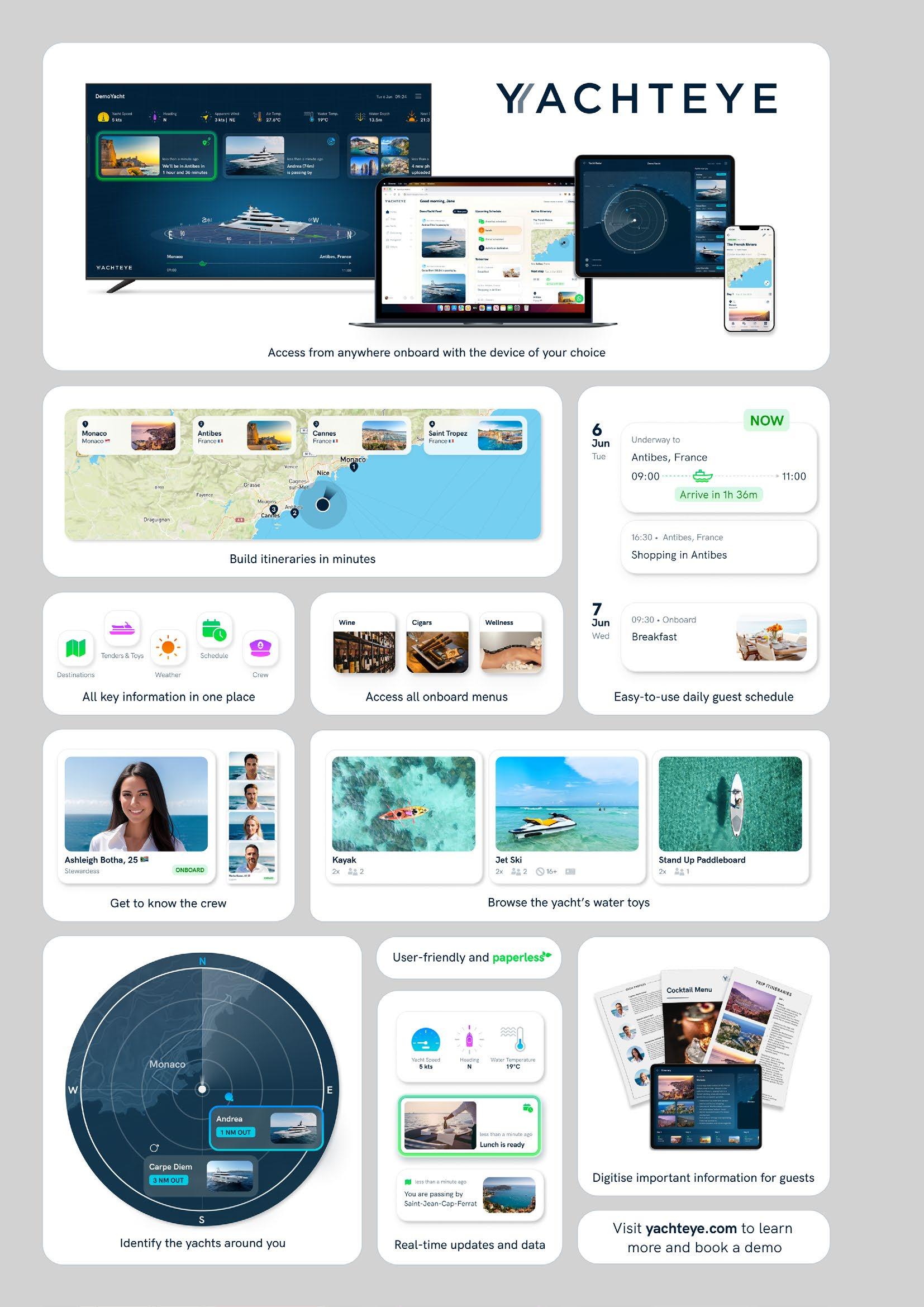

TEIGNBRIDGE

The technical magazine for those involved in the design, construction and refit of superyachts

Supplier

Quick, the Italian maker of

18 CEO in Conversation: Ned Wood of Bowmaster Anchor deployment manufacturer Bowmaster is making strides in its sector, despite a remote location in New Zealand.

20 Build Report: Making Maverick

The second in Cantiere delle Marche’s Flexplorer series, 44-metre Maverick has been designed and built expressly for a round-the-world tour.

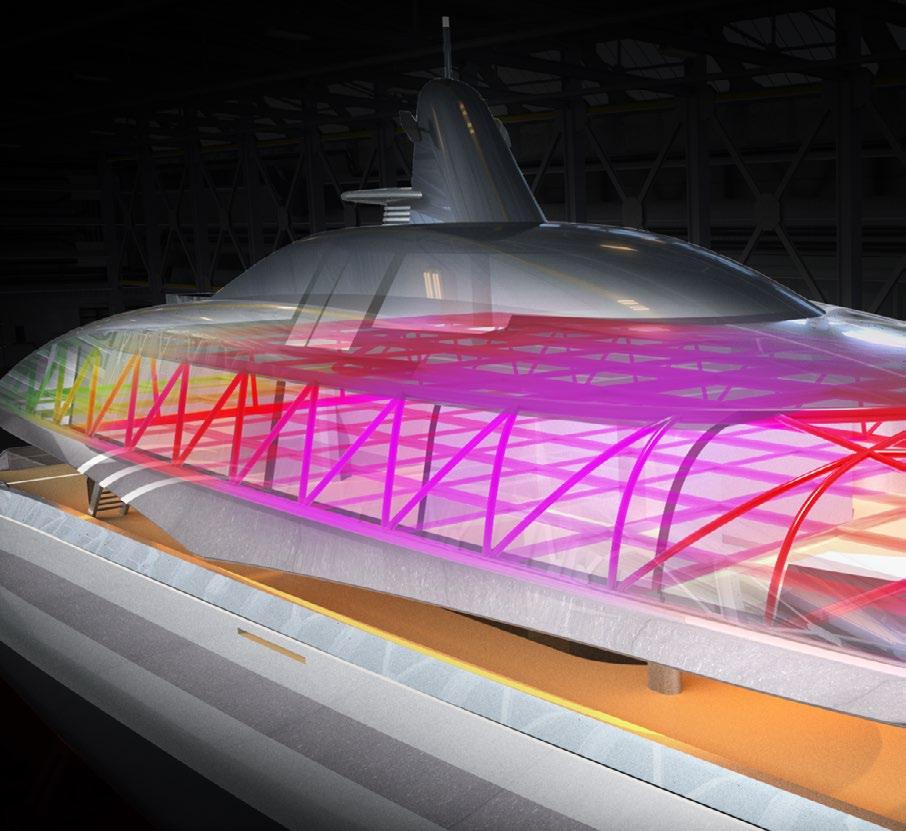

32 Concept in Focus: Design Without Constraint

Luiz de Basto’s 92-metre Project Med takes inspiration from an open architectural concept proposed by Lateral Naval Architects.

40 Build Report: Lessons Learned

Aquarius II, a modern classic ketch in-build at Royal Huisman, is the beneficiary of hundreds of tweaks to enhance operations and performance.

52 Build Report: Team Toro

Project Toro is the first in a new engineering platform from Turquoise Yachts offering faster delivery and ample opportunity for customisation.

64 OEM: Stern Stuff

A visit to Teignbridge Propellers in the UK reveals the science behind propeller design and how they are made.

76 Inside Angle: James Hutchinson

Project management experience in production boatbuilding has given Hutchinson Yacht

Consulting a unique perspective in the superyacht world.

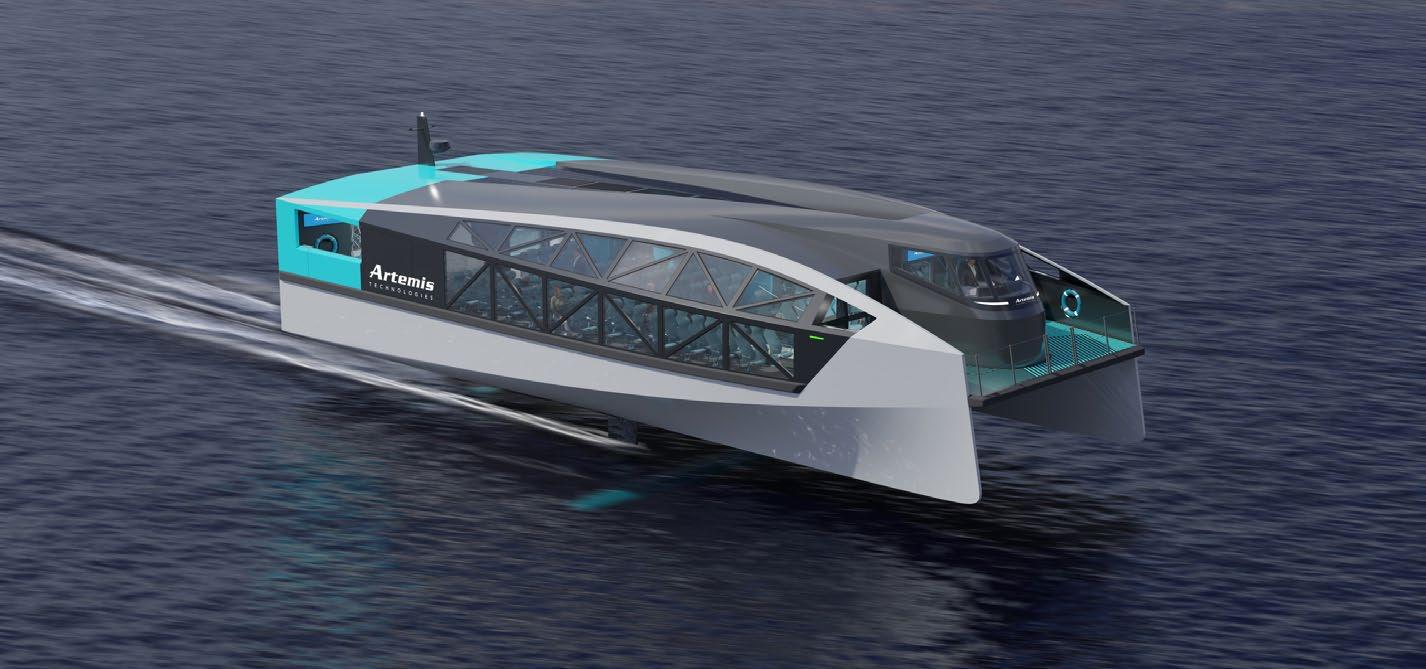

80 Hulls & Appendages: Flight Club

The latest foiling technology has overcome many of the shortfalls of older systems, but are foiling superyachts feasible?

