EXORDIUM

FROM THE PUBLISHER

WELCOME TO ISSUE 144 OF SUBTEL FORUM, OUR OFFSHORE ENERGY EDITION

FEATURING A PREVIEW OF IWCS CABLE & CONNECTIVITY INDUSTRY FORUM ‘25

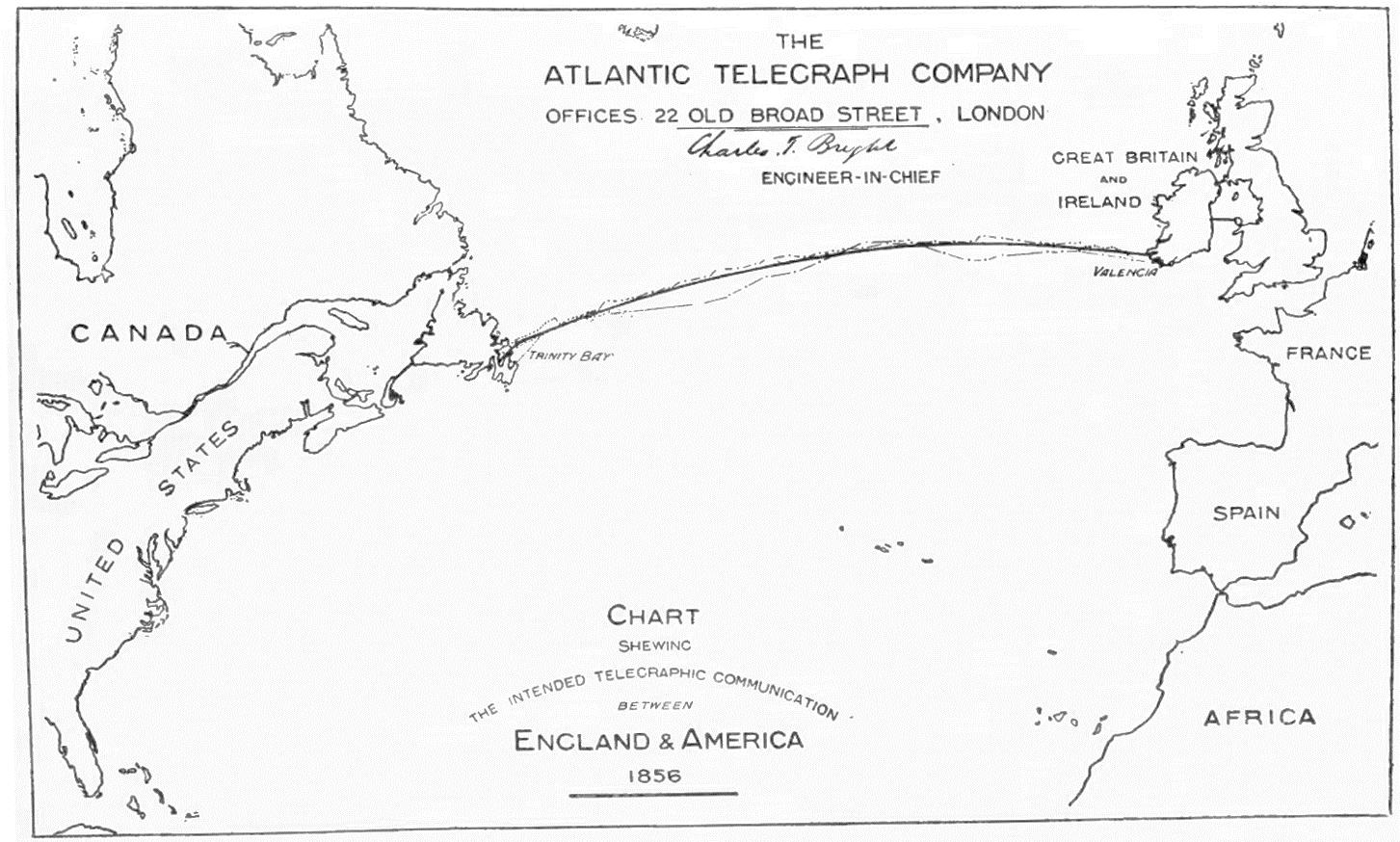

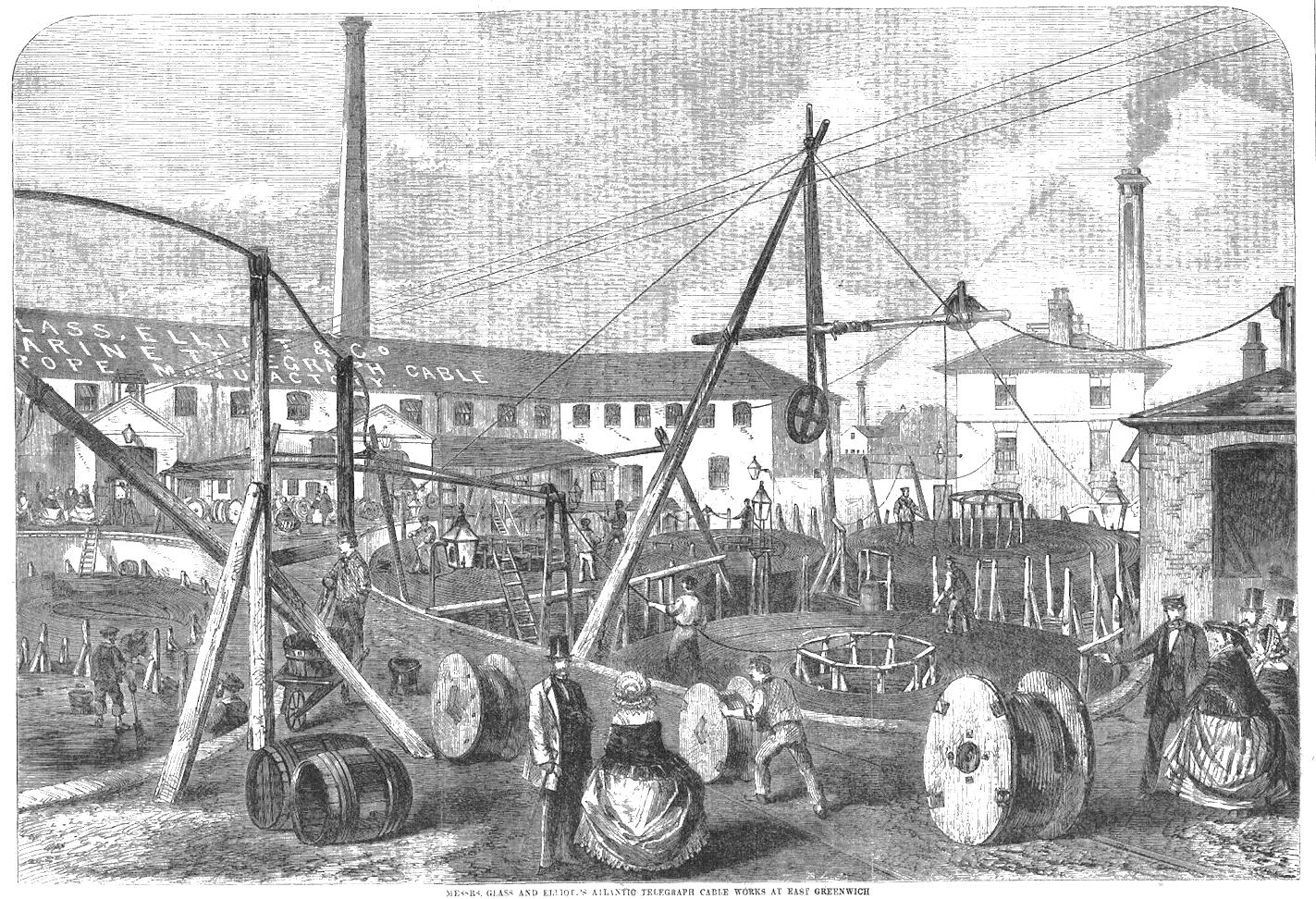

Alate summer vacation found me on the west coast of Ireland… Peg had been talking about visiting her grandparent’s home countryside for years and a simple email solicitation last autumn from some unknown travel company gave me a wonderful Christmas present for her – a nine day self drive tour of a good chunk of the island. This trip was really all for her and other than my share of the driving was along for the ride, except I wanted to do one thing: visit the village where John Ford’s 1951 classic,

“The Quiet Man,” was filmed. The day I was leaving Stewart Ash asked in our weekly projects meeting if I was also going to Valentia Island, which I had not even considered. Four days into the trip I received an email from Derek Cassidy about his article, which I answered on my phone and mentioned offhandedly that I was excited to be visting Valentia some two hours away the next morning, to which he jumped into gear and arranged within minutes an incredibly wonderful, personal tour to one of the most important places in our industry’s history, Valentia Island cable station.

UC BERKELEY CERTIFICATE – WINNING STUDENT ARTICLES

SubTel Forum is proud to support UC Berkeley’s Global Digital Infrastructure Certificate, the first program focused on the backbone of the internet—submarine cables and data centers. Running May through August 2025, the program brought together students worldwide to explore how connectivity can be made more sustainable, resilient, and equitable. We contributed cable maps, industry reports and features

to enrich the curriculum, bridging academic inquiry with real-world insights. From more than two hundred submissions, three standout articles—by Henry el Bahnasawy, Jessica Halim, and Emma Stevens—were selected by a joint academic and industry panel which appear in this issue.

2025–26 SUBMARINE TELECOMS INDUSTRY REPORT

Our flagship Submarine Telecoms Industry Report returns this fall with its most comprehensive analysis yet. The last edition was downloaded over 500,000 times and cited widely across global business and trade media, making it the industry’s most visible annual publication.

Advertising and sponsorship opportunities for the 2025–26 Report are now open. Secure your placement today and put your brand in front of the subsea industry’s key decision-makers worldwide. Contact Nicola Tate (ntate@associationmediagroup.com) or +1 804-469-0324) to reserve your space.

2025 SUBMARINE CABLE MAPS – IWCS EDITIONS

We’re gearing up to print the 2025 Submarine Cable Map for Submarine Networks World 2025 (Singapore, September)

and IWCS Forum 2025 (Pittsburgh, October). These exclusive maps highlight global subsea system advancements and will be distributed directly to key decision-makers across the industry.

2026 SUBMARINE CABLE MAPS – PTC, EMEA, SNW & IWCS

Sales are now open for the PTC’26 edition of the Submarine Cable Map. Additional 2026 editions are planned for Submarine Networks EMEA (London, May), Submarine Networks World 2026 (Singapore, September), and IWCS Forum 2026 (location TBD, October). Each map offers premium visibility at the subsea industry’s most influential gatherings.

Want your logo featured? Now’s the time to secure your ad space and gain high-visibility placement across the full 2026 conference series. Click here to secure your spot!

THANK YOU

Thank you as always to our awesome authors who have contributed to this issue of SubTel Forum. Thanks also for their support to this issue’s advertisers: APTelecom , Fígoli Consulting, International Wire & Cable Symposium, Submarine Networks World 2025, and WFN Strategies. Of course, our ever popular “where in the world are all those pesky cableships” is included as well.

Yes, we also visited the village of Cong, where we had a pint in Pat Cohan’s pub and enjoyed a touch of Hollywood magic courtesy of John Wayne, Maureen O’Hara, Barry Fitzgerald, and Ward Bond, who, 74 years ago, brought electricity, jobs, and generational prosperity to some 200 local village extras!

A Publication of Submarine Telecoms Forum, Inc. www.subtelforum.com | ISSN No. 1948-3031

PRESIDENT & PUBLISHER: Wayne Nielsen | wnielsen@subtelforum.com | [+1] (703) 444-2527

VICE PRESIDENT: Kristian Nielsen | knielsen@subtelforum.com | [+1] (703) 444-0845

ANALYTICS: Kieran Clark | kclark@subtelforum.com | [+1] (540) 533-6965

SALES: Nicola Tate | ntate@associationmediagroup.com | [+1] (804) 469-0324 subtelforum.com/advertise-with-us

DESIGN & PRODUCTION: Weswen Design | wendy@weswendesign.com

DEPARTMENT WRITERS:

Andrés Fígoli, Camila Paulino, David Kiddoo, Iago Bojczuk, John Maguire, Kieran Clark, Nicola Tate, Nicole Starosielski, Phillip Pilgrim, and Wayne Nielsen

FEATURE WRITERS:

Anders Tysdal, Derek Cassidy, Emma Stevens, Geoff Bennett, Henry el Bahnasawy, Jessica Halim, John Manock, Kieran Clark, Kristian Nielsen, Martin Reilly, Michael Brand, Nicole Starosielski, Ron Larsen, Sarah Hudak, and Wayne Nielsen

NEXT ISSUE: November 2025 – Data Centers & New Technology featuring PTC ’26 Preview and SubTel Forum’s 24th Anniversary Edition

AUTHORS INDEX: https://subtelforum.com/authors-index

MAGAZINE ARCHIVE: subtelforum.com/magazine-archive

Submarine Telecoms Forum, Inc. www.subtelforum.com/corporate-information

BOARD OF DIRECTORS:

Margaret Nielsen, Wayne Nielsen, Kristian Nielsen and Kacy Nielsen

Contributions are welcomed and should be forwarded to: pressroom@subtelforum.com.

Good reading – Slava Ukraini STF

Wayne Nielsen, Publisher

Submarine Telecoms Forum magazine is published bimonthly by Submarine Telecoms Forum, Inc., and is an independent commercial publication, serving as a freely accessible forum for professionals in industries connected with submarine optical fiber technologies and techniques. Submarine Telecoms Forum may not be reproduced or transmitted in any form, in whole or in part, without the permission of the publishers.

Liability: While every care is taken in preparation of this publication, the publishers

cannot be held responsible for the accuracy of the information herein, or any errors which may occur in advertising or editorial content, or any consequence arising from any errors or omissions, and the editor reserves the right to edit any advertising or editorial material submitted for publication.

New Subscriptions, Enquiries and Changes of Address: 21495 Ridgetop Circle, Suite 201, Sterling, Virginia 20166, USA, or call [+1] (703) 444-0845, fax [+1] (703) 349-5562, or visit www. subtelforum.com. Copyright © 2025 Submarine Telecoms Forum, Inc.

