A consultancy report by Superyacht

MARKETING SURVEY REPORT 2025

November 2025

The Superyacht Agency

The Superyacht Agency does not work in isolation, but rather operates as a collective where our core team draws on the wider expertise within The Superyacht Group as and when needed. The Superyacht Group’s editorial, intelligence, events and support divisions represent the global elite – the finest journalists, editors, analysts and event planners in the industry, coupled to market-leading publications, digital portals and global events.

For more than two decades, The Superyacht Group has dedicated its global media channels to educating, informing and advising all sectors of the superyacht market. The Group’s team of industry experts consistently deliver on our mantra ‘building a better superyacht market’.

The Superyacht Agency is here to meet the need for superior data-driven decisions in the superyacht market.

Through a tailored service and long-standing relationships with industry business leaders, we understand what the superyacht market needs –and the tools needed to deliver it.

EXECUTIVE SUMMARY

The following commentary provides a clear summary of the findings from the Superyacht Marketing Survey 2025, allowing readers to digest the key takeaways and understand the principal trends shaping marketing strategy and performance across the superyacht industry.

1. Survey Demographics

Respondents represented a broad cross-section of the superyacht industry, including shipyards, suppliers, brokers, charter companies, marinas and marketing agencies. The survey sample was heavily weighted toward senior and strategic decision-makers, indicating that many responses reflect leadership perspectives within participating organisations. The majority of respondents came from small to mid-sized companies employing fewer than 50 people, with the largest concentration based in Europe. This composition provides a descriptive overview of who contributed to the survey.

2. Marketing Budgets and Investment

Marketing budgets varied, reflecting the diversity of company scale. Nearly half of all respondents reported annual budgets below €50,000, highlighting a lean and highly selective marketing environment. While events and yacht shows continue to command the largest share of marketing budget, with 63% of companies allocating most of their spend to these activities, investment in digital channels is steadily increasing, particularly in video production, website development and AI-based tools. This trend suggests that companies are gradually evolving toward more data-enabled, technology-supported marketing strategies.

3. Marketing Channels and Performance

Events remain central to brand visibility and client engagement, with the Monaco Yacht Show dominating participation and investment. However, digital channels now play an increasingly complementary role. LinkedIn and Instagram lead social media use, combining professional credibility with lifestyle storytelling. Meanwhile, print media continues to decline as marketers shift toward measurable, interactive platforms. This reflects a growing need to balance relationshipdriven engagement with scalable, data-informed communication.

4. Marketing Challenges and Limitations

Across companies, six recurring marketing challenges emerged: limited budgets, audience targeting, content creation, under-resourced teams, lack of analytical tools and unclear strategic direction. Many marketing departments function as micro-teams, responsible for strategy, content and communications with minimal data support. This structural imbalance often results in reactive decision-making and reliance on traditional methods.

5. Industry-Wide Marketing Challenges

Across the wider industry, several recurring challenges were identified: market saturation, declining differentiation, over-reliance on traditional channels, limited digital capability and a growing tension between innovation and brand heritage. Many companies reported that crowded events, repetitive content and inconsistent professional standards make it harder to achieve meaningful visibility. Rapid technological change adds further pressure, forcing marketers to balance modernisation with the need to maintain credibility and trust.

6. Emerging Themes and Opportunities

Respondents described a marketing culture that is stable but cautious. Tradition, senior management preference and brand heritage continue to guide marketing activity, sometimes at the expense of innovation. However, optimism remains strong. Many companies plan to increase investment in digital storytelling, sustainability and audience insight tools. There is also growing awareness of the need to reach younger, cross-sector audiences through collaborations with luxury lifestyle, art and property brands.

7. Future Outlook

The data points to a superyacht marketing sector in transition, seeking to reconcile craftsmanship and exclusivity with transparency, authenticity and modern engagement. As sustainability, technology, and audience expectations reshape luxury communication, marketing leaders recognise that future success depends not only on visibility but on meaningful, measurable and story-led brand experiences.

INTRODUCTION

The Superyacht Marketing Survey 2025, conducted by The Superyacht Agency, provides a comprehensive view of the evolving marketing landscape across the global superyacht industry. Drawing on insights from senior leaders, marketing professionals and decision-makers, the report explores how companies are navigating the intersection of tradition and transformation, striking a balance between the enduring power of personal relationships and the growing influence of data, digital media and automation.

This research aims to deepen the industry’s collective understanding of how marketing is adapting to new

audience behaviours, accelerating technological change, and shifting global dynamics. In an era defined by changing client expectations, rapid digitisation, and growing social and environmental scrutiny, the report captures the insights of an industry learning to harmonise authenticity, creativity and sustainability with strategic agility and measurable impact.

The full findings of the Superyacht Marketing Survey are presented in this standalone report, showcasing the most compelling insights, emerging trends and strategic developments defining the future of superyacht marketing.

DEMOGRAPHICS AND COMPANY PROFILE

The Superyacht Marketing Survey 2025 draws on a diverse respondent base, capturing insights from various companies and professionals across the superyacht industry. This mix of industry sectors, job roles, geographic regions and company sizes provides a snapshot of the market’s key players and forms the foundation for understanding and interpreting the insights explored throughout this report.

JOB ROLES

The survey drew responses largely from stakeholders who primarily held senior or strategic positions, offering a leadership-level view of

marketing decision-making within their companies. Almost half of the participants (47%) identified as CEOs, directors or owners, with a further 24% holding a marketing manager role and 16% serving as chief marketing officer. The remaining smaller shares represented marketing executives, agency managers, social media managers, creative professionals and lawyers.

This leadership-driven distribution of roles suggest that the survey captures insights from those directly responsible for setting or influencing marketing strategy, rather than purely executing it.

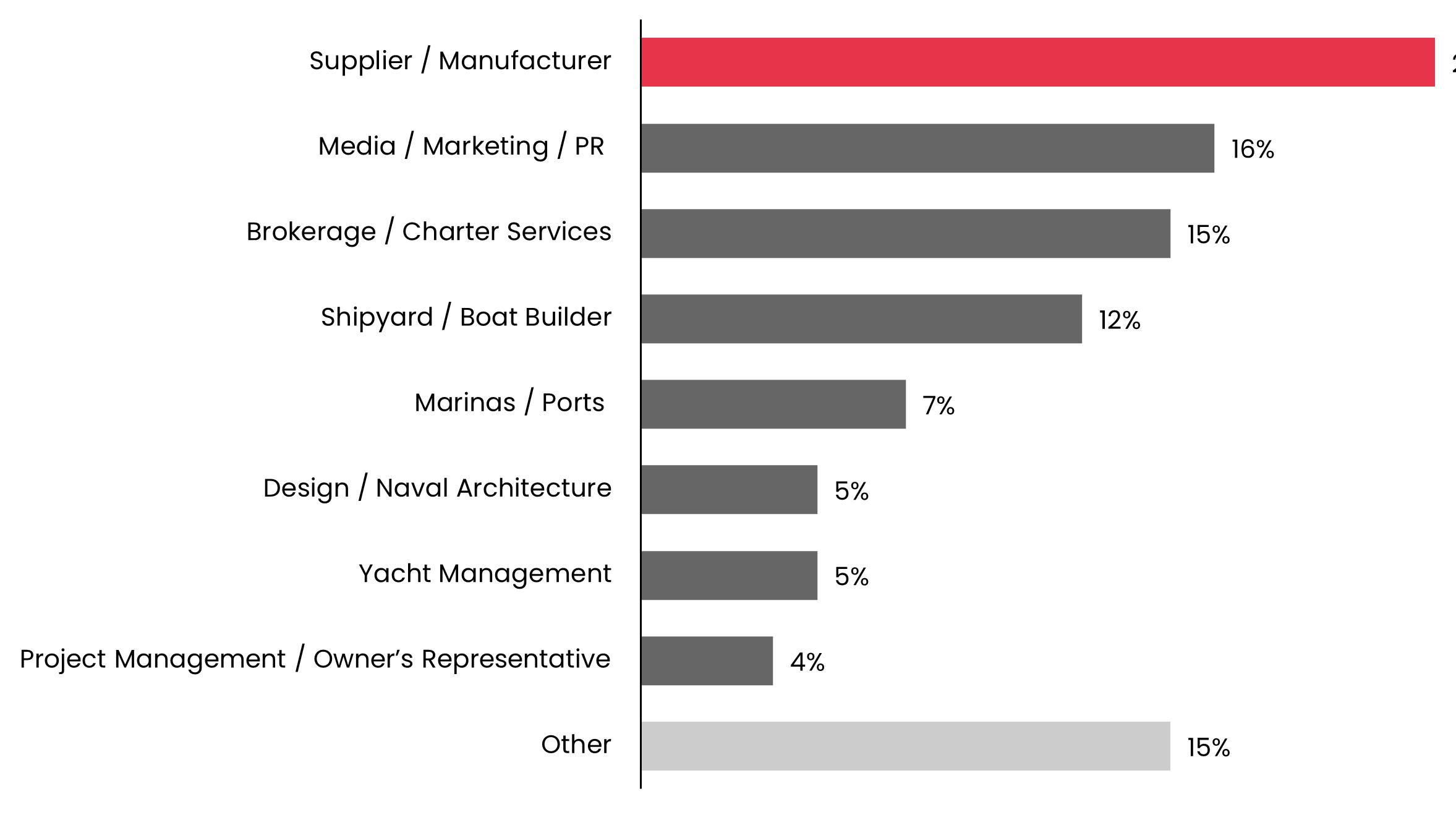

INDUSTRY SECTORS

Respondents represented companies from a broad range of sectors across the superyacht industry. The largest segment came from suppliers and manufacturers (22%), followed by media, marketing or PR (16%), brokerage and charter services (15%) and shipyards or boat builders

(12%). Smaller proportions were drawn from marinas and ports (7%), design and naval architecture (5%), yacht management (5%) and project management or owner representatives (4%). Together, these groups reflect the spectrum of organisations shaping the superyacht ecosystem, from production and operations to communications and client experience.

