FINANCE

LEGAL AND

EXORIDUM

FROM THE PUBLISHER

WELCOME TO ISSUE 135, OUR FINANCE & LEGAL EDITION

FEATURING ICPC PLENARY ’24 PREVIEW!

When I first arrived in Southampton in 1991 to take over BTM’s Marketing Department, one of my first tasks was to finish a company history effort that had started months before. By that time my work simply consisted of signing off printing invoices; so, in truth my involvement was negligible. But what I did have sitting next to my desk were a number of boxes that contained much of the source information the writers had used, and being someone who loves digging through old, musty archives I couldn’t help myself from exploring its contents. In those boxes I learned about much of the early history of the company, which for much of its time had been the General Post Office. I learned about the early days of WWI and how GPO cableships severed Germany’s cables, or how D-Day -1 its ships sat offshore awaiting a cleared beach for landing. I also learned how one of its cableships had been lost a little earlier, probably as an unfortunate result of friendly American fire. I am reminded of these things as I watch the recent events in the Red Sea unfold. We seem to be entering a new chapter in our industry. What we do every day is already dangerous. I pray for sanity to prevail.

2024 SUBMARINE CABLE MAP

We are thrilled to announce the upcoming release of our updated 2024 Submarine Cables of the World printed wall map, an essential resource for industry professionals. This carefully crafted map provides a visually stunning and highly detailed representation of global submarine cable networks, serving as an invaluable tool for anyone involved in the field with the updated map set to be unveiled at Submarine Networks EMEA and Submarine Networks

World, guaranteeing extensive visibility among key industry stakeholders. Additionally, we are opening the door for more advertisers to join us in this venture. This opportunity offers unparalleled exposure to a focused audience deeply engaged in the submarine cable and telecommunications sector. Interested in advertising? Contact Nicola Tate at ntate@associationmediagroup.com.

SUBTEL FORUM APP

Our innovative app, designed specifically for the submarine telecommunications industry, has been successfully operating for the past month. In this short time, a significant number of professionals have added it to their smartphones, propelling us full steam ahead. This app offers users real-time updates, comprehensive data, and interactive features tailored for those involved in submarine cable projects. Seamlessly integrated with our website, the app delivers an intuitive user interface and streamlined access to vital industry insights. However, it’s more than just a source of information; it’s an interactive platform designed

to facilitate learning and collaboration. It includes features like real-time project tracking and AI-driven analytics, ensuring it evolves to meet the changing needs of its users. (https://subtelforum.com/stf-app/)

“THIS WEEK IN SUBMARINE TELECOMS”

Since the beginning of the year, our “This Week in Submarine Telecoms” email digest has been serving approved users with a weekly curation of the latest developments in the submarine telecommunications industry, directly to their inboxes or on the App. This digest is carefully designed to present essential news, insights, and updates, offering subscribers a concise overview of the most significant events each week. Our objective is to ensure our users remain informed and ahead in the rapidly evolving submarine telecommunications sector. If you’re interested in staying on the pulse of industry trends and developments, consider subscribing to our service. (https://subtelforum.com/register)

THANK YOU

Thank you to our awesome authors who have contributed to this issue of SubTel Forum. Thanks also for their support to this issue’s advertisers: AP Telecom, AP Procure, Fígoli Consulting, IWCS, and WFN Strategies. Of course, our ever popular “where in the world are all those pesky cableships” is included as well.

www.subtelforum.com | ISSN No. 1948-3031

PRESIDENT & PUBLISHER:

Wayne Nielsen | wnielsen@subtelforum.com | [+1] (703) 444-2527

VICE PRESIDENT:

Kristian Nielsen | knielsen@subtelforum.com | [+1] (703) 444-0845

ANALYTICS: Kieran Clark | kclark@subtelforum.com | [+1] (540) 533-6965

SALES:

Nicola Tate | ntate@associationmediagroup.com | [+1] (804) 469-0324

DESIGN & PRODUCTION: Weswen Design | wendy@weswendesign.com

DEPARTMENT WRITERS:

Anjali Sugadev, Andrés Fígoli, Ella Herbert, John Maguire, Iago Bojczuk, Isabelle Cherry, Isabel Jijon, Kieran Clark, Michael Brand, Nicola Tate, Philip Pilgrim, Syeda Humera, and Wayne Nielsen

FEATURE WRITERS:

Andrés Fígoli, Andrew D. Lipman, Anjali Sugadev, Brittany E. Buhler, Dean Veverka, Denise S. Wood, Evelyn Namara, Fernando Margarit, Isabelle Cherry, John Tibbles, Kristian Nielsen, Michael Brand, Michael J. Sanchez, Michelle Elsa George, Patricio Rey, Sonia Jorge, Tahani Iqbal, and Uriel A. Mendieta

NEXT ISSUE: May 2024 – Global Capacity

AUTHOR & ARTICLE INDEX: www.subtelforum.com/onlineindex

Submarine Telecoms Forum, Inc.

www.subtelforum.com/corporate-information

BOARD OF DIRECTORS:

Margaret Nielsen, Wayne Nielsen, Kristian Nielsen and Kacy Nielsen

SubTel Forum Continuing Education, Division of Submarine Telecoms Forum, Inc. www.subtelforum.com/education

CONTINUING EDUCATION DIRECTOR:

Kristian Nielsen | knielsen@subtelforum.com | [+1] (703) 444-0845

Good reading – Slava Ukraini STF

Wayne Nielsen, Publisher

Wayne Nielsen, Publisher

Contributions are welcomed and should be forwarded to: pressroom@subtelforum.com.

Submarine Telecoms Forum magazine is published bimonthly by Submarine Telecoms Forum, Inc., and is an independent commercial publication, serving as a freely accessible forum for professionals in industries connected with submarine optical fiber technologies and techniques. Submarine Telecoms Forum may not be reproduced or transmitted in any form, in whole or in part, without the permission of the publishers.

Liability: While every care is taken in preparation of this publication, the publishers cannot be held

responsible for the accuracy of the information herein, or any errors which may occur in advertising or editorial content, or any consequence arising from any errors or omissions, and the editor reserves the right to edit any advertising or editorial material submitted for publication.

New Subscriptions, Enquiries and Changes of

Address: 21495 Ridgetop Circle, Suite 201, Sterling, Virginia 20166, USA, or call [+1] (703) 444-0845, fax [+1] (703) 349-5562, or visit www.subtelforum.com.

Copyright © 2024 Submarine Telecoms Forum, Inc.

ISSUE 135 |

6 QUESTIONS WITH RYAN WOPSCHALL

52 42 48

IRUS AND FIBER OPTIC CABLES

55 59 40

GOOD PRACTICES FOR SUBSEA CABLE POLICY

By Sonia Jorge, Evelyn Namara, and Tahani Iqbal WHY ATTEND 2024 ICPC? PLUS ICPC PLENARY SCHEDULE

By Fernando Margarit, Uriel A. Mendieta, Brittany E. Buhler and Michael J. Sanchez

GLOBAL NATIONAL SECURITY AND SANCTIONS

By Andrew D. Lipman and Denise S. Wood

THE ROLE OF REGULATION IN RECOVERING DECOMMISSIONED SUBSEA CABLES

62

INTRODUCING THE SUBTEL FORUM APP

By Kieran Clark66

FREE TRADE CHALLENGES IN THE SUBMARINE CABLE INDUSTRY

By Patricio Rey69

THE GLOBAL SUBSEA NETWORK

2024: A PERSONAL VIEW

By John Tibbles72

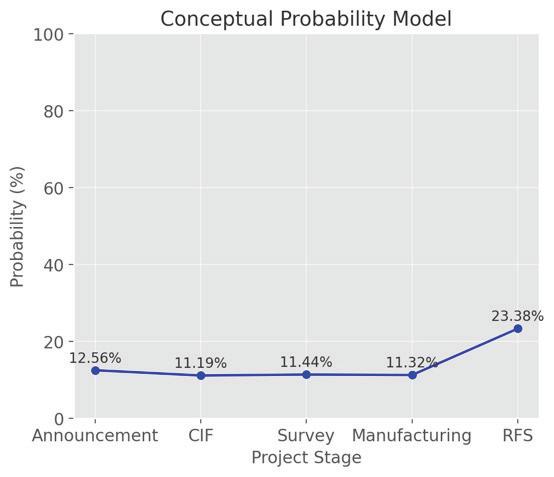

FORECASTING THE VOYAGE

By Syeda Humera and Kristian NielsenDEPARTMENTS

2 EXORDIUM

Find out about advertising opportunities to connect with our specialized audience.

