Florida.

DOGE has created a frenetic pace of changes to the business as usual in Washington, DC. $36.5 trillion in debt, with over a trillion dollars going to simply paying the interest rate each year on that debt, necessitated a dramatic shake-up to the status quo that has persisted for decades in our nation’s capital.

Will it be successful? In the short term we have already seen $170 billion in spending cuts, but with a deficit that is currently $2 trillion these cuts are insufficient to fix the budget. Longer and lasting changes will require legislation from Congress that entrenches austerity in law.

In addition to the DOGE firestorm, we have been enjoined in the latest dance craze – the Tariff Tango. Tariffs being threatened but not imposed, tariffs being imposed but then delayed, tariffs generally being used as a lever to achieve other policy objectives that are unrelated to international trade (border control, drug flows). It may not be as fun as doing the Macarena, but eventually the music will stop, and the economy will adjust to whatever the final version of these policies may be. In the meantime, you should probably dance by your 401k statement and not open it, financial markets do not respond well to uncertainty.

The atmosphere in DC seems to have drifted down to Tallahassee. Governor DeSantis has advocated for several policy changes that

mirror what is transpiring in our nation’s capital. He has called for a state-level version of DOGE for Florida’s government and public universities and colleges, and he has supported the end of property taxes and has signed immigration laws that aim to advance enforcement in the state.

I can’t seem to get this lyric from Bob Dylan’s1 song Tangled Up in Blue out of my head:

“There was music in the cafes at night and revolution in the air.”

I don’t think we would have seen this flurry of activity coming out of Tallahassee if it were not for the happenings in Washington, DC. I’m also not sure that in the long run these laws and initiatives will ultimately have a dramatic impact in Florida.

State and local governments in Florida must operate in a manner that results in balanced budgets. There is no running up debt in the manner that has driven our national debt to $36.5 trillion, and as a result there is unlikely to be the level of fraud and waste that is being revealed by DOGE taking place in Florida. DOGE in our state is simply budgetary oversight which must be in place when governments are required to balance budgets. 1

The end of property taxes sounds great initially, nobody likes paying taxes, and the notion that something you worked your whole life to purchase could be taken away because of an inability to pay property taxes – particularly when property assessments continue to rise alongside housing prices is problematic. However, local governments, school districts, first responder and other locally funded operations will have to be paid for somehow and when that reality of how they would be funded in lieu of a property tax becomes part of the discussion the support for such a move may make it difficult to meet the 60% approval necessary for a constitutional amendment.

Lastly, on the immigration front the main issue in Florida and at the national level is the ability to enforce these laws and the resources required to do so, particularly given the large number of illegal immigrants in both the nation and in Florida. Deportations will by necessity be focused on those who commit additional crimes when in the State.

Despite the head-spinning activity of the past two months, I am still not sure if there is revolution in the air or just sound and fury.

FLORIDA’S HOUSING MARKET

Inventories Rising, Sales Up and Prices up Slightly

The January 2024 single-family home report released by Florida Realtors shows a market for existing housing with a rising level of inventories, but still a small shortage—a shortage that was responsible for sparking rapid price appreciation during 2021-2023. The median price has been pushed to $152,200 above the peak price of the housing bubble in June 2006. The median sales price for single-family homes increased by $5,000

from January 2023, year-over-year, and now stands at $410,000—a year-over-year price appreciation of 1.2%. Price depreciation in the townhome/ condominium market has set in, at least for the moment, with a decrease in the median sales price of $7,500 year-over-year, registering at $312,500 in January of this year. This price change represents a 2.3% decrease in median prices year-over-year.

Inventories of single-family homes in January are up from 3.8 months of supply a year ago to 5.1 months of supply this year. This indicates an inventory balance that is still slightly skewed in favor of the sellers in the single-family market, according to the Florida Realtors report. 2 From January 2024 to January 2025, inventories of condominiums rose from 5.8 months to 9.1 months, indicating that the condo market has fully shifted from a seller’s market to a buyer’s market. There remain shortages in the existing singlefamily homes market, but condo markets have now fully swung in favor of buyers.

Distressed sales of single-family homes in the form of short sales remain at extremely low levels showing little impact of higher mortgage rates, prices, and homeowners insurance costs. They have increased from 25 in January 2024 to 28 in January 2025, an increase of 12.0% year-over-year but at still historically low levels. Foreclosure/ REO sales have also increased year-over-year by 26.7% versus January 2024, increasing from 131 to 166 in January of this year, but levels remain quite low. Traditional sales are up 3.4% year-over-year versus January 2024, as continued appreciation and homeowners’ insurance rates propagate affordability challenges that are partially offset by growing levels of inventories and by lower mortgage rates.

Distressed sales of condos in the form of short sales are still at very low levels, just 11, in January

2 According to Florida Realtors, the benchmark for a balanced market (favoring neither buyer nor seller) is 5.5 months of inventory. Numbers above that indicate a buyers’ market, numbers below a sellers’ market. Other real estate economists suggest a 6-to-9month inventory as being a balanced market.

2024. Foreclosure/REO sales are up 20.0% from January 2024 but remain at low levels of just 36. Traditional sales of condos are down 4.0% in January 2025 when compared to January 2024.

In January 2025, the percentage of closed sales of singlefamily homes that were cash transactions stood at 33.1%. For condos, that figure is much higher, as 54.3% of all closings were cash transactions. The condo market’s share of cash transactions decreased by 1.6 percentage points year-over-year, while the single-family home market share of cash transactions has increased by 0.6 percentage points. This is occurring amidst a still-tight market for mortgages. 3

Source:FloridaRealtors

Figure 1 depicts the monthly realtor sales of existing single-family homes, as well as the 12-month moving average of these sales. The smoother moving average line evens out the seasonality and other statistical noise inherent in monthly housing market data. Sales had been on a strong upward path over the past post-pandemic, and the 12-month moving average and monthly sales vastly exceeded their peak value during the housing bubble. Over the past two years the 12-month moving average has sharply declined, but in recent months, it has started to flatten out. This reflects affordability issues easing in the face of slower price appreciation over the past year; a rising inventory of houses for sale; slight easing in mortgage credit markets; stabilizing homeowners insurance premiums; and lower mortgage rates for

3 The Mortgage Credit Availability Index (MCAI), put out by the Mortgage Bankers Association, increased by 2.5% to 99.0 in January from December 2024. The increase in the index in November from October indicates that mortgage lending standards loosened. The index is benchmarked to 100 in March 2012. Relative to that month, mortgages in January 2025 were 1.0% less available. In 2006, the value of this same index approached 900 and at the start of 2020, the index was near 185. Despite lower mortgage rates, financing is not available to all comers.

those able to get loans. The short-lived COVID-19 plunge in sales during January and May pulled down the moving average in 2020, but the immediate post-shutdown rebound was strong, fueled by pent-up demand and then record-low mortgage rates.

The housing market in Florida is still challenged by the burden of high prices and higher insurance premiums despite somewhat lower mortgage rates. Economic and job growth in Florida are forecasted to slow as the U.S. economy decelerates. More baby boomers continue to reach the end of their working lives, and this bodes well for continued population growth via the immigration of retirees, as well as job seekers to Florida. We expect sales to remain under some pressure, as increases in the supply of new housing will help keep price appreciation contained in an environment with continuing strength in the demographic drivers of housing demand. Housing demand had some relief from higher mortgage rates that had hit 8.0% at their recent peak, with the possibility of the Federal Reserve Bank continuing interest rate cuts in the year ahead. Also, continued relief from recent surges in homeowners’ insurance rates will help support this demand.

Figure 1.

$100,000

$50,000

$0

Source:FloridaRealtors

Figure 2 displays median sales prices for existing single-family homes. Median sales prices have continued to climb since bottoming out in 2011. The double-digit pace of price increases in 2016 and 2017, which eased in 2018 and 2019, resumed in 2020. Over the past year, the 12-month moving average of median sales prices has risen by more than $6,772.

Low inventories of existing homes for sale and lagging housing starts growth since 2016 contributed to the environment where home prices rose at a rapid pace. But others who have refinanced mortgages at sub-3.0% levels have been hesitant to sell when current rates are near 7.0%. However, the slowing of housing demand will result in a slowdown in housing starts. Some tightness in the housing market will be a persistent feature of Florida’s economy for several years to come.

This period of unsustainable multi-year price appreciation has ended. The possibility of recession or economic slowdown, coupled with relatively higher mortgage rates, has dampened rising prices. The economic conditions may lead to some price depreciation, but not anything like the 2008-09 collapse in prices.

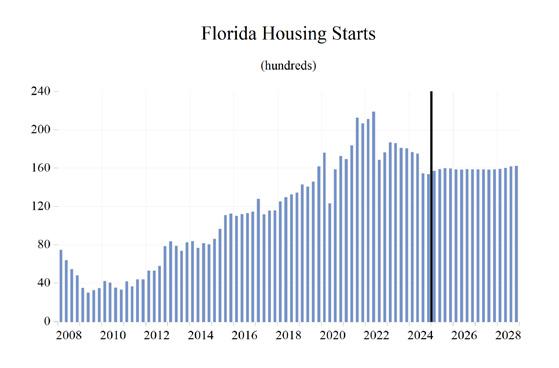

Housing starts in 2028 are expected to increase to slightly over 161,000, falling from 183,675 in

2023 to 158,756 in 2027. Lower interest rates should support this sector of the economy after higher rates had a chilling effect on home construction activity.

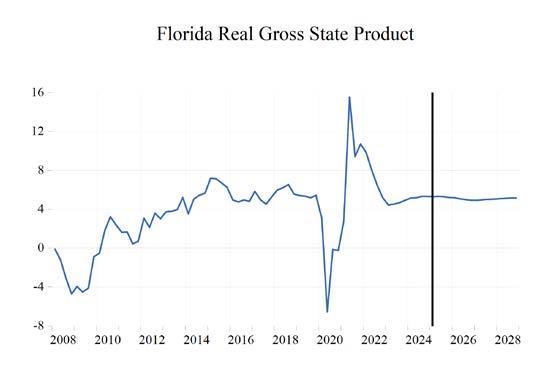

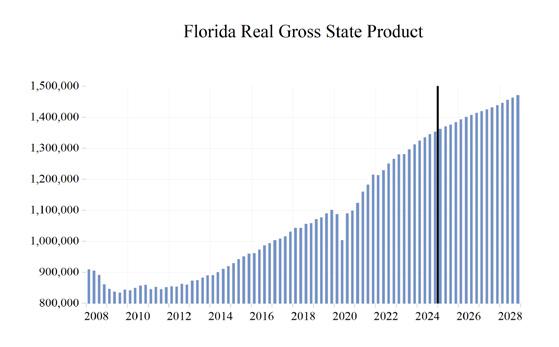

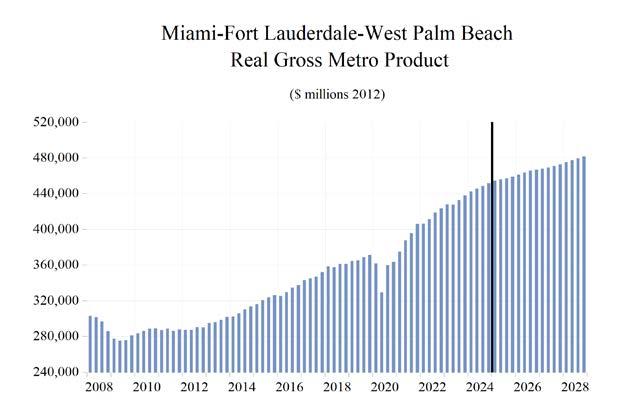

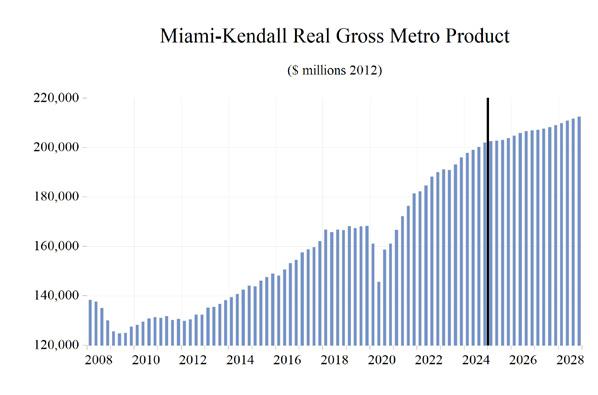

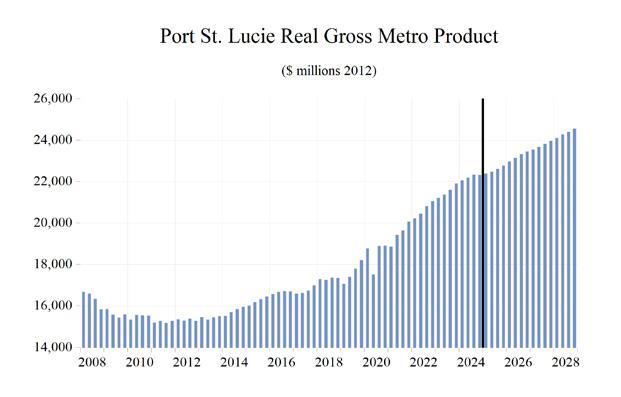

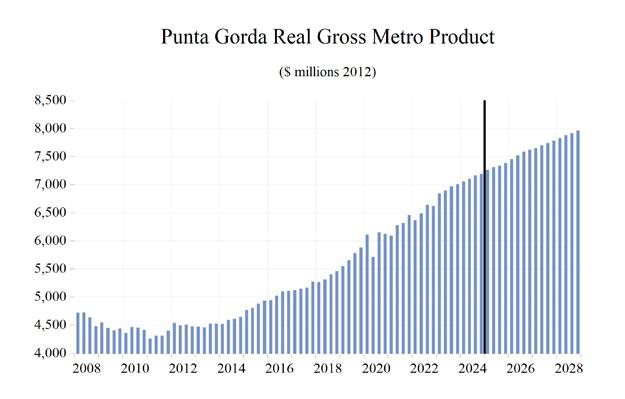

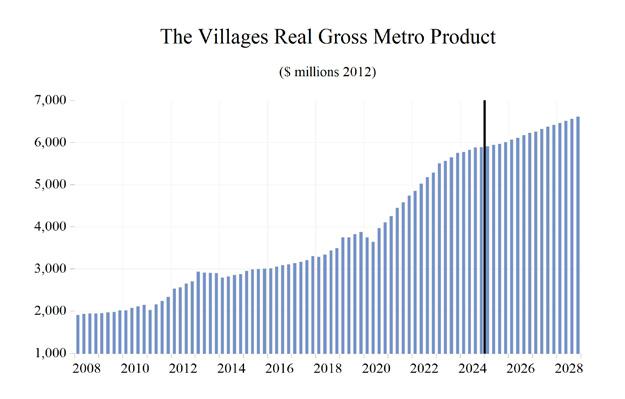

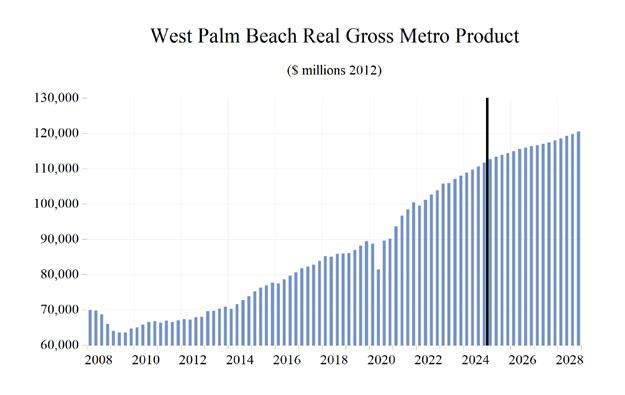

GROSS STATE PRODUCT

Lockdowns caused a contraction in real Gross State Product (GSP) in 2020 of 1.4% year-over-year. This decline was smaller than both annual declines that occurred during the Great Recession (3.9% in 2008 and 5.5% in 2009). However, the second quarter’s year-overyear decline in 2020 was steeper than any quarter during the Great Recession. Fortunately, the COVID-19 recession, while much deeper than the previous recessions, was also very short-lived at just two months. Florida’s decision to avoid heavyhanded and lengthy restrictions on the economy allowed the state to come roaring back in 2021 when growth hit 9.4%.