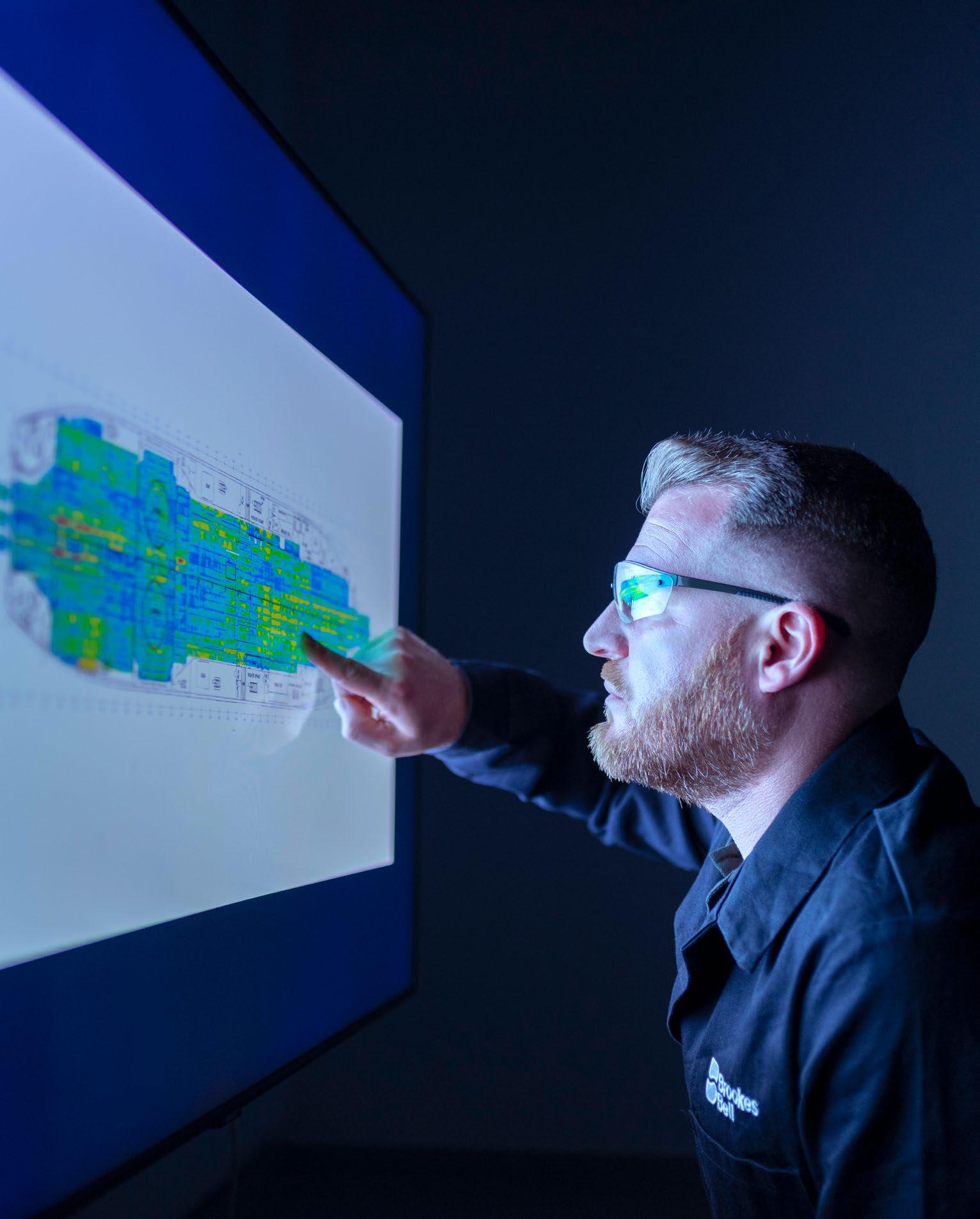

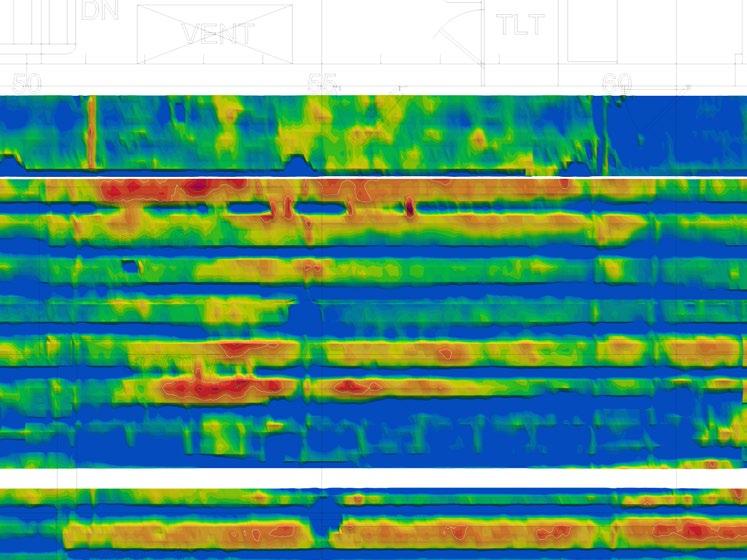

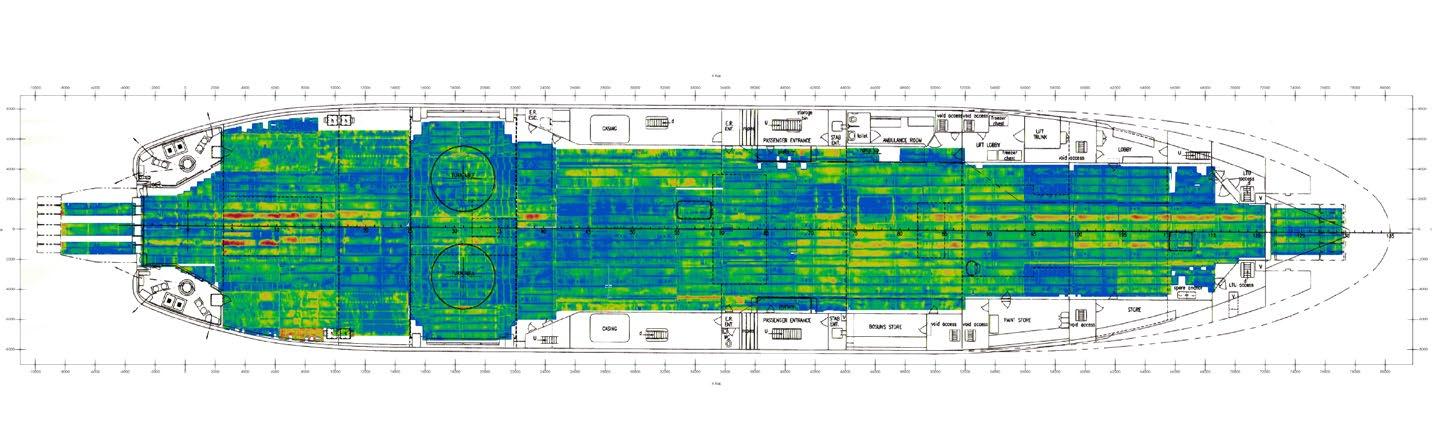

91 Ops & Maintenance: Rust Never Sleeps

All ferrous metals are prone to corrosion, but Pulsed Eddy Current Array can help mitigate the damaging effects of rust.

98 Sustainability: Green Your Shipyard

Shipyards are gradually switching on to the need to implement more sustainability into their operations, business practices and infrastructures.

106 Industry Opinion: Now is the Time

Feargus Bryan of the Superyacht Technology Steering Council explains why the time is ripe for collective action.

110 Refit & Repair: Sailing on an Uneven Keel

Mark Small, Technical Director at Rob Doyle Design, describes a mighty repair job when the largest sloop in the world lost its keel tip.

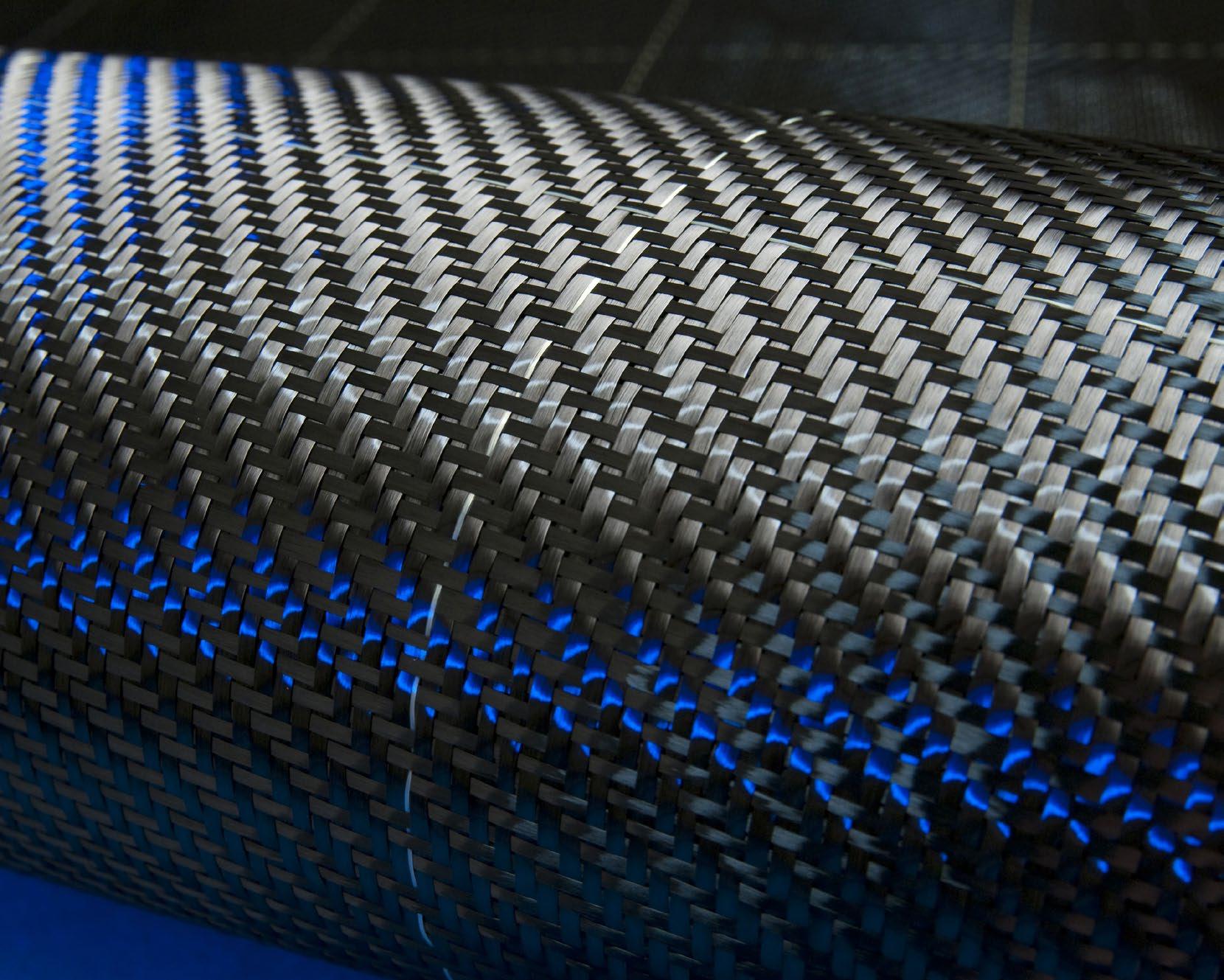

118 Ask the Experts: Composites

Choosing the right composites for the right application is not always straightforward. A panel of leading experts offers words of wisdom.

Welcome to the first of this year’s three editions of How to Build It

At the close of last year, SYT iQ reported that 2023 had seen a 51 percent decline in the total sales of 24-metre plus sailing yachts – the lowest point in the past six years. This rather sombre statistic provided the perfect excuse to visit one of my favourite shipyards. In-build at Royal Huisman for repeat clients, 65-metre Aquarius II is a modern classic cruising ketch and the kind of project the Dutch brand excels at. She is also the beneficiary of more than 700 design tweaks collated by her captain and crew during five years of operating the owners’ previous Huisman.

Talking of new builds, for this issue we also travelled to Italy to catch up with 44-metre explorer Maverick during her fitting out at Cantiere delle Marche, one of the most consistent shipyards building over 40 metres, and to Turkey, now ranked second behind Italy in terms of numbers of units in build, to take a peek at 79-metre Project Toro under construction at Turquoise Yachts.

In keeping with the international flavour of this issue, our concept analysis comes courtesy of Miami-based designer Luis de Basto and those clever people at Lateral Naval Architects in the UK. Project Med takes inspiration from a study by Lateral that reduces the need for watertight bulkheads, the main engineering limitation when defining an interior arrangement. De Basto’s open architectural concept is the result of looking at the rules “in a slightly different way.”

