EXORIDUM FROM THE PUBLISHER

WELCOME TO ISSUE 129, OUR FINANCE & LEGAL AND ICPC ‘23 PLENARY PREVIEW EDITION!

Ahectic year is well underway. Besides the usual work, we like many are attending one or more submarine-related conferences every month through June, which speaks volumes about the positive sentiment of our industry. We continue to be very, very busy!

WEBSITE ENABLED NOTIFICATIONS

SubTel Forum’s website now enables notifications through all major desktop and Android browsers allowing subscribers to be notified of news as it breaks. The website is wicked fast and since the new year we have seen more than 500 subscribers enable the announcement system. If you haven’t yet, we suggest you give it a try.

SUBMARINE CABLE ALMANAC

The 45th issue of the Submarine Cable Almanac is now available and contains details on every major submarine cable system in the world. Since the last issue, we have added one new system and updated an additional 25. (https://subtelforum.com/ almanac/) The data provided in this document is, as it ever has been, from the public domain and/or directly supplied by owners and suppliers. If you see a system that needs updating or know of an upcoming system that needs to be represented, please feel free to contact us directly at almanac@subtelforum.com.

PRINTED CABLE MAP

Our Submarine Cable Map for 2023, which showcases every major international submarine cable system, was mailed to

industry movers and shakers, and we hope you are as excited as us on how it looks. Next stop for the spares – Madrid.

ICPC ‘23 PLENARY PREVIEW

Speaking of Madrid, we are pleased to be supporting ICPC ‘23 this year. The International Cable Protection

Committee (ICPC) is the long-standing workhorse association of our industry, the men and women who have been developing the international policies to keep our cables safe or repair them when they’re not for over 60 years. ICPC has provided some excellent articles this issue to better describe their submarine cable content we can all enjoy in April.

THANK YOU

Thanks for their support to this issue’s advertisers: Southern Cross, Submarine Networks EMEA, and WFN Strategies. Thanks also to the many authors who continue to make our issues interesting and so far reaching. Of course, our ever popular “where in the world are all those pesky cableships” is included as well.

Lastly, we would like to thank everyone for helping SubTel Forum start 2023 off on a high note and pushing us past the 6,000 LinkedIn follower milestone! (https://www.linkedin.com/company/ subtel-forum/?viewAsMember=true)

We hope that SubTel Forum will continue to be your primary destination for news and analysis related to the submarine fiber industry.

Stay well and save me an aisle seat –Slava Ukraini STF

A Publication of Submarine Telecoms Forum, Inc. www.subtelforum.com | ISSN No. 1948-3031

PRESIDENT & PUBLISHER: Wayne Nielsen | wnielsen@subtelforum.com | [+1] (703) 444-2527

VICE PRESIDENT: Kristian Nielsen | knielsen@subtelforum.com | [+1] (703) 444-0845

PRODUCTION MANAGER: Hector Hernandez | hhernandez@wfnstrategies.com | [+1] (210) 338-5413

EDITOR: Stephen Nielsen | snielsen@subtelforum.com

ANALYTICS: Kieran Clark | kclark@subtelforum.com | [+1] (540) 533-6965

SALES: sales@subtelforum.com | [+1] (703) 444-0845

DESIGN & PRODUCTION: Weswen Design | wendy@weswendesign.com

DEPARTMENT WRITERS: George N. Ramírez, Kieran Clark, Kristian Nielsen, Nicole Starosielski, Philip Pilgrim, and Wayne Nielsen

FEATURE WRITERS:

Andrés Fígoli, Andy Lipman, Ian Mathews, Jean-François Bilodeau, Kier Clark, Kristian Nielsen, Lewis Baxter, Mencía Martínez, Mike Conradi, Patricio Alberto Rey Sommer, Rita Melo, Ryan Wopschall, Ulises Pin, and Wayne Nielsen

NEXT ISSUE: MAY 2023 – Global Capacity, featuring Submarine Network EMEA Conference Preview

AUTHOR & ARTICLE INDEX: www.subtelforum.com/onlineindex

Submarine Telecoms Forum, Inc. www.subtelforum.com/corporate-information

BOARD OF DIRECTORS: Margaret Nielsen, Wayne Nielsen and Kristian Nielsen

SubTel Forum Continuing Education, Division of Submarine Telecoms Forum, Inc. www.subtelforum.com/education

CONTINUING EDUCATION DIRECTOR: Kristian Nielsen | knielsen@subtelforum.com | [+1] (703) 444-0845

Wayne Nielsen, PublisherContributions are welcomed and should be forwarded to: pressroom@subtelforum.com.

