If it’s July, it must be time for le Tour de France!

Like always, this years tour is fabulous watching and like many, I have my phone plugged into the race stream on a daily basis, which has proven to make any project meetings a tad more difficult. We are also in the process of moving into a new office after some 17 years, not to mention the 18 students who recently arrived from everywhere for our annual Canto opera training support. A typical restful July is not in the cards this year!

We’ve launched a new Authors Index on SubTel Forum Magazine and our website—a searchable directory that allows readers to easily find articles by contributor. It’s a great way to spotlight industry voices and access expert insights from across the subsea cable community. Click here to check it out!

We’re gearing up to print new editions of the 2025 Submarine Cable Map for two major industry events: Submarine Networks World (Singapore, September) and IWCS Forum 2025 (Pittsburgh, October). These exclusive maps highlight global subsea system advancements and are distributed directly to key decision-makers across the industry. Want your logo featured? Now’s the time to secure your ad space and gain high-visibility placement. Click here to secure your spot!

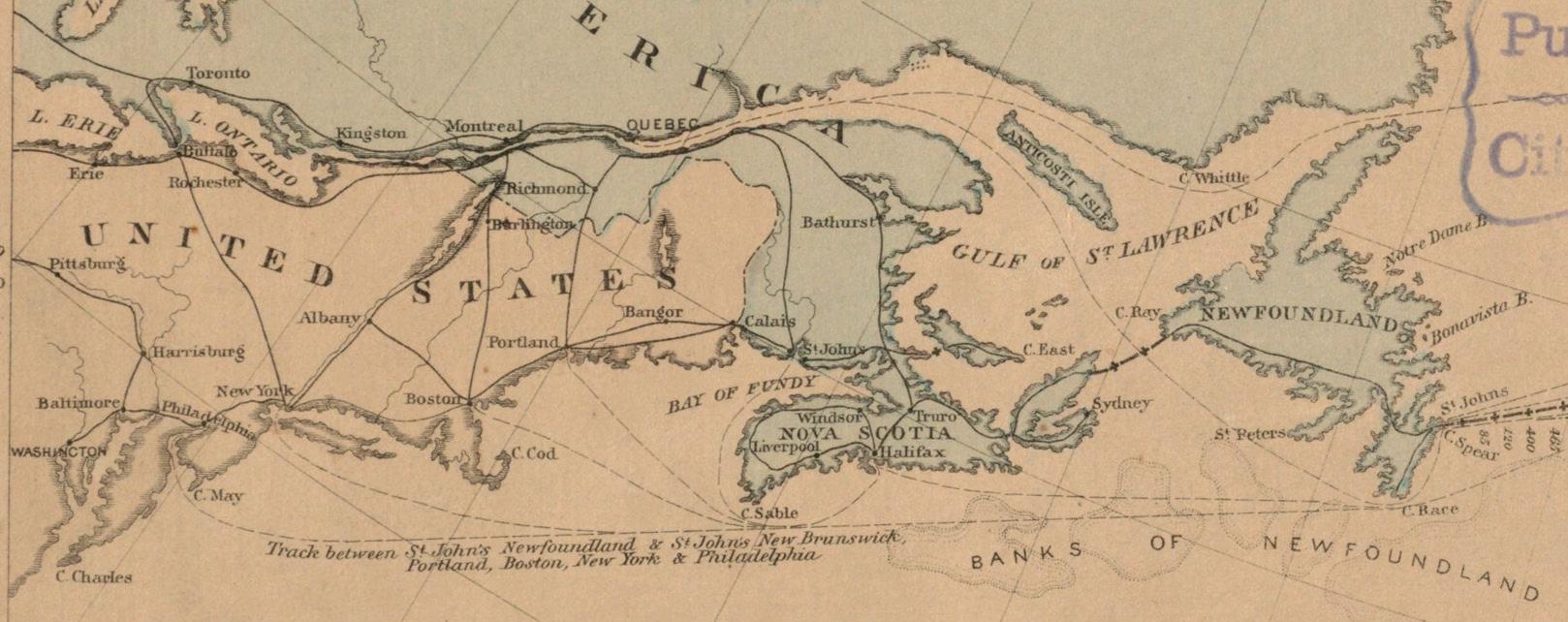

The updated SubTel Forum Online Cable Map is now live—featuring a sleeker interface, faster performance, and improved usability across all devices. Inspired by the

historical theme from the printed SubOptic cable map, the new design delivers a visually rich, intuitive experience that bridges past and present subsea infrastructure. Special thanks to ACS and WFN Strategies for coming aboard as premier sponsors. Explore the map here.

Interested in sponsoring the Online Cable Map? Contact Nicola Tate to learn more.

SubTel Forum was honored to present the Excellence in Industry Awards at SubOptic 2025 in Lisbon—recognizing exceptional contributions across the submarine cable sector. Since 2010, these awards have celebrated the best in thought leadership, innovation, and impact, spotlighting individuals and organizations shaping the future of global connectivity. This year’s honorees exemplify the cutting edge of subsea communications, and we were proud to acknowledge their achievements at the industry’s premier global gathering.

Congratulations to Andy Palmer-Felgate, Rafiah Ayandipo, and Quynh Nguyen on their well-deserved recognition!

SubTel Forum is proud to support UC Berkeley’s new Global Digital Infrastructure Certificate, a pioneering academic program focused on the physical backbone of the internet—submarine cables and data centers. Offered in partnership with the Berkeley Center for New Media, SubOptic Foundation, and iMasons, the program runs from June through August and brings together students from around the world to explore sustainability, resilience, and global equity in digital infrastructure.

Now, students are invited to submit research articles for publication in Submarine Telecoms Forum and Data Center Dynamics. A panel of industry and academic experts will select standout work that showcases the voices shaping the future of global connectivity.

The 55th Submarine Cable Almanac will be published in August featuring the latest global cable system data. The next edition arrives in November—interested in sponsoring? Contact Nicola Tate.

Thank you as always to our awesome authors who have contributed to this issue of SubTel Forum. Thanks also for their support to this issue’s advertisers: Fígoli Consulting, International Wire & Cable Symposium, Submarine Networks World 2025, and WFN Strategies. Of course, our ever popular “Where in the world are all those pesky cableships” is included as well.

Good reading and vive le tour – Slava Ukraini STF

Wayne Nielsen, Publisher

A Publication of Submarine Telecoms Forum, Inc. www.subtelforum.com | ISSN No. 1948-3031

PRESIDENT & PUBLISHER: Wayne Nielsen | wnielsen@subtelforum.com | [+1] (703) 444-2527

VICE PRESIDENT: Kristian Nielsen | knielsen@subtelforum.com | [+1] (703) 444-0845

ANALYTICS: Kieran Clark | kclark@subtelforum.com | [+1] (540) 533-6965

SALES: Nicola Tate | ntate@associationmediagroup.com | [+1] (804) 469-0324 subtelforum.com/advertise-with-us

DESIGN & PRODUCTION: Weswen Design | wendy@weswendesign.com

DEPARTMENT WRITERS:

Aidé Cabrera, Amina Ibrahim, Andrés Fígoli, Caroline Crowley, Federica Tortorella, Iago Bojczuk, Kieran Clark, Landry Moyou, Nicola Tate, Philip Pilgrim, and Wayne Nielsen

FEATURE WRITERS:

Alex Vaxmonsky, Anders Ljung, Andy Palmer-Felgate, Derek Cassidy, John Hibbard, Kieran Clark, Kitch Kennedy, Kristian Nielsen, Lynsey Thomas, Magda Abdelkader, Nicole Starosielski, Paul McCann, Philip Pilgrim, Quynh Nguyen, Rafiah Ayandipo, Robert Brumley, Rune Jensen, Tony Frisch, and Wayne Nielsen

NEXT ISSUE: September 2025 – Offshore Energy featuring IWCS Cable & Connectivity Industry Forum ‘24

AUTHORS INDEX: https://subtelforum.com/authors-index

MAGAZINE ARCHIVE: subtelforum.com/magazine-archive

Submarine Telecoms Forum, Inc. www.subtelforum.com/corporate-information

BOARD OF DIRECTORS: Margaret Nielsen, Wayne Nielsen, Kristian Nielsen and Kacy Nielsen

Contributions are welcomed and should be forwarded to: pressroom@subtelforum.com.

Submarine Telecoms Forum magazine is published bimonthly by Submarine Telecoms Forum, Inc., and is an independent commercial publication, serving as a freely accessible forum for professionals in industries connected with submarine optical fiber technologies and techniques. Submarine Telecoms Forum may not be reproduced or transmitted in any form, in whole or in part, without the permission of the publishers.

Liability: While every care is taken in preparation of this publication, the publishers

cannot be held responsible for the accuracy of the information herein, or any errors which may occur in advertising or editorial content, or any consequence arising from any errors or omissions, and the editor reserves the right to edit any advertising or editorial material submitted for publication.

New Subscriptions, Enquiries and Changes of Address: 21495 Ridgetop Circle, Suite 201, Sterling, Virginia 20166, USA, or call [+1] (703) 444-0845, fax [+1] (703) 349-5562, or visit www. subtelforum.com. Copyright © 2025 Submarine Telecoms Forum, Inc.

ISSUE 143 | JUNE 2025

EXCELLENCE IN INDUSTRY RECOGNIZED AGAIN: SUBTEL FORUM AWARDS PRESENTED AT SUBOPTIC 2025

Recognizing top SubOptic innovators

By Wayne Nielsen

REVOLUTIONIZING ROUTE SURVEYS WITH LOW-CARBON, UNCREWED PLATFORMS: INSIGHTS FROM THE 2024 NORTH ATLANTIC DEEP-WATER SAILDRONE DEMONSTRATION

Uncrewed survey revolutionizes deep water By Andy Palmer-Felgate and Kitch Kennedy

By Quynh Nguyen

Multi-domain

By Magda Abdelkader EMERGING TRENDS AND APPLICATIONS OF UNREPEATERED SYSTEMS IN REGIONAL SUBSEA NETWORKS

Unrepeatered cable systems' rising relevance

By Tony Frisch, Anders Ljung and Lynsey Thomas

Creating Subsea Infrastructure In Egypt To Enable Global Connectivity

COMPETING OR COMPLEMENTARY?

