POWERHOUSES

I am fortunate enough to chair some of the many roundtable discussions that The Business Magazine organises each year and every one offers up fascinating insights.

It is an excellent litmus test for the south east economy as we gain an understanding of how business leaders think, how confident they are of their prospects now, and what they think the future holds.

Over the past six months we have held two roundtables on Employee Ownership, in partnership with Fieldfisher and Shawbrook Bank, which are covered in this magazine alongside a guide on the intricacies of leaving your employees in charge once you exit the business.

There was, from the many founders that attended, a real emotional attachment to the businesses they had built up and a desire to protect their employees and keep their business in its current location.

We also held another round table in partnership with Herrington Carmichael which focused on hospitality. It demonstrated how robust and up for a fight this industry is as stories

of pandemic business survival were recounted.

The sector isn’t out of the woods yet as labour shortages and rising costs continue to bite, however the resounding message from the discussion was that the industry must adapt if it is to survive.

In this issue we also speak to John Phillipou of Paragon Bank about the early lessons learned in his banking career, including noticing the small details and building up a big picture, which continue to serve him well to this day.

We also speak to Dominique Tillen of Brush-Baby about her child friendly toothbrushes that are now sold around the world.

The Business Magazine Property Podcast launched earlier this year and is aimed at people working with the industry.

It can be found on all readily available podcast channels and covers topics from sustainability to auctions.

Please do give it a listen and let us know what you like, dislike or want to see more of.

Stephen Emerson Managing Editor stephen.emerson@thebusinessmagazine.co.uk

The power of TV was evident for an independent fishcake business producing sustainable British fish products.

Hayley Elston’s business, The Fabulous Catch Company, based in the New Forest, landed a contract with supermarket Aldi after it picked her award-winning Crabulous Crabcakes to stock as a “specialbuy” in stores nationwide.

Aldi selected Hayley’s zero waste crabcakes as part of the Channel 4 series Aldi’s Next Big Thing, now in its second season. Hayley was one of hundreds of applicants competing to stock Aldi stores nationwide.

Each episode sees hopeful suppliers compete for shelf space before Julie Ashfield, Managing Director of Buying at Aldi UK, decides on a winner which will appear as a Specialbuy in more than 1,000 stores.

The Fabulous Catch Company’s Crabulous Crabcakes beat five other hopefuls, including a gourmet mac and cheese by Stormzy’s private chef.

Hayley’s fishcakes use brown crab meat, and she adds leeks, chilli, fresh parsley and lemon juice.

Julie loved the taste, but as a four-pack weighing less than Aldi’s twin variety (and at double the price of its gastro version), Hayley was told she needed to scale up her product, not lose consistency and deliver in volume to win the order.

Hayley finally secured an order to supply Aldi with 50,000, which the judges said tasted even better than the first batch.

Hayley saw a business opportunity in 2012. She wanted to help fishermen on the Isle of Wight sell their brown crab waste. Brown crab meat is found in the body of the crab and with a pate-like

texture, is often treated as a by-product, with the white meat favoured for its texture. She set up her fish company, using this surplus element to give her fishcakes their fabulous flavour.

Hayley’s New Forest fish factory has 12 employees, and supplies local farmer’s markets, farm shops – and now Aldi.

Hayley said: “What started out as helping a group of fishermen deal with their crab waste has led to our products landing in stores across the country – I am utterly delighted to have won.”

Aldi’s Julie Ashfield added: “Not only did Hayley impress with her crabcakes, which are absolutely delicious, but also with her commitment to reducing food waste.

“I was impressed at how she took on our feedback, whilst keeping the nuance of what they were to start with. We’ve ended up with a great product, that our shoppers will love.”

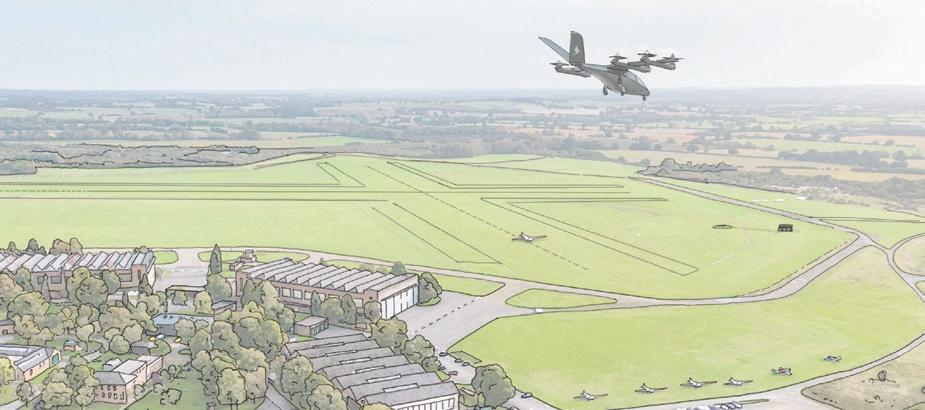

The skies above Oxfordshire could look rather different later this year.

Skyports, which is developing vertiport infrastructure for the advanced air mobility (AAM) industry, is to develop the UK’s first vertiport testbed at Bicester Motion, the 444-acre estate dedicated to celebrating historic aviation, automotive achievements and pioneering new mobility technology.

The new vertiport, which will include a compact 160 sq m passenger terminal, will provide a testing ground infrastructure and flight operations, and plans to play a significant role in enabling the next generation of electric, low noise aviation in the UK.

The vertiport will sit next to Bicester Motion’s existing general aviation grass runways.

Backed by Innovate UK’s Future Flight Challenge, the vertiport will be a key site for early vertiport network planning and demonstrations, as well as for the consortium’s wider testing programme alongside public and stakeholder engagement.

Bristol-based Vertical Aerospace, the company developing one of the world’s most advanced electric aircraft, will conduct demonstration flights and test key procedures at Bicester ahead of its commercial launch.

Skyports will aim to open the doors to the vertiport by the end of the year.

The vertiport design, which has been submitted to Cherwell District Council, has drawn inspiration from Skyports’ existing testbeds in Paris and California.

The location of Skyports’ Bicester Motion vertiport, which is less than two hours’ drive from central London, and close to Oxford and the Cotswolds, will demonstrate how air taxi services could provide a vital link between urban centres, regional, tourism and retail hubs.

Final preparations are being made at a new multi-million pound football arena at Landsec’s Bluewater Shopping Centre in Kent.

Covering 30,000 sq ft and with capacity for up to 500 people, the Ballerz all-weather dome features a 5G pitch, stadium-style seating, players’ tunnel and changing rooms, along with realtime pitch technology to provide action replays on the sidelines.

Ballerz is a new immersive and innovative football entertainment concept. And it’s got the support of some A list players including Mark Noble, Bobby Zamora, Roberto Carlos and Rio Ferdinand.

Rio said: “Ballerz brings the thrill of the game to life. It’s designed to provide entertainment in a competitive space and to inspire the next football generation to have fun, get active and enjoy developing their skills.”

Nick Weir, co-founder of Ballerz and managing partner of leisure property consultants Shelley Sandzer, is hoping to build “the UK’s most immersive competitive socialising space”.

He said: “We’ve brought together a passion for the game and teamed it with a premier all-day entertainment venue and the latest technology to create a new concept for both kids and adults”, he said.

“There’s been a significant move towards competitive socialising in the hospitality industry – yet there remains a gap in the market when it comes to football.

“The trend is expected to grow further over the next five years, and we have plans to expand the Ballerz brand to other areas of the UK and internationally.”

Nick is joined on the operational team by Matt Hobbs, former managing director at the Groucho Club; Sam Hubert, onetime development coach at Chelsea FC and Ben Childs, formerly of Puttshack.

Launching this month, Ballerz expects to attract 250,000 visitors in its first year and has already created 50 new jobs for catering, coaching, tech and events staff.

The south east’s film industry has seen a surge of investment over the last few years, which has triggered a studio construction boom.

And with more studios, goes more opportunities for young people wanting to train to work in the industry.

Seizing the initiative, Basingstoke College of Technology is investing £500,000 in a new production suite.

The new facility will feature technology used by directors such as James Cameron and Jon Favreau.

This includes motion tracked cameras, an advanced greenscreen and lighting set up, high-spec video editing, colour grading hardware and software, and real time rendering equipment allowing filmmakers to see digital environments live on set.

