10 COOL ENTREPRENEURS GREEN TECHNOLOGY, WHAT’S WORKING FOR THE WORLD? AMBITIOUS LEADERS ROUND TABLES

10 COOL ENTREPRENEURS GREEN TECHNOLOGY, WHAT’S WORKING FOR THE WORLD? AMBITIOUS LEADERS ROUND TABLES

want stability, and they’re relying on the new government for it

The new Labour government hit the ground running after winning July’s General Election.

Fast and furious came the announcements – the promise to launch a new skills body, called Skills England, to “bring together the fractured skills landscape”.

Then there are its proposed planning reforms to boost UK housebuilding, and the setting up of Great British Energy to invest in clean, home-grown energy. There’s a new trade strategy too.

Of note for businesses is a promise to support the country’s impressive science and technology sector. Just one announcement by Business and Trade Secretary Jonathan Reynolds was more than £100 million in funding for aerospace research and development projects, an important sector for this region.

The UK’s Science Secretary, Peter Kyle, also announced an action plan to identify how AI can drive economic growth, but then the government revealed plans to scrap £1.3 billion of funding for AI and technology projects which had been promised by the previous Conservative administration.

The Arundel bypass in West Sussex, Stonehenge road tunnel, 40 new hospitals and 45 new railway lines proposed under the Conservative are amongst the infrastructure projects that will also be scrapped

These cuts, says the Chancellor, will help plug the multi-billion pound funding gap left by the previous administration.

Whatever your politics, most people agree that fresh eyes on the British economy are no bad thing.

The South East’s Chambers of Commerce also agree.

Paul Britton, CEO, Thames Valley Chamber of Commerce said “The business community across the Thames Valley faces unique local challenges. We will work tirelessly with the Labour government, both locally and nationally, to ensure the voice of business is heard.”

Hampshire Chamber Chief Executive and Executive Chairman Ross McNally said: “After all the economic shocks we have gone through in recent years, we need to see an industrial strategy that restores confidence and creates the right conditions for employers and entrepreneurs to invest in skills, jobs and commercial success over the next decade and beyond.

Ian Girling, chief executive of Dorset Chamber, added: “As the voice of business in Dorset, we will be working closely with fellow members of the British Chambers of Commerce (BCC) to encourage the government to use this new start to rebuild economic confidence and tackle the myriad challenges holding business back.”

Stephen Emerson Managing Editor stephen.emerson@thebusinessmagazine.co.uk

John Lewis gets the green light for its first build-to-rent scheme in Bromley

With the new Labour government wasting little time in setting out its changes to the National Planning Policy Framework, local councils are following suit. John Lewis Partnership’s first flagship build-torent project, above a Waitrose store in Bromley South, has been given the green light by the local council.

The project will see 353 new build-torent homes constructed on a brownfield site in the town centre, all managed by JLP and prioritised for local people.

Also included in plans are a modernised Waitrose store, a cafe fronting the new public piazza, and three new pedestrian and cycling routes through the site.

The scheme, designed by Assael Architects, will reportedly provide a £70 million boost to the local economy in extra council tax and local spend over the first 10 years, once homes are occupied.

It will also see the provision of 200 construction jobs.

Amelia Hunt, of Savills planning team which secured the planning permission, said: “John Lewis Partnership’s flagship build-to-rent scheme is an important

project, delivering much-needed homes for local people on a highly accessible brownfield site in Bromley.”

Wesley Ankrah, head of social value at Savills Earth, added: “This is a positive and important result that primarily drew more local support than opposition.

“This isn’t just about the creation of homes, but also creating a diverse space that will benefit the local area. The basis of this sort of project is to ensure we create new communities, which is the kind of concept that councils should be championing up and down the country.”

Councillor Alexa Michael, Chairman of Bromley’s Development Control Committee, said: “While finely balanced with many factors to consider, the proposal represents a clear net benefit to the borough and enhances local housing supply.

It optimises land use on this highlyaccessible brownfield site at the edge of Bromley’s town centre.”

John Lewis is now calling on Chancellor Rachel Reeves to introduce tax breaks for developers that start building immediately.

Katherine Russell, the director of buildto-rent at the Partnership, is also asking for the government to cut red tape for builders to help the industry meet Labour’s goal of building 1.5 million new homes over this parliament.

IT distributor Westcoast looks set to merge with Swiss firm ALSO, pending regulatory approval.

Established in 1983, Westcoast is now the Thames Valley’s largest private company, with a turnover of £4.2 billion last year.

Joe Hemani, chair of Westcoast, said: “This is an alliance of two highly successful businesses.

“Over the last 42 years, our company went from strength to strength, and this is how it will remain in the future.

“The continuity of the business, which is paramount for vendors, customers, and our team alike, is secured with this move. I’m excited to play an active role during what I know will be a smooth transition and beyond.”

The deal will see Joe become a major shareholder in ALSO and maintain leadership over operations in Germany and the Netherlands under the Westcoast name.

Gustavo Möller-Hergt, chair of ALSO, added: “We already have a successful collaboration. This next level opens exciting opportunities for us to scale our business and benefit from the expertise of the UK team.

The results of the Growing Kent & Medway’s Prototyping and Demonstrator Fund have been revealed.

The research consortium, whose partners include the University of Kent and UK Research and Innovation (UKRI), put £500,000 towards four projects looking to commercialise new technological advancements in horticulture.

MiDeVa (Mites Demonstration and Validation), led by Saga Robotics, was awarded £113,000 to trial a robotic approach to pest and disease control in Kent’s commercial strawberry farms.

It marks the first ever deployment of Saga Robotics’ fully modular dispersal system for mites – beneficial insects used to control pests – during the strawberry growing season.

VineAI, a project from agri-tech firm Deep Planet in collaboration with vineyards across the South, received £144,500.

Deep Planet aims to use satellite imagery and AI to detect and predict the presence of diseases like downy mildew and botrytis, which threaten grapevines.

These methods could replace inefficient disease detection methods of monitoring with human scouts or drones.

Drytec Spray Drying in Tonbridge secured £149,500 to investigate the effectiveness of traditional spray drying in creating sustainable food ingredients from byproducts of Kent’s food and farming sectors – particularly spent brewery yeast and cereal crops.

The project will deliver industrial

prototypes of novel ingredients which could provide an alternative, non-animal protein source for food manufacturers and help reduce sugar levels in food products.

Finally, RePizza Ltd, a manufacturer of artisan pizza doughs, has received £149,000 to bring to market a new category of high-fibre, low-calorie, sustainable pizza bases for food service customers.

They’ll be making use of the latest innovation from Cambridge Glycoscience – Grain & Stalk (G&S) flour, which uses both the grain of wheat as well as the typically wasted or underused stalk.

G&S flour could enable wheat farms to double their food output without using more land and resources.

Slough-based software and supply chain company ByBox is working with electric vehicle charging provider ZevHub to roll out 35 smart lockers to an electric vehicle charging hub at Southwark in Central London,

And plans are already being made to expand the number of lockers to 120 this year.

ByBox has more than 45,000 smart lockers across 1,500 or so sites around the UK. They enable field service engineers to securely collect and return equipment and parts from places of maximum convenience near their points of service.

ZevHub provides charging for commercial vehicles in urban areas to ensure EV commercial vehicles have convenient access to charging stations wherever they go.

Andy Crees, Chief Operations Officer at ByBox said: “Our smart lockers users to pick up the essential parts they need for the day. This ultimately reduces unnecessary vehicle weight and increases electric vehicle range for customers looking to transition to an electric fleet.

“Customers can return used parts to the locker which ByBox will collect.”

George Cook, Fleet Operations Director at ZevHub added: “The introduction of ByBox smart lockers are a welcome and unique addition to our EV charging Hubs.

Jonathan White, Chief Executive Officer at LockerQuest, added: “Having ByBox operational at this ZevHub location makes perfect sense with many UK businesses making the transition to electric vehicles. This facility will only support their decision to transition even faster.”

ByBox’s model allows customers to minimise in-van inventory by adopting a ‘just in time’ approach, where customers can pick up the parts they need for the day and return waste parts to a locker once they have finished a job.

Operating in 31 countries, ByBox delivers 30 million items per year. ByBox has nine distribution centres including in Bristol, Coventry, London, Milton Keynes and Solihull.

Buckinghamshire automotive repair business Steer has opened its first purpose-built electric vehicle repair location in Eastleigh, near the Southampton import docks.

Steer Electric Eastleigh spans more than 14,000 square feet, with full aluminium structural repair capabilities and advanced EV technology tooling.

Its technicians have undergone courses on EV safety, battery management and high-voltage systems in preparation for the launch.

