elcome to the December/January issue of Convenience & Impulse Retailing magazine. Reflecting on the past year in the petrol and convenience industry, there have been highs and lows, as our supply chains remain impacted, staff shortages remain a real problem, and fuel prices continue to climb. But on the flip side, it’s been wonderful to see our Aussie retailers thriving on a global scale, with not one, but two stores being recognised at the NACS Asia Pacific awards this year.

In these pages, we take a visit to APCO Wangaratta, which picked up an assortment of awards in 2022 –NACS Asia Pacific Convenience Retailer of the Year, AACS Store of the Year, and AACS Independent Store of the Year. These awards are testament to the fact that Australian P&C retailers are redefining what makes a successful store model and are putting emphasis on having a ‘sexy’ store layout and a high quality food and coffee offering – setting themselves up for the next five, 10, 20 years of success.

Speaking of having a quality food offering, in this issue Darren Park discusses the recent UCB Stores USA Study Tour, which visited almost 50 convenience stores and came back with a wealth of ideas that Aussie retailers could consider within their stores.

We also have category features on carbonated beverages, healthy snacks, and energy drinks, along with a special feature that talks about sustainability in the supply chain, which is a hot topic at the moment. Also look out for our special international feature which looks at the high incidence of fuel drive offs in the UK.

As the year draws to a close, I’d like to take a moment to thank the team at C&I who have worked so hard to bring these pages to life this year. A huge thanks goes to Safa de Valois, Thomas Oakley-Newell, James Wells, Rachel White, Alyssa Coundouris, and Rosie de Valois.

I’d also like to thank our advertising partners who have supported us throughout the year along with all our wonderful contributors – particularly Theo Foukkare, Darren Park, Dan Armes, and Skye Jackson for the valuable industry insights you have all shared with us throughout the year. We truly appreciate your support and can’t wait to work with you again in 2023.

From all of us here at C&I, we wish you a very Merry Christmas and all the good health and prosperity into the new year.

The world’s number one potato chip brand, Lay’s, is now available exclusively through The Distributors Group (TDG).

TDG has partnered with PepsiCo to become the exclusive import partner for Lay's potato chips, which are a fantastic and unique product with three core range flavours set to launch in Australia, including Barbecue, Sour Cream & Onion, and Original.

Lay’s are currently ranged in several national accounts including NewsLink and EG Australia. Please contact your local TDG partner for more details or call 1800 989 022.

Lo Bros has launched Not Soda, a new impact-led range with a mission to clean up two million plastic bottles from the ocean by 2025.

Independent retailers Drakes and Ritchies have got behind the effort, with Not Soda to be sold in up to 130 of the two retailers’ stores across the country.

Not Soda is a fizzy, zero-sugar, naturally sweetened soda that comes in four flavours – Raspberry, Lemon, Orange, and Pink Grapefruit.

For every can of Not Soda sold, Lo Bros will fund the removal of the equivalent weight of two plastic soft drink bottles from marine environments through a partnership with Seven Clear Seas.

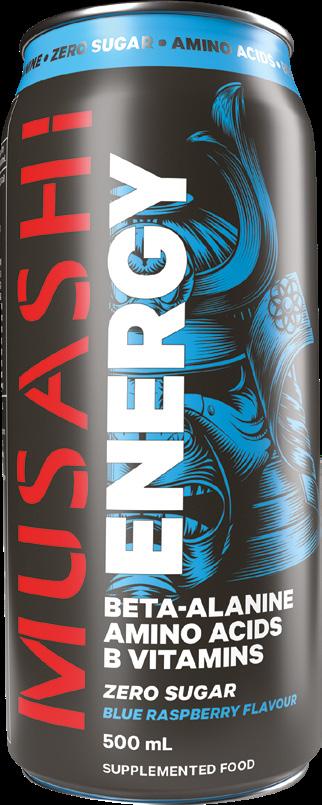

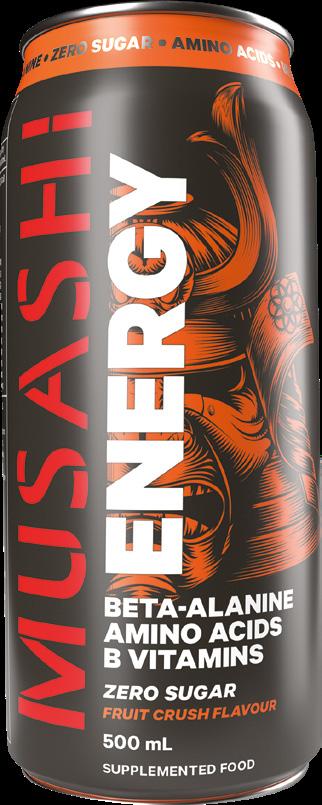

Musashi is a highly trusted sports nutrition brand that was established in 1987 and named after the famous Japanese philosopher and swordsman, Miyamoto Musashi.

More than 30 years on, the Musashi brand remains renowned for offering a full spectrum of sport nutrition solutions, sourced from the highest quality ingredients.

This includes the Musashi Protein Cookie, which is loaded with 15g of high quality protein, low in sugar, filled with delicious choc chunks and has a ‘melt in your mouth’ soft bake texture, guaranteed to fulfil that sweet craving. Great for your protein hit postworkout, or as an easy snack on the go.

For more information visit vitaco.com.au.

Snackinar Beef Strips are the ideal convenience food for people who are carnivores and enjoy red meat as part of a balanced diet.

With a new improved recipe, and a new Chilli Flavour, Snackinar is a class leader when it comes to taste while also having incredible nutritional value with 14 essential nutrients and no seed oils. Importantly, Snackinar is naturally high in Haem Iron to easily combat iron deficiency, which is a growing problem in Australia.

This natural convenience food is designed to sit in the health food aisle and prices have recently dropped due to higher production runs.

For more information visit snackinar.com.

The Intermedia Group takes its Corporate and Social Responsibilities seriously and is committed to reducing its impact on the environment. We continuously strive to improve our environmental performance and to initiate additional CSR based projects and activities.

As part of our company policy we ensure that the products and services used in the manufacture of this magazine are sourced from environmentally responsible suppliers. This magazine has been printed on paper produced from sustainably sourced wood and pulp fibre and is accredited under PEFC chain of custody. PEFC certified wood and paper products come from environmentally appropriate, socially beneficial and economically viable management of forests.

The wrapping used in the delivery process of this magazine is 100% biodegradable.

This publication is published by C&I Media Pty Ltd (the “Publisher”). Materials in this publication have been created by a variety of different entities and, to the extent permitted by law, the Publisher accepts no liability for materials created by others. All materials should be considered protected by Australian and international intellectual property laws. Unless you are authorised by law or the copyright owner to do so, you may not copy any of the materials.

The mention of a product or service, person or company in this publication does not indicate the Publisher’s endorsement.

The views expressed in this publication do not necessarily represent the opinion of the Publisher, its agents, company officers or employees. Any use of the information contained in this publication is at the sole risk of the person using that information. The user should make independent enquiries as to the accuracy of the information before relying on that information.

All express or implied terms, conditions, warranties, statements, assurances and representations in relation to the Publisher, its publications and its services are expressly excluded save for those conditions and warranties which must be implied under the laws of any State of Australia or the provisions of Division 2 of Part V of the Trade Practices Act 1974 and any statutory modification or re-enactment thereof. To the extent permitted by law, the Publisher will not be liable for any damages including special, exemplary, punitive or consequential damages (including but not limited to economic loss or loss of profit or revenue or loss of opportunity) or indirect loss or damage of any kind arising in contract, tort or otherwise, even if advised of the possibility of such loss of profits or damages. While we use our best endeavours to ensure accuracy of the materials we create, to the extent permitted by law, the Publisher excludes all liability for loss resulting from any inaccuracies or false or misleading statements that may appear in this publication. Copyright © 2022 - C&I Media Pty Ltd.

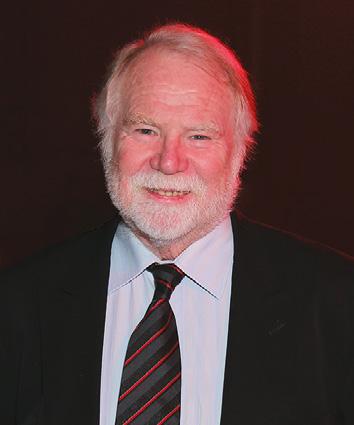

Iwas born in Melbourne in the inner suburb of Carlton but spent most of my younger years living in rural Victoria with my single mother and three siblings.

I was in the middle with one older brother and one older sister, and a younger sister. We were very close growing up, as we lived in rural areas, on large farms with cattle, sheep, pigs, and lots of horses. It was a great environment to grow up in and we entertained ourselves and had adventures constantly. It made us highly independent – a trait that would be in my favour in later years.

When I was about 11, we moved back to Melbourne, so it was quite a shock to come from the country where I had to walk two to three miles to catch the school bus, to being in Melbourne’s suburbs.

My love of horses never waned – I started riding from about the age of five and by 12 I had my first horse. Riding was my everything, I trained six days a week and competed in showing and dressage mostly, along with some jumping – I had wanted to become an Olympian rider.

Growing up, school bored me, but I loved sports, so I competed in swimming, diving, track and field. I was one of those kids that excelled in most sports, so I was always in demand in team

sports. As I got older in school I wanted to contribute more, so I became School SRC Head, School Sports Captain, and took on as many leadership roles as I could.

My first job was as a retail assistant in Target. I lied about my age to get the job, at the time I was only 13, but being from a single parent family I wanted to contribute, so I worked there throughout my school years. Working from such a young age it taught me to become mature, responsible, and to appreciate hard work and the rewards hard work can provide.

When I was 22, I took my first overseas trip to Italy. The trip was for work, so I lived and worked in Southern Italy, in the Provence of Rimini for more than a year as a Marketing Assistant to an Italian global fashion jewellery house – it was quite the experience. Since then, over the years, most of my travel has been for pleasure, around Australia and to New Zealand and the South Pacific, but trust me, having horses doesn’t allow me to leave home much.

These days I love working as the National Sales Manager for Halo Food Co, an Australian ASX-listed company that has been the number one health and wellness contract manufacturer in Australia for more than 20 years. I’ve been with Halo since last April, I manage our Brands Division, which includes Tonik, our own protein brand, and The Healthy Mummy, an Australian company we acquired last February.