The Evolving Relationship Between LEO Satellites and Submarine Cables in the Pacific! By John Hibbard and Paul McCann

THROUGH ICE AND ISOLATION

Laying the Foundations for the Arctic’s Connected Future By Rune Jensen

Balancing Control and Innovation in Subsea Cable Management By Kristian Nielsen

Subsea cable archaeology across the Atlantic

By Derek Cassidy and Philip Pilgrim

A Sustainable Future For Suboptic 2025: A Review from the Student & Young Professionals Track

WHERE IN THE WORLD ARE ALL THOSE PESKY CABLESHIPS? Follow the missions of cableships crucial to undersea connectivity.

Regulatory Charges For Submarine Cables: Towards A Fair Model

the career movements in the

developments in the submarine telecom world

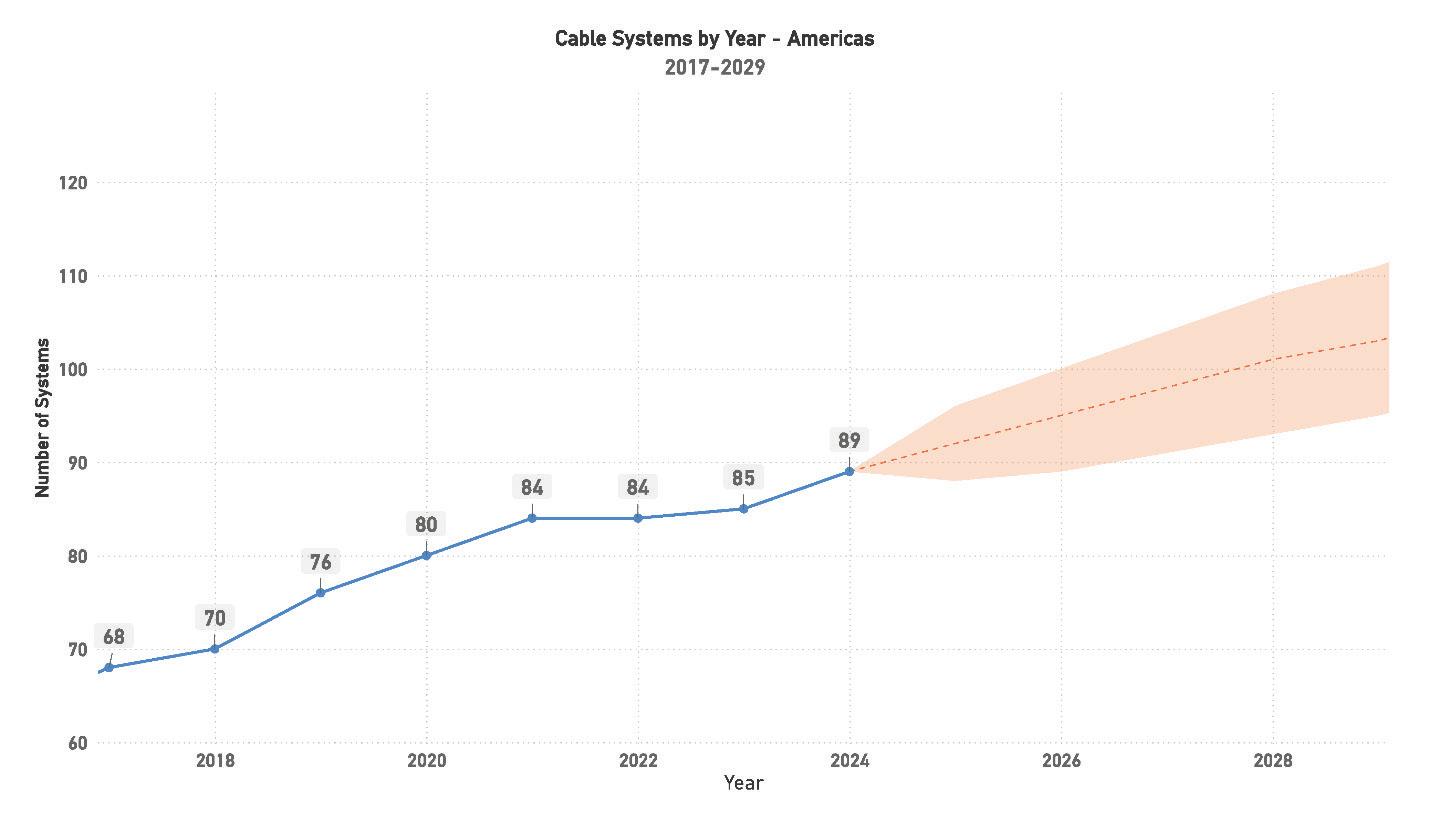

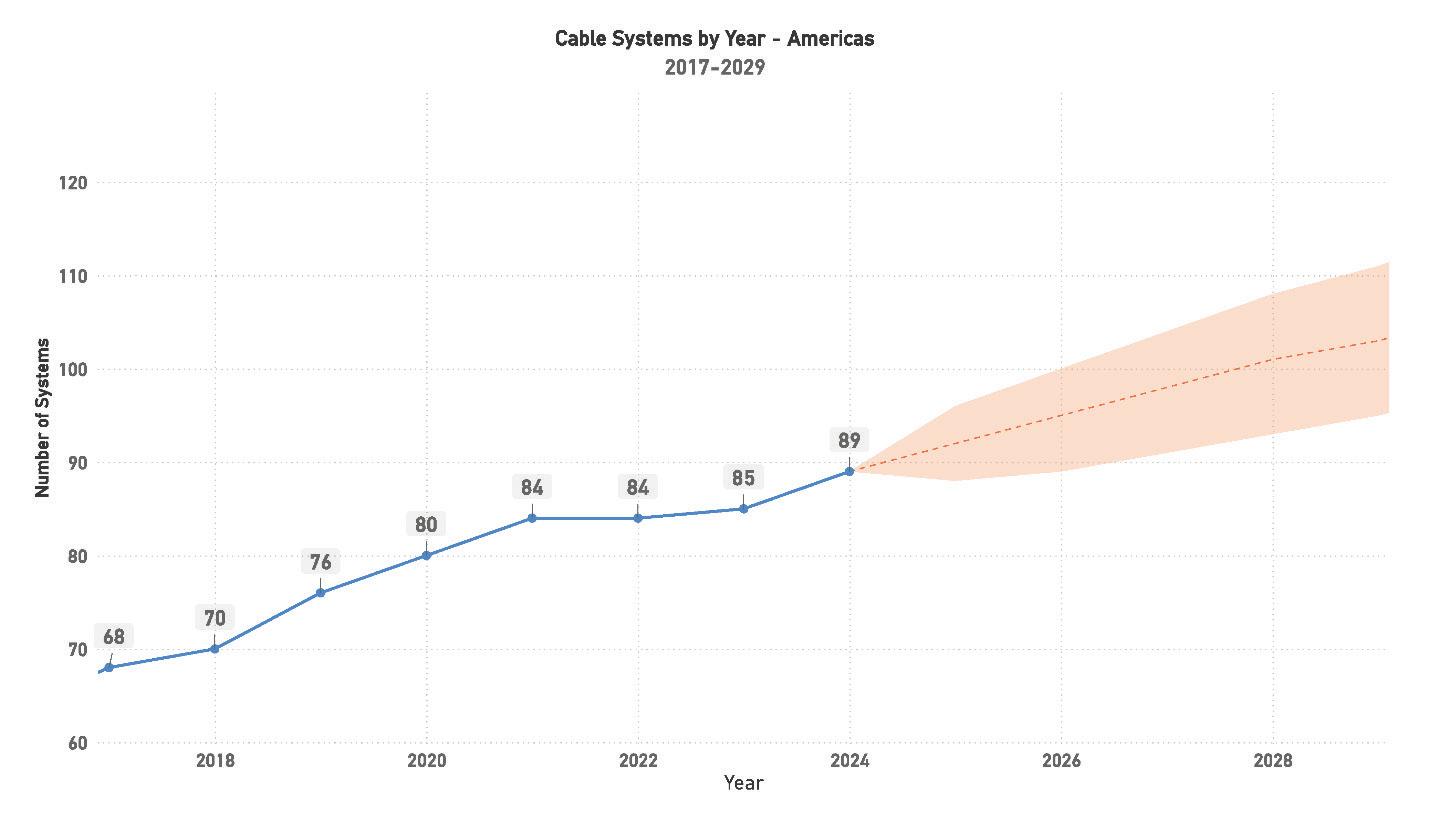

Regional Systems: A Snapshot of Where We Are and Where We Are Headed

CORNER Find out about advertising opportunities to connect with our specialized audience

The most popular articles, Q&As of 2019. Find out what you missed!

Welcome to an exclusive feature in our magazine, where we explore the captivating world of SubTelForum.com, a pivotal player in the submarine cable industry. This expedition takes us on a detailed journey through the myriad of resources and innovations that are key to understanding and connecting our world beneath the oceans.

mapping efforts by the analysts at SubTel Forum Analytics, a division of Submarine Telecoms Forum. This reference tool gives details on cable systems including a system map, landing points, system capacity, length, RFS year and other valuable data.

CONNECTING THE DEPTHS: YOUR ESSENTIAL GUIDE TO THE SUBTEL FORUM DIRECTORY

Keep on top of our world of coverage with our free News Now daily industry update. News Now is a daily RSS feed of news applicable to the submarine cable industry, highlighting Cable Faults & Maintenance, Conferences & Associations, Current Systems, Data Centers, Future Systems, Offshore Energy, State of the Industry and Technology & Upgrades.

Submarine Cable Almanac is a free quarterly publication made available through diligent data gathering and

Submarine Telecoms Industry Report is an annual free publication with analysis of data collected by the analysts of SubTel Forum Analytics, including system capacity analy sis, as well as the actual productivity and outlook of current and planned systems and the companies that service them.

In our guide to submarine cable resources, the SubTel Forum Directory shines as an essential tool, providing SubTel Forum.com readers with comprehensive access to an array of vetted industry contacts, services, and information. Designed for intuitive navigation, this expansive directory facilitates quick connections with leading vendors, offering detailed profiles and the latest in submarine cable innovations. As a dynamic hub for industry professionals, it fosters community engagement, ensuring our readers stay at the forefront of industry developments, free of charge.