It will open in September for the first cohort of students taking the college’s new media, broadcast and production T-Level and advanced games development HND course.

But students taking any course in the Creative Industries Department will have access to the studio.

Peter Gordon, Course Director for Games, Media and Art & Design, said:

“All our creative industries students will have access to some of the highest specification equipment being used in the industry today for example the Red

Komodo 6k camera that was used on Transformers: Rise of the Beasts.

“We have also consulted with leading companies such as Mo-Sys Engineering and Epic Games to ensure the equipment chosen for the new facility is the best.

“Our students will have real hands-on experience of working as a production team, which is exactly what employers want and need.

“This project has been years in the making, so we are all very excited to see construction work starting in the studio space, and we cannot wait for it to open for the next academic year.”

Berkshire IT distributor Westcoast has acquired rival firm Spire Technology.

Headquartered in Verwood, Dorset, Spire has supplied laptops, tablets, computers, PC components and peripherals to the IT industry for more than 30 years.

Alex Tatham, executive director of Westcoast, said: “There are so many benefits to the combination of Spire and Westcoast for companies, vendors, UK resellers and employees.

“It will add significantly to Westcoast’s components portfolio. Spire will become the group’s main components

pillar with full access to all the customers, finance and tools that make Westcoast such a strong distributor in the UK and Europe.

“Both businesses emphasise their agility and flexibility when it comes to speed of decision making and performance as well as a strong customer intimacy.

“This cultural fit will help realise immediate mutual opportunities.”

Spire CEO John Appleton added: “Westcoast can only help grow our business. In return, we can bring a range of accretive components

vendors to Westcoast’s significant and diverse customer base.

“We’re delighted that we can form part of Britain’s largest privately owned technology group and can use its considerable resources to accelerate our growth.”

Westcoast was founded in 1983 by entrepreneur Joe Hemani to distribute global IT brands to resellers, retailers and other organisations across the UK and Europe. It provides creative credit, marketing and logistics services to more than 5,000 customers. It’s also Britain’s biggest IT distributor, and employs more than 1,000 people.

With local enterprise partnerships now a fond memory, our regions should look at the bigger pictureBy Nicky Godding, Editor

Over the years the government has struggled to understand what individual regions need to grow their economy. And that’s not surprising if the regions don’t even know themselves.

But policy-makers have long acknowledged that co-ordinated regional development is essential to grow the UK economy.

In 1998, the (Labour-led) government established Regional Development Agencies (RDAs) to drive economic regeneration through regional investment

in infrastructure, people, business and skills.

Even though “levelling up” was introduced much later (a phrase coined in the 2019 Conservative manifesto), this was a primary objective of the RDAs. The trouble was it was driven from the top down by government, rather than locally.

But some of the RDA regions were so big and unwieldy that one end often had completely different priorities from the other (Buckinghamshire and Kent were both in the South East RDA, but they’re

miles away from each other on different sides of the capital).

Over 12 years, RDAs did achieve some notable successes in local regeneration projects, but increasingly attracted criticism for being unelected quangos. In 2010, the government announced that they would be abolished, citing the need for government to cut costs.

But growing regional economies is a longterm endeavour, what could fill the void?

Enter Local Enterprise Partnerships (LEPs), also established by the government. While their objectives were largely the same, LEPs differed from RDAs in that they were supposed to be private sector led and there were more of them (38 rather than nine), representing smaller regions.

LEPs engaged with local businesspeople to ensure their views were considered when planning local economic growth strategies. Each LEP set up sector working groups which included local people and businesses.

For the longer-term strategic work that was being done by LEPs, there’s a new plan – pan-regional partnerships.... These subnational bodies want to become regional powerhouses to drive economic growth

The LEPs also set up Growth Hubs – a network of physical business support centres which had funding to support ambitious start-ups, scale-ups and entrepreneurs. These (sort of) replaced the government’s Business Link network, established in 1992 and abolished in 2012.

Local Enterprise Partnerships also secured millions of pounds in government funding for major strategic and infrastructure projects such as colleges, roads and technology hubs.

And the more successful ones rallied the business community around their causes. They, too, have now met the same fate as the erstwhile regional development agencies.

What comes next, from government anyway, is patchier. In some areas, much of the day-to-day work local enterprise partnerships were doing has been integrated into local councils, while other local enterprise partnerships will continue (for now), having won local support.

But we’ve not mentioned other UK-wide business organisations such as the CBI (currently sorting out its own problems) and Chambers of Commerce.

Should these private sector-led organisations be supporting the businesses they represent to government in the national conversation for economic growth and investment?

The British Chambers of Commerce would argue that it already does, but each local chamber is autonomous, so it’s more difficult for the national chamber to fairly represent each region.

Some regions, such as the Thames Valley Chamber of Commerce, has a strong chamber supported by thousands of members and can confidently say that it truly represents its members and engages regularly with local MPs and the government.

Others, such as Kent’s Invicta Chamber of Commerce, are determined to represent their members, but with fewer than half than those in the Thames Valley, will have less clout. Kent was previously part of the South East Local Enterprise Partnership, which covered East Sussex, Essex, Kent, Medway, Southend and Thurrock.

So for the longer-term strategic work that was being done by LEPs, there’s a new plan – pan-regional partnerships.

These are subnational bodies and there are two sorts – economic partnerships and transport partnerships (which support each other).

The most established economic partnerships are the Northern Powerhouse and the Midlands Engine. Others are emerging such as the Western Gateway (which is unique in that it straddles two countries, stretching from Wiltshire in the East across to Bristol, Cardiff and right across to Pembrokeshire in the west) and the Oxford Cambridge Partnership.

These subnational bodies want to become regional powerhouses to drive economic growth from the ground up.

The more established ones – such as the Midlands Engine which has been in existence since 2017, are doing a good job, drawing together all partners (businesses, local authorities, colleges, universities and other organisations), and looking at its region’s particular strengths before identifying where investment has to occur to drive a long-term growth strategy.

Roger Mendonca, Chief Executive of the Midlands Engine, said: “The Midlands Engine is a partnership built up from the region, rather than top down from government, and that makes a difference. Our local authorities are good to work with, as are all our partners.

“From time to time there will inevitably be issues between areas within the Midlands Engine, but because we focus on working to achieve something beyond what they’re doing individually, they largely see the partnership as a force for good.”

After a slow start the Western Gateway now has a clear set of objectives, but Oxford Cambridge Partnership is still in development. Elsewhere, particularly across the south east, there is still discussion and debate within the business and local government community as to what support they need – or indeed what their region is. Should the Thames Valley be a pan-regional partnership? If so where does it begin and end? What about Kent and the South Coast? Should they be the same region?

It’s all a bit ad hoc, and this could come back to bite the government in a few years.

Another issue for pan-regional partnerships is that they don’t have much money. The existing Midlands Engine, Oxford Cambridge Partnerships and Western Gateway’s government funding runs out next year.

It is likely, given the pending election, that funding will roll forward another year while a new government decides how it is going to deliver vital regional support. But that’s not certain.

Talking to the key players for this feature it’s likely that, whatever the government decides, the regions know that they can’t rely on central funding, especially when national coffers are so empty, and they must drive growth themselves.

Local business ecosystems will have to step up. Regional powerhouses are the future, and those areas which haven’t yet embraced the concept risk being left behind.

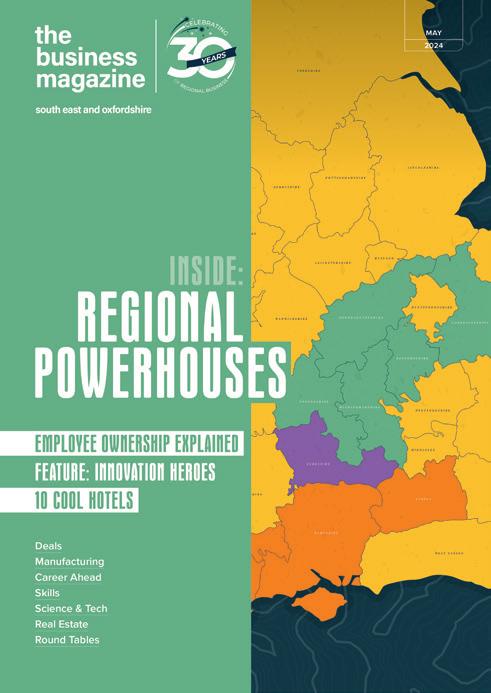

A tight cluster of five counties sitting snugly in between London and the West Midlands is planning global domination.

