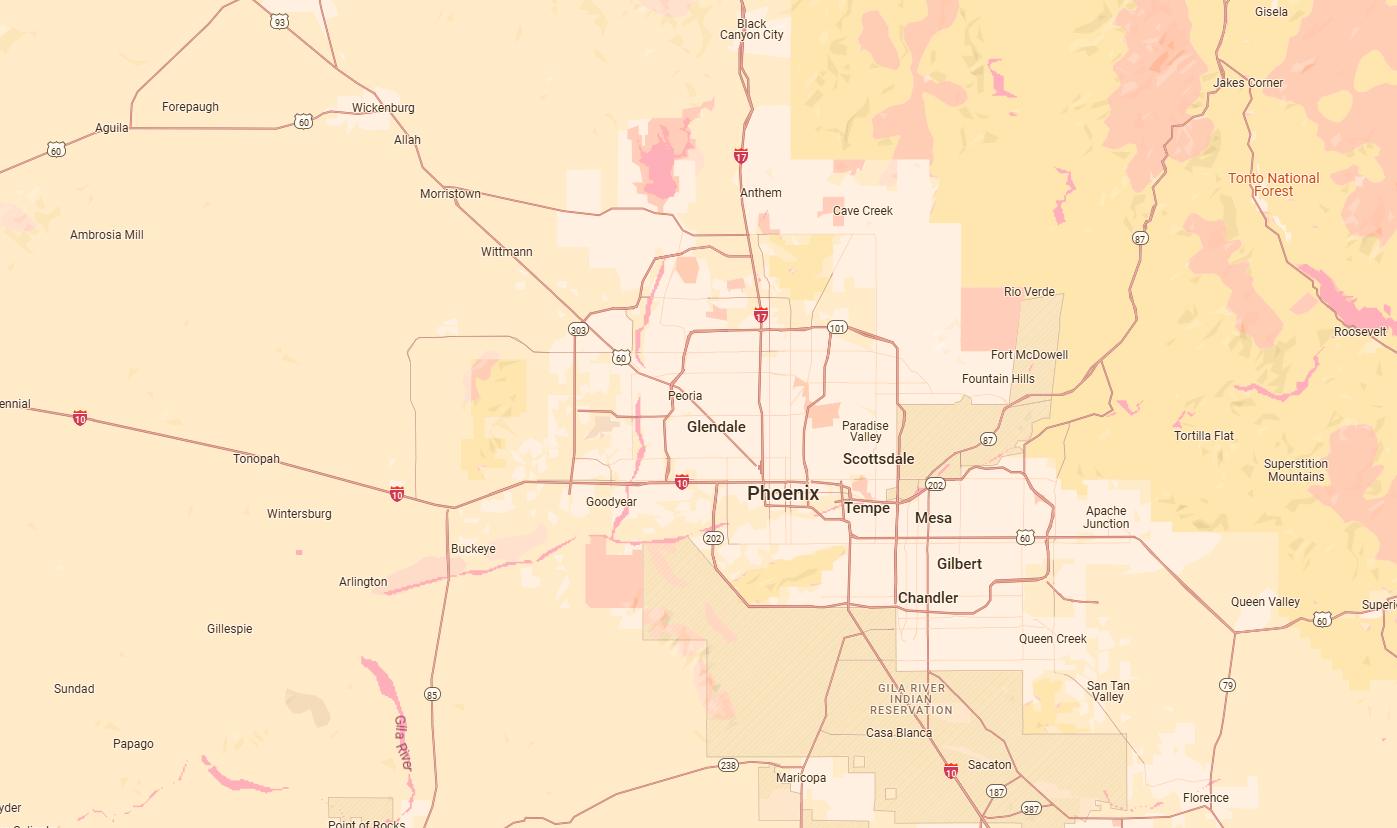

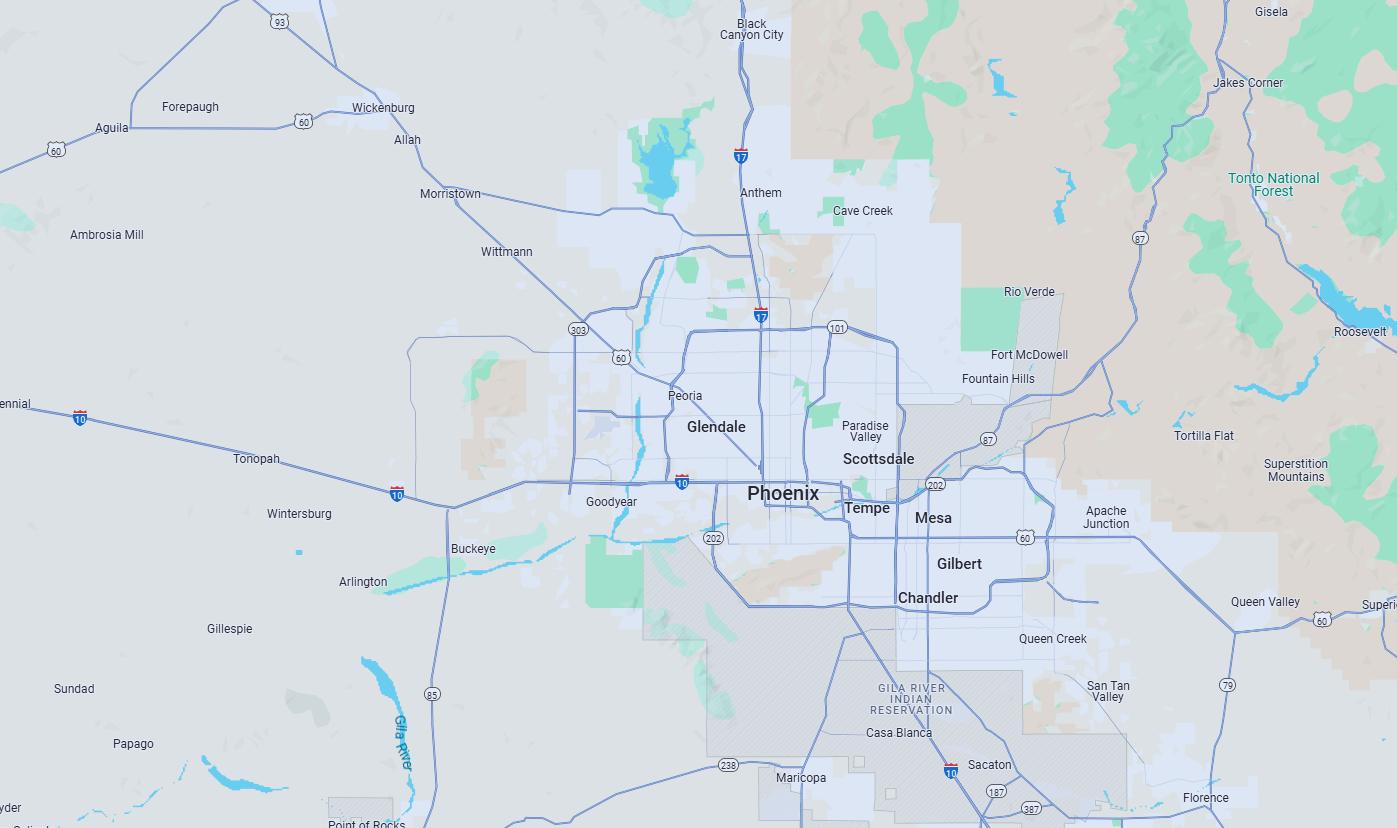

Viking Capital presents Avondale Commons, a 324-unit, newly constructed multifamily and townhome community located in Avondale, Arizona—an emerging submarket within the thriving Phoenix MSA and a key node in the explosive West Valley growth corridor.

Strategically positioned in the path of progress, Avondale is experiencing rapid population and employment expansion, fueled by major corporate investments from Intel, TSMC, leading AI and semiconductor firms, and nationally ranked healthcare institutions. This powerful convergence of innovation, infrastructure, and positive net migration is driving exceptional demand for high-quality housing.