Submarine Telecoms Forum magazine is published bimonthly by Submarine Telecoms Forum, Inc., and is an independent commercial publication, serving as a freely accessible forum for professionals in industries connected with submarine optical fiber technologies and techniques. Submarine Telecoms Forum may not be reproduced or transmitted in any form, in whole or in part, without the permission of the publishers. Liability: While every care is taken in preparation of this publication, the publishers cannot be held

responsible for the accuracy of the information herein, or any errors which may occur in advertising or editorial content, or any consequence arising from any errors or omissions, and the editor reserves the right to edit any advertising or editorial material submitted for publication.

New Subscriptions, Enquiries and Changes of Address: 21495 Ridgetop Circle, Suite 201, Sterling, Virginia 20166, USA, or call [+1] (703) 444-0845, fax [+1] (703) 349-5562, or visit www.subtelforum.com.

Copyright © 2023 Submarine Telecoms Forum, Inc.

FORUM IN THIS ISSUE

ISSUE 129 | MARCH 2023

5 QUESTIONS WITH RYAN WOPSCHALL

FEATURES

SUB-SEA CABLES: A FINANCING PERSPECTIVE

By Ian MathewsICPC ’23 PLENARY PREVIEW SPOTLIGHT

CURRENT TOPICS IN FEDERAL COMMUNICATIONS COMMISSION AND NATIONAL SECURITY REVIEWS FOR SUBMARINE CABLE SYSTEMS

By Andrew D. Lipman, Ulises R. Pin, and Tanya Tiwari

By Andrew D. Lipman, Ulises R. Pin, and Tanya Tiwari

22 YEARS AGO

By Patricio Alberto Rey Sommer

By Patricio Alberto Rey Sommer

By Kieran Clark

By Kieran Clark

Andrés

FREE RESOURCES FOR ALL OUR SUBTELFORUM.COM READERS

The most popular articles, Q&As of 2022. Find out what you missed!

TOP STORIES OF 2019

The most popular articles, Q&As of 2019. Find out what you missed!

NEWS NOW RSS FEED

a division of Submarine Telecoms Forum. This reference tool gives details on cable systems including a system map, landing points, system capacity, length, RFS year and other valuable data.

Keep on top of our world of coverage with our free News Now daily industry update. News Now is a daily RSS feed of news applicable to the submarine cable industry, highlighting Cable Faults & Maintenance, Conferences & Associations, Current Systems, Data Centers, Future Systems, Offshore Energy, State of the Industry and Technology & Upgrades.

NEWS NOW RSS FEED

Keep on top of our world of coverage with our free News Now daily industry update. News Now is a daily RSS feed of news applicable to the submarine cable industry, highlighting Cable Faults & Maintenance, Conferences & Associations, Current Systems, Data Centers, Future Systems, Offshore Energy, State of the Industry and Technology & Upgrades.

PUBLICATIONS

mapping efforts by the analysts at SubTel Forum Analytics, a division of Submarine Telecoms Forum. This reference tool gives details on cable systems including a system map, landing points, system capacity, length, RFS year and other valuable data.

Submarine Telecoms Industry Report is an annual free publication with analysis of data collected by the analysts of SubTel Forum Analytics, including system capacity analysis, as well as the actual productivity and outlook of current and planned systems and the companies that service them.

CABLE MAP

Submarine Telecoms Industry Report is an annual free publication with analysis of data collected by the analysts of SubTel Forum Analytics, including system capacity analysis, as well as the actual productivity and outlook of current and planned systems and the companies that service them.

CABLE MAP

PUBLICATIONS

Submarine Cable Almanac is a free quarterly publication made available through diligent data gathering and

Submarine Cable Almanac is a free quarterly publication made available through diligent data gathering and mapping efforts by the analysts at SubTel Forum Analytics,

The online SubTel Cable Map is built with the industry standard Esri ArcGIS platform and linked to the SubTel Forum Submarine Cable Database. It tracks the progress of

The online SubTel Cable Map is built with the industry standard Esri ArcGIS platform and linked to the SubTel Forum Submarine Cable Database. It tracks the progress of some 450+ current and planned cable systems, more than 1,200 landing points, over 1,700 data centers, 37 cable ships

as well as mobile subscriptions and internet accessibility data for 254 countries. Systems are also linked to SubTel Forum's News Now Feed, allowing viewing of current and archived news details.