OK – that’s a journalistic overstatement, but the geographical area covering Oxfordshire, Buckinghamshire, Northamptonshire, Bedfordshire and Cambridgeshire has long been recognised by government as a globally significant area of the country and a net contributor to UK GDP – so why not invest and capitalise on it for the benefit of the nation?

While on the face of it, they might not seem a logical grouping, take a look at a map of the UK and it becomes clear why they should work together as a regional powerhouse.

With two world-leading universities buffering both ends (and a multi-billion pound investment in an east-west rail link currently being constructed to link the areas between them), a population of around 3.9 million people (the size of a small country) and a commitment by the region’s political and industry leaders to make the most of the region’s substantial science, technology

and business expertise, great things could happen for UK PLC thanks to the Oxfordshire to Cambridge Pan-Regional Partnership.

This isn’t the first time the region has tried to work together. Its previous reincarnation was the Oxford-Cambridge Arc, drawn up by government in 2017 but abandoned by the Johnson administration to apparently prioritise levelling-up spend in the North of England. There was also some dispute across the Arc as to the location of a potential one million new homes and the route of a new link road envisaged for the region.

via rail

But that’s all in the past. In January last year, the government confirmed its support for an Oxford to Cambridge Pan-Regional Partnership after new proposals were submitted by leaders from local councils alongside the universities and the area’s transport body.

While plans for a new trunk road, the Oxford to Cambridge expressway proposed in the Arc’s plans were abandoned, the east-west rail link has backing from every quarter and is making progress. In March, the East West Rail Company connected Oxford and Bletchley for the first time in 50 years, and the Spring budget brought promises of more government investment to accelerate the Oxford to Bedford service.

The new Partnership will champion the region as a world leader in science, technology and innovation, and work with investors, real estate, developers, government and local authorities to secure investment for high quality sustainable development for the region.

Managing Director of the new Partnership is Richard Hutchins. He has excellent credentials for the role, which include being a former Chief Operating Officer at the West Midlands Growth Company, Deputy Chief Executive for Advantage West Midlands and a director of Jaguar Land Rover Programmes at the University of Warwick.

“To get this right we must ensure that

“Making a success of the OxfordCambridge Pan-Regional Partnerships is a coalition for the willing”

we have the right identity to present our region’s investment and distinctive business offer to the world,” he says.

“It took years for the Northern Powerhouse and Midlands Engine to be acknowledged as regions. We must create a vision and narrative for the region which business, universities and democratic leadership all buy into.”

And while it’s easy to point to Oxford and Cambridge, two of the world’s most prestigious universities as being at the heart of the project, there is great diversity in the region’s universities, including The Open University in Milton Keynes (which has more students than any other UK university), Cranfield – a world leader in management training and research and a new University Campus in Peterborough.

Luckily, there is an overarching organisation which brings all these universities together. The Oxford-Cambridge Arc Universities

Group is backing the regional collaboration alongside the region’s local and county councils and Mayoral Combined Authority

Alistair Lomax is the Arc Universities Group’s director. He said: “The Arc Universities Group has been working on bringing the region’s research and expertise together for years, along with England’s Economic Heartland, the sub-national transport body advising government on the region stretching from Swindon to Cambridgeshire, the Oxford-Cambridge Supercluster Board and East West Rail.

The Supercluster is private sector-led and dedicated to harnessing the immense potential of the Oxford-Cambridge region to become a science superpower. It facilitates access to international finance and global investors, helped by its immense networks and expertise.

“Making a success of the Oxford-Cambridge Pan-Regional Partnership is a coalition for the willing,” Alistair continued. “We have a disparate region which is currently disconnected within it, but well connected into London. However, with the new rail transport plans, this is changing.”

Alistair added: “We have all welcomed the Pan Regional Partnership. Collaboration is in the DNA of universities and we are working well with the team who can draw on years of work that we have all already put into building a cohesive region.”

“The government doesn’t have to do much, but I would ask for all the country’s six panregional partnerships to receive funding for five to 10 years, separating them from the electoral cycle so that businesses and institutions can build a sense of stability.”

Richard’s team at the Oxford and Cambridge Pan-Regional Partnership is pursuing two main priorities. The first is to develop a strategy and identity to make the most of the region’s strong economy and innovation. The second is to look at enhancing and connecting the region’s extensive natural capital.

“Those who don’t know the region well might not be aware that it’s incredibly rural, and largely defined by farming and woodland, but also has quite low levels of biodiversity,” said Richard.

“We need to improve the biodiversity of the region for the environment and the people who live here. We are a major producer of food for the nation and that needs to be appreciated too.

“In fact, the only government agency that recognises this region and maps resources directly on to it is the Environment Agency.

“One of the things that we’re short of as a region is joined up data and intelligence so we’re building a data observatory which will corral all existing data across the region into one place.

“This will help us develop programmes, alongside promoting the region, so we can talk about it in a coherent way.”

All that takes time, but it’s important to get the basics right to give regional projects the greatest chance of success.

Richard said: “Businesses and investors look for a great place to live for them and their employees, good transport connectivity, highly skilled people and premises with the right services, such as lab space.

“We’ve got all of that except the connectivity, and we are investing in that.”

The Partnership is also looking at key infrastructure issues such as water and energy supply, working alongside local authorities and other bodies such as Water Resources East

“Working collaboratively among local authorities is very important,” said Richard. “We don’t have a direct role in planning or housing, that’s local authority territory, but where there are cross cutting issues like bringing investment into the region, or challenges around infrastructure, or being a voice into government and selling the region to the world, that’s our added value and what we will focus on.

“Very soon we will have a name and narrative for the region that will be recognised nationally and internationally. People will understand what the Oxford to Cambridge region has to offer and will want to invest even more here in our world leading clusters.”

What do Hampshire, Surrey and Dorset have in common? It’s not a trick question. There are a growing number of stakeholders in these counties who are considering the possible answers themselves.

Business leaders, organisations and local authorities are trying to work out how a pan-regional partnership, as seen in other parts of the country, could bring these counties together, alongside the major cites of Southampton and Portsmouth and towns including Bournemouth, Christchurch, Poole and Chichester (just over the border in West Sussex) to help power the regional economy and attract more inward investment.

Peter Taylor is Senior Partner at South Coast law firm Paris Smith, and also President of Hampshire Chamber of Commerce. He can certainly see the benefits of such an approach.

“Hampshire has a centuries old geographical boundary, but people move across counties to live and work. There is a growing sense of unanimity among business leaders in Dorset, Hampshire and Surrey –an area which has been commonly defined as the Central South.”

For some, Central South is already a recognised region, though it has a way to go before it’s formally established in the same way as the Midlands Engine and the OxfordCambridge Pan-Regional partnership.

Stuart Baker is executive director of The Solent Cluster, managing director at Maritime UK Solent and executive director of Solent Partners. He said: “Historically, policy makers have carved the south simplistically between the south east and south west. This has resulted in the central south of England, anchored around the major cities of Southampton and Portsmouth being peripheral and overlooked. Yet the area - particularly the coastal strip - is of

Portsmouth is the home of the Royal Navy, and has global companies such as BAE Systems, Lockheed Martin and Airbus based there. The region also has six universities, two national parks and the acknowledged technology triangle of Portsmouth, Southampton and Surrey, which includes worldleading AI research and space technology

strategic importance to the UK, with major infrastructure assets critical to supply chains and economic performance. These include the ExxonMobil refinery at Fawley, and the Ports of Southampton and Portsmouth, as well as university excellence.”

Peter added: “Portsmouth is the home of the Royal Navy, and has global companies such as BAE Systems, Lockheed Martin and Airbus. The region also has six universities, two national parks and the acknowledged technology triangle of Portsmouth, Southampton and Surrey including worldleading AI research and space technology.”

Alastair Welsh, director at AB Ports, is also in favour of working together. He added:

“Too often Hampshire has been overlooked for investment as part of a perceived affluent south east or has missed out as infrastructure development has focussed in London. We need to articulate the clear and compelling case for investment in Hampshire and if doing this as part of a wider Central South helps in this aim, I welcome it.”

Last year Associated British Ports, which owns Southampton Port, handled more than half a million vehicles through the port, 2.75

million passenger movements, more than 450 cruise calls, two million containers and 1.2 million tonnes of bulk.