And while this began as a ground-up development, it’s important to note that Avondale Commons is already built and preparing for lease-up, greatly reducing the risk typically associated with new construction. With stabilized costs, completed construction, and immediate revenue potential, this is no longer a speculative project —it’s a nearly turnkey opportunity.

Surrounded by vibrant new development and economic momentum, Avondale Commons is designed to meet the lifestyle expectations of an affluent and growing renter base with modern design, premium finishes, and resort-style amenities. This asset benefits from a strong rent-to-own delta, favorable demographic trends, and a robust job market, all contributing to sustained rental demand and long-term appreciation. Structured with conservative financing and a phased lease-up strategy, Avondale Commons offers investors a rare chance to capitalize on Phoenix’s next wave of growth while locking in value in one of the nation’s most resilient and opportunityrich metros.

TOTAL UNITS

TOTAL VIKING BASIS

$15,000,000 $10,000,000 $5,000,000

Lease-Up: Drive occupancy through targeted marketing and leasing.

Operations: Finalize staffing, vendors, and management systems.

Rent Strategy: Optimize pricing for absorption and revenue.

Retention: Focus on service and community to boost renewals.

Pickleball Court

Theatre

Fitness Room

Heated Pool

Washers & Dryers in units

Electric Car Charge Stations

Walking Paths

Bocce Ball Court

Cabanas for Poolside

Controlled Access Gates

Modern, Upgraded Fixtures

Walking distance to mixed

use shops

Positioned for attractive risk-adjusted returns driven by Phoenix’s booming West Valley expansion and long-term rental demand.