3 IMPRESSUM/MASTHEAD

Meet our team, from editors to designers, establishing our commitment to transparency.

6 SU BTELFORUM.COM

8 INTERACTIVE CAB LE MAP UPDATES

Get the latest on global submarine cable infrastructure from our interactive map.

9 SUSTAINABLE SUBSEA

Discover industry innovations for reducing environmental impact and protecting marine life.

14 WHERE IN THE WORLD ARE ALL THOSE PESKY CABLESHIPS?

Follow the missions of cableships crucial to undersea connectivity.

20 CAPACITY CONNECTION

Learn how collaborations and advancements are boosting global network capacity.

26 ANALYTICS

Delve into the latest trends and data shaping the future of submarine telecoms.

76 BACK REFLECTION

Explore the history and evolution of the submarine telecoms industry.

82 LEGAL & R EGULATORY MATTERS

Understand the legal and regulatory issues affecting the submarine telecom industry.

86 ON THE MOVE

Track the career movements within the submarine telecom sector.

87 NEWS NOW

Stay updated with the latest developments in the submarine telecom world.

88 ADVERTISER CORNER

Find out about advertising opportunities to connect with our specialized audience.

INSIDE THE WORLD OF SUBTEL FORUM: A COMPREHENSIVE GUIDE TO SUBMARINE CABLE RESOURCES

TOP STORIES OF 2019

The most popular articles, Q&As of 2019. Find out what you missed!

NEWS NOW RSS FEED

Welcome to an exclusive feature in our magazine, where we explore the captivating world of SubTelForum.com, a pivotal player in the submarine cable industry. This expedition takes us on a detailed journey through the myriad of resources and innovations that are key to understanding and connecting our world beneath the oceans.

mapping efforts by the analysts at SubTel Forum Analytics, a division of Submarine Telecoms Forum. This reference tool gives details on cable systems including a system map, landing points, system capacity, length, RFS year and other valuable data.

blending real-time updates, AI-driven analytics, and a user-centric interface into an indispensable resource for industry professionals. More than just a technological advancement, this app is a platform fostering community, learning, and industry progression. We encourage you to download the SubTel Forum App and join a community at the forefront of undersea communications innovation.

DISCOVER THE FUTURE: THE SUBTEL FORUM

Keep on top of our world of coverage with our free News Now daily industry update. News Now is a daily RSS feed of news applicable to the submarine cable industry, highlighting Cable Faults & Maintenance, Conferences & Associations, Current Systems, Data Centers, Future Systems, Offshore Energy, State of the Industry and Technology & Upgrades.

APP

PUBLICATIONS

2024 marks a groundbreaking era for SubTel Forum with the launch of its innovative app. This cutting-edge tool is revolutionizing access to submarine telecommunications insights,

Submarine Cable Almanac is a free quarterly publica tion made available through diligent data gathering and

Submarine Telecoms Industry Report is an annual free publication with analysis of data collected by the analysts of SubTel Forum Analytics, including system capacity analysis, as well as the actual productivity and outlook of current and planned systems and the companies that service them.

YOUR DAILY UPDATE: NEWS NOW RSS FEED

CABLE MAP

The online SubTel Cable Map is built with the industry standard Esri ArcGIS platform and linked to the SubTel Forum Submarine Cable Database. It tracks the progress of

Our journey begins with the News Now updates, providing daily insights into the submarine cable sector. Covering everything from the latest technical developments to significant in-

dustry milestones, this feed ensures you’re always informed about the latest trends and happenings. It’s an essential tool for professionals who need to stay on top of industry news.

THE KNOWLEDGE HUB: MUST-READS & Q&AS

Dive deeper into the world of submarine communications with our curated collection of articles and Q&As. These insightful pieces offer a comprehensive look at both the history and current state of the industry, enriching your understanding and providing a broader perspective on the challenges and triumphs faced by submarine cable professionals.

IN-DEPTH PUBLICATIONS

• Submarine Cable Almanac: This quarterly treasure trove provides detailed information on global cable systems. You can expect rich content including maps, data on system capacity, length, and other critical details that sketch a vivid picture of the global network.

• Submarine Telecoms Industry Report: Our annual report takes an analytical approach to the industry, covering everything from current trends to capacity analysis and future predictions. It’s an invaluable resource for anyone seeking to understand the market’s trajectory.

VISUALIZING CONNECTIONS: CABLE MAPS

• Online SubTel Cable Map: An interactive tool mapping over 550 cable systems, perfect for digital natives who prefer an online method to explore global connections.

• Printed Cable Map: Our annual printed map caters to those who appreciate a tangible representation of the world’s submarine fiber systems, detailed in a visually appealing and informative format.

EDUCATIONAL OPPORTUNITIES: CONTINUING EDUCATION

SubTel Forum’s commitment to education is evident in our courses and master classes, covering various aspects of the industry. Whether you’re a seasoned professional or new to the field, these learning opportunities are fantastic for deepening your understanding of both technical and commercial aspects of submarine telecoms.

FIND THE EXPERTS: AUTHORS INDEX

Our Authors Index is a valuable tool for locating specific articles and authors. It simplifies the process of finding the information you need or following the work of your favorite contributors in the field.

TAILORED INSIGHTS: SUBTEL FORUM BESPOKE REPORTS

• Data Center & OTT Providers Report: This report delves into the evolving relationship between cable landing stations and data centers, highlighting trends in efficiency and integration.

• Global Outlook Report: Offering a comprehensive analysis of the submarine telecoms market, this report includes regional overviews and market forecasts, providing a global perspective on the industry.

• Offshore Energy Report: Focusing on the submarine fiber industry’s oil & gas sector, this report examines market trends and technological advancements, offering insights into this specialized area.

• Regional Systems Report: This analysis of regional submarine cable markets discusses capacity demands, development strategies, and market dynamics, providing a detailed look at different global regions.

• Unrepeatered Systems Report: A thorough examination of unrepeatered cable systems, this report covers project timelines, costs, and operational aspects, essential for understanding this segment of the industry.

• Submarine Cable Dataset: An exhaustive resource detailing over 550 fiber optic cable systems, this dataset covers a wide range of operational data, making it a go-to reference for industry specifics.

SubTelForum.com stands as a comprehensive portal to the dynamic and intricate world of submarine cable communications. It brings together a diverse range of tools, insights, and resources, each designed to enhance understanding and engagement within this crucial industry. From the cutting-edge SubTel Forum App to in-depth reports and interactive maps, the platform caters to a wide audience, offering unique perspectives and valuable knowledge. Whether you’re a seasoned professional or new to the field, SubTelForum.com is an indispensable resource for anyone looking to deepen their understanding or stay updated in the field of submarine telecommunications.

SUBTEL CABLE MAP UPDATES

The SubTel Cable Map, built on the industry leading Esri ArcGIS platform, offers a dynamic and engaging way to explore over 440 current and planned cable systems, 50+ cable ships, and more than 1,000 landing points. This interactive tool is linked to the SubTel Forum Submarine Cable Database, providing users with a comprehensive view of the industry.

Submarine cables play a pivotal role in global communications, acting as the backbone of the internet. They are responsible for transmitting over 99% of all international data, connecting continents and enabling global connectivity. Without these underwater highways, the speed and efficiency of global internet communication that we enjoy today would not be possible.

The Esri ArcGIS platform, upon which the SubTel Cable Map is built, is a powerful geographic information system (GIS) for working with maps and geographic information. It is used for creating and using maps, compiling geographic data, analyzing mapped information, sharing and discovering geographic information, and using maps and geographic information in a range of applications. Its robust capabilities make it an ideal platform for the SubTel Cable Map, allowing for dynamic, interactive exploration of complex data.