Arbinder Chatwal, Partner at BDO points out what has been achieved even without a regional strategy, and what more could be achieved with one.

“In the last few years, we have had one of the UK’s largest listings on the US Stock Market, RD innovation at Southampton Science Park that has attracted investment from Microsoft and advanced manufacturing in Dorset that has secured investment from the largest of the Asian private equity houses.

“All this is despite no cohesive regional identity. Imagine the potential if we went to market as a regional powerhouse on the global stage? If we don’t put aside historic divisions and pull together to really

capitalise on what we have, I fear the Central South will never fulfil its potential.”

Julian Gray, Senior Partner and South East Market Leader at PwC, highlighted the diversity of the region.

“Each area boasts its own unique strengths such as thriving tech hubs, renowned universities, a concentration of young talent, coastal access and much more.

“By effectively identifying, leveraging and pooling these features and strengths, the region can attract investment, enhance productivity, and establish a stronger national presence. It is also crucial for businesses across the region to collaborate with policymakers, working towards a common goal of fostering key industries and inclusive growth. Through strategic partnerships and coordinated efforts, the south east can unlock its full potential and drive sustainable economic development.”

Business South, an independent organisation made up of businesses, public bodies and the education sector across the Central South region, is promoting the region on the world stage – most recently at MIPIM, the huge commercial real-estate fair in the South of France, which attracts around 23,000 delegates every March.

Business South covers a population of nearly 950,000 people and around 495,000 jobs, but the lack of a defined geographical area, straddling the south east and south west has blocked the collective promotion of the region.

In Southampton, a Renaissance Board launched last year by the local council and private sector is aiming to shape the city’s future. But if everyone joined together across the three counties, the population would be almost three million, and there’s strength in numbers.

Freeport status awarded by government to rhe Solent Freeport last year, is another strategic economic initiative which offers immense global opportunities. It aims to boost the UK’s international trade, attract significant investment, and promote employment in the Solent region, particularly in maritime, logistics and technology sectors.

By offering favourable trading conditions such as tax reliefs, simplified customs

procedures, and government support, the £2 billion freeport freeport could bring 16,000 jobs to the Solent.

Farnborough Airport, arguably in the Central South region, is not only home to one of the UK’s major airshows (which takes place this year from July 22-26), it has an international conference centre and is home to more than 70 tenants on the airfield, many in the aerospace and aviation sector.

It is currently undergoing a £55 million investment programme to expand its facilities and infrastructure.

Net zero, investment in skills, better transport systems and sustainable growth are ambitions across the county and local authority areas, but the realisation of these ambitions is more likely by working together rather than independently, says Peter.

“The key is to inspire collaboration through a regional shared sense of purpose and compelling strategic narrative with agreed goals,” said Peter.

Ian Girling is Chief Executive of Dorset Chamber. He added: “It is essential we look to establish pan regional partnerships that connect regions and within this, a strong business voice. Many businesses in the conurbation of Bournemouth, Christchurch and Poole will naturally look towards the Central South region and we are in early discussions with our fellow chambers on how we can support and facilitate this. It’s vital we embrace this opportunity to help realise the full economic potential of the Central South region. Dorset Chamber is fully supportive.”

Leigh-Sara Timberlake, Group CEO, Business South said: “The Central South resonates with investors – we are the UK’s global gateway with our three international ports, three international airports and growing cruise industry.

“We truly advocate working collaboratively to promote our region for trade, investment and careers. We are clearly a region of opportunity for all – our lifestyle offer is second to none. We all need to work together to promote the benefits.”

“Everyone wants this region to thrive,” said Peter. “And that will only happen if we work together.”

Paul Britton has been Chief Executive of Thames Valley Chamber for eight years, and before that he led on inward investment into the region.

Over the years he’s seen various regional government support organisations come and go.

So would the Thames Valley benefit from having a pan-regional partnership, such as in other areas of the country?

“What could it do that we aren’t already doing?” he asks.

“The Chamber isn’t a government creation. We are independent and can praise or challenge when our members think that things need to change for their businesses to thrive and grow.”

It certainly has the authority. The Thames Valley Chamber (which covers Berkshire, Buckinghamshire, Oxfordshire and Swindon) has more than 3,000 members and international trade customers. They include major global companies which have set up

their UK or European headquarters in the region, to SMEs which are the backbone of the UK economy.

“Our members like working as a collective,” says Paul.

“We look at the risk register for the region and the business community,” said Paul. “We ask members what they see as the greatest threats to their businesses – internal and external – and that sets the scene for how we can help.”

What are the Thames Valley’s biggest challenges? “Creating stability so companies of all sizes have the confidence to plan and invest for the longer term,” said Paul.

“Also attracting and retaining talent in key sectors where the Thames Valley is particularly strong – such as life sciences and healthcare, technology and software development.”

Paul cites the Thames Valley Chamber’s Local Skills Improvement Plan (LSIP), published last year, as an example of close collaborative working with businesses irrespective of whether they are members. The plan will contribute directly to local curriculum and workforce development planning.

The LSIP came about after chambers across the country were invited by the Department for Education to produce local skills improvement plans.

Another skills plan? Haven’t they been written many times before? Yes, but the difference this time is that it puts employers at the centre of future skills planning, rather than universities and colleges of higher education.

“The report will form part of a wider transformation in skills and training provision,” said Paul.

“The most exciting part of the work we did on the plan was the new connections we developed with the local business

community and local education providers. The chamber facilitated these new connections and found a common language to support the development of new, modular courses and curriculum to suit employers.”

Thames Valley Chamber doesn’t often take on such projects on behalf of the government, because the terms of reference are often tight.

“With the local skills improvement plan research, we made sure that everything we heard from participating members was logged. The information the government required was integrated into the plan, but we kept all the other frustrations and issues highlighted by our members around skills policy to help in our wider lobbying to government.

“Businesses recognise skills can’t just be a problem for the state, we need to play our part. Depending on which region you are in, there will be different skills gaps and issues. That’s where we, as a chamber, can offer real value if we help keep the energy and engagement of SMEs into the system.”

“Facilitating growth and investment is another priority area,” said Paul. “Promoting the region on the world stage is very important, because it raises overall confidence in the region.”

The Thames Valley is one of 53 chambers across the UK affiliated to the British Chambers of Commerce. Each one is independent and they vary in size and strength. It is fair to say that The Thames Valley Chamber is probably one of the strongest and most vocal on behalf of its members.

“We are the voice of our members, and we are also the voice of the local economy,” said Paul.

As the region hasn’t got a governmentbacked pan-regional partnership, or one in the planning, the Thames Valley Chamber is filling the vacuum.

“We continually engage with policy makers, particularly highlighting the value of our SMEs, and local exporters, and emphasising

that the issues they face should be given greater consideration as they are a fundamental part of the region’s supply chain,” added Paul.

“Our members are also encouraging us to look at more strategic issues for the region.

“We have all got a key part to play in creating a regional economy where companies and industry sectors can thrive and grow. This is a key reason for them moving or expanding here and becoming part of the chamber. They are willing get around the table, identify the issues, pick up on the actions and deliver on them.”

That’s the thing about local chambers of commerce. They have a direct relationship with their members who expect them to achieve successful outcomes.

But the Thames Valley Chamber doesn’t operate in a vacuum. “We discuss common challenges with chambers across the country, such as in Birmingham and Liverpool,” said Paul. “We are also working more closely with our region’s universities. These are anchor institutions and the closer we can work with them, the better.”

“Together with local civic leaders we can identify key issues and make the case for transformational projects and investment in transport (such as the proposed Western Rail link) and infrastructure across the region. To be successful we need the business community on board to fund and help co-develop them.”

The proposed Western Rail link is a major project which would reduce rail journey times between Reading and Heathrow by delivering a faste and more frequent direct train service.

This collaborative working has grown over the last few years, according to Paul. “We are here to listen to our members and lead on their priority issues. And most of those aren’t dissimilar to the priorities that the government has set out, but getting real world on-the-ground solutions is another matter.”

While the Thames Valley isn’t a pan-regional partnership, it is increasingly playing the role of one, but with the added benefit of the direct support of its members.

“We get out and about a lot. We know what the issues are,” said Paul.