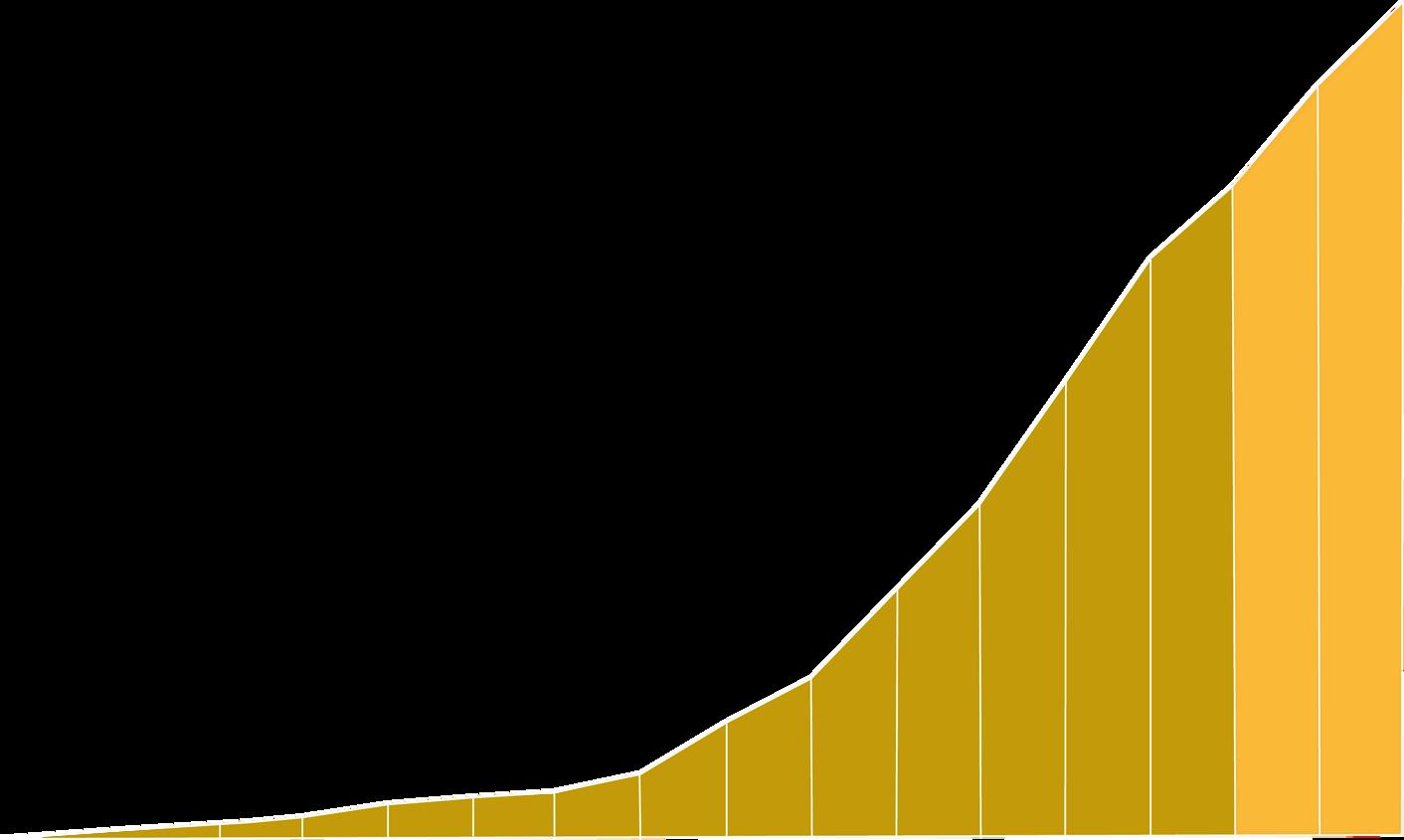

Strategic lease-up and operational ramp-up deliver exponential income potential—fueling asset value and investor distributions - expecting an 815% NOI growth by year 4.

First 24 months focused on lease-up and NOI growth.

Cash flow stabilizes as occupancy and rents increase.

Distributions are expected to begin in year one.

Stabilization drives longterm asset value.

Viking Capital owns another development in the area, providing economies of scale for management.

Optionality to exit as a portfolio with other Viking PHX properties increasing liquidity, and appealing to institutional buyers.

TWO-TIERED RETURN OPTIONS

TWO-TIERED RETURN OPTIONS

TWO-TIERED RETURN OPTIONS

A two-tiered return structure gives investors options when placing their equity. Investors have the ability to invest in either tier of equity

Class B or Reserve Class..

$82,200,000 $67,200,000 $45,250,000

LOAN PRINCIPAL $67,200,000

*Subjecttochangebeforeclosing

ADJUSTABLE

RECAPITALIZATION

$30.25M

$79.0M $4.5M

EXISTINGEQUITY DEBT PREFEQUITY

EXISTINGEQUITY

KINGEQUITY

$7.2M $31.5M $30.25M

(with16%IRR) (with16%IRR)

EXISTING EQUITY DEBT PREFEQUITY $67.2M

VIKINGEQUITY($15M) DEBT($67.2M) COSTBASIS

$82 M 16% IRR

$98 5 M TOR RETURNS .5 M

45%

DEPRECIATION BONUS MINIMUMOF

OFF MARKET ADVANTAGE:

We secured this deal off-market, at a major discount, allowing us to negotiate favorable terms and avoid the bidding war environment typical in Phoenix today.

16% IRR net to the deal, is built into the structure, providing additional risk mitigation and investment confidence.

Our preferred equity position is secured well below construction cost, providing a strong margin of safety and favorable upside potential.

Avondale is experiencing explosive growth, driven by major employers like Intel, AI tech firms, and healthcare giants migrating to the West Valley.

Strong renter demand paired with a low pipeline of new deliveries supports long-term rent growth.

LOW ENTRY BASIS: ECONOMIES OF SCALE:

With another new build underway in Peoria, we’re unlocking economies of scale across operations, allowing us to streamline costs, share resources, and enhance overall returns for both projects.

This mix of modern apartments and townhomes offers the high-quality housing today’s renters demand. FLIGHT TO QUALITY

Vikng’s equity position places our investors ahead of the existing preffered and common equity, reducing downside risk.

Bonus depreciation reallocation creates larger upfront paper losses, lowering your tax bill immediately.

Reduced taxes mean stronger after-tax distributions and higher effective returns from day one.

Viking holds full governance authority to protect investor interests at every stage.

