Iran my first London Marathon last month. Having lived in the UK years ago I expected the “usual” April cool, rainy weather, but just in case I planned for two other scenarios, including a warm Virginia spring day. And as the day approached I watched as the temperatures slowly climbed higher and higher until the early morning of the race I received a text from the organizers suggesting this may not be a good day for a PR. Needless to say but a warm, sunny spring day which is wonderful for touring is not so ideal for a long run; so, like many I ran simply to enjoy and complete, and of course earn that coveted finishers’ medal. The best laid plans… often go awry!

We mentioned it last issue, but it bears repeating: the new SubTelForum.com is live. With a sleek design, improved navigation, real-time trending topics, and curated Editor’s Picks, it’s built for sharper insights and a smoother experience—on any device. Click here to check it out!

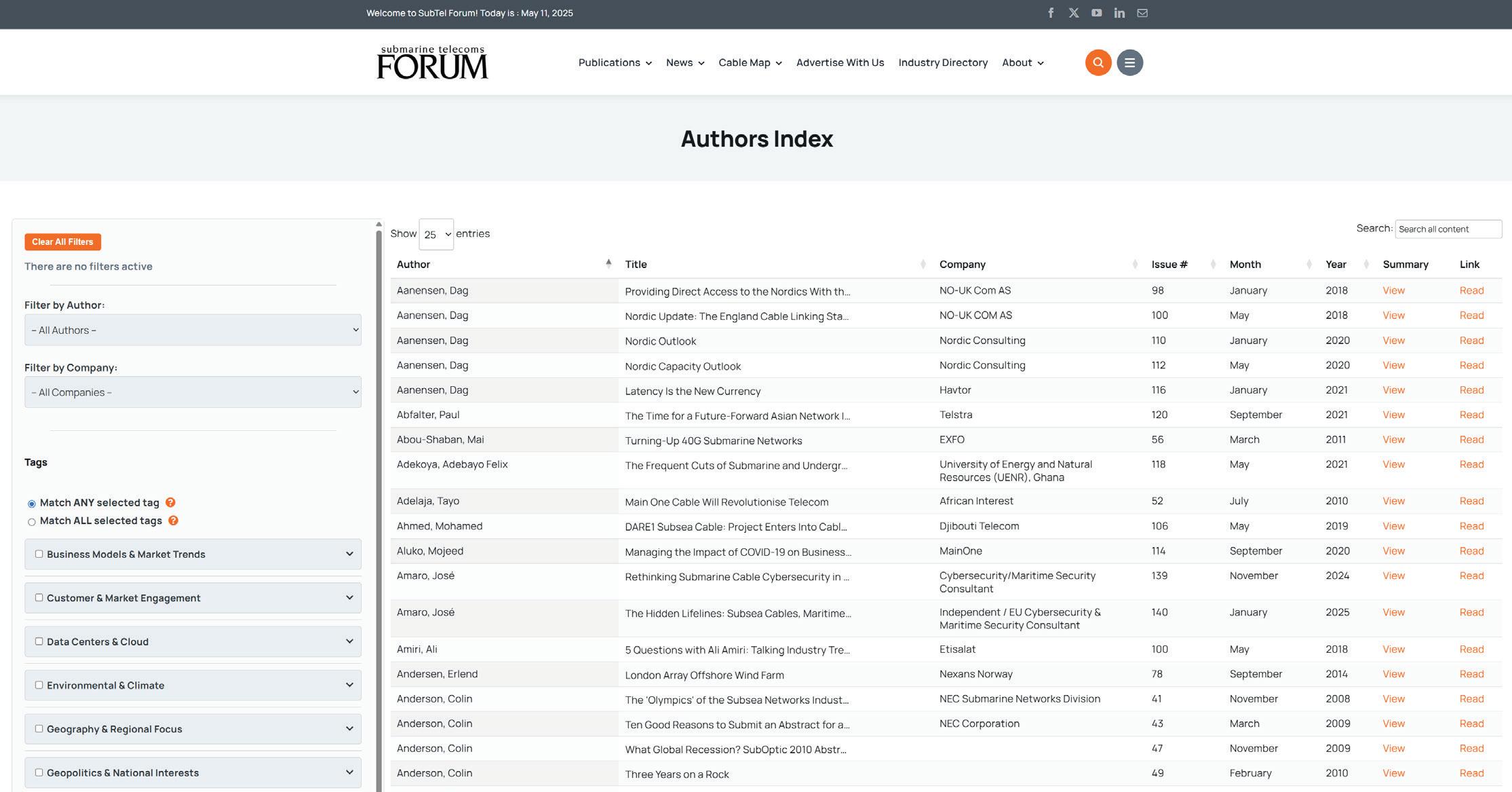

We’ve launched a new Authors Index on SubTel Forum Magazine and our website—a searchable directory that lets readers easily find articles by contributor. It’s a new way to spotlight industry voices and access expert insights. Click here to check it out!

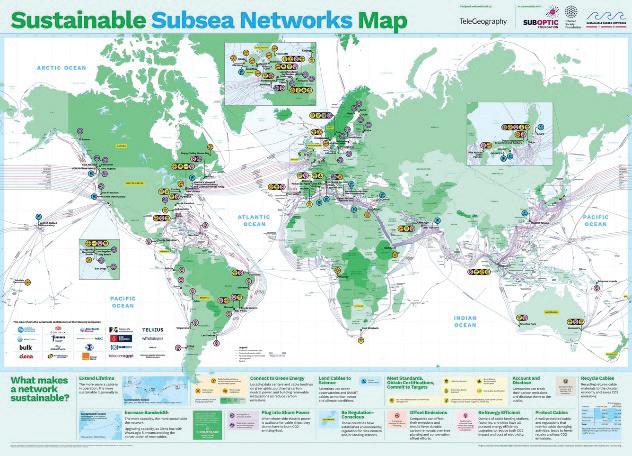

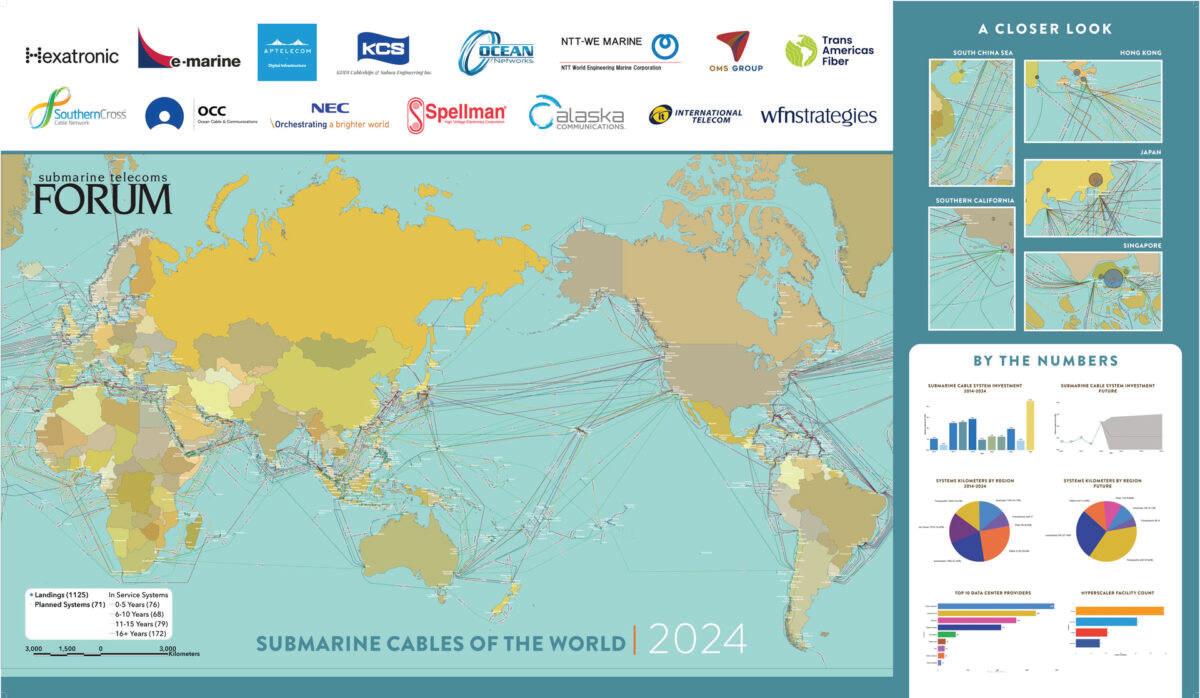

The exclusive SubOptic ’25 Submarine Cable Map is printed and headed to Lisbon, showcasing subsea tech milestones and advancements. Next editions will debut at

Submarine Networks World (Singapore) in September and IWCS Forum 2025 (Pittsburgh) in October. Want your logo featured? Click here to secure your spot!