The printed Cable Map is an annual publication showcasing the world's submarine fiber systems beautifully drawn on a large format map and mailed to SubTel Forum Readership and/or distributed during Pacific Telecommunications Conference in January each year.

CONTINUING EDUCATION

SubTel Forum designs educational courses and master classes that can then appear at industry conferences around the world. Classes are presented on a variety of topics dealing with key industry technical, business, or commercial issues. See what classes SubTel Forum is accrediting in support of the next generation of leaders in our industry.

AUTHORS INDEX

The Authors Index is a reference source to help readers locate magazine articles and authors on various subjects.

SUBTEL FORUM BESPOKE REPORTS

SubTel Forum provides industry analyses focused on a variety of topics. Our individualized reporting can provide industry insight for a perspective sale, business expansion or simply to assist in making solid business decisions and industry projections. We strive to make reporting easy to understand and keep the industry jargon to a minimum as we know not everyone who will see them are experts in submarine telecoms.

In the past we have provided analyses pertaining to a number of topics and are not limited to those listed below. Reach out to info@subtelforum.com to learn more about our bespoke reports.

DATA CENTER & OTT PROVIDERS: Details the increasingly shrinking divide between the cable landing station and the backhaul to interconnection services in order to maximize network efficiency throughout, bringing once disparate infrastructure into a single facility.

If you are interested in the world of Data Centers and its impact on Submarine Cables, this reporting is for you.

GLOBAL CAPACITY PRICING: Details historic and current capacity pricing for regional routes (Transatlantic, Transpacific, Americas, Intra-Asia and EMEA), delivering a comprehensive look at the global capacity pricing status of the submarine fiber industry. Capacity pricing trends and forecasting simplified.

GLOBAL OUTLOOK: Dive into the health and wellness of the global submarine telecoms market, with regional analysis and forecasting. This reporting gives an overview of planned systems, CIF and project completion rates, state of supplier activity and potential disruptive factors facing the market.

OFFSHORE ENERGY: Provides a detailed overview of the offshore oil & gas sector of the submarine fiber industry and covers system owners, system suppliers and various market trends. This reporting details how the industry is focusing on trends and new technologies to increase efficiency and automation as a key strategy to reduce cost and maintain margins, and its impact on the demand for new offshore fiber systems.

REGIONAL SYSTEMS: Drill down into the Regional Systems market, including focused analysis on the Transatlantic, Transpacific, EMEA, AustralAsia, Indian Ocean Pan-East Asian and Arctic regions. This reporting details the impact of increasing capacity demands on regional routes and contrasts potential overbuild concerns with the rapid pace of system development and the factors driving development demand.

SUBMARINE CABLE DATASET: Details more than 450 fiber optic cable systems, including physical aspects, cost, owners, suppliers, landings, financiers, component manufacturers, marine contractors, etc. STF

ANALYTICS

FINANCE & LEGAL OVERVIEW

A Snapshot Of Where We Are And Where We Are Headed

[Reprinted with permission from SubTel Forum 2022/2023 Submarine Industry Report]

HISTORIC FINANCING PERSPECTIVE

Financing a cable system tends to be the most difficult barrier to overcome in an already lengthy process and can take years to secure. There are three models found in submarine cable system funding: multiple financiers Debt/ Equity (typically a combination of investment bank capital and capacity pre-sales), Self-Financed, and Multilateral Development Banks (MDB). Hyperscalers can generally provide the full funding amount without need for outside financial assistance and are Self-Financed on systems

owner. An MDB is typically involved in financing projects that promote growth and modernization in less wealthy countries. They also have the capability to provide lower-cost financing than a commercial bank. (CFI Team, 2021)

Over the last 10 years, the ratio has remained steady between the three financing models. Debt/Equity financed systems have kept a notable lead, accounting for 56 percent of all accomplished cable systems over the last 10 years while Self-Financed teams accounted for 38 percent and MDBs the remaining 6 percent. (Figure 35)

The quantity of the financial investments made in submarine cable systems does not always match with the amount invested. Self-Financed investments account for 52 percent of dollars invested, Debt/Equity Financing accounted for 35 percent and MDBs invested the remaining 13 percent of the $16.7 billion invested through 2022. (Figure 36) While Debt/Equity financed systems tend to be less risky than Self-Financed systems, the prevalence of Hyperscaler driven systems and

the flexibility afforded to Self-Financed projects accounts for its higher percentage of dollar investment.