DEMOGRAPHICS AND COMPANY PROFILE (CONTD)

GEOGRAPHICAL REGIONS

The majority of respondents (80%) were from companies located across Europe. The largest concentration of respondents were based in Southern Europe (28%), followed by Western Europe (24%) and the United Kingdom (15%). Eastern Europe

accounted for 8% of the survey sample and Northern Europe represented 6%. This European concentration reinforces the region’s continued role as the operational and commercial hub of the superyacht industry.

3: Geographical distribution of companies

SIZE OF COMPANIES

Just under three quarter of respondents represented small to mid-sized companies employing ufewer than 50 people. Within this group, 41% of respondents worked at companies that had fewer than 10 employees, while 21% employed 20–49 employees.

Although these figures describe the composition of the survey sample rather than the wider industry, they suggest that many participating companies operate with lean, specialised teams where marketing activity may typically be managed within small, flexible or owner-led structures.

MARKETING INVESTMENT PATTERNS

ANNUAL MARKETING BUDGETS

Marketing budgets among participating companies varied, mirroring the scales of operation within the survey sample. Nearly half of respondents (46%) reported that their company had annual marketing budgets of under €50,000, suggesting that these businesses operate with limited but targeted marketing spend.

At the upper end, only 7% of companies, primarily shipyards, reported annual marketing budgets exceeding €2 million. The mid-range brackets (€50k–€500k) accounted for around 41% of companies, reflecting moderate investment levels across much of the sample.

5: Distribution of annual marketing budgets among companies

BUDGET ALLOCATION PRIORITIES

The data points to a marketing landscape that remains rooted in tradition but shows signs of diversification and experimentation, with some respondents prioritising newer, more contemporary marketing channels.

A majority of companies (63%) continue to invest the largest share of their marketing budgets into events and yacht shows, underscoring the enduring value of face-to-face engagement in an industry built on trust and relationships. Even as costs rise and ROI is questioned, yacht shows remain the superyacht sector’s primary platform for brand visibility and client networking,.

Beyond this dominant category, all other key areas of

marketing each attract less than 10% of companies’ primary marketing investment, including social media advertising (10%), print media, websites, and branding agencies (each around 4%). This distribution suggests that while diversification is occurring, no single alternative channel has yet rivalled the centrality of events in the yachting industry marketing mix.

Notably, when combined, a growing segment of companies direct the majority of their marketing budgets in digital and automation-driven channels. Collectively, around 1 in 4 companies (25%) reported prioritising areas such as digital advertising, video production and AI-based tools. This suggests a gradual but meaningful shift toward technologyenabled marketing.

MARKETING INVESTMENT PATTERNS (CONTD)

RECENT SHIFTS IN MARKETING FOCUS

The data illustrates how superyacht marketing strategies are being refined rather than radically restructured.

The strongest areas of growth were website development (46%), events and yacht shows (38%) and video content production (35%). This pattern suggests that companies are not moving away from experiential marketing but are instead redefining it through digital integration, using digital platforms, content creation and online promotion to extend event visibility and brand engagement beyond the dockside. The growing focus on video content reflects the industry’s parallel shift with broader marketing trends, where visual storytelling formats across platforms have become central to how brands communicate and engage audiences today.

Other areas showing moderate growth include AIbased tools (28%), social media advertising (27%), and digital advertising (27%), alongside increased investment in CRM integration (19%), branding and PR agencies (19%) and market research (15%). Together, these trends signal that compnaies are exploring more data-enabled and strategically integrated marketing, where automation, analytics,

and professional expertise work in tandem to improve audience targeting, campaign performance, and brand consistency. At the same time, while interest in data-driven and automated approaches is growing, many organisations remain in the early stages of implementation, constrained by small teams and long-standing habits.

Conversely, when asked where companies had reduced or stopped spending in recent years, print media led by a wide margin (54%), signalling a decisive move away from traditional publications as audiences and advertisers increasingly prioritise digital formats and more measurable forms of communication. This reduction is consistent with a broader luxury-sector trend in which brands are re-evaluating the ROI of paid editorial exposure and shifting towards owned and interactive channels that provide greater control over narrative and audience engagement.

Interestingly, events and yacht shows (9%) and website development (9%) also appeared among the categories seeing reduced investment. However, these relatively low figures likely indicate selective reallocation rather than decline. Companies may be participating in fewer events or streamlining website expenditures to focus on measurable impact and operational efficiency.

INVESTMENT LEVELS ACROSS WEBSITE, VIDEO AND RESEARCH

A closer look at investment levels across key marketing channels provides further context to these trends. While spending patterns show a general move toward digital integration and selective refinement, the depth of financial commitment varies widely by category. Some areas, such as video content and websites, attract significant investment from companies, while others, particularly market research, remain underdeveloped, reflecting an ongoing imbalance between creative execution and data-driven strategy.

Websites remain a stable investment anchor, with nearly half (46%) of companies allocating between €5k and €50k annually. This sustained spend suggests that companies view their digital platforms as essential for brand credibility, content control and lead generation. The modest share (10%) spending over €50k indicates that few may be investing in advanced digital ecosystems such as personalised user journeys, automation or integration with CRM systems.

Video content stands out as a rising priority of brand communication. Although 38% of respondents spend less than €5k annually, just under a third spend between €5k and €50k and a further 12% invest over €50k, signalling that visual storytelling is becoming central to brand equity.

Research and analytics, in contrast, remain under funded with 46% of companies reported not investing in it at all and another 29% spend less than €5k. This absence of data investment reveals a persistent blind spot in strategic planning, particularly in an era where customer insights, segmentation and behavioral analytics are increasingly defining competitive advantage. The result is a continued reliance on intuition and relationship-based decision-making, rather than evidence-based approaches that could unlock new growth opportunities.

Taken together, the data depicts a marketing landscape where storytelling and presentation lead, but strategic intelligence lags behind. Companies are investing to be seen but not always to understand their audiences more deeply.

MARKETING INVESTMENT PATTERNS (CONTD)

DIVERSIFICATION IN MARKETING SPEND

Survey results reveal a clear inward focus in superyacht marketing. A striking 60% of companies spend less than 5% of their marketing budgets outside the yachting sector, signalling a continued preference for industry-centric visibility over broader luxury positioning. While this narrow targeting reinforces exclusivity and domain authority, it may also limit potential exposure to adjacent audiences and emerging wealth segments that increasingly define the luxury landscape.

Only a small share of companies, around 5%, are investing more aggressively in luxury lifestyle crossover marketing, with at least half of their marketing budgets spent outside yachting. These firms are aligning superyachts with fashion, travel and luxury property sectors. This strategy may be increasingly essential to reach next-generation high-net-worth (HNW) clients.

Figure 10: Marketing budget spent outside the yachting industry –percentage of companies

MARKETING CHANNELS AND VISIBILITY APPROACHES

MEDIA CHANNEL INVESTMENT

The findings highlight a media landscape that remains anchored by a few established media outlets but also characterised by fragmentation and diversification. The most invested-in outlets were Superyacht Times (51% of companies) and Boat International (49% of companies), which together represent the sector’s twin pillars of visibility. The combined media channels of The Superyacht Group – SuperyachtNews.com and The Superyacht Report (37% of companies) – continue to play a strong supporting role.

Respondents’ selection of multiple media outlets indicates that most companies do not rely on a single publication but instead adopt a portfolio approach, investing across several outlets to balance audience reach, brand positioning and budget. This overlap also underscores the interconnected nature

of the superyacht media ecosystem where media companies compete for attention but together form a shared infrastructure of visibility that the industry still depends on.

