14 years of reliable services

Human

Services

Complete Loads (FTL)

Groupage Loads (LTL)

Special Transports

FTL Temperature Controlled Loads

Daily Departures Italy & Greece

Handling & Storage Services

Intermodal Transport with less CO2 emissions

9.000 m2 of Storage Italy & Greece

120 Trucks & Trailers

3.500.000 km / year

10.000 shipments / year

3 Certifications

Member of ASTRE 37 years

ISO 9001 · ISO 39001 · HACCP

In a particularly dynamic market with many prospects for further development, Greece has been developing in recent years, at the level of promoting commodity flows from and to Europe, transforming itself at a new South-eastern European Logistics Hub.

The country’s main port, Piraeus, ranking 4th at the European Container Ports Rank, and the Port of Thessaloniki in the North, are both high-levelled and appreciated by depositors from all over the world, given their excellent geographical position and capabilities.

The country at a strategic level, places the Supply Chain sector second, after tourism. The sector contributes to the national GDP by more than 11%, creating a new modern law that governs the needs of the Supply Chain, operating on a permanent basis National Supply Chain Council - as the central government’s key advisory body and undertaking multiple initiatives to facilitate related investments.

On the private sector side, companies operating in the wider logistics service industry are showing remarkable dynamism, are a steadily rising force and have significant growth prospects, adapting to a difficult economic environment and having proven that they can withstand special situations.

OMIND CREATIVES and it’s magazine “Supply Chain & Logistics”, is one of the leading marketing companies in the Greek industry, focusing our philosophy on three pillars: Vision, Responsibility, Reliability. Thus it is the fifth time we participate as exhibitors at the ‘TRANSPORT-LOGISTIC/Munich Exhibition’ through the Hellenic Pavilion (Hall 4 / Stand 324). It is also the fifth time we publish a Special English Edition of the Magazine, which is addressed to anyone who is interested to the Greek Market and is looking for further information on how to start up, step by step.

This Special Edition, begins its journey, in the context of the national logistics mission in Germany, June 2025, but will also be sent to other international exhibitions (p.e. SIL Barcelona/ June 2025) and will also reach the offices of all the appointed institutional authorities and the leading business in Greece and across the Greek borders, informing them of the development prospects of the country.

Theodoros Dimitriadis CEO OMIND CREATIVES & Publisher of ‘SC&L’ Magazine-Greek

THE NOTE OF THE EDITOR

INDEX

COVER STORY

Why is it worth investing in the Greek logistics market?

INFOGRAPHICS

All the crucial numbers for the Greek Logistics Sector

SURVEY_ by

Hellenic Logistics association for the Greek Logistics Market

INTERVIEW with IRO DOUMANI

President of IRU’S goods transport council

ADVERTORIALS

• Athens International Airport

• Elikon Transport

• Epsilon Singularlogic

EU FUNDING

EU funding for 134 transport projects with €7 billion allocated by cef transport

EVENT

The 10th ‘Supply Chain & Logistics’ exhibition comes at October 18-20th in Athens – Greece

COMMUNITIES

Article by the Heavy Lift Group

ARTICLE by PwC

Electrification of fleet operations: innovating for a greener transportation landscape

EUROPEAN LEGISLATION

Challenges in the digitisation of accompanying documents for goods and in connecting greece with the eFTI application

WHAT ABOUT CUSTOMS?

An interview with CARGO3600

CONSTRUCTIONS

Industry & Logistics: Design and Construction of complex industrial units

ARTICLE by GRANT THORNTON

Digitisation in Supply Chain: navigating the digital transformation and evaluating the panacea of AI

LEGISLATION

The import control system 2 (ics2) extends to rail and road on 1 April 2025

ISSN 1792-4200

Subscriptions: syndromes@omind.gr www.supply-chain.gr • info@supply-chain.gr

PUBLISHER - CEO

Theodoros Dimitriadis

COMMERCIAL DIRECTOR

Antonis Moschonidis

CHIEF EDITOR

Mary Efthymiatou editor@supply-chain.gr

ADVERTISING

Manos Georgoulakis

Sofia Katsardi

George Glynos

ART DIRECTOR & GRAPHIC DESIGNER

Yiannis Ntrigios

Charis Papageorgiou PRODUCTION

Aggelos Anastasopoulos

SUBSCRIPTION Eleni Vagionaki MEDIA & MARKETING ASSISTANT Alex Dagres

Anastasia Kolovou

Katerina Kosiva SECRETARY Maria Michalochrista

The publication you are holding in your hands is the annual review of the Greek logistics market and a broader review of how the supply chain ecosystem works in Greece, as illustrated by the best-known industry magazine "Supply Chain & Logistics".

So let's assume that in order to invest in a market, there are 4 key elements that one should monitor (along with several other parameters which, combined, create the full picture).

Greece in 2025 is portrayed as the child prodigy of Europe. With a balanced budget, a primary oversurplus of 3% and markets applauding, the country appears to be gaining precious economic stability. Greece has developed a track record of primary surpluses and, since 2021, has achieved a significant reduction in its debt-to-GDP ratio by 54.8 percentage points.

Although much still needs to be improved and companies in the country insist that they are overtaxed, a new tax bill was recently put to the vote in Parliament, which includes 12 tax cuts and measures to boost citizens' income, while a supplementary budget was submitted to fund important infrastructure and ongoing projects, totalling €400 million. Of these 12 measures, those concerning companies relate to:

• providing incentives for mergers and acquisitions, boosting innovation and empowering start-ups;

• extending tax incentives for scientific and technological research and introducing new deductible expenditure limits for the growth and innovation of companies and investors;

• reducing social security contributions for companies by 1 additional percentage point.

This is a great starting point for a major debate. After several years, what Greece has achieved is to have proper infrastructure in terms of port logistics services, as well as road freight transport, even in the area that concerns the small in percentage but perfectly reliable air transport. Regarding interconnections, the ports of Piraeus and Thessaloniki, i.e. the central ports of the country, have secured connections with the major European E-roads and the rail network, as there are rail lines within the ports. In addition, Piraeus is directly connected to the country's largest airport. Regarding rail

connections, Thessaloniki is booming with routes to all the Balkan capitals, while the Athens-Thessaloniki network continues to suffer from long-standing and serious problems. In terms of organised terminals, or freight centres, we are not able to say that we have such parks at a national level. Current plans for the construction of such parks in the coming years include the area of Thriasio for Attica and the area of Fyli, which will again serve Attica and the islands, the former Gonou military base for the wider Thessaloniki area, and Thessaly, which is under discussion. However, everything that is being done so far is mainly based on private initiative. So, unofficially, there are organised industrial zones in Aspropyrgos and Oinofyta for the Attica and Boeotia prefectures, and in Kalochori and Sindos in Thessaloniki. These are areas with a large number of warehouses of medium size and specific height (due to restrictions in Greek legislation), while a large-scale private investment (HULL logistics park) is in progress in Aspropyrgos.

Geostrategic advantages

These are self-evident in the case of Greece. The port of Piraeus, which has been operating under concession to COSCO for more than a decade, is the central and shortest gateway for goods from Asia to Europe via the Suez Canal, while Thessaloniki is the main (and only) port that connects the entire Balkan peninsula and offers the option of automatic transhipment by rail to all Balkan capitals.

In addition to the above essential findings, if someone wants to enter the Greek logistics market, they should, of course, monitor other indicators that have a decisive impact on such a decision.

Such indicators are, for example, the rental prices of warehouses around large urban centres.

Similarly, one indicator that makes a difference relates to the ease of interconnection between modes of transport. That is, how easy it is to tranship goods from a central port in the country to the rail network or to one of the main E-roads, or from a port to an airport and vice versa.

A third indicator relates to customs simplification, even if this is a pan-European issue that needs to be addressed as a whole. To that, we can say that serious steps have been taken to make it easier for traders, and in the following pages of this special issue, you will have the opportunity to read articles on the introduction of eFTi and the improvements it brings to transport, as well as proposals concerning customs, clarifications and the benefits of customs warehouses.

