Despite the Onset of Geopolitical, Policy, and Tropical Storm Seasons, Florida’s Economy Should Continue to Grow.

It is June in Florida, and that of course means the start of another hurricane season. Florida was impacted by several tropical storms/hurricanes, and while they can wreak havoc on the areas hard hit by the wind, rainfall, and storm surges that accompany these seasonal weather events, they tend not to have large and lasting statewide economic consequences.

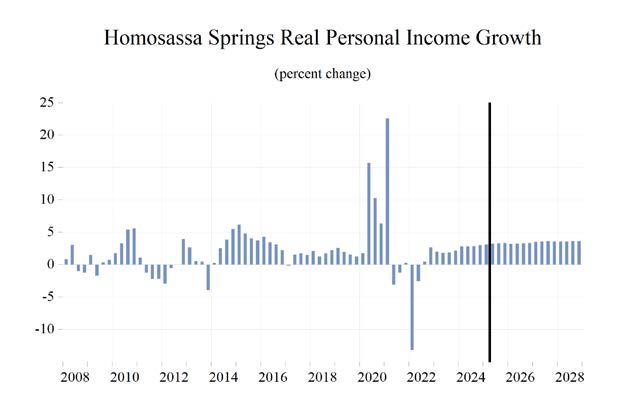

Locally, the pattern of economic impact is consistent across time with regards to the effects on the jobs market and economies of impacted areas, and the macro impacts tend to last a period of months rather than years.

State government has been enjoying a windfall of tax revenue the past several years and that has allowed rainy day funds to rise to $4.4 billion, which could allow the state to ameliorate any potential impacts from hurricanes.

Longer effects could come from the potential of any storms leading to further challenges in the homeowner’s insurance markets, a persistent problem that has exacerbated the housing affordability challenges the state has been facing.

Policy-wise the debated changes at the state level to both sales and property taxes in Florida did not move forward, and a budget has been sent to the Governor that contains an increase of 2% over the previous year.

Nationally, the “big, beautiful bill” is currently in the Senate awaiting modification and passage as the latest continuing resolution slowly makes its

way through the dysfunctional budgeting process in Washington, DC.

They say that beauty is in the eye of the beholder, and I am struggling to see the beautiful part of a spending bill that will add trillions of dollars to an existing national debt of $37 trillion that comes with an interest payment burden of over $1 trillion per year.

The near-term consequences for Florida’s economy are not an immediate threat, but the continuing failure to address the out-of-control spending in our nation’s capital could have significant consequences for Florida’s economy in the years that lay ahead. The burden of such high interest payments every year could show up first by limiting the federal government’s ability to fund discretionary projects such as partnering with the state on much needed transportation infrastructure projects.

It appears that DOGE was unable to bring about the needed changes to a bureaucracy that is deep and entrenched. A discouraging outcome— to say the least—leaves me wondering what it will take to bring about the needed changes.

Geopolitics seems to be the greatest risk as the war between Israel and Iran continues to escalate alongside calls for the United States to get involved in yet another foreign war. The threat of a large-scale war involving the U.S. poses in my mind the greatest risk to the economy in Florida. Disruption of shipping lanes, and a massive blow

to global oil markets could rattle the economy on multiple fronts, and while not necessarily leading to a recession, there would be multiple adverse economic consequences of escalating the conflict. Perhaps we will get lucky this hurricane season, and maybe cooler heads will prevail in the Middle East, but I am increasingly worried that a debt crisis may be the only way that we see any significant changes to the spending problem in Washington, DC. There are a lot of storms brewing that could have severe consequences for our nation and Florida’s economies.

FLORIDA’S HOUSING MARKET

Inventories Rising, Sales Slowing, and Prices Down

The April 2025 single-family home report released by Florida Realtors shows a market for existing housing with a rising level of inventories, shrinking the shortage that was responsible for sparking rapid price appreciation during 20212023. The median price has been pushed to $154,934 above the peak price of the housing bubble in June 2006. The median sales price for single-family homes decreased slightly more than $17,200 from April 2024, year-over-year, and now stands at $412,734—a year-over-year price appreciation of -4.0%. Price depreciation in the townhome/condominium market continues with a decrease in the median sales price of $20,000 year-over-year, registering at $315,000 in April of this year. This price change represents a 6.0% decrease in median prices year-over-year.

Inventories of single-family homes in April are up from 4.1 months of supply a year ago to 5.6 months of supply this year. This indicates an inventory balance that is slightly skewed in favor of the buyers in the single-family market,

according to the Florida Realtors report.1 From April 2024 to April 2025, inventories of condominiums rose from 6.8 months to 10.3 months, indicating that the condo market has fully shifted from a seller’s market to a buyer’s market. There is balance in the existing singlefamily homes market, but condo markets have now fully swung in favor of buyers.

Distressed sales of single-family homes in the form of short sales remain at extremely low levels, showing little impact on higher mortgage rates, prices, and homeowners insurance costs. They have increased from 30 in April 2024 to 40 in April 2025, an increase of 33.3% year-over-year, but at still historically low levels. Foreclosure/ REO sales have decreased year-over-year by 30.4% versus April 2024, decreasing from 224 to 156 in April of this year; levels of foreclosures remain quite low. Traditional sales are down 4.3% year-over-year versus April 2024, as high prices and homeowners’ insurance rates propagate affordability challenges that are partially offset by rising levels of inventories and slightly lower mortgage rates.

Distressed sales of condos in the form of short sales are still at extremely low levels, just 4, in April 2025. Foreclosure/REO sales are down 43.4% from April 2024 and remain at a low level of just 30. Traditional sales of condos are down 14.7% in April 2025 when compared to April 2024.

In April 2025, the percentage of closed sales of single-family homes that were cash transactions stood at 28.3%. For condos, that figure is much higher, as 54.3% of all closings were cash transactions. The condo market’s share of cash transactions decreased by 0.6 percentage points year-over-year, while the single-family housing market’s share of cash transactions increased by

1 According to Florida Realtors, the benchmark for a balanced market (favoring neither buyer nor seller) is 5.5 months of inventory. Numbers above that indicate a buyers’ market, numbers below a sellers’ market. Other real estate economists suggest a 6-to-9month inventory as being a balanced market.

1.8 percentage points. This is occurring amidst a still-tight market for mortgages. 2

Figure 1 depicts the monthly realtor sales of existing singlefamily homes, as well as the 12-month moving average of these sales. The smoother moving average line evens out the seasonality and other statistical noise inherent in monthly housing market data. Sales had been on a strong upward path over the past postpandemic, and the 12-month moving average and monthly sales vastly exceeded their peak value during the housing bubble. Over the past two years, the 12-month moving average has sharply declined, but in recent months, it has started to flatten out. This reflects affordability issues easing in the face of slower price appreciation over the past year; a rising inventory of houses for sale; slight easing in mortgage credit markets; stabilizing homeowners insurance premiums; and lower mortgage rates for those able to get loans. The short-lived COVID-19 plunge in sales during January and May pulled down the moving average in 2020, but the immediate post-shutdown rebound was strong, fueled by pent-up demand and then record-low mortgage rates.

Source:FloridaRealtors

The housing market in Florida is still challenged by the burden of high prices and higher insurance premiums despite somewhat lower mortgage rates. Both economic growth and job growth in Florida are forecasted to slow as the U.S. economy decelerates. More baby boomers continue to

2 The Mortgage Credit Availability Index (MCAI), put out by the Mortgage Bankers Association, increased by 2.1% to 105.1 in May from April 2024. The increase in the index in May from April indicates that mortgage lending standards loosened slightly. The index is benchmarked to 100 in March 2012. Relative to that month, mortgages in January 2025 were 1.0% less available. In 2006, the value of this same index approached 900 and at the start of 2020, the index was near 185. Despite lower mortgage rates, financing is not available to all comers.

1.

reach the end of their working lives, and this bodes well for continued population growth via the immigration of retirees, as well as job seekers to Florida. We expect sales to remain under pressure, as increases in inventories will help keep downward pressure on prices in an environment with sustained strength in the demographic drivers of housing demand. Housing demand had some relief from higher mortgage rates that had hit 8.0% at their recent peak, with the possibility of the Federal Reserve Bank continuing interest rate cuts in the second half of the year. Also, any relief from recent surges in homeowners’ insurance rates will help support this demand.

Figure 2 displays median sales prices for existing single-family homes. Median sales prices have continued to climb since bottoming out in 2011. The double-digit pace of price increases in 2016 and 2017, which eased in 2018 and 2019, resumed in 2020. Over the past year, the 12-month moving average of median sales prices has risen by just $41.67.

Low inventories of existing homes for sale and lagging housing starts growth since 2016 contributed to the environment where home prices rose at a rapid pace. This was exacerbated by those who had refinanced mortgages at sub-3.0% levels and were hesitant to sell when current rates are

Figure

$500,000

$450,000

$400,000

$350,000

$300,000

$250,000

$200,000

$150,000

$100,000

$50,000

$0

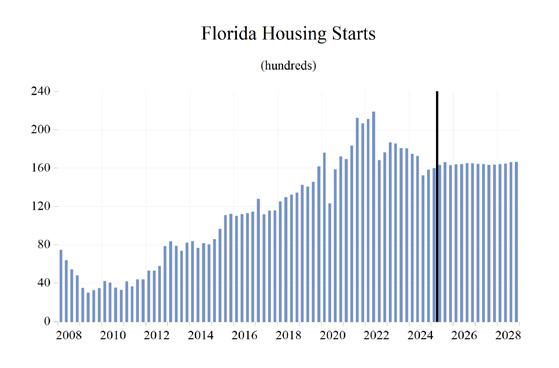

near 7.0%, but they may be adjusting to the new reality of housing finance. The slowing of housing demand will result in a mild slowdown in housing starts. Some softness in the housing market will be a feature of Florida’s economy over the next few years barring any significant dip in mortgage rates as inventories continue to rise.

This period of unsustainable multi-year price appreciation ended several years ago. The likelihood of economic slowdown, coupled with relatively higher mortgage rates, and rising inventories has led to a softening of prices. The economic conditions will lead to some price depreciation, but not anything like the 2008-09 collapse in prices.

Housing starts in 2028 are expected to increase to over 165,000, falling from 183,675 in 2023. Lower interest rates should support this sector of the economy after higher rates had a dampening effect on home construction activity.

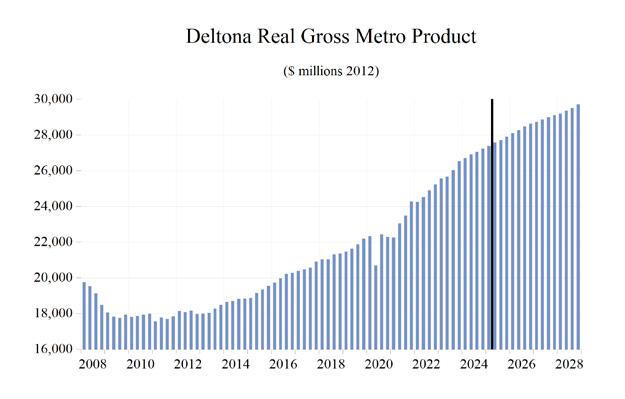

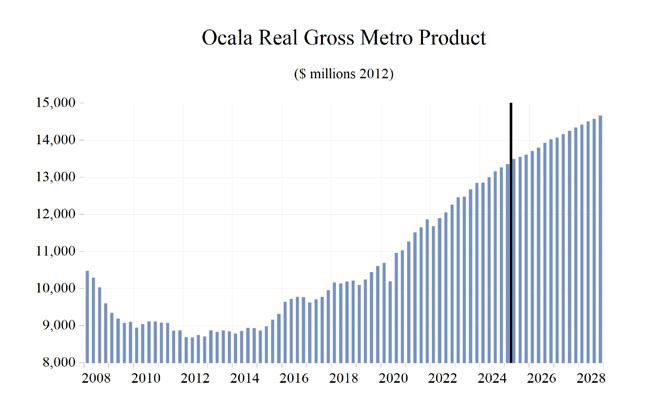

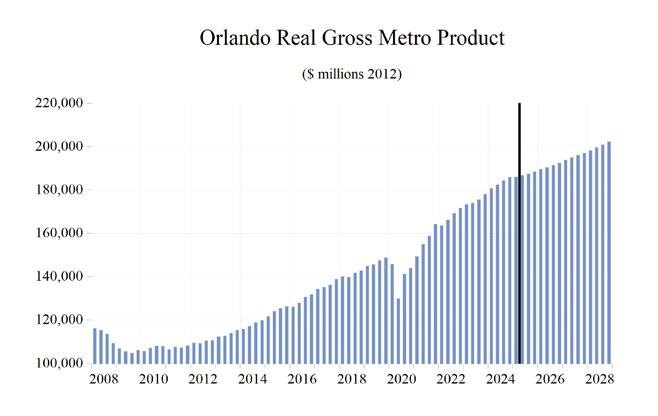

GROSS STATE PRODUCT

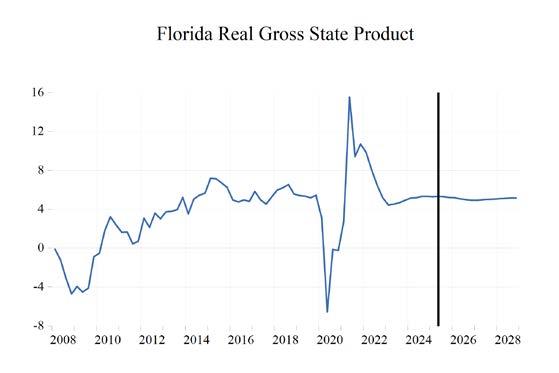

Lockdowns caused a contraction in real Gross State Product (GSP) in 2020 of 1.4% year-overyear. This decline was smaller than both annual declines that occurred during the Great Recession (3.9% in 2008 and 5.5% in 2009). However, the

second quarter’s year-over-year decline in 2020 was steeper than any quarter during the Great Recession. Fortunately, the COVID-19 recession, while much deeper than the previous recessions, was very short-lived at just two months. Florida’s decision to avoid heavy-handed and lengthy restrictions on the economy allowed the state to come roaring back in 2021 when growth hit 9.4 percent.