ChargeUK, the voice of the UK’s EV charging industry, has revealed that a public charge point is being installed every 25 minutes.

In a new report published by the organisation, it says there are nearly a million home, work and public charge points in the UK today, almost one for every fully electric vehicle (EV). Current infrastructure can provide enough power to enable every EV in the UK to drive 580 miles a day. If current growth continues, the rollout of public chargers will track ahead of EV adoption and there will be more than 300,000 public charge points in the UK by 2030.

Vicky Read, CEO of ChargeUK, said: “Convenient and affordable charging for all is key to the UK’s switch to EVs. This new analysis will give current and future EV drivers confidence that the charging infrastructure will be there for them.”

The Eastleigh site is equipped with solar panels to cover a portion of the site’s energy needs, and will aim to use ESGcompliant parts where applicable.

It also includes rapid EV chargers for staff and customers, as well as valet facilities, a customer consultation and meet and greet area, and a colleague lounge.

Steer Automotive Group operates 162 locations across the UK.

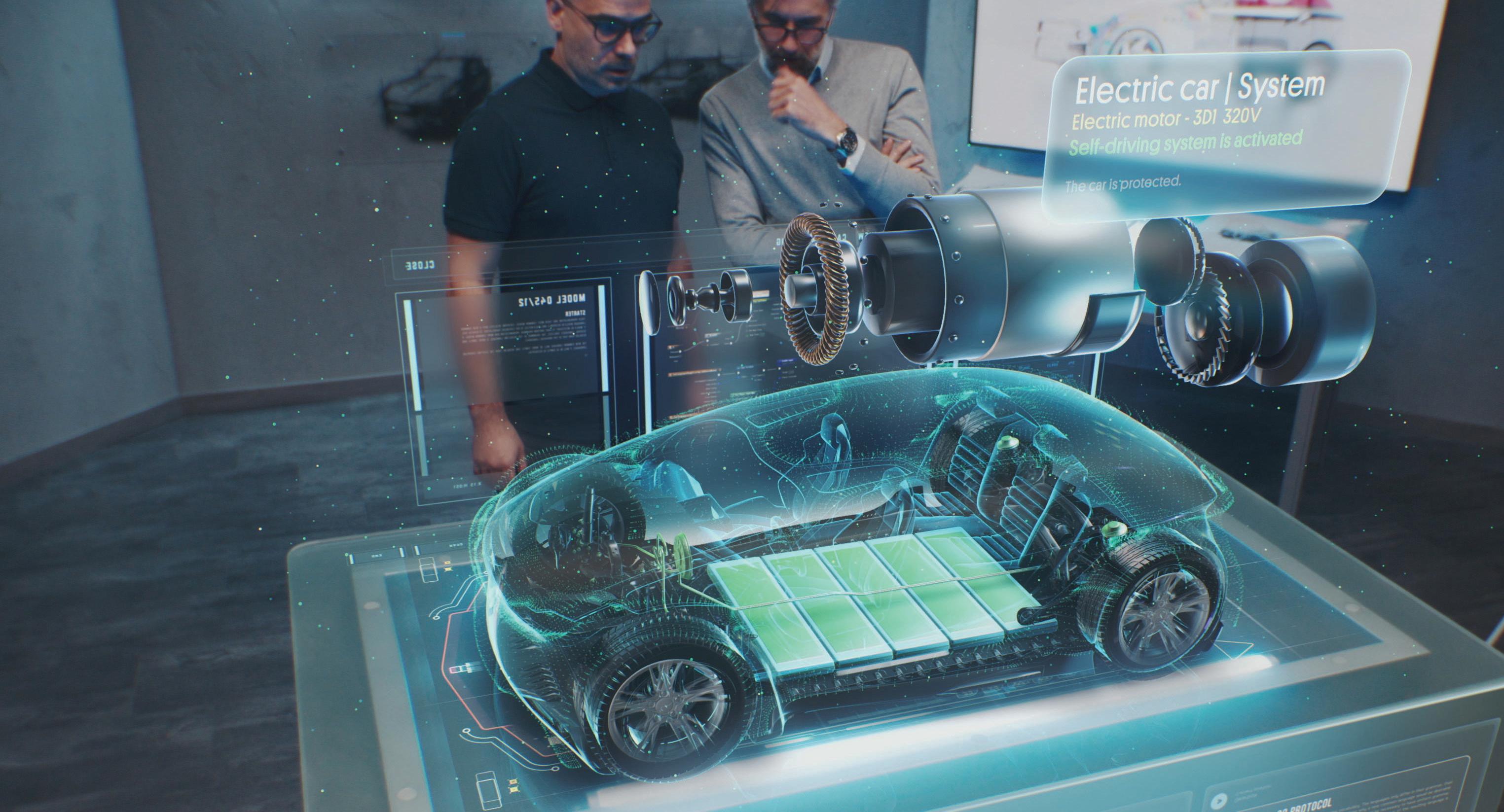

The UK’s automotive industry is fundamental to this country’s future but it can’t do it alone

The UK automotive sector could fuel £50 billion of green growth over the next decade, according to the UK’s influential trade association for the automotive industry, the Society of Motor Manufacturers and Traders (SMMT).

That’s a serious claim – but the organisation warns: “Provided the right conditions are in place.”

Those include government policies and consumer incentives to help 17 million drivers switch to zero emission motoring by 2035, halving the number of fossil fuel cars in use.

The analysis forms the basis of the SMMT’s Vision 2035 which also includes a series of five pledges for the industry: Net zero mobility for all, Britain as global power in vehicle production, an upskilled workforce for the new automotive technologies, clean, cost-effective energy and a proper industrial transformation strategy (something the whole of the manufacturing sector has long been calling for).

The UK automotive industry has had a torrid few years, and it’s not back on the open road yet. While the country had been investing in developing electric vehicles (for a decade before Brexit, the UK’s departure from the European Union put the brakes on.

If the country’s focus is economic growth and net zero, you can't deliver that without decarbonising road transport, so the automotive industry will be central to the UK strategy

The country’s exit forced radical changes in supply chains. One of these was the Rules of Origin requirements within the UK and EU’s Trade and Co-operation Agreement. These are scheduled to come into force in 2027 and require that an increasing percentage of parts in an electric vehicle must be made in the UK or EU. If car manufacturers don’t meet these thresholds, exported cars in either direction will face a 10 per cent tariff.

With more than 70 per cent of all UK-made vehicles exported, and more than half of those going to the EU, these rules will be disproportionately felt in the UK.

Then there was Covid, which stalled car production. While the sector has somewhat recovered from the dark days of 2020,

things aren’t yet back to what they were. In the first six months of this year, UK car production fell 7.6 per cent. Despite manufacturing 416,074 vehicles, this was 34,000 fewer than in the same period last year.

This overall fall was driven by a significant decline in exports. While vehicles produced for the UK market increased by more than 17 per cent year-on-year to 106,157 in the first six months, those produced for export fell by just under 14 per cent to 309,917.

However, the decline in total vehicle exports had, to a certain extent been expected, said theSMMT, due to manufacturers retooling lines to make electrified models, following the announcement last year of some £23.7 billion of UK investment.

Mike Hawes is the Chief Executive of SMMT. He says: “If the country’s focus is economic growth and net zero, you can’t deliver that without decarbonising road transport, so an automotive industry will be central to the UK strategy.”

The new Labour government has said it remains committed to the decarbonisation of road transport. But there could be an issue here. Last year the previous government said it would delay the UK ban on the sale of new petrol and diesel cars until 2035. It was previously set at 2030. The new Labour government has said it wants to move the date back to 2030.

“That will divide the industry”, said Mike. “And it’s not clear what it means. If we revert to the previous target, the last government’s definition was that would mean the end of conventional petrol and diesel engines.

“They never clearly defined what you could sell after 2030 until 2035. A vehicle has to have significant zero emission capability, but they didn’t define what that was. So it’s still an open issue.”

Last year Labour launched its automotive sector strategy. This addressed some of the issues around demand, infrastructure and competitiveness.

“Labour’s approach will result in a new industrial strategy for the country –something we’ve been calling for ever since

the one from the last government withered away on the vine,” said Mike.

“The new government understands that you must bring together not just policies but government departments, because the issue involves the Departments for Business, Transport, Energy Security and Net Zero. It also involves Trade and the Treasury – and when you look at the international perspectives, it will increasing involve the Foreign, Commonwealth and Development Office.”

The Labour government wants to encourage the market, especially for those less able to afford an electric vehicle and drive the roll-out of infrastructure – a critical enabler to achieve the strategy. It wants to encourage investment in automated manufacturing and gigafactories.

