Vol.42, No.28

www.thewarrengroup.com

W E E K O F M O N D A Y, J U LY 1 3 , 2 0 2 0

THE REGISTRY REVIEW NEW HAMPSHIRE’S STATEWIDE REAL ESTATE & FINANCIAL NEWSPAPER A Publication of The Warren Group

WEEKLY SALES OF NOTE

C O V I D A F T E R M AT H

Industrial Leads CRE Out of Pandemic Wilderness

Sunapee

23 LAKE AVE..........................................$2,882,000 B: Brian C Drew & Karyl C Drew S: Robert S Yorgensen Tr, Tr for Linda N Yorgensen RET Mtg: Morgan Stanley $2,000,000 Use: 4 Bdrm Colonial, Lot: 15682sf

Seabrook

Office Activity ‘Kind of Frozen’ as Questions Loom

NH HIGHWAY 107...................................$2,200,000 B: BJS Wholesale Club Inc S: Seabrook Dev Assoc

BY JAY FITZGERALD

Manchester

SPECIAL TO THE REGISTRY REVIEW

T

276 ABBY RD.........................................$2,100,000 B: 276 Abby Road LLC S: 276 Abby Road Realty LLC Mtg: Peoples United Bank $1,575,000 Use: Industrial Office Building, Lot: 145055sf

he state’s commercial real estate industry, particularly the industrial subsector, has seen a noticeable uptick in activity since the economy began reopening from its spring lockdown due to the coronavirus. However, industry officials remain concerned about both the short-term and longterm prospects for the office and retail sectors, amid fears that the national economy remains fragile and that another virus surge could hit the region later this fall. “There’s definitely more activity today, but there’s also a lot of caution,” Bob Rohrer, managing director of New Hampshire for Colliers International, said of the market in general since the late spring and early summer reopening. “There are still so many unknowns.” Since the reopening of the economy started in late May, the same four commercial real estate officials say the mood has dramatically changed from April’s stunned pessimism. “Somehow, the switch got turned back on,” said Chris Norwood, president of NAI Norwood Group. “There are more discussions and decisions being made. More people are coming off the sidelines. There’s a feeling that the worst, broadly speaking, may be behind us.” Still, Norwood said, there are a number of short-term challenges ahead this summer that’s he monitoring closely, including what will happen if and when state and federal

Moultonboro

87 JEREMIAH SMITH ROAD...................$2,075,000 B: Todd Ruderman Tr, Tr for 2020 Jeremiah Smith T S: Carl A Crupi & Maribeth Crupi

Claremont

364 RIVER RD........................................$2,037,333 B: Crestwood Services LLC S: Plains LPG Services LP

Wolfeboro

SPRINGFIELD POINT RD L:4-1 & L:4-2........$1,900,000 B: Jares Real Estate Hldg S: Southern Spectrum LLC

Hampton Falls

33 LINDEN RD........................................$1,650,000 B: Daniel J Slottje S: John A Garner Tr, Tr for Land T No.39

Sunapee

25 BIRCH POINT LN...............................$1,520,000 B: Jessica Simonetti Tr, Tr for Jessica Simonetti 2019 T S: Robin R Shield Tr, Tr for Robin R Shield RET

Moultonboro

2 CAMP ROAD........................................$1,442,000 B: Kathleen A Campbell Tr, Tr for Kathleen A Campbell T S: Thomas R Barker Tr, Tr for Barker RET

Bedford

11 GRANT DR.........................................$1,100,000 B: Sarah W Kenda Tr, Tr for Sask 2018 T S: George J Zarella & Cheryl L Zarella Mtg: Residential Mtg Svcs $510,400 Use: 4 Bdrm Colonial, Lot: 113256sf

Durham

eviction and foreclosure bans expire – and what will happen if enhanced unemployment benefits expire for millions of jobless Americans. “There’s still a lot of uncertainty out there,” said Norwood.

The Surprise Pandemic Winner Heading into the early spring, the industrial sector – which includes warehouses, distribution centers, manufacturing and light-indus-

trial properties – was on a tear. According to Colliers International’s first quarter data, the industrial occupancy rate statewide stood at 94.7 percent by the end of March, with average rents hovering around $6.80 per square foot for the 67.3 million square feet of industrial space tracked by Colliers. That was driven by a surge in e-commerce business and a smaller bump in advanced manufacturing.

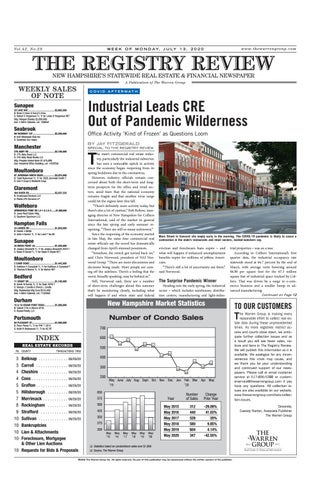

New Hampshire Market Statistics

15 & 16 CEDAR POINT ROAD.................$1,089,000 B: Valerie V Ek & Steven W Ek S: Russel Realty LLC

84 PLEASANT ST....................................$1,000,000 B: Peter Floros Tr, Tr for PNF T 2013 S: Keith R Malinowski Tr, Tr for KC RT

700 700

INDEX

600

REAL ESTATE RECORDS

500

TRANSACTIONS THRU

3 Belknap �������������������������� 06/26/20 3 Carroll ���������������������������� 06/26/20 4 Cheshire ������������������������ 06/26/20 4 Coos �������������������������������� 06/26/20 5 Grafton ���������������������������� 06/26/20 5 Hillsborough ������������������ 06/26/20 7 Merrimack ���������������������� 06/26/20 8 Rockingham ������������������ 06/26/20 9 Strafford ������������������������ 06/26/20 10 Sullivan �������������������������� 06/26/20 10 Bankruptcies 10 Lien & Attachments 10 Foreclosure, Mortgagee & Other Lien Auctions 10 Requests for Bids & Proposals

400 300 300 200 200

May June June July July Aug. Aug. Sept. Sept. Oct. Oct. Nov. Nov. Dec. Dec. Jan Jan. Feb. Feb. Mar. Mar. Apr. Apr. May May May ’19

’20

Number 650 of Sales 650 575 575 500 500 425 425

350 350 275 275 200 200

May May ’15

May May ‘16

May May ’17

May May ’18

May May ’19

May May ‘20

Continued on Page 12

TO OUR CUSTOMERS

T

Number of Condo Sales

Portsmouth

PG COUNTY

Main Street in Concord sits empty early in the morning. The COVID-19 pandemic is likely to cause a contraction in the state’s restaurants and retail sectors, market-watchers say.

Year

Number of Sales

Change Prior Year

May 2015 May 2016 May 2017 May 2018 May 2019 May 2020

312 440 528 580 604 347

-29.09% 41.03% 20% 9.85% 4.14% -42.55%

q Statistics based on condominium sales over $1,000 q Source: The Warren Group

©2020 The Warren Group Inc. All rights reserved. No part of this publication may be reproduced without the written consent of the publisher.

he Warren Group is making every reasonable effort to collect real estate data during these unprecedented times. As more registries restrict access and courts close down, we anticipate further collection issues and as a result you will see fewer sales, notices and liens in The Registry Review. We will publish this information as it is available. We apologize for any inconvenience this crisis may cause, and we thank you for your understanding and continued support of our newspapers. Please call or email customer service at 617-896-5388 or customerservice@thewarrengroup.com if you have any questions. All collection issues are also available on our website, www.thewarrengroup.com/data-collection-issues. Sincerely, Cassidy Norton, Associate Publisher The Warren Group