2024 marks a groundbreaking era for SubTel Forum with the launch of its innovative app. This cutting-edge tool is revolutionizing access to submarine telecommunications insights, blending real-time updates, AI-driven analytics,

The online SubTel Cable Map is built with the industry standard Esri ArcGIS platform and linked to the SubTel Forum Submarine Cable Database. It tracks the progress of

and a user-centric interface into an indispensable resource for industry professionals. More than just a technological advancement, this app is a platform fostering community, learning, and industry progression. We encourage you to download the SubTel Forum App and join a community at the forefront of undersea communications innovation.

Our journey begins with the News Now updates, providing daily insights into the submarine cable sector. Covering everything from the latest technical developments to significant industry milestones, this feed ensures you’re always informed about the latest trends and happenings. It’s an essential tool for professionals who need to stay on top of industry news.

Dive deeper into the world of submarine communications with our curated collection of articles and Q&As. These insightful pieces offer a comprehensive look at both the history and current state of the industry, enriching your understanding and providing a broader perspective on the challenges and triumphs faced by submarine cable professionals.

• Submarine Cable Almanac: This quarterly treasure trove provides detailed information on global cable systems. You can expect rich content including maps, data on system capacity, length, and other critical details that sketch a vivid picture of the global network.

• Submarine Telecoms Industry Report: Our annual report takes an analytical approach to the industry, covering everything from current trends to capacity analysis and future predictions. It’s an invaluable resource for anyone seeking to understand the market’s trajectory.

• Online SubTel Cable Map: An interactive tool mapping over 550 cable systems, perfect for digital natives who prefer an online method to explore global connections.

• Printed Cable Map: Our annual printed map caters to those who appreciate a tangible representation of the world’s submarine fiber systems, detailed in a visually appealing and informative format.

Explore the Submarine Telecoms Forum Magazine Archive, a comprehensive collection of past issues spanning 23+ years of submarine telecommunications. This essential resource offers insights into project updates, market trends, technological advancements, and regulatory changes. Whether researching industry developments or seeking

expert analysis, the archive provides valuable perspectives on the technologies and trends shaping global connectivity.

Our Authors Index is a valuable tool for locating specific articles and authors. It simplifies the process of finding the information you need or following the work of your favorite contributors in the field.

• Data Center & OTT Providers Report: This report delves into the evolving relationship between cable landing stations and data centers, highlighting trends in efficiency and integration.

• Global Outlook Report: Offering a comprehensive analysis of the submarine telecoms market, this report includes regional overviews and market forecasts, providing a global perspective on the industry.

• Offshore Energy Report: Focusing on the submarine fiber industry’s oil & gas sector, this report examines market trends and technological advancements, offering insights into this specialized area.

• Regional Systems Report: This analysis of regional submarine cable markets discusses capacity demands, development strategies, and market dynamics, providing a detailed look at different global regions.

• Unrepeatered Systems Report: A thorough examination of unrepeatered cable systems, this report covers project timelines, costs, and operational aspects, essential for understanding this segment of the industry.

• Submarine Cable Dataset: An exhaustive resource detailing over 550 fiber optic cable systems, this dataset covers a wide range of operational data, making it a go-to reference for industry specifics.

SubTelForum.com stands as a comprehensive portal to the dynamic and intricate world of submarine cable communications. It brings together a diverse range of tools, insights, and resources, each designed to enhance understanding and engagement within this crucial industry. From the cutting-edge SubTel Forum App to in-depth reports and interactive maps, the platform caters to a wide audience, offering unique perspectives and valuable knowledge. Whether you’re a seasoned professional or new to the field, SubTelForum.com is an indispensable resource for anyone looking to deepen their understanding or stay updated in the field of submarine telecommunications.

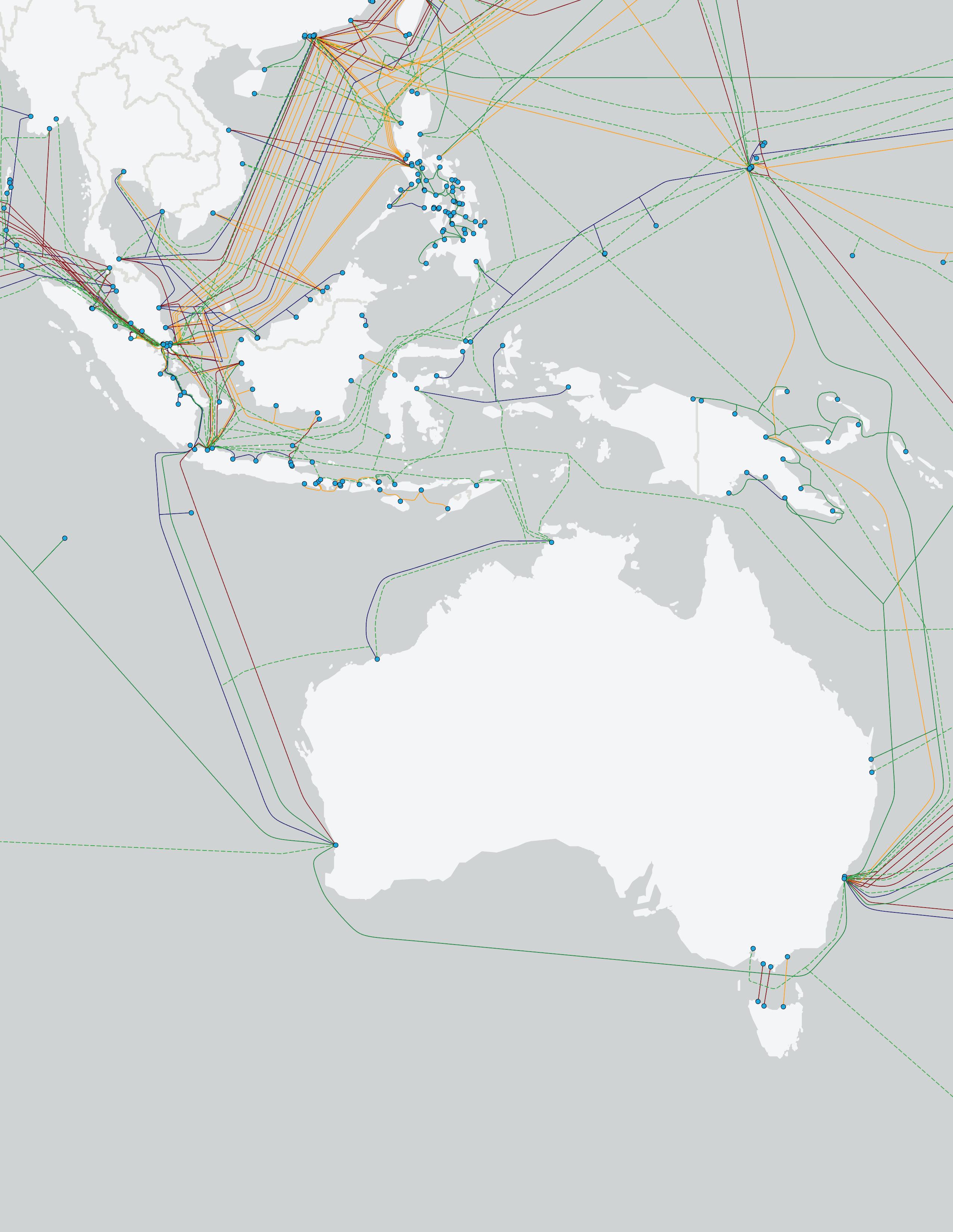

BY KIERAN CLARK

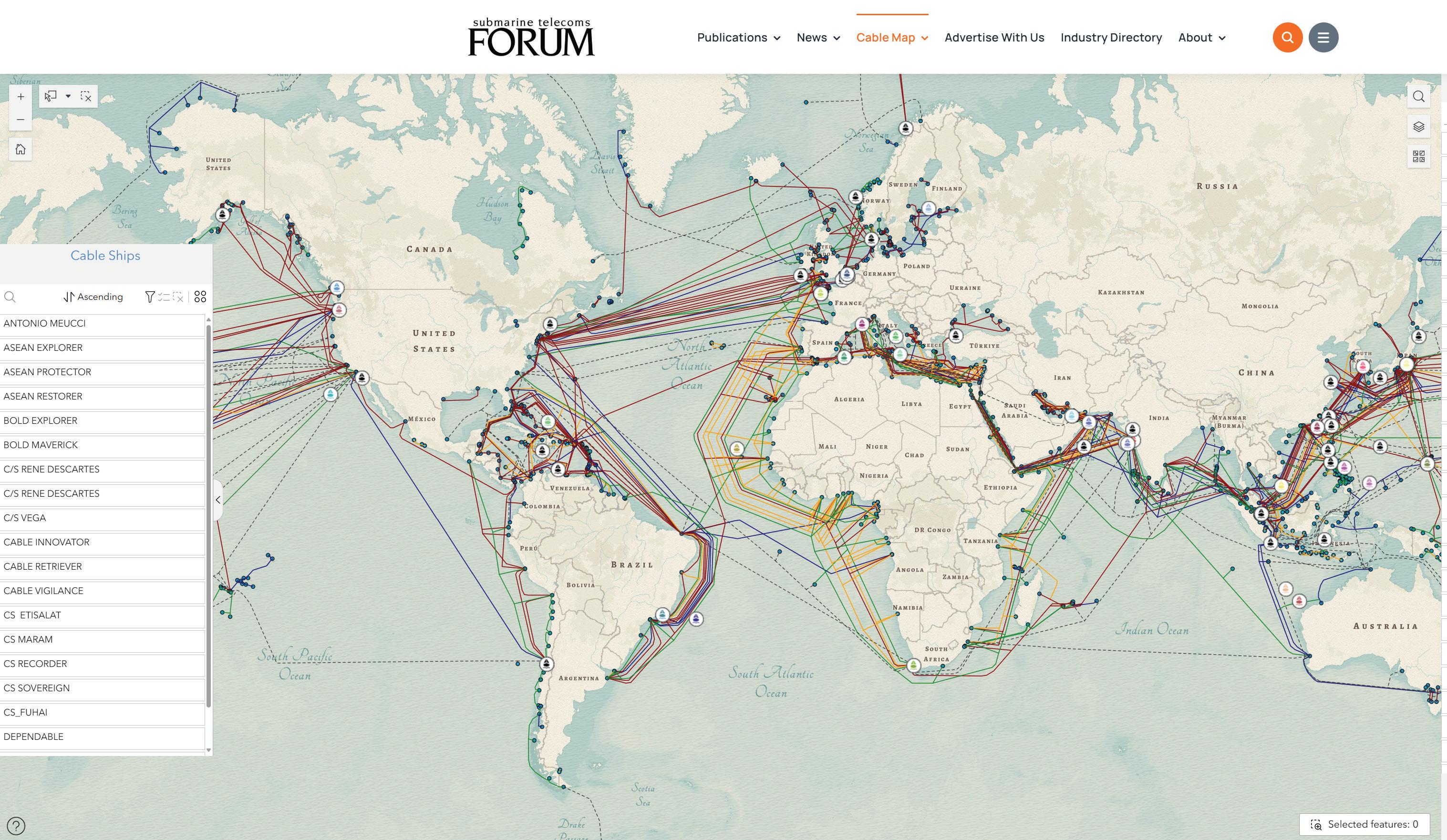

The SubTel Cable Map— powered by Esri’s ArcGIS platform—offers an interactive and detailed way to explore the global network of submarine cables. This indispensable resource provides information on over 440 existing and planned systems, more than 50 cable ships, and upwards of 1,000 landing points. Connected directly to the SubTel Forum Submarine Cable Database and integrated with our News Now Feed, the map enables real-time tracking of industry activity and cable-specific news coverage.