“They rightly want to focus on growing the UK automotive industry, but this will have to be done in an increasingly competitive global environment,” Mike said. “We want a good relationship with Europe – a better one than we’ve had before (which shouldn’t be difficult), but everyone has to take into account the protectionism that’s happening around the world.

“What can we do to make sure we have good and progressive relations with all markets when in some cases they are turning their back on international trade?”

There is concern across the UK that this country is being flooded by overseas automotive imports, with China often cited. Mike acknowledges that the market share of Chinese brands is growing.

“Currently their share of the UK market is between four and five per cent. A significant portion of that is MG.”

This British brand was acquired by SAIC Motor Corp, the Chinese state-owned automotive company, in 2007. There are also newcomes such as BYD, but the difficulty in establishing a new brand overseas shouldn’t be underestimated.

Mike says: “A new entrant must convince consumers to invest considerable money in an unfamiliar brand. It will also need to build

a dealer network and aftermarket. That’s all expensive and takes time.

“Sometimes it’s a bit easier with a new technology like EV, and that’s why the Chinese in particular are doing better in the EV market than they are in the general market. Their EVs are perhaps priced more competitively, but they’re still not cheap, and there remains a good degree of brand loyalty among UK consumers who want to know the companies they’re buying from.”

But this country is in a good position. Last year more than £22 billion of automotive investment was announced, trumping the preceding seven years put together.

“The industry must now realise those investments – such as the gigafactories which have been announced,” said Mike. “I know the market is really tough for EVs at the moment, but the UK, EU and other markets are committed to the decarbonisation of road transport. That means that those who are making vehicles to fit that requirement, using batteries made locally, are in a good place.”

And now the UK is a free tradingnation, it can look at new markets. We have signed trade agreements with Japan, an important one, and with Australia and New Zealand, which are also useful but relatively small markets.

Where the UK government direction differs from the European Union is in tariffs. First the USA put 100 per cent tariffs on Chinese electric vehicles (more a symbolic gesture to reassure US automotive manufacturers, according to Mike, as China doesn’t sell many into the US market). More recently the EU has also announced increased tariffs on the import of Chinese EVs – which hasn’t been met with mass celebration in certain parts of the European automotive industry because of how their manufacturers have constructed supply chains.

“The UK government is taking a more nuanced view,” said Mike. “China is a critical trading partner and owns a number of UK automotive brands. This country wants free and fair trade with the world, but we will have to watch the market closely.”

Discussions are ongoing with other countries such as Mexico, Canada and potentially India to improve access to those markets.

A big issue facing the UK is equipping the country’s automotive workforce with the skills needed to produce electric vehicles.

“While they are highly skilled in making cars with internal combustion engines, they will have to understand new electric vehicle technology,” said Mike. “These are high voltage systems so additional training will be needed for something like 80 per cent of the workforce.

“Then there’s the service repair aftermarket. And that’s where there is a massive skills gap because a mechanic will know the ins and the outs of an internal combustion engine, but an electric vehicle is very different.

However, this is an ongoing transition so there is time to invest in skills development – as long as companies have got the wherewithal to do so.”

The next few years are going to be tough for the UK’s automotive sector, admits Mike.

Not just for big companies but for the supply chain too. Many are small or medium-sized businesses that don’t have deep pockets but will have to change what they make because it’s not needed for new electric vehicles. They’ll also need to reskill their workforce.

While our workforce is highly skilled in making cars with internal combustion engines, they will have to understand new electric vehicle technology

“Cars of the future will still have four wheels, a chassis, seats and so forth, but many of the parts will be different,” said Mike. “The need now is for power control technology. We need to make sure we’ve got a resilient, capable and innovative supply chain and a workforce fit for the future.”

It’s not all about electric vehicles or their cost

There is a misconception that competitiveness is all about the cost. It’s not says Mike. “It’s about making the right product well and at the price you make it.”

What about other technologies? The government has invested a lot of money

in researching the use of hydrogen in transport. Is it worthwhile?

“At the moment it's hard to see hydrogen being commercially viable to compete with batteries at the same cost by 2030, or even 2035,” said Mike.

“Looking longer term and at different use cases, including for off-road heavy-duty construction work, some manufacturers believe it could have a key role to play. Others are not so sure. There are certainly some cases where batteries won’t really be suitable – such as long-distance coaches where passengers won’t want to stop for two hours for their transport to recharge. The question will be – what will be the alternative? Could it be hydrogen fuel cells?”

The jury is still out on that.

What isn’t in dispute is that the UK’s automotive industry is fundamental to this country’s future. And the government is taking that seriously.

The country has a total budget of £4 billion being invested in automotive research and development. This is being undertaken in 22 centres across the country, many working with our universities – particularly the University of Warwick and Warwick Manufacturing Group, the MTC in Coventry, the Institute for Advanced Automotive Propulsion Systems in Bath and MIRA Technology Park near Nuneaton, Warwickshire.

Prodrive in Banbury has joined forces with Warwick-based Astheimer Design to develop what they say will be the most efficient last-mile electric vehicle.

The companies have launched a new joint venture, ELM Mobility Ltd, to launch the “Tuk-Tuk of the Western World”.

Astheimer Design is a world-class design studio which has worked on many major automotive projects including an allelectric long range concept car which it developed with a consortium of British companies. The project was funded by the Office for Zero Emissions. It also worked with a Swedish start-up on designing the world’s first, purpose-built, fully electric truck.

Prodrive has been designing, building and racing world championship-winning cars for 40 years, across both rally and track.

With a long history of successful collaborations, these industry leaders have developed a vehicle platform which they say will revolutionise last-mile logistics, offering an efficient commercial vehicle that will significantly impact our urban environment.

ELM Mobility unveiled its new electric vehicle at Cenex this month and will also present it at the Leaders in Logistics Summit in Twickenham in October.

Another Oxfordshire company is also on a mission to revolutionise green transport in urban environments.

Another Oxfordshire company is also on a mission to revolutionise green transport in urban environments

Electric Assisted Vehicles (EAV), which has just moved into larger accommodation at Wates Way in Banbury, has developed an award-winning e-cargo bike for this rapidlygrowing market segment. The company, which now has 25 employees, won its biggest order to date this summer.

More logistics companies are deploying e-cargo bikes across the UK. In June, delivery company Evri said it was investing a further £19 million in new plans to fast-

track the roll-out of electric cargo bikes. The move is expected to give Evri the UK’s biggest fleet of e-cargo bikes for parcel delivery, and grow its fleet from 33 to 99 and its electric vehicles from 168 to 270 within the next year.

The business plans to grow its fleet of electric cargo bikes to 3,000 over the next decade.

Evri operates electric cargo bikes in London, Bristol, Oxford and Cambridge and delivers 1.5 million parcels a year by bike or EV. It aims to triple that number to around four million over the next year.

Amazon is also using electric cargo bikes. It says millions of packages have been delivered in this way across some of the UK’s biggest cities using its “micromobility” hubs. These are physical centres within urban areas where packages are sorted before the final leg of their journey. Packages arrive from nearby Amazon fulfilment centres and loaded on to delivery vehicles, taking traditional delivery vans off city centre roads. Amazon says it’s planning to invest around £300 million in the electrification and decarbonisation of its transportation network in the UK.

There are seven big premium and sports car manufacturers in the UK, four mainstream car manufacturers, four commercial vehicle manufacturers and more than 60 specialist car manufacturers. Many proud British car marques are now owned by foreign investors.

You could say it’s selling off the family silver, but it’s also a blessing, according to Mike Hawes, CEO of the Society of Motor Manufacturers and Traders.

“The challenge of transitioning an 100-yearold technology to a new one needs someone with deep pockets to fund it. In the case of Mini and Rolls-Royce, BMW bought them both and gives them access to technology and their supply chain.”

And such iconic marques might be foreignowned, but they retain their British identity and importantly their British manufacturing bases.

“The UK is also good at attracting research and development investment from all over the world, and many international brands have a British design centre. That’s why seven out of the 10 Formula 1 teams are

We want to keep our intellectual capability here and our links to UK universities, which is very important

based in the UK, even though they race under another flag,” said Mike.

“We want to keep our intellectual capability here and our links to UK universities, which is very important.”

And international links are also very important. “If you’re going to understand global markets, you need to understand the consumer in China and the USA as well as in Europe and you can only do that by having some exposure to them.”

In 1997, BMW Group acquired Rolls-Royce Motor Cars. This was much more than just another business deal – Rolls-Royce is an institution going back to 1904.

BMW built a new manufacturing facility at Goodwood for its new prize,and it remains the only place in the world where Rolls-Royce motor cars are designed and built – still by hand.

