Vol. 26 No. 03 | Aug-Sep, 2025

Vol. 26 No. 03 | Aug-Sep, 2025

August-September, 2025, Paper Mart

028 ITC PSPD Champions Sustainable Packaging Through Research and Innovation

034 TNPL Gearing Up to Produce More FBB Grade Products

038 JK Paper Boosts Packaging Portfolio with Focus on Innovation and Conversion Line Expansion

048 Khanna Paper Mills Carves a Niche in the Packaging Board Segment, Focussing on FMCG Sector

056 N R Agarwal Industries to Install Another 1020 TPD Board Machine, Capacity to Reach 8,00,000 TPA

060 Sripathi Paper and Boards Aims to Become World’s First Fully Sustainable Packaging Board Enterprise

066 Star Paper Mills Targets Capacity Expansion and Product Innovation Amid E-Commerce and FMCG Boom

068 Chandpur Paper Eyes Global Growth with Sustainable Packaging Solutions

072 Ruchira Papers Propels Sustainability Through Agro-Based White Packaging Paper

076 Apollo Papers Eyes Global Market Expansion; Plans to Manufacture VTL and Paper Bag Grades

081 Sappi Sees Growth Opportunities in WetStrength Labels and Functional Packaging in India

084 Klabin Strengthens Its Containerboard Paper Production Chain With Robust Presence in Asia and Europe

089 Waste to Containerboard: Al-Jawdah Paper Driving Circular Economy in Saudi Arabia

Chain

092 Valmet’s Future-Ready Supply Chain Strategy- Greener Logistics and Circular Economy Practices

The Indian paper industry has steadily evolved in the past two decades. Once dominated by writing and printing paper, it is now the packaging segment that drives expansion, spurred by kraft, duplex, and specialty grades amid fast changing packaging preferences.

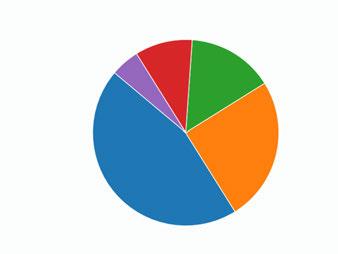

Rising consumption, the growth of e-commerce, and sustainability pressures have made packaging paper one of the fastest-growing categories. Recent estimates place the Indian packaging paper and paperboard market at roughly 15 million tonnes in 2023-24, growing at 8.2% year-on-year, and generating around USD 15.8 billion in 2024, with forecasts pointing toward USD 25.2 billion by 2030. The segment’s robust year-on-year growth is a clear reflection of demand resilience despite global supply chain pressures.

Corrugated boxes, folding boxboards (FBB), coated duplex boards, kraft paper, and liquid packaging boards together make up the bulk of this demand. The market is also supported by increasing penetration of organized retail and government initiatives promoting sustainable packaging. India remains one of the fastestgrowing paper markets globally, with per capita paper consumption at 15–16 kg, still far below the world average of 55–60 kg, indicating significant headroom for long-term expansion.

The packaging paper industry in India is broad-based, with several distinct sub-segments catering to different end-use applications, each showing its own growth trajectory.

Kraft paper forms the backbone of the sector, driven largely by the rise of e-commerce and the rapid expansion of supply chains. It is the most widely used material for corrugated boxes, which account for nearly 65–70 per cent of all packaging needs in logistics. India’s kraft paper market has already reached around 11 million tonnes in 2024 and is projected to grow at a CAGR of about 7.2%, likely exceeding 21 million tonnes by 2033.

Producers are actively investing in stronger and lighter kraft grades. As Dinesh Haripara, MD of Apollo Papers

explains: “Our core product portfolio includes high BF kraft paper…Manufactured with a strong focus on strength, durability, and printability, our products perform exceptionally well in high-speed corrugation lines...” The company adds that a shift is underway towards higher-BF and low-GSM kraft to optimize box design.

Sripathi Paper and Boards also caters to kraft and linerboard demand alongside its duplex offerings. As Sudarshan Rangaswami, Assistant VP (Finance) notes: “We have a wide variety of products ranging from eco-FBB, white top kraft liner,…developed because of our customer focused approach and a vision to build a value- added packaging board business.” These kraft liners and eco-

friendly solutions address the growing preference for recycled, high-performance grades.

Duplex board is another large sub-segment, available in both coated and uncoated varieties, which finds widespread use in FMCG, pharmaceuticals, and personal care packaging. From toothpaste cartons to over-thecounter medicine boxes, duplex board serves as the face of retail packaging. Though coated duplex demand was around 5.2 million tonnes in 2021–22 with projected growth around 7.1%, recent forecasts suggest a more cautious outlook, at approximately 5–6% CAGR through 2034. This moderated outlook is primarily driven by volatility in pulp and chemical prices, which constrains mill margins, and by recurring demand slowdowns linked to surplus domestic capacity.

Khanna Paper Mills has made deep inroads here with flagship grades such as Diamond Graphic Grey Back (duplex) and Dezire (folding box board). SVR Krishnan, Executive Director (Operations) states, “Our packaging boards are used by the leading national and international brands in consumer goods or FMCG.”

Sripathi Paper and Boards contributes with dust-free duplex grades. “The variety which includes dust-free grey back (nano super), dust-free white back duplex boards (nano gloss), and eco-FBB (nano green) with a wide GSM range from 180 right up to 450 GSM, enables us to offer a one-stop solution to our customers,” explains Sudarshan Rangaswami.

NR Agarwal Industries (NRAIL) is another significant duplex and board producer with a strong domestic footprint. Its portfolio spans FBB, SBS, duplex and triplex boards. “Customer preferences are evolving across industries. To meet this evolving need, we have produced coated duplex boards (WLC) that are eco-friendly, made from recycled fibers…suitable for cereal boxes, dry foods, and FMCG… Folding Box Board (FBB) which is premiumgrade... Solid Bleached Sulphate (SBS) boards which are made up of 100% virgin fiber…for embossing and highend packaging (e.g., perfumes, chocolates, cosmetics),” informs R.N. Agarwal, CMD, NRAIL. The company is scaling up with a new board machine to meet rising demand. “Our roadmap is ambitious and future-ready. To expand our production capacity, a new 1,020 TPD board machine project is underway, enabling us to cater to rising demand.”

Corrugated boards and sheets, which rely heavily on kraft paper as raw material, have surged with the boom in e-commerce. India’s express parcel market is expected to handle 10–11 billion shipments in FY2025, over half of which come from e-commerce, and is projected to grow nearly 3 times to 24–29 billion parcels by FY2030, driving sustained demand for corrugated packaging. Mills are innovating with strength-to-weight optimization, as Apollo Papers highlights.

Specialty papers and boards represent the most dynamic frontier of the sector. These include barriercoated papers for food-safe packaging, greaseproof wrappers, liquid packaging boards, and decorative laminates. The segment has gained significant traction after India’s phased ban on single-use plastics, with QSR chains and FMCG majors shifting to sustainable alternatives. The specialty paper market is expected to grow at double-digit rates, with estimates ranging from 10 to 12 per cent CAGR over the next decade.

ITC PSPD has pioneered here with its Filo series: “Our path-breaking Filo series of sustainable paperboards has gained significant traction in the food and beverage industry, both in India and abroad as a substitute to single use plastics, further underlining our commitment to sustainability.”

Tamil Nadu Newsprint and Papers Ltd (TNPL) has invested in premium coated boards. “Our product portfolio includes Folding Box Board (FBB), Solid Bleached Sulphate (SBS) board and cup stock, with a GSM range of 150–400. For cup stock, Aura Flute and Aura Flute Supreme are well suited for paper cups used with hot and cold beverages, with the Supreme range offering premium printability and gloss,” explains Sandeep Saxena, Chairman & MD.

Ruchira Papers is differentiating with agro-residue-based white packaging grades. “We offer high-quality white packaging paper across various GSMs ranging from 60

to 180, suitable for food packaging, pharma, hygiene products, retail packaging, and value-added converting applications,” says Ruchica, Director.

Star Paper Mills, with its legacy portfolio, supplies grease-resistant and colored boards. Managing Director Madhukar Mishra informs, “We also offer an array of specialty papers, including MG poster, ARSR poster, stiffer cover, oil- and grease-resistant (OGR) paper, cup stock paper, honeycomb paper, and colored papers & boards for diverse specialized applications.”