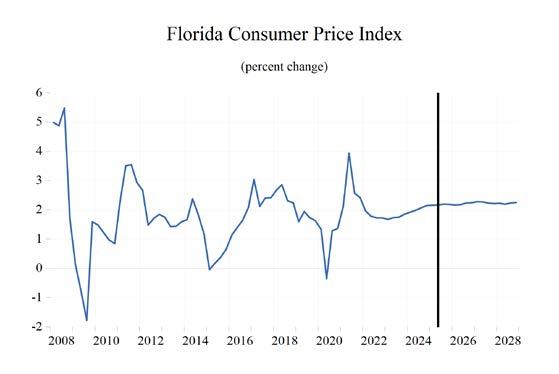

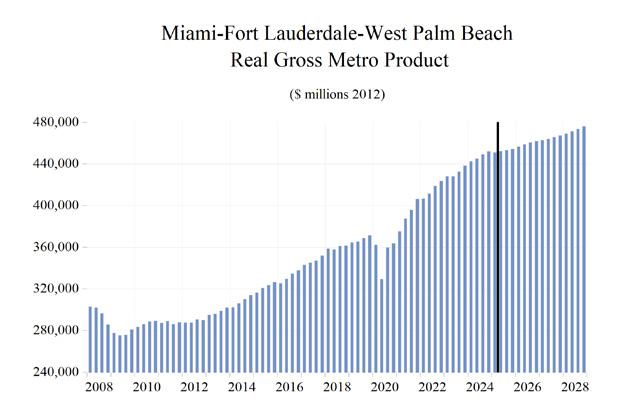

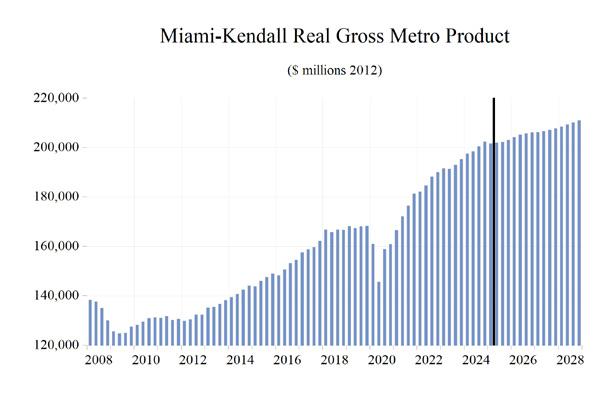

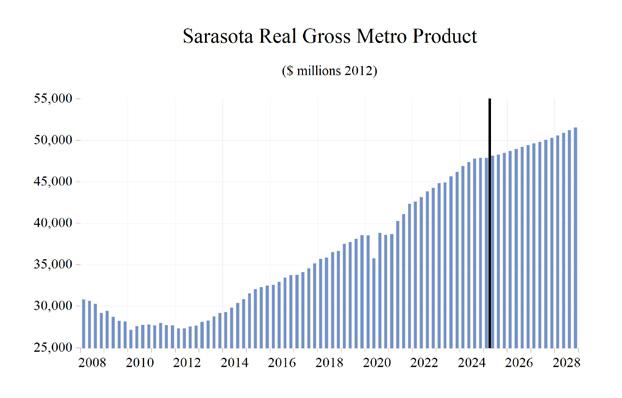

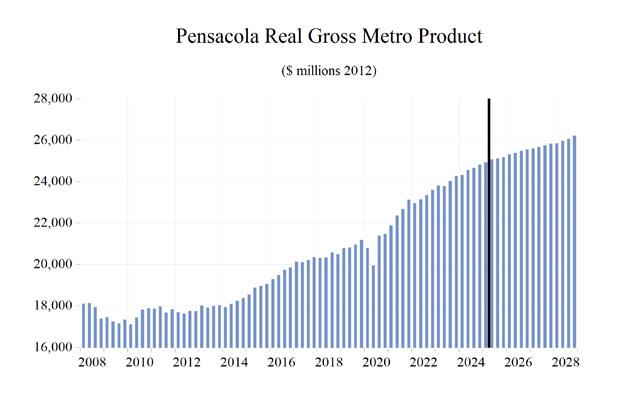

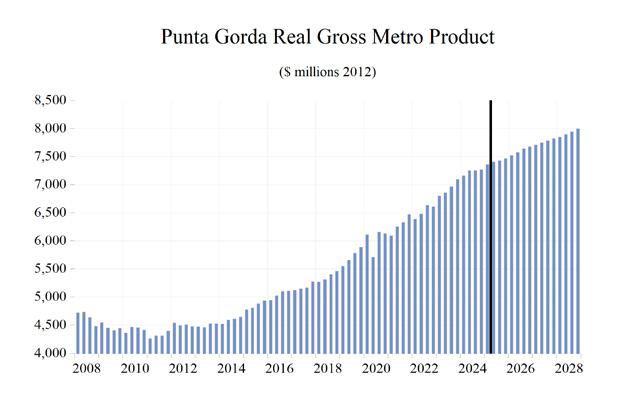

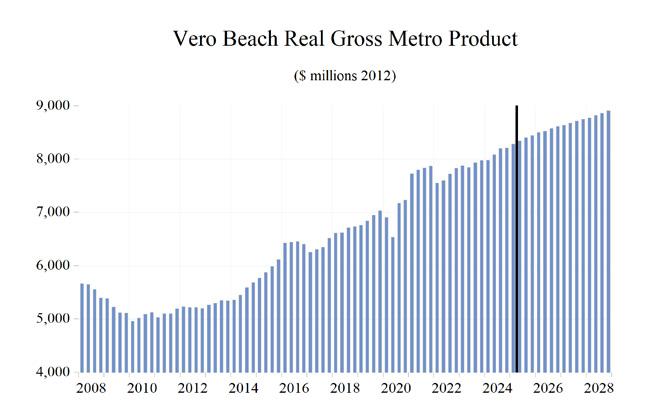

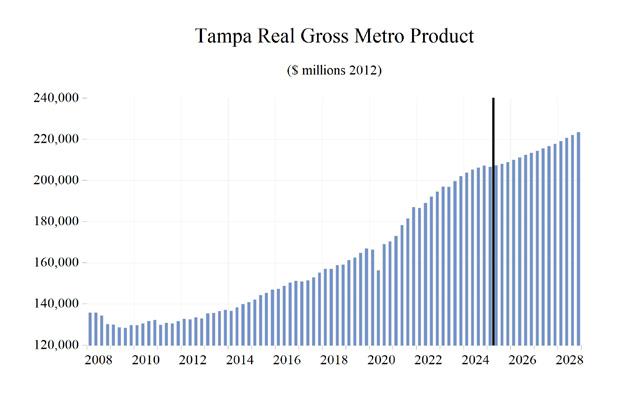

During 2025-2028, Florida’s real GSP is expected to grow by an average of 1.8% annually. This growth will include a 2025 deceleration to 1.7% from 3.6% in 2024. The 1.8% average growth from 2025 through 2028 will be a slower pace for growth compared to the prior four years (when growth averaged 5.8%), and this is due to an anticipated slowdown in the U.S. economy. This projected average rate of growth for Florida’s economy over the 2025-2028 period is higher than the average of our forecasted real GDP growth for the U.S. economy (1.6%) over the same time frame.

Housing prices have soared since the bottom of the housing crisis. During the crisis, median existing-home prices fell to a low of $122,200 but now stand at $412,734. This price appreciation significantly improved household balance sheets in Florida. With the price appreciation to date, Florida has long since recovered the aggregate housing value lost during the housing market collapse and has soared past the lofty levels at the peak of the housing bubble, but higher mortgage rates and a slowing economy led to partial decline in prices. Fortunately for homeowners, but not for potential buyers, any further price declines will not be anything like the price collapse of 2008-09.

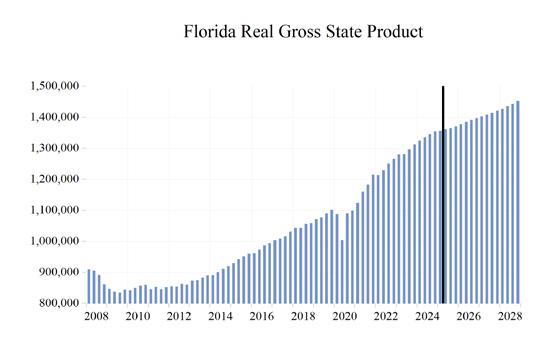

In 2017, Florida’s economy broke the $1-trillion threshold with a nominal (not adjusted for

inflation) Gross State Product (GSP) of $1.003 trillion, which increased to $1.29 trillion in 2021. The GSP reached $1.47 trillion in 2022 and hit $1.60 trillion in 2023. We expect Florida’s GSP to rise to $1.80 trillion in 2025, $1.90 trillion in 2026, $1.98 trillion in 2027 and $2.07 trillion in 2028.

Real GSP (adjusted for inflation) exceeded $1.1 trillion in 2021 and will climb to nearly $1.46 trillion in 2028.

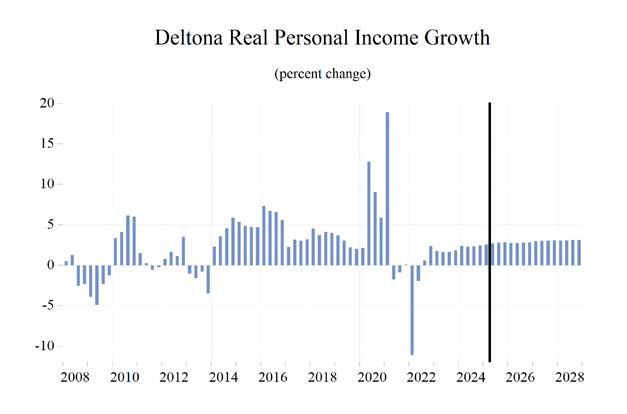

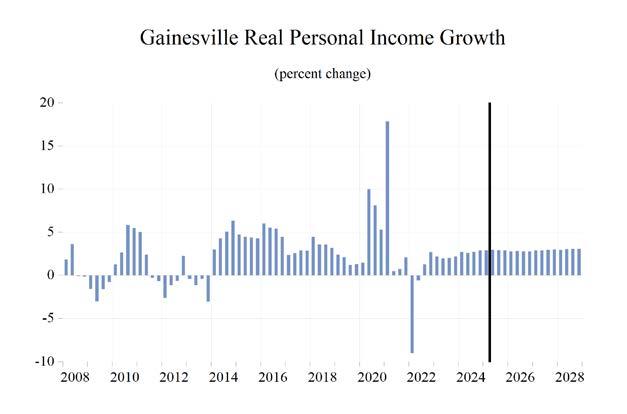

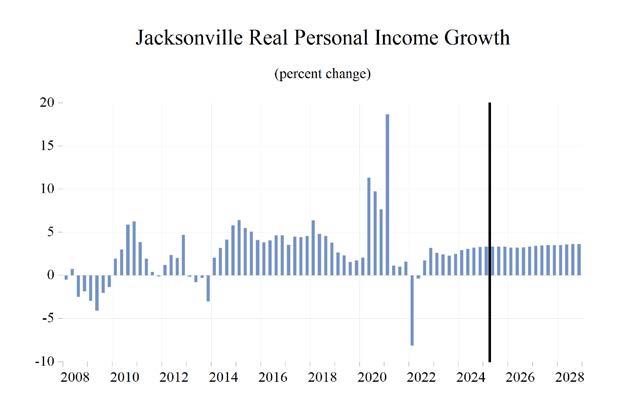

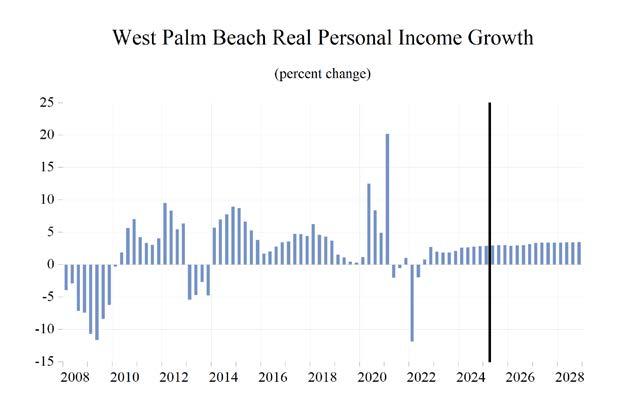

PERSONAL INCOME, RETAIL SALES, AND AUTO SALES

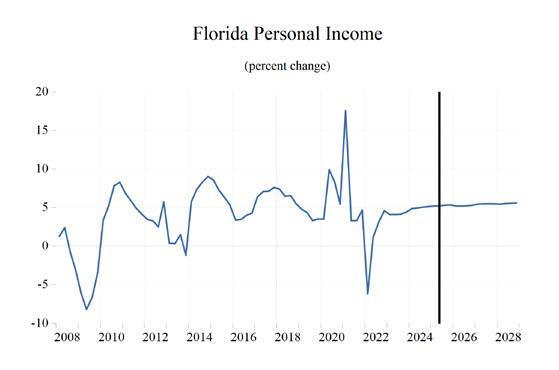

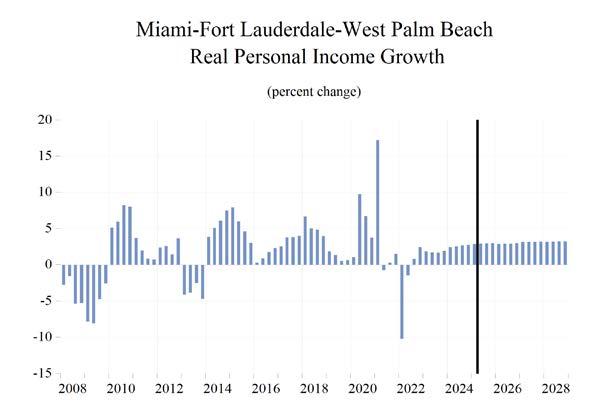

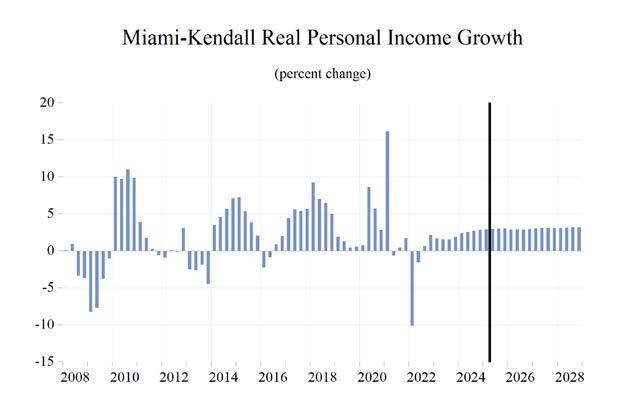

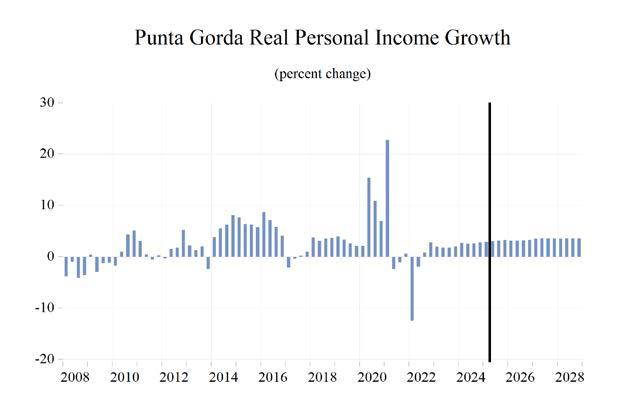

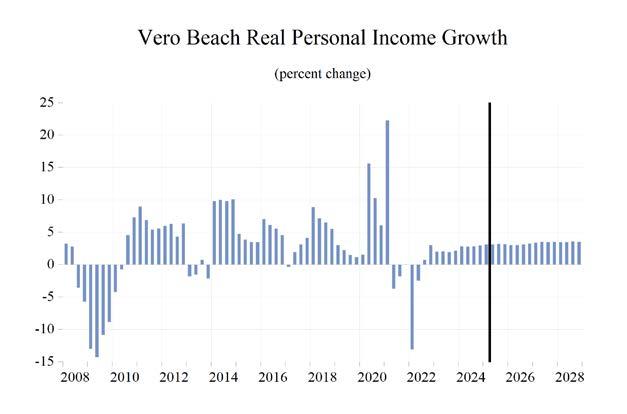

Nominal personal income growth surged to 6.5% (thanks to COVID stimulus and bonus unemployment payments) in 2020 and 11.3% in 2021, amid further federal stimulus spending and tax credits. Nominal personal income will be slightly above $2.0 trillion in 2028, marking an increase in personal income of over $1.0 trillion from its Great Recession low point in 2009.

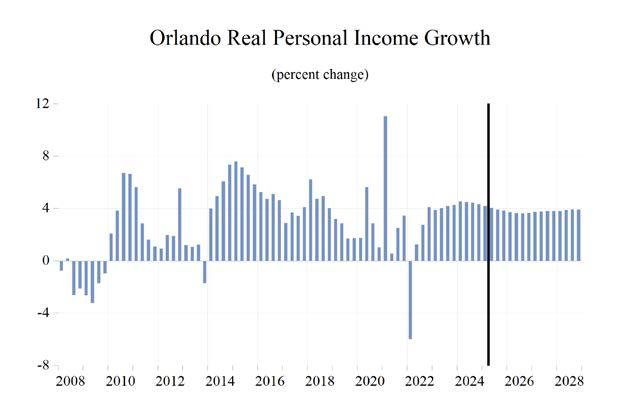

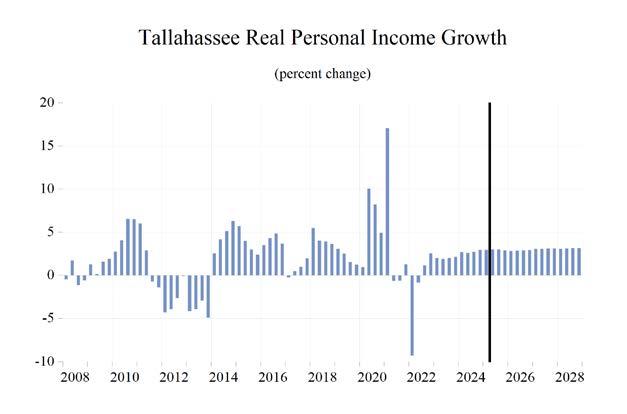

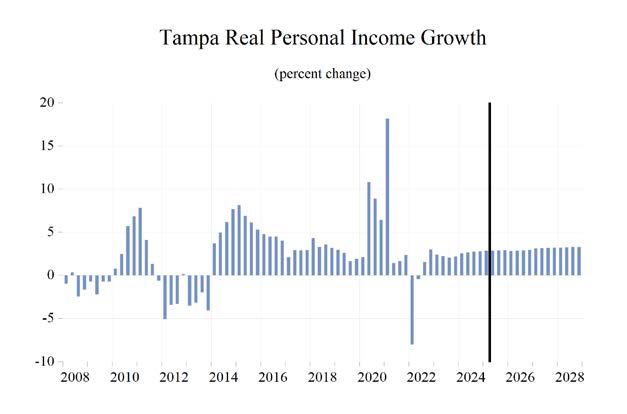

Thanks to rising inflation, real personal income contracted by 1.7% in 2022 but rose by 3.0% in 2023. Growth was 3.2% in 2024 and is expected to be 1.7% in 2025, 2.6% in 2026, 3.9% in 2027, and 3.4% in 2028. Real personal income growth during 2025-2028 will average 2.9% in Florida, weighed down a bit by slower growth and some persistent inflation in the near term, but still 0.5 percentage points higher than our forecast for the U.S.