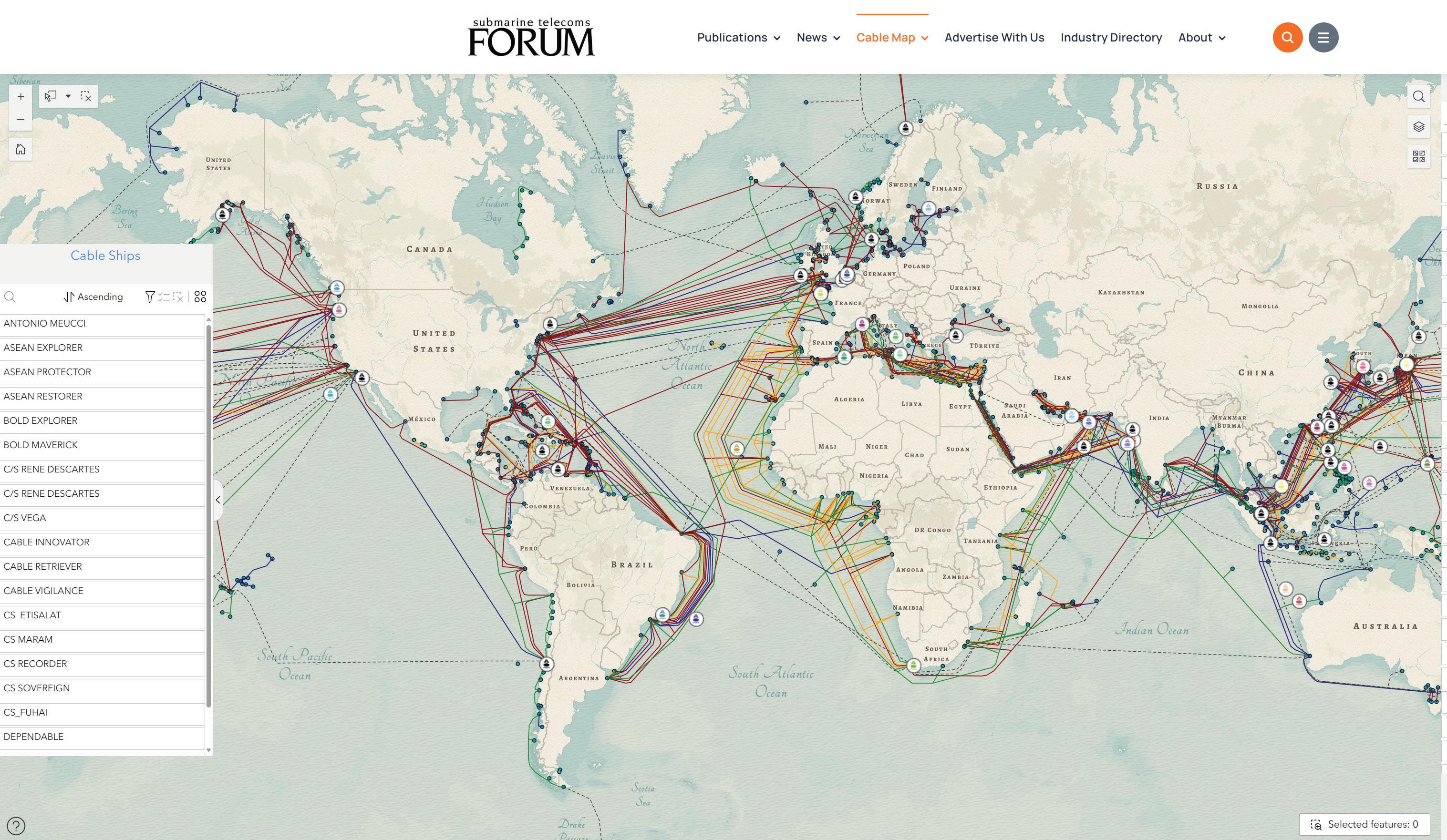

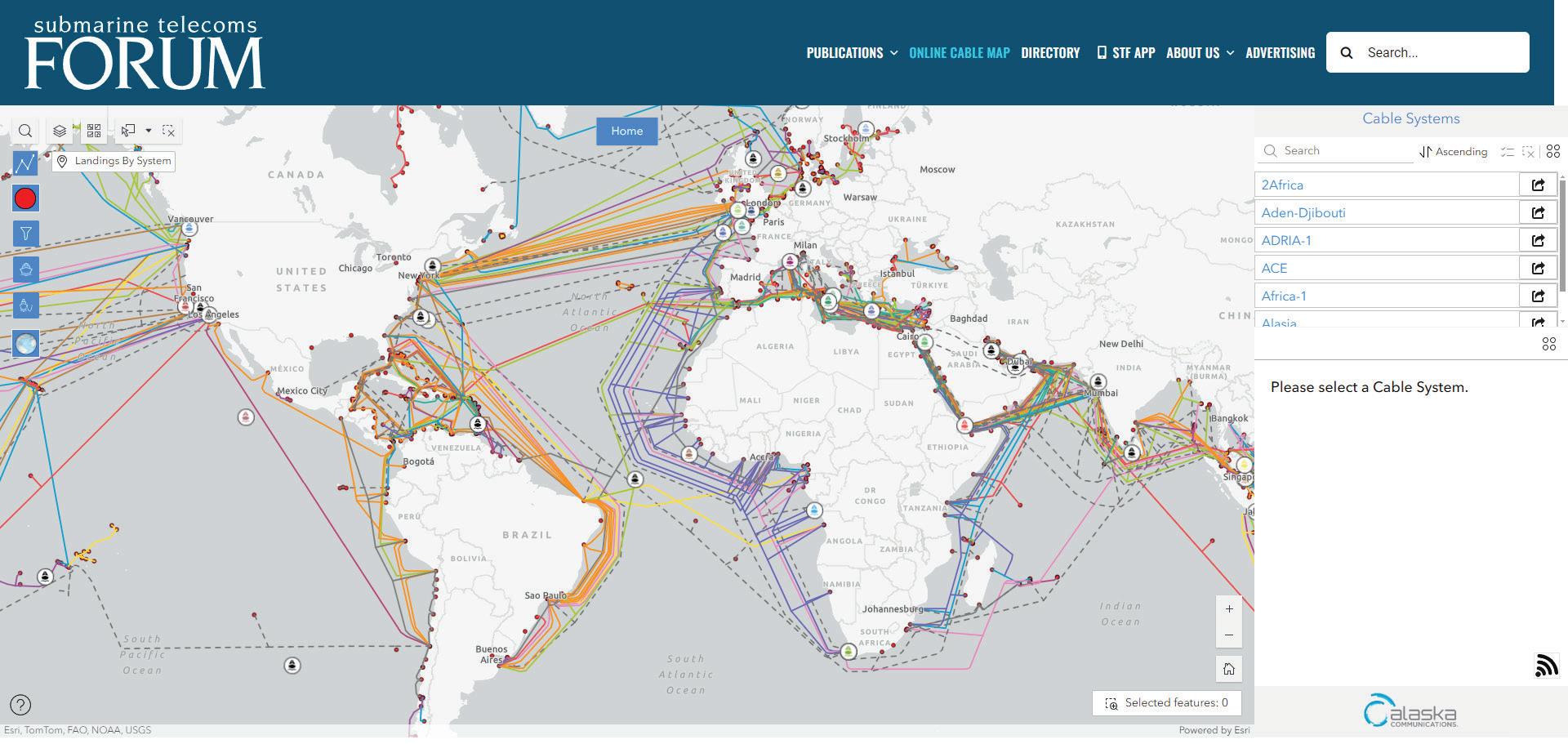

Our updated Online Cable Map is now live featuring a sleeker interface, faster performance, and enhanced usability across all devices. Built using the historical theme featured in the printed SubOptic cable map, the updated design offers a visually rich, intuitive experience that connects past and present global infrastructure. Interested in sponsoring the Online Cable Map? Contact Nicola Tate.

SubTel Forum is once again honored to present the Excellence in Industry Awards at SubOptic 2025—recognizing outstanding contributions across the submarine cable sector. Since 2010, these awards have highlighted the best in thought leadership, innovation, and impact, celebrating individuals and organizations shaping the future of global connectivity. This year’s honorees represent the cutting edge

of subsea communications, and we’re proud to shine a spotlight on their achievements at the industry’s premier gathering.

SubTel Forum is proud to support the University of California, Berkeley’s new Global Digital Infrastructure certificate program—an unprecedented academic initiative focused on the multifaceted world of submarine telecommunications. As the program’s official industry thought partner, we’re contributing editorial resources, decades of archival content, and a platform for emerging voices through our Big Talk essay competition. It’s a meaningful step toward cultivating the next generation of subsea cable leaders, and one we believe will shape the future of our industry.

The 54th Submarine Cable Almanac will be published in May featuring the latest global cable system data. The next edition arrives in August—interested in sponsoring? Contact Nicola Tate.

Thank you as always to our awesome authors who have contributed to this issue of SubTel Forum. Thanks also for their support to this issue’s advertisers: Angola Cable, APTelecom, Fígoli Consulting, FLAG, Hexatronic, Southern Cross, Starboard Marine Intelligence, SubOptic 2025, and WFN Strategies. Of course, our ever popular “where in the world are all those pesky cableships” is included as well.

Good reading and see you in Lisbon –Slava Ukraini STF

Wayne Nielsen, Publisher

A Publication of Submarine Telecoms Forum, Inc. www.subtelforum.com | ISSN No. 1948-3031

PRESIDENT & PUBLISHER: Wayne Nielsen | wnielsen@subtelforum.com | [+1] (703) 444-2527

VICE PRESIDENT: Kristian Nielsen | knielsen@subtelforum.com | [+1] (703) 444-0845

ANALYTICS: Kieran Clark | kclark@subtelforum.com | [+1] (540) 533-6965

SALES: Nicola Tate | ntate@associationmediagroup.com | [+1] (804) 469-0324 subtelforum.com/advertise-with-us

DESIGN & PRODUCTION: Weswen Design | wendy@weswendesign.com

DEPARTMENT WRITERS:

Alice Shelton, Andrés Fígoli, Anup Gupta, Caroline Crowley, Ella Herbert, Kieran Clark, Nicola Tate, Philip Pilgrim, and Wayne Nielsen

FEATURE WRITERS:

Angelo Gama, Derek Cassidy, Geoff Bennett, Italo Godoy, Joel Ogren, Kieran Clark, Kristian Nielsen, Magnus Angermund, Nicole Starosielski, Patricio Boric, Rob Cash, Stuart Barnes, and Wayne Nielsen

NEXT ISSUE: July 2025 – Regional Systems featuring Submarine Networks World 2025 Preview

AUTHORS INDEX: https://subtelforum.com/authors-index

MAGAZINE ARCHIVE: subtelforum.com/magazine-archive

Submarine Telecoms Forum, Inc. www.subtelforum.com/corporate-information

BOARD OF DIRECTORS:

Margaret Nielsen, Wayne Nielsen, Kristian Nielsen and Kacy Nielsen

Contributions are welcomed and should be forwarded to: pressroom@subtelforum.com.

Submarine Telecoms Forum magazine is published bimonthly by Submarine Telecoms Forum, Inc., and is an independent commercial publication, serving as a freely accessible forum for professionals in industries connected with submarine optical fiber technologies and techniques. Submarine Telecoms Forum may not be reproduced or transmitted in any form, in whole or in part, without the permission of the publishers.

New Subscriptions, Enquiries and Changes of Address: 21495 Ridgetop Circle, Suite 201, Sterling, Virginia 20166, USA, or call [+1] (703) 444-0845, fax [+1] (703) 349-5562, or visit www. subtelforum.com.

Copyright © 2025 Submarine Telecoms Forum, Inc.

Liability: While every care is taken in preparation of this publication, the publishers cannot be held responsible for the accuracy of the information herein, or any errors which may occur in advertising or editorial content, or any consequence arising from any errors or omissions, and the editor reserves the right to edit any advertising or editorial material submitted for publication.

By Joel Ogren

By Geoff Bennett

By Kristian Nielsen

Kieran Clark

By Patricio Boric and Italo Godoy

Gama

The most popular articles, Q&As of 2019. Find out what you missed!

Welcome to an exclusive feature in our magazine, where we explore the captivating world of SubTelForum.com, a pivotal player in the submarine cable industry. This expedition takes us on a detailed journey through the myriad of resources and innovations that are key to understanding and connecting our world beneath the oceans.

mapping efforts by the analysts at SubTel Forum Analytics, a division of Submarine Telecoms Forum. This reference tool gives details on cable systems including a system map, landing points, system capacity, length, RFS year and other valuable data.

CONNECTING THE DEPTHS: YOUR ESSENTIAL GUIDE TO THE SUBTEL FORUM DIRECTORY

Keep on top of our world of coverage with our free News Now daily industry update. News Now is a daily RSS feed of news applicable to the submarine cable industry, highlighting Cable Faults & Maintenance, Conferences & Associations, Current Systems, Data Centers, Future Systems, Offshore Energy, State of the Industry and Technology & Upgrades.

Submarine Cable Almanac is a free quarterly publication made available through diligent data gathering and

Submarine Telecoms Industry Report is an annual free publication with analysis of data collected by the analysts of SubTel Forum Analytics, including system capacity analy sis, as well as the actual productivity and outlook of current and planned systems and the companies that service them.

In our guide to submarine cable resources, the SubTel Forum Directory shines as an essential tool, providing SubTel Forum.com readers with comprehensive access to an array of vetted industry contacts, services, and information. Designed for intuitive navigation, this expansive directory facilitates quick connections with leading vendors, offering detailed profiles and the latest in submarine cable innovations. As a dynamic hub for industry professionals, it fosters community engagement, ensuring our readers stay at the forefront of industry developments, free of charge.

2024 marks a groundbreaking era for SubTel Forum with the launch of its innovative app. This cutting-edge tool is revolutionizing access to submarine telecommunications insights, blending real-time updates, AI-driven analytics,

The online SubTel Cable Map is built with the industry standard Esri ArcGIS platform and linked to the SubTel Forum Submarine Cable Database. It tracks the progress of

and a user-centric interface into an indispensable resource for industry professionals. More than just a technological advancement, this app is a platform fostering community, learning, and industry progression. We encourage you to download the SubTel Forum App and join a community at the forefront of undersea communications innovation.

Our journey begins with the News Now updates, providing daily insights into the submarine cable sector. Covering everything from the latest technical developments to significant industry milestones, this feed ensures you’re always informed about the latest trends and happenings. It’s an essential tool for professionals who need to stay on top of industry news.

Dive deeper into the world of submarine communications with our curated collection of articles and Q&As. These insightful pieces offer a comprehensive look at both the history and current state of the industry, enriching your understanding and providing a broader perspective on the challenges and triumphs faced by submarine cable professionals.

• Submarine Cable Almanac: This quarterly treasure trove provides detailed information on global cable systems. You can expect rich content including maps, data on system capacity, length, and other critical details that sketch a vivid picture of the global network.

• Submarine Telecoms Industry Report: Our annual report takes an analytical approach to the industry, covering everything from current trends to capacity analysis and future predictions. It’s an invaluable resource for anyone seeking to understand the market’s trajectory.

• Online SubTel Cable Map: An interactive tool mapping over 550 cable systems, perfect for digital natives who prefer an online method to explore global connections.

• Printed Cable Map: Our annual printed map caters to those who appreciate a tangible representation of the world’s submarine fiber systems, detailed in a visually appealing and informative format.

Explore the Submarine Telecoms Forum Magazine Archive, a comprehensive collection of past issues spanning 23+ years of submarine telecommunications. This essential resource offers insights into project updates, market trends, technological advancements, and regulatory changes. Whether researching industry developments or seeking

expert analysis, the archive provides valuable perspectives on the technologies and trends shaping global connectivity.

Our Authors Index is a valuable tool for locating specific articles and authors. It simplifies the process of finding the information you need or following the work of your favorite contributors in the field.

• Data Center & OTT Providers Report: This report delves into the evolving relationship between cable landing stations and data centers, highlighting trends in efficiency and integration.

• Global Outlook Report: Offering a comprehensive analysis of the submarine telecoms market, this report includes regional overviews and market forecasts, providing a global perspective on the industry.

• Offshore Energy Report: Focusing on the submarine fiber industry’s oil & gas sector, this report examines market trends and technological advancements, offering insights into this specialized area.

• Regional Systems Report: This analysis of regional submarine cable markets discusses capacity demands, development strategies, and market dynamics, providing a detailed look at different global regions.

• Unrepeatered Systems Report: A thorough examination of unrepeatered cable systems, this report covers project timelines, costs, and operational aspects, essential for understanding this segment of the industry.

• Submarine Cable Dataset: An exhaustive resource detailing over 550 fiber optic cable systems, this dataset covers a wide range of operational data, making it a go-to reference for industry specifics.

SubTelForum.com stands as a comprehensive portal to the dynamic and intricate world of submarine cable communications. It brings together a diverse range of tools, insights, and resources, each designed to enhance understanding and engagement within this crucial industry. From the cutting-edge SubTel Forum App to in-depth reports and interactive maps, the platform caters to a wide audience, offering unique perspectives and valuable knowledge. Whether you’re a seasoned professional or new to the field, SubTelForum.com is an indispensable resource for anyone looking to deepen their understanding or stay updated in the field of submarine telecommunications.