Chandpur Paper has positioned itself in MG and chromo papers, also serving specialty end uses. Founder Amit Mittal explains, “Our portfolio includes MG poster paper and chromo (C1S) paper, which are retailed primarily in GSM ranges of 35 to 70. Our paper grades find applications in FMCG packaging, labeling, commercial print, PE lamination, and flexible packaging segments. Keeping an eye on changing market trends and growing environmental pressures, we are also producing valueadded and specialty grades.”

Together, these sub-segments highlight the breadth of India’s packaging paper industry, from commodity kraft and duplex to high-value specialty paper and boards. Kraft and duplex papers dominate current market volumes, but specialty paper segments are driving the industry’s expansion. Companies like ITC PSPD with its FiloBev brand, TNPL’s Aura Flute Supreme, Ruchira’s white paper offerings, Sripathi Paper and Boards’ ecofriendly folding box board, and Chandpur Paper’s chromo grades represent the sector’s most dynamic growth opportunities. These specialty paper manufacturers are capturing market share by targeting specific applications that command premium pricing over commodity grades. The shift reflects broader industry consolidation around value-added products as traditional paper demand faces headwinds from digital alternatives.

Packaging paper production in India today runs on a balanced mix of virgin pulp and recycled fiber, but the industry remains exposed to global price swings in both imported pulp and wastepaper. Despite an improving domestic wastepaper ecosystem, the collection and segregation infrastructure is still fragmented, forcing mills to source high-quality recovered fiber from overseas. For integrated players like ITC PSPD and JK Paper, captive pulp capacity helps de-risk supply volatility, while recycled-fiber–based producers such as Khanna Paper Mills, NR Agarwal Industries, and Sripathi Paper and Boards continue to invest in better sorting, pulping, and de-inking technologies to maximize fiber yield.

On the technology front, the industry has seen a steady wave of upgrades aimed at improving strength, reducing grammage, and enhancing resource efficiency. ITC PSPD

has strengthened its packaging portfolio through recent technological upgrades, including the commissioning of PM1A and a BCTMP plant at Bhadrachalam for high-quality board furnish, installation of a coater for sustainable barrier boards and a laminating machine at its Bollaram unit, and capacity enhancement of décor paper at Tribeni, alongside being the first in India to commission a High-Pressure Recovery Boiler (HPRB), underscoring its commitment to green technology.

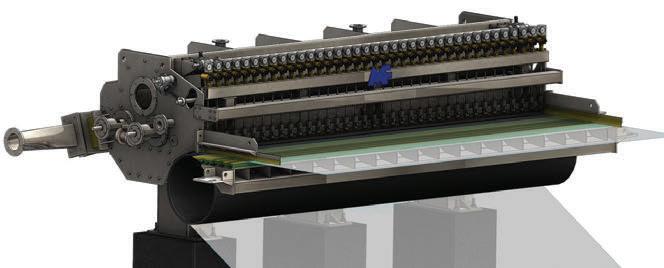

TNPL has adopted two shoe-press machines and invested in coatability and surface sizing systems to produce premium FBB and SBS boards with higher bulk and smoothness at lower basis weights. JK Paper’s 170,000 TPA multi-layer board machine at Fort Songadh is one of the most modern lines in the country, featuring advanced dilution control and quality monitoring systems to produce lightweight boards with consistent performance.

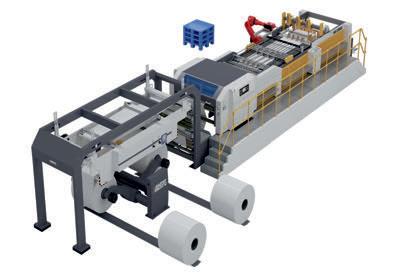

Several mid-sized players have made targeted process upgrades. Khanna Paper Mills has commissioned a Voith Master Jet Tech-3 headbox, allowing better fiber orientation and strength properties. NR Agarwal Industries has focused on lightweighting technology and has recently commissioned a 900 TPD state-of-theart multiwire board machine, supplied by GSPT Korea and Andritz. Ruchira Papers’ investment in agro-residue pulping lines allows the use of wheat straw, bagasse, and rice husk as raw material, thereby lowering wood dependence and cutting carbon intensity. Besides, the company has invested in automation in sheet formation, process control systems to reduce variability, and enhancements in pulping efficiency to improve yield from agro-residue

In South India, Sripathi Paper and Boards has executed a string of upgrades under its Vision 2028 plan, including a glass-lined calenderer, blade coater on PM4, automatic sheeters with vertical stacking, and a Warehouse Management System (WMS) for seamless dispatch planning. Apollo Papers has implemented real-time monitoring systems that track key quality parameters and improve machine runnability on high-speed corrugation lines.

Chandpur Paper has recently installed new-technology paper machines and fiber lines to improve both product quality and operational efficiency, complemented by real-time quality monitoring systems that ensure batchto-batch uniformity and minimize profile deviations. Star Paper Mills has modernized its turbine and energy systems to enhance power efficiency and cut operating costs.

Lightweighting remains a common technological theme across the industry, as converters demand lower GSM paper and boards without compromising strength. “Lightweight packaging is steadily becoming the

preference for many due to cost-efficiency and increased awareness on sustainability and we have ensured that we maintain our competitive advantage by meeting this demand without compromising on the performance or the quality of our grades,” informs ITC PSPD.

Several mills are also developing barrier-coated and grease-resistant grades to replace plastic laminates in food service and delivery packaging. Across the board, digitalization, predictive maintenance, and energyefficiency programs are gaining traction, driven both by cost pressures and the need to meet ESG commitments.

Collectively, these investments show a sector in the midst of technological renewal, building capacity, improving fiber efficiency, lowering energy and water footprints, and laying the groundwork for more specialized, highermargin packaging products.

The packaging paper sector in India reflects a layered market structure, where large integrated majors set the pace, mid-sized firms scale through innovation, and regional mills sustain niche demand. Together, they create a fabric of resilience and adaptability that has allowed the industry to grow despite challenges of cost pressures and global volatility.

At the top end of the spectrum, ITC PSPD, India’s largest integrated pulp and paper manufacturer with close to one million MT capacity, continues to emphasize sustainability and product diversification. The company affirms, “We are confident this will strengthen the market standing of ITC PSPD and create new opportunities in both the domestic and international markets.”

TNPL, with 600,000 TPA of capacity, has built a strong base in premium boards and is preparing for the next wave of demand. Sandeep Saxena says, “To tap into the growing packaging grade products demand, TNPL is gearing up to produce more Folding Box Board (FBB) grade products which will further enhance customer delight.”

JK Paper has consolidated its leadership in the packaging board segment with both greenfield and acquisition-led expansion. In early 2022, the company commissioned its INR 2,000 crore integrated unit at Fort Songadh, Gujarat, adding 170,000 TPA of multi-layer packaging board and 160,000 TPA of integrated pulp. This pushed its total capacity close to 800,000 TPA, with 15–20 percent of output already routed to export markets.

Complementing this, JK Paper also entered the packaging conversion space through the acquisition of Borkar Packaging, one of India’s leading corrugated and folding-carton producers. As Chairman & Managing Director Harsh Pati Singhania was quoted as saying, “The

Packaging Conversion business is amongst the fastest growing segments in the Indian Paper and Packaging industry driven by growth in end use industries. The acquisition of BPPL is in line with the long-term strategic objective of the Company and gives us an opportunity to offer combined solutions to customers with respect to secondary and tertiary packaging.”

Century Pulp & Paper has steadily positioned itself as a leading player in the premium packaging board space, with nearly 182,500 TPA dedicated to multi-layer packaging board production (out of a total 480,000 TPA capacity). Multi-layer packaging board contributes about 40–44% of Century Pulp & Paper’s revenue, underscoring its role as a core product alongside writing & printing paper, tissue, and rayon pulp. Its portfolio includes high-quality grades such as Folding Box Board (FBB) and Solid Bleached Sulphate (SBS), catering to the demanding needs of FMCG, pharmaceutical, and personal care segments. The company emphasizes the use of virgin pulp and eco-friendly coatings, aligning with the growing preference for sustainable and foodsafe packaging solutions. Following its recent acquisition by ITC for INR 3,498 crore, CPP’s packaging business is expected to gain further momentum through synergies with ITC’s Paperboards and Specialty Papers Division, expanding capacity utilization and enhancing its presence in domestic and export markets.