REGIONAL DISTRIBUTION OF FINANCING ANALYTICS

MULTILATERAL DEVELOPMENT BANKS

Multilateral Development Banks have invested $2.1 billion in submarine telecoms cables over the last 10 years. The largest portions of this total investment — 36 percent — have been invested in the EMEA region. The Americas region received the next most, 24 percent, and the Transatlantic received 23 percent while AustralAsia received 14 percent of total investment and the Indian Ocean region the remaining 3 percent. The Transpacific and Polar regions have yet to receive any MDB investment. (Figure 37)

The EMEA and Americas regions accounting for the two largest portions of MDB investment is little surprise as both regions benefit and, in many cases, rely on MDB financing for various kinds of infrastructure projects. The Transatlantic region receiving nearly one-quarter of MDB investment is somewhat surprising if only traditional Transatlantic routes are considered, but this is due to the SAIL system connecting South America to Africa directly and is a perfect use case for MDB banks.

The AustralAsia region accounting for just 14 percent is likely due to the general growth slowdown observed in this region as nations in most need of new connections has largely been accomplished while the Indian Ocean region has historically not received much investment from MDBs.

DEBT/EQUITY FINANCING

From 2012 to 2022, the largest portion of Debt/Equity financed systems were in the Americas region at 26 percent of total with AustralAsia being

the next most at 19 percent. (Figure 38) Systems in these two regions are typically comprised of multiple local telecoms companies and governments connecting various parts of their respective regions and can be quite expansive and therefore costly.

The Transpacific was the next most at 16 percent of new system activity while the EMEA and Transatlantic regions accounted 14 and 13 percent, respectively. Transpacific systems are some of the largest Transoceanic systems in the world and have higher costs associated even though the total system count is lower than other regions. The EMEA region is like the Americas and AustralAsia regions though investment from local telecoms and governments has fallen off slightly in favor of invest-

Figure 37: Distribution of MDB Investment, 2012-2022

Figure 37: Distribution of MDB Investment, 2012-2022

ment from Hyperscalers accounting for its relatively lower investment percentage. The Transatlantic region has observed multiple new cable systems over the last several years and continues to have very high capacity demand resulting in a noticeable amount of new Debt/Equity investment despite the number of cables already present within the region.

The Indian Ocean and Polar regions are the least active regions in the world and will generally have lower investment interest from those looking to rely on strong commercial cases to bring in capacity sales.

SELF-FINANCED

Between 2012 and 2022 the AustralAsia region accounted for the highest portion of Self-Financed system investment at 31 percent of total dollars invested. Many of these are government backed systems that do not have to rely on capacity sales to justify their development. The EMEA region at 24 percent accounts for the second largest amount of Self-Financed systems owing to its overall size and the number of point-topoint systems that do not require large consortiums to develop. (Figure 39)

The Indian Ocean at 16 percent is largely due to the large, inter-regional SEAME-WE type systems that pass through the region involving multiple parties and are treated more as utility infrastructure than revenue generating assets despite the low activity typical to the region.

The Transpacific and Americas region had the next highest percentage of Self-Financed system investment at 12 percent and 10 percent, respectively. While Transpacific systems tend to be costly, they are not developed at a fast enough pace to warrant further investment. Systems in the Americas tend to be revenue generating assets and are more likely to be financed through Debt/Equity.

In the Transatlantic, Self-Financed systems account for just five percent of total investment as only two Hyperscaler driven systems had the ability to finance themselves. The Polar region once again accounts

for the smallest amount of investment as this region is difficult to develop in and has much lower overall demand compared to others.

CURRENT FINANCING

There has been a total of $16.7 billion invested in submarine cables systems from 2012-2020. (Figure 40) Nearly half of this amount – 47 percent – was invested in just three years from 20162018. This was the result of a boom kicked off by Hyperscaler investment and an overall rise in global bandwidth demand. Had the COVID-19 pandemic not occurred, there may have been even more investment all the way through 2022.

The least amount invested was in 2015 when only $465 million worth of systems were added. This was the lowest activity period for the industry since the crash of the early 2000s, but annual investment has averaged $1.8 billion since then. Overall, this peak and valley trend appears to happen every eight to nine years and has remained consistent since the early 90s. Currently the industry is roughly halfway through an investment drop. If the trend continues, we can expect another boom between 2024 and 2025 which coincides with observed bandwidth demand projections.

The sum of installed cable over the past ten years is estimated to be 506 thousand kilometers, with a yearly average of 46,000. (Figure 41) Comparing the amount of investment to the quantity of kilometers installed a similar eight-to-nine-year cycle is observed.