Submarine cables serve as the foundation of global digital infrastructure, carrying more than 99% of international data traffic. These systems enable the seamless connectivity the world depends on—from personal communication to enterprise operations. Without them, modern, highspeed global communication simply wouldn’t be feasible.

Our analysts continually update the map using verified data from the Submarine Cable Almanac and valuable input from industry contributors. This ensures a timely and accurate picture of the subsea cable landscape, spotlighting the latest deployments and developments. As we approach the end of the year, map updates may slow during the holiday season, but our commitment to delivering reliable insights remains unchanged.

We’re proud to feature Alaska Communications Systems and WFN

Submarine cables serve as the foundation of global digital infrastructure, carrying more than 99% of international data traffic. These systems enable the seamless connectivity the world depends on—from personal communication to enterprise operations.

Strategies as the current sponsors of the SubTel Cable Map. Additional sponsorship opportunities are available—offering high-visibility placement for your logo and a direct link to your organization. It’s a great way to align your brand with global connectivity and the future of the submarine cable industry.

We invite you to explore the SubTel Cable Map and gain a deeper understanding of the vital role submarine cable systems play in our interconnected world. As always, if you are a point of contact for a system or company that requires updates, please email kclark@subtelforum.com

We hope the SubTel Cable Map proves to be a valuable resource for you, offering insight into the continually evolving submarine cable industry. Dive into the intricate network

Here’s the list of systems updated since our last issue:

that powers our global communications today. Happy exploring! STF

KIERAN CLARK is the Lead Analyst for SubTel Forum. He originally joined SubTel Forum in 2013 as a Broadcast Technician to provide support for live event video streaming. He has 6+ years of live production experience and has worked alongside some of the premier organizations in video web streaming. In 2014, Kieran was promoted to Analyst and is currently responsible for the research and maintenance that supports the Submarine Cable Database. In 2016, he was promoted to Lead Analyst and his analysis is featured in almost the entire array of Subtel Forum Publications.

JULY 21, 2025

Newly Added Systems:

• AAE-2

• GlobalConnect Baltic

• Sol

• TGN-IA2

• Updated Systems:

• Celia

• MANTA

• SEA-ME-WE 6

• Sihanoukville-Hong Kong (SHV-HK)

• Southern Cross Tasman Express (SX-TX)

• Sydney-Melbourne-Adelaide-Perth (SMAP)

Do you have further questions on this topic?

BY KIERAN CLARK

The SubTel Cable Map has long served as one of the submarine telecom industry’s most comprehensive, web-based resources. Built on ArcGIS Experience Builder, this interactive application offers real-time visualization of global subsea cable systems, including active, planned, and historic routes. With industry professionals, researchers, and policymakers relying on the platform for reference and analysis, usability and performance are paramount.

Over the past several weeks, we’ve rolled out a significant series of updates to the map’s user interface and data structure. These improvements focus on navigation, clarity, and ease of access, helping users locate and filter the information they need faster and more intuitively.

This article walks through the major updates to the map and offers a look at the kinds of refinements we’ll continue to make based on user feedback and evolving data needs.

One of the most visible improvements is a complete restructuring of the map layout. Previously, key interface panels were spread across multiple sections of the screen, including a side-by-side arrangement that often made the experience feel cramped—especially on smaller screens or in embedded environments.

In the new version, we’ve introduced a vertical accordion layout that consolidates all supporting tools into collapsible headers. The Cable Ships list, for instance, now lives inside its own accordion tab rather than occupying a fixed sidebar. This design shift drastically reduces visual clutter and provides users with more uninterrupted map space by default, while still offering detailed supporting

data when desired.

We also deployed the map as a full-screen embedded experience on a dedicated blank page of the SubTel Forum website. By stripping away the WordPress header, footer, and scrollbars, we allow the ArcGIS app to use 100% of the browser window—no more accidental scrolling or loss of navigation context.

The core Cable Systems list received a major upgrade as well. Users can now sort entries in four different ways:

• Cable Name (Ascending)

• Cable Name (Descending)

• Cable RFS (Ready for Service) Date (Ascending)

• Cable RFS Date (Descending)

Previously, entries could only be viewed in a static, alphabetical list. Now, users can tailor the sort order to fit their research workflows—whether they’re scanning by name or organizing cables chronologically for historical review.

We also expanded the search box to be far more robust. In addition to matching cable names, the new system

now allows partial match searches for owner, supplier, and installer fields. This small change dramatically improves discoverability for users tracking infrastructure by organization or vendor.

To better support visual analysis of deployment status, we added a new Planned Status field to the dataset. This field classifies systems as either:

• “In Service” – for systems currently operational (Planned = 0), or

• “Planned” – for future deployments (Planned = 1)

This change came from user feedback: the raw binary values used in the previous attribute table weren’t immediately intuitive. By creating a readable, calculated field for planned status, we made the dataset easier to interpret and filter.

The Planned Status field is now used across both the filter panel and the cable list display. Users can toggle between operational and planned systems in a single click, enabling faster comparative assessments or visual breakdowns for reporting.

Perhaps the most powerful change of all comes in the form of a fully redesigned filtering system, accessed via the familiar funnel icon. The previous implementation offered only basic search functionality, with limited support for precise querying. The new version introduces advanced multi-field filters, organized cleanly by data type and purpose. Most importantly, these filters are combinable, allowing users to apply multiple criteria at once without writing queries or exporting data.

Users can now filter global cable systems using criteria such as:

• Cable RFS:

» Greater than

» Less than

» Between two dates

• Design Capacity (Tbps):

» Greater than

» Less than

» Between two values

• Affiliated Entities:

» Owner(s)

» System Installer(s)

» System Supplier(s) (all via substring match)

• Service Status:

» In Service

» Planned

The Cable Ships layer includes its own set of dedicated filters, allowing users to isolate vessels based on:

• Ownership (multi-select dropdown)

• AIS Zone (multi-select dropdown)

• Flag State (multi-select dropdown)

• Length (m):

» Greater than

» Less than

• Year Built:

» Greater than

» Less than

» Between two years

These filters now work in tandem, giving users the flexibility to zero in on specific systems and vessels that meet highly specific criteria. For example, a user might find all planned systems with over 60 Tbps of capacity and then compare them to cable ships built after 2015 operating in a specific AIS zone.

The updated interface also includes smart behaviors like auto-clearing stale filters, preventing conflicting query states, and live previews of filtered results before applying them.

Altogether, the new system brings the filtering experience more in line with what users expect from modern SaaS platforms—powerful, responsive, and intuitive.

In tandem with these interface upgrades, we undertook a comprehensive audit of the core cable dataset. Dozens of field entries were reviewed for consistency and formatting, particularly:

• Normalizing inconsistent vendor names

• Ensuring valid RFS values across records

• Verifying system lengths, where available

• Removing legacy null fields from the view layer

This data cleanup reduces user confusion and increases the reliability of search results and analytics based on the attribute table. More importantly, it lays the groundwork for future enhancements, including the possible addition of regional grouping tags and interactive system profiles.

While these upgrades already make the SubTel Cable Map more useful and usable, we are always looking to improve. Two general areas are under active consideration:

1. Custom Data Views: We recognize the value of giving users the ability to generate clean, printable or exportable map views for use in reports and presentations. While this functionality is not currently implemented, we are exploring lightweight ways to support this in the future without overcomplicating the user experience.

2. Optional Live Layers: We’ve also begun experimenting with optional overlays for dynamic data—such as active ship locations, planned outages, or cable landings under construction. These layers would not be visible by default, but could be toggled on for users who want to monitor real-time events against the global cable map.

Both of these ideas are still in early stages, and we welcome feedback from users about which capabilities would provide the most value.

This release represents the most significant update to the SubTel Cable Map in several years. With a clearer layout, faster filtering, smarter search, and meaningful attribute enhancements, the platform is now better equipped than ever to serve as a daily reference tool for anyone working in the submarine telecom space.

As always, we invite users to explore the updated map, try out the new features, and let us know what’s working— or what could work even better. STF

KIERAN CLARK is the Lead Analyst for SubTel Forum. He originally joined SubTel Forum in 2013 as a Broadcast Technician to provide support for live event video streaming. He has 6+ years of live production experience and has worked alongside some of the premier organizations in video web streaming. In 2014, Kieran was promoted to Analyst and is currently responsible for the research and maintenance that supports the Submarine Cable Database. In 2016, he was promoted to Lead Analyst and his analysis is featured in almost the entire array of Subtel Forum Publications.

BY CAROLINE CROWLEY, IAGO BOJCZUK, AIDÉ CABRERA, AMINA IBRAHIM, LANDRY MOYOU, AND FEDERICA TORTORELLA

This year at SubOptic 2025 in Lisbon, Portugal, the conference halls gained fresh faces and new energy. Thanks to the inaugural Student & Young Professionals Track, sponsored by the SubOptic Association and welcomed warmly into the main program, attendees could rub shoulders with rising members of the submarine telecoms industry at the world’s longest-running and most comprehensive industry event. The Track brought together more than twenty students and early-career professionals from over 15 countries, spanning disciplines from telecom engineering and maritime operations to environmental science and internet governance.

