www.papermart.in papermart.in/emagazine

Our Brands:www.cablewirefair.com Mommy & Baby Fair www.mommybabyfair.com

www.mommybabytimes.com www.tubepipeindia.com

www.wirecable.in wirecable.in/emagazine mommybabytimes.com/emagazinetubepipeindia.com/emagazine Magazines

Events Online Platform www.papermartdirectory.com FAIR www.tubepipefair.com

Our Services:• Magazine Publishing • Events • Market Research • Bespoke Publishing • Digital Marketing

An upcoming media company, Tulip 3P Media brings out publications for different B2B verticals. The activities of the company now embrace events and market research as well. Tulip is currently on its way to further expanding its publication portfolio through publications for other business verticals and a rich offering of other niche media services. Tulip 3P Media Pvt Ltd 501-502, ABW Tower, MG Road, IFFCO Chowk, Gurugram-122002, Haryana Mobile : +91 99999 35011 / 22 / 44, Email: info@tulip3pmedia.in www.tulip3pmedia.in

2025, Tube & Pipe India

India’s Steel Capacity Surges to 205 Million Tonnes: Production in 2025 to Ride on the Twin Priorities of Growth and Greening

India’s steel sector stands at a decisive moment, balancing the pressure of global competition with the momentum of domestic demand and policy support...

ESL Steel Gearing Up for Green Steel Production, Focussing on ESG-Centric Manufacturing

ESL Steel Limited, a subsidiary of Vedanta Limited envisions becoming a benchmark in the Indian steel industry for responsible...

Sambhv Steel Tubes: Driving Growth Through Capacity Expansions and Strategic Greenfield Project

Sambhv Steel Tubes Private Limited, a subsidiary of Sambhv Steel, has acquired land...

Vardhman Special Steels Plans to Increase Rolling Mill Capacity to 270,000 TPA

Vardhman Special Steels Limited (VSSL) plans to increase its

to 270,000...

Ratnadeep Metal & Tubes Gears Up for Growth with Backward Integration

Ratnadeep Metal & Tubes is making significant strides towards the company’s growth through backward integration...

Mukand Limited Eyes High-End Application Sectors With Automation & Digitalization

Mukand Limited, comprising two divisions - steel and industrial machinery, is looking forward to contributing and being a part of a greener...

Kamdhenu: Poised to be a Part of Indian Steel Industry’s Growth Story

Kamdhenu Limited, a one-stop construction material solutions company engaged in manufacturing and supply of TMT bars...

Arya Tubes: Specialist in Drawn and Bright Annealed Tubes for Engineering and Industrial Applications

Arya Tubes, a division of KnitPro International, specializes in the manufacturing and export of small diameter and thin-walled stainless steel...

and

Apollo Pipes to Scale Up Capacity; Targets 286,000 Tonne by 2028

Apollo Pipes Limited is set to expand its total production capacity by 70,000 tonnes through its ongoing expansions, including its INR 135 crore greenfield facility in Varanasi...

Sintex Launches India’s 1st CPVC Antimicrobial Pipes

With the launch of its India’s 1st CPVC antimicrobial pipes, Welspun World’s acquired Sintex is highlighting the health aspect in the water story. The company...

Prince Pipes and Fittings Eyes East Indian Markets With 48,000 MT Facility in Bihar

Prince Pipes and Fittings Limited makes inroads into bathware products by acquiring Aquel Bathware in March 2024. Mr. Parag Chheda, Joint Managing Director, Prince Pipes and Fittings Limited, revealed during an exclusive...

PRODUCT PROFILE

Tecnar and OM Techcorp Partner to Bring Lut 2.0 Wall Thickness Gauge to Indian Market

OM Techcorp, a leading supplier of machinery and technology to the steel...

COMPANY PROFILE

OM TechCorp Providing Valuable Expertise to Seamless Tubes and Pipes Industry

OM TechCorp, with its combined expertise of production technology and market trend in the seamless tubes & pipes sector...

Tecnar Rotoweld: Transforming Pipe Spool Welding Productivity and Quality in India

Tecnar, a spin-off from Canada’s National Research Council, with 35 years of experience in automated pressure pipe welding...

Beyond the top tier, a different but equally dynamic story is unfolding. India’s secondary steel segment includes longproduct specialists, coated steel units, pipe manufacturers, and stainless steel suppliers.

India’s steel sector has reached a consequential phase in its industrial trajectory. With crude steel capacity at 205 MT and a national target of 300 MT by 2030, the country is advancing toward becoming one of the few nations capable of supplying both volume and variety to global markets. Yet growth today is not defined merely by output. The urgency of carbon compliance and trade defensibility has introduced new dimensions of competitiveness.

The country’s leading producers such as JSW Steel, Tata Steel, SAIL, AM/NS India, and Jindal Steel & Power are scaling up rapidly. JSW is targeting 51.5 MTPA by 2030, while Tata Steel is expanding its Kalinganagar unit by 5 MTPA. These are capital-intensive projects aimed at increasing both efficiency and downstream capability. At the same time, they are responses to shifting global norms. The European Union’s Carbon Border Adjustment Mechanism (CBAM), due to come into full effect by 2026, will penalize carbon-intensive steel. For India, which still relies heavily on coal-based blast furnaces, the implications are strategic.

Large producers have begun to reposition. JSW is investing in hydrogen-based energy integration. Tata is embedding sustainability into core production lines. These moves are vital for preserving access to export markets. With India’s per capita steel consumption still under 80 kg—far below the global average of 230 kg—domestic demand offers runway. However, global buyers increasingly seek traceable, low-carbon inputs. The export narrative will hinge not just on scale but on emissions benchmarks and life-cycle disclosure.

Beyond the top tier, a different but equally dynamic story is unfolding. India’s secondary steel segment includes long-product specialists, coated steel units, pipe manufacturers, and stainless steel suppliers. These firms are geographically dispersed, often closer to consumption zones, and are building capabilities in energy optimization and integrated supply.

Welspun Corp, for example, has emerged as a global line pipe supplier. It is investing in ductile iron and stainless steel capacity and is pursuing full carbon and water neutrality by 2040. Sambhv Steel Tubes, a newer entrant, has integrated backward into coils and captive power. It produces specialty alloy and Corten-grade pipes. Mukand Ltd, with a long legacy in alloy and stainless steels, now serves the auto, defense, and nuclear sectors. Hisar Metal Industries is scaling up cold-rolled precision production and plans to double its solar energy share in the next fiscal year. Vardhman Special Steels is reinforcing its position in SBQ and automotive-grade steel through OEM partnerships.

What unites these players is a converging shift toward energy independence and emissions discipline. Solar, wind, captive thermal, and waste heat recovery are now active cost strategies. They are no longer niche pilots.

Together, India’s integrated and secondary producers are reshaping the country’s industrial geography. They bring manufacturing to underserved regions. They buffer global price shocks with flexibility and add resilience to infrastructure supply chains.

Still, challenges remain. The country continues to rely on imported coking coal. Infrastructure must keep pace with expanded output. Policy support will need to evolve beyond incentives. It must include mechanisms that reward low-emission steel through procurement or certification.

If India succeeds in aligning capacity with carbon efficiency, its steel sector could emerge as both a domestic enabler and a credible global supplier in an era defined by green trade. That prospect depends on keeping both tracks, i.e. scale and sustainability, in close alignment.

Priyank Jain, CEO Tulip 3P Media Private Limited

India’s steel sector stands at a decisive moment, balancing the pressure of global competition with the momentum of domestic demand and policy support. As producers expand capacity and shift toward green technologies, the sector is positioned to redefine India’s industrial trajectory.

In 2025, India’s steel industry stands at a defining inflection point. Prime Minister Narendra Modi, addressing the India Steel 2025 program in Mumbai, emphasized, “Our steel sector has to be ready for new processes, new grades and new scale.” This vision transcends rhetoric. It signals a profound structural evolution—a shift not merely in output but in essential character. From volume-centric to valueconscious, from bulk production to purpose-driven manufacturing, Indian steel undergoes a reinvention that mirrors the aspirations of a modernizing economy.