Henry el Bahnasawy

SENSING THE SEABED

How Fiber-Optic Sensing Technologies Are Protecting Critical Submarine Infrastructure

By Anders Tysdal

HOW MOFN UNLOCK OPPORTUNITY FOR TELCOS AND HYPERSCALERS

By Martin Reilly

DECODING THE FLEET

Launching the Cableship Codex – A New Era of Cableship Intelligence

By Kieran Clark

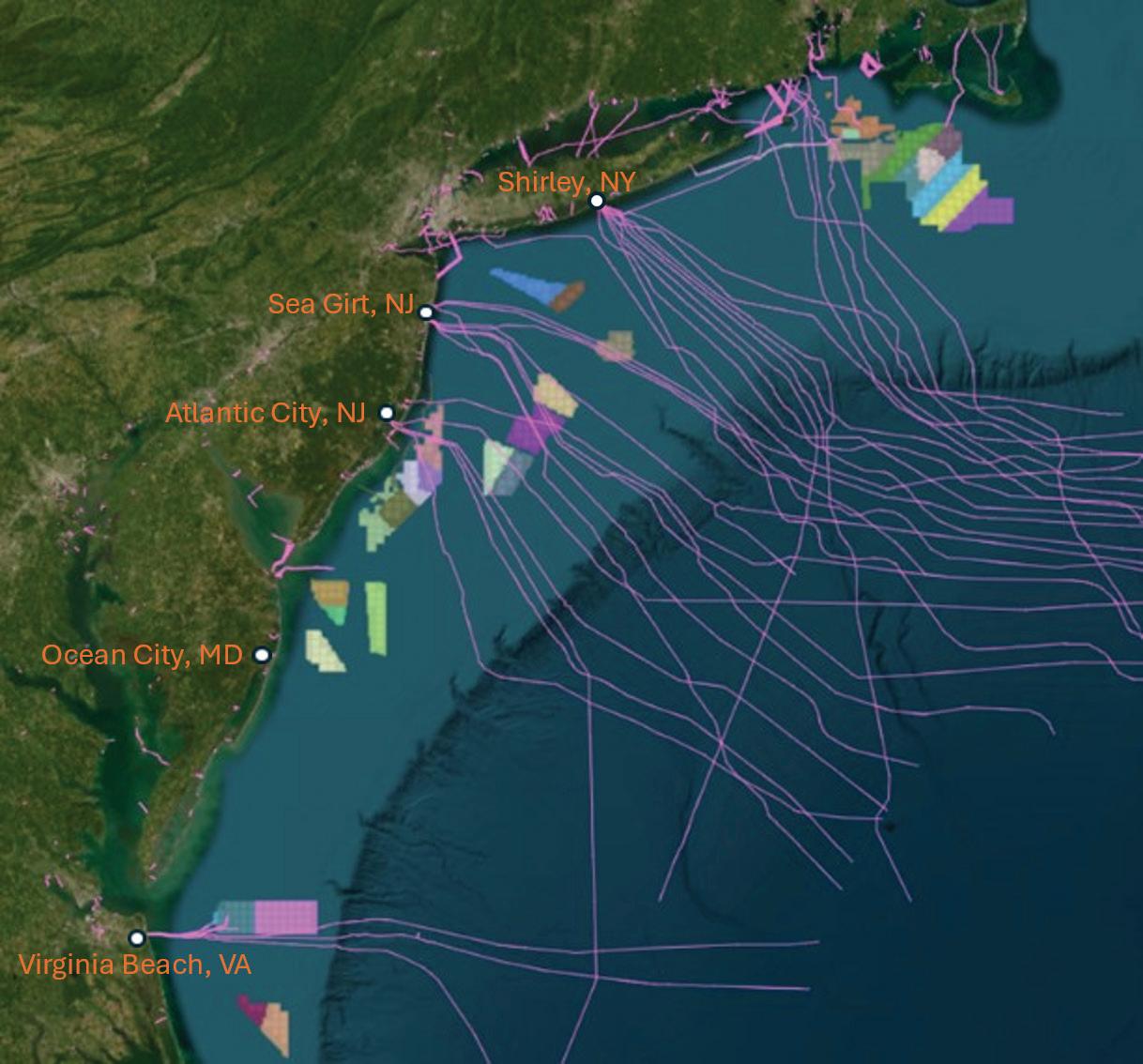

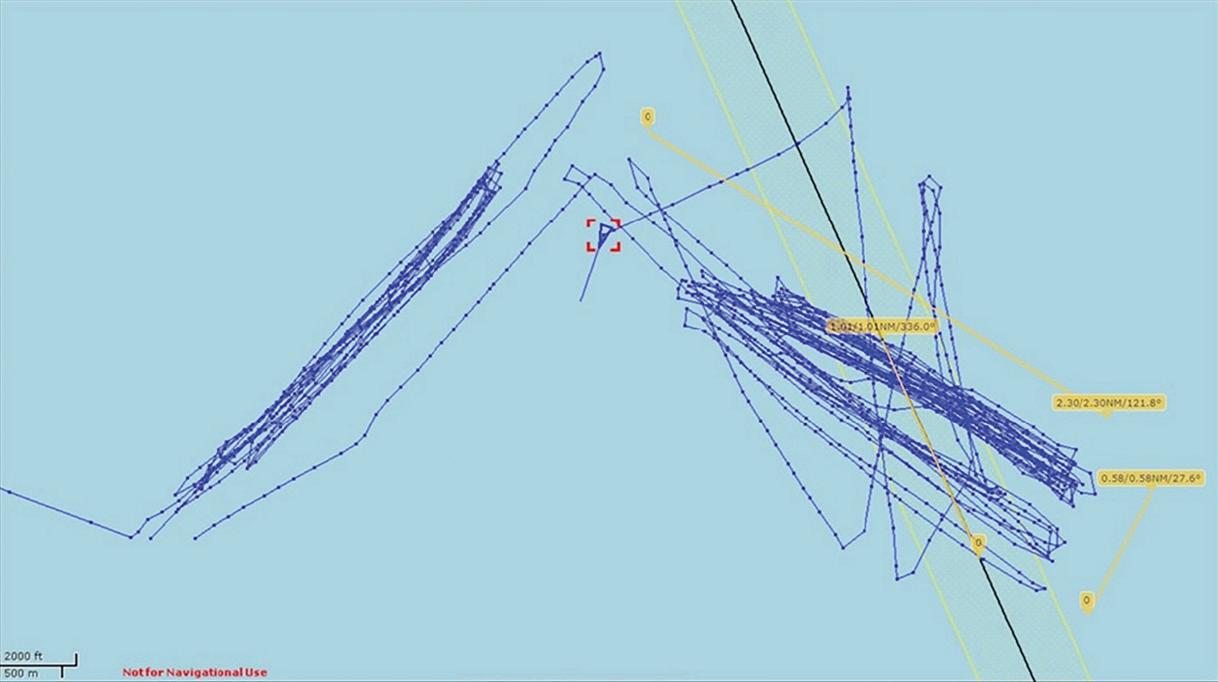

CROSSED PATHS

Managing Telecom Cable, Offshore Wind Energy, and Fishing Interests on the U.S. Seabed

By Sarah Hudak and Ron Larsen

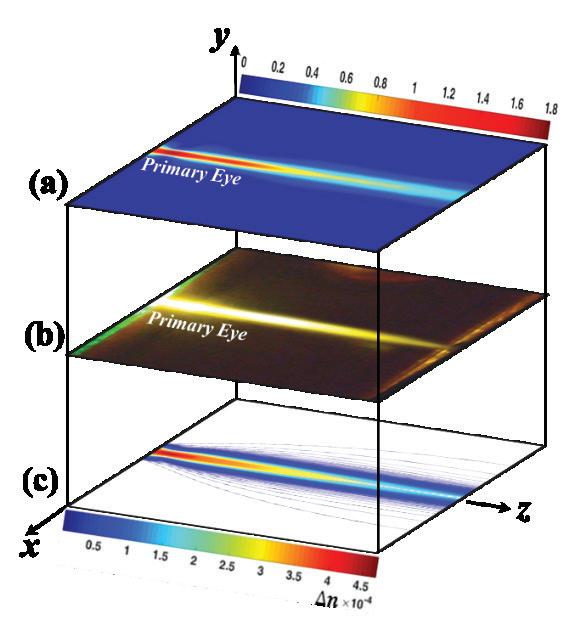

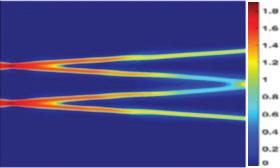

OPTICAL AND SUBMARINE CABLE SENSING: A BRIEF OVERVIEW

By Derek Cassidy

UNDERSEA CURRENTS

How Geopolitics and Policy Are Reshaping Submarine Cables (Sep 2024–Sep 2025)

By Kristian Nielsen

HANDS OFF OUR CABLES!

Detecting Human Activities Around Submarine Cables

By Geoff Bennett

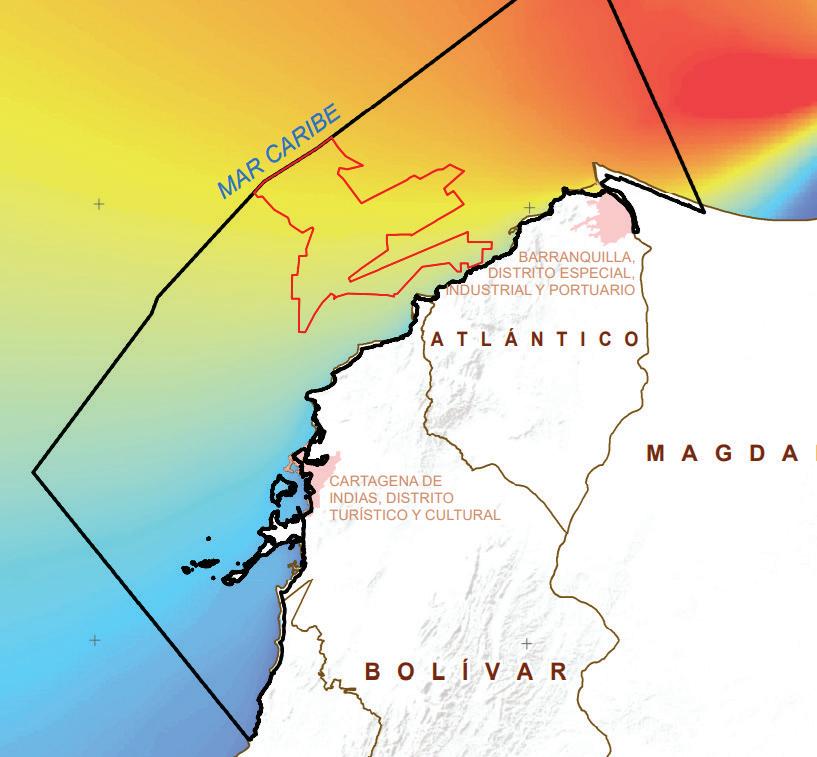

EMERGING OFFSHORE WIND CABLE MARKETS SOUTH AMERICA AND AFRICA

By John Manock

INSIDE THE WORLD OF SUBTEL FORUM: A COMPREHENSIVE GUIDE TO SUBMARINE CABLE RESOURCES

TOP STORIES OF 2019

The most popular articles, Q&As of 2019. Find out what you missed!

NEWS NOW RSS FEED

Welcome to an exclusive feature in our magazine, where we explore the captivating world of SubTelForum.com, a pivotal player in the submarine cable industry. This expedition takes us on a detailed journey through the myriad of resources and innovations that are key to understanding and connecting our world beneath the oceans.

mapping efforts by the analysts at SubTel Forum Analytics, a division of Submarine Telecoms Forum. This reference tool gives details on cable systems including a system map, landing points, system capacity, length, RFS year and other valuable data.

DISCOVER THE FUTURE: THE SUBTEL FORUM APP

CONNECTING THE DEPTHS: YOUR ESSENTIAL GUIDE TO THE SUBTEL FORUM DIRECTORY

Keep on top of our world of coverage with our free News Now daily industry update. News Now is a daily RSS feed of news applicable to the submarine cable industry, highlighting Cable Faults & Maintenance, Conferences & Associations, Current Systems, Data Centers, Future Systems, Offshore Energy, State of the Industry and Technology & Upgrades.

PUBLICATIONS

Submarine Cable Almanac is a free quarterly publication made available through diligent data gathering and

Submarine Telecoms Industry Report is an annual free publication with analysis of data collected by the analysts of SubTel Forum Analytics, including system capacity analy sis, as well as the actual productivity and outlook of current and planned systems and the companies that service them.

CABLE MAP

In our guide to submarine cable resources, the SubTel Forum Directory shines as an essential tool, providing SubTel Forum.com readers with comprehensive access to an array of vetted industry contacts, services, and information. Designed for intuitive navigation, this expansive directory facilitates quick connections with leading vendors, offering detailed profiles and the latest in submarine cable innovations. As a dynamic hub for industry professionals, it fosters community engagement, ensuring our readers stay at the forefront of industry developments, free of charge.

2024 marks a groundbreaking era for SubTel Forum with the launch of its innovative app. This cutting-edge tool is revolutionizing access to submarine telecommunications insights, blending real-time updates, AI-driven analytics,

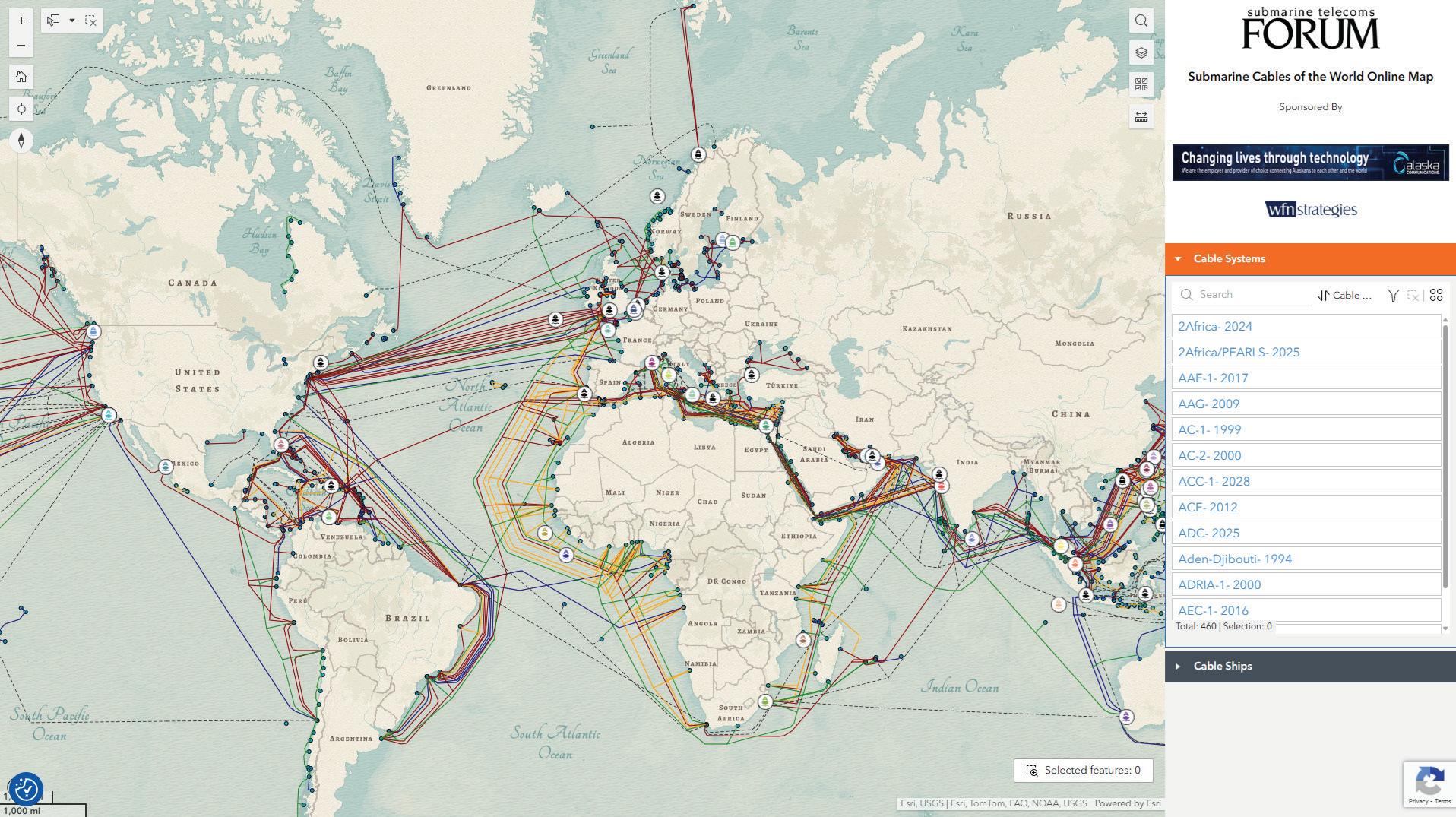

The online SubTel Cable Map is built with the industry standard Esri ArcGIS platform and linked to the SubTel Forum Submarine Cable Database. It tracks the progress of

and a user-centric interface into an indispensable resource for industry professionals. More than just a technological advancement, this app is a platform fostering community, learning, and industry progression. We encourage you to download the SubTel Forum App and join a community at the forefront of undersea communications innovation.