Lisa Schilling-Thomson is the National Sales Manager for Halo Food Co. She is passionate about taking Aussie brands to new heights. She is also a mother of two and once dreamt of becoming an Olympic horse rider. This is her story...My FMCG career started at Ferrero Australia, and I spent 10 years working with some of the most iconic brands in the world, Rocher, Kinder, Tic Tac and Nutella. Working those years with Ferrero taught me so much from account management, manufacturing, supply chain, marketing, brand management, customer service, trade marketing, and category management –all the skills and strengths I would use throughout my career.

From Ferrero, I had a stint as the National Business Development Manager with TDG, but soon realised I loved working with brands, so I moved into the sports and diet category when I joined Crankt Protein as the Sales Director in 2016. Crankt was one of the very first Australian protein start-up companies, and it was my first experience taking a new brand to market. Today, Crankt is still a very much-loved Australian brand.

I then went on to work with Vitaco Australia, working with the Musashi and Aussie Bodies brands. I also had a time with Healthier-Tastier Foods, where I developed a new brand called Coco Pet, a range of dog and cat MCT supplement oils.

Then out of the blue one day, Danny Rotman, who recently resigned as CEO of Halo, called, and asked what I was up to, which led me to my current role.

Over almost 20 years I have worked across all channels, from grocery, independents, petrol and convenience, route, foodservice, specialty, and health. I don’t think there’s many FMCG specialists that do all channels, I fortunately can.

A career highlight that comes to mind is winning two of the Account Manager of the Year Awards with JB Metro while I was with Ferrero. The JB team are the best distributors and sales team in this country, as well all The Distributors Group members.

One of my best career highlights was when I got a Crankt Bar onto all international and domestic Jetstar inflight menus, the first protein bar to be on one. I got onto a Jetstar flight one morning, and halfway through the flight looked down the aisle, and saw at least 10 to 15 people eating one of our bars – it was a very proud moment.

I’d really love to see most retailers supporting many more Australian-owned and made brands and products in their stores. If we have learned nothing else from Covid, we should have learned that manufacturing and industry in our own country is essential, having to rely on imported products from other countries is not the position we want to be in.

Ageism is a real thing in FMCG, particularly for women, I’ve experienced it, and many other women I know have as well. It’s fine to employ university graduates for two years, then off they go to their next role, but there’s real lifelong skills and experience in older employees, experience you can’t learn from a book or a class. You get experience, depth, maturity, and reliability from older employees, so don’t ignore them.

My passion is working with Australian companies that manufacture their own products – new and exciting brands –and taking them to market. So right now, I’m living my best career highlight, working with two amazing Australian brands, and taking them both to the Australian people.

Most of my spare time is spent with my daughter who is a rider with her own horse now, and training thoroughbred horses. For more than 25 years, I’ve rehabilitated, retrained and re-homed ex-racehorses off the track, another passion of mine. If I have any other spare time, it’s usually spent with my family, or trying to get to the gym.

We are a lively bunch, I have a 20-year-old son who’s almost finished his plumbing apprenticeship, a feisty 12-year-old daughter about to go into year seven, and we have three horses, two dogs, and a cat.

Looking to the future, I’d like to see Tonik as being the leading protein brand in Australia, Healthy Mummy the leading women’s supplement company in Australia, and I’d like to be sitting down having a lovely, chilled glass of Aussie Sauvignon Blanc and feeling proud of my achievements.

I’d also love to be in the position to lead and mentor women in FMCG. C&I

I’d really love to see most retailers supporting many more Australianowned and made brands and products in their stores.”

– Lisa Schilling-ThomsonLisa, her husband Scott and daughter Lana getting into the Christmas spirit with their cat Lizzy and toy poodle Jessie

Despite picking up an assortment of awards in 2022 – NACS Asia Pacific Convenience Retailer of the Year, AACS Store of the Year, and AACS Independent Store of the Year – APCO Wangaratta has not lost sight of what makes it so successful.

“We try and offer that great customer service every time a person comes in. It’s an experience. Our vibe and ambience for a service station with a café is very loud. It’s not like a normal, everyday service station. It has a really good vibe about it,” explains Brett Anderson, Owner of APCO Wangaratta.

It’s this dedication to providing quality customer service that sees not only the usual road trippers travelling from Sydney or Melbourne pull in, but a steady stream of locals who know they can grab whatever essentials they need while chatting to a friendly face behind the counter.

“I would say 70 per cent of our customers are local. Our local customers are amazing. We still serve every customer face to face, and I think that helps a lot. We have a lot of elderly people

come in and sit at the café and they can have a chat and we’ll wait the tables for them.”

Such is the popularity of the store; Anderson says they now have customers calling to book a table at the café so they can sit and have a coffee and a cake.

“It’s become a meeting point for a lot of people. The locals really supported us during our renovations two years ago, then during Covid, then when we won the awards; they really embraced us.”

The renovations in 2020 included the addition of an IGA X-press, expanding their offer to give customers access to an extensive range of fresh produce at competitive grocery prices 24/7.

“For us, we just want to be a one-stop store for everyone in Wangaratta. They’re not going to come here to do their $100 shop, but they’ll come here for a $30 shop and have their coffee and cake and grab their meat to make their dinner. It’s just about the convenience of having everything in the one place.”

Operating 24 hours a day, seven days a week, Anderson understands the importance of always having fresh food ready to go. Whether it be a family travelling on holiday from Sydney to Melbourne, or a local tradie coming late at night to grab dinner, there will always be something available.

“You can come off the highway at any time of the night and it’s all good. All our fridges are always full. You won’t come in and just find little scraps of shopping left over. There’s also always someone in the kitchen, 24 hours a day, so you can come in at any time and we’ll make you whatever you want. If you’re travelling down the highway at four in the morning and want a hamburger, someone here will cook it for you.”

It’s not just the midnight snacks though, APCO Wangaratta and its Café 24/7 offer has something for any time of the day, covering breakfast, lunch, dinner, and snacking, both on-the-go and ready-to-eat.

“We try and cater for every meal of the day, so people can walk around our fridges and grab whatever they need to last them for the day. You’ve got your Bircher muesli with yoghurt for breakfast, fresh salads, and sandwiches for lunch, then you could sit in and have a roast or parmigiana for dinner. If you bought a steak at the IGA, you could come in and we’d cook it for you.”

Anderson believes that between Sydney and Melbourne there’s nothing like APCO Wangaratta, with its clean toilets, fresh foods, car wash, and comfortable seating, the store doesn’t do gimmicks, just the essentials very well.

“I guess we’re not Instagram friendly. We’re not a place where you come and spend $50 on breakfast and take a photo, but we’ll do the same breakfast for $20. When locals come in here the baristas know who they are and what they want.”

Despite Anderson’s humbleness, the achievement of winning not only the AACS awards, but the NACS Asia Pacific Convenience Retailer of the Year award, is not lost on him.

“For a small town like Wangaratta to win that award is pretty incredible. A store between Melbourne and Sydney to pick up such a large international award is very impressive. It’s exciting for both Wangaratta and us.”

The locals, former and present, were quick to offer their congratulations to Anderson and the team for the impressive feat.

“In those first couple of weeks after winning the award, the amount of people who came in to have a look around the store was incredible. We’ve had people from Western Australia, Northern Territory, Tamworth, people who used to live in Wangaratta, call up because they heard the news on the radio or TV to congratulate us and just say it’s so nice to hear Wangaratta mentioned so far from home.”

Robert Anderson, APCO Service Station Director, said he was extremely proud of all the team, both at the support office and APCO Wangaratta to achieve this acknowledgement and amazing award recognition.

“I’m extremely proud. It is a testament to the collective effort of everyone to share a vision and then bring this to life, and importantly this is a well-deserved award for Brett and Karen Anderson, our retail partners that pride themselves and are passionate on providing an incredible customer experience.” C&I

I would say 70 per cent of our customers are local. Our local customers are amazing. We still serve every customer face to face, and I think that helps a lot.”

– Brett Anderson, Owner, APCO WangarattaCustomers can book a table at the Café Fresh food is available 24/7 Barista made coffee is available every day

For further information, please contact Tru Blu Beverages on (02) 9912 6700, or visit the website trublubeverages.com.au

However you approach it, tackling sustainability along complex supply chains that cross borders, intersect time zones and navigate a multitude of un-aligned priorities is no small task, writes Rachel White

Given the increasing international attention on sustainability over the past few years, businesses are now actively looking for ways to improve their environmental credentials, including the performance of their end-to-end supply chains.

Many have ambitious sustainability targets, with the ultimate goal of achieving net zero emissions in the long term, but it’s not always easy to control or indeed measure outcomes for FMCG companies with established operations and complicated networks.

Among other factors, a key driver for change is a shift in consumer habits as the public increasingly favours sustainable products and services, demanding environmental action with their wallets.

“Consumers are absolutely concerned about the environment, and we see accelerating demand for action on climate change. There is an expectation that brands, and companies are part of the solution,” says Amanda Robertson, Head of Sustainability, Nestlé Oceania.

Brent Gapes, National Sustainability Manager at PepsiCo ANZ agrees, saying that in relation to sustainability, consumers are demanding locally produced products with lower carbon miles.

“We’ve seen a renewed focus on local relevance, purpose and sustainability. Local relevance is increasingly an important metric that consumers seek out,” he says.

These sentiments align with recent research released by commerce platform Shopify in its Future of Commerce trend report, which found a radical change in consumer behaviour globally.

More than ever, people are seeking out products from brands that resonate with them because of geography, company values or sustainability, with 77 per cent of respondents saying they’re concerned about the environmental impact of the products they buy.

“Conscious commerce is growing on a mass scale and plays a significant role in the purchasing decision of today’s consumer,” says Shaun Broughton, APAC Managing Director at Shopify.

Therefore, it is imperative that businesses clearly show consumers strong sustainability goals and achievements that align with widespread consumer values to succeed in the marketplace going forward.

Lisa Rippon-Lee, Vice President, Public Affairs, Communications & Sustainability, Australia, at Coca-Cola Europacific Partners (CCEP), says more than just passively choosing sustainable

products, consumers are now mobilised and prepared to take positive action to do their part to promote sustainability.

“We know consumers are highly motivated to redeem their 10c deposits, in a way [that] they aren’t through mixed-waste recycling bins at home. In locations where the Container Deposit Scheme (CDS) operates, plastic returned via collection depots makes up 80 per cent of all plastic returned for recycling, compared to just 20 per cent through kerbside recycling bins,” she says.

So, it’s important to consumers, but how can large multinational companies like Nestlé, PepsiCo and CCEP ensure sustainability in the supply chain when they have complex relationships with multiple suppliers?