BY KIERAN CLARK

The SubTel Cable Map, built on Esri’s ArcGIS platform, offers a dynamic and interactive way to explore the global network of submarine cable systems. This essential resource provides detailed information on over 440 current and upcoming cable systems, more than 50 cable ships, and over 1,000 landing points. Directly connected to the SubTel Forum Submarine Cable Database and integrated with our News Now Feed, the map gives users real-time insights into the industry, allowing them to view current and archived news related to each cable system.

Submarine cables are the backbone of global communications, carrying over 99% of the world’s international data. These cables connect continents and enable the seamless connectivity we rely on for everything from daily communications to critical business operations. Without this vast network, fast, efficient communication between countries and continents would not be possible.

Our analysts work diligently to keep the SubTel Cable Map up to date with data from the Submarine Cable Almanac, along with valuable feedback from users. This ensures a comprehensive and accurate view of the industry, highlighting both the latest deployments and key updates. As the year draws to a close, updates to the map may slow slightly as we move into the holiday season, but our commitment

Submarine cables are the backbone of global communications, carrying over 99% of the world’s international data. These cables connect continents and enable the seamless connectivity we rely on for everything from daily communications to critical business operations.

to delivering timely, reliable information remains as strong as ever.

We also want to highlight that a sponsor slot is currently available for the SubTel Cable Map. Sponsorship offers an excellent opportunity to showcase your organization to a global audience, with your logo prominently displayed on the map and linked directly to your company’s offerings. This is a unique chance to demonstrate your commitment to global connectivity and support for the submarine cable industry.

We invite you to explore the SubTel Cable Map and gain a deeper understanding of the vital role submarine cable systems play in our interconnected world. As always, if you are a point of contact for a system or company that requires updates, please email kclark@subtelforum.com

Below is the full list of systems added and updated since the last issue of the magazine:

We hope the SubTel Cable Map proves to be a valuable resource for you, offering insight into the continually evolving submarine cable industry. Dive into the intricate network that powers our global communications today. Happy exploring! STF

KIERAN CLARK is the Lead Analyst for SubTel Forum. He originally joined SubTel Forum in 2013 as a Broadcast Technician to provide support for live event video streaming. He has 6+ years of live production experience and has worked alongside some of the premier organizations in video web streaming. In 2014, Kieran was promoted to Analyst and is currently responsible for the research and maintenance that supports the Submarine Cable Database. In 2016, he was promoted to Lead Analyst and his analysis is featured in almost the entire array of Subtel Forum Publications.

Do you have further questions on this topic?

MAY 19, 2025

Newly Added Systems:

•E2A

•Pan-Arctic Cable System (PACS)

• Tusass Connect 1

Updated Systems:

•Asia Link Cable (ALC)

•ANDROMEDA

•Arctic Way Cable

•Australia Connect Interlink

•EMC West-1

•EMC West-2

•Honomoana

•Leif Erikson

•Project Waterworth

•Sydney-Melbourne-Adelaide-Perth (SMAP)

BY CAROLINE CROWLEY AND ELLA HERBERT

Power is one of the most significant constraints and enablers of data center growth today. It’s also a touchpoint for digital infrastructure’s community impacts. While there have historically been an array of reasons for opposition to data centers, from noise, land use, and unequal levels of local benefit, the energy issue is now a growing concern.

Despite complaints from residents, data center development remains sought after in many communities due to the billions in tax revenue they produce (PwC 2023). However, the disparity between power demand and grid capacity poses challenges for both data centers and residents. Data centers are critical infrastructures that are only becoming more important as we shift to a digital economy, and utilities are struggling to catch up. This dynamic has significant implications for data center and community relationships as concerns grow over who will foot the bill for this investment. Recent moratoriums and a push for increased regulation in the sector reflect a strain between data centers and the communities they reside in.

Sustainability adds to this another layer of complexity: will the new infrastructure that data centers require aid or inhibit clean energy goals? As development plans are made to accommodate our progressively digital society, will environmental considerations be at stake? In this article from Sustainable Subsea Networks,

a research initiative of the SubOptic Foundation, we track the connections between energy usage, data center growth, and community concerns, and pay attention to their ramifications across the digital infrastructure sectors.

Recent pushback for data center development is increasingly tied to limited electricity supply and subsequent price impacts. In some computing hubs around the world, grid capacity issues have slowed data center expansion, either due to government action or lack of infrastructure. Without careful and active management by utilities and industry members, the explosive growth of data centers can strain the grid and

lead to community resistance.

For instance, Northern Virginia, the largest data center hub in the world, is facing power constraints (Telegeography, 2024). Dominion Energy, the largest utility in the state, issued a warning in 2022 that it may not be able to meet power demands in Ashburn, Virginia (Judge, 2022). Since then, it has nearly doubled its data center capacity under contract and increased its forecasted spending until 2029 by 16 percent (Skidmore, 2025). In the face of electricity strain, Virginia is spending more and more to keep up with demand.

In contrast, Dublin, Ireland serves as an example of a different government reaction to data center demand outpacing grid capacity. The city issued seven system alerts in a year, starting

in December 2020, due to the shrinking gap between electricity needed and electricity produced (Swinhoe, 2022). Due to concerns about power shortages, the state-owned transmission operator EirGrid issued a de facto moratorium on data center development in the city of Dublin from 2022 until 2028. For them, the moratorium was a way to alleviate the pressure on the grid despite the outcry from the data center industry. Dublin had faced significant community opposition to data centers and had protests against data centers even after the effective ban (Riaz, 2022).

Amsterdam is another European hub that issued a moratorium on data centers. In 2019, it suddenly banned all new data center developments, primarily due to concerns around space. While the moratorium has since been lifted, hyperscale facilities are still banned in most of the Netherlands, and the government cited a lack of power capacity as a reason (Gooding, 2024). There appears to be a general discrepancy between the trend toward large hyperscale facilities in the data center industry and the dwindling availability of power in data center hubs.

Singapore’s 2019 moratorium was a result of concerns over the resource consumption and energy demand of data centers (Soares, 2024). While they temporarily halted data center construction, they eventually created a roadmap for sustainable data center development. Their main concerns were focused on environmental damage and water consumption, but the substantial electricity demand drove government action.

Data center capacity constraints can also delay housing projects. In West London, data centers were named as the reason for insufficient electricity capacity for new housing developments by a Financial Times Article (Financial Times, 2022). This appeared to be a grid

management problem – developers did not accurately anticipate the amount of power that would be required by incoming data centers. However, the media coverage of the event highlights how the strain on the grid negatively impacts communities and can lead to frustration with data centers as a result.

While these cases are complex and result from a variety of factors, concern over data center power usage played a role in restrictive action or negative sentiment against the sector. These cases reveal the importance of building relations with residents in data center hubs and working to ensure local communities find tangible benefits in the data centers that may require hefty investments in electrical infrastructure.

Utility rate increases from increased data center demand may be passed on to residents. Data centers are a primary driver in the growth of electricity demand – taking up 3% of global draw, according to the latest IER Report – and are cited as the primary driver of electricity demand growth in the United States (IER, 2025). The infrastructure needed to accommodate this new demand will require significant investment, which can play a role in rate increases for residential and high-energy use customers. This is a cause for alarm for residents and may cause the overall tide to turn against data center development, as seen by some new proposed legislation in Virginia.

For instance, Virginia House Bill 1601 would require sound and resource-use assessments, as well as a study on the impact on parks, historic sites, and forestland for any new high-energy use facility. It recently passed both chambers of the Virginia General Assembly but was delayed by

one year by the governor. Senate Bill 1047 would have called in the Department of Energy to investigate the effects and benefits of a data center demand response program; it passed both chambers but was also vetoed. Another proposed bill would have required the State Corporation Commission to evaluate every proposed project over 100 MW and determine whether the state’s utilities could supply its demands (Willams Mullen, 2025). While these bills failed, their proposition and support highlight the significance of local pushback to the growing data center industry (Gooding, 2025).

Virginia’s utilities have also come under scrutiny. A bill was just passed requiring the State Corporation Commission to evaluate if Dominion Energy’s classifications of utility customers are reasonable (HB2084). Subsidies for data centers, funded by taxpayer dollars, may also be a source of dissent for residents. If local communities feel data centers do not benefit them and are a financial burden, they may think their tax money should be redistributed to other sectors.

In a recent development, Dominion Energy proposed new rates in April of 2025 that would include “base rate increases of $8.51 per month in 2026 and $2.00 per month in 2027” and an additional “$10.92 monthly fuel rate increase” for typical residential customers (Dominion Energy, 2025). Inflation, new natural gas builds, and rising demand are all cited as justifications

for these price increases, but data centers could face public blame given the controversy thus far.

In the court of public opinion, data centers are fighting a battle on both sides with–facing limitations with grid capacity that could increase electricity rates and isolation from the communities they reside in. Proactive and collaborative efforts are needed with both utility infrastructure and community relations for any solution that includes continued growth.

And solutions vary. Government oversight can help minimize community impact, especially when it comes to price hikes. By limiting the ability of utilities to overcharge customers or reworking the historically discounted electricity rates granted to data centers, legislation can keep local changes in check. This is especially key in instances where large corporations like Google, Meta, and Amazon begin developments in smaller residential areas. For instance, California’s proposed Senate Bill 57 would establish a special rate structure for data centers in order to limit cost shifts to residents and small businesses (CA 57). Utilities are able to take the first step as well. New forms of Power Purchasing Agreements (PPAs) and rate structures can reallocate costs for new energy infrastructure away from residents living near data center hubs. Last year, American Electric Power of Ohio proposed that new data center campuses agree to a 10-year commitment to pay at least 90% of monthly electricity costs up front, regardless of final usage (AEP Ohio, 2024).

Clashes between utilities and data center power demands are a wellknown issue throughout the industry. Our team witnessed this during recent conversations at Data Center Dynamics in New York this past March. One

specific conversation about potential improvements in data center demand revolved around “duplicate demand.”

As noted by Jerri Negash, a senior associate at the Emerald Strategy Group, this occurs when a data center is searching for the same quantity of power as a colocation data center that could lease capacity to them.

By limiting the ability of utilities to overcharge customers or reworking the historically discounted electricity rates granted to data centers, legislation can keep local changes in check.

A possible solution to this conflict that is being explored is data centers bringing their own power to the table in the face of a deficit. However, issues arise from the high concentration of skilled labor needed, the long-term management of the infrastructure, and changing relationships with the grid. Overall, there appears to be a missing link between data centers and utility operators that could be further amplified by new data-center-owned power developments. With a potential hike in prices on the horizon, community engagement is more crucial than ever.

The sustainability of the electricity being used to power data centers plays a growing role in local opinion

as well. Many large data center companies have ambitious net-zero and ESG goals. However, in the scramble to keep up with demand, both utilities and data center companies may struggle to pivot to renewable energy in time. As a result, there have been several cases of data center demand spurring the continuation and expansion of fossil fuel energy sources.

Northern Virginia’s “Data Center Alley” is predicted to house “nearly half (45%) of new data center electricity demand through 2035.” Furthermore, the grid operator in the region,110 PJM Interconnection, has moved to delay the planned retirement of Brandon Shores and H.A. Wagner power plants by four years, from May 31, 2025, to May 31, 2029, due to local grid reliability concerns (Talen Energy, 2025). PJM cited “unprecedented” data center growth as a primary driver of load growth in its Reliability Analysis (PJM Interconnection, 2023).

In Omaha, where two large data centers are operated, a coal plant projected to close in 2023 was extended until 2026. The utility claimed there was not enough clean energy to support demand, and residents were quick to blame the data centers since they occupy two-thirds of the projected growth in demand (Halper, 2024).

Entergy and ExxonMobil are building up natural gas infrastructure specifically for data centers (Skidmore 2025). While an improvement from coal, natural gas emissions remain quite significant. Building large amounts of natural gas infrastructure rather than renewables is contrary to the environmental goals necessary to limit global warming.

In the coming years, this environ-

mental progress may slow, at least in the United States. A recent executive order as part of the U.S. “national energy emergency” aims at expanding the output and export of coal, postponing the retirement of older coal plants. The order specifically cites the need to power “artificial intelligence data centers” as part of its motivation and also temporarily suspends previous requirements for these plants to reduce emissions of toxins (The White House, 2025).

It is important to recognize that data center owners also hold significant potential to contribute positively to sustainability. As infrastructure expands to keep up with demand, data centers could also spur more investment in renewables. Many large companies are already doing this through Power Purchase Agreements (PPAs), but their progress could be counteracted by utilities retaining power plants to stay on track with demand. While some key players are increasingly prioritizing sustainability, the sector as a whole may still face challenges in sustainable energy development as a result of grid capacity limits.