With systems connected to SubTel Forum’s News Now Feed, users can easily view current and archived news details related to each system. This interactive map is an ongoing effort, updated frequently with valuable data collected by SubTel Forum analysts and insightful feedback from our users. Our aim is to provide not only data from the Submarine Cable Almanac, but also to incorporate additional layers of system information for a comprehensive view of the industry.

We encourage you to explore the SubTel Cable Map to deepen your understanding of the industry and to educate others on the critical role that submarine cable systems play in global communications. All submarine cable data for the Online Cable Map is sourced from the public domain, and we’re committed to keeping the information as current as possible. If you are the point of contact for a company or system that needs updating, please don’t hesitate to reach

out to kclark@subtelforum.com.

Below is the full list of systems added and updated since the last issue of the magazine:

MARCH 18, 2023

SYSTEMS ADDED:

• Trans Americas Fiber System

SYSTEMS UPDATED:

• AAE-1

• Alpal-2

• EAC-C2C

• EIG

• MainOne

• OMRAN/ EPEG Cable System

• Raman

• SAEx East

• SAEx West

We hope the SubTel Cable Map serves as a valuable resource to you and invites you to dive into the ever-evolving world of submarine cable systems. We invite you to start your exploration today and see firsthand the intricate network that powers our global communications. Happy exploring! STF

KIERAN CLARK is the Lead Analyst for SubTel Forum. He originally joined SubTel Forum in 2013 as a Broadcast Technician to provide support for live event video streaming. He has 6+ years of live production experience and has worked alongside some of the premier organizations in video web streaming. In 2014, Kieran was promoted to Analyst and is currently responsible for the research and maintenance that supports the Submarine Cable Database. In 2016, he was promoted to Lead Analyst and his analysis is featured in almost the entire array of Subtel Forum Publications.

Do you have further questions on this topic?

ASK AN EXPERT

PTC 2024: A REVIEW FROM GEN Z

BY MICHAEL BRAND, ISABELLE CHERRY, ELLA HERBERT, AND ISABEL JIJONFor our small group of undergraduate students, the first few steps walking into PTC 24 felt like a jump into the deep end of the telecommunications industry. The four of us had come here from the University of California, Berkeley. Before we began working for the SubOptic Foundation’s Sustainable Subsea Networks research team, we had never even known about subsea internet cables, data centers, and the maritime industry. What we had thought about, though, was how our young generation was going to fight climate change and make our built environment more sustainable. We had joined Sustainable Subsea Networks in the hope of finding new ways to reduce the carbon emissions of what, we learned, was critical infrastructure.

Since August each of us had been working diligently to learn all we could about the history and importance of the digital infrastructure industries–especially the subsea cable sector. By the time PTC rolled around in January, we were eager to learn about how this critical industry could do its part to halt the escalating climate crisis. Each of us sat dutifully at a variety of sessions across the days of the conference, typing frantically to record as much information as possible about the state of the industry and its sustainability initiatives.

But before this, much to our surprise, at the very first session our group was spotlighted for our young age and the novelty of our research. It became apparent to us that this industry welcomed young, creative minds who were unafraid to propose new ideas to address the increasingly complicated environmental challenges that the world faces. In the later sessions of PTC, many people mentioned that sustainability was important. What we were looking for was a clear and detailed plan to achieve it – we hope we can help be part of that plan.

After attending PTC, we felt inspired and confident that our generation, and young people more broadly, will be capable of addressing the challenges that the industry

faces. Below we describe some of these challenges, including power generation, artificial intelligence, and geopolitics, that were discussed at the conference. These challenges, from our perspective, are all connected to the issue of sustainability, which is both affected by power, technology, and politics, and will shape their future. We hope to grow with the industry into the next chapter of its development – one where careful approaches to sustainable initiatives, economics, and politics can all be implemented together.

THE SHIFTING LANDSCAPE OF POWER GENERATION

Power is at the heart of sustainable development, and throughout the

conference we were keen to note the different discussions and attitudes towards it. We realized that the digital infrastructure industry in general was quite concerned with power: it was at the core of several panels and sparked discussions and controversy. The location, source, and efficiency of power were the primary focal points of these discussions. We were interested in observing how sustainability plays into these discussions and the degree of impact that concern for the future of our planet would hold against other considerations such as economics and growth.

The discussion of power was connected to 5G and the advent of artificial intelligence (AI), the latter of which consists of not only machine learning, but also human labor and digital infrastructure. Discussions about 5G all pointed out that it will require an increase in capacity. For AI, panelists speaking about topics ranging from data centers to fiber manufacturing all identified that it will play a critical role in the development of new digital infrastructure. However, all noted that the extent to and ways in which AI will impact the telecom industry is yet to be determined.

So far, all that is known about AI is that it has a high power demand, could increase manufacturing demand, and presents the opportunity for new projects and jobs. The question remains, however, where we are going to see AI’s infrastructure being built. Many participants noted that digital infrastructure development, especially of data centers, is no longer simply being driven by the location of end-users, but also by the location of power.

Following a surge in demand during the COVID-19 pandemic, alongside 5G and AI, there has been a larger and larger demand for data

SUBSEA

centers. As a result, the industry has turned to developing new hyperscale data centers as well as upgrading the capacity of old ones. This demand has become so large, Chris Downie of Flexential, a hybrid digital infrastructure provider, observed that for the first time in his company’s history they were “pre-selling inventory 275 days in advance.” All of these facilities will require more and more power, and the cost and availability of this power will become increasingly important. What we took away from this is that now is the perfect time to prioritize sustainability initiatives that balance peoples’ needs for capacity and power, and the planet’s need for carbon emissions reduction.

of hyperscale data center campuses, noted, is that “there isn’t enough green power to go around.” This is particularly concerning since with the advent of AI, says Carl Grivner, CEO of Global Cloud Exchange, capacity is going to increase by at least 10 times as much as there is currently. Therefore, hyperscalers and the industry as a whole are going to see changes in the location of and type of power generation.

Following a surge in demand during the COVID-19 pandemic, alongside 5G and AI, there has been a larger and larger demand for data centers. As a result, the industry has turned to developing new hyperscale data centers as well as upgrading the capacity of old ones.

With this focus on power, we saw industry leaders call for the use of renewable and alternative energy. One of the primary challenges with embracing renewable energy, as Jeff Tench of Vantage Data Centers, a provider

Members of the industry believe that natural gas and fossil fuels are essential power sources for now, but many were hopeful that data centers would be powered by a variety of sustainable power sources including solar, wind, geothermal, and nuclear in the future. There appeared to be a consensus that fossil fuels must be phased out soon, but there wasn’t a clear agreement on how to do this. When considering which types of power to use, industry leaders consistently noted the importance of considering the localities they were operating in. We observed that while renewable energy was a prominent discussion point, most of these discussions revolved around the economic aspects of this change, with less focus on many of the other aspects of sustainability–such as the need for a cultural shift, regulatory shifts, and coordination with adjacent industries. Additionally, the conflict between growth and sustainability was a critical challenge to the implementation of renewable power. The amount of sustainable power available currently simply does not align with the level of corporate commitments to reduce carbon emissions.

Another area of focus was the potential centralization of energy generation around data centers. Centralization will mean serious power demands and real challenges in

terms of resiliency. With the increased need for power, many conversations arose about the possibility of building power plants for data centers that were separate from the grid. Joe Kava, Vice President of Global Data Centers at Google, noted that AI training at scale tends toward infrastructure centralization whereas application and consumer-end tends toward decentralization. Kava also pointed out that obtaining power needed isn’t guaranteed because the grid can’t support all power needs. We saw this reiterated in discussions throughout the conference: most smaller markets do not have the capacity to generate sufficient power and this would require outsourcing. Some observed that there was no regulation against operators building their own plants, and argued that the industry had to find ways to make its own power. While it is yet to be seen if AI and 5G will stimulate a turn toward further centralization of energy generation around data centers, it is certain that any development will be a sustainability issue.