GROUNDBREAKING

(First delivery of units)

EQUITY RAISE

July - Dec. 2025 Q4 2025

2022 2025

Final delivery of units CONSTRUCTION BEGINS

Dec 2022 SELL FIRST EQUITY RAISE July - September 2023

October 2027 July 2025

November 2025 - October 2027

LEASE-UP TO STABILIZATION STABILIZATION

Private structured parking

EV Charging Stations

Bocce Ball / Pickleball Court

Community walking trails

Playground

Pool cabanas

Heated year round pool

Outdoor kitchen

Fitness center w/ interactive equipment

Clubhouse

Billiards room

Theatre Room

Controlled Access Gates & Entry

3BR2.5BA

16Units5%

3BR2BA

16Units5%

2BR2.5BA

16Units5%

1BR1BA

176Units55%

2BR2BA

100Units30%

With a mix of spacious townhomes and smaller units, Avondale Commons is thoughtfully designed to meet the needs of both growing families and young professionals seeking modern, rightsized living. Unit Mix

Spacious Floor Plans

Modern GE Appliances

Granite Countertops

Walk-in Closets

Full Size Washers and Dryers

Smart Locks and Thermostats

Private Balconies

Pool & Outdoor Area

Mixed Use Buildings

Luxury Apartments

WINGWAM GOLFCLUB

HARKINSTHEATRES ESTRELLAFALLS

MORERETAIL& RESTAURANTS

Goodyear

GOODYEARBALL PARK

PHOENIX/GOODYEAR AIRPORT

AVIDHOTEL

RETAIL&REHAB CENTERS

WESTGATE PEORIA,AZ

PHOENIXCHILDREN’S EMERGENCYDEPT.

TALKINGSTICKRESORT AMPITHEATRE DESERTSKYMALL

AKOSMEDICAL CAMPUSPHASE2

Homes at River Run

3.4Miles

DeConcini Park Civic Center Park 4.4Miles

2 MILLION RENOVATION $4.5 MILLION RENOVATION

Goodyear Ball

HOME

INCOME GROWTH

AVERAGE HOUSEHOLD $102,820

POPULATION

FAMILY HOUSEHOLDS

MEDIAN AGE 32.1 INCOME ANNUAL VISITORS 1.8 M

235,099 ALONG INTERSTATE 10 3.3% 97,574 775

DAILY TRAFFIC COUNT

POPULATION UNDER 47% RATE 30 YEARS OLD

UNEMPLOYMENT

3,000 CONSTRUCTION & TECHNOLOGY JOBS MARKETCATALYST

$1.5 BILLION INVESTMENT

AVONDALETECHCAMPUS

66.5 ACRES OVER 5 BUILDINGS INCLUDE 1.3 MILLION SQUARE FEET OF SPACE

$5 MILLION 150 NEW JOBS

40,000+ CONSTRUCTION JOBS 10,000+ HIGH-PAYING TECH JOBS 28 MILLION SQUARE FEET

$65 billion project

+ 12,000 jobs

28 million square feet 8,960 residential units

2.3 MILLION VISITORS PER YEAR

RandallMcDaniel SportsComplex

4MILESFROM AVONDALECOMMONS

KoiPond,Splash Pad,&more Lodging,Cafe’s,& Breweries

INTERNATIONALECONOMICDEVELOPMENTCOUNCIL(IEDC)

key area for economic development

NEWLY RENOVATED MOUNTAIN VIEW COMMUNITY CENTER IS A VIBRANT HUB FOR RECREATIONAL PROGRAMMING AND COMMUNITY ACTIVITIES. MOUNTAIN VIEW PARK IN AVONDALE REOPENS WITH MODERN UPGRADES FOLLOWING $1M RENOVATION

$1.57 MILLION GRANT TO REVITALIZE OLD TOWN

Hosts two NASCAR events each racing season.

$500 MILLION ECONOMIC IMPACT CONTRIBUTES WELL OVER IN AVONDALE, AZ

$3.1BILLION ANNUAL ECONOMIC IMPACT

OVER 25,500 JOBS

AVONDALE LOGISTICS CENTER

THE CUBES

“THE CUBES” AT GLENDALE IS HOME TO WILLIAMS SONOMA, U.S. MERCHANTS AND IS SURROUNDED BY RED BULL, WHITE CLAW, BALL CORP., AMAZON, WALMART AND FEDEX.

