EXECUTIVE REPORT

2022: Another Year of Success for the Credit Union

As we close out another year, I want to thank our 135 employees for their outstanding work and dedication in 2022, and for delivering world-class financial solutions and services to our member-owners. Providing the members with excellent service is a bedrock principle here at the credit union. We have coined a phrase, “no members, no credit union.” Everything we do centers around what is best for our members.

While each year is a new opportunity to make a difference in the lives of our members, 2022 was especially successful and profitable. With all the news of inflation, rising interest rates, supply chain shortages, challenging economic times, and calamity abroad, the credit union remained focused on taking care of the financial needs of our members.

With inflation a top priority for the Federal Government, the Federal Reserve aggressively hiked short-term policy rates throughout the year. Despite this shock to the economy, we continued to deliver the kinds of financial services you have come to expect from your credit union.

Throughout the year we exceeded financial targets despite the gloomy economic outlook. For the first time in the organization’s history, we surpassed a billion dollars in loans to our members and member businesses. The credit union made more loans to our members than any other year. Whether it was a home loan, refinance, personal, home equity, home improvement, homeowner, business, auto, lines of credit, student credit, credit cards, or any of our lending products, we met your needs. The loan growth, while historic, is only meaningful because you are the ones benefiting. We have always prided ourselves on being present when our members need us the most. We will continue to do so.

In addition to our financial success, we rolled out two major platforms to improve your member experience:

1. Enhanced mobile and online banking: converted to a more robust mobile and online banking platform. The new Banno system provides 2-factor authentication with an assortment of improved and interactive features.

2. New communications call-in system: a new menu, call flow, and features designed to provide a more streamlined and efficient member experience.

2022 Milestones: Total Assets, Member Deposits, Loans, Net Income

Total Assets: $1.259 billion

Member Deposits: $1.14 billion

Loans to Members: $1.02 billion

Net Income: $4.7 million

2022 Highlights

Higher Dividend Rates

Interest rates on all our products and services are priced with you in mind. Credit unions in general offer higher deposit and lower loan rates. For the last few years in a low-rate environment, deposit rates lagged significantly. During this time, conversely, mortgage rates were at an all-time low. We were able to help many members realize their dream homes with very attractive rates. Members also took advantage by refinancing higher-rate mortgages and saving hundreds ¬ even thousands of dollars on monthly payments. In contrast, we are now in a rising rate environment and can offer very attractive rates on deposits and savings. At one point, we were offering a promotional certificate of deposit (CD) with the highest rate in the country. This year we significantly increased all deposit rates to bring you some of the top dividend returns for your money. At the credit union, we know you work hard for your savings and want to pay you competitive rates.

Retaining and Recruiting Talent

This year and beyond, we will place additional focus on retaining and recruiting talent. Keeping employees motivated and engaged during this “great resignation” period has been an emphasis for us. We are very proud of our people and the work they do seeking new and better ways to serve you. It starts with the leadership we assembled and cultivating a thriving organizational culture that permeates the entire credit union. Our people know we care and support them, which helps retention and fosters a healthy and successful workforce.

2023 & Beyond

As we move forward and inflation subsides, consumer price index (CPI) data fit with our view that the Federal Reserve will slow the pace of rate hikes in the coming months. This should help stabilize deposit and loan interest rates. While some believe the aggressive rate hiking to curb inflation will eventually throw the economy into a recession, one thing you can be assured of is your credit union will continue to thrive and prosper. We have seen many economic downturns in our 88-year history, and each time we weathered the storms and stood with our members by providing them with financial services, solutions, and security for every circumstance and situation.

As we look to the future with our collective efforts of working together, we are confident our credit union will continue to flourish and prosper. Our Federal regulator, the National Credit Union Administration (NCUA), and external auditor, Doeren Mayhew, CPAs and Advisors, agree with us. Once again, we earned good reviews and ratings during our yearly examinations.

On behalf of the Board of Directors, Management and staff, we say thank you. We are very proud of our success –without you, none of what we celebrate is possible.

