WEDNESDAY 25 OCTOBER 2023

THE STAR EVENT CENTRE SYDNEY

WEDNESDAY 25 OCTOBER 2023

THE STAR EVENT CENTRE SYDNEY

Welcome to the April issue of National Liquor News.

As we power through the middle of Autumn, the name of the game is ‘be prepared.’ While it’s a cautious environment out there, this can give us a chance to stop and take stock of what we are doing, and how best to move forward. To me, caution doesn’t need to mean holding back, but just being prepared for what is to come and gathering intel on how to create opportunities, no matter the situation.

One important occasion to be prepared for with this theme is Mother’s Day, coming up next month (you can find our gift guide ideas from page 46). Another exciting occasion next month is World Cocktail Day, which gives retailers a fun chance to shake things up in-store and inspire cocktailloving consumers. We’ve covered this occasion from page 34.

Other useful segments we’ve covered in this issue are those that are worth thinking about in coming months. This includes a dive into independent beer from page 50, which is a vibrant

market to get behind; an analysis of family wineries from page 28, which continue to demonstrate a competitive edge in the Australian industry; and the RTD category, which is as well placed going into winter as it is in summer.

This month our wine tasting panel has gotten into the spirit of the cooler months by tasting a huge range of Pinot Noir wines. You can find their top picks across three price brackets from page 54. Finally, in this issue you will find all the latest industry news and insights, including that of regular contributors such as Retail Drinks Australia, eLease Lawyers, Strikeforce, Wine Australia and Circana (formerly IRI). Have a great April, and see you next month!

Cheers,

BrydieGet the facts DrinkWise.org.au

PUBLISHED BY: Food and Beverage Media Pty Ltd

A division of The Intermedia Group 41 Bridge Road GLEBE NSW Australia 2037 Tel: 02 9660 2113 Fax: 02 9660 4419

Publisher: Paul Wootton pwootton@intermedia.com.au

Editor: Brydie Allen ballen@intermedia.com.au

Journalist: Seamus May smay@intermedia.com.au

Journalist: Caoimhe Hanrahan-Lawrence chanrahanlawrence@intermedia.com.au

General Manager Sales –Liquor & Hospitality Group: Shane T. Williams stwilliams@intermedia.com.au

Group Art Director –Liquor and Hospitality: Kea Thorburn kthorburn@intermedia.com.au

Production Manager: Jacqui Cooper jacqui@intermedia.com.au

Subscription Rates

1yr (11 issues) for $70.00 (inc GST) 2yrs (22 issues)for $112.00 (inc GST)

Brydie

Allen, Editor 02 8586 6156 ballen@intermedia.com.au

– Saving 20% 3yrs (33 issues) for $147.00 (inc GST)

– Saving 30%

To subscribe and to view other overseas rates visit www.intermedia.com.au or Call: 1800 651 422 (Mon – Fri 8:30-5pm AEST) Email: subscriptions@intermedia.com.au

Ltd (the “Publisher”). Materials in this publication have been created by a variety of different entities and, to the extent permitted by law, the Publisher accepts no liability for materials created by others. All materials should be considered protected by Australian and international intellectual property laws. Unless you are authorised by law or the copyright owner to do so, you may not copy any of the materials. The mention of a product or service, person or company in this publication does not indicate the Publisher’s endorsement. The views expressed in this publication do not necessarily represent the opinion of the Publisher, its agents, company officers or employees. Any use of the information contained in this publication is at the sole risk of the person using that information. The user should make independent enquiries as to the accuracy of the information before relying on that information. All express or implied terms, conditions, warranties, statements, assurances and representations in relation to the Publisher, its publications and its services are expressly excluded save for those conditions and warranties which must be implied under the laws of any State of Australia or the provisions of Division 2 of Part V of the Trade Practices Act 1974 and any statutory modification or re-enactment thereof. To the extent permitted by law, the Publisher will not be liable for any damages including special, exemplary, punitive or consequential damages (including but not limited to economic loss or loss of profit or revenue or loss of opportunity) or indirect loss or damage of any kind arising in contract, tort or otherwise, even if advised of the possibility of such loss of profits or damages. While we use our best endeavours to ensure accuracy of the materials we create, to the extent permitted by law, the Publisher excludes all liability for loss resulting from any inaccuracies or false or misleading statements that may appear in this publication.

Copyright © 2023 - Food and Beverage Media Pty Ltd

winning in the

age of customer experience 26 Industry Event: ALM’s inaugural Supplier Conference 34 World Cocktail Day: Shaken and stirred

46 Mother’s Day: Let’s hear it for mum!

58 Retailer Profile: My Beer Dealer, Brisbane

23 Wine Australia: Spending more, buying less

28 Family Wineries: Growing up in the vines

38 RTD: The category preps for cooler weather

50 Independent Beer: Proud independence

54 Wine Tasting Review: Pinot Noir

The premium whisky brand is celebrating its #MadeForMixing message across a range of activity throughout this year.

There’s no denying it – mixed drinks are having a moment right now. According to William Grant & Sons, cocktails in particular are shaking up a storm, having seen the largest increase as the ‘drink of choice’ for Australian consumers, up from six per cent to 35 per cent. Spirits overall are a very close second, seeing growth rates go from five per cent up to 38 per cent.

When it comes to dark spirits, a key demographic driving this growth is the consumer who is newer to the premium whisky category. These consumers don’t take their whisky too seriously – they want fun, simple and easy drinks, that still deliver exceptional taste and refreshment for any occasion and in any serve.

Ticking all of these boxes is Monkey Shoulder®, a leading premium spirit that continues to see growth in the premium whisky value pool, while challenging bourbon along the way. What sets Monkey Shoulder apart is its unique brand personality and smooth and rich flavour profile, expertly crafted for enjoyment from all angles.

“What sets Monkey Shoulder apart is taste and approachability,” says Mike Lowe, Brand Manager for Monkey Shoulder at William Grant & Sons.

“Our Master Blender, Brian Kinsman who also works across Glenfiddich, set the team the task of creating a whisky whose profile could be enjoyed neat, mixed, or in a cocktail. When we say approachable, we mean that our ‘Made For Mixing’ message communicates the ease in which consumers can use our whisky to enjoy in whichever way they like.”

This approachability for a premium product is certainly resonating with consumers. Two in five are now aware of Monkey Shoulder, with two in three of these consumers then purchasing it. In addition, according to the AUS Pulse Report of February 2023, consumers are spending more to treat themselves, buy better quality or consume more.

With the accessible quality and value proposition of Monkey Shoulder in the spotlight like this, the brand is well placed to ladder retail shoppers up to premium purchases and also entice drinkers to enter the dark spirit or whisky sector from other categories.

“As consumers are continuing to premiumise their cocktails and spirit options, Monkey Shoulder is precisely positioned to be their premium whisky of choice and their mixable companion,” said Lowe.

To communicate these key messages, Monkey Shoulder is inviting consumers to #MakeItMonkey with two major ATL media campaigns this year, in June and October. This is alongside a range of activity and appearances with the iconic Monkey Mixer Truck at festivals around the country, including GABS, Crafted Festival, Yours & Owls and Vanfest, as well as an activation around World Redhead Day on 26 May (AKA World Ginger Day). ■

Monkey Shoulder’s flavour profile easily plays in simple serves, cocktails and long drinks. A key mix to try is the Ginger Monkey – an easily made and simple yet refreshing drink that is a great start to any night.

Ingredients:

50ml Monkey Shoulder

200ml Ginger ale

Orange wedge

Method:

1. Build in highball glass with ice

2. Serve with orange wedge garnish and enjoy!

Visit @monkeyshoulderau on Instagram for more inspiration on how you can #MakeItMonkey. Or contact your local William Grant & Sons representative for more information.

After Ballistic Brewery announced that it was entering administration, the popular craft brewery has been rescued by new investors, including Catchment Group and an interstate hospitality group. Catchment Group CEO Matt Newberry will assume the group CEO role and Ballistic Founder David Kitchen will remain as a shareholder and Strategic Advisor the Board.

“We are confident that with the capital injections from our partners and strategic input to the plans we have been working on will see Ballistic remain a large, relevant and popular craft beer brand in the Australian Craft beer Industry,” said Kitchen.

The investors have developed a new plan for Ballistic Brewery, including a revitalisation of its Brisbane venue and distribution across NSW, ACT and Victoria. They provide a firm financial base and a solid strategy to get the business back up and running, as well as new opportunities for the brewery to grow.

Non-alcoholic beer specialist, Heaps Normal, became an accredited B Corp late last month, and is now the fifth Aussie brewery to achieve the accreditation.

The ‘B’ in B Corp stands for ‘Benefit to all’, and the status is achieved only after rigorous auditing through which businesses must meet high standards of social, corporate and environmental responsibility. The status must be reapplied for every three years.

Heaps Normal obtained a 95.1 score in the B Corp accreditation, which is significant considering the threshold is 80 points, with the average company median score being 50.9.