This evolution unfolds across multiple dimensions: the advancement of highend alloy and engineering steel, the expansion of flat and coated products to meet infrastructure requirements, the growth of pipes, tubes and hollow sections for energy and water sectors, and the emergence of stainless steel as an integral component of lifestyle, transport and healthcare solutions. This product diversity serves multiple strategic functions. It shields the industry from cyclical downturns, integrates it with global supply chains, and ensures the steel sector propels rather than constrains India’s broader industrial ambitions.

Scaling Up for a $5 Trillion Economy

India’s crude steel production capacity has reached 205 million tonnes (MT) in FY25, marking a 10% increase from the previous year. Its crude steel production totaled 151.1 MT in fiscal year 2024–25. March alone saw production of 13.8 MT, reflecting 7% year-over-year growth. The National Steel Policy (NSP) 2017 targets 300 MT by 2030. This ambitious goal rests on large-scale infrastructure projects, urban housing initiatives, smart city missions, and the comprehensive $1.3 trillion National Infrastructure Pipeline.

Kamdhenu Limited, a major player in TMT bars, structural steel, and coated sheet production with over 80 franchise-based manufacturing units across India, exemplifies how

decentralized growth is shaping the domestic steel landscape. “India plays a pivotal role in the global steel industry both as a major consumer and producer of steel,” says Sunil Kumar Agarwal, Director, Kamdhenu Limited. “It is the second-largest producer of crude steel, has abundant iron ore reserves, and is a net exporter of steel.”

This growth extends beyond a few prominent companies or regions. It represents a nationwide phenomenon. Greenfield capacities emerge in eastern and central India, leveraging proximity to raw material reserves.

Concurrently, brownfield expansions in western and southern India aim to serve export markets through coastal integration. The sector’s geographic diversification brings economic opportunity to underserved regions while generating multiplier effects in cement, power, transport, and capital equipment industries.

Simultaneously, demand is no longer just infrastructure-driven. With the government promoting electric mobility, renewable energy, and electronics manufacturing, steel enters new domains—from battery casings and wind turbine towers to

electric vehicle platforms and solar panel frames. Each application requires not just increased steel volume but more specialized, highperformance variants.

Moreover, India’s per capita steel consumption, under 80 kg currently, is far below the global average of 230 kg. This gap represents substantial untapped potential, particularly as rising incomes, housing demand, and rural connectivity drive consumption deeper into tier-2 and tier-3 markets. In this context, capacity expansion constitutes strategic preparation rather than speculation.

From Make in India to Green Steel

The central government’s policy initiatives provide robust support. From Production-Linked Incentive (PLI) schemes to the National Manufacturing Mission and the PMGati Shakti Master Plan, India aligns logistics, mining and manufacturing to foster steel-intensive development. The government has also mandated the use of ‘Made in India’ steel in public projects.

Highlighting the sector’s wideranging impact, Prime Minister Modi remarked, “Whether it is skyscrapers, shipping, highways, high-speed rail, smart cities, or industrial corridors, steel is the strength behind every success story.”

Government programs function not as top-down directives but as enabling frameworks. The PM-Gati Shakti plan integrates over 16 ministries to facilitate logistics-driven growth. This ensures timely availability of raw materials like iron ore and coking coal while enabling finished products to reach markets efficiently. For an industry as weight- and cost-sensitive as steel, these backend efficiencies deliver competitive advantages.

Simultaneously, the Make in India mandate extends beyond symbolism. It drives demand across all categories—from TMT bars in rural roads to stainless steel in metro railcars, from precision tubes in auto components to DI pipes in drinking

water projects. Even small-scale producers of long and structural steel benefit as government projects extend to the district level.

Importantly, these policies advance beyond capacity creation to foster technological innovation. Incentives linked to emission norms, scrap recycling, and value-added

Company Capacity (MTPA)

manufacturing have encouraged the development of forwardlooking ecosystems around steel clusters. Industrial parks dedicated to foundries, forging units, and pipe processing centers indicate a maturing industrial geography, where scale and specialization increasingly coexist.

Import Surge, Raw Material Risks, and Global Trade

Despite momentum, the industry is facing difficulties. India became a net importer of steel in FY25, with imports reaching a nine-year high of 9.5 MT. Most of these came from China and South Korea, putting pressure on domestic producers.

“The country primarily meets its demand for coking coal through imports, exposing the steel industry to global supply chain risks and price fluctuations,” Agarwal noted.

Moreover, Europe’s Carbon Border Adjustment Mechanism (CBAM), set to start taxing high-carbon imports by 2026, poses a challenge for India’s largely coal-dependent steel production.

What makes these challenges acute is their asymmetry. Global producers, especially those with energy subsidies or surplus capacity, can afford to

dump products in markets like India. This affects not only primary integrated steelmakers but also smaller players in coated, flat, and pipe segments, who find it hard to compete on price. Meanwhile, dependence on imported coking coal means any geopolitical or logistical disruption, like the Russia-Ukraine war or Red Sea blockades, has a ripple effect across the value chain.

CBAM specifically serves as an urgent signal. It does not merely penalize emissions—it reconfigures global trade based on carbon intensity. Indian producers, many still relying on blast furnace technology, must accelerate their decarbonization strategies or risk losing access to lucrative European markets. The emerging frontier involves green premiums—where global buyers pay premium prices for low-carbon steel, benefiting only those who’ve invested in decarbonization.

hydrogen plant for green steel. Tata Steel continues integrating sustainability measures into its production processes.

Notably, capacity expansion extends beyond primary steel to encompass all segments. Producers invest in hot-dip galvanizing lines, cold rolling mills, ERW and seamless pipe manufacturing, alloy steel melting shops, and forging facilities. This reflects the industry’s recognition that future competitiveness depends on product diversity and downstream integration.

India’s steel success story rests on its leading producers. Tata Steel maintains a total installed capacity of 35 million tonnes per annum (MTPA) across its global operations, including India, Europe, and Southeast Asia. Within India, the company operates at a capacity of 21.6 MTPA through its major plants in Jamshedpur, Kalinganagar, and Meramandali. As part of its ongoing expansion, Tata Steel is increasing the capacity of its Kalinganagar plant from 3 MTPA to 8 MTPA.

JSW Steel, currently India’s largest steelmaker, commands an installed capacity of 29.5 MTPA and aims to grow this to 38.2 MTPA by FY25 and 51.5 MTPA by 2030. Its flagship Vijayanagar plant alone contributes 12.5 MTPA.

Other major producers include SAIL (Steel Authority of India Ltd), operating five integrated plants with a combined capacity of 21 MTPA; Jindal Steel and Power Ltd (JSPL), which holds a capacity of 9.6 MTPA with a focus on long products; and ArcelorMittal Nippon Steel India, formerly Essar Steel, which runs a 9.6 MTPA plant at Hazira. RINL (Vizag Steel) has a capacity of 7.3 MTPA, while Bhushan Power & Steel Ltd (now part of JSW) plans to expand its current 3.5 MTPA capacity to 5 MTPA. Electrosteel Steels, a Vedanta

subsidiary, contributes 2.5 MTPA, and JSW Ispat Special Products, based in Raigarh, adds another 1.5 MTPA to the national output.

These companies also invest in green steel initiatives. JSW Steel plans to utilize energy from a 3,800-tonne

To counter these pressures, Indian companies are diversifying portfolios and greening their operations.

Mukand Limited, a pioneer in India’s alloy and engineering steel segment

and the country’s first approved supplier of nuclear-grade stainless steel, is focusing on high-end sectors like aerospace and defense while decarbonizing operations. “We have signed a power delivery agreement for the supply of power from renewable sources like solar, wind and hydro. These sources are likely to fulfill approximately 70 percent of our total power needs,” says Neeraj Kant, CEO.

Similarly, Sambhv Steel Tubes, a rising manufacturer of ERW and GI pipes with backward-integrated capabilities and a recent foray into specialty alloy and stainless steel products, is investing in greenfield expansion and renewable energy. “We have developed the capability to produce steel directly from ore... and set up a 25MW captive power plant to optimize our power cost,” says Vikas Goyal, CEO.