“One of the things I’m most proud of during my tenure is that we have made enormous strides in terms of welcoming, influencing and challenging our MPs. We offer wellinformed comment and they recognise that. They know that when they hear from us it’s unfiltered and apolitical.

“The Thames Valley has got fundamental challenges to tackle that 10 years ago would have been dealt with by the civic purse.

“This year there will be a new government. Whatever colour it is we will work with it, alongside listening to the concerns of our members and the wider business community. This gives us the knowledge to have a constructive conversation and deliver on some of the required solutions.”

Two leading law firms with offices in Romsey are thrilled to announce their merger, reinforcing both firms’ presence in the legal landscape across the South. On 1st May 2024, Parker Bullen LLP, a highly respected legal practice who have made a real mark in Romsey since opening in 2021, merged with Kirklands Solicitors LLP, a well-established firm boasting an impeccable reputation with over 40 years in Romsey and Totton.

While Parker Bullen LLP have been a well-recognised organisation across Hampshire and Wiltshire for many decades, the firm quickly gained recognition for their exceptional legal services and commitment to client satisfaction following the opening of its Romsey office three years ago. Following a rapid expansion with an additional office in Witney launching just 18 months later, the firm has established itself as a trusted advisor for individuals, families, and businesses alike.

Since the launch of its Romsey office, the firm has been incredibly active in the local community, attending and sponsoring many initiatives including the Romsey Relay Marathon and the Romsey Mayor’s Picnic. With an enthusiasm to engage with and support the businesses, not only in the town

centre but the surrounding districts, the firm has been a proactive force in the Romsey & District Chamber of Commerce & Industry events and membership and is a proud sponsor of this year’s Test Valley Business Awards, specifically the Small Business of the Year Award.

The firm’s dedication also reaches their employees. In recent years, the firm has re-launched their extensive Employee Benefits, introduced a Charity of the Year initiative which is chosen by the employees, expanded the agile working policy, grown the Marketing and Human Resources functions, launched a new career progression platform to support employees through the firm, as well as hosting regular social events and activities to encourage engagement across the offices.

This merger brings together the collective expertise, experience and resources of two esteemed firms, creating a synergy that will benefit clients and the community ...

Kirklands Solicitors LLP boasts over four decades of experience in Romsey and Totton, earning a sterling reputation for its integrity, professionalism and dedication to delivering optimal outcomes for its clients. The merger with Parker Bullen marks a new chapter in Kirklands' storied history; one that promises to enhance the joint firm's capabilities and reach. During its time in the area, the Kirklands team has developed an enviable reputation for being friendly, approachable and professional, as well as working closely with the community in Romsey; all qualities similar to those of Parker Bullen.

This merger brings together the collective expertise, experience and resources of two esteemed firms, creating a synergy that will benefit clients and the community at large due to their commitment to excellence and client-focused values.

The current Kirklands offices at Strong House in Romsey and on Commercial Road in Totton will be known as Parker Bullen Incorporating Kirklands from 1st May 2024, with Parker Bullen retaining its current office on The Hundred in Romsey, in addition to its premises in Andover, Salisbury and Witney.

Gareth Horner, Managing Partner at Parker Bullen LLP, spoke of the merger: “As a firm we have grown significantly over the last few years; expanding from two offices at the beginning of 2021 to a firm of six offices and over 100 employees from May of this year. Our history and the reputation we built up in Andover and Salisbury served us well when opening our Romsey office in 2021 and our Witney office in 2022, and this merger with Kirklands will allow us a new exciting avenue into Totton and the wider New Forest area. Having met the Kirklands team on many occasions, we are convinced that their values align keenly with ours in relation to looking after our clients and colleagues to deliver the best legal services we can.”

Peter Slade, Managing Partner for Kirklands Solicitors LLP, commented: “We are excited to embark on this journey with Parker Bullen LLP and unite our strengths to deliver unparalleled legal advice to our clients. This merger represents a significant milestone for both firms, and we are confident that together we will continue to set new benchmarks in the legal industry. When making this important decision about which firm to collaborate with for the future of Kirklands, I was impressed with the culture of Parker Bullen and feel they align with our own ethos of unity as well as their support for one another, their clients and their surrounding communities.”

Parker Bullen Incorporating Kirklands will carry on offering legal services to individuals, families and businesses across the South with the current Partners and staff from Kirklands remaining to practise after the merger.

For commercial clients, the firm’s experienced lawyers understand the nuances of the legal environment as well as the intricacies of the corporate world. Their commitment to excellence combined with the proactivity required in such matters ensures that businesses receive the comprehensive legal support they deserve, while keeping their objectives at the centre of that advice. Whether you are a start-up business, an established company, or facing specific challenges, the Commercial departments can advise on a variety of legal queries concerning:

• Commercial Litigation

• Commercial Property

• Corporate & Commercial

• Employment Law.

For individuals and families facing potentially complex or emotionally charged

legal matters, the expert team can guide clients through every key stage of their life, offering personalised, compassionate and prompt assistance. Taking pride in their welcoming and open approach, the firm’s lawyers go above and beyond to ensure your unique needs are met in the following matters:

• Dispute Resolution

• Employment Law

• Family Law

• Moving Home

• Wills, Trusts and Estate Planning.

In addition to these areas, the firm boasts several consultants who specialise in Military Law, Criminal Law and Immigration Law.

Looking ahead, the leadership teams of both firms are committed to fostering a culture of teamwork, innovation, and continuous improvement. Through investment in technology, professional development, and client engagement initiatives, Parker Bullen Incorporating Kirklands aims to stay at the forefront of the legal industry and anticipate the evolving needs of their clients.

email info@parkerbullen.com or visit their website www.parkerbullen.com.

Ethical brand One Water used World Water Day in March to celebrate a £30 million fundraising milestone with its charity partner The One Foundation.

The Richmond-on-Thames brand and The One Foundation were founded by ethical entrepreneur Duncan Goose in 2004.

Since then the millions of pounds raised through the sales of bottled water, corporate partnerships and donations, has helped to change the lives of more than five million people around the globe.

“Having set out to change just one life, to have changed five million is an incredible milestone and would not have been possible had it not been for all our partners, customers and the wider public who’ve been buying One Water over the years,” said Duncan.

He launched the brand after experiencing Hurricane Mitch in Honduras in 1998 during a two-year round-the-world motorbike adventure.

Around the planet, there are still 703 million people who lack access to safe, clean drinking water, including 115 million who still collect untreated surface water from lakes, ponds, rivers and streams.

These people survive on as little as five litres for all their daily needs. The average person in the UK uses 152 litres of water per day.

One Water donates to The One Foundation on every sale made to fund its water programmes.

The Co-op have worked with The One Foundation for more than 15 years and donate three pence per litre from sales of Co-op branded water, which has significantly helped to reach the £30 million milestone.

The funds raised are invested across two key sectors in Rwanda, Ghana, Malawi and Kenya, where large scale urban water systems are being implemented and handpumps repaired in rural communities.

The One Foundation aims to fund selfsustaining water solutions, so everyone has access to clean, safe water.

Duncan added: The Co-op has particularly been such a significant part of our journey and given so much over the years, as well as Starbucks and World Duty Free and all the other partners who share our vision for a fairer world.

“My hope is that One Water is recognised for all it has done and becomes a truly global brand for change.”

One Water is currently available in Co-op stores, Holland & Barrett, NISA, Starbucks, Whole Foods Market, World Duty Free, other leading hospitality and convenience outlets and major wholesalers including Bidfood and Brakes.

Reading Football Club has confirmed that its owner, Dai Yongge, has committed to a letter of intent with a potential purchaser of the club.

The parties entered a period of exclusive negotiation to agree the final terms. The completion is expected to take up to two months, at which time the purchaser will be announced, expected at the end of May.

The transaction would include the transfer of Mr Dai’s shareholding in Reading Football Club, as well as the Select Car Leasing Stadium and Bearwood Park training ground.

The news offers a light at the end of what has been a long and protracted tunnel, with the club suffering 18 points deducted under the seven-year tenure of Dai Yongge for failure to pay staff and HMRC, with a further two points currently suspended.

Last year, Reading was relegated to League One, the third flight of English football, for the first time in 20 years, and the club was forced to part ways with a number of key staff.

Vacancy rates for office space in Berkshire and north Hampshire are at a 20-year high, despite there being a recent spate of big deals in the prime end of the market.

The data comes from CoStar, the commercial real estate data giant, which showed that the vacancy rate in the two south east areas stood at 12.8 per cent as of late March.