It is also the global headquarters of a business that now operates in more than 50 countries worldwide. In 2016, the company opened its Technology and Logistics Centre in Bognor Regis, to support Goodwood’s fully integrated manufacturing processes. Rolls-Royce employs around 1,200 people at its Goodwood site in West Sussex.

Prodrive has been designing, building and racing world championship winning cars for 40 years, across both rally and track.

It has won dozens of international motorsport titles and grown into a world-leading independent motorsport company which designs and manufactures a wide range of technology across the mobility sector (not only in motor sport).

It has a composites factory in Milton Keynes which manufactures for leading original equipment manufacturers and where its designers are driving the development of recyclable and natural fibre composites.

Its engineering teams across the Prodrive Group already work alongside some of the most famous automotive marques to help them develop their own road cars. The company employs more than 500 people across its Banbury and Milton Keynes composite sites.

Founded in 1963 by racer, engineer and entrepreneur Bruce McLaren, the Group is formed of McLaren Automotive, which hand-builds lightweight supercars; and a majority stake in McLaren Racing which competes in the Formula 1 World Championship, NTT IndyCar Series in the US, ABB FIA Formula E World

Championship, Extreme E and E-Sports.

McLaren is one of the UK’s largest independent companies and is globally headquartered at the iconic McLaren Technology Centre in Woking, Surrey. More than 2,500 people are employed at McLaren Automotive.

Gordon Murray spent 20 years as technical director to two Formula 1 teams. In 1990 he established McLaren Cars Ltd for McLaren Racing, His first project, the F1 road car, is still regarded as one of the world’s bestengineered cars.

Gordon left McLaren in 2005, and in 2007 set up Gordon Murray Group, of which he is Executive Chairman. Last year he sold Gordon Murray Technologies, part of the

group to CYVN Holdings, an Abu Dhabi government investment vehicle. Earlier this year Gordon Murray Automotive moved production of its T.50 supercar to newlybuilt headquarters at Highams Park, Surrey – an investment of more than £50 million.

The new campus, the Group’s global headquarters, is home to a purpose-built 4,300 sq m vehicle production centre, and the Gordon Murray Heritage collection.

In 1957 the celebrated Formula 1 design engineer Colin Chapman built a little two-seater car designed to be “fit for purpose” – he wanted owners to experience the joy of building their own car and then take it on the track. In 1973 Caterham acquired the rights to build and develop the Seven.

In June, Caterham Cars relocated to a new factory in Dartford. The multimillion-pound investment from owner VT Holdings (one of Japan’s largest retailer groups which bought the business from Team Lotus in 2021), will increase production capacity by 50 per cent up to 750 units per annum. For the first time in the car’s 50-year history the production, engineering, motorsport and commercial teams will all be housed under one roof.

In April Williams F1 launched a new company that will apply the innovation and technologies of F1 to tackling clients’ engineering challenges in other sectors.

Drawing on lessons learned over almost 50 years at the top of motorsport, Williams Grand Prix Technologies will focus on solving clients’ problems using its worldleading engineering capabilities.

Sitting alongside Williams Racing, and also owned by Dorilton Capital, the new company will be based at the team’s technology campus in Grove.

BMW acquired the iconic MINI brand in 1996. While the MINI is assembled at Cowley in Oxford, more than 350 different body parts are pressed for the MINI at its plant in Swindon. Engines come from Hams Hall in the West Midlands.

The MINI Plant Oxford currently produces the MINI 3-door, the MINI 5-door as well as its Clubman and the MINI vehicles. The plant is also producing the next generation MINI 3-door and MINI 5-door with combustion engines, as well as the new MINI Convertible, before they are joined by the new all-electric vehicles in 2026 – the MINI Cooper 3-door and the MINI Aceman.

A world leader in the design and manufacture of transmission systems has celebrated 40 years of high-performance engineering and customer service.

Xtrac’s Chief Executive, Adrian Moore, said: “Our commitment to engineering excellence, hard work and customer service has propelled us to become the world’s leading supplier of transmissions for top-level motorsport and high-performance road cars. It’s a testament to the collective effort that has brought us here and inspires us for the exciting future that awaits.”

Xtrac’s early success in the off-road and Group A rally categories led to collaborations with manufacturers such as Mazda, Mitsubishi, Opel and Toyota. In 1989 the company moved into Formula 1 when Onyx contracted Xtrac to develop a transverse gearbox. McLaren followed and within a few years, Xtrac was supplying most Formula 1 teams, including BAR, Minardi, Benetton, Jordan, McLaren, Tyrrell, and Williams, and it continues to supply high specification gearbox components to teams today.

In the 1990s, Xtrac expanded into various motorsport categories, supplying teams competing in the 24 Hours of Le Mans and British Touring Car Championship (BTCC). It introduced sequential gearboxes to rallying, enhancing vehicle performance with its reputation for reliability, a key selling point.

Xtrac also secured significant single-supply contracts, starting with IndyCar in 1999. This required rapid production of 100 gearboxes, leading to the construction of a new 88,00 sq ft factory in Thatcham in 2000. Three years later, Xtrac established its first American operation in Indianapolis to support US customers.

Beyond motorsport, Xtrac has built an exceptional reputation with

The plant at Cowley employs around 4,500 staff who build more than 1,000 MINIs each day.

Since the launch of the first modern MINI in 2001, more than 4.4 million MINIs have been produced in Britain – including 150,000 MINI Electric models built between 2019 and 2023.

its high-performance automotive business. Since its first project for Tesla prototypes in 2006 and the Rolls-Royce 102EX Phantom Experimental Electric prototype in 2011, as well as providing transmissions for hypercars, Xtrac has expanded significantly into EV and hybrid transmissions. It also supplies transmissions for hydrogen combustion engine prototypes as the industry pursues alternative propulsion systems for reaching net zero emissions.

Today, Xtrac’s business is about 65 per cent motorsport and 35 per cent high-performance road cars. It provides transmissions across motorsport and high-performance automotive sectors for internal combustion, hybrid and electrically powered vehicles, producing more than a quarter of a million parts annually. The Thatcham plant includes the advanced machinery and equipment needed to manufacture gearbox components and complete systems in-house, high-security data systems, transmissions control system software and hardware development, and a dedicated R&D department. The Xtrac Academy trains apprentices and graduates. Many remain with the company long after completing their training, with well over 50 current staff members trained through this scheme.

Last year MiddleGround Capital, the private equity company acquired Xtrac. Speaking after the announcement was made, John Stewart, MiddleGround’s founding partner, said: ““We believe that under Adrian Moore’s leadership, Xtrac is well-positioned for longterm growth and leading the future transition of the motorsport and high-performance automotive industry to hybrid and EV drivetrains by delivering innovative products in a sustainable manner.”

Silverlake Automotive Recycling, based in Shedfield, Hampshire, has secured two four-year police contracts following competitive tenders.

The company renewed its contract with Surrey and Sussex Police, which it’s held since 2014, as well as picking up a new one with Hampshire and Isle of Wight Constabulary.

On behalf of each police force, Silverlake will collect vehicles for disposal via recycling or auction, once they’re released from storage with the appointed recovery operators.

Silverlake works with recovery operators to minimise storage costs and aims to deliver strong returns via its auction site.

The contracts were awarded by Automobile Association Developments (AADL) Contractor Management.

Dan Bristow, contractor scheme manager at AADL, said: “This longstanding collaboration is testament to the hard work and dedication that the team at Silverlake have demonstrated over the years.

Steve Diaper, operations manager at Silverlake, added: “We’re really proud to have won these prestigious contracts.

“The fact that AADL and Surrey and Sussex Police have relied on our services for 10 years and have renewed our contract for a further four demonstrates great trust in our operations – that’s hugely rewarding for the team.

“To then go on to win the contract for Hampshire and Isle of Wight Constabulary as well is even further validation, reinforcing our credibility and helping to position us as the automotive recycling partner of choice in the market.”