Respectfully,

Timothy L. Anderson President & CEO Jay Moore Chairman of the Board

Jay Moore Chairman of the Board

SUPERVISORY COMMITTEE REPORT

Under the Federal Credit Union Act, your Supervisory Committee—appointed by the USSFCU Board of Directors—is responsible for providing assurance that USSFCU’s operations are carried out in a safe and sound manner in accordance with the Federal Credit Union Act, the regulations of the National Credit Union Administration (NCUA) and the USSFCU’s bylaws.

The Supervisory Committee meets regularly with external auditors to monitor and evaluate internal controls that help ensure that your assets are safeguarded and that USSFCU is operating effectively and efficiently.

Financial Audit

The Supervisory Committee is assisted by the Certified Public Accounting firm Doeren Mayhew, USSFCU’s financial auditor. As one of the nation’s leading CPA firms, Doeren Mayhew is comprised of cross-functional professionals delivering industry-focused expertise to more than 350 financial institutions across the nation. They delivered their audit report to the Supervisory Committee on April, 28th 2023. The 2022 Financial Statements audit report was “unmodified” indicating the financial statements of USSFCU were presented fairly.

Internal Audit

In addition to the annual audit as described above, the Supervisory Committee directs the efforts of USSFCU internal audit function. We were supported in this function by RSM US LLP (RSM). Audits of USSFCU’s key risk areas provide an additional layer of review of the effectiveness of the internal control mechanisms used by USSFCU. Tests and reviews are performed on the overall system of internal controls and ensure adherence to policies and procedures and accounting principles, as well as compliance with Federal Regulations.

RSM was able to deliver nineteen completed audit reports to the Supervisory Committee in 2022. This would not have been possible without the efforts of the USSFCU management and staff, and their efforts to coordinate with the auditors from RSM. Throughout 2022, RSM made various control and procedural recommendations in specific audit areas. The Supervisory Committee discussed the recommendations during regular meetings with RSM and Management. Management reported that it satisfactorily addressed or is working to address RSM’s recommendations that the Committee agreed were prudent or required. Further, the Supervisory Committee requested RSM to review and revisit specific areas of USSFCU operations. The Supervisory Committee continues to receive the results of these evaluations, and Management will actively implement the additional controls and procedures recommended by RSM, as the Committee considers prudent or required.

The Supervisory Committee also acts as an ombudsman for Members. If ever you need assistance that cannot be resolved through normal channels, we encourage you to contact us at the following address:

USSFCU Supervisory Committee

Attention: Supervisory Committee Chair

P.O. Box 77920, Washington, DC 20013-8920

On behalf of the Supervisory Committee, I would like to thank the USSFCU staff and Board of Directors for supporting our work to assure fiscal soundness for the benefit of our members. This Committee is proud to volunteer our time to serve you, our valued members.

Thank you,

Josef Martens, PhD Chair, Supervisory CommitteeNOMINATING COMMITTEE REPORT

Effective May 24, 2023, three (3) seats on your United States Senate Federal Credit Union (USSFCU) Board of Directors expire.

Pursuant to Article V of our Bylaws the Board Chair appointed a Nominating Committee consisting of Board Director Joe Eckert, Volunteer Milton Salvador, and myself.

Three members submitted applications for nomination to the Board. The Nominating Committee reviewed the applications and selected the three incumbents below for renomination. Each of the candidates has met the USSFCU volunteer service requirements and were found to be a member in good standing as well as highly qualified for Board service.

Nominations for expiring seats and vacancies could also have been made through signed petitions by obtaining the signatures of one percent (1%) of the USSFCU membership (approximately 442 members in good standing). Petitions filed under this procedure had to be submitted to the Nominating Committee as of the close of business on April 10th, 2023. As of that date there were no petitions submitted.

Since the number of nominees equals the number of expiring terms and vacancies to be filled, a ballot election was not necessary, and the three (3) nominees named above will be elected by acclamation.

Please join me in congratulating the three nominees as they continue to volunteer their time and talent in the service of each of you, the valued members of our United States Senate Federal Credit Union!

Sincerely,

Judy Rainey Chair, Nominating Committee

Judy Rainey Chair, Nominating Committee

TREASURER’S REPORT

As of December 31, 2022, Total Assets were $1.259 billion.