Many corporations report that their supply chains create more emissions than the processing and manufacturing side of the business, making it hard to guarantee end-to-end sustainability outcomes. This is the case at CCEP, according to Rippon-Lee.

“Our suppliers are responsible for over 90 per cent of our value chain greenhouse gas (GHG) emissions, and we will not meet our own GHG emission reduction targets unless we work in partnership with them,” she says.

By way of an example, she points to a collaborative recycling plant in Albury-Wodonga, a joint venture partnership between Pact Group, Cleanaway Waste Management Ltd, Asahi Beverages and CCEP.

The $45 million plant is “a world-class facility…helping to build a domestic circular economy, increasing the amount of locally sourced and recycled PET in Australia by twothirds, from around 30,000 tonnes to more than 50,000 tonnes per annum.

“Contributing to closing the loop on PET recycling, the site will recycle 30,000 tonnes of PET each year, converting it to raw material that can be used to produce new beverage bottles plus other food and beverage packaging in Australia,” she says.

Along a similar vein, Robertson says the same of Nestlé: “Only five per cent of our GHG emissions globally come from sources within our direct operations. We must collaborate with our suppliers, customers, industry associates and consumers to develop solutions to the challenges of climate change,” she says.

“For Nestlé to achieve our ambitious sustainability goals we need to understand the impact of every part of our value chain. This includes parts we control, such as factories, warehouses, and packaging choices, and parts we only influence like the farmers who supply our ingredients.

The whole company is on a journey as we work with our suppliers, customers, industry associations, and sometimes government to reduce our impact on the planet. We know that we can’t do this alone. When it comes to tackling big sustainability challenges, collaboration is key.”

– Amanda Robertson, Head of Sustainability, Nestlé Oceania

We believe that business success and sustainability go hand-in-hand, and we aim to grow our business in a way that manages our social and environmental impacts responsibly and makes our people, our customers and other stakeholders proud.”

– Lisa Rippon-Lee, Vice President, Public Affairs, Communications & Sustainability, Australia, at Coca-Cola Europacific Partners

“The whole company is on a journey as we work with our suppliers, customers, industry associations, and sometimes government to reduce our impact on the planet,” says Robertson. “We know that we can’t do this alone. When it comes to tackling big sustainability challenges, collaboration is key.

“A great example of this is Nestlé’s approach to packaging. Each piece of packaging is being reviewed to ensure it is ‘fit for purpose’ and can be recycled. Nestlé’s Institute of Packaging Science is supporting this effort with 50 packaging experts dedicated to developing the next generation of sustainable packaging materials and developing refillable or reusable packaging systems,” she says.

While collaboration is vital, it also brings with it challenges says Gapes: “Inconsistencies in approaches to sustainability can be challenging and the progress across individual sustainability journeys can be quite varied, not everyone is at the same stage or level.”

While much progress has already been made, there’s no disputing on a local, regional, national, and global level, there’s still a lot to be done to ensure sustainable practices are implemented and maintained for generations to come.

“We are on a journey, and part of this involves learning. With our 2025 commitments, it is clear what needs to be done and so these actions are supported with a detailed set of projects and actions, to achieve these commitments,” says Robertson.

“Longer term goals are still having plans developed against them,” she says of Nestlé’s three phase Net Zero Roadmap with the ultimate long term goal being net zero emissions by 2050.

CCEP is also committed long term, especially to sustainability goals revolving around establishing a circular economy, water stewardship and transitioning to 100 per cent renewable energy consumption by 2025. CCEP’s ultimate goal is net zero emissions by 2040, 10 years ahead of most other corporations.

“We believe that business success and sustainability go hand-in-hand, and we aim to grow our business in a way that manages our social and environmental impacts responsibly and makes our people, our customers and other stakeholders proud,” she says.

A noble idea that’s hard to attain in reality, sustainability in the supply chain is far from guaranteed, even with the sincerest efforts and the best frameworks in place. As consumer spending habits change and shipping and logistics become more expensive post-pandemic, the only constant in commerce is change. C&I

Rippon-Lee says

Rippon-Lee says

Despite the rise of a host of new drink segments, carbonated beverages has held its own as one of the most pivotal products in a convenience retailer’s fridge.

Once the king of the cooler, carbonated beverages must now compete with the likes of functional beverages, energy drinks, iced tea, water, sports drinks, and milks.

While this competition has no doubt had an impact on market share, the continual growth of carbonated beverages within independent grocery and P&C is impressive.

Carbonated soft drinks are the second largest category in the convenience channel, making up approximately one-fifth (20.6 per cent) of sales and delivering $282 million in retail sales in the last year*.

Felicity Needham, Vice President of Sales Away From Home, Coca-Cola Europacific Partners (CCEP) Australia, said that the independent grocery and convenience channels are core channels for soft drinks at CCEP.

“At CCEP, our strategic focus for the petrol and convenience channel for 2022 has centred on accelerating growth within the energy, flavours, and no sugar segments, and we have seen great results across each of these as a result.

“Cola-Cola Classic continues to be the number one soft drinks brand within the petrol and convenience channel, while Coca-Cola No Sugar is the largest no sugar total carbonated soft drinks brand (including colas and flavoured CSDs)*.”

For Asahi Lifestyle Beverages (ALB), the P&C and independent grocery channels are incredibly important to the company’s ongoing success.

“P&C delivers almost 20 per cent of the volume in the on-thego channel, playing a key role in getting our iconic Australian brands to as many consumers as possible.”

Ben Faulkhead, Category Manager at APCO, said they have observed strong growth in carbonated beverage sales in the YTD, with double-digit growth in units on prior years.

“While we are seeing good growth across full sugar options in the segment, the strongest performers in the sub segment are particularly around low or no sugar varieties with Pepsi Max, up over 30 per cent, and Coke No Sugar, up over 20 per cent, all increasing significantly in unit share.”

Michael Pillon, CEO and co-owner, Famous Soda Co, said that P&C and independent grocery are equally important to the business as they would like all Australians to have access to their sugar free, all natural, better-for-you alternatives.

Stiff competition in the P&C fridge means the carbonated beverages category must fight harder than ever before to maintain its crown as the dominant drink, writes Thomas Oakley-Newell.

“Our Famous Pink Lemonade is our best seller, followed closely by Passionfruit and Blood Orange. And we think our new to be launched Tangerine will be up there with these three.”

Needham is also pleased at how CCEP’s flavoured soft drink brands are performing within the P&C channel, being up 9.9 per cent in the latest MAT*.

“Sprite continues to be the number one flavoured soft drink brand (in value) within the P&C channel, with Sprite No Sugar delivering strong growth in particular. Fanta has also experienced accelerated growth over the past year, making it the number one contributor to the value growth in flavoured soft drinks in the last year.”

The increased consumer demand for a carbonated yet low-sugar or no-sugar beverage has seen companies respond in kind, with Asahi Lifestyle Beverages (ALB) stating that the no-sugar market in Australia is booming.

“We’ve been early movers in providing more options for consumers in that space. Asahi Lifestyle Beverages is leading the way in providing zero-sugar alternatives to some of the most popular brands in our range, including Pepsi Max, Solo, Sunkist, Mountain Dew, and Schweppes.

“We provide a range of no-sugar, reduced-sugar, and regular sugar products to meet the wide range of consumer preferences.”

ALB has more than one-third of the market for non-cola nosugar CSDs, driven by the growth of zero-sugar versions of classics such as Schweppes Lemonade Zero and Solo Zero.

“Non-cola no-sugar has grown by 86.5 per cent in value in the latest quarter period to 23/10/2022, against the same period last year.

“Cola no-sugar now comprises over half the total value of the cola market. This has been driven by the ongoing success of products such as Pepsi Max and the ever-evolving Pepsi Max Flavours portfolio. Pepsi Max has grown by 19.2 per cent in value in the latest quarter period (to 23/10/2022) against the same period last year. Its continued success will be driven via a strong innovation pipeline with regular flavour rotations that recruit new consumers to the cola category.”

Needham has identified that reducing sugar intake remains a top three priority for shoppers who are looking to improve their diet.

“Half of all shoppers are claiming to be actively reducing their sugar intake and while sugar content is a concern to soft drink buyers (37 per cent), taste is still the most important factor (67 per cent) when making a purchase**.

“Off the back of this trend, we see consumers continuing to turn to no sugar options within the total carbonated soft drinks category. In the cola segment, no sugar has continued to grow year-on-year and now makes up 42 per cent of total cola value within the P&C channel. In flavoured soft drinks, no sugar is up by 72 per cent compared to last year, gaining an additional 4.4pts of value share*.”

At CCEP, our strategic focus for the petrol and convenience channel for 2022 has centred on accelerating growth within the energy, flavours, and no sugar segments, and we have seen great results across each of these as a result.”

– Felicity Needham, Vice President of Sales Away From Home, Coca-Cola Europacific Partners (CCEP) Australia

Pillon has also noticed the trend of consumers looking for a healthier alternative, which is great for their range, which is entirely sugar-free and 100 per cent natural.

“We have seen the better-for-you space starting to pick up momentum, and in some channels, it is becoming the norm rather than the exception, which we are delighted about.”

Faulkhead said that with APCO being a business that is very customer centric, they believe it is important to put the customer front of mind when making ranging decisions within the category.

“We want to understand what a customer is wanting when they are looking to purchase a carbonated beverage. Is it fulfilling a need such as a morning pick me up, a great combination with a food offer, or a sweet flavour profile without the full sugar intake.”

While the move to reduced sugar has been the biggest change Faulkhead has recognised within the market, he said they are also seeing shifts among other sectors of the carbonated beverage category.

“We are also seeing strong results across traditional flavour variants such as Raspberry, Ginger Beer, and Passionfruit. We have also started to see that younger consumers are being driven to trial brands, flavours, and products that haven’t traditionally been available within the Australian market.”

ALB has also recognised the prevalence of consumer’s desires for functional drinks.

We want to understand what a customer is wanting when they are looking to purchase a carbonated beverage. Is it fulfilling a need such as a morning pick me up, a great combination with a food offer, or a sweet flavour profile without the full sugar intake.”

–“In the P&C channel, energy drinks solve consumers’ need for a pickup, and continue to experience significant growth (mainly though no-sugar offerings). We expect to see more products enter this category, offering a variety of different functional benefits. These functional benefits include proactive health (e.g., gut health, immunity, and clean energy) which will help drive further growth in the category over the coming years.”

Needham said CCEP is also leaning into the functional market with the release of the company’s biggest innovation of the year.