Co-founder and CEO of Heaps Normal, Andy Miller, said: “B Corp is a gold standard for business done better, so we’re really proud to not only have achieved certification, but to have become the first dedicated non-alcoholic brewery in Australia to do so.

“We’re always looking for ways we can improve how we do business, but to have this recognition reflects the team’s hard work in putting people and the planet at the core of what we do.

“The B Corp mission to transform business into a force for

good resonates strongly with our own. We have a standing commitment to provide a significant portion of our resources to effective charitable giving. Our aim is to make real positive impact in our community.”

The certification is Heaps Normal’s latest social and environmental move as part of its ‘purpose program.’ This sees the brewery give to ‘1% For The Planet’ and ‘1% For The People’, and partner with OzHarvest, Support Act, the Seabin Project and Rainforest 4, as well as be a major sponsor of Sydney Rangers FC, a gay and inclusive men’s football club.

Industry shocked by death of NT bottle shop employee ➤ Hard kombucha: an opportunity brews

➤ Pernod Ricard launches Sovereign Brands in Australia

Pepper Tree Wines has announced the return of legendary winemaker, Jim Chatto, who will take on a consultancy position at the winery.

Chatto previously worked at Pepper Tree for seven years between 2007 and 2014, where he earned a reputation as one of Australia’s foremost awardwinning winemakers. Previous to winemaking, he was also a grape buyer for the winery, and served as Chief Winemaker for the McWilliam family.

Chatto said this latest move feels like a “natural progression” of his great working relationship with Pepper Tree’s Owner, John David, for over 20 years.

“It is a chance to support this new generation of Pepper Tree winemakers and taking the vineyards and wines to the next level. It is an exciting challenge,” Chatto said.

David said he was excited to have Chatto return, noting: “Having Jim join the winemaking team will ensure Pepper Tree has the experience and expertise to create the best possible house style, utilising our vineyards in the Hunter, Orange, Wrattonbully and Coonawarra.”

Bacardi has announced the retirement of Francis Debeuckelaere, Regional President Western Europe, Australia and New Zealand (EUROC). His duties will be split between Vijay Subramaniam, Regional President of AMEA and Global Travel Retail (pictured), who adds Australia and New Zealand to his responsibilities; and Ignacio ‘Nacho’ del Valle, who will take on the role of Regional President, Western Europe.

Debeuckelaere has been with Bacardi for nearly 30 years, starting as a local Marketing Director in 1994 and delivering incredible success with key markets across the world. He retires into a consulting role for the company, to oversee the transition.

“I am proud of the work we have accomplished together and look forward to seeing Bacardi thrive for generations to come,” Debeuckelaere said.

Mahesh Madhavan, Chief Executive Officer of Bacardi Limited, added: “I want to give a heartfelt thank you to Francis for his many years of service. He is a true industry professional and a friend to many of us. His expertise and deep knowledge of the business and markets have played such an invaluable role in building our business and brands.”

Max Gawn, captain of the Melbourne Football Club, has been announced as the official ambassador for Pepperjack as part of the brand’s partnership with the AFL for the 2023 season.

Gawn led the club to its first premiership in over 50 years in 2021, and said the partnership brings together his two favourite things: footy and wine.

“[Pepperjack] is a well-known crowd favourite and always goes down well with footy, friends or a night in with my family. My favourite varietal would have to be the Barossa Shiraz,” he said.

Ben Culligan, Treasury Premium Brands’ Director of Marketing & Category, said: “Max is one of the standout characters of the AFL. His warm and relaxed nature mixed with his honest and courageous leadership abilities encompasses the Pepperjack brand, making him the perfect ambassador.”

2023 will mark Pepperjack’s second consecutive year as the Official Wine of the AFL.

BrightSide Executive Search is the only dedicated drinks recruitment specialist nationally and has been a trusted advisor to the industry for well over a decade. Through accessing its wide-reaching network of potential candidates, BrightSide takes the hassle out of recruitment for drinks businesses, advising how they can stay nimble and competitive in a tight market to attract the absolute right person for each role. The latest BrightSide success stories below show the strong abilities of the recruitment agency in partnership with drinks businesses of all sizes, country-wide.

Peter Antonopoulos is a valued new member of the LMG VIC sales team building strong local connections.

Charlie Wong brings passion and energy to his new role as State Activation Manager NSW with Fever-Tree.

Jordan Gunning is enjoying his transition to the spirits category as ASM Sunshine Coast with Proximo Spirits.

Liquor Legends loves the entrepreneurial flair James MarsdenSmedley brings as Category Manager Beer & Cider QLD.

Amy March has brought a wealth of industry experience to Coopers as National Campaign Manager SA.

Laura Utting is utilising her creative and commercial marketing flair as Brand Manager at Fever-Tree.

Matilda Bay is thrilled with the energy and experience Blake Proud brings to the team as Brand Ambassador WA.

LMG is enjoying Lian Bryne’s support in her new role as Marketing and Communications Coordinator in VIC.

The Wine Company is delighted to welcome Jake Briggs to the team in NSW as Sales Area Manager.

Kieron O’Boyle’s extensive wine industry experience is invaluable as BDM VIC at Blue Pyrenees.

For more information go to www.brightside.careers or to look for current opportunities check out the BrightSide LinkedIn page: www.linkedin.com/company/bright-side-executive-search

On 8 March, the liquor industry came together in many ways to recognise International Women’s Day (IWD), a global day that celebrates women and marks a call to action for accelerating gender equality.

Food and Beverage Media, Publisher of National Liquor News, was the media partner for once such event – the Women of Australian Distilling and Women of Hospitality IWD dinner, held at Bloodwood in the Sydney suburb of Newtown.

The theme for this event was one set by the official IWD website – ‘embrace equity.’ Throughout the night, attendees were treated to food prepared by young female chefs of Bloodwood, matched with cocktails featuring spirits created with females at the helm, all of which told their stories to the crowd on the night. There was Ruby Jay of North of Eden, Nicola Thompson-Hancock of Mother of Pearl Vodka, Rosemary Smith of Black Snake Distillery and Corinna Kovner of Ester Spirits. Hosted by Christina Butcher of Mr and Mrs Romance, other event partners and sponsors included the

Australian Gin Distillers Association, P&V, Nip of Courage, Four Pillars and ChefWorks.

There was also another theme for IWD 2023, set by UN Women Australia off the back of the UN Women Global theme. This was: ‘Cracking the Code: Innovation for a Gender Equal Future’, which is about innovating to create meaningful positive change.

What both themes have in common is a need to create long lasting positive change –it’s not enough to have a conversation once per year. In recognition of the importance of this, The Shout kicked off IWD 2023 with a collection of insights of industry women, followed by the relaunch of its Industry Women Spotlight series (theshout.com.au/ tag/industry-women-spotlight).

Linda Boswell, General Manager – Western & Central Region, Australian Liquor Marketers Fortunately, Linda counts her experiences around equity as mostly positive, however she has noticed that unconscious biases can arise from the different ways that people think,

even as the industry shifts. Being aware of these biases is a great first step, and Linda has been challenging herself to think differently around the theme of equity, not only between genders, but between generations. She said it’s important to understand that the needs of those entering the industry now are different to those generations that came before them –recognising and catering to this change will ensure equity.

“What excites me is we are experiencing a greater level of diversity of thought from the newer generations. For them it is not just about gender it about the experience for all and more pleasingly, I feel they are confident and comfortable to have a voice because of the environment we are creating to nurture our future leaders,” said Linda.

“I believe a holistic conversation focusing on embracing the needs across generations is starting, has started and needs to continue to be had. Equity is all about inclusivity and the more conversations, formal and informal we can have on this topic the better our industry will be.”

In terms of the #EmbraceEquity IWD theme, Thomson said that “it’s great, but it’s probably not urgent enough,” and that the issue deserves stronger attention and funding to create lasting improvements.

“We’ve tiptoed around equity in the wine industry for a long time, and there’s a lot of lip service paid to it… but there’s just not the urgency to make actual long-lasting change in a concrete way,” Thomson continued.

“The industry just isn’t putting its hand in its pocket to say, let’s actually really address the issue of equity and gender equality. To solve any issue in the wine industry, we know we need funding, but when it comes to this particular one, no one seems to have it.”

Ingram-Hegarty and Teale both joined Liquor Barons within the past year, during a significant restructure to the head office team – now more than 60 per cent of the office team are female.

Ingram-Hegarty said: “The ‘digital gender divide’ in innovation and technology is something that I’ve seen across many of the different industries I’ve worked within. I’m proud to say that ‘gender digital divide’ is not something that’s seen within Liquor Barons Cooperative.”

Teale added: “I was anticipating to find a male dominated industry likely with a lingering ‘boy’s club’ mentality. This has not been the case. I have been supported to succeed by our group and the supplier community, and I have no doubt that I have been offered the same amazing opportunities as any man would have been within my role.”

Hopwood, meanwhile, has been at the company for seven years. Her development

At its first official advisory board meeting on the eve of IWD, Women of Australian Distilling elected the following positions and members:

• Chairperson: Kathleen Davies, Founder of Nip of Courage and NOC Wholesale

• Vice Chairperson: Dervilla McGowan, Founder and Head Distiller at Anther Spirits

• Treasurer and Secretary: Harriet Leigh, Head of Hospitality at Archie Rose Distilling Co.