That is up from below eight per cent when the coronavirus pandemic struck and nearly 500 basis points above the national office average. CoStar said this was likely to rise further in the next couple of years amid continued subdued demand.

That said, Stanley Black & Decker committed in November to 30,000 sq ft at the Tempo building in Maidenhead, while earlier this year Johnson & Johnson leased 97,000 sq ft at the same building.

In December, global engineering company Wood leased 117,000 sq ft at Green Park, Reading, in what was the south east’s biggest office letting for two years.

But CoStar noted: “Rising momentum at the prime end comes as the overall

market struggles. Firms continue to release space on to the market or consolidate into smaller spaces amid the pivot to hybrid working and stagnant economic growth.

“A high-profile example saw Chinese telecoms giant Huawei exit its 140,000 sq ft office at Green Park for just 35,000 sq ft at nearby Thames Valley Park,” it added.

“High vacancy and interest rates have deterred investment and caused prices to fall.

“Last year was the weakest year for office investment in Berkshire and north Hampshire for 11 years and it remains quiet in 2024, with only a handful of transactions over £10 million since the beginning of 2023,” CoStar also noted.

As an example of the fall in prices, last December Aprirose bought the Pearce building in Maidenhead for £13.5 million, with the price reflecting a lofty 9.7 per cent yield.

But seller M&G Real Estate acquired the 51,000 sq ft building two years earlier for £26 million, a 6.9 per cent yield and nearly double the recent sale price, noted CoStar.

Jakes Indoor Playworld, which trades as Jakes Indoor Soft Play and Mini Farm, has been sold for an undisclosed sum.

The Sandhurst venue is now owned by Yarmouth-based Adventure Farms Limited – a new company founded by Bean Chapman and Tom HoneymanBrown, owners of Chobham Adventure Farm in Surrey and Tapnell Farm on the Isle of Wight.

Jakes has been family owned and operated for the last 14 years, during which time the vendors invested in the site to develop the successful business operating today.

The site comprises an activity centre with indoor soft play facilities and mini farm, as well as outdoor adventure park.

With the vendors now looking to retire, they sought a sale with legal representation from Cheltenhambased Hughes Paddison Solicitors. The buyers were represented by Cradley Heath firm George Green LLP.

Tepeo has opened a new facility in Wokingham which will allow it to triple manufacturing capacity of its ZEB, a direct replacement for fossil fuel burning boilers, drive research and development.

Lord Callanan, minister for energy efficiency and green finance, attended the official opening ceremony.

The facility is set to provide a new home for tepeo’s growing team, which has doubled in size over the past year, and will enable the firm to produce many more of its zero emission boilers (ZEBs).

There’s also space for research and development, where engineers will work on designing more advanced and

accessible ways to decarbonise the UK’s domestic heating as oil and gas boilers are phased out.

Johan du Plessis, founder and CEO of tepeo, said: “Our mission is to become leaders in low-carbon heating solutions.

“We need to increase our manufacturing capacity to build more of our smart heat batteries to achieve this.

“The expansion is not just a success story for the company, but a promising development for British manufacturing.

“Opening our new facility reflects the increasing demand for low-carbon home heating technology.

“It’s a tangible sign of what the future will hold for tepeo and how we think about home heating.”

Lord Callanan added: “The UK is a world leader in decarbonising, becoming the first major economy to halve its emissions between 1990 and 2022.

“Reducing carbon emissions from our homes is key to helping us push further and support families towards net zero.

“It gives me great pride to see British manufactured technology, like tepeo’s heat batteries, contributing to our mission and giving consumers a greater choice in switching from fossil fuels to cleaner, greener heating.”

Medical equipment manufacturer Occuity has been awarded a government-funded Small Business Research Initiative research contract to support development of a non-invasive screening device for Alzheimer’s disease.

The Amyloid Beta Plus (Aβ+) Reader will help to identify the presence in the brain of Aβ+ plaques, which have been targeted in recent therapeutic breakthroughs to slow the progression of Alzheimer’s.

More than 50 million people around the world currently live with dementia – a number expected to triple by 2050 according to the World Health Organisation – and Alzheimer’s is the leading cause.

“Alzheimer’s disease poses one of the most daunting health challenges of our era”, said Dr Dan Daly, CEO of Readingbased Occuity.

“Current diagnostic methods are inadequate, being either non-specific, expensive, or invasive, and there is no effective screening programme.

“Our work embodies our mission to revolutionise healthcare technology with accessible, non-invasive, optical solutions.

“This SBRI contract provides important funding that will enable us to move towards our goal of delivering a painless, rapid screening method which integrates seamlessly into routine eye exams, thus enabling earlier intervention.”

Occuity’s Aβ+ Reader will use patented technology to scan the eye’s lens for specific biomarkers indicative of Alzheimer’s disease, providing a swift and painless assessment tool.

Dr Alistair Bounds, senior research scientist and project lead at Occuity, said: “This is a very exciting project, combining state-of-the-art photonics technologies, advanced biomarkers, and Occuity’s deep expertise in optical and ophthalmic measurements to target the most prevalent form of dementia.

“It sits perfectly between Occuity’s existing diabetes screening work and our longer-term FLF project, bringing together highly skilled scientists and engineers from both of these projects.”

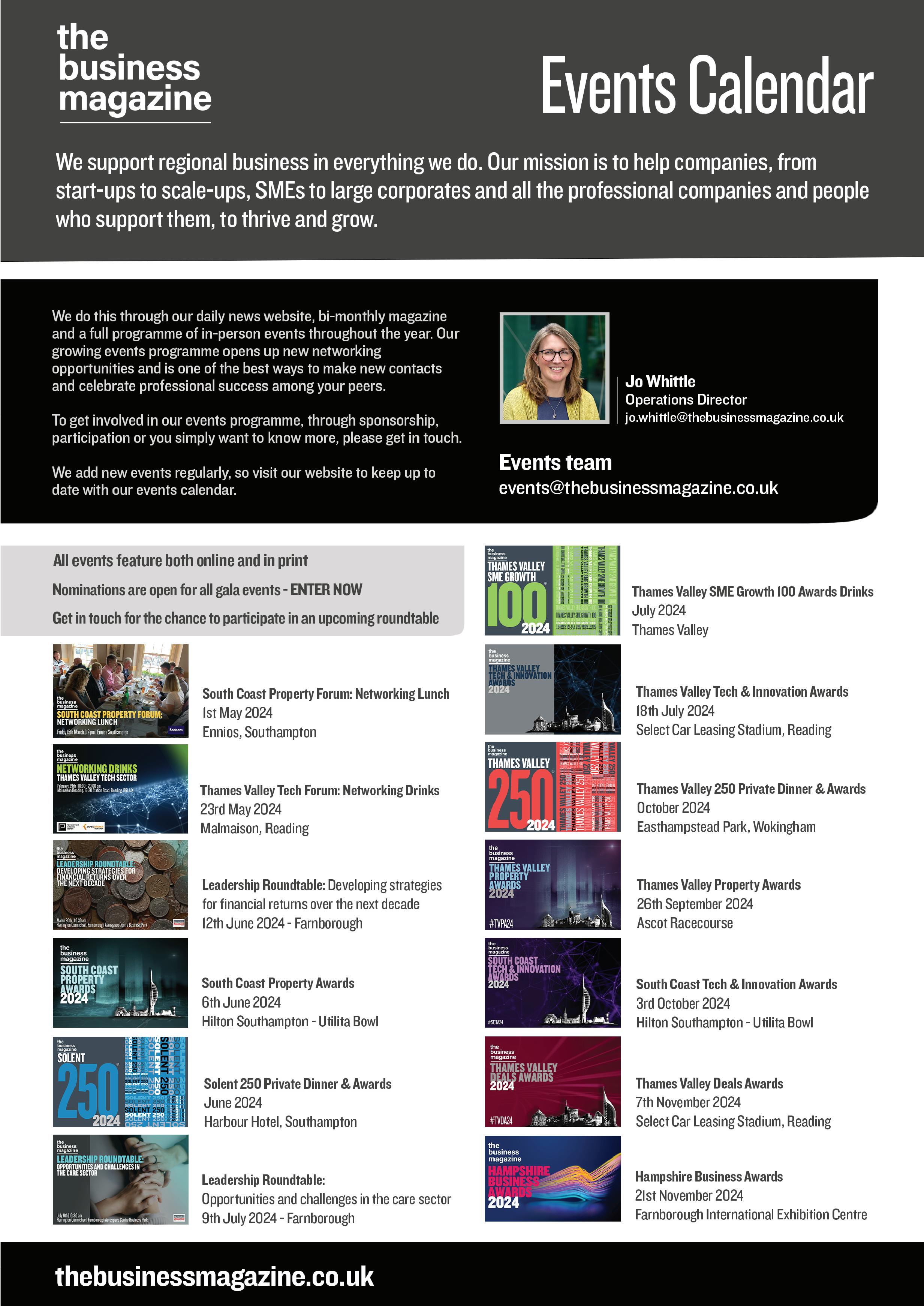

The Business Magazine marked the launch of the 2024 Solent 250 with a special drinks reception. The Ranking celebrates the top privately-owned companies in the Solent region.