YOUR DAILY UPDATE: NEWS NOW RSS FEED

Our journey begins with the News Now updates, providing daily insights into the submarine cable sector. Covering everything from the latest technical developments to significant industry milestones, this feed ensures you’re always informed about the latest trends and happenings. It’s an essential tool for professionals who need to stay on top of industry news.

THE KNOWLEDGE HUB: MUST-READS & Q&AS

Dive deeper into the world of submarine communications with our curated collection of articles and Q&As. These insightful pieces offer a comprehensive look at both the history and current state of the industry, enriching your understanding and providing a broader perspective on the challenges and triumphs faced by submarine cable professionals.

IN-DEPTH PUBLICATIONS

• Submarine Cable Almanac: This quarterly treasure trove provides detailed information on global cable systems. You can expect rich content including maps, data on system capacity, length, and other critical details that sketch a vivid picture of the global network.

• Submarine Telecoms Industry Report: Our annual report takes an analytical approach to the industry, covering everything from current trends to capacity analysis and future predictions. It’s an invaluable resource for anyone seeking to understand the market’s trajectory.

VISUALIZING CONNECTIONS: CABLE MAPS

• Online SubTel Cable Map: An interactive tool mapping over 550 cable systems, perfect for digital natives who prefer an online method to explore global connections.

• Printed Cable Map: Our annual printed map caters to those who appreciate a tangible representation of the world’s submarine fiber systems, detailed in a visually appealing and informative format.

EXPLORING OUR PAST: MAGAZINE ARCHIVE

Explore the Submarine Telecoms Forum Magazine Archive, a comprehensive collection of past issues spanning 23+ years of submarine telecommunications. This essential resource offers insights into project updates, market trends, technological advancements, and regulatory changes. Whether researching industry developments or seeking

expert analysis, the archive provides valuable perspectives on the technologies and trends shaping global connectivity.

FIND THE EXPERTS: AUTHORS INDEX

Our Authors Index is a valuable tool for locating specific articles and authors. It simplifies the process of finding the information you need or following the work of your favorite contributors in the field.

TAILORED INSIGHTS: SUBTEL FORUM BESPOKE REPORTS

• Data Center & OTT Providers Report: This report delves into the evolving relationship between cable landing stations and data centers, highlighting trends in efficiency and integration.

• Global Outlook Report: Offering a comprehensive analysis of the submarine telecoms market, this report includes regional overviews and market forecasts, providing a global perspective on the industry.

• Offshore Energy Report: Focusing on the submarine fiber industry’s oil & gas sector, this report examines market trends and technological advancements, offering insights into this specialized area.

• Regional Systems Report: This analysis of regional submarine cable markets discusses capacity demands, development strategies, and market dynamics, providing a detailed look at different global regions.

• Unrepeatered Systems Report: A thorough examination of unrepeatered cable systems, this report covers project timelines, costs, and operational aspects, essential for understanding this segment of the industry.

• Submarine Cable Dataset: An exhaustive resource detailing over 550 fiber optic cable systems, this dataset covers a wide range of operational data, making it a go-to reference for industry specifics.

SubTelForum.com stands as a comprehensive portal to the dynamic and intricate world of submarine cable communications. It brings together a diverse range of tools, insights, and resources, each designed to enhance understanding and engagement within this crucial industry. From the cutting-edge SubTel Forum App to in-depth reports and interactive maps, the platform caters to a wide audience, offering unique perspectives and valuable knowledge. Whether you’re a seasoned professional or new to the field, SubTelForum.com is an indispensable resource for anyone looking to deepen their understanding or stay updated in the field of submarine telecommunications.

SUBTEL CABLE MAP UPDATES

BY KIERAN CLARK

The SubTel Cable Map— powered by Esri’s ArcGIS platform—offers an interactive and detailed way to explore the global network of submarine cables. This indispensable resource provides information on over 440 existing and planned systems, more than 50 cable ships, and upwards of 1,000 landing points. Connected directly to the SubTel Forum Submarine Cable Database and integrated with our News Now Feed, the map enables real-time tracking of industry activity and cable-specific news coverage.

Submarine cables serve as the foundation of global digital infrastructure, carrying more than 99% of international data traffic. These systems enable the seamless connectivity the world depends on—from personal communication to enterprise operations. Without them, modern, high-speed global communication simply wouldn’t be feasible. Our analysts continually update the map using verified data from the Submarine Cable Almanac and valuable input from industry contributors. This ensures a timely and accurate picture of the subsea cable landscape, spotlighting the latest deployments and developments. As we approach the end of the year, map updates may slow during the holiday season, but our commitment to delivering reliable insights remains unchanged.

Submarine cables serve as the foundation of global digital infrastructure, carrying more than 99% of international data traffic. These systems enable the seamless connectivity the world depends on—from personal communication to enterprise operations.

We’re proud to feature Alaska Communications Systems and WFN Strategies as the current sponsors of the SubTel Cable Map. Additional sponsorship opportunities are available—offering high-visibility placement for your logo and

a direct link to your organization. It’s a great way to align your brand with global connectivity and the future of the submarine cable industry.

We invite you to explore the SubTel Cable Map and gain a deeper understanding of the vital role submarine cable systems play in our interconnected world. As always, if you are a point of contact for a system or company that requires updates, please email kclark@subtelforum.com.

We hope the SubTel Cable Map proves to be a valuable

Here’s the list of systems updated since our last issue:

SEPTEMBER 15, 2025

resource for you, offering insight into the continually evolving submarine cable industry. Dive into the intricate network that powers our global communications today. Happy exploring! STF

KIERAN CLARK is the Lead Analyst for SubTel Forum. He originally joined SubTel Forum in 2013 as a Broadcast Technician to provide support for live event video streaming. He has 6+ years of live production experience and has worked alongside some of the premier organizations in video web streaming. In 2014, Kieran was promoted to Analyst and is currently responsible for the research and maintenance that supports the Submarine Cable Database. In 2016, he was promoted to Lead Analyst and his analysis is featured in almost the entire array of Subtel Forum Publications.

Do you have further questions on this topic?

Newly Added Systems:

• Oman Emirates Gateway (OEG)

• Updated Systems:

• Celia

• E2A

• Humboldt

• MANTA

• SEA-ME-WE 6

• SHV-HK

• SJC2

ANALYTICS

OFFSHORE ENERGY

[Reprinted Excerpts from SubTel Forum’s 2024/25 Submarine Industry Report]

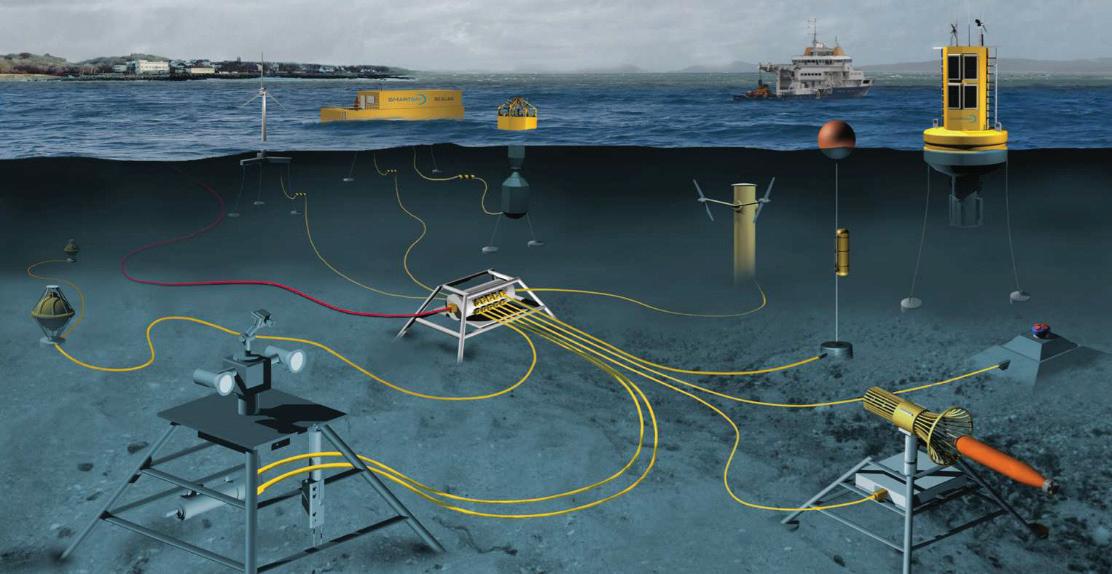

Subsea fiber optic cables are becoming an indispensable part of the offshore energy sector, particularly for the offshore oil & gas and wind industries. Both sectors have seen substantial growth in recent years, largely driven by increasing demands for reliable and high-capacity communications to support operations in remote and harsh environments. This report will explore the latest developments in subsea fiber communications supporting these industries, focusing on the expansion of fiber networks in offshore oil & gas, as well as the rapid growth of the offshore wind industry.

OFFSHORE OIL & GAS AND FIBER COMMUNICATIONS

improvements. The Campos Basin project is a significant contributor to Brazil’s offshore oil production, and fiber communications have enabled operators to link offshore platforms with onshore control centers. This reduces the need for human presence on platforms while enhancing safety and efficiency. Subsea fiber networks provide the capacity for real-time monitoring and predictive maintenance, which is increasingly vital as oil & gas companies strive to reduce costs and environmental risks. (Global Wind Energy Council, 2024)

Globally, the trend towards digitization in oil & gas is transforming the way companies operate.

Automation

and

digital technologies have become fundamental to reducing operational risks and improving decisionmaking in real-time. Fiber optics play a critical role in this transformation by providing the bandwidth needed to support dataintensive applications.

In the offshore oil & gas sector, robust communication networks are essential for supporting the complex operations of platforms, which include drilling, extraction, monitoring, and logistics. Companies like Tampnet have been pioneers in providing high-speed, low-latency communications across critical oil-producing regions. Tampnet’s Gulf of Mexico System, for example, is a major project that illustrates the role of fiber in offshore operations. Tampnet has been upgrading the communications infrastructure in the Gulf of Mexico to integrate fiber optics and 4G LTE networks, enabling enhanced data transfer and remote control of offshore platforms. These upgrades allow oil & gas companies to manage operations more efficiently, with applications such as real-time video surveillance, automation of key processes, and monitoring of equipment through IoT devices. (World Forum Offshore Wind, 2024) (Global Wind Energy Council, 2024)

Similarly, other key offshore oil regions, like Brazil’s Campos Basin, have leveraged subsea fiber for operational

Globally, the trend towards digitization in oil & gas is transforming the way companies operate. Automation and digital technologies have become fundamental to reducing operational risks and improving decision-making in real-time. Fiber optics play a critical role in this transformation by providing the bandwidth needed to support data-intensive applications. From monitoring well performance to enabling predictive analytics, fiber communications are essential for optimizing offshore production and ensuring the safety of personnel. (Global Wind Energy Council, 2024)

EXPANSION OF OFFSHORE WIND AND FIBER COMMUNICATIONS

While oil & gas continues to be a key driver of subsea fiber growth, the offshore wind industry is emerging as an equally significant market for fiber suppliers. The offshore wind sector has expanded rapidly over the past decade, with a notable increase in global capacity. In 2020, offshore wind capacity stood at around 29.1 GW, and by 2023, it had increased to approximately 75 GW. The industry is projected to grow even further, with estimates suggesting that global offshore wind capacity could reach 487 GW by 2033. (Det Norske Veritas, 2024)

Fiber optic communications are critical to the operation of offshore wind farms, providing the infrastructure needed to connect turbines to control centers and national power grids. As the size and complexity of offshore wind farms increase, the demand for reliable and scalable communication networks grows. Subsea fiber networks support real-time monitoring of turbine performance, grid stability, and environmental conditions. These networks also enable remote diagnostics and control, reducing the need for maintenance crews to be physically present on offshore platforms. (Det Norske Veritas, 2024)

Europe continues to lead the offshore wind market, with countries like the United Kingdom and Germany driving much of the capacity expansion. However, new markets in the Asia-Pacific region and the U.S. are expected to fuel further growth. In the U.S., for example, the federal government has set ambitious targets for offshore wind capacity, with a goal of reaching 30 GW by 2030. This growth is expected to spur demand for subsea fiber to connect wind farms along the Atlantic coast (Det Norske Veritas, 2024)

nearby wind farms. This not only reduces greenhouse gas emissions but also provides a more stable and sustainable energy source for offshore production. Fiber optic networks will be essential to managing the flow of information between these interconnected systems, ensuring that they operate efficiently and safely.

FUTURE OUTLOOK AND CHALLENGES

In addition to offshore wind, emerging markets like floating wind farms are opening up new possibilities for fiber suppliers. Floating wind farms, which can be installed in deeper waters than fixed-bottom turbines, require even more advanced communication infrastructure.

In addition to offshore wind, emerging markets like floating wind farms are opening up new possibilities for fiber suppliers. Floating wind farms, which can be installed in deeper waters than fixed-bottom turbines, require even more advanced communication infrastructure. Subsea fiber networks are key to managing the complexities of floating platforms and ensuring stable operations in challenging conditions.

INTEGRATION OF OFFSHORE OIL, GAS, AND WIND INFRASTRUCTURE

As the offshore energy sector evolves, there is increasing interest in the integration of offshore oil, gas, and wind infrastructure. Hybrid energy systems, which combine oil & gas platforms with offshore wind farms, could offer significant benefits by sharing infrastructure such as subsea cables, power supplies, and communication networks. Fiber optics could be the backbone of such integrated systems, enabling the simultaneous management of multiple energy sources from a single control center.