Beyond that, there are other details that a prospective investor could look at, such as the wage balance in the country, the ease or otherwise of recruiting staff to staff warehouses or transport projects, etc., the digitalisation of the supply chain as a whole, the existence or otherwise of organised clusters that promote the functioning of the supply chain as an ecosystem. In general, Greece has nothing less than other European countries, as the steps taken in the last 10 years have been immense, and this has been recognized internationally, helping to promote the country to 19th place in the World Bank's Logistics Performance Index. The National Logistics Council has included among its commonly accepted goals the goal of promoting the country further in this international ranking, even placing it in the top 10.

• BY MARY EFTHYMIATOU, CHIEF EDITOR OF SC&L MAGAZINE

BY THE HELLENIC LOGISTICS ASSOCIATION AND THE DESIGN, OPERATIONS, & PRODUCTION SYSTEMS LAB

The documenting and analysis of the current state of Greek logistics; the mapping of the challenges and prospects of the sector from the perspective of businesses; the synthesis of trends on issues related to national strategy & growth prospects, digital transformation, sustainability and green logistics and the outlining of the way forward. These were the main topics covered with quantitative and qualitative indicators by the 6th national survey of the Hellenic Logistics Association (EEL) on logistics, which is a key driver of competitiveness, especially in the modern business environment. A total of 206 companies participated in the survey, from the trade (47%), logistics (40%) and manufacturing (13%) sectors.

Key findings of the survey

• The logistics sector

• Greece ranks 19th in the global logistics market based on the World Bank’s LPI results for 2023, and is on par with countries such as China, the United Kingdom and Italy.

• The logistics sector contributes €23.5 billion (11.4%) to Greek GDP and €12.4 billion (6.85%) to Gross Value Added.

• 5.4% of Greece’s total workforce is employed in the transport and warehousing sector, which translates into 225 thousand workers.

• The increase in the workforce is not sufficient to support the growth

Logistics’ contribution to GDP (in bill euros) Greek GDP 206,6 bill euros (2022)

Logistics sector contribution to GDP (2022)

Source: ELSTAT, 2024: Eurostat, 2024

23.5 bill €

of the sector and the need for additional workers.

• The majority of workers in the logistics sector have a secondary school education and perform manual occupations.

• Current situation

• Road transport is the predominant mode of transport (67% share). However, the fleet is old and has limited capacity.

• Synergies in road transport and the development of combined transport (using rail transport) are necessary.

• The port of Piraeus dominates the Mediterranean, although it has been significantly affected by the turmoil in the Red Sea.

• The port of Thessaloniki has great prospects to become a hub for the Balkans.

• 3PL warehousing areas are increasing significantly. Nevertheless, outsourcing shows significant growth potential.

• 3PL companies offer a wide range of services, but they need to invest in automation and employee training in order to become more competitive, reducing their operating costs and increasing the quality of their services.

• Future trends

• Legislation regarding the licensing of Storage and Distribution Centres, the creation of business parks and the development of railways continue to be a hindrance to the development of the logistics sector.

• The creation of a Special/General Secretariat for Logistics is required to coordinate and support the development of this sector.

Logistics is a key driver of competitiveness, especially in the modern business environment

• Significant progress is being made in the adoption of cutting-edge technologies. Companies have realised the importance of their digital transformation. Company size affects the rate of adoption of new technologies.

• Sustainable development is a priority for companies, as it reduces their operating costs, attracts new customers and increases their financial valuation.

A. Current situation

Cost of logistics processes: Logistics costs in relation to total operating costs range from 1-5% in a large number of the companies in the sample. Companies that have opted for the in-house model have managed to have costs close to those of 3PLs.

Outsourcing: The outsourcing rate is low (18%) compared to the European average, while partial outsourcing accounts for 58% and in-house supply chain management for 24%. The main reasons why a large proportion of companies choose in-house operations rather than fully outsourcing their logistics operations to a 3PL company are: lack of flexibility (45%), no end-to-end visibility on orders to be delivered (41%), lack of a large number of orders (32%), lack of quality services (27%), high costs (18%) and lack of good customer service (9%). The activities outsourced to logistics service providers are: national/international transport (82%), intra-city distribution (76%), warehousing (68%), reverse logistics (55%) – a service that is showing significant increase –forwarding (50%), packaging/re-packaging (47%), labelling (42%) and order management and fulfilment (26%).

Online services: The most popular information provided by 3PL companies to their customers (via a BI tool or reporting) include real-time stock based on codes (58%), PoD/IoD (proof and/or information of delivery) (50%), reports tailored to company needs (50%), Track‘n’trace (traceability) (42%), followed by KPIs (32%) and inventory management and/or activity planning (4PL) (13%). Location of warehouse facilities: The highest concentration of warehouse facilities in Greece is located in Attica (93%) and mainly in the broader Thriasio Plain area, followed by Central Macedonia (Sindos, Kalochori) (33%), Central Greece (Schimatari, Oinofyta) (15%), Thessaly (11%), Western Greece (9%), Macedonia & Thrace (7%), Peloponnese (7%) and the rest of Greece (13%).

Warehouse space: The majority of trading/manufacturing companies continue to manage small warehouses (43% < 5,000 sqm), in contrast to logistics service providers, where a significant increase in warehouse capacity (> 45,000 sqm) is currently observed compared to previous years. In particular, 24% of the participating 3PL companies claimed warehouse spaces of more than 45,000 sqm, 18% claimed a warehouse surface area of 10,000-20,000 sqm and 16% claimed a storage capacity of 20,000-45,000 sqm.

Type of cargo to be handled: The percentage of the total surface area of refrigerated cargo handling facilities is particularly low for both trading/manufacturing companies and logistics service providers. Only 2% of companies have more than 75% of total warehouse space dedicated to refrigerated cargo handling facilities

With 3PLs we are not flexible enough 45%

With 3PLs we don’t have end-to-end visibility of the deliveries we have executed and send 41% We don’t have so many orders to co-operate with a 3PL 32%

3PLs do not offer quality services 27%

3PLs have high costs 18%

3PLs don’t offer high customer service 9%

(refrigeration, freezing, special conditions) and another 2% have between 50-75%. It is noteworthy that the majority of logistics service providers (53%) and trading/manufacturing companies either do not have a single cold storage facility or cover a surface area of only 1%. These figures once again highlight the need for cold storage facilities in Greece, due to new consumer trends as well. Dry cargo remains the main type of handled cargo (82%), while a particularly big increase is observed with regard to refrigerated cargo (frozen foods, dairy products, pharmaceuticals). The main product categories handled by logistics service providers are mainly food/beverages (58%), electrical goods and consumables (49%), electrical appliances (42%), clothing and footwear (36%), with a positive trend observed in the storage of pharmaceuticals (18%).

Truck fleet: Both trading/manufacturing companies and logistics service providers have shifted their focus to the use of small and medium-sized vehicles in order to increase the speed and flexibility of distribution (city logistics). Logistics service providers have begun to adopt transition and alternative fuels to reduce their transport costs and carbon footprint.

Information systems: Regarding storage, the majority of 3PL companies (85%) focus on the use of WMS, 45% on Voice/Light picking technologies and only 8% on robotic systems. Regarding distribution information systems, the use of fleet management systems (58%), PoD/IoD (55%) and routing (47%) applications seems to be gaining ground compared to previous years.

B. Organisation of companies in their internal environment

Internal environment & challenges: The majority of the companies in the survey see opportunities for growth and a reboot of the domestic logistics market. However, it sees the lack of available warehouse space and appropriate financing tools as key obstacles to the development of the sector. The inability to find staff and the competence level of existing employees are the two main internal obstacles to company growth. The majority of the businesses that participated in the survey (84%) expect a heavier workload, greater use of information technologies (71%) and a need for an increased workforce (45%). Although sales are expected to go up, this will not always mean increased profitability.

Investments: reorganisation of logistics processes and in training/up-skilling their staff in information systems (mainly in warehousing and distribution).