But location is everything. The siting of generation facilities is crucial, with impacts to communities dependent on placement in regions with varying demographics and demand. Clean energy developments are not necessarily being put in high-demand areas. At a company-wide level, data center businesses may meet their own net-zero goals by emitting in certain communities and offsetting with clean energy infrastructure in others – thus contributing to an environmental justice problem.

For example, residents in Omaha face high rates of health problems from the pollution of fossil fuel plants that are not alleviated by renewable contracts in Europe. While data centers have a large potential positive impact through PPAs, these PPAs can have a larger impact if they are strategically placed in communities that do not have a significant pre-existing renewable sector.

As global weather patterns change and extreme temperature spikes become more common, high-power draw from residences to data centers could also present additional strain on local grids.

Areas dependent on electric cooling and heating to maintain safe indoor temperatures put residents at risk should cooling for computing come to compete with residential needs. This possibility has been highlighted in Texas after the rolling blackouts of the 2021 winter storm Uri. Proposed legislation would require data center developers to pay a grid connection fee, develop a voluntary program that pays large users like data centers to reduce consumption during periods of grid strain, and allow administrators to require data centers to switch to backup generators or curtail power usage during temperature swings (Hao, 2025).

The stakes are high in Northern Virginia and around the world. Data center growth could strain the grid, raise utility prices, and counteract sustainable development. If community resistance to data center growth grows, there could be a shift to new locations for development, as seen by the new proposed regulations in Virginia and moratoriums in hubs across the world.

If internet infrastructure development is to advance in these places, developers and communities must be on the same page. Engaging with the communities in which the digital infrastructure resides is crucial now more than ever.

There have been many attempts to remedy the community engagement disconnect in place across the data center industry. One sector that plays a growing role is consulting, with community engagement becoming a service provided by various companies with data center clientele. company working to resolve the conflict between data centers and opposition from local communities is the sustainable consulting firm ERM. In their work to help data center developers gain local support, they emphasize the importance of identifying and considering the individuals and groups that are impacted by data center development (Mullard, 2024).

In a recent article, Boston Consulting Group also identified community engagement as a barrier to data center growth (Lee, 2025). They outlined a potential solution of working with utilities and regulators to design equitable power rates that shield residents from price hikes and less reliable power. Proactive engagement with communities was also suggested as a path for action.

Improvement in community engagement is an industry-wide target, and there are currently awards and scorecards that aim to incentivize internal improvement in this sector. Data Center Dynamics includes Community Impact as an award category and aims to evaluate where data centers have become “true stewards of the community they serve.” DataCloud is another organization with an Excellence in Community Engagement award. Academia can also play a role as

a mediator, as shown by the work of the MIT Renewable Energy Facility Siting Clinic. Classified as a “public service center,” it acts as both a connection point and a source of advising for industry, government, and citizen stakeholders. In addition to its mediation and research work for clients, the organization hosts open-attendance forums and an open-access course on resolving clean energy siting disputes.

While there are many new and proposed avenues to address the need for community engagement, there remains much work to be done. As data center demand continues to climb, the grid will need to expand to keep up. If the price of expansion is passed onto residents who do not gain any benefits from data centers in their communities, more pushback could be seen in the form of regulations and even moratoriums. As the industry faces its power capacity problems, we believe the issue is more than just a technical one. It should also be considered from a sustainability and community engagement perspective. Collaboration with academia, third-party groups, utilities, and community members could help forge a way forward that benefits all stakeholders.

At this crucial moment in the climate fight, new infrastructure plans are a fork in the road to a sustainable society. We ask: is it possible for the data center industry to play an active role in steering development toward a greener future that prioritizes local communities? STF

This article is an output funded by the Internet Society Foundation.

CAROLINE CROWLEY is an undergraduate student at the University of California, Berkeley pursuing a B.S. degree in Environmental Economics and Policy. She works as a research assistant with the

SubOptic Foundation’s Sustainable Subsea Networks team. Her work analyzes global, national, and local policies regulating the environmental sustainability and resilience of digital infrastructure.

ELLA HERBERT is an undergraduate student at the University of California, Berkeley, pursuing her B.S. in Environmental Science. She is currently a research assistant for the SubOptic Subsea Sustainable Networks team, focusing on data center sustainability by exploring metrics, industry trends, and publications within the field of telecommunications.

REFERENCES:

AEP Ohio. (2024, May 13). AEP Ohio files plan to secure grid resources for data centers, protect residential customers. [Press Release] https://www.aepohio.com/ company/news/view?releaseID=9539#:~:text=Under%20 the%20proposal%2C%20data%20centers%20would%20 be%20required,service%20territory%2C%20especially%20 in%20the%20Central%20Ohio%20region.

California Legislature (2025) SB 57: Electrical corporations: tariffs. Legislative Information System. https://legiscan.com/CA/text/SB57/id/3044106

Dominion Energy. (2025, April 1). Dominion Energy Virginia proposes new rates to continue delivering reliable service and increasingly clean energy [Press release] https://news.dominionenergy.com/press-releases/pressreleases/2025/Dominion-Energy-Virginia-proposesnew-rates-to-continue-delivering-reliable-service-andincreasingly-clean-energy/default.aspx

Financial Times. (2022, July 28). West London faces new homes ban as electricity grid hits capacity. https://www. ft.com/content/519f701f-6a05-4cf4-bc46-22cf10c7c2c0

Good, Q., Neumann, J., Scarr, A., Cross, R. J., Frontier Group, Environment America Research & Policy Center, & U.S. PIRG Education Fund. (2025). The surging environmental and consumer costs of AI, crypto and big data. Retrieved from https://publicinterestnetwork. org/wp-content/uploads/2025/01/Big-data-centers-bigproblems-January-2025.pdf

Gooding, M. (2024, August 22). The ongoing impact of Amsterdam’s data center moratorium. Data Center Dynamics. https://www.datacenterdynamics.com/en/ analysis/the-ongoing-impact-of-amsterdams-data-centermoratorium/

Gooding, M. (2025, January 20). Legislation proposed in Virginia to regulate data centers, ease grid concerns. Data Center Dynamics. https://www.datacenterdynamics.com/ en/news/virginia-data-center-laws/

Halper, E. (2024, Oct 12). Big tech’s data centers keep coal alive in omaha. The Washington Post Retrieved from https://www.proquest.com/newspapers/big-techs-datacenters-keep-coal-alive-omaha/docview/3115602739/se-2

Hao, C. (2025, March 28) Texas Senate propose new regulations to protect the power grid from huge data center demand growth. Houston Chronicle. Retrieved from https://drive.google.com/ file/d/1WqpzFZ2YzwZtEpTd5F-VZcyT4wlosKWI/ view?usp=sharing

International Energy Agency. (2025). Electricity 2025. In Gas, Coal and Power Markets (GCP) Division & International Energy Agency, Electricity 2025. https://iea. blob.core.windows.net/assets/0f028d5f-26b1-47ca-ad2a5ca3103d070a/Electricity2025.pdf

Judge, P. (2022, July 29). Dominion Energy admits it can’t meet data center power demands in Virginia. Data Center Dynamics. https://www.datacenterdynamics.com/en/ news/dominion-energy-admits-it-cant-meet-data-centerpower-demands-in-virginia/

Lee, V., Seshadri, P., O’Niell, C., Choudhary, A., Holstege, B., & Deutscher, S. A. (2025, February 5). Breaking barriers to data center growth. BCG Global. https:// www.bcg.com/publications/2025/breaking-barriers-datacenter-growth

Mullard, Z (2024, January 17) Partnering with communities in data center development. . ERM. https:// www.erm.com/insights/partnering-with-communities-indata-center-development/

PJM Interconnection. (2023, December 5).Item 15 - Reliability Analysis Update 2022 Window

United States. Data Center Coalition. https://static1. squarespace.com/static/63a4849eab1c756a1d3e97b1/t/ 65037be19e1dbf4493d54c6e/1694727143662/DCCPwC+Impact+Study.pd

Prince William County Government. (DPA202100020: Data Center Opportunity Zone Overlay District Comprehensive Review. https://www.pwcva.gov/ department/planning-office/data-center-overlay-districtcomprehensive-review

Riaz, A. (2022, November 16). Protest against lifting ban on data centres in South Dublin amid blackout fears. Irish Independent. https://www.independent.ie/regionals/dublin/ dublin-news/protest-against-lifting-ban-on-data-centresin-south-dublin-amid-blackout-fears/42149470.html

Skidmore, Z. (2025, February 14). Dominion Energy nearly doubles data center capacity under contract to 40GW. Data Center Dynamics. https://www.datacenterdynamics.com/ en/news/dominion-energy-nearly-doubles-data-centercapacity-under-contract-to-40gw/

Skidmore, Z. (2025, January 11). Diversity of power - the biggest data center energy stories of 2024. Data Center

data-centers-the-end-of-the-road/ Talen Energy Corporation. (2025, January 27). Talen Energy, Other Parties Reach Reliability Must Run Settlement Agreement for Brandon Shores and H.A. Wagner Power Plants [Press release]. Talen Energy Corporation.

TeleGeography. (2024). State of the Network 2024. https://www2.telegeography.com/hubfs/LP-Assets/ Ebooks/state-of-the-network-2024.pdf

The White House. (2025, April 8). Reinvigorating America’s Beautiful Clean Coal Industry and Amending Executive Order 14241. Retrieved from https:// www.whitehouse.gov/presidential-actions/2025/04/ reinvigorating-americas-beautiful-clean-coal-industryand-amending-executive-order-14241/ Virginia General Assembly. (2025). HB2084: Public utilities; SCC to determine if using reasonable classifications of customers. Legislative Information System. https://lis.virginia.gov/bill-details/20251/ HB2084

BY KIERAN CLARK

The global subsea cable network—the invisible backbone of the internet—relies on a small fleet of specialized vessels for cable installation, inspection, and maintenance. These cable ships play a vital role in ensuring connectivity between continents, yet their operational patterns remain difficult to interpret. Most tracking is based on AIS (Automatic Identification System) data, which shows where ships are and how fast they’re moving, but offers little direct information about what the vessels are actually doing.

This article presents the results of a geospatial analysis of over 7,500 AISbased data points, focused on identifying where cable ships gather, how their behavior varies by region, and what their proximity to infrastructure might reveal about their operational roles. The goal is not just to observe where ships are located, but to interpret the likely purpose of that presence—whether conducting cable repairs, deploying new systems, or awaiting assignment.

AIS data was collected at six-hour intervals, creating a consistent global dataset of vessel locations, speeds, and identities. Points where ships moved slowly for extended periods were flagged as potential operations or staging events. To understand what may have been happening during those periods, each data point was compared against a global list of known cable depots and cable factories.

If a ship remained within 50 kilometers of a depot or factory for more than 24 hours, it was assigned a projected classification:

• Installation if near a factory

• Maintenance if near a depot

• Unclassified if no infrastructure was nearby or conditions were inconclusive

• Installation was prioritized if both a factory and depot were in range, based on two factors: the understanding that some factories can supply spare cable for repairs, and the assumption that when a ship is located near a factory-adjacent area—such as Calais—it is more likely preparing for a new installation than conducting a repair

The 50 km proximity threshold was chosen to account for uncertainty in infrastructure coordinates and minor inaccuracies in AIS-reported vessel positions. Some facility

coordinates are approximate, and vessel paths may not consistently align to specific berths or harbors, especially when drifting at low speed. A 50 km radius offers a reasonable balance—close enough to indicate likely association, but broad enough to avoid false exclusions.

This type of spatial behavior analysis is widely used in other sectors. In the logistics industry, for example, analysts routinely map vehicle dwell times near distribution centers to infer unloading, refueling, or staging activity. In fisheries management, vessel clustering patterns near known reef or spawning zones are used to monitor effort and enforce quotas. The benefits of such approaches include better situational awareness, performance monitoring, and resource allocation—all of which are applicable to cable fleet management. By applying this method to cable ships, we can begin to build a clearer picture of where global operations are concentrated, how they relate to infrastructure, and what behavior patterns emerge over time. The following sections explore the results of this analysis in detail, beginning with a geographic overview of ship activity worldwide.

To establish a geographic baseline for cable ship be-

havior, this analysis begins with a spatial overview of over 7,500 AIS-tracked data points from multiple vessels. These points represent locations where vessels were stationary for extended periods or operating within proximity to known infrastructure. The map below displays the global distribution of these data points and provides a visual reference for assessing where cable ship activity is concentrated.

Each point is color-coded according to the projected activity classification applied during post-processing:

• Blue: Projected Maintenance Activity

• Green: Projected Installation Activity

• Gray: Unclassified Activity

In addition, the map includes infrastructure reference points:

• Wrench icon: Cable Depot

• Factory icon: Cable Factory

Several areas of high-density data points are visible. South and Southeast Asia show a high concentration of points associated with projected maintenance activity, frequently in the vicinity of cable depots. Similar patterns are present in the Eastern Mediterranean and along parts of the North Atlantic, where data clusters are also observed

near known depot locations. East Asia displays a mix of classifications, with both installation and unclassified points appearing in nearshore zones, some of which are adjacent to cable factories.