“Sprite Lemon+ and Sprite Lemon+ No Sugar, which offers consumers an extra hit of zesty lemon flavour, sharp fizz, and a kick of caffeine to refresh their minds when they need it most. Consumers are increasingly seeking out beverages with functional ingredients and this product – with its added caffeine – is designed to appeal to those looking for an energy uplift.”

ALB points out that beverages are the third highest shopper mission with the P&C channel and play a key role in driving traffic to stores.

“In the petrol channel, 24 per cent of shoppers’ missions are fuel focused, which presents an opportunity to influence behaviour. Increasing the location of beverages in-store (for example, fast lane fridges where chilled beverages are placed outside the cool room) presents cross-category opportunities that increase basket size and drive average spend.”

Needham said it was crucial for retailers to ensure that soft drinks are allocated sufficient space with the fridges.

“Support shoppers to navigate through the soft drink offer through brand blocking and drive impulsivity at all points of engagement.

“It’s crucial to plan ahead with the field teams to maximise the activation opportunity at key times through the year.”

One of the biggest opportunities for soft drinks within P&C, says Needham, is to maximise events and activations to drive beverage conversion when shoppers are in-store.

“There is also an opportunity to continue to engage shoppers by increasing choice of offers, including providing a range of permissible products and drive excitement through innovation.” C&I

* IRI AU Convenience Scan, value, MAT To 23.10.22

**CSIRO Research Scientist Brad Ridoutt, The Conversation Feb 2022 | Mintel GNPS Australia 20-22, CBL Australia 2019, Mintel GNP

Ben Faulkhead, Category Manager, APCO

Scan

Scan

Healthy snacking is a trend that continues to grow in Australia, as consumers become more aware of what is beneficial in a product and what to avoid, they are actively seeking out products that won’t just tide them over until mealtime but will provide nourishment and sustenance.

This expectation that a snack needs to provide consumers with health benefits has led a change in the way brands sell their products, as it is no longer good enough to simply just be tasty, they must also provide nutritional value.

Data from the AACS State of Industry Half Year Report 2022 showed that the snackfoods category maintained its strong momentum of the past two years, backing up 14.3 per cent growth in 2021 with growth of 3.4 per cent in the first half of 2022.

The petrol and convenience (P&C) channel has always been a strong avenue for the sale of snacks, and now as consumers are becoming more health-conscious, the channel must continue to update its retail offer to include these in-demand products.

One brand reaping the benefits of the increasingly health-conscious population is Snackinar, which produces dried meat snacks. Michael Hearne, Founder of Snackinar, believes Australians are increasingly on the lookout for healthy meat-based products.

“Some of the best market research that can be done to understand emerging trends simply comes down to looking at what everyone is Googling. For the past 12 months, Google search data shows Australians have been more interested in a meat-eating diet (carnivore diet) than a vegan diet. Five years ago, interest in the vegan diet was much higher than carnivore.”

Hearne believes that retailers are still behind the eight ball when it comes to stocking natural food products that align with the carnivore diet.

“Thus, we see great opportunities for our newly upgraded Beef Strips, which perfectly align with the carnivore diet. Along with being minimally processed, it’s important to note our products are free from the seed oils and other questionable ingredients our competitors use to make cheap imitations of our products.”

Although Hearne said that convincing retailers to stock a health food product made from real natural meat has proved difficult.

“However, as more consumers demand natural convenience food that’s minimally processed without seed oils, sugars, and other questionable ingredients, it seems inevitable convenience, grocery, and health food retailers and distributors will carry Snackinar products.”

As Australians become increasingly curious of what they’re putting into their body, the presence of healthy snacks in P&C is growing in importance, writes Thomas Oakley-Newell.

As Australians become increasingly curious of what they’re putting into their body, the presence of healthy snacks in P&C is growing in importance, writes Thomas Oakley-Newell.

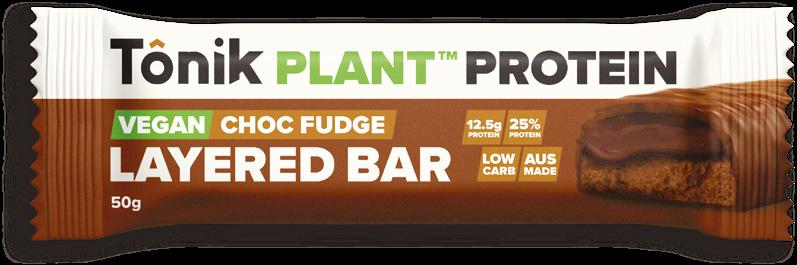

Lisa Schilling-Thomson, National Sales Manager at Halo Food Co, producers of Tonik protein bars, says that Australian consumers are educated and discerning.

“They are actively looking for products with less sugar, no added sugar, all natural, no artificial additives, GMO free, gluten free, and are functional to living a healthier life.”

Tonik bars were only launched in P&C in August this year, so for Schilling-Thomson it has been a learning curve, but the decision has been worth it.

“Tonik was conceptualised and developed specifically with the P&C shopper in mind. Protein bars started to trend and really grow within the P&C channel back in 2016 when I was Sales Director launching Crankt Protein into the market.

“Prior to 2016, the category was highly underdeveloped, the only brands really in the Australian market were Musashi and Aussie Bodies, the ‘better-for-you’ category was mostly made up of muesli bars and the like, products not particularly good for you, and full of sugar.”

The immediate and fast growth of Tonik’s range of plant-based protein bars, which were only released in Coles in April, has surprised Schilling-Thomson.

“The plant bar sales at Coles have been staggering. Also, every banner group I have met with in the past three months has taken into range one or two of our plant bars. Even diehard whey protein consumers are loving our plant bars, which have historically tasted pretty average, our Choc Fudge plant bar is unbelievable.”

Another plant-based snack is Purabon, which has also recently expanded its range to include bars. A choice Kerin O’Brien, Sales Director at Purabon, said is all about inspiring consumers to see delicious yet healthy alternatives.

“Our family creates nutritious whole food plant-based snacks. We don’t compromise on taste. After being a market leader in food service balls for the past five years, we’ve now diversified into bars. With a new range of Peanut Butter bars made of Australian

peanuts and featuring 150 calories they make the perfect snack in three delicious flavours; Caramel Peanut Butter, Choc Chip Peanut Butter, and Peanut Butter and Jelly.”

Taste is one of, if not the most, important factor for all companies and Ross Webb, Brands and Partnerships Manager at Musashi, said that consumers are now seeking all the traditional benefits of protein bars combined with the taste experience that confectionery products offer.

“This has forced many sports nutrition brands to become very inventive with new products and a large focus on taste as the main driver. Functional benefits remain a priority for consumers as they remain conscious of selecting low sugar, better-for-you options. As the category begins to broaden, we are also seeing consumers seeking other snacking formats like protein cookies.”

Skye Jackson, General Manager Merchandise at Ampol, said at Ampol they’ve noticed a strong alignment from their shoppers to trusted brands.

“Prioritising local ingredients and companies, sees suppliers such as Barbell entering the P&C channel, which meets this shopper profile.

“Customers will not compromise on flavour or quality when electing to pick up a healthy snack, so there is more focus on items like low sugar versus no sugar, or a balanced formulation rather than a ‘free from’ of years past.”

Traditionally for Musashi, its strongest performing product is its high protein bars, which offer 45g of protein per bar.

“As many new consumers enter the category, more indulgent style protein bars and other protein snacks like cookies are experiencing significant growth due to the comparable taste and texture experience that confectionery offers, without all the nasties.

Australians are actively looking for products with less sugar, no added sugar, all natural, no artificial additives, GMO free, gluten free, and are functional to living a healthier life.”

– Lisa Schilling-Thomson, National Sales Manager, Halo Food Co

“Musashi’s newest protein bar, Protein Crisp, has been the brand’s strongest performer as it still has all the functional benefits while offering a unique taste and texture experience. This bar has driven double digit growth for the brand with the majority of the sales being incremental to the category,” explained Webb.

Ben Faulkhead, Category Manager at APCO, echoes Webb’s sentiment that products featuring higher protein are proving popular.

“We certainly are seeing a strong increase in sales for those products that feature increased levels of protein while low-carb options have declined.”

Faulkhead said that healthy snacks have really evolved over the past few years, and as a retailer, they are tapping into this potential.

“We have introduced a number of grab-and-go options to complement our food offering including crackers, veggie sticks and dip packs, and fruit salad but we have also expanded our range of bars to include protein balls and protein and muesli bars.

“We have seen large unit increases from brands such as My Muscle Chef and Musashi. We believe that there is a large untapped potential here to bundle healthy snacking with both food and beverage offers.”

Articulating to consumers that these healthy products are for everyone and no longer just for the serious gym goer, is a challenge Webb and Musashi are facing head on.

“Musashi is focused on communicating and educating the benefits these products can provide to everyday people looking to place a focus on making smarter nutrition decisions.”

The importance of P&C due to its high visibility means that the channel has become a priority for many of the leading health snack brands, and Webb says the ability to secure visibility in-store, coupled with continuous foot traffic, has enabled the category to experience significant growth.

“New consumers into the category are seeking convenient, low-cost products and quite often these products are unplanned purchases.

“The P&C channel allows Musashi to have a much stronger connection with our target audience, with tradespeople over indexing strongly with sports, energy, and active nutrition products.”

From a retailer perspective, Jackson points to three key drivers when deciding which healthy snacks to range at Ampol.

“Product overlap; demand for format based on customer profile and/or shopper mission; and where the snack sits in regard to daily macros or protein intake.”

Hearne makes the point that Snackinar’s value is based on its nutritional value and convenience, and that means the P&C channel is pivotal to the convenience aspect of that.

“Buying snacks from Amazon and waiting a week is not convenient, thus, convenience and independent grocery stores are extremely important. Many people assume health food stores would be important, and they should be, however, health food stores in Australia are still almost exclusively selling highly processed plant-based food products.”

The P&C channel allows Musashi to have a much stronger connection with our target audience, with tradespeople over indexing strongly with sports, energy, and active nutrition products.”

– Ross Webb, Brands and Partnerships Manager, Musashi

Not a new category, but certainly a booming one, energy drinks are perennially popular in the impulse-driven petrol and convenience channel, where they continue to be a best-selling product, writes Rachel White.

According to the Australian Association of Convenience Stores (AACS) State of the Industry Half Yearly Report 2022, packaged beverages, in general, enjoyed a strong start to 2022, up 5.9 per cent, with energy drinks leading the way in the category, up 8.9 per cent.