Human resources: actions, companies stated that they will implement training programmes, enhance skills (re-skilling, up-skilling) and provide a range of benefits to reward productivity.

C. Future trends & prospects

National strategy & growth prospects:

focus on modernising the legislative framework, developing business parks and strengthening the role of the railway network. Attracting international cargo will also be a result of promoting Greek logistics abroad. In the coming years, the surveyed companies believe that significant investments will be made in the e-commerce sector, and also that the development and implementation of new technologies will play a key role in the growth of the sector. Substantial prospects are emerging in the tourism, pharmaceuticals and energy sectors.

Digital transformation: sample think that Big Data management information systems, robotic systems/automation and AI applications contribute significantly to the optimisation of their supply chain. A significant portion of the sample (41%) use cloud applications, while several have started or will start in the near future (1-3 years) to invest in robotic systems, automation and IoT or AI technologies.

Sustainability & Logistics: with calculating the carbon footprint are the most important actions regarding sustainability in logistics, according to the companies’ responses. 52% of the companies in the sample have already launched environmental actions, while 23% have planned actions for the next 1-3 years.

These technological advancements have not only boosted efficiency but also enhanced the professionalism and strategic importance of drivers in the modern logistics ecosystem.

SC&L_ Despite this upgrade, one of the main problems facing the sector across Europe - and even globally - is the shortages of workforce. The shortage of drivers. Why do you think this is happening and what’s IRU’s plan to find solutions?

The shortage of professional drivers is a pressing issue across Europe and globally, driven by an ageing workforce, challenging working conditions, and accessibility issues.

IRU is working to address these issues by advocating for better working conditions, such as more safe and secure truck parking areas, improving working conditions at delivery sites, promoting

management of the IRU. We would like you to share with the magazine and its readers the main policy pillars of the organization, its priorities for 2025 and how these can be tailored to the Greek market.

IRU’s strategic priorities for 2025 revolve around what we like to call the “3Ds”: driver shortages, digitalisation and decarbonisation.

I’ve already touched on the issue of driver shortages. For digitalisation, we are advocating for a full digitalisation of all road transport documentation, whether it be on the passenger or goods side. Digitalisation will further raise the efficiency and security of operations, as well as its transparency.

A good example is the eCMR protocol, the global UN standard for digital consignment notes that IRU supports. Greece ratified this protocol in 2023, and our challenge now is to work with all supply chain stakeholders and the government to bring this to life, so that we can advance to fully paperless road freight.

On decarbonisation, the IRU Green Compact is our industry’s collective global roadmap to achieve net-zero emissions by 2050, with the support of governments and our suppliers. It advances a pragmatic “dual” approach to reducing emissions that leverages efficiency measures and alternative fuels. This approach allows the sector to be fully carbon neutral by 2050 in the most cost effective way – for both private and public sectors – and to allow more transport to meet society’s future transport needs. 30 Years of EXPERIENCE

100% Greek Company

24.000 m2 OWNED FACILITIES

30.000 SHIPMENTS/YEAR

The first level of action is efficiency measures to reduce transport energy consumption. Often bringing immediate CO2 reductions as the solutions are tried and tested, these actions target boost efficiency in overall logistics networks (for example retiming, route optimisation and using larger and longer vehicle combinations), in trucks (for example with tyres, lightweighting and advanced lubrication), and with drivers (for example with eco-driving, skills monitoring and certification schemes).

The second level of action in this dual approach focuses on building a robust, practical and steady transition to alternative fuels – ensuring alternative fuels investments by road transport operators and logistics firms is feasible from a practical, technological, infrastructure and –perhaps most importantly – economic perspective.

All of these are global challenges that also apply to Greece and our own unique logistics and transport landscape. And, of course, we need to tailor our solutions to our situation in Greece in the broader EU context.

SC&L_ How honorable and special was your election to your new duties, both as a representative of a relatively small market, such as the Greek one, and as a woman in the field of freight transport?

Being elected as the President of IRU’s Goods Transport Council, and by extension, also as the organisation’s Vice President on its global governing board, was a defining moment in my road transport career. It is a great honour and a significant responsibility.

Moreover, as a woman in a traditionally male-dominated sector, this achievement highlights the progress made in embracing diversity. IRU has two global vice presidents and, for the first time, both are women (IRU’s new Passenger Transport Council President is Anna Grönlund from Sweden). Of IRU’s 10 board members, four are women, echoing the road transport sector’s drive to boost the representation of women in its workforce.

I hope my election and that of my colleagues inspires others, demonstrating that gender should never be a barrier to working in logistics and transport, including in leadership roles.

SC&L_ As a member of a younger generation of people who entered the field of transportation and logistics, coming essentially from different fields, we would like you to share with us what was the element that captivated you and made you stay in the industry. How different a person are you now and how much have the specificities that you inevitably encounter every day as a professional helped you?

My first steps into the transport and logistics sector were driven by curiosity and a fascination with the industry’s dynamic nature. Over time, I became captivated by its critical role in the global economy and its continuous evolution through innovation. Working in this field has profoundly influenced my personal growth, honing my problem-solving skills, adaptability, and understanding

of diverse market demands. It has been a transformative journey, shaping both my professional and personal perspectives.

SC&L_ From the same perspective (a young but experienced professional in the industry) I would like you to give us your perspective on what the challenges of the future are for those involved in the road transport industry? What are the pillars that will change its ‘morphology’? And therefore what should new colleagues who are now entering the market expect?

One thing is for sure, the industry is changing and changing rapidly. Environment and technology are obviously the main drivers of this change, but there are also many exogenous factors that contribute and make developments less predictable. The external environment is particularly volatile with intense geopolitical developments. The transport sector acts as a key recipient of these changes and must remain resilient.

This in itself also shapes the necessary characteristics of young professionals who wish to enter the transport and logistics sector and play an important role in its development. Adaptability and resilience are the key skills that the market requires from professionals in the sector, always combined with professional training, digital skills and expertise in logistics project management that is admittedly lacking in the labour market today.

As for the young professionals themselves, I cannot predict exactly what they can expect, but I am sure that an exciting professional journey awaits them and plenty of space for them to leave their personal footprint in shaping the industry of the future and the role it will play in the development of Greece as an international transit hub, as I am convinced that this is a one-way street.

SC&L_ I would like you to share with us through the magazine a prediction of what the industry will look like 10 years from now.

In 10 years, the road transport industry will be even more efficient, greener, and more interconnected. Sustainability will be a key driver, with carbon-neutral solutions steadily becoming standard.

Autonomous trucks and advanced driver-assistance system will play a growing role, boosting efficiency and safety and cutting costs.

Digitalisation will transform operations. For example, advanced data analytics and AI will increase real-time tracking and predictive maintenance. Freight-matching platforms will optimise load management, minimising empty trips and maximising efficiency.

Despite technological progress, adaptability and workforce development will be crucial. As roles evolve, businesses will invest in training and upskilling to equip their workforce with new competencies.

Ultimately, road transport will continue to be a crucial pillar of sustainable global trade, economic progress and social inclusion, bringing together innovation and resilience to continue advancing safe, efficient and green supply chains.

thens International Airport S.A. (AIA) and its cargo partners invite airlines, forwarders, and other customers to further develop their business through Athens by taking advantage of its strategic location, functional environment, multimodal services, and onestop-shop potential provided on 24-hr basis.

There are also several other good reasons for flying your cargo through Athens:

The strategic position

• Southeastern gateway to Europe • Proximity to major seaport (Port of Piraeus) • Fast access to the Balkans • Multimodal transport potential

The functional environment

• 24-hour airport operation, no slot & night constraints • Two independent runways • New flexible infrastructure, modern technology & equipment • High standards of safety & security • EU Border Inspection Post for Veterinary and Phytosanitary Control • Extended Customs working hours • Simplified Customs procedure for sea-air cargo • IATA CEIV Pharma certified handlers & forwarders • Sustainable and eco-friendly strategy

The collaborative community approach

• Airport Cargo Community Committee (ACCC) as a communication & development platform • AIA acting as communicator, integrator,

and facilitator of new cargo-relevant projects • Close cooperation with Hellenic Customs for seamless and fast cargo flows

The extroversion

• Joint participation at international events • Synergies with offairport partners to boost exports and multimodal traffic

The attractive incentives for airlines

• Competitive handling fees • Incentive scheme for new or additional cargo flights • Multiple incentive programs for airlines operating passenger aircraft

Contact us at Athens International Airport to make things fit as we all fit together.