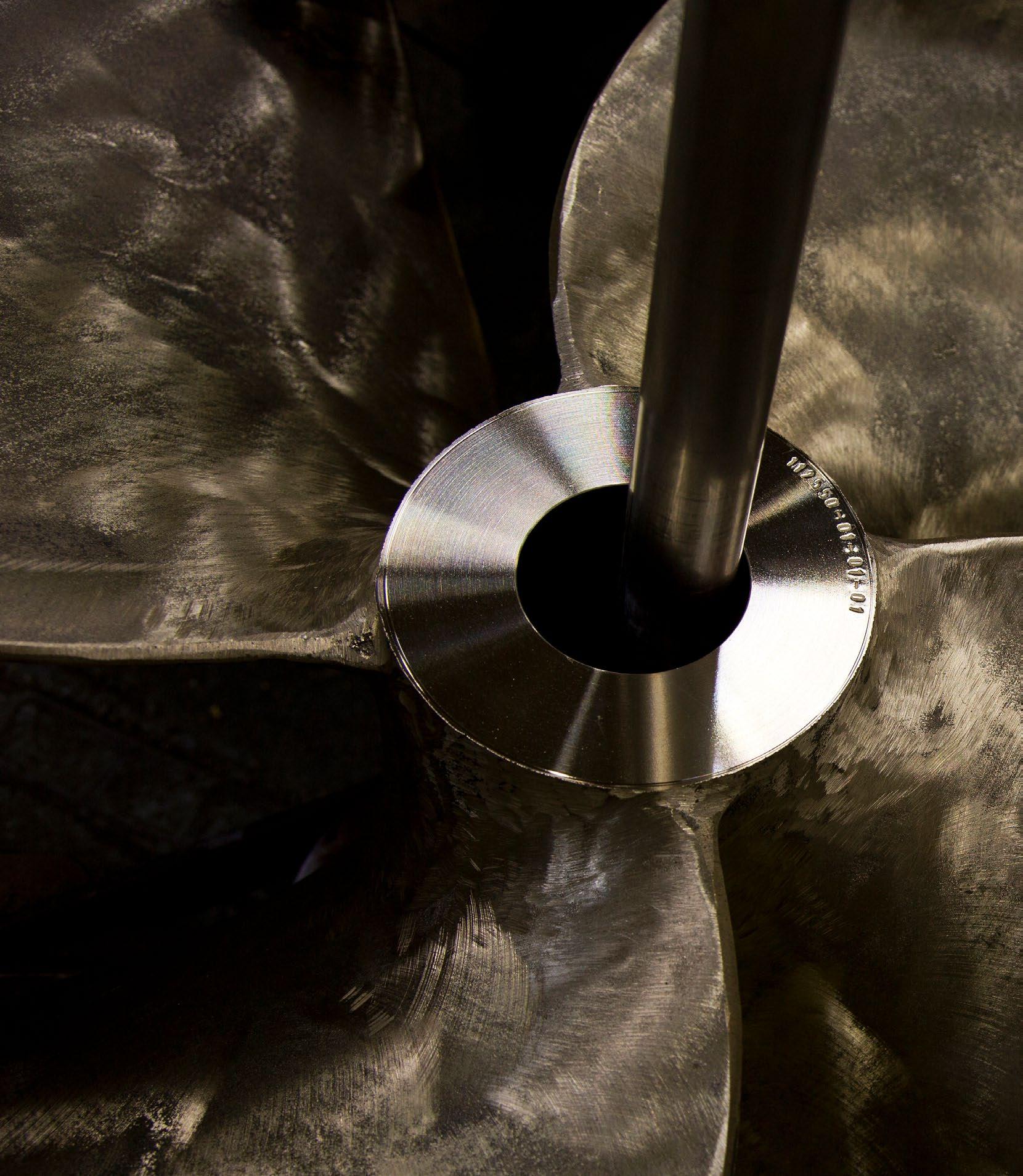

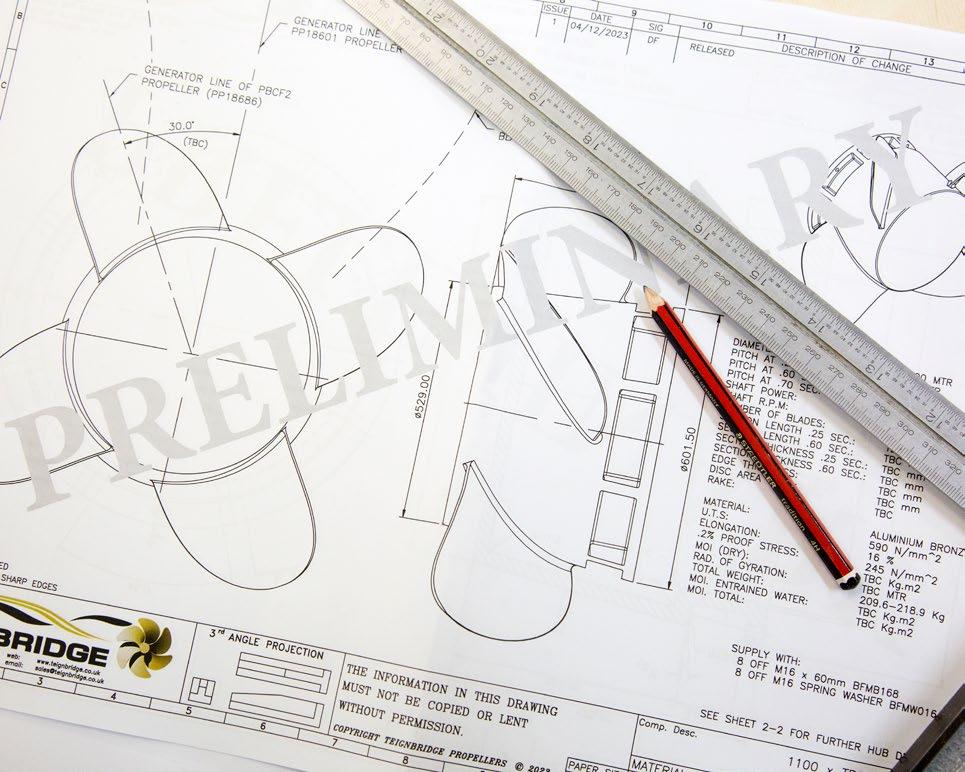

Amidst all the talk of alternative fuels and greenhouse gases, the carbon footprint of the facilities building the yachts has usually taken a back seat. Not anymore. We look at how shipyards are switching on to the need to implement more comprehensive sustainability solutions in their business practices – and the operational and financial benefits that can be enjoyed as a result. But for me the most rewarding assignment was a trip to Teignbridge Propellers in deepest Devon. I thought I knew something about stern gear, but quickly realised I was almost entirely ignorant of how propellers are designed and manufactured. After being introduced to a fascinating process that combines the latest CNC technology with old-fashioned human labour, I learned why propellers sometimes ‘sing’, what ‘fettling’ is, and why the moulds for casting are made one blade at a time using ‘patterns’. I hope you learn something too.

Justin Ratcliffe - Editor

At West Istanbul Marina, we're passionate about what we do. With decades of experience, our team is dedicated to providing a customized plan for yacht maintenance & repair, because we believe that every yacht is as unique as its owner.

We treat each yacht with utmost care, no matter the size. As part of our services, we offer a progress report so that our clients rest assured that their yacht is in good hands and will be delivered within the agreed time-frame. With our 700 Ton Travel-lift, 14 yacht sheds and 600 berths, we’re able to accommodate yachts up to 90m long.

EDITORIAL

EDITOR IN CHIEF

EDITOR | HOW TO BUILD IT

EDITORIAL CONTRIBUTOR

NEWS WRITER

FEATURES WRITER

WRITER

SOCIAL MEDIA MANAGER

CONTEN CREATOR

Francesca Webster

Justin Ratcliffe

Charlotte Thomas

Sophie Spicknell

Enrico Chhibber

Amy Larsen

Marina Vargas

Nick Smits

DESIGN PRODUCTION

CREATIVE DIRECTOR

GRAPHIC DESIGNER

UI/UX DESIGNER

Ivo Nupoort

Beatriz Ramos

Claudia Sabbadin

INTELLIGENCE

HEAD OF INTELLIGENCE

RESEARCH ANALYST

DATABASE MANAGER

DATABASE MANAGER

YACHT HISTORIAN

Ralph Dazert

Adil Zaman

Syrine Mellakh

Darwin Manguiat

Malcolm Wood

SALES & ADVERTISING

HEAD OF SALES

SALES MANAGER

SALES MANAGER

CLIENT SERVICE MANAGER

SALES ITALY

Marieke de Vries

Justus Papenkordt

Daniel Van Dongen

Johanna Borreli

info@admarex.com

CORPORATE

FOUNDER & DIRECTOR

TECHNOLOGY DIRECTOR

FINANCE DIRECTOR

Merijn de Waard

Fabian Tollenaar

Laura Weber

The Port Authority in Livorno, Italy, home to Benetti’s superyacht shipyard, has issued tenders for the concession of four areas, totalling approximately 53,000 square metres, between the Calafati Docks and Pisato, to establish a new facility for the construction of superyachts.

The plan presented by RINA Consulting recommends technical adjustments and administrative procedures, as well as demolishing or renovating certain structures and making improvements to the docks. These investments would fall under the responsibility of future concessionaires.

The driving force behind the plan is the substantial demand within the luxury yacht industry for more dedicated spaces for building vessels to address the order backlog.

After successful first-stage testing, Williams Jet Tenders has approved HVO100 fuel (Hydrotreated Vegetable Oil) for all its Yanmar 4JH engine-powered tenders, including the DieselJet 415, 445, and 505, and SOLAS 505. HVO fuels bring environmental benefits such as reduced greenhouse gases, fewer particulates, and lower SOx and NOx emissions.

“We are committed to finding innovative sustainable solutions that reduce the direct emissions impact from our factory and our vehicles,” says Sarah Moore, sustainability specialist at Williams Jet Tenders “By using UCO HVO, a renewable fuel made from waste cooking oil, we will accelerate our efforts to decarbonise.

Williams was recently awarded a grant by Innovate UK Edge to test alternative and more sustainable composite materials and complete Life Cycle Analysis (LCA) for its TurboJet 325 and DieselJet 415 to calculate their carbon footprint.

Sanlorenzo and Nautor Swan have announced the muchanticipated signing of a Memorandum of Understanding signalling the initiation of an exclusivity period to evaluate the potential joint strategic opportunities between the Nautor Swan Group and Sanlorenzo.

“The combination of these brands within the same group would create a unique Maison of motor and sail yachts at the top-end of the nautical competitive landscape,” says Massimo

Perotti, chairman and CEO of Sanlorenzo, who is eager to add luxury sailboats to the Sanlorenzo line-up.

“A strategic partnership with Sanlorenzo Group would offer several opportunities to move forward on this virtuous path with joint investments in innovative technologies, in sustainability, and in a more extensive service network for our customers globally,” adds Leonardo Ferragamo, chairman of Nautor Swan.

Maritime security eLearning platform VIRSEC has launched a course on lithiumion battery safety awareness to help yacht crews, officers, captains and yacht managers recognise and implement measures to prevent L-ion fires and respond to battery-related emergencies.

Gulf Craft has announced it is exploring hydrogen tech with the aim of developing a zero-emission Majesty yacht that could be powered by an innovative LOHC (Liquid Organic, Hydrogen Carrier) energy system. The research programme is being conducted in partnership with H2-Enterprises, a company that has been working on hydrogen technology for the last 13 years.

“CO2 emissions need to be reduced rapidly and radically to achieve the climate change goals. Our LOHC technology is suitable for replacing the current carbon-based, pollutant-contaminated CO2 and NOx based energy system,” says Michael Stusch, executive chairman and CEO of H2-Enterprises.

Gulf Craft chairman Mohammed Hussein Alshaali maintains that the collaboration will allow the company “to lead in a new era of emissions-free luxury, where opulence and sustainability intertwine seamlessly.”

Navico Group, a division of the Brunswick Corporation, has announced a partnership with Oyster Yachts. Under the agreement, B&G, CZone and Mastervolt will be the preferred electronics and power suppliers across Oyster’s fleet of 50 to 90-foot sailing yachts.

“With our wide range of industry-leading brands, Navico Group is uniquely positioned to offer premium integrated systems and technology that will provide an enhanced experience on the water for Oyster’s customers,”says Ton de Winter, EMEA president, Navico Group.

Navico is also expanding its Michigan facility to create two Centres of Excellence, one in metal fabrication and the other in electrification. The multi-million-dollar investment will increase quality and efficiency while improving manufacturing capabilities.

In its recent MGN 681, the UK’s MCA introduced the requirement that competent persons undertake battery charging operations. ISM Code 6.3 further mandates yacht managers to establish procedures for personnel, especially regarding safety and environmental roles. The online course comprises eight short lessons that provide an in-depth study of the electrochemistry and hazards associated with Li-ion batteries in order to keep onboard personnel updated regarding safety protocols. More information is available on the VIRSEC website.

Derecktor Fort Pierce, Florida, has been designated as a Foreign Trade Zone (FTZ. The designation brings with it substantial benefits for the marine industry by alleviating duty and taxes on imported boat parts and foreign-built yachts within the zone. Foreign-built yachts can be brought into Derecktor Ft. Pierce without incurring the typical 1.5 percent import duty. This opens up opportunities for prospective US buyers to explore vessels that were previously restricted. Moreover, major refit projects conducted within the FTZ benefit from deferred duties until the project’s completion. Upon completion, vessels can leave the U.S. without the obligation to pay duties or taxes. The FTZ designation also facilitates operational flexibility, allowing vessels to enter and exit the zone during owners’ trips and yacht charters.

Quantum’s new F45 Hybrid Hyraulic/Electric Integrated Power System for the 50 metre-plus market was unveiled in November. Testing has demonstrated that the system is highly efficient, offering a smooth power source and requiring 50 percent less power than a traditional hydraulic system. Unlike traditional systems, the F45 only consumes energy as required, when required, partially due to the elimination of control valves in exchange for a servo motor. Quantum has also developed two new methods of storing and recovering power for future use, to overcome the power fluctuation challenge. This new solution is called MESS—Mass Energy Storage System.

OutSail has developed its first retractable wing sail for the yachting sector, the OutSail 60 prototype, that can offer 30% fuel savings in average wind conditions. The wings automatically adjust to wind strength and direction and can be fitted with solar panels to offer power up to 30kw of solar power under way or at anchor. The wing has been designed by Arpan Rau, Robotics Engineer and OutSail has recently moved to a large facility for the construction of its 20 metre-plus wings.

Swiss Ocean Tech has launched its Anchor Guardian to reduce the risk of anchor dragging and to provide prediction and immediate alarms. The system consists of an anchor module on the chain, a boat module attached to the hull and a user interface at the helm station, with the modules feeding realtime information back to the user interface to alert the captain of changes to the anchor positioning. During anchor deployment, the user interface simultaneously reports boat, chain and anchor movements, and once settled, the captain receives a continuous stream of intel around the anchor and chain, including sediment type, force and current. This allows the Guardian to predict the anchor hold and alert the crew of potential issues, before they take place.

Helicopter Visual Landing Aid specialist Optonaval has launched its GPI light beams that enable pilots to locate helidecks from c.5 nautical miles, and guide helicopters to position above the landing area. A high-resolution camera with motorised zoom facing towards the approaching helicopter will assist visual surveillance of helideck landing operations. When not used as GPI, the camera can be integrated in the CCTV system and act as pan / tilt camera for additional observations.

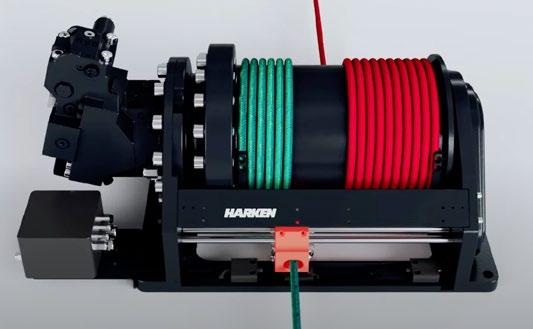

The Push/Pull Captive Reel Winch moves horizontal and vertical underwater foils, sail controls, or retractable superyacht recreation spaces such as extendable stern platforms in two directions (in and out, side-to-side, up or down). This single winch solution saves at least 400 kg and approximately 50 cubic centimetres of interior space below the cabin floor. Proof of concept is installed in a 43 metre monohull. It has a 20-tonne capacity. Its design replaces the need for two winches and their accompanying space and power requirement. It also assists the marine industry’s move towards electrification of control gear in preference to hydraulics.

New projects in early stages of construction that present opportunities for OEMs, suppliers and subcontractors.

The 68m ketch is an evolution of several highly successful sailing yachts including the 54.6-metre Adele, the 54.64-metre Marie, the 52.5-metre Anne and the 49.7-metre Meraki, all of which were a result of this design and build partnership. American designer Bunny Williams is responsible for her interior decoration. Van Ineveld & Co will also work as the owner’s representative during her build. The 68m ketch has been commissioned by a highly experienced repeat client, who wanted increased accommodation and the ability to cross the Panama Canal.