For instance, as oil & gas companies look to decarbonize their operations, some have begun exploring ways to power their offshore platforms using electricity generated by

The demand for subsea fiber communications is set to grow significantly over the next decade as both the offshore oil & gas and wind industries expand. However, there are challenges that could impact the pace of growth. For the oil & gas sector, geopolitical risks, regulatory changes, and fluctuating oil prices could affect investments in new fiber networks. Similarly, the offshore wind industry faces challenges such as supply chain constraints and rising capital costs, which may slow the development of new projects (Det Norske Veritas, 2024) Despite these challenges, the long-term outlook remains positive. Both sectors recognize the critical importance of reliable, high-capacity communications in supporting their operations, and fiber optics will continue to play a central role. As digital technologies evolve, the offshore energy industry will increasingly rely on real-time data, predictive analytics, and automation—all of which require robust fiber communications.

In conclusion, subsea fiber communications are vital to the continued growth and success of both the offshore oil & gas and wind industries. As these sectors expand and become more interconnected, the demand for high-speed, reliable communications will only increase. Fiber optic networks will remain the foundation for modern offshore energy infrastructure, enabling the efficient and sustainable production of energy in some of the world’s most challenging environments. STF

NOW OUT: SUBOPTIC FOUNDATION’S 2025 REPORT ON BEST PRACTICES IN CABLE LANDING STATION SUSTAINABILITY

BY IAGO BOJCZUK, CAMILA PAULINO, AND NICOLE STAROSIELSKI

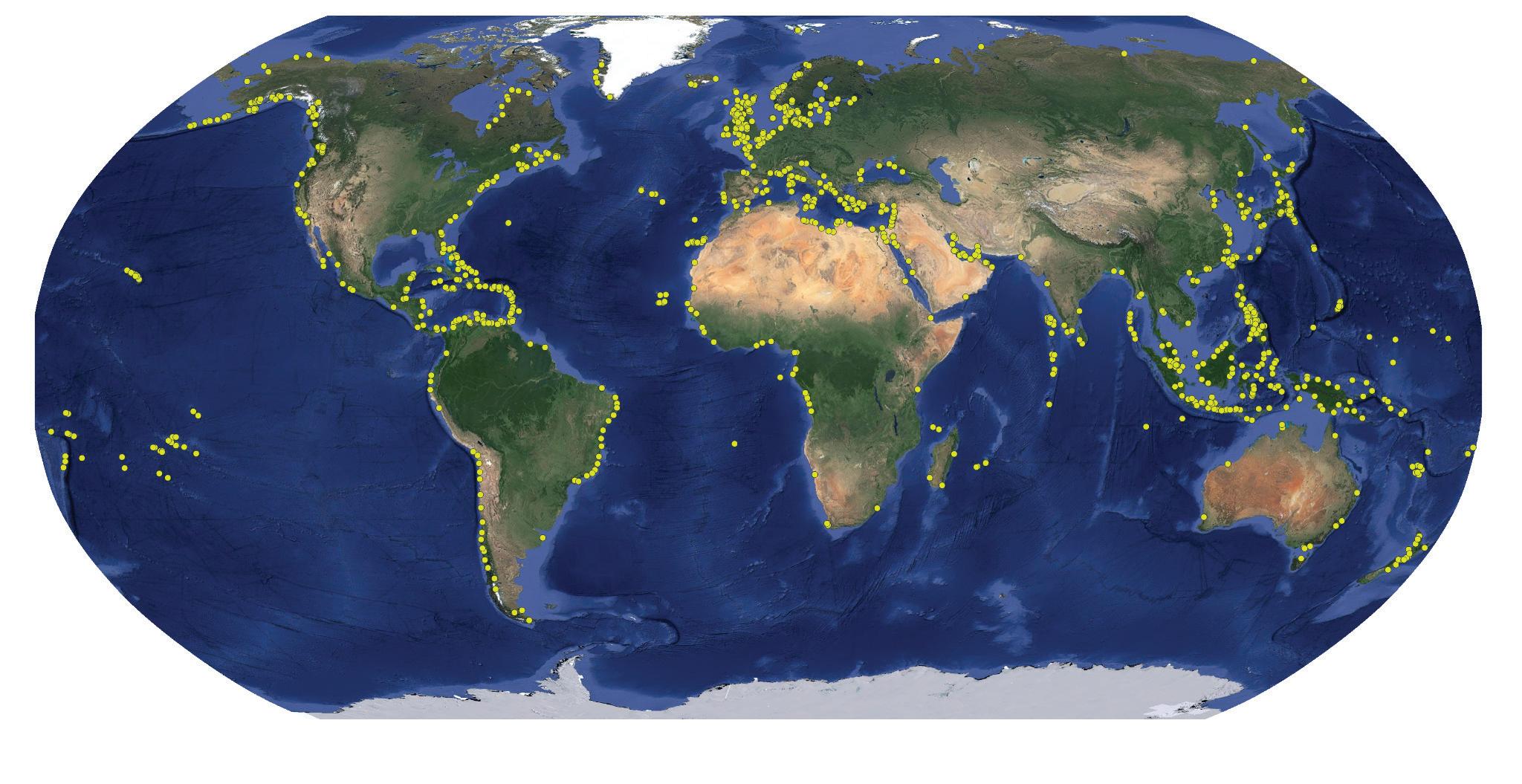

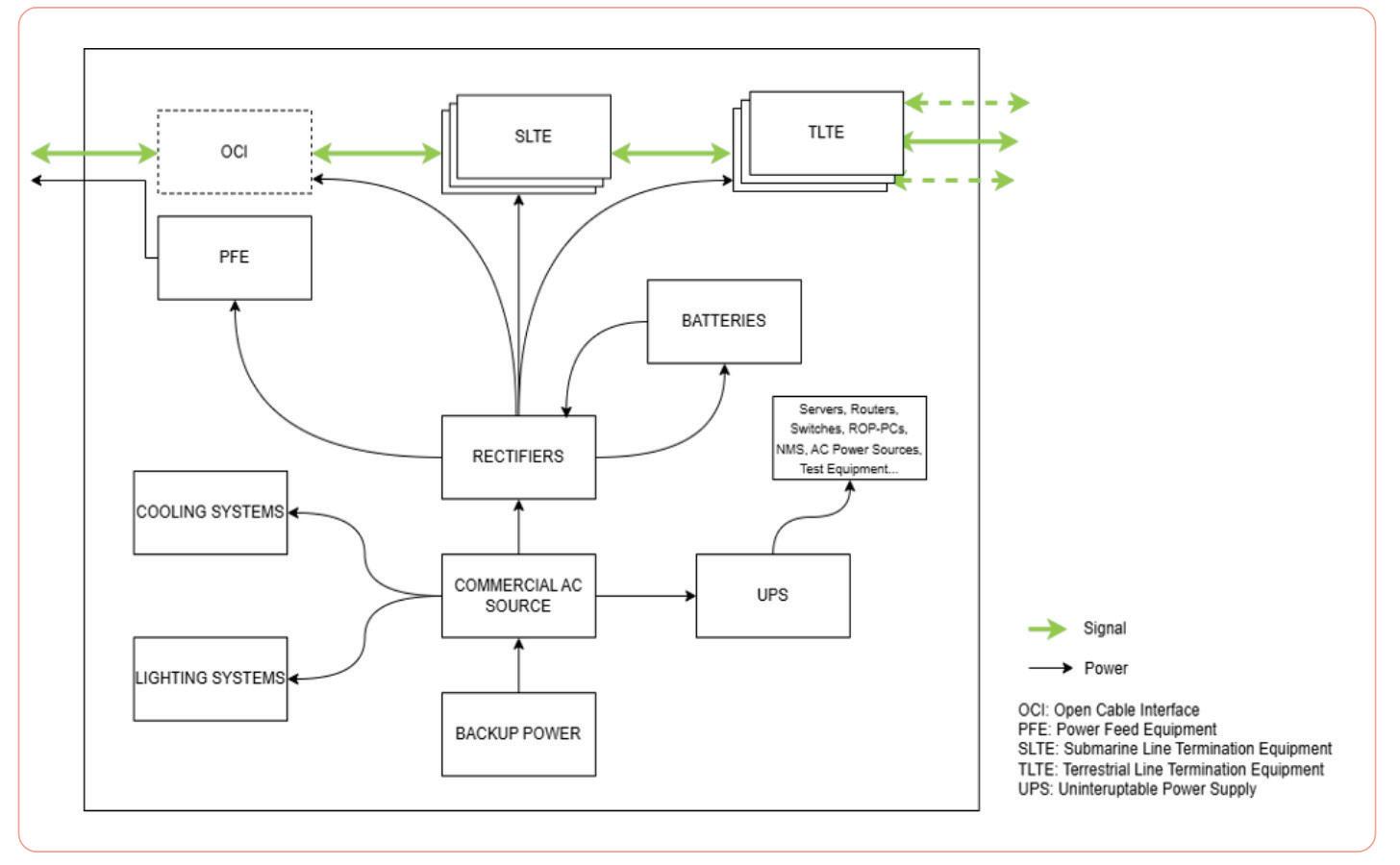

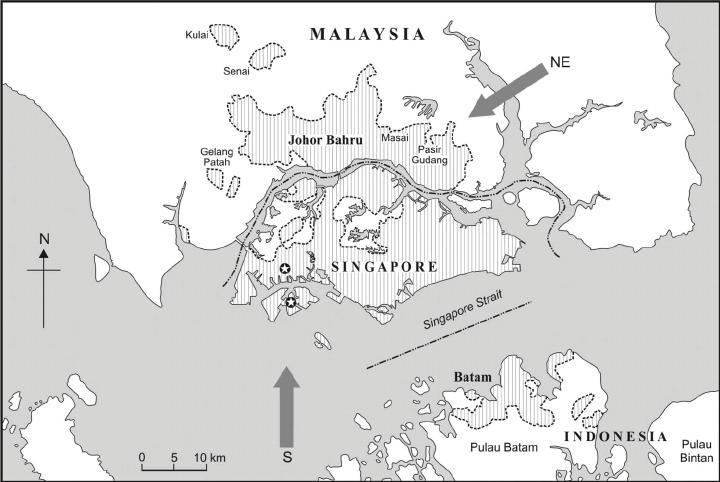

Acable landing station (CLS) is the essential dry-plant facility where a subsea cable ends and connects to terrestrial networks. According to TeleGeography, there are over 1,500 cable landings distributed worldwide (Fig. 1) (Burdette, 2025). Inside one of these facilities, you typically find power-feed equipment (PFE) that supplies constant-current power to the undersea cable’s repeaters (amplifiers), submarine line terminal equipment (SLTE) that terminates and processes high-capacity optical signals, terrestrial back-haul equipment, and the critical facility stack: redundant power and HVAC, battery backup, monitoring and control systems, and physical security—usually supported by 24/7 network operations, even though some sites are not manned, they are continuously and remotely monitored. Engineers and technicians work around the clock at these sites to ensure smooth operation.

In other words, the CLS is where the system’s energy and computing resources are concentrated, cooling systems must operate flawlessly, and all equipment supporting optical transmission is housed. Although sizes and capacities vary, most facilities tend to follow a similar layout (Fig. 2). As internet bandwidth demand increases, CLS energy use and environmental impact could also grow. However, with the advancement of high-data-rate networks and more efficient terrestrial and subsea LTE,

power consumption can be reduced. As a vital part of the dry plant, neglecting CLS sustainability means missing a major opportunity to improve the environmental performance of today’s subsea cable systems.

Over the years, with more cables being deployed globally, the strategic importance of where and how to build CLSs cannot be overstated. Increasingly, operators must weigh facility design and site selection. Energy availability—both grid capacity and carbon intensity—will remain key drivers, alongside new potential for deploying on-site renewable energy. New CLSs are being deployed in regions with abundant or low-carbon power. Energy profiles vary by location: Portugal has a high share of

renewables, whereas Singapore and Oman remain gas-heavy, so “low-carbon” does not uniformly apply across those examples. Redundancy and interconnection needs are also pushing the industry toward open, carrier-neutral CLS models that support multiple cables and terrestrial providers. In parallel, regulators commonly require environmental assessments, coastal and seabed permits, and national-security reviews for CLS projects (Ogren, 2025).

As with other layers of digital infrastructure, the cable landing station (CLS) brings long-overlooked sustainability issues into focus: although the cable itself lies offshore, the CLS—the dry-plant facility that powers the system—operates on land

and its sustainability parameters have historically been under-mapped. Yet now, disclosure rules are tightening.

Three questions organize the CLS sustainability agenda: Are we measuring the right things in the right places, with clear operational boundaries, so impacts can be seen and compared? Do governance and reporting routines turn those measurements into continuous improvement across varied ownership and co-located contexts? Are design, procurement, and refresh decisions aligned with grid realities and climate risk to minimize both operational and embodied impacts over time? Framed this way, improving CLS efficiency goes to the heart of a subsea cable system’s environmental footprint.

In this month’s Sustainable Subsea column, we summarize a new SubOptic Foundation report that brings sustainability squarely into CLS operations. Produced with the UK-based firm Carbon3IT, the 2025 Report on Best Practices in Cable Landing Station Sustainability identifies the CLS as one of the most sensitive—and

most actionable—levers for improving network environmental performance. The report treats the CLS as a practical focal point for sustainability because it concentrates powered optical transmission equipment and supporting infrastructure. The premise is simple: if each CLS operates more cleanly and efficiently, the global telecommunications network becomes more resilient and better prepared for climate risks. Yet the complexity of the environmental considerations at play makes this systematic study a timely contribution to a more sustainable subsea cable industry.

CLS AND ENVIRONMENTAL SUSTAINABILITY

As climate change regulation advances worldwide, the energy demands of digital infrastructure are under increasing scrutiny. The energy efficiency and carbon emissions of data centers have been thoroughly examined, and frameworks such as the European Code of Conduct for Energy Efficiency in Data Centres (EUCoC) have been crafted for that sector. By

contrast, CLS facilities lack a systematized, data-driven view of their global footprint and still do not benefit from standardized sustainability metrics. Because many CLS facilities are smaller than full data centers and were built before sustainability was a priority, they offer clear upgrade opportunities. A few operators—such as Equinix in Marseille, BT in Dublin— are beginning to fold the CLS into the data-center footprint, but such arrangements remain the exception.

Against this backdrop, the published SubOptic report constitutes the first industry-wide, systematic study of sustainability at the CLS layer of the subsea cable system (Fig. 2). While CLSs are only one component of the larger submarine ecosystem, which includes cable manufacture and deployment, marine operations, repair, and recovery, they offer a tractable locus for data collection and benchmarking. Focusing here enables mutually beneficial pathways: actionable improvements for operators and measurable progress in greening cable operations.

Figure 1. Global footprint of CLS facilities, based on TeleGeography data (2024).

The United States is by far the country with the most CLS facilities.

According to Nicole Starosielski, co-convenor of the SubOptic Global Citizen Working Group and the Sustainable Subsea Networks team, this report offers a useful view for the industry because it applies well-established frameworks in the data center industry and beyond to the specific case of the subsea industry.