Athens International Airport S.A. (“AIA”), a joint venture between the Greek State and a consortium of private shareholders, was established in 1996, its aim being to construct, operate and further develop the new Athens Airport. Having outsourced cargo handling to expert handling companies, AIA acts as the communicator, facilitator, and integrator of the local cargo community, aiming at continuous synergies among its members, including Customs, and furthermore off-Airport business partners such as Piraeus seaport and various exporting agencies.

CONTACTS

Cargo Development team

cargo@aia.gr

Alexis Sioris

Ground Handling & Cargo Development Manager

siorisa@aia.gr

Lina Palli Senior Account Supervisor Cargo Development pallia@aia.gr

Panagiotis Zagkas

Cargo Specialist zagasp@aia.gr

Elikon Logistics with over 25 years of experience in the field of logistics continues to committee and passionate about providing the best logistical solutions in a world of constant changes and challenges.

Acting from its owned offices in Levadia, Central Greece, Elikon Logistics has managed to expand its operation around Greece and across Europe. Nowadays, is able to rely on a loyal and effective transportation network in Europe for procurement and distribution logistics for industrial and consumer goods.

Elikon Logistics offers end to end solutions for imports, exports, intra-community shipments of dry and refrigerated cargo. In the recent years, wanting to offer even more tailor-made solutions, has been providing the sprinter van transport service, satisfying even the strictest deadlines and covering continental Europe from 48 till 72 hours. In the frame of supplying holistic international logistics management, provides inventory solutions for the delivery & distribution of goods in mainland Greece and islands through its rental storage spaces in Aspropyrgos, Thessaloniki and Levadia. Complementary services are also provided adding value to cross docking.

Elikon Logistics constantly investing in new technologies, so that can proudly declare a learning organization

DRY CARGO OPERATIONS

CONTROLLED TEMPERATURE TRANSPORT

FREIGHT MANAGEMENT

WAREHOUSE STORAGE

SUPPORT AND VALUE ADDED SERVICES

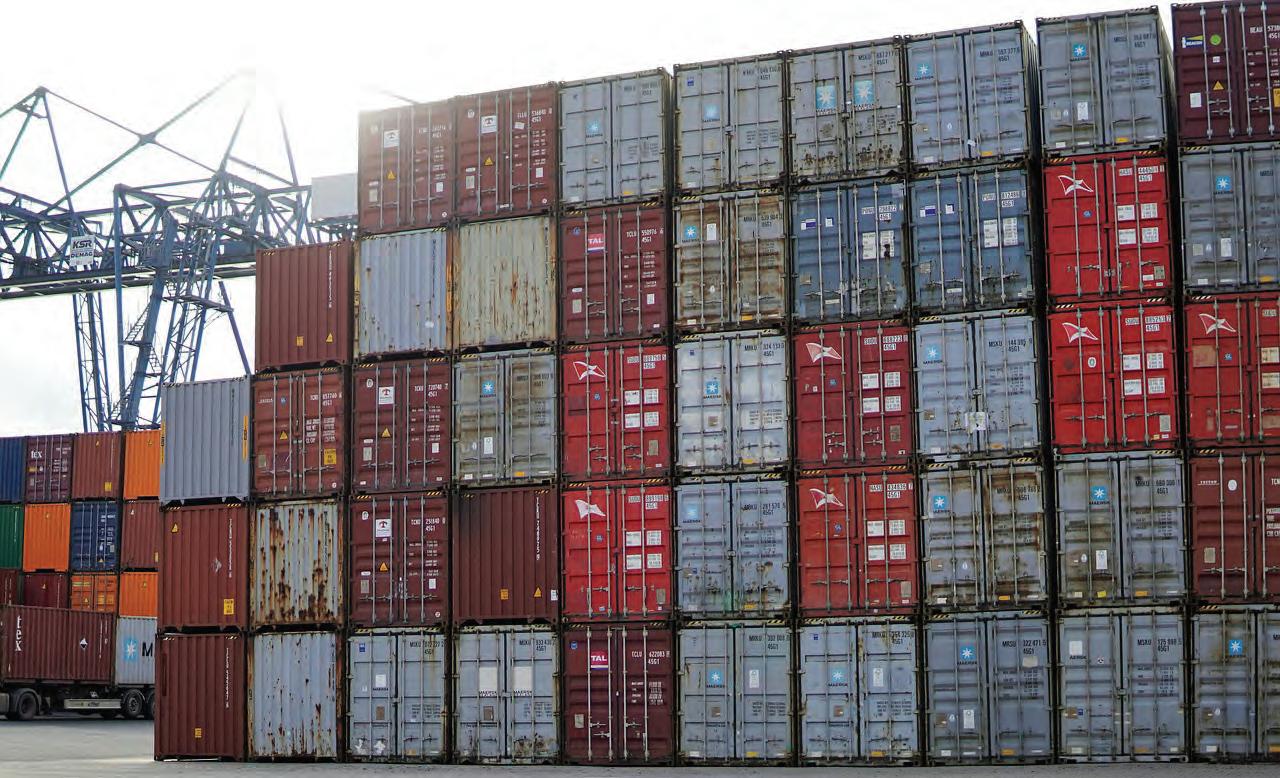

CONTAINER SERVICES SOLUTIONS

www.elikontransport.gr

Production planning and supply/inventory flow optimization

Planning and execution of logistics operations (WMS / WES)

Shipment management and transportation optimization (Routing & Dispatching)

Estimation and optimal distribution of product/service demand

Integration and use of automation in selected execution flows

Coordinated transportation - deliveries (Upstream - Downstream)

Approximately 83% of the funding will support projects that meet EU climate targets by improving and modernising the European Union’s network of railways, inland waterways and maritime routes along the Trans-European Transport Network (TEN-T). Rail projects will receive the lion’s share, around 80% of the €7 billion. The funding will be allocated to major projects to improve cross-border rail connections along the TEN-T core network – in the Baltic Member States (Rail Baltica), between France and Italy (Lyon-Turin) and between Denmark and Germany (Fehmarnbelt tunnel).

Around 20 seaports in Ireland, Spain, Finland, the Netherlands, Germany, Malta, Lithuania, Cyprus, Croatia, Greece and Poland will also receive European funding/support for infrastructure upgrades, with a focus on cold ironing infrastructure, in order to be considered ‘green’ ports, with the potential to fully utilize renewable energy sources.

Another area of emphasis in the funding programme for the new TEN-T is the funding of works to improve inland waterway infrastructure, which will upgrade the cross-border connections between France and Belgium in the Seine-Scheldt basin and between Romania and Bulgaria on the Danube. Inland ports in Austria, Germany and the Netherlands will also receive funding to continue to promote the European network of rivers and canals for sustainable transport.

As for road transport, the deployment of cooperative Intelligent Transport Systems and Services (ITS) and the construction of new, safe and secure parking areas will increase safety for private citizens and professionals alike and will receive 5% of the total funding.

Meanwhile, air traffic management projects will continue to develop the Single European Sky so that air transport becomes more efficient, safer and more sustainable, and will receive just 2% of the total funding budget.

Under the new TEN-T, several projects will allow for greater capacity along the EU-Ukraine solidarity lanes, which have been created to facilitate imports and exports between Ukraine and the EU. These projects cover: improvements to road transport infrastructure at border crossing points between Ukraine, Moldova and Romania; works to increase capacity on the Hungary-Ukraine railway border crossing; a new road section in Poland extending to the border with Ukraine; and studies and works to integrate the Ukrainian rail system into the EU.