Beyond these leading platforms, the presence of Superyachts.com (20%), Dockwalk (16%), Yachting Pages (13%) and a substantial “Other” category (37%) points to a long tail of niche and regional outlets, including lifestyle, trade, and cross-sector publications. Mentions of platforms such as Forbes, Triton and regional luxury magazines, alongside companyowned channels and social advertising, reinforce that firms diversify exposure beyond traditional trade media. This pattern reflects a pragmatic response to a crowded and fragmented media landscape, where reaching the right audience requires blending specialist and lifestyle channels rather than relying solely on established yachting titles.

MARKETING CHANNELS AND VISIBILITY APPROACHES (CONTD)

EVENT PARTICIPATION

Survey results confirm that major international yacht shows remain the cornerstone of marketing and client engagement within the superyacht industry, but the way companies participate and invest is distributed.

Unsurprisingly, Monaco Yacht Show (MYS) dominates the yacht industry’s calendar, with 68% of companies attending and 39% actively investing

This makes MYS not only the most attended but also the most financially committed event, reaffirming its position as the flagship global showcase for brand prestige, networking and visibility among ultrahigh-net-worth (UHNW) audiences.

While Monaco represents the pinnacle of prestige, participation across other major events highlights the industry’s functional diversity. Just below Monaco, a cluster of events demonstrates strong but distinct participation patterns. The Cannes Yachting Festival and METSTRADE attract comparable levels of attendance (63% attending), although they serve distinct purposes within the industry. In terms of yacht shows, Cannes draws the second largest crowd overall, reflecting its broad appeal and accessibility as an earlyseason meeting point. The event functions primarily as a client-facing showcase, providing earlyseason exposure in the Mediterranean market; however, only 11% of companies reported investing in the event. METSTRADE, by contrast, is the industry’s technical and supply-chain hub, with higher levels of commercial commitment (22% investing) reflecting its focus on B2B engagement, supplier relationships and product innovation.

The Fort Lauderdale International Boat Show (59% attending, 20% investing)ranks among the key global events, providing the main access point to the North American market and serving as a major brokerage and supplier platform. Its combination of high attendance and moderate investment underscores its value and positions it as complementary to the

European concentration of activity around Monaco and Cannes.

Beyond these core shows, The Superyacht Forum (53% attending) and Dubai International Boat Show (45% attending) demonstrate consistent professional engagement, reflecting their roles in knowledge exchange and regional market access, respectively. The Palm Beach International Boat Show (43% attending, 13% investing) occupies a similar niche within the US circuit, offering a more targeted environment for client interaction and relationship management.

At the specialist and emerging end of the calendar, the Miami International Boat Show (25% attending, 5% investing), Superyacht Technology Show (14% attending, 8% investing) and Singapore Yachting Festival (12% attending) attract smaller but focused participation, suggesting that these platforms serve niche purposes such as technology showcases, regional brand representation or innovationfocused networking rather than large-scale promotional exposure.

With shows such as Miami and Singapore seeing lower engagement, this suggests that marketing investment still gravitates toward the traditional hubs of wealth and visibility.

Overall, the findings indicate a tiered ecosystem of event participation, with Monaco positioned firmly at the apex, followed by a set of highengagement European and American shows that balance visibility with cost efficiency. Cannes and METSTRADE attract strong attendance for distinct reasons (client access and technical networking) while regional and specialist events provide supplementary opportunities for targeted presence. Yacht shows remain a cornerstone of superyacht marketing activity, functioning not only as exhibition platforms but as strategic venues where credibility, connection and commercial opportunity intersect.

MARKETING CHANNELS AND VISIBILITY APPROACHES (CONTD)

SOCIAL MEDIA USAGE

Social media adoption across the superyacht industry is strong and widespread. LinkedIn and Instagram dominate by a wide margin, with 93% and 86% of companies using these platforms, respectively. LinkedIn serves as the hub for B2B visibility, recruitment and corporate positioning, while Instagram provides the visual storytelling canvas through which brands convey lifestyle, design and experience.

Together, these two platforms capture both sides of the industry’s communication spectrum, with LinkedIn for authority, reputation and professional reach, and Instagram for aspiration, design and lifestyle association. High adoption rates do not necessarily equate to high engagement, and the lack of diversification may limit reach to new or younger audiences entering the luxury lifestyle ecosystem.

Facebook (64%) and YouTube (46%) maintain strong secondary positions. Facebook continues to function as a versatile channel for community engagement and broad awareness. However, its continued use probably reflects convenience and historical reach rather than active strategic focus. For many companies, Facebook functions as a maintenance channel, a space to sustain visibility, post updates and mirror content shared elsewhere, and less central to brand storytelling or client acquisition. However, in an environment where organic reach and engagement are declining globally, this raises an important question: does maintaining presence on traditional platforms still deliver meaningful engagement or is effort being sustained out of habit rather than return?

Across broader digital marketing sectors, Facebook’s organic reach and engagement rates have been in long-term decline, while algorithmic changes

increasingly favour paid content and communityspecific groups over brand pages. If similar patterns hold true within the superyacht space, continued investment of time and resources in low-interaction environments may represent a misalignment between audience attention and marketing effort.

YouTube, used by fewer than half of respondents, represents a possible underutilised channel. The platform offers scope for more dynamic storytelling from virtual tours and design showcases to behind-the-scenes narratives that extend brand engagement well beyond the dock.

Platforms such as TikTok (15%) and Twitter/X (14%) remain peripheral. Their low adoption highlights that the industry may have a cautious stance toward fastpaced, high-turnover media environments, where message control is limited and brand positioning can be more volatile. Nonetheless, these spaces increasingly define audience attention in the luxury lifestyle and travel sectors, pointing to opportunities for agile, creative engagement among brands willing to experiment with short-form video, influencer partnerships and trend-driven storytelling.

This distribution illustrates a measured but multiplatform approach. Most companies now maintain a core presence across two or three major channels, favouring those that combine professional credibility with strong visual utility. The balance leans toward depth over breadth, using established networks to reinforce brand authority rather than pursuing rapid expansion into newer, less predictable spaces. However, the gap between the adoption of traditional platforms and emerging ones also signals potential inefficiencies: firms may be missing opportunities to reach younger, lifestyle-oriented audiences through formats increasingly central to global luxury marketing.

EXTERNAL MARKETING SUPPORT

Nearly half of companies (46%) reported working with a marketing or branding agency, underscoring a recognition of the value in specialist support for positioning, campaign design, and creative execution. PR agencies, used by 24% of companies, and content agencies, used by 24%, trail significantly behind, reflecting either limited budgets, a preference for handling communications in-house, or a sector-wide hesitation to fully delegate brand communication to external partners.

The data also revealed that on average just over half of the companies (55%) report no current or planned use of any type of agencies. This may reflect

the industry’s enduring culture of self-reliance, where founders and senior leaders often oversee brand representation directly.

However, the data also suggests some movement. On average, 14% of companies indicated plans to begin collaborating with agencies in the near future, suggesting that outsourcing is gradually being viewed as an enhancement to marketing strategies.

For many firms, particularly small to midsized organisations with lean marketing teams, partnering with agencies may provide access to creative bandwidth, digital expertise and analytics capabilities that are difficult to replicate internally.

CURRENT MARKETING STRATEGIES AND CHALLENGES

PATTERNS IN THE MARKETING MIX

Despite the growing conversation around digital transformation, the pace of change remains uneven. Many companies still rely on established marketing routines, reflecting a cautious approach that balances innovation with risk avoidance. The data reveals a marketing culture that is stable, but perhaps too stable.

More than three-quarters of respondents (77%) said there was nothing in their current marketing mix they wanted to stop, a finding that can be read as either confidence and satisfaction in existing strategies or a sign of institutional inertia. In a sector where reputation, relationships and brand continuity carry significant weight, the limited appetite for change suggests that most companies operate within highly entrenched marketing routines.

Among the minority of respondents (23%) who wish to discontinue certain marketing activities, several underlying reasons offer some insight into how marketing decisions are made. Tradition was cited by 31% of respondents and senior management insistence was another reason highlighted by 19% respondents, indicating that marketing strategy sometimes reflects traditional practice and leadership preference rather than performance-

led analysis. Additionally, 31% of respondents stated that existing activities still yielded some results and 25% were uncertain about the impact of stopping. Both these reasons highlight a cautious, risk-averse approach to experimentation.

Taken together, the findings point to a culture of continuity, one where marketing is treated as a reputational safeguard rather than an evolving growth tool. This conservatism is not without rationale. In an industry built on trust, discretion and craftsmanship, radical shifts in messaging may feel misaligned with brand identity. The data also raises a strategic question: In a market where visibility, technology and audience behaviour are changing rapidly, does stability still equal strength or has it become a comfort zone that limits innovation?

The reluctance to discontinue underperforming activities may reflect deeper structural factors, such as small teams, limited analytics capacity and leadership hierarchies that prioritise tradition over data-driven agility. As the industry faces new competitive pressures and shifting digital expectations, companies that can balance brand heritage with adaptability may hold a distinct advantage, not by discarding the old practices but by re-evaluating which traditions still serve strategic value.