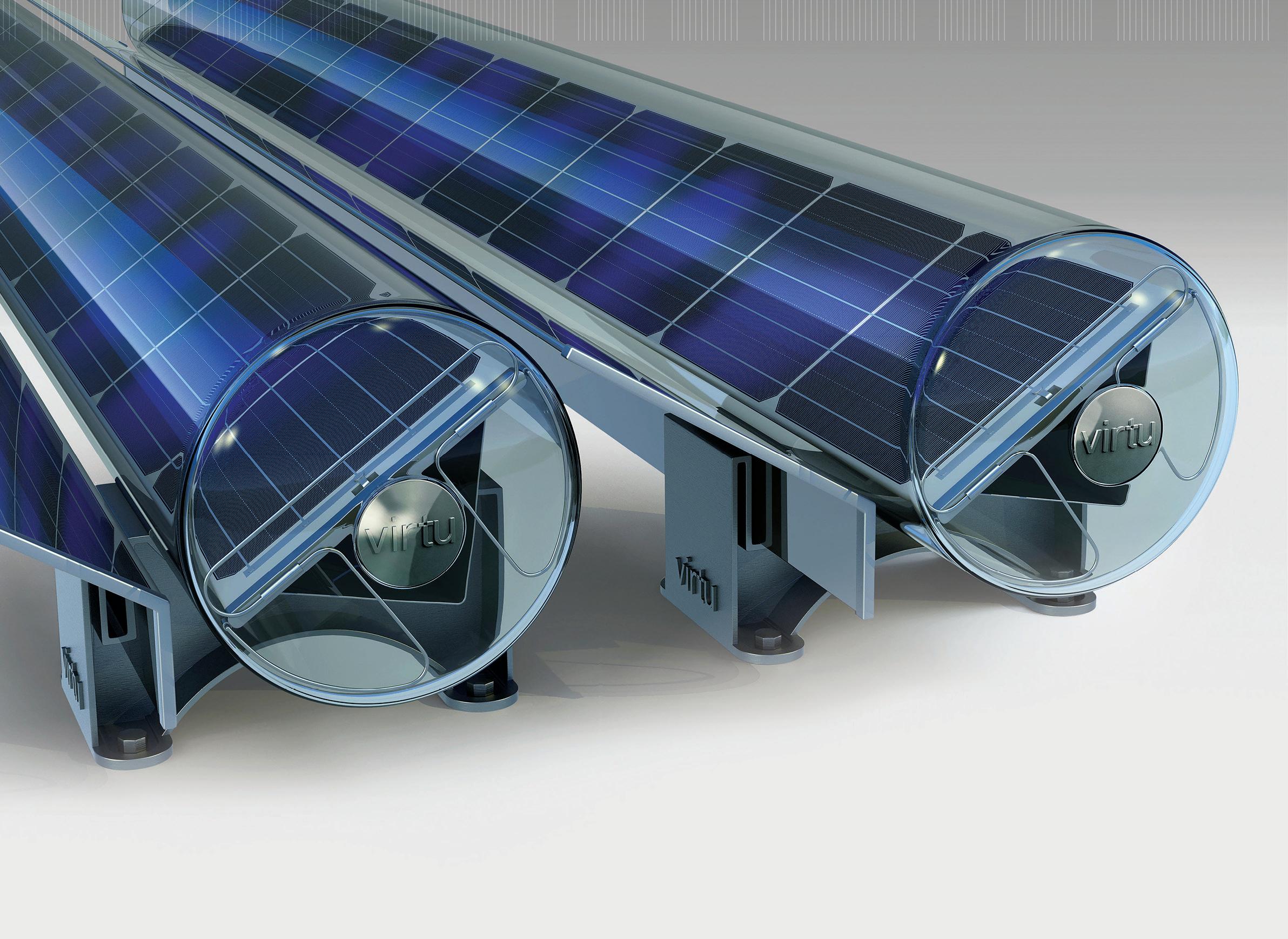

A Leatherhead company is pioneering sustainable transport refrigeration using a battery and solar power.

Sunswap has successfully completed a trial of its battery and solar-powered transport refrigeration technology with JS Davidson, the temperature-controlled logistics specialist.

JS Davidson has set out a target to reach net zero by the end of 2025 at its Peterborough headquarters.

The successful two-week trial with Sunswap showcased the capabilities of the Surrey firm’s Endurance refrigeration unit running frozen delivery cycles.

The logistics company was able to integrate the Endurance unit into its fleet without disruption or special measures, treating it as ‘just another fridge’ in their operation.

The data collected during the trial suggests JS Davidson could remove 519 tonnes of CO2and 5 tonnes of NOx over the lifetime of five units, taking a substantial step towards a cleaner cold chain.

It would also see operational savings of 70 per cent compared to diesel.

John Davidson, managing director of JS Davidson, said: “Collaborating with Sunswap on this trial has been an eyeopening experience.

“The Endurance unit not only met but exceeded our expectations in terms of performance and reliability.”

Alastair Gough, head of business development at Sunswap, added: “Our partnership with JS Davidson is a testament to the viability and effectiveness of our battery and solar-powered refrigeration technology.

“The Endurance unit’s performance during this trial demonstrates that sustainable solutions can integrate into existing logistics operations, delivering tangible benefits for business and the environment.”

Woking-based McLaren Racing is collaborating with the Ministry of Defence on a variety of innovative defence projects.

The MOD will work with McLaren Racing’s accelerator team on initiatives like Project LURCHER – a push to electrify the Army’s armoured vehicle fleet.

Electrification could make military vehicles more operationally effective, cutting down the need to resupply and reducing the vulnerability of forces in the field.

Matt Dennington, Co-Chief Commercial Officer at McLaren Racing, said: “The partnership with the MOD provides a great opportunity to stretch and apply our innovation and technological know-how and a high-performance culture to improve operational efficiencies across a wide range of exciting projects.

“Under the multi-year partnership, the MOD will collaborate through McLaren Accelerator to apply motorsport innovation and insights to projects that are jointly selected by Defence and McLaren teams.”

The iconic studio is approximately 53,600 sq ft in total size and includes five sound stages, 77,400 sq ft of workshops, 39,400 sq ft of office space, 182,900 sq ft of backlot, all with plenty of parkinh.

Bray Film Studio has been the production home for the second season of the hit Prime Video series The Lord of the Rings: The Rings of Power since 2022.

The first Amazon MGM Studios production to be located at the studio after the acquistion will be the second season of the Russo Brothers’ spy series Citadel, starring Richard Madden and Priyanka Chopra Jonas, scheduled to begin filming this month.

This purchase is in addition to Amazon’s significant presence at the UK’s Shepperton Studios, where it has a longterm contract for the exclusive use of nine sound stages, workshops and office accommodation, totalling approximately 450,000 sq ft.

Mike Hopkins, Head of Prime Video and Amazon MGM Studios, said: “With Bray as our creative home in the UK, we are committed to deepening our relationships with the country’s creative community, which is rich with world-class storytellers and creative talent of all kinds.

“The acquisition of a studio with such a storied heritage not only empowers us to produce more film and television in the UK, but also unveils opportunities in the local community with respect to jobs and skills training at all levels of the production process.”

Culture Secretary, Lisa Nandy, said: “We are determined to support the huge potential for economic growth in our creative industries. We want to do all we can to help make sure career opportunities in these exciting sectors are available for people from all backgrounds right across the UK.”

Frank Burke, Chairman of Bray Film Studios Ltd, the previous owner of the site, added: “For more than 70 years, Bray Studios has held an important place in the history of British film-making.

“During our period of ownership, My family and team and I have witnessed the rebirth of this iconic facility and we are extremely proud of the part we have been able to play in bringing it to renewed prominence.

“We are now genuinely excited to be handing the studios over to Amazon, who we believe share our commitment to quality and excellence and are perfectly suited to preserving the character of the studio while enhancing the first-class creative production spaces for generations of filmmakers to come.”

The Thames Valley’s emergence as a data centre hub is continuing with Dutch operator Yondr Group revealing it has completed the first 20MW of a 30MW centre in Slough.

The centre will be the firm’s first data centre in the UK and is located on its planned 100+MW data centre campus, it was reported.

It comes after Slough Borough Council authorised property investor Segro to build two additional data centres in the area – in addition to the previously-approved Segro data centre development in Iver, Buckinghamshire.

And in March, Equinix revealed plans to transform a former paint factory industrial site in Slough into a data centre campus.

Close by in Maidenhead, managed services provider Iomart says it has installed 560 solar panels on its flagship data centre in the town.

The 2,800 sq m data centre in Maidenhead is the largest site across its UK estate of 13 data centres. It’s also the company’s main

self-managed infrastructure facility, powering more than 12,000 servers.

This investment is part of Iomart’s wider long-term sustainability strategy, which has seen a move to power all its data centres with 100 per cent renewable energy coming from sources including wind, hydro and solar.

Fast-growing Indoor activity brand Oxygen Activeplay has taken over activity park Red Kangaroo Reading, with a complete refurbishment planned.

The venue will reopen as Oxygen Reading in time for October half-term, joining eight other Oxygen parks across the country.

It’s set to house around 32 trampolines – including five long bed trampolines, 26

single trampolines, and one long tumble track.

Oxygen Reading will also feature the brand’s signature Excite Tunnel, parkourstyle stunt areas, an interactive sports pitch and a large airbag and trapeze.

Stephen Wilson, CEO of London-based Oxygen Activeplay, said: “The plans for Reading are extremely exciting.

“The Red Kangaroo team has done a phenomenal job of becoming part of Reading’s community.”