Hisar Metal Industries, a veteran coldrolling specialist in precision stainless steel coils, pipes, and tubes with an integrated manufacturing setup, is another example. The company is expanding its exports from 25% to 50% and ramping up its solar energy share from 25% to 60% by next year. “The world has shifted its focus towards India and it’s going to remain so for the next 10 years,” says Karan Dev Tayal, Director.

Welspun Corp, a global leader in line pipes, ductile iron pipes, and specialty stainless steel bars and tubes, is investing INR 2,000 crore across India and Saudi Arabia. Its subsidiary, Welspun Specialty Steel Ltd, has achieved indigenous production of supercritical boiler tubes, aligning with the government’s Make in India and green steel vision. “The company also targets 55% renewable electricity utilisation by 2026 and 100% carbon and water neutrality by 2040,” says Vipul Mathur, MD & CEO of Welspun Corp Limited.

Sustainability: The Green Steel Imperative

Sustainability transcends trendy terminology. Indian steelmakers now align with global ESG norms, particularly as the EU’s CBAM

Stainless Steel & Alloy Steel Producers

approaches. Companies like JSW Steel increase green steel production to comply with emerging regulations. Tata Steel implements sustainability initiatives throughout its production processes. Companies like Welspun target 100% carbon and water neutrality by 2040. Mukand and Sambhv likewise invest in waste heat recovery and solar power.

“Our commitment to sustainability benefits not only the environment but also our customers, employees

and stakeholders,” says Neeraj Kant of Mukand.

The green shift responds to consumer demands as well. Multinational customers request carbon footprint data. Investors demand ESG disclosures. Governments offer incentives for decarbonization. Indian companies that act swiftly stand to avoid penalties and secure first-mover advantages.

“Environmental sustainability is

integral to our mission for creating a better and greener world,” says Vipul Mathur of Welspun. “... we envisage a significant shift towards new-age innovations by 2030.”

Government initiatives like the green steel taxonomy and star rating on emissions guide the industry toward greener alternatives. With growing emphasis on circular economy principles, companies explore scrap recycling, carbon capture, and hydrogen-based ironmaking as longterm solutions.

The government has reinforced its commitment to industry

Disclaimer

transformation through the PM-Gati Shakti National Master Plan and the National Manufacturing Mission. “The government policies and the steel industry are playing a crucial role in the development of many other industries in India and making them globally competitive,” Prime Minister Modi noted.

The road to 300 MT of annual production is not without its potholes. Yet, India’s steel industry has shown resilience, driven by demand, policy support, and private sector dynamism.

“More and more steel companies are coming up in the country, fueling the steel sector growth, which will result in a boom in the manufacturing

sector,” says Tayal of Hisar Metal. India’s steel sector must now focus on technological innovation, environmental stewardship, and global competitiveness. The opportunities are immense—from supplying the burgeoning EV and solar sectors to fulfilling infrastructure needs across Asia and Africa.

In Modi’s words: “India is preparing for global leadership... the world now views India as a trusted supplier of high-quality steel.”

And to rise to that challenge, the steel industry must keep forging ahead— with strength, sustainability, and scale.

The company listings and capacity figures presented in this article are not exhaustive and intended solely for informational, segmentation, and reference purposes. The data has been compiled from publicly available sources, including investor presentations, company websites, government filings, industry reports, and credible third-party databases. While every effort has been made to ensure the accuracy of the information, the installed capacities mentioned are only indicative and reflect the most recent verifiable figures available at the time of publication. These capacities may have changed due to ongoing expansions, plant-level modifications, or operational updates that may not yet be in the public domain. The placement of companies within specific product or process categories (such as long products, flat products, specialty steel, or tubes and pipes) is based on their dominant manufacturing focus, but does not imply exclusivity in that segment. In cases where direct confirmation from companies was unavailable, estimates have been made in good faith using historical data and industry insights. We welcome and encourage companies to share updates or corrections to ensure that future editions reflect the most accurate and up-to-date information.

ESL Steel Limited, a subsidiary of Vedanta Limited envisions becoming a benchmark in the Indian steel industry for responsible, ESG-centric manufacturing and technological leadership. While making significant strides in community development through its impactful social initiatives, the company is preparing to venture into production of Green Steel. In an interaction with Tube&PipeIndia , Mr. Ravish Sharma, Dy. CEO & WTD, ESL Steel Ltd. shared that they are well-positioned to grow further and solidify their standing in the steel sector, with a clear focus on customer satisfaction, digital transformation, and a wellthought-out market approach.

Tube & Pipe India: Kindly share details about your business journey, highlighting major milestones and crucial achievements.

Ravish Sharma: Vedanta Limited is a global diversified company dealing in critical metals and minerals, renewable energy and technology. It is one of the largest mining companies in India, with global mining operations in Australia and Zambia, and oil and gas operations in three countries. It mainly delves into zinc, lead, silver, oil and gas, iron ore, steel, aluminium, technology, renewable energy and power industries, through its various subsidiaries.

ESL Steel Limited (ESL), a subsidiary of Vedanta Limited, stands as a pivotal player in India’s iron and steel sector, deeply rooted in the heart of Jharkhand. ESL Steel Limited is a state-of-the-art integrated primary steel manufacturer of high-quality

products & steel intermediaries -wire rod (V-WIRRO), TMT rebars (V-XEGA), ductile iron pipe (V-DUCPIPE), billets & pig iron.

The company has got strong footprints and has been supplying its various products in the domestic market across all major sectors thereby facilitating and contributing to the multi-faceted growth of the nation. As a company we have achieved numerous milestones marked by growth, innovation, and purpose. Our Chairman, Mr. Anil Agarwal believes in nation-building, which is enshrined in Vedanta’s core values, mission and vision. From setting new production benchmarks to launching steel-strong initiatives, ESL Steel Limited has consistently shaped the future of steel with unwavering dedication.

Our commitment towards the communities surrounding us, is reaffirmed by the vision of, ‘From Genesis to Legacy’, wherein our community centric initiatives, driven by a growing awareness of social and environmental issues, aim to create positive impacts across various aspects of life, aligning with the broad vision of catering to every stage of life a human undergoes in a lifetime. Here’s a breakdown of how ESL Steel engages in such initiatives that touch upon different stages of life:

• Improving Maternal and Child Health (Beginnings): Through projects like NandGhar, we took a transformative leap dedicated to benefit rural children and women in India. It is a measure undertaken by Vedanta under the Anil Agarwal Foundation Initiative, which conceptualized as state of the art Anganwadis, wherein children under 6 years of age have access to a safe and stimulating environment for their holistic and optimal development through strengthening of early childhood care, nutrition, health and hygiene, and education services. With over 150 Nandghars in Bokaro, Jharkhand, ESL Steel is instrumental in catering to the

early needs of children.

• Education and Holistic Development (Progress): ESL Skill School, with the vision of identifying, nurturing, and training local talent in archery, stands as a beacon of excellence, under Project Prerna. The academy provides a structured training environment for young archers, fostering their growth from grassroots to elite levels, ensuring representation at national level. Ancillary projects like Nirman, Swajal also contribute to community welfare.

• Adulthood and Livelihood (Fulfillment): Jivika project seeks to create sustainable economic and livelihood opportunities for women beneficiaries, fostering self-reliance and increasing household income. Our efforts empowered 2,784 women through Self-Help Groups, fostering financial independence and community leadership. 1,941 youth were trained in industryrelevant skills, achieving an impressive 74.56% job placement rate. The company also supported 500 farmers through enterprise training programs, under the WADI project, resulting in a 100% engagement rate and contributing to increased agricultural productivity.

• Retirement (Legacy): Our Project MACE contributes to healthy ageing and wellness of elderly people, keeping them physically & mentally active, engaging them with different kinds of activities such as physical and online training & learning, events, informative sessions etc. It facilitates healthcare support to elderly people through healthcare camps, special camps, and regular doctor’s visits, in collaboration with Vedanta Cares Field Hospital, under Project Aarogya.

In FY25 alone, we positively impacted over 85,437 lives through initiatives focused on empowerment, skillbuilding, and sustainable livelihoods.