During 2025-2028, Florida’s real GSP is expected to grow an average of 2.2% annually. This growth will include a 2025 deceleration to 2.5% from 3.6% in 2024. The 2.2% average growth from 2025 through 2028 will be a slower pace for growth compared to the prior four years (when growth averaged 5.8%), and this is due to an anticipated slowdown in the U.S. economy. This projected average rate of growth for Florida’s economy over the 2025-2028 period is higher than the average of our forecasted real GDP growth for the U.S. economy (1.8%) over the same time frame.

Housing prices have soared from the bottom of the housing crisis. During the crisis, median existing-home prices fell to a low of $122,200 but now stand at $410,000. This price appreciation improved household balance sheets in Florida.

With the price appreciation to date, Florida has long since recovered the aggregate housing value lost during the housing market collapse and soared past the lofty levels at the peak of the housing bubble, but higher mortgage rates and a slowing economy may lead to some declines in prices. Fortunately for homeowners, but not for potential buyers, any price declines that do occur will not be anything like the price collapse of 2008-09.

In 2017, Florida’s economy broke the $1-trillion threshold with a nominal (not adjusted for inflation) Gross State Product (GSP) of $1.003 trillion, which increased to $1.29 trillion in 2021. GSP reached $1.47 trillion in 2022 and GSP hit $1.60 trillion in 2023. We expect GSP to rise to $1.80 trillion in 2025, $1.90 trillion in 2026, $1.98 trillion in 2027 and $2.07 trillion in 2028.

Real GSP (adjusted for inflation) exceeded $1.1 trillion in 2021 and will climb to nearly $1.46 trillion in 2028.

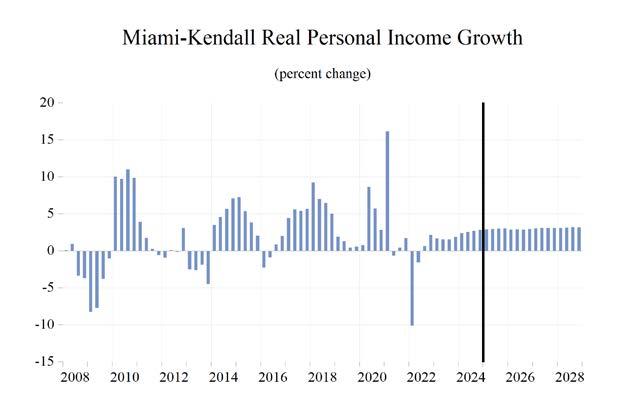

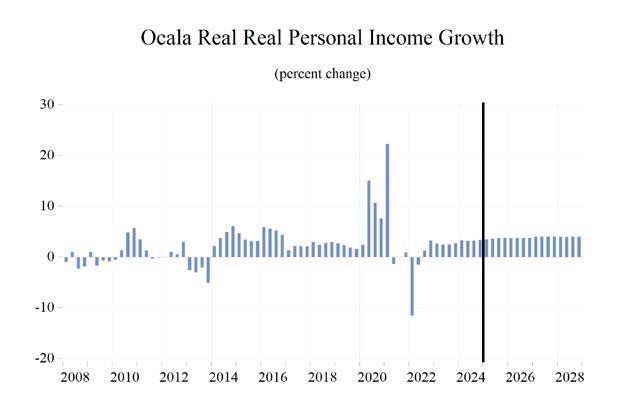

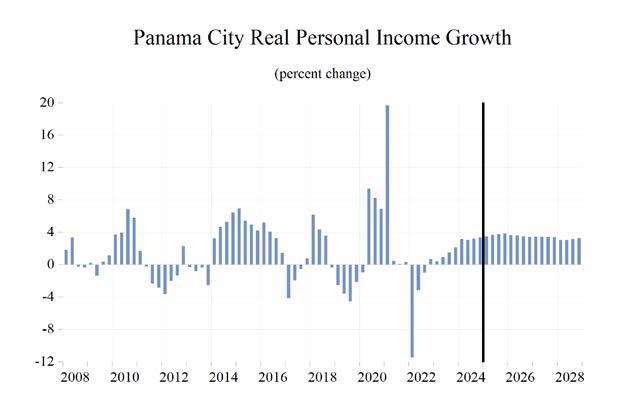

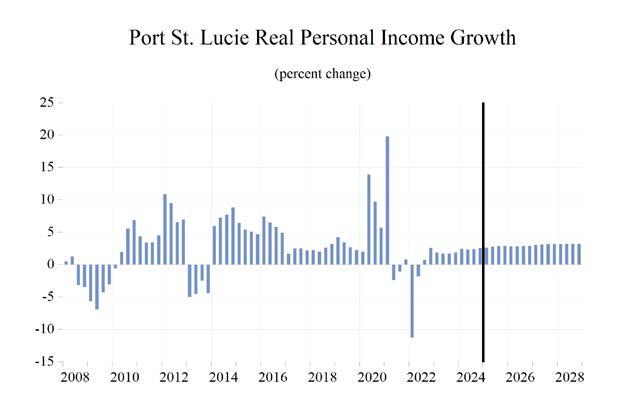

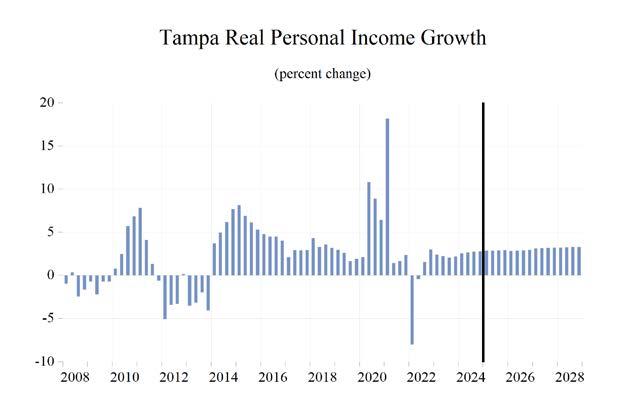

PERSONAL INCOME, RETAIL SALES, AND AUTO SALES

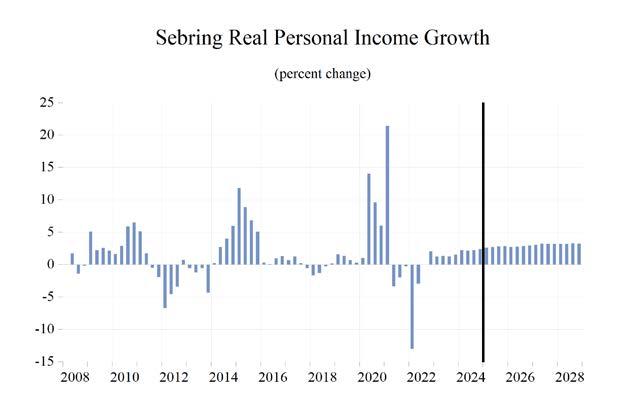

Nominal personal income growth surged to 6.5% (thanks to COVID stimulus and bonus unemployment payments) in 2020 and 11.3% in 2021, amid further federal stimulus spending and tax credits. Nominal personal income will be slightly above $2.0 trillion in 2028, marking an increase in personal income of over $1.0 trillion from its Great Recession low point in 2009.

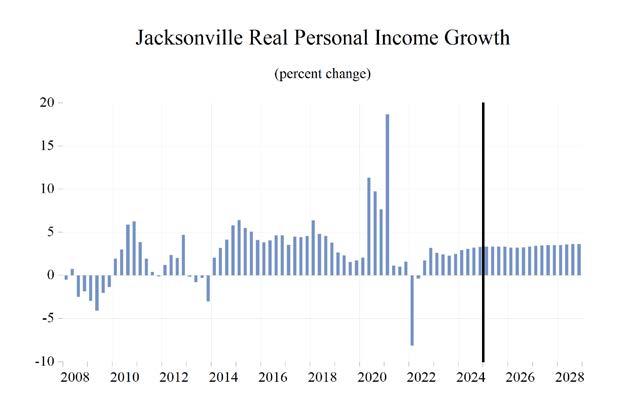

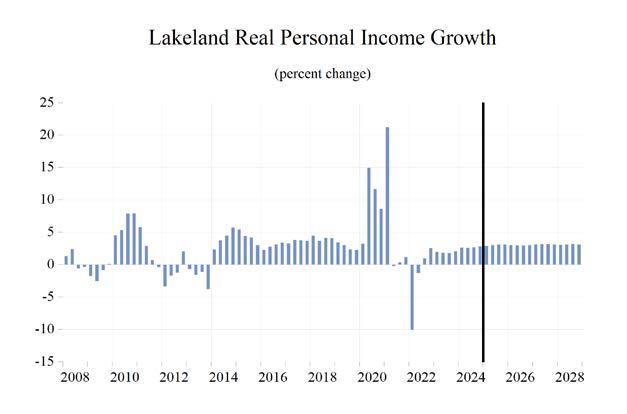

Thanks to rising inflation, real personal income contracted by 1.7% in 2022 but rose by 3.0% in 2023. Growth was 3.3% in 2024 and is expected to be 2.5% in 2025, 3.2% in 2026, 3.6% in 2027, and 3.5% in 2028. Real personal income growth during 2025-2028 will average 3.2% in Florida, weighed down a bit by slower growth and some persistent inflation in the near term, but still 0.5 percentage points higher than our forecast for the U.S.

Real disposable income growth, because of surging inflation, turned negative at -3.8% in 2022. Average growth in Florida during 2025-2028 will be 3.5% with inflation steadily declining, accompanied by still-solid wage and salary growth supported by Florida’s sturdy labor market.

Financial markets experienced a strong rebound from the COVID-19 induced financial downturn, thanks in large part to the Federal Reserve Bank’s resumption of the financial crisis zero-interest-rate policy, quantitative easing, and the other federal stimulus programs. The Dow Jones Industrial Average fell to 18,214 in March 2020 but then surged to a then new record high of 36,953 in January 2022. The market declined as the Fed commenced its fight against inflation, causing financial markets to decline from those highs to the Dow falling under 34,000. Recently with the Fed starting to cut interest rates, the market hit a new all-time high above 45,000 but has declined significantly in the past two months with DOGE and tariff uncertainty spooking financial markets.

Home equity in Florida did not recover as rapidly as financial asset wealth following the Great Recession, but housing prices have been climbing over the past five years and current median prices have greatly exceeded the once heady highs seen during the housing bubble. The housing market did not suffer the pandemic pain that financial markets experienced during the COVID-19 recession, nor will it during any economic slowing in the next few years. Home prices could fall slightly if this slowdown is worse than anticipated, but to date, price declines have not materialized in a housing market where inventories are rising with the Fed putting interest rate cuts on hold for now.

Housing may not be as large a driver in the economy over the next few years as housing starts have dipped from their post-pandemic highs. However, housing will still be an important economic factor as builders work to replenish,

albeit at this diminished pace, depleted inventories as Florida’s population continues to grow, thus driving housing demand.

Retail spending was hurt in the short run by the public health shutdowns and the effective collapse of the tourism industry in Florida from the pandemic response. Retail spending in the first quarter of 2020 contracted by 11.8% at an annual rate followed by a 9.3% contraction for the second quarter. Spending levels exploded after the short, deep recession and a series of economic lockdowns, fully countering the first half of the year’s plunge, and driving full-year growth into positive territory for the year. In 2021, retail sales grew robustly compared to 2020, rising 18.9% year over year. Sales came back down to Earth from the postlockdown growth, and after a few quarters of weak growth from an erosion of consumers’ purchasing power and a slowing economy, growth will average 4.7% during 2025-2028, hitting 3.9% in the final year of our forecast.

Consumers began to purchase light vehicles at a faster pace after the Great Recession ended, releasing several years of pent-up demand, and continued to do so through 2016, though at a considerably slower pace. The 2020 COVID recession once again caused a contraction of new passenger car and truck registrations of 5.1% year-over-year in the fourth quarter of 2020, versus the fourth quarter of 2019. This contraction was not as sharp or as persistent as the one that took place during the Great Recession. Supply chain disruptions injected chaos into light vehicle markets, and prices for both new and used vehicles soared in the wake of these problems. New cars were selling for thousands above sticker price and used vehicle inflation at one point hit 40% yearover-year. The rate of vehicle inflation has declined significantly, but prices remain still elevated above pre-pandemic levels and interest rates on auto loans remain high for now.

Pent-up demand and the economic recovery boosted registrations coming out of the COVID

recession, and vehicle registration growth in Florida surged in 2021, rising to 11.6%. Registration growth in Florida during 2025-2028 will average 1.3%. Over this period, high interest rates on auto loans and high auto prices potentially further impacted by tariffs, will decelerate the growth in the number of new registrations in 2024 to 1.4%. In 2028, Florida’s new passenger car and truck registrations will be slightly under 1.47 million.