Real disposable income growth, because of surging inflation, turned negative at -3.8% in 2022. Average growth in Florida during 2025-2028 will be 3.2% with inflation steadily declining, accompanied by still-solid wage and salary growth supported by Florida’s durable labor market.

Financial markets experienced a strong rebound from the COVID-19 induced financial downturn, thanks in large part to the Federal Reserve

Bank’s resumption of the financial crisis zerointerest-rate policy, quantitative easing, and the other federal stimulus programs. The Dow Jones Industrial Average fell to 18,214 in March 2020 but then surged to a new record high of 36,953 in January 2022. The market declined as the Fed commenced its fight against inflation, causing financial markets to decline from those highs to the Dow falling under 34,000. Recently with the Fed starting to cut interest rates, the market hit a new all-time high above 45,000 but has declined significantly in the early months of 2025 with DOGE and tariff uncertainty spooking financial markets. Once again, the rebound has been relatively rapid as after hitting 36,611 in April, the Dow has recovered to 42,172.

Home equity in Florida was slow to recover unlike financial asset wealth following the Great Recession. Housing prices have been climbing over the past five years, and current median prices have greatly exceeded the once heady highs seen during the housing bubble. The housing market did not suffer the pandemic pain that financial markets experienced during the COVID-19 recession, nor will it during any economic slowing in the next few years. Home prices will fall slightly if this slowdown is worse than anticipated, but to date, large price declines have not materialized in a housing market where inventories are rising, with the Fed putting interest rate cuts on hold for the past six months.

Housing may not be as large a driver in the economy over the next few years, as housing starts have dipped from their post-pandemic highs. However, housing will still be an important economic factor as builders work to replenish, albeit at this diminished pace, inventories as Florida’s population continues to grow, supporting housing demand.

Retail spending was hurt in the short run by the public health shutdowns and the effective collapse of the tourism industry in Florida from the pandemic response. Retail spending in the

first quarter of 2020 contracted by 12.4% at an annual rate, followed by a 7.9% contraction for the second quarter. Spending levels exploded after the short, deep recession and a series of economic lockdowns, fully countering the first half of the year’s plunge, and driving full-year growth into positive territory for the year. In 2021, retail sales grew robustly compared to 2020, rising 18.9% year over year. Sales came back down to Earth from the post-lockdown growth, and after a few quarters of weak growth from an erosion of consumers’ purchasing power and a slowing economy, growth will average 3.7% during 2025-2028, hitting 3.6% in the final year of our forecast.

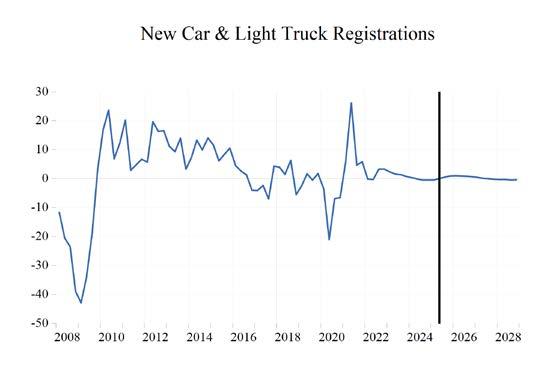

Consumers began to purchase light vehicles at a faster pace after the Great Recession ended, releasing several years of pent-up demand, and continued to do so through 2016, though at a considerably slower pace. The 2020 COVID recession once again caused a contraction of new passenger car and truck registrations of 5.1% year-over-year in the fourth quarter of 2020, versus the fourth quarter of 2019. This contraction was not as sharp or as persistent as the one that took place during the Great Recession. Supply chain disruptions injected chaos into light vehicle markets, and prices for both new and used vehicles soared in the wake of these problems. New cars were selling for thousands above sticker price and used vehicle inflation at one point hit 40% year-over-year. The rate of vehicle inflation has declined significantly, but prices remain elevated above pre-pandemic levels and interest rates on auto loans remain high for now. Tariff uncertainty has boosted sales in the near term as consumers try to beat potential tariff-induced price increases.

Pent-up demand and the economic recovery boosted registrations coming out of the COVID recession, and vehicle registration growth in Florida surged in 2021, rising to 11.6%. Registration growth in Florida during 2025-

2028 will average 0.1%. Over this period, high interest rates on auto loans and high auto prices, potentially further impacted by tariffs, will decelerate the growth in the number of new registrations in 2025 to -1.1%. In 2028, Florida’s new passenger car and truck registrations will be slightly over 1.38 million.

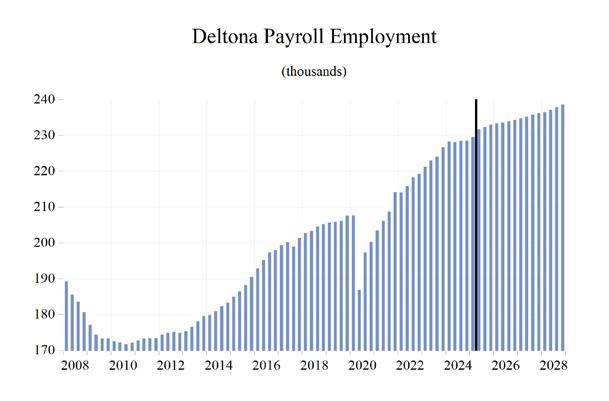

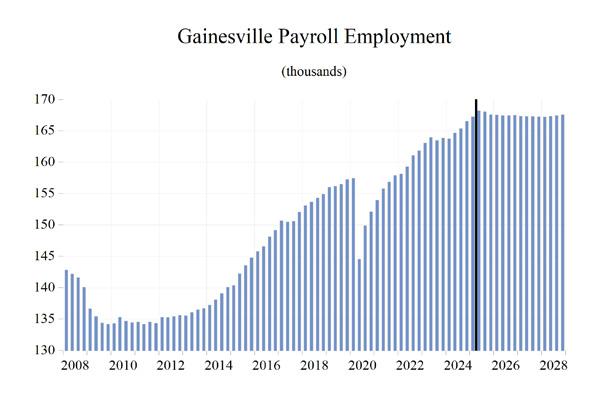

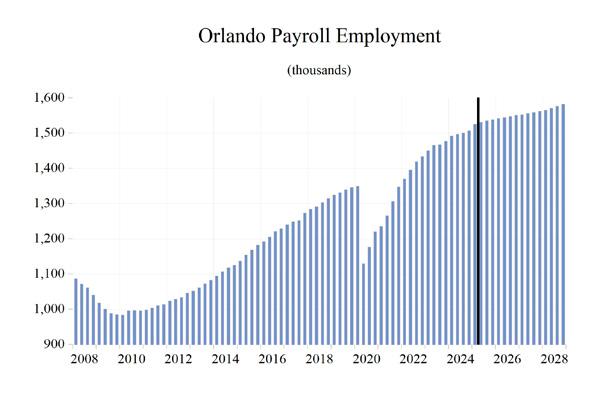

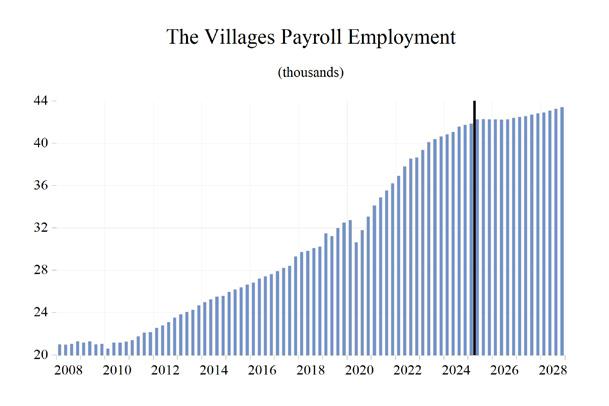

EMPLOYMENT

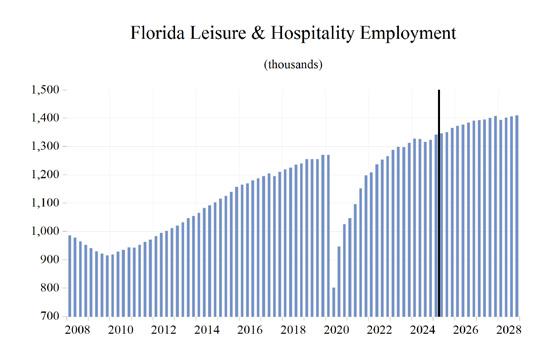

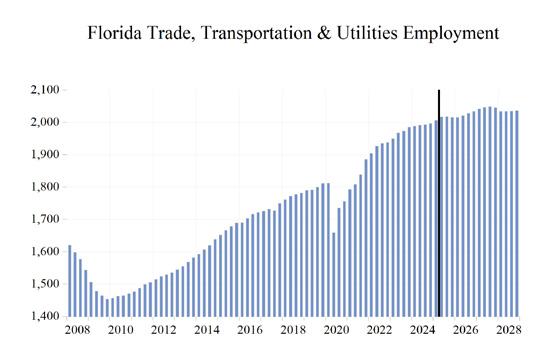

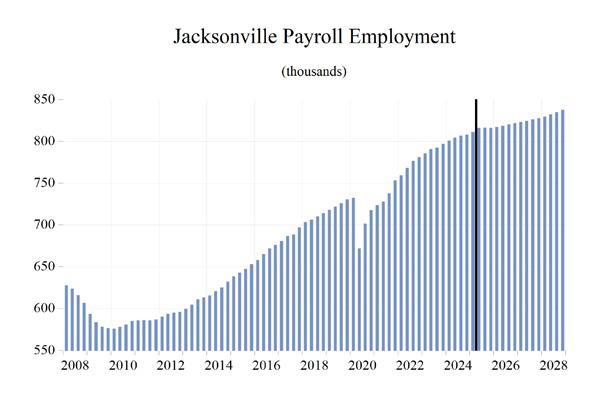

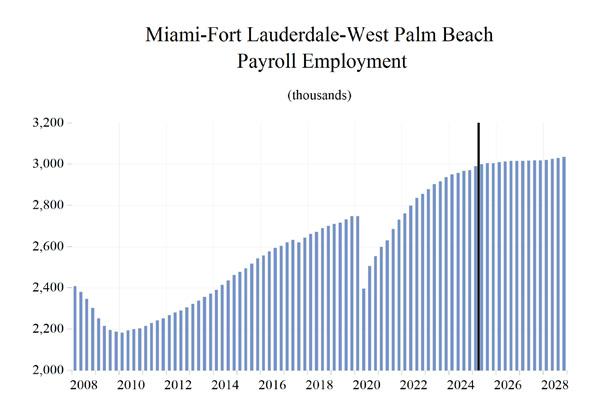

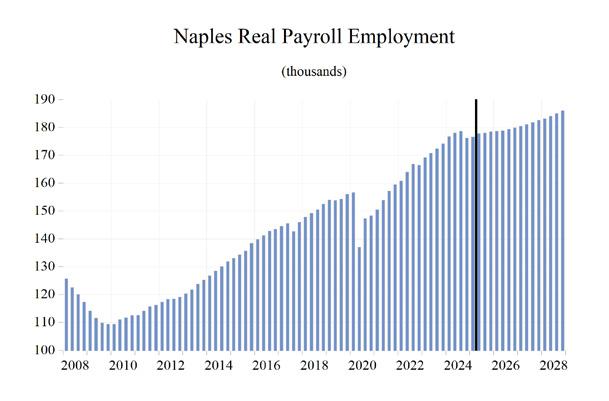

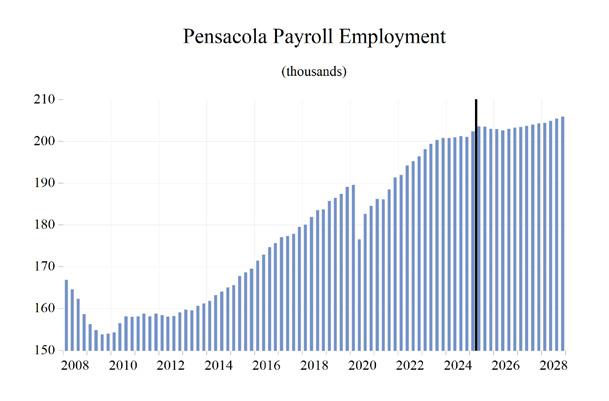

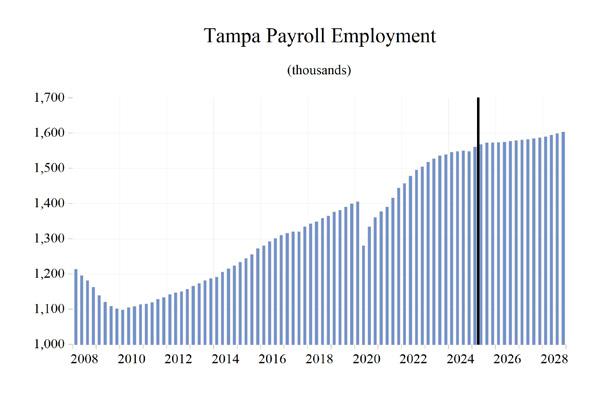

Business payrolls were devastated by the illconceived COVID-19 lockdowns, as layoffs happened in a massive, but thankfully short-lived, wave. In Florida, total business payrolls surpassed their pre-pandemic levels late in 2021, as Florida ended ill-advised lockdowns much sooner than most other states. Since then, the strength of Florida’s labor market has exceeded that of the national job market, and it will continue to do so throughout the remainder of our forecast horizon in 2028.

The COVID-19 lockdowns, closures, and travel restrictions were followed by aggressive federal spending and monetary policies to counter the devastating effects of shutting down the economy. This added fuel to an economy that was roaring back to life and had a strong impact on the labor market.

Job growth plummeted in March and April because of lockdowns, contributing to a 4.9% year-over-year contraction in 2020, but Florida’s decision to open the economy and avoid further lockdowns caused job growth to roar back to 4.6% in 2021, accelerating to 5.7% in 2022.

In 2024, the effects of the slowing economy impacted job growth. Total payroll jobs rose by 3.4% in 2023 and then decelerated to 1.8% growth in 2024 and 2025. The deceleration will resume to 0.6% in 2026 and 0.5% in 2027, before ticking up 0.7% in 2028. Florida’s labor market will continue to outperform the national economy each year through 2028.

Construction job growth turned slightly negative in 2020 but increased in 2021, with housing starts rising amid depleted inventories and as large-scale public works projects carried on uninterrupted by COVID. Construction job growth fell to -0.1% in 2020 and then recovered to 2.4% in 2021. Job growth rose further to 4.2% in 2022 and grew by 4.6% in 2023, and then by 3.4% in 2024. Job growth will tick up to 3.5% in 2025 before easing to 1.6% in 2026, and 0.5% in 2027 then rise to 1.1% in 2028. Average annual job growth during 2025-2028 will be 1.7%. Construction employment will average 697,474 in 2028.

The Professional and Business Services sector, one of the fastest-growing sectors coming out of the COVID recession, is in for a deceleration as the economic slowdown develops. Job growth in this sector is expected to average -0.3% during 2025-2028. Growth in this sector fell to -2.3% in 2020 due to the pandemic and lockdowns. Growth surged to 7.4% in 2021 and then to 8.6% in 2022. It slowed to 2.1% in 2023 and continued to trend lower at 0.2% in 2024. In 2025, growth should be 0.9%; then after a couple of years of job losses of 2.3% and 1.9% in 2026 and 2027, growth resumes at 2.0% in 2028.

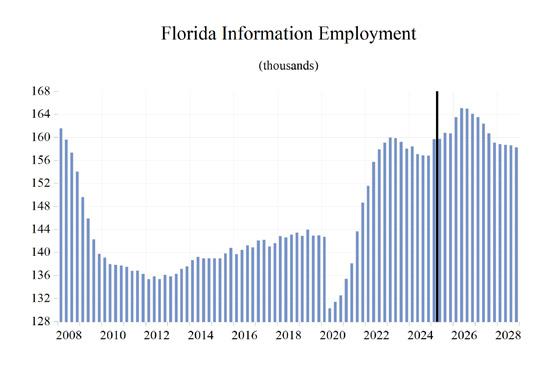

The Information sector is a mix of high-tech ventures, including computer programming and software development, but job growth in this sector has long been weighed down by the unraveling of the traditional print media. Structural and technological changes in the gathering and dissemination of information have decimated the print industry. Sources of growth within the information sector in Florida such as software development, data processing and hosting, wireless telecommunications, and content creation have offset the loss of jobs in traditional print media and publishing. Job growth dropped to -6.2% in 2020, recovered to 5.4% in 2021, and hit 10.3% in 2022—boosted by the roll-out of 5G wireless services. Job growth slowed to 2.1% in 2023 before it slid to -1.2% in 2024. Growth

should come in at 1.9% in 2025 and 2.6% in 2026 and then contract by 1.8% in 2027 and 1.7% in 2028. The projected growth rate will average 0.2% during 2025-2028.