These statistics act as an impetus for us to have an all encompassing range of activities that touch upon various stages of human life, from supporting the health and education of children to promoting sustainable practices for future generations.

Recognized for our dedication to quality, sustainability, and inclusion, we were honoured with the 2025 Happiness & Well-Being Award as one of the Happiest Places to Thrive. Our impactful social initiatives also earned us the Indian CSR Award 2024 for Best Rural Health Care Initiative in the Corporate Category. Furthermore, we achieved several noteworthy milestones, including winning eight Gold Awards at the 31st Chapter Convention on Quality Concepts (CCQC).

On the environmental front, we made significant progress by achieving 100% reutilisation of fly ash and blast furnace slag to reflect our commitment to ensuring a sustainable value chain across all operations. Our dedication to community development was equally strong, with initiatives such as critical road repairs

in our operational areas and Project Wadi, which promotes sustainable agriculture and supports rural livelihoods.

TPI: Please give information about your manufacturing plants and annual production capacity catering to the steel sector.

RS: ESL Steel operates a state-of-theart 1.5 million TPA integrated steel plant located in the Bokaro district of Jharkhand, with 100% production at a single site. This integrated facility includes blast furnace, basic oxygen furnace, coke oven plant, sinter, billet caster, DI pipe plant, rolling mills and power plant. The company is equipped with cutting edge modern machinery for all steel making processes & having its own iron ore mines and coke oven plant, which ensures good quality raw material for its manufacturing processes.

It is also instrumental in driving significant socio-economic growth in the region. The company’s strategic location, with proximity to key resources such as coal and iron ore mines, coupled with dedicated infrastructure, ensures high

operational efficiency.

Additionally, we have implemented numerous advanced technical measures to ensure the production of high-quality steel products. For instance, in our coke ovens, stamp charging technology has been adopted to enhance coke strength. The blast furnace operations are fully computer-controlled, equipped with internal top image cameras, temperature flux profiling, and a ropeless stock measurement system. To optimize productivity and reduce production costs, we have integrated high-temperature stoves, a coal dust injection system, and oxygen enrichment technology. Furthermore, specially designed runners and an online slag granulation system are employed to maximize metal yield, simultaneously reducing our carbon footprint significantly

TPI: Please tell us about your steel-related products basket. Which industries do these products find application in?

RS: At ESL Steel, we manufacture a range of high-quality steel products including TMT bars, Ductile Iron (DI) pipes, wire rods, pig iron, and billets designed to meet the diverse needs of the construction, infrastructure, and industrial sectors.

Our TMT bars are produced through a single process that combines work hardening and heat treatment, resulting in superior performance and durability. These bars offer exceptional corrosion resistance with a specialized rib pattern, high strength, excellent ductility, superior seismic resistance, and fire-retardant properties. They are widely used in individual housing projects, infrastructure development, reinforced structures, bridges, flyovers, dams, and high-rise buildings.

Billets, the second-stage product in steel manufacturing, are semi-finished steel bars used as raw material for producing TMT bars and wire rods. Our billets are cast using a 5-strand caster integrated with a basic oxygen furnace and linked to a blast furnace,

ensuring consistent quality. They are extensively used in towers, power transmission structures, construction, and general engineering applications.

Wire Rods are long, semi-finished steel products produced through the hot rolling of billets. Known for their high dimensional accuracy and excellent thermo-mechanical properties, our wire rods are free from surface defects and benefit from an advanced cooling system that minimizes scale formation. With low phosphorus and sulphur content, they are ideal for manufacturing industrial wires, fasteners, chain and rivet wires, springs, wire mesh, and various automobile components.

Endeavouring for customer empowerment & governance, through the trailblazing Vedanta Metal Bazaar E-Commerce initiative, ESL Steel has ensured to maintain the highest standards of ease of doing business to facilitate a customer-centric approach via end-to-end order lifecycle management.

TPI: What is your USP that sets you apart from others? How do you manage to stay ahead of the curve in the industry?

RS: At ESL Steel, we are committed to delivering best-in-class steel products and services that consistently meet and exceed customer expectations. Our focus on quality is firm, with rigorous standards upheld at every stage of production, powered by international expertise and sustainable solutions from reputed global partners. We are driven by a spirit of continuous innovation, pushing boundaries in both current operations and future endeavours.

At the heart of ESL Steel are our people and the communities we serve. Empowering individuals and fostering a culture where excellence and empathy go hand in hand is central to our mission. We remain dedicated to transforming lives, uplifting communities, and setting benchmarks in operational excellence, sustainability and inclusive growth. What truly sets us apart is Vedanta’s

dynamic culture of empowering young talent. Unlike traditional conglomerates, we promote lifelong learning and encourage continuous upskilling to stay ahead in a rapidly evolving world.

TPI: How are you addressing sustainability and environmental concerns in your production?

RS: As a leader in environmental, social, and governance (ESG) initiatives, we are taking bold steps toward a greener future. Sustainable development has always been a vital spoke of ESL’s Wheel of Goals. Aligned to Vedanta’s seven

organized Sustainability Assurance Programme known as VSAP has been developed to conduct regular analytic assessments. We are committed to sustainability in energy conservation, recycling, proper treatment and disposal of waste, health and safety practices, employee wellbeing and local community development.

In alignment with the government’s progressive regulatory framework and the increasing global demand for sustainable practices, we are preparing to embark on a transformative journey toward the production of Star-Rated green steel.

“ESL operates a state-of-the-art 1.5 million TPA integrated steel plant located in the Bokaro district of Jharkhand, with 100% production at a single site.”

pillars, we continuously strive to enhance our contribution to the global sustainability movement by incorporating pragmatic and environmentally friendly alternatives along with ensuring social and environmental compliance.

Our approach towards sustainability is strategized effectively based on the PDCA (plan–do–check–act) cycle intertwined in the fabric of needbased assessment. Being a responsible IMS-certified organization, ESL Steel executes every project with strict sustainability-centric considerations in line with the updated rules and regulations.

Following Vedanta’s structure, an

In addition to being already categorized as a primary steel producer officially, our forthcoming strategy will focus on innovation, environmental stewardship, and longterm competitiveness in the evolving steel industry. Our future green steel initiative will be anchored on the following key pillars:

• Coke Dry Quenching (CDQ) Technology Deployment: We plan to implement this advanced technology to reduce emissions and boost energy efficiency in our coke-making operations—an essential step toward low-carbon steel production.

• Carbon Capture, Utilization, and Storage (CCUS): We are actively exploring solutions to manage and repurpose CO₂ emissions, contributing to our broader decarbonization objectives.

• Integration of Renewable Energy: Aiming for 70% renewable energy usage by 2030, we will work toward embedding clean energy into our operations as a core component of our sustainability roadmap.

• Green Hydrogen Trials: As we look ahead, trials with green hydrogen—an alternative to fossil fuels—will form a key part of our low-emission energy strategy.

• Decarbonizing Transportation: By 2030, we aim to fully transition our light motor vehicle (LMV)

“We are significantly reducing carbon emissions with the concept of green steel produced for minimal or zero carbon emissions. The EAFs or hydrogen-based technologies are also gaining momentum globally. ”

and implementation of our program.

TPI: Shed light on your recent developments. Where do you see yourself five years down the line?

RS: At ESL Steel, we continue to evolve through innovation, operational excellence, and a strong focus on sustainability and community impact. We have achieved significant milestones across quality, environment, and social development. We received several prestigious accolades, showcasing the dedication, hard work, and collective excellence of the entire team. The company was honoured with the ‘Happy Place to Thrive Award 2023’ by ET HR World, recognized as Best in Large & Gen Y at the W.E. Global Awards, and received the CII Award for Excellence in Women in STEM. ESL Steel also earned a Star-Rated Memento at the ENCON Awards and the ‘Excellence Award for TMT Supply at Samvaad 4.0, presented by the Union Minister of Heavy Industries & Steel.

engagement rate and contributing to increased agricultural productivity. Additionally, 50 young athletes are being groomed to represent at state and national levels.