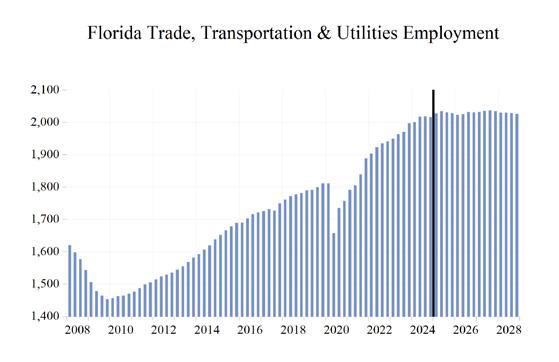

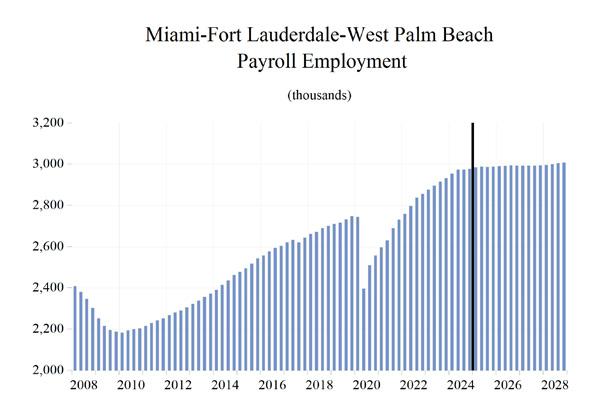

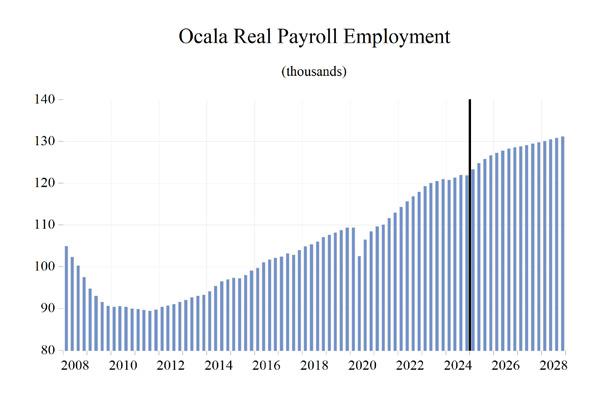

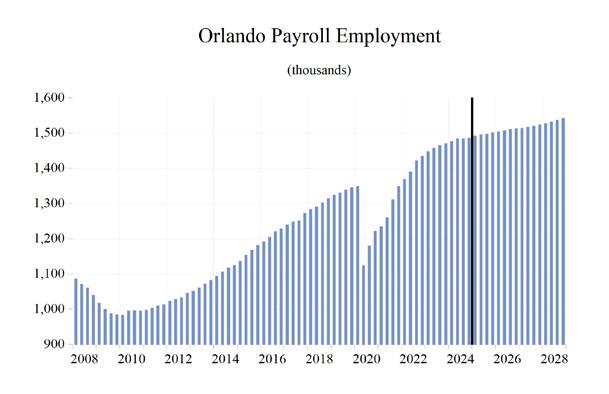

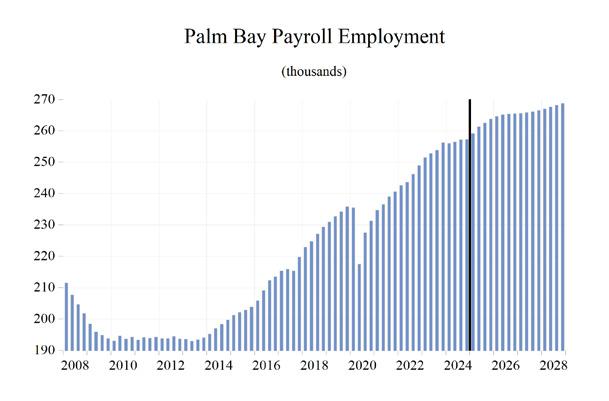

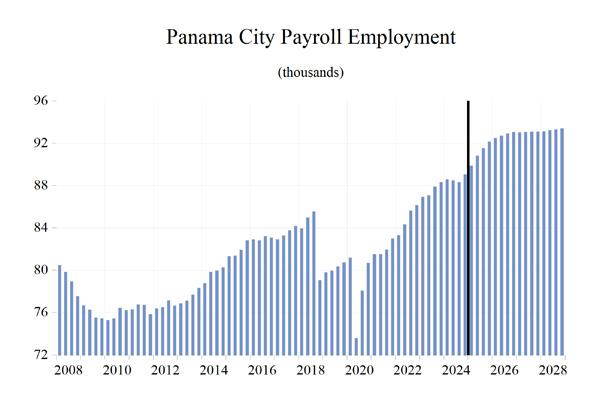

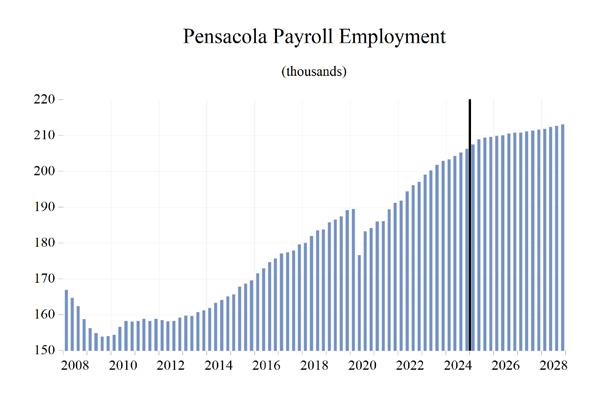

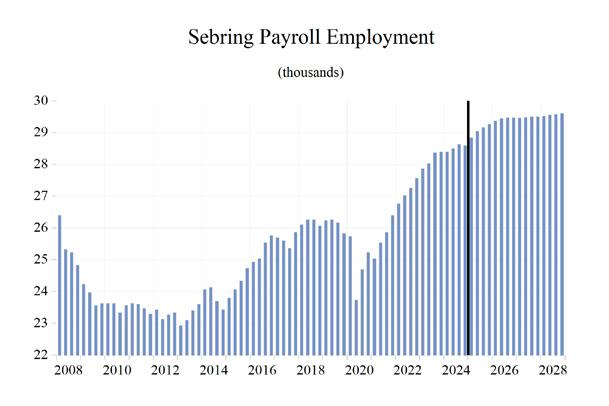

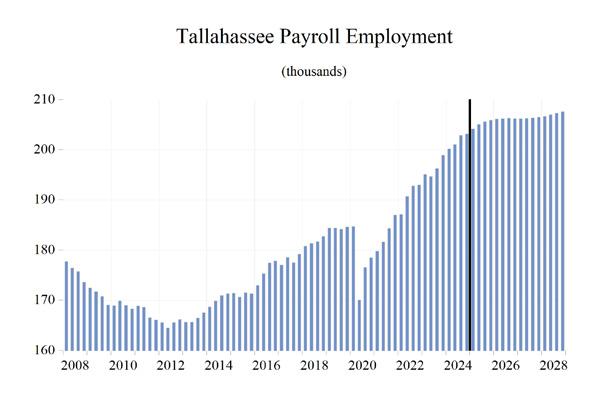

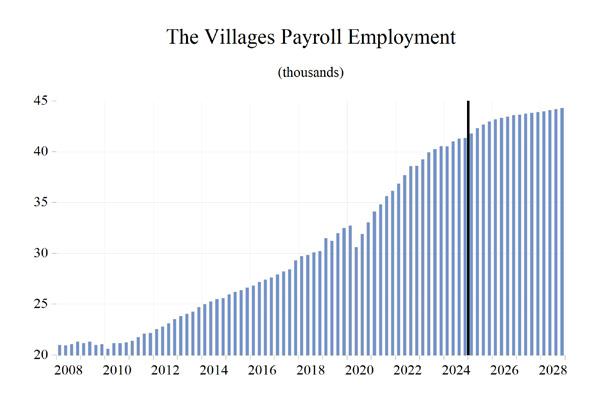

EMPLOYMENT

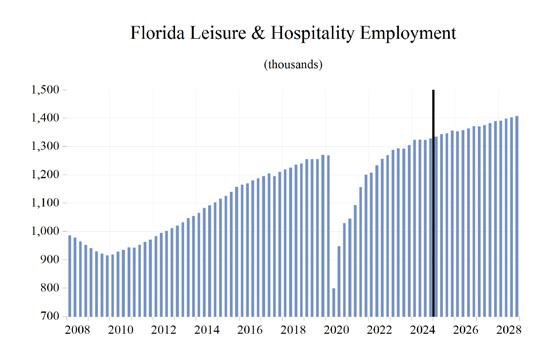

Business payrolls were devastated by the COVID-19 lockdowns, as layoffs happened in a massive, but thankfully short-lived, wave. In Florida, total business payrolls surpassed their pre-pandemic levels late in 2021 as Florida ended ill-advised lockdowns much sooner than most other states. Since then, the pace of Florida’s labor market recovery has exceeded the recovery of the national job market, and it will continue to do so throughout the remainder of our forecast horizon in 2028.

The COVID-19 lockdowns, closures, and travel restrictions, were followed by aggressive federal spending and monetary policies to counter the devastating effects of shutting down the economy. Job growth plummeted in March and April, contributing to a 4.9% year-over-year contraction in 2020, but Florida’s decision to open the economy and avoid further lockdowns caused job growth to roar back to 4.6% in 2021, accelerating to 5.7% in 2022.

In 2024, the effects of the slowing economy impacted job growth. Total payroll jobs rose by 3.3% in 2023 and then decelerated to 2.1% growth in 2024. The deceleration will continue to 1.3% in 2025, 0.7% in 2026, 0.3% in 2027 before ticking up 0.6% in 2028. Florida’s labor market will continue to outperform the national economy each year through 2028.

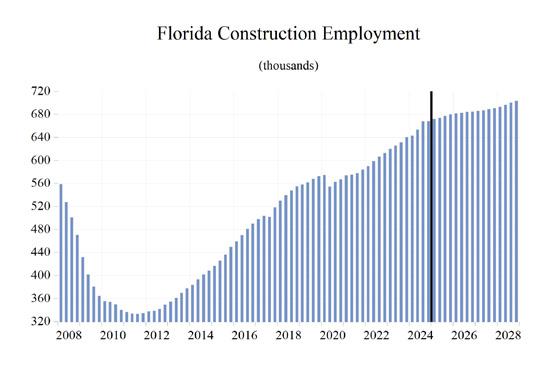

Construction job growth turned slightly negative in 2020 but increased in 2021, with housing starts rising amid depleted inventories and as large-scale public works projects that carried on uninterrupted by COVID. Construction job growth of 4.2% in 2019 fell to -0.1% in 2020 and then recovered to 2.3% in 2021. Job growth rose to 4.2% in 2022 and grew by 4.5% in 2023, and by 4.9% in 2024. Job growth will slow to 2.7% in 2025, 1.1% in 2026, and 0.7% in 2027 then rise to 1.5% in 2028. Average annual job growth during 2025-2028 will be 1.5%. Construction employment will average 698,588 in 2028.

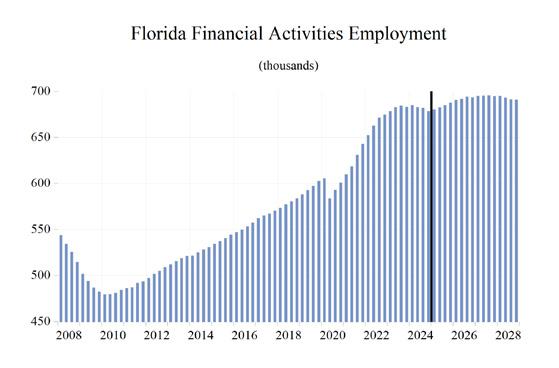

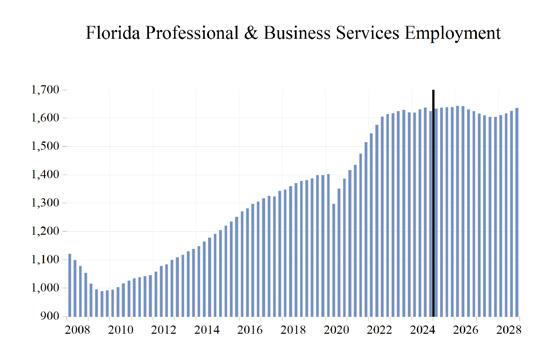

The Professional and Business Services sector, one of the fastest-growing sectors coming out of the COVID recession, is in for a deceleration as the economic slowdown develops. Job growth in this sector is expected to average -0.1% during 2025-2028. Growth in this sector fell to -2.3% in 2020 due to the pandemic and lockdowns. Growth surged to 7.4% in 2021 and then to 8.6% in 2022. It slowed to 2.4% in 2023 and continued to trend lower at 0.3% in 2024. In 2025, growth should be 0.5%, then after a couple of years of mild job losses of 0.1% and 1.6% in 2026 and 2027, growth resumes at 0.8% in 2028.

The Information sector is a mix of high-tech ventures, including computer programming and software development, but job growth in this sector has long been weighed down by the unraveling of the traditional print media. Structural and technological changes in the gathering and dissemination of information decimated the print industry. Sources of growth within the information sector in Florida such as software development, data processing and hosting, wireless telecommunications, and content creation and they have offset the loss of jobs in traditional print media and publishing. Job growth dropped to -6.2% in 2020, recovered to 5.4% in 2021, and hit 10.3% in 2022—boosted by the roll-out of 5G wireless services. Job growth slowed to 1.7% in 2023 before it slid to -0.4% in 2024. Growth should come in at 0.3% in 2025 and

2026 and then contract by 2.6% in 2027 and 1.4% in 2028. The projected growth rate will average -0.9% during 2025-2028.

The Education and Health Services sector in Florida has grown consistently, even during the worst part of the 2007-2009 Great Recession. However, the pandemic hit this sector hard, as schools closed and most elective procedures, screenings, and wellness checks were postponed; employment contracted by 2.3% in 2020. The state’s growing population, with a larger share of older residents with a higher demand for health services, has supported growth in this sector and will continue to do so. Job growth will continue, though at a decelerated pace, through the next several years. During 2025-2028, employment in this sector is expected to continue to expand at an average rate of 1.4%.

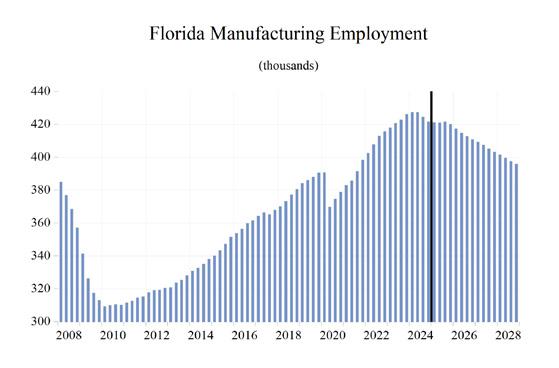

During 2016-2019, Manufacturing job growth averaged 2.9% in Florida, as trade policies helped level the playing field for U.S. manufacturers. The economic environment for the manufacturing sector is increasingly uncertain as slower economic growth looms over the U.S. and the “Tariff Tango” is in full swing. After job losses of 2.2% in manufacturing in 2020, the economy and manufacturing in Florida came back to life. Job growth accelerated to 2.9% in 2021 and rose by 5.2% in 2022. After that year’s burst, job growth decelerated to 2.9% in 2023 and then slowed to 0.8% in 2024; the sector will once again lose jobs from 2025 through 2028. Average job growth during 2025-2028 will be -1.6%.

The State and Local Government sector in Florida is enjoying higher revenues from increased property values and state sales tax revenues that continue to exceed forecasts. As housing prices soared during 2020-22, property tax revenues rose as well. Though housing price growth has slowed, there will not be a repeat of the local government budget shortfalls after the housing market crashed which led to job losses in this sector that persisted for six years from 2009 through 2014.

As Florida’s population and economy continue to grow, the demand for state and local government services continues to rise as well. To meet this demand, growth in state and local government employment will be necessary despite DOGE arriving in Tallahassee, but not to the levels seen during the housing boom. Average job growth in State and Local Government during 2025-2028 will be 0.8%, after annual growth hitting 2.8% in 2023 and slowing to 2.3% in 2024. The slowing economy may eventually put some pressure on both sales and property tax revenue growth (assuming the latter isn’t overturned), but this should not result in any severe budgetary issues or layoffs in the sector.

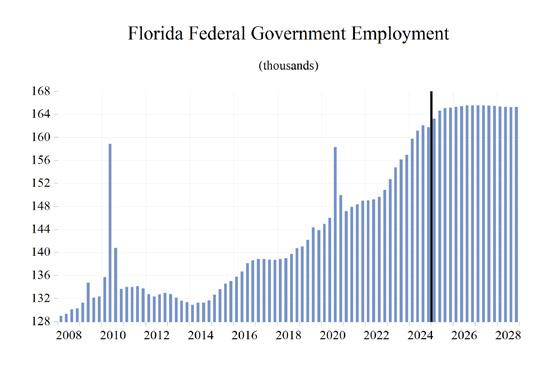

Federal Government employment growth boosted by the decennial census hiring turned negative in 2021 after the temporary hiring surge during the 2020 census year ended. However, historic deficits, a national debt of over $36.5 trillion, and an increasing debt service burden along with DOGE being in full swing will become considerable factors going forward. Job growth in the Federal Government sector in Florida will average 0.6% during 2025-2028.