Our net loan portfolio ended the year at $1.02 billion and $444.9 million in loans were approved; this was an approved loan increase of $94.9 million, compared to 2021. Our loan delinquency and charge-offs have remained low during this reporting period and lending continues to remain a high-level strategic goal.

Management’s calculation of USSFCU’s allowance for loan loss was reviewed by our internal and external audit firms, in addition to the National Credit Union Administration (NCUA). They have all indicated that our loan loss reserves continue to be conservatively stated to meet potential loan losses as of December 31, 2022.

In 2022, deposits ended the year at $ 1.14 billion.

Your Board has continued to measure the strength of your financial institution by means of total capital. USSFCU completed the year with a very strong capital position (and Net Worth Ratio) of 9.51% of assets or $109.2 million; therefore, USSFCU remains well capitalized.

To maintain financial soundness, the Asset Liability Management Committee (ALCO), Management and the Board monitor financial activities on a monthly basis. ALCO uses both external and independent models to assess balance sheet risk, return and volatility over various rate cycles. USSFCU’s balance sheet risk is currently considered “Low Risk,” as calculated by an independent third party as well as our regulatory agency—the NCUA.

Management remains dedicated towards the accuracy and integrity of our financial statements and accompanying footnotes. Our financials are prepared in conformity with the United States’ generally accepted accounting principles. USSFCU’s independent auditor, Doeren Mayhew CPAs and Advisors, has completed the 2022 audit and again issued a favorable opinion. Audited 2022 financial statements are available at ussfcu.org/financials

We continue to extend our thanks to you, our valued members, for placing your trust in the safety and soundness of USSFCU.

Respectfully,

Ileana Garcia Board TreasurerTotal Assets $1,259,076,240 (As of December 31, 2022)

I am pleased to report that the financial performance of USSFCU continues to be very strong.

CONDENSED BALANCE SHEETS (AUDITED)

As

CONDENSED INCOME STATEMENTS (AUDITED)

These condensed financial statements do not constitute a complete presentation. The complete set of audited financial statements, including the statements of cash flows and changes in members’ equity, and notes to financial statements, are available at the Credit Union office during normal hours of operation or through our website at ussfcu.org/financials.

USSFCU’S LEADERSHIP

BOARD OF DIRECTORS

Jay MooreChair

Anthony J. “Tony” Zagami Vice Chair

Ileana Garcia Secretary/Treasurer

Christopher C. Dey Director

Joe Eckert Director

Judy Rainey Director

Margaret P. “Margo” Rushing Director

Christopher D. Shunk Director

Deborah Yarborough Director

EXECUTIVE COMMITTEE

Jay Moore Chair

Ileana Garcia

Anthony J. “Tony” Zagami

ALCO

Ileana Garcia Chair

Timothy L. Anderson

David Cape

Kathy Dalfrey

Danielle McLean

Laura Parker

Christopher D. Shunk

Jeff Smith

NOMINATING COMMITTEE

Judy Rainey Chair

Joe Eckert

Milton Salvador

SUPERVISORY COMMITTEE

Josef Martens Chair

Pierre Kamga

Vikram Kulkarni

Margaret P. “Margo” Rushing

Clint Trocchio

IT ADVISORY COMMITTEE

Audie Hopkins Chair

Jack Anderson

Laura Robertson

Jay Moore

Timothy L. Anderson

President & CEO

Kathy Dalfrey

SVP & CFO

EXECUTIVE MANAGEMENT

Jeff Smith Chief LendingOfficer

Omar Ramsay

Chief Risk Officer

Mark Fournier

Chief Information Officer

Heather Mansour Chief Human Resources Officer

Bonnie Ortiz

Chief Strategic Management Officer

SENIOR MANAGEMENT

Angela Collier VP Lending

Troy Ferguson VP Retail Services

Sylvia Galo VP Deposit Products & Support Services

Arthur Green VP Marketing

Pete Gotthold

Director, Financial Accounting

Stefanie Mortenson Director, Human Resources

James Ruley

VP Business Services

Sue Ruiz VP Risk Management

Nagaraj Reddi Director, IT

2022 ACCOMPLISHMENTS

Interactive Teller Machine (ITM)

Offers all the functionality of a basic ATM, plus live video tellers to assist with making deposits, withdrawals, account transfers, loan payments, check cashing and more.