Like Century Pulp & Paper, West Coast Paper Mills has reinforced its position in the packaging space, with the bulk of its 320,000 TPA capacity devoted to paperboards and specialty grades such as folding box board, cup stock, and coated duplex board. Packaging products form a significant share of its revenue, reinforcing their role as a strategic growth driver alongside traditional printing and writing papers. Its portfolio serves a diverse range of end-use sectors, including FMCG, pharmaceuticals, foodservice, and e-commerce, where demand for high-strength and food-safe packaging is rising. The company’s “minimum impact–best process” approach underlines its focus on sustainable production, energy efficiency, and eco-friendly packaging solutions. With capacity operating at over 90% utilization and an increasing focus on exports, West Coast Paper Mills is well-positioned to capitalize on the robust growth in consumer packaging demand both in India and key overseas markets.

Mid-sized players are carving out their own space by leveraging recycled fibre, agro-based raw materials, and targeted product differentiation. Khanna Paper Mills, one of the largest recyclers in the country processing nearly 390,000 tonnes annually, is optimistic: “We, at Khanna Paper Mills, are very optimistic about this growth trajectory of good quality paper and packaging boards, due to the major push on literacy level, industrialization,

urbanization, e-commerce, Q-commerce and technological advancements.”

Among these, NR Agarwal Industries (NRAIL) is scaling aggressively with a new 1,020 TPD board machine project, describing its roadmap as “ambitious and future-ready.” Ruchira Papers has positioned itself around agro-residuebased packaging grades, with its leadership noting, “Our white packaging paper is made from agri-residue such as wheat straw, sugarcane bagasse, and rice husk –agricultural byproducts that would otherwise go to waste or worse, be burnt.” In South India, Sripathi Paper and Boards, with 800 TPD of capacity at Sivakasi, is pursuing a bold sustainability-driven vision. “Through Vision 2028, we aim to become the first sustainable board enterprise… we will have a unique offering in the export markets,” says Sudarshan Rangaswami.

Regional and specialized producers are also shaping the future of packaging paper. Apollo Papers, based in Gujarat, leverages its proximity to Mundra Port to drive exports and expand its global footprint. Managing Director Dinesh Haripara explains, “With our strategic location near Mundra Port, continuous investment in technology, and customer-centric innovation, we are wellpositioned to scale globally and meet the evolving needs of the packaging industry.”

Star Paper Mills, with nearly nine decades of history, underscores its continued relevance. Madhukar Mishra says, “As India’s key packaging paper company, we have been producing packaging grades for nearly 90 years. With the flexibility to manufacture multiple grades, we are well-positioned to cater the rising demands of our customers.” Chandpur Paper, a newer entrant with 120 TPD of capacity, is charting a roadmap based on diversification and exports. Founder Amit Mittal remarks, “Our five-year plan is based on increasing production capacity, consolidating exports, and diversification into food-grade and specialty papers divisions…creating Chandpur Paper as a globally accepted brand.”

Taken together, these voices illustrate the multi-layered nature of India’s packaging paper industry. This diversity of scale and strategy ensures that the sector not only meets growing domestic demand but also strengthens its standing as a globally competitive and sustainable packaging hub.

The packaging paper industry continues to navigate a demanding environment, shaped by raw material volatility, energy costs, logistics bottlenecks, and evolving regulation. Fiber sourcing remains one of the most pressing concerns for producers, especially for those dependent on imported recovered paper. “Disruptions in global supply chains, more specifically shipping, and volatility in raw material, both availability and pricing,

and increasing energy costs have been some of the key challenges that have affected the industry at large, and Sripathi Paper and Boards is not an exception to this,” says N. Rama Mohan Murali of Sripathi Paper & Boards.

Energy pricing, in particular, has become a significant variable in cost structures. Chandpur Paper’s Amit Mittal observes, “Raw material and energy price uncertainty continue to be our greatest challenges for our company. In reaction to this, we have diversified our suppliers and are aggressively pursuing backward integration to achieve more cost control and supply guarantees.”

Logistics inefficiencies and regulatory changes compound these pressures. Apollo Papers highlighted the shift in customer preference that requires mills to constantly adjust machine settings and production schedules: “We are witnessing a clear shift in customer preference toward higher-BF as well as low GSM packaging paper and board variants by reducing the number of ply in the box.”

Ruchira Papers points out that managing performance while keeping costs under control remains challenging. Ruchica says, “Balancing performance and cost-efficiency has always been a challenge, especially in times of raw material price volatility and rising energy costs. We tackle this through backward integration, localized sourcing networks, and by continuously benchmarking our processes against best-in-class operations.”

Policy frameworks, including Extended Producer Responsibility (EPR) regulations, have been instrumental in driving demand for recycled fiber-based solutions. “Post-COVID packaging demand has not only grown but also diversified, with a clear tilt towards eco-friendly, recycled, and performance-optimized grades—areas where Sripathi Paper and Boards has a strong, scalable product portfolio,” noted Murali.

This shift aligns with the government’s push for plastic substitution, which continues to encourage innovation in barrier-coated and food-grade papers. ITC PSPD says, “There have been several regulatory changes in the packaging industry – such as the Plastic Waste Management Rules and ban on Single-use plastic items. We have been able to leverage our R&D capabilities to launch several paper-based alternatives to single-use plastics.”

Packaging paper demand in India is projected to remain strong through the rest of the decade, though growth estimates vary by source. Some forecasts see the market expanding from about USD 13.7 billion in 2025 to nearly USD 18.9 billion by 2030, implying a CAGR of 6–7 per cent. Other reports are more bullish, projecting an increase from USD 8.4 billion in 2024 to roughly USD 19 billion by 2030, which would reflect double-digit growth

We are a company that started almost two decades ago with a vision to provide practical and long lasting solutions to the burgeoning paper industry in India by creating a fusion of chemistry applications and local industry environment and requirements.

Packaging & Board

Printing & Writing Recycled Fiber Enzymes

Internal Sizing & Surface Sizing

Retention and Drainage

Dry Strength Resin

Paper Machine Deformer and DE-AERATION

Surface Additives

Felt Cleaning and Conditioning Program

Microbiological & Deposit Control Program

Wet Strength Resin

Stickies Control program

Deinking chemicals

Enzymes

Starch(Native, Modified cationic/oxidized)

Coating thickener

Coating lubricant

Dispersants

Antisclants

Flocculants

Coagulants

Pulp mill Cooking-aid

Pulp mill Wash-aid

Odor control

of around 14 per cent annually. Regardless of the exact pace, analysts agree that kraft paper and duplex boards will remain the largest contributors to overall demand.

Driven by the push to replace plastics, demand for advanced packaging solutions is on the rise. Barriercoated boards, mono-material food-safe wraps, and flexible specialty papers are gaining ground, particularly among premium FMCG and food service brands. In fact, the specialty papers market, covering decorative and high-barrier grades, was at about USD 1.92 billion in 2023 and is expected to grow from about USD 2.52 billion in 2024 to USD 5.76 billion by 2035, at a CAGR of approximately 7.8%.

Further, as domestic mills scale up their production and improve quality, India is poised to tap growing demand across Asia and Africa. Compact and cost-sensitive, these markets are increasingly seeking paper-based packaging alternatives, especially for fast-moving consumer goods and food items. With improved economies of scale and competitive pricing, Indian producers are well-positioned to fill this gap, especially in corrugated and folding-carton grades that dominate but also premium liquid cartons, which are seeing growth at around 7.6% CAGR.

Sustainability is now central. Paperboard based on recycled fibers already accounts for over half of sales (53%), while hybrid grades that blend recycled with virgin

fibers are gaining, with a projected 7.8% CAGR, according to a report. To secure raw material and reduce ecological impact, investments in wastepaper collection and inhouse forestry (bagasse or agro-residues) will become increasingly important. These efforts will not only reduce import dependency but also cater to eco-conscious consumers and regulatory requirements.

The medium-term outlook remains optimistic, supported by e-commerce growth, rising penetration of organized retail, and brand-owner commitments to sustainability. ITC PSPD emphasized its confidence in growth momentum: “…while we keep driving our growth in our existing export markets, we are now venturing into international markets that have remained untapped until now.”