As such, the petrol and convenience (P&C) channel continues to be vital for energy drink manufacturers, as Ashleigh Taylor, Channel Category Manager, Frucor Suntory Oceania, explains: “The P&C channel is the heartland of the impulse consumer, the core group who purchases and enjoys energy drinks the most.

“Within the convenience channel, beverages are forecasted to grow by $439m into 2026, and energy will contribute 70 per cent of the growth,” she says.

Felicity Needham, Vice President of Sales Away From Home – Australia, Coca-Cola Europacific Partners, says: “The P&C channel is an incredibly important channel for our Monster Energy Company brands.

“Energy drinks are a standout non-alcoholic ready-to-drink beverage in the P&C channel, making up close to one-third (31 per cent) of total retail sales value,” she adds.

Such massive sales figures are hard to ignore, and Taylor says innovation is key in an already crowded segment. “Innovation is hugely important to the future success of the energy category. Our research suggests that there are more than 7.5 million people in Australia that are open to drinking energy drinks but currently don’t,” she says.

“The traditional energy drink consumer is male (74 per cent) and under 44 years old,” says Taylor. “But innovation in the low/ no sugar space is bringing more women into the category who we know spend more on average at a total store level.”

For women, the perception that energy drinks are high in sugar and unhealthy is a major deterrent. Needham says innovations with low or no-sugar options are yielding great success across all consumer groups.

“In the last year, no sugar options have increased by an incredible 34.3 per cent, significantly higher than regular variants, which increased by 6.3 per cent. Despite only making up around one-fifth (21 per cent) of sales, diet energy drinks have contributed more than half (53 per cent) of total value growth in the category,” she says.

–

V Refresh has experienced the highest level of trial of any energy drink NPD in the last 12 months and has proven to be 30 per cent incremental to the total energy category.”

Ashleigh Taylor, Channel Category Manager, Frucor Suntory Oceania

Ashleigh Taylor, Channel Category Manager, Frucor Suntory Oceania

Taylor relates a similar experience with Frucor Suntory’s new low-sugar, low-calorie energy drink V Refresh. “Since launching 12 weeks ago, the new range has shown exceptional performance within the convenience channel, and as we head into the warmer months, there are no signs of slowing down.

“V Refresh has experienced the highest level of trial of any energy drink NPD in the last 12 months and has proven to be 30 per cent incremental to the total energy category,” she says.

Sam Tsagaris, Category Development Manager at Red Bull, says innovations in new flavours and packaging are also critical as they drive growth with existing and potential customers.

He says innovation increases sales by “appealing to new users who may have barriers to entry such as the taste of energy drinks”. He adds both factors are equally important for “driving incremental traffic and spending among existing energy consumers seeking exciting new flavours and offers to increase their engagement and consumption within the category.”

Flavour innovation has also been vital for new kids on the block Hype Energy, which recently won a Superior Taste Award from the International Taste Institute in Brussels for its original flavour energy drink.

Steve Haider, National Sales Manager at Boomerang Worldwide, Hype’s Australian distributor, says having a product with a unique flavour is the most significant factor setting Hype Energy drinks apart from the established brands.

“It’s a pretty big award,” says Haider, happy to acknowledge the accolade.

“While energy drink sales peak early in the morning, typically between 6am and 8am, when people need an energy hit to get their day going. We are seeing an increase in shoppers purchasing throughout the day, with the biggest growth in penetration between 8am and 11am,” says Needham.

As a high impulse category, Needham says retailers can help themselves capitalise on changing consumer behaviour by offering the right products to “energise”, no matter the time of day.

“One of the biggest opportunities for energy drinks is to ensure that there is enough space allocated within fridges to allow the category to grow to its full potential.

“In conjunction with this, there is also a greater opportunity to drive impulsivity at all points of engagement by working with suppliers to use eye-catching and inventive stock builds, on brand offers, with a focus on the key times of the year,” she says.

Haider says it’s all about position, position, position. “Fridge layout is one of the biggest problems we’ve encountered,” he said. Being a newer product, particularly in the very beginning, Hype was sometimes put in the wrong section of the fridge. “It just doesn’t go,” says Haider. “A consumer coming in for energy is not going to look around for the product.”

Taylor agrees, saying that space allocation matters. “In most fridges, energy drinks have maintained the same amount of space despite strong growth over the last five plus years.”

Tsagaris adds that retailers need to put forethought into their available storage space and should be conscious of space limitations in cold-vaults in-store.

“As the demand for energy drinks continues to grow driven by increased penetration and consumption year-on-year, the range and space allocated for energy drinks must also keep pace with this growth to ensure we can satisfy growing consumer demand,” he says.

It’s clear that energy drinks are a significant and growing category within the P&C sector, with sales showing no sign of slowing down any time soon.

On the contrary, projected growth over the next few years is set to increase exponentially, fuelled by ever-increasing demand and continual innovation from Australia’s leading manufacturers.

Expect to see further releases in the no and low-sugar ranges across the board and plenty of sporting partnership events, including the Red Bull Cliff Diving World Final in Sydney Harbour, the Red Bull Billy Cart in Melbourne, and Monster Ultimate Fighting Championship (UFC) competitions running in BP, Ampol, EG, and NSG. C&I

One of the biggest opportunities for energy drinks is to ensure that there is enough space allocated within fridges to allow the category to grow to its full potential.”

– Felicity Needham, Vice President of Sales Away From Home – Australia, Coca-Cola Europacific Partners

The 2022 C&I Choice Product of the Year has been awarded to a product that delivers delicious lollies without the nasties.

After much deliberation, innovative lolly company FUNDAY Natural Sweets has been named this year’s C&I Choice Product of the Year.

With so many fantastic products that could be crowned the winner, it’s a testament to FUNDAY Natural Sweets’ ability to deliver a range of lollies that contains no added sugar and no sugar alcohols, yet still achieves a delicious flavour.

The range currently includes red frogs, vegan gummy bears, sour peach hearts, and gummy snakes, all with up to 91 per cent less sugar than their traditional counterparts and full of prebiotic fibre.

Daniel Kitay, Founder of FUNDAY Natural Sweets, said the entire team was incredibly excited by the news of being named the 2022 C&I Choice Product of the Year, and reinforced that the company is on the right track.

“To be named C&I Choice Product of the Year is a huge deal for a young company (less than two years old) and I think it’s a fantastic representation of the amount of hard work we all put in each day to make sure we have the best products in the market and accessible to our current and potential consumers.

“We continue to engage with our customers and ensure we are hitting the mark and being led by the market each and every step of the way.”

The past 18 months have seen the company make a meteoric rise, with the range now stocked in more than 3,000 stores, including Woolworths, Chemist Warehouse, and Ampol Foodary in Australia and New Zealand.

“As the leader in better-for-you candy in the market it was fantastic to secure a nationwide deal with Ampol early this year. Not only did we recently get the runner up in the Emerging Supplier of the Year Award (Medium) and Sustainability Award runner up (Medium), but through the power of our innovative product and wonderful brand, we have been successful in attracting new faces into the confectionery category who have typically avoided the confectionery aisle.

“It’s been a huge win for both Ampol Foodary and us and the team is excited for our plans with Ampol for 2023.”

Kitay said it has been hugely rewarding to see FUNDAY thrive in the notoriously competitive and tough P&C confectionery channel.

“Through our innovation pipeline, reinvestment into brand, direct to consumer connections and strong community we are so glad to be able to support our retailers throughout launch and beyond.”C&I

To be named C&I Choice Product of the Year is a huge deal for a young company (less than two years old) and I think it’s a fantastic representation of the amount of hard work we all put in each day to make sure we have the best products in the market and accessible to our current and potential consumers.”

– Daniel Kitay, Founder, FUNDAY Natural Sweets

Created by Australasia’s largest sports nutrition manufacturer with over 25 years of experience in producing health and wellness solutions in Australia, Tonik High Protein RTDs provide Australians with accessible on-the-go nutrition.

As Australians become increasingly time poor, and yet, maintain an appetite for an active lifestyle and healthy diet, a clear gap emerged for high quality and accessible, on the go nutrition.

Tonik High Protein RTDs come in six different flavours – Chocolate, Choc Honeycomb, Banana, Strawberry, Vanilla, and Coffee – and each feature 20g of protein per bottle.

Retailers can stock TONIK Pro RTDs via The Distributor Group members, All JB Metro DCs, Accredited, Brisbane Distributors, Nutritional Systems, Fitness Vending, Global By Nature, Health Magic, and The Market Grocer.

Featuring only five ingredients and Australian grown oats, Alternative Dairy Co’s Barista Oat Milk is simple, clean, and delicious.

Tapping into the growing consumer movement towards a plant-based diet, Barista Oat Milk delivers a smooth and creamy experience in your cup which makes switching to plant-based milk easy.

Following the success of the recently released new and improved formula for Original Rockstar energy drink, Frucor Suntory has released Rockstar Original No Sugar 500ml.

The energy drink provides all the great taste of the original but without the sugar, providing consumers with 160g of caffeine, B vitamins, and the benefits of guarana and taurine, it is perfect for those who are looking for long-lasting energy without the addition of sugar.

Since its launch, Rockstar Original No Sugar 500ml has become the second best-selling SKU in the Rockstar range. Fore more information on stocking contact Frucor Suntory Support on 1800 237 727.

Each year C&I awards one product as the C&I Choice Product of the Year along with our pick of the best new product releases in several categories. Here are the winners...

Allen’s brought party icons together with their collaboration with Kirks, producing a range of Kirks inspired lollies.

The three Kirks flavours that inspired the range are Kirks Classic Pasito, Creaming Soda, and Lemonade, meaning there is something for everyone to enjoy.

Joyce Tan, Head of Marketing Confectionery at Nestlé, said they were so excited to introduce the range as a celebration of party memories.

“So many Aussies share moments of Kirks soda flavours and Allen’s lollies at their social celebrations – and now we’ve brought these icons together for the ultimate classic party combo.”

The Allen’s Inspired by Kirks range is available in a 170g pack for RRP $3.60 from convenience retailers and major supermarkets.

Using a specially formulated combination of high-quality natural ingredients plus 22 essential vitamins and minerals, Supercoat Dog Food with Smartblend provides dogs with everything they need to live their best lives.

Every ingredient in Supercoat serves a purpose and has been added with the dog’s health in mind, from the Smartblend Puppy formula designed to have the right ingredients to support immunity and healthy bones as well as providing for that puppy energy.