Over the course of the conference, participants immersed themselves in expert-led masterclasses, roundtables, research presentations, and field visits to local internet infrastructure sites. Highlights included tours of host company Alcatel Submarine Network’s cable-laying vessel Ile de Sein and the EllaLink Network Operations Center. Staff from Start Campus also welcomed the youth track to tour their 1.2GW AI-ready Sines Data Center, a pioneer in sustainable digital infrastructure solutions with seawater-based cooling and high energy efficiency. Organized and facilitated by Student & Young Professional Coordinator Iago Bojczuk, the new track offered participants a meaningful way to engage with and contribute to the broader conference dialogue. “Attending SubOptic 2025 has been a

transformative experience that deepened both my academic curiosity and my professional ambition,” said Landry Moyou, a graduate student pursuing a master’s degree in Enterprise Digital Architecture at Télécom ParisTech. “I came to the conference with a strong technical foundation, but what I found at SubOptic was much more—a global ecosystem of infrastructure builders, innovators, and strategists engaged in rich, forward-thinking discussions about the future of connectivity.”

Despite backgrounds in a wide range of disciplines, members of the Track are coming together for this month’s article with a common focus on one area repeated throughout the SubOptic proceedings: sustainability. Members presented their own work

on the topic: Hesham Youssef, a senior transmission engineer at Telecom Egypt, with “Metrics for Cable Landing Station Sustainability,” and Tochukwu Egesi, a PhD candidate at the University of Cape Town, with “The Potential Use of On-Site Renewable Power for Cable Landing Station.” These contributions draw on research developed by the Sustainable Subsea Networks team over the past three years and were made possible through academic-industry collaboration. They reflect the value of ongoing exchanges between companies and researchers, the importance of data sharing, and a growing commitment to deeper cooperation between industry professionals, academia, and broader society.

The headliner session, starting off the

first day of the conference, was the Second Suboptic Congress on Subsea Cable Sustainability, following the First Suboptic Congress in Bangkok 2023. But this year, the Congress presented their years of research in the original format of a detective play. Young professionals joined seasoned industry leaders onstage to investigate the lifecycle of a subsea cable in “The Case of the Missing Emissions,” following a cable from its coastal landing station back to its factory.

Kicking off this year’s conference, the Congress set the stage for a series of discussions on the current and future state of the submarine cable industry as new technologies, climate concerns, and geopolitical events produce global impacts. In this article, Student & Young Professionals Track coordinator Iago Bojczuk and Track participant Caroline Crowley give their key takeaways from SubOptic 2025, joined by Track members Amina Ibrahim and Aidé Cabrera, who share their thoughts on visiting Start Campus’ sustainable Sines AI-ready Data Center.

Attending SubOptic 2025 in Lisbon felt like returning to a conversation

that has been slowly maturing over the past few years. I kept thinking back to the First Congress on Sustainability in Bangkok in 2023. Back then, there was energy and intent, but no real framework for addressing these issues systematically or collaboratively. That gathering marked a shift. But in Lisbon, the tone felt different. The urgency had deepened, not just around sustainability on its own, but around how it’s now tangled up with broader forces — geopolitical instability, regulatory pressures, and the growing challenge of balancing technological growth with social responsibility. It became clear to me that sustainability isn’t a separate agenda anymore. It’s part of every serious conversation about the future of digital infrastructure.

As someone who studies digital infrastructures across Global South contexts, I have often looked at these systems through the lens of inequality and asymmetry. But here, surrounded by engineers, policymakers, executives, and researchers, I found myself listening differently. What mattered to me was not just the technical debates but the quiet signals of institutional culture—who gets heard, how collaboration is framed, and where the boundaries of responsibility are drawn. One of those moments came in the remarks

of Professor Nicole Starosielski of UC Berkeley, during the Second Congress of Sustainability, who observed that the push for sustainability is shaped by company values and customer expectations, but also that when organizations work in isolation, they run the risk of duplicating efforts and losing on the progress they could otherwise achieve. That idea stayed with me. It reminded me that sustainability, if it is to be meaningful, requires a shift in mindset. It cannot simply be about checking boxes or adopting greener practices in isolation. It must be phased and based on a multilateral approach: it must involve shared tools, shared language, and shared responsibility.

Throughout the conference, a lot of the talks and side conversations circled back to a common question: What does it mean to work in this industry given the state of the world right now? That came into focus during the session called “Shifting Tides: Geopolitics and the Subsea Cable Industry.” The speakers—Mike Constable, Mike McGovern, and Catherine Creese, moderated by Kent Bressie—dug into the geopolitical pressures that are actively reshaping the sector. McGovern, a director at Alcatel Submarine Networks (ASN), pointed out how the industry suddenly gained visibility during the pandemic,

when subsea cables were recognized as essential infrastructure. But even with that recognition, there’s still a clear gap between political awareness and the actual capacity to act. As Constable from Infra-Analytics put it, permits are still slow, policies differ wildly from country to country, and decisions keep getting pushed back. For me, that all pointed to something deeper: sustainability isn’t just a matter of improving technology. As many of the discussions at SubOptic 2025 suggested, it’s about rethinking how the different layers of the sector interact: how companies share data, how they build trust, and how they make decisions that look ahead rather than just respond to crises.

Furthermore, this disconnection between institutional capacity and technological progress came up again and again, especially in conversations about governance, responsibility, and long-term sustainability. Catherine Creese, from the U.S. Navy, made a particularly striking point when she said, “Every government and every agency acts differently,” referring to how states engage with the subsea cable industry. It was a sharp reminder of how fragile institutional memory can be. If we don’t capture what’s been learned and pass it on, we risk ending up with systems that are technically advanced but institutionally brittle. Kent Bressie, chair of HWG’s international practice, echoed a similar concern: “Sometimes there’s a view that there’s a lot of information collection but not enough information sharing,” he says. I keep coming back to that line when I think about the role of technology companies and the weight of their social responsibility. It gets at the heart of a

much larger challenge—how to make sustainability not just a stated goal, but a practice that lasts, that’s built into the fabric of how this industry operates across time and borders.

As the event came to a close, I found myself thinking about what comes next. The industry is changing. It is not just facing external pressures; it is also absorbing new kinds of talent—people who are entering with very different expectations, values, and concerns. Many of us care deeply about the climate crisis and want to build and shape our careers in meaningful ways that are good for the planet and for the legacy we want to leave behind. And we are also asking difficult questions about artificial intelligence and its growing demands on infrastructure: rather than just accessing the latest technology, we, as young people, are also invested in shaping the future. As we start to incorporate new minds into this space, we have an opportunity to reshape the culture of the industry itself. We must create room for their questions, support their ideas, and acknowledge that the infrastructures of the future will need to be not only

faster and more secure, but also more broadly accessible, more sustainable, and organized in sustainable ways.

To me, and as we continue to shape the discourse of sustainability, it is about building practices that can sustain collective learning, that can adapt to changing regulatory climates, and that can make room for those who have historically been kept at the margins of these conversations. That is what I carried home from Lisbon. And that is where, I believe, the work must continue.

Attending SubOptic 2025 provided me the opportunity to see how sustainability is being incorporated in real-world technology and infrastructure, not just for environmental benefit but for the continuation of the industry as a whole. The field’s vision of resilience is evolving, growing from cable redundancy to long-term innovation and inclusion of new perspectives. As a student of sustainable economies and environmental policy, I was excited to see the variety of tech-

nological and operational approaches to preparing the industry for future challenges, including climate change.

The conference demonstrated how industry leaders are rethinking traditional models of resilience during a more complex era of marine operations. With the seabed becoming increasingly congested with legacy cables, offshore wind development, and deep-seabed mining contracts, the future of durable cable systems may rely less on building out redundancy and more on smarter, more cooperative route planning. Building cable route resilience may now involve not just additional routes, but careful collaboration and the recovery of decommissioned cables. The practice of cable recycling –to clear seabed space, lower cable systems’ carbon footprint, and reduce the need for raw materials – appeared as a solution for multiple speakers.

In addition to new methodologies, new technologies debuted at booths and presentations throughout the week. Members of our youth track attended a demo of the Climate Change Node, part of Alcatel Submarine Network’s SMART Cable system, designed to record environmental data in real time. Hitting the model node with a hammer to simulate seismic activity and blowing it with a hair dryer to represent seabed temperature change, we got to see the dual role this infrastructure can play in enabling global connectivity while also contributing to safety systems and climate science.

The emphasis on sustainability also stood out as a key pillar during presentations on the future of maritime operations and cable maintenance. I particularly enjoyed the discussion on autonomous route surveying by Meta’s Andy Palmer-Felgate and Saildrone’s Captain Kitch Kennedy, presenting Sail-

drone’s “Surveyor.” This sail-equipped, uncrewed vessel is piloted remotely, capable of three months or 10,000 kilometers of autonomous operation. The design reduces greenhouse gas emissions by 98% compared to conventional crewed vessels, while improving crew safety, reducing costs, and keeping critical survey work going in an era where fewer workers are opting for months at sea. Technological solutions for industry and climate resilience appear key, especially given the aging of cable installation fleets, a topic emphasized by several speakers throughout the week.

The variety in approaches to resilience, as well as panels on new workforce development, mentorship, and DEI, struck me as a sign of an overall adaptive perspective on the future of industry. It was encouraging to see presentations surprise even the most long-time attendees of SubOptic. As a new face in the field alongside twenty other members of the Student & Young Professionals Track, I left Lisbon confident that the industry can find innovative ways to maintain its personnel and infrastructure networks in the long term.

Before visiting Start Campus and learning about the EllaLink system in Sines, Portugal, I had not thought much about data centers, cable landing stations, and their cooling systems. I knew they used a lot of energy, but I never realized how critical and innovative their cooling systems could be, especially with sustainability in mind.

As part of the SubOptic 2025 Student & Young Professionals Track, I had a unique chance to see how these systems work firsthand. What I discovered completely changed my view of what sustainable infrastructure can look like in the digital age.

One fascinating thing I learned at Start Campus was that seawater can be used for data center cooling. At first, it seemed almost too simple or impossible to use cold water from the ocean to absorb heat from data centers. But when we looked closer at the system, I understood how smart and intentional the engineering is.

Seawater can be pumped from the ocean, reducing the need for high-energy pumps and lowering the site’s overall emissions. The system features a closed-loop heat exchange design, which means the saltwater does not mix with the sensitive cooling fluids or internal infrastructure. Instead, it flows through corrosion-resistant pipes made from materials like titanium or stainless steel, protecting both the facility and the surrounding environment.