Strategically, mills are aligning investments with future demand centers. Ruchira Papers’ leadership summed up their approach: “We continue to explore new categories and functional improvements that cater to emerging applications and align with sustainability goals.”

All told, the industry’s future looks set for steady expansion, with a mix of measured volume growth and strategic upgrading in product quality. The decade ahead is less about raw scale and more about innovation, sustainability, and global competitiveness.

ITC PSPD has been driving sustainability in the packaging segment through innovative solutions. In an exclusive interview to Paper Mart, ITC Paperboards & Specialty Papers Division (PSPD) shares that the company is leveraging its R&D capabilities to launch several paperbased alternatives to single-use plastics. From sustainable packaging solutions to helping customers with ‘light-weight’ packaging requirements, the company’s innovative and sustainable paperboard segments- like ‘Filo’ series- has gained significant traction, both in India and abroad, underscoring the company’s commitment to sustainability.

“Our paperboard brands such as Cyber XLPac, Carte Lumina and FiloBev are well established in the market.

Paper Mart: Could you begin by giving us an overview of your packaging paper and board operations – including your production capacity, facility locations, and manufacturing setup?

ITC PSPD: ITC’s Paperboards & Specialty Papers Division (ITC PSPD) is amongst the leading names in the business worldwide. We are the largest integrated pulp and paper manufacturer in India. Our worldclass facilities - Bhadrachalam & Bollaram in Telangana, Kovai in Tamil Nadu and Tribeni in West Bengal respectively offer a wide range of products with an annual capacity of almost 1 million MT.

We proactively anticipate industrial trends and have stayed ahead of the curve by investing in state-of-theart green technology, implementing

ground-breaking renewable energy projects, focusing on R&D and launching innovative paper products. We leverage cutting edge technology through digitalization and adoption of Industry 4.0. All of these, accompanied by a diverse product range of high-quality paper & paperboards have helped us emerge as one of the leading manufacturers in the industry. Our innovative solutions fulfilling a diverse cross-section of printing and packaging needs have helped carve a niche for ourselves.

PM: Please walk us through your current product portfolio. What grades, GSM ranges, and end-use applications do you cater to, and are there any specialty packaging paper and board products you offer?

ITC: We manufacture a wide array of products that meet a variety of needs across industries, ranging from packaging boards, graphic boards, plastic substitution products to specialty papers. We are the pioneers of virgin boards and décor papers in India. We have consistently upscaled our portfolio of products and services over the

years. Today, ITC PSPD’s products and pool of knowledge-based services are much sought-after, both in India and internationally, by discerning customers. Our paperboard brands such as Cyber XLPac, Carte Lumina and FiloBev to name a few, are well established in the market.

Our product verticals include paperboards (both virgin & recycled) that find applications as carton packaging, liquid packaging, graphic boards, barrier boards, solid boards, top liners, etc. We also manufacture specialty papers for decorative laminates, thin printing, food wrapping and other applications. Our fine papers range serves a variety of writing & printing applications. We are also the pioneers of sustainable packaging products in India, having launched several paper-based alternatives to single-use plastics in the F&B segment.

Our GSM range starts from as low as 21 GSM for specialty paper and goes up to as high as 450 GSM for virgin paperboards. We also have solid boards with thicknesses up to 4mm that are a substitute for

“Some of the recent technological upgrades at our facilities include the installation of PM1A and a BCTMP plant at the Bhadrachalam unit, a coater for sustainable barrier boards and a laminating machine at the Bollaram unit, as well as increased décor paper production capacity at the Tribeni unit.

rigid plastics in in-store branding applications.

PM: Which are your key domestic and international markets? How has your market footprint evolved in the past few years?

ITC: ITC PSPD has a pan-India footprint with an extensive dealer network spread throughout. We have 5 sales offices in major cities of India with a dedicated sales & marketing team to build and enhance our customer relations. In order to be closer to our markets and ensure faster deliveries, we maintain 5 Quick Service Centres (QSCs) across the country. Our robust supply-chain systems ensure round-the-clock service.

Internationally, we cater to almost 50 countries. While concentrating on our home-grown markets, we also intend to increase our global penetration and are foraying into unexplored international markets.

PM: Sustainability is becoming a cornerstone of packaging. What steps have you taken to integrate environmentally responsible practices into your manufacturing and sourcing?

ITC: At ITC, sustainability has been at the heart of everything we do. ITC is the only company of

comparable size in the world to be carbon positive for 20 years, water positive for 23 years and solid waste recycling positive for 18 years in a row.

In 2022, our Bhadrachalam unit commissioned India’s first high pressure recovery boiler (HPRB), leading to a significant reduction in the unit’s coal consumption. As a result, the Bhadrachalam mill consumes 53% of its energy from renewable sources, already surpassing our 2030 target of 50%.

We are strongly committed to developing a sustainable raw material base, and hence we progressively source our pulpwood from renewable plantations under our Social and Farm Forestry programmes, which provide sustainable livelihood opportunities to tribals and marginal farmers. We are proud to say that our afforestation programme has helped green over 1.32 million acres of land and sequestered around 6.4 million MT of CO2, while generating over 241 million person-days of employment till date. We are also the first paper company in India to obtain the Forest Stewardship Council - Forest Management (FSCFM) certification for our forestry program. All 4 of our manufacturing units are FSC®-CoC (Chain of

Custody) certified, ensuring ‘zero deforestation.’

ITC PSPD’s facilities at Bhadrachalam and Kovai are CII GreenCo PLATINUM + certified, the highest rating in the system. Similarly, both the facilities have achieved Alliance for Water Stewardship (AWS) Platinum certification. Under our solid waste management programme, Well-being Out of Waste (WOW), we had 67,100 MT of dry waste collected in FY25 and promoted sustainable livelihoods for 17,900 waste collectors till date.

PM: How has demand for packaging paper and board evolved post-COVID and amid growing e-commerce and FMCG consumption? Which segments are currently driving the most growth for you?

ITC: Post-Covid, we have definitely seen a surge in demand as growing e-commerce and FMCG consumption has led to demand for packaging that is both sustainable and robust. Our products serve a diverse range of industries such as pharma, FMCG, food & beverage and publishing to name a few. Our path-breaking ‘Filo’ series of sustainable paperboards has gained significant traction in the food and beverage industry, both in India

and abroad as a substitute to single use plastics, further underlining our commitment to sustainability.

PM: According to recent global market data, the packaging paper and board market is projected to grow steadily through 2033. How are you positioning your business to tap into this rising global demand?

ITC: We have augmented our capacities and enriched our product portfolio by adding innovative products such as single-use plastic alternatives and brown boards. In addition, while we keep driving our growth in our existing export markets, we are now venturing into international markets that have remained untapped until now.

We are confident this will strengthen the market standing of ITC PSPD and create new opportunities in both the domestic and international markets.

PM: What are some of the most significant technological upgrades or process improvements you’ve made recently in your mills to enhance quality, reduce waste, or optimize energy usage?

ITC: At ITC PSPD, we are consistently implementing innovations in technology. Some of the recent technological upgrades that have been made are PM1A and BCTMP plant in Bhadrachalam unit, coater for sustainable barrier boards and laminating machine in Unit Bollaram, and capacity enhancement of décor paper at Unit Tribeni.

We were the first to commission the high-pressure recovery boiler (HPRB) in India, underscoring ITC PSPD’s investment in green technology. Through our focus on accelerating digitalization across businesses, ITC PSPD is implementing several transformative projects leveraging Industry 4.0 technologies across key business

areas, to enhance productivity, achieve strategic cost efficiencies and superior product performance. IoT, advanced analytics, and image analytics are the levers ITC PSPD is using to achieve its digital vision.

ITC PSPD is also leveraging real-time AI models to enhance visibility, control and predictability in operations. We have been recognised for developing an inhouse digital twin technology that goes beyond machine-level insights to capture and simulate behaviors of complex chemico-physical processes. This innovation is helping shift from reactive problem-solving to real-time, data-driven decision making, leading to improvements in efficiency and quality across the entire value chain.

PM: Are you seeing a shift in customer preference toward higher-strength or lightweight packaging paper and board variants? How are you balancing performance with cost-efficiency in product development?