LENGTH: 67.93-metres BUILDER: Vitters COUNTRY OF BUILD: Netherlands DELIVERY YEAR: 2026

NAVAL ARCHITECTURE: Hoek Design EXTERIOR DESIGNER: Hoek Design INTERIOR DESIGNER: Bunny Williams

Started on speculation in June 2023 and sold in November, the first hull of the new Bilgin series offers a different design to her sistership the Bilgin 164, with a larger and more traditional bow shape, to create an overall sleeker appearance. The Bilgin 170 features an elongated bridge deck aft, extending by 1.5-metres to amplify her living space and offer a spacious and shaded area for guests to unwind. Her beach club on the lower deck ensures plenty of natural light with expansive windows when all three doors are closed.

LENGTH: 52-metres BUILDER: Bilgin Yachts COUNTRY OF BUILD: Turkey DELIVERY YEAR: 2025

NAVAL ARCHITECTURE: Unique Yacht Design EXTERIOR DESIGNER: Unique Yacht Design INTERIOR DESIGNER: Hot Lab

Construction began on the Columbus Crossover 42 yacht on speculation at the Columbus Yachts Savona shipyard in Italy in May 2022. She features exterior design by Hydro Tec, in collaboration with Francesco Guida, with interior design by awardwinning designers Hot Lab. The model was first introduced in April 2022, with the first hull sold in November 2023.

LENGTH: 42-metres BUILDER: Columbus Yachts COUNTRY OF BUILD: Italy DELIVERY YEAR: 2025

NAVAL ARCHITECTURE: Columbus Yachts EXTERIOR DESIGNER: Hydro Tec INTERIOR DESIGNER: Hot Lab

Announced in June 2023, the 44-metre superyacht, designed by long-time partner Francesco Paszkowski, takes inspiration from the shipyard’s traditional fast aluminium boats. The superyacht features a traditional layout, with the master cabin located forward on the main deck, where a conversation area and the dining area can also be found. Two fold-down balconies at the stern offer a generous sunbathing area and a pool.

LENGTH: 44-metres BUILDER: Baglietto COUNTRY OF BUILD: Italy DELIVERY YEAR: 2025 NAVAL ARCHITECTURE: Baglietto EXTERIOR DESIGNER: Francesco Paszkowski INTERIOR DESIGNER: Margherita Casprini and Francesco Paszkowski

Sold in September 2023, the full custom YN256 is under construction at the shipyard in Monnickendam. The 45.2-metre motor yacht will have an eco-conscious design and will be equipped to meet the needs of all guests onboard. Project YN256 is characterised by her glass superstructure and round bilge displacement hull. Her distinct exterior styling includes a slightly flared bow and metallic bronze-painted features, as well as a cleverly designed funnel that acts as additional storage, and minimises the size of her radio masts.

LENGTH: 45-metres BUILDER: Royal Hakvoort COUNTRY OF BUILD: Netherlands DELIVERY YEAR: 2026

NAVAL ARCHITECTURE: Hoek Design EXTERIOR DESIGNER: Hoek Design INTERIOR DESIGNER: Hoek Design

BY FRANCESCA WEBSTER

Quick Spa originally specialised in the sales, installation and after-sales management of marine electronics, refrigeration, air conditioning, heating and electrical systems. But the company has developed beyond recognition since it was set up over 40 years ago in Ravenna.

Founded in 1982 by Michele Marzucco and Alfonso Peduto, the Italian nautical product manufacturer Quick Spa has evolved over the decades, expanding into its neighbouring sectors with a series of major acquisitions. At the 2023 METSTRADE, Quick announced the acquisition of Nemo Industrie, yacht components manufacturer, only weeks after closing on yacht control systems manufacturer Xenta Systems.

We join Lorenzo Cesari, long term Quick employee and Sanguineti CEO, to discuss the company’s continued expansion.

In 2022, Fondo Italiano d’Investimento SGR and Armònia SGR acquired a majority stake in Quick Spa, with the ambition to undertake a series of acquisitions to broaden the Group’s portfolio. Having taken over Catt, the group’s flagship company that specialises in the mechanical processing of aluminium and steel parts as well as plastic manufacturing, in the early 2000s, the search was on for a manufacture of deck equipment and products. Reviewing a number of potential brands, Quick honed in on Sanguineti, another historic Italian company, that specialises in the design and manufacture of products such as gangways, boarding ladders, winches and handrails for super motor and sailing yachts.

Quick completed the acquisition of Sanguineti in 2023, appointing Cesari, who has worked at the Group for over 20 years, and charging him with an ambitious three year growth plan. “The goal we aimed for is to achieve significant growth with an ambitious three-year outlook: in 2023 turnover increased by 36% and we foresee a further growth of 33% in 2024, in order to reach a turnover doubling by 2026, thanks also to investments of €3.5 million by the Group. The relocation of the company’s headquarters to Casarza Ligure (GE) will allow the company to expand its space by about 6,000 square metres total, including about 3,500 square metres of covered space, making it possible to absorb the orderbook and increase production capacity, including a 35% increase in the workforce.”

Both Nemo and Xenta have been 100% acquired by the group, with Nemo providing the production of components for sail and motor yachts, specifically hatches, portholes, furlers and gangways. With the goal to provide products for the entire yachting segment, Nemo will focus on the sub-30 metre segment. “Sanguineti and Xenta solidifies the group’s position in a

Last year, Quick Spa completed the extensive refit of a 1996 Falcon 80 motoryacht, Project Maverick, to serve as a comprehensive demo boat and ongoing R&D vessel for its growing portfolio of products. The main Quick systems include the MC2 Seacentric System, the electric stabilisation system comprising Viator carbon fire fins and Intercepta trim tabs; Quick Nautical Network, a device allowing the integration of Quick systems with third-party navigation protocols; the new XR6 vertical windlass; new synchronous BTAC 300S thruster propellers; and a Proportional Control System (PCS) for precise and perfect feedback from thrusters, fins and windlass when under way or manoeuvring.

growing market,” explains Cesari, “and are part of the broader strategy to focus on the growing 40-70 metre sector. Historically Quick has provided for the sub-30 metre segment but the recent acquisitions will bolster the production capacity and reputation of Quick in the superyacht sector.”

One of the main strategies of the group has always been the centralisation of product production at the headquarters in Ravenna. This allows the company to closely oversee the quality control of all components within its 50,000 square metre facility, centralising the research and development and design of all products within the group. Despite this centralisation, each of the acquired companies retain their unique identity, something that Cesari explains is at the heart of Quick’s acquisition ethos. With an impressive annual production exceeding 640,000 products, Quick Spa exports its products worldwide, through a network of more than 110 distributors. With a clear growth strategy centred on new technologies, acquisitions, and market expansion, Quick Spa is set to achieve its goal of surpassing €100 million in revenue by 2026.

Facing page: From left Lorenzo

Founded in Auckland in 2008, anchor deployment manufacturer Bowmaster has taken a lead in its sector despite a remote location in New Zealand. The company was originally the deployment system department of anchor manufacturer Manson Anchors set up by Kiwi offshore sailor Kerry Mair. The decision to create a stand-alone business to design and build modular and bespoke anchoring systems led to the foundation of Bowmaster. Recent projects to carry its systems include Abeking and Rasmussen’s Liva O, Lurssen’s latest Kismet, and the Echo Marine catamaran Charley 2. We sat down with Ned Wood (pictured left), Technical Sales Director, to find out more.

BY FRANCESCA WEBSTER

What is the scope of Bowmaster’s portfolio?

From small tenders to 200 metre-plus vessels, we have a range of approximately 40 different systems for integrating 15 different anchors into a vessel. The systems – chain, anchor and windlass – are customised depending on the size of the vessel and the hull material, and from a material perspective we design and build systems in aluminium, carbon steel, duplex and ordinary stainless, as well as titanium. Today we produce 40-60 systems per year for the luxury marine industry.

How have anchor systems evolved in terms of design and materials used?

Manson Anchors have launched 10 new Class-approved anchors in the last 10 years. The use of higher strength materials means that the anchor is getting material where it’s structurally needed and ensures greater holding power. This has resulted in the most recent anchors achieving Super High Holding Power certification and a much more robust construction. We continue to use more exotic materials such as titanium to ensure an optimised anchor combined with weight saving.

What are the most critical fail points for anchoring systems?

One fail point is potentially where you have competing systems (eg. hydraulic/pneumatic) that fight against the windlass. Anchor systems can also be vulnerable to bumps during deployment, by a boat or pier for example, which can cause them to fail and not retract. In our systems everything is designed and built to fail above chain break load, so in essence the chain will snap before the system fails. A 100-metre yacht, for example, might use a 42mm diameter chain, which has a break-load of 1280kN or 128 tonnes.

It’s worth mentioning that anchor systems are required by Class to be able to be deployed immediately by pressing ‘go’ on the winch or releasing a brake, so if you lose power you can still stop the boat in an emergency. We like to keep things as simple as possible, so we generally use gravity to deploy the system, and the windlass to lift the anchor back up and stow it.

Tell us about your testing procedures?

We test everything on site before installation. It’s much easier to solve potential issues while the system is still in our factory than when aboard the vessel. This saves time in the build and lowers the risk of problems when the vessel is in use. Within the facility we undergo testing that simulates the anchor deployment and the potential loads. We are essentially a mini shipyard and are inspected and tested by the same regulatory bodies, be that Lloyds or ABS, who check and test all welds throughout the build process. When we’re building a new, bespoke system, we often build a steel mock-up of the hull, with the anchor pocket and deployment system to validate the design and make any necessary tweaks.

What about your submarine anchors – what advantages or disadvantages do they offer?

Space is always finite on a boat, so ensuring that it’s used in the most efficient way is a priority. We can do that by changing around the anchor type and anchoring arrangement. People are sometimes nervous about submarine systems because you can’t see the anchor chain, but you would normally use underwater cameras to look at chain direction in a standard system and use your GPS to drop a pin where you drop the anchor, so you know the chain direction from where the anchor lies and your current recovery position. Moreover, due to the flair in the topsides of a yacht it is very hard to actually see the anchor chain, which is why some yachts have viewing hatches in the hull at deck level. Once captains are familiar with using a submarine system they are usually happy with the performance. And from a crew point of view, polished anchors and anchor pockets are not required and there is no ‘bleed’ from a rusty galvanised anchor that can leave unsightly marks on the hull.

Are there any challenges associated with manufacturing in New Zealand?

We have a very low dollar compared to the US dollar or Euro, but a highly skilled workforce. Freighting to Europe is normally just one percent of the contract value, so it really doesn’t affect us, beyond the perception of being in the Southern Hemisphere, which can sometimes be negative. From a positive perspective, we can design during the night European time, so clients see updates first thing in the morning and we can receive their feedback during our working day. We also try to design anchoring systems that require low ongoing maintenance and we only use quality components that can be sourced globally, so ongoing supply is not an issue.

Maverick, the second in Cantiere delle Marche’s Flexplorer series, is fast approaching completion at the shipyard in Ancona.

Owned by Tom Schröder, Top Gun aficionado and now principal shareholder in the shipyard, the 44-metre explorer yacht has been designed and built expressly for a round-the-world tour.

Facing

When Tom Schröder was first introduced to Cantiere delle Marche in 2019 at the Cannes Yachting Festival, he was particularly struck by the onboard technical spaces. “I could see how well everything had been put together and that impressed me,” says the German-born entrepreneur. “I thought that sooner or later I wanted to own a CdM.” A year later he attended the launch of Aurelia, the first Flexplorer, and a few months after that he signed the contract for Maverick in the midst of the pandemic. Little did he know at the time that he would end up investing in the company.

“Maverick had been in construction for a year and I had built up a very good relationship with the management – always the most important factor in an investment decision,” he says. “When the main shareholder decided to sell his stake in the company, Vasco [Buonpensiere, then sales & marketing director, latterly CEO and co-owner] told me about the management buy-out and investment opportunity. Naturally I checked out the numbers and everything, but I’d already decided I wanted to step in because I trusted the management.”

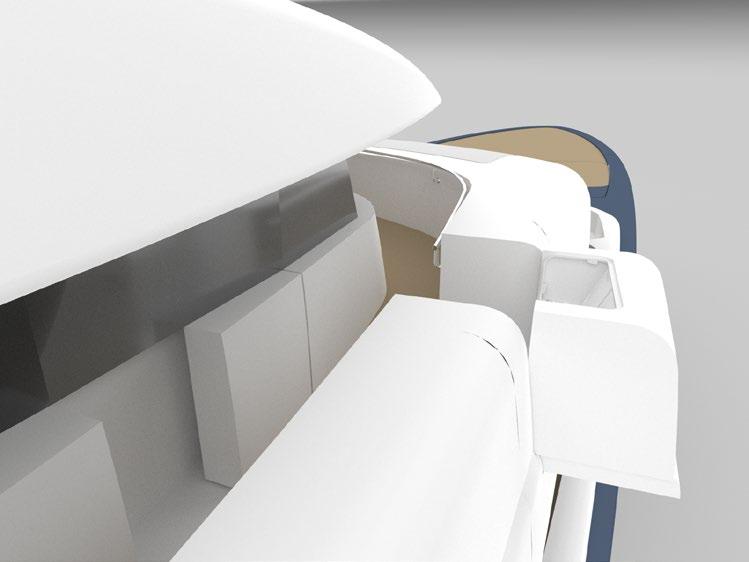

Like her predecessor Aurelia, Maverick embodies all the key elements of a true explorer vessel – robustness, long range, ample storage, seaworthiness in all weathers, and so on – but the flexibility and functionality that defines the Flexplorer concept has been ratcheted up a notch.