According to Derek Cassidy, Senior Submarine Cable Technologist and Programme Manager at British Telecom (BT), CLS infrastructure is a vital link in international connectivity and is directly tied to BT’s climate ambitions. As he puts it, “with the increasing demands to meet the climate challenge, BT has already instigated a programme to become carbon neutral by 2030.” He explains: “By applying this ethos to our infrastructure, power systems, and line terminal equipment, we have already begun a programme to reduce power consumption and reduce the carbon footprint that we have, thereby helping us to achieve our 2030 goal of being carbon neutral.” Cassidy, who worked with the broader Sustainable Subsea Networks team, adds that consolidating sites and infrastructure is another lever to accelerate progress and concludes that being more power efficient is seen as a pillar that helps to promote BT’s climate goals.

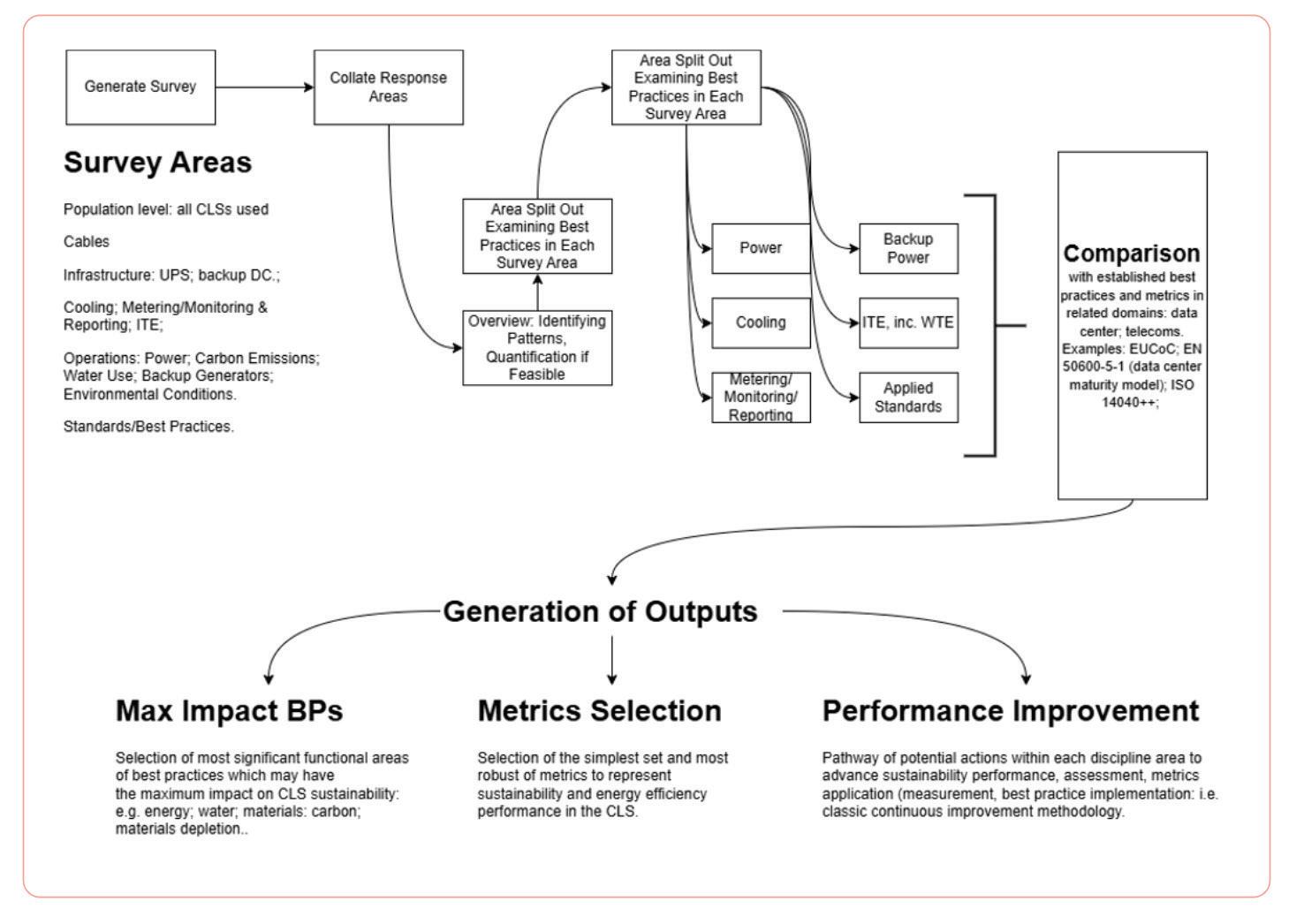

THE SURVEY’S METHODOLOGY

Because systematic studies of the environmental dimensions of cable landing stations (CLSs) were scarce, SubOptic Foundation’s Sustainable Subsea Networks (SSN) Cable Landing Station working group set out to develop a creative, practical methodology that could be applied in the field. Over two years, the team mapped and measured key sus-

tainability factors across the subsea ecosystem, focusing on CLSs as the primary unit of analysis. Building on this groundwork, the team developed a sector-wide survey in partnership with Carbon 3IT. Convened by Vedrana Stojanac of Ciena, the subgroup’s membership includes Aqua Comms, BT, Bulk Infrastructure, Ciena, Colt, e&, Exa Infrastructure, Google, Orange, R&G Telecomm, the Solomon Islands Submarine Cable Company, Telecom Egypt, Telxius, and Vodafone.

Reflecting on her work with the SubOptic Foundation’s SSN Cable Landing Station subgroup, Vedrana Stojanac, Senior Consultant of the Global Submarine Systems Engineering Team at Ciena, said: “Given the critical role of subsea cables in ensuring the reliability of the internet and their status as key infrastructure, CLS facilities warrant focused study to optimize operations and safeguard sensitive data transmission. Adopting sustainability practices not only supports environmental goals but also enhances operational efficiency,

resilience, and security, creating a robust and future-ready facility. By integrating sustainable approaches, CLS operators can better address the fast-growing demands of global connectivity. The group’s efforts represent an important step toward achieving these objectives.”

An inevitable part of the process was considering CLSs in relation to data centers, since both rely on similar electrical and cooling equipment. As late British scientist Lord Kelvin—whose innovations enabled signal detection on the first transatlantic telegraph cables—famously observed, “If you cannot measure it, you cannot improve it.” Guided by this principle, our first task was to determine what to measure and how to do so repeatably. Drawing on established data-center standards, we assembled performance metrics and energy-efficiency/sustainability best practices and paired them with continuous-improvement methods from manufacturing. As Nick Morris of Carbon3IT explains, “Combining these tools with continuous improvement method-

Figure 2. Typical CLS layout and its ICT equipment. With an Open Cable Interface (OCI), the SLTE connects to the subsea fiber pair through the OCI, which may support optical spectrum sharing (multiple SLTEs on one pair) and includes wet-plant supervisory and photonic components. Source: 2025 Report on Best Practices in Cable Landing Station Sustainability.

ologies initially developed in manufacturing enables the measurement of absolute and relative performance across time and between different infrastructures.”

However, unlike the data center sector— which relies heavily on the metric of power usage effectiveness (PUE), despite its limitations—CLS operations lack a phased, granular understanding of how power and other resources are used. Accordingly, the survey targeted critical operational areas: (1) ICT equipment—optical transmission and IT (servers); (2) power—primary and backup; AC/UPS and 48 V DC; (3) cooling; (4) measuring, metering/monitoring, and reporting; (5) environmental conditions; (6) standards applied—sustainability, energy efficiency, and related; and (7) indicators monitored and logged—carbon emissions and water use.

rity model)—to assess how proven energy-efficiency practices apply to CLS operations, alongside ISO 14040–se-

ries life-cycle standards.

In the survey, metering, monitoring, data management, and reporting were treated as prerequisites for applying metrics and best practices—particular-

ly because ownership and colocation models complicate data access. Facilities spanned diverse configurations: cables with 2–12 fiber pairs, AC power typically N+1 with 2(N+1) UPS, DC at 2N or N(A+B), lead-acid batteries where disclosed, and cooling dominated by DX with over/under-floor delivery, with chillers added in colocated sites. The survey also addressed building operations and environmental conditions, including power sourcing, carbon emissions/water use, as well as backup generators, noting the widespread use of low-carbon electricity through PPAs or supplier mix, and the universal use of diesel backup.

While comprehensive sustainability management processes were not

The survey captured data from companies representing around 150 CLS facilities, covering primary and backup power (AC/UPS and 48V DC), cooling approaches, metering/ monitoring and reporting practices, environmental conditions, and ownership/management models (methodology shown in Figure 4). The results were then mapped against established data-center frameworks—notably the EU Code of Conduct for Energy Efficiency in Data Centres and EN 50600-5-1:2023 (a data-center matu-

Figure 3. Click here to access the full version of the 2025 Report on Best Practices in Cable Landing Station Sustainability.

Figure 4. Survey methodology summary. Source: 2025 Report on Best Practices in Cable Landing Station Sustainability.

SUBSEA

widespread, several efficiency-oriented practices were observed, including strategic layout design and the use of metrics to track energy performance. Collected data was organized into a continuous-improvement loop—establish a performance baseline, apply the selected metrics, implement targeted upgrades, and measure again. As Nick Morris of Carbon3IT observes, “The resulting framework contains a practically applicable set of actions that will measurably reduce emissions and energy and materials use, thereby reducing bottom-line costs and enhancing business and operational resilience against climate change and economic shocks.” This cycle enables standardized comparisons across facilities, supports

climate-adaptation planning, and integrates sustainability criteria into procurement and operational decisions.

Building and readying this measurement-driven framework for adoption is—and will remain—a collective effort across the industry. Hesham Youseff, a senior transmission engineer at Telecom Egypt, emphasizes the collaborative nature of the research: “This achievement would not have been possible without the dedication, commitment, and cooperation of all CLS owners and operators and the entire team who contributed to the project. It was a great honor to represent the CLS Working Group and Telecom Egypt and to present the results of this

project at SubOptic 2025 in Lisbon.” Looking ahead, translating this framework into consistent practice will require sustained coordination among CLS owners, operators, and technical partners—and continued commitment from the people responsible for implementation.

KEY FINDINGS

The survey yielded several broad findings. First, carbon emissions are not comprehensively estimated by CLS owners and are rarely split by Scopes 1, 2, and 3. Second, ownership and colocation arrangements—including whether a CLS sits inside a data center—significantly affect the complexity of acquiring sustainability data. Third, electricity use is often

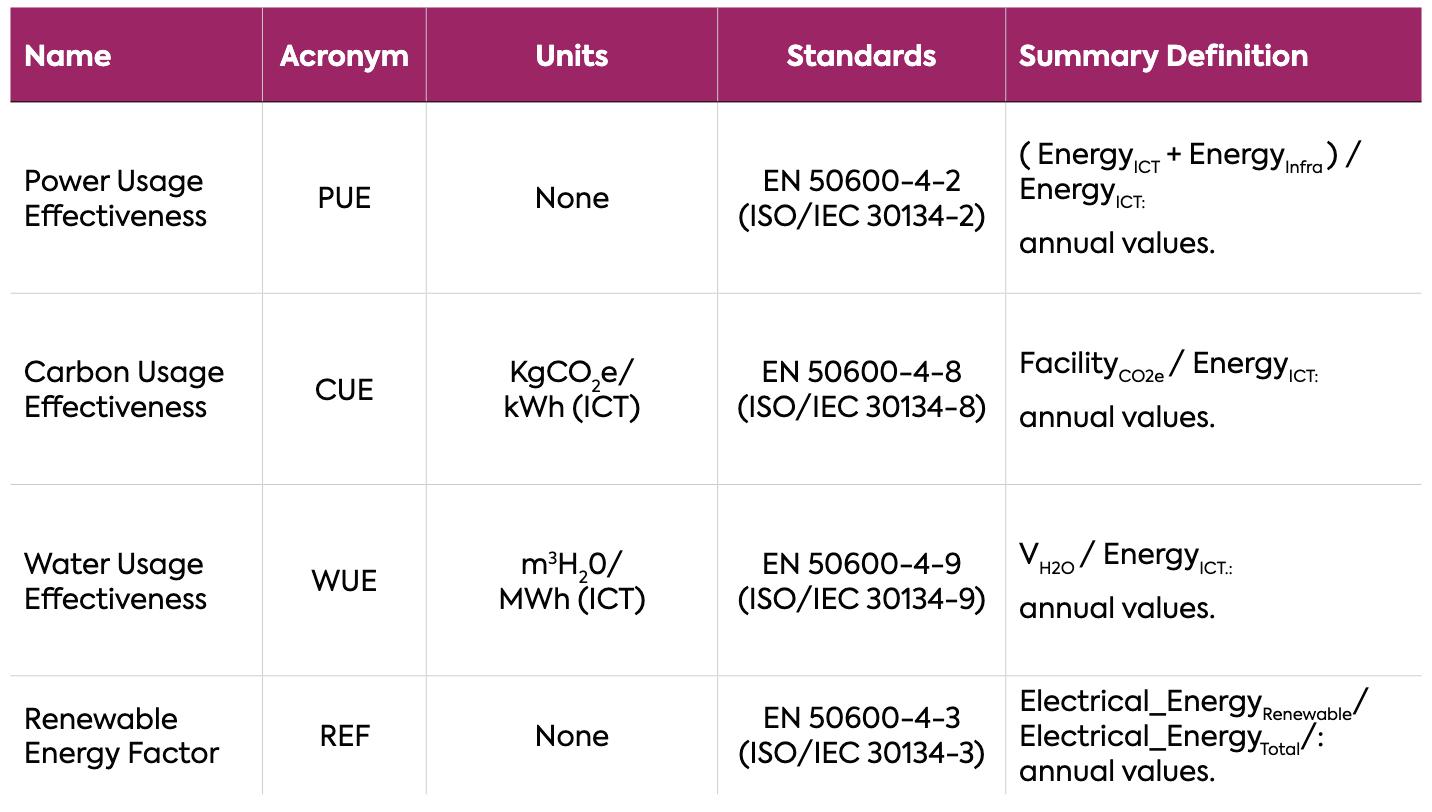

Figure 5. Summary of the main metrics with their respective standards, definitions, and units. These metrics cover sustainability’s core facets—energy, carbon, and water—with energy prioritized for its influence on the others. Source: 2025 Report on Best Practices in Cable Landing Station Sustainability.

not metered at the points needed to calculate core metrics and attribute energy accurately. Fourth, refresh cycles followed expectations: ICT equipment is refreshed more often than infrastructure (M&E, power, cooling), with upgrades improving performance per unit of power. Finally, only one reporting company had a holistic sustainability/energy-efficiency standard in place, and PUE was evaluated in full compliance with the standard in only one case.

Recommended next steps are to obtain EUCoC/EN 50600-5-1 and the metric standards, assign a lead, prioritize metering/monitoring/ reporting, run a continuous-improvement cycle, report metrics alongside absolute quantities, leverage procurement, and integrate outputs into corporate and operational reporting—optionally adding a procurement-oriented scoring mechanism and aggregating key KPIs into reporting flows.