ITC: ITC PSPD has always been at the forefront of achieving sustainability in packaging in various forms – from innovating unique sustainable packaging solutions that can replace single-use plastics, to helping

customers in ‘light-weighting’ their packaging requirements, to having an established solid waste management program called ‘Wellbeing Out of Waste (WOW)’ for achieving circularity.

Lightweight packaging is steadily becoming the preference for many due to cost-efficiency and increased awareness on sustainability and we have ensured that we maintain our competitive advantage by meeting this demand without compromising on the performance or the quality of our grades. Our range of paperboards, both virgin and recycled, are well known for their high bulk and stiffness properties.

PM: What are the major challenges you currently face as a packaging paper and board manufacturer– be it raw material volatility, energy costs, logistics, or regulatory changes? How are you navigating them?

ITC: We have always been proactive when it comes to foreseeing challenging situations and taking relevant actions.

To tackle raw material volatility, we continue to invest in our largescale afforestation programme and work closely with farmers to turn their unproductive land assets into profitable and renewable

plantations, using clonal saplings specially developed by ITC PSPD R&D to grow in harsh conditions.

To deal with energy costs, we commissioned India’s first high pressure recovery boiler (HPRB), which has helped enhance energy efficiency and increase renewable energy share at the mill since its installation.

There have been several regulatory changes in the packaging industry – such as the Plastic Waste Management Rules and ban on single-use plastic items. We have been able to leverage our R&D capabilities to launch several paper-based alternatives to singleuse plastics. Our ‘Filo’ series of sustainable paperboards has gained significant traction in the packaging industry, both in India and abroad. Under the Filo series, we currently

“We were the first to commission the high-pressure recovery boiler (HPRB) in India, underscoring ITC’s investment in green technology.

replacements to single-use plastic and LDPE-coated packaging/ disposables in the F&B industry.

PM: Looking ahead, what’s your strategic roadmap –capacity expansion, backward integration, export push, product diversification? How do you envision your mill’s role in the global packaging paper and board value chain in the next 5 years?

actively venturing into all avenues of growth. We are entering into unexplored markets abroad while strengthening and penetrating deeper into our existing ones within the country.

Our ‘Filo’ series of plastic substitution products shows our firm commitment to sustainability before it became the norm. We further plan to expand this portfolio by deepening product development to target newer applications. As mentioned earlier, at ITC, sustainability is at the heart of everything we do and we are constantly looking for innovative solutions to cater to rising consumer demand for sustainable alternatives.

ITC PSPD will continue to grow & innovate, and remain a significant player in the global paper &

Artemyn provides a range of high quality calcium carbonate products which are used both as llers and coating in various types of paper and board applications. Ground Calcium Carbonate (GCC) and Precipitated Calcium Carbonate (PCC) primarily provide excellent brightness and whiteness in paper and board applications. Our product range is engineered to combine optical performance with other attributes, such as excellent rheology, high light scatter bulk and gloss generation. We can advise on product selection to meet these requirements.

Tamil Nadu Newsprint & Papers Limited (TNPL) offers a diverse packaging paper product portfolio under its flagship ‘Aura’ range. Its facility at Kagithanagar in Trichirapalli district, is dedicated to online coated paper boards with an annual production capacity of 2,00,000 metric tonnes. While the company initially focused on FBB and recycled-based products, it has since broadened its portfolio to include cup stock, SBS board, and FBB. The company exports to several international markets, including the UK, Korea, Sri Lanka, Africa, the Middle East, and European countries. In an exclusive interview with Paper Mart, Dr. Sandeep Saxena, IAS, Additional Chief Secretary / Chairman and Managing Director, Tamil Nadu Newsprint & Papers Limited, shared that the mill will soon set up a tissue manufacturing plant with a capacity of 100 metric tonnes per day, marking a significant milestone in its product diversification strategy.

“We are constantly upgrading our manufacturing infrastructure, furnish, and coating formulations to meet the evolving market demand.

Dr. Sandeep Saxena, IAS, Additional Chief Secretary / Chairman and Managing Director, TNPL

Paper Mart: Could you begin by giving us an overview of your packaging paper and board operations including your production capacity, facility locations, and manufacturing setup?

Sandeep Saxena: Tamil Nadu Newsprint and Papers Limited (TNPL) operates a manufacturing facility at Kagithapuram in Karur district for fine paper production, including writing and printing paper, with an annual capacity of 4,00,000 metric tonnes. The company has a second facility at Kagithanagar in Mondipatti village, Trichirapalli district, dedicated to online coated paper boards, with a production capacity of 2,00,000 metric tonnes per annum.

In the paper board segment, the mill established and commissioned a green field project in the year 2016, to manufacture online coated boards (two coating heads on topside and one at back side multifourdrinier four layer board machine), along with 400 metric tonnes per day waste paper processing plant. The plant is equipped with automated intermediate reel storage and conversion systems to efficiently meet market demand. To further augment pulp requirements, a 400 BDMT (Bone-Dry Metric Tonnes) hardwood-based pulp mill was commissioned in 2022.

PM: Please walk us through your current product portfolio. What grades, GSM ranges, and end-use applications do you cater to, and are there any specialty packaging paper and board products you offer?

SS: Our product portfolio includes Folding Box Board (FBB), Solid Bleached Sulphate (SBS) board and cup stock, with a GSM range of 150–400.

Some of our products include: Aura Shiksha Natural which is ideal for textbook and notebook covers, while Aura Fold Eco Plus is designed for pharmaceutical and food packaging. Aura Graphic serves cosmetics and personal care products, and Aura Fold Eco is a versatile choice for FMCG cartons, POP danglers, menu cards, brochures, books, and notebook covers.

For cup stock, Aura Flute and Aura Flute Supreme are well suited for paper cups used with hot and cold beverages, with the Supreme range offering premium printability and gloss. Aura Fold Eco Blue is specially tailored for school notebook covers. In the uncoated variety, Aura Celebration Plus is used for invitation cards, greeting cards, wedding cards, menu cards, brochure covers and folders, while Aura Celebration is particularly suitable for embossing, debossing, and hot foil stamping. Aura Ace has been developed for playing cards.

Aura Brilliant Plus finds application in pharma, cosmetics, and FMCG packaging. Aura Fold Blue is meant for highend packaging such as personal care products, cosmetics, hosiery boxes, and garment tags. Aura Fold Premium caters to premium FMCG packing including pharma, personal care and cosmetic packaging, as well as cartons for industrial and automotive products. Aura Fold Plus

“

We are a leading player in the premium segment of coated liquid packaging products, with a strong pan-India presence supported by an extensive dealer network.

“Post COVID-19, demand for all packaging grades peaked, driven by the surge in online purchases, along with strong growth in the education sector, foodgrade packaging, industrial packaging, and pharmaceuticals.

offers a versatile solution for mono cartons, cosmetics, FMCG, spirits and liquor packaging, and is also suitable for panel and picture mount boards.

In addition, TNPL offers barriercoated products as a sustainable alternative to PE-coated grades, reinforcing its commitment to ecofriendly packaging solutions.

PM: Which are your key domestic and international markets? How has your market footprint evolved in the past few years?

SS: We are a leading player in the premium segment of coated liquid packaging products, with a strong pan-India presence supported by an extensive dealer network. We export to countries like the UK, Korea, Sri Lanka, Africa, the Middle East, and several European countries. Initially focused on FBB and recycledbased products such as white-lined chipboard and grey-back duplex boards, TNPL has since expanded its portfolio to include cup stock, SBS board, and FBB.

PM: Sustainability is becoming a cornerstone of packaging. What steps have you taken to integrate environmentally responsible practices into your manufacturing and sourcing?

SS: TNPL has installed a 35.5 MW windmill to generate renewable energy, enabling the export of green power to the grid, supporting GHG reduction and thereby mitigating the

risk of climate change. The captive power plants meet 100% energy requirements, having an installed capacity of 133.62 MW.

The company also boasts FSCFM and FSC-CoC certified captive plantation and farm forestry for pulp wood, which serve as a major source of raw material for packaging boards.