In addition to considering what type of power data centers should be using, there was a heavy emphasis on efficiency of facilities. Across the conference, industry representatives referenced battery systems that could make data centers more efficient and reduce greenhouse gas emissions. Sanjay Bhutani of AdaniConneX, a hyperscale data center provider, argued that the main issue for the industry was efficiency, rather than who was building or generating the power. Joe Reele, Vice President, Solution Architects at Schneider Electric, an energy management company, noted that many data centers were underutilized by consumers, with some statistics showing that only 60% of the power going to data centers is actually used.

Some argued that a new focus on power capacity effectiveness could increase the efficiency of data centers and reduce greenhouse gas emissions. We reflected that power efficiency in data centers was likely such a central topic because it is an area of alignment between economic and sustainable goals.

Finally, throughout the conference and across industry subsectors, there were persistent calls for collaboration. Many of the challenges in obtaining renewable and alternative energy, such as permitting, sourcing, and localizing, are shared across the digital infrastructure industries, making it essential that companies come together to overcome them. In addition to focusing on the sustainability of data center operations, the industry also noted the importance of examining the sustainability of the supply chain. While many industry leaders were concerned about how the increasing demand for data centers has led to shortages of essential materials, they

pointed out that it is also important to consider the environmental impacts of sourcing all of those materials.

While many industry leaders were concerned about how the increasing demand for data centers has led to shortages of essential materials, they pointed out that it is also important to consider the environmental impacts of sourcing all of those materials.

We attended panels on subsea cables where sustainability was also highlighted as an important issue. However, the challenges facing renewable power for data centers compared to cable operations differ substantially in terms of scale. Cable landing stations typically consume far less power than data centers, and as a result, there are not the same opportunities in terms of the centralization of generation, although some cable landing stations are currently sourcing power renewably and considering onsite installations. Their smaller-scale infrastructure means that cable owners and operators may need to think differently about sustainability than the data center industry, even as they draw lessons from it. Regardless, we observed that subsea cables are key to two forms of green transition: on one hand, laying more subsea power cables between green sites of generation and sites of consumption (transporting the energy). On the other hand, there is the option to lay more subsea cables to data centers powered by renewable sources (transporting the bits).

As members of Generation Z, it might be assumed that we would care more about increased capacity through 5G and being able to use AI no matter the cost, even if that meant the data centers that these technologies are dependent on are powered by natural gas and fossil fuels. However, we are more concerned with ensuring that the infrastructure we depend on will be sustainable enough that it can help stop the climate crisis. This will ensure that there is a healthy world for us to thrive in and thus be able to utilize 5G and AI.

SUBSEA

NAVIGATING INTERNATIONAL AND GEOPOLITICAL CHALLENGES

As cables span the globe, landing in many countries and crossing many territorial waters, the subsea cable industry must navigate regional and international tensions, State interests, and policy and permitting restrictions. Although we did not see much discussion of sustainability in relation to geopolitics, we know from our environmental education that sustainability regulation is only growing globally. How, we wonder, will these new regulations–which are taking different shapes all over the world–layer on this geopolitical landscape?

Repeatedly noted in the conference, the subsea cable industry is becoming entangled in the growing Sino-American technological and geopolitical rivalry, especially in the Pacific. This has major consequences for companies working in East and South East Asia. Paul Abfalter, Head of North Asia & Global Wholesale at Telstra, stated that 2023 was a record year for cable-cutting incidents and permitting issues and delays in the South China Sea. At the same time, divisions in the marketplace are emerging, especially between American and Chinese companies, pushed towards decoupling by their respective States. With heightened earthquake activity, and the aging of existing, overcrowded cable routes, companies are grappling with a contentious economic, political, and geographic zone. In overcrowded areas such as the Taiwan Strait, a significant number of cable repairs also means a greater climate impact since there are more emissions generated by maintenance ships. Simultaneously, rising demand has outpaced supply, and investors and entrepreneurs are now diversifying connectivity projects in South East Asia and South Asia.

In some panels of the conference, participants also discussed the new opportunities and challenges presented by a “New Asia Opportunity.” Growth is happening not only in historical connectivity hubs such as Japan, Singapore, Hong Kong, and Sydney, but there has also been sustained demand in large “second-tier

Indeed, with the rise of temperatures, sea levels, and the progressive heightening of frequency and intensity of natural hazards, infrastructure including subsea cables, landing stations, and data centers must be able to face surges, waves, cyclones, earthquakes, floods, and tropical storms.

markets” in countries such as India, Malaysia, and Indonesia, driving new investments. Many large cities such as Mumbai, with a population of over 20 million, have long been underrepresented in the digital infrastructure industries in terms of the level of data center infrastructure. This is now changing. In these geographies, governments are adopting the path of digitalization, and trying to attract data centers. However, we heard that deployment into these markets is challenging because of power, land,

and regulatory challenges.

In all of these discussions, the importance of “resilient systems” was highlighted. Indeed, with the rise of temperatures, sea levels, and the progressive heightening of frequency and intensity of natural hazards, infrastructure including subsea cables, landing stations, and data centers must be able to face surges, waves, cyclones, earthquakes, floods, and tropical storms.

Yet even with the expansion of digital infrastructure, we still heard many participants discuss major disparities in terms of access to connectivity. Indeed, there remain many underserviced areas, such as the Arctic, where historically challenging terrain, uncharted waters, extreme temperatures, long distances, and a sparse population have made the development of connectivity infrastructure difficult. This remains a difficult place to build. Emerging federally funded projects in Alaska and Canada will have to surmount high costs and risks related to installment and maintenance of cables, limited accessibility, and the need for multivessel operations. Environmental concerns are also especially prevalent in this fragile area, with its unique and delicate biodiversity. To ensure the sustainability of new infrastructures, Steve Arsenault, VP at IT International Telecom, explained it is “key that engagement with local communities, scientific, research, multilateral and regional organizations is done early on.” Upholding the strict and unique Polar Code, and ensuring a sustainable framework, will be crucial to respect indigenous livelihoods, biodiversity, and the important role of this geography in maintaining the world’s climate balance. Such careful work is also necessary in other under-connected and fragile zones such as the Amazon basin. Erick Contag

of the SubOptic Foundation introduced us to The Amazônia+Conectada project, a major river cable infrastructure project, currently being deployed with support from USAID and Grupo +Unidos, a Brazilian non-profit civil society organization.

From our perspective, we see sustainability connected to each of the concerns that arises in the navigation of geopolitical terrain. In the intra-Asia cable landscape, we wonder what will happen when sustainability regulation enters the scene? Will this compound existing tensions? Can sustainable practices–such as removing and recycling systems from overcrowded routes–create a little more room for everyone? The importance of balancing connectivity with sustainability is essential, and this is nowhere more apparent than in the Arctic. Are there lessons learned here that would help the digital infrastructure industries in other parts of the world? As young researchers passionate about sustainability in the subsea cable industry, we are eager to keep tracking the emergence of sustainability initiatives and regulations at local, regional and international levels, and study how they intertwine with geopolitical developments.

ON THE FUTURE

While our research team primarily focuses on environmental sustainability, in conclusion we would like to turn to the digital infrastructure industries’ sustainability in a broader sense. Over the course of the conference we heard concerns across all parts of the digital infrastructure landscape, from cable manufacturers to data center operators to academic researchers, pointing out the relative absence of youth in the industry. Many people across these sectors worry that there are not

enough young people in both the subsea cable and data center industries to support their resilient development in the coming decades. This is especially true given the industry’s need for specialized knowledge and skills.

We want to help build a resilient network, connecting people around the world, in the most sustainable way possible.

Throughout the conference, we collectively met with dozens of members of the digital infrastructure industries, both data center operators and those in the subsea industry. In every conversation we felt like our opinions and ideas were valued, and we were excited to learn more. The more immediate step, however, is getting more young people into the room in the first place and then providing opportunities for knowledge and skill acquisition. We wondered: how would we communicate to our friends about what we had seen here? How would other students both learn about these industries, and what would make them want to join?