In its biggest collaboration ever, KitKat has paired with Milo to create KitKat packed with Milo in block, bar, and chunky formats.

KitKat packed with Milo combines the crisp wafer and smooth milk chocolate of a classic KitKat, but with the addition of delicious Milo choc-malt fudge filling.

Joyce Tan, Head of Marketing Confectionery at Nestlé, said they were beyond thrilled and proud to announce KitKat’s biggest ever collaboration with KitKat packed with Milo

“We know KitKat lovers are passionate about how they eat their KitKat and similarly, Milo fans have unique ways of enjoying their hot or cold Milo. So now, we can’t wait to see how Aussies enjoy their KitKat packed with Milo.”

KitKat packed with Milo is available in three formats: KitKat packed with Milo Block (170g, RRP $5), KitKat packed with Milo Bar (45g, RRP $2.00) and KitKat Chunky packed with Milo (47g, RRP $2).

Three years after launching in Australia, Japan’s Suntory BOSS Coffee has added a new blend to its successful canned coffee range, Iced Caramel Latte. It joins the already popular line-up of Suntory BOSS Coffee, including Iced Long Black, Iced Double Espresso, Iced Latte, and Iced Vanilla Latte.

Iced Caramel Latte is a blend that will appeal to those who love the taste of quality coffee but also have a bit of a sweet tooth. The new blend taps into the younger audience’s coffee and flavour preferences and will help recruit new consumers into the category, driving incremental sales.

The latest flavour to be added to the Level range, Level Lemonade & Cola, is the perfect balance to cater to all the angels and devils out there, providing a better for you option for Cola enthusiasts.

With demand for both grab-and-go meals and betterfor-you options steeply on the rise, it was only a matter of time before we saw a delicious and healthy on-the-go breakfast option.

Enter Yog’n Oats.

Through rigorous consumer taste-testing and research of more than 21 flavour variants, I am Company landed on four mouth-watering Yog’n Oats flavours: Blueberry Coconut, Cranberry Walnut, Apple Cinnamon, and Apricot Almond, which all come in 180g pots.

Using Australian-grown wholemeal oats that have been steamed to denature the enzymes and rolled into flat oats, the products include 11g of natural protein with 4g of digestible fibre in every pot, achieving a minimum of a Four Health Star Rating across the range.

Since Yog’n Oats launched in Melbourne in March of 2021, the brand now has ranging in more than 120 stores, primarily in P&C.

The iconic Four’N Twenty has introduced its latest innovation, the Four’N Twenty Traveller Hi-Protein Beef, providing consumers with 20 grams of protein per serve and a four-star health rating.

The Hi-Protein Traveller is jam-packed with the classic Four’N Twenty beef filling and delicious gravy we all know and love, wrapped inside their famous golden pastry. With each Hi-Protein Traveller packed with 25 per cent more than the Four’N Twenty Traveller Classic Meat Pie and a four-star health rating, consumers can now make more conscious choices at the checkout.

From those consumers on-the-go, to tradies picking up a quick lunch, the Hi-Protein Traveller is sure to hit the spot for many Four’N Twenty lovers.

Much like the company’s current Level Lemonade range, the new addition is low in sugar, and contains 160mg of magnesium and 100 per cent of the recommended daily intake of Vitamin C. It is also marketed as 100 per cent Australian made and owned.

LeveL Lemonade & Cola will be available through the proven wholesale partners as well as in Ampol, EG, Coles Express, New Sunrise, OTR, Ezymart to name but a few.

Calm & Stormy is a premium range of 100 per cent Australian made and owned still, sparkling, and fruit juice infused mineral waters.

The Calm & Stormy flavoured range contains no added sugar, sweeteners, additives, or nasties of any kind. It is flavoured with nothing but real fruit that is sourced locally, Blood Orange from Griffith, Tasmanian Raspberry from the Derwent Valley, Pink Lady Apple from Officer and Lemon Lime from Mangrove Mountain.

Calm & Stormy is available for sale as single serve cans in 300ml or 500ml for the still mineral water and sparkling mineral water. And the fruit juice infused sparkling water is available in 300ml cans.

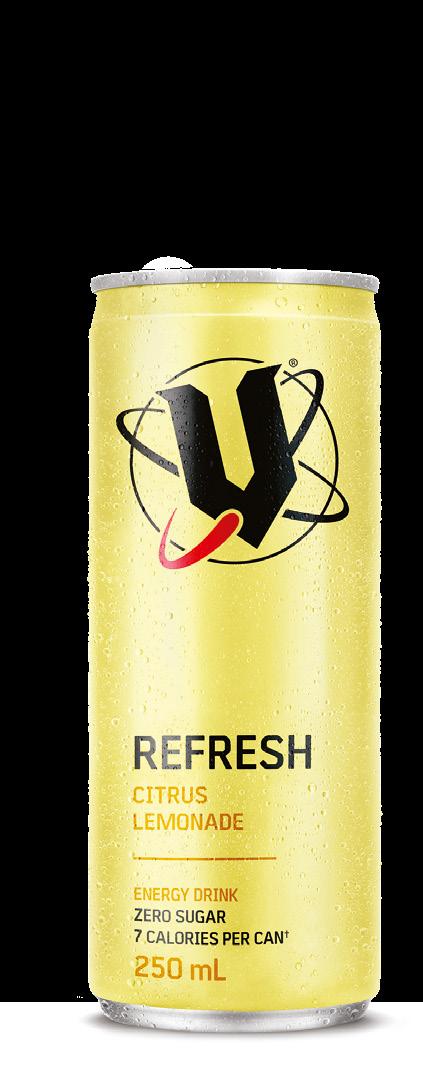

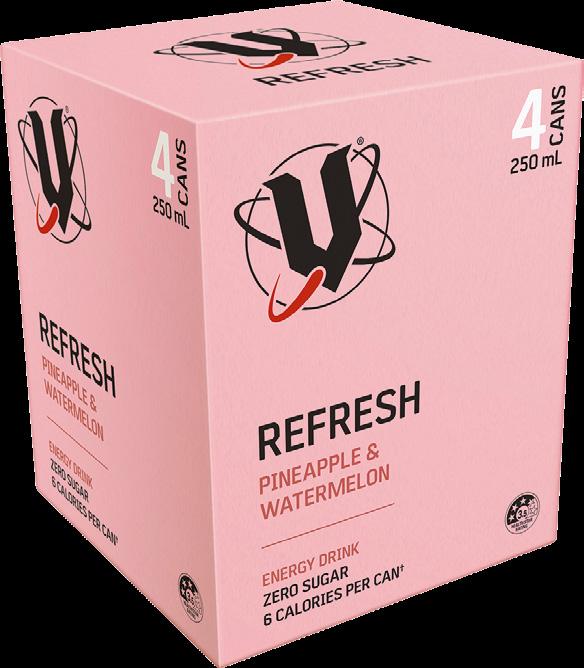

Our C&I Choice product for this issue is V Refresh, a sugar-free and low-calorie sub-range of Frucor Suntory’s most popular beverage line – V Energy.

Available in two delicious flavours Citrus Lemonade and Pineapple & Watermelon, V Refresh delivers the iconic V taste but with added refreshment and energy boost consumers seek.

Nikki Apostolidis, Product and Innovation Manager for V Energy, said they know their consumers love the taste of V Energy but are also starting to look for more options that are better for them.

“This led us to develop a new refreshing range that continues to offer that boost of energy with the iconic V taste.”

Research by Datamine, reveals energy drinks with low or no sugar are expected to deliver 40 per cent of growth in the energy drink category by 2025, and that currently those that drink both full-sugar and sugar-free make up 24 per cent of all consumers, representing 49 per cent of energy sales.

V Refresh uses a new vibrant packaging, combining the contemporary design with pastel colours to help consumers differentiate between the V Energy range options.

The range is available in 250mL, 500mL, and 250mL multipack varieties. V Refresh looks fun and has a sophisticated twist. It’s the full package and worth a taste!