300+JOBS

$675 MILLION INVESTMENT

$27 MILLION INVESTMENT NESTLÉ (GLENDALE)

COLDWATER DEPOT LOGISTICS CENTER

AVONDALE COMMONS

10.8 MILES FROM AVONDALE COMMONS

$100 MILLION

rbor Airport named

t Airport In the US

1

#1 City for Manufactoring

Job Growth In the US #

5

8,000,000

7,000,000

6,000,000

5,000,000 4,000,000 3,000,000 2,000,000 1,000,000

PHOENIX POPULATION HAS GROWN FOUR TIMES THE NATIONAL AVERAGE.

2023 POPULATION

4,717,000

2040 Population Estimate

8,700,000

ARIZONA’S MAYO CLINIC RATED THE NO. 1 HOSPITAL IN ARIZONA FOR THE 12TH CONSECUTIVE YEAR.

Mayo Clinic generates $28 billion within the overall national economy.

More than 13,000 jobs in Arizona

$4.7 BILLION ANNUAL ECONOMIC IMPACT

Mayo Clinic is regularly recognized among the very best in the nation in the following specialties:

CANCER

CARDIOLOGY AND HEART SURGERY

DIABETES AND ENDOCRINOLOGY

GASTROENTEROLOGY AND

GASTROINTESTINAL SURGERY

GERIATRICS

GYNECOLOGY

NEUROLOGY AND NEUROSURGERY

ORTHOPEDICS

Arizona State University ranks 9th globally in the Times Higher Education Impact Rankings 2024. ASU excels in sustainable development goals, leading in multiple areas such as sustainable cities and communities, and life on land.

The University of Arizona is known for its strong research output and quality of education, placing it in the top 10% of universities globally.

INTEL IS BUILDING TWO MORE PLANTS IN TANDEM FOR A $20-BILLION PROJECT FAB 52 AND FAB 62

SEMICONDUCTOR MANUFACTURING PLANT: (FAB - semiconductor fabrication plant)

MIC IMPACT

NTEL EMPLOYEES

WO CAMPUSES

TO PRODUCE THE MOST ADVANCED LEADINGEDGE SEMICONDUCTORS IN THE U.S.