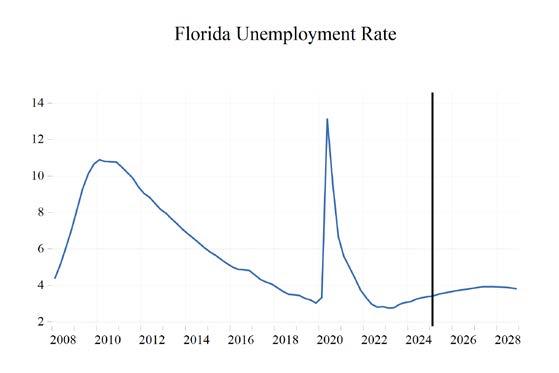

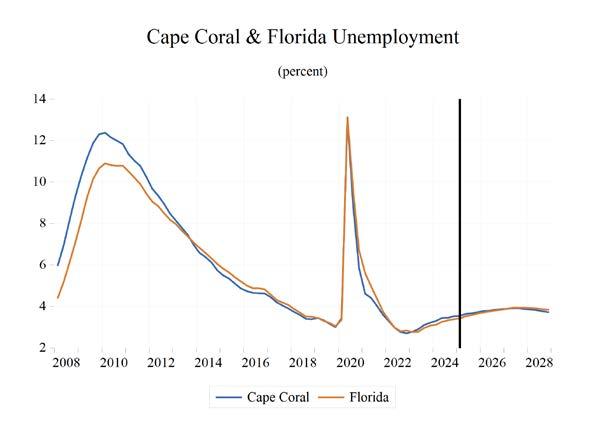

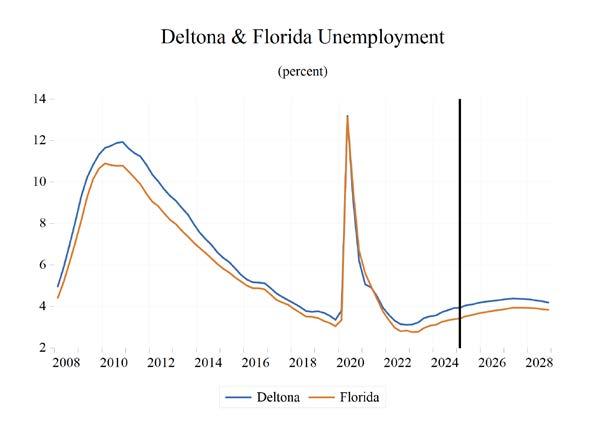

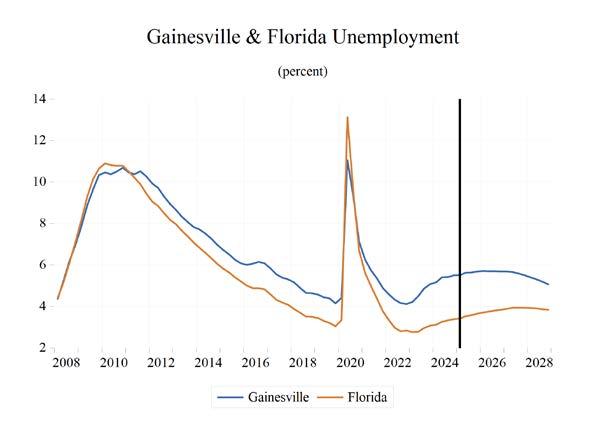

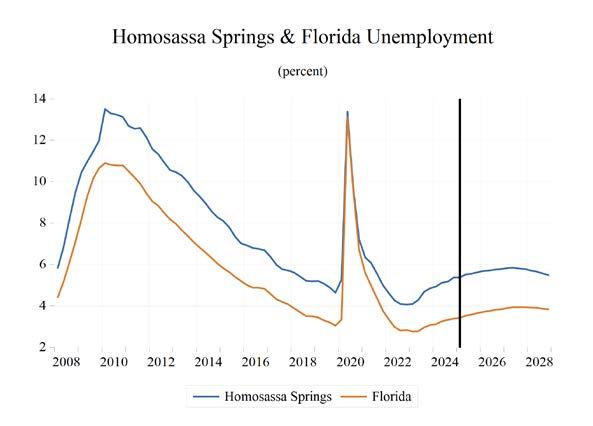

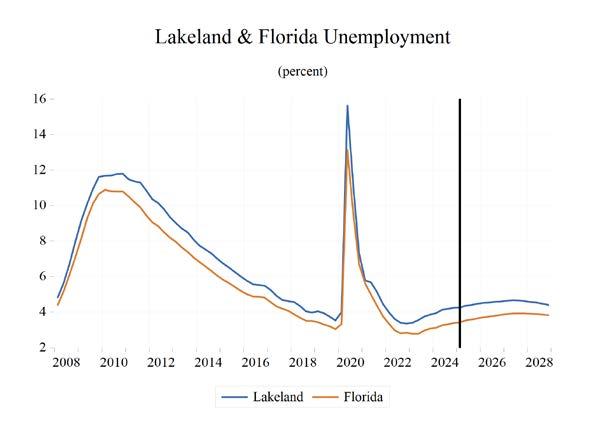

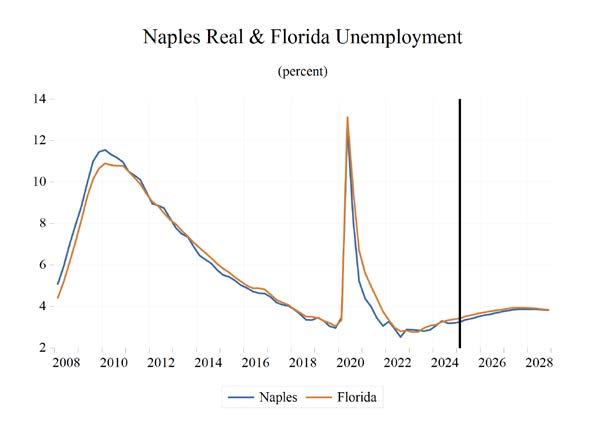

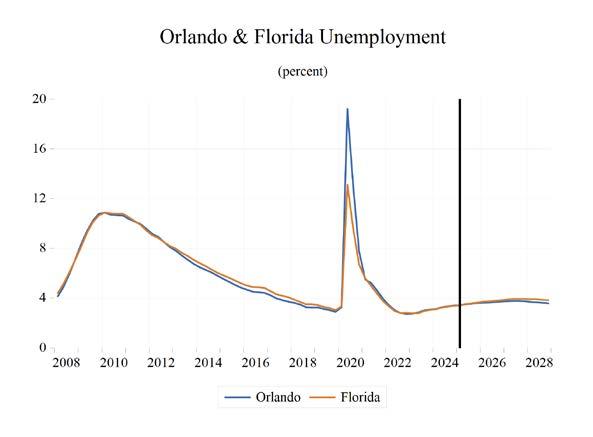

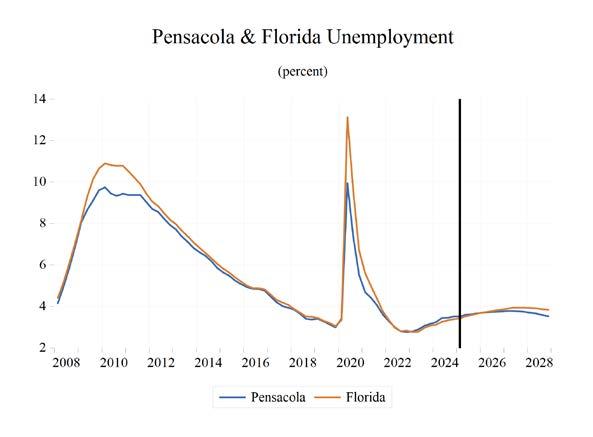

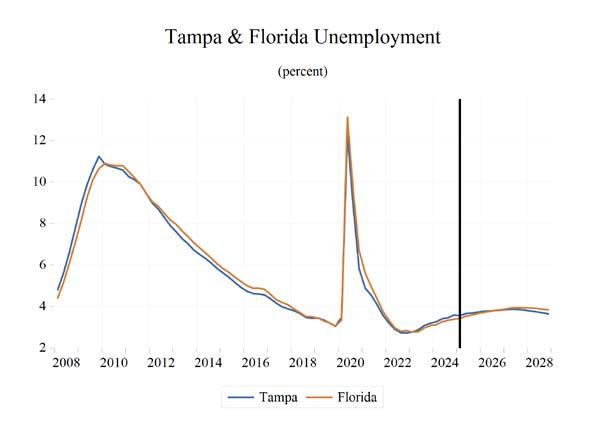

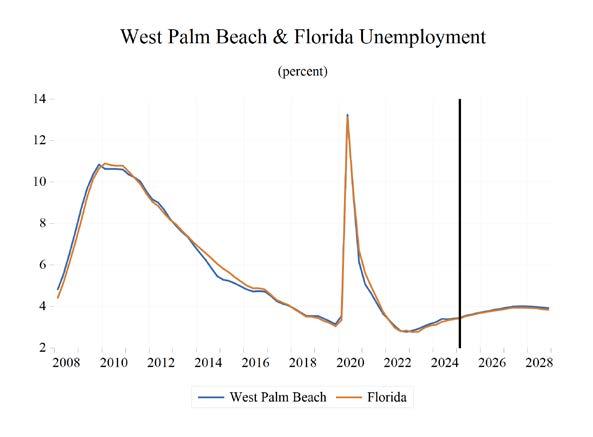

UNEMPLOYMENT

The unemployment rate in Florida has fallen from its May 2020 peak of 14.2% and stands at 3.4% as of December 2024. When unemployment spiked to 14.2% in May 2020, it was 2.9 percentage points higher than the peak level of unemployment from the Great Recession. This unprecedented spike in unemployment transpired over just three months, while it took two-anda-half years for the unemployment rate to peak in the Great Recession. The December 2024 unemployment rate is up 0.3 percentage points from a year ago and is 0.7 percentage points lower than the U.S. unemployment rate.

Both nationally and in Florida, the number of workers who are working part-time, but not by choice, and workers marginally attached to

the labor force—defined as workers who are not currently employed or seeking employment but express a desire to work, are available for a job, and have searched for work within the past 12 months —spiked during the public health shutdowns. When adding these groups with discouraged workers—defined as workers who are currently not working and did not look for a job in the four weeks preceding the Bureau of Labor Statistics’ monthly survey of households—to the headline unemployment figure, U-3, we get the broadest measure of unemployment estimated by the BLS, known as U-6.

Looking at U-6, we see a labor market in Florida that remains the strongest in several decades. U-6 in Florida averaged 6.6% during 2024. Meanwhile, the national rate of U-6 averaged 7.5% during the same period. U-6 unemployment in Florida during 2024 was 5.5 percentage points below the U-6 rate in 2014, 9.4 percentage points lower than the 16% rate in 2012, and down 12.7 percentage points from its peak average rate of 19.3% in 2010 (the nation’s U-6 averaged 16.7% in 2010). As the national economy continues to slow, these numbers will begin drifting slightly higher in Florida in the face of a slowing national economy.

Analysis of how U-6 behaves relative to the headline unemployment rate (U-3) continues to provide valuable information necessary to fully comprehend the health of the labor market. The gap between these two measures continues to narrow. The average spread between U-6 and U-3 during 2024 was hovering at 3.5% at the national level. That gap was the same for 2024 in Florida.

Table 1. Annual Summary of the University of Central Florida's Forecast for Florida 202020212022202320242025202620272028

Personal Income and GSP

PersonalIncome(Bil.$)1220.81358.81436.11553.41645.41729.21833.61939.42046.3

Florida.(%ChYearago)6.511.35.78.25.95.16.05.85.5

U.S.(%ChYearago)6.89.23.15.95.55.15.75.14.9

PersonalIncome(Bil.2012$)1159.61230.31209.41246.21286.71318.91361.01409.61459.3

Florida.(%ChYearago)4.46.1-1.73.03.32.53.23.63.5

U.S.(%ChYearago)5.74.9-3.32.12.92.32.82.92.9

Disp.Income(Bil.2012$)1032.41083.41042.21105.91141.61176.71221.01265.41310.4

Florida.(%ChYearago)4.04.9-3.86.13.23.13.83.63.6

U.S.(%ChYearago)6.33.5-5.65.12.92.83.43.02.9

GSP(Bil.$)1142.01298.61465.31600.81705.41802.41900.41979.72067.8 (%ChYearago)0.713.712.89.26.55.75.44.24.5

GSP(Bil.2012$)1069.81170.51239.91292.81339.61373.31404.01428.91459.1 (%ChYearago)-1.49.45.94.33.62.52.21.82.1

Employment and Labor Force (Household Survey % Change Year Ago)

Employment-4.94.65.73.32.11.30.70.30.6

LaborForce-1.82.53.62.80.70.50.60.50.5

FLUnemploymentRate(%)8.24.73.02.93.33.53.83.93.9 U.S.UnemploymentRate(%)8.15.43.63.64.04.24.44.54.4

Nonfarm Employment (Payroll Survey % Change Year Ago)

TotalNonfarm

U.S.-5.82.94.32.21.31.10.40.00.1 Florida-4.94.65.73.32.11.30.70.30.6 Mining-3.7-0.92.83.93.6-1.50.32.10.3 Construction-0.12.34.24.54.62.71.10.71.5 Manufacturing-2.22.95.22.90.8-1.0-1.7-1.8-1.9 NondurableGoods-3.32.65.12.73.5-0.9-2.2-1.1-0.8 DurableGoods-1.73.15.23.1-0.5-1.0-1.4-2.2-2.4

Trans.Warehs.&Utility-3.25.25.22.32.20.9-0.10.3-0.3 WholesaleTrade-2.82.85.73.73.41.30.41.0-0.5 RetailTrade-4.74.14.01.91.70.4-0.9-0.1-0.2 FinancialActivities0.15.06.32.50.00.31.30.4-0.4 Prof.andBusinessServices-2.37.48.62.40.30.5-0.1-1.60.8 Edu&HealthServices-2.32.64.45.53.12.51.81.21.1 Leisure&Hospitality-19.711.210.54.32.31.51.31.31.5 Information-6.25.410.31.7-0.40.30.3-2.6-1.4 FederalGov't.4.9-1.11.13.63.92.10.60.0-0.1 State&LocalGov't.-2.9-1.20.22.82.31.50.60.50.5

Population and Migration

Population(ths)21614.021901.922447.322963.723409.023650.423789.923945.224109.9 (%ChYearago)1.11.32.52.31.91.00.60.70.7

NetMigration(ths)60.0109.5148.4122.8102.142.438.542.445.5 (%ChYearago)6.182.535.5-17.3-16.9-58.4-9.210.27.3

HousingStartsTot.Private(ths)157.8193.1193.8183.7165.1158.9158.8158.8161.1

HousingStartsSingleFamily(ths)111.6144.1133.8127.1125.8121.0115.3111.4108.2

HousingStartsMulti-Family(ths)46.149.060.056.539.337.943.547.352.9

Consumer Prices

(%ChYearago)1.25.49.66.12.92.93.02.42.0

Table 2. Quarterly Summary of the University of Central Florida's Forecast for Florida*

2024Q42025Q12025Q22025Q32025Q42026Q12026Q22026Q32026Q42027Q12027Q22027Q32027Q4

Personal Income and GSP

PersonalIncome(Bil.$)1670.11691.11713.71743.41768.81797.11822.61845.31869.51899.61926.71953.11978.4

Florida.(%ChYearago)1.21.31.31.71.51.61.41.21.31.61.41.41.3

U.S.(%ChYearago)1.31.31.31.61.41.61.31.11.21.51.21.21.1

PersonalIncome(Bil.2012$)1297.31303.61312.01325.01335.11346.21356.61365.71375.51389.71403.61416.81428.5