The trademark A-frame crane, for example, has undergone important upgrades. Custom-built in carbon fibre by Advanced Mechanical Solutions (AMS), the lifting capacity has been bumped up to 4,000kg and its dimensions increased to improve the functionality of the aft deck. Aurelia’s crane is not full beam and the recesses that house the structure and close flush with the deck when not use (the teak planks are cut at 45 degrees to further disguise the join) reduce head height in the lazarette that houses a gym. Maverick’s crane is wider and its recesses are further outboard, so they intrude less on the beach club, laundry and technical spaces below. Moreover, the crane has a mobile snatch block that can be positioned directly above the tenders and toys instead of moving them around the deck on cradles during lifting operations. A portable, carbon-fibre davit crane by Atlas is used to handle smaller loads with sockets located around the deck perimeter. The mooring system in the stern has also been revised. Aurelia has her winches mounted on the main deck with hawseholes in the stern quarters, which limited the length of the collapsible bulwarks. By moving the mooring winches and fairleads to the swim platform, the side platforms now extend all the way aft on main deck to create an open garage-come-beach area of 135 square-metres. The heated 3,300-litre capacity pool in the centre of the aft deck is another new addition, although in explorer mode it is more likely to be used for storage than swimming.

The aft deck will carry several tenders, including a 9.55-metre custom chase boat designed by Valerio Rivellini. With an aluminium hull, carbon fibre topsides and powered by a 370-hp inboard Yanmar engine, it will be able to carry a jet RIB tender on its aft deck for rapid transfers (called Iceman and Goose respectively after other Top Gun characters, towing one support craft is also easier than towing two). The custom tender is being assembled offsite, although the shipyard built the aluminium hull and plan is to offer the design to CdM clients as a standalone product.

“Maverick represents the maximum evolution of the Flexplorer concept within the 500GT threshold.”

Maximising the loading capacity of the main deck aft meant concentrating the living areas forward and adding a fourth deck to house the wheelhouse and captain’s cabin.

The upper deck is now dedicated to the owner’s use, with a VIP suite on the main deck forward and four guest cabins on the lower deck. Additionally, there is a ‘crow’s nest’ or observation deck under the radar mast (the winglets are a styling feature that recall the tail fins of the F-14 fighter jets in Top Gun).

The extra deck brings with it added volume and the yacht is rated at 499GT – appreciably more than average for her length overall. Despite the higher superstructure, however, her profile looks balanced on the water.

“Maverick represents the maximum evolution of the Flexplorer concept within the 500GT threshold,” says Sergio Cutolo of Hydro Tec, responsible for the naval architecture and exterior design. “Because of the increase in volume at the top of the vessel and extra weight towards the bow, we had to keep the construction and outfitting materials as light as possible and reevaluate the hull form, which has a different distribution of immersed volumes to compensate for the longitudinal weight distribution.”

The owner’s previous yacht was a 74-foot Sunreef sailing catamaran (also called Maverick), which he sold in 2018. The idea of building an explorer yacht and a world tour came during the Covid lockdown while holed up at home. Due to start after this year’s Monaco Yacht Show, the seven-year, globetrotting expedition will take in high latitudes as well as the Northwest Passage. To this end, Maverick is partially winterised with preheating for lubricants and the hull has an ‘Ice Belt’ around the waterline. Ice strengthening usually involves doubling the number of frames where reinforcement is needed to make the whole hull structure several times stiffer, along with thicker plating for extra strength to prevent buckling caused by floating ice, but CdM already builds to higher specs than normal.

“The transversal hull structures we design for CdM offer a simple and reliable solution that combine strength and efficiency while minimising impact on the living spaces inside the hull,” explains Cutolo. “Whereas in a similar vessel you may have a shell thickness of 5-6 mm around the waterline, Maverick has a longitudinal strip of 12mm plating, at least double what you would usually expect to find. This transversal structure offers optimal support for the thicker shell plating around the waterline without the addition of longitudinal stringers.”

Sales of explorer yachts have boomed in recent years, thanks in part to younger, adventurous owners who are less interested in cruising the usual hotspots. The explorer category often favours styling over substance, with the result that most so-called ‘explorer’ yachts are no more designed for long distance passage-making than your average SUV is for serious off-roading. CdM is different and since launching its hardy Darwin Class of steel-hulled explorers in 2010, the brand has carved out a niche for itself in the market for ocean-going, pocket explorers under 500GT. As Vasco Buonpensiere points out: “We believe it should be you that sets the limits of what you want to do with the boat. Not the boat.”

With 16 projects under contract and seven deliveries, including Maverick, scheduled for this year alone, CdM has seen production turnover increase from 37 to 80 million and its staff double in the last three years. Due to lack of space, its steel hulls are currently built up the coast in Trieste and Porto Marghera near Venice, but a new onsite construction shed will bring all the steelworks inhouse by the end of the year.

According to Buonpensiere, the entry of Tom Schröder as majority shareholder will not affect day-to-day operations: “Tom wants to stay small, stay family, stay high quality, because that’s what attracted him to the brand in the first place,” he says. “The most important thing is that his is not a speculative investment.”

Although technically a series builder, CdM has always offered a high level of customisation. However, the brand is also developing new models of around 100 feet/200GT, a size range in which clients are accustomed to more standardised products.

“Clients upsizing from 70 or 80 feet are often nervous about customisation and prefer less choice, not more,” says Vasco Buonpensiere. “I’m a big believer in the smaller boats because they are the foundation of this company. We have quite a few Australian owners, for example, where most of the market is for boats under 35 metres. Especially in boom times you see yards start to build bigger, but nearly all our clients start at 100 feet.”

The layout of Maverick’s main and lower decks is similar to Aurelia’s. The asymmetrical arrangement of the main saloon, which is widebody to starboard, remains, but the galley is designed to be more family-friendly and communicates directly with the saloon with no intervening pantry. In line with the yacht’s explorer vocation, there is a large walk-in cold room inside the galley with more cold/dry storage space on the tank deck, and in the full-height tunnel that runs between the engine room and the crew quarters –one of the features that the owner first liked about the brand.

Maverick is powered by conventional Caterpillar C32 ACERT diesel engines for a range well above 5,000 nm at 10 knots. The fact that CdM has no current plans to build a yacht with hybrid propulsion – although it is researching PTO/PTI solutions and salt batteries – may seem retrogressive at a time when sustainability is a hot topic, but the strategy is a logical consequence of its practical approach to yacht building as well as the type and size of vessel it specialises in.

“We had the hybrid conversation with Tom, as we do with all our clients, but the more you look into it the less it makes sense for us and our owners,” says Buonpensiere. “Firstly, an explorer has to be reliable, so simplicity is the top priority. Secondly, Maverick burns around 70 litres of fuel an hour at 10 knots, so any additional savings a hybrid system may provide will never outweigh the extra cost. Thirdly, alternative fuels require more storage and technical space on board, which is a problem on the size of yachts we build.”

Instead, CdM has opted for something far simpler and more sustainable: wind power. Maverick will carry a wing kite (see sidebar) supplied by Wingit in Germany, which during long transfers can tow the yacht at low speed assisted by the engines (having the props turning at idle speed reduces drag). It is a solution that appeals to the owner’s sailing background and Wingit is working with CdM to develop a kite system specifically tailored to the requirements of its explorer fleet.

Dresden-based Wingit was set up in 2010 by kite surfing enthusiast Stephan Schröder (no relation to Maverick’s owner). The company began with wing kites for smaller sports boats and nearly 40 have been installed to date, but later started receiving requests for automated systems on larger yachts. It is currently developing a special system for CdM able to handle much higher loads based on a feasibility study for kites of 20, 25 and 30 square metres on a steel-hulled vessel like the Flexplorer displacing 440 tonnes. The results show that they will be able to tow the yacht at over 8 knots on wind power alone, or more when engine assisted. The size of the kite does not dramatically affect performance, but the smaller the surface area the greater the angle it can sail to the wind.

No mast is required to fly the kite, just a deck-mounted coupling above the height of the railing in the bow for attaching the three control lines –one to take all the forces and the other two for steering. After inflating, the kite is released and launched it into the air by pulling the lines. When the kite reaches the optimal height, it begins to trace a figure of 8 in the sky on an automatically controlled flight path. To bring the kite down the auto pilot moves it to a position directly above the boat where it exerts the least force. It can then be winched down and collapsed for stowage.

“The advantage of a kite over a conventional sail system is that it does not need a tall mast, flies higher in the sky where there’s more wind, and generates up to 10 times more power than a traditional sail per square metre,” says Schröder. The main thing is not the size of the kite but the speed at which it performs the figure of 8 in the sky – ideally you want constant flight speed to maintain constant power.”

How can engineering free us from the evolutionary constraints in superyacht design? This was a question asked by Lateral Naval Architects when they unveiled a concept in collaboration with Michael Leach Design at the 2022 Monaco Yacht Show. Coined Free From Bulkheads (FFB), the proposal stripped down the technical backbone of a conventional yacht by removing restrictive watertight bulkheads. Luiz de Basto’s Project Med, presented at last year’s show, takes inspiration from this open architectural concept.

BY FRANCESCA WEBSTER

Seeing the FFB was a lightbulb moment for Luiz de Basto, who has been experimenting with ‘floating’ decks since the 1990s and saw the FFB as the technical solution. Starting with a 60-foot, planing speed boat, the original concept evolved into the 45-metre Yara first published in 2000, which featured an enclosed flybridge floating over an open foredeck.

Yara was never built, but the idea of an openplan deck with a floating superstructure stayed with de Basto and over the years he sketched variations of the concept. The latest is 92-metre Project Med, which features an almost entirely open-air, open-plan main deck dedicated exclusively to convivial entertainment.

“The concept draws inspiration from the traditional towns across the Italian, French and Spanish coastlines, where piazzas are the centre of life,” says de Basto. “I wanted to create an environment for guests to relax together out in the open, and provide a variety of locations for dining, entertainment and socialising.”

A single open deck with a floating, reflective glass superstructure, the concept presented a number of challenges from an engineering perspective, notably the superstructure with its four structural pillars and a central stairwell. The overhanging structure had to be light, but also have a high level of structural integrity to withstand the dynamic loads of a seagoing vessel. It also needed to be able to support the huge glass surface that wraps around the superstructure. As in the design of bridges and buildings, de Basto incorporated lattice-truss engineering into the superstructure design.

“I considered buildings like Heathrow Airport with its huge lattice structure,” he explains. “The glass is floating above the frame, but it is quiet inside the building, despite planes roaring overhead. I imagined adapting this for the marine world and realised that the structure itself could become an interesting architectural motif of its own.”

Andy Douglas, chief structural engineer at Lateral, took up the proposal and began researching potential avenues to incorporate such a structure into a yacht.

Opening spread: The 92-metre Project Med.

Left: Luiz de Basto’s 45-metre Yara

Below: The CAD model of the lattice frames supporting the yacht’s glass superstructure.

“We began by looking at existing examples of architecture and bridges and came up with the solution of having transverse frames with diagonals across it alongside some longitudinal supports.”

“We began by looking at existing examples of architecture and bridges and came up with the solution of having transverse frames with diagonals across it alongside some longitudinal supports,” says Andy. “De Basto liked the solution, so we created an initial CAD model of the superstructure, before creating an FEA model for analysing the strength and stiffness of the structure and proving it would be able to withstand the loads at sea.”

By reducing the large foredeck overhang and adding additional supports to prevent potential drooping, Lateral was able to demonstrate that the overall concept was viable and the resulting steel lattice-truss arrangement provided the necessary strength, as well as maximising the space between the lattice framework providing large unobstructed windows.

Below: Project Med within a shipyard, with

Bulkheads have always been the main engineering limitation for defining a superyacht’s interior configuration. Lateral’s FFB platform limits the bulkheads to the decks at waterline level, thereby creating a new, unconstrained deck adjacent to the waterline, which opened up the potential for more layout innovations and, ultimately, an elevated user experience. It also allowed de Basto to create his open-plan main deck and to utilise the whole of the lower deck for guest accommodations. Unlike traditional yacht designs and drawing again on the architecture of Mediterranean coastal towns and villages, the resulting corridors are angular and irregular.

Project Med validates the FFB platform by demonstrating that there is demand for a new approach to general arrangements on yachts, but also that a seemingly radical concept can be structurally feasible.

“We’ve had a lot of clients interested in something different,” says Lateral’s chief mechanical engineer, Simon Brealey. “These are clients who question the status quo and want to live without constraints near the water. We’re also constantly having to redesign and redevelop platforms to suit different designers’ ideas. Sometimes this process of aligning designers and owners to technical requirements can create friction and delay projects so the FFB process removes many of these problems.

“ We played with the parameters of the beam and freeboard to see at which point you can remove the watertight bulkheads from the lower deck, but still be compliant with the stability requirements.”

In developing the FFB platform Lateral first analysed the existing fleet. The majority of yachts had the same double-deck engine room, crew cabins forward, a beach club or garage to aft, and guest accommodations in the middle. Taking an 85-metre yacht of 2,500GT as its baseline, Lateral’s goal was to create a new design that opened up these spaces, offering designers more creative potential and more fluid environments for guests to enjoy.

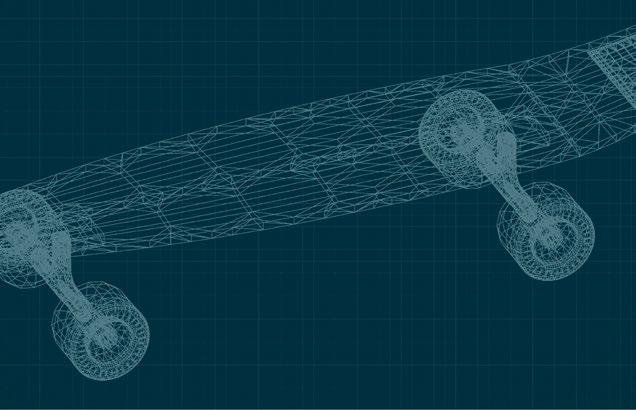

Adrien Thoumazeau, Principal naval architect and research & development coordinator at Lateral, was the main driver behind the concept. His initial concept, dubbed the Lateral Skateboard, was a reimagining of the desired result – a clean and empty deck unhindered by technical mechanisms. To execute this goal, Adrien created a parametric model to test the platform with different engineering arrangements.