Upgraded Application Portal

Advanced features, easier access and mobile first design enhance the online application experience.

January 2022

myUSSFCU Online Banking

A new online and mobile banking platform offers a faster, simpler, easierto-use interface, upgraded security, advanced account capabilities, personalized controls/dashboards and much more.

February 2022

May 2022

Rapid Refi

Contactless Cards

20-Month Certificate Special

A new personalized refinance experience offers members a quick, easy way to lower existing loan and credit card payments.

Gives members a touch-free, secure, and easy way to make payments using their USSFCU cards.

A limited-time incentive offers savings-minded members an opportunity to lock in ones of the nation’s highest interest rates.

July 2022

August 2022

November 2022

Upgraded Phone System

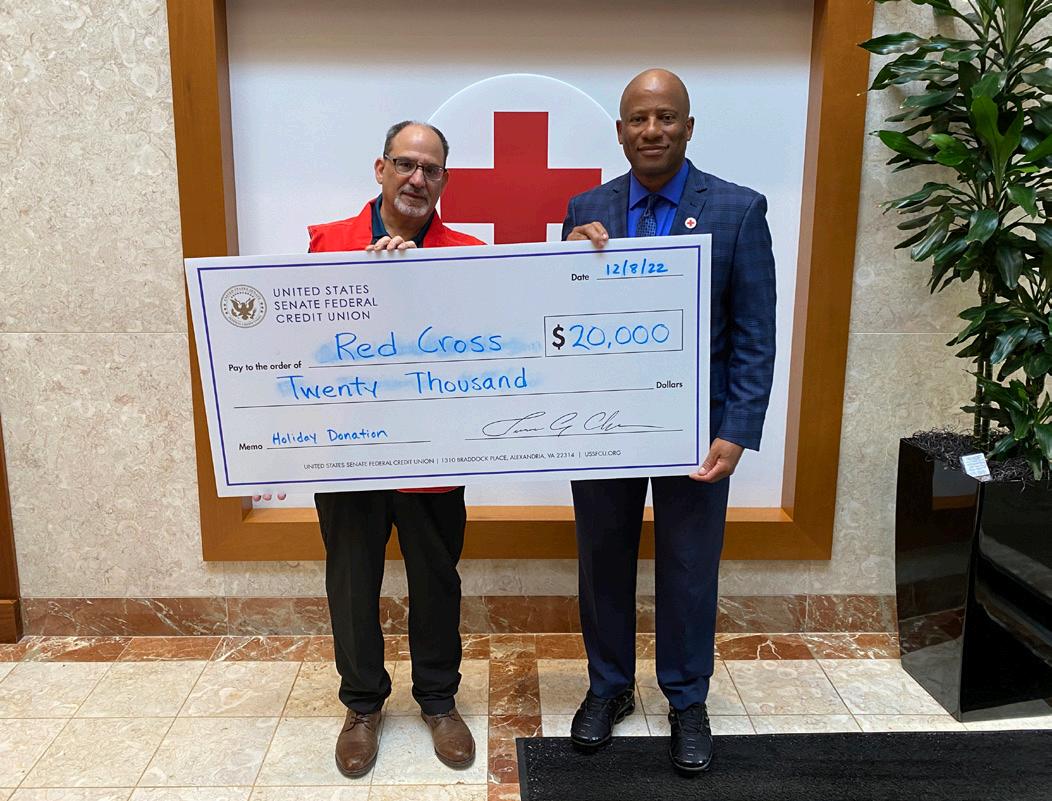

Giving Back to the Community

A new menu, call flow and features provide members a more streamlined and efficient call-in experience.

Seven high-impact charities receive a total of $70,000 in donations from USSFCU, including Capital Area Food Bank and American Red Cross.

Award Winning Recognition

» Appointed a “Best of Bauer” Credit Union after achieving 100+ consecutive 5-star ratings from BauerFinancial, the nation’s premier financial institution rating firm

» Credit Union Mortgage Association (CUMA) Double Titanium Award for mortgage loan production

» Voted Zebra Reader’s Choice for Best Credit Union in Alexandria, Virginia

November 2022

December 2022