The green belt developed around Unit-2 in Mondipatti spans about 650 acres, housing 6.84 lakh trees and covering 55% of the total area with 123 species. Additionally, landscaped areas of about 27,248 sq. mt. have been developed and are maintained within the factories and colonies. These initiatives have contributed to a balanced ecosystem, fostering stability and a conducive environment. This biodiversity is reflected in the presence of 123 tree species, 26 shrub species, 124 herb species, 16 grass species, 35 medicinal plants, 91 bird varieties, 88 orthopod varieties, 16 reptile species, 10 mammal species, and 2 amphibians.

Besides making the surrounding aesthetic, these areas have also restored water balance, capture fugitive emissions as well as attenuate the noise generated within the plant. TNPL is known for its environment conscious and eco friendly approach as the company has one least consumption of water in the country. The wastewater generated in the mill is treated through an advanced effluent treatment plant, and the treated water is reused for irrigating the company’s own plantations in and around the premises.

PM: How has demand for packaging paper and board evolved post-COVID and amid growing e-commerce and FMCG consumption? Which segments are currently driving the most growth for you?

SS: Post COVID-19, demand for all packaging grades peaked, driven by the surge in online purchases, along with strong growth in the education sector, food-grade packaging, industrial packaging, and pharmaceuticals.

PM: According to recent global market data, the packaging paper and board market is projected to grow steadily through 2033. How are you positioning your business to tap into this rising global demand?

SS: To tap into the growing packaging grade products demand, TNPL is gearing up to produce more Folding Box Board (FBB) grade products which will further enhance customer delight.

PM: What are some of the most significant technological upgrades or process improvements you’ve made recently in your mills to enhance quality, reduce waste, or optimize energy usage?

SS: TNPL is constantly upgrading its manufacturing infrastructure, furnish, and coating formulations to meet the evolving market demand. By fully utilizing its pulp manufacturing facilities, the company is able to meet the requirements of Unit 2 and partially supply Unit 1 in the form of wet-lapped pulp. Additionally, surplus steam generated from chemical recovery

“To tap into the growing packaging grade products demand, TNPL is gearing up to produce more Folding Box Board (FBB) grade. The two shoepress configuration board machines further enable the company to retain bulk and deliver product performance.

boilers is used to partially replace coal-fired boiler steam, thereby enhancing operational efficiency and sustainability.

PM: Are you seeing a shift in customer preference toward higher-strength or lightweight packaging paper and board variants? How are you balancing performance with cost efficiency in product development?

SS: The market is consistently looking for high bulk and stiffness in lower GSM products, which is met through selective furnish usage and

costs, logistics, or regulatory changes? How are you navigating them?

SS: Some of the challenges in the packaging paper and board segment include the scarcity of pulpwood, which has significantly increased input costs. To address this, TNPL actively promotes pulpwood plantations on small and marginal farmers’ lands by supplying highquality seedlings or clones at the farm gate, along with providing buy-back assurance at a minimum support price.

On the energy front, TNPL focuses on keeping costs under control by developing wind and solar power projects. Further, energy audits are conducted periodically to identify and implement conservation

In logistics, the company adopts a ‘road–sea–road’ shipping model

wherever feasible to optimize costs and efficiency. However, cheaper imports continue to pose another major challenge, which requires regulatory intervention. In this regard, TNPL has also joined hands to represent the implementation of minimum import price to safeguard the domestic industry.

PM: Looking ahead, what’s your strategic roadmap –capacity expansion, backward integration, export push, product diversification? How do you envision your mill’s role in the global packaging paper and board value chain in the next 5 years?

SS: Going forward, TNPL is setting up a state-of-the-art tissue manufacturing plant with a capacity of 100 metric tonnes per day, marking a significant step in its product diversification strategy.

“The packaging board market is growing at 6–7% annually, with the total market estimated to be over 17 lakh tonnes.

JK Paper Limited, producing 100 percent virgin-grade packaging boards with an annual capacity over 3 lakh tonnes, maintains a strong pan-India presence. In an exclusive interaction with Paper Mart, Mr. Manoj Agrawal, Senior General Manager (Sales–Packaging), JK Paper Limited, shared that the company has recently invested in its BCTMP pulp mill, scheduled to be operational by the end of this year. Alongside strengthening its board line, JK Paper is expanding into the conversion line to gain deeper insights into customer needs and market trends. The company is also working closely with FMCG and food & beverage players on joint development projects, with a strong focus on innovative paperboard solutions as sustainable alternatives to plastic products.

“We have invested in a new packaging board line called BM5, a brand new machine from Valmet with an annual production capacity of about 1,70,000 tonnes. With this new machine, we are close to producing 2,00,000 tonnes of packaging board and we plan to take this capacity to 2,20,000 tonnes in the next one or two years.

Paper Mart: Could you begin by giving us an overview of your packaging paper and board operations – including your production capacity, facility locations, and manufacturing setup?

Manoj Agrawal: JK Paper Limited is a paper and packaging board company wherein we have three plants—one in Odisha, other in Gujarat and the third plant is in Telangana. Out of these three plants, we mainly produce packaging boards in our CPM plant in Gujarat. We have two machines BM4 and BM5 for producing quality packaging boards in our company. Our packaging board is manufactured 100 percent from pure virgin grade, with no use of recycled board.

We started our packaging board business in the year 2009 with the installation of a BM4 machine. At that time, the capacity of that machine was around 60,000 tonnes and today we are producing around 1,00,000 tonnes, with all the modifications and removing the bottlenecks.

Recently, we have invested in a new packaging board line BM5, a brand new machine from Valmet with an annual production capacity of about 1,70,000 tonnes. With this new machine, we are close to producing

2,00,000 tonnes of packaging board and we plan to take this capacity to 2,20,000 tonnes in the next one or two years, by removing all the bottlenecks.

We are also expanding our product portfolio to include higher GSM grades, which will help us further increase the machine’s production. With this expansion, our total production capacity currently standing at around 3,00,000 tonnes, is expected to rise to 3,20,000 tonnes.

Additionally, we operate a small multi-layer machine at our Telangana plant, which is dedicated to producing cup stock. This machine has a production capacity of about 40,000 tonnes per annum.

With all these additions, our total production capacity is around 3,60,000 tonnes. Alongside this, we operate integrated pulp mills across all our units, with dedicated pulp lines for producing chemical pulp in-house.

PM: Please walk us through your current product portfolio. What grades, GSM ranges, and end-use applications do you cater to, and are there any specialty packaging paper and board products you offer?

MA: We currently produce a wide range of products, including Folding Box Board (FBB), Solid Bleached Sulfate (SBS) boards, uncoated boards, cup stock, and several specialty grades. At our plant, we operate two machines— one dedicated to producing SBS boards and the other dedicated to FBB boards. This serves as a great advantage to serving our customers as each machine runs a single grade, ensuring efficiency and timely deliveries of customers’ orders. This is a key USP for us.

In terms of GSM, our product range spans from 190 GSM to 400 GSM across all categories. Additionally, we manufacture specialty products such as cigarette boards, antifungal boards, aqueous barrier-coated boards, and poly-extrusion boards. We also have a fully integrated inhouse extrusion facility at our plant.

PM: Can you tell us about the key domestic and international markets in the packaging grade segment?

MA: We, as a company, always believe in having a pan-India presence. For our products—be it copier paper, maplitho, or any other segment—JK Paper’s strength lies in its deep distribution network across the country. Just as we have a pan-

India presence in copier paper, we also enjoy nationwide reach in our packaging board segment, with our products available across India.

That being said, we focus more on markets closer to our factories, as this gives us an advantage in terms of logistics costs and ensures better service to our customers.

One of our plants is located in the western part of India, one of the biggest markets for packaging, while also being close to the northern market, which is rapidly growing. All in all, our plant is strategically positioned compared to competition—well-placed both in terms of production facility and proximity to high-potential markets.

PM: Can you shed light on the recent developments in the company in the packaging segment? How has the market evolved over the years in the packaging segment?

MA: We are not only investing in the board line but also expanding into the conversion line. The idea is to better understand our customers— their needs, and the requirements of the end-users, who are the brand owners, in terms of packaging. With the growing demand for sustainable products, it is important to analyze what future sustainable products that are needed in the market. It is important to align with future market needs. By gaining deeper insights into this business, we believe we can produce better boards that truly

meet customer requirements.