Florida.(%ChYearago)0.70.50.61.00.80.80.80.70.71.01.00.90.8

U.S.(%ChYearago)0.70.50.50.80.70.80.70.50.60.90.80.70.7

Disp.Income(Bil.2012$)1150.71156.41163.91188.81197.61207.61216.91225.31234.31247.41259.91271.91282.4

Florida.(%ChYearago)0.70.50.62.10.70.80.80.70.71.11.00.90.8

U.S.(%ChYearago)0.70.50.61.80.70.80.70.50.60.90.80.80.7

GSP(Bil.$)1738.11765.01789.81814.21840.81869.51890.11910.81931.01949.81969.51988.92010.5

(%ChYearago)1.21.51.41.41.51.61.11.11.11.01.01.01.1

GSP(Bil.2012$)1353.51362.61370.41376.21384.11392.81400.91408.21414.21419.21425.31431.91439.3

(%ChYearago)0.60.70.60.40.60.60.60.50.40.40.40.50.5

Employment and Labor Force (Household Survey % Change Year Ago)

Employment0.10.50.40.20.20.10.10.10.00.00.10.10.1

LaborForce-0.30.50.40.10.10.20.10.10.10.10.10.10.1

FLUnemploymentRate(%)3.43.43.53.63.73.73.83.83.83.93.93.93.9

U.S.UnemploymentRate(%)4.24.14.24.24.34.34.34.44.44.54.54.54.5

Nonfarm Employment (Payroll Survey % Change Year Ago)

TotalNonfarm

U.S.0.30.40.30.20.10.10.10.00.00.00.00.00.0

Florida0.10.50.40.20.20.10.10.10.00.00.10.10.1

Mining-1.3-0.2-0.1-0.1-0.3-0.20.40.60.50.60.70.20.1

Construction0.10.60.30.50.40.20.20.20.10.20.10.30.3

Manufacturing-0.7-0.1-0.10.1-0.3-0.7-0.6-0.5-0.5-0.3-0.5-0.6-0.5 NondurableGoods-1.30.10.0-0.7-0.6-0.7-0.6-0.5-0.3-0.2-0.2-0.3-0.3

DurableGoods-0.4-0.2-0.10.5-0.2-0.6-0.7-0.5-0.6-0.4-0.6-0.7-0.6 Trans.Warehs.&Utility-0.10.60.3-0.2-0.1-0.30.10.4-0.10.00.20.1-0.1 WholesaleTrade0.90.30.1-0.1-0.30.30.20.50.20.50.2-0.1-0.1 RetailTrade-0.50.70.4-0.2-0.2-0.70.00.2-0.3-0.20.20.2-0.2

FinancialActivities-0.50.30.30.30.40.40.20.3-0.10.20.00.0-0.1

Prof.andBusinessServices-0.70.50.20.10.00.3-0.1-0.7-0.4-0.5-0.4-0.30.0 Edu&HealthServices0.70.80.80.50.40.50.40.40.20.40.30.30.2 Leisure&Hospitality0.30.60.60.20.7-0.10.20.50.6-0.10.40.50.5

Information0.70.6-0.80.00.70.6-0.3-0.7-0.5-0.4-0.9-1.0-0.7

FederalGov't.-0.20.90.90.20.10.10.10.10.00.00.00.00.0 State&LocalGov't.0.50.40.30.10.20.10.20.10.10.10.10.10.1

Population and Migration

Population(ths)23,540.923,597.523,634.723,668.123,701.423,735.423,770.723,807.423,845.923,885.523,925.223,965.024,005.2

(%ChYearago)0.30.20.20.10.10.10.10.20.20.20.20.20.2

NetMigration(ths)76.158.939.635.635.636.337.639.141.042.142.442.442.8 (%ChYearago)-21.4-22.5-32.8-10.20.02.23.54.04.82.90.60.10.9

HousingStartsTot.Private(ths)153.8157.0159.0160.1159.6158.8158.5159.2158.9158.9158.7158.4158.9

HousingStartsSingleFamily(ths)118.4121.8121.8121.1119.4117.3115.7114.5113.6112.7111.7111.0110.2

HousingStartsMulti-Family(ths)35.435.237.238.940.341.542.744.645.346.247.047.548.7

Housing Consumer Prices

(%ChYearago)0.80.90.70.70.70.90.80.70.80.70.40.40.5

*Quarterlyatanannualrate

Table 3. Employment Quarterly*

2024Q42025Q12025Q22025Q32025Q42026Q12026Q22026Q32026Q42027Q12027Q22027Q32027Q4

Florida Payroll Employment (Thousands)

TotalNonfarm9,986.110,041.010,080.710,100.110,120.810,135.010,149.110,161.910,166.210,168.310,177.310,186.910,196.5 Manufacturing421.6421.3421.0421.6420.1417.4414.7412.8410.8409.4407.5405.2403.3

DurableGoods285.7285.3285.0286.5285.9284.1282.1280.9279.2278.1276.4274.5272.9 WoodProducts14.915.115.315.515.515.415.315.515.615.715.916.016.1

Computer&Electronics45.845.545.345.245.145.045.045.145.145.045.044.844.7 TransportationEquipment55.755.555.857.157.657.957.757.657.256.856.155.454.8 Nondurables135.9136.0136.0135.1134.3133.4132.6131.9131.5131.3131.1130.7130.4 Foods38.938.938.938.738.538.338.138.038.038.138.138.238.2 Non-Manufacturing9,564.59,619.79,659.79,678.69,700.69,717.69,734.49,749.19,755.49,758.99,769.89,781.79,793.3 Mining5.95.95.95.95.95.95.95.96.06.06.06.16.1

Construction668.4672.1674.2677.6680.2681.8682.9684.3685.0686.4687.1688.8691.1 Trans.Warehs.&Utility2,016.42,028.12,034.42,031.42,028.52,022.82,024.92,032.12,031.02,031.92,035.22,036.82,034.3 WholesaleTrade408.8410.1410.4409.9408.7409.8410.5412.4413.3415.3416.2415.9415.5 RetailTrade1,164.11,171.91,176.51,173.61,171.01,162.61,162.41,165.31,161.81,159.61,161.71,163.91,161.8 Information158.3159.3158.0158.1159.2160.2159.8158.6157.8157.1155.7154.1153.0 Prof.&Bus.Services1,625.41,634.21,636.71,639.01,638.61,644.21,643.31,631.51,624.91,616.61,610.11,605.01,605.4 Admin.&Support741.8748.0751.7750.7747.6745.8742.1727.9726.5724.0721.3720.1718.8 Prof.Sci&Tech130.8131.3131.2131.3131.3131.4131.7131.9131.9132.0131.8131.5131.3 Mgmt.ofCo.752.7754.9753.8757.0759.7766.9769.5771.7766.6760.7756.9753.4755.3 FinancialActivities678.6680.5682.9685.0687.6690.7691.8694.1693.7695.1695.4695.6694.7 RealEstate&Rent464.0465.0466.1468.5471.4474.4475.7478.2478.0479.1479.3479.7479.1 Fin.&Insurance214.6215.5216.8216.5216.2216.3216.0215.9215.7216.0216.1215.9215.7 Edu.&HealthService1,533.61,545.81,558.41,566.21,571.81,580.31,586.11,591.71,594.71,601.01,606.21,610.71,613.8 EducationServices208.1208.4209.1208.8209.4210.8211.2211.3211.5212.8214.1215.4217.0 HealthServices1,325.51,337.41,349.31,357.41,362.41,369.51,374.91,380.41,383.21,388.21,392.11,395.41,396.8 Leisure&Hospitality1,328.11,335.51,343.61,346.31,355.61,354.11,357.51,364.61,372.21,370.71,376.21,382.81,389.5 OtherServices388.4391.3393.8395.8397.9400.8403.6406.2408.7411.6414.4417.0419.7 Government1,161.41,167.01,171.71,173.31,175.21,176.91,178.61,180.01,181.51,182.41,183.61,184.71,185.7 FederalGov't.161.8163.3164.7165.1165.2165.3165.4165.6165.6165.6165.6165.5165.5 State&LocalGov't999.71,003.81,007.01,008.21,010.11,011.51,013.11,014.41,015.91,016.81,018.01,019.21,020.3

*Quarterlyatanannualrate

202020212022202320242025202620272028

Florida Payroll Employment (Thousands)

TotalNonfarm8,534.48,930.79,440.99754.119,954.410,085.710,153.010,182.310,241.7

Manufacturing378.6389.7409.9421.9425.2421.0413.9406.3398.7

DurableGoods259.4267.5281.4290.0288.6285.7281.6275.5268.9

WoodProducts14.014.315.215.215.015.415.515.916.3

Computer&Electronics44.344.345.547.046.645.345.044.944.2 TransportationEquipment48.350.754.057.156.456.557.655.853.2

Nondurables119.2122.2128.5131.9136.6135.4132.3130.9129.8 Foods33.634.235.737.339.238.738.138.238.4

Non-Manufacturing8,155.88,541.09,031.19,332.29,529.29,664.69,739.19,775.99,843.0 Mining5.55.45.65.86.05.95.96.06.1

Construction564.7577.9602.4629.3658.3676.0683.5688.3698.6 Trans.Warehs.&Utility1,740.31,831.11,925.71,970.02,013.22,030.62,027.72,034.62,028.9 WholesaleTrade347.0356.7377.0391.0404.4409.8411.5415.8413.6 RetailTrade1,042.71,085.01,128.31,149.41,168.91,173.21,163.01,161.81,159.2 Information134.3141.5156.1158.8158.2158.7159.1155.0152.8

Prof.&Bus.Services1,359.51,460.61,586.01,623.61,628.71,637.21,636.01,609.31,622.8 Admin.&Support602.5651.1710.4739.4746.0749.5735.6721.0716.6

Prof.Sci&Tech111.8115.6125.9134.5132.9131.3131.8131.7130.8 Mgmt.ofCo.645.1693.9749.8749.7749.8756.4768.7756.6775.4

FinancialActivities595.9625.8665.5682.4682.2684.0692.6695.2692.6

RealEstate&Rent408.2429.2454.3464.5464.6467.7476.6479.3477.5

Fin.&Insurance187.7196.6211.2217.8217.6216.3216.0215.9215.1

Edu.&HealthService1,305.71,339.71,398.71,475.71,522.21,560.61,588.21,607.91,625.8 EducationServices168.4178.1191.8202.0205.7208.9211.2214.8220.8

HealthServices1,137.31,161.61,206.91,273.71,316.51,351.61,377.01,393.11,404.9

Leisure&Hospitality1,011.51,124.31,242.11,295.01,325.21,345.21,362.11,379.81,400.3

OtherServices334.9344.2355.6366.5381.8394.7404.8415.7426.2 Government1,103.61,090.41,093.51,125.11,153.51,171.81,179.21,184.11,189.0

FederalGov't.149.8148.1149.7155.2161.2164.6165.5165.5165.3

State&LocalGov't953.8942.3943.8969.9992.31,007.31,013.71,018.61,023.6

2024Q42025Q12025Q22025Q32025Q42026Q12026Q22026Q32026Q42027Q12027Q22027Q32027Q4

Billions Current Dollars

PersonalIncome1670.11691.11713.71743.41768.81797.11822.61845.31869.51899.61926.71953.11978.4

Wages&Salaries743.1753.6764.1777.8792.0806.5818.2826.4834.7843.7853.8863.8873.7

OtherLaborIncome149.4151.5153.7156.5159.1161.9163.8165.1166.5168.4169.8171.3173.1

Nonfarm87.788.690.090.590.991.892.996.298.7100.5101.8103.4104.9

Farm0.91.01.11.11.31.41.51.51.61.61.71.71.7

PropertyIncome465.6468.7474.5485.0491.0495.7503.3509.8517.8528.2539.0548.3556.9

TransferPayments334.7340.3344.1348.0351.8359.4363.8367.9372.5380.7385.3389.7394.4

SocialInsurance115.5117.1118.2119.8121.5123.8125.2126.1126.8128.0129.1129.7130.9

Billions 2012 $

PersonalIncome1297.31303.61312.01325.01335.11346.21356.61365.71375.51389.71403.61416.81428.5

Wages&Salaries577.2580.9585.0591.1597.8604.1609.0611.7614.2617.2622.0626.7630.9

OtherLaborIncome116.0116.8117.7119.0120.1121.3121.9122.2122.5123.2123.7124.3125.0

Nonfarm68.168.368.968.868.668.869.171.272.673.574.175.075.7 Farm0.70.80.80.90.91.01.11.11.21.21.21.21.2

PropertyIncome361.6361.3363.3368.6370.6371.3374.6377.3381.0386.4392.7397.7402.1

TransferPayments259.9262.4263.4264.5265.5269.2270.8272.3274.1278.5280.7282.7284.8

SocialInsurance89.790.290.591.191.792.793.293.393.393.794.094.194.5

NewPassengerCar&TruckRegistrations1497.71428.21434.91438.81449.41442.21446.01451.41456.71457.51458.21462.31461.5

RetailSales(Billions$)528.8537.0543.1550.3557.3565.0571.2578.1584.2589.7595.7601.5607.5

RealRetailSales(Billions2012$)410.8414.0415.8418.2420.6423.2425.2427.8429.9431.4434.0436.4438.7

*Quarterlyatanannualrate

202020212022202320242025202620272028

Billions Current Dollars

PersonalIncome1220.81358.81436.11553.41645.41729.21833.61939.42046.3

Wages&Salaries512.1578.0641.5688.0731.6771.9821.5858.8900.5

OtherLaborIncome105.8114.7122.6137.0146.6155.2164.3170.6178.2 Nonfarm65.678.076.682.386.790.094.9102.6108.2

Farm0.80.91.11.10.81.11.51.71.7

PropertyIncome339.6359.0399.1444.1462.4479.8506.7543.1578.0

Billions 2012 $

PersonalIncome1159.61230.31209.41246.21286.71318.91361.01409.61459.3

FLORIDA NEWS SUMMARIES

USTA Florida Unveils Inaugural Economic Impact Report Showing $145.9 Million Return on Tournaments & Events

• The Oxford Economics company Tourism Economics conducted an Economic Impact Report on behalf of USTA Florida that highlighted the large impact of tennis tournaments and events in Florida in 2023. They found an economic impact of $145.9 million.

• They found that the events attracted 92,456 participants and 160,325 spectators which generated direct spending of $81.8 million. The total impact supported 1,007 full and part-time jobs which contributed to $11.4 million in state and local taxes.

• They found that each dollar spent by USTA Florida generated $12.84 in visitor spending, $6.95 in total income, and $1.80 in state and local taxes. They found that the events brought lots of tourists, and non-local attendees accounted for 112,838 participants and spectators.

Source: USTA Florida, December 5, 2024

State reports record-breaking $131 billion spent by tourists in 2023

• F lorida saw a record number of tourists in 2023, with nearly 157 million out-of-state visitors which is a 1.4% increase from 2022. The report came from Rockport Analytics and was commissioned by Visit Florida.

• They found that visitors spent $131 billion in Florida, an increase of 4.9% compared to 2022. Of that, $38 billion was spent on lodging and $33.5 billion was spent on food and beverages. Visitors generated $36.9 billion in federal, state, and local taxes. It claims that every Florida household received $1,910 in tax savings due to the tourism activity.

• The report also found that Florida is outpacing the country in its Covid-19 recovery. It states, “While both Florida and the U.S. have not fully rebounded in international visitor spending, Florida has moved beyond pre-pandemic benchmarks in tourism GDP, employment, and domestic visitor spending –areas where the U.S. has only recently caught up. Florida’s recovery momentum continues to outpace the national average since the 2020 downturn.”