In sum, the report treats the cable landing station (CLS) as a practical focal point for sustainability because the transmission equipment and supporting infrastructure are concentrated there. Drawing on the survey, it recommends carrying over proven data-center practices—tracking Power Usage Effectiveness (PUE), Carbon Usage Effectiveness (CUE), Water Usage Effectiveness (WUE), and Renewable Energy Factor (REF)— into coastal, high-resilience CLS operations, underpinned by clear system boundaries and robust metering and monitoring, with each ratio reported alongside absolute quantities: kilowatt-hours (kWh), tonnes of carbon-dioxide equivalent (tCO₂e), and cubic meters (m³). Co-location within data centers can facilitate this

transfer, provided boundaries are defined from the outset. The report also cautions against composite indices that obscure real performance drivers. Taken together, these steps position CLSs to embed sustainability in day-to-day operations and to scale a greener approach across the global subsea cable industry. STF

In sum, the report treats the cable landing station (CLS) as a practical focal point for sustainability because the transmission equipment and supporting infrastructure are concentrated there.

This article is an output from a SubOptic Foundation project, Sustainable Subsea Networks, funded by the Internet Society Foundation.

IAGO BOJCZUK is a Ph.D. candidate in the Department of Sociology at the University of Cambridge, UK, and the Student and Young Professional Coordinator for the SubOptic 2025 conference. His research focuses on the sustainability and governance of digital infrastructures, including subsea cables, data centers, and satellites.

CAMILA PAULINO is a Master’s student at NOVA University Lisbon. Her research focuses on health and development, particularly in the context of climate resilience and adaptation.

NICOLE STAROSIELSKI is Professor of Film and Media at the University of California, Berkeley. Dr. Starosielski’s research focuses on the history of the cable industry and the social aspects of submarine cable construction and maintenance. She is author of The Undersea Network (2015), which examines the cultural and environmental dimensions of transoceanic cable systems, beginning with the telegraph cables that formed the first global communications network and extending to the fiber-optic infrastructure.

Starosielski has published over forty essays and is author or editor of five books on media, communications technology, and the environment. She is co-convener of SubOptic’s Global Citizen Working Group and a principal investigator on the SubOptic Foundation’s Sustainable Subsea Networks research initiative.

Works Cited

Burdette, L. (2025) Shore things: a data-driven look at submarine cable landing stations. Washington, DC: TeleGeography.

Ogren, J. (2025) ‘The evolving role of cable landing stations in a hyperconnected world’, Data Center Dynamics (DCD), 14 July. [Online]. Available at: https:// www.datacenterdynamics.com/en/opinions/the-evolvingrole-of-cable-landing-stations-in-a-hyperconnectedworld/ (Accessed: 16 August 2025).

SubOptic Foundation (2025) Report on best practices in cable landing station sustainability. London: SubOptic. [Online]. Available at: https://www.suboptic.org/paperspresentations/report-on-best-practices-in-cable-landingstation-sustainability

European Commission (no date) ‘European Code of Conduct for Energy Efficiency in Data Centres’, The Joint Research Centre: EU Science Hub. [Online]. (Accessed: 25 August 2025).

TeleGeography (2024) ‘Data Center Research Service’. [Online]. Available at: https://www2.telegeography.com/ data-center-research-service (Accessed: 1 August 2025).

WHERE IN THE WORLD ARE THOSE PESKY CABLESHIPS?

BY KIERAN CLARK

A GLOBAL ANALYSIS OF CABLE SHIP PATTERNS, INFRASTRUCTURE PROXIMITY, AND PROJECTED ACTIVITY USING AIS

DATA

The subsea cable network—the hidden foundation of global connectivity—depends on a small, specialized fleet of vessels tasked with installing, repairing, and maintaining undersea systems. These cable ships are indispensable, but their operations remain opaque. Most available insights derive from AIS (Automatic Identification System) signals, which reveal where ships are and how they move, but not their precise mission. As a result, interpreting cable ship behavior requires inference, data modeling, and a contextual understanding of regional infrastructure.

This article presents the latest results of a geospatial analysis of cable ship movement based on 9,000+ AIS-derived idle data points collected between 1 July and 31 August 2025. Building on prior reporting, the September dataset highlights evolving patterns in maintenance and installation activities, shifts in regional clustering, and the persistent dominance of unclassified behaviors. By applying a proximity-based model, we can better infer whether vessels are engaged in cable repairs, system deployments, or other standby operations.

The AIS dataset was again compiled at six-hour intervals to ensure consistent temporal coverage. Idle points—where vessels moved slowly or remained stationary for extended periods—were classified against known depot and factory locations within a 50 km threshold. This classification scheme applied three categories:

• Installation if located near a cable factory

• Maintenance if located near a cable depot

• Unclassified if no infrastructure proximity or vessel routing patterns provided sufficient context

Where both facility types were present, installation was prioritized, consistent with observed practices around factory-adjacent staging zones.

This methodology mirrors approaches used in other sectors, such as logistics (vehicle dwell times near warehouses) and fisheries (vessel clustering near reefs). The aim is the same: transforming raw positional data into operational insight.

GLOBAL MAP OF OBSERVED BEHAVIORS

To establish a geographic baseline, Figure 1 provides a spatial overview of cable ship idling between July and August 2025. The map integrates thousands of AIS records, highlighting locations where ships remained slow-moving or stationary near infrastructure or in open waters. Each point is color-coded by projected classification:

• Blue: Maintenance Activity

• Green: Installation Activity

• Gray: Unclassified Activity

Icons indicate infrastructure locations:

• Wrench: Cable Depot

• Factory: Cable Factory

Clusters are again visible in historically significant corridors. East Asia and Southeast Asia dominate the dataset, showing strong concentrations around Shanghai, Busan, Kitakyushu, Singapore, and Manila. The North Atlantic continues to exhibit dense patterns around Calais, Brest, Lowestoft, and the Canary Islands, reinforcing its role as a global repair hub. Emerging concentrations are also visible in the Bay of Bengal, Arabian Sea, and West Africa, where both depot-linked maintenance and unclassified behaviors

appear. The Pacific basin shows smaller but persistent tracks near Papua New Guinea and eastern Australia. These clusters underscore the correlation between vessel idling and infrastructure proximity, while also highlighting regions where large shares of unclassified points obscure activity context. Together, these patterns set the stage for deeper analysis in the following sections on activity types, regional distribution, and facility influence.

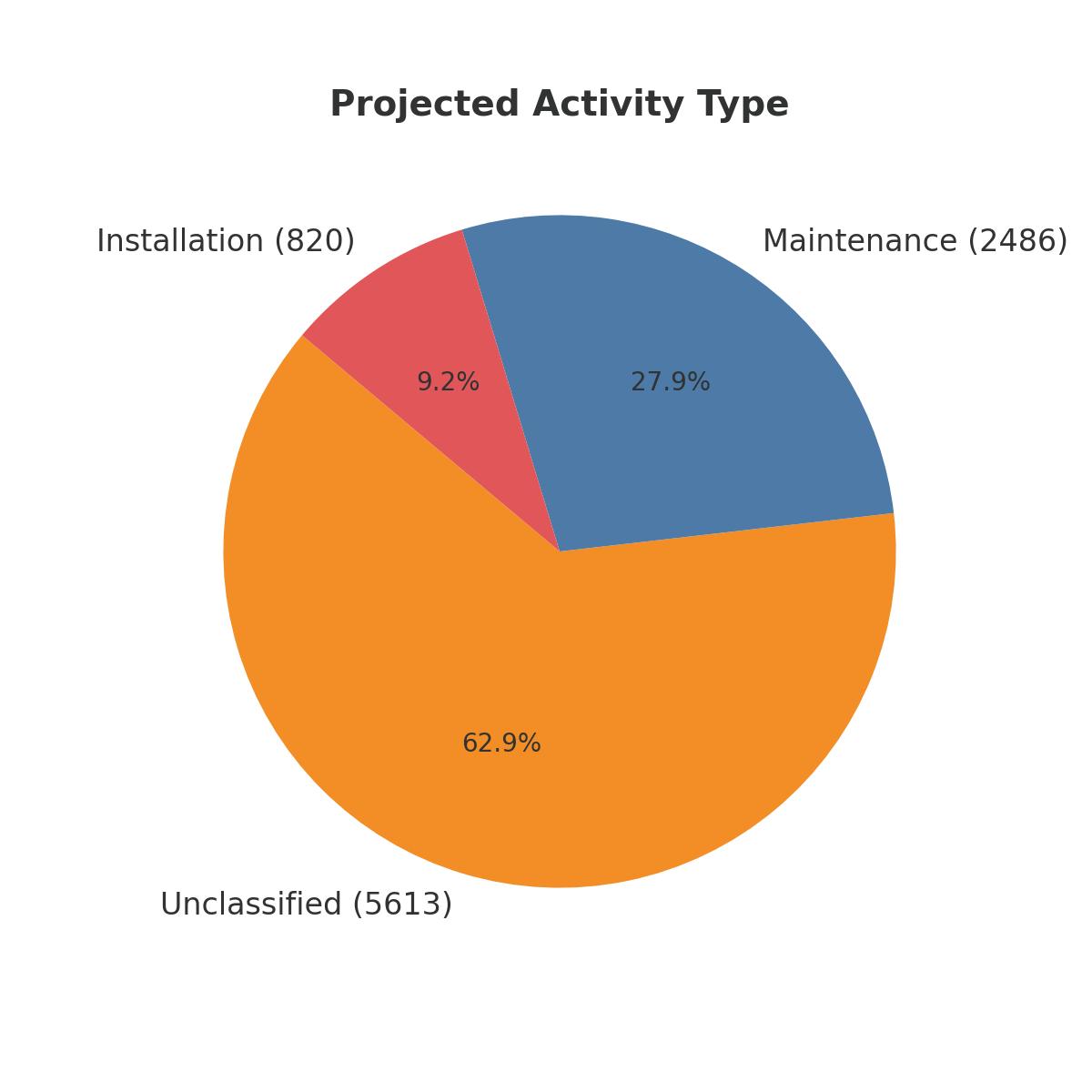

PROJECTED ACTIVITY TYPE

With the global footprint established, the next step is to interpret the underlying purpose of cable ship behavior. Each AIS-derived idle point was classified into one of three categories—Maintenance, Installation, or Unclassified—based on proximity to known facilities and post-idle routing patterns. Figure 2 illustrates the resulting distribution for July–August 2025.

CLASSIFICATION RESULTS:

• Maintenance: 2,486 data points (27.9%)

• Installation: 820 data points (9.2%)

• Unclassified: 5,613 data points (62.9%)

Ships associated with maintenance activity typically lin-

Figure 1: Vessel Activity Map

CABLESHIPS

gered near depots, reflecting patterns consistent with fault response readiness, repair staging, and short-range positioning around high-density cable corridors. By contrast, installation activity was tied to factory adjacency or observed along deepwater transit routes, often corresponding to long-haul system deployment.

The September dataset shows a rise in the unclassified share, now accounting for nearly two-thirds of idle points. This increase highlights the ongoing challenge of inferring purpose without vessel-reported metadata. Nonetheless, the identifiable behaviors reinforce long-standing dynamics: maintenance remains the most consistent operational demand, while installation continues to appear episodic and geographically dispersed.

In short, the picture that emerges is one of a fleet dominated by depot-linked maintenance, supplemented by a smaller but critical layer of installation-driven deployments. The high proportion of unclassified points underscores the limits of inference—but also signals an opportunity for richer operational transparency across the industry.

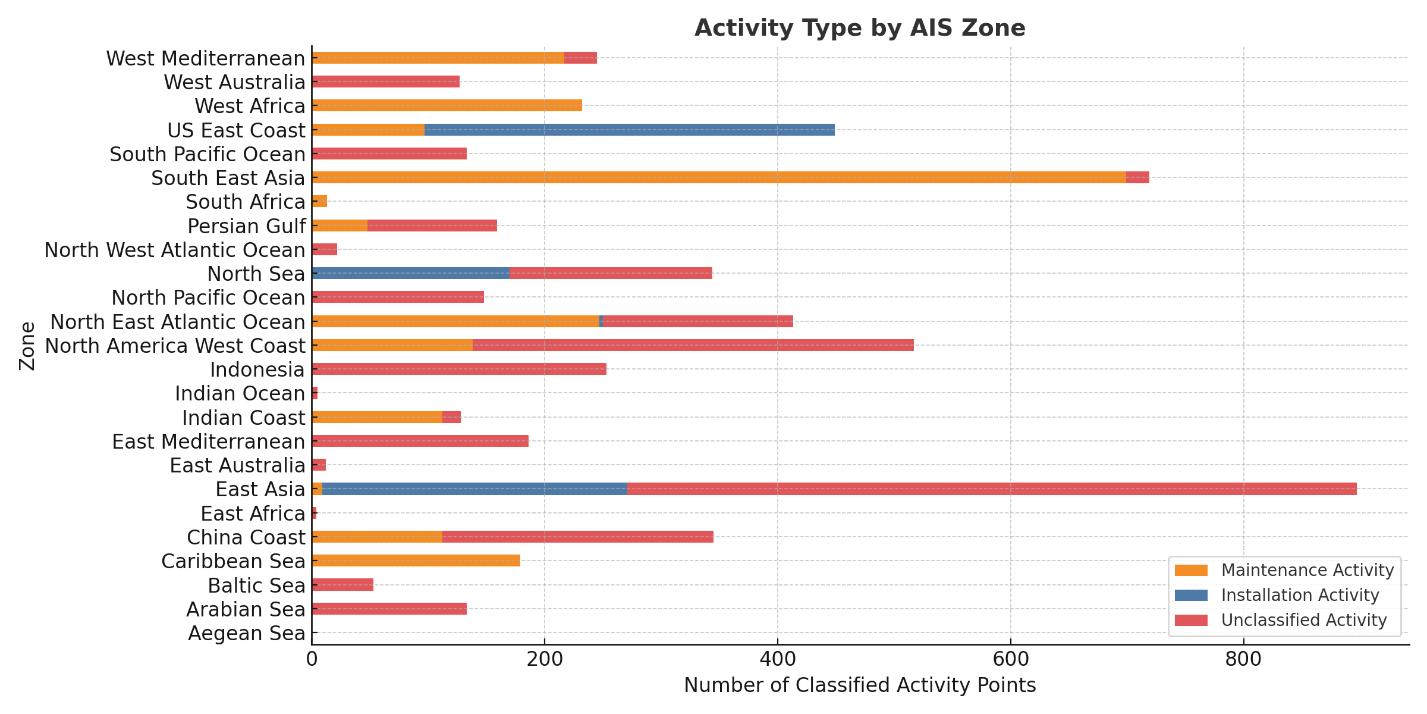

REGIONAL TRENDS IN ACTIVITY TYPE

After establishing a global classification framework, the analysis turns to how activity varies across geographic regions. By grouping idle points according to AIS Zones, we can better understand how maintenance, installation, and unclassified behaviors distribute globally. Figure 3 presents this breakdown for July–August 2025.