Oxygen was acquired by Literacy Capital Plc in July 2021. The private equity company has provided growth capital which has resulted in a number of acquisitions, including Red Kangaroo in 2022. Last year Oxygen acquired Jump Evolution.

Waitrose is ramping up investment in its portfolio, with plans to open as many as 100 convenience stores across the UK in the coming five years.

The retailer is planning a record £1 billion investment over the next three years in new locations and improvements to 150 existing shops – including a makeover of its Maidenhead outlet, due this autumn.

New concepts will be trialled at Waitrose’s John Barnes shop on Finchley Road, London.

Works will include improvements to meat and fish counters, an expanded

selection of wines, greater flexibility to respond to local demand, more thirdparty collaborations, and more dedicated space for on-demand grocery orders via services like Deliveroo and Uber Eats.

The first new Waitrose store in six years will open in Hampton Hill, Richmondupon-Thames later this year, with a second following in Greater London.

Executive director James Bailey said: “The groundwork we’ve undertaken behind the scenes in recent years means we can now focus on growth through new shops and ensuring our existing ones are providing great shopping

experiences that match the quality of our products.

“In designing the store, we’ve taken time to understand how our customers like to shop and used this knowledge to introduce new concepts that will be tested and rolled out nationally as we continue to work towards the Waitrose of the future.”

Nish Kankiwala, CEO of the John Lewis Partnership, added: “As our retaildriven plan continues to gain traction, our growing number of shoppers and increasing customer satisfaction scores are clear indicators of its success.

Newbury flight case manufacturer Absolute Casing has acquired Market Harboroughbased competitor Nomad Cases in a move that it says will create a market-leading flight case group.

The deal was negotiated and led by corporate finance specialist Watersheds.

Absolute Casing, now in its 25th year, supplies high quality, bespoke protective flight cases to a vast number of market sectors, including Formula 1, Premier League football, the Olympics, medical, television production and the oil and gas industry.

Managing director, Ed Franklin wanted to increase market share and in-house capability and acknowledged that an acquisition could help the strategy become reality.

Nomad Cases is already a well-known name in the industry, employing 29 people in Market Harborough.

Ed said: “There is a lot of synergy between Absolute Casing and Nomad Cases in terms of what we do and who we supply, so when Nomad’s owner was considering retirement, we were keen to explore the opportunity. We had worked together

before on certain projects and I knew Absolute Casing would be a good home for its customers and staff.”

Jessica Painter, partner at Watersheds, said: “A strategic acquisition like this can be an excellent growth plan for a business.

“The current funding landscape for small businesses is challenging at the moment and it can be difficult for business owners to navigate as well as find the best deals”

Thrings and Marriott Harrison provided legal advice on the transaction, with funding provided by HSBC Commercial Banking.

Chancerygate has sold Vantage 41, its 165,000 sq ft Grade A urban logistics scheme in Aston Clinton, to a private investor for an undisclosed sum.

Located four miles east of Aylesbury, the development comprises 16 units ranging from 4,800 sq ft to 43,600 sq ft.

Four units totalling 88,000 sq ft, which is over half of the available space at the development, were let by practical completion.

Matthew Connor, senior development director at develoepr Chancerygate, said: “The sale of Vantage 41 is testament to its strategic location and sustainable accommodation, which has proved attractive to both investors and occupiers.

“The deal is also the cumulation of our expertise and hard work to develop much-needed, flexibly sized Grade A urban

logistics units to satisfy the high demand for space across the Buckinghamshire region.”

Chancerygate currently has around 1.16 million sq ft of urban logistics space under construction or ready for development across 10 sites from Edinburgh to Croydon.

Graeme Lipman’s experience in running his own printing and publishing and other businesses has equipped him with the tools to be a fixer for companies looking to get out of difficult situations or those that have their eye on growth.

Graeme established his own printing and publishing company at the age of 23 which he subsequently ran for 24 years and during that time saw it grow into a firm with a turnover of £7m+ and employing 52 staff before selling the business.

His specialist printing and publishing companies focused on producing marketing materials, magazines, periodicals and books and counted the BBC, Sotheby’s, John Lewis, Waitrose and the Metropolitan Police amongst its clients.

The move from printing and publishing to

insolvency is not a common career path. However, for Graeme, it was an approach by Begbies Traynor to work as a consultant that steered him away from retirement and onto his current career trajectory.

He said: “When I was approached, I said I didn’t know anything about insolvency at all. They said that if you have run your business for 24 years then you will have the experience, tools and knowledge to talk to all kinds of directors.”

Graeme after 24 years then went on to work as an advisory consultant for Begbies Traynor where he has been helping companies for over seven years and is now based at the firm’s Salisbury office within the South West region where he holds the post of Director.

He deals with companies from a range of sectors, including construction, automotive and printing, that are facing insolvency, business stress or are looking to grow.

Of the companies that contact him in a distressed situation, they all have one thing in common and this is a failure to keep upto-date accounts.

Graeme expanded: “Since COVID, companies don’t seem to have as up to date financials generally. Now when

information is requested it takes two or three times longer than pre COVID. If they are not aware of what is going on, then they are unable to plan a strategy going forward.

“If companies don’t know what their cashflow is going to be then they cannot reassure their backers of what their future prospects are and if the business is going to be stable and viable.”

The trend of a growing number of companies failing to keep on top of the books, Graeme argues, can be attributed to the sluggish economy since the pandemic with many firms forced to cut back on staff.

He said: “Directors are probably having to multitask where they probably weren’t so much pre COVID and they’re asking their accountants to do less and asking their inexperienced internal accounts department to do more.”

Alongside failing to keep track of finances, over-trading is also a key cause of financial difficulties.

Graeme explained: “It’s ironic that after COVID, where some businesses were closed, others are now grabbing everything they can. This means they can swing straight into over-trading. If they haven’t got the right credit lines with their suppliers and

If you are interested in speaking to Graeme, he can be contacted through email via graeme.lipman@btguk.com www.begbies-traynorgroup.com

full backing from their funders. Suddenly, their working capital is tight. They might have plenty of orders coming but if they haven’t got working capital sorted then their business can be brought to a grinding halt.”

The direction of travel for all business is rarely linear with many pivots and U-turns along the way which is why having back up strategies can help keep a company on course for the financial year and beyond.

Graeme said: “It is important that companies have a second back up strategy or even a third if their first plan doesn’t work. So that they are positioned to act if their sales revenues are say 15 per cent lower than expected or their gross margins are down compared to their forecasts. This helps with communicating your position with shareholders, funders and backers as you are able to come up with a strategy if your original path doesn’t work out.”

With his role focused on helping companies grow out of difficulty and also helping grow firms, he also assists companies in a semistressed position.

He said: “A lot of companies are not aware of their true financial position and only act when creditors start knocking at the door. The frustration in our job is that people are not coming to us as early as possible

and only do so when they are forced to respond. They may be in denial where they think they are a great company that just needs one or two orders, and everything will be fine. We make sure that people are aware of what the next few days or weeks hold for them cashflow wise and what threats they are likely to encounter given their position.”

One of the most satisfying parts of the job, says Graeme, is achieving a turnaround for a company with every situation requiring a different approach. He has worked on a number of business rescues which have retained as many staff as possible and kept the business intact. He highlights the work he did for a film industry logistics company where the Managing Director had a heart attack, and he helped the staff achieve a management buyout.

Graeme also worked with a family printing business that had run into difficulty after the father had passed the business to his sons. With a tight timeframe, due to the business running out of cash, he was able to help secure a buyer for the business with most of the staff retained.

When helping companies to grow, Graeme draws on the lessons of his publishing business to help owners overcome growth obstacles and also utilises his wider contact

If companies don’t know what their cash flow is going to be then they cannot reassure their backers of what their future prospects are

network to help firms gain funding and win orders. As any CEO knows, company survival depends on growing areas of the business to balance the books.

Graeme urges firms that he advises to seek out pockets of growth in connected sectors. He said: “The printing sector has been eroding for the last two or three decades because the demand of print generally has dropped. But there are still pockets of growth and the sector is still a multi-billion pound industry. There is growth in the packaging side and in promotional material. There is also growth in the travel sector. People like to see glossy brochures and magazines apart from just the internet.”

A good team can put a firm on the road to growth and this is one of the core areas that Graeme will work on with teams. He said: “I have always said that it is important to look after your clients but looking after your staff is even more important. If you can get the right team in place then you can tackle anything. You do need clients, as you do need the revenue that they bring in, but clients come and go, but good key members of staff need retaining.”

The importance of an exit strategy is a cornerstone of advice that Graeme gives to company founders. He said: “A lot of owners run into problems when they come to sell as they find that the value of their business is nowhere near what they thought it would be. Also, too many businesses come to the point where they want to sell and find that too much is reliant on the founder.