2 BILLION OMIC IMPACT

CT TAX REVENUES

000 JOBS TO PHOENIX

PLUS $195.1M IN INDIRECT TAX REVENUES

AMKOR HAS COMMITTED TO DEVELOP THE LARGEST OUTSOURCED SEMICONDUCTOR PACKAGING AND TEST FACILITY IN THE UNITED STATES

11MILESFROM AVONDALECOMMONS

CORPORATE AND TECH EMPLOYEES & GOING A 63,000-SQUARE-FOOT EXPANSION

n

$44.3 BILLION ECONOMIC IMPACT

$130,000 32,000 1,200+

PASSENGERS PER DAY EMPLOYEES FLIGHTS EACH DAY

$24.2 BILLION ECONOMIC IMPACT + 347,500 JOBS

$13 MILLION PROJECTED ECONOMIC IMPACT

ARIZONA’S FIRST FULLY THEMED INDOOR/OUTDOOR AMUSEMENT PARK

$500 MILLION

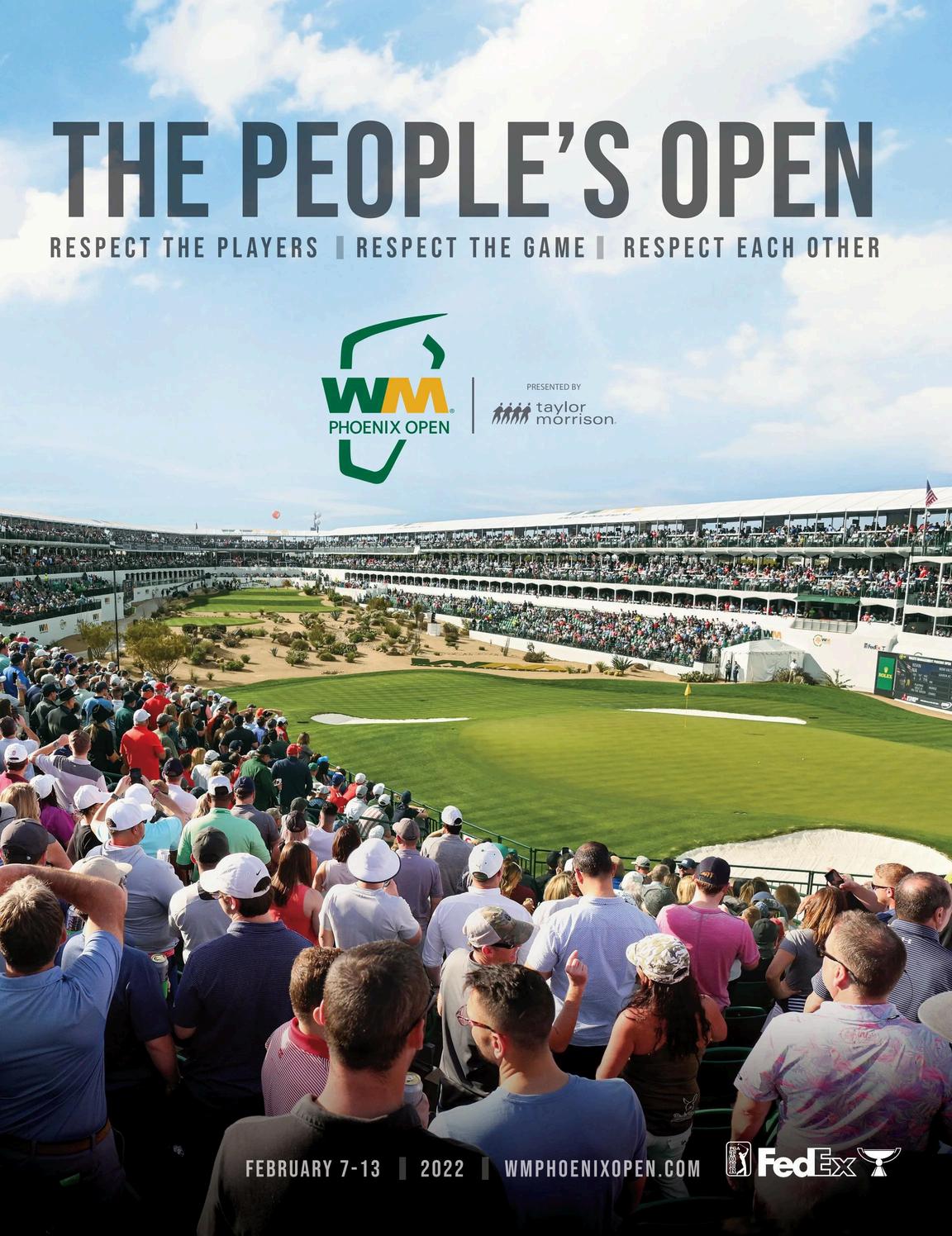

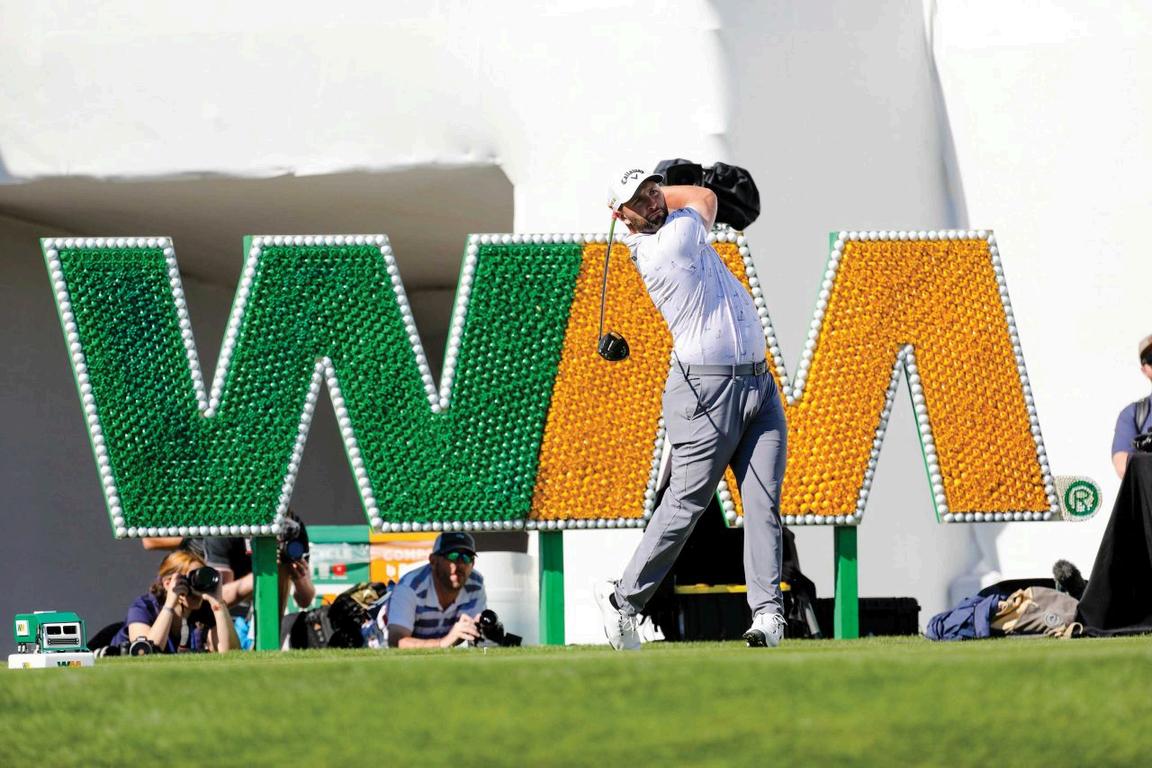

THEWM PHOENIX OPEN IS THE MOST-ATTENDED EVENT ON THE PGA TOUR, AVERAGING MORE THAN 700,000 SPECTATORS EACH YEAR.

BILLION DOLLAR INVESTMENT

MILLION ECONOMIC IMPACT BY 2030

6,000 DIRECT JOBS WITH AN ECONOMIC IMPACT OF MORE THAN $100 MILLION BY 2030.

$1B VAI Resort is Arizona’s largest and boldest hotel, entertainment, and culinary destination

$32 MILLION ANNUAL ECONOMIC IMPACT