India today is highly capable of producing not only high-quality boards but also good quality converted boards. The technological

“We have developed aqueous barrier-coated paper as an alternative to poly-extruded paper. Unlike poly-coated paper, our aqueous barriercoated cups decompose naturally within six to eight months.

advancements happening in the printing lines are significantly ahead of developments in packaging board production itself. This is because most converting machinery now comes from countries like Germany, Japan, and Korea, and these machines are highly sophisticated.

Earlier, Indian converters largely relied on second-hand equipment— machines that were 6–7 years old, such as Heidelberg machines, purchased at 30–40% of the cost of a new one. However, the trend has now shifted. Indian converters are increasingly investing in brand-new machines equipped with multiple functions—eight-color jobs, UV coating, embossing, and other value-added capabilities. These enable them to meet a wide range of

customer requirements.

As a result, Indian converters are now fully capable of delivering the quality standards required by FMCG, pharmaceutical, and food & beverage industries for their monocartons. As a country, we are well-positioned to meet these evolving needs.

PM: Sustainability is becoming a cornerstone of the packaging sector. What steps have you taken to integrate environmentally responsible practices into your manufacturing and sourcing?

MA: The most critical aspect of paper and board production is raw material, which essentially comes from wood. JK Paper is one company that recognized this need over 10–15 years ago and invested heavily in plantation activities. Every year, we undertake plantation drives covering about 35,000 hectares, planting nearly 12 crore trees annually through our social farm forestry model—since land ownership is not permitted in India.

To support this effort, we maintain large nurseries and have state-ofthe-art R&D facilities at our plants, enabling us to develop high-quality saplings and accelerate growth cycles so farmers can harvest yields in 2–3 years as compared to much longer time duration earlier. This increases farmers’ earnings while ensuring a reliable, high-quality, and costefficient wood supply for us.

On average, each tonne of paper

requires about 3–3.5 tonnes of wood, so logistics also play a vital role. We have expanded our green cover and as a result JK Paper has become a carbon-positive company. We grow more trees than we consume, contributing positively to the environment.

Beyond raw materials, we are also focused on energy and water sustainability. At our CPM plant in Gujarat, nearly 40% of our fuel is non-fossil based, biofuel. Going forward, we are targeting 100% biofuel usage by 2030. Our team is working on this goal and we may even succeed in this target much earlier, by 2028–29. Our plants are designed to minimize both water and energy consumption, as we are investing in new machineries which require much less water and energy. In the long run, this upgrade will give us a cost advantage, and at the same time, it will also take care of the environment.

On the consumer side, we are helping customers transition from plastic to paper-based solutions. For instance, we have developed aqueous barriercoated paper/ paper cups as an alternative to poly-extruded paper cups. Unlike poly-coated cups, which take years to degrade, our aqueous barrier-coated cups decompose naturally within six to eight months. Once regulatory restrictions on polycoated cups are enforced, we expect significant growth in its (aqueous barrier-coated cups) volume.

Similarly, we have developed antifungal boards that eliminate the need for poly-lamination in soap packaging or any other packaging, offering a more sustainable solution to avoid fungal growth.

In essence, we are continuously exploring possibilities to replace plastic with paperboard, and polyextrusion, with more sustainable alternatives. This will reinforce our commitment to the environment and support customers’ shift towards greener solutions.

PM: What are some of the most significant technological upgrades or process improvements you’ve made recently in your mills to enhance quality, reduce waste, or optimize energy usage?

MA: The investment we made in the brand new state-of-the-art multilayer board machine (BM5) by Valmet in 2021 was close to INR 2,000 crore. More recently, we have also invested about INR 700 crore in our BCTMP pulp mill, which will be operational by the end of this year.

On the technology front, we began

“Earlier, Indian converters largely relied on second-hand equipment— machines that were 6–7 years old. However, the trend has now shifted. Indian converters are increasingly investing in brand-new machines equipped with multiple functions—eightcolor jobs, UV coating, embossing, and other value-added capabilities

collaborating with a consultant 2–3 years ago to drive digitalization across the company—covering production, marketing and sales, finance, HR, procurement, and more. We have effectively transitioned into Industry 4.0.

Today, we have a strong in-house IT team, and every production parameter is mapped with sensors. This enables us to reduce downtime, minimize finishing losses, and optimize machine efficiency. As a result, JK Paper has emerged as one of the leading companies in implementing digitalization at the factory level in a practical sense.

The biggest advantage has been

on the manufacturing side, where our IT and production teams have worked tirelessly together. Our efforts were recognized about one and a half years ago when we received an award for Industry 4.0, acknowledging the progress we have made in digitalizing our operations.

PM: Are you seeing a shift in customer preference toward higher-strength or lightweight packaging paper and board variants? How are you balancing performance with cost-efficiency in product development?

MA: When we talk about higherstrength paper in packaging boards, it essentially comes down to higher bulk. We are able to meet customer requirements by producing boards with a bulk in range of 1.6 to 1.7, which is what our customers require. Beyond this, there isn’t much additional requirement, and we are fully capable of manufacturing and supplying such boards.

In terms of lightweight packaging paper, when the bulk increases, the GSM requirement naturally comes down. For example, customers who earlier purchased 300 GSM are now opting for 290 or even 280 GSM, as bulk goes up. This allows us to provide better quality products as compared to imports that are coming in and this gives us a strong competitive edge.

PM: What are the major challenges you currently face as a packaging paper and board manufacturer– be it raw material volatility, energy costs, logistics, or regulatory changes? How are you navigating them?

MA: Currently, we are facing a couple of challenges, the foremost being raw material prices. Due to COVIDrelated disruptions, plantations were limited during the lockdown period, leading to reduced wood availability. This shortage has impacted the entire paper industry, including us. As a result, raw material costs today are nearly double compared to two years

ago. While input costs have increased substantially, selling prices have declined, leaving either no margins or extremely thin ones—particularly in the packaging board segment. Profitability has therefore become a challenge across the industry.

The second challenge is the huge new capacities which have come across in packaging boards, particularly from Indonesia and China over the past two years. In the coming 2 to 4 years, nearly 90 lakh tonnes of fresh virgin capacity is expected to be added, with about 50 to 60 lakh tonnes already added by China and Indonesia, and another 30 to 40 lakh tonnes likely to be added in next 1-2 years.

Though these mills are primarily meant to cater to markets in China, Europe, and the U.S., until those capacities are absorbed by those markets, the companies are dumping excess boards in India at prices even below pulp costs.

Adding to this challenge, countries like Indonesia have zero import duty when supplying to India, coupled with lower sea freight costs—just 3–4% compared to more than 5% for inland logistics from let say, Gujarat to Delhi. As a result, port cities such as Mumbai, Chennai, Visakhapatnam, and Kolkata are flooded with cheaper imports, and tap even northern markets like Delhi that are now accessible from ports like Kandla and Mundra through improved rail connectivity.

The only silver lining is the good growth of the packaging segment. The packaging board market is growing at 6–7% annually, with the total market estimated to be over 17 lakh tonnes. So we need an additional requirement of nearly 1–1.5 lakh tonnes of capacity every year to feed this market. While this indicates healthy growth potential, the domestic profitability does not align with this market growth. So, we need to carefully evaluate this situation before deciding on capacity

“The Free Trade Agreement (FTA) with ASEAN countries has severely impacted the domestic market, creating a major challenge for companies like us. For instance, in Indonesia, abundant wood availability reduces production costs by nearly 30% compared to India, making it easy for them to dump products here at unsustainable prices.

expansion.

PM: Looking ahead, what’s your strategic roadmap in terms of capacity expansion, backward integration, export push, product diversification? How do you envision your mill’s role in the global packaging paper and board value chain in the next 5 years?

MA: Going forward, we plan to enhance our capacities by debottlenecking existing operations. We may also consider investing in a new board line, although it is not an immediate decision and will depend entirely on the return on investment (ROI). In fact, even

with the investments made in the last two years—whether in forward integration or backward integration—we are yet to achieve the expected ROI.

The bigger concern at present is the influx of cheap imports, which is severely impacting the industry. Any country can truly grow only when it utilises its domestic capability which is the essence of ‘Atmanirbhar Bharat’. We have the talent, resources, and infrastructure to do so. The paper and packaging industry is ready to invest, but the problem lies in the dumping of low-cost imports, particularly from countries like Indonesia and China.