The September dataset reveals strong regional contrasts. As in previous reporting, East Asia and Southeast Asia dominate total idle records, accounting for the largest concentration of vessel activity worldwide. Both regions continue to show a diverse profile of maintenance and installation, reflecting the combination of regional depots and multiple cable factories in Japan, Korea, and China. The scale of unclassified activity here, however, reinforces the sheer density of vessel presence and the limitations of AIS-only inference.

The North Atlantic and North Sea zones remain perennial hubs for depot-supported maintenance. Notably, activity clusters persist around Calais, Brest, and Lowestoft, underscoring the strategic importance of Europe’s depot network in supporting both transatlantic and regional systems. The US East Coast and Caribbean Sea also feature prominently, reflecting hybrid roles in maintaining legacy systems while staging for system buildouts across the Americas.

Elsewhere, regional dynamics are more fragmented. The Indian Coast and Arabian Sea reflect balanced patterns of installation and maintenance, consistent with both emerg-

ing buildouts and legacy fault response. The South Pacific and East Australia show modest but steady concentrations of unclassified events, indicating ongoing vessel presence in less-instrumented zones. Meanwhile, West Africa and the South America East Coast remain dominated by unclassified points, highlighting persistent data opacity in areas where infrastructure coverage is sparse.

Two takeaways emerge from the zonal analysis:

1. Maintenance activity continues to cluster in well-served regions with depot density, supporting rapid fault response.

2. Installation activity remains episodic and geographically selective, tied to factory staging and project deployments.

The zonal view reinforces the interplay between infrastructure distribution, cable age, and fleet availability in shaping global vessel behavior.

INFRASTRUCTURE INFLUENCE ON VESSEL BEHAVIOR

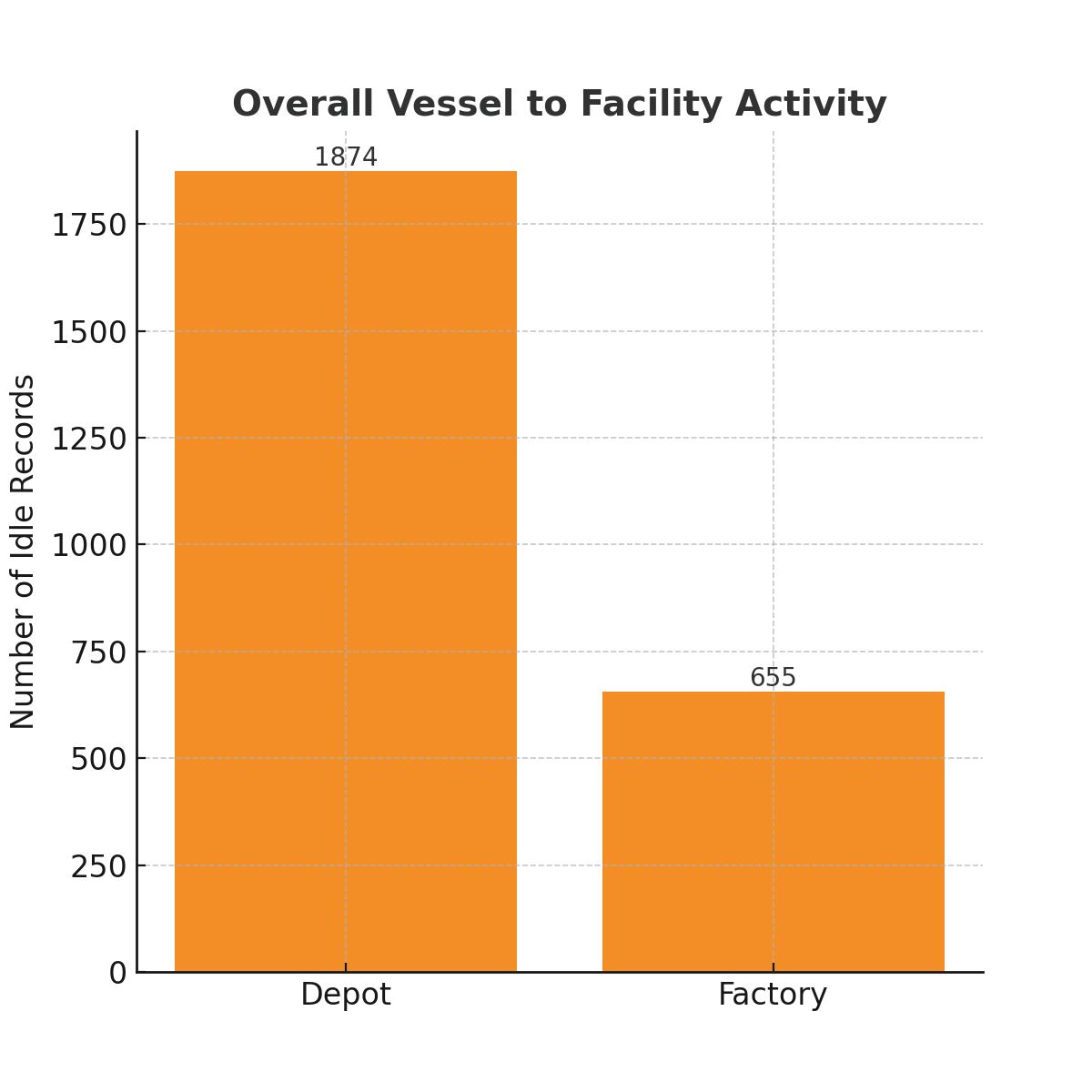

Beyond geography, cable ship behavior is also shaped by its relationship to nearby infrastructure—specifically, depots and factories. These facilities anchor vessel activity: depots serve as hubs for fault response and restaging, while factories support cable loading and the initiation of system deployments. Figure 4 illustrates the facility-linked breakdown for July–August 2025.

The September dataset records 1,874 depot-associated idle points compared to 655 factory-associated idle points, showing that vessels were nearly three times more likely to

Figure 2: Projected Activity Type

remain near depots than factories. This distribution echoes the broader classification findings: maintenance remains the dominant driver of vessel activity, while installation, though crucial, appears less frequent and more episodic.

The operational rhythms of these two facility types remain distinct. Depot-linked presence is cyclical and sustained, with vessels frequently returning for resupply, crew turnover, or immediate fault mobilization. By contrast, factory-linked presence tends to spike before deployment campaigns, after which ships quickly disperse along new-build routes.

This facility-based lens reinforces the importance of global depot coverage. Regions with strong depot networks—such as Europe and East Asia—benefit from faster repair cycles and reduced vessel transit times. By contrast, underserved regions often show higher concentrations of unclassified points, as vessels cluster in fallback zones without nearby infrastructure.

In short, the facility analysis underscores the central role of depot availability in maintaining system reliability, while highlighting how factory adjacency continues to signal episodic but high-impact installation campaigns.

CONCLUSION: PERSISTENT PATTERNS, EMERGING SHIFTS

This September analysis provides an updated snapshot of cable ship behavior using AIS data, covering over 9,000 idle points recorded between July and August 2025. By classifying vessel activity into maintenance, installation, and unclassified categories, and mapping them across regions and infrastructure, several key patterns emerge.

Maintenance remains the backbone of fleet activity. With 2,486 depot-linked idle points, maintenance accounted for nearly 28% of the dataset—slightly below July’s 30.6%. These operations continue to cluster around major depots in East Asia, Southeast Asia, and the North Atlantic, underscoring the enduring demand for repair readiness as systems age and traffic volumes grow.

Installation activity remains episodic but essential. September’s dataset captured 820 installation points (9.2%), down slightly from July’s 12.2%. While fewer in share, these events were geographically dispersed, highlighting the global scope of new system deployments. Factory-adjacent hubs in East Asia, particularly Japan and Korea, continued to anchor this behavior.

Unclassified activity has grown significantly. Nearly 63% of idle records this period could not be definitively linked to maintenance or installation, up from 57% in July Issue 143 Cable Ships.

This rise reflects both the scale of vessel presence in high-density corridors and the limitations of inference without vessel-reported context. The persistence of large unclassified shares emphasizes the opacity of fleet operations in regions lacking depots, factories, or transparent reporting.

Depot influence continues to outweigh factory staging. Ships were nearly three times more likely to idle near depots than factories, consistent with July’s ratio. This pattern underscores the critical role of depot infrastructure in supporting fault response and ongoing maintenance cycles, while reinforcing the episodic nature of installation campaigns.

TREND COMPARISON: JULY VS. SEPTEMBER

Comparing July’s analysis (May–June dataset) with September’s (July–August dataset) reveals several subtle but

Figure 3: Activity By AIS Zone

CABLESHIPS

important shifts:

• Maintenance share fell slightly (30.6% 27.9%), though absolute volume rose, suggesting more overall activity but a larger share of unclassified points.

• Installation share also declined (12.2% 9.2%), reinforcing the episodic nature of deployments.

• Unclassified share increased significantly (57.2% 62.9%), pointing to persistent gaps in classification confidence.

• Depot vs. factory ratios remained stable, with depots continuing to dominate vessel idling.

Taken together, these results highlight both continuity and change. Maintenance continues to anchor global fleet behavior, while installation remains critical but episodic. Yet the growing share of unclassified activity underscores the limits of AIS-based inference and the pressing need for better transparency.

LOOKING FORWARD

As this reporting series continues, the trendline is clear: maintenance demand is steady, installation activity is episodic, and unclassified activity remains stubbornly high. Without more structured data sharing from operators—such as AIS message extensions, anonymized mission logs, or port call declarations—these patterns will remain partially hidden.

Greater transparency would not only sharpen analytical insight but also support faster response coordination, improved forecasting, and more efficient fleet utilization. In a world increasingly dependent on subsea connectivity, understanding cable ship behavior is not just an analytical exercise—it is a strategic imperative. STF

KIERAN CLARK is the Lead Analyst for SubTel Forum. He originally joined SubTel Forum in 2013 as a Broadcast Technician to provide support for live event video streaming. He has 6+ years of live production experience and has worked alongside some of the premier organizations in video web streaming. In 2014, Kieran was promoted to Analyst and is currently responsible for the research and maintenance that supports the Submarine Cable Database. In 2016, he was promoted to Lead Analyst and his analysis is featured in almost the entire array of Subtel Forum Publications.

Figure 4: Vessel to Facility Activity

CAPACITY CONNECTION

REGIONAL CABLE SYSTEMS IN A HYPERSCALE WORLD

BY JOHN MAGUIRE

GLOBAL CONTEXT

There is a veritable frenzy of submarine cable builds currently planned and underway. And the cables we know most about are absolutely huge. Consider Meta’s wonderfully named Project Waterworth and Google’s flabbergasting Pacific Network.

Waterworth is a 50,000km project expected to be the world’s longest 24 fiber pair submarine cable, connecting North and South America, Africa, Asia and Australasia—engirding the globe.

Google’s Pacific network is a mesh, depending on how you count it, of five 16 fiber pair transpacific cables, spanning more than 70,000km connecting Australia (with three landings), with the Americas (two landings North and one South) via Fiji (four landings); Guam/Tinian (four landings), French Polynesia (with eight (sic!) landings) and Hawaii (three landings).

The mind boggles at the cable kilometres (120,000) but is doubly boggled at the fiber kilometres (2.3 million, give or take). And none of this is to mention anything of so much else that either of these players—or any other global platform provider—is otherwise doing.

The International Telecommunication Union (ITU) and United Nations Conference on Trade and Development (UNCTAD), however, have long advocated for developing regional infrastructure to reduce reliance on centralized, vulnerable transit

paths1, so what practical effects do we see of this advocacy?

POLITICAL AND GEOPOLITICAL RESPONSES

Not all hyperscalers are U.S. companies, but those building their own global networks are, a fact that has come into increasingly sharp relief this year, especially in the context of independence and sovereignty. It is an issue that is addressed in different ways by different political/geopolitical players. For our purpose here we will look at just three examples with mutually contrasting points of view: the European

1 https://www.subseacables.net/industry-news/brazilreignites-brics-submarine-cable-project-with-2025feasibility-study-proposal/

THE EUROPEAN UNION

The EU is relatively easy to analyse, of course, because it operates quite transparently. It has a benign regulatory environment. Hyperscalers can readily acquire rights to operate their own networks. To create some European independence from the U.S. in connectivity, however, the EU has articulated

2 BRICS: A group comprising Brazil, Russia, India, China, South Africa, Saudi Arabia, Egypt, UAE, Indonesia, and Iran. BRICS serves as a political and diplomatic coordination forum for countries from the ‘Global South’ and for coordination in the most diverse areas. It does not have a constitutive treaty, its own budget, or a permanent secretariat (https://brics.br/en/about-the-brics/frequently-askedquestions-about-the-brics?activeAccordion=14356ea5-08e24bae-b630-f74c238249de).

Union (EU), BRICS2 and Vietnam.

1

ATMED Nador–DG Atlantic–Mediterranean via Morocco

ATMED EAST–DG East Mediterranean route

Grant to integrate Malta into Medusa

Part of Medusa grant package

Alongside other Medusa grants

ATMED–DG Western Mediterranean gateway Unspecified One of six Medusa-related grants Far North Fiber Arctic route linking EuropeU.S.Japan Unspecified CEF support confirmed Atlantic CAM–CM Mainland Portugal Azores–Madeira

The largest single CEF Digital grant EllaLink (French Guiana)1

a digital strategy3 aimed at improving its resilience and reducing the extent to which it relies on outside entities (“third countries”, in EU parlance) and, in the process, consolidating intra-regional coherence. It seeks to improve intra-EU connectivity and better connect the EU to other geographies. Let’s have a quick look4 at what Europe is doing. Table 1 summarises readily available information about EU supported subsea projects: This is not a huge amount of money in industry or population terms—but it is public money, coming into private, mostly regional cable systems, aimed at strategically improving Europe’s interconnectivity with the world and, crucially, bolstering Europe’s independence and resilience.

3 https://digital-strategy.ec.europa.eu/en/library/ joint-communication-strengthen-security-and-resiliencesubmarine-cables

4 Focusing only on subsea telecom cables and ignoring power cables and cable sensing.

To create some European independence from the U.S. in connectivity, however, the EU has articulated a digital strategy aimed at improving its resilience and reducing the extent to which it relies on outside entities

BRICS

The interesting characteristic of this group from our point of view is its longstanding interest in increasing its independence, as a group, from western (or

northern) infrastructure, which it would define to include that of EU. As far back as in 20125 the idea was mooted by a far smaller BRICS6 than we have today, of creating a submarine cable system connecting them all. Geographically, this would be very much a global submarine cable (of some 34,000km), of course, but BRICS, as a champion of the underserved, identifies regardless of geography, as a ‘region’—an approach consistent in principle, if not scale, with the EU’s towards French Guiana and its other overseas territories.

While the initial BRICS cable proposal approach did not gather much momentum at the time of its launch—it

5 https://web.archive.org/web/20151119214406/http:// www.yourfibreopticnews.com/brics+cable+unveiled+ for +direct+and+cohesive+communications+services+ between+brazil,+russia,+india,+china+and+south+africa_ 31525.html

6 The original members—Brazil, Russia, India, China, South Africa—who generate the acronym.

Here, French Guiana being in South America, we see evidence of ‘regional’ being defined not in geographical terms, but by sovereignty.