Following yesterday’s approval of the list of 134 projects by the Member States, the European Commission will officially adopt the financing decision and CINEA will then start the preparation of the grant agreements. The results are provisional and will only become definitive once the European Commission adopts the corresponding award decision.

39 Gounari, 185 31, Piraeus

Τ: +30 210 9648771-775

+30 210 4112135-137

+30 210 4112325-327

F: +30 210 9648771-775

E-mail: info@harlas.gr

2025 will dawn with a field of glory for the domestic supply chain industry, which is adapting succesfully to all major trends, despite all the international disruptions. Greece has elevated to LPI’s performance index no 19, creating expectations for intensive growth in the near future.

In this environment, O.MIND CREATIVES, true to its commitment to promote the logistics, supply chain and commercial vehicle sectors, with a staff of experienced partners, organizes the 10th “Supply Chain & Logistics” exhibition and 5th “Cargo Truck & Van Expo”, October 18-20, 2025, at Metropolitan Expo-Athens.

Recognized for its value and efficiency, the exhibition, with 350 exhibitors from across the entire supply chain field, (logistics, material handling, freight transport and commercial vehicles etc), in a exhibition area of more than 25,000 sq.m., framed by a series of parallel events and Conferences, is expected to set the “tone” of the market’s growth pulse, being once again a business “meeting point”.

With thousands of visitors from the entire spectrum of the commercial and industrial world from Greece and abroad, the organization of the 2025, looks forward to become the meeting point and set the pace for a rapid growth in the country’s events in the next 5 years, with significant investments, company partnerships and cluster creation.

Book your participation in time!

SATURDAY

October 18

10:00 - 19:00 SUNDAY October 19 10:00 - 19:00 MONDAY October 20 10:00 - 19:00

The exhibition will be held in the state-of-the-art Metropolitan Expo exhibition center at the “El. Venizelos” international airport in Spata.

Metropolitan Expo is the most advanced and modern Exhibition center in Greece today, combining a multitude of advantages such as:

State-of-the-art facilities and high quality services for exhibitors and visitors

Easy access by car and public transport

Next to El. Venizelos International Airport

Comfortable free parking

Restaurant, Cafe and Shopping in the Airport’s Retail park

(for all exhibition days)

Cost of stand area required (ground trace)

Up to 40m2: From 41m2 to 100m2: From 101m2 to 200m2: From 201m2 and more:

Prices are subject to VAT

Info: www.sce.gr

160 €/m2

150 €/m2

135 €/m2

130 €/m2

As an international group of specialised heavy transport companies, the range of project cargoes handled by members of The Heavy Lift Group (THLG) is broad, but identifiable trends are driving particular areas for growth.

ALogistics services capable of handling heavy lift, project cargo, and oversized transport assignments start-to-finish are being sought by the renewables sector, for example, as demand to transport and deliver wind farm components and solar power plant surge.

THLG members also report strong opportunities in coordinating the intricate logistics behind establishing the synchronised condenser stations used to stabilise the electrical grid as more renewable energy sources are introduced.

These are the type of high value, out of gauge and often fragile loads on which THLG’s logistics expert members build their businesses. They will provide or manage all trucking, rail and ship transportation, but also the surveying, inspection and documentation, loading and terminal handling processes, and the relationships with importers, exporters, brokers and specialised freight services in between.

Decarbonisation imperatives are not only influencing the kind of cargoes we are assigned to handle; they are driving change in the methods we use to transport these cargoes, too.

Increasingly, customers demand the use of solutions and processes

that minimise carbon dioxide emissions, such as biofuels, electric vehicles, and optimised routing for fuel efficiency. They also expect sustainable packaging and handling methods for reduced waste, as well as the ability to track their carbon footprint as part of a fully transparent supply chain.

Striving to meet these expectations, THLG is actively monitoring, through in-house surveys, the status of its members’ sustainability programmes. In addition, future group conferences will place greater emphasis on decarbonisation to help members keep abreast of their sustainability commitments.

Environmental regulations pertinent to our members include the International Maritime Organization’s Carbon Intensity Indicator and the European Union’s Fit for 55 package, which target reduced CO2 emissions from the maritime industry and the wider transport sector, respectively.

However, intensifying environmental requirements are just one part of a fast-evolving regulatory framework that is adding new layers of complexity to an already-complex business. Our members also have to consider changes in European trade regulations and customs procedures, the EU’s proposed speed limiter mandate, challenges surrounding heavy transport permits in Germany, the United States’ planned introduction of port fees for Chinese-flagged vessels, and

the growing international demand for supply chain transparency, among other factors.

Against this background, THLG members need to remain informed and agile, ready to adjust their operations as the rules dictate. Proactive measures include regularly updating compliance protocols, investing in staff training, and collaborating with industry partners to navigate the evolving regulatory landscape successfully.

The THLG Executive Committee is refining governance structures to ensure continuous improvement and member engagement, involving new members in its meetings, and participating in masterclasses and panels to stay on top of industry requirements.

These steps aim to enhance the ExCom’s overall capabilities in selecting the best candidates from around the world to expand our international presence while contributing invaluable local expertise. This global–local approach has been effective in securing logistics projects covering delivery of large-scale mining equipment to remote locations and the safe delivery of massive components for the world’s largest telescope, for example.

Other developments which benefit from coordination and information exchange between TLHG members through its formal channels include our collective response to fast-paced changes in digitalisation.

In recent years, our members have leveraged new technologies to enable real-time cargo tracking and route planning, improve risk management, and streamline documentation. Looking ahead, artificial intelligence will further optimise efficiency and security in heavy lift logistics through smarter routing, predictive analytics, automated documentation, and even AI-driven risk assessment. For THLG customers, this will translate to better and faster feedback, quotations, and solutions.

Yet while emerging technologies – and in particular AI – promise to transform project cargo logistics for the better, they will never replace the human element: in our business, relationships, trust, and handson problem-solving will always be critical. This is, in part, why we remain confident in our ability to provide best-in-class support to an ever-evolving market.

A recent surge in joint ventures and expanded service portfolios among liner shipping companies indicate that this is also a market that others see as full of promise. However, THLG believes that - if utilised

properly - these additional resources and tools present new opportunities to serve small-scale project logistics more effectively.

Besides, project cargo logistics are inherently complex, frequently involving the transport of oversized, heavy, or high-value items and thus requiring flexible, customised solutions that are planned and executed with meticulous precision. In this specialised field, our members provide an invaluable personal touch, with local knowledge and technical expertise that surpass the standardised operational procedures typically employed by larger organisations.

Members often describe THLG as feeling less like a network and more like an exclusive club where professionalism meets genuine friendship. Here, expertise is not only expected but celebrated, and longterm partnerships are built on mutual respect and shared success. By joining the THLG family, companies gain instant access to a trusted international network, allowing them to offer world-class heavy lift solutions while maintaining their independence.

It is therefore no surprise that we continue to receive a steady stream of membership applications from around the world – particularly from emerging markets. Equally, we remain eager to welcome new members into our diverse network from various regions, regardless of existing representation, to further enhance our global reach and effectiveness.

Our current focus for strategic growth targets Africa and Southeast Asia, where demand is growing for energy and infrastructure projects and manufacturing and project cargo logistics, respectively. We are also seeking heavy transport engineering specialists and equipment owners to enhance our capabilities.

In an industry that never stands still, tactical expansion and continuous improvement are key to sustained success. We therefore encourage our members to maintain close personal connections within the group and to keep learning, sharing knowledge and experiences, spreading the word about THLG, and taking advantage of networking opportunities. In this way, we can continue to set the standard in an increasingly complex and competitive market.

infrastructure, and concerns over grid capacity slowing widespread adoption.