The Free Trade Agreement (FTA) with ASEAN countries has severely impacted the domestic market, creating a major challenge for companies like us. For instance, in Indonesia, abundant wood availability reduces production costs by nearly 30% compared to India, making it easy for them to dump products here at unsustainable prices. If such imports were curtailed,we will without wait invest in new machines and increase our capacity. This would not only generate significant employment but also benefit farmers—who often remain outside the limelight. The government should step in and safeguard the domestic industry.

Khanna Paper Mills produces 160,000 tonnes of coated board grade annually and 240,000 tonnes of newsprint and other paper grades per annum. It is one of the country’s largest consumers of secondary fibres, utilizing approximately 390,000 tonnes secondary fiber, with a total production capacity is of 4 lakh tonnes per annum. In an exclusive interview with Paper Mart, Mr. SVR Krishnan, Executive Director – Operations, Khanna Paper Mills, shares insights into how the company’s packaging boards are widely used by leading national and international FMCG brands. Their strong presence in the packaging segment is driven by flagship products such as the ‘Diamond Grey Back’ for duplex boards and the ‘Dezire’ brand for folding box boards, creating a niche in the packaging segment. Going forward, the company aims to focus on both backward integration and capacity expansion, alongside product development, to strengthen its position as a key player in the packaging segment.

“The growth of the paper and paperboard will be steady in the coming years till 2033, with the projected rate of 4-5% growth each year.

Mr. SVR Krishnan, Executive Director – Operations, Khanna Paper Mills

Paper Mart: Could you begin by giving us an overview of your packaging paper and board operations –including your production capacity, facility locations, and manufacturing setup?

SVR Krishnan: We, at Khanna Paper Mills, manufacture coated recycled and virgin fiber based boards, writing and printing papers, copier papers and newsprint grade. The company is a ‘one-stop-shop’ for all cultural and industrial needs.

We produce 160,000 tonnes of coated boards and 240,000 tonnes of newsprint and other paper grades per annum. We operate two paperboard machines equipped with cylinder moulds and pressure formers, along with two high-speed paper machines featuring top formers.

We are the single largest consumers of recycled waste paper or secondary fibers in the country, using close to 390,000 tonnes per annum. Currently, we operate from a single location in Amritsar, Punjab.

“The emulsion-based barrier-coated paper and paperboards are gaining momentum all across the globe.

PM: Please walk us through your current product portfolio. What grades, GSM ranges, and end-use applications do you cater to, and are there any specialty packaging paper and board products you offer?

SK: Our current product portfolio includes virgin and recycled fiber-based packaging boards, ranging from 200 GSM to 450 GSM basis weights. In paper grades, we produce writing and printing paper ranging from 54 GSM to 120 GSM, and newsprint grades ranging from 42 to 45 GSM. Our products are sold to the consumers through a vast dealer network and the majority of our market is in the northern part of the country itself.

Our packaging boards are used by the leading national and international brands in consumer goods or FMCG. Our papers are utilised in the text books and notebooks by leading publishing houses and our newsprint grade is utilised by the leading regional and national newspapers or dailies.

PM: Which are your key domestic and international markets? How has your market footprint evolved in the past few years?

SK: As mentioned earlier, our key markets include leading FMCG brands and printing and packaging houses or converters. Over the years, we have established a strong presence in the packaging segment with our flagship brands—‘Diamond Graphic Grey Back’ for duplex boards, ‘Dezire’ for folding box boards, ‘Elegance Super Print’ for writing and printing papers, and ‘Impact Super’ for newsprint. Each of these product grades has carved out a distinct niche within the printing, packaging, and publishing industries.

Our headbox is engineered to deliver superior sheet formation, consistency, and runnability perfect for high-performance paper machines. With every project, MFI continues to push the benchmark for quality and innovation in the Indian paper machinery segment.

We supply a proportion of our paper volumes to countries like Sri Lanka, Nepal, Egypt, and Kenya etc., depending on the business feasibility and the need to balance the existing volumes between domestic and export markets.

PM: Sustainability is becoming a cornerstone of packaging. What steps have you taken to integrate environmentally responsible practices into your manufacturing and sourcing?

SK: Sustainability is a key factor in today’s business landscape. With the environment being the first component of ESG reporting, we now view the entire supply chain through the lens of economic circularity. All our processes and new capex project initiatives are undertaken, keeping environmental protection and business sustainability at the forefront.

The freshwater consumption, electrical power usage, and the overall energy efficiency and associated costs are given the highest priority—right from project conceptualisation and vendor selection to final execution—in order to strike a balance between environment and economy.

PM: How has demand for packaging paper and board evolved post-COVID and amid growing e-commerce and FMCG consumption? Which segments are currently driving the most growth for you?

SK: During the COVID-19 pandemic, we often spoke about the ‘new normal.’ However, in reality, we find ourselves in a deeply abnormal global scenario post-2023 due to geopolitical disruptions, including the Russia–Ukraine war, the Red Sea crisis, the Israel–Gaza conflict, unrest in Pahalgam and the Thai–Cambodia region, and recent U.S. policies imposing higher tariffs on India.

Practically, we are yet to see a good complete year. The pulp and paper industry has taken the worst hit post 2022–23, across all four quarters, due to its high capital costs, thin margins, and overdependence on imports for raw materials (waste paper and pulp grades). However, the thrust of eco-friendliness, sustainability, e-commerce boom, increasing levels of education, packaged food, beverages, pharma and electronic goods industries are driving the growth of quality paper and boards.

The global focus on the prevention of using single-use plastics, provides a great opportunity to the paper mills to develop a suitable and sustainable alternative to LDPE coatings or poly extruded paper and paper boards. This emulsion-based barrier-coated paper and paperboards are gaining momentum all across the globe.

PM: According to recent global market data, the packaging paper and board market is projected to grow steadily through 2033. How are you positioning your business to tap into this rising global demand?

SK: The growth of the paper and paperboard will be steady in the coming years till 2033, with the projected growth rate of 4-5% each year. Notably, the packaging board was growing at the rate of 12-14% just before COVID-19 period and the same segment dipped in the last couple of years. But now we expect a moderate growth of 4-5%.

Similarly, the writing and printing paper was growing at the rate of 6% before COVID. And now we will see a growth of 4-5%. This growth trajectory is normally followed by our country’s GDP growth, which is now projected to be at 6-6.5%, for the current year 2025-26.

We, at Khanna Paper Mills, are very optimistic about this growth trajectory of good quality paper and packaging boards, due to the major push on literacy level, industrialisation, urbanisation, e-commerce, Q-commerce and technological advancements in the business landscape.

“We, at Khanna Paper Mills, are very optimistic about this growth trajectory of good quality paper and packaging boards, due to the major push on literacy level, industrialisation, urbanisation, e-commerce, Q-commerce and technological advancements in the business landscape.

PM: What are some of the most significant technological upgrades or process improvements you’ve made recently in your mills to enhance quality, reduce waste, or optimize energy usage?

SK: We have recently done many rebuild projects , focussing on the overall efficiency and improvement in the areas of quality, productivity, water and energy conservation.

To name a few advancements, we were the first in the country to install and commission the high-tech headboxMaster Jet Tech-3 (from VOITH) on one of our high-speed paper machines. We now plan to install a second Master Jet Tech-3 headbox on our second high-speed machine. This upgrade will significantly enhance the overall quality of the final paper product by providing precise control over cross-profile uniformity, achieving up to 40% improvement in two-sigma grammage and moisture profiles, along with superior paper formation.

We have replaced our high power-consuming liquid ring vacuum pumps with the single and multi-stage turbo blower, which has reduced our energy consumption by 17%, making our operations simpler and more reliable.

Additionally, we have revamped our 100 TPH power boiler by Thermax and installed a new 23.3 MW turbo generator (TG) from Siemens. This upgrade has improved the efficiency of our utility plant by 24% and enhanced the overall stability and reliability of utility operations.

We have implemented the modular waste water treatment in some of the fiber processing plants to maximize recycling of treated water in the respective plants so that the load on the central effluent treatment plant is reduced, and the overall performance of the ETP is improved by 20%. It will also reduce the fresh water drawl by 14% on a daily basis.

PM: Are you seeing a shift in customer preference toward higher-strength or lightweight packaging paper and board variants? How are you balancing performance with cost-efficiency in product development?