“We played with the parameters of the beam and freeboard to see at which point you can remove the watertight bulkheads from the lower deck, but still be compliant with the stability requirements,” he explains. “We quickly realised that increasing the yacht’s beam was not the way forward, but that increasing the freeboard and raising the deck height was the way we could solve the problem and still be compliant.”

Typically a yacht’s lower deck is 0.5 metres above the waterline, whereas the FFB platform has the lower deck at 1.5 metres, at which point the watertight bulkheads can be limited to the technical deck, leaving the lower deck almost entirely free. “The beauty of that,” continues Thoumazeau, “is that in combination with an e-hybrid propulsion system, we’re able to put the engine room fully below the lower deck as well, creating a 70-metre unrestricted lower deck.”

An additional advantage of the increased freeboard is that shell door platforms can be opened on the lower deck in the beachclub or alongside guest staterooms, and because they are higher above the waterline they are no longer susceptible to wave-slapping.

To remain within the 2,500GT envelope, however, the additional deck height had to be taken from elsewhere and so the superstructure has been reduced, which is the compromise when working with the FFB platform. The result is a more streamlined profile, which is not necessarily a bad thing: “You’re shifting the living and luxury onto the lower deck, allowing the focus of the main and upper deck to be purely for guest experience,” says Brealey. “It’s not a sacrifice, just a different approach, with all guest areas closer to the waterline.”

Lateral have identified a sweet spot of 75 to 85 metres as the ideal length before running into potential damage stability issues. Naturally, such a dramatic adjustment comes with regulatory challenges, but these are not insurmountable. “Bending the rules in the superyacht world is very difficult, and we’ve definitely faced questions about how the FFB will increase costs and whether it poses extra risks, but we see no potential issues when it comes to regulatory approval,” says Brealey. ““We’ve done nothing radical. We’ve worked within the letter of the rules, only looking at them in a slightly different way.”

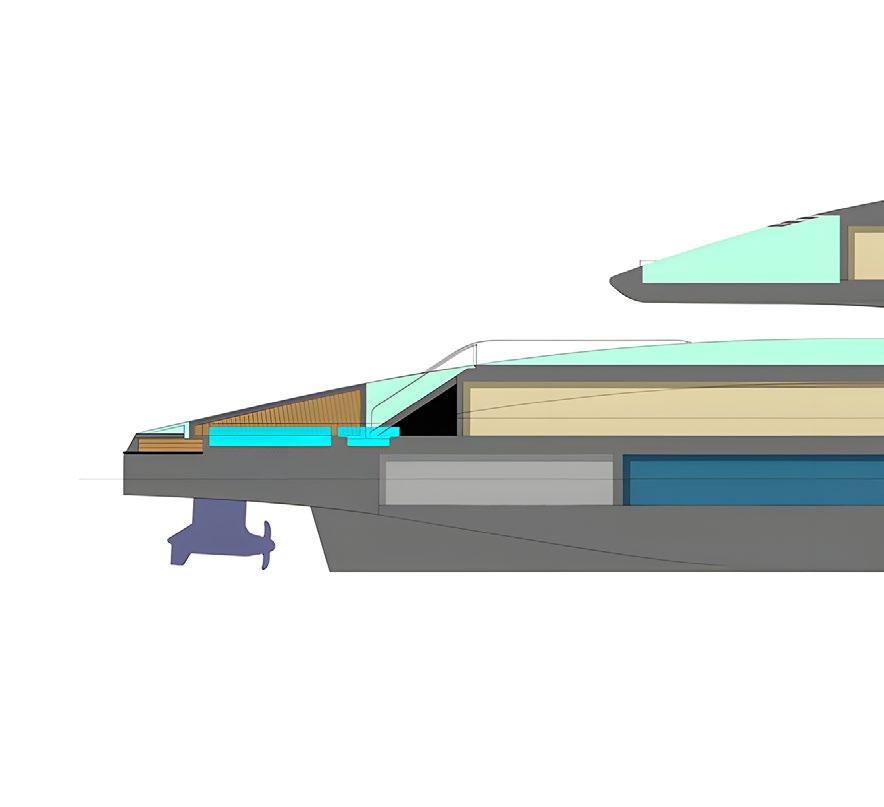

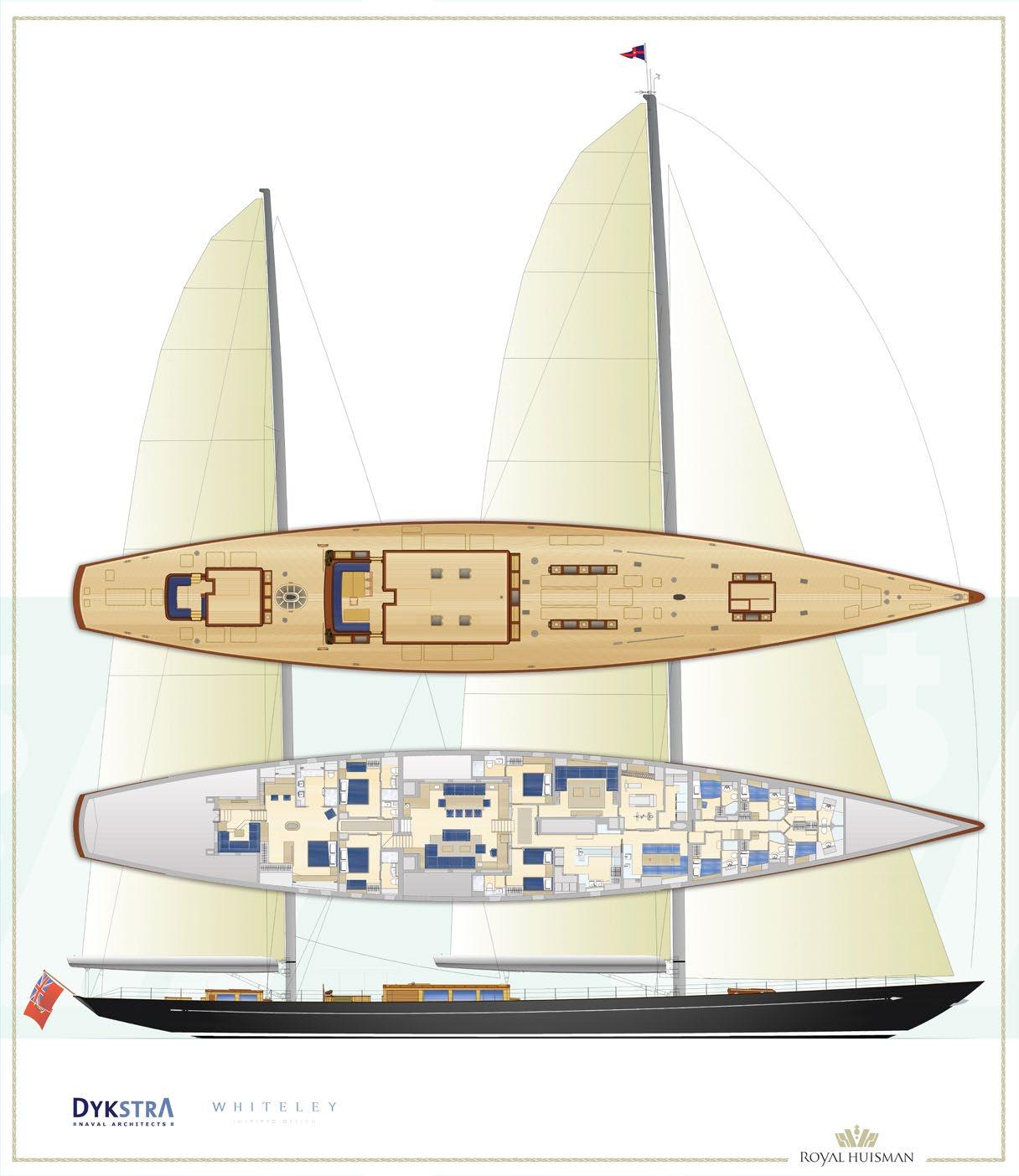

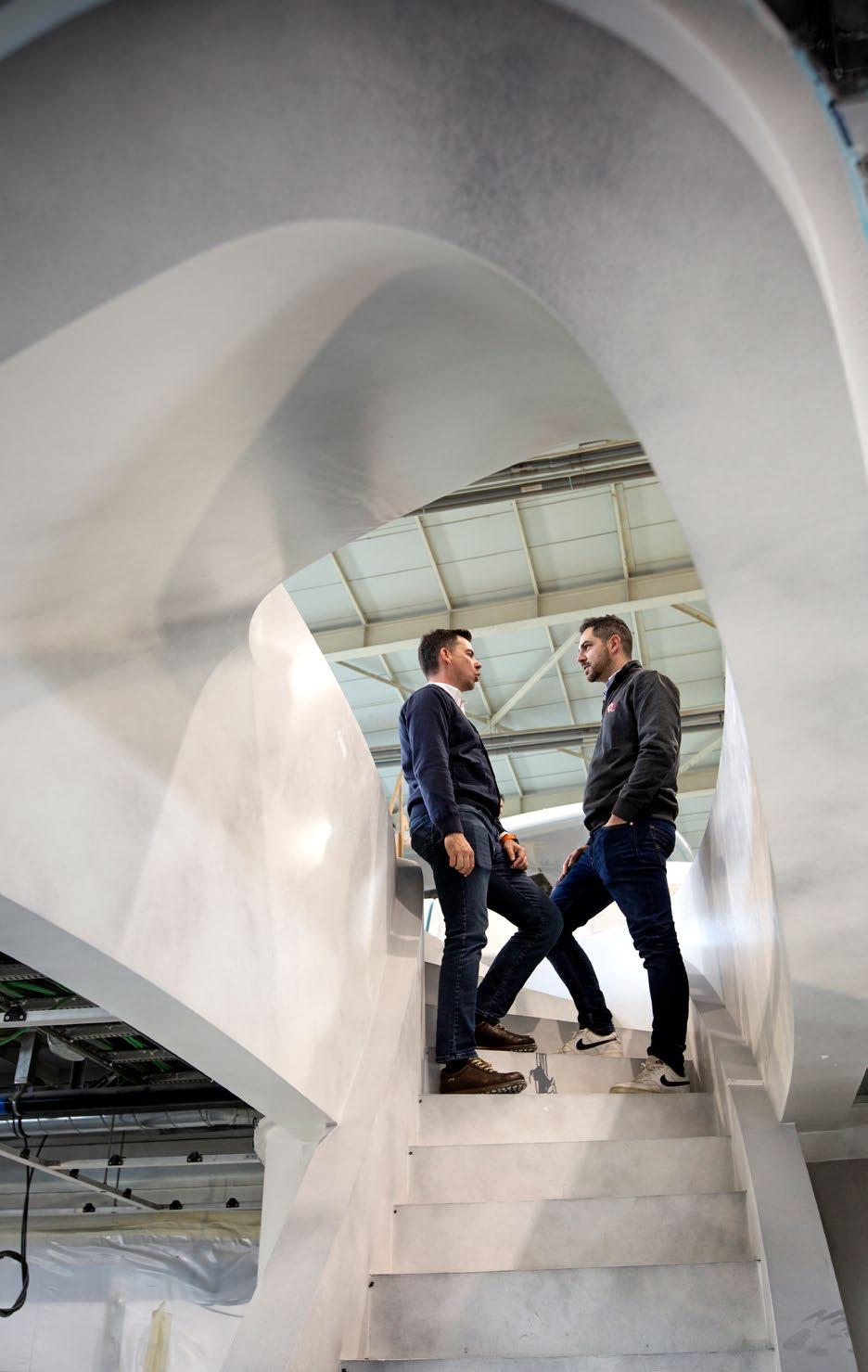

In-build at Royal Huisman and scheduled for delivery later this year, 65-metre Aquarius II is so similar in style and spirit to her smaller predecessor that you might think you’re seeing double. But under her modern classic exterior, the custom cruising ketch benefits from literally hundreds of tweaks to enhance operations and improve performance.

BY JUSTIN RATCLIFFE

Launched in 2018, 56-metre Aquarius redefined the modern classic genre. Graceful and understated yet powerful and exciting to sail, she came first in class at her racing debut in the St. Barths Bucket. Aquarius II may be a full nine metres longer, but the ideology behind her design has not changed. “She’s basically the same boat on steroids,” says her captain.

Aquarius II reunites the Dutch shipyard with Dykstra Naval Architects, interior designer Mark Whiteley, owner’s rep Godfrey ‘Goddy’ Cray, and yacht captain James Turner. The latter came to the project armed with a checklist of 728 ‘improvements’ meticulously compiled during five years of sailing the previous yacht. That’s not to say there was anything wrong with Aquarius Indeed, she was “close to perfect” for her owners and their decision to build bigger was dictated by a growing family and the

desire for a fourth guest cabin, more crew accommodation, a larger gym, and generally more space for onboard services such as the laundry and galley.

The checklist deals mostly with technicalities affecting the everyday operation of the vessel, such as the orientation of HVAC drip trays, the position of the fuel tank vents and relocating a hydraulic cooling pump. In other words, the kind of things you can only figure out when the yacht has been sailed a lot. Rather than a catalogue of errors, it was an invaluable inventory outlining how operations, maintenance and comfort could be enhanced.