• Board member: Nicole Lestal, Communications and Program Manager at Spirits & Cocktails Australia

• Board member: Paul McLeay, CEO of the Australian Distillers Association

to a current leadership role was made possible by investment in training to further her knowledge.

“I’d like to see more organisations investing into training and development opportunities for females who show an interest in this space,” Hopwood noted.

Ingram-Hegarty and Teale also noted that investment in the development of female staff is critical to ensure equity in the industry moving forward.

Teale added: “Aligning the external perception of the liquor industry with a clear image of gender equity is critical to successfully recruiting new and highly skilled individuals and store owners to the fold.”

Bree Nicholls

The pair behind Sip’er have seen that men were traditionally given the more substantial platform in drinks businesses run by female and male partnerships. Although there has already been a definite shift towards giving women the same opportunities and resources to be celebrated, there is still a long way to go.

“As we continue to celebrate the gender minority in the industry, the more this will inspire others to do the same, until we see a true balance of public celebration in the industry, regardless of gender or circumstance,” Nicholls and Cheng said.

“Changing how an industry is perceived is a long-term game and may not happen overnight, but having a chat with people in your inner circle and workplace is a small action we can all take to spread awareness.”

Small said that we need to acknowledge the facts about gender equality and diversity overall in the brewing industry.

“I believe diversity makes successful organisations create diversity of thought, diversity of ideas, diversity of approach. The brewing industry, like many others, has a long way to go in this respect,” Small said.

“Change isn’t spontaneous; it needs to be proactive. Equity recognises that diverse people have equal potential when given the opportunity to exhibit it, and those opportunities must be proactively created. #EmbraceEquity recognises this fact and ideally creates momentum for transitioning from conversation to action.” ■

This is a snapshot of industry women insights. Read the full story on The Shout.

Australian Liquor Marketers (ALM) has continued to develop its exclusive and owned brand portfolio by acquiring successful Australian craft beer brands, Doss Blockos and Lick Pier.

These are the first beer brands to join the ALM portfolio, and continue the group’s strategy to help independent retailers gain a competitive advantage with superior quality, value, and margin products.

Murray Riemann, General Manager of Exclusive & Owned Brands said: “ALM is very proud to be new owner and distributor for Doss Blockos and Lick Pier, as we continue to build our portfolio with the shopper in mind, to ensure we remain relevant in an ever-changing liquor retail landscape.

“We are excited to welcome these stalwart brands into our portfolio as we continue to champion successful independents.”

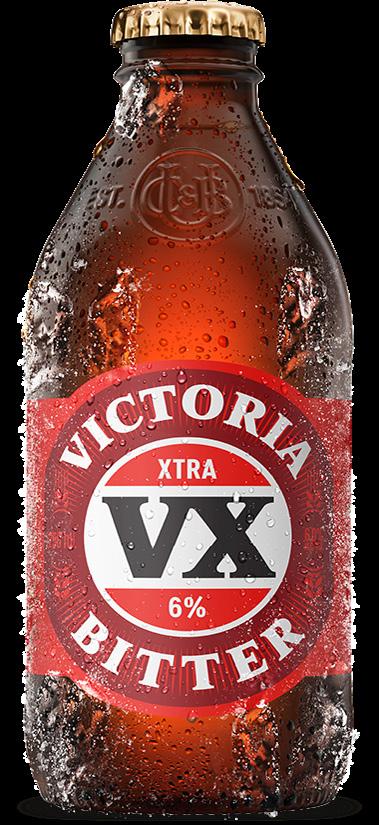

Victoria Bitter has announced the launch of a new beer, Victoria Bitter Xtra, which will also be known as VX. The new brew comes in 250ml bottles with six per cent ABV, compared to the 4.9 per cent ABV in the classic VB stubbies and tinnies.

While the new brew uses the same ingredients and has the distinctive VB flavour, the brewer is keen to point out the classic VB will remain unchanged.

Brand Director Sarah Wilcox said: “We’ve launched VX to give beer lovers a slightly bolder and more intense version of the great VB taste they’ve enjoyed for generations. It is brewed to be enjoyed with mates and to offer more choices of great-tasting beer for various occasions.

“We didn’t want to mess too much with the iconic VB recipe for the new VX. Beer lovers with long memories will remember we did that once before and we definitely won’t be rushing to do it again. This time we are listening to our consumers and giving them what they want.”

It’s been a smooth ride for Thirsty Camel Victoria in the first months of 2023. Changes to the customer incentive Hump Club over the past six months have made it easier for both customers and retailers to initiate sign-ups and use in-store with incredible results.

This translated to a big win for the latest Thirsty Bonanza, a loyalty campaign that saw Thirsty Camel stores across Victoria give away more than 2,000 prizes, including a major prize of $5,000 in cash. This year’s promotion saw four times as many customers engage with the Hump Club, compared to the same period in 2022.

Transactions also increased dramatically during the promotion, and the Hump Club had its biggest single day of loyalty transactions, beating the previous record set in December 2022 by 12 per cent. This translated to an increase in daily value throughout the campaign by 9.7 per cent compared to December.

It all bodes well for the next important period for Thirsty Camel stores - Easter. The group’s personality has always been a point of difference, so during this period, the lovable larrikin came to life with ‘Unseriously Good Easter Deals.’ After all, who needs the Easter Bunny, when you’ve got the Camel?

To bring the campaign to life, Thirsty Camel partnered with radio station Nova and its on-air personality Fitzy. From late March, the Easter Camel chatted to Fitzy on air throughout the day to hint at special eggs planted across Thirsty Camel outlets. Listeners could then head to their nearest store to find them, for the chance to win epic prizes.

In Victoria, there was a focus on regional radio to ensure regional and seasonal stores could capitalise on families, friends and groups travelling throughout the Easter and school holidays. It all added up to great value for customers and a win for Thirsty Camel stores.

White Claw has released its second variety 10 pack iteration, which includes three new hard seltzer flavours (Strawberry, Lemon, and Passion Fruit) alongside the already established Pineapple flavour. Like all existing White Claw flavours, the new SKUs are available in 330ml cans with 4.5 per cent ABV and 95 calories.

The three new flavours will only be available in this Variety Pack No. 2, which has been designed as a convenient option for sharing occasions in the warm weather of early Autumn.

This latest variety pack is well positioned for successaccording to a recent IRI Australia seltzer report, the original Variety Pack No. 1 is the most popular format of White Claw product in Australia.

Lion has announced the national release of Hahn’s lowest carb beer to date, which has a longer brewing time to remove as many carbs as possible, while still maintaining the taste profile.

Hahn Head R&D Brewer, Graeme Gibson, said: “With no compromise on the malty beer taste, the beer profile result is a perfect balance of flavour and easy drinking crispness, with ultra low carbs and a low bitterness. It’s made for those who want the rewarding taste of beer, but don’t want to blow out on carbs and calories.”

Lion noted that the demand for lower carb beers has been on the rise as of late, with growth of 7.3 per cent year on year growth projected since 2017.

Chris Allan, Lion Australia’s Head of Marketing for Core Beer, said: “There’s so much room to play in the low carb category and we’re excited to continue innovating in this space.”

First produced in 1992 and discontinued in 2000, Reschs Real Lager is returning after a campaign by the NSW Reschs Appreciation Society.

The beer has been reformulated for 2023 tastes, sitting at 4.2 per cent ABV, and will be sold in a 330ml stubbie format. Real Lager is described by the brewers as ‘a modern easy drinking take on the classic lager’, and it will be marketed with the slogan ‘New taste. Real beer.’

CUB’s Head of Classic Beer Brands, Sarah Wilcox, said: “We’ve listened to the fans. The Reschs Appreciation Society have been strong supporters of the brand and continue to shine a light on how much NSW loves this famous brand.”

But it’s not just the members of the Reschs Appreciation Society that the revival is aimed at - Wilcox said the brand is attracting a new generation of beer drinkers who love classic beers and the nostalgic stories behind them.

Australian rum distillery Brix is set to expand its national footprint after signing a deal to join leading liquor distributor, SouthTrade International.

Damien Barrow, Co-Founder at Brix Distillers, said the deal came from an alignment between the two companies’ values.

“It’s an extremely exciting time to be involved in the Aussie rum category and with a number of other amazing local brands contributing to change within the category, we expect to see consumer perception continue to shift over the coming years. Brix continues to focus on transparency, education and innovative production techniques in bringing our brand to life, all of which are qualities we feel are well aligned with SouthTrade’s own operational brand pillars,” Barrow said.

The deal coincides with a suite of changes within Brix, including a new bottle and label design and the appointment of Andrew Walters into a Brand Ambassador role.

Ray Noble at SouthTrade International was also excited for the partnership, and said: “Local craft spirits remain a key pillar of growth for us, and I can’t think of a better brand to partner to lead the evolution of craft rum in Australia. There is a lot of untapped opportunity in the super-premium rum segment and the passion Brix bring to this category is infectious.