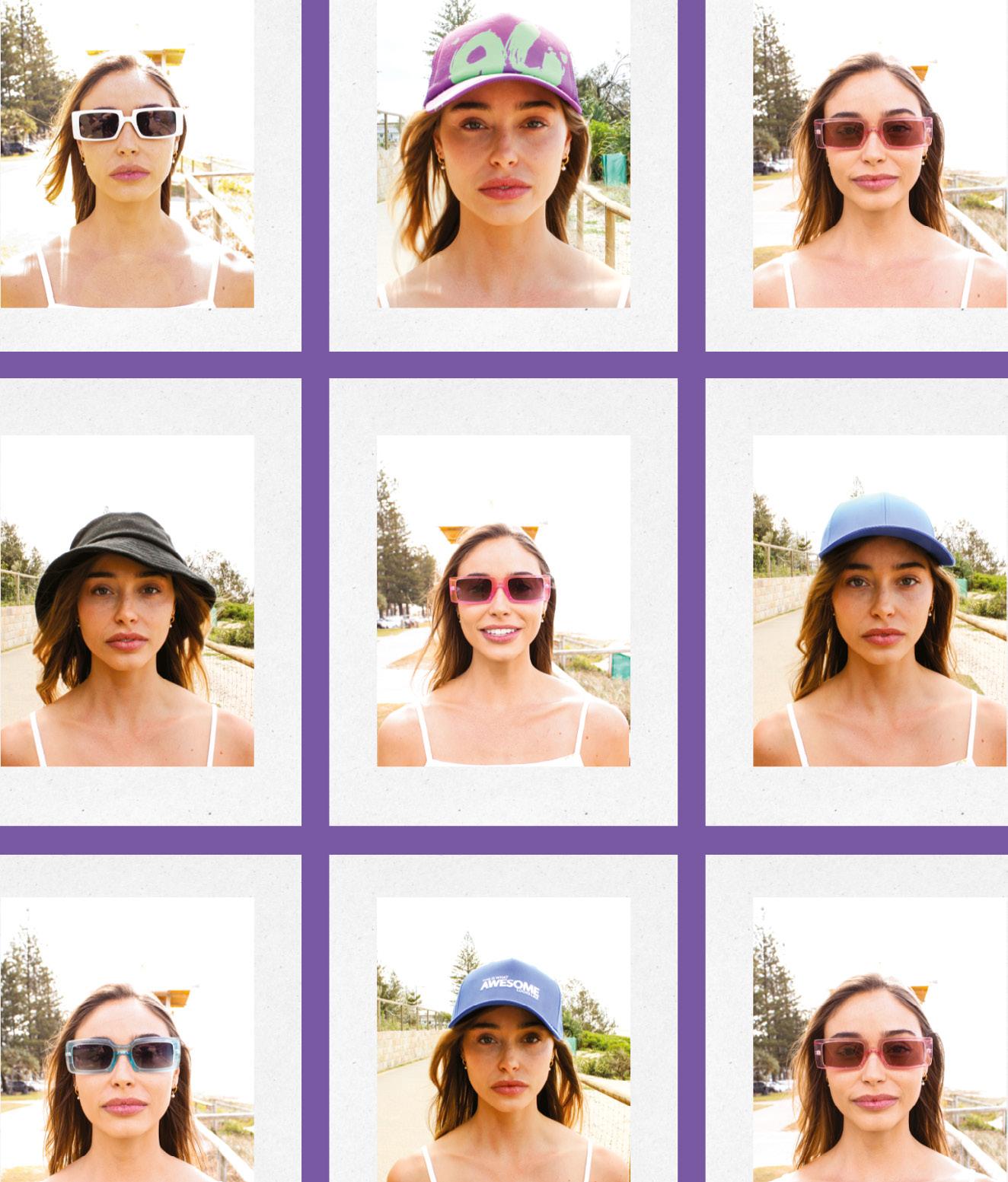

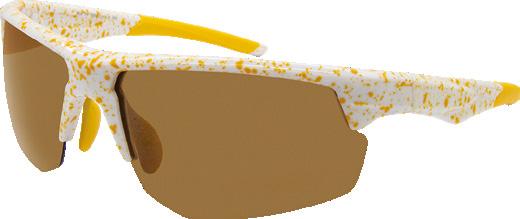

Think of the last time you were beachside, lakeside or poolside, enjoying the warm sun beaming down, and having a good quality chin wag with your bestie and just enjoying yourself. Well, that time is here again. You know, summer! The season of sun, good times, festivals, outdoor music, community events, summer sports, days at the lake, beach, or waterhole. The season that Aerial is born for, to keep you covered while you adventure through Australia.

While summer is here, this year it will be a little different. After the Covid lockdown induced misery of last year we are free, and it’s time to express our freedom with fun colours – you might say dopamine inducing colour. Check out the windows of the fashion stores in your local shopping mall, you will see it, calling you to join in the celebration of summer with shows of yellow, blue, green, and pink (yes even for the gents). Well, colours are on point and telling you it’s time to ‘Get Shady’.

More convenient than an hour-long car park tour at your local mall (yes people are shopping for Christmas already), Aerial is directing thousands of people to get to their local convenience store and shop the latest trends with you. Aerial’s ‘Get Shady’ campaigns are running through social media and Google Display tells shoppers to get to site and embrace the bright. Aerial Hats and Sunglasses will be the bright light in-store this summer with on trend styles that people will be delightfully surprised to find in a convenience store.

On top of being bright, on trend, and exciting, Aerial’s Sunglasses are crafted and then independently tested to ensure they meet the Australian and New Zealand Standard AS/NZS 1067.1:2016. Are you ready for summer? Do you want to maximise your sales? Aerial has got you covered – visit pacificoptics.com or email orders@pacificoptics.com.

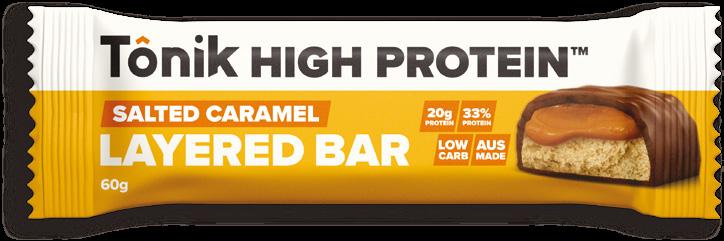

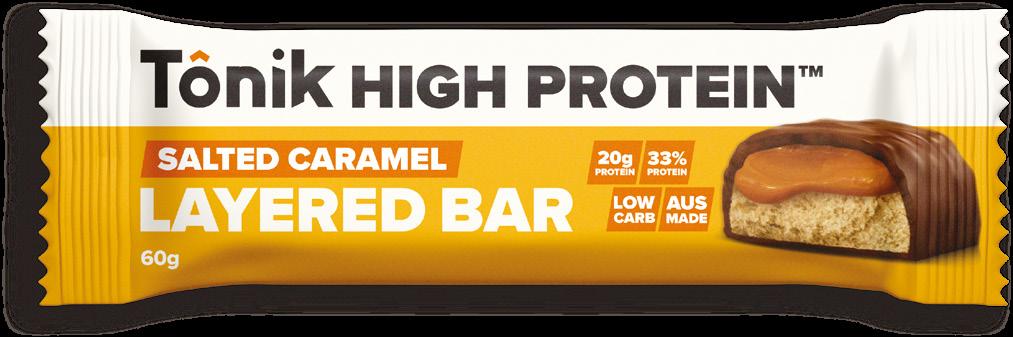

Caramel as a flavour has been an Australian favourite for decades, it’s been an iconic, gooey ingredient in confectionery for all of us as kids that we all loved – tell me who didn’t love a Cadbury Caramello Koala with caramel dripping all over their hands and face.

Salted Caramel became popular around the 90s, with salted caramel ice-cream, sauce, toppings, it was all about balancing the saltiness and the sweetness.

So, what better way to honour Australians than to create and manufacture a true Aussie favourite, Halo Food Co’s Salted Caramel Tonik High Protein Bar. The unique dual layering manufacturing technology enables them to create a bar with two separate layers, a creamy soft fudge layer, atop a gooey delicious caramel layer, balanced perfectly between the salty and the sweet, satisfying the confectionery desire, but without all the sugars and unhealthy ingredients.

“We developed our protein bars after seeing a gap in the Australian market. What was missing were protein bars that were providing the consumer with the highest quality ingredients, the best tasting products, made by Australians,” says Lisa Schilling-Thomson, National Sales Manager, Halo Food Co.

“Our R&D team created our own proprietary protein blend, a blend of whey protein concentrate, calcium caseinate, whey protein isolate, hydrolysed whey protein concentrate, soy protein isolate, and soy protein nuggets.

“This very special blending is the key to a creamy smooth texture and exquisite, delicious taste.”

Tonik High Protein Bars have all natural flavours and colours, no added sugar chocolate, they are high in natural fibre, low carbs, low sugar, and are gluten and gmo free.

So, what do you have? A classic Australian flavoured bar, Salted Caramel, which is bloody great for you.

Starbucks has launched Starbucks Frappuccino, a collaboration with Nestlé, which brings consumers the classic Starbucks flavour in a convenient ready-to-go format.

The result is a delicious, perfectly blended coffee with creamy milk and just the right amount of sweetness available in two different flavours – milk coffee latte and mocha.

Ready-to-drink coffee is a fast-growing category in Australia and Starbucks will continue to develop a strong innovation pipeline to further grow the category.

Rebecca Dobbins, General Manager of Dairy at Nestlé, said through this new collaboration, Nestlé and Starbucks are bringing Australians the signature taste of Starbucks coffee in an easy, ready-to-drink format.

“These new products will enable us to grow our younger consumer segment, with a tailored and new beverage offering. We are confident Australian coffee lovers will love these products in the summer months when a cold beverage is perfect for on-the-go.”

Nestlé will have the exclusive rights to market, distribute, and develop the Starbucks ready-to-drink coffee beverages in Australia, leveraging its local footprints and distribution.

The launch of the range will be supported by a media and influencer campaign to drive awareness of the new format.

Currently, the Frappuccino range is available in IGA, 7-Eleven, bp, Woolworths, and EG Group, in 280mL bottles at an RRP of $4.25.

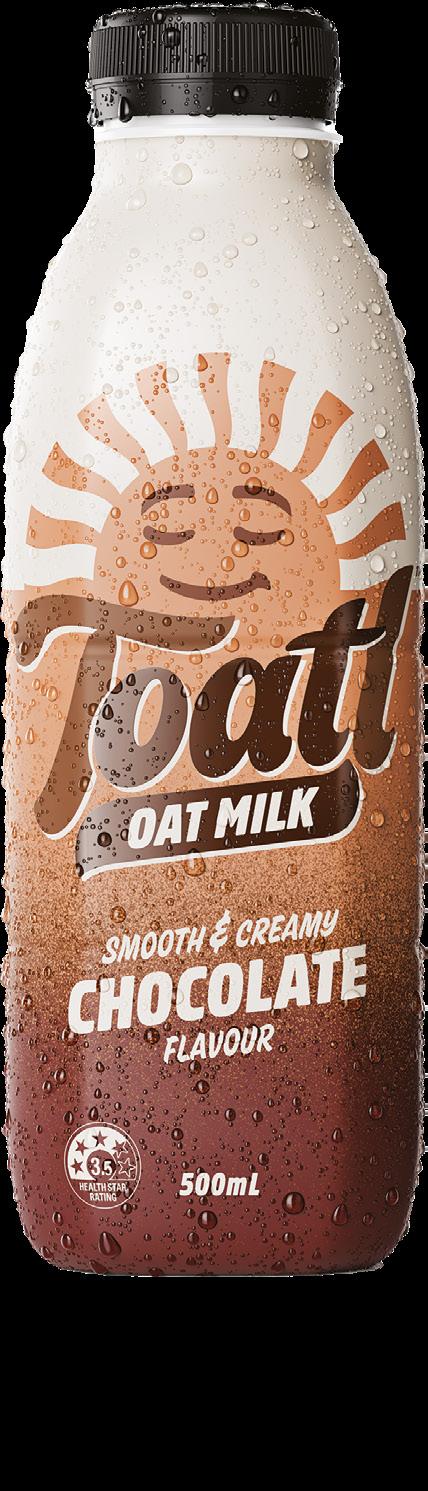

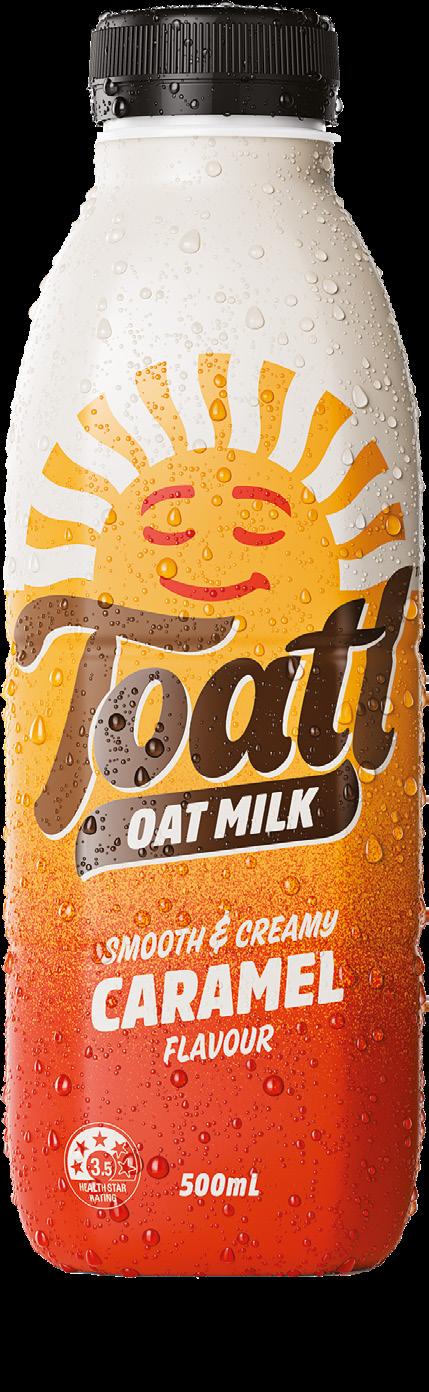

Toatl brings plant-based flavoured milks to the fridge.