“All shipyards have their preferred way of doing things, but input like this is beneficial for both parties because we get a better boat at the end of the day and they can incorporate the lessons learnt into subsequent projects,” says the captain.

Facing

from

Exhilarating performance was a priority from the start as the owners aim to repeat St Barths Bucket victories in 2019 and 2022 with the new boat. The issue, however, is that bigger doesn’t necessarily mean better in terms of sailing performance.

“The design issue with sloops approaching 50 metres and ketches over 60 metres is that you struggle for sufficient keel draft and sail area,” explains Cray, working on his third Royal Huisman project after Ngoni and Aquarius. “Maintaining the right balance between the two is essential and If either is compromised then performance will be limited, which is why the naval architecture always comes first on sailing boats.”

Unlike her smaller sibling, Aquarius II has a lifting keel with a variable draft from 4.8 to 7.6 metres for access to most anchorages and marinas as well as stability and performance when powered up. The keel trunk, milled from solid aluminium, penetrates the area between the galley and crew mess with only a small impact on interior volume.

More complicated was the sail area and mast height. On world cruisers these are restricted by the Bridge of the Americas over the Panama Canal that has a ‘Panamax’ air draft limit of around 62.5 metres. However, it did not escape Cray’s notice when Unfurled, a Vitters sloop with a 65-metre mast, was able to pass under the bridge heeled over by using water bags attached to her rig. With this in mind and taking into account the owners’ request for more interior volume, the design team came up with a proposal for a 61-metre yacht with a 64-metre main mast, plumb bow, bowsprit and submarine anchors.

“We thought we’d ticked all the right boxes, but just to be sure I did a final check with the port authority in Panama,” says Cray. “It turned out they were no longer entertaining a heeled-state transit under the bridge. Oops!”

Rudder feedback is the grail of a highperformance steering system and the compelling advantage of mechanical steering systems. While hydraulic steering provides power, it does so at the cost of eliminating feedback to the helm. However, the high loads of sailing superyachts require mechanical systems to use high gear ratios to make steering loads manageable, commonly resulting in 8-10 turns of the wheel from hardover to hard-over. This means small course adjustments require a lot of wheel movement.

This was the conundrum Edson Marine was looking to resolve with its new powerassisted steering system, displayed at METSTRADE last year and being fitted for the first time on Aquarius II. After looking at electric power-assisted steering systems in the automotive industry, the US-based company designed its own solution with a software package developed specifically for large sailboats whose steering systems are loaded up in one direction for much longer periods compared to cars.

“The system basically comprises an electric motor with a gearbox that is driven by a torque sensor between the wheel and the rudder,” explains Edson’s president, Chip Johns. “That sensor measures how much torque the helmsman is putting on the wheel and the data is sent to the control software, which decides whether to add or subtract load. It’s a variable system with five levels of assist.”

With just one torque tube instead of two, the Edson system already reduces weight and friction, providing an incremental improvement to the mechanical steering on Aquarius II. The power-assist function is a separate module engineered to add 140 Nm (Newton Metres) or about 103.25 ft-lb of torque. In practical terms, if 20 kg of rim load are required to turn the wheel, the system is able to reduce the loading to around 5 kg and make a 4-turn lockto-lock manoeuvre as easy as 10 turns using conventional mechanical assistance, all without losing the feel of the rudder.

“It’s not just about racing in the St Barths Bucket, because the system will make it easier for owners - as well as their friends and children - to enjoy cruising on a prolonged reach, for example,” says Johns. “Whatever we can do to make the sailing experience more enjoyable is good for the owner and good for the industry.”

At this point the owners reiterated their commitment to sailing performance, even if it meant going beyond the Panamax limit. They also voiced their preference for a classic spoon bow like Aquarius as opposed to a plumb bow configuration with a bowsprit. No longer constrained by air draft the main mast height was pushed up to 67.5 metres and the hull extended to 65 metres overall.

The extra length means that Aquarius II has nearly 45 percent more interior volume than her predecessor, more than enough to accommodate the extra cabins, guest space and service areas. To better illustrate what this increase in volume signifies in practical terms, Cray produced a table for the owners comparing the main areas aboard both boats. The figures show that the owner’s areas range from 21 to 55 percent larger, the gym nearly 39 percent, the galley 67 percent, and the laundry a whopping three times bigger.

Although less weight means more performance, combining aluminium construction with carbon composite elements as Royal Huisman had done on 60-metre Sarissa would have produced only incremental gains at significant extra cost. Instead, the structural weight was reduced by using FEM analysis to study local loads and

vary the size and spacing of the hull frames according to where reinforcement is needed. Combined with Rondal’s fully integrated carbon rig and sailing system (see sidebar), carbon elliptical rigging from Carbo-Link and Doyle’s structured luff sail technology, the result will be an elegant bluewater cruising yacht with a muscular turn of speed for the occasional superyacht regatta.

“The slender hull shape, lifting keel and extra mast height means the yacht will be quick around the race course, but also responsive in the light airs typical of the Med,” says Erik Wassen of Dykstra. “With a 400-tonne boat flying more than 2,000 square metres of canvas and sailing with over 16 knots of boat speed, the loads on the rudder are tremendous. It’s a very fine line between having a good feel on the wheel and struggling at the helm, so we put a lot of effort into optimising the rudder shape and balance.”

To further enhance steering responsiveness, US-based Edson Marine was brought in to develop a torque-assisted system that reduces the number of turns of the wheel from lock to lock while maintaining the hands-on ‘feel’ of the mechanical cable and wire steering (see sidebar).

Throughout the design and specification process, Cray was attentive to technological developments that might be considered of limited value. Innovations can add function and enjoyment, but they may also come with downsides in terms of time, cost and reliability.

“Our goal with Aquarius had been to keep it as simple as possible within the bounds of a luxury yacht,” says Cray. “Given the nature of superyachts that’s a bit of an oxymoron, but it was important to steer away from risky innovations and the same mantra applies for Aquarius II. That said, we have incorporated some current but tested developments.”

One such is the semi-hybrid technology for power generation and management. The hybrid system comprises a 900kW MTU diesel engine for propulsion with a 70kW alternator/shaft generator mounted on the gearbox that can run the hotel loads when the yacht is motoring, and two fixed-speed diesel generators coupled to a 125kW battery bank for peak shaving. Instead of the second generator cutting in during peaks

in demand, the batteries can absorb the excess. The system brings efficiency and flexibility benefits as the generators are sized according to energy usage over 24 hours, not the total energy demand at any one time.

The MG Energy batteries are housed in a A60-rated watertight and floodable compartment low down in the hull amidships. In the remote case of thermal runaway, a network of fireproofed pipes help to dissipate the heat outboard. The battery pack can also supply electrical power to the shaft generator to feed power into the grid. All Royal Huisman yachts have a small electric power pack for minor hydraulic functions that is powered in port via the shore converter. The system on Aquarius II offers enhanced flexibility. So when in harbour, for example, the captain doesn’t need to start up the engine or generator to operate the passarelle. Further, the hydraulic system is load sensing and can adjust pressure and flow rate to reflect the requirements of one or more consumers for smoother and quieter operations.

“New-builds like this are all about maintaining momentum.”

The high-modulus carbon rig and integrated sail handling by Rondal is another area that has benefitted from close consultation with the crew and the lessons learned from operating the previous boat. More than a scaled-up version of the rig on Aquarius, the state-ofthe-art system introduces additional refinements for pushing the yacht hard under racing conditions with a crew of 30 while also being able to cruise safely with minimal numbers of permanent crew.

“The primary design variable is mast stability, which is driven by local and global buckling,” says Edoardo Volpe, Rondal’s project lead engineer. “Mast stability is optimised by engineering the mast tube section size, shape and by controlling the stiffness properties of the laminate, including fibre type and direction, to keep the weight low while complying with classification. The secondary variable is mast tuning or trimability.”

Aquarius has checkstays and runners for modify mast bend controlling the shape of the mainsail, but Aquarius II makes use of deflectors to control mast bend and stability. More effective than checkstays as they pull back laterally instead of downward, deflectors also reduce drag to enhance racing performance. While in cruising mode deflectors are locked at a certain position, like checkstays, to make rig handling easier with a short-handed crew, also in reefed conditions.

Another improvement is the continuous carbon elliptical rigging from Carbo-Link. Structurally, this is exactly the same as Carbo-Link’s round-section cables and just as strong, but the elliptical shape provides better aerodynamics and less windage when sailing or at anchor, which means less vibration. Carbon rigging is susceptible to resonance that can be surprisingly noisy – an important consideration when the mizzen mast passes through the

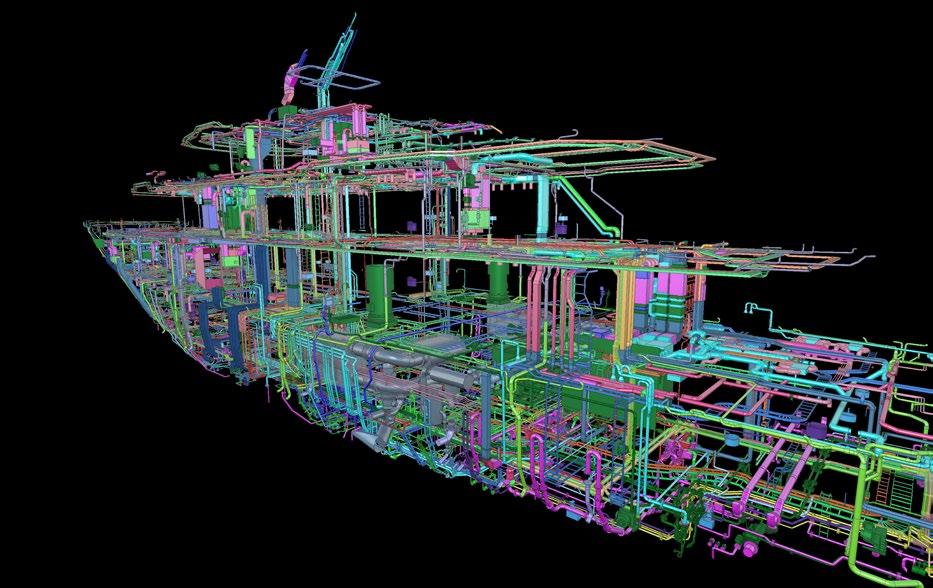

Many of the 700-plus items on the checklist of improvements involved the onboard systems. Overseen by Royal Huisman project manager Dimitri van Zwieten, it fell to systems manager Sjoerd Schrichte and lead engineer Richard Daenen to integrate them into the schematics of Aquarius II in consultation with the crew. As part of the shipyard’s custom build approach, it was then routed into its proprietary construction management software that logs all the system components according to type, function, location and ‘skid’ number (the system racks that are pre-assembled for subsequent plug-and-play installation). The result is a complete guide to how the onboard systems have been designed and executed in case of repair or replacement in the future. The data is also routed into Navisworks, a 3D modelling program that can track seamlessly through exterior and interior

owner’s suite and the mizzen forestay is the longest and skinniest exposed stay on the boat.

The higher mast meant that the masthead could be designed with better separation between the forestay and Code 0/A3 sails for easier handling when racing. Cruising superyachts tend to leave the Code 0 up as crews are getting smaller and handling big free-flying sails (ie. sails attached to the rig only through their corners) can be a messy and sometimes dangerous business. Sensors measuring mast compression and loads on runners, deflectors, forestays and main sheets provide real-time feedback.

Additionally, Rondal shares its software with Doyle Sails so they can run both the sails and the rig through the same program to see how the spars and rigging behave.

“Loads are getting higher and captains are more reluctant to fully trust their own sailing experience,” says Volpe. “Part of our job is to give them as much information as possible so they know how best to handle the rig.”

net spaces and is used across all departments to review the project in build.

In addition, Royal Huisman has long embraced product development and management methodologies such as Concurrent Engineering and Stage-Gating to ensure complex projects don’t get bogged down by the sheer number of decisions that have to be made and solutions found. Involving multiple disciplines simultaneously rather than consecutively, and breaking projects into a series of stages with decision ‘gates’ helps to keep the ball rolling.

“New-builds like this are all about maintaining momentum,” concludes Cray. “Planning is important because you need to keep it flowing, and Royal Huisman are very good at doing the groundwork upfront. Otherwise the risks in terms of budget, build time and reliability just keep mounting up.”

Project Toro is the first in a series from Turquoise Yachts based on an in-house engineering platform that offers clients faster delivery times combined with ample opportunity for customisation. Now in the outfitting stage, we travelled to the shipyard in Istanbul to visit the project before her launch later this year.

Project Toro began in classic fashion with a charter client looking for a pre-owned yacht to buy. His long-term broker, Simon Ting of SuperYachtsMonaco, marked a potential 60-metre candidate and designers Harrison Eidsgaard were brought in to assess the interior for refit. After discussions with the client, however, it was felt the yacht wasn’t ticking the right boxes and the focus changed to a new build. Armed with a preliminary exterior and interior design by Harrison Eidsgaard, Ting began the search for a suitable shipyard.

“We initially focused on northern Europe, but this was during Covid, slots were scarce and prices were going crazy,” recalls Ting. “I’m one of those brokers who likes finding deals that represent good value for money, so my search quickly shifted worldwide. Turquoise in Turkey had a hull they had started on spec but was still in the very early stages that fitted my client’s needs, so we jumped on it.”

Project Toro (NB65), as it is now known, is a 79-metre vessel of 2,050GT that can accommodate up to 14 guests in seven staterooms. Her technical platform is shared with others in build at Turquoise Yachts, including Project Vento (NB74), Project Arrow (NB75) and Project Bravo (NB76), which vary in length overall but have the same 13.2-metre maximum beam. Toro is powered by conventional Caterpillar diesel engines, but the platform has been engineered to offer the option of an mtubased hybrid propulsion package.