Jo Whittle, Operations Director at The Business Magazine, welcomed invited guests and sponsors and thanked them for their engagement and support of the programme.

Held at Ordnance Survey, no 19 on the Solent 250, CEO Nick Bolton gave an insightful keynote on the company’s history and the challenges involved in leading a business so steeped in history into modern times. Effectively adopting new technologies and tailoring them to ensure Ordnance Survey’s continued relevance.

The Solent 250 is compiled by The Business Magazine and sponsored by HSBC UK, specialist recruiter CMA Recruitment Group, property experts Vail Williams, law firm BDB Pitmans, wealth, accountancy & advisory firm Evelyn Partners and the University of Southampton Business School

All companies on the Ranking are now invited to put themselves forward for one of six awards.

If your company is on the Ranking and you would like to selfnominate, or for more information please contact Jo Whittle. Jo.whittle@thebusinessmagazine.co.uk

The new Solent Rail Terminal has been officially opened by Minister for Rail and HS2, Huw Merriman.

The minister visited the Port of Southampton and met representatives from Associated British Ports (ABP) and Solent Stevedores, whose joint £17.5 million investment aims to cement the city as the UK’s leading gateway for deep-sea trade.

The 18-acre facility can handle laden and empty containers, plus storage, maintenance and repair, all within a singlesite boundary – a first for the port.

The larger site includes a new track layout to allow for simultaneous train arrival and departures, boosting the terminal’s efficiency and extending the rail loading pad by 130 metres.

Overall, it should be able to accommodate a 71 per cent increase in daily services and handle 125 per cent more containers.

Alastair Welch, regional director of ABP Southampton, said: “This project is a great example of expanding container handling, increasing rail use, reducing reliance on

HGVs and offering new services within the port boundary.

“We’re proud of our continued partnership with Solent Stevedores, supporting their journey to reduce carbon emissions within their operations and across the wider port.”

Stuart Cullen, executive chairman of Solent Stevedores, added: “The completion of this project marks a major shift for intermodal transport at the Port of Southampton.

“This is the latest project in our long-term investment programme and it’s greatly expanded our offering for container management at the port.

“Along with generating a significant increase in our efficiency at the rail terminal, it goes a long way to supporting the government’s targets of reaching net zero by 2050.”

Rail minister Huw Merriman said: “The opening of the Solent Rail Terminal demonstrates the strength of the industry and its ambitions to grow, and I’m pleased that this multi-million pound upgrade will provide the increased capacity to allow the Port of Southampton to thrive.”

A partnership between Dorsetbased C3IA solutions and Birmingham’s Black Space Technology has developed a lifesaving initiative.

The two companies have developed a system which shares the health and medical information of a casualty on the battlefield or in a disaster zone instantly with experts able to give rapid advice.

Patients are fitted with sensors which constantly transmit information, while Silvus StreamCaster radios allow those on the ground to video call medical professionals with little interference.

Ash Williams from C3IA said: “This collaboration is about saving lives.

“The Silvus radios are the best there are and enable communications in places where there is no other way of keeping in touch.

“They’re robust and powerful and create their own network on the ground. They also enable Black Space Technology’s software to be used to send and receive vital information.”

David Morgan, CEO and Medical Director of Black Space Technology, explained how the first hour after injury is known as the ‘golden hour’, when 80 per cent of deaths occur.

“Speed of reaction and care therefore is absolutely crucial,” he explained.

“Through the Silvus radios and utilising Bluetooth and other technology, our software can make all the difference.”

Rail minister Huw Merriman (third from left) joined ABP Southampton and Solent Stevedores at the Port of Southampton

Colleagues at Silverlake Automotive Recycling in Hampshire have completed an electric vehicle dismantling course as the garage continues to process growing numbers of such vehicles.

Last year Silverlake dealt with 172 per cent more high voltage vehicles than in 2022, including a 94 per cent increase in fully electric and 218 per cent increase in hybrid vehicles.

The business has been proactive in equipping its staff with the skills needed to keep up with the EV revolution – including

the NA International EV dismantling course.

Participants on the course learned how to make vehicles safe before removing high voltage components and batteries, earning an Institute of the Motor Industry certificate on completion.

Tom Harvey, organisation development manager at Silverlake, said: “The automotive industry is evolving and we’re investing in our people and our facilities to serve our customers, futureproof our business and embrace the opportunities presented.

The University of Southampton is to be home to two new multi-million pound research centres, which will train the students needed for Britain’s quantum technology and defence sectors.

Around £32 million has been given to the university for the centres. They are among 65 announced by UK Research and Innovation (UKRI) to train 4,000 PhD students across the next decade.

The £18 million centre, funded by the government’s Engineering and Physical Sciences Research Council,

is for doctoral training in Quantum Technology Engineering.

It will also receive funding from tech businesses including Microsoft, QinetiQ, Riverlane and Oxford Ionics.

Meanwhile, the £12.5 million Centre for Complex Integrated Systems for Defence and Security will train the next generation of leaders and experts needed to support UK safety and resilience. It will receive funding from EPSRC, the Ministry of Defence and numerous industry partners.

Kier Construction Southern has started work on a new four storey extension and wider refurbishment works at Bournemouth and Poole College.

The college is carrying out work on its Bournemouth Campus following a multi-million-pound investment from the Government’s Further Education Capital Transformation Fund.

New facilities will contain teaching space tailored for courses in media, digital, business, travel, hair, beauty, hospitality, catering and sport.

It will also feature new community amenities including a restaurant and salons.

The historic landmark Clock Tower Building will go under wraps for 18 months for a full heritage restoration.

Phil Sayles, Principal of Bournemouth and Poole College, said: “The work will future-proof the buildings on our Bournemouth Campus until the end of the century, and represents a huge vote of confidence in Bournemouth.”

Cheryl Parsons, Regional Director at Kier Construction Southern, said: “We are working closely with Bournemouth and Poole College to deliver a first-class teaching space in the heart of town that will enrich the learning experience of students for generations to come.”

The construction is due to be completed by 2026.

One of Bournemouth’s best-known retailers has been made watertight for the first time in more than 50 years thanks to a £5.6 million investment.

The store first opened in May 1915. It became Debenhams in 1972 but closed when the national department store chain collapsed spectacularly in 2021.

In 2019 the building was bought by Verve Properties, which is now aiming to create a regionally significant destination centred on beauty, health, retail, food and beverage, culture, workspace

and community events. Verve focuses on developing brownfield sites and regenerating existing buildings.

Finally, after two and a half years of constant renovations and building works, the Bobby’s building is watertight.

Lewis Rogers, Site Manager at Wimbornebased Spetisbury Construction, which is carrying out the work, said: “Making the building watertight has been one of our biggest challenges, it hasn’t been dry for decades. As well as reroofing the entire building, we’ve also been working hard

to protect the tenants already in situ, this is one of the major challenges of working on an open building.

“We had more than 50 buckets up on the fourth floor to catch leaks, and during the worst storms, we were going in throughout the night to empty buckets to minimise disruption to those below.”

Verve’s decision to take the project on came about due to a belief in the potential for UK high streets to reinvent themselves after the economic downturn of the past 10 years.

Government ministers, industry stakeholders and Hampshire MPs have launched a landmark report at Westminster.

Commissioned by The Solent Cluster, the report reveals that the Solent could be a catalyst for sustainable growth.