One thing that is very important not only to us, as we study the environment, but to our generation as a whole, is sustainability. This is something that our friends and peers care about. We know that climate change will impact our lives for many decades to come. We want to help build a resilient network, connecting people around the world, in the most sustainable way possible. We hope that this

will not be a passing focus at PTC, but that these conversations will continue to grow. We will be there to listen. STF

MICHAEL BRAND is an undergraduate student at the University of California, Berkeley pursuing a B.S. in Environment Economics and Policy. He is also a research assistant on the Sustainable Subsea Networks research team. His research focuses on the intersection of behavioral economics, environmental policy, and public communication for the development and regulation of digital infrastructure.

ISABELLE CHERRY is an undergraduate student pursuing a B.S. in Environmental Policy and Management at the University of California, Berkeley. As a research assistant on the SubOptic Foundation’s Sustainable Subsea Networks research team she explores sustainability metrics relating to the global manufacturing, deployment, and disposal of subsea telecommunications cables. Her research has a particular focus on how regulations impact cable recycling efforts.

ELLA HERBERT is an undergraduate student at the University of California, Berkeley pursuing her B.S. in Environmental Science. She is currently a research assistant for the Sustainable Subsea Networks research team, focusing on data center sustainability by exploring metrics, industry trends, and publications within the field of telecommunications.

ISABEL JIJON is an undergraduate student pursuing a B.A in Political Philosophy and International Relations at Sciences Po Paris and the University of California, Berkeley. She is a Research Assistant for the Subsea Sustainable Networks research team. She focuses on topics related to the International Maritime Organization and regulatory bodies, cable-laying ships, and the consideration of sustainability in the maritime sector of the subsea cable industry.

Do you have further questions on this topic?

ASK AN EXPERT

WHERE IN THE WORLD ARE THOSE PESKY CABLESHIPS?

BY SYEDA HUMERAMARITIME NAVIGATION DATA INSIGHTS: A POWER BI VISUAL ANALYSIS

INTRODUCTION

In an era where data reigns supreme, the maritime industry stands to benefit significantly from harnessing the power of analytical insights. Navigating the vast oceans efficiently and safely is paramount to maintaining the lifeline of global commerce. With this premise, our Power BI report delves into the ocean of data provided by the Automatic Identification System (AIS), presenting a distilled narrative of ship movements, traffic patterns, and navigational trends.

The purpose of this report is to unlock the potential of AIS data, transforming raw numbers into a strategic asset. Through a carefully crafted set of Power BI visuals, we offer stakeholders a dashboard of knowledge, from real-time positional mapping to historical trends of vessel operations. Each visual is a piece of the larger puzzle, providing insights that can lead to enhanced route planning, improved fleet management, and optimized maritime operations.

As we chart the course of this analytical journey, we invite you to explore the intricate dance of submarine traffic through our visual representations. From the macroscopic views of global ship distributions to the microscopic details of individual vessel attributes, our report is tailored to aid decision-makers in steering through the competitive waters of the maritime industry with confidence and foresight.

Let’s set sail into the data-driven decision-making horizon, where every point of data is a beacon guiding us

to smarter, safer, and more efficient maritime navigation. In the fabric of our hyperconnected realm, the submarine telecommunications network emerges as a critical enabler of our digital dialogues. This network’s vast, unseen channels of communication underpin the ceaseless pulse of the global economy, making it an essential infrastructure of the modern world. Our report for 2024 delves into the dynamic confluence of innovation, demand, and strategy that shapes the submarine telecommunications landscape.

Beneath the ocean’s expanse lies a complex matrix of cables, slender yet formidable, forming the underpinnings of our digital age. These conduits carry the lifeblood of our connectivity, embodying the relentless exchange of information that bridges distances and dissolves borders.

The appetite for data and connectivity burgeons, driven by an ever-growing demand for digital services. Our analysis navigates through the burgeoning requirements for bandwidth and the industry’s agile expansion to keep pace. Submarine cables have also risen as geopolitical vectors, with nations recognizing their strategic importance in the digital power play. Concurrently, environmental consciousness steers the course of expansion, integrating sustainable practices into the development of these undersea arteries.

VISUALIZING THE CABLE SHIP FLEET

Our visuals map out the intricate web of submarine cables that traverse the ocean floor, a reflection of 2024’s connectivity grid. The industry’s timeline is chronicled through pivotal advancements, painting a picture of technological progress and the evolution of a network that undergirds the communication capabilities of nations and enterprises alike.

Amidst the bustling activity of the maritime industry, the vitality of data stands undiminished as it courses through the veins of global trade and communication. Within the grand scheme of marine navigation, the analysis of vessel speeds presents a compelling narrative, one that is crucial for understanding the dynamics of sea traffic. It is on this premise that we anchor our focus on a particular temporal marker—January’s Day 20. Commanding a 7.62% share in the average AIS.SPEED, this day emerges as a pivotal point, warranting a comprehensive examination of its prominence and the factors contributing to this statistic.

As the month of January sets the tone for the year, Day 20’s impact on speed averages is not merely a figure but a reflection of underlying trends and operational forces at play. This report sails through the granular details of this specific day, exploring the confluence of variables that conspire to influence vessel velocity and, by extension, the very rhythm of maritime telecommunications.

The significance of the 7.62% rise on this January day is multifaceted. To unravel its essence is to engage with a myriad of potential drivers—from environmental influences

and seasonal weather patterns that favor expedited travel to the strategic deployment of vessels in response to market demands or geopolitical events. Each percentage point encapsulates an aspect of the operational environment, painting a complex picture of maritime mobility.

Delving into the data, we seek to understand whether this increase is an anomaly or part of a predictable pattern influenced by recurring factors. Does this surge correspond with specific routes or regions? Is it a testament to technological advancements in navigation systems or propulsion efficiency? Or does it align with a surge in economic activities post-holiday season, as the industry revs its engines in response to the uptick in commerce?

The heightened average speed on Day 20 reverberates through the industry, echoing in the operational protocols and strategic decision-making frameworks of maritime entities. It influences scheduling, fuel consumption, port operations, and even the supply chain logistics that hinge on the timely arrival of cargo. In recognizing the ripples caused by this surge, industry players are better positioned to anticipate similar trends, allocate resources more efficiently, and optimize route planning.

By situating Day 20 within the broader context of January’s operational lan dscape, we not only benchmark this increase but also set a precedent for predictive analysis in maritime operations. The data captured on this day becomes a touchstone for comparative analysis, serving as a gauge for the performance and efficiency of the industry at large.

The exploration of January’s Day 20 and its 7.62%

CABLESHIPS

ascendancy in average AIS. SPEED transcends mere number crunching. It is a quest to distill actionable insights from the depths of data, to chart a course through the complex waters of maritime navigation with a compass oriented by knowledge. For the stakeholders of this industry, such insights are not just statistical waypoints but navigational aids that direct strategic thinking and operational finesse. As the year unfolds, this report will serve as a lodestar, guiding the maritime telecommunications industry toward informed, data-driven decision-making and robust industry analysis.

In the complex tapestry of global maritime operations, the nuanced dance of vessel statuses unfolds, a vital narrative captured by the Automated Identification System (AIS). Diving into this profound sea of data, our analytical odyssey charts the diverse vessel states that rhythmically pulse through the arteries of maritime commerce and navigation.

Emerging prominently in our analysis is the “Moored” status, a behemoth among vessel states with a towering count of 3,403. This figure is not a mere statistic; it embodies the multitude of vessels nestled within the embrace of the world’s ports. “Moored” represents more than a temporary halt—it is a symphony of orchestrated efforts involving crew rest, cargo transactions, and critical maintenance. In essence, this state is a cornerstone of maritime operation, facilitating the seamless flow of global trade.

In a poignant contrast lies the status “Not Under Command,” with a solitary count of 1. This state often signals a vessel’s compromised maneuverability, a testament to the unpredictability of maritime journeys. Though statistically minimal, this outlier offers a stark reminder of the inherent perils of seafaring, highlighting the singular moments when even the mightiest giants of the ocean find themselves at the mercy of nature’s whims.