Table 1: Summary of financial support from the EU for EU regional subsea cable systems

FEATURECABLESHIPS

CAPACITY CONNECTION

had become dormant by 20157--ten years later it has re-emerged into a very different environment. Following the recent 17th summit in Brazil, Brazil’s president, Luiz Inácio Lula da Silva (“Lula”), announced that a feasibility study into the cable would be undertaken, funded by the New Development Bank (www.ndb.int). Lula went on to state that “submarine cables directly connecting BRICS members will increase the speed, security and sovereignty in the exchange of data”. And interestingly was at pains to note, especially in the context of trade sanctions that might affect the viability of realising the system, that the development should not contribute to fragmentation of the internet.

AND VIETNAM

Vietnam’s situation is quite different from the EU’s, and indeed the BRICS’, and the details of its approach are not especially clear, viewed from without. A big country with a late-developing telecom market, it adeptly balances itself in the powerful geopolitical magnetic field generated by its massive neighbour and BRICS member to the north and the western aligned countries that represent a great portion of its global market. Vietnam is currently connected by five subsea cable systems but, recognising that improved connectivity is essential to the country’s continued growth and success, the government recently announced an objective to have 10 (yes, 10) new subsea cables connecting Vietnam to the world by 20308. The number and date may be to some extent arbitrary—certainly

7 https://jsis.washington.edu/news/reactions-u-scybersecurity-policy-bric-undersea-cable/ 8 https://vietnamnews.vn/society/1657723/viet-namto-have-10-new-undersea-fibre-optic-cable-lines.html

Vietnam is currently connected by five subsea cable systems but, recognising that improved connectivity is essential to the country’s continued growth and success, the government recently announced an objective to have 10 (yes, 10) new subsea cables connecting Vietnam to the world by 2030.

ambitious—but one underestimates Vietnam at one’s peril. According to state-owned Viettel, Vietnam’s undersea cables suffer about 10 incidents per year, each typically taking roughly a month to repair9—for context, the global average is 24 cable faults per week, or about 100 faults annually, worldwide10. The government has the vision and will to rectify the situation.

The new 10,000km Asia Direct Cable, linking Vietnam with China, Japan, Philippines, Singapore, Thailand has recently achieved RFS status and other players are jockeying for position, seeking to get more new systems into the water with a recent announcement, for example, from Singapore’s Keppel and Vietnam’s Sovico11 of their intention to connect Vietnam and Singapore with a new system.

GLOBAL MARKET EFFECTS

While we have considered regionalisation at the political level, cables are not built there. So, in the real world, what is the rest of the world doing while industry behemoths gobble up the available capacity of the major con-

9 https://e.vnexpress.net/news/news/vietnam-sinternet-infrastructure-hangs-by-a-thin-thread-4569266. html

10 https://blog.telegeography.com/what-to-know-aboutsubmarine-cable-breaks

11 https://www.reuters.com/technology/singaporevietnam-firms-talks-new-undersea-cables-sourcessay-2024-12-13/

tractors such as SubCom and ASN?

The first thing to remark upon is that the sheer scale of major new builds is severely testing the ability of the traditional major players, SubCom, ASN and NEC (the “Big Three”) to keep up even with this demand. The bigger buyers, naturally, seek to buy at the lowest possible price and are supported in their efforts to do so by being able to commit to significant ongoing new builds over many years. We see evidence of the effects of this in announcements of capacity expansions, for example, at SubCom12 and ASN13. The evidence is, however, from those who might build independent regional systems, that because such capacity expansions take years to come on stream, and because they may anyway be mopped up by the global platforms, it remains more difficult than it used to be to get a major manufacturer interested in a smaller new build. This is reflected in higher prices for smaller players—and delivery lead times being longer than they used to be.

We also see evidence of increasingly rigorous opportunity qualification

12 subcom.com/documents/2023/SubCom_ Ramps_Up_Production_and_Marine_Fulfillment_ Capabilities_21SEPT2023.pdf

13 https://www.lemonde.fr/en/economy/ article/2024/11/05/asn-strategic-manufacturerof-submarine-telecom-cables-nationalized-byfrance_6731573_19.html

among the Big Three. A request for a rough order of magnitude (ROM) price for a new system that might once have rapidly been turned around with few questions is today met with something that Jerry Maguire’s (no relation) client, Ron Tidwell, might once have said: “Show me the money!”14 Before committing resource even to a ROM, some financial rigor is required to be shown. And, assuming said money is indeed shown, it may still take many months for the ROM to materialise.

There is never any shortage of ambitious thinking among those who would develop submarine cables, but this situation has forced them to think a little more outside the box even than usual. Among the approaches being explored are:

Using disaggregated supply. This means, rather than seeking to engage a big supplier to provide a turnkey delivery, sourcing elements separately and accepting some of the delivery risk associated with that. (About which a little more to follow).

Designing systems for repeaterless technology. By festooning a proposed regional system, the need for repeaters can be designed out of the solution, opening the possibility of someone other than the transoceanic suppliers providing the solution. This eliminates the possibility of longer segments, yes, but permits of much higher fibre counts in the shorter ones, which can reduce unit cost. And drives some interesting thinking around landings.

In response to market shifts, we also see traditional suppliers of repeaterless system increasing their manufacturing capacity and even, working to some extent with Big Three incumbents,

14 https://www.imdb.com/title/tt0116695/quotes/

integrating third party repeaters into their own cables. A tipping point may occur when these players begin to stepup, to offer turnkey delivery, critically taking on the task of assembling the supply chain required for delivery and assuming responsibility for the warranties and liabilities that attach to that. It is beyond the scope of this article to

Enabled by open standards and shifting political and regulatory attitudes, these operators are constructing a complementary and resilient mesh of regional routes that will underpin the modern Internet for a generation.

consider, but one is forced to wonder what the industry might look like at the inevitable point where hyperscaler cable building winds back and the Big Three become hungry again.

CONCLUSION

The global submarine cable landscape is not being shaped solely by hyperscalers or by national or supranational government. Smaller, regional players are innovating with purpose-driven builds that prioritize latency, openness, and localized infrastructure. Enabled by open standards and shifting political and regulatory attitudes, these operators are constructing a complementary and resilient mesh of

regional routes that will underpin the modern Internet for a generation.

It is interesting to note the contrasting responses from the EU, BRICS and Vietnam. While Europe admittedly operates a somewhat more socialist economy than, say the U.S., it is still very much a liberal, market economy, or union of economies. The response here: to direct public funding at private enterprises in support of efforts to increase regional independence, sovereignty and resilience. Contrast this with the response of the Socialist Republic of Vietnam, governed by the country’s only political party, the Communist Party of Vietnam: tell your enterprises (state and privately owned) to get building. Makes one wonder who the free marketeers are, and who the socialists.

Given the first appearance of the first air-gapped cracks in the global platform model15, we are certainly living in interesting times—with plenty more ahead. STF

Currently Director, EMEA, with APTelecom, JOHN MAGUIRE has experience gained across a broad spectrum of telecommunications roles and businesses over the past 30 years. He has sold security and network control software to mobile networks worldwide; established a regional federation fibre network across a family of affiliated telcos and, several times, established interconnect networks and wholesale structures for leading telco brands in new entry and emerging markets. He’s done this in roles across the business: using satellite and cable technology, for OEM and service provider companies and in fixed and mobile domains—including for start-ups and mature companies. His roles have encompassed general management, sales management, direct and indirect sales, business development, market development and operations. A native of Dublin, Ireland, he’s also lived and worked in Australia, UK, Singapore, Hong Kong, Thailand, Qatar, UAE and Malaysia. John holds a B.Tech. degree from University of Limerick in Ireland and an M.A. from Macquarie University Graduate School of Management in Sydney, Australia.

15

https://aws.eu/

10 QUESTIONS WITH DAVID KIDDOO

Talking Submarine Cable Industry with IWCS

Cable & Connectivity Industry Forum’s CEO/Director

As the global submarine cable sector continues to evolve at an unprecedented pace, few events serve as a clearer signal of what’s ahead than the Cable & Connectivity Industry Forum. Organized by IWCS, the Cable & Connectivity Industry Forum brings together top deci sion-makers, innovators, and infrastruc ture builders shaping the future of global connectivity. With the IWCS 2025 Cable & Connectivity Industry Forum on the horizon, we sat down with David Kiddoo, CEO/Director at IWCS, to discuss this year’s focus, industry trends, and what lies ahead for the event—and the ecosystem it supports.

1.

CAN YOU INTRODUCE CABLE & CONNECTIVITY INDUSTRY FORUM 2025 AND EXPLAIN THE CORE MISSION BEHIND THE EVENT?

IWCS organizes the Cable & Connectivity Industry Forum as the premier technology event for the exchange of information about product, material and pro-

cess innovation for cabling and connectivity solutions. The IWCS Technical Symposium Committee generates an extremely high-caliber program for each year’s Forum and the peer-reviewed papers presented during the Technical Symposium remain archived for ongoing research and education. IWCS also provides networking and development opportunities for industry professionals by offering educational webinars and scholarships. If I could summarize our goals in one short phrase, I would say IWCS facilitates the exchange of critical information and professional networking in an effort to grow our industry and enhance the careers for those who are

2.

HOW DOES THE CABLE & CONNECTIVITY INDUSTRY FORUM 2025 DIRECTLY ENGAGE WITH AND IMPACT THE GLOBAL SUBMARINE CABLE MARKET?

The submarine cable market is an important application for long-haul network deployment across wide

regions, particularly for optical fiber cables. The IWCS Forum presents a wide variety of Technical Papers covering innovations in materials selection, cable designs, manufacturing, and deployment challenges for the wide range of thermal, mechanical, exposure stresses and other engineering considerations for submarine cables.

3.

WHAT KEY INNOVATIONS IN SUBMARINE CABLE SYSTEMS OR EMERGING APPLICATIONS WILL TAKE THE SPOTLIGHT THIS YEAR?

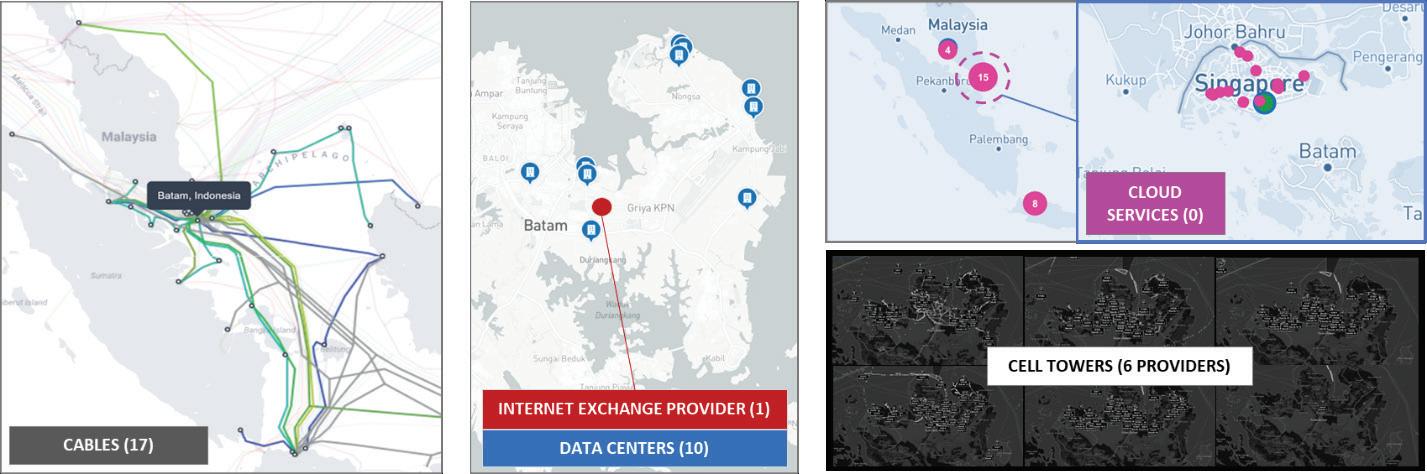

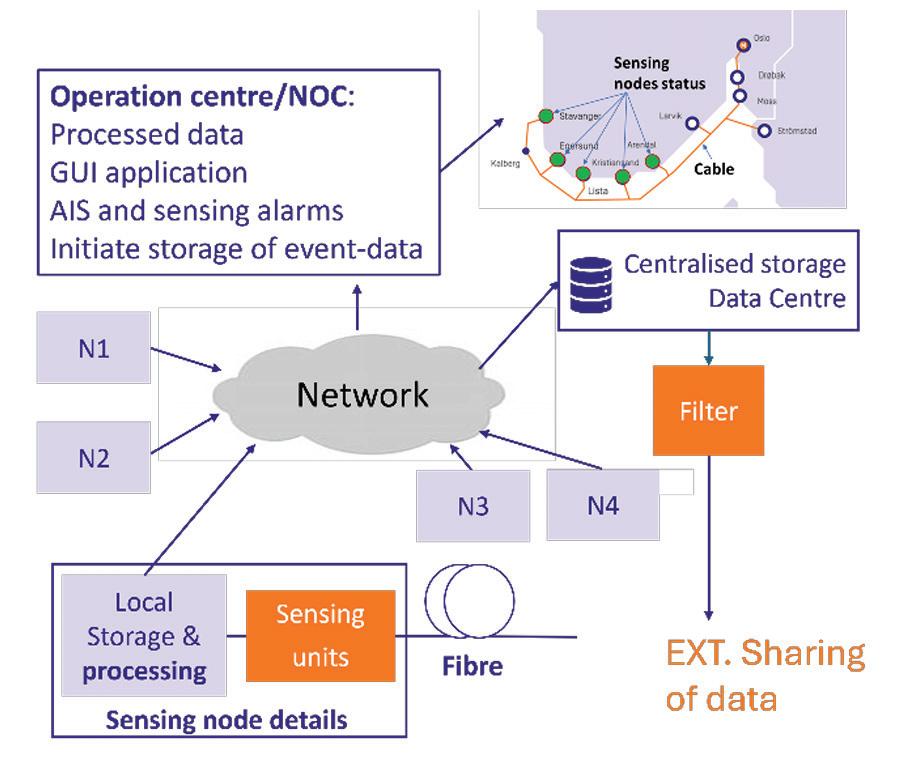

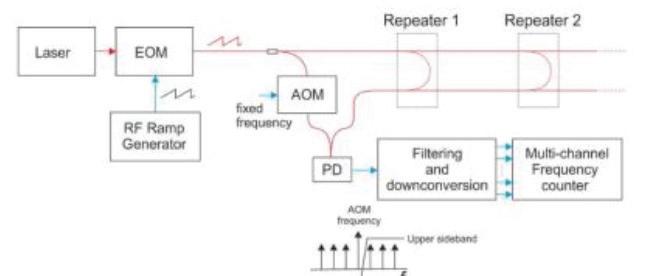

The robust program for this year includes 11 topic-specific Technical Sessions, offering content relevant to a wide-variety of technical-minded professionals working in the cable industry. This includes many presentations relevant to our submarine-specific cable audience that highlight advancements in cable materials and the evaluation of long-term aging under environmental stresses.