While progress is being made, achieving full fleet electrification will require coordinated efforts from policymakers, businesses, and infrastructure developers to overcome these barriers and ensure a smooth transition toward lower emissions and sustainable transportation. Fleet electrification is on track to significantly reduce CO2 emissions, with full decarbonization of new vehicle sales expected by 2040. While challenges exist, the transition offers major economic, environmental, and energy security benefits, making it a key pillar in Europe’s sustainability strategy.

Governments worldwide, particularly in Europe, are implementing strict regulations to accelerate fleet electrification and to reduce CO2 emissions from commercial fleets, pushing for a transition to electric vehicles. These policies are designed to meet climate goals, reduce dependency on fossil fuels, and enhance air quality. Also, they focus on emission reduction targets for cars, vans, and trucks, financial incentives, and charging infrastructure development with public and private investment in expanding charging networks. The European Union (EU) is leading this transition with a regulatory framework that

mandates a phased reduction of CO2 emissions and promotes the adoption of zero-emission vehicles (ZEVs).

Looking ahead, regulations will become even more strict, aiming for a complete phase-out of ICE vehicles in new sales by 2035-2040. Future policies will emphasize stronger CO2 Reduction Targets, investment in charging networks, and renewable energy integration that will support the integration of EV charging with cleaner electricity sources and improved grid capacity. Furthermore, the restrictions on fossil fuel-powered trucks, including higher taxes and emissionbased toll systems will increase.

While these measures will accelerate fleet electrification, challenges such as infrastructure expansion and financial feasibility will need to be addressed. Policy developments in the next two decades will make diesel fleets increasingly outdated.

Total cost of ownership (TCO) reduction prospect as one of the most compelling reasons for fleet electrification

Total cost of ownership (TCO) plays a significant role in the decisionmaking process between an electric (EV) and a conventional (ICE) vehicle. The key elements contributing to TCO are the net price of the purchase, the fuel, the insurance, the maintenance & repair, the

financing cost and the taxes (purchase and use). In various countries, like the example of Germany, TCO of an EV vehicle appears to be 25% lower compared to the relevant TCO of an ICE vehicle due to subsidies offered by the government and affecting the net price or 15% lower without the subsidy option. In contrast, in other countries like the example of UAE, TCO of an EV vehicle remains higher to the relevant TCO of an ICE vehicle making the decision towards electrification less favorable.

Focusing only on the reality of the EU, significant progress concerning the operational and cumulated savings due to electric transition of vehicles is expected to be made by 2040. More particularly, operational cost savings are estimated to reach 20 billion € and 590 billion € in 2025 and in 2040 respectively. Concerning the cumulated savings, an important milestone of 330 billion € is expected by 2030, while in 2040 the savings will account for approximately 25% of the EU GDP in 2022.

E-mobility energy consumption as a significant part of total electricity demand in the near future

As the world moves towards a more sustainable future, fleet electrification is becoming a pivotal strategy in reducing carbon emissions and enhancing energy efficiency. As it is represented in

Source: PWC Survey European Fleet Electrification, From Electric Vehicle Sales to a complete Fleet Transition,

the diagram below, by 2040, the energy demand for electric fleets is expected to surge significantly, driven by advancements in battery technology, increased adoption of electric vehicles, and supportive government policies.

By 2040, the overall demand for electricity from light vehicles is projected to be around 240 TWh, which is approximately 9% of today's European electricity production. For trucks, the overall demand for electricity is expected to be around 115 TWh, which is about 4% of today's European electricity production. This shift not only promises a cleaner environment but also presents challenges and opportunities in managing the growing energy needs of electrified fleets.

The electrification of fleets is unlocking new revenue-generating opportunities across the e-mobility value chain, as numerous Mobility as a Service (MaaS) operators adopt electrification strategies to minimize their environmental impact. This section delves into the fleet electrification value chain, covering its upstream, midstream, and downstream components.

The upstream segment of the value chain involves several layers dedicated to creating essential assets within the e-mobility space. It includes three main categories: Fleet Procurement, Fleet Financing, and Infrastructure. Fleet operators can either lease or purchase vehicles, often collaborating with OEMs and financial institutions to facilitate these acquisitions. The increasing adoption of electric fleets is bolstered by government incentives, loans, and financing schemes, while their success hinges on the development of supportive infrastructure through joint ventures and partnerships.

The midstream segment of the value chain comprises two key elements: Fleet Management Software and Fleet as a Service (FaaS). Fleet management software integrates technologies such as cloud computing, data analytics, and connectivity, forming the foundational layer for online services. Conversely, FaaS serves as the consumerfacing layer, where end-users physically utilize fleets, catering to both B2B and B2C models.

The downstream segment of the value chain focuses on maintaining

optimal vehicle conditions and identifying opportunities for the reuse and recycling of batteries and vehicles. Beyond regular downstream MaaS operations, two emerging pillars for pure EV operators are the operations and maintenance of fleets and charging stations, and endof-life operations. Here, identifying reuse, refurbishment, and recycling of batteries can unlock new value pools for MaaS operators.

The transition to electric fleets represents a pivotal step toward a more sustainable and cost-effective future for transportation. As businesses and governments strive to meet environmental goals, electrification offers a compelling solution-reducing carbon emissions, lowering operational costs and improving energy efficiency.

Key strategies to realize this potential include supportive government policies and regulations, robust charging infrastructure, marketfit products and services, digital enablement, and effective battery recycling. By adopting these strategies, fleet operators can navigate challenges and seize opportunities, ensuring a successful and impactful transition to electrified fleets.

The integration of the above-mentioned strategies into the organizations’ electrification journey can unlock significant environmental and economic benefits. Fleet electrification is more than just a technological upgrade; it is a strategic investment in longterm sustainability and resilience. Organizations that embrace this transition will not only benefit from regulatory incentives and cost savings but will also position themselves as leaders in the evolving transportation landscape. Careful planning and adaptation might be required, nevertheless the expected benefits can outweigh the obstacles and pave the way for a cleaner, smarter and more efficient future in mobility.

Sotiris Gayialis Director of Operations Transformation and Excellence sotiris.gayialis@pwc.com

Documents that must be issued in triplicate, internal documents kept in duplicate, printouts that take time and occupy space, which no longer exists... Businesses are trying to sort out the unmanageable volume of printed and electronic documents that accumulates every day and to be able to retrieve the information they need when they need it. The public sector is trying to follow suit, having similar issues to deal with.

• BY ALEXANDRA NASSOU

In the age in which AI does the chores in our homes, it can certainly have a hand in simplifying things there too, through digitisation.

Let’s look at the developments within our borders concerning the digitisation of goods movement documents, which seems to be progressing smoothly in the hands of the public bodies in charge, but also the private parties who, as usual, are the first to undertake the daunting task and pave the way for the public sector to follow.

The National Logistics Council has informed the competent Government Committee of the updated National Action Plan for the drafting of our country’s Logistics strategy. The digitisation of goods movement documents is part of the National Action Plan and has already been given high priority by the Government Committee for the development of Logistics.

Starting with this already known fact, the Independent Authority for Public Revenue (IAPR) is planning the digital consignment note, which will replace the ones in paper form, and is proceeding on schedule. Our cooperation with the IAPR as regards the examination of the relevant issues related to Logistics is great.

The Logistics Development Agency of the Ministry of Development will implement the National Action Plan which includes the aforementioned digitisation of goods movement documents as one of the actions. We are engaged in advanced discussions with stakeholders in order to explore the possibility of creating an umbrella platform that will use/collect data from existing information systems. The initial step, therefore, is to achieve networking and information on goods being moved on road, rail, sea and air networks.

Some of the interfaces that are being discussed are, for example, G.E.MI., the Single Window, the Hellenic Maritime Single Window, the Digital Consignment Note, the National Register of Transport Companies and other registers from many institutions.