For the more recent period 2018-2022 a total of $7.4 billion has been invested globally. Of this amount, the AustralAsia region received the highest percentage at 29. The Transpacific, Americas and Transatlantic are the next most – all accounting for double digit percentages as these regions continue to see active development due to traffic between East Asia, North America and Europe. (Figure 42)

While the EMEA is the largest region

it only account for 8 percent of total investment over the last five years. This will change moving forward once expansive systems like Equiano and 2Africa are completed.

OWNERSHIP FINANCING ANALYSIS | HISTORIC FINANCING PERSPECTIVE

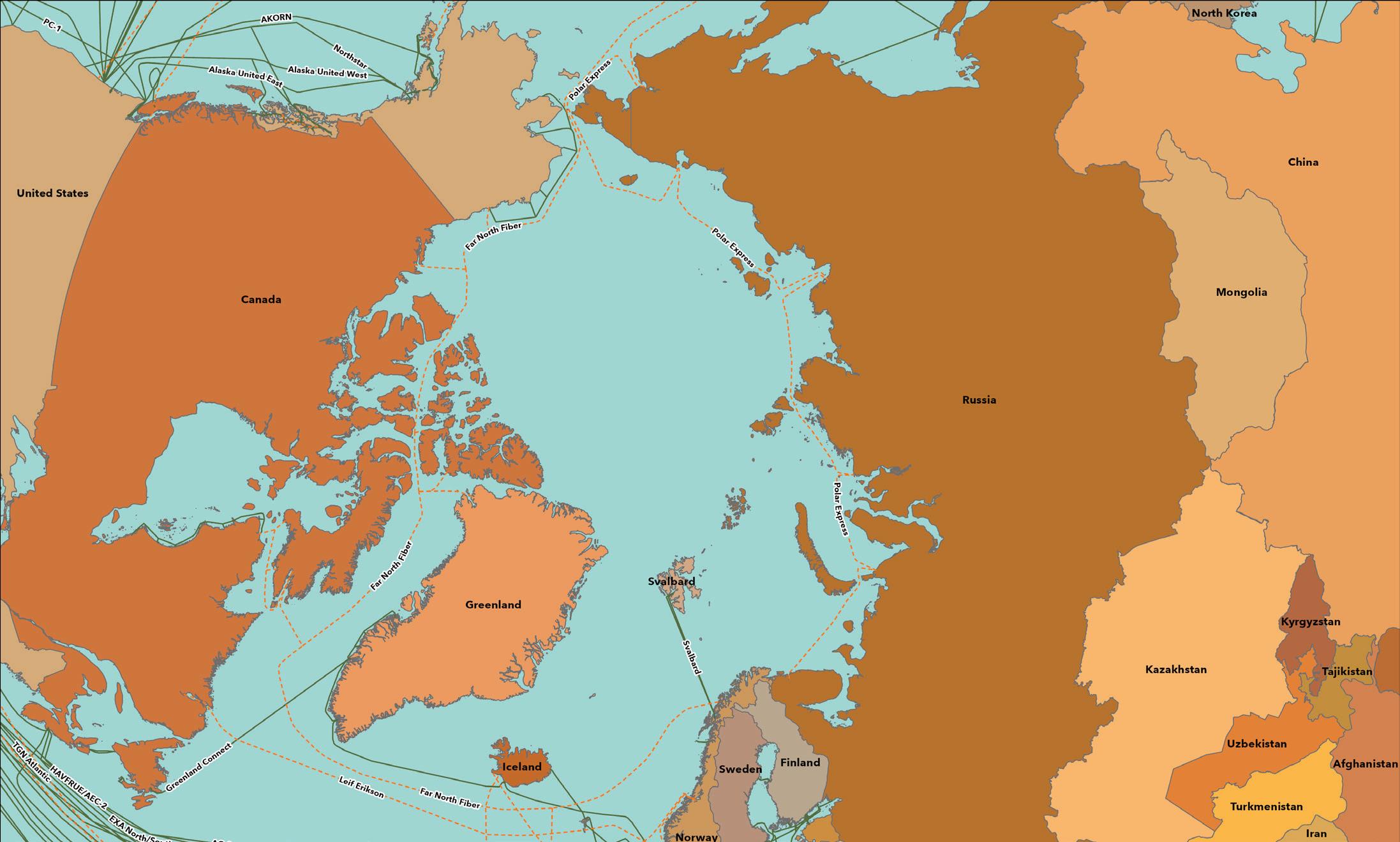

The Indian Ocean and Polar regions accounted for four and three percent, respectively, indicating demand in these regions has not been high recently. However, looking forward, the Polar region is gaining interest to seek alternative routes to bottlenecks in the Middle East and Mediterranean as well as connecting Antarctica.