Figure 15: Respondents’ desire to discontinue element(s) of their company’s marketing mix and reasons for their continuation Is there something in your company’s current marketing mix that you would like to stop doing? If yes, why haven’t you stopped doing it?

It’s still yielding some results

It’s a long-standing tradition in the company

Senior management insist on it

We’re unsure about the impact of stopping Other

CURRENT MARKETING STRATEGIES AND CHALLENGES (CONTD)

CHALLENGES WITH CURRENT COMPANY MARKETING STRATEGY

When asked about their company’s biggest challenges, respondents highlighted recurring themes:

1. Budget constraints

Across all responses, budget limitations surfaced as the most persistent challenge. Even in a highvalue luxury sector, many marketers operate within

“BUDGET FOR REACH.”

lean financial frameworks that restrict reach, experimentation and campaign scale.

Several participants noted that boat show costs have escalated sharply, forcing difficult decisions about ROI and channel prioritisation. Others described the broader issue of achieving visibility with limited resources, despite the expectation of a luxury-standard output.

“BOAT SHOW COSTS INCREASED TOO MUCH.”

“COMPETING WITH EXORBITANT BUDGETS INVESTED BY OTHERS.”

“BUDGET AND TRAVEL BUDGET IN PARTICULAR.”

“SECURING A SUFFICIENT BUDGET”

2. Audience targeting and reach The challenge of reaching UHNWIs, or those who influence their decisions, remains a defining issue. Respondents cited difficulties with both audience identification and precise targeting, particularly across international markets.

A recurring frustration involved reaching inbound

clients before they arrive in key yachting destinations, and the complexity of navigating diverse markets and cultural nuances while maintaining brand consistency.

The following statements reveal the core dilemma of a niche global market, one that is simultaneously small, elite and geographically dispersed.

“TARGETING INTERNATIONAL CUSTOMERS WHO ARE INBOUND TO OUR MARKET BEFORE THEY ARRIVE HERE.”

“HARD TO TARGET A VERY LARGE GROUP WHEN WE DO NOT HAVE THE OPTION TO BE MORE SPECIFIC.”

“REACHING THE RIGHT CUSTOMER OR DECISION MAKER IS HARDER THAN IT SOUNDS.”

“CHASING NEW TARGET GROUPS AND CONNECTING WITH THE NEXT GENERATION OF SUPERYACHT OWNERS.”

“AS A NEW ENTRANT, WE FACE BRAND RECOGNITION CHALLENGES IN A MARKET DOMINATED BY LONG-STANDING COMPETITORS.”

CURRENT MARKETING STRATEGIES AND CHALLENGES (CONTD)

3. Content creation and visibility

In a visually driven luxury industry, marketers are expected to tell powerful stories; however, many are constrained by owner privacy, internal hesitancy and creative fatigue.

Respondents frequently described difficulties obtaining photography or video content and the struggle to stand out in a crowded, repetitive content environment. Several also referenced internal cultural barriers to visibility, such as staff reluctance to appear on camera.

This theme underscores a visibility paradox where marketers are expected to deliver constant innovation and aspiration while being restricted in what they can share. The result is often underexposure of craftsmanship and value, reinforcing the need for creative workarounds, from anonymised storytelling to behind-the-scenes narratives that protect discretion while sustaining engagement.

“NOT ABLE TO GET HIGH-END IMAGES OF THE JOBS WE DO DUE TO PRIVACY.”

“GETTING STAFF IN FRONT OF THE CAMERA FOR SOCIALS IS STILL A CHALLENGE.”

“TO SHOW THE MARKET OUR BOATS (OWNERS PREFER NOT TO SHOW).”

“CREATING RELEVANT CONTENT WITHIN SUCH A CROWDED MARKETPLACE WHERE EVERYONE IS VYING FOR ATTENTION.”

“TRYING TO MAKE SOMETHING BORING, INTERESTING.”

4. Time, human resources and internal alignment

The human dimension of marketing emerged strongly, with respondents highlighting chronic time pressure, under-resourcing and internal misalignment.

Many teams operate as “micro-departments”, responsible for everything from strategy to social media, often alongside unrelated duties. Even in larger companies, respondents described difficulties

“BEING A TEAM OF ONE!”

coordinating between departments or securing buy-in from leadership and sales teams.

These reflections reveal an industry where marketing is often strategically recognised but operationally under-supported. The lack of dedicated resources constrains execution, innovation and consistency, particularly when marketing must compete internally with production and sales for attention.

“ENOUGH TIME TO REACH PEOPLE IN A MEANINGFUL WAY AND HAVE AN OPEN CONVERSATION ABOUT THEIR YACHT OR NEW BUILD.”

“FINDING TIME TO PARTICIPATE IN MARKETING ACTIVITIES.”

“GETTING OTHER DEPARTMENTS TO GET ON BOARD WITH THE STRATEGY.”

“MANAGEMENT/DEDICATED RESOURCE — THAT’S THE MISSING PIECE.”

CURRENT MARKETING STRATEGIES AND CHALLENGES (CONTD)

5. Technology, data and adaptation

Respondents expressed acute awareness of technological acceleration, from social media algorithm shifts to CRM integration and AI adoption, but also frustration at the pace of adaptation within their organisations.

Many cited a lack of technical expertise or tools to effectively use data, automate engagement, or personalise communication at scale. Others noted that cultural adaptation across markets

and generations is just as challenging as digital transformation itself.

These insights suggest an industry aware of the need to evolve but often constrained by traditional systems, limited training and the absence of dedicated data infrastructure. The marketers themselves recognise that technological proficiency, not just aesthetic excellence, will increasingly define competitive advantage in the years ahead.

“ENSURING SOCIAL MEDIA TARGETING REMAINS SUPERYACHT-FOCUSED THROUGH TECHNOLOGY UPGRADES AND META ALGORITHM CHANGES.”

“WE DON’T HAVE THE RIGHT MARKETING RESEARCH OR DATA — NO PROPER CRM INTEGRATION, POOR FOLLOW-UP, A LOT OF MISSED OPPORTUNITIES.”

“THE LACK OF KNOWLEDGE OF FAST-GROWING TECHNOLOGIES AND TOOLS THAT CAN HELP US INCREASE EFFECTIVENESS.”

“ADAPTING TO NEW CULTURES AND MAKING IT SCALABLE WHILE KEEPING IT PERSONAL.”

“TAKING THE BRAND INTO THE NEXT GENERATION.”

6.Strategic clarity and measurement

Finally, many respondents cited a sense of strategic fatigue, where there is a constant cycle of reevaluating tactics without clear data and research to confirm what truly works.

The difficulty lies in measuring ROI across diverse channels and understanding whether underperformance reflects internal execution or the platform itself. This uncertainty drives what one respondent called a “fear-of-loss driven notion”, the

feeling that every channel must be maintained to avoid missing opportunities, even if resources are stretched thin.

This theme captures an emerging trend where marketers are aware that focus and refinement, not omnipresence, are the hallmarks of effective strategy. However, without the analytical infrastructure or confidence to act on those insights, many remain trapped in reactive cycles of trial and error.

“DECIDING WHICH AREA OF MARKETING GIVES THE BEST EXPOSURE AND HOPEFULLY THE BEST ROI.”

“MEASURING RESULTS VERSUS LEADS/CONVERSION DUE TO LIMITATION OF CRM.”

“THE CONSTANT RE-EVALUATION OF WHAT IS WORKING AND WHAT ISN’T … AND PUSHING BACK AGAINST THE FEAR THAT WE HAVE TO BE DOING EVERYTHING WHEN WE COULD INSTEAD BE STRONGER BY FOCUSING ON FEWER ACTIONS.”

“HOW TO WISELY SPEND THE MONEY.”

“DOING MY JOB BECAUSE I’M DOING OTHER JOBS — TOO MANY PRIORITIES!”

CURRENT MARKETING STRATEGIES AND CHALLENGES (CONTD)

CHALLENGES WITH CURRENT SUPERYACHT MARKETING LANDSCAPE

When asked what aspects of the current superyacht marketing landscape they find most challenging or frustrating, respondents revealed a complex picture of an industry caught between traditional practices and rapid transformation.

Six dominant themes emerged that highlight a marketing ecosystem that is evolving unevenly, where creativity, authenticity and agility increasingly define competitive advantage, but operational and institutional inertia continue to constrain progress.

1. Market saturation, sameness and audience fatigue

By far the most common frustration centred on over-saturation across both digital and physical marketing environments. Respondents described a crowded marketplace where too many brands are

producing indistinguishable content, attending the same events and competing for the same limited audience attention.

This “sea of sameness” has dulled engagement and made differentiation increasingly difficult, particularly for smaller or specialised businesses seeking to carve out distinctive narratives.