SCOTTSDALE POLO CHAMPIONSHIPS OVER 12,000 ATTENDEES

best polo event in the world,” the Bentley o Championships features exciting polo y fashion, and exotic car displays.

$11 MILLION ECONOMIC IMPACT

ISITOR SPENDING RTED MORE THAN 0 REGIONAL JOBS.

ENT $77 MILLION PER DAY ACROSS , SAYS ECONOMIC IMPACT REPORT

$28.1 BILLION

DIRECT VISITOR SPENDING IN 2022

WATER DELIVERIES HAVE CONTRIBUTED $2 TRILLION IN ECONOMIC BENEFITS TO ARIZONA'S GROSS STATE PRODUCT (GSP) SINCE 2017

$7.1BILLION ECONOMIC IMPACT

$4.5BILLION $1.8BILLION

GDP HOUSEHOLD INCOME TAX REVENUE

DIVERSIFICATION APPRECIATION TAX ADVANTAGES EQUITY

Viking Capital was founded in 2015 and has become a premier multifamily investment firm with agile investment sourcing, structuring, execution, and asset management capabilities and the flexibility to scale and cater to investor preferences. Through its team of acquisitions, asset management, and disposition experts, Viking Capital invests in tier one, secondary, and tertiary markets across the United States.

PHEONIX, AZ

TX

AUSTIN, TX

TN

6,290 1,024,200,000