ASK AN EXPERT

YEAR PROJECT MDB DETAILS

2019

Improving Internet Connectivity for Micronesia Project

2019 Coral Sea

Asian Development Bank

The ADB Board of Directors has approved a total of $36.6 million in grants to help fund the delivery of the Improving Internet Connectivity for Micronesia Project. This project will help install a submarine cable connection between Micronesia and a proposed Transpacific cable system.

2020 Cook Islands to Samoa

Australian Government Official Development Assistance $60 million

The Australian Government Official Development Assistance provided two-thirds majority funding of the Coral Sea submarine cable system to support the economies of Papua New Guinea and the Solomon Islands.

2020 Echo

Asian Development Bank $15; Gov. of New Zealand $20; Gov. of Cook Islands $2 million

U.S. International Development Finance Corporation

2021 2Africa IFC

2021 East Micronesia Cable system World Bank

2022 2Africa, EASSy, Equiano, WACS IFC

The Government of Cook Islands has requested the ADB to support a $37 million submarine internet cable project, which will link the islands of Rarotonga and Aitutaki in the Cook Islands to Samoa, where interconnection to the international internet hubs in Fiji and Hawaii will occur.

DFC will provide a loan of up to $190 million to Trans Pacific Networks to support construction of a 15,200 km submarine fiber optic cable connecting Singapore, Indonesia, and the United States. The new cable will expand and enhance internet access across the region, including to isolated islands.

Broadband network and digital services offered in Seychelles will soon get a boost from a new cable system that will be leased by Seychelles-based telecommunications provider Intelvision Limited with support from IFC.

The East Micronesia Cable system was designed to improve communications in the island nations of Nauru, Kiribati, and Federated States of Micronesia.

The investment from the IFC will support WIOCC Group’s continued rollout of terrestrial fiber-optic networks, investment in new subsea cables, and the launch of world-class, openaccess core and edge data center infrastructure across the continent.

Figure 42: Regional Investment in Submarine Fiber Systems, 2018-2022SUBTEL CABLE MAP UPDATES

The SubTel Cable Map is built with the industry standard Esri ArcGIS platform and linked to the SubTel Forum Submarine Cable Database. It tracks the progress of over 440 current and planned cable systems, 50+ cable ships and over 1,000 landing points.

Systems are also linked to SubTel Forum’s News Now Feed, allowing viewing of current and archived news details.

This interactive map is a continual work and progress and regularly updated with pertinent data captured by analysts at SubTel Forum and feedback from our users. Our goal is to make easily available not only data from the Submarine Cable Almanac, but also more and more new layers of system information.

We hope you continue to make use of the SubTel Cable Map to learn more about the industry yourself and educate others on the importance of submarine cable systems.

All the submarine cable data for the Online Cable Map is pulled from the public domain and we always strive to keep the information as up to date as possible. If you are the point of contact for a company or system that needs to be updated, please don’t hesitate to reach out to kclark@subtelforum.com.

The full list of updated systems since the last issue of the magazine are as follows:

MARCH 20, 2023

SYSTEMS ADDED

Unitirreno

SYSTEMS UPDATED

ALC

Amitié

Bifrost

CX

Equiano

Hawaiki Nui

Highclere Cable

IEX

KAFOS

MedLoop

PDSCN

PEACE

PEACE Singapore Extension

TOPAZ STF

KIERAN CLARK is the Lead Analyst for SubTel Forum. He originally joined SubTel Forum in 2013 as a Broadcast Technician to provide support for live event video streaming. He has 6+ years of live production experience and has worked alongside some of the premier organizations in video web streaming. In 2014, Kieran was promoted to Analyst and is currently responsible for the research and maintenance that supports the Submarine Cable Database. In 2016, he was promoted to Lead Analyst and his analysis is featured in almost the entire array of Subtel Forum Publications.

Do you have further questions on this topic?