Energy Efficiency Minister, Lord Callanan, said: “We need to cut emissions to get to net zero and carbon capture will play an important role in this mission. That’s why we’re backing it with investment of £20 billion. And with the UK’s infrastructure,

skills and geology, we are in a prime position to become world leaders in this pioneering technology. I welcome this report which shows the potential to unlock major investment in the carbon capture industry and create thousands of new jobs in the region.”

Anne-Marie Mountifield, Chair of The Solent Cluster, said: “The Solent has a unique potential to accelerate net zero ambition by transforming energy production and consumption. Our anchor projects could not only strengthen energy resilience but also create a low carbon

economy, boost economic growth, and contribute to the expansion of the regional employment market.”

The Solent Cluster comprises public and private organisations collaborating on the decarbonisation of the Solent region.

Members include international energy producers with expertise in carbon capture and storage and hydrogen technology along with global manufacturers and engineering companies, academic institutions and regional businesses.

As organisations grapple with evolving threats, understanding human behaviour, and fostering a security-conscious workforce are critical imperatives in ensuring robust cybersecurity within your business.

Social Engineering: The Art of Deception

Social engineering is a sophisticated psychological technique that manipulates individuals to obtain sensitive information, such as personal credentials or financial data. It is a cyberattack that exploits human behaviour and vulnerabilities, rather than technical weaknesses, to achieve its objective. Some typical social engineering techniques are listed below:

Phishing: Cybercriminals impersonate trusted email sources and trick people into sharing confidential information or clicking on malicious links. For instance, an employee may unwittingly reveal login credentials by responding to an urgent-looking email.

Pretexting: Perpetrators create elaborate scenarios to extract information in pretexting attacks. Imagine an attacker posing as an IT support technician, convincing an employee to reveal system details or reset passwords.

Tailgating: This physical social engineering tactic involves an unauthorised person following an employee into a secure area. A friendly request like “Hold the door, please” can lead to unauthorised access.

Security Awareness Training: A Vital

Investing in security awareness training pays dividends. Here’s how organisations can foster a security-conscious culture:

Regular Training Sessions: Conduct interactive sessions on phishing awareness, password hygiene, and safe browsing. Employees should recognise red flags and report suspicious incidents promptly.

Simulated Attacks: Regularly simulate phishing attacks to gauge employees’ responses. Provide immediate feedback and reinforce good practices.

Tailored Content: Customise training materials to address industry-specific risks. For instance, financial institutions may focus on protecting customer data, while healthcare organisations emphasise patient privacy.

Leadership buy-in is an excellent way to encourage staff to endorse cybersecurity and become a security conscious workforce.

Board Commitment: Boards must prioritise cybersecurity. Allocate resources for training, technology, and incident response.

Lead by Example: Executives should champion security practices. When leaders prioritise security, employees follow suit.

Once employees are onboard and training has been introduced, it is vital that on-going security is adhered to.

Clear Policies: Communicate security policies. Employees should understand their responsibilities and the consequences of non-compliance.

Reward Vigilance: Acknowledge employees who report incidents or demonstrate security awareness.

In cybersecurity, the human element can be the weakest link. However, it can also act as the most robust defence mechanism. By instilling a security-conscious mindset among employees, organisations can mitigate risks, safeguard sensitive data, and strengthen their digital resilience. It is crucial to understand that cybersecurity is not limited to the IT department alone – it is the responsibility of every individual in the organisation to remain alert and follow best practices to ensure a secure digital environment.

Dominique Tillen’s move online during lockdown saw sales at child toothbrush retailer Brush-Baby shine

By Stephen Emerson, managing editorWe had to pivot very quickly and brought in an Amazon expert who has produced some amazing results for us

The pandemic was make or break for many south east firms, with markets and distribution channels closing overnight once the country entered the first pandemic lockdown.

When the dust settled, however, many made successful and lasting changes in the way that they sold their products and Dominique Tillen of Hampshire-based Brush-Baby was one such business.

The company’s growth had followed a steady growth trajectory, hitting the £1 million turnover milestone in 2017, however it was a pivot made during Covid that accelerated Brush-Baby’s growth.

The firm, founded in 2007, now has a turnover of £4 million a year and employs 15 people in the market town of Alresford near Winchester.

Dominique said: “Between 2020 and 2021 we grew by 43 per cent and that was during Covid when we switched the business to online.

“We heavily focused on Amazon as our retailers had all shut down.

“We had to pivot very quickly and brought in an Amazon expert who has produced some amazing results for us.”

Dominique trained as a nurse before

working as a midwife at Great Ormond Street Hospital before moving into clinical research.

It was this experience, and struggling to find a toothbrush that would work for her daughter, that gave Dominique the idea of starting Brush-Baby.

She said: “My daughter would always chew her toothbrush and I knew if you started a business which would be useful to lots of people then it could be a success. We started out with one little chewable toothbrush.”

In the early months and years, Dominique found herself, as many founders do, wearing sales, marketing and operations hats.

She said: “I would sit by myself at the kitchen table and divide the business into different functions.

“One day I’d be wearing my sales hat, another I’d have on my marketing or finance and operations hat.”

Dominique says one of the reasons behind Brush-Baby’s growth is her early adoption of exporting.

The bulk of exports go to Eastern Europe

and the Nordics, with the company also having a foothold in the United Arab Emirates.

Dominique says that she learned quickly that frequently visiting the country to which you are exporting is vital to success.

She said: “It’s very important that you travel and meet people and go around the shops to see how your product’s displayed.

“You can do so much online, but you really need to get out there and see what’s happening on the ground.”

Many UK businesses face language and cultural barriers when it comes to exporting, however, these obstacles haven’t hindered the growth of BrushBaby.

Dominique said: “Children tend to like the same sort of things and mothers have the same issues when it comes to looking after their teeth.”

However, there are some important cultural preferences that have to be respected.

“We can’t sell yellow toothbrushes in Arabia, because they don’t like the colour. We also have a little hippo toothbrush which they won’t accept because it looks like a pig.

Dominique’s other business is a vineyard on the outskirts of Offington in West Sussex.

English wine has enjoyed a revival over the past decade, particularly in the south east where increased temperatures have led to rich harvests for growers large and small.

Dominique has collected her first harvest which is now in the hands of a Hampshire winery where it will be ready for consumption in 2026.

For Dominique though, the vineyard, while a commercial concern, is about escaping the stress and strains of the day job.

She said: “It’s very much my sideline and doesn’t take up too much time because it just grows on its own.

“It’s my relaxation project. I can combine what I know about agriculture and chemistry to make new wine. You also get to meet lots of people which I enjoy too.”

Brush-Baby’s success shows the value of finding a niche in a market which is dominated by large multi-nationals.

Dominique has developed toothbrushes which are specially adapted to children, and this is a market that larger players in the industry such as Colgate and Aquafresh have not moved into.

She said: “We are quite an unusual segment of a market which has some really big players, and we are still quite niche.”

One of the decisive factors of any business, large or small, is its people and getting the right staff on board is crucial to future success.

Dominique said: “I look for energy, dedication, people who really buy into the brand and are those that are willing to take that little step further.

“If you are in a growing company, you need energy to make it grow.”

Dominique’s daughter Elizabeth also works at the firm but receives no special treatment.

She said: “My daughter’s been exposed to the business since she was small. She’s now working in the business, but is starting right at the bottom.”

Gaining investment for a business idea is no easy task. Dominique urges people

starting out, or those at the growth stage of a business, to seek out the right investor.

And she cautions against taking investment money from relatives.

“Involving your family is a really bad thing to do,” she said.

“Find an investor who has experience in your sector so that they can actually help you grow.”

The next five years will see Brush-Baby target the United States with the company focused on breaking into what is a sizeable and lucrative market.

Dominique said: “We want to continue growing and have started in the United States.

“That venture is growing quite nicely and over the next five years we will have a lot of focus on growing that part of the business.

“We want Brush-Baby to be the go-to brand for mums, parents or carers who are looking after their little one’s teeth right from when they start.”

McLaren Racing in Surrey is to collaborate with the Ministry of Defence (MoD) on a variety of innovative defence projects.

The MoD and McLaren’s Accelerator team will work together on initiatives like Project LURCHER – a push to electrify the Army’s armoured vehicle fleet.

To mark the start of the partnership, the NEOM McLaren Extreme E race car was shown alongside a Project LURCHER vehicle at BattleLab in Dorset.

BattleLab is a “co-creation space”, part of the government National Strategic