The discharge system is also carefully designed to minimize ecological impact, returning water to the ocean in a way that avoids disturbing marine ecosystems. This approach isn’t just a clever use of local resources; it’s a wellthought-out sustainability strategy.

This design doesn’t rely on air conditioning units or mechanical systems that waste a lot of electricity. Instead, it effectively takes advantage of the ocean’s natural cooling properties, prioritizing renewable and environmentally responsible solutions.

Coming from Tanzania, where access to this level of infrastructure is still growing, it was both inspiring and humbling to see sustainability in action. It made me think critically about the longterm effects of the systems we build and the choices we make as engineers.

We often hear terms like green data center or net-zero infrastructure, but being there in person and seeing the pipes and systems gave those concepts real meaning. It was no longer just about words; it became about practical, local, and intelligent solutions that balance performance with care for the earth.

What struck me most was that this is not some future innovation; it’s happening now. Start Campus is developing the whole 1.2 GW campus with a PUE (Power Usage Effectiveness) of

just 1.1, an impressive efficiency for such a large-scale facility. They’re powered by renewable energy and aiming for net-zero emissions. Similarly, EllaLink’s infrastructure has sustainability in its design from the beginning.

In contrast, many other parts of the world still rely on traditional cooling methods, which often use massive amounts of freshwater for evaporative cooling or depend on electricity systems. This visit showed me that it is possible to do better, and that we must.

Also, one unexpected highlight during our tour of Start Campus was meeting Freddy, the autonomous robot that navigates the facility like a futuristic assistant. Freddy is not just a robot;

he plays a real role in maintaining the data center’s performance. From environmental monitoring to equipment inspections, Freddy shows how automation is shaping the future of sustainable infrastructure. Watching him glide through the facility while we were leaving made me think about how robotics and AI will continue to integrate into the operational core of submarine cable and data network ecosystems.

My visit to Sines reminded me that sustainability does not always mean high cost or advanced technology. Sometimes it means using what nature provides in smart, respectful ways. Seawater cooling is one of those solutions. Now, whenever I think

of subsea cable systems, I will also consider the land-based infrastructure that supports them and how we can improve it for the planet.

Overall, as a young engineer, this experience left a strong impression on me. It made me realize that infrastructure is not invisible. The systems behind the internet data centers, cables, and landing stations have physical, environmental, and social effects. Understanding and addressing those impacts is part of our responsibility as future leaders in this industry.

In my role as an Optical Communications Engineer, I focus on pursuing three core objectives: achieving greater capacity, higher transmission speeds over increasingly longer distances, and broader geographic coverage. This ensures global populations are better connected and can access the benefits of worldwide communication. We operate in a landscape where companies, societies, and governments increasingly pursue digital transition to meet sustainable development goals. Consequently, telecommunications serves as an enabling industry, allowing other sectors to achieve sustainability targets.

With nearly four years in this field, I viewed global connectivity through satellite systems, terrestrial fiber networks, and submarine cables, all serving as bridges for information exchange. Yet a critical piece was missing from this vision: data centers. These facilities centralize computing resources to operate digital services while guaranteeing data availability, scalability, and security. Their strategic importance became undeniable

post-pandemic, with the industry now growing at 10% annually.

To complete this understanding, nothing surpassed experiencing a data center firsthand. Listening to engineers explain operations at Start Campus proved invaluable, particularly learning how they host sustainable facilities.

This visit sparked deep reflec-

tion and a closer examination of my region. Across Latin America, Brazil, Mexico, and Chile lead in data center deployment. Notably, my country is experiencing robust growth in this sector, fueled by surging demand from fields like AI and cloud computing. Mexico’s strategic advantages – proximity to the U.S., lower construction costs, and regulatory flexibility – allow

its role as a connectivity bridge between North and Latin America. Yet this expansion amplifies critical infrastructure and sustainability challenges.

Querétaro, a preferred data center hub, has severe water stress and pressures operators to adopt alternative cooling systems and renewable energy to mitigate environmental impact. Meanwhile, Mexico’s national grid (77% fossil-fuel-dependent) faces overloading, creating clear opportunities for sustainable power solutions.

By contrast, Chile confronts a different obstacle: transmission and distribution networks operating at 3x current demand capacity. This necessitates urgent infrastructure upgrades to capture wasted energy and enable redistribution. Despite regional variations, a common imperative emerges: establishing multidisciplinary forums (industry-academia-government-community) to align technological development with ecological preservation through coordinated action and knowledge exchange.

Later, SubOptic 2025 demonstrated our industry’s active pursuit of minimal environmental impact –from decarbonization and optimized cooling (like Start Campus’ Sines facility), to low-emission fuels and HVO, to submarine cable recycling. Telecom is not just an enabling industry. Our sustainability quest is underway, and will continue evolving and encouraging the finding of specific solutions for each region.

I extend my gratitude to SubOptic, Start Campus, ASN and EllaLink teams for showcasing their sustainable achievements. Most importantly, thank you for enabling me and 22 other young professionals to propose solutions and join this critical conversation.

At SubOptic 2025, our team was delighted to see a forward-looking focus echoed across the masterclasses, panels, roundtables, and networking sessions packed into the four days of the conference. Speakers highlighted the need to incorporate new technologies and welcome new approaches into an industry situated in the middle of complex global challenges. Encouraging for our group in particular was the willingness we saw to develop young and diverse talent, from the shoutouts the Student & Young Professionals Track received on the main conference stage, to the

many seasoned professionals who visited the student zone to swap insights and introduce us to their work.

That commitment to fostering the next generation of leaders was equally evident beyond the conference halls, particularly during the site visits that showcased cutting-edge, sustainable infrastructure in action. At the Start Campus Sines Data Center, the team warmly demonstrated the future of digital infrastructure and its dedication to sustainability. As Fernando Borges Azevedo, Start Campus’s Head of Connectivity, put it, “These site visits are more than just tours – they are moments that bridge

ambition with understanding. When young professionals witness sustainable digital infrastructure in action, like our seawater-cooling system and AI-ready design, it turns abstract goals into tangible impact. If we want to build a truly sustainable and future-proof subsea sector, it starts with inspiring the next generation to lead it.”

As we enter and continue our work within the submarine cable and broader telecommunications sectors, we carry with us energy, enthusiasm, and global perspectives as emerging professionals from around the world. SubOptic 2025 did more than showcase what the industry is working on, it invited us to be part of it. This sense of inclusion and momentum has reinforced our commitment to shaping an industry proving itself capable of staying resilient and sustainable. As Track participant Federica Tortorella emphasized: “I am grateful for this opportunity and happy to see great professionals who genuinely invest time and resources to help the next generation to fit in this amazing and particular industry!” Similarly, Moyou remarks: “SubOptic

has strengthened my motivation to help shape a more equitable, resilient, and sustainable digital future—and I hope to carry this spirit forward in both my studies and career.” We are excited to continue building on these conversations and relationships in the years ahead, and we look forward to reconnecting with this growing global community at SubOptic 2028 in Cape Town, South Africa. STF

This article is an output from a SubOptic Foundation project funded by the Internet Society Foundation.

IAGO BOJCZUK is a Ph.D. candidate in the Department of Sociology at the University of Cambridge, UK, and the Student and Young Professional Coordinator for the SubOptic 2025 conference. His research focuses on the sustainability and governance of digital infrastructures, including subsea cables, data centers, and satellites.

encouraging women and young people into the STEM world. Currently, she collaborates with the Diversity, Inclusion & Belonging (DIB) working group at SubOptic, where she participates in the Spanish Mentoring Program.

AMINA IBRAHIM is a Technical Consultant at Vodacom Tanzania PLC with over 2 years of experience in the Network department. She specializes in managing customer queries, troubleshooting technical issues, and supporting client integration for MW, Fiber, and LTE technologies. As a Sponsored Student/Young Professional, she is passionate about technology and actively pursues continuous learning and professional growth.

MOYOU NGANDJON CARREL LANDRY graduated in telecommunications Engineering in 2018 from the Catholic University of Central Africa. With several years’ experience, he has worked on 2G, 3G, and 4G network deployment and optimisation projects with Alcatel-Lucent and has held positions with Orange. Since September 2024, he has been pursuing a specialised master’s degree at Telecom Paris, focusing on subjects such as 5G, cloud, IoT and also developed a keen interest in submarine cable systems.

CAROLINE CROWLEY is an undergraduate student at the University of California, Berkeley, pursuing a degree in Environmental Economics and Policy. She works as a research assistant with the SubOptic Foundation’s Sustainable Subsea Networks team. Her work analyzes the policies regulating digital infrastructures, particularly data centers, and their impacts on local economies and electrical grids.

AIDÉ CABRERA is a Telecom Engineer with 4 years of industry experience. Focused on Optical Networks, she is a Pre-sales Engineer at Nokia, running projects across Mexico and Latam. She is passionate about

FEDERICA TORTORELLA is a lawyer from the Dominican Republic with a Master’s in Risk Management. She has been actively involved in the Internet governance ecosystem and currently serves as a member of the Caribbean Youth Advisory Board at SubOptic Foundation. Her work is focused on policy and regulatory developments related to domain names and Internet infrastructure, with a strong interest in fostering multisectoral collaboration in favor of a resilient and sustainable Internet ecosystem.

BY KIERAN CLARK

The global subsea cable network—the invisible backbone of the internet—relies on a small fleet of specialized vessels for cable installation, inspection, and maintenance. These cable ships play a vital role in ensuring connectivity between continents, yet their operational patterns remain difficult to interpret. Most tracking is based on AIS (Automatic Identification System) data, which shows where ships are and how fast they’re moving, but offers little direct information about what the vessels are actually doing.

This article presents the latest results from a geospatial analysis of cable ship movement using 7,360 AIS-derived data points collected between 1 May and 30 June 2025. Building on our previous methodology, this analysis identifies where cable ships cluster, how their behavior varies across global regions, and what their proximity to infrastructure might reveal about their roles—whether conducting cable repairs, deploying new systems, or simply waiting on standby.