Brix already has plans underway to construct a one million litre per year rum distillery in Western Sydney, which will see larger investment in liquid under maturation.

Vodka Cruiser has brought a twist to its classic RTD with new range Vodka Cruiser Double, available in three flavours: Guava, Raspberry and Lemon Lime.

The new range stands apart from its traditional glass bottle with a striking black 375ml can featuring a splash of colour. This is accompanied by a higher ABV, with Vodka Cruiser Double coming in at 6.8 per cent ABV.

Georgina Chao, Brand Manager for Vodka Cruiser, said the new range was designed to appeal to a range of drinkers across different occasions.

“Vodka Cruiser Double is a highly anticipated innovation by the number one light RTD in Australia, inspired by recent drinker trends,” she said.

“We can’t wait for Vodka Cruiser Double to be embraced by customers and their friends as their drink of choice for a night out.”

Vodka Cruiser Double will be available to retailers nationwide and will carry a $29.99 RRP for a four-pack.

Meanwhile, Vodka Cruiser has continued to expand its much loved existing range as well, most recently with a new Sour Apple flavour that is exclusive to Coles Liquor retailers.

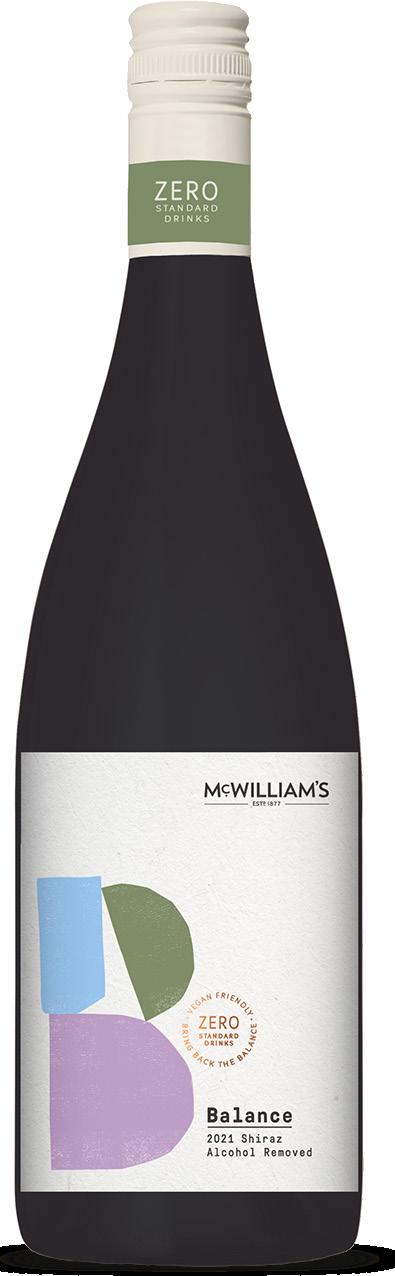

Riverina family winery McWilliam’s has entered the nonalcoholic wine category with the return of its Balance range. The decade old line features two new wines - the Balance Alcohol Removed Sauvignon Blanc 2022, and Balance Alcohol Removed Shiraz 2021.

Carrah Lymer, Brand Manager for McWilliam’s Wines, said there wasn’t as much demand for the category when McWilliam’s entered it originally.

“McWilliam’s Balance was ahead of its time over ten years ago. Back then, the no and low alcohol category was not as exciting as today,” Lymer said.

“Step forward ten years later, and the innovations in removing alcohol in wine production have improved dramatically. Our winemakers can now impart winelike characteristics to wines with little to zero traces of alcohol while still giving drinkers a full-flavoured experience to enjoy with friends or over a meal. We’re excited to bring back Balance and have McWilliam’s join the booming no and low alcohol category.”

The new release Balance shows a modern evolution on the packaging as well, with the wine aiming to appeal to health-conscious Gen Y consumers.

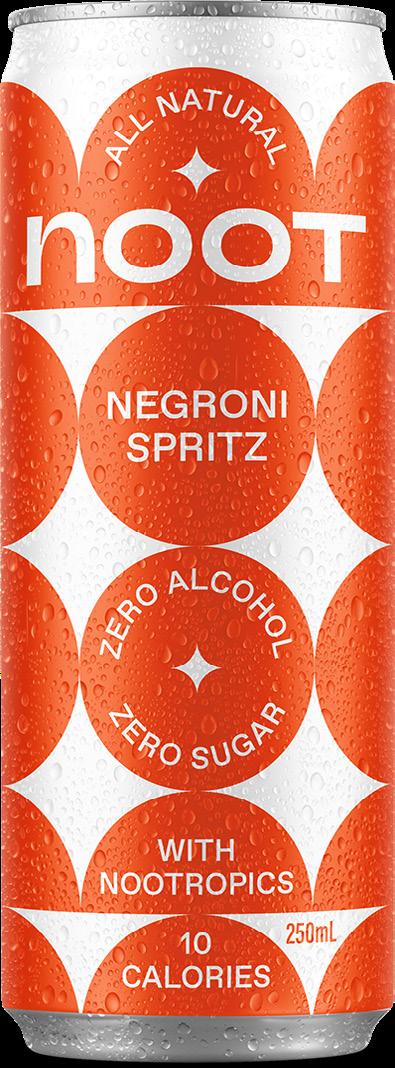

Hard Fizz has entered the non-alcoholic RTD market with the launch of Fizz Functional, a range of zero alcohol cans that feature ‘functional’ ingredients.

Fizz Functional launched with two flavours - Dialled In, a pink lemonade containing ginseng and guarana for focus and energy; and Glow, a berry infused beverage that contains marine collagen to strengthen hair, skin and nails. A third flavour, Splash Tropical Crush, is set to come soon.

Already there is great momentum behind the ‘better for you’ range, with the two launch flavours selling out within 12 hours of coming online. The brand has said it has now ramped up production, and is taking orders for a national retail rollout.

CEO of Hard Fizz, Wade Tiller, said the reception so far has shown there is “proof of concept,” and inspired them to push forward with the range further.

The all-occasion Fizz Functional range has been in development in a while, and as Tiller noted, it’s “about giving consumers another option” if they’re not drinking alcohol.

Alcohol has been in the spotlight in the NT as of late, as the Territory reviews a range of policy items in its Liquor Act, writes Michael Waters, CEO of Retail Drinks Australia.

Alcohol related issues in the Northern Territory have gathered increased attention in the past few months, particularly in Alice Springs and surrounding communities culminating in a visit by the Prime Minister in January. Following this visit, a report was completed by the Central Australian Regional Controller which recommended to the Commonwealth and the Northern Territory Governments that various town camps and remote communities return to being alcohol-free areas after previous Commonwealth legislation establishing dry zones in these areas lapsed in July 2022.

Separately to the issue of reinstating these dry zones, there are many important areas of the NT Government’s alcohol policy which are currently under review as part of a wide-ranging three-year review of the Territory’s Liquor Act. The Liquor Act 2019 implemented a number of other significant alcohol policies as recommended by the 2018 Riley Review, which contained 220 recommendations of which, 219 were accepted or accepted in-principle. Issues currently under consideration by the NT Government are the operation of the Banned Drinker Register (BDR), as well as grocery stores being required to ensure that alcohol does not exceed more than 25 per cent of their total retail sales.

Retail Drinks has provided a submission in response to this review process, noting several potential areas of improvement to these policies. In regard to the BDR, additional mechanisms are required to ensure that

persons who should be on the register are captured appropriately. This increases the number of authorised persons able to apply for the making of a Banned Drinker Order, such as Transit Safety Officers and Council Rangers. Another option is introducing a mechanism for licensees to refer people to licensing authorities for potential addition to the BDR.

We have also noted the issue currently facing grocery store licensees, where they are required to ensure that no more than 25 per cent of their total sales are alcohol. However, there are several factors beyond the licensee’s control that make this requirement difficult to adhere to, including the wide disparity in the price of alcohol compared to grocery items, as well as the seasonality of customer purchasing patterns. For grocery store licences, a higher cap is possible whilst still ensuring that alcohol remains an ancillary, or minority, component of a grocery store business as per the original intention of this policy.

The NT Government’s review of the Liquor Act 2019 is expected to be completed over the coming months, with a report due to be tabled to the Legislative Assembly by October 2023. Once the report is finalised, the NT Government will then decide which recommendations to accept, with legislation formally enacting any legislative changes to the Act to follow. Although the outcomes of the NT Government’s Review process will not be known for the coming months, it is certain that there will be important ramifications for licensees across all different licence categories. ■

Michael Waters CEO Retail Drinks Australia

“There are many important areas of the NT Government’s alcohol policy which are currently under review as part of a wide-ranging threeyear review of the Territory’s Liquor Act.”

The retail leasing market in Australia has faced significant challenges, particularly in relation to the power imbalance between landlords and tenants.