Other areas with visible concentrations include the Bay of Bengal, the Western Indian Ocean, and segments of West Africa and Northern Europe. These distributions suggest repeated presence of cable ships in these regions during the timeframe captured by the AIS dataset.

The geographic layout of observed behaviors serves as a foundation for further analysis. It establishes where ship activity occurs most frequently and offers spatial context for interpreting the classifications and facility relationships explored in subsequent sections.

With the spatial footprint established, the next phase of analysis focuses on interpreting the likely purpose behind cable ship behavior. Each of the 7,608 AIS-based data points was categorized into one of three projected activity types—Maintenance, Installation, or Unclassified—based on a combination of infrastructure proximity and post-idle vessel trajectory.

The classification results are summarized as follows:

• Maintenance: 2,363 data points (31.1%)

• Installation: 876 data points (11.5%)

• Unclassified: 4,369 data points (57.4%)

These categories reflect inferred behavior rather than direct reporting. Ships associated with projected maintenance activity typically remained close to depots and displayed routing patterns consistent with return-to-port cycles, nearshore operations, or repeated positioning within known service areas. In contrast, ships associated with projected installation activity were more likely to operate at greater distances from shore, sometimes staging near cable factories or dispersing into deeper ocean corridors following idle periods.

While installation behavior accounts for a smaller share of the dataset, its pattern is more dispersed geographically and often tied to specific cablew corridors or newly built infrastructure. This reflects the episodic and project-based nature of installation missions. By contrast, maintenance activity represents a larger and more sustained operational footprint, suggesting a continuous global demand for cable repairs, inspections, and service continuity.

The observed trend—where maintenance activity is both more frequent and generally located closer to shore—has important implications. Maintenance missions appear to anchor around existing infrastructure nodes, particular-

ly depots, and demonstrate less variability in geographic spread. This concentration implies a persistent, foundational workload underpinning subsea connectivity: the routine detection, mobilization, and resolution of faults.

As subsea cable systems age and traffic demands grow, the need for responsive maintenance capacity remains constant. The presence of these vessels in predictable locations, operating with high frequency, reinforces the ongoing operational burden of keeping the global internet running. It also emphasizes the strategic role of depot locations and resourcing in enabling rapid response.

The large proportion of unclassified points—over half of the dataset—underscores the limitations of AIS-based inference when metadata or standardized vessel reporting is unavailable. However, the patterns that do emerge from classifiable behavior provide valuable insight into the scale, structure, and distribution of global cable ship operations.

After establishing a global overview and a behavioral classification framework, the next step is to examine how projected cable ship activity varies by region. To do this, data points were grouped by AIS Zone—a standardized geographic reference field derived from vessel tracking metadata. For each zone, projected activity types were aggregated to evaluate regional patterns in maintenance, installation, and unclassified behavior.

The visualization highlights substantial variation between regions. In many zones—particularly those encompassing the Bay of Bengal, South China Sea, and Eastern

Mediterranean—maintenance activity accounts for the majority of classified points. These zones include a high number of nearshore operations, often clustered around depots or major cable landing regions. This aligns with observed industry practices, where densely cabled regions with aging infrastructure exhibit consistent maintenance demands.

Other zones, such as East Asia and parts of the Western Pacific, show a greater proportion of installation activity relative to maintenance. These zones often correlate with factory-adjacent points or shipping routes associated with long-haul buildouts. While installation behavior is less frequent overall, it appears more geographically distributed and less tightly clustered than maintenance, consistent with its role in long-distance cable deployment.

The Unclassified category remains significant across nearly all zones. In some regions—particularly Northern Europe, West Africa, and sections of the Indian Ocean— unclassified activity comprises the majority of data points.

This reflects the difficulty of assigning operational context in areas where vessels are present but infrastructure proximity is insufficient or follow-on routing is inconclusive.

These regional breakdowns offer two primary takeaways. First, maintenance activity is both more prevalent and more spatially concentrated, particularly in areas with robust infrastructure networks and fault-prone systems. Second, installation activity is more episodic and spread across fewer zones, indicating a more project-specific footprint. Together, these patterns help explain how operational demands differ geographically and suggest where infrastructure support may need to be strengthened to match observed behavior.

This zonal view also reinforces the importance of improved classification practices. In regions with high levels of unclassified activity, access to more granular vessel logs or project metadata could significantly enhance interpretability and forecasting capabilities.

In addition to geographic clustering, cable ship behavior can also be examined through its relationship with nearby infrastructure—specifically depots and factories. These facilities play a central role in shaping vessel movement patterns. Depots serve as staging and mobilization points for fault response and routine maintenance, while factories support cable loading and the initiation of installation campaigns.

To explore this relationship, each AIS-tracked data point was evaluated for proximity to a known infrastructure location. When vessels were stationary within defined radii of a depot or factory, the location type was recorded. The resulting distribution is shown below.

The majority of data points classified by infrastructure proximity were associated with depots. This indicates that vessels were significantly more likely to remain near depot locations than near factories during periods of inactivity or low-speed movement. Factories accounted for a smaller— but still meaningful—portion of the dataset.

This pattern is consistent with the earlier classification analysis. Projected maintenance behavior was more frequently observed near depots, while projected installation behavior—though less common—was more often associated with factory-adjacent staging. The skew toward depot proximity further supports the conclusion that maintenance comprises the bulk of cable ship operational time, and that depots serve as key hubs for recurring vessel activity.

In contrast, factory-adjacent points tended to be more dispersed and less repetitive, reflecting the episodic nature of cable manufacturing and deployment projects. Ships did not typically linger near factories unless preparing for installation, and their presence in these areas did not occur as consistently or predictably as with depots.

This facility-based view helps explain both the operational logic behind vessel positioning and the infrastructure demands of different mission types. It also reinforces

the importance of maintaining well-distributed depot coverage across high-density cable corridors. Regions lacking nearby depots may see longer fault response times, increased vessel transit delays, or clustering of idle behavior at suboptimal locations.

In total, the infrastructure analysis adds another layer of interpretive clarity: cable ship behavior is not only regionally defined, but also shaped directly by the availability and function of nearby support facilities. Identifying and addressing gaps in this coverage could improve both response efficiency and fleet utilization.

This analysis presents a global view of cable ship behavior using AIS data, focusing on how vessel locations, projected activities, and infrastructure proximity interact across 7,608 observed data points. By classifying behavior into maintenance, installation, and unclassified categories— and mapping these across regions and facility types—it is possible to draw several consistent patterns.

Maintenance activity accounts for the largest identifiable share of behavior and is more likely to occur near depots, in areas with frequent fault management or aging cable systems. Installation behavior, while more geographically

dispersed, appears less frequently and is more commonly observed near factories or staging locations. The map and zone breakdowns reinforce the importance of regional hubs, especially in South and Southeast Asia, the Eastern Mediterranean, and East Asia, where infrastructure and recurring vessel presence overlap.

However, more than half the dataset—57.4% of points— remains unclassified. This reflects a broader industry challenge: much of the vessel behavior data captured via AIS lacks the metadata or reporting standards necessary to confidently determine operational purpose. The absence of explicit activity tagging, mission status, or routine reporting means that large volumes of movement must be interpreted indirectly.

Improving this situation will require better data structures and collaboration. If vessels or operators consistently provided operational context—either through standardized AIS extensions or shared project metadata—the interpretive value of this analysis could increase significantly. Such improvements would support more accurate forecasting,

more efficient fleet utilization, and stronger alignment between infrastructure location and vessel behavior.

As the global communications ecosystem becomes more dependent on reliable, high-capacity subsea systems, the need to understand and plan around cable ship operations will grow. Insights from AIS data already highlight key behaviors and infrastructure dependencies. With better data and classification methods, these insights can evolve into proactive tools for the industry—supporting everything from maintenance resourcing to long-term strategic planning.

STF

KIERAN CLARK is the Lead Analyst for SubTel Forum. He originally joined SubTel Forum in 2013 as a Broadcast Technician to provide support for live event video streaming. He has 6+ years of live production experience and has worked alongside some of the premier organizations in video web streaming. In 2014, Kieran was promoted to Analyst and is currently responsible for the research and maintenance that supports the Submarine Cable Database. In 2016, he was promoted to Lead Analyst and his analysis is featured in almost the entire array of Subtel Forum Publications.

Click here to view the entire 2024-2025 Industry Report

[Reprinted Excerpts from SubTel Forum’s 2024/25 Submarine Industry Report]

CAPACITY

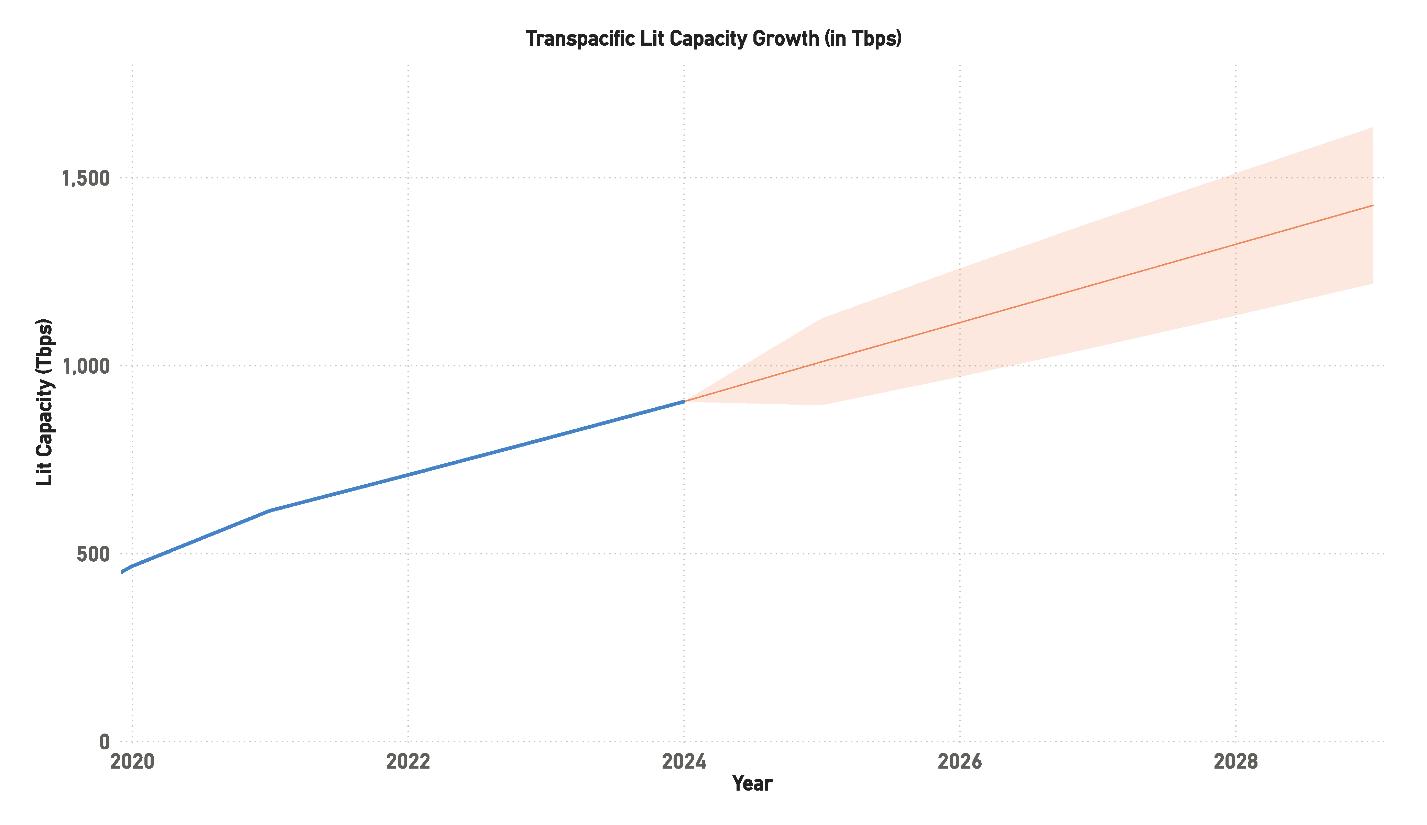

The global demand for data continues to drive substantial growth across major submarine cable routes. From 2020 to 2024, several key trends have emerged that highlight both the opportunities and challenges within the submarine fiber industry.

Transatlantic routes were the only ones to experience

growth in 2023, adding 132 Tbps of capacity. In contrast, other major routes like the Transpacific and AustralAsia saw a year of stagnation before bouncing back strongly in 2024. The Transpacific route is projected to add 384 Tbps in 2024, while AustralAsia will add 284 Tbps, showcasing the increasing focus on routes that connect the Asia-Pacific region with other global markets.

The Americas saw a modest increase in 2024, adding only 12 Tbps. This slower growth trend contrasts with the significant capacity additions seen in previous years, signaling a potential plateau in demand across this route or a shift in investment focus toward other regions.