The AIS dataset was compiled at six-hour intervals, generating a consistent view of vessel locations, movement speeds, and identities. Points where ships remained slow or stationary for extended periods were flagged as likely idle events. These idle points were then classified using a proximity-based model: if a ship remained within 50 kilometers of a known cable depot or factory for more than 24 hours, a projected classification was applied:

• Installation if near a factory

• Maintenance if near a depot

• Unclassified if no infrastructure was nearby or conditions were inconclusive

If both a depot and factory were within range, installation was prioritized—based on historical trends suggesting factory-adjacent sites (e.g., Calais or Kitakyushu) are more commonly used for system deployment rather than repairs.

The 50 km threshold accounts for both geolocation uncertainties in infrastructure coordinates and positional drift in AIS data, which may not consistently reflect specific berth positions or anchoring locations. This range offers a reason-

able margin for association without excessive overreach.

This type of spatial classification mirrors practices in other industries. In freight logistics, analysts use vehicle proximity to warehouses to infer loading and staging activity. In fisheries management, vessel clustering near reefs and breeding zones helps indicate effort. The benefits—ranging from situational awareness to predictive resource planning—are equally applicable to cable fleet operations.

By applying this methodology to cable ships, we gain a clearer picture of where activity is concentrated, how it aligns with infrastructure, and what behavioral patterns may be emerging over time. The following sections explore these insights in detail, beginning with a global activity map and updated behavioral breakdown.

To establish a geographic baseline for cable ship behavior, this analysis begins with a spatial overview of 7,360 AIS-tracked data points collected between 1 May and 30 June 2025. These points represent vessel locations where ships were either stationary for extended periods or operating at low speeds near known cable infrastructure. The map below displays the global distribution of these idle events,

offering a visual reference for assessing where cable ship activity is concentrated.

Each point is color-coded according to the projected activity classification applied during post-processing:

• Blue: Projected Maintenance Activity

• Green: Projected Installation Activity

• Gray: Unclassified Activity

In addition, infrastructure reference points are indicated with iconography:

• Wrench icon: Cable Depot

• Factory icon: Cable Factory

Several high-density clusters are immediately apparent. South and Southeast Asia continue to show elevated levels of projected maintenance activity, particularly around the Singapore Strait, Manila, and the Java Sea. This pattern reflects both the heavy concentration of subsea infrastructure in the region and the number of regional depots.

New for this reporting period, East Asia displays a notably strong presence of both installation and maintenance behaviors—especially around Shanghai, Busan, and Kitakyushu—reinforcing the region’s role as a hub for both repairs

and new buildouts.

In the North Atlantic, concentrated clusters are again visible near Calais, the UK’s south coast, and the Canary Islands. Meanwhile, Northern Europe and the Eastern Mediterranean remain consistent staging zones for both classified and unclassified behaviors, suggesting continued demand for regional fault response and system work.

Other visible concentrations appear in the Bay of Bengal, Gulf of Oman, West Africa, and northern South America, each showing either isolated installations or depot-linked maintenance events. The South Pacific, particularly east of Papua New Guinea and around eastern Australia, shows several dense tracks of unclassified or maintenance points.

Overall, the geographic layout of observed behaviors reinforces the role of infrastructure adjacency in shaping idle patterns. These spatial signatures serve as the foundation for further analysis in the following sections, including behavior classification, regional variation, and facility proximity.

With the spatial footprint established, the next phase of analysis focuses on interpreting the likely purpose behind cable ship behavior. Each of the AIS-based data points was categorized into one of three projected activity types—Maintenance, Installation, or Unclassified—based on proximity to known infrastructure and post-idle vessel routing patterns.

The classification results for May–June 2025 are as follows:

• Maintenance: 1,608 data points (30.6%)

• Installation: 640 data points (12.2%)

• Unclassified: 3,004 data points (57.2%)

These categories reflect inferred behavior based on location and movement—not direct vessel reporting. Ships linked to projected maintenance activity typically remained near cable depots and exhibited movement patterns indicative of fault response, port returns, or nearshore positioning. In contrast, ships classified under installation activity more often staged near cable factories or dispersed along deepwater cable corridors, aligning with long-haul buildout missions.

While installation accounts for a smaller portion of the dataset, its footprint is more geographically distributed— consistent with its episodic and project-based nature. By contrast, maintenance activity remains more frequent, more nearshore, and more spatially concentrated—particularly around established depot hubs. This pattern reinforces the

notion that a steady baseline of maintenance operations underpins global subsea network reliability.

The ongoing dominance of maintenance-linked idling— nearly one-third of all idle points—highlights the constant demand for cable repairs, inspections, and response readiness as systems age and traffic volumes increase. These operations depend heavily on depot infrastructure and vessel availability within high-density cable regions.

Finally, the high proportion of unclassified points (57.2%) continues to underscore a key limitation of AIS-derived analysis: the absence of structured activity metadata from vessels. Without explicit reporting of mission type or status, inference remains the only path to behavioral insight. Still, the patterns that do emerge through classification offer a valuable window into the operational scope and logistics of the global cable ship fleet.

After establishing a global overview and a behavioral classification framework, the next step is to examine how projected cable ship activity varies by region. To do this, data points were grouped by AIS Zone—a standardized geographic reference field derived from vessel tracking metadata. For each zone, projected activity types were aggregated to evaluate regional patterns in maintenance, installation, and unclassified behavior.

The visualization reveals strong regional distinctions across all three activity types.

As in previous periods, Southeast Asia and the East Asia region dominate in total idle records, with East Asia

now showing the highest absolute volume of classified points. Both regions reflect mixed activity profiles, but with notable gains in installation-linked presence, especially near Japan, Korea, and eastern China. These areas are home to multiple cable factories and feature recurring deployment-related idling.

North East Atlantic and North Sea zones also rank highly, continuing to reflect depot-supported maintenance cycles near major European ports like Calais, Brest, and Lowestoft. This region remains a perennial hub for service continuity operations.

On the other end of the spectrum, areas like the Caribbean Sea, Persian Gulf, and Arabian Sea show a more balanced distribution between maintenance and installation—often tied to hybrid support roles for aging legacy systems and regional buildout corridors.

In contrast, unclassified behavior remains dominant in less-instrumented regions. West Africa, South America, and portions of the Indian Ocean exhibit high shares of vessel activity where infrastructure proximity or movement context is insufficient to infer a clear purpose. These zones highlight continued data opacity in locations underserved by regional depots or real-time reporting structures.

The zonal view reinforces two key takeaways:

• Maintenance activity remains both more frequent and spatially concentrated, largely tracking with the global depot network.

• Installation activity is more episodic and distributed across fewer zones, reflecting its project-by-project operational model.

Together, these patterns provide insight into how infrastructure distribution, cable age, and fleet positioning shape regional workloads. They also underscore the opportunity for enhanced classification via integration of project metadata or AIS message extensions to reduce the volume of unclassified behavior in future datasets.

In addition to geographic clustering, cable ship behavior can also be examined through its relationship with nearby infrastructure—specifically depots and factories. These facilities play a central role in shaping vessel movement patterns. Depots act as staging and mobilization points for fault response and routine maintenance, while factories support cable loading and the initiation of installation campaigns.

To explore this relationship, each AIS-tracked idle data point was evaluated for proximity to a known facility. If a vessel remained within a defined radius of a depot or factory for over 24 hours, the nearby location type was recorded. The resulting distribution is shown below.

The updated proximity analysis shows:

• Depot-associated idle records: 1,130

• Factory-associated idle records: 416

This means vessels were 2.7 times more likely to be found idling near a depot than near a factory—a strong signal that maintenance continues to dominate vessel operations. This outcome is consistent with previous classification findings: most projected maintenance activity occurred in depot-adjacent waters, while installation behavior—though less frequent—was linked to isolated, factory-side staging events.

The contrast also reflects the differing operational rhythms. Depot presence is cyclical and frequent, as ships return for restaging, resupply, or immediate fault response.

Factory adjacency, by comparison, tends to be episodic: ships only linger there when gearing up for system deployments, and their paths diverge quickly once operations begin.

This facility-based view reinforces the strategic significance of well-distributed depot coverage across major cable corridors. Regions lacking nearby depots may suffer from longer repair delays, increased vessel transit burden, or clustering of idle ships in less optimal fallback locations.

In total, the infrastructure proximity analysis provides a complementary lens to regional and behavioral classification: it highlights not only where vessels go, but why they tend to remain—and how facility placement shapes operational readiness and mission efficiency across the fleet.

This analysis presents a current global snapshot of cable ship behavior using AIS data, focusing on how vessel locations, projected activities, and infrastructure proximity intersect across 7,360 observed data points collected between 1 May and 30 June 2025. By classifying idle periods into maintenance, installation, and unclassified categories—and mapping them across geographic regions and infrastructure types—we can identify several enduring patterns.

Maintenance activity continues to account for the largest identifiable share of classified behavior, and remains strongly correlated with depot proximity. These operations cluster around aging systems and fault-prone corridors—particularly in areas with dense subsea infrastructure. By contrast, installation behavior is less common but more geographically dispersed, often observed near factory-adjacent staging zones or long-haul deployment routes. Together, these patterns emphasize the strategic role of depot coverage and factory logistics in shaping vessel presence and mission timing.

The updated zonal and facility analysis reaffirms the significance of regional hubs such as East Asia, Southeast Asia, and the North Atlantic corridor, where vessel concentration and infrastructure overlap are most visible. These areas anchor both sustained maintenance cycles and episodic deployment campaigns.

Yet, a persistent challenge remains: 57.2% of records remain unclassified. This reflects the continued limita-

tions of AIS-based inference, especially in regions lacking infrastructure density or post-idle trajectory clarity. Without standardized reporting mechanisms or access to mission-level metadata, vast portions of vessel activity must still be interpreted indirectly.

Overcoming this barrier will require a renewed industry push toward better data transparency. If vessel operators consistently shared operational context—whether through structured AIS message extensions, port call declarations, or anonymized project logs—the value of behavioral analysis could expand significantly. Such collaboration would support improved forecasting, faster response coordination, and more efficient fleet utilization—all of which are critical to maintaining the resilience of global subsea connectivity. STF

KIERAN CLARK is the Lead Analyst for SubTel Forum. He originally joined SubTel Forum in 2013 as a Broadcast Technician to provide support for live event video streaming. He has 6+ years of live production experience and has worked alongside some of the premier organizations in video web streaming. In 2014, Kieran was promoted to Analyst and is currently responsible for the research and maintenance that supports the Submarine Cable Database. In 2016, he was promoted to Lead Analyst and his analysis is featured in almost the entire array of Subtel Forum Publications.