“Having an effective business plan that is aligned with your exit strategy is vital.”

Six of the most impressive businesses in the Thames Valley SME Growth 100 ranking were recognised at an annual awards event hosted at Maserati Ascot.

The programme is an annual campaign highlighting and celebrating the top 100 SMEs with turnover under £25m that have grown significantly in the past year. The TV SME Growth 100 sponsors are Herrington Carmichael, Hicks Baker and Crowe UK

Jo Whittle, Operations Director at The Business Magazine, said: “The ranking encompasses companies of all kinds and is a substantial list of diverse and exciting businesses which are driving innovation and growth.”

She added: “Thank you to all our finalists for your willingness to get involved and for

readily opening your doors and sharing your stories. Your passion and enthusiasm made for a long and difficult judging meeting.”

Welcoming guests to its showroom, Paul Eaton, General Manager, Maserati Ascot, gave a brief history of the worldfamous automotive brand. He pointed out Maserati’s long history in motorsport, from touring cars and endurance racing to the Formula E World Championships.

He said Sytner-owned Maserati Ascot was looking forward to “turning electric” and that the company had enjoyed the first six months at its showroom in the town.

The networking event culminated in winners being announced across six business categories.

SME GROWTH AWARD (UNDER £10M)

WINNER: TC Communications

FINALISTS: Carless + Adams • Mediafleet • Workbooks CRM

EMPLOYER OF THE YEAR

WINNER: CleanEvent Services

FINALISTS: Bridewell • Business Moves Group • Gekko • Hazlemere

SME GROWTH AWARD (OVER £10M)

WINNER: Redstor

FINALISTS: Bridewell • Juice • Naturetrek • Perspectum

SME IMPACT AWARD

Juice

FINALISTS: Francis Construction • Intralink • Naturetrek • Redstor

TECH COMPANY OF THE YEAR

WINNER: Perspectum

FINALISTS: Bridewell • FullCircl • Gekko • Redstor

RESILIENCE AWARD

WINNER: Naturetrek

FINALISTS: Carless + Adams • Gekko • Juice • Perspectum

Are you thinking of making a ‘green’ claim when advertising your products and/or services?

Regulators such as the Competition and Markets Authority (CMA) and the Advertising Standards Authority (ASA) are reviewing ‘green’ claims made by businesses when advertising their products and services. For example, the CMA carried out an investigation into fashion retailers ASOS, Boohoo and George at Asda over their ‘green’ claims. This year, the CMA published undertakings from the retailers, which have committed to promises on how they will make ‘green’ claims moving forward.

If you are thinking of making a ‘green’ claim to highlight environmental merits of your products and/or services, it is important to be on the right side of the rules. B P Collins’ corporate and commercial team discusses the guidance you need to consider when making ‘green’ claims.

What is a ‘green’ claim and what is ‘greenwashing’?

‘Green’ claims are those that state a particular product, service, process, brand or business is better for the environment, such as advertising a service as carbon neutral or claiming that a product is ecofriendly or recyclable. ‘Greenwashing’ is when a business provides misleading information about its environmental merits and credentials.

What does the law and guidance say about ‘green’ claims?

There are no specific laws for ‘green’ claims as a whole and the relevant laws depend on whether you sell to businesses or consumers. It is important to check if there is any relevant sector-specific guidance that may apply. Also, certain areas such as automotive, cleaning

products and household appliances have their own rules on ‘green’ claims.

However, the CMA has put together the Green Claims Code, which provides six key principles to help businesses comply with the law:

• Claims must be truthful and accurate

• Claims must be clear and unambiguous

• Claims must not omit or hide relevant information

• Comparisons must be fair and meaningful

• Claims must consider the full life cycle of the product

• Claims must be substantiated.

Whilst the Green Claims Code is helpful guidance, it is not a substitute for the law and other regulations must be considered. In terms of consumer protection law, the relevant rules come from the Consumer Protection and Unfair Trading Regulations 2008 (CPRs), which prohibit unfair commercial practices.

Business protection law is also relevant, and the applicable rules are in the Business Protection from Misleading Marketing Regulations 2008 (the BPRs).

The BPRs are similar to the CPRs but apply to relationships between businesses.

What are the sanctions if you get it wrong?

The sanctions include criminal sanctions punishable by an unlimited fine and/or imprisonment for up to two years as well as civil proceedings. A business may also suffer reputational risks and may have to withdraw greenwashing adverts – for example, in July 2024, the ASA ordered that Wessex Water Services Ltd had to withdraw an advert as it omitted material information about the company’s environmental impact.

For businesses that sell to consumers, the Digital Markets, Communications and Consumer Act 2024 has recently expanded the powers of the CMA. The CMA can now impose fines of up to 10% of a business’s annual turnover or £300,000 for non-compliance (whichever is higher). The CMA can also impose an additional daily penalty for continued non-compliance, require businesses to offer consumers compensation and/or give consumers the option to terminate a contract early.

If you are thinking about making ‘green’ claims when advertising your products and/or services and would like advice as to how the rules may apply to you, you can contact us on enquiries@bpcollins.co.uk or call 01753 889995.

The husband and wife team behind Sugoi Campers says past lessons have equipped them for the road ahead

by Stephen Emerson, Managing Editor

Bravery, courage and determination are just some of the qualities needed when stepping out of the corporate world and into your own small business.

Emma Ward and her husband John have these qualities in abundance and have used their skills and experience, along with a passion for travel, to create a fast-growing campervan business that is seeking to smash down the barriers of ownership.

Sugoi Campers has a staff of eight and, despite beginning trading only in 2020, it is on track for a turnover of £750,000 this year.

Emma and John focus on the vehicle conversion market, importing vans from Japan then converting them to each individual customer’s specification.

They also work with vans that people bring to them.

The company began in a small unit near Southampton docks before moving to premises in Fareham.

This year the firm moved to nearby premises which doubled its floor space.

Emma said: “I’m really proud of where we’ve got to as a business.

“I would say to anybody out there who is thinking of starting their own business that

I would say to anybody out there who is thinking of starting their own business that you don’t have to have a degree, you don’t have to have the best education, but you do need to be determined

you don’t have to have a degree, you don’t have to have the best education, but you do need to be determined.

“If you want something then it is your hard work that is going to get it for you.”

Emma left school with few qualifications and, at aged 18, worked as a buyer for kitchenware firm Kenwood, negotiating the price of raw materials in what was then a tough male-dominated industry.

She then joined the Kingfisher Group and was part of a team that set up the Trade Depot before internal restructuring led to redundancy.

Emma then moved on to Fareham B2B mobile phone provider Onecom, where her husband also worked, and headed up the purchasing department as it embarked on a period of strong growth.

The concept of Sugoi Campers was born when Emma and her family visited Malaysia to visit John’s terminally ill mother.

The couple travelled around Malaysia and

Singapore in a Nissan Grand when John had the lightbulb moment that their hire van would make an excellent camper van if converted.

Emma said: “We came back from that trip and his mum sadly passed away. After that John began to really think about what he wanted to do with his life.

“He didn’t want to stay in the corporate world anymore and he had an opportunity to take redundancy.”

Sugoi Campers was born in September 2020 and Emma joined the business in March 2021.

The couple, who had always had an interest in camping, received investment from an independent investor in early 2021 that enabled them to buy eight vans and move into larger offices.

Emma said: “We felt that if we’re going to do this, we’re going to plough every bit of our redundancy into this project and we’re going to really go for it.

“We had our first few vans on display for our first day of trading which was when lockdown was lifted in 2021.”

Emma says that the experience of the couple’s previous business has shaped their outlook in their latest venture.

John owned a company called In Car Solutions which would work primarily with dealers to add electronic devices to cars including parking sensors, heated seats and Bluetooth car kits.

The business began to suffer when manufacturers started putting these same electrical devices directly into vehicles.

Emma said: “When we had our previous business, we didn’t diversify it quickly enough and I think for us this time round, we are looking at every opportunity we possibly can.

“We’ve also made the leap into much bigger premises and our overheads have gone up.

“We now need to make this work and we’re literally working seven days a week at the minute to make sure that we do deliver that.”

The team’s work on the TECH:TRUCK project is an example, Emma says, of the firm diversifying and going out of the comfort zone of its employees.

TECH:TRUCK is a modified vehicle that travels around schools in Hampshire promoting non-vocational qualifications such as modern apprenticeships and championing causes such as women in engineering.

Sugoi Campers worked with nine colleges across the county on the project and was recognised for its efforts at last year’s Hampshire Business Awards, organised by The Business Magazine.