Respondents also expressed concern that the superyacht brand itself, long associated with exclusivity and perfection, may now be undermining its own message. For some, the word “superyacht” has become synonymous with excess rather than excellence, creating barriers when communicating more practical or service-led value propositions.

This reflects a growing concern that the industry’s polished surface may be eroding authenticity, leaving audiences disengaged and brands struggling to articulate true distinctiveness.

“OVER-SATURATION ON SOCIALS – VERY LITTLE VALUE BEING ADDRESSED. NOT ENOUGH AUTHENTICITY.”

“TOO MUCH CONTENT, TOO SIMILAR – MAKING PEOPLE NUMB TO MOST CONTENT.”

“THE TERM ‘SUPERYACHT’ CARRIES AN EXTREMELY EXPENSIVE CONNOTATION, WHICH CAN MAKE IT HARDER TO COMMUNICATE VALUE.”

“BEING ABLE TO STAND OUT WITHOUT HAVING HUGE INVESTMENTS.”

“SAMENESS OF COMMUNICATION AND BRANDING.”

2. Authenticity, credibility and industry noise

Closely linked to saturation is a growing disillusionment with credibility and professionalism within the marketing landscape. Many respondents expressed frustration at the proliferation of “experts”, influencers and agencies who promise quick wins but lack genuine industry understanding. Others noted widespread misinformation, recycled ideas and what some described as exaggerated or superficial PR.

This frustration reveals an industry fatigued by superficiality, one that values authentic storytelling, technical competence and honesty over style without substance. The commentary underscores a call for higher standards in communication, journalism, and marketing ethics, as well as for more transparent collaboration among legitimate professionals.

“WE ARE TIRED OF THE ‘EXPERTS’ WHO RECYCLE AS THEIR OWN OTHER REPORTERS’ HARD-WON LEARNING AND RESEARCH.”

“DEALING WITH SO-CALLED EXPERTS THAT DO NOT HAVE A CLUE.”

“MISINFORMATION, NEGATIVITY OF THE INDUSTRY.”

“HONESTY.”

“PR BS.”

“LOTS OF CONFUSION IN THE MARKETPLACE ABOUT THE GENUINE PERFORMANCE AND CAPABILITIES OF THE MAIN PLAYERS.”

CURRENT MARKETING STRATEGIES AND CHALLENGES (CONTD)

3. Content creation, access and confidentiality constraints

A recurring operational challenge concerns the ability to produce and share original, high-quality content. Respondents cited persistent restrictions linked to client privacy, NDAs and confidentiality clauses, particularly when marketing bespoke projects or technical solutions. This creates a paradox: the industry depends on visual storytelling but often cannot show its work.

For many, the problem extends beyond privacy to logistical constraints: short lead times, limited access to yachts and inconsistent support from brokers, captains or owners when filming or photographing projects.

The result is an uneven playing field where companies with stronger access networks dominate visibility, while others struggle to represent their capabilities.

“GETTING REAL-LIFE CONTENT! AS A TECHNOLOGY SUPPLIER, WE HAVE LIMITED OPTIONS TO SHOW REAL LIFE EXAMPLES DUE TO THE ‘CONFIDENTIALITY’ OF PROJECTS. WE GET NO RIGHTS TO USE ANY CONTENT FROM FINISHED PROJECTS TO SHOWCASE OUR SOLUTIONS.”

“SHORT LEAD TIMES DUE TO CONSTANT ITINERARY CHANGES PREVENT US FROM CREATING MORE CREATIVE CONTENT.”

“THE CAPTAIN DOES NOT ALLOW TIME FOR QUALITY CONTENT CREATION.”

4. Traditionalism, event fatigue and ROI pressure Despite its luxury profile, the superyacht industry remains anchored in traditional marketing channels, particularly boat shows, print magazines and networking events. These platforms continue to serve as the backbone of credibility, relationshipbuilding, and brand visibility.

However, beneath this dependence lies growing strain. Respondents acknowledged both the enduring necessity of such events and a mounting sense of exhaustion surrounding them. Rising costs, crowded calendars and limited measurability have fueled increasing scepticism about ROI.

This dynamic has produced a clear sense of fatigue among marketers and business leaders. The tension reflects a broader identity struggle within the industry between heritage and innovation, and between the prestige of face-to-face engagement and the efficiency of digital marketing.

Many participants described the challenge of maintaining visibility across an ever-expanding calendar as increasingly unsustainable, reinforcing the need for greater focus and more selective, highvalue participation.

“THE INCREASE IN THE NUMBER OF BOAT SHOWS.”

“BOAT SHOWS AND TOO MANY MAGAZINES.”

“TOO MANY EVENTS AND PRESSURE FROM NEW EVENTS TRYING TO COME INTO THE INDUSTRY.”

“REACHING THE RIGHT AUDIENCE IS MOST CHALLENGING. BOAT SHOWS ARE EXPENSIVE AND YOU HAVE TO QUESTION THE ROI.”

“EVENTS LIKE BOAT SHOWS AND REGATTAS ARE VERY TRADITIONAL AND EXPENSIVE.”

CURRENT MARKETING STRATEGIES AND CHALLENGES (CONTD)

5. Technology, AI and digital transition fatigue

The accelerating pace of technological change, particularly the integration of AI, was cited as both opportunity and frustration.

While some see potential in emerging tools, many described confusion, inconsistency, and even ethical concern about overreliance on automation. Others voiced irritation at the dominance of short-

form, influencer-led content on platforms such as TikTok, which they perceive as misaligned with the tone of luxury yachting.

This theme highlights an evolving tension between tradition and transformation where the industry recognises the need to modernise but continues to wrestle with where technology genuinely adds value versus where it dilutes brand authenticity.

“CONTINUOUS CHANGE IN MARKETING APPROACH AS WELL AS AI IS VERY CHALLENGING.”

“ARTIFICIAL INTELLIGENCE AND MORE INPUT ON SOCIAL MEDIA AND PLATFORMS AS TIKTOK.”

“AI INVOLVEMENT.”

“THE AI INCORPORATION.”

“LIMITED UNDERSTANDING BY BRANDS OF HOW TO DEVELOP THEIR DIGITAL MEDIA STRATEGY.”

6. Structural and systemic constraints

Finally, respondents identified deeper structural challenges that limit progress spanning workforce capability, regulation and industry governance.

Several highlighted a shortage of skilled marketing professionals who truly understand the sector, as well as a lack of transparency in subcontracting practices and insufficient collaboration across the value chain.

“OLD-FASHIONED MINDSETS.”

Others pointed to outdated mindsets and lack of creativity within brand leadership, creating inertia in an industry otherwise known for innovation.

Underlying these frustrations is a broader critique of the industry’s self-perception, one still dominated by a few powerful players, slow to evolve and too comfortable relying on legacy prestige rather than strategic modernisation.

“TRYING TO BE RELEVANT WITHIN AN INDUSTRY SOLELY FOCUSED AND DOMINATED BY THE BIG PLAYERS.”

“THE ROLE OF SUBCONTRACTORS – WE NEED MORE REGULATIONS AND PREFERRED SUPPLIER LISTINGS.”

“EXTRAORDINARY AMOUNT OF BULLSHIT EVERYWHERE.”

“LACK OF IMAGINATION, CREATIVITY AND RISK-TAKING.”

SUSTAINABILITY AND ITS EMERGING PRIORITY

INTEGRATION OF SUSTAINABILITY IN MARKETING

The data indicates that sustainability is gaining meaningful traction in superyacht marketing, but remains unevenly embedded across the industry. A combined 51% of respondents rated their company’s focus as either “very” (22%) or “extremely” (29%) high and a substantial 36% described their engagement as “moderate”. Meanwhile, 13% said their organisations are minimally or not at all focused on integrating sustainability into marketing.

This distribution suggests that sustainability has moved beyond symbolic awareness and is now a

visible, if inconsistently applied, component of brand positioning. For many firms, sustainability appears to function primarily as a communications pillar within marketing, signalling alignment with client expectations rather than functioning as a deep operational differentiator.

Taken together, the findings reveal a sector in transition, where sustainability has become a reputational necessity, but not yet a fully integrated marketing strategy. The challenge for superyacht companies lies not simply in adopting the language of responsibility, but in demonstrating authentic, evidence-based sustainability that aligns with the values of an increasingly conscious society.

MAKE YOUR MARK AMSTERDAM

The Superyacht Marketing, Advertising and Digital Strategy Summit

Book Your Seat: Hosted By:

2025 SUPERYACHT MARKETING SURVEY

63% of companies’ still direct the majority of their marketing budgets to events - but ROI is unclear.

60% of companies spend less than 5% of their marketing budget outside the yachting sectorpotentially limiting access to new UHNW audiences.

46% of companies invest nothing in research or data.

49% plan to increase video content and 42% plan to invest in AI tools.

Budget constraints, audience targeting, and limited content access emerged as some of the most significant challenges for companies.