Source: Florida Phoenix, December 10, 2025

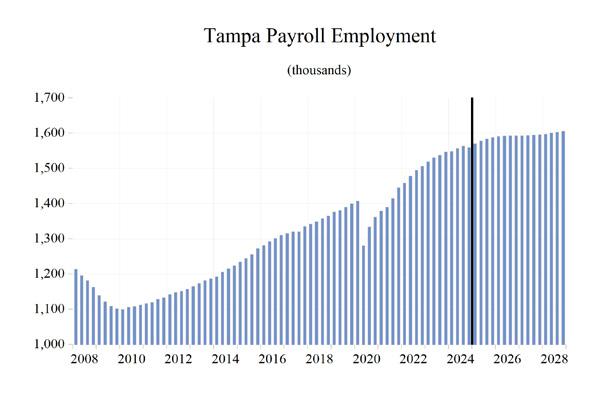

Economic Forecast 2025: Tampa Bay’s Industry Trends to Watch

• Tampa Bay seems to have a strong trajectory with industries like technology, real estate, and tourism setting the stage for significant economic development.

• Tampa Bay’s technology sector is anticipating significant developments in 2025. Over the past 5 years, the area saw a 30% increase in IT job growth and is expected to add more than 3,700 jobs by 2027. Initiatives such as CyperTechIX Accelerator at the Tampa Bay Wave, along with Embarc Collective have fostered over 500 startups focused on cutting-edge cyber products.

• Some big projects include a $6.5 billion Historic Gas District Redevelopment and a 50-acre mixed-use development Ybor City’s Gas Worx. The redevelopment also features a $1.3 billion stadium for the Tampa Bay Rays, with an anticipated opening of 2028.

Source: TTBW, January 15, 2025

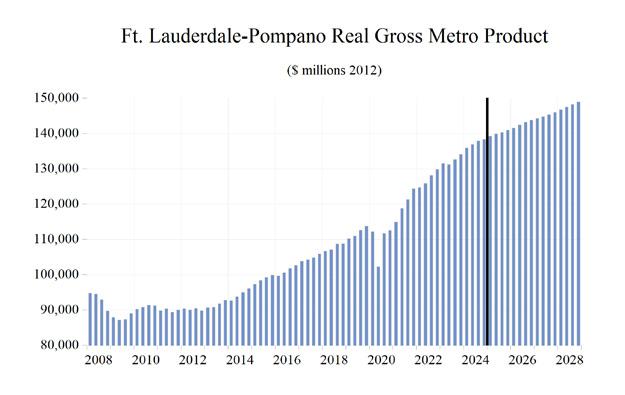

South Florida’s foreclosure rate among highest in the nation, report says

• Property data company Attom released a report stating that South Florida had the 14th highest foreclosure rate in the nation in 2024. In the Miami-Fort Lauderdale-West Palm Beach metro area, one in every 247 housing units and properties were under foreclosure, a 4.14% increase compared to 2023. 8,603 of the 10,696 foreclosures were foreclosure starts.

• The report found that the entire state of Florida tied with New Jersey for the highest foreclosure rate in 2024, with one out of every 267 housing units having foreclosure filings in 2024.

• In South Florida, home and rental prices soared during the Covid-19 pandemic due to highincome households moving to the area to avoid state income taxes and Covid-19 restrictions. Housing prices are increasing at a slower rate compared to prior years, whereas sale volumes have been going down. In the U.S. foreclosure filings went down 10% year-over-year.

Source: South Florida Business Journal, January 24, 2025

What’s at risk for Florida in the US-Canada trade tensions? Citrus and sightseers

• F lorida is getting caught up in the trade disputes between the U.S. and Canada, despite the agreed pause on the tariffs. With the threat of trade tensions, Florida’s orange juice will be more expensive in Canada as Prime Minister Justin Trudeau warned grocery shoppers they might have to “forego Florida’s orange juice altogether.”

• 60% of American orange juice exported to Canada comes from Florida, and Canada accounts for most of Florida’s orange and tangerine exports according to the USDA. Outside of trade, tourism could also be negatively affected.

• In 2023, Canadians were the top international tourists to Florida and spent $700 million in just Broward County. Compared to 2022, 20% more Canadian tourists visited in 2023. Prime Minister Justin Trudeau warned Canadians to consider changing their vacation plans before agreeing to the 30-day pause on tariffs.

Source: WLRN, February 3, 2025

Nearly 80% of Tampa Bay architects say hurricanes hurting business

• The Tampa Bay chapter of the American Institute of Architects (AIA) annual survey of 96 architects found that 65.6% of architects expect more work in 2025, a steep decline from the 85% in 2022. A suspected factor for this decline is the uncertainty surrounding development following hurricanes Helene and Milton.

• The survey found that 77.3% of architects expect project costs to rise. The AIA claims that the survey is useful in predicting real estate development in the Tampa Bay area. Other notable findings are that 60.4% of architects have cut costs due to higher interest rates and only 41% are optimistic about the national economy.

• “ Back-to-back hurricanes have introduced new challenges, from rising project costs to the need to rebuild damaged structures in a manner that matches the latest codes,” said Jody Beck, the chapter president of Traction Architecture.

Source: Business Observer Florida, February 24, 2025

PROFILES

The Cape Coral MSA is comprised of Lee County, located on the southwest coast of Florida. Known for its extensive canal system, Cape Coral boasts over 400 miles of canals, the most of any city in the world. It is also recognized as the largest master-planned community in the U.S.

QUICK FACTS

• Metro population estimate of 834,573 as of 2023 (ACS 5-Year Estimate) (U.S. Census Bureau).

• L ee County population estimate of 834,753 as of 2023 (ACS 5-Year Estimate).

• Civilian labor force of 376,970 in December 2024 (FRED, U.S. Bureau of Labor Statistics).

• A n unemployment rate of 3.1% as of December 2024, not seasonally adjusted. This amounts to 11,769 unemployed people (FRED, U.S. Bureau of Labor Statistics).

OUTLOOK SUMMARIES

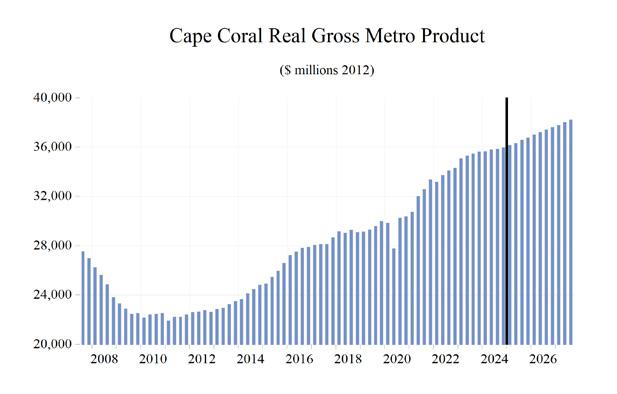

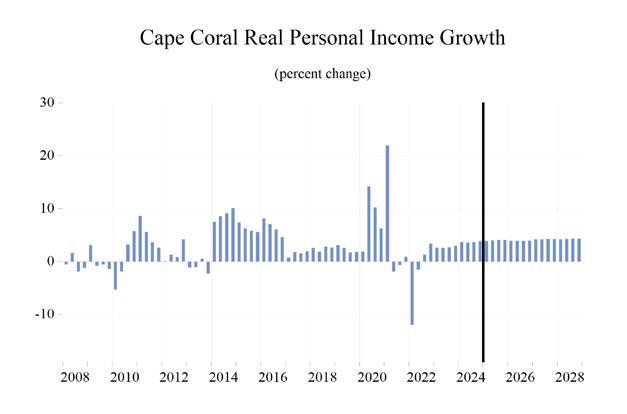

The studied economic indicators are predicted to show strong levels of growth in the Cape Coral Metropolitan Statistical Area (MSA). Gross Metro Product for the MSA will come in at $43,310.7 million. Real per-capita income is expected to average $56,900, the 9th highest, and the MSA is ranked 4th in personal income growth at 6.5 percent. The average annual wage will grow at an annual rate of 4.4 percent to $75,900. Cape Coral’s population will grow at the 2nd highest rate, at an annual rate of 2.4 percent. Employment growth is expected to average 1.5 percent, and Cape Coral will experience a relatively average unemployment rate in the state at 3.7 percent. The Other Services sector will lead the MSA in average annual growth at 4.7 percent. The Leisure sector will follow at 2.9 percent. The Information sector and Manufacturing sector will see contractions in growth of -1.2 and -1.0 percent respectively.

METRO NEWS SUMMARIES

Developer pays record $100 million for 1,745 acres of raw land in Cape Coral

• The 1,745-acre Hudson Creek property in Cape Coral sold for a record $100 million, marking the largest unimproved land transaction in Lee County’s history. It is already approved for a large-scale mixed-use development, including up to 3,500 homes and 425,000 square feet of commercial space.

• The site will feature residential, commercial, and recreational spaces, with approvals for 150,000 square feet of office space, an 800bed assisted living center, and a 500-room hotel. Additionally, a 3,000-student university is planned, significantly boosting the area’s growth.

Source: News Press, December 13, 2024

City eyes another land buy for Bimini Basin East project

• The Cape Coral City Council is advancing the $40 million Bimini Basin East project, which includes acquiring 43 parcels (18.73 acres) for development in the downtown entertainment district. The city has already purchased these parcels for $40 million, and a $1.8 million demolition contract has been awarded to Honc Destruction, Inc. for site preparation.

• The city is proposing changes to its land development code through Ordinance 79-24, which would introduce technical requirements for plat vacations and impose a one-time payment into the city’s tree fund for certain land-use applications, aiming to ensure public interests are maintained when private land rights are relinquished.

• The Cape Coral City Council is pushing for state and federal legislative support on various infrastructure and environmental projects, including the widening of State Road 78/Pine Island Road and a new I-75 interchange.

• The Council is exploring grants for strengthening commercial property resilience against disasters, aiming to enhance the local economy’s ability to recover after events like wind, flooding, and power outages.

Source: Cape Coral Breeze, December 3, 2024

Cape Coral Expands with Development The Cove at 47th

• The Cove at 47th is set to become South Cape Coral’s first mixed-use development, blending residential units with commercial spaces. The development includes a parking garage for both residents and the public, aimed at alleviating South Cape Coral’s current parking and traffic issues.

• Cape Coral’s population is projected to grow to 375,000 by 2050, creating a need for more mixed-use developments like The Cove to accommodate the growing demand for both housing and business spaces.

Source: WINK, January 10, 2025

Demolition Begins on Bimini East Initiative to Revitalize South Cape

• Demolition began on a 19-acre site east of Bimini Basin on January 21, 2024, marking the start of the Bimini East revitalization project. The site will pave the way for new development, including housing, commercial spaces, and public amenities.

• In August 2024, the City of Cape Coral’s Community Redevelopment Agency (CRA) purchased nearly 19 acres of land for $40 million to jumpstart the redevelopment of a blighted area south of Cape Coral Parkway, aiming to address long-standing challenges from Hurricane Ian’s devastation.

• The project encompasses 43 parcels and is part of a larger strategy to revitalize South Cape Coral, targeting economic growth and community renewal through the creation

of mixed-use spaces that will attract both residents and businesses.

Source: Cape Coral.Gov, January 21, 2025

Ambitious redevelopment plans in the works for former News-Press site in Fort Myers

• The Fort Myers City Council is considering the sale of the 9.8-acre former News-Press building site to Catalyst Community Development for $11.5 million. The deal will also carve out 2+ acres for a new 170,000-square-foot police headquarters.

• The proposed redevelopment includes 600 multifamily homes, 50,000 square feet of retail space, a grocery store, up to 160 hotel rooms, 150,000 square feet of office space, and two parking garages. A portion of the residential units will be designated as workforce housing, targeting households making up to $88,000 annually.

Source: News Press, February 10, 2025

Fort Myers riverfront condo One breaks ground

• One, a 21-story riverfront condominium development in Fort Myers officially broke ground on February 7. The $40 million project will feature 34 luxury units, with prices ranging from $1.25 million to $5.5 million for a penthouse suite.

• With 30% of the units already sold, the project is attracting significant attention. The real estate market in Fort Myers has surged, driven by a migration to the region following the COVID-19 pandemic, as well as relatively affordable pricing compared to markets like Naples and Miami.

• At approximately $850 per square foot, one offers luxury at a fraction of the price seen in other high-end markets.

Source: Gulfshore Business, February 10, 2025

Long Term Outlook for Cape Coral-Fort Myers, FL

March 2025 Forecast

Personal Income (Billions $)

202020212022202320242025202620272028

TotalPersonalIncome44.948.550.655.058.562.066.470.875.4

PctChgYearAgo8.38.04.48.76.46.07.06.66.5

WagesandSalaries14.616.518.620.021.222.523.925.226.7

NonwageIncome30.332.032.035.037.339.642.545.648.7

RealPersonalIncome(12$)43.744.542.844.546.147.749.751.954.2

PctChgYearAgo6.81.8-3.94.03.73.44.14.44.5

PerCapitaIncome(Ths)58.561.061.064.967.871.074.978.682.6

RealPerCapitaIncome(12$)57.056.051.652.553.554.656.157.659.4

AverageAnnualWage(Ths)54.457.862.165.067.970.674.677.680.7

PctChgYearAgo7.76.37.44.74.53.95.74.04.0

Establishment Employment (Place of Work, Thousands, SA)

TotalEmployment267.6283.7297.4305.9310.7317.0319.2323.2329.2

PctChgYearAgo-3.86.04.82.81.62.00.71.21.9

Manufacturing6.57.27.98.28.08.18.07.97.7 PctChgYearAgo-0.811.210.63.3-2.00.4-1.4-1.3-1.4 Nonmanufacturing261.1276.5289.5297.7302.7308.9311.2315.3321.4 PctChgYearAgo-3.95.94.72.81.72.10.71.31.9 Construction&Mining32.834.536.841.143.344.344.745.346.6 PctChgYearAgo0.55.36.611.75.42.30.81.52.8 Trade,Trans,&Utilities53.556.158.359.860.561.561.762.663.2 PctChgYearAgo-2.35.04.02.61.11.70.31.41.0 WholesaleTrade7.98.38.58.89.19.49.59.79.9 RetailTrade39.541.542.943.843.944.444.344.644.9 Trans,Wrhsng,&Util6.16.36.97.37.57.77.98.28.4 Information2.93.13.33.63.63.63.53.53.4 PctChgYearAgo0.87.68.77.10.8-1.5-0.4-1.9-0.8 FinancialActivities13.514.315.515.615.415.415.816.216.6 PctChgYearAgo-3.35.97.81.0-1.30.22.02.72.5 Prof&BusinessServices36.740.543.844.945.044.844.243.444.0 PctChgYearAgo-2.410.38.22.50.1-0.3-1.5-1.61.4 Educ&HealthServices30.632.133.334.234.435.236.036.737.4

PctChgYearAgo-2.44.73.92.60.52.32.22.11.8

Leisure&Hospitality37.141.342.640.941.042.943.644.645.9

PctChgYearAgo-14.911.33.1-4.00.44.51.62.52.8 OtherServices10.711.111.411.812.112.713.213.814.5

PctChgYearAgo-7.24.32.43.12.55.04.54.64.8 FederalGovernment2.62.42.42.52.62.62.62.62.6

PctChgYearAgo8.0-7.11.53.91.22.3-0.80.10.8 State&LocalGovernment40.841.142.043.344.946.046.146.547.2