As the global submarine cable sector continues to evolve at an unprecedented pace, few events serve as a clearer signal of what’s ahead than Submarine Networks World (SNW). Organized by Terrapinn, SNW brings together top decision-makers, innovators, and infrastructure builders shaping the future of global connectivity. With Submarine Networks World 2025 on the horizon, we sat down with Adam Ball, General Manager at Terrapinn Asia, to discuss this year’s focus, industry trends, and what lies ahead for the event—and the ecosystem it supports.

1.

CAN YOU INTRODUCE SUBMARINE NETWORKS WORLD 2025 AND EXPLAIN THE CORE MISSION BEHIND THE EVENT?

Submarine Networks World takes place every year here in Singapore in September and only focuses on the

subsea industry. The event is the only ‘one-stop shop’ where it is possible to meet with all the components required to create or facilitate a cable project. The core mission is to stay No.1 and that requires continuous improvements across the event, to be brave where possible with the conference content and not to be afraid to try new approaches. We can always ‘do better’ and that is our headspace each and every year.

2.

HOW DOES SNW 2025 DIRECTLY ENGAGE WITH AND IMPACT THE GLOBAL SUBMARINE CABLE MARKET?

SNW provides a platform for the industry to meet and do business. The event attracts the entire value-chain and therefore can add value to any cable project or company that attends or participates. By increasing the global reach and ensuring more and more persons/ companies attend is the only impact we can have on the

industry. What takes place directly onsite, or as a result of meetings that take place onsite, is purely down to those working in the industry itself.

3.

WHAT KEY INNOVATIONS IN SUBMARINE CABLE SYSTEMS OR EMERGING APPLICATIONS WILL TAKE THE SPOTLIGHT THIS YEAR?

AI and all aspects of how it affects the industry is impossible to ignore. How to accommodate for AI, utilize AI, what are the new applications for AI - it is seemingly the root of all change right now and will be for some time.

4.

WHAT ARE THE PRIMARY REASONS BEHIND SNW’S CONTINUED RELEVANCE AND GROWTH IN THE TELECOMMUNICATIONS SPACE? WHAT KEEPS THIS EVENT AT THE CENTER OF THE CONVERSATION?

Whilst other events have focused on scale, at SNW we focus on sustainable growth. It’s a very basic mindset of understanding why the industry comes to the event and every year this must be delivered without exception.

There is no reason to move away from solely focusing on having the ‘right people’ in the room and increasing the value proposition with more of the ‘right people’ being in the room each and every year.

5.

HOW IS SNW HELPING DRIVE DIVERSITY, EQUITY, AND INCLUSION ACROSS THE SUBSEA AND TELECOM INDUSTRIES?

The ‘Free for Under 25’ initiative is growing each year whereby any company that has bought a pass or package can bring an employee aged 25 or under to the event without having to purchase a pass. We openly encourage companies to bring more than 1 person as the true change in the make-up of the industry will only come from the next generation.

6. AS SNW APPROACHES, HOW IS SNW SETTING ITSELF APART OR COMPLEMENTING THE BROADER CONFERENCE CALENDAR?

SNW sets itself apart from other conferences by shying away as little as possible from the various ‘elephants in the room’ and so any attendee can expect presentations and panels on the main talking points of the last 12 months. Cable security, The Red Sea, OTT and private

cable operator relationships, geopolitics… all the main topics everyone is talking about but more importantly what everyone isn’t openly talking about at other events. Add in the constant of ‘Singapore in September’ then there isn’t any scuppering of the conference calendar by changing dates, or creating regional spin-offs to further saturate an already busy schedule. Like our long-term relationship with PTC – they are every January, SNW is every September, and all other events can fight it out between them for the period in between.

7.

HOW IS SNW EVOLVING TO MATCH THE ICT SECTOR’S ACCELERATING DIGITAL TRANSFORMATION AND GROWING SUBMARINE INFRASTRUCTURE DEMANDS?

The growing demand is reflected in the conference content. For instance, the topic of AI. SNW would be some way behind the curve to have an AI specific theatre, or even an AI specific session. With subsea cables having to deliver AI (and everything that comes with it) to meet the needs of the global population, you will find AI appearing in almost every theatre and every session in some form of talking point.

8.

WHAT ARE THE MOST PRESSING CHALLENGES SNW CURRENTLY FACES, AND HOW IS TERRAPINN PREPARING TO MEET THEM?

The challenge of refreshing the event where possible each year, whilst not losing the reason why persons attend the event, along with always looking to grow the attendee levels from what is a relatively small industry –remains the constant overall challenge.

We have little to no margin for genuine error in this respect but have to keep expanding our approach, always thinking and being open to trying new ideas. STF

ADAM BALL is General Manager of Terrapinn responsible for the management of Submarine Networks World since 2018. He is an experienced sales leader with a proven track record in both London and Singapore. Coupling an affable nature with outstanding influencing and communication skills, he has directly formed and maintained long-term business relationships of integrity and success across a variety of high value/high profile products and services.

1. Paul Clark, MD, Asia, Terrapinn

2. Abdullah A. Alghonaimi, VP Wholesale Operations, Mobily

3. Rayan Alsaedi, Senior Advisor, Digital Infrastructure and Communication Deputyship, MCIT (Kingdom of Saudi Arabia)

4. Hasnain Ali, Director Permitting & Regulatory Affairs, Pioneer Consulting

5. Senior representative, Nokia

6. Dr. Stephen J McCombie, Professor of Maritime IT Security, NHL Stenden University of Applied Sciences

7. Jurgen Hatheier, Vice President International CTO, Ciena

8. Mark Brownscombe, Senior Director – Commercial & Sales Ops, Ooredoo

9. Anup Gupta, President – India and SAARC, APTelecom

10. Ivan Skenderoski, Managing Partner, Salience Consulting

11. Alpheus Mangale, Group CEO, SEACOM

31. Michael Ruddy, Director of International Research, Terabit Consulting

32. Andy Palmer-Felgate, Acting President, NASCA

33. Senior representative, Digital Realty

34. Tom Janssen-Manning, Operations Program Manager, Submarine Networks APAC, Google

35. Oli Pope, Managing Director, Route Position

36. Sophie Wright, Technical Program Manager, Google

37. Philippe Recco, ACE MC Chairman, Orange

38. Rohitash Bhaskar, Head International Infrastructure, Batelco

39. Senior representative, IMDA

12. Cynthia Mehboob, PhD Scholar | Department of International Relations, The Australian National University

13. Eckhard Bruckschen, CTO, IOEMA Fibre Ltd

14. Felipe Yasuda, Telecommunication Engineer, Angola Cables

15. Senior representative, HMN Tech

16. Geraldine Le Meur, Director, GreenLink Marine

List of Speakers

40. Philip deGuzman, Senior Director, Pioneer Consulting

41. Vinay Nagpal, President, InterGlobix

42. Diego Teot, Head of OTT, Media & Telco, Retelit

43. Majed Almaghlouth, GM Digital & OTT Partners & Sales Management, Mobily

44. Tim Parker, Chief Growth Officer, Assured Communications

45. Aurelien Vigano, SVP, International Infrastructures, Orange

46. Carlos Casado, VP of Sales, Telxius, Northern Region

47. Senior Representative, Bermuda Business Development Agency

48. Julian Rawle, Associate, Cambridge MC

49. Nadya Melic, VP – Product & Marketing, FLAG

1. Paul Clark, MD, Asia, Terrapinn

17. Giuseppe Valentino, VP Product Management, Backbone & Infrastructure Solutions, Sparkle

50. Russ Matulich, CEO, RTI Advisors

2. Abdullah A. Alghonaimi, VP Wholesale Operations, Mobily

18. Tony Mosley, Director of Business Development, Ocean Specialists

19. Senior representative, Fiberhome

31. Michael Ruddy, Director of International Research, Terabit Consulting

51. Prenesh Padayachee, Group Chief Digital and Operations Officer, SEACOM

3. Rayan Alsaedi, Senior Advisor, Digital Infrastructure and Communication Deputyship, MCIT (Kingdom of Saudi Arabia)

32. Andy Palmer-Felgate, Acting President, NASCA

20. Senior representative, Nokia

4. Hasnain Ali, Director Permitting & Regulatory Affairs, Pioneer Consulting

21. Haitham Zahran, Head of Global Subsea Cable Business, PCCW Global

5. Senior representative, Nokia

22. Vlad Ihora, SVP Global Sales, EllaLink

23. Andy Bax, Senior Partner – Digital Infrastructure, Cambridge MC

24. Senior representative, Nokia

6. Dr. Stephen J McCombie, Professor of Maritime IT Security, NHL Stenden University of Applied Sciences

25. Diego Matas, COO, EllaLink

7. Jurgen Hatheier, Vice President International CTO, Ciena

26. Ben Cooper, Partner - APAC, Cambridge MC

27. David Simarro, Head of Sales EMEA, Telxius

8. Mark Brownscombe, Senior Director – Commercial & Sales Ops, Ooredoo

28. Joel Ogren, CEO, Assured Communications

9. Anup Gupta, President – India and SAARC, APTelecom

10. Ivan Skenderoski, Managing Partner, Salience Consulting

29. Graham Evans, Vice Chairman, ICPC

11. Alpheus Mangale, Group CEO, SEACOM

30. Jorge Andrade Santos, Head of International Wholesale, Altice

12. Cynthia Mehboob, PhD Scholar | Department of International Relations, The Australian National University

13. Eckhard Bruckschen, CTO, IOEMA Fibre Ltd

14. Felipe Yasuda, Telecommunication Engineer, Angola Cables

15. Senior representative, HMN Tech

16. Geraldine Le Meur, Director, GreenLink Marine

17. Giuseppe Valentino, VP Product Management, Backbone & Infrastructure Solutions, Sparkle

18. Tony Mosley, Director of Business Development, Ocean Specialists

19. Senior representative, Fiberhome

20. Senior representative, Nokia

21. Haitham Zahran, Head of Global Subsea Cable Business, PCCW Global

22. Vlad Ihora, SVP Global Sales, EllaLink

23. Andy Bax, Senior Partner – Digital Infrastructure, Cambridge MC

24. Senior representative, Nokia

25. Diego Matas, COO, EllaLink

26. Ben Cooper, Partner - APAC, Cambridge MC

27. David Simarro, Head of Sales EMEA, Telxius