The breadth of AIS data casts a light on a spectrum of 7 navigational statuses, delineating a rich landscape of operational dynamics. Of these, the status corresponding to “Moored” stands out, accounting for 35.73% of the total count—a testament to its predominant role in maritime operations.

The extreme disparity between the highest and lowest counts of status—3,403 for “Moored” and 1 for “Not Under Command”—presents a striking 340,200.00% difference. This dramatic range encapsulates the operational diversity of the maritime sector, from serene harbors to vessels adrift, governed by a myriad of factors including environmental conditions, regulatory frameworks, and the pulsating demands of global logistics.

As we distill the essence of AIS data into coherent narratives, we uncover more than just figures—we navigate through the lifeblood of maritime operations. This exploration into the realm of vessel states is not merely analytical. It is a saga of the strategic, operational, and logistical fibers that weave together the complex fabric of international maritime travel.

With these insights, the AIS data stands as a navigational beacon, guiding the maritime industry toward a horizon marked by increased safety, efficiency, and environmental responsibility. It underscores the importance of understanding not only where we are but also where we are heading— charting a course for the future of maritime navigation that is as informed as it is ambitious.

In closing, the voyage through maritime data is a continuous journey, one that highlights the robustness and adaptiveness of this essential industry. Each data point, each trend, is a narrative of resilience, a chronicle of the strategic ingenuity that propels the ceaseless journey of our global fleet.

In the intricate world of maritime navigation, understanding the operational capabilities of vessels is paramount. This report delves into the relationship between two critical attributes: SPEED and DRAUGHT, focusing on FAIR-

WIND LEGION and POLARIS 3 for their exemplary performances in these areas.

FAIRWIND LEGION: THE SPEED PRODIGY

FAIRWIND LEGION distinguishes itself with an unparalleled average SPEED of 11.60, setting a benchmark in maritime velocity. This exceptional speed not only highlights the vessel’s adeptness at navigating vast oceanic expanses swiftly but also marks it as a leader in the race against time on the high seas. On the scatter plot, we expect FAIRWIND LEGION’s data points to shine towards the upper echelons of speed, embodying its status as the speed champion.

POLARIS 3: MASTER OF THE DEPTHS

In contrast, POLARIS 3 commands attention with the highest average DRAUGHT of 9.21, showcasing its significant underbelly depth. This measure is crucial for assessing a vessel’s ability to navigate through various marine environments, underpinning its operational depth and cargo-carrying capacity. On the scatter plot, POLARIS 3’s data points are anticipated to cluster at the higher end of the draught axis, highlighting its substantial load-bearing prowess.

The scatter plot analysis serves as a visual narrative that brings to light the interaction between SPEED and DRAUGHT for these vessels. This comparative analysis aims to uncover potential correlations or patterns, offering insights into how these two dimensions coalesce to define the operational envelope of FAIRWIND LEGION and POLARIS 3.

A critical aspect of this analysis is the identification of outliers, which may reveal instances where FAIRWIND LEGION and POLARIS 3 exceed typical operational parameters. These outliers are not mere statistical anomalies but gateways to understanding exceptional operational capabilities or innovative navigational strategies employed by these vessels.

This exploration into SPEED and DRAUGHT, with a focus on FAIRWIND LEGION and POLARIS 3, illuminates the vast spectrum of navigational dynamics in the maritime industry. By mapping these attributes on a scatter plot, we not only celebrate the unique characteristics of these vessels but also enhance our understanding of the complex interplay between speed and draught in maritime operations. This analysis stands as a testament to the diversity and richness of operational strategies within the maritime domain, offering valuable perspectives for optimizing vessel performance and efficiency.

Understanding the distribution of vessel types through AIS

CABLESHIPS

data is critical for numerous stakeholders within the maritime industry, including regulatory bodies, shipping companies, and maritime safety organizations. The AIS.TYPE classification serves as a key indicator of the composition of the maritime fleet, offering insights into shipping trends, operational priorities, and potential areas for policy development.

The analysis focused on the count of instances across different AIS.TYPE categories within the dataset. The findings reveal a distinct pattern of distribution, emphasizing the predominance of specific vessel types.

• Highest Count Observed: The dataset indicated that category “90” recorded the highest count with 4,526 instances. This figure significantly surpasses the counts of other vessel types, marking category “90” which is other ship of all types as the most prevalent within the maritime data analyzed.

• Percentage Share: Remarkably, category “90” which is other ships accounted for 47.52% of the total AIS.TYPE count observed in the dataset. This substantial proportion highlights the central role of this vessel type in maritime operations, suggesting a widespread application and critical importance in the industry’s ecosystem.

COMPARISON WITH OTHER CATEGORIES

• Following Leaders: While category “90” which are other ships leads in prevalence, categories “Dredging or under-

water ops” and “Cargo “ also emerged as notable vessel types within the dataset. Though these categories do not match the volume represented by other ships, their presence underscores the diversity and range of vessel operations captured through AIS data.

• Operational Implications: The variation in the count of AIS.TYPE categories reflects the multifaceted nature of maritime operations. The high prevalence of category “90” which are other ships might indicate specific operational or logistical preferences within the industry, potentially driven by factors such as vessel functionality, regulatory compliance, or market demands.

• The analysis of AIS.TYPE distribution within the maritime dataset underlines the significant predominance of category “90”, which are other ships marking it as a cornerstone of maritime operations. The overwhelming representation of this category has profound implications for understanding the operational landscape of the global maritime fleet.

• Strategic Insights: Stakeholders can leverage these insights to strategize fleet management, regulatory oversight, and safety measures. The dominance of a particular vessel type may inform targeted strategies for enhancing operational efficiency, compliance monitoring, and safety protocols.

• Future Research Directions: The findings also open avenues for further research into the specific characteristics, uses, and operational patterns associated with the leading vessel types. Understanding the reasons behind the dominance of category “90” which are other ships and its implications for maritime logistics and safety represents a valuable area for in-depth investigation.

This detailed analysis of AIS.TYPE distribution not only enhances our understanding of the current maritime operational landscape but also informs future strategic decisions and policy development within the maritime sector.

The network graph presented herein aims to elucidate the intricate web of relationships between cable ships and their operational zones as captured by the Automatic Identification System (AIS). This analysis is pivotal for deciphering the complex interaction patterns that underlie maritime operations, specifically in the domain of global communications infrastructure. The dataset central to this analysis encompasses a myriad of zones that represent the diverse operational areas serviced by cable ships. These zones span a broad spectrum, from regional seas like the Aegean and Baltic to significant oceanic expanses such as the North Pacific Ocean and the Indian Ocean. In telecommunications, these could parallel data centers and connectivity nodes, serving as origination and termination points for data transmission.

Upon examining the network graph, one observes a constellation of nodes, each representing a maritime zone, with the cable ships serving as the dynamic links that form the edges within this network. The prominence of a node is a function of the volume of connections it boasts, indicating the frequency and strategic importance of cable ship activity in that region.

Certain maritime zones manifest as pivotal hubs within the network. Notable among these are the Gulf of Mexico and the East Asia zones, distinguished by their dense nexus of connections. These hubs are instrumental in sustaining the global communications network, ensuring operational continuity across the board. The direction and density of connections between nodes shed light on the operational patterns of cable ships. High-density routes may signify areas with elevated data transfer demands or regions prone to cable faults requiring frequent maintenance.

The graph reveals clusters indicative of regional networks, where cable ship operations are particularly interwoven. For instance, the North Sea and the Baltic Sea exhibit a tightknit community of activity, possibly reflective of a localized network with high interdependency.

OPERATIONAL INSIGHTS

• Strategic Importance of Cable Ships: The analysis underscores the strategic importance of cable ships in ensuring robust global connectivity. These vessels embody the linchpins of the physical internet, their operations critical to the resilience and integrity of international data exchange.

• Risks and Challenges: The report also brings to the fore the myriad challenges these vessels encounter. From geopolitical tensions affecting certain maritime zones to the environmental hazards of the open sea, each factor significantly influences operational strategies.