One of the most significant issues in retail leases is the high cost of rent and outgoings. Retail tenants often face high rents and additional costs such as outgoings, which can include utilities, taxes, insurance, and maintenance fees. These costs can be a significant burden for businesses, particularly for smaller operators, and can make it difficult to operate profitably. Landlords, on the other hand, may be incentivised to charge high rents to maximise their returns on investment.

Another issue is the limited negotiation power that tenants have in retail lease agreements. Many landlords use their own prepared lease agreements that are heavily skewed in their favour, leaving little room for negotiation. This can leave tenants at a disadvantage, particularly in a market where rental demand is high, and the supply of suitable properties is limited. Tenants may be forced to accept lease terms that are not favourable to them, such as limited lease renewal options, high rent increases, and inflexible conditions around fit-out and alterations. Having a lawyer assisting with negotiations can help tenants obtain more

preferable conditions to decrease their obligations and costs under the lease.

Uncertainty around lease terms is another issue faced by retail tenants, and can make it difficult to plan for the future. Lease terms can vary widely depending on the landlord and the specific property, and impact things such as lease renewal options, rent reviews, and the ability to assign or sublease the premises.

It is imperative that tenants are aware of the lease terms before they agree to them. Leasing lawyers can help provide a summary of the key lease terms so that tenants are aware of their rights and obligations.

Maintenance and repair obligations are also significant issues. While landlords are responsible for maintaining the structure of the building, tenants may be responsible for maintaining and repairing the premises, e.g. periodic maintenance of the air conditioning units. Tenants need to be aware that if there is no positive obligation on the landlord to perform certain repairs noted in the lease (e.g. if the air conditioning system breaks), then the tenant may have to spend more than anticipated if they require such repair. It is advisable for tenants to do a thorough inspection of the building to ensure it is in a good condition. Further, tenants should seek amendments in the lease to limit their obligations relating to maintenance and

repair, e.g. asking that the landlord must repair or replace the air conditioning system if it is reasonably required.

Limited protection under the law is another challenge for retail tenants in Australia. While the Retail Leases Act (different in each state) provides some protection, it may not go far enough to address the power imbalance between landlords and tenants. The Act provides guidelines around issues such as disclosure, rent reviews, and dispute resolution, but these guidelines are not always binding. In practice, this can leave tenants with limited recourses in the event of a dispute with their landlord.

Dispute resolution is itself another issue, and can be time-consuming and expensive to resolve between landlords and tenants, particularly if the dispute involves complex legal or financial issues.

All of these issues can be significant burdens for businesses, particularly smaller operators who may have limited financial resources.

In conclusion, while the Retail Leases Act provides some protection for tenants, it may not go far enough to address these issues. It is recommended that tenants obtain legal advice from a lawyer who specialises in retail leases, to help negotiate a more balanced lease that does not favour the landlord. ■

Marianna Idas, Principal Solicitor at eLease Lawyers, details some of the key issues that tenants should be aware of in retail leases.The current economic environment is anything but clear, a little bit scary with the only certainty that households are forensically analysing almost every aspect of the spend – both discretionary and non-discretionary.

The trend of ‘premiumisation’ is experiencing slowing momentum, as is drinkers’ willingness to risk their ‘hard earned’ to try new brands and experiences.

There are dire predictions of further interest rate increases and rents increasing at an exponential rate, with impacts to be felt well into 2024.

Coupled with soaring power and supermarket shopping bills, there is a growing appetite for fiscal restraint.

Historically, during times of financial duress there has been a flight to traditional, comfortable and trusted brands that offer perceived value and purchasing certainty.

The challenge for brands and retailers is to assess this ‘step change’ and continually recalibrate their range offering to ensure they maintain a loyal customer base.

Any range review should start at a macro level and ask questions like “does space allocated to each category reflect demand?”

While understanding each categories’ share of liquor sales across the market is a great starting point, this may not necessarily be reflective of the store’s customer base.

To add another layer of complexity, the prevailing

economic environment will probably drive brand and possibly category switching in some cases.

For example, where it was a reasonable assumption that RTD sales accounted for 26 per cent of total store sales, it may now be true that a portion of these customers have switched to mainstream beer or cider brands at a lower price point.

The impact of not identifying this trend could lead to increased inventory holding costs, where demand for higher priced products has waned and inventory takes longer to clear.

Allocation of existing space comes to the fore here as well, with cool room, floor and fridge space needing to be reapportioned. The risk of not doing so is lost sales through out of stocks and impact on cash flow.

From a category perspective it would be prudent to look at the mix of sales and identify where there has been a shift in spend from one brand to another and adjust inventory and space allocation accordingly.

Finally, the best source of information to understand fluctuations in demand is to go straight to your customer base and ask the question: “I noticed you have changed your regular brand; I am interested to know why?”

This approach should inform and allow retailers to make small incremental range and space allocation changes and stay abreast of any deviation in purchasing patterns rather than be forced to make wholesale changes. The result will be a healthier cash flow and happier customers. ■

“Historically, during times of financial duress there has been a flight to traditional, comfortable and trusted brands that offer perceived value and purchasing certainty.”

Stephen Wilson

Category & Insights Manager StrikeforceThe increasing cost of living is creating cautious consumers. Stephen Wilson discusses what this could mean for the liquor industry.

Around the world, inflation of consumer goods continues to rise. The result is consumers are spending more but purchasing less volume. For example, in November 2022 the dollars spent globally increased by 11 per cent but volume declined by two per cent. As financial stability is under threat, people must decide between paying more for everyday essentials, trading down to lower-cost alternatives or forgoing items entirely.

According to the NielsenIQ 2023 Consumer Outlook report, this year consumers intend to spend more on utilities, education and groceries and household items, but significantly less on out of home dining/eating and entertainment (down by more than 20 per cent). Within the groceries and household items category, spending on alcohol is expected to fall by the most (down 14 per cent), offset by increased spending on fresh produce, home essentials, health and wellness, dairy and fresh meat.

Businesses are feeling the pressure too. According to Euromonitor, 66 per cent of retail professionals said the rising cost of raw materials had an extensive impact on their company in the past 12 months. Higher production and operational costs spill over into retail prices. Profit margins are shrinking, and some players will be pushed out of the market. SKU rationalisation, updated pricing strategies, restructured investments and supply chain optimisation are measures taken to respond to new shopping habits.

Euromonitor International reports that while

saving is taking precedence over sustainability in the current economic conditions, increased cost of living is creating a new sustainable behaviour. Consumers will continue switching to energy-saving products, eating at home, reducing appliance use and limiting travel. However, less than one-fifth of consumers were willing to pay more for household essentials with sustainable features last year. While 45 per cent of professionals said investing in sustainability initiatives is a strategic priority for their company in the next five years, 41 per cent said a lack of consumer willingness to pay more for sustainable products is the most significant challenge. Consumption patterns are less about purchasing and more about reduction to positively impact the planet.

While increased cost of living is forcing consumers to cut back, they don’t want to be set back. People made significant sacrifices over the past few years to deal with economic instability and consumers became accustomed to the unexpected.

Euromonitor International’s report highlights the ‘here and now’ trend; it’s about living in the moment – consumers don’t know what tomorrow brings and aren’t wasting anymore time. While financial stability is important, time, health and bliss are equally important. Price is still relevant, but emotional benefit also justifies discretionary purchase decisions. Productivity, personal growth, and joy are reasons to buy. Smart splurges and affordable luxuries let consumers reasonably indulge to unwind. ■

“While increased cost of living is forcing consumers to cut back, they don’t want to be set back.”

Peter Bailey Manager Market Insights Wine AustraliaWhile inflation is impacting purchase decisions, affordable luxuries such as wine are still on the table, writes Peter Bailey, Manager Market Insights at Wine Australia.

With a wide and growing range of shopping options, it’s more important than ever to focus on connecting with customers, according to Circana.

Daniel Bone, Insights Director at IRI, says: “While sustainability is top of mind for many shoppers, the need to close the cost gap is going to present significant opportunities for brands. Brands that embrace value, as well as values, will be rewarded for their ingenuity.”

The way people interact with retail brands is evolving at break-neck speed. As we transition into a new age of customer experience, the focus must now be firmly on connecting and converting consumers in a wide and growing range of shopping options, especially as Australia navigates the fast-rising cost of living and inflationary impacts on the supply chain. As household budgets squeeze tighter and price becomes even more intrinsic to shopping decisions, loyalty will be tested by value, and in turn, our values will be tested too. And this means shopper behaviours will continue to change rapidly.

Value itself is in fact overwhelmingly behind why we are changing brands, followed by sustainability for younger consumers and personal choice for older people. Sustainability still matters to all generations driven by concern around the ethical status of the products we buy and the companies we buy them from.

For example, 53 per cent of Australians are willing to pay more to purchase from a purpose-led business with almost one in five willing to pay over 10 per cent more. This rises to over seven in 10 Gen Zs who would pay higher prices for products from companies that align with their purpose and core beliefs.