PctChgYearAgo-0.70.72.23.23.62.50.30.91.4

Other Economic Indicators

Population(Ths)767.2795.3828.6847.6862.9873.9886.1899.8912.9

PctChgYearAgo2.23.74.22.31.81.31.41.51.5

LaborForce(Ths)344.4358.4371.4379.3379.2384.7389.6393.9398.4 PercentChange,YearAgo-0.44.13.72.10.01.41.31.11.1

UnemploymentRate(%)7.84.22.93.03.43.63.83.93.8

TotalHousingStarts11009.912107.211759.712696.514619.913480.811160.610727.610950.5

Single-Family6617.210682.59099.08547.110738.19656.77438.66824.76591.5

Multifamily4392.71424.62660.74149.43881.83824.13722.03903.04359.0

Short Term Outlook for Cape Coral-Fort Myers, FL

March 2025 Forecast

Personal Income (Billions $)

2024:42025:12025:22025:32025:42026:12026:22026:32026:42027:12027:22027:32027:4

TotalPersonalIncome59.660.561.462.663.664.866.066.967.869.170.271.372.4

PctChgYearAgo6.35.15.86.56.77.07.47.06.76.66.46.66.7

WagesandSalaries21.621.922.322.723.123.523.824.124.424.725.025.425.7

NonwageIncome38.038.639.239.940.541.342.242.943.544.445.245.946.7

RealPersonalIncome(12$)46.747.147.448.048.449.049.550.050.351.051.652.252.7

PctChgYearAgo4.02.83.43.73.74.04.54.24.04.14.14.44.7

PerCapitaIncome(Ths)68.769.570.471.572.573.674.675.476.177.278.279.180.0

RealPerCapitaIncome(12$)53.854.154.354.855.255.656.056.356.557.057.457.958.3

AverageAnnualWage(Ths)68.769.369.971.072.273.474.475.075.876.577.278.078.8

PctChgYearAgo4.12.33.84.65.16.06.45.65.04.23.94.04.0

Establishment Employment (Place of Work, Thousands, SA)

TotalEmployment312.5315.0317.0317.6318.3318.3318.6319.6320.3321.2322.5323.8325.2

PctChgYearAgo1.52.12.41.71.91.00.50.60.60.91.21.31.5

Manufacturing8.08.18.18.18.18.08.07.97.97.97.97.87.8

PctChgYearAgo-1.20.30.40.80.1-1.1-1.3-1.6-1.7-1.4-1.2-1.4-1.4

Nonmanufacturing304.5306.9309.0309.5310.3310.3310.6311.6312.3313.3314.6316.0317.4

PctChgYearAgo1.52.22.41.71.91.10.50.70.71.01.31.41.6

Construction&Mining43.644.044.244.544.644.644.644.744.745.045.245.445.7

PctChgYearAgo2.93.62.60.62.31.40.90.50.30.81.31.62.1

Trade,Trans,&Utilities60.461.061.761.861.661.461.561.962.062.262.562.862.9

PctChgYearAgo0.11.01.71.92.10.6-0.30.20.61.31.61.41.4 WholesaleTrade9.19.29.49.49.49.49.59.59.69.79.79.89.8 RetailTrade43.744.144.644.644.444.144.244.444.444.444.644.844.8 Trans,Wrhsng,&Util7.57.67.77.77.87.87.98.08.08.18.28.28.3 Information3.63.63.63.53.53.63.53.53.53.53.53.53.4

PctChgYearAgo0.1-0.2-2.6-0.9-2.4-1.3-0.20.5-0.7-1.5-1.8-2.0-2.3 FinancialActivities15.115.215.415.515.615.715.715.815.916.016.116.216.3

PctChgYearAgo-3.7-3.0-0.41.32.92.71.81.91.82.22.72.83.1 Prof&BusinessServices44.945.144.944.744.644.544.344.043.743.643.443.443.4

PctChgYearAgo0.80.40.1-1.0-0.8-1.2-1.3-1.6-1.8-2.2-2.0-1.4-0.7 Educ&HealthServices34.734.835.135.335.535.735.836.136.336.536.736.837.0

PctChgYearAgo1.42.42.22.32.42.42.12.32.22.22.32.11.9

Leisure&Hospitality41.942.442.942.943.243.243.343.744.044.144.544.845.2

PctChgYearAgo2.14.36.04.63.01.71.01.81.92.22.62.62.6

OtherServices12.212.412.612.812.913.013.213.313.413.613.813.914.1

PctChgYearAgo2.64.34.65.06.15.44.44.34.14.24.54.74.9

FederalGovernment2.62.62.62.62.62.62.62.62.62.62.62.62.6

PctChgYearAgo2.73.63.40.71.7-0.2-1.2-1.0-0.7-0.40.10.20.5

State&LocalGovernment45.545.846.046.046.146.146.146.146.246.346.446.646.8

PctChgYearAgo4.03.53.11.91.40.60.10.20.10.50.81.11.3

Other Economic Indicators

Population(Ths)867.7870.7872.8874.7877.2880.5884.2887.9891.6895.0898.2901.3904.5

PctChgYearAgo1.61.51.31.21.11.11.31.51.61.61.61.51.4

LaborForce(Ths)378.7381.8384.3385.7386.9388.1389.1390.1391.1392.2393.3394.5395.6

PctChgYearAgo-0.60.41.51.72.21.71.31.11.11.11.11.11.1

UnemploymentRate(%)3.53.53.63.73.73.83.83.83.93.93.93.93.9

TotalHousingStarts15770.515077.614042.812865.411937.311613.811295.810932.510800.110751.310718.910703.810736.5

Single-Family11138.710971.810120.59154.58380.07972.97583.77180.47017.46928.26846.16787.96736.5

Multifamily4631.84105.93922.33710.93557.33640.83712.13752.23782.73823.23872.83915.84000.1

PROFILES

The Crestview MSA is comprised of Okaloosa and Walton counties and is located in the northwest corner of the state. Crestview is known as the “Hub City” because of the convergence of Interstate 10, State Road 85, U.S. Highway 90, the Florida Gulf & Atlantic Railroad and the Yellow River and Shoal River in or near the city.

QUICK FACTS

• Metro population estimate of 304,418 as of 2023 (ACS 5-Year Estimate) (U.S. Census Bureau).

• Okaloosa County population estimate of 218,464 as of 2023 (ACS 5-Year Estimate).

• Walton County population estimate of 86,354 as of 2023 (ACS 5-Year Estimate).

• Civilian labor force of 139,464 in December 2024 (FRED, U.S. Bureau of Labor Statistics).

• A n unemployment rate of 2.9% as of December 2024, not seasonally adjusted. This amounts to 3,986 unemployed people (FRED, U.S. Bureau of Labor Statistics).

OUTLOOK SUMMARIES

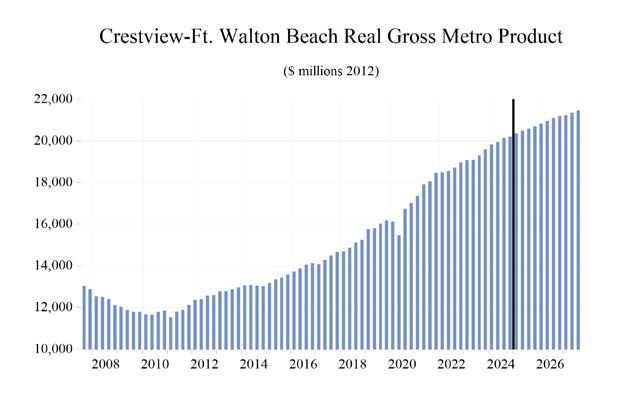

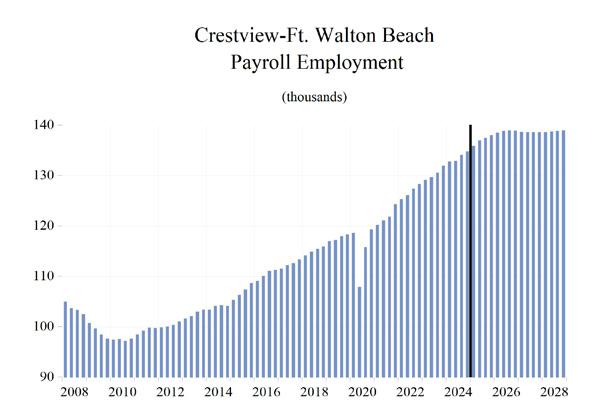

The studied economic indicators are predicted to show average levels of growth in the Crestview Metropolitan Statistical Area (MSA). Gross Metro Product for the MSA will come in at $21,207.8 million. The MSA will experience slightly aboveaverage personal income growth of 6.2 percent, and real per capita income will be $59,100. The average annual wage will grow at an annual rate of 4.8 percent (ranked 2nd in the state) to $76,900. Crestview’s population will grow at an annual rate of 0.9 percent.

Employment growth is expected to average 1.0 percent, and Crestview will experience an unemployment rate of 3.4 percent.

The Other Services sector will lead the MSA in average annual growth at 3.6 percent. The Financial sector will follow at 2.8 percent. The Construction and Mining sector and the Manufacturing sector will see contractions in growth of -0.5 percent and -1.1 percent respectively.

METRO NEWS SUMMARIES

Structural work to begin at Crestview Elementary

• Structural work on the elementary grade portion of the new PreK-12 campus at Crestview is set to begin this week, with the campus expected to be operational by the next school year. The new athletic facility is also progressing smoothly.

• The district is starting contract negotiations with the teaching union ahead of the certified union contract’s expiration in August 2025, aiming to address needs and ensure fair treatment.

• The board authorized the superintendent and district treasurer to sign a mineral right lease agreement with Hilcorp International, L.P. for 1.45 acres for five years.

Source: Morning Journal, December 24, 2024

FPL awards $50K to local nonprofits in Northwest Florida

• F lorida Power & Light (FPL) awarded $50,000 in grant funding to local nonprofits in Okaloosa, Walton, and Bay counties, focusing on education, food insecurity, senior citizen support, and child advocacy.

• Notable grant recipients include the Emerald Coast Theatre Company, A Bed 4 Me Foundation, Okaloosa Public Schools Foundation, Mattie Kelly Arts Foundation, Able Trust Florida Endowment for Vocational Rehabilitation, and St. Andrews Christian Care Center Inc.

• A n additional $19,000 was awarded to several nonprofits in Escambia County, supporting various community initiatives.

Source: NWF Daily News, December 10, 2024

Local business awarded $509K grant in Fort Walton Beach, Precision Measurement Inc to bring new jobs to Okaloosa County

• Precision Measurement Inc. (PMI), a veteranowned business in Fort Walton Beach, announced a five-year growth strategy to expand services and create jobs in Okaloosa County, supported by a $509,000 grant from the University of West Florida’s Industry Resilience and Diversification Fund.

• PMI provides calibration and testing services and has seen an average annual growth of 20% since 2005. The expansion will initially create four full-time positions with average salaries of $60,000 and may require larger facilities in the future.

• The company is also expanding its services to include FAA-mandated certifications for aircraft avionics and hospital medical equipment servicing, addressing a critical need for local law enforcement calibration services.

Source: Northwest Florida Daily News, December 14, 2024

Charlotte County’s Mid-County Regional Library to reopen in 2026

• The Mid-County Regional Library in Port Charlotte, which was severely damaged by Hurricane Ian in September 2022, is expected to reopen in 2026 after approximately $6.9 million in repairs and renovations.

• Originally a Kash n’ Karry convenience store, the building was purchased by the county in 2002, renovated, and opened as a library in 2005.

• W harton-Smith Inc. was contracted as the construction manager for the project, with a Guaranteed Maximum Price of $6,914,843, excluding pre-construction services fees.

Source: Gulfshore Business, January 14, 2025

Long Term Outlook for Crestview-Fort Walton Beach-Destin, FL

March 2025 Forecast

Personal Income (Billions $)

202020212022202320242025202620272028

TotalPersonalIncome17.019.219.921.322.624.025.827.228.7

PctChgYearAgo6.713.53.47.15.96.47.25.75.5

WagesandSalaries7.88.79.49.810.511.212.012.513.0

NonwageIncome9.210.510.511.512.112.913.814.715.7

RealPersonalIncome(12$)17.118.317.518.118.619.320.220.921.6

PctChgYearAgo6.66.9-4.13.13.23.84.33.53.5

PerCapitaIncome(Ths.)58.865.465.868.971.675.280.084.088.1

RealPerCapitaIncome(12$)59.262.057.958.359.160.662.764.566.3

AverageAnnualWage(Ths)57.861.664.165.368.371.175.478.882.4

PctChgYearAgo8.16.74.11.94.54.16.14.54.5

Establishment Employment (Place of Work, Thousands, SA)

TotalEmployment115.4121.9126.8130.3133.6137.1138.8138.6138.8

PctChgYearAgo-1.95.64.02.82.52.61.2-0.10.1 Manufacturing3.43.43.63.43.43.43.33.33.3

PctChgYearAgo8.6-0.94.7-3.5-0.8-0.5-1.0-1.5-1.3

Nonmanufacturing112.0118.5123.2126.9130.2133.7135.5135.3135.5

PctChgYearAgo-2.25.84.03.02.62.71.3-0.10.2

Construction&Mining7.07.37.88.18.68.88.88.68.5 PctChgYearAgo1.54.47.53.85.82.6-0.4-2.3-1.7 Trade,Trans,&Utilities20.421.522.423.023.724.424.624.724.7 PctChgYearAgo-3.45.24.03.02.83.00.90.40.0 WholesaleTrade1.71.92.02.12.12.22.32.32.3 RetailTrade16.417.117.718.318.919.519.619.619.5 Trans,Wrhsng,&Util2.32.52.72.72.62.72.72.82.8 Information1.31.41.61.61.61.61.61.61.6 PctChgYearAgo-0.76.614.82.7-0.10.51.1-2.2-0.9

FinancialActivities7.07.67.97.97.88.28.58.78.7

PctChgYearAgo-2.18.54.10.0-0.64.44.11.90.6 Prof&BusinessServices18.420.722.323.524.424.624.724.124.2

PctChgYearAgo2.912.08.15.43.51.00.2-2.30.3 Educ&HealthServices12.212.412.813.213.714.014.214.214.3

PctChgYearAgo-1.71.73.52.73.92.01.60.30.4

Leisure&Hospitality20.722.523.223.824.225.225.725.725.7

PctChgYearAgo-8.68.73.42.51.94.01.80.3-0.2

OtherServices4.24.34.24.34.44.64.95.05.1

PctChgYearAgo-2.41.9-2.73.72.55.04.72.92.4

FederalGovernment9.29.39.19.29.29.59.69.79.7

PctChgYearAgo3.40.8-1.61.00.22.31.21.00.7

State&LocalGovernment11.611.711.912.212.612.813.013.013.1

PctChgYearAgo-2.40.52.02.42.82.21.20.30.3

Other Economic Indicators

RrealGrossMetroProduct(Billio16343.417949.218686.219265.120036.520536.621024.521416.621853.5

Population(Ths)288.5294.6302.6309.5315.2319.2321.8324.0325.9

PctChgYearAgo1.52.12.72.31.91.30.80.70.6

LaborForce(Ths)127.3133.5136.4139.9141.6142.2142.1141.9141.7

PercentChange,YearAgo-0.34.82.22.61.20.40.0-0.2-0.1

UnemploymentRate(%)5.93.52.62.73.03.33.43.43.3

TotalHousingStarts2967.83495.93702.85030.83894.93046.72942.53030.83079.7

Single-Family2409.13217.92751.32796.62667.52550.42252.52109.22013.6

Multifamily558.7277.9951.52234.21227.4496.2690.0921.61066.1

Short Term Outlook for Crestview-Fort Walton Beach-Destin, FL March 2025 Forecast

Personal Income (Billions $)