The TECH:TRUCK is a converted NHS truck kitted out with technology to inspire students and even has a drone landing pad on its roof.

Emma said: “My initial reaction was no because it was a huge project.

“We then had subsequent chats with Fareham College, they supported us and we have created what is a very important vehicle for all of the colleges.”

Campervans have exploded in popularity since lockdown with an increasing number of people discovering the freedom that they offer.

However, with this expanding market comes competition and for Emma and her husband, their aim from the start was to create a bespoke offering that would open the campervan world up to people who felt excluded due to cost.

Emma said: “When we set the business up, what we didn’t want to do is be another VW converter as there’s hundreds of them out there.

“We wanted to be affordable and it was about creating a product that was a bespoke conversion.

“Every conversion that we have done since we started has been different and the customer is able to choose everything that goes into their van.”

What type of customer is attracted to the campervan lifestyle?

Emma says her biggest market is newly

retired people that love travelling but don’t want to stay in hotels all the time.

Sugoi Campers is also popular with cost-conscious outdoor enthusiasts, with vehicles starting from £20,000.

She said: “People will always come to us saying they wanted to get a VW but they were £70,000.

“They come to us and see the product and realise that what they are getting is actually a better product.”

With two apprentices on board and new premises, the future looks bright for the Sugio Campers team.

Since 2015, Lakeside North Harbour has partnered with Hampshire & Isle of Wight Wildlife Trust (HIWWT) to advance a shared vision for a sustainable future, where wildlife conservation and community engagement are at the forefront. The partnership is due to the fact that commitment to environmental sustainability and community connection is at the heart of everything done at Lakeside.

Wilder Conference & Awards

Last year in September, Lakeside hosted the Wilder Conference & Awards ceremony at the campus, a significant event that underscored its longstanding partnership with the Trust. This event marked a significant milestone in the collective journey, recognising the progress made under the Wilder 2030 strategy, an initiative led by the Trust to drive nature’s recovery.

To tip the balance in favour of nature’s recovery, the trust needs one in four people to take action for nature by 2024. Through Team Wilder, the Trust is supporting others to make changes, educating people about the natural world and building a people powered movement of individuals, communities, and businesses standing up for nature. This initiative has empowered individuals in and around Portsmouth to actively enhance local wild spaces, demonstrating the impact of communitydriven conservation.

Lakeside’s wildlife walks

As part of Lakeside’s ongoing commitment to fostering a deeper connection with nature, weekly Wildlife Walks for all occupiers are hosted at the Campus. Every Wednesday, interested participants join a guided 45-minute walk around the picturesque Lakeside campus, led by experts from the Wildlife Trust. These walks offer a unique opportunity to learn about the diverse flora and fauna that thrive here, making each outing both educational and refreshing.

Family day event: a summer celebration of wildlife

This summer, Lakeside North Harbour celebrated its partnership with the Trust by hosting a special Family Day event. Held in early August, this event was designed to engage families in wildlife conservation and exploration. Occupiers were encouraged to bring their children to work, allowing them to participate in a variety of fun and educational activities.

Children enjoyed building and decorating bug houses, participating in bug hunts, and planting pollinator pots to attract beneficial insects like bees and butterflies. These hands-on workshops not only provided a memorable day but also helped instil a love for nature in the younger generation, emphasising the importance of conservation from an early age.

forward

Lakeside North Harbour remains dedicated to promoting environmental sustainability. Its partnership with Hampshire & Isle of Wight Wildlife Trust will continue to drive meaningful impact on conservation while fostering a strong sense of community around these vital initiatives in a sustainable environment for all who visit, work, and live around Lakeside North Harbour.

If you’re looking for a prime location for your business and would like to take your place among our thriving community in a stunning and sustainable environment, come to Lakeside, the south coast’s premier business campus with flexible room to grow. With space available from 500 sq ft up to 100,000 sq ft, Lakeside extends beyond the office.

Visit www.lakesidenorthharbour.com for more information.

In the second of a series of articles from accountants and business advisors, BDO LLP, we look at the growth strategies being deployed by Central South businesses.

Given the backdrop of rising costs, high inflation and geopolitical instability, growth has been more difficult to achieve in recent years. Even though this has eased, businesses striving for growth in the current economic environment need to be specific about their strategy and what might provide the catalyst to unlock expansion.

In our most recent Economic Engine survey of 500 mid-market businesses, 35% of Central South companies said they are planning to explore private equity (PE) or VC investment to scale-up in the next one-tothree years.

Helen O’Kane, Deal Advisory Partner –M&A, considers how private equity could be the catalyst to supercharge growth. The Central South is an exciting region to do business and has many young and ambitious businesses looking to establish and grow here. We’re also home to a significant number of high-quality multi-

generational companies which reach a point when they want to go through the next growth phase and achieve scale.

The key to successfully achieving a business’ ambitions is navigating the funding process to find the right match in an investor. The first step towards a successful PE partnership is understanding what it means for you and your business. A PE investment will often also involve an element of debt funding.

It will stand a business in good stead to get ahead on the timeline and be as ‘deal-ready’ as possible when having early-stage meetings with investors. It’s also a gamechanger to put a well-rounded management team in place and give them the mandate to lead the business so PE is backing that team and their appetite to grow beyond a deal. The Central South benefits from an ability to attract high-quality people given our location, proximity to

London and being a great place to live. Investors are typically looking for a track record of growth, as well as a future expansion thesis to get behind, so having high-quality management information is valuable. If a business is in a sector which is ever-changing, such as tech or compliance, the future growth opportunity may be clear. For some businesses, buy and build can also be a good growth thesis for PE to get behind if a focused acquisition strategy is deliverable. International expansion may also be part of a growth strategy and could be very attractive to private equity if it is possible to do the necessary due diligence.

Overall, if PE is the route you’d like to take, it is about finding the right fit investor as you will need to deliver against shared growth ambitions in future. Get advice from people who have been on the journey and talk to an adviser who can help you manage the steps to success.

Arbinder Chatwal, partner at BDO in Southampton, looks at where Central South companies can find international expansion.

BDO’s most recent Economic Engine research revealed a third of companies will look to scale-up through organic international growth and 55% of Central South businesses are attracted by opportunities in emerging markets, which is higher than any other UK region.

Michael Colebourn, CFO at success story Mar-Key Group, shares how the business has achieved growth. As the demand for modular, aluminium buildings continues to increase, so does the appetite for a British-made quality solution. We are the only UK structure manufacturer and have experienced significant growth in recent years.

We’ve developed a bigger, more durable product range in addition to our event product that historically provided structures for our prestigious event clients. Our new range is suitable for long-term use for warehousing, distribution centres, education facilities and allowed us to diversify.

We’ve continued improving our product range, relocated to a much larger manufacturing facility and secured private equity investment from Alcuin Capital Partners to enable us to continue our growth trajectory. We’ve started to export and have secured our second Australian project, having delivered the first last year.

Our growth couldn’t have happened

While the reason for why the Central South bucks this trend isn’t entirely clear, there is a palpable ambition in the region to do business with the rest of the world. Historically, UK businesses have looked towards the US for growth and indeed we’ve seen some significant US private equity investment into businesses in the Central South.

The US is always going to be a consideration because of the scale of opportunity, the common language and cultural relativity. However, it’s a difficult market to crack. Success balances on a business’ ability to be able to invest in an on-the-ground presence to meet suppliers, customers and show a commitment to the US market.

It’s interesting to see that more than half of businesses are attracted by opportunities in emerging markets which can often feel further outside of a company’s comfort zone. However, the agenda is being forced. Tariffs associated with doing business in the EU Zone and the additional red tape cost have made European expansion less attractive.

There is a limitation to UK growth and global supply chains are moving to the

likes of India and Indonesia, driven by the scale of opportunity as opposed to cost savings. India has a growing economy with political stability, and more than half of India’s population will soon be middle class. We’re also moving closer to an IndiaUK Free Trade Agreement.

The Central South is well-placed with support from globally networked banks, advisers, and strong universities that have wider initiatives to forge global links. The University of Southampton’s India Centre for Inclusive Growth and Sustainable Development unlocks opportunities for policy change and sustainable development in India, the UK and globally. All of this helps to facilitate international trade from our region.

Businesses looking overseas for growth know they can’t stand still but an investment of working capital must be well-considered. We don’t know what the medium term looks like and there’s plenty of support available from the DIT and advisers to help with insight and research to pinpoint where the greatest opportunity is, so businesses can feel well-equipped to invest and go for growth.

without our team. Our CEO calls it a ‘wintogether, lose-together’ mentality. Our staff retention is down to the culture we’ve maintained during growth. We encourage internal promotions, with many members of our senior leadership and board having started in junior roles.