The aim of this platform is to ensure reliability and flexibility when it comes to the transformation of supply chains. The requested information on logistics and flows will now be collected in real time, kept up-to-date and accessible. In this way, it will be used by the State for drafting the National Strategy, but also by private individuals for controlling investments, identifying opportunities, partnerships, etc. Geographical data, data on types of cargo, data on flows from prefecture to prefecture and from region to region, data on warehouse locations and on the method of handling and transhipment, but also on bottlenecks created by the transport of goods are only some of the possibilities that the system in

question will be able to provide with these interfaces. And still others that will arise during daily operations and emerging data, since our world is changing rapidly, technology is evolving at a fast pace and the market is trying to find ways to move forward with as few obstacles as possible and with the necessary speed and security.

The purpose of this digital umbrella system that is being discussed is mainly to enable the option to download dashboards and visualize the combination and analysis of existing and on-time data. This will also cover the intermodality required by logistics, collecting non-value-based data, which will boost the network and the sharing of information.

For example, the immediate resulting benefits are the synchronous monitoring of transport, handling and warehousing data, the reduction of operating costs for companies, the reliability of freight transport and the digital transformation of companies, which is necessary for their growth.

Obviously, there are European guidelines and specifications for all of the above, i.e. for the secure transfer of data between platforms.

And, of course, we must not forget eCMR, which concerns international freight transport and is another link in the chain for the digitisation of goods movement documents.

The UN Secretary-General announced that, on 21 January 2024, Greece acceded to the Additional Protocol to the Convention on the Contract for the International Carriage of Goods by Road (Customer-Managed Relationship-CMR), an event that we have been anticipating for a long time as a country.

To date, CMRs have information on the transported cargoes and concern the transport and receiving companies involved, with access to specific required information about transport and liability.

The benefits of the transition to eCMR are well known by now, and many private companies are already aware of them. The first countries to test it, Spain and France, according to the IRU confirmed that it works easily, simply and effectively. However, an agreement on the format is required in order for all countries to implement the same digitised CMRs, which so far does not seem to have been reached. Still, we remain optimistic, and as long as discussions continue, we are confident that there will soon be results, with the subsequent linking of eCMR to eFTI.

As can be seen, everything that is being discussed to be done for the digitisation of goods movement documents within our country is directly linked to the mandatory implementation of eFTI. When implemented, eFTI will be the European obligation that will push us to move towards a deeper, more accurate and more secure interconnection of information systems with the required data.

Thus, internal digitisation will work in such a way that the European platform will become our “eyes” outside our borders.

And when we coordinate these “eyes” that look towards Europe with the “eyes” that look inside our country, then we will be able to see straight ahead; way ahead, so we can move goods quickly, with all the necessary data in our hands!

Alexandra Nassou is Head of Service for the Development of Supply Chain, General Secretariat of Commerce, Ministry of Development

published, and therefore made public, its comprehensive proposals for the reform of the European Union’s customs, which will be the first radical ones since its formation in 1968, through a revised Union Customs Code.

The need to reform the current customs legislation was a result of:

• The increasing volume and speed of trade globally

• The rapid increase in the number of border controls to be carried out by customs authorities, due to the adoption of new standards (environmental protection, forced labour, etc.)

• The changing geopolitical situation and the various crises (wars, etc.)

The main changes to the European customs map that will affect all economic operators involved in the supply chain are:

• The creation of a single data centre in the EU (EU Customs Data Hub). This will act as a main gateway through which economic operators will be able to submit their customs data/ records to the customs authorities. The customs declaration, as we know it today, will be replaced by data sets.

• The introduction of the concept of Trust and Check Traders. This regulation is an upgraded version of the Authorised Economic Operators programme, which will allow Trusted Traders to freely circulate their goods throughout the EU without any active customs intervention (self-assessment), including various other benefits.

• The abolition of the €150 threshold for payment of customs

duties in order to control e-commerce (b2c) fraud. As a result, customs formalities for all goods in transit will be required and the role of e-commerce platforms, courier companies, postal operators, carriers and customs brokers will change.

• New concepts regarding importers, exporters and carriers, in order to address the confusion that often arises in the role of the declarant and the carrier. The EU is moving towards abolishing the role of the declarant and expanding the role of the importer/exporter, whether they own the goods or not. Under the new Code, the carrier will be responsible for the transport, as the principal of the procedure (EU transit procedure).

SC&L_ What is the EU’s goal with these changes for the next decade?

M. C._ The aim of the EU customs authorities, with all these truly radical interventions, seems to be:

• To reduce customs interventions to a minimum without compromising security, since all customs formalities will be carried out by Trust & Check Traders.

• Comp liance with security and anti-fraud obligations at the EU’s external borders and for customs authorities to monitor economic operators involved in supply chains as a whole through a central database.

• The EU Customs Data Centre, to which customs data will be submitted, should allow competent bodies and/or authorities to carry out checks on compliance with customs or other legislation. Note that the term “other legislation” is broadly

defined and covers all legislation, other than customs legislation, applicable to goods entering, leaving or transiting through the EU or being put into circulation in the European market, where customs authorities play an enforcement role.

As you can see, the next decade will be a period of huge changes in the flow of goods to and from the EU. For all of us, preparing and adapting to these conditions as quickly as possible will be vital. I think that as the costs for small companies (digitalisation, connecting to e-custom, etc.) will be high, synergies between the Economic Operators involved in the entire supply chain will be a one-way street for faster trade flows.

But imagine that, from 2025 to 2035, we can finally talk about:

• The entry of goods into the EU without any customs control

• Direct transport to warehouse facilities without the intervention of customs authorities and without obtaining special authorisations

• Payment of customs and tax duties by determination of the customs value by the Economic Operators themselves, without the intervention of customs authorities, at a time after importation

• System to system communication between customs authorities and economic operators to carry out the required controls

We are talking about a completely different reality that will change our daily lives. At Cargo3600, we are looking forward to and working for these changes!

• 24-hour operation of customs offices, especially those located at the entry and exit points of the country.

• Customs services, in collaboration with TAXUD, must be 100% digitalised and develop and model tools for risk identification.

• Centralise control services and limit the physical presence of traders.

• Attract EU and non-member state companies for manufacturing and use Customs Zones and Customs Warehouses.

• Incentives for the creation of Free Zones by Business Clusters.

• Establishment of general tax warehouses managed by third parties for the storage of excise goods.

• New customs procedures and simplifications with national initiative. Inclusion in IAPR’s strategy of the maximum participation of Logistics companies in simplified procedures following AEO certification.

The design of modern industrial facilities is evolving rapidly, following the requirements of Industry 4.0, automation and sustainable development. New production units are no longer just production sites, but intelligent systems that integrate technology, flexibility and energy efficiency.

• BY VIVIAN (PARASKEVI) ANTONATOU

Industrial architecture worldwide is adapting to new standards, with sustainability and efficiency becoming key design drivers. Despite the challenges, Greek industrial facilities must adopt these developments in order to remain competitive and to create a more sustainable and efficient development model.

1. Flexible and smart industrial facilities

The architecture of industrial units is evolving, adopting an approach of flexibility and adaptability. The aim is to build facilities that can be upgraded without requiring extensive structural interventions.

This is accomplished through:

• Open-plan layouts, open architectural arrangements, which allow for easy rearrangement of production areas

• Modular design, which allows for the gradual development or modification / expansion of facilities without pausing operations

• Height utilisation for the integration of automated systems for both storage and production, as well as space saving

Adopting these practices facilitates production management, reduces the cost of adapting facilities and allows the integration of new technologies without the need for major reconstruction.

2. International trends in industrial design

A. Architecture and Integration into the Environment

Traditionally, industrial buildings were designed solely with functionality in mind. Today, however, the scientific community focuses on the optimal integration of facilities into the landscape and urban environment. Modern approaches include:

• Use of appropriate surfaces and contemporary materials to reduce the massiveness of buildings, and to integrate light into the interior of work spaces

• Bioclimatic and sustainable design, which improves thermal insulation and the aesthetic quality of facilities (green roofs - planted facades)

• Design that respects the topography, where possible, in order to minimise the visual and environmental footprint

B. Sustainable Development and Energy Efficiency

Today, energy sustainability is a key priority in the design of industrial units. Research shows that integrating passive and active energy-saving strategies can reduce consumption by up to 40%. The most common practices include:

• Utilisation of renewable energy sources (solar, geothermal, wind energy)

• Passive cooling and heating systems based on natural air circulation

• Dynamic facades with light sensors, which adapt to weather conditions

In Greece, although there is interest in green buildings, industrial units often remain outside this design framework. The transition to more sustainable practices is not a luxury, but a strategic necessity.