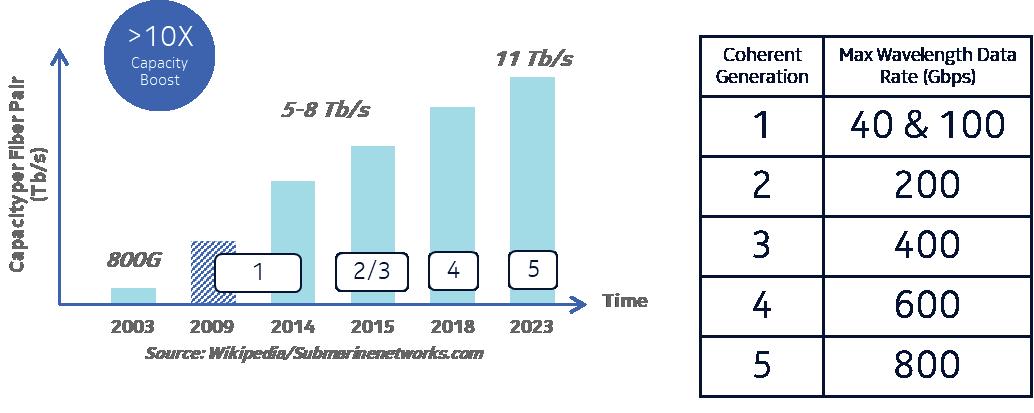

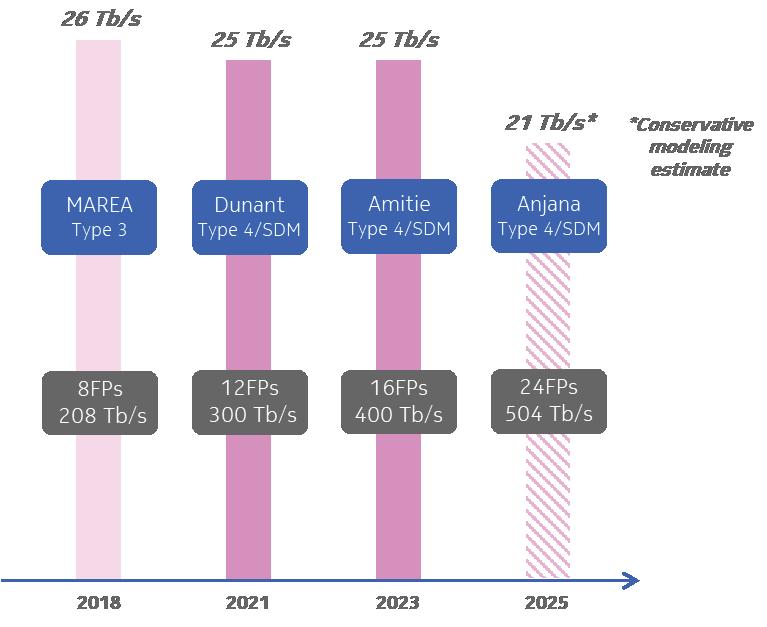

Overall, the capacity growth between 2020 and 2024 highlights the ongoing need for new cable systems and capacity upgrades, particularly in the Asia-Pacific region. The push towards higher-capacity systems, such as those utilizing 400G wavelengths and increased fiber pair counts, remains essential to keeping pace with the world’s ever-growing data transmission requirements.

Additionally, as the industry continues to expand, balancing supply and demand for submarine cable capacity will be a critical factor in determining the future growth trajectory. Ensuring that systems are not only built but also optimized for future scalability will be key to meeting the ongoing demand for data transmission.

Looking ahead, the submarine cable industry is poised to experience significant capacity growth across several key routes by 2025. The Americas route is expected to see the most substantial increase, with 1,122 Tbps of capacity projected to be added. The Transpacific route will follow closely behind with 756 Tbps, while AustralAsia will see an addition of 400 Tbps. This strong capacity growth underscores the industry’s focus on bolstering connectivity across these high-demand regions.

Interestingly, planned capacity additions decrease sharply in the following years. In 2026, only 324 Tbps of capacity is expected to be added on the Americas route, a significant decline from the previous year’s growth. Similarly, 2027 projects a modest increase of 108 Tbps on the Transatlantic route. This suggests that while there is substantial growth on the horizon, much of it will be concentrated in 2025, with a slower rate of new capacity coming online in the subsequent years.

These projections reflect the submarine cable industry’s current development pipeline, which, while impressive in the near term, shows signs of tapering off in the medium term. However, it is important to note that many planned systems have not yet finalized their capacity specifics, meaning there is potential for these numbers to grow as new systems are announced or existing projects reach more advanced stages of development. The adoption of advanced technologies like 400G wavelengths and high fiber pair count systems will continue to play a pivotal role in meeting the ever-increasing global demand for data transmission.

While these figures are substantial, they also indicate the need for continued investment in new systems beyond 2025 to maintain momentum and support future global data growth. The industry will need to focus on ensuring that announced systems are brought to completion and that future projects address both regional connectivity needs and global demand. STF

Since 2020, improvements in data collection have significantly enhanced the accuracy of lit capacity reporting for submarine cable routes, with the average lit capacity now around 61 percent of total design capacity. This reflects growing demand from cloud services, 5G networks, and streaming platforms.

Although the Federal Communications Commission (FCC) has anonymized reporting, reducing visibility at the individual cable level, the overall accuracy of the data has improved. The industry now receives reliable totals for regional and route-level capacity. While this data only covers cables that touch the U.S., as a significant center of the internet, trends observed here often shape broader global patterns.

As the demand for data transmission continues to grow, particularly with the widespread adoption of cloud services, 5G networks, and streaming platforms, it becomes more critical to monitor and project lit capacity with greater accuracy to ensure that submarine cable infrastructures can meet future needs.

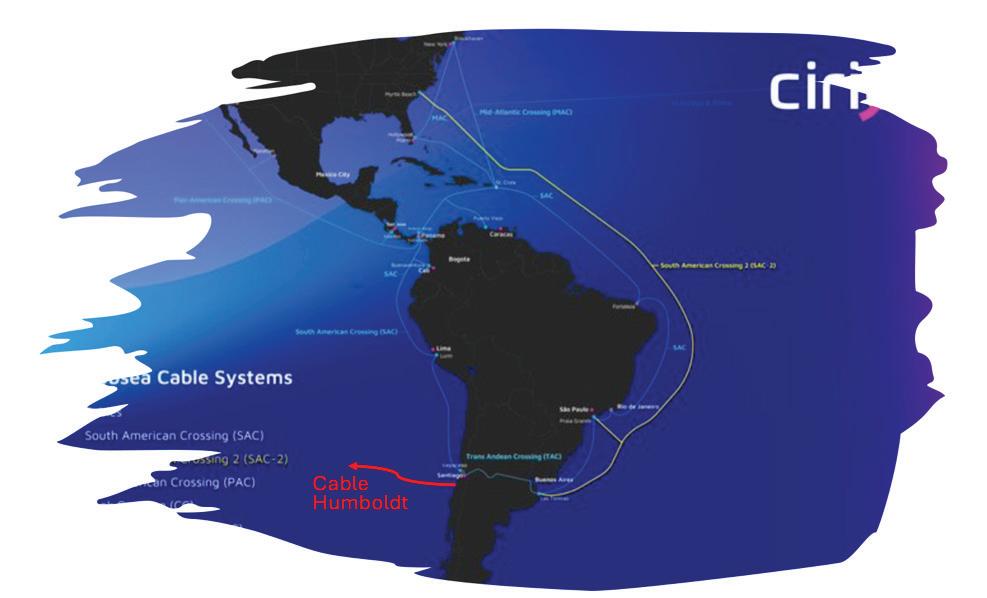

The Americas region has experienced substantial growth in recent years, with total capacity along major routes nearly quadrupling from 233.5 Tbps in 2016 to 803.5 Tbps in 2020. This surge reflects the increasing demand for data transmission capacity across North, Central, and South America, driven largely by the rise of cloud services, data center expansions, and the growing adoption of digital services in Latin America.

From 2020 to 2024, the Americas region has continued to experience significant capacity growth, although the pace has fluctuated. In 2020, total capacity was 913.22 Tbps, with lit capacity at 802.03 Tbps. By 2024, total capacity is expected to reach 1,524.82 Tbps, with lit capacity projected to grow to 1,102.16 Tbps. However, the Compound Annual Growth Rate

(CAGR) for lit capacity shows significant variability during this period. In 2020, the lit capacity CAGR was 29%, but it dropped sharply to 4% in 2021, before rebounding to 16% by 2024.

This volatility in CAGR suggests that while the Americas region is still expanding its total capacity, the pace of lit capacity growth is subject to fluctuations due to economic and political factors, particularly in Latin America. The region has struggled with underutilized capacity, and much of the growth has been concentrated in the United States, where demand remains high. Emerging markets in Latin America have yet to fully realize their potential as major drivers of new system growth, largely due to ongoing economic instability and political challenges.

Hyperscalers have played a key role in driving new capacity growth in the Americas, particularly along North-South routes connecting the United States with key markets like Brazil, Chile, and Argentina. However, many new systems built by Hyperscalers are primarily for their own use, limiting the capacity available for broader market consumption. While these systems are critical for supporting cloud services and data center traffic, they do not necessarily translate into higher lit capacity across the region unless the broader market begins to utilize these resources more effectively.

Looking forward, lit capacity in the Americas is projected to continue its upward trend, but the rate of growth is expect-

ed to slow compared to earlier years. By 2028, lit capacity could reach anywhere between 1,700 Tbps and 2,000 Tbps, depending on regional demand and the extent to which unlit capacity is utilized. The slower growth reflects a combination of factors, including a potential overbuilding of capacity in recent years and the economic and political uncertainties facing key markets in Latin America.

Brazil, Argentina, and Chile have traditionally been the main drivers of new system demand in Latin America, and these markets remain critical for the region’s long-term capacity needs. However, growth in these areas has been

slower than anticipated, largely due to economic constraints. The potential for further growth is there, particularly as Hyperscalers continue to expand in South America, but the full realization of this capacity may take longer than expected.

Much of the new bandwidth expected to be in place by 2025 will likely be concentrated on routes serving the East Coast of the United States, where demand continues to grow. While this offers opportunities for North American operators, it may not significantly benefit markets further south unless broader economic recovery and political stability are achieved in Latin America. The region’s future capacity

growth will depend on how effectively existing infrastructure is utilized and whether new investments are made to expand system capacity.

The total design capacity in the Americas region is expected to grow steadily, with projections suggesting it will reach between 2,000 Tbps and 2,500 Tbps by 2028. This growth is driven primarily by new system builds, upgrades to existing systems, and the increasing demand for data transmission across both North and South America. By 2025, total capacity is expected to reach 1,524.82 Tbps, while lit capacity is anticipated to rise to 1,102.16 Tbps, representing a significant increase over previous years.

However, despite this robust growth in total capacity, the region continues to face challenges in utilizing this capacity effectively. Much of the existing infrastructure remains unlit, with operators hesitant to invest further until demand materializes more fully. This has created a situation where the region has ample potential capacity, but its actual usage remains constrained by external factors, including the pace of economic recovery and technological adoption in Latin America.

The long-term outlook for the Americas remains positive, particularly as demand for data transmission grows in both the North and South. However, the region will need to address the current underutilization of capacity and ensure that future growth is supported by investments in infrastructure and technology to meet the needs of emerging markets.