ASK AN EXPERT

SUSTAINABILITY AT PTC ’23: THREE TAKEAWAYS

BY GEORGE N. RAMÍREZ AND NICOLE STAROSIELSKISustainability was a hot topic at this year’s Pacific Telecommunications Conference. Many sessions reported on sustainable practices as well as pressing challenges for sustainable development. A highlight of the event was the SubOptic-sponsored series of panels on Sunday, where subsea cable leaders discussed the state of sustainability in the industry. Posters documenting the subsea industry’s carbon footprint, environmental progress, and policy futures were displayed on the walls. Over the following days of the conference, many subsequent panels focused on data centers, with participants often arguing that sustainability is now a necessity. Data center customers, many speakers noted, were increasingly looking for fully sustainable offerings that could be implemented as soon as possible. Joley Michaelson of The Sun Company stated about the future: “The main thing is a turn-key solution option, a full sustainability offering, as quickly as possible. We don’t want anything that is less than 100% renewable.” Others wondered where the drive and investment would come from for sustainability initiatives.

The Sustainable Subsea Networks team of the SubOptic Foundation attended PTC ‘23, presented our research, and listened in to these conversations. We found many points of agreement between speakers, regardless of where they fell on this spectrum between full-on determination

and cautious hesitation. For example, most people agreed that there is no single solution to sustainability out there--no easy or quick fix. Whether they were in the data center or subsea industry, companies needed to think carefully about how sustainability might be implemented across all parts of their business rather than search for a blanket solution. Some common areas and factors affecting sustainability included: limitations on real estate, energy availability, ESG targets, water usage, and the circular economy.

Across the conference, however, participants repeated a strong sentiment that sustainability is an opportunity, not a cost; it is an imperative, not an option. If they don’t get ahead of the sustainability curve, companies

will be hit by a tsunami of government regulation. Many companies are already paving the path forward. Below we chronicle three resounding practical takeaways from the conference: a need for cooperation and collaboration; a search for both low-hanging fruit and long-term solutions--working efficiently, investigating renewable energy, and working remotely; and a call for better metrics.

COOPERATION AND COLLABORATION

A refrain at PTC ‘23 was that industries and companies should work with one another, adapting existing strategies, best practices, and technologies in new contexts. There was no need to re-invent the sustainability wheel. In the lunchtime panel on

SUBSEA

submarine cables, chaired by Elaine Stafford of DRG Undersea Consulting, Stephen Alexander of Ciena made a point of how sustainable practices can be scaled according to different company needs: “One of the biggest things that we have learned is that we can scale up and scale out. We want to scale out a little more. Scaling out means that you have to work with other companies.” On the same panel, Tunde Coker of Open Access Data Centres (OADC) pointed out the need to work with others to motivate change across the supply chain: “We do that through our own supply chain if you are going to be part of our business ecosystem,” Coker said. “We have process accreditation to drive these behaviors.” And as Nigel Bayliff of Aqua Comms stated, “We can all do this together.”

PTC participants suggested that subsea cable companies must not only work with one another, but with others across sectors, especially drawing inspiration from the data center business. The iMasons Climate Accord was consistently named as an example of the ways that companies could collaborate together in order to set strategic goals for this issue. Tunde Coker thought the Accord did a good job of thinking in depth about methodology, measurement, and statistics. This makes collaborative work within an industry and across sectors possible, he observed. When speaking about the iMasons Accord, Joseph

Kava of Google shared, “That’s how you certify what the embedded carbon is in all the equipment that is along the supply chain in building our digital infrastructure.”

The subsea industry has no such Accord or industry-wide agreement. Yet there are many companies that are working together and looking across industries. One example that several participants mentioned was the work of subsea cable companies to branch out to marine renewable energy markets. Didier Dillard of Orange Marine reported that his company was deploying service offerings in the marine renewable energy markets, providing installation and repair of energy cables at offshore wind farms. Orange Marine has also established connections with numer-

ous environmental certification and scientific organizations, including Green Marine Europe, ACt 4 Nature France, and Euro Argo among others.

Andrew Robinson of Xtera suggested another mode of collaboration: subsea cable companies could consider reusing existing materials or sharing resources. Robinson challenged the audience to think about sharing high impact resources like factories and ships more effectively, and how this could lead to improved sustainability. Another strategy: he pointed out that new systems are designed with new cable even though the necessary capacity could be achieved using redeployed cable. While some still believe that sustainability should be a closely-guarded secret, he argued that collaboration could help reduce time and costs, helping everyone in the long run.

In sum, the subsea and data center industries already have a long history of collective action and collaboration in building connections. This provides a firm foundation on which to direct efforts now and in the future towards sustainability.