The findings of the 2025 Superyacht Marketing Survey reveal an industry at a turning pointchallenged by rising costs, content saturation, shifting audience behaviours and the pressure to modernise. Companies want clearer ROI, stronger storytelling and smarter use of data.

Join us at Make Your Mark 2026, where we’ll take these insights off the page and into practice.

YOUR

BRAND IS WHAT OTHER PEOPLE SAY ABOUT YOU WHEN YOU ARE NOT IN THE ROOM

Jeff Bezos, Amazon

ABOUT MAKE YOUR MARK

Make Your Mark is the Superyacht Marketing, Advertising and Digital Strategy Summit. Two focused days where the best ideas from the wider marketing world meet hard data from the superyacht market.

We’ll stress-test what works, discard what doesn’t and give you practical ways to make your marketing more effective in 2026. Expect smart keynotes, sharp case studies, live clinics and working sessions that translate into action the morning you’re back at your desk.

Who should attend: CMOs, marketing leads, content and digital teams, founders and agency partners who want results not noise.

WHY ATTEND

In the spirit of inspiring, informing and collaborating with friends and colleagues, MAKE YOUR MARK will help drive a smarter, more effective and more creative superyacht industry.

- Get a concise playbook for superyacht marketing in 2026

- Learn from real campaigns with numbers, not guesswork

- Hear candid panels on brand, content, paid, PR, events and partnerships

- Join small working sessions to solve your live challenges

- Benchmark your strategy against peers and competitors

- Leave with clear priorities, timelines and metrics you can own

SPEAKERS

Make Your Mark will bring to the stage marketing experts and strategic gurus from outside the superyacht market, who will inspire, inform and engage with the delegates, to bring them up to speed with the wider world of luxury and strategic marketing and branding. They will deliver powerful keynotes and then drive interactive workshops and brainstorms in smaller groups, with smart exercises and case studies to challenge the delegates to be brave and think differently. No one from the superyacht market will be on stage as an expert, only in the audience as delegates who want to Make Their Mark in the future.

WHILE SOME SEE POTENTIAL IN AI AND EMERGING TOOLS, MANY DESCRIBED CONFUSION, INCONSISTENCY AND EVEN ETHICAL CONCERN ABOUT

The Superyacht Agency, Marketing Survey Report 2025

THE FEAR THAT WE HAVE TO BE DOING EVERYTHING WHEN WE COULD INSTEAD BE STRONGER BY FOCUSING ON FEWER ACTIONS.

Superyacht marketer on their biggest challenge, Marketing Survey Report 2025

WHAT IS INCLUDED

Secure your seat for 19–20 March 2026 in Amsterdam. Places are limited to keep the quality high.

Your ticket includes:

- Full access to all sessions, clinics and networking - Slides and take-home frameworks

- Coffee, lunch and the day-one reception - Post-event briefing notes for your team

Book Your Seat:

BECOME A PARTNER

Put your brand in front of the people who shape superyacht marketing. Partners gain visibility across the summit and meaningful time with decision-makers. For partnership enquiries contact martin@thesuperyachtgroup.com

Your partnership includes:

- Thought-leadership slots or hosted roundtables - Research or report alignment with TSG’s data team - Activation space in the networking hub - Branding on lanyards, breaks or the reception

- Targeted lead follow-up after the event

MARKETERS REVEALED

A COMPLEX PICTURE OF AN INDUSTRY CAUGHT BETWEEN TRADITIONAL PRACTICES AND RAPID TRANSFORMATION.

The Superyacht Agency, Marketing Survey Report 2025

MAKE YOUR MARK AMSTERDAM

Book Your Seat: Hosted By:

FUTURE OUTLOOK AND CONSIDERATIONS

FUTURE MARKETING INVESTMENTS

The data points to a forward-looking but pragmatic marketing outlook, with companies selectively increasing investment in tools and channels that support both visibility and capability. The top areas of projected growth include video content production (49%), social media advertising (44%), events and yacht shows (43%), website development (43%) and AI-based tools (42%), signalling that the industry’s next phase of marketing evolution may lie in the fusion of digital infrastructure and experiential storytelling.

This investment pattern suggests that the sector is not abandoning traditional relationship-driven platforms like yacht shows, but is instead layering them with digital enhancements, using video, social media and data integration to extend the impact and reach of event-based engagement. It reflects a growing

recognition that brand awareness now depends on continuous narrative building, not just periodic visibility.

Equally notable is the growing investment in data infrastructure and insight tools. Just over one quarter of respondents expect to increase budgets for CRM systems (27%) and research or customer behaviour analysis (26%), suggesting a gradual shift toward data-informed decision-making. Although still emerging, it is gaining strategic value as companies seek to understand audiences more deeply and measure the return on marketing spend with greater precision.

At the lower end of future investment priorities are branding or PR agencies (19%) and print media (9%), indicating that traditional outsourced communications and formats are becoming secondary.

FUTURE OUTLOOK AND CONSIDERATIONS (CONTD)

RATIONALE BEHIND FUTURE MARKETING INVESTMENTS

The comments accompanying the investment data reveal a consistent theme: companies are investing not simply to spend more, but to stay relevant in a rapidly shifting marketing environment. Across the industry, motivations for increasing spend reflect a blend of defensive necessity, keeping pace with technological change and strategic ambition to build stronger, more measurable brand engagement.

Several core rationales emerged:

1. Staying aligned with audience and market evolution.

Many respondents framed their decisions as a response to changing audience behaviour and media consumption patterns. As one noted, the goal is to “stay up to date on the channels our target audience is using most.” This highlights an acute awareness that the next generation of yacht owners and decisionmakers consume information differently, prioritising immediacy, transparency and visual storytelling. The surge in investment in video content (49%) and social media advertising (44%) reflects this adaptive focus.

2. Building visibility through storytelling and authenticity

Numerous respondents linked their increased marketing spend to brand storytelling and long-term reputation building, describing content as “proof” and “the story behind my agency”. This reinforces the idea that in a high-trust, reputation-driven sector, credibility is earned through narrative depth rather than volume of exposure. The link between video content, events and website development underscores a cohesive strategy of showcasing craftsmanship and personality, extending brand experiences beyond traditional show formats.

3. Future-proofing through technology and data. A significant cluster of comments referred to AI, CRM and automation as necessary to “keep up with the market” and “future-proof brand awareness”. These responses point to an early-stage but growing shift toward data-enabled marketing infrastructure, not as a replacement for personal relationships, but as a means to scale and refine them. AI-based tools (42%) and CRM integration (27%) appear to represent the industry’s digital evolution, driven by both competitive pressure and curiosity about ROI.

4. Expanding reach and market share.

Many respondents cited market expansion and new audience acquisition as key motivators, from entering new geographic markets to targeting younger, more digitally fluent client segments. The sentiment that “opening new markets requires investments in brand, resources, tools and campaigns” captures a shift from reactive to proactive marketing, suggesting that companies now see brand building as a lever for growth, not just reputation maintenance.

5. Balancing tradition with modernisation. Interestingly, while companies recognise the need to innovate, there remains a strong desire to preserve the craft and personal engagement that define the superyacht experience. Comments like “face-toface at shows is the best” and “we are telling stories about who we are and what we do” illustrate that digital transformation is not being pursued at the expense of tradition, but rather as a complement to it.

FUTURE MARKETING REDUCTIONS

The outlook for marketing reductions is notably restrained. 41% of respondents indicated no plans to reduce spending in any area of marketing, suggesting that most firms are maintaining, rather than contracting, their current marketing mix. This aligns with a general picture of cautious continuity, where budgets are being reshaped rather than scaled back.

Where reductions are anticipated over the next five years, they are concentrated in print media (44% of companies), reinforcing its continued decline as investment continues to shift toward digital and experiential channels. This future outlook builds on the reductions reported in recent years (p. 16), indicating that print’s contraction is part of a sustained, longterm evolution in the superyacht marketing mix. The fact that print continues to dominate planned cutbacks, while other categories remain largely protected, highlights a growing preference for measurable and flexible media.

The modest planned reduction in social media advertising (9%) and influencer marketing (9%) may reflect several converging factors, from scepticism about ROI and audience relevance, to the desire for greater brand control, message precision and the practicality of sustaining high-maintenance digital channels. For some firms, the cost and complexity of managing these initiatives may outweigh their perceived benefits; others may simply be reallocating limited resources toward channels that offer clearer metrics or stronger alignment with brand tone.

Interestingly, events and yacht shows (6%), despite their high cost, remain largely safeguarded from reduction, underscoring their continued value as relationship and deal-making platforms. This reinforces earlier findings that experiential engagement still sits at the core of the industry’s marketing strategy, even as companies selectively rebalance spend across digital and traditional channels.