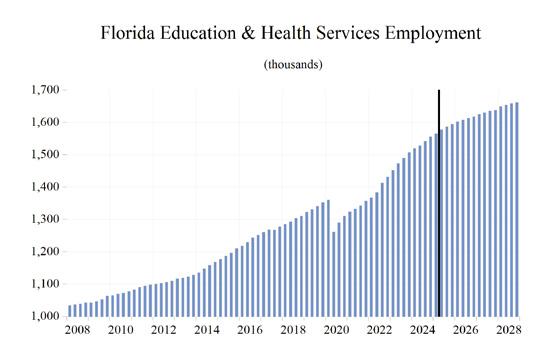

The Education and Health Services sector in Florida has grown consistently, even during the worst part of the 2007-2009 Great Recession. However, the pandemic hit this sector hard, as schools closed and most elective procedures, screenings, and wellness checks were postponed; employment contracted by 2.4% in 2020. The state’s growing population, with a larger share of older residents with a higher demand for health services, has supported growth in this sector and will continue to do so. Job growth will continue, though at a decelerated pace, through the next several years. During 2025-2028, employment in this sector is expected to continue to expand at an average rate of 1.9 percent.

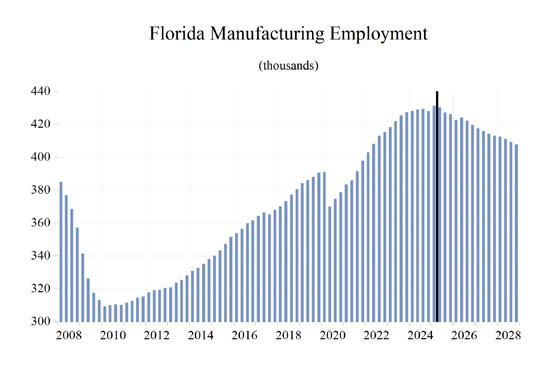

During 2016-2019, Manufacturing job growth averaged 2.9% in Florida, as trade policies helped level the playing field for U.S. manufacturers. The economic environment for the manufacturing sector is increasingly uncertain as slower economic growth looms over the U.S. and the “Tariff Tango” in Washington, DC is in full swing. After job losses of 2.2% in manufacturing in 2020, the economy and manufacturing in Florida came back to life. Job growth accelerated to 2.9% in 2021 and rose by 5.2% in 2022. After that year’s burst, job growth decelerated to 3.2% in 2023 and then slowed to 1.3% in 2024; the sector will once again lose jobs from 2025 through 2028. Average job growth during 2025-2028 will be -1.1 percent.

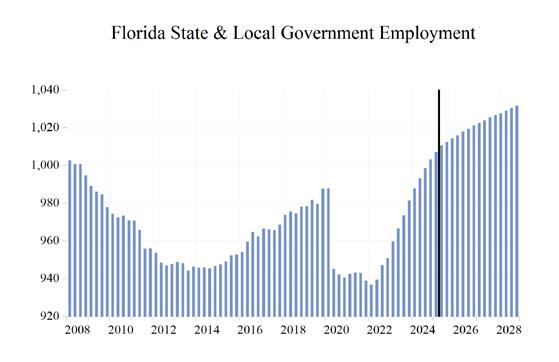

The State and Local Government sector in Florida is enjoying higher revenues from increased property values and state sales tax revenues that continue to exceed forecasts. As housing prices soared during 2020-22, property tax revenues rose as well. Though housing price growth has slowed, there will not be a repeat of the local government budget shortfalls after the housing market crashed, which led to job losses in this sector that

persisted for six years from 2009 through 2014.

As Florida’s population and economy continue to grow, the demand for state and local government services continues to rise as well. To meet this demand, growth in state and local government employment will be necessary but not to the levels seen during the housing boom, despite DOGE arriving in Tallahassee. Average job growth in State and Local Government during 2025-2028 will be 0.8%, after annual growth hit 2.8% in 2023 and slowed to 2.6% in 2024. The slowing economy and softening housing market may eventually put some pressure on both sales and property tax revenue growth, but this should not result in any severe budgetary issues or layoffs in the sector.

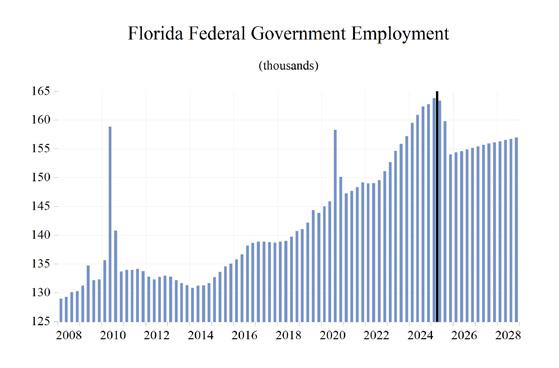

Federal Government employment growth, which was boosted by the decennial census hiring, turned negative in 2021 after the temporary hiring surge during the 2020 census year ended. However, historic deficits, a national debt of over $37.0 trillion, and an increasing debt service burden along with any DOGE spending cuts that may stick will become considerable factors going forward and, as job growth in the Federal Government sector in Florida will average -0.7% during 2025-2028.

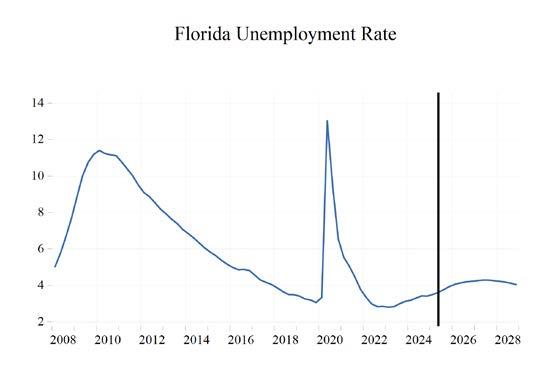

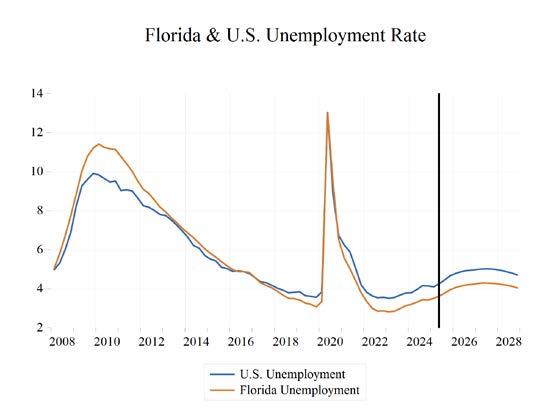

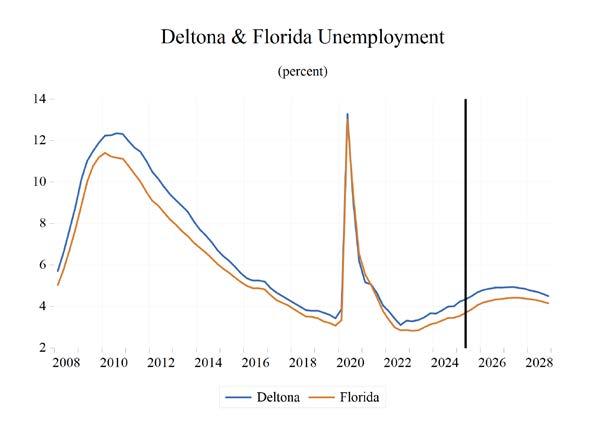

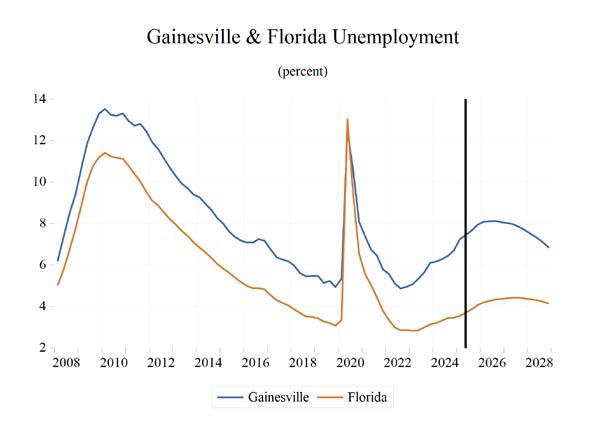

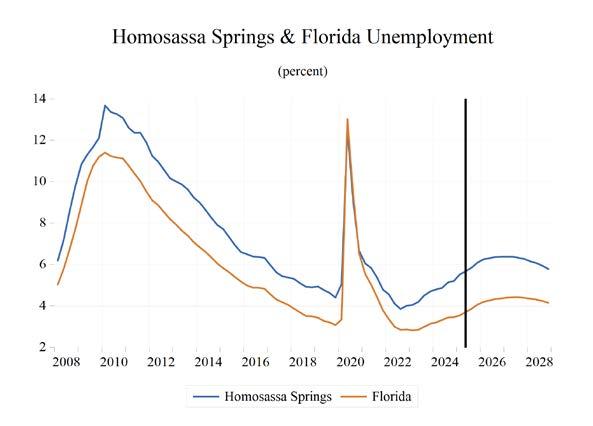

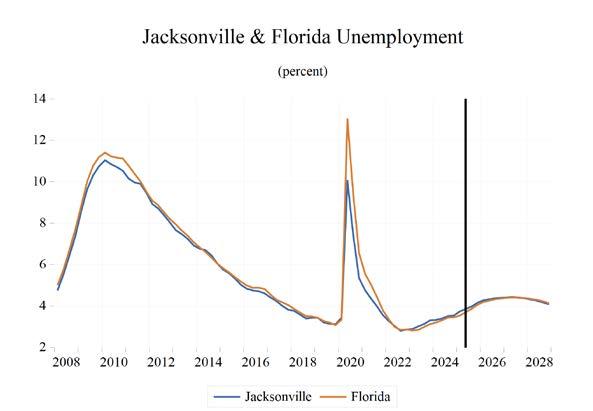

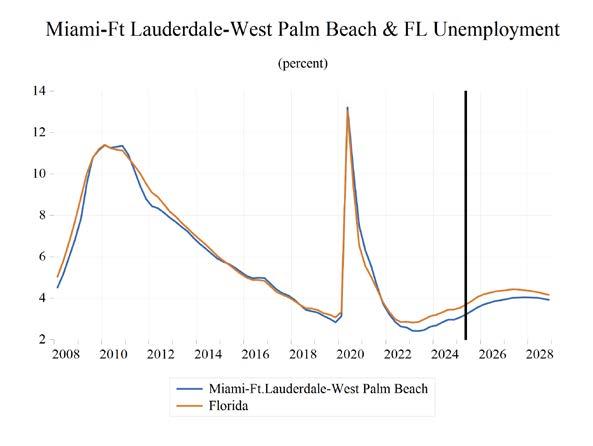

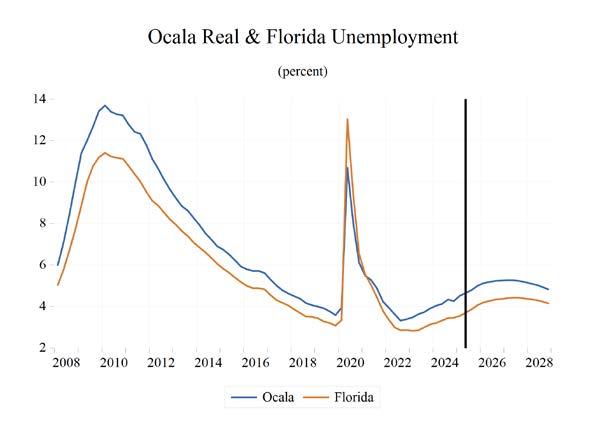

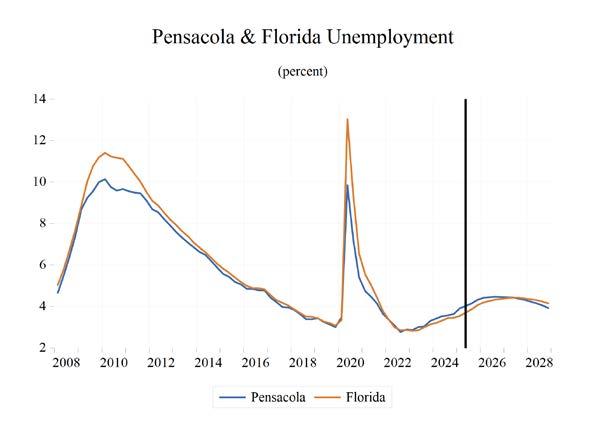

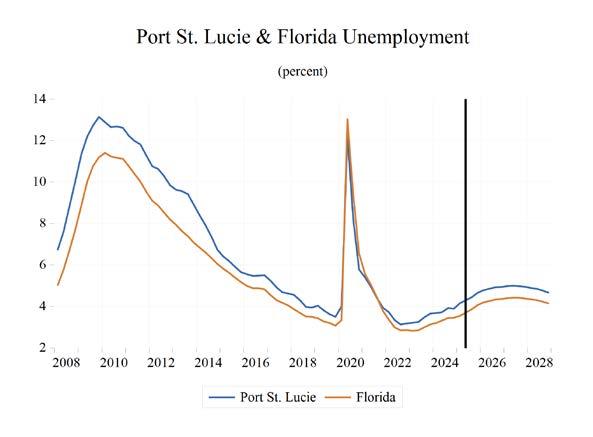

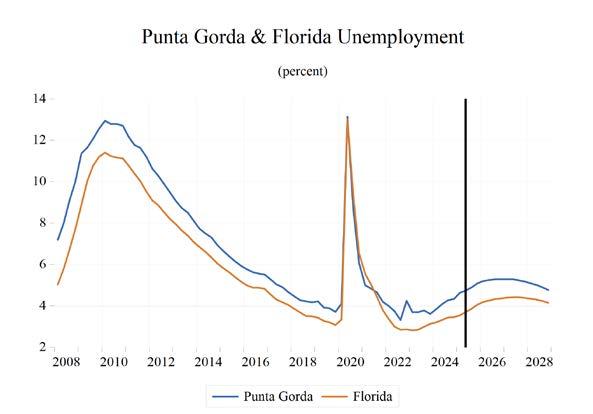

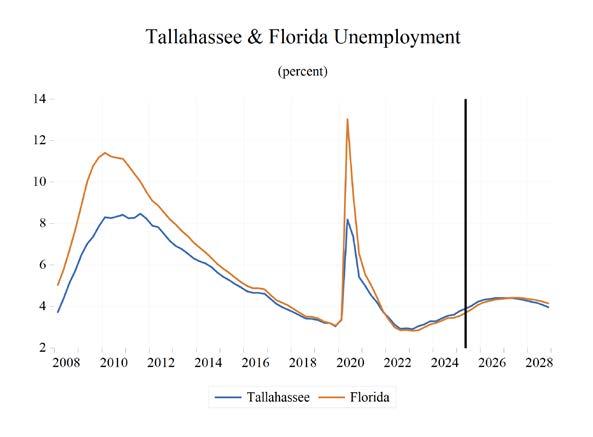

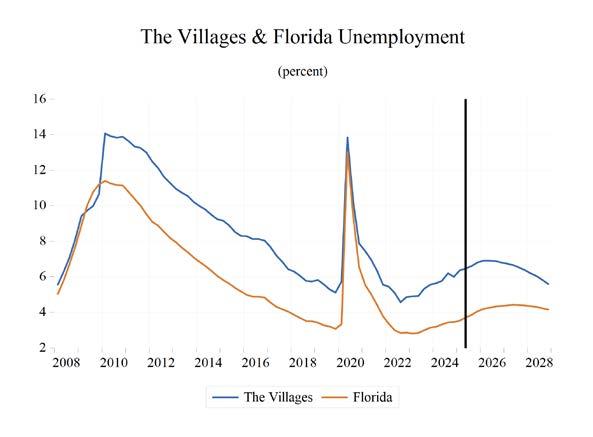

UNEMPLOYMENT

The unemployment rate in Florida has fallen from its May 2020 peak of 14.2% and stands at 3.7% as of April 2025. When unemployment spiked to 14.2% in May 2020, it was 2.9 percentage points higher than the peak level of unemployment from the Great Recession. This unprecedented spike in unemployment transpired over just three months, while it took two-and-a-half years for the unemployment rate to peak in the Great Recession. The April 2025 unemployment rate is up 0.4 percentage points from a year ago and is 0.5 percentage points lower than the U.S. unemployment rate.