The newly launched Toatl flavoured oat milk combines the deliciousness of traditional flavoured milk with the growing trend of plantbased options.

The three flavours include a decadent chocolate, a smooth caramel, and a fruity flavoured strawberry, all made using Aussie oats, by an Aussie company, right here in Australia.

Toatl plans to disrupt the flavoured milk segment with its oat milk based offer, using the knowledge that oat milk has been outgrowing other milks in the category over the last two to three years, and predicting that this trend will continue as more consumers add plant-based milk into their repertoire.

Recognising that plant-based eating is on the rise, and with an increasing number of consumers adopting plantbased milk into their diet, Toatl capitalised on the fact that there was no plant-based options in the flavoured milk category.

Tim Clarke, Shopper Strategy Manager at Sanitarium, producer of Toatl, said the flavoured milk segment thrives on innovation.

“With more consumers at the fridge looking for a plant-based option, Toatl provides the opportunity to convert these shoppers with a great tasting offer. This will bring new consumers into the segment and drive incremental sales. It’s a must have!”

Most importantly, said Clarke, is that they wanted to make a plant-based flavoured milk option that didn’t compromise on taste.

“We know that flavoured milk is a bit of a treat, and we couldn’t be happier with how delicious Toatl tastes. We have three of the most popular flavours – everyone loves chocolate and we’re sure our smooth and creamy tasting Chocolate Flavour will be a hit. Fruity Strawberry Flavour is a delightful treat, and our silky-smooth Caramel Flavour is a standout.”

Appealing to a younger generation that is increasingly health focused, Toatl provides a tasty alternative to traditional flavoured milk.

“This younger generation wants to eat healthy without taste compromise and are embracing plant-based eating. They are likely to consume dairy and plant-based milk, so having Toatl Flavoured Oat Milk provides a plant-based option to meet changing taste and preferences,” explained Clarke.

The initial launch will see the new flavoured milks packaged in 500ml PET bottles.

“Quick and easy, grab and go convenience with a 500ml PET bottle you can consume immediately or reseal to enjoy later.”

With ranging already secured across 7-Eleven, Coles Express, Ampol, and bp, Toatl can be found in the majority of buying groups throughout the petrol and convenience channel.

With more consumers at the fridge looking for a plant-based option, Toatl provides the opportunity to convert these shoppers with a great tasting offer.”

– Tim Clarke, Shopper Strategy Manager, Sanitarium

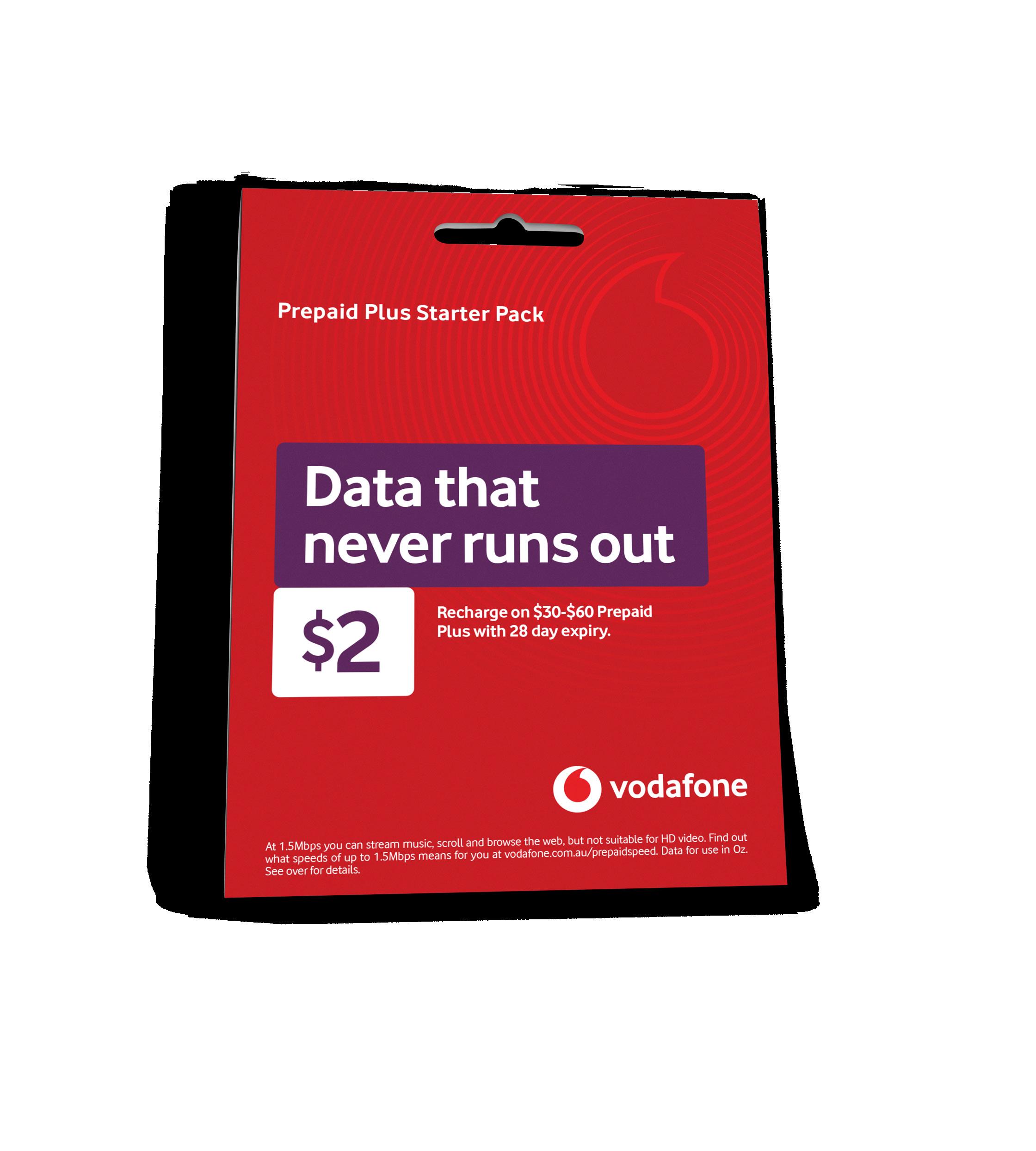

Packed with heaps of included data you can use at Vodafone’s fastest available speeds.

Bank up to 200GB unused My Data when you recharge on any Prepaid Plus plan before expiry.

Get $5 off every recharge when you set your $30+ Prepaid Plus on Auto Recharge. You can opt-in to Automatic Recharge when saving your payment details when you activate your SIM or by texting ‘ATR’ to 1263 or through My Vodafone.

With recharges from 7 days to 365 days.

Data that never runs out on Prepaid Plus with 28 day expiry.

First use all other data, then use infinite data at speeds up to 1.5Mbps. With 1.5Mbps you can check your socials, browse the web and stream music but its not suitable for HD videos.

Stay in touch with your friends and family with your included international minutes. See Zone 1 and Zone 2 countries at vodafone.com.au/prepaid-iddrates

of up to 1.5Mbps until your recharge expires. Data Banking: You can save up to a maximum 200GB of unused My Data, when you recharge on eligible Prepaid Plus plan before expiry, otherwise forfeited.Data Bank balance forfeited will rollover (up to max $250) if recharge before next expiry & maintain an active Pay and Go Recharge. If you switch to an ineligible plan, unused credit will be forfeited. See vodafone.com.au/prepaid/plans/pay-and-go for more increments. International Roaming rates subject to change – check vodafone.com.au/prepaid-roaming. International Roaming charges deducted from Pay and Go credit first, then My Credit balance. Vodafone Services subject within 72 hours following successful recharge or activation of Starter Pack. Limit 2 per Eligible Customer. Unused included data will rollover once into your next recharge period (up to 50GB) when you recharge before expiry. of 04.08.21. See website for current pricing. T&C apply, see vodafone.com.au/mobile-broadband/prepaid

Prepaid Plus plan.

pack by 31.01.23. $30-$60 Starter Packs incl. total data + unlimited int’l calls as advertised above for first 6 eligible recharges each time you recharge before expiry. Data for use in Oz. All 6 eligible recharges must be on $30-60 Your included data (My Data) and any data saved in your Data Bank data will be used first, this is data at the fastest speed the Vodafone network can deliver, depending on device/time/place;thereafter, data is available at speeds forfeited if recharge on ineligible plan, or do not recharge within 90 days of expiry or service is disconnected or deactivated. For more info and full T&C check vodafone.com.au/prepaid/plans. Prepaid Pay and Go: Unused credit more information. Standard international voice calls: To selected countries + rates may change. See vodafone.com.au/prepaid-idd-rates for list of current countries and rates. Charged from your Pay and Go Credit in per minute subject to network availability, individual device capabilities + limitations of overseas networks. Vodafone services such as video calling + PXT may not be available whilst roaming. Prepaid Mobile Broadband: Bonus data applied It will be available for use until the expiry of your current recharge. Any unused rolled over data will be forfeited. Unused bonus data does not rollover. For use in Australia. Usage is calculated in 1kB increments. Pricing correct as LBR220145

Featuring a wide variety of flavour options, the Fancy Feast Classic Singles range allows shoppers to quickly and easily purchase cat food that will keep them and their feline friend happy.