Over the next five years, we visualise ESL becoming a benchmark in the Indian steel industry for responsible, ESG-centric manufacturing and technological leadership. We aim to expand our capacity, further reduce our carbon footprint, and deepen our engagement with the communities we serve. Our focus will remain on empowering talent, fostering innovation, and delivering value to all stakeholders while contributing meaningfully to India’s infrastructure and economic development journey, thus furthering our Chairman, Mr. Anil Agarwals’s vision of nation building.

TPI: What trends do you see shaping the future of the metal industry?

fleet to low-emission alternatives, contributing to a cleaner logistics footprint.

• Expansion of Gas-Based DRI (Direct Reduced Iron): Looking to the future, we plan to scale up the use of gas-based DRI—a more sustainable and less carbon-intensive method of steel production.

This integrated approach, anchored in the adoption of breakthrough technologies like CDQ and green hydrogen, not only ensures regulatory compliance but also positions us as a leader in the global transition to sustainable steelmaking.

With a group philosophy of ‘Zero Harm, Zero Discharge & Zero Waste’, we have developed the Vedanta sustainability framework with the standards of internationally recognized institutions such as ICMM, IFC, OECS, UNEP etc. Our framework covers four crucial areas; governance, environment, health & safety and social performance. We have also engaged an independent, external consultant for periodic reviews to measure the effectiveness

Furthermore, the company made significant strides in community development through its impactful social initiatives. Over 2,784 women were empowered through Self-Help Groups (SHG), fostering financial independence and community leadership. Simultaneously, 1,941 youth were trained in industryrelevant skills, achieving an impressive 74.56% job placement rate. The company also supported 500 farmers through enterprise training programs, resulting in a 100%

RS: Globally, the metal industry is undergoing a major transformation, influenced by emerging trends focused on sustainability and technological innovation. As India moves towards becoming the third-largest economy, we anticipate a substantial boost in the manufacturing, infrastructure, and engineering sectors. This growth will naturally accelerate demand within the metal and steel industries.

Although, it must be noted that in recent times, there has been

a shift toward more sustainable manufacturing practices. With rising consumer awareness and preference for eco-friendly products, sustainable steel has come to the forefront.

Some of the measures that companies are implementing range from using energy-efficient electric arc furnaces (EAFs), which use electric currents to melt recycled or scrap metal, significantly reducing carbon emissions compared to traditional coal-fired blast furnaces. The concept of green steel produced with minimal or zero carbon emissions, often through EAFs or hydrogenbased technologies is also gaining momentum globally.

Looking ahead, we expect manufacturers to continue integrating transformative technologies, leading to the rise of smart factories that prioritize innovation and environmental responsibility.

TPI: Tell us about your local and international market footprint. How do you plan to enhance your business presence in India as well as at the global level?

RS: ESL Steel has emerged as a key player in the steel industry, offering a wide range of products including TMT bars, wire rods, DI pipes, billets, and pig iron. With a strong foothold across sectors like construction, infrastructure, automotive, engineering, and machinery, the company plays a vital role in nationbuilding and strengthening India’s self-reliance. Given the strong domestic demand and ongoing global uncertainties, ESL Steel has strategically chosen to prioritize the Indian market. This move allows the company to leverage local opportunities and respond effectively to the country’s growing steel needs.

Although exports currently make up less than 2% of its overall business,

ESL Steel continues to maintain a global footprint with targeted exports to regions such as the Indian subcontinent, Europe, the USA, MENA, and JKT. This diversified export strategy enables the company to remain agile amid changing global demand patterns.

At the core of ESL Steel’s operations is a strong customerfirst philosophy. The company’s teams work closely with clients to understand their requirements and deliver customized solutions. This approach is further strengthened by digital advancements like the Vedanta Metal Bazaar portal, an integrated digital platform designed to simplify customer interactions and enhance transparency. With a clear focus on customer satisfaction, digital transformation, and a wellthought-out market approach, we are well-positioned to grow further and solidify our standing in the steel sector.

Apollo Pipes Limited is expecting an enhancement of 41,500 tonnes in its capacity in the next three years through greenfield and brownfield expansions.

Mar 5, 2025

Apollo Pipes Limited, leading manufacturer of PVC pipes and related products in India, has announced plans to increase its capacity from the existing 2.16 lakh tonnes to 2.86 lakh tonnes in the next three years.

Presenting its earnings for Q3 FY’25, the company said it is undertaking brownfield expansion at its Dadri facility to cater to the strong demand in northern parts of the country. This will enhance the current capacity of the facility by 28,500 tonnes.

Apollo Pipes will continue to focus on improving utilization at Dadri, Ahmedabad, Bengaluru and Raipur facilities. The existing capacity of Apollo Pipes’ four facilities stands at 1,56,000 tonnes.

The company will establish plants for the manufacturing of value-added products, such as PVC-O pipes and window & door profiles, at new locations.

The company expects a capacity enhancement of 41,500 tonnes in the next three years through greenfield and brownfield expansions. NEWS

It expects an addition of 11,500 tonnes through these products by FY’26. Applications of the products include water infrastructure and home building material.

Apollo Pipes expects its greenfield plant at Varanasi, having a capacity of 30,000 tonnes, to become operational by FY’26.

Organized by: FOR IMMEDIATE RELEASE

dynamics, and sustainable practices.

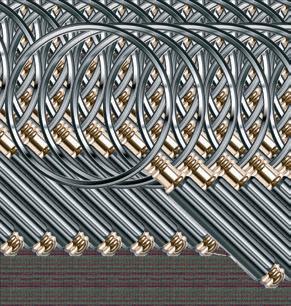

New Delhi, India, April 11: The Bharat Metal Expo 2025 (BME25) is set to debut from November 4–6, 2025, at Pragati Maidan, New Delhi. This expo, alongside the Cable & Wire Fair (CWF) and Tube & Pipe Fair (TPF), will be a crucial component of an integrated platform for three key industries. The global demand for steel is surging, driven by rapid infrastructure growth and technological advancements. This massive three-industry mega event will be a one-stop hub for steel manufacturers, suppliers, and traders, boasting over 500 exhibitors, 15,000+ attendees, and a 35,200 sq.m show area.

Where Success is Legacy

The launch of BME follows the remarkable success of its co-located events:

Cable & Wire Fair (CWF): One of Asia’s leading exhibitions for the wire and cable industry, witnessed 350+ exhibitors, 12000+ visitors, and participation from over 20 countries in its previous edition.

Tube & Pipe Fair (TPF): Showcasing cutting-edge innovations and a global exhibitor base, the quickly growing exhibition serves the tube and pipe industry. The August 5-7, 2024 edition saw participation from over 100 brands and attracted more than 5,000 visitors.

BME is strategically positioned to capitalize on increased customer traffic, improved supply chains, and new business opportunities, thanks to its support from CWF & TPF, which brings together the stakeholders of two important steel consumer industries.

Event Highlights

Exhibition and Showcase: Leading brands will display state-of-the-art steel processing, manufacturing, and recycling technologies.

Conferences and Knowledge Sessions: Industry experts will share insights on emerging trends, market

Networking and B2B Meetings: A platform to connect with key decision-makers, investors, and policymakers.

Live Demonstrations: Showcasing cutting-edge machinery, automation, and production innovations.

“India’s steel sector is at a crucial juncture of transformation and growth. Bharat Metal Expo 2025 will be a game-changer, offering a worldclass platform for businesses to connect, showcase innovations, and explore emerging opportunities. Being co-located with two highly successful expos, i.e., CWF and TPF which showcase two of the mega steel consumer industries, no doubt BME is going to be a perfect platform for the Indian steel industry to exhibit its products, processes, and technologies,” said Priyank Jain, CEO, Tulip 3P Media

Why Attend BME25?

• Learn about the latest trends in the steel industry directly.

• Network with key decision-makers, buyers, and suppliers to grow your business.

• Discover breakthroughs in the science of steelmaking.

• Get valuable market knowledge from industry professionals.

• Watch live demos highlighting breakthroughs in steel manufacturing.

Don’t miss this landmark event. Register now to secure your spot at BME25! For exhibitor and sponsorship opportunities, visit: https:// bharatmetalexpo.com/

About the Organizer

Tulip 3P Media Pvt. Ltd. is a leading trade fair organizer and a well-established publisher of highquality industry publications. With a proven track record in launching successful B2B expos, the company is committed to create business growth and knowledge-sharing platforms for various industries.