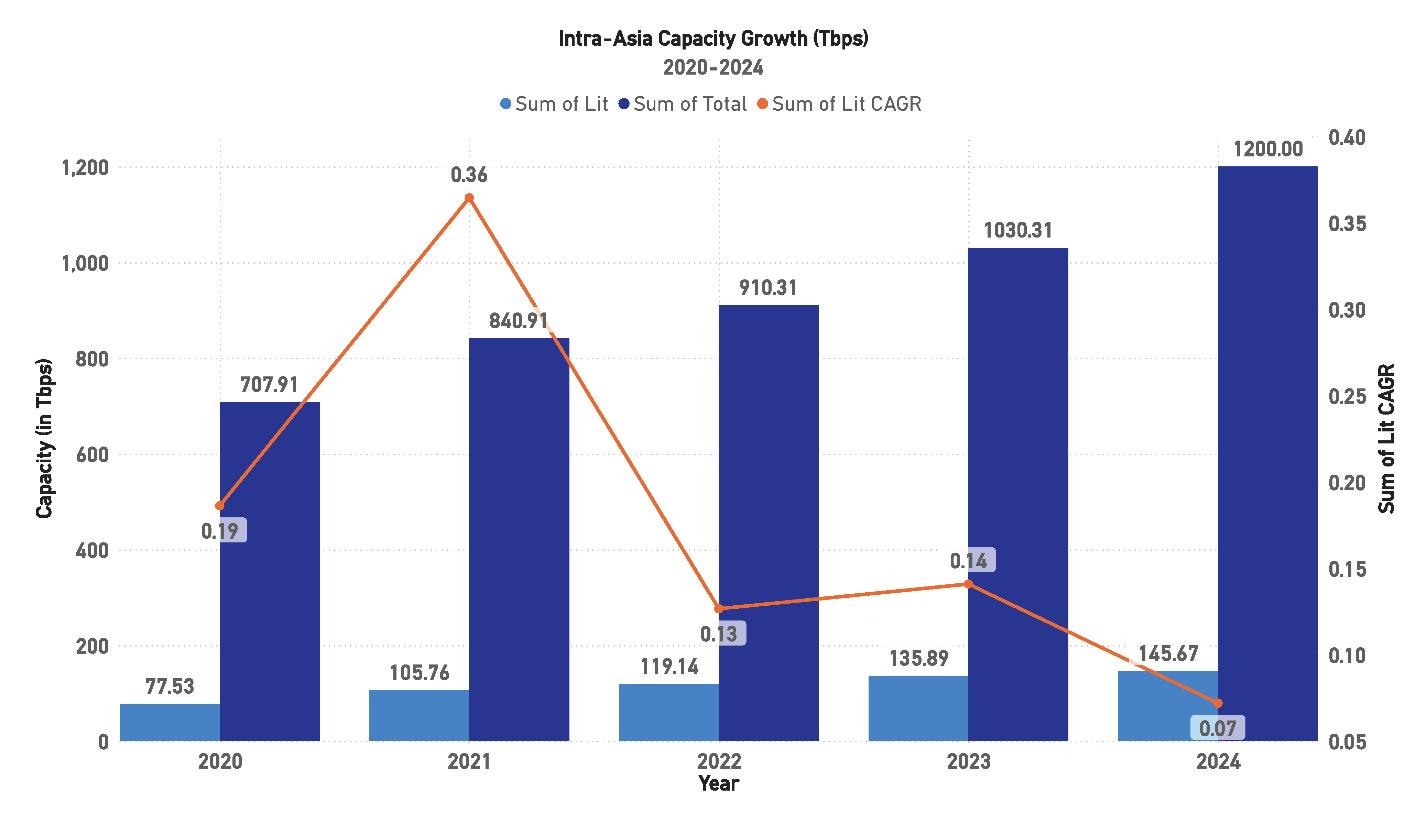

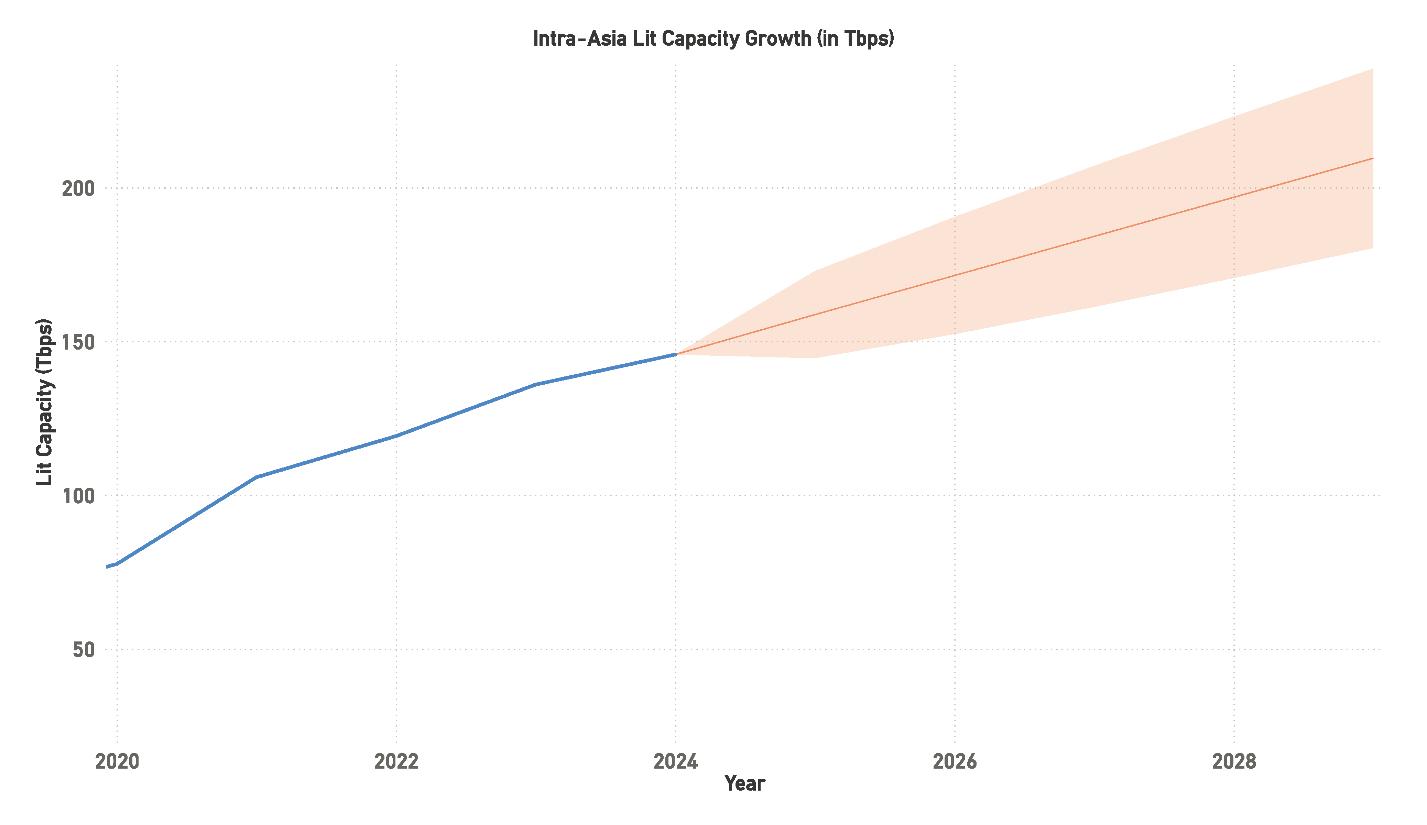

From 2020 to 2024, the Intra-Asia route experienced moderate growth in design capacity. In 2020, total capacity reached 707.91 Tbps, with lit capacity at 77.53 Tbps. By 2024, total capacity is expected to rise to 1,200 Tbps, while lit capacity is projected to grow to 145.67 Tbps. However, the Compound Annual Growth Rate (CAGR) for lit capacity has seen a significant drop during this period. The CAGR for lit capacity was 36% in 2021, but by 2024 it is expected to fall to just 7%.

This fluctuation in growth can be attributed to the irregular nature of infrastructure development in the region. Largescale projects, such as new submarine cable systems, are not developed annually, and the region’s capacity expansion is often tied to the completion of major builds. As a result, growth tends to occur in bursts rather than at a steady pace. Additionally, the relatively low lit capacity as a percentage of total design capacity suggests that there is still significant

room for growth, particularly as more traffic is routed through Southeast Asia’s emerging markets.

Growth along the Intra-Asia route is contingent on significant infrastructure builds that connect major hubs across Asia and Southeast Asia, a development that does not occur annually. The Intra-Asia region has seen periodic surges in capacity growth, driven largely by the need to connect emerging markets in Southeast Asia with established hubs like Singapore, Hong Kong, and Tokyo. However, this growth has been slower and more variable than on other major global routes, reflecting the complexity of building infrastructure in this diverse region.

Despite these fluctuations, the outlook for the Intra-Asia region remains positive, with capacity projected to continue increasing over the next few years. However, the region’s ability to meet growing demand will depend on the timely completion of new systems and the ability of operators to fully utilize the available capacity.

Looking ahead, lit capacity along the Intra-Asia route is expected to grow steadily, with projections indicating that it could reach 200 Tbps by 2028. This growth will be driven by increased demand for connectivity within Asia as well as rising traffic between Asia and other global regions, particularly the United States and Australia. As data consumption

and cloud services continue to expand in markets like India, Indonesia, and Vietnam, the region is poised for substantial growth in both lit and total capacity.

In addition to the new cable systems being developed, technological advancements such as 400G and higher fiber pair counts will also contribute to capacity expansion. These new systems will provide the region with the infrastructure needed to handle future traffic demands, particularly as more data-intensive services, such as 5G and cloud computing, take hold in Asia. However, the region will need to overcome challenges related to regulatory issues and geopolitical tensions, which have the potential to delay the completion of

new systems and impact overall growth.

Total design capacity in the Intra-Asia region is expected to continue its upward trajectory, with projections suggesting that it could reach between 1,500 Tbps and 2,000 Tbps by 2028. This represents a significant increase over current levels, reflecting the region’s growing importance as a hub for global data transmission. By 2025, total capacity is expected to reach 1,200 Tbps, with lit capacity anticipated to rise to 145.67 Tbps.

However, as with other regions, the challenge for Intra-Asia will be ensuring that this capacity is fully utilized. Much of the existing infrastructure remains underutilized, and operators will need to focus on maximizing the use of

available capacity to meet future demand. This will require ongoing investment in both infrastructure and technology, as well as close collaboration between governments, telecom operators, and tech companies to ensure that the region’s capacity needs are met.

The long-term outlook for Intra-Asia is positive, with demand for data transmission expected to grow as emerging markets continue to develop and more traffic is routed through Asia. However, the region’s growth will depend on its ability to address the challenges posed by infrastructure development, regulatory hurdles, and geopolitical risks.