Aussies are now changing retailers if they find better value, convenience, availability and choice. While we’ll pay more in some categories, we’re switching brands or seeking promotions for essentials. In fact, perceived value drove 56 per cent of Australians to a new store or brand, while supply chain issues have also contributed to the three in five faced with stock-out issues when doing our grocery shop. But despite being more tech savvy and purchasing from a wider variety of e-commerce platforms to combat the effects of inflation on our hip pocket, people also still value the in-store experience. For example, for every $1,000 that Australians spend in overall retail, $850 is transacted inside a bricks and mortar store.

It is the era of the consumer, but it’s not one size fits all. Each generation is shopping and valuing their brands and retailers very differently. But overall – and

most importantly – a consistent experience includes ensuring that shoppers can use their loyalty privileges and enjoy seamless service and fulfilment, no matter whether they purchase through livestream shopping or walk into your bricks and mortar outlet.

To ensure you’re delivering to the value and values that Australian shoppers crave as they navigate the cost of living crisis, do your detective work and deep dive into your data, and synchronise your customer experience across all touchpoints. Your focus should be on an omnichannel strategy and the base for all planning. Gone are the days of looking at each channel independently – in 2023, it’s all about an integrated lens on how the same unique shopper uses each channel on their path to purchase. Optimising the intimacy of your customer data is key to showing where, when and how they shop in the moment so you can deliver the balancing of the price of value with the price of our values.

Learn more in the IRI 2023 FMCG Outlook Report: Winning in the new age of customer experience. ■

Sources:

• CommBank, CommBank Consumer Insights: The power of moving with purpose, March 2022.

• McKinsey & Co, Survey: Australian consumer sentiment during the coronavirus crisis, 17 October 2022.

• IRI analysis of Australian Bureau of Statistics (ABS) data; 12 mnths to Feb 2022 vs. 12 mnths to Feb 2021; IRI Shopper Panel, *All Outlets, 52 Wks to 27/02/22

Following a merger with the NPD Group last year, IRI has unveiled the new name and brand identity for the company: Circana.

Circana tracks millions of products spanning 2,000+ categories across 500,000+ stores in 20 countries, leveraging the data and expertise of the heritage firms behind it. The new and improved brand seeks to understand more about the complete customer, complete store and complete wallet, to assist its 7,000+ clients go beyond the data to apply insights, ignite innovation and meet consumer demand.

Find out more about Circana and the merger of IRI and NPD Group at www.circana.com

“It is the era of the consumer, but it’s not one size fits all. Each generation is shopping and valuing their brands and retailers very differently.”

National Liquor News attended the conference alongside more than 200 suppliers, getting an inside look at ALM’s strategy across wholesale, retail IBA banners and on-premise.

Australian Liquor Marketers (ALM) recently hosted its inaugural Supplier Conference in Sydney, which brought together more than 200 suppliers in the spirit of partnership.

The content for the day was structured around the feedback ALM received directly from suppliers through the Advantage Report - both good and areas to improve. With every presentation laddering up to the business strategy house of famous, frictionless and sticky, ALM showcased its strategy into execution for wholesale, on-premise, IBA retail banners, operations and committees.

Central to the conference was ALM’s purpose of ‘championing successful independents.’ Through each session, ALM demonstrated the importance of its role as ‘the big guy helping the little guys’, and how beneficial it was for the retail and supply side of the industry to connect on a human level.

For Josh Gaudry, General Manager of Marketing, Digital and Loyalty at ALM, this togetherness was

a meaningful outcome from the conference and the networking drinks which followed.

“My absolute highlight was bringing this community of suppliers together in person. Our industry is about sociability. What other industry can you think of that fierce rivals can come together in the same room, participate in the experience of our sharing in our strategy and then come together for a sociable drink afterwards? We’re proud to be able to facilitate that and are quite happy to leave two hour Zoom calls behind in the COVID years,” Gaudry said.

Accolade Wines was one supplier in attendance which saw this value. The company’s Head of Independents, Jonathan Chang, congratulated ALM on a fantastic event.

“There was a real sense of collaboration and aligned purpose as we heard about how we can work together to champion and support independent liquor retailers across Australia,” Chang said.

“It was also a really valuable opportunity not only

to network across the industry but also to celebrate the sociability that is so central to our industry.”

Hayley Fazakerley, National Account Manager for IBA at Accolade Wines, was in full agreement, adding that it was a great opportunity for open two-way dialogue about each arm of the ALM business.

“From a strategy perspective, we learned more about ALM’s strategy to champion successful independents and how we as suppliers can be part of this and work collaboratively to drive immediate and future growth,” she said.

“It was great to learn more about ALM’s and IBA’s priorities and strategies and their mindset of continuous improvement, including detailed plans by banner across wholesale, retail and on-premise.”

Throughout each session, suppliers were impressed by the transparency from ALM about its blueprints for IBA retail banners, as well as its strategies as a wholesaler and on-premise supplier. Diageo, for example, noted that this uncovered innovative ways the companies can partner together in the year ahead and beyond.

Nigel Hahnel, National Business ManagerIndependents at Diageo, said: “The consistency in strategy enables us to better plan and execute, as does getting real insight into the IBA banner strategy.

“As an insight led business Diageo is always keen to collaborate more in this space to really unlock value for the customer, the shoppers and the category.”

The ALM Supplier Conference didn’t just focus on the bigger suppliers either - with a core desire to create a level playing field, ALM welcomed smaller and independent producers as well. This included Hawkes Brewing Co., which congratulated the ALM team on an informative and useful day.

Vince Bateman, National Sales Director - Retail at Hawkes Brewing Co., said a particular highlight was the team “bringing to life the integration of the ALM strategy across the various business functions, the proposed improvements in process and clarity in the contact matrix, all of which will make doing business that much easier.

“As a smaller supplier it was good to understand the evolving banner partner opportunities available to us, particularly as we grow our brand and expand into new markets.”

Chris Baddock, CEO of ALM, closed the conference by reinforcing ALM’s philosophy that success needed to be founded in partnerships, with both retailers and suppliers. Baddock did this by quoting an African proverb: “If you want to go fast go alone, if you want to go far go together.” ■

Chris Baddock

Supplier delegates

Anthony Rose

Chris Baddock

Supplier delegates

Anthony Rose

Family wineries have helped shape the Australian wine industry from its inception and are continuing to make an impact today – Caoimhe Hanrahan-Lawrence investigates.

Far from the corner shop stereotype that the name might have once evoked, family businesses are often as successful, if not more so, than other businesses. In fact, Credit Suisse reports indicate that family-owned businesses have consistently outperformed non-familyowned businesses for over a decade.

Many of the household names in the Australian wine industry are family owned and run. Family wineries have been instrumental in growing regions, popularising varieties and styles, and promoting Australian wine on the international stage.

For family wineries, success does not just mean economic growth. Instead, many of these businesses express their ideas of success in qualitative terms. Success is about continuing the family legacy, creating a beloved product, or simply having a job that you love.