2024:42025:12025:22025:32025:42026:12026:22026:32026:42027:12027:22027:32027:4

TotalPersonalIncome23.023.423.824.324.725.225.626.026.226.727.027.427.8

PctChgYearAgo5.34.76.27.27.57.87.86.96.35.95.65.65.7

WagesandSalaries10.710.811.011.311.511.711.912.012.212.312.412.512.7

NonwageIncome12.312.512.713.013.213.513.713.914.114.414.614.915.1

RealPersonalIncome(12$)18.819.019.219.519.719.920.120.320.420.620.821.021.2

PctChgYearAgo3.02.53.84.44.54.74.84.13.63.43.33.53.8

PerCapitaIncome(Ths)72.473.574.575.977.178.479.780.681.482.583.584.585.5

RealPerCapitaIncome(12$)59.459.860.260.961.462.062.663.063.263.764.264.865.2

AverageAnnualWage(Ths)69.069.770.471.672.874.175.175.876.677.578.479.380.2

PctChgYearAgo3.72.43.94.65.66.46.86.05.34.54.34.64.6

Establishment Employment (Place of Work, Thousands, SA)

TotalEmployment134.8135.9137.0137.5138.0138.5138.9139.0138.9138.7138.6138.6138.6

PctChgYearAgo2.12.43.12.62.41.91.41.10.60.1-0.2-0.3-0.2

Manufacturing3.43.43.43.43.43.43.43.33.33.33.33.33.3

PctChgYearAgo-0.2-0.3-1.6-0.90.7-0.1-0.6-1.4-1.8-1.6-1.5-1.5-1.3

Nonmanufacturing131.4132.6133.6134.1134.7135.1135.5135.6135.6135.4135.3135.3135.3

PctChgYearAgo2.22.43.22.72.41.91.41.10.70.2-0.1-0.2-0.2

Construction&Mining8.88.88.88.88.88.88.88.88.78.78.68.68.5

PctChgYearAgo6.65.64.00.50.60.5-0.1-0.7-1.4-2.0-2.4-2.5-2.2

Trade,Trans,&Utilities23.824.124.524.524.524.524.624.724.724.724.724.824.7

PctChgYearAgo2.43.03.62.52.91.60.60.80.50.60.50.30.3 WholesaleTrade2.22.22.22.32.32.32.32.32.32.32.42.32.3 RetailTrade19.019.319.619.619.619.519.619.619.619.519.619.619.6 Trans,Wrhsng,&Util2.62.62.72.72.72.72.72.72.82.82.82.82.8 Information1.61.61.61.61.61.61.61.61.61.61.61.61.6

PctChgYearAgo-0.21.1-0.40.01.41.32.11.3-0.2-1.7-2.4-2.4-2.5 FinancialActivities7.98.08.18.28.38.48.58.58.68.68.78.78.7

PctChgYearAgo-0.20.45.76.25.25.24.23.83.12.52.31.61.3 Prof&BusinessServices24.324.524.624.724.724.824.824.624.424.324.124.024.0

PctChgYearAgo1.81.31.10.11.61.20.9-0.3-1.0-2.3-2.8-2.3-1.8 Educ&HealthServices13.813.814.014.014.014.114.214.214.214.214.214.214.2

PctChgYearAgo3.33.52.10.62.02.11.71.51.10.60.30.20.4 Leisure&Hospitality24.825.025.125.325.525.525.625.725.925.725.725.725.8

PctChgYearAgo1.71.65.46.52.52.01.71.81.50.90.60.1-0.4 OtherServices4.54.54.64.74.74.84.84.94.95.05.05.05.1

PctChgYearAgo3.74.24.75.75.45.74.94.43.73.22.92.82.7 FederalGovernment9.29.39.59.59.59.59.69.69.69.69.79.79.7

PctChgYearAgo-0.91.52.32.43.01.81.01.01.11.21.00.80.8 State&LocalGovernment12.712.812.812.912.912.913.013.013.013.013.013.013.0

PctChgYearAgo3.33.51.91.61.71.51.31.10.80.50.20.20.3

Other Economic Indicators

Population(Ths)317.1318.1318.9319.6320.3321.0321.6322.1322.6323.2323.7324.2324.7

PctChgYearAgo1.71.61.41.21.00.90.80.80.70.70.70.70.7

LaborForce(Ths)141.1141.8142.3142.3142.3142.3142.2142.1142.0141.9141.9141.8141.8

PctChgYearAgo-0.4-0.70.11.40.90.3-0.1-0.2-0.2-0.2-0.2-0.2-0.2

UnemploymentRate(%)3.23.23.33.33.33.43.43.43.43.43.43.43.4

TotalHousingStarts2919.23055.13080.93052.02998.72962.32882.72898.23026.73014.53019.23025.23064.4

Single-Family2484.72593.42594.02553.02461.42363.62252.42209.52184.62150.02118.82094.92073.0

Multifamily434.5461.6486.9499.1537.3598.7630.3688.7842.1864.5900.4930.3991.4

PROFILES

The Deltona–Daytona–Ormond Beach MSA is comprised of Volusia and Flagler Counties. It is located on the east coast of Florida and is notable for special events that occur throughout the year such as Bike Week. It is home to NASCAR headquarters and the Daytona International Speedway, which hosts popular races such as the Daytona 500.

QUICK FACTS

• Metro population estimate of 721,796 as of 2023 (ACS 5-Year Estimate) (U.S. Census Bureau).

• Volusia County population estimate of 721,796 as of 2023 (ACS 5-Year Estimate).

• Civilian labor force of 319,155 in December 2024 (FRED, U.S. Bureau of Labor Statistics).

• A n unemployment rate of 3.5% as of December 2024, not seasonally adjusted. This amounts to 11,260 unemployed people (FRED, U.S. Bureau of Labor Statistics).

OUTLOOK SUMMARIES

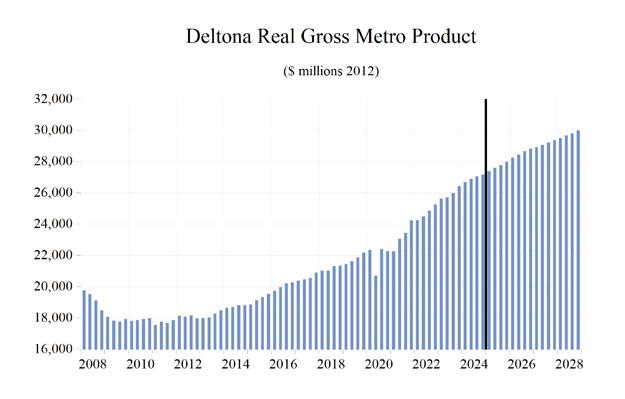

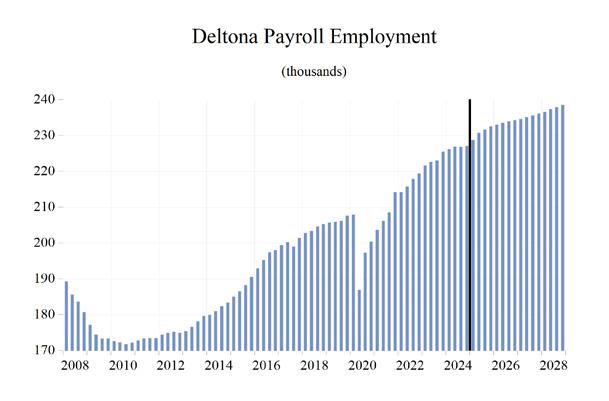

Growth in the economic indicators studied in this forecast is expected to be moderate for the Deltona –Daytona – Ormond Beach Metropolitan Statistical Area (MSA). Gross Metro Product in the Deltona MSA will be $28,379.33 million, placing it 12th in the state for metro output. Average annual wage will grow at a rate of 4.5 percent, driving the average annual real wage to increase to $65,800 which is the ranked 22nd in the state. Per capita income levels will come in at $50,800, with average per personal income growth of 5.8 percent annually. We expect population growth of 1.0 percent per year.

The Deltona – Daytona – Ormond Beach MSA labor market will experience an average employment growth of 1.2 percent, with an unemployment rate of 4.2 percent.

The Other Services sector will experience the fastest growth rate in this MSA with an annual growth rate of 4.4 percent. The Construction and Mining sector will follow at 1.6 percent. Deltona will see the largest contraction in growth in the Manufacturing sector at -0.9 percent.

METRO NEWS SUMMARIES

Commercial-Plus Project Pending for NW Deltona

• A developer plans to transform 36.5 acres in northwest Deltona into a mixed-use district with retail, offices, and apartments.

• The project is expected to generate millions in new tax revenue, while reducing residents’ reliance on Orlando for jobs.

• The Deltona City Commission tabled a request to rezone almost 36.5 vacant acres adjacent to the newer of the Amazon fulfillment centers.

Source: West Volusion Beacon, November 27, 2024

Seminole Towne Center set for transformation in new mixed-use development deal

• A mazon’s fulfillment center is adding 200 new warehouse and logistics jobs in early 2025.

• The expansion includes a high-tech automation system, increasing efficiency and boosting productivity.

• Deltona leaders say the facility is becoming a key driver of job growth in west Volusia County.

Source: Daytona Beach News-Journal, January 10, 2025

Deltona mayor faces scrutiny over use of tax dollars

• Deltona Mayor Santiago Avila Jr. faces scrutiny over the use of taxpayer funds to attend former President Donald Trump’s inauguration, raising concerns about the allocation of public money.

• The controversy has sparked debate over government transparency and accountability in local budgeting practices.

• Accusations about improper spending could impact public trust and future funding decisions for Deltona’s city projects and initiatives.

Source: Fox 35 Orlando, February 17, 2025

Deltona -Daytona Beach - Ormond Beach MSA

Long Term Outlook for Deltona-Daytona Beach-Ormond Beach, FL

March 2025 Forecast

Personal Income (Billions $)

202020212022202320242025202620272028

TotalPersonalIncome32.436.437.941.343.846.349.252.055.0

PctChgYearAgo5.212.14.39.06.05.76.25.75.7

WagesandSalaries9.510.711.712.613.414.215.215.916.8

NonwageIncome22.925.726.228.830.432.134.036.138.2

RealPersonalIncome(12$)32.134.133.134.735.937.038.239.641.1

PctChgYearAgo3.06.5-3.25.13.33.13.33.53.7

PerCapitaIncome(Ths)48.252.753.256.458.661.264.567.570.6

RealPerCapitaIncome(12$)47.649.546.447.448.048.950.251.452.8

AverageAnnualWage(Ths)47.751.053.856.158.861.264.667.270.1

PctChgYearAgo6.96.85.54.24.94.15.54.04.3

Establishment Employment (Place of Work, Thousands, SA)

TotalEmployment198.1208.1216.8223.2226.7230.9233.7235.3237.6

PctChgYearAgo-4.05.14.22.91.61.81.20.70.9 Manufacturing10.711.512.513.012.612.612.512.312.2

PctChgYearAgo-6.27.88.34.0-2.4-0.4-1.0-1.2-1.2 Nonmanufacturing187.4196.6204.4210.2214.1218.3221.2223.0225.4

PctChgYearAgo-3.94.93.92.91.82.01.30.81.1 Construction&Mining14.114.314.714.815.315.716.016.116.3 PctChgYearAgo-0.92.02.40.93.22.91.70.51.2 Trade,Trans,&Utilities38.942.543.844.445.045.946.146.646.9 PctChgYearAgo-1.59.43.11.41.22.10.51.00.6 WholesaleTrade4.95.25.75.85.96.26.36.46.5 RetailTrade30.231.832.733.333.634.234.234.434.7 Trans,Wrhsng,&Util3.75.65.55.45.55.55.75.75.7 Information2.01.81.91.91.91.92.02.02.0 PctChgYearAgo-16.0-9.01.01.70.20.33.8-1.30.0 FinancialActivities9.09.79.910.09.79.810.110.210.2 PctChgYearAgo4.46.92.60.7-3.01.42.60.90.3 Prof&BusinessServices23.023.425.125.926.026.827.026.526.6 PctChgYearAgo-1.71.47.33.20.63.10.6-1.90.4 Educ&HealthServices39.440.542.243.945.846.146.847.548.4

PctChgYearAgo-2.32.94.14.14.30.51.61.61.7

Leisure&Hospitality27.831.033.734.935.235.836.436.837.4

PctChgYearAgo-15.311.58.73.40.91.91.51.31.4 OtherServices8.07.97.77.98.18.69.09.39.7

PctChgYearAgo-8.6-0.7-2.72.43.45.15.23.83.5 FederalGovernment1.61.51.51.51.61.71.71.71.7

PctChgYearAgo5.3-5.70.00.14.85.91.7-0.8-1.0

State&LocalGovernment23.623.923.925.025.525.926.226.326.4

PctChgYearAgo1.01.4-0.34.91.91.70.90.50.4

Other Economic Indicators

Population(Ths)673.0690.1713.2733.2748.0756.5762.3770.0778.2

PctChgYearAgo1.62.53.32.82.01.10.81.01.1

LaborForce(Ths)295.1304.1313.8322.5324.0325.1327.1328.5330.0

PercentChange,YearAgo-1.43.13.22.80.40.30.60.40.5

UnemploymentRate(%)8.14.63.33.33.84.14.34.44.3

TotalHousingStarts5943.07127.68066.96878.95896.75567.76062.36205.96204.8

Single-Family4637.16571.96179.65465.15167.15062.95051.64931.74799.3

Multifamily1306.0555.81887.31413.8729.6504.81010.71274.21405.5

Short Term Outlook for Deltona-Daytona Beach-Ormond Beach, FL

March 2025 Forecast

Personal Income (Billions $)

2024:42025:12025:22025:32025:42026:12026:22026:32026:42027:12027:22027:32027:4

TotalPersonalIncome44.545.245.946.747.448.248.949.550.150.951.652.453.1

PctChgYearAgo5.24.55.36.46.56.56.56.05.75.75.65.75.9

WagesandSalaries13.613.814.114.314.614.915.115.315.515.615.816.016.2

NonwageIncome30.931.431.832.432.833.333.834.334.735.335.836.436.9

RealPersonalIncome(12$)36.336.536.837.237.537.838.138.438.639.039.439.840.1

PctChgYearAgo3.02.33.03.63.53.53.63.23.03.23.43.73.9

PerCapitaIncome(Ths)59.260.060.761.762.563.464.264.965.566.467.267.968.6

RealPerCapitaIncome(12$)48.248.448.749.149.449.850.150.350.550.951.351.651.9

AverageAnnualWage(Ths)59.660.260.661.662.663.664.465.065.666.266.967.668.2

PctChgYearAgo4.72.84.14.75.05.76.25.54.84.13.94.04.0

Establishment Employment (Place of Work, Thousands, SA)

TotalEmployment227.1228.7230.7231.6232.5233.0233.5233.9234.3234.6235.1235.6236.1

PctChgYearAgo0.71.11.72.12.41.91.21.00.70.70.70.70.8

Manufacturing12.512.612.612.612.612.612.512.512.412.412.412.312.3

PctChgYearAgo-2.6-1.2-0.90.10.6-0.2-0.7-1.3-1.6-1.3-1.1-1.2-1.2

Nonmanufacturing214.6216.1218.1219.0219.9220.5221.1221.5221.9222.2222.7223.3223.8

PctChgYearAgo0.91.31.82.32.52.01.31.10.90.80.80.80.9

Construction&Mining15.415.515.715.815.916.016.016.016.016.016.116.116.1

PctChgYearAgo1.32.42.82.93.62.92.11.30.70.60.40.50.6 Trade,Trans,&Utilities45.045.546.146.146.145.946.146.346.346.446.646.746.7