FUTURE OUTLOOK AND CONSIDERATIONS (CONTD)

RATIONALE BEHIND FUTURE MARKETING REDUCTIONS

The comments accompanying the reduction data reveal that companies are not retreating from marketing, but recalibrating. Most spending cuts appear driven by performance-based evaluation, changing audience behaviour and the pursuit of greater efficiency. Rather than signalling contraction, these adjustments indicate a more selective, outcome-oriented approach to where marketing effort delivers more value.

Several core rationales emerged:

1. Declining returns from traditional media. The most frequently cited reason for reduced spending in print media was attributed to its diminishing impact. Respondents pointed to “poor ROI”, “high costs” and “lack of visibility,” with some noting that “clients no longer have time to read leisurely” and that “everyone has a phone”. Others cited environmental considerations, ineffectiveness and distribution inefficiencies, describing print as increasingly unsustainable both economically and socially. This consistent feedback points to a structural reallocation, with a move away from traditional media toward channels that offer immediacy, interactivity and data-driven visibility. Firms are increasingly unwilling to fund channels whose impact cannot be quantified or connected to lead generation.

2. Responding to changing audience behaviour. Several companies noted that their target clients, particularly next-generation yacht owners, are no longer reachable through traditional channels. Comments such as “everyone has a phone” and “clients just don’t have time to read leisurely” highlight a shift in media consumption and attention habits. Companies are learning that reach alone is not enough and effectiveness depends on audience relevance and authenticity.

3. Caution around social and influencer marketing. Although adoption of social media platforms across

the superyacht industry is now almost universal, confidence in their effectiveness remains uneven. Many companies view social media as an essential visibility tool rather than a proven driver of measurable engagement or lead generation. Several respondents expressed scepticism about the effectiveness of influencer collaborations and paid social campaigns, questioning both their authenticity and ROI. Phrases such as “influencers are fake”, “low quality”, “too crowded” and “poor results against competitors” underscore persistent uncertainty about these channels’ credibility within a high-trust, reputationdriven industry. The scepticism suggests that while social channels remain part of the marketing mix, a few firms are becoming more selective in how and where they engage, favouring brand-controlled narratives over outsourced influence.

4. Refocusing resources for clarity and efficiency. Budget discipline was another recurrent theme. A subset of responses reflected a pragmatic recalibration of priorities. Comments such as “too many slices of cake, do what you can achieve well”, and “to get our marketing mix right” reveal an emphasis on focus rather than expansion. In an industry where many marketing teams are small and budgets tight, efficiency and clarity of purpose are fundamental. Reductions here often reflect a choice to consolidate resources into fewer, betterperforming activities.

5. Prioritising relationship-driven engagement. Amid digital optimisation, many respondents reiterated that personal interaction remains their strongest commercial driver. Comments like “person-to-person is the way to capture and increase business sales” and “face-to-face works best” underscore a deeply held belief that relationship-based marketing, built on trust, discretion and craftsmanship, cannot be replaced by algorithmic reach. For many, this translates into a preference for more curated, personalised experiences over broad digital exposure, suggesting that in the superyacht sector, human connection remains the ultimate differentiator.

IF BUDGETS GREW

Across the industry, the most common use for a larger budget is to reinvest in events and client experiences but in ways that are more intimate, curated and narrative-led than the traditional yacht show model. Although the industry remains deeply attached to face-to-face connection, rather than simply attending more boat shows and chasing more exposure for its own sake, respondents envisioned crafting experiences that embody brand values and foster meaningful, personal relationships.

This reflects a shift from exposure-driven participation to experience-driven connection, where success is measured not by the scale of attendance but by the depth of interaction and memorability. For many, hosting smaller, more purposeful gatherings offers greater authenticity and differentiation than largescale, transactional showcases.

There was also a the growing interest in partnershipled initiatives. Some companies expressed plans to co-create events with other luxury or adjacentsector brands, recognising collaboration as a way to access shared HNW audiences and reinforce credibility through association. This suggests an evolving understanding of brand ecosystems, one built on shared values and cross-sector storytelling rather than isolated visibility.

In many cases, experiential ambitions were linked with digital and content integration, including video production, social storytelling and post-event CRM follow-up to extend engagement beyond the event itself. This suggests a more strategic integration of live and online marketing, where physical experiences generate digital equity and long-term visibility.

“EXPERIENTIAL EVENTS FOR CLIENTS IN REMOTE REGIONS.”

“HOST MORE DIRECT MARKETING EVENTS WITH STAKEHOLDERS OF CLIENTS TO SHOW AND EXPLAIN OUR SERVICES.”

“ADDING BOUTIQUE EVENTS AND MEANINGFUL CAMPAIGNS TO RAMP UP PERSONAL COMMUNICATION.”

“BOAT SHOWS AND DIRECT LINKS TO CAPTAINS, ENGINEERS.”

“CREATING AN OWN EVENT WITH OTHER BRANDS.”

FUTURE OUTLOOK AND CONSIDERATIONS (CONTD)

2. Expanding digital presence through content, video and social media

A significant share of respondents expressed a desire to strengthen their digital storytelling through richer content, video production, influencer collaborations and more strategic social media activity. The focus was not simply on producing more material but on creating content that conveys expertise, emotion and brand character with greater impact and consistency.

Many respondents described the need to elevate visual quality and narrative depth, transforming brand communication into a more cinematic and authentic reflection of their identity. This signals an understanding that in a luxury market defined by

aspiration and craftsmanship, visual storytelling can be a vehicle for differentiation.

Video emerged as a particularly prominent priority, cited as both a creative outlet and a means to translate the sensory richness of the superyacht experience into shareable, emotionally resonant narratives.

Social media, meanwhile, was seen as the most direct pathway to visibility and relevance, but one that demands a more refined and professional approach. Several responses reflected an ambition to move from ad hoc posting to intentional brand storytelling, supported by stronger visual assets, consistent tone and planned campaign structures.

“CONTENT CREATION, TO CAPTURE ENGAGEMENT AND START A CONVERSATION WITH OUR CLIENTS.”

“MORE VIDEOS.”

“VIDEO CONTENT FOR SOCIAL MEDIA.”

“INVEST IN MORE VIDEO CONTENT AND CREATING EVENTS.”

“INFLUENCER MARKETING AND UGC CREATION.”

3. Investing in data, technology and CRM integration

Another key area of focus among respondents is the desire to strengthen technological and analytical capabilities. With additional resources, companies would invest in CRM systems, automation tools and AI-driven analytics to improve lead generation, customer tracking and campaign performance.

This aspiration signals a growing recognition that the future of competitive marketing lies in operational intelligence as much as creative expression. Respondents understand that data can transform fragmented marketing activity into structured, measurable strategies, enabling precision targeting, better conversion tracking and more efficient client nurturing.

The emphasis on CRM integration reflects frustration with existing limitations around data use and followup, an issue raised repeatedly in other parts of the survey. Companies recognise that while personal relationships remain at the heart of the industry, technology can amplify human engagement rather than replace it by turning client insights into tailored communication and sustained loyalty.

Similarly, interest in AI-based tools suggests curiosity about automation’s role in enhancing efficiency and personalisation. For many, these technologies represent not a radical disruption but a natural evolution towards smarter, more connected marketing systems.

“ADDING A CONTENT AND PR AGENCY … THEN INVEST A LOT INTO OUR CRM AND BUILDING OUR COMMUNITY MORE WIDELY.”

“INVEST IN A BETTER CRM WITH MARKETING AUTOMATION FOR CUSTOMER JOURNEY MAPPING.”

“CRM AND MARKET INTELLIGENCE.”

“AI INTEGRATION, CRM.”

“CLEVER AI CLIENT TARGETING TOOLS.”

“WINDFALL DATA PLATFORM FOR HUBSPOT CRM INTEGRATION … ACTIONABLE DATA TO FIND, ENGAGE, AND CONVERT OUR NEXT BEST CUSTOMERS.”

FUTURE OUTLOOK AND CONSIDERATIONS (CONTD)

4. Strengthening people, skills and partnerships Beyond technology, marketers expressed a profound desire to invest in people and collaboration. For many, an increased budget would mean hiring additional team members, engaging specialist agencies or training existing teams, not to expand bureaucracy but to gain creative and strategic bandwidth.

Unsurprisingly, this sentiment is strongest among

small to mid-sized firms where marketing often falls to a single generalist. Here, even a modest increase could unlock professionalisation, relieving the “team-of-one” pressure that surfaced repeatedly in the challenges section. For larger companies, the emphasis shifts toward upskilling, agency partnerships and talent development, investing in agility and cross-functional expertise rather than headcount alone.

“AN EXTRA 20% GIVES ME THE OPPORTUNITY TO INVEST IN PEOPLE AND SKILLS.”

“MORE TRAINING AND MORE PEOPLE.”

“ADDING A CONTENT AND PR AGENCY TO HELP SORT ALL THE BRANDS.”

“GETTING AN ASSISTANT.”

“HIRING A MARKETING DIRECTOR.”