Both nationally and in Florida, the number of workers who are working part-time, but not by choice, and workers marginally attached to the labor force—defined as workers who are not currently employed or seeking employment but express a desire to work, are available for a job, and have searched for work within the past 12 months—spiked during the public health shutdowns. When adding these groups with discouraged workers—defined as workers who are currently not working and did not look for a job in the four weeks preceding the Bureau of Labor Statistics’ monthly survey of households—to the headline unemployment figure, U-3, we get the broadest measure of unemployment estimated by the BLS, known as U-6.

Looking at U-6, we see a labor market in Florida that remains the strongest in several decades. U-6 in Florida averaged 6.9% during the second quarter of 2024 through the first quarter of 2025. Meanwhile, the national rate of U-6 averaged 7.5% during the same period. U-6 unemployment in Florida during the second quarter of 2024 through the first quarter of 2025 was 5.2 percentage points below the U-6 rate in 2014, 9.1 percentage points lower than the 16% rate in 2012, and down 12.4 percentage points from its peak average rate of 19.3% in 2010 (the nation’s U-6 averaged 16.7% in 2010). As the national economy continues to slow, these numbers will begin drifting slightly higher in Florida in an environment of a slowing national economy.

An analysis of how U-6 behaves relative to the headline unemployment rate (U-3) continues to provide additional information to fully comprehend the health of the labor market. The gap between these two measures continues to narrow. The average spread between U-6 and U-3 during the second quarter of 2024 through the first quarter of 2025 was hovering at 3.6% at the national level. That gap was 3.7% for the second quarter of 2024 through the first quarter of 2025 in Florida.

Table 1. Annual Summary of the University of Central Florida's Forecast for Florida 202020212022202320242025202620272028

Personal Income and GSP

PersonalIncome(Bil.$)1220.81358.81436.11553.41645.31726.11817.71923.62025.1

Florida.(%ChYearago)6.511.35.78.25.94.95.35.85.3

U.S.(%ChYearago)6.89.23.15.95.44.64.95.14.7

PersonalIncome(Bil.2012$)1159.61230.31209.41246.21286.61308.01342.61394.41442.4

Florida.(%ChYearago)4.46.1-1.73.03.21.72.63.93.4

U.S.(%ChYearago)5.74.9-3.32.12.81.22.23.12.9

Disp.Income(Bil.2012$)1032.41083.41042.21105.91141.31165.51203.21249.71293.3

Florida.(%ChYearago)4.04.9-3.86.13.22.13.23.93.5

U.S.(%ChYearago)6.33.5-5.65.12.71.62.83.22.9

GSP(Bil.$)1142.01298.61465.31600.81705.81801.41886.21957.82038.3 (%ChYearago)0.713.712.89.26.65.64.73.84.1

GSP(Bil.2012$)1069.81170.51239.91292.81339.81363.21387.91411.61439.7 (%ChYearago)-1.49.45.94.33.61.71.81.72.0

Employment and Labor Force (Household Survey % Change Year Ago)

Employment-4.94.65.73.41.81.80.60.50.7

LaborForce-2.02.53.93.11.22.00.70.60.6

FLUnemploymentRate(%)8.14.73.03.03.33.74.24.34.2

U.S.UnemploymentRate(%)8.15.43.63.64.04.44.95.04.8

Nonfarm Employment (Payroll Survey % Change Year Ago)

TotalNonfarm

U.S.-5.82.94.32.21.31.00.20.20.3 Florida-4.94.65.73.41.81.80.60.50.7 Mining-3.7-0.92.83.6-1.21.10.42.20.6 Construction-0.12.44.24.63.43.51.60.51.1 Manufacturing-2.22.95.23.21.30.0-1.5-1.7-1.2 NondurableGoods-3.32.65.22.81.2-0.1-1.0-1.1-0.9 DurableGoods-1.73.15.23.41.30.1-1.8-1.9-1.3 Trans.Warehs.&Utility-3.25.25.12.21.21.10.51.0-0.5 WholesaleTrade-2.82.85.73.61.61.51.11.2-0.1 RetailTrade-4.74.04.01.70.90.6-0.31.0-1.0 FinancialActivities0.15.06.32.80.72.21.50.80.3 Prof.andBusinessServices-2.37.48.62.10.20.9-2.3-1.92.0 Edu&HealthServices-2.42.64.45.93.72.91.81.41.5 Leisure&Hospitality-19.711.110.54.71.82.12.21.30.3 Information-6.25.410.32.1-1.21.92.6-1.8-1.7 FederalGov't.4.9-1.21.13.64.0-0.7-3.40.70.5 State&LocalGov't.-2.8-1.30.22.82.61.60.70.60.5

Population and Migration

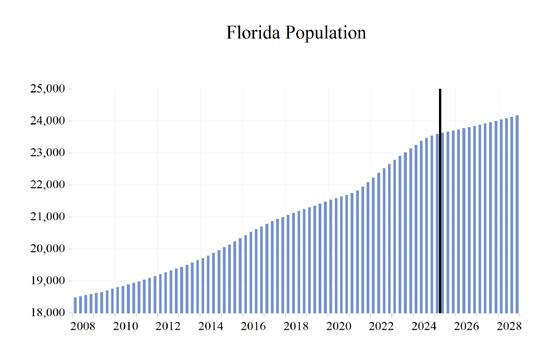

Population(ths)21614.021901.922447.322963.723409.023650.423789.923945.224109.9 (%ChYearago)1.11.32.52.31.91.00.60.70.7

NetMigration(ths)60.0109.5148.4122.8102.142.438.542.445.5 (%ChYearago)6.182.535.5-17.3-16.9-58.4-9.210.27.3

HousingStartsTot.Private(ths)157.6193.0193.7183.6164.7163.1164.7163.9165.4

HousingStartsSingleFamily(ths)111.5144.0133.7127.1123.8116.9113.3109.5106.1

HousingStartsMulti-Family(ths)46.149.059.956.540.946.251.454.559.3

(%ChYearago)1.25.49.66.13.03.32.92.22.1 Consumer Prices Housing

Table 2. Quarterly Summary of the University of Central Florida's Forecast for Florida*

2025Q12025Q22025Q32025Q42026Q12026Q22026Q32026Q42027Q12027Q22027Q32027Q42028Q1

Personal Income and GSP

PersonalIncome(Bil.$)1698.41720.31734.01751.71778.61806.11830.31855.91885.51911.51936.61960.71986.9

Florida.(%ChYearago)1.81.30.81.01.51.51.31.41.61.41.31.21.3

U.S.(%ChYearago)1.61.30.70.91.51.41.21.21.41.21.11.11.3

PersonalIncome(Bil.2012$)1307.61304.41307.21312.91324.31337.61348.51360.11375.71388.31401.31412.21424.4

Florida.(%ChYearago)0.9-0.30.20.40.91.00.80.91.10.90.90.80.9

U.S.(%ChYearago)0.7-0.30.10.40.80.80.60.71.00.70.70.60.8

Disp.Income(Bil.2012$)1158.11155.71171.61176.61187.01198.81208.41218.71232.91244.21255.91265.81277.1

Florida.(%ChYearago)0.8-0.21.40.40.91.00.80.91.20.90.90.80.9

U.S.(%ChYearago)0.7-0.31.10.40.90.80.60.71.00.70.70.60.8

GSP(Bil.$)1757.31797.41815.61835.31859.61876.11895.11913.91930.71949.11965.91985.72005.6

(%ChYearago)1.02.31.01.11.30.91.01.00.91.00.91.01.0

GSP(Bil.2012$)1355.61361.51365.11370.51377.91384.51391.71397.51402.81408.41414.31420.81427.0

(%ChYearago)0.10.40.30.40.50.50.50.40.40.40.40.50.4

Employment and Labor Force (Household Survey % Change Year Ago)

Employment0.80.50.20.10.10.10.10.10.10.10.10.10.1

LaborForce1.20.60.10.10.20.20.20.20.20.20.20.10.1

FLUnemploymentRate(%)3.53.63.84.04.14.14.24.24.34.34.34.34.2

U.S.UnemploymentRate(%)4.14.34.54.74.84.94.95.05.05.05.05.04.9

Nonfarm Employment (Payroll Survey % Change Year Ago)

TotalNonfarm

U.S.0.30.30.10.00.10.10.10.10.00.00.00.10.1

Florida0.80.50.20.10.10.10.10.10.10.10.10.10.1

Mining1.20.1-0.1-0.2-0.20.40.60.50.70.70.20.2-0.1 Construction1.10.80.80.60.30.20.20.10.20.00.20.20.3

Manufacturing0.7-0.2-0.7-0.2-0.80.3-0.4-0.6-0.5-0.4-0.4-0.2-0.2 NondurableGoods0.20.1-0.6-0.2-0.3-0.1-0.4-0.4-0.2-0.3-0.3-0.3-0.1

DurableGoods1.0-0.3-0.8-0.2-1.10.5-0.4-0.8-0.6-0.5-0.5-0.2-0.2 Trans.Warehs.&Utility0.50.50.0-0.10.00.20.40.30.40.20.1-0.2-0.6 WholesaleTrade0.70.30.30.00.30.30.50.40.50.2-0.1-0.10.2 RetailTrade0.40.5-0.3-0.4-0.30.20.30.10.40.30.3-0.2-1.2 FinancialActivities1.10.50.30.50.60.20.30.10.30.20.1-0.10.5

Prof.andBusinessServices0.50.70.1-1.2-0.6-0.8-0.6-0.6-0.8-0.2-0.20.20.9

Edu&HealthServices0.60.80.60.50.50.40.30.30.50.30.30.20.7 Leisure&Hospitality1.30.40.31.10.50.30.50.50.10.10.40.5-0.9 Information1.80.00.60.01.80.9-0.1-0.5-0.3-0.7-1.0-1.0-0.1 FederalGov't.0.7-0.3-2.2-3.60.20.20.20.20.20.20.10.10.1

State&LocalGov't.0.40.30.20.20.20.20.10.20.10.10.10.10.1

Population and Migration

Population(ths)23,597.523,634.723,668.123,701.423,735.423,770.723,807.423,845.923,885.523,925.223,965.024,005.224,045.6 (%ChYearago)0.20.20.10.10.10.10.20.20.20.20.20.20.2

NetMigration(ths)58.939.635.635.636.337.639.141.042.142.442.442.843.2

(%ChYearago)-22.5-32.8-10.20.02.23.54.04.82.90.60.10.90.8

HousingStartsTot.Private(ths)159.8163.2166.1163.0164.0164.3165.4165.0164.5164.1163.5163.7164.1

HousingStartsSingleFamily(ths)116.2117.2117.7116.3114.7113.8112.7111.8110.8109.8108.9108.2107.2

HousingStartsMulti-Family(ths)43.646.048.446.849.350.552.753.253.754.254.555.557.0

Housing Consumer Prices

(%ChYearago)0.91.30.70.60.80.60.60.70.50.50.30.60.5

*Quarterlyatanannualrate

Table 3. Employment Quarterly* 2025Q12025Q22025Q32025Q42026Q12026Q22026Q32026Q42027Q12027Q22027Q32027Q42028Q1

Florida Payroll Employment (Thousands)

TotalNonfarm10,068.010,120.210,140.510,147.210,159.810,171.210,186.310,197.210,207.010,218.510,231.510,244.010,255.5

Manufacturing431.1430.4427.2426.2422.7424.1422.3419.6417.6415.9414.1413.1412.4

DurableGoods297.2296.3293.9293.2290.0291.5290.3288.0286.4285.0283.6283.0282.5

WoodProducts14.714.814.615.415.516.016.116.216.316.516.716.817.0

Computer&Electronics48.648.548.748.848.848.949.049.049.149.149.149.048.8

TransportationEquipment56.556.054.854.153.754.454.754.754.554.253.853.653.4 Nondurables134.0134.1133.3133.1132.7132.5132.0131.6131.2130.9130.5130.1130.0 Foods39.439.439.539.639.639.739.739.739.839.839.839.940.0

Non-Manufacturing9,636.99,689.89,713.39,721.09,737.19,747.29,764.09,777.79,789.49,802.79,817.49,830.99,843.1 Mining5.85.85.85.85.75.85.85.85.95.95.95.95.9 Construction667.3672.8678.0681.9684.0685.5686.9687.4688.5688.8689.9691.5693.3 Trans.Warehs.&Utility2,006.52,017.02,017.72,015.62,015.42,020.02,028.12,033.62,041.62,045.92,048.32,045.12,033.5 WholesaleTrade401.2402.5403.8403.9405.2406.3408.3409.8412.0412.8412.4411.9412.6 RetailTrade1,162.71,168.61,165.21,160.81,157.31,159.31,163.31,164.81,169.21,172.21,175.31,172.51,158.7 Information159.7159.8160.8160.7163.5165.1165.0164.1163.5162.4160.7159.1158.9 Prof.&Bus.Services1,632.71,644.31,645.91,626.91,616.51,603.61,594.61,585.11,572.11,568.91,566.41,570.11,584.6 Admin.&Support765.6769.0772.0767.5763.3756.5749.4743.5737.6737.1735.7733.6733.0 Prof.Sci&Tech137.5138.0138.6139.0139.4139.7140.0140.3140.3140.2140.2140.1140.5 Mgmt.ofCo.729.7737.4735.3720.3713.8707.4705.2701.3694.2691.5690.5696.4711.0 FinancialActivities699.4702.6704.5708.2712.4713.5715.6716.5718.9720.0720.8720.3723.9 RealEstate&Rent469.7471.1471.6475.2479.0480.4482.7483.5485.5486.3487.0486.5489.3 Fin.&Insurance229.8231.5233.0233.0233.4233.1232.9233.1233.4233.8233.8233.8234.6 Edu.&HealthService1,564.91,577.21,586.31,594.51,601.81,607.91,612.41,617.81,625.11,630.31,634.91,637.71,649.0 EducationServices211.0212.2213.8213.4212.9211.0210.1210.3211.6212.9214.3215.9218.7 HealthServices1,354.01,365.01,372.51,381.11,388.91,396.91,402.31,407.51,413.51,417.41,420.61,421.91,430.3 Leisure&Hospitality1,341.81,346.81,350.81,366.01,372.91,377.71,384.31,391.71,393.61,395.71,401.31,407.81,395.0 OtherServices387.8389.5391.0393.0394.4395.6396.9399.2402.2405.0407.7410.6415.0 Government1,170.91,174.01,172.31,168.41,170.41,172.61,174.41,176.41,177.91,179.71,181.31,182.71,184.0 FederalGov't.163.9163.4159.8154.1154.4154.6154.9155.2155.4155.7155.9156.2156.4 State&LocalGov't1,007.11,010.61,012.51,014.31,016.01,017.91,019.51,021.21,022.51,024.01,025.41,026.61,027.6

*Quarterlyatanannualrate

202020212022202320242025202620272028

Florida Payroll Employment (Thousands)

TotalNonfarm8,533.98,928.29,439.69763.779,943.010,119.010,178.610,225.310,294.5

Manufacturing378.6389.7409.9423.2428.6428.7422.1415.2410.2

DurableGoods259.5267.5281.4291.1294.9295.1290.0284.5280.7

WoodProducts14.014.315.215.214.714.915.916.616.9

Computer&Electronics44.344.345.547.148.048.748.949.148.6 TransportationEquipment48.350.754.057.057.555.354.454.052.8

Nondurables119.1122.2128.5132.1133.7133.6132.2130.7129.5 Foods33.634.235.737.539.339.539.739.840.1

Non-Manufacturing8,155.38,538.59,029.79,340.69,514.49,690.29,756.59,810.19,884.3 Mining5.55.45.65.85.75.85.85.95.9

Construction564.6577.9602.4630.2651.9675.0685.9689.7697.5 Trans.Warehs.&Utility1,740.51,831.31,925.61,968.61,992.22,014.22,024.32,045.22,034.3 WholesaleTrade347.0356.7377.0390.6396.8402.9407.4412.3411.9 RetailTrade1,042.91,085.01,128.11,147.41,157.91,164.31,161.21,172.31,160.3 Information134.3141.5156.1159.3157.3160.2164.4161.4158.6 Prof.&Bus.Services1,359.11,460.21,585.71,619.01,622.21,637.51,599.91,569.41,601.0 Admin.&Support602.5651.2710.6739.9755.8768.5753.2736.0729.3

Prof.Sci&Tech111.8115.6125.9134.3136.4138.3139.8140.2140.1 Mgmt.ofCo.644.8693.4749.3744.7730.0730.7706.9693.2731.5