Sambhv Steel Tubes Private Limited, a subsidiary of Sambhv Steel, has acquired land (in Chhattisgarh) for the establishment of a greenfield project. The company has also expanded its product portfolio by manufacturing specialty alloy steel pipes, including Corten steel pipes, and has increased the installed capacities for ERW (Electric Resistance Welded) and GI (Galvanized Iron) pipes to better meet the rising demand from both domestic and international markets. In an exclusive interview with Tube&PipeIndia , Mr. Vikas Goyal, CEO & Managing Director of Sambhv Steel Tubes, shares valuable insights into the company’s recent developments and its ambitious expansion strategies aimed at boosting production capacity across the tube, pipe, and stainless steel segments; driving sustainable growth; enhancing operational excellence and expanding global presence.

“At Sambhv Steel, we have developed the capability to produce steel directly from ore, and subsequently convert it into our final product, thereby reducing our dependency on the external market and allowing greater control over quality and cost.”

Tube & Pipe India: Please share your views on the Indian vis-a-vis the global steel industry. What is the role of the Indian government in the growth of this sector?

Vikas Goyal: The global steel industry is undergoing a transformation, driven by decarbonization, digitalization, and dynamic trade policies. While developed markets are maturing, India is clearly in a growth phase, both in terms of consumption and capacity creation.

The government’s focus on infrastructure, renewable energy, railways, and electric vehicles is further fuelling demand. Initiatives like PLI schemes and the National Steel Policy 2017 have created an enabling environment for domestic players to scale, integrate, and innovate. India is well-positioned to be a global hub for value-added steel and steel products and governmentindustry collaboration will be the key in realizing this potential.

TPI: What are the major ongoing challenges in the Indian steel industry?

VG: The steel industry is facing few headwinds. Some of them are:

Macroeconomy: With the global economy facing a slowdown, the government and individual spending may slow down as well, affecting demand for steel.

Global demand-supply scenario: Typically, when global demand is high, steel availability in India for domestic consumption gets impacted. The cost of imported raw materials in India, such as iron ore and coking coal can be affected by fluctuations in global demand and supply.

Raw material availability: India is self-sufficient in iron ore, but it has high dependence on imports for coal and scrap. Factors such as regulatory issues, environmental concerns, international trade restrictions and logistical constraints pose challenges to the availability of raw materials. Any disruption in the availability of raw materials

can result in increased production costs, decreased profitability and reduced competitiveness for steel manufacturers.

Raw material prices: Raw materials account for ~70% of production cost in the steelmaking process. Iron ore, coal, melting scrap, etc., are the major raw materials used in steelmaking. Any variation in the prices of these raw materials can significantly affect the margins of steelmaking companies, thereby affecting their competitiveness.

Decarbonisation: With the global steel industry moving towards achieving net-zero emissions from its steelmaking process, major countries are imposing restrictions on the trade of steel that does not meet their decarbonisation standards. The European Union (EU) has introduced the Carbon Border Adjustment Mechanism (CBAM) to support its rising climate ambition, which is expected to impact steel imports into the nation.

Trade restrictions negatively affect India’s steel exports, thereby impacting the overall growth of the industry. Domestic steelmakers are making capital investments to upgrade their facilities to produce green steel, in line with the government’s climate targets and to remain competitive in the market.

TPI: How can these challenges of the industry be addressed? How is your company contributing towards this transition?

VG: Addressing these challenges needs a multi-pronged approach.

Firstly, the steel industry needs to enhance raw material security by adopting backward integration. At Sambhv Steel, we have developed the capability to produce steel directly from ore, and subsequently convert it into our final product such as steel pipes and tubes, and stainless steel coils. This reduces our dependency on the external market and allows greater control over quality and cost.

Secondly, in order to reduce input

cost, especially power cost, we have to promote captive renewable energy generation. We have set up a 25MW captive power plant to optimize our power cost.

The industry also needs to strengthen logistics and infrastructure by upgrading last-mile connectivity. At Sambhv Steel, we are leveraging our natural geographical advantage. Being located in the central region of India, we enable efficient pan-India distribution and quicker access to key demand centres.

Lastly, the industry must accelerate decarbonisation by offering incentives on green steel adoption, and encouraging R&D for energy efficient processes. We, at Sambhv Steel, have invested in sustainable energy practices like installing a 16MW captive power plant from renewable source and Waste Heat Recovery Boiler (WHRB), reducing our environmental footprint

TPI: Can you tell us about the recent developments at your organization?

VG: Over the past 12 months, we have achieved significant milestones that have expanded our production capacities, and broadened our product portfolio. We have increased our installed capacity of ERW and GI pipes to increase our ability to meet rising domestic and international demand. We have also expanded the production capacities of our intermediate products, including

captive power generation, striving to achieve greater self-reliance.

We have manufactured specialty alloy steel pipes, such as corten steel pipes to further diversify our product offerings, and have also introduced value-added products like pre-galvanized (GP) coils and pipes which are widely used across diverse industries particularly in coastal regions.

Further, we have also entered into the stainless steel segment with integrated production of stainless steel flat products.

Our subsidiary, Sambhv Steel Tubes Private Limited has acquired land, where we are planning to commission a greenfield project, with one of the critical machinery (HR Mill) already procured and in process of being imported. We are also proud to have been officially certified as a Great Place to Work® in 2025.

TPI: Brief us about your specialized steel products along with their USPs. Where do your products find their applications? VG: We specialize in manufacturing ERW steel pipes and tubes and stainless steel coils offering a range of size, thicknesses, and value added options tailored to customer needs.

Our USPs include end-to-end customization, quick turnaround time, strategic geographic location, advanced galvanizing unit, specialized alloy steel capabilities, and captive

and sustainable power infrastructure.

With control over the end-to-end supply chain, we offer customization in terms of size and thickness striving to ensure that each product aligns with our customer’s requirement. Further, our backward integration strategy minimizes reliance on external markets for raw materials (such as HR coils), and provides our company with the ability to fulfil orders in faster lead times. Situated in the central part of India, we are able to achieve logistics and supply chain efficiency, enabling timely delivery across diverse markets.

We have set up a galvanizing line based on advanced technology ensuring superior coating quality with less consumption of Zinc. We also manufacture alloy steel pipes, including Corten steel pipes which expand our product basket to meet industry specific needs. Lastly, our captive power plant that includes a Waste Heat Recovery Boiler (WHRB) system enables us to conserve energy as no fuel is required for power generation.

Our steel pipes, tubes including GP pipes and stainless steel coils are integral to a wide range of critical sectors. Key application areas include architecture, building, and construction which include modern building frames, pre-fabricated buildings, purlins, fencing, handrails and industrial and manufacturing applications. Further, these products

are used in automobiles, railways, and transport (ART).

Steel pipes and tubes are also solar energy sector products, where they are utilized in the fabrication of module mounting structures for solar panels.

The urban infrastructure such as airports, telecom towers, transmission poles, signage and display structures etc. and the general engineering such as the construction of HVAC systems, fire safety systems, electrical panels, cable trays etc also use steel products. Lastly and most importantly agriculture uses steel pipes and tubes for water pipeline and irrigation systems, and manufacturing of agriculture equipment like tractors, cultivators etc.

TPI: What are your future growth plans or investments aimed at strengthening your market position?

VG: As we look to the future, our focus remains firmly on expanding

capacities, driving sustainable growth, enhancing operational excellence and expanding our global presence.

Our strategic priorities include capacity expansion of our pipes and tube segment with backward integration, as well as our stainless steel segment from our greenfield project. In addition to it, we also plan to increase our international footprint, and focus on renewable energy sources including solar power which will further reduce greenhouse gas emissions and carbon dioxide emissions, thereby reducing our power costs and enhancing operational sustainability.

Our integrated approach to capacity expansion, global outreach, and sustainable energy adoption positions us for long-term growth, improved operational efficiency, and a reduced environmental footprint—reinforcing our commitment to responsible and future-ready business practices.