“There are variations within that common structural envelope that allow us to create a variety of solutions for our respective clients with different interior layouts and exterior styling,” says Turquoise executive director, Burak Akgul. “The shared technical platform means we can cut short the upfront engineering time of each project, a saving that is then passed on to the client.”

Facing

Ting interviewed a number of technical consultants, but chose to partner with Monaco-based ACP Surveyors headed up by Andrea Carlevaris, because they have worked together in the past and because ACP had been part of the owner’s team on Roe (NB66) launched by Turquoise in 2021. With Project Toro the relationship is somewhat unusual insofar as ACP is the owner’s technical rep, while all commercial considerations and direct relations with the owner are handled by Ting.

“In the case of a change order, for example, our job is make sure Simon has what he needs to have that informed conversation with the owner and advise him on the best outcome,” says Carlevaris. “It’s a relationship based on trust that also suits the shipyard as the project managers generally prefer to deal with technical people. It seems to work well as we haven’t had a single change order that has been refused by the client.”

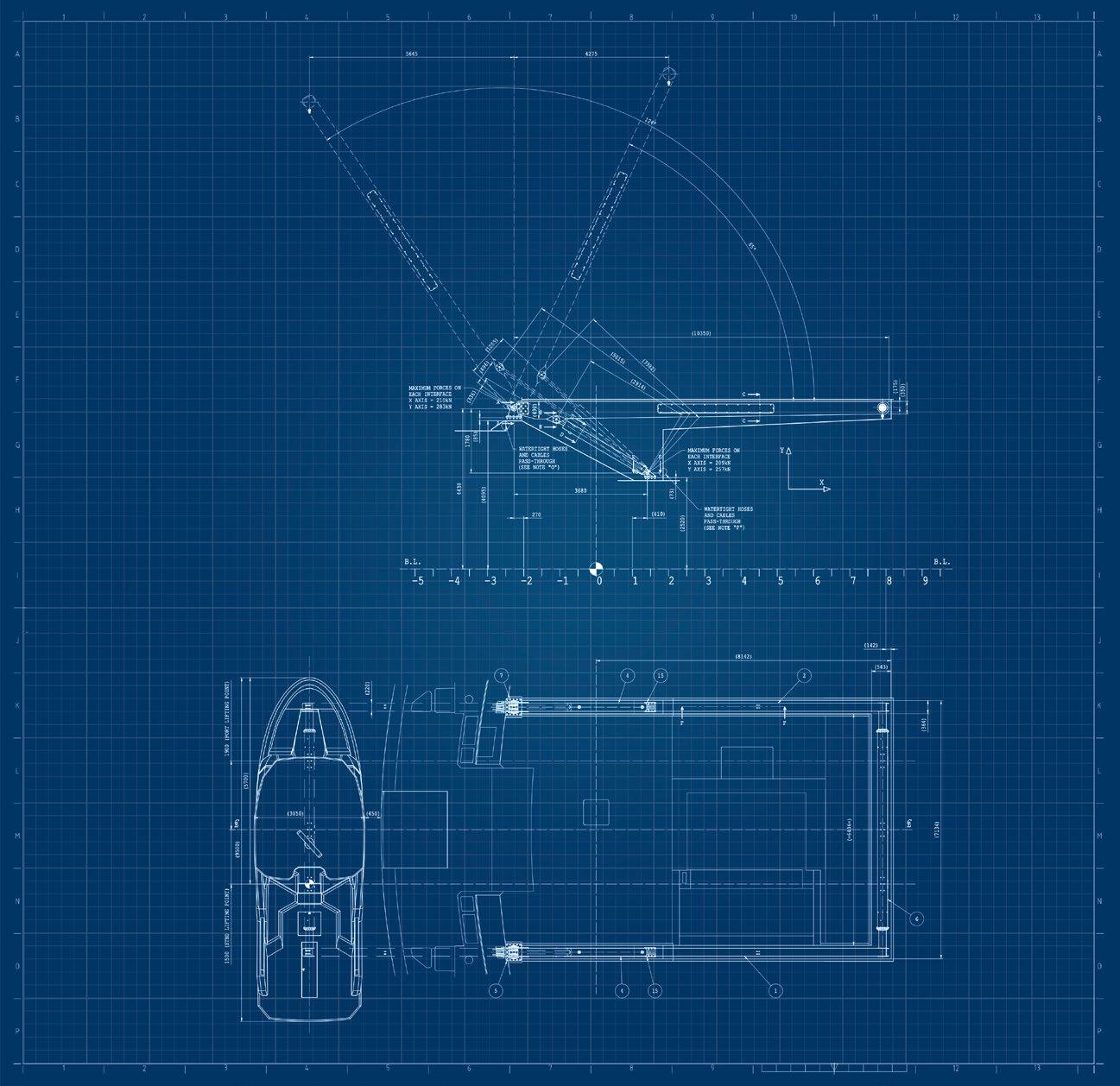

Harrison Eidsgaard’s superstructure and interior design are completely bespoke, but as part of a series with a common technical platform there were limits to what engineering changes could be made. Nevertheless, by working closely with the shipyard’s in-house technical department, the owner’s team has been able to introduce significant features that set Project Toro apart. Arguably the most demanding of these features is the Neptune Lounge.

Facing

BCE Glass in Istanbul was founded in 1970 and its first yacht project was 66-metre Aglaia (now Ahimsa) launched by Vitters in 2011. Today it has a branch office in the Netherlands and is a leading supplier of turnkey glazing solutions in the marine sector, offering full-scope support from design consultancy to engineering services. As this issue of How To Build It was going to print, BCE Glass was completing the process of obtaining Lloyd’s approval for the hull windows in Project Toro’s Neptune Lounge. This has involved extensive destructive testing, including the setting up of a 40-metre water column to test the glass at a pressure of 4 bars, as well as tests to evaluate the strength of the window frames and mullions.

The windows themselves are made of laminated double glazing with an air gap to reduce condensation issues and provide a barrier against waterborne noise from the propellers and underwater exhaust. Interlayers of varying elasticity add strength and dampen different sound frequencies (the stiffer the material the higher the wavelength it absorbs). Each of the six windows has a total thickness of 116mm, which is based on FEM calculations to simulate loading in different sea conditions and impact scenarios.

“The glass is bonded to the window frames, but because they’re installed at a negative angle and above the water, Lloyds also required mechanical fastening,” says Ahmet Ozcan, head of BCE’s specialty glazing division. “We developed a proprietary retainer system comprising a flange imbedded inside the glass with no penetrations or external fixtures, so if the bonding should fail for any reason the glass remains in place.”

BCE also produced the mirrored glass for superstructure windows on the main, owner’s and bridge decks. Glass on large yachts is nearly always chemically toughened and BCE is investing in a 3,000-square-metre extension to its factory to house a new chemical toughening plant, but the process of submerging the glass in a bath of molten potassium salts at 450°C rules out applying any coatings, including the aluminium oxide used to produce a mirror effect.

BCE has developed its own closely guarded method for producing chemically toughened glass that is also mirrored. Moreover, as the coating is imbedded in the glass it is not susceptible to moisture that can break down the bond between the glass and the silvered backing, causing it to come away and leave unsightly black spots.

Underwater viewing ports are rare on superyachts. Although the mechanical properties of glass are well understood and submarine windows appear on yachts such as Feadship’s Savannah and Abeking & Rasmussen’s Elandess, Class societies are still conservative when glass appears below the waterline. The complexity and cost of meeting the required criteria can be enough to dampen initial enthusiasm, but the owner of Project Toro decided to push ahead regardless.

The windows are supplied by BCE Glass in Turkey (see sidebar). Comprised of six large panes of double-glazed laminated glass, each 120mm thick and weighing 800kg, three are positioned above the waterline and three below in a space that makes up part of the spa on the lower deck aft. Access is via a watertight door and the room extends down into the tank deck.

The glass, however, wasn’t the main challenge. Turquoise Yachts routinely mounts its engines on springs rather than rubber bushes to dampen noise and vibration, but as the Neptune Lounge is positioned between the engine room and the props, structure-borne sound were always going to be a concern.

“Because the lounge is on two levels inside the hull with a wall of glass, we especially wanted to avoid low-frequency resonance from the engines and underwater exhaust,” says ACP’s project manager, Simone Curti. “This low-frequency noise is something you’re more likely to feel as vibrations than hear. The normal limit of human hearing is around 20Hz or cycles per second, but we can pick up mechanical oscillations in frequencies well below 1 Hz, so our sensitivity to vibration is much broader than the range of human hearing.”

Acoustic consultants Van Cappellen Sound Solutions were brought in to recommend further damping measures, including the redesign of the drive shaft brackets. As a result noise levels are expected to be up to 30 percent lower in the Neptune Lounge than the contractual 53dB in harbour mode.

Unusually, the full-height windows on the upper decks from amidships aft are of mirrored glass. External doors are clad in the same mirrored glass, which meant they had to be engineered and built to precise tolerances so when closed they are perfectly flush with the surrounding glazing. An additional issue is that during washdowns the calcium carbonate found in ‘hard’ water leaves behind chalky deposits as limescale, which is particularly noticeable on mirrored glass if not dried immediately. For this reason, Project Toro has two filtering systems that work in tandem: a water softener and a reverse osmosis purifier to remove unwanted impurities and sediments.

While the superstructure was still under construction at Turquoise Yachts’ metalworking shipyard in Kocaeli across the bay from its outfitting facility in Istanbul, it was realised that navigational visibility from the bridge and wing stations could be improved.

“We had to find a remedy that required only minimal modifications to the existing structure and didn’t adversely affect the exterior lines by Harrison Eidsgaard,” says İlker Dorkip, Turquoise’s project manager.

“Initially we thought of having fold-out platforms but the final solution, completely engineered in-house, was to have hydraulic wing stations that pop out 1.2 metres from the sides to maximise visibility fore and aft.”

Most superyacht shipyards would outsource engineering works like this. The fact that Turquoise can rely on its own technical office makes life easier for the owner’s reps. Unforeseen issues can be resolved on the spot in a meeting without having to involve outside contractors. Moreover, the knowledge and experience accumulated over time stays in-house and can be applied to subsequent projects.

Turquoise is receiving more requests for large pools on the upper decks, which offer more privacy than the usual location on the main deck aft. The pool on Toro’s bridge deck actually spans two levels with an RGB waterfall feature cascading down from the sundeck and a skylight at the top. Measuring 8.5 metres in length and three metres wide with underwater audio speakers, its 15 tonnes of water can be dumped into a heated recovery tank three decks below in minutes and pumped back up again when at anchor in 20.

“Turquoise in Turkey had a hull they had started on spec but was still in the very early stages and fitted my client’s needs, so we jumped on it.”

The fold-down side bulwarks in the stern increase the usable deck area, but created another conundrum as to where to place fairleads and cleats when moored stern to in a marina. ACP and the shipyard’s team came up with a smart system that from the mooring winches on main deck has the lines feed into a stainless tube and exit between the staircases folding bulwarks on the swim platform. They then then run at deck level through a fairlead to the bollards on shore. By keeping tensioned mooring lines under cover and low to the deck the system is safer but also looks clean and tidy. Additionally, an electric roller for the shore cable means crew don’t have to manhandle heavy power cables back and forth.

Turquoise began testing AkzoNobel’s sprayable fairing compound on 53-metre Jewels, but it was limited to parts of the superstructure such as the mast and shell doors in the hull. It is now used for all Turquoise projects and on Project Toro the epoxy surfacer has been used everywhere above the waterline.

“It’s more expensive but is much quicker because it comes ready mixed and you can apply it wet on wet to bigger sections without having to wait for it to dry,” says Taylan Salgur, Operations Director at Turquoise. “We had to retrain our painters but the fairing time has been cut by 25-30 percent.”

On area where new build projects can easily run over budget are the IT systems and Project Toro’s, on special request of the owner, is particularly advanced and complex. Combining multiple solutions for fail-safe redundancy, from standard VSAT and Starlink to One Web and Poynting Wavehunter, the system is based on MBX technology that can combine the bandwidth of different cellular links into an unbreakable, high-speed Ethernet connection. An integrated filter also means any hardware connected to MBX complies with Lloyd’s Register Marine Type Approval standards for electromagnetic (EMC) compatibility. Videoworks, a longterm partner of Turquoise with an office in Istanbul, is the systems integrator.

“Turquoise is receiving more requests for large pools on the upper decks, which offer more privacy than the usual location on the main deck aft.”

“I’ve never seen such a focus on the IT system,” says Carlevaris. “We were briefed in one of the first meetings with the owner’s IT team, but the challenge has been tracking all the industry developments while building the yacht at the same time. When we started, for example, Starlink still wasn’t available and we will be one of the first to have the new OneWeb antenna.”

Not so long ago Turkey was viewed simply as a cheaper alternative to building in Europe. That view is fading fast. The premier Turkish yards can now compete with – and sometimes outshine – their counterparts in Italy and northern Europe in terms of quality as well as price, which is why Ting chose to build with Turquoise Yachts in the first place. In this context, Project Toro is an example of the kind of creative engineering, skilled execution and flexible attitude that has seen Turkey creep up the league table of yachtbuilding nations.

Teignbridge Propellers has been designing and manufacturing propellers and stern gear since 1974. With subsidiaries in India, Dubai and Malaysia, we visited its UK headquarters to discover more about the science behind propeller design and how they are made.

BY JUSTIN RATCLIFFE

“Some clients are specifically interested in fuel economy for longer range, or low noise and vibration.”