FinancialActivities595.9625.6665.3683.7688.7703.7714.5720.0722.3

RealEstate&Rent408.2429.2454.3465.4466.3471.9481.4486.3488.3

Fin.&Insurance187.7196.5211.0218.3222.4231.8233.1233.7234.1

Edu.&HealthService1,305.31,339.11,398.61,480.71,536.21,580.81,610.01,632.01,655.8 EducationServices168.3178.0191.8203.5211.3212.6211.1213.7220.7

HealthServices1,137.01,161.11,206.91,277.21,324.91,368.21,398.91,418.31,435.1

Leisure&Hospitality1,011.51,123.41,241.61,299.91,323.61,351.41,381.61,399.61,403.6

OtherServices334.9344.1355.6368.0379.6390.3396.5406.4418.9 Government1,103.81,090.11,093.31,125.51,157.11,171.41,173.41,180.41,186.4

FederalGov't.149.9148.1149.7155.1161.4160.3154.8155.8156.7

State&LocalGov't954.0942.0943.5970.3995.71,011.11,018.71,024.61,029.7

Billions Current Dollars

PersonalIncome1698.41720.31734.01751.71778.61806.11830.31855.91885.51911.51936.61960.71986.9

Wages&Salaries754.7764.5772.2781.7793.0802.4812.2822.8833.3844.0854.5864.5874.9

OtherLaborIncome152.5154.9157.3158.8161.0162.4164.0165.8167.9169.5171.2173.1175.5

Nonfarm88.590.491.992.695.196.298.098.999.499.9100.4101.2101.5

Farm1.21.61.11.21.31.31.41.51.51.61.71.81.8

PropertyIncome471.9476.4476.4479.0483.4495.7503.5512.0521.9531.8540.5548.4556.0

TransferPayments343.6347.7351.2355.4363.8368.1372.3377.1384.9389.4393.7398.4406.0

SocialInsurance118.3119.5120.4121.4123.3124.4125.6126.6128.0129.2129.9131.2133.3

Billions 2012 $

PersonalIncome1307.61304.41307.21312.91324.31337.61348.51360.11375.71388.31401.31412.21424.4

Wages&Salaries581.0579.7582.1585.9590.5594.3598.4603.0608.0613.0618.3622.7627.2 OtherLaborIncome117.4117.5118.6119.0119.9120.3120.9121.5122.5123.1123.9124.7125.8 Nonfarm68.168.569.369.470.871.272.272.572.572.572.672.972.8 Farm0.91.30.90.90.91.01.01.11.11.21.21.31.3

PropertyIncome363.3361.2359.1359.0359.9367.1371.0375.2380.8386.2391.1395.0398.6

TransferPayments264.5263.6264.7266.4270.9272.6274.3276.3280.8282.8284.9286.9291.0 SocialInsurance91.190.690.891.091.892.192.592.893.493.894.094.595.6

NewPassengerCar&TruckRegistrations1457.31416.61311.41291.81286.01301.31328.71348.71350.51356.81362.01362.91368.7

RetailSales(Billions$)524.8534.2531.2533.2538.0544.3551.8559.3566.3573.8580.4586.7591.4

RealRetailSales(Billions2012$)404.1405.1400.4399.7400.6403.1406.5409.9413.2416.8420.0422.6424.0

*Quarterlyatanannualrate

Billions Current Dollars

PersonalIncome1220.81358.81436.11553.41645.31726.11817.71923.62025.1

Billions 2012 $

FLORIDA NEWS SUMMARIES

$18B proposed in Senate budget for transportation, economic development

• The Florida Senate’s proposed $117 billion budget prioritizes disaster funding, transportation infrastructure, and housing affordability, including $13 billion for transportation projects and $1 billion for emergency management.

• Housing initiatives feature prominently, with nearly $183 million allocated to the SHIP Program, $150 million each for the Hometown Heroes and CDBG-DR programs, and over $71 million for affordable apartment development under SAIL.

• The plan includes strategic investments across multiple agencies, such as new funding for cultural grants, security upgrades, and equipment replacements, alongside a 4% pay raise for state workers and increased reserves to bolster emergency preparedness and reduce state debt.

Source: Florida Politics, March 28, 2025

Medicaid cuts could put a $3 billion hole in Florida’s economy, study predicts

• Proposed federal Medicaid cuts could trigger significant economic fallout in Florida,

including an estimated 33,000 job losses—half within health care—and a $3 billion decline in the state’s economic output over the next decade.

• The ripple effects of reduced federal funding would stretch beyond health care, impacting other industries and potentially forcing closures of nursing homes and community clinics that serve low-income residents.

• F lorida’s state and local governments could also lose approximately $177 million in tax revenue, making it harder to fund core public services like education and infrastructure.

Source: WUSF NPR, April 8, 2025

Governor Ron DeSantis Announces Infrastructure and Workforce Development Investments Through the Job Growth Grant Fund

• Governor Ron DeSantis awarded over $14.5 million through the Florida Job Growth Grant Fund to support infrastructure enhancements and workforce development, with a focus on bolstering key sectors like aerospace, aviation, and manufacturing.

• Indian River State College and Miami Dade College will receive funding to launch advanced training programs in industrial manufacturing and aircraft maintenance, helping meet regional workforce demands and accelerate job placement.

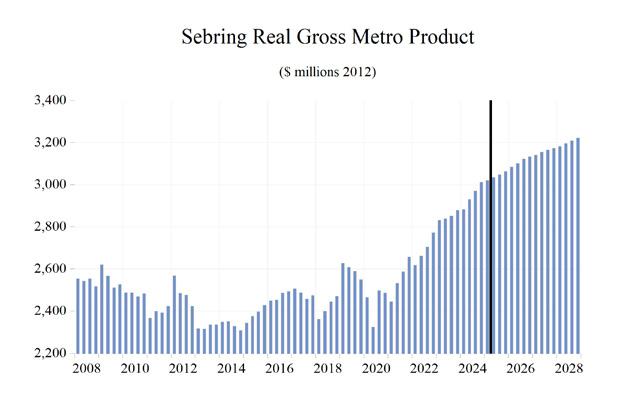

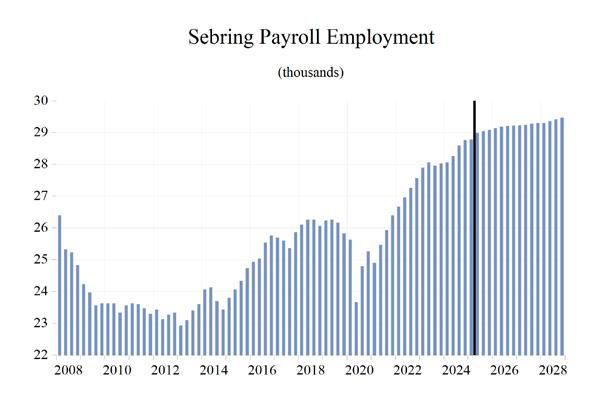

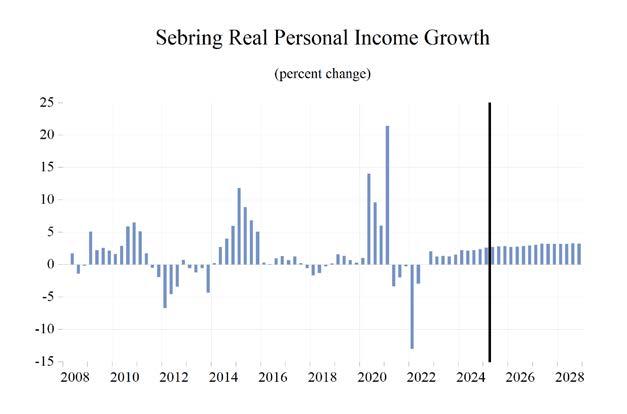

• Infrastructure investments in Sebring and Wakulla County will improve transportation efficiency and expand industrial capacity, positioning these regions for long-term economic growth and business attraction.

Source: Office of the Governor, April 23, 2025

Here’s how Florida is already feeling the effect of Trump’s tariffs

• F lorida businesses are grappling with rising import tariffs, prompting many to increase prices, delay expansion plans, or seek short-term strategies like bulk buying and foreign trade zones to absorb extra costs.

• Industries such as manufacturing, construction, and hospitality are particularly vulnerable, as they rely heavily on imported materials like steel, lumber, coffee, and tea, all now subject to steep duties.

• Uncertainty around shifting tariff policies are causing hesitation among small business owners who may struggle to plan ahead, and many, like TeBella Tea Company, are already experiencing financial strain and cautious consumer spending.

Source: Tampa Bay Times, May 24, 2025

Tallahassee-based WeatherStem collaborates with Disney in new monitoring partnership

• WeatherStem, a Florida weather technology company known for its real-time alert systems, has partnered with Disney SyncLink Technology to develop a global weather monitoring network—dubbed the “Disney Mesonet.” The system will provide real-time, hyper-local weather data across Disney’s global portfolio of theme parks, cruise lines, and resorts.

• The collaboration was initiated through the Florida Division of Emergency Management, which previously worked with WeatherStem to implement the Florida Severe Weather Mesonet, a statewide network of solar-powered weather stations supporting public safety and emergency response.

• Th is partnership aims to centralize and enhance Disney’s weather safety protocols, particularly for outdoor and marine operations. The initiative is expected to enhance disaster preparedness and improve beach and surf safety at Disneyaffiliated locations, highlighting Florida’s ongoing leadership in applied climate and safety technologies.

Source: Tallahassee Democrat, May 28, 2025

Royal Palm Square in Fort Myers set for demolition, new growth ahead

• The reimagined Royal Palm Square will feature new residential units, medical office space, a hotel, and commercial buildings, replacing the previously stalled retail and luxury apartment plans, creating a diverse economic base likely to attract millions in private investment to Fort Myers.

• The eastern half of the property is slated for demolition starting next month, setting the stage for phased redevelopment and job creation across healthcare, hospitality, and construction sectors, a timely revitalization of an underperforming commercial asset.

• With only three tenants currently operating in the square, including the 32-year-old Broadway Palm Theater, the redevelopment promises a major commercial boost, potentially increasing tenant occupancy by over 500% upon project completion and drawing more foot traffic into the area.

Source: WINK, April 4, 2025

Construction to begin on affordable housing communities in Fort Myers, East Naples

• DeAngelis Diamond and McDowell Housing Partners are investing over $75 million to construct 304 affordable housing units across Fort Myers and East Naples, directly supporting local construction jobs and longterm economic stability.

• Ekos Creekside’s 160 units and Ekos on Evans’ 144 units will prioritize residents earning up to 80% of the area median income, addressing the needs of the 54% of Collier County households earning $45,000 or less.

• The projects leverage diverse funding sources, including $3.75 million in Collier County surtax funds and federal Community Development Block Grant –Disaster Recovery dollars, amplifying the impact of Florida’s 4% Low Income Housing Tax Credit program and enhancing regional housing affordability.

Source: GulfShore Business, April 29, 2025

Cape Coral Considers Launching a Tourist Development Fund- Funded by Rental Registration Fees

• The proposed increase in Cape Coral’s residential rental registration fee from a onetime $35 to an annual $600 per unit could generate significant recurring revenue to fund tourism initiatives without using general taxpayer dollars.

• A ll proceeds from the new Tourist Development Fund would come exclusively from tourist-generated rental fees, enabling strategic investments in cultural venues, athletic facilities, and local attractions to stimulate long-term economic growth and increased visitor spending.

• In addition to boosting Cape Coral’s tourism economy, the increased fee would fund code enforcement targeting property upkeep, noise control, and absentee landlords, contributing to economic vitality through neighborhood stabilization and improved quality of life.

Source: Cape Coral Florida, May 21, 2025

Cape Coral considers $600 yearly fee for rental property owners

• Imposing a $600 annual fee on approximately 10,000 residential rental properties could generate over $6 million per year, fueling large-scale economic development projects like recreation centers, swimming pools, or a performing arts hall —amenities currently lacking in Cape Coral.

• The proposed 1,600% jump from a $35 onetime fee to a $600 recurring annual fee could increase rents by an estimated $50/month per unit, disproportionately affecting working-class families and potentially worsening the city’s 29.7% rental vacancy rate.

• City officials estimate that revenue from the proposed fee could help unlock $250 million to $500 million in tourism-enhancing infrastructure, positioning Cape Coral as a more competitive destination and stimulating local job creation and business investment.

Source: Gulfshore Business, May 22, 2025

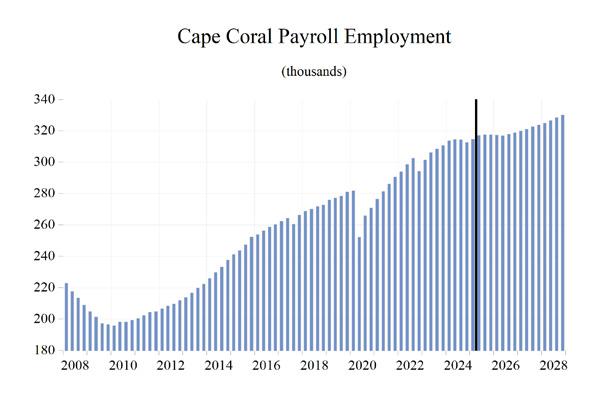

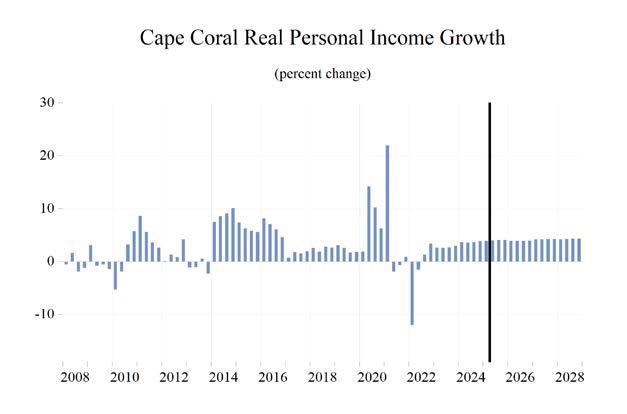

Long Term Outlook for Cape Coral-Fort Myers, FL

June 2025 Forecast

Personal Income (Billions $)

202020212022202320242025202620272028

TotalPersonalIncome44.948.550.655.058.561.765.469.673.8

PctChgYearAgo8.38.04.48.76.45.56.06.46.1

WagesandSalaries14.616.518.620.021.222.223.324.726.1

NonwageIncome30.332.032.035.037.339.542.144.947.7

RealPersonalIncome(12$)43.744.542.844.546.147.248.750.953.0

PctChgYearAgo6.81.8-3.94.03.72.23.34.44.3

PerCapitaIncome(Ths)58.361.061.165.067.870.874.277.881.4

RealPerCapitaIncome(12$)56.856.051.752.653.554.255.356.958.5

AverageAnnualWage(Ths)54.357.862.164.867.269.873.076.379.3

PctChgYearAgo7.76.47.54.43.73.84.64.53.9

Establishment Employment (Place of Work, Thousands, SA)

TotalEmployment267.8283.8297.4306.8313.9316.8317.9322.0327.6

PctChgYearAgo-3.86.04.83.12.30.90.31.31.8

Manufacturing6.57.27.98.28.38.38.28.18.1 PctChgYearAgo-0.811.210.63.41.40.2-1.4-1.3-0.8 Nonmanufacturing261.3276.6289.5298.5305.5308.4309.6313.8319.6

PctChgYearAgo-3.85.94.63.12.30.90.41.41.8

Construction&Mining32.834.636.841.142.844.044.645.246.3 PctChgYearAgo0.55.46.611.74.02.81.31.42.5 Trade,Trans,&Utilities53.556.258.359.960.861.561.262.162.1 PctChgYearAgo-2.35.03.92.71.51.1-0.41.40.0 WholesaleTrade7.98.38.58.99.29.59.69.89.9 RetailTrade39.641.542.943.844.244.443.944.443.9 Trans,Wrhsng,&Util6.16.46.97.37.47.67.88.08.2 Information2.93.13.33.63.63.63.73.73.8 PctChgYearAgo0.97.68.76.50.8-0.53.30.91.0 FinancialActivities13.514.315.515.615.616.016.416.917.4 PctChgYearAgo-3.25.97.71.00.12.72.13.13.3 Prof&BusinessServices36.840.543.844.844.944.743.242.643.6 PctChgYearAgo-2.310.38.12.30.0-0.3-3.4-1.52.4 Educ&HealthServices30.632.133.334.535.636.837.538.439.3 PctChgYearAgo-2.44.73.93.63.23.41.92.22.4 Leisure&Hospitality37.241.342.641.142.240.541.542.443.0

PctChgYearAgo-14.711.03.1-3.52.9-4.02.22.21.5 OtherServices10.711.111.412.012.812.913.313.814.5

PctChgYearAgo-7.24.32.35.36.41.32.73.94.9 FederalGovernment2.62.42.42.52.62.62.42.42.5

PctChgYearAgo8.0-7.11.44.21.5-0.3-5.30.51.2 State&LocalGovernment40.841.142.043.444.745.845.946.447.1

PctChgYearAgo-0.60.72.23.33.02.60.11.11.6

Other Economic Indicators

Population(Ths)769.5795.4827.8846.4862.1870.7880.8894.1907.0

PctChgYearAgo2.43.44.12.21.91.01.21.51.4

LaborForce(Ths)335.2348.2361.1370.8375.8381.1385.4390.3395.1 PercentChange,YearAgo-0.63.93.72.71.41.41.11.31.2

UnemploymentRate(%)7.84.33.43.33.54.24.54.54.2

TotalHousingStarts11002.712099.211753.712695.714504.513208.811284.111019.111156.5

Single-Family6609.110674.29093.48544.810597.29537.57372.16698.96459.1

Multifamily4393.61425.02660.44150.93907.33671.33912.04320.24697.4

PROFILES

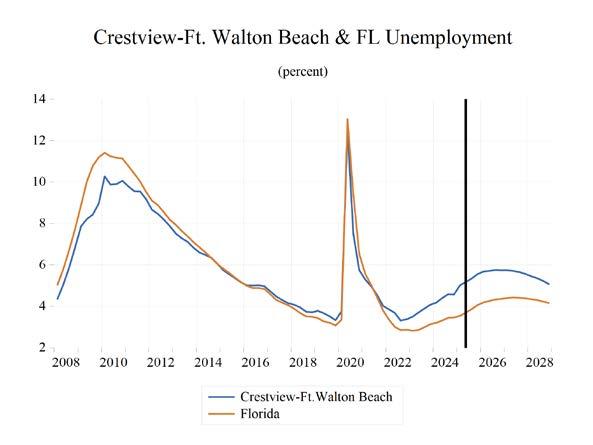

The Crestview MSA is comprised of Okaloosa and Walton counties and is located in the northwest corner of the state. Crestview is known as the “Hub City” because of the convergence of Interstate 10, State Road 85, U.S. Highway 90, the Florida Gulf & Atlantic Railroad and the Yellow River and Shoal River in or near the city.