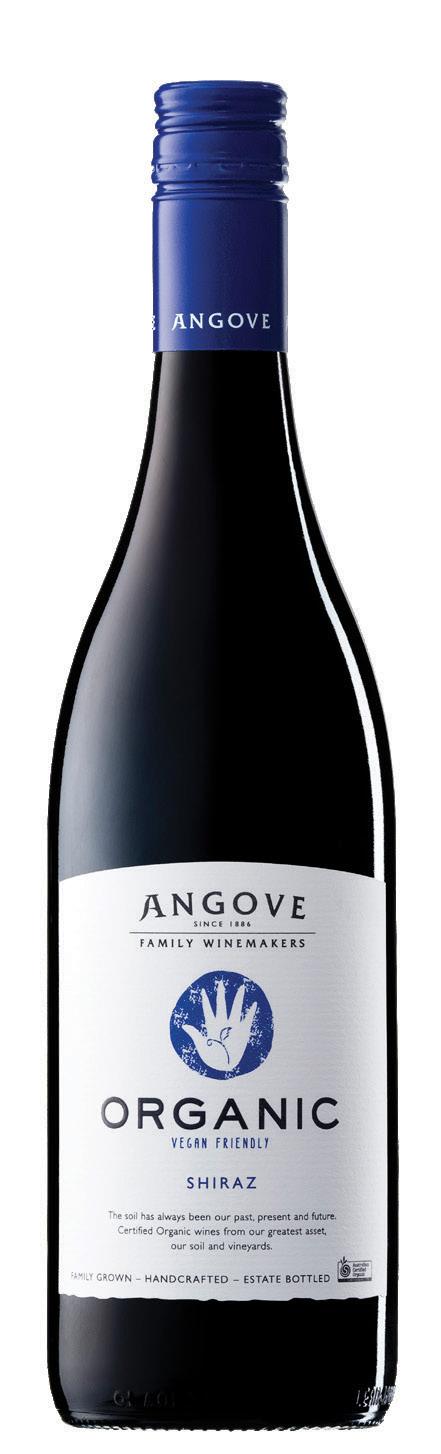

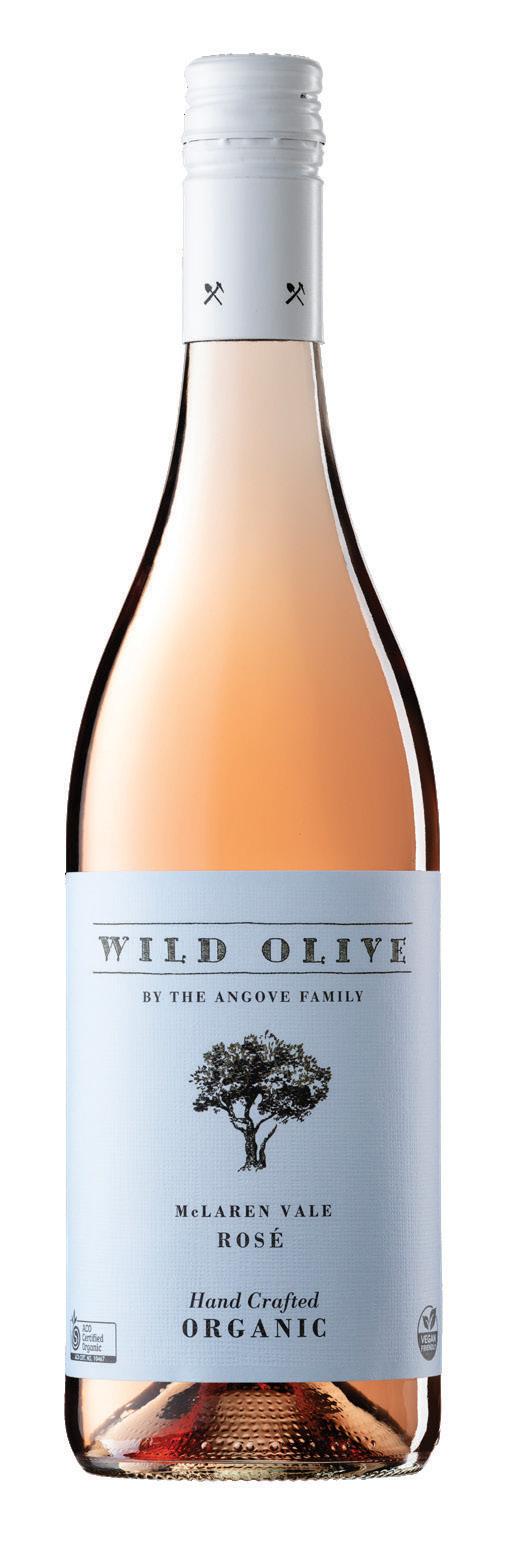

For Richard Angove, fifth generation

winemaker at Angove Family Wines, success means creating “a business that is diverse and able to weather the peaks and troughs of both economic and agricultural challenges.”

Although, as he admits: “gold medals and trophies for our wines are nice as well.” However, any history of success necessarily includes a few defeats along the way. Many family-run wineries share the same stories; illnesses in the family, harsh droughts, and vineyards decimated by pests and disease. These setbacks require sacrifices, but they are a key part of forming a resilient, steadfast winery. The experience of the previous generation then becomes an invaluable resource when it comes to future hurdles.

Andrew Calabria, the third generation at Calabria Family Wines, said: “Dad’s been a really good, steady hand and always passing on advice that the industry does go through ups and downs. That’s why we try to have that long term perspective.”

But how do family wineries ensure their

long term success? The consensus is that it’s important to have a core range of styles. Obviously, there is room for experimentation and new styles, but having a well-established core is vital to the business’s longevity.

Chester Osborn, the fourth generation of d’Arenberg Wines, added: “I read stories about my father’s wine styles back in the 60s. They said that his wines were very French-like, they were structured, with long ageability and great balance, good tannins. That’s what I still do.”

Michelle Geber, the second generation of Château Tanunda, agrees, adding: “It’s really important for us that we’re not making wines that are a trend at the moment, or because we found an opportunistic parcel of fruit in a particular year, but we’re about crafting and marketing high end wines from the Barossa.”

Just how long term the thought process is can differ. In order to hand the business on to the next generation, many family

Angove Family Winemakers is Australia’s leading certified organic grape grower and winemaker, with a deep commitment to sustainability at all levels. With major interests in vineyards across South Australia, the links to the land are as strong as ever and the desire to protect and improve this finite natural resource is driving much of the development of the Angove brand.

Established 135 years ago by Dr William Angove, the brand has a deep heritage in health and wellbeing. Dr Angove emigrated to Australia from Cornwall in 1886. He entered viticulture when as a medical doctor he recommended wine as a tonic to his patients, and he began cultivating vines and making wine.

Made with the gentlest touch and with minimal inputs, the Angove family crafts their range of exceptional Certified Organic wines from premium grapes sourced from their organic and biodynamic vineyards through McLaren Vale and the Riverland. At no stage during the grape growing or winemaking processes are synthetic chemicals or nonorganic inputs used.

Angove has been certified organic for 15 years, with Angove Organic the leading Organic wine brand in Australia. All Angove Organic wines and promotional material proudly display the “bud” logo, which required rigorous testing and auditing. One major highlight was being named Organic Business of the Year in 2019 and exporter of the year in 2021. The prestigious awards were presented as part of the annual Australian Organic Industry Awards, which recognise the achievements of businesses who are committed to sustainable and organic practice across different sectors, including wine.

wineries think in terms of the next five or ten years, which can provide a safeguard against economic and environmental fluctuations.

While the family is obviously a central component of a family winery, it is also necessary to involve people outside of the family.

Natalie Burch, the second generation of Howard Park Wines, said: “Family businesses across all sectors can become stuck in their micro-climate of ideas if they close themselves off to outsiders being a part of their business.”

There are numerous benefits for nonfamily workers in family businesses, with the atmosphere one notable aspect. Many producers identified a desire for their staff to feel like they are part of the family, and part of the story of the winery.

As Angove said: “It’s important to note that it is not only family members that have laid the foundations, but a series of team members throughout the 137 years our business has been in operation. We have always had such a great team working together towards common goals.”

Consistency is a major drawcard for

outside staff to join family businesses, as fourth-generation Bruce Tyrrell explained.

“If you’re getting a new CEO every three years, your life changes every three years pretty dramatically. You may or may not like it, and you’re probably not going to have a say in it,” said Tyrrell.

Family winemakers have also found community amongst each other, particularly through Australia’s First Families of Wine (AFFW). It has proven a valuable resource for inspiration, education, promotion, and friendship for the member families. Tyrrell spoke of an early AFFW event where a journalist asked how the families worked together despite being industry competitors.

“They’re also my oldest and dearest friends,” Bruce replied.

“So if you say anything about Ross Brown (Brown Family Wine Group), the business side of it is gone. You’ve insulted one of my greatest mates.”

Playing the long game

A challenge unique to family legacy labels is the need to raise the next generation of winemakers. How does the current generation ensure that their grapes don’t fall too far from the vine?

dVictoria AngoveThe first step is to build a successful business, as this gives the new generations opportunities to learn and make their own mark. Geber’s interest in Château Tanunda came through an internship at her family’s winery, during which time she was involved in launching their wines into the US market. The experience gave her a greater understanding of the international wine scene and cemented her pride in Australian wines.

How closely a person grew up amidst the family winery can also impact their interest later in life – Angove and Calabria both identify the smell of vintage as a strong childhood memory.

Tyrrell adds: “I grew up around the place ever since I could walk. Wineries are wonderful places for children because you’ve got 50, 60 aunts and uncles to keep an eye out for you. I find that happens now with my grandchildren.”

Osborn says this was an educational experience for him, noting: “I was always going to be a winemaker. I learnt the process at a very young age. Only as a cog, not really understanding winemaking, but it infiltrates a bit.”

However, a childhood spent in the vineyard is not the only way the future generation enters the industry. Osborn’s three daughters grew up in Adelaide, but are now all studying winemaking. His youngest had always shown an interest – the turning point for the eldest daughters was during the March 2020 lockdown, which they all spent at the winery. Each night they would have wine tastings together, and by the end of the six week lockdown, all three daughters had decided to pursue winemaking as a career.

Third generation of Taylors Wines, Mitchell Taylor came to winemaking as an adult as well. Though he grew up around the winery, he initially pursued a career in finance. It was while he was setting up the winery’s first computer system that he “really saw how interesting the business was from the inside and could see where there was an opportunity to really try to improve things.”

The wine industry is fast paced and competitive, and it may seem like family wineries could easily be mired down by tradition. However, innovation is the thing that has kept these wineries alive for decades or even centuries – the stories of risk associated with unique thinking has created a family legacy of adaptivity.

“When people say, what makes you want to try new things or be innovative, like be the first winery to go 100 per cent on screwcap? It’s those sorts of stories that really are in the family DNA, about making sure that you’re adaptive and still have that entrepreneurial spirit to survive,” Taylor says.

Tyrrell also speaks of that spirit. For example, in 1989, he hid 1,000 cases of Vat 1 Semillon from his father. The wine was released a decade later and introduced drinkers to the ways Semillon changes when aged. A similar story would be hard to imagine in a commercial winery.