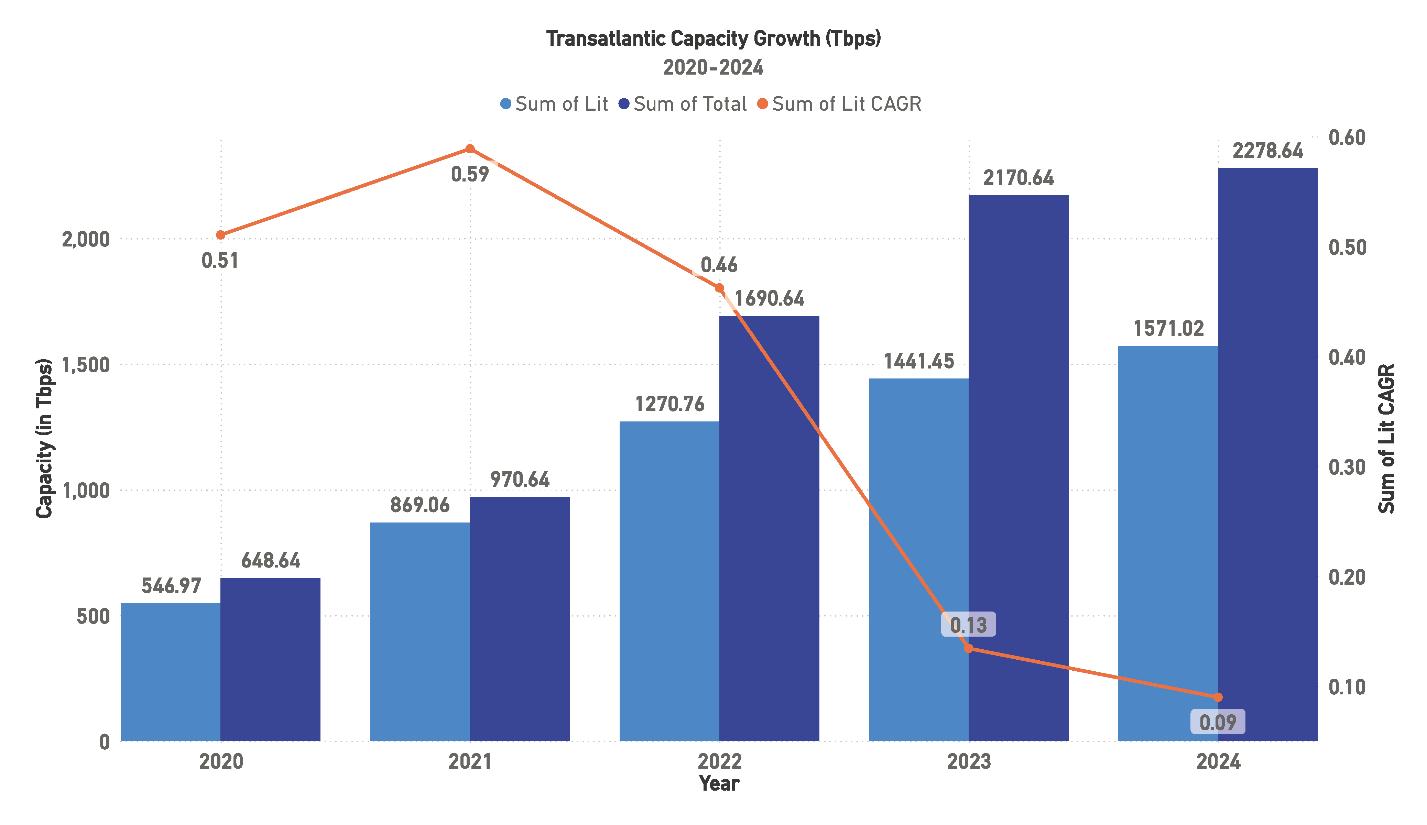

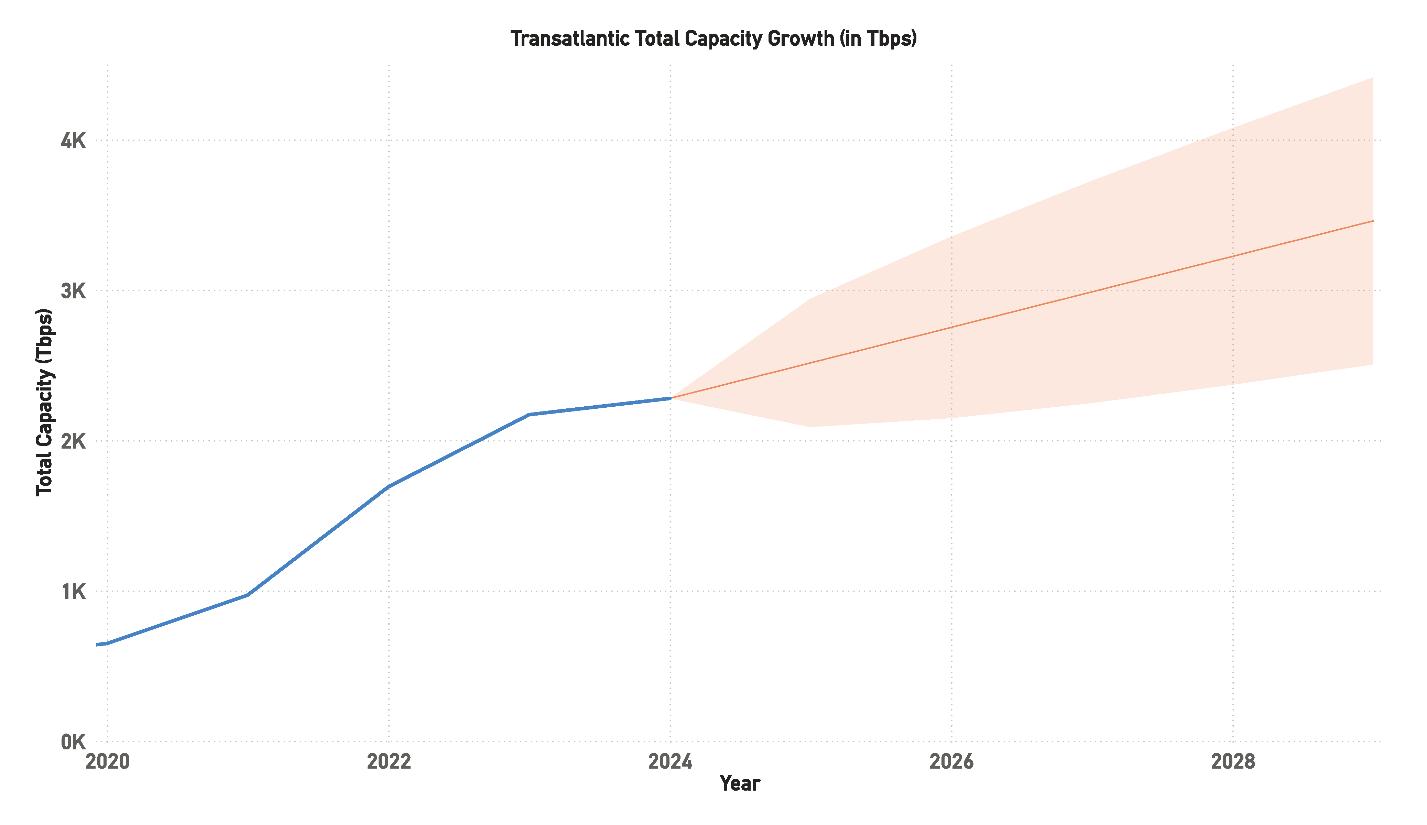

Transatlantic Capacity Growth, 2020-2024

Transatlantic routes are among the most competitive globally, particularly those connecting the major economic hubs of New York and London. These routes facilitate traffic between the highly developed economies and technology markets of North America and Europe, playing a crucial role in sustaining the global digital economy.

From 2020 to 2024, the Transatlantic region has seen strong growth in both lit and total design capacity. This growth is being driven by a surge in demand for data transmission, particularly as more businesses and consumers rely on cloud services, 5G networks, and streaming platforms. The region has historically been a critical corridor for global internet traffic, and this trend continues to hold true.

As of 2024, total capacity has reached 2,278.64 Tbps, while lit capacity has grown to 1,571.02 Tbps, representing a significant increase over previous years. This rise in capacity indicates that cable operators and stakeholders are working to keep pace with the ever-growing demand. However, the Compound Annual Growth Rate (CAGR) for lit capacity has slowed over the past few years. In 2021, the CAGR was at a peak of 59%, but it has since declined to 9% by 2024. This suggests that while capacity expansion is ongoing, the rate of lit capacity growth is stabilizing after the substantial surge seen in the early 2020s.

This leveling off of the CAGR could indicate a more measured approach to future upgrades and deployments,

as cable operators seek to avoid overbuilding. However, it also highlights the importance of closely monitoring capacity trends to ensure there is enough room for future growth. The region’s reliance on these cables means any shortfall in capacity could have significant implications for global internet traffic. Although the total capacity is growing, the industry must ensure that the amount of lit capacity keeps pace with demand. If not, there could be risks of bottlenecks or congestion in the future, particularly as new data-intensive applications and services continue to emerge.

Looking ahead, lit capacity in the Transatlantic region is projected to continue its upward trajectory, though at a slower rate than the rapid growth seen between 2020 and 2022. The forecast suggests that lit capacity could reach anywhere from 2,500 Tbps to 3,000 Tbps by 2028. While this represents a slower growth rate compared to previous years, it still points to a steady expansion of capacity to meet the evolving needs of businesses and consumers.

One of the key drivers behind this growth is the increasing reliance on cloud-based services and platforms, which require massive amounts of data transmission across international borders. Additionally, as more industries adopt digital transformation strategies, the need for reliable and fast data transmission continues to grow. The widespread adoption of 5G networks, which enable faster internet speeds and more efficient data transfer, is another critical factor in this capacity expansion.

However, despite these positive trends, there are risks on the horizon. The growth of lit capacity is expected to slow, which could mean that future capacity needs may outpace what is available, especially if demand continues to rise at

its current rate. If this happens, there could be regional disparities in the availability of high-speed internet, with more developed markets benefiting while underserved regions struggle to keep up. As such, it is essential for stakeholders in the submarine cable industry to plan for both short-term needs and long-term growth to avoid any disruptions or limitations in global connectivity.

The total design capacity of the Transatlantic region is also projected to continue growing over the next several years, with estimates ranging between 3,500 Tbps and 4,000 Tbps by 2028. This growth is driven by the continued introduction

of new submarine cables, many of which are utilizing the latest advancements in cable technology. Systems with higher fiber pair counts, such as those using 16 to 24 fiber pairs or more, and cutting-edge technology like 400G, are contributing to the rapid expansion of overall capacity.

In the short term, this suggests that the industry is wellequipped to meet the current demand. However, over the longer term, there is still some uncertainty about whether the rate of new cable installations and upgrades will be enough to keep up with growing global data traffic. The increasing deployment of new cables over the next few years is a positive

sign, but if the rate of new installations starts to slow down, it could lead to potential capacity shortfalls in the longer term, especially as new technologies and applications emerge.

Despite this uncertainty, the forecast remains generally optimistic. The current pipeline of planned cable projects indicates that the industry is actively working to meet the growing demand. However, the ongoing challenge will be to ensure that capacity expansions keep pace not only with current demand but also with future innovations that may require even more bandwidth. Continued investment in new systems, upgrades to existing cables, and close collaboration among stakeholders in the industry will be crucial to ensuring that the Transatlantic region remains a vital and competitive corridor for global data transmission.

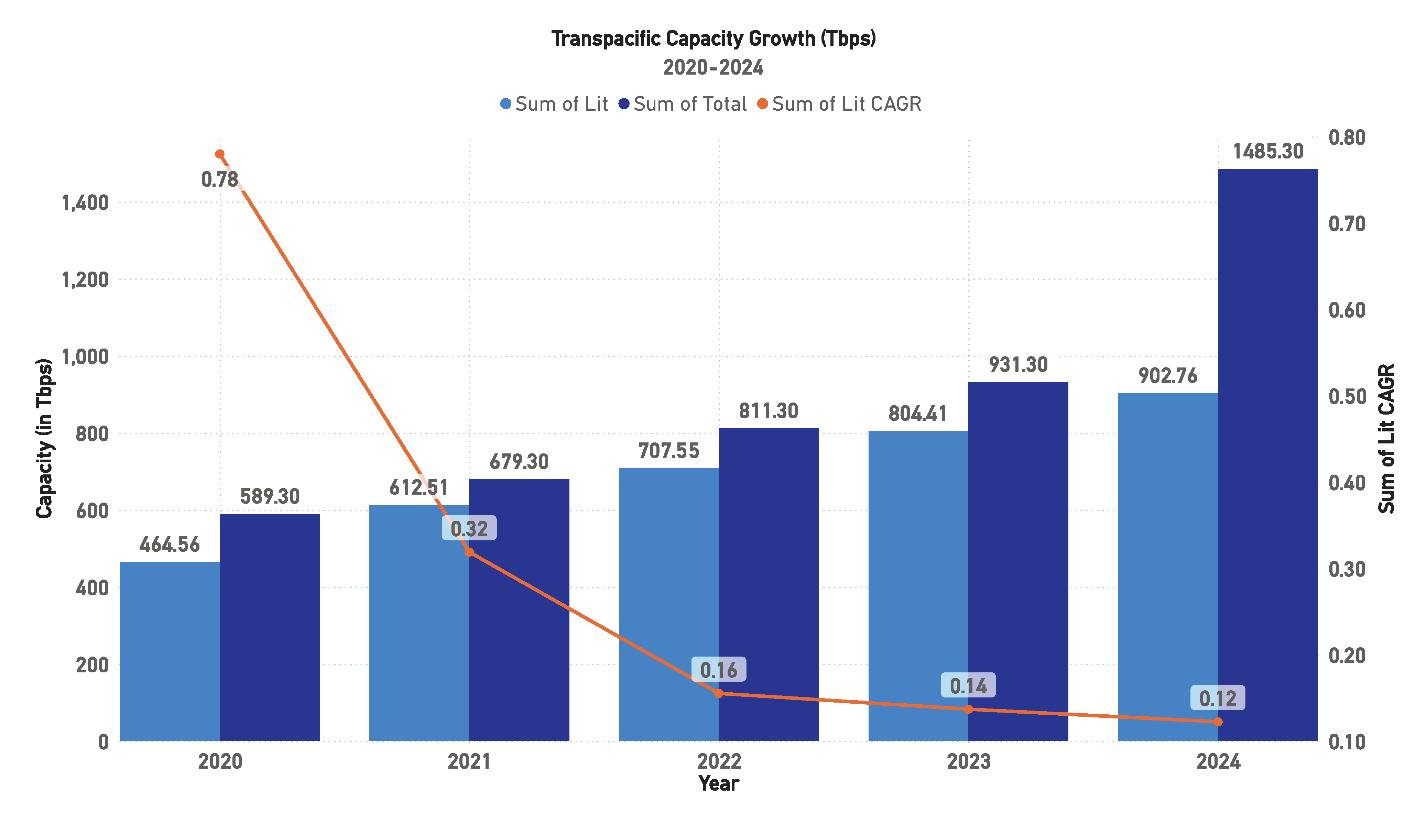

In the Transpacific region, Hyperscalers are also extending their infrastructure, mirroring trends seen in the Transatlantic area. These systems serve as vital links connecting the economies of the United States and Canada with Australia and East Asia.

From 2020 to 2024, the Transpacific region saw steady capacity growth, driven by the ongoing demand for cloud services, data centers, and connectivity between North America, East Asia, and Oceania. This region is highly competitive, with major Hyperscalers like Google, Amazon, and Microsoft playing key roles in building new systems to handle increasing data traffic.

In 2020, the total capacity was 589.30 Tbps, with lit capacity reaching 464.56 Tbps. By 2024, total capacity is projected to reach 1,485.30 Tbps, with lit capacity growing to 902.76 Tbps, reflecting a steady upward trend in system usage. However, the CAGR for lit capacity has seen a noticeable decline. Starting at 78% in 2020, the CAGR has fallen sharply to 12% by 2024. This decrease in the CAGR mirrors trends seen in other major cable routes, such as the Transatlantic, where capacity growth is beginning to stabilize after the initial boom period of the early 2020s.

Despite the slower CAGR, overall capacity continues to increase, and