QUICK FACTS

• Metro population estimate of 304,418 as of 2023 (ACS 5-Year Estimate) (U.S. Census Bureau).

• Okaloosa County population estimate of 218,464 as of 2023 (ACS 5-Year Estimate).

• Walton County population estimate of 86,354 as of 2023 (ACS 5-Year Estimate).

• Civilian labor force of 139,464 in December 2024 (FRED, U.S. Bureau of Labor Statistics).

• A n unemployment rate of 2.9% as of December 2024, not seasonally adjusted. This amounts to 3,986 unemployed people (FRED, U.S. Bureau of Labor Statistics).

OUTLOOK SUMMARIES

The studied economic indicators are predicted to show average levels of growth in the Crestview—Fort Walton Beach Metropolitan Statistical Area (MSA). Gross Metro Product for the MSA will come in at $20,465.85 million. The MSA will experience personal income growth of 5.6 percent, and real per capita income will be $63,100. Crestview will have the 3rd highest average annual growth rate at 4.5 percent, to $76,100. Crestview’s population will grow at an annual rate of 0.6 percent.

Crestview is expected to have the 3rd lowest employment growth rate at an average of 0.5 percent. The unemployment rate will be the 2nd lowest in the state at 3.8 percent.

The Financial sector will lead the MSA in average annual growth at 3.0 percent. The Other Services sector will follow at 2.5 percent. The Construction and Mining sector and the Professional and Business Services sector will see contractions in growth of -1.4 percent and -1.0 percent respectively.

METRO NEWS SUMMARIES

Okaloosa County will buy property for new tourism office and improve Cinco Bayou boat ramp

• The Okaloosa County Commission approved a $4.1 million package to purchase the former PNC Bank building in Cinco Bayou to serve as the new headquarters for the Tourist Development Department.

• The acquisition includes a 13,859-squarefoot, three-story building and two adjacent vacant lots, funded through a combination of tourism-related revenue sources, including $3.1 million from the Tourism Development budget and $750,000 from Cinco Bayou Tourism Development Tax funds.

• Community concerns raised during public meetings include issues related to security, traffic, and environmental preservation; officials have committed to addressing these through design and operational measures. A deed covenant between the county and the Town of Cinco Bayou will require mutual approval for any future land use changes, and officials emphasized the importance of preserving existing live oak trees on the property.

Source: NWF Daily News, March 5, 2025

City of Fort Walton Beach completes phase one of $8 million Landing Park renovations

• The $8 million renovation of Fort Walton Beach Landing is underway, with the first phase—focused on waterfront improvements— now complete. Key waterfront upgrades include a reinforced 700-foot seawall, a 10-foot-wide concrete boardwalk with aluminum handrails, bench seating, and new lighting fixtures.

• The second phase of the project involves interior park upgrades, including a new bandshell with tiered seating, replacement of restrooms, additional lighting, sidewalks, vendor electrical outlets, and a designated food truck area.

• The project is funded through a combination of grants and local revenue sources, including the Natural Resource Damage Assessment Grant, RESTORE Act funds, Okaloosa County taxes, and the city’s Community Redevelopment Agency, with no funding from the city’s General Fund.

Source: Get The Coast, March 25, 2025

New I-10 Exit Construction in Florida Continues

• The Florida Department of Transportation (FDOT) is continuing construction on the new I-10/P.J. Adams Interchange (Future Exit 53) and a related resurfacing project in Crestview.

• The resurfacing project spans from west of the Yellow River to mile marker 52 and from mile marker 54 to east of the Shoal River at mile marker 60, with shoulder gutters being installed to improve stormwater management and roadway safety.

• The resurfacing project is expected to be completed by mid-2025, while the interchange construction is projected to finish in late 2026.

Source: I-10 Exit Guide, April 2, 2025

FDOT to connect 1,300 Northwest Florida high school students with construction career opportunities

• The 5th Annual Northwest Florida Construction Career Days will take place on April 22– 23 at the Santa Rosa County Fairgrounds in Milton, offering over 1,300 high school students hands-on exposure to the transportation and construction industries.

• The event includes interactive experiences such as operating heavy equipment and learning about bridge inspections, paving, concrete work, traffic control, and engineering.

• The initiative supports FDOT District Three’s long-term workforce development strategy, addressing labor shortages amid billions of dollars in planned construction activity across Northwest Florida.

Source: Get The Coast, April 10, 2025

Williams International brings billion-dollar aerospace investment to Okaloosa County

• Williams International will invest over $1 billion to construct a one-million-square-foot aviation gas turbine engine manufacturing facility at Shoal River Industrial Park in Crestview, Okaloosa County. The project is expected to create more than 330 hightechnology jobs, making it one of the largest economic investments in Northwest Florida’s history.

• Construction will occur in three phases: the initial 250,000-square-foot facility is scheduled to begin later in 2025 and be completed by late 2026, with additional phases planned for 2028 and 2035–2036.

• The initiative was supported by a $3.2 million grant from the Florida Job Growth Grant Fund and involved collaboration among multiple state and local entities, including Triumph Gulf Coast, CareerSource Florida, and One Okaloosa EDC. Officials highlighted the project as a strategic win for Florida’s advanced manufacturing sector and a testament to longterm regional planning and public-private partnerships.

Source: Get The Coast, May 29, 2025

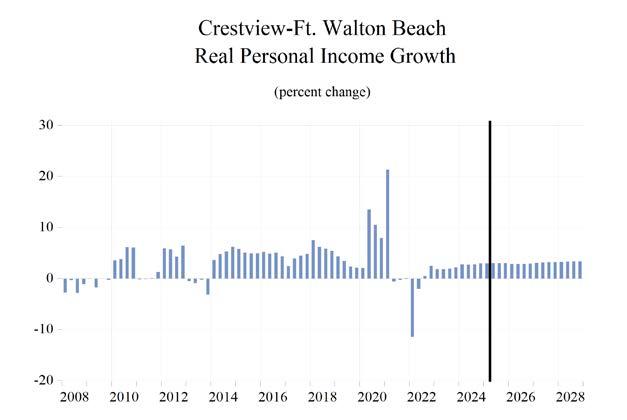

Long Term Outlook for Crestview-Fort Walton Beach-Destin, FL

June 2025 Forecast

Personal Income (Billions $)

202020212022202320242025202620272028

TotalPersonalIncome17.019.219.921.322.423.625.026.427.8

PctChgYearAgo6.713.53.47.14.95.55.95.75.2

WagesandSalaries7.88.79.49.810.310.811.311.912.5

NonwageIncome9.210.510.511.512.112.813.614.515.3

RealPersonalIncome(12$)17.118.317.518.118.518.919.520.220.9

PctChgYearAgo6.66.9-4.13.12.22.23.23.73.3

PerCapitaIncome(Ths)58.765.566.269.672.175.779.683.687.4

RealPerCapitaIncome(12$)59.262.158.258.959.560.562.164.065.7

AverageAnnualWage(Ths)57.961.864.365.868.270.874.377.981.4

PctChgYearAgo8.26.64.12.33.73.74.94.94.5

Establishment Employment (Place of Work, Thousands, SA)

TotalEmployment115.0121.5126.4129.3130.8132.4133.0133.1133.5

PctChgYearAgo-1.95.74.02.31.11.20.40.10.3

Manufacturing3.43.43.53.43.33.33.33.23.2

PctChgYearAgo8.7-0.94.7-4.0-3.00.1-1.0-1.5-0.7

Nonmanufacturing111.6118.1122.9125.9127.5129.1129.7129.9130.3 PctChgYearAgo-2.25.94.02.51.21.30.50.20.3 Construction&Mining7.07.37.88.18.38.28.28.07.8 PctChgYearAgo1.54.37.53.72.0-0.5-0.5-2.6-2.0 Trade,Trans,&Utilities20.421.522.422.923.023.323.323.523.2 PctChgYearAgo-3.35.24.02.30.61.10.30.5-1.1 WholesaleTrade1.71.92.02.12.22.22.32.32.3 RetailTrade16.417.117.718.218.318.318.318.318.0 Trans,Wrhsng,&Util2.32.52.72.62.62.72.82.82.9 Information0.91.01.21.11.11.01.11.11.1 PctChgYearAgo-3.714.521.9-6.2-6.1-1.64.90.2-0.7 FinancialActivities7.07.67.97.67.37.67.98.18.2

PctChgYearAgo-2.18.54.1-3.4-4.23.74.22.41.7 Prof&BusinessServices18.520.722.323.223.223.122.421.922.3

PctChgYearAgo2.912.08.04.10.0-0.8-2.7-2.41.9 Educ&HealthServices12.212.412.813.313.714.014.214.314.4

PctChgYearAgo-1.61.73.54.22.92.31.30.40.6

Leisure&Hospitality20.622.523.223.724.125.025.726.026.0

PctChgYearAgo-8.99.03.42.21.53.92.91.1-0.3 OtherServices4.24.34.24.34.74.84.95.05.1

PctChgYearAgo-2.31.8-2.74.27.32.22.92.22.6 FederalGovernment9.29.39.19.29.59.49.19.29.3

PctChgYearAgo3.50.8-1.61.33.1-1.4-3.31.30.9 State&LocalGovernment11.611.711.912.312.612.712.812.812.9

PctChgYearAgo-2.30.52.02.82.60.71.00.50.4

Other Economic Indicators

Population(Ths)288.7294.1300.9306.4310.3311.7313.7315.7317.5

PctChgYearAgo1.51.92.31.81.30.50.60.60.6

LaborForce(Ths)128.6134.8138.9142.0143.0146.7146.5146.5146.4

PercentChange,YearAgo-0.64.93.02.20.72.5-0.10.00.0

UnemploymentRate(%)5.83.52.62.73.13.63.93.93.6

TotalHousingStarts2965.23494.13701.45030.33863.13099.53052.23095.13123.4

Single-Family2406.43216.12749.92796.72630.82199.12122.02073.21975.5

Multifamily558.8278.0951.62233.61232.2900.4930.21021.91147.9

Short Term Outlook for Crestview-Fort Walton Beach-Destin, FL

June 2025 Forecast

Personal Income (Billions $)

2025:12025:22025:32025:42026:12026:22026:32026:42027:12027:22027:32027:42028:1

TotalPersonalIncome23.223.523.724.024.424.825.225.525.926.226.626.927.2

PctChgYearAgo4.95.85.65.75.35.76.26.36.15.65.55.55.2

WagesandSalaries10.610.710.810.911.111.311.411.611.711.812.012.112.2

NonwageIncome12.612.812.913.013.313.613.813.914.214.414.614.815.0

RealPersonalIncome(12$)18.818.818.919.019.219.419.619.719.920.120.320.420.6

PctChgYearAgo2.62.42.02.01.83.23.84.03.93.53.63.73.4

PerCapitaIncome(Ths)74.475.576.176.778.079.280.281.082.283.284.185.086.0

RealPerCapitaIncome(12$)60.560.460.560.761.362.062.462.763.363.864.364.665.1

AverageAnnualWage(Ths)69.870.471.071.973.073.874.775.676.677.578.479.380.2

PctChgYearAgo2.93.93.74.44.64.95.15.14.95.05.04.84.8

Establishment Employment (Place of Work, Thousands, SA)

TotalEmployment131.8132.7132.6132.4132.7132.9133.1133.1133.0133.1133.2133.2133.1

PctChgYearAgo1.41.61.10.90.70.20.40.50.20.10.00.10.1

Manufacturing3.33.33.33.33.33.33.33.33.23.23.23.23.2

PctChgYearAgo0.80.6-1.40.3-1.3-0.9-0.6-1.3-1.1-1.9-1.8-1.1-0.8

Nonmanufacturing128.5129.3129.3129.1129.4129.6129.8129.9129.8129.8129.9130.0129.9

PctChgYearAgo1.41.61.20.90.70.20.40.60.30.10.10.10.1

Construction&Mining8.28.28.38.38.38.28.28.18.18.08.07.97.9

PctChgYearAgo-1.7-0.8-0.10.80.5-0.2-0.8-1.6-2.2-2.7-2.8-2.6-2.4 Trade,Trans,&Utilities23.123.423.423.323.323.323.423.423.423.523.523.423.2

PctChgYearAgo0.61.81.21.00.8-0.30.20.50.80.60.40.1-1.0 WholesaleTrade2.22.22.32.32.32.32.32.32.32.32.32.32.3 RetailTrade18.218.418.418.318.218.318.318.318.318.318.318.318.0 Trans,Wrhsng,&Util2.72.72.72.72.72.72.82.82.82.82.82.82.8 Information1.01.01.01.11.11.11.11.11.11.11.11.11.1

PctChgYearAgo-4.0-6.10.53.54.15.85.24.62.10.5-0.6-1.3-1.5 FinancialActivities7.47.57.67.77.87.87.98.08.08.08.18.18.2

PctChgYearAgo1.84.64.73.85.34.14.03.42.82.72.21.92.0 Prof&BusinessServices23.123.223.122.822.722.522.322.222.021.921.921.922.1

PctChgYearAgo0.8-0.2-2.2-1.3-1.6-2.8-3.4-2.9-3.3-2.7-2.2-1.20.7 Educ&HealthServices13.914.014.114.114.214.214.214.214.314.314.314.314.4 PctChgYearAgo2.22.81.82.41.81.41.20.90.60.30.30.40.7 Leisure&Hospitality24.924.925.025.325.525.625.826.026.026.026.126.125.9

PctChgYearAgo3.63.35.13.42.62.93.32.81.91.30.90.5-0.5 OtherServices4.74.74.84.84.94.94.94.95.05.05.05.05.1

PctChgYearAgo1.30.93.33.33.93.02.52.02.02.12.42.42.7

FederalGovernment9.69.69.49.09.09.19.19.19.29.29.29.29.3

PctChgYearAgo1.91.8-2.6-6.4-5.9-5.5-2.91.21.41.41.21.11.0

State&LocalGovernment12.612.712.712.712.712.812.812.812.812.812.912.912.9

PctChgYearAgo0.60.90.50.71.11.00.90.80.60.40.40.40.4

Other Economic Indicators

Population(Ths)311.3311.6311.8312.2313.0313.5314.0314.5315.0315.5315.9316.4316.8

PctChgYearAgo0.70.50.30.30.50.60.70.70.60.60.60.60.6

LaborForce(Ths)146.2146.9146.8146.7146.6146.5146.5146.5146.5146.5146.5146.5146.4

PctChgYearAgo3.03.02.31.70.3-0.3-0.2-0.1-0.10.00.00.00.0

UnemploymentRate(%)3.43.53.63.83.93.93.93.93.93.93.93.83.7

TotalHousingStarts3053.23148.53143.23053.13063.92994.43013.83136.63088.03087.53085.13119.83111.0

Single-Family2147.22209.82238.12201.22161.42106.82104.12115.82118.02083.72056.32034.82006.1

Multifamily906.1938.7905.1851.8902.6887.6909.81020.8970.01003.81028.81084.91104.9

PROFILES

The Deltona–Daytona–Ormond Beach MSA is comprised of Volusia and Flagler Counties. It is located on the east coast of Florida and is notable for special events that occur throughout the year such as Bike Week. It is home to NASCAR headquarters and the Daytona International Speedway, which hosts popular races such as the Daytona 500.