• Navigational Data Utilization: Leveraging AIS data for this analysis affords a rich perspective on navigational trends and the operational health of the maritime telecommunications infrastructure. Such insights are invaluable for strategic planning, risk assessment, and reinforcing the infrastructure against potential disruptions.

CONCLUDING THOUGHTS

This network graph analysis provides more than just a visual representation; it offers a narrative on the critical role played by cable ships in the interconnected world. As they traverse the globe, these vessels not only connect disparate zones but also uphold the unseen yet essential framework that supports the world’s growing connectivity needs. In the context of an increasingly data-driven future, such analyses have become imperative for enhancing the resilience and efficiency of global maritime operations. The network graph of sources and destinations provides a valuable visual representation of the connectivity and relationships within a complex system. By analyzing this graph, we gain insights into hubs, flow patterns, and potential communities within the network.

This analysis serves as a foundation for making informed decisions, optimizing operations, and enhancing the resilience of the system. As we continue to navigate and understand complex systems, network graph analysis remains an indispensable tool for uncovering hidden patterns and connections. STF

SYEDA HUMERA, a graduate from JNTUH and Central Michigan University, holds a Bachelor’s degree in Electronics and Communication Science and a Master’s degree in Computer Science. She has practical experience as a Software Developer at ALM Software Solutions, India, where she honed her skills in MLflow, JavaScript, GCP, Docker, DevOps, and more. Her expertise includes Data Visualization, Scikit-Learn, Databases, Ansible, Data Analytics, AI, and Programming. Having completed her Master’s degree, Humera is now poised to apply her comprehensive skills and knowledge in the field of computer science.

CAPACITY CONNECTION

DYNAMICS OF THE SUBMARINE CABLE BANDWIDTH MARKET: HOW TECHNOLOGICAL DEVELOPMENTS INFLUENCE COMMERCIAL CONDITIONS – 2ND EDITION

BY JOHN MAGUIREINTRODUCTION

In this edition of Capacity Connections, we look at the commercial impact of relentless technological development in Internet, Communications and Technology (ICT), as it affects the submarine cable sphere. It is a heavily inter-dependent system, so we also touch upon governance and regulation—and the market. In a piece this short, we must focus on a detail, the better to observe the evolution in a narrowly defined segment. Accordingly, I have elected to focus on the Transatlantic market.

At the submarine cable route level, note that demand and prices can vary widely depending on the system, route, capacity purchased, contract term, market conditions, and so on. Additionally, as new cable systems are deployed, with continuously increasing capacity and efficiency, the unit cost of submarine cable bandwidth reduces—and we expect bandwidth prices to reflect this continuous downward trend, albeit at a rate that can independently vary significantly depending on any number of factors, including the quantum of advancements, extent of overbuild, relative speed of parallel growth in market demand and, indeed, political and geopolitical factors.

THE DAWN OF SUBMARINE COMMUNICATIONS 1

The emergence and evolution of submarine cable technology has been pivotal in shaping the modern world, enabling global connectivity and the near seamless flow of information between countries and continents. Submarine cables emerged during in a time of massive industrial and scientific development towards the end of the industrial revolution and, particularly, following the invention of the telegraph.

1 https://en.wikipedia.org/wiki/Submarine_communications_cable, especially citing Haigh, Kenneth Richardson (1968). Cable Ships and Submarine Cables. London.

As early as the 1840s, German engineers were experimenting with underwater cables across the River Rhine. In 1850, the first cross-channel submarine cable was laid between France and England. The first Transatlantic telegraph cable was laid between Valentia Island, off the south-west coast of Ireland, and Newfoundland, by the appropriately named Atlantic Telegraph Company. The system achieved RFS in August 1858 and its in-service life ended a brief three weeks later. Its short life did little to encourage immediate re-building, but even its brief life, notably by means of a congratulatory telegram from Queen

Victoria to President Buchanan, set the stage for a long and continuing series of ever more technologically advanced successors.

The earliest commercial driver was a desire to grow the reach of telegraph services, internationally. The Transatlantic telegraph cable was a massively expensive facility and throughout the period until the advent of coaxial cables and telephony global electronic communications was the province of governments and large corporations, ordinary citizens accessing services, expensively, only on a limited time-share basis.

In 1865, the International Telegraph Union (ITU) was formed. This body’s purpose was to set technical and operational standards as well as regulations for international telegraphy, including a form of universal access obligation and, of course, tariff and accounting rules2

2 https://www.itu.int/en/history/Pages/ITUsHistory. aspx https://en.wikipedia.org/wiki/International_Telecommunication_Union

The ITU was renamed the International Telecommunication Union in 1932, reflecting the technical evolution of the sector, and in 1949 became a specialized agency within the United Nations system.

THE INTRODUCTION OF COAXIAL CABLES AND THE ADVENT OF TELEPHONY

The first Transatlantic telephone cable system employing coaxial cable technology (TAT13) was laid between Oban, Scotland, and Clarenville, Newfoundland. With capacity of 36x 4kHz channels, it went RFS in September 1956. This system marked a significant milestone in telecommunication history, enabling the first sustained transatlantic communications link. The system was built by the U.K.’s General Post Office (GPO), the U.S.’s AT&T and Canada’s Overseas Telecommunications Corporation, at a staggering cost of GBP 120 million4

3 TAT1 was, in fact, a pair of separately laid parallel cables: one transmitting in each direction.

4 https://en.wikipedia.org/wiki/TAT-1

At this stage, submarine telecommunications comprised exclusively of telephony. It is notable that the TAT1 shareholders were by now government-owned or regulated monopolies. International telephone accounting processes and rates were set by the ITU and that, while this is clearly a commercial enterprise, it is heavily regulated and highly profitable. There is, as yet, little we might consider dynamic about it.

THE ARRIVAL OF OPTICAL FIBER CABLES AND COMPETITION IN TELECOMMUNICATIONS

The 1980s ushered in a technical revolution in telecommunications generally, and in submarine cable technology particularly, with the advent of fiber-optic cables. In parallel, an equally powerful and necessary revolution was occurring in markets and regulation.

Fiber technology dramatically increased the data transmission capacity of submarine cables. This leap in

CAPACITY CONNECTION

technology was made possible by the development of laser-based transmission systems and optical amplifiers, which allowed for the transmission of data, at close to the speed of light, through glass or plastic fibers. The vastly increased capacity of fiber meant that more data could be transmitted through a cable, significantly reducing the cost per bit of data transmitted, opening the door to more accessible and affordable global connectivity.

These potential benefits could not be expected to accrue, however, to users of services in a monopoly environment.

The introduction of competition to national telecom markets was an equally important milestone in the development of the sector. As we focus on the Transatlantic market, the evolution of competition in the U.S. and the U.K. sheds useful light on the market’s evolution into the open competition we see today.

IN THE UNITED STATES

Telecom competition was unleashed in the U.S. following a 19745 MCI Communications lawsuit against AT&T, then a privately held but regulated monopoly. This case prompted an FCC investigation that ultimately led to the landmark event that was the breakup of AT&T, following a successful U.S. versus AT&T anti-

5 https://casetext.com/case/mci-communications-corpv-am-tel-tel-co

TABLE 1: COMPARISON OF SYSTEM THROUGHPUT FOR TRANSATLANTIC CABLES UP TO TAT141

1 https://atlantic-cable.com/Cables/speed.htm For comparison, in 2021, Meta’s MAREA cable was been tested to 240 Tbps (or about 4 million telephone channels equivalent) https:// subtelforum.com/ice6-trial-on-marea-trans-atlantic-cable-yields-two-record-results/

trust lawsuit in 19826. This resulted in AT&T’s divestiture of its local operating companies in 1984, creating local exchange carriers (LECs) to provide local service while AT&T continued to provide long distance and international service. The breakup opened the door to competition in long-distance and local service markets, with the birth of competitive local exchange carriers (CLECs), laying the foundation for the diverse telecom landscape in the U.S. today.