SAMBHV STEEL TUBES LIMITED is proposing, subject to, receipt of requisite approvals, market conditions and other considerations, to undertake an initial public offer of its Equity Shares and has filed the draft red herring prospectus dated September 30, 2024 and the corrigendum dated November 28, 2024 (“DRHP”) with the Securities and Exchange Board of India (“SEBI”), BSE Limited and National Stock Exchange of India Limited. Any potential investor should note that investment in equity shares involves a high degree of risk and for details relating to such risk, please see the section entitled “Risk Factors” of the red herring prospectus, when filed. Potential investors should not rely on the DRHP for making any investment decisions.

For the preparation of the report, CRISIL MI&A has relied on third party data and information obtained from sources which in its opinion are considered reliable. Any forward-looking statements contained in the report are based on certain assumptions, which in its opinion are true as on the date of the report and could fluctuate due to changes in factors underlying such assumptions or events that cannot be reasonably foreseen. The report does not consist of any investment advice and nothing contained in the report should be construed as a recommendation to invest/disinvest in any entity. The industry report is prepared for use in the Offer Documents to be filed by the Company with the RoC, SEBI and the Stock Exchanges in India.

Man Industries (India) Limited plans to complete its INR 650 crore pipe manufacturing expansion facility in Damman, Saudi Arabia, in the FY 2025-26, and will be investing a fresh capex of INR 500 crore to complete the plants that will be operational by OctoberNovember.

May 03, 2025

Man Industries (India) Limited is set to complete its pipe manufacturing expansion facility worth INR 650 crore in Damman, Saudi Arabia, in the FY 2025-26. For this, the company plans to invest a fresh capex of INR 500 crore to make the plant operational by OctoberNovember.

Justifying its plan to have a facility in Saudi Arabia, Mr. Nikhil Mansukhani, MD of Man Industries said the country is levying a 20% duty on imports, on top of the freight cost of USD 100-200 per tonne incurred for shipping large diameter pipes. The new facility will help it capitalise on growing demand, ending import duties and cater to growing markets in Europe and America.

Mr. Mansukhani also added that apart from making special-grade pipes for the oil and gas sector and the transportation of water, Man Industries is also entering the manufacturing of special-grade pipes for hydrogen transportation. These pipes have already been tested and certified in Italy and the company is expecting orders from European countries that are developing a pipeline network for LNG transportation which will later be used for hydrogen distribution.

Vardhman Special Steels Limited (VSSL) plans to increase its rolling mill capacity to 270,000 tonnes by successful commissioning of the Kocks Block and installation of a new reheating furnace in FY26. The company is coming up with an INR 2,000 crore investment for a new 5,00,000 TPA steel plant in Punjab for the manufacturing of special and alloy steel. This was revealed by Ms. Soumya Jain, Executive Director, Vardhman Special Steels Limited in an exclusive interview with Tube&PipeIndia

Ms. Soumya

Jain, Executive Director, Vardhman Special Steels Limited

Tube & Pipe India: Kindly share details about your business journey, highlighting major milestones and crucial achievements.

Soumya Jain: Vardhman Special Steels Limited (VSSL) has undergone a remarkable transformation since its inception in 1973 as Oswal Steels with an initial capacity of 50,000 TPA of special and alloy steels. The company demonstrated early ambitions for growth with the acquisition of Mohta Alloys in 1986, expanding capacity to 1,00,000 TPA. Over the following decades, the company consistently invested in technology and infrastructure, installing a modern steel melting shop with electromagnetic stirrer in 1995 and commissioning a vacuum degassing system in 2000. In 2001, it further diversified its offerings by adding a bright bar facility. A key strategic shift came in 2010, when the company gained an independent identity under the prestigious Vardhman Group, setting the stage for a new era of growth and recognition, including being listed on both the BSE and NSE in 2012.

The 2010s marked a period of aggressive capacity expansion, technology upgrades, and corporate strengthening. In 2013, the company installed a fully automatic rolling mill and advanced testing systems from global leaders. The years that followed saw further infrastructure upgrades, such as the fume extraction system (2015), transformer enhancements (2016), and significant increases in both bright bars and hot rolled capacities. Capital infusions through a rights issue (2017) and a QIP (2018), land acquisitions, and a credit rating upgrade by CRISIL strengthened the company’s financial and operational position.

A landmark collaboration came in 2019 with Japanese specialty steel manufacturer, Aichi Steel Corporation of Japan, bringing in both technical expertise and strategic equity investment, marking a new phase of international alignment. More recently, the partnership with Aichi

Steel Corporation led to the commencement of mass production in 2023 and authorised approvals from Toyota & Maruti, showcasing Vardhman’s readiness to compete on a global scale. VSSL has announced a capex of INR 2,000 crore for a new greenfield steel plant in Punjab for the manufacturing of special and alloy steel.

TPI: Shed light on your recent developments. Where do you see yourself five years down the line?

SJ: We recently commissioned the Kocks Block. It is currently in the stabilization phase. We are planning to install a new reheating furnace in FY26. Once both are fully operational and stabilized, they will enhance our productivity, reduce inventory requirements and increase the rolling mill capacity to 270,000 tonnes from the current 200,000 tonnes. We realise that these incremental additions will suffice only for a couple of years, so we are setting up a state-of-the-art steel plant in Punjab with a planned capacity of 5,00,000 TPA of billet

“More recently, the partnership with Aichi Steel Corporation led to the commencement of mass production in 2023 and authorised approvals from Toyota & Maruti, showcasing Vardhman’s readiness to compete on a global scale.”

production with commensurate rolling mill and testing facilities. All inputs in the plant will be from Aichi Steel. This will make us distinct from others in the industry. We shall be producing Green Steel from this new plant. The company also aims to keep the flexibility in the new unit to diversify into new product segments. The new capacity, expected to be commissioned by FY 2029-30, will reduce the overall cost of steel manufacturing. The project aligns with trends such as the circular economy and green steel, a trend gaining momentum in the Western world that will soon cascade to the Indian shores. Vardhman may look forward to forging business in India. We expect Aichi Steel Corporation to invest more in VSSL.

TPI: Please give information about your manufacturing plants and annual production capacity catering to the steel sector.

SJ: VSSL operates its primary manufacturing facility in Ludhiana, Punjab. We have increased our billet-making operating capacity from 50,000 TPA in 2010 to 3,00,000 TPA in FY25, largely through process improvements and an investment of over INR 150 crore, which is a fraction of what we would have otherwise invested for a brownfield expansion of the same size.

TPI: Please tell us about your steel-related products basket. Which are the industries where these products find application?

SJ: Our products are majorly used for making components having application in the automotive industry. Some of the components made from our steel include axle gears, stabilizer bar, piston, knuckle spindle, connecting rod, camshaft, center velocity joint, crankshaft, differential gears, transmission gear, drive-shaft, tie-rod, bearings, companion-flange, axle shaft, pistonpin, steering-yoke, and steering shaft.

TPI: What is your USP that sets you apart from others? How do you manage to stay ahead of the curve in the industry?

“

Vardhman is among the few steel manufacturers with low carbon intensity with 0.73 tonnes of CO2 per tonne of steel as against about 3 tonnes of CO2 per tonne of steel of peers. ”

SJ: Vardhman is among the few steel manufacturers with low carbon intensity with 0.73 tonnes of CO2 per tonne of steel as against about 3 tonnes of CO2 per tonne of steel of peers. Our partnership with Aichi has enabled us to build an optimal global production system and meet customer requirements. We plan to manufacture Japanese quality steel in India for auto majors in the country as well as for the ASEAN region, while focusing on reduced manufacturing costs through waste elimination. We have the best-in-class R&D facility, which ensures the highest level of quality and compliance.

TPI: Tell us about your local and international market footprint. How do you plan to enhance your business presence in India as well as at the global level?

SJ: We have a strong domestic and international base of 200+ reputed and long-term customers. Our major clients include Toyota, Maruti, Hero Moto Corp, Caterpillar, Hino Motors, Bajaj and Hyundai. In FY-25, we exported 6 percent of our products in countries such as Thailand, Taiwan, Turkey, Russia, Germany and Spain. Our collaboration with Aichi Steel Corporation will increase this

percentage in future.