C. Life Cycle and Circular Economy

Modern industrial design is based on the Life Cycle Assessment (LCA) principle. The aim is to reduce waste and reuse construction components, contributing to sustainable development.

s supply chains become increasingly complex, the drive for digital transformation has never been more urgent. However, the critical question remains: Is AI the panacea for supply chain challenges, or is it just one of many important tools in our arsenal?

Historically, supply chains were managed using fragmented processes and systems that often led to inefficiencies and a lack of transparency. Over the years, advancements in digital technologies have paved the way for a more integrated and proactive approach to supply chain management. Today, companies leverage technologies such as the Internet of Things (IoT), cloud computing, blockchain, and big data analytics to enhance visibility, streamline operations, and improve decision-making.

One of the primary advantages of digitisation in the supply chain is the seamless integration of data across different functions. With IoT sensors and connected devices, real-time monitoring has become a reality. These technologies provide continuous data on everything from inventory levels to shipment locations, enabling managers

to make more informed decisions rapidly. Digital platforms now integrate multiple data sources, ensuring that insights are derived from a comprehensive view of operations rather than isolated snapshots.

The advent of big data analytics has transformed how supply chains forecast demand and manage risks. In the past, forecasting was based on historical trends and gut feelings; today, advanced analytics allow us to model complex scenarios and predict fluctuations with greater accuracy. This has led to more efficient inventory management, reduced costs associated with stockouts or overstocking, and an overall more agile response to market changes.

Artificial intelligence has emerged as a game-changing technology within this digitised ecosystem. AI’s ability to process vast amounts of data, identify patterns, and learn from historical trends offers significant promise in optimizing various aspects of the supply chain.

AI-powered predictive analytics tools are at the forefront of modern supply chain management. These tools can analyze historical data,

market trends, and external factors (such as weather patterns and geopolitical events) to forecast demand more precisely. This enables companies to adjust production levels, manage inventories efficiently, and optimize distribution networks in real time. The ability to anticipate demand and respond proactively is a significant advantage in today’s volatile markets.

AI-driven algorithms are also revolutionising logistics by determining the most efficient transportation routes. By factoring in variables such as traffic conditions, fuel prices, and weather disruptions, these

systems can significantly reduce delivery times and operational costs. This not only improves customer satisfaction through timely deliveries but also helps companies reduce their carbon footprint by optimising fuel usage.

Robotic Process Automation (RPA) and AI-driven decision support systems are increasingly used to automate routine tasks in the supply chain. From order processing to invoice management, automating these tasks minimizes human error and frees up valuable human resources for more strategic activities. The enhanced efficiency brought

Buyuksehir Mah. Cumhuriyet Cad. No:1 | Ekinoks E1 A Blok Kat:4 D:47 34520 Beylikduzu, Istanbul, Turkiye | T. +90 850 202 88 80 | info@sparklojistik.com.tr

Mladost 2 district, blok 257B | Sofia 1799, Bulgaria T. +359897736099 | info@sparklogistics.gr

53-55 Akti Miaouli Str | 185 36 | Piraeus, Greece Τ. +30 210 4622800, +30 210 4622900 | info@sparklogistics.gr www.sparklogistics.gr | www.sparklojistik.com.tr

by these technologies is driving a fundamental shift in the operational model of many organisations.

Despite the impressive capabilities of AI, it is important to temper expectations. While AI provides powerful tools for optimisation and automation, it is not a cure-all for every supply chain challenge. There are several critical limitations and risks that organisations must consider.

AI systems are only as effective as the data they are fed. In many organisations, legacy systems and siloed data repositories continue to pose a challenge. Integrating disparate data sources into a cohesive, high-quality dataset is essential for AI to deliver accurate insights. Without this foundational step, even the most advanced AI models can produce misleading or suboptimal recommendations.

Implementing AI technology requires substantial investment-not just in software and hardware, but also in talent. Building and maintaining AI systems necessitate expertise in data science, machine learning, and supply chain management. For smaller companies or those with limited budgets, the cost and complexity of implementing these solutions can be prohibitive.

As AI becomes more integrated into critical business functions, ethical and regulatory issues come to the forefront. Decisions made by AI systems can have significant repercussions for workers and consumers alike. Concerns about data privacy, bias in algorithms, and accountability for automated decisions are challenges that need careful consideration. Companies must develop robust governance frameworks to ensure that their AI implementations are ethical and compliant with evolving regulations.

Perhaps the most significant limitation is the risk of overreliance on technology. While AI can process information and predict trends with impressive accuracy, it lacks the nuanced understanding and flexibility of human judgment. Supply chain management is a complex field that often involves unexpected challenges and nuanced decision-making. Relying too heavily on AI can lead to a false sense of security and a diminished capacity to respond to unforeseen disruptions.

Given the strengths and limitations of both digitisation and AI, the future of supply chain management lies in a hybrid approach that leverages

technology while maintaining robust human oversight.

To fully harness the benefits of AI, companies must first invest in building a robust data infrastructure. This involves not only integrating legacy systems and data sources but also ensuring that data is accurate, timely, and accessible. By prioritising data quality, organisations create a solid foundation on which AI and other digital tools can operate effectively.

A successful digital transformation goes beyond technology—it requires a cultural shift within the organisation. Embracing change, encouraging continuous learning, and fostering innovation are key to integrating new technologies seamlessly. Supply chain leaders must work to develop talent that understands both the technological and operational aspects of the business, ensuring that digital tools are used to augment, rather than replace, human expertise.

Despite the impressive capabilities of AI, human oversight remains essential. Experts in supply chain management bring invaluable insights, particularly when dealing with ambiguous or complex situations that AI might not fully grasp. A collaborative approach where technology enhances human decision-making is likely to yield the best outcomes. Human intuition and experience are crucial for interpreting AI-generated insights and implementing strategies that align with broader business goals.

The digitisation of supply chains has ushered in an era of unprecedented efficiency, transparency, and agility. AI plays a pivotal role in this transformation by offering advanced predictive analytics, route optimisation, and automation capabilities. However, while AI represents a powerful tool for overcoming many supply chain challenges, it is not a panacea. The success of digital transformation initiatives depends on robust data integration, significant investments in technology and talent, and, critically, the continued involvement of human expertise found either internally in the organization and/or with the engagement of expert management consultants.

Andrea Stylidiadis is Director of Supply Chain and Transformation Services Department at Grant Thornton

Miltos Chatzimanolakis is Principal of Supply Chain and Operations Transformation Services at Grant Thornton

The European Union’s Import Control System 2 (ICS2) aims to enhance the safety and security of goods entering the EU by introducing a standardised, pre-arrival customs process for all transportation modes, including road and rail, in addition to the existing air, maritime and inland waterway requirements . By mandating the submission of accurate and complete Entry Summary Declaration (ENS) data prior to arrival, the ICS2 enables customs authorities to better assess the risks associated with incoming goods, thereby improving the EU’s ability to prevent and combat customs offenses, and ultimately ensuring a safer and more secure trade environment.

From 1 April 2025, road and rail carriers will need to provide data on goods sent to or through the EU prior to their arrival, through a complete ENS. This obligation also concerns postal and express carriers who transport goods using these modes of transport as well as other parties, such as logistics providers. In certain circumstances, final consignees established in the EU will also have to submit ENS data in the ICS2.

Economic operators who are not ready by this date need to contact the National Service Desk of the EU Member State (National Customs Authority) where they have registered and obtained their EORI number to request a deployment window by 1 March 2025, at the latest. Deployment windows are granted only upon request.

To comply with the ICS2 requirements, affected businesses will