IN THE UNITED KINGDOM

In the U.K., the process of telecom deregulation and the introduction of competition started around the same time as in the U.S. Before the 1980s, telecommunication was dominated by the state-owned entity, the GPO, later British Telecom (BT). The U.K. government began the process of liberalizing the telecom market with the Telecommunications Act 1981, which allowed for the licensing of competitors. This was a significant step towards introducing competition. The most notable early competitor was C&W’s Mercury Communications, launched in 1983 as a direct competitor to BT for national and international telephone services.

IN GOVERNANCE AND REGULATION

The arrival of competition within the industry now presented a challenge to the rulemakers, the ITU. The Union is a body built on large scale consensus, with members from nearly every country in the world—and initially only a single member from each,

6 https://www.washingtonpost.com/archive/ politics/1982/01/09/us-ends-antitrust-suits-againstat38/6545a672-b488-4915-9064-8baf4da21590/

usually the national PTT 7. Those slower to embrace competition sought to hold back the unstoppable tide and to impose the ITU’s rigidly defined telephone accounting rates structure upon the competitive environment. Almost immediately, however, the ITU’s “Telephone Accounting Rates”, “Official Transit Fees” and “Return Traffic Arrangements” (along with the SDR 8) came under irresistible pressure and were to yield to what we know today as the wholesale voice market: “refile”. Competition in telecommunications had broken free of international regulation.

In the early 2000s, the so-called dot-com boom led to a surge in demand for bandwidth, prompting a significant increase in submarine cable deployment.

There is a data business in global telecoms now, but it is small and still to some extent, and perhaps because of the nature of submarine cable investors, based in the old, heavily regulated “half-circuit” regime. An operator at each end of an international circuit (still heavily regulated in its home market) provided service to

7 Postal, Telegraph and Telephone Authority, e.g., in the case of the U.K., the GPO, later BT. In most cases, then, still a state-owned monopoly.

8 Special Drawing Rights (SDRs) were, along with the Gold Franc (GFC), the common ‘currency’ of ITU accounting. https://www.imf.org/en/Topics/special-drawing-right and https://en.wikipedia.org/wiki/Gold_franc

some notional mid-point of a circuit-based link.

ENHANCED CAPACITY AND A BURGEONING MARKET

As optical fiber technology continued to evolve, subsequent generations of submarine cables saw further increases in capacity and reductions in unit cost. Techniques such as wavelength division multiplexing (WDM) enabled multiple signals to be transmitted simultaneously over a single fiber, multiplying the data capacity of submarine cables without the need for additional physical cables. This capacity expansion further drove down data transmission costs which, by virtue of competition, benefitted consumers, businesses, and economies globally. In parallel, and with experience, engineering improved incrementally and cables, while still expensive, became more reliable—and much more numerous.

THE DOT-COM BOOM AND BEYOND

In the early 2000s, the so-called dot-com boom led to a surge in demand for bandwidth, prompting a significant increase in submarine cable deployment. Initially, this resulted in a sharp drop in bandwidth prices as cable capacity outpaced demand. Later, in the mid- to late-2000s, after the bubble burst, there was an oversupply of bandwidth, which led to a further decrease in prices and the failure of a range of service providers including those that were overly financially engineered and those without access to “eyeballs”, or end-user customers, and relying completely on a wholesale business. Technological advancements continued to improve the efficiency and capacity of submarine cables, con-

CAPACITY CONNECTION

tributing to the increased downward pressure on prices.

The Internet boom was reinforced by a similar boom in mobility. Rapid generational change in mobile technology, coupled with ever-increasing penetration and massive growth in the number and variety of data-based mobile services, compounded the growth rate of the market.

CONSOLIDATION AND EXPANSION

Following the boom and inevitable bust, the 2010s were a period characterized by consolidation in the submarine cable industry, with key players expanding their networks. Despite the consolidation, the introduction of new technologies like coherent optical transmission and ultra-long haul cables continued to drive down the cost per bit. The mobile market, and its attendant content plays, regardless, continued to grow rapidly.

THE FUTURE OF SUBMARINE CABLE MARKET

TECHNOLOGY FUTURES

The trend of decreasing prices continues today, with continuous advances in technology. New cable systems are being designed with even greater capacity, utilizing spatial division multiplexing (SDM) and other innovations to meet the soaring demand for data driven by cloud computing, video streaming, and other bandwidth-intensive services. Innovations in materials science, such as the development of hollow-core fibers, promise even greater efficiencies and lower attenuation rates, which could translate into lower operational costs and lower bandwidth costs for developers.

MARKET EVOLUTION

The market is also undergoing significant change. As we emerged from the dot-com boom and bust, a new category of operator became involved in submarine.

As mobile had grown, the ability of mobile operators to corral customers within walled-garden mobile environments was quickly shown by global players specialising in content, not carriage, to be virtually non-existent. These players, who came to be known as over-the-top service providers (OTTs) quickly established a substantial presence in the ecosystem. Their services were at the heart of the development of the cloud as they sought to get ever closer to their end users. And as the number of end-users grew, and the end-users’ individual appetite for bandwidth grew with it, the OTT players, operating from their own data centers, became large providers of content and service. They began to invest in submarine cables and their commitments underpinned many new cable builds. Today, referred to as hyperscalers in the infrastructure sector, they have gone beyond building in cooperation with global telecom providers and are lead developers, becoming sellers where they used to buy.

CONCLUSION

The evolution of submarine cable technology from simple telegraph cables to sophisticated, high-capacity optical fiber systems is the very essence of global connectivity growth and has been a key driver of worldwide economic development. Without parallel sloughing off of unnecessary regulation and innovation in Internet, cloud and mobility, however, there would have been no traffic to fill the

cables—and a very different commercial ecosystem.

With 5G now emerging—the commercial 5G roaming realm has yet to be defined—we find ourselves today in a world where mobility players ponder the extent to which their subscribers utilise mobile services only to gain access to what, in mobile terms, are OTT services such as Tik-Tok, YouTube or WhatsApp.

Simultaneously, global connectivity players, historically the lead developers of submarine cables, may need to look to these hyperscalers as emergent providers of underpinning infrastructure. Is the path of the global network provider to prove similar to that of its mobile subsidiary (or parent?): a provider of first- and last-mile access?

The impact of all this activity on demand, pricing and other commercial dimensions in subsea is still unfolding but, to the extent that all the world’s a stage, we are indeed players—and awaiting our cues. STF

Currently Director, EMEA, with APTelecom, JOHN MAGUIRE has experience gained across a broad spectrum of telecommunications roles and businesses over the past 30 years. He has sold security and network control software to mobile networks worldwide; established a regional federation fibre network across a family of affiliated telcos and, several times, established interconnect networks and wholesale structures for leading telco brands in new entry and emerging markets. He’s done this in roles across the business: using satellite and cable technology, for OEM and service provider companies and in fixed and mobile domains—including for start-ups and mature companies. His roles have encompassed general management, sales management, direct and indirect sales, business development, market development and operations. A native of Dublin, Ireland, he’s also lived and worked in Australia, UK, Singapore, Hong Kong, Thailand, Qatar, UAE and Malaysia. John holds a B.Tech. degree from University of Limerick in Ireland and an M.A. from Macquarie University Graduate School of Management in Sydney, Australia.

October 14–17, 2024 | Providence, Rhode Island, USA

TECHNICAL SYMPOSIUM

DISCUSSIONS WITH EXPERTS

PLENARY & KEYNOTE

PROFESSIONAL DEVELOPMENT

EXECUTIVE SESSION

RELATIONSHIP BUILDING SUPPLIER EXHIBITION™

Generate premiere exposure for your work by participating in the leading forum for the exchange of information on technical innovations and solutions for the cable and connectivity industry.

Abstracts for Technical Papers are sought from academic or industry professionals with work that is relevant to cable products, materials, processes, and applications worldwide.

Authors of accepted Technical Papers are invited to present or display a poster at the IWCS Cable & Connectivity Industry Forum and papers will be published for additional exposure.

SUBMIT A TECHNICAL PAPER ABSTRACT

• Get your work published in the IWCS archives and select journals

• Help advance the worldwide cable and connectivity industry by sharing your research