QUICK FACTS

• Metro population estimate of 721,796 as of 2023 (ACS 5-Year Estimate) (U.S. Census Bureau).

• Volusia County population estimate of 721,796 as of 2023 (ACS 5-Year Estimate).

• Civilian labor force of 319,155 in December 2024 (FRED, U.S. Bureau of Labor Statistics).

• A n unemployment rate of 3.5% as of December 2024, not seasonally adjusted. This amounts to 11,260 unemployed people (FRED, U.S. Bureau of Labor Statistics).

OUTLOOK SUMMARIES

Growth in the economic indicators studied in this forecast is expected to be moderate for the Deltona—Daytona—Ormond Beach Metropolitan Statistical Area (MSA). Gross Metro Product in the Deltona MSA will be $28,598.80 million. Per capita income levels will come in at $50,800, with average per personal income growth of 5.5 percent annually. The average annual wage will grow at a rate of 4.3 percent, driving the average annual real wage to increase to the 4th lowest in the state at $64,700. We expect population growth of 0.9 percent per year.

The Deltona—Daytona—Ormond Beach MSA labor market will experience an average employment growth of 1.0 percent, with an unemployment rate of 4.7 percent.

The Other Services sector will experience the fastest growth rate in this MSA with an annual growth rate of 3.4 percent. The Information sector will follow at 2.6 percent. Deltona will see the largest contraction in growth in the Manufacturing sector at -1.3 percent.

METRO NEWS SUMMARIES

Deltona Commissioners Plan to Manage Growth and Preserve Green Spaces

• Deltona commissioners have approved initial steps for a new zoning overlay aimed at curbing overdevelopment and preserving green space in the city’s fast-growing southeast region.

• The initiative, called Keep Deltona Wild, would impose additional development rules to protect rural areas and improve infrastructure resilience against flooding.

• Officials see the plan as a way to balance residential growth with long-term economic goals, including tax base diversification and sustainable land use.

Source: WESH 2, March 5, 2025

Deltona townhouse development on pause after residents raise flooding concerns

• A developer plans to transform 36.5 acres in northwest Deltona into a mixed-use district with retail, offices, and apartments.

• The project is expected to generate millions in new tax revenue, while reducing residents’ reliance on Orlando for jobs.

• The Deltona City Commission tabled a request to rezone almost 36.5 vacant acres adjacent to the newer of the Amazon fulfillment centers.

Source: WESH, March 19, 2025

Deltona pans mixed-use project

• Deltona commissioners rejected final approval of the $100M Synergy mixed-use project, citing concerns over traffic impact and infrastructure strain near the proposed site on North Normandy Boulevard.

• The development plan included 320 apartments and 271,000 sq. ft. of industrial, commercial, and flex space, designed to align with the city’s long-term live-work-play economic goals.

Deltona -Daytona Beach - Ormond Beach MSA

Long Term Outlook for Deltona-Daytona Beach-Ormond Beach, FL

June 2025 Forecast

Personal Income (Billions $)

202020212022202320242025202620272028

TotalPersonalIncome32.436.437.941.343.846.248.751.454.3

PctChgYearAgo5.212.14.39.06.05.45.55.65.5

WagesandSalaries9.510.711.712.613.414.114.915.616.5

NonwageIncome22.925.726.228.830.432.133.935.837.8

RealPersonalIncome(12$)32.134.133.134.735.936.637.739.140.5

PctChgYearAgo3.06.5-3.25.13.32.12.93.73.7

PerCapitaIncome(Ths)48.152.753.556.959.161.764.667.670.6

RealPerCapitaIncome(12$)47.649.546.647.848.548.950.051.452.7

AverageAnnualWage(Ths)47.851.053.855.958.360.563.266.068.9

PctChgYearAgo6.96.85.54.04.33.74.44.54.4

Establishment Employment (Place of Work, Thousands, SA)

TotalEmployment198.1208.1216.9223.8228.4231.7233.8235.5237.5

PctChgYearAgo-4.05.14.23.22.01.50.90.70.9

Manufacturing10.711.512.513.012.812.512.412.312.2

PctChgYearAgo-6.27.88.34.3-1.5-2.3-0.9-1.2-0.8 Nonmanufacturing187.4196.6204.4210.8215.6219.2221.4223.2225.4

PctChgYearAgo-3.94.94.03.12.31.71.00.81.0 Construction&Mining14.114.314.714.915.115.215.515.515.7

PctChgYearAgo-1.02.02.41.31.80.22.10.30.9 Trade,Trans,&Utilities38.942.543.844.545.246.346.346.746.5 PctChgYearAgo-1.59.43.11.61.62.30.01.0-0.6 WholesaleTrade4.95.25.75.96.26.36.46.56.6 RetailTrade30.231.832.733.333.634.334.034.434.1 Trans,Wrhsng,&Util3.75.65.55.45.55.75.85.85.8 Information2.01.81.91.91.91.92.02.12.1 PctChgYearAgo-16.0-9.01.01.80.1-0.37.81.31.4 FinancialActivities9.09.79.910.010.210.711.011.211.2 PctChgYearAgo4.46.92.61.21.65.12.81.20.8 Prof&BusinessServices23.023.425.125.826.026.325.725.225.7 PctChgYearAgo-1.71.57.33.00.61.0-2.1-2.11.9 Educ&HealthServices39.440.542.244.346.647.848.549.350.3 PctChgYearAgo-2.32.94.14.95.22.61.41.62.0

Leisure&Hospitality27.831.033.834.734.935.035.836.336.5

PctChgYearAgo-15.311.58.82.90.60.12.31.40.4 OtherServices8.07.97.77.98.38.58.99.19.5

PctChgYearAgo-8.6-0.7-2.73.04.83.13.63.13.7 FederalGovernment1.61.51.51.51.61.61.51.51.5

PctChgYearAgo5.4-5.80.10.65.00.5-2.7-0.4-0.3 State&LocalGovernment23.623.923.925.125.725.926.126.326.5

PctChgYearAgo1.01.4-0.35.32.10.90.80.70.6

Other Economic Indicators

Population(Ths)674.0689.7709.5726.4740.6748.7754.2760.9768.7

PctChgYearAgo1.72.32.92.42.01.10.70.91.0

LaborForce(Ths)289.5298.5308.8318.3322.7330.2332.3334.4336.2

PercentChange,YearAgo-1.83.13.53.11.42.30.60.60.5

UnemploymentRate(%)8.14.73.43.43.94.44.94.94.7

TotalHousingStarts5937.67122.78063.06874.85825.76085.36492.56316.36283.4

Single-Family4631.56566.96175.75462.75096.75151.25113.84897.34757.6

Multifamily1306.2555.91887.31412.0729.0934.11378.71419.01525.8

Short Term Outlook for Deltona-Daytona Beach-Ormond Beach, FL

June 2025 Forecast

Personal Income (Billions $)

2025:12025:22025:32025:42026:12026:22026:32026:42027:12027:22027:32027:42028:1

TotalPersonalIncome45.346.046.446.947.748.449.149.750.451.151.852.553.2

PctChgYearAgo4.85.55.65.65.15.45.75.85.85.65.65.65.5

WagesandSalaries13.814.014.214.414.614.714.915.115.315.515.715.916.1

NonwageIncome31.531.932.232.633.133.734.134.535.135.636.136.537.1

RealPersonalIncome(12$)36.636.536.736.937.237.637.938.138.538.939.339.640.0

PctChgYearAgo2.52.12.01.91.62.93.33.53.73.53.73.83.7

PerCapitaIncome(Ths)60.861.461.962.563.464.365.065.766.567.368.068.769.5

RealPerCapitaIncome(12$)49.048.848.949.149.449.950.250.450.851.251.651.852.2

AverageAnnualWage(Ths)59.860.160.761.462.162.863.564.365.065.766.467.067.8

PctChgYearAgo3.34.03.73.93.94.44.74.84.64.64.54.34.4

Establishment Employment (Place of Work, Thousands, SA)

TotalEmployment229.7231.7232.4233.0233.3233.6233.9234.3234.7235.3235.8236.2236.4

PctChgYearAgo0.61.61.71.91.60.80.70.60.60.70.80.80.7 Manufacturing12.612.512.512.512.412.512.412.412.312.312.212.212.2

PctChgYearAgo-3.1-2.5-1.9-1.5-1.4-0.7-0.4-1.1-0.7-1.4-1.5-1.1-0.8

Nonmanufacturing217.1219.2219.9220.5220.9221.2221.5222.0222.4223.0223.6224.0224.2

PctChgYearAgo0.81.81.92.11.80.90.70.60.70.80.90.90.8 Construction&Mining14.915.115.315.415.515.515.515.515.515.515.515.615.6

PctChgYearAgo-1.8-0.1-0.13.03.82.51.50.60.40.20.20.30.5 Trade,Trans,&Utilities45.946.546.446.346.246.246.346.446.646.746.846.846.4

PctChgYearAgo2.23.42.31.30.6-0.6-0.20.31.01.11.10.7-0.4 WholesaleTrade6.26.36.36.46.46.46.46.56.56.56.66.66.6 RetailTrade34.134.534.434.234.034.034.134.134.234.334.534.434.0 Trans,Wrhsng,&Util5.65.75.75.85.85.85.85.85.85.85.85.85.8 Information1.91.91.91.92.02.02.12.12.12.12.12.12.1

PctChgYearAgo-2.9-2.30.04.37.89.27.96.53.21.40.40.00.3 FinancialActivities10.510.710.810.911.011.011.011.111.111.211.211.211.2

PctChgYearAgo3.75.25.26.34.83.12.11.51.21.31.31.01.2 Prof&BusinessServices26.126.326.426.226.025.825.625.525.225.225.125.225.4

PctChgYearAgo0.02.31.8-0.1-0.4-2.1-3.1-2.7-3.0-2.3-1.9-1.00.7

Educ&HealthServices47.447.748.048.248.348.448.548.749.049.249.449.650.0

PctChgYearAgo2.22.82.43.21.91.51.21.11.31.61.81.82.1

Leisure&Hospitality34.634.935.035.435.635.735.836.136.136.236.436.536.2

PctChgYearAgo-1.5-0.30.61.72.82.22.51.81.41.31.41.30.3

OtherServices8.48.58.68.78.88.88.98.99.09.19.29.29.4

PctChgYearAgo1.02.24.15.05.13.92.92.52.63.03.43.43.8

FederalGovernment1.61.61.61.51.51.61.61.51.51.51.51.51.5

PctChgYearAgo4.61.8-0.5-3.6-4.0-4.4-2.70.4-0.2-0.5-0.5-0.4-0.3

State&LocalGovernment25.825.925.926.026.026.126.126.226.226.326.326.426.4

PctChgYearAgo0.4-0.21.71.70.90.80.80.80.70.70.70.60.6

Other Economic Indicators

Population(Ths)746.2748.2749.6750.8752.0753.4754.9756.4758.1759.6761.7764.0765.8

PctChgYearAgo1.41.21.00.80.80.70.70.70.80.80.91.01.0

LaborForce(Ths)328.0330.6331.0331.3331.7332.0332.5333.1333.6334.1334.6335.1335.5

PctChgYearAgo1.82.52.52.61.10.40.50.60.60.60.60.60.6

UnemploymentRate(%)4.24.44.54.74.84.94.94.94.94.94.94.84.8

TotalHousingStarts5800.56075.76227.06238.26318.46451.56605.26594.96374.46325.16288.06277.86270.8

Single-Family5017.05157.65216.25214.35134.35135.95117.45067.64968.44910.64868.54841.94798.7

Multifamily783.6918.11010.81023.91184.11315.61487.81527.41406.01414.51419.41436.01472.0

PROFILES

The Broward County MSA is located in Southeastern Florida. It is estimated to be the second-most populous county in the State of Florida and the 18th most populous county in the United States.

QUICK FACTS

• Metro population estimate of 1,962,531 as of 2023 (ACS 5-Year Estimate) (U.S. Census Bureau).

• Broward County population estimate of 1,962,531 as of 2023 (ACS 5-Year Estimate).

• Civilian labor force of 1,085,153 in December 2024 (FRED, U.S. Bureau of Labor Statistics).

• A n unemployment rate of 2.9% as of December 2024, not seasonally adjusted. This amounts to 31,278 unemployed people (FRED, U.S. Bureau of Labor Statistics).

OUTLOOK SUMMARIES

The Fort Lauderdale—Pompano Beach area is expected to show below-average levels of growth in the economic indicators. The area has the 5th highest Gross Metro Product at $141,867.83 million. Personal income is expected to grow an average of 4.8 percent annually, the 2nd lowest rate in the state. It will experience an average real per capita income level of $54,500. Average annual wage growth will be 4.2 percent, and the annual wage level is expected to be $86,900 (4th highest). Fort Lauderdale is expected to average a population growth of 0.2 percent each year (3rd lowest).

Employment is expected to grow at a growth rate of 0.6 percent, while unemployment is expected to be 3.9 percent (4th lowest).

Fort Lauderdale’s fastest growing sector is expected to be the Education and Health Services sector, which will experience 1.8 percent average annual growth, followed by Other Services sector, which will grow at an average of 1.7 percent annually. The Professional and Business Services sector will see the largest contraction at -0.8 percent.

METRO NEWS SUMMARIES

New Fort Lauderdale apartment will offer ‘luxury’ affordable housing to city’s workforce

• A ffiliated Development has broken ground on The Era, a luxury workforce housing project in Fort Lauderdale offering 400 units, over half reserved for residents earning 80– 120% of the area median income, with preference for first responders and government workers.

• The project is backed by tax incentives from Fort Lauderdale and Broward County, along with $80M in financing, enabling rents up to $700 below market while still providing high- end amenities like a resort-style pool, coworking space, sauna, and rooftop deck.

• Slated for completion in 2027, The Era aims to address South Florida’s worsening housing crisis and is part of a broader effort by Affiliated to expand attainable housing across the region.

Source: Miami Herald, March 25, 2024

What are the plans for the old Sears at Broward Mall?

• The former Sears building at Broward Mall has remained abandoned since redevelopment plans stalled following their 2019 approval; the pandemic and permit delays left the site unfinished and neglected.

• Originally planned by Seritage Growth Properties for retail and entertainment, the site was sold in November 2023 to Midtown Group for $28 million.

• M idtown Group is now exploring a mixeduse redevelopment, with community interest focused on quality dining and lifestyle options; a formal proposal is expected by late 2025, with potential city approval in 2026.

Source: NBC Miami, April 22, 2025

Omni Fort Lauderdale hotel now accepting reservations ahead of September 2025 opening

• Opening this September, the new 29-story Omni Fort Lauderdale Hotel is now accepting reservations. It will offer 801 rooms, six dining venues, a full-service spa, and 120,000 square feet of event space directly connected to the expanded Broward County Convention Center.

• The $450M project was developed through a public-private effort and is expected to generate over 3,000 jobs while enhancing Fort Lauderdale’s catering to business and leisure travelers.

• Signature features include a rooftop pool deck, the Mokara Spa, and dining spots like Barchetta Italian Chophouse and the Ibis Sky Lounge.

Source: PR Newswire, April 30, 2025

Long Term Outlook for Fort Lauderdale-Pompano Beach-Deerfield Beach, FL (Division of Miami MSA)

June 2025 Forecast

Personal Income (Billions $)

202020212022202320242025202620272028

TotalPersonalIncome110.5122.1129.0139.3146.9153.1160.3168.9177.3

PctChgYearAgo6.110.55.78.05.54.24.75.45.0

WagesandSalaries52.058.664.769.173.276.380.184.288.3

NonwageIncome58.463.564.370.273.876.880.284.689.0

RealPersonalIncome(12$)96.4102.099.4103.4106.3107.3109.5113.2116.8

PctChgYearAgo4.05.8-2.54.02.81.02.03.43.2

PerCapitaIncome(Ths)56.962.965.469.472.074.678.382.486.3

RealPerCapitaIncome(12$)49.752.550.451.552.152.353.555.356.9