5. Diversifying reach through partnerships and cross-sector positioning

A notable theme that appeared is the desire to expand visibility beyond the yachting bubble. Although current investment remains largely industry-bound, many marketers aspire to extend brand reach through cross-sector partnerships.

Respondents expressed growing interest in crosssector collaborations with luxury brands in art, fashion, property and travel, industries that engage the same UHNWI audiences. This indicates a growing recognition that future clients may be reached through indirect or lifestyle-adjacent channels rather than traditional yachting media only.

By aligning with parallel sectors, they aim to access fresh audiences and redefine how superyachts fit within the broader luxury narrative. Regionally, Western Europe and North America lead this trend, reflecting mature luxury markets where cross-sector collaboration is already an established strategy.

The sentiment represents a notable pivot from insularity to integration. As one respondent noted, their goal is to “broaden the base into other targeted UHNWI areas and tandem market with highvalue companies.” Such diversification suggests a recognition that tomorrow’s owners and charterers are no longer found solely within the maritime sphere. They are global citizens whose loyalties span multiple lifestyle dimensions.

“MORE PARTNERSHIP EVENTS WITH COMPANIES HAVING THE SAME TARGET GROUP: HNWI/UHNWI.”

“BROADEN THE BASE INTO OTHER TARGETED UHNWI AREAS AND TANDEM MARKET WITH HIGH-VALUE COMPANIES.”

“USING PARTNERSHIPS.” “BRAND VISIBILITY OUTSIDE OF THE YACHTING SECTOR.” “DIVERSIFY INTO PARALLEL MARKETS.”

FUTURE OUTLOOK AND CONSIDERATIONS (CONTD)

6. Refining brand strategy and creative identity

A final theme emerging from the responses highlights a growing awareness of the need for clearer, more consistent brand strategy. Many marketers expressed the desire to use additional budget to strengthen how their brands communicate who they are and what they stand for, moving beyond tactical promotion towards a more deliberate and enduring brand narrative.

For many companies, this aspiration reflects a shift from being seen to being understood. Respondents spoke of refining messaging, improving PR and investing in branding not merely to attract attention but to articulate authenticity and build credibility.

“WOULD INVEST IN PR SERVICES.”

A number of comments also pointed to fatigue with superficial or fragmented marketing efforts. Phrases such as “true, reliable information” and “strengthen our brand in general” suggest a desire for marketing that informs and reassures rather than dazzles, as brands seek to communicate expertise and values with greater integrity.

For others, refinement meant aligning brand storytelling with craftsmanship and expertise, ensuring that marketing reflects the true quality of their product and service.

“STRENGTHEN OUR BRAND IN GENERAL.”

PRIMARY CONCERNS FOR THE FUTURE OF THE SUPERYACHT MARKET SECTOR

When asked about their concerns for the future of the superyacht market, respondents revealed a mix of structural tensions, ethical reflections and marketdriven uncertainties. The responses collectively suggest a sector that remains confident in its longterm demand but is increasingly aware of pressures around sustainability, workforce capability, and public legitimacy.

Six interconnected themes emerged, reflecting both macro-level risks and internal industry challenges:

1. Market competition and consolidation

A recurring theme that emerged relates to rising competition and industry consolidation, with many respondents describing an increasingly saturated market landscape and a perceived imbalance of power among dominant players.

Respondents voiced growing frustration about an

industry that feels increasingly crowded and unevenly competitive. Many highlighted that large brokerage groups and marketing powerhouses dominate visibility, media coverage and event exposure, leaving smaller companies struggling to gain traction. The consolidation of resources and clients within a handful of major players is seen as limiting diversity and innovation, with independent firms describing a sense of exclusion from opportunities such as sponsorships, speaking slots or editorial features.

There is also a pervasive feeling that the market has become oversaturated with events, content and suppliers, while the actual number of yacht buyers and decision-makers remains small. This imbalance is driving a perception of “noise”, with too many voices chasing the same audience. This makes it difficult for genuine expertise and creativity to stand out. Ethical concerns were also noted, with reports of imitation campaigns and commercial practices that undermine fairness and professionalism across the sector.

“COMPETITION FROM THE LARGEST BROKERAGE HOUSES.”

“DILUTION OF SECTOR.” “TOO MUCH CONTROL BY TOO FEW COMPANIES.”

“THERE WILL BE MORE COMPETITION SO WE NEED TO ADAPT FAST TO NEW TRENDS.”

“THE LARGE AMOUNT OF STARTUPS SATURATING THE INDUSTRY AND CONSEQUENTLY STANDARDS DROPPING.”

“COMPETITORS SPOOFING OUR CAMPAIGNS, WHICH HAS BEEN ON THE RISE. VERY UNETHICAL.”

FUTURE OUTLOOK AND CONSIDERATIONS (CONTD)

2. Workforce shortages and professional decline Echoing the earlier marketing challenges, respondents consistently expressed concern about human resource shortages and declining professionalism across the sector.

The shortage of skilled technical and operational staff, from shipbuilding to crew, was described as both chronic and worsening, driven by an ageing workforce, limited training pipelines and burnout at sea.

“THE LACK OF SKILLED PERSONNEL.”

“PROFESSIONALISM IS IN DECLINE.”

This concern runs deeper than headcount. Respondents warned that the influx of underqualified personnel and the quick-turnover mentality threaten to erode the reputation of excellence on which the superyacht industry depends.

The cumulative effect is a perceived erosion of service quality, morale and institutional knowledge which is a critical vulnerability in a market built on trust and expertise.

“AVAILABILITY; HUMAN RESOURCES, BOTH IN TERMS OF OPERATORS AND TECHNICAL MANAGEMENT.”

“CREW BURNOUT, NEED MORE ROTATION.” “LACK OF NEW QUALIFIED WORKERS.” “FOCUSING ON QUICK TIME, LESS QUALITY.”

3. Sustainability, ESG and ethical accountability

Sustainability dominates future-facing concerns, with environmental responsibility and ESG adaptation emerging as central priorities and sources of concern. While more than half of respondents rated their company’s sustainability focus as high or very high, follow-up commentary suggests that many of these efforts remain surface-level rather than systemic. This gap between perceived progress and practical implementation underpins growing concern about the industry’s readiness for change.

Respondents widely acknowledged that regulatory and cultural pressures are intensifying, but many fear the industry is not adapting fast enough to meet

them. Concerns ranged from the need for genuine decarbonisation and transparency to the danger of “greenwashing” eroding credibility.

Interestingly, this theme often appeared intertwined with brand reputation and client perception, as participants worry that failure to demonstrate progress could invite stricter regulations and diminish appeal from the next generation of owners.

At the same time, some companies expressed frustration at lacking the resources or scale to market their sustainable efforts effectively, even when they are genuine.

“FALLING BEHIND ON SUSTAINABILITY AND DISRUPTIONS DUE TO POLITICAL INSTABILITY.”

“CLIENTS BECOME MORE SUSTAINABILITY ORIENTED.”

“MAKING YACHTS SUSTAINABLE IN THE CURRENT STATUS OF THE UNSTABLE WORLD.”

“IT’S A VERY MALE-DOMINATED WORLD, WITH A LOT OF GREENWASHING –IT SHOULD BE MORE REAL AND GENUINE.”

“THE ONGOING REQUIREMENT TO MAKE YACHTS AND THE INDUSTRY A LOT MORE SUSTAINABLE IN EVERY WAY, AND TO MAKE SURE THAT MESSAGE IS COMMUNICATED LOUD AND CLEAR.”

“OUR TARGET GROUP IS SMALL … WE HAVE TO INVEST MORE IN FINDING SUSTAINABLE SOLUTIONS TO MAKE YACHTS ACCEPTABLE FOR THE NEXT GENERATION.”

FUTURE OUTLOOK AND CONSIDERATIONS (CONTD)

4. Economic and geopolitical volatility

Respondents expressed strong awareness of macroeconomic fragility and geopolitical risk, identifying these as major uncertainties for the decade ahead. Concerns ranged from global financial instability and inflationary pressures to the effects of political unrest, trade conflicts and environmental regulation.

Many respondents linked these issues to buyer confidence, noting that geopolitical shocks and economic downturns have an immediate impact

on discretionary luxury purchases. In an industry so dependent on the spending confidence of UHNWIs, even minor global disruptions can ripple sharply through order books, charter demand and employment stability.

The tone of these responses suggests an industry that has learned from past cycles of growth and contraction, and now recognises that its success depends not only on global wealth but also on broader economic and geopolitical stability.

“GLOBAL ECONOMIC UNCERTAINTY, ENVIRONMENTAL REGULATIONS AND TECHNOLOGICAL ADVANCEMENTS.”

“THE INSTABILITY OF THE WORLDWIDE FINANCIAL MARKET.”

“HOW SIGNIFICANT WILL THE DROP IN SALES BE AFTER THESE EXTRAORDINARY YEARS.”

“GLOBAL POLITICAL SITUATION, UNPREDICTABLE SUDDEN EFFECTS.”