TPI: How are you addressing sustainability and environmental concerns in your production?

SJ: Vardhman is among the few steel manufacturers with low carbon intensity. By adopting the Electric Arc Furnace (EAF) route for steel making since its inception, we have embedded environment management as our operating platform. The EAF route uses 80 percent ferrous scrap, which shows we are best suited to auto OEs in complying with the Circular Economy norms. We are at 0.73 tonnes of CO2 per tonne of steel against about 3 tonnes of CO2 per tonne of steel for manufacturers using the blast furnace route. We are going a few steps further. We have contracted for setting up a 42 MW AC solar power plant, which will further optimize our carbon footprint to about 0.45 tonnes of CO2 per tonne of steel. Apart from this, we have developed Miyawaki Forest of about 12 acres, which will become a denser forest in the next 2-3 years. It will further reduce our carbon footprint. Also, we have replaced fuel oil with natural gas in all the operations of our plant. We have installed a fume extraction system, which collects dust particles before they are released in air.

TPI: What trends do you see shaping the future of the metal industry?

“ With the right blend of technology, sustainability, and customercentric approach, Vardhman Special Steels will play a leading role in shaping the future.”

SJ: India is fast emerging as a global manufacturing powerhouse. The metal industry is undergoing a transformation driven by technological advancements and a strong global push towards sustainability. Environmental regulations and customer expectations are pushing metal manufacturers to reduce carbon footprints. This includes adopting green steel, electric arc furnaces, and renewable energy in production. The move towards a circular economy is another crucial trend. With raw material scarcity and environmental concerns, metal recycling is gaining prominence. This is encouraging closed-loop systems to reduce waste and reliance on virgin ores.

Supportive government policies, such as PLI schemes and infrastructure initiatives, National Steel Policy, and infrastructure spending are directly aiding the growth of domestic manufacturing and exports. Infrastructure, construction, automotive, and renewable energy projects are driving up demand for steel, aluminium and specialty alloys, particularly in emerging markets like India.

Multinational corporations are de-risking their supply chains by diversifying away from China. India is becoming a key alternative hub for sourcing and manufacturing, boosting domestic capacity and foreign investment in metals and forging. Lastly, as geopolitical tensions and trade dynamics reshape the global landscape, building resilient, localized supply chains has become vital. We are forging long-term partnerships and diversifying our procurement strategies to remain agile and secure. We are investing in energy-efficient processes, waste reduction, and increased use of recycled materials to ensure that we stay ahead of environmental expectations. Overall, we see this as a time of great opportunity. We’re confident that with the right blend of technology, sustainability, and customer-centric approach, Vardhman Special Steels will play a leading role in shaping the future.

Astral Limited has been granted certification by the Bureau of Indian Standards (BIS) for its Oriented Polyvinyl Chloride (OPVC) pipes used for water supply.

Apr 03, 2025

Astral Limited has announced that it has been granted a certification by the Bureau of Indian Standards (BIS) for its Oriented Polyvinyl Chloride (OPVC) pipes used for water supply.

The company informed the stock exchange board about the certification that will strengthen Astral’s position in the market and is expected to enhance

product reach and revenue potential going forward. The certification is a significant achievement for Astral, reinforcing its commitment to the quality standards in its OPVC segment.

Ratnadeep Metal & Tubes is making significant strides towards the company’s growth through backward integration. In an exclusive interview with Tube&PipeIndia , Mr. Bharat Sanghavi, Managing Director & CEO of Ratnadeep Metal & Tubes, and Mr. Jaimik Sanghavi, Director of the company, discuss the company’s plans to produce raw materials inhouse. With this strategic move, Ratnadeep Metal & Tubes aims to boost its production capacity to 15,000 metric tonnes per annum from 12,000 tonnes per annum within the year.

Tube & Pipe India: How do you view the Indian steel industry in comparison to the global market? Bharat Sanghavi: We see robust growth in the Indian steel industry and expect the domestic steel consumption to grow at a healthy rate of 9-10 percent in FY2025. For the past three years, the steel industry has witnessed one of the fastest growth periods since the global financial crisis of 2020, following the pandemic. In FY24, the industry registered a consumption growth of more than 13 percent, giving a positive outlook to the industry.

Jaimik Sanghavi: In recent years, the steel industry has witnessed remarkable growth. If you look at the government data, the performance of the Indian steel sector during April-June FY25 (Q1:FY25) surpassed the levels for this period in any fiscal year. The crude steel production reached 36.61 million tonnes, finished steel production was at 35.77 million tonnes, while finished steel consumption reached 35.42 million tonnes. India is set to become a major global player in steel production, showing an upward trajectory

in both crude and finished steel production, as well as in finished steel consumption. The robust demand and expansion in the sector position it for consistent growth in the coming quarters. India, which is currently the world’s second-largest producer of steel, will play a significant role in shaping global steel markets and supporting industrial advancements worldwide.

TPI: How do you see the growth trajectory of the tube and pipe segment? What role does the Indian government play in supporting the growth and development of this sector?

JS: We foresee huge growth in the Indian tube and pipe industry, owing to the government’s increased investment in sectors such as oil & gas, fertilizers, power plants and nuclear energy. However, several policies require immediate attention of the government. For example, certain types of steel are neither melted nor produced in India. We believe the government should recognize the needs of the steel industry and support the production or melting of these specialized steels

domestically. This would reduce our reliance on imports and enable the Indian companies to manufacture special grades like nickel alloys, which hold significant potential in future markets.

TPI: Tell us briefly about your company.

BS: Established in 2004, Ratnadeep Metal & Tubes specializes in the manufacturing of seamless and welded tubes and pipes composed of stainless steel, nickel alloy, duplex and super duplex, titanium, carbon steel and alloy steel. Equipped with modern production facilities, the company has an in-house bright annealing system and testing facility to ensure that every single product is of the highest quality and meets international standards. Ratnadeep Metal & Tubes leverages its strong infrastructure and highly-skilled engineers to create efficient products, building transparency and longterm customer relationships. The company produces tubes and pipes with external diameters ranging from 3.0 mm to 323.9 mm and a wall thickness of 0.5 mm to 15.0 mm. The tube and pipe company has an annual

production volume 12,000 metric tonnes.

TPI: Can you mention some of the recent developments in the company?

JS: Our company will significantly expand its manufacturing capacity this year. Our capacity enhancement plans further include technology upgradation and automation of machinery. We are implementing a backward integration strategy to produce raw materials in-house. Currently, our production capacity stands at approximately 12,000 metric tonnes per annum. With these developments, we expect to increase our capacity to 15,000 metric tonnes per annum within the year.

We are proud to be part of Chandrayan – 3 mission by supplying our stainless steel seamless instrumentation tubes for critical application. Recently, we installed two high-speed cold pilger mills to produce tubes from 10 mm OD to 38.10 mm OD. We have also installed a bright annealing furnace with a fast cooling chamber for special alloys materials and for better surface roughness of tubes and pipes.

TPI: How do you ensure quality management of your products?

BS: Ratnadeep Metal & Tubes upholds high manufacturing standards by sourcing premium raw materials and implementing rigorous quality control measures. By leveraging advanced technologies and precise quality testing methods, including hydrostatic tests, Eddy Current tests, ultrasonic tests, and various other parameter checks, the company ensures consistent product quality that meets international standards. Its robust quality management system guarantees complete traceability, supported by comprehensive documentation.

TPI: How do you stay ahead of the curve?

JS: Ratnadeep Metal & Tubes caters to a wide range of clients due to inhouse manufacturing & testing of product mix in terms of metallurgy & size range. The founder of Ratnadeep Metal & Tubes, Mr. Bharat S.

Sanghavi, has a rich experience of manufacturing tubes and pipes for over 40 years. We have approvals in all major domestic & international end users, engineering companies & fabrication industry. A very highlyskilled & experienced team of employees has been part of Ratnadeep Metal & Tubes since beginning, which provides seamless solutions to clients. Our consistency on quality and delivery plays a major role in getting repetitive business.

TPI: Can you tell us about your key clientele and market footprint, including your reach in international markets?