A diversity of skills is necessary to drive innovation. Winemaking, in particular, is an incredibly varied and multifaceted business, and so members of family wineries often don’t have a single area of expertise.

Calabria noted: “It’s kind of crazy that you get Dad who will be in the lab tasting wines or out on a forklift in the warehouse,

John, Evelyne and Michelle Geber Jeff and Richard Burch Natalie Burch Howard Park Wines“Family businesses across all sectors can become stuck in their micro-climate of ideas if they close themselves off to outsiders being a part of their business.”

or with his shirt off in the garden of roses at the cellar door.”

To build these skills, many family wineries require the next generation to go out and gain experience and qualifications elsewhere, outside the family business or in another industry altogether.

Taylor recalls a time when his eldest son was told by schoolfriends that he didn’t have to work hard because he was guaranteed a job in the family’s winery. Taylor’s response to his son was that he did need to work hard, because not only was winemaking a demanding profession, but he would be expected to find work elsewhere before entering the family business.

Angove and his siblings also were encouraged and given the freedom from their parents to choose their own paths, thus bringing all different skills to the family business today.

“There was no real pressure to copy anyone or anything. My sisters Victoria, Sophie and I were given plenty of space to develop ourselves and our own style,” Angove said.

Still, the suggestions of the next generation are sometimes met with resistance. Osborn speaks of his decision to stop using fertiliser and herbicide in the vineyards early in his winemaking career, after he had been experimenting with fruit from derelict vines and realised that the cultivation practices

were sterilising the soil and affecting the quality of the wine. Though the change proved to be a profitable one, the initial response from Osborn’s father (d’Arry) was: “Well, you should sell the vineyard now while it’s still alive, before it all dies.”

As Leanne de Bortoli, third generation at De Bortoli wines, points out, it is vital that the next generation is allowed to make their own decisions.

“Knowing that sometimes the decisions that other people would make are not necessarily the decisions that you would make, that’s part of being prepared to step back and let the next generation make their mark. It’s not always not always easy,” she explains.

While each family has a different approach to their business and their wines, the pride in their family legacy is something they all share. For Calabria, the family story is a key part of the winery’s appeal and will be for generations to come.

He said: “I think it just resonates with someone sitting around the table of their family enjoying a bottle of wine, knowing that a similar family has made this product.” ■

Justin Taylor, Mitchell Taylor and Clinton Taylor

Justin Taylor, Mitchell Taylor and Clinton Taylor

In recent years, Australian consumers’ interest in cocktails has clearly and significantly expanded. No longer are the delicious mixed drinks just a treat when out at a bar. During the pandemic, cocktails cemented themselves as an easy and satisfying option in the home, by necessity.

And the taste for cocktails in any location has stuck around ever since. According to De Kuyper, 50 per cent of Australians drink cocktails when they’re out, and 28 per cent are drinking more cocktails overall.

Next month is World Cocktail Day, a great opportunity to connect with the cocktail loving consumers around country. With the love of home mixology staying strong, this is not just something bars should

celebrate, but retailers as well, bringing a bit of fun and theatre in-store to inspire shoppers around the occasion.

The way to a cocktail lover’s heart may well be through their tastebuds, so the first thing to think about when preparing for World Cocktail Day is what flavours and recipes are trending right now.

Emily Prochazka, Brand Manager for De Kuyper at William Grant & Sons, said that consumers are currently gravitating towards “classic cocktails primarily with a tequila, vodka and gin base as these categories have experienced the most growth.”

Topping most lists when it comes to the

highest in-demand cocktails of our time is the margarita. Agalima is one cocktail mixer that has certainly seen this.

“Margaritas are certainly riding the agave boom! Tequila has been steadily growing over the last couple of years, and Margarita Mix has become the top bundle purchase across key independent banners,” said Sally Turki, Brand Manager for Premium Cocktail Mixers at Agalima’s local distributor, SouthTrade International.

Another classic that is high on everyone’s radars is the martini, and all its iterations (including the espresso martini). Simon Ford, creator of Ford’s Gin, said the simple martini has made a huge comeback in the last couple years, as witnessed in a growing

number of bartenders using Ford’s Gin in their signature martini recipes. This is inspiring cocktail making outside of bars, for example, with twists on the classics.

As Ford said: “Home bartenders have definitely taken to trying at home what they have seen in cocktail bars and the drinks that they find in cocktail books.”

There are wider industry movements that are impacting taste trends in the home cocktail space. Things like the ‘better for you’ trend (including the no and low alcohol boom), the desire for refreshment and the need to try something new and interesting all are influencing the segment.

Lisa Antoney, Senior Brand Manager for premium cask wine brand Winesmiths, said the exploratory nature of cocktail consumers has opened the door for wine as an exciting cocktail ingredient, particularly for lower alcohol batched serves.

“There is a desire for no and lower alcohol drinks that are interesting and fun, with younger consumers having diversified tastes,” Antoney said.

“Consumers are looking for refreshing, lighter drinks that are easy to prepare, but that are also good for sharing with friends.”

Saturday, 13 May, 2023

Convenience is a wider movement that is also influencing demand. This has seen ready to serve bottled cocktails become of interest, for example, Batch & Bottle by William Grant & Sons.

“Look out for ready to serve as a category, bringing bartender quality cocktails to the home in an easy and efficient serve,” said Mike Lowe, Brand Manager for Challenger Brands at William Grant & Sons.

One of the key reasons to celebrate occasions like World Cocktail Day in retail settings is to bring a bit of fun energy instore, for more special shopping experiences for consumers. That not only means more sales around the occasion itself, but more satisfied (and hence loyal) customers.

This energy can come from a number of places. For Prochazka, it’s about empowering customers to have everything they need for fun cocktails at home – from the ingredients themselves to the bar equipment essentials they’ll need to put it all together.

“Do the classics well – really highlight those top global cocktails by showcasing all products and brands that go into each one, and maybe even creating bundles with some collateral for shoppers to take home (like ‘how to’ guides),” she said.

This white wine mojito is made to refresh, perfectly pairing with relaxation in the Australian sun. It uses Winesmiths Sauvignon Blanc, a bright and zesty delight featuring grassy scents complemented by tropical fruit flavours. Available in premium two litre casks, Winesmiths helps consumers craft light and delicious drinks for the at-home sharing occasion. This is just one example of the easy, affordable and lower alcohol cocktail recipes that are possible with Winesmiths.

Servings: 8-10

Ingredients:

3 cups of Winesmiths Sauvignon Blanc

3 limes

2 cups of lemonade

1 cup of mint

Sugar to taste (optional)

Method:

1. Add the wine, two juiced limes, lemonade, half the mint and sugar into a large jug and give it a good stir.

2. Pour into a glass, add a few pieces of fresh lime and the remaining mint leaves.

Discover more wine-based cocktail recipes by heading to: www.winesmiths.com.au/cocktails

“Inspire shoppers to try something new – the average shopper will stick to what they know and what is easy, but if you can engage with a shopper and inspire them to try something different there is a chance that you can make a loyal shopper out of them.”

Creating some hype around those different ideas is key to Antoney, who said: “World Cocktail Day is a great opportunity for retailers to generate some theatre around the two litre cask category by showing consumers exciting ways to enjoy the wine. Once they have the wine in their homes, they will continue to discover this format’s benefits.”

The tried and true ‘liquid on lips’ strategy is always a safe bet when it comes to in-store theatre. Jeremy Davidson, CEO and Co-Founder of Mr. Consistent cocktail mixers, noted that this can show how easy it is to make certain cocktails and where creative touches can come from.

“As simple as it sounds, there is so much power in sampling a product. The surprise and delight element gets people excited and getting liquid on lips is a sure fire way to convert people into customers,” he said.

Ford noted as well that many cocktail enthusiasts will now already have all the basics for cocktail creation, so there can be opportunity in helping them step up their game. Fords, for example, has launched a vinyl record called ‘Music to Drink Martinis to’, designed to help people consider the full experience they are creating.

A final note to remember comes from Turki, who said it can be useful to think about the situations in which consumers are creating cocktails in your area, and heroing everything that can help them get there.

“Consumers are starting to experiment with different flavours as well as looking at larger formats. With Australians back to busy lifestyles and challenged with the rising cost of living, cocktail mixers are an essential for any social gatherings or sunset drink with a partner, friend or family member,” she said.

“Simple is best! A cocktail shaker, strainer and a jigger for measuring [are the basics]. A fun glass never goes astray…” ■

The margarita is the most in-demand cocktail in Australia right now, and with De Kuyper, the possibilities around the drink are endless. As a leading liqueur brand that has been in the business since 1695, De Kuyper knows how to create the flavours that perfect cocktails. Consumers don’t need to just settle with the classics they already know and love –they can easily shake up high quality, delicious twists on all their favourites.

Replace Triple Sec with other De Kuyper liqueurs for a twist on this classic. Great options include Watermelon, Wild Strawberry, Mango, Passionfruit and Blue Curaçao.

Ingredients:

45ml tequila