LONG-TERM SOLUTIONS: EFFICIENCY, ENERGY, REMOTE WORK

Collaboration takes trust, which takes time to build. Solutions have to be carefully thought through, rather than simply dropped into new contexts. Building collaborative transformation through contracts, supply chains, and partnerships are often long-term strategies. Many confer-

ence participants wondered: “What can be done now to build toward longterm sustainability?”

One area of vibrant discussion about sustainable development at PTC was efficiency. Throughout PTC, we heard stories about industries across the ICT sector striving to be energy efficient and work at maximum capacity. We heard from many that this was simply “common sense.” Companies are installing new energy efficient technologies, ranging from engines to light bulbs. But this work is not yet universal.

The move toward energy efficiency is a matter not simply of technological upgrades, but of efficient management. According to Chris Thorpe of Leading Edge Data Centers, “The problem in our industry is that… it’s not 100% usage. Of the 105 GW of capacity in physical locations, we have a minimum of 37 GW never used ever.” Many factors can play into this, from redundancy and buffers to utilizations and underestimations. Taking sustainability into account is a matter of doing business better and of maximizing the use of infrastructure.

In the subsea cable industry, efficiency not only means ensuring that the cable landing station or data center is energy-efficient, but that cable surveying and laying operations themselves are well managed and conducted efficiently. In Sunday’s submarine cable sessions, Bruce Neil-

son-Watts of Global Marine pointed out, “my biggest way to reduce carbon is finding ways to better manage my ships.” Proper planning can minimize marine transportation, reducing the number of trips needed and thus the

CO2 emitted. New technologies also enable the efficient use of ships themselves. Earlier that day, Emmanuel Danjou shared that ASN had many energy efficiency projects underway, including heat recovery and reuse at manufacturing sites.

A second action companies can undertake is investment in renewable energy. PTC ’23 featured innovative sustainable technologies across the telecommunications landscape.

Of interest for immediate adoption for the subsea industry is renewable energy, which can be purchased from energy providers or installed on site.

In a presentation on Bulk Infrastructure, Peder Naerboe highlighted three facilities powered by green energy: the Oslo Internet Exchange, the N01 Campus, and the DK01 Campus. Didier Dillard shared that his company, Orange Marine, uses electricity from solar panels. “Since 2020, our ships in La Seyne-sur-Mer use 100% green energy following the installation of solar panels…seventy-five percent

NEC was able to accomplish reductions by announcing their policies and plans to their suppliers as well as surveying suppliers to learn about their emissions: measurements, standards, and information circulation all facilitate progress.

SUBSEA

of our fleet is electrically connected to the shore-based grid during stand-by and therefore produces no direct emissions.” Emmanuel Danjou highlighted ASN’s solar projects in cable landing stations and Takahiro Kashima of NEC’s Submarine Network Division described an elaborate network of solar powered energy at their factories in Japan.

The third immediate action that can be undertaken is to find creative ways to work remotely. Emmanuel Danjou of ASN reported that reducing business travel during the pandemic resulted in an 895 tonnes CO2 emissions reduction between 2020 and 2021. The evident sustainability benefits of this approach has led to reduced travel for many companies. For Stephen Alexander, “Travel is the biggest thing.” For some, the minimal disruption posed by remote work today even provides a clear business advantage. Andrew Robinson shared that the NO-UK cable system was mostly completed virtually: “our experience on the NO-UK project shows that [CO2 emissions] can be reduced significantly with no impact on project outcome,” he said.

What can companies do now? Ensure that they are not just meeting the ESG targets of regulatory and other environmental bodies in their industry sector but exceeding them; stay ahead of the curve that is the growing level and intensity of government oversight by investing in and deploying sustainable R&D initiatives; work with suppliers and customers to improve the sustainability of products, processes, and practices; and look for ways to make one’s operation more efficient. Sustainability does not necessarily mean extra cost.

BETTER METRICS AND DATA SHARING

At the conference, in both panels and in conversations, we witnessed a widely felt need for better metrics for measuring sustainability progress. Especially within the subsea cable industry, several panelists called for transparent strategies for sharing data with customers and stakeholders. Once a portfolio of metrics was agreed upon, several argued, compa-

Creating a common language for measuring improvements in sustainability is essential, several panelists argued. Having metrics for carbon emissions, for example, will enable companies to assess and reduce their emissions in new and different ways. Doing this requires increased time, management, and coordination that can best be leveraged through collaboration based on professional relationships. “If we don’t take charge, it’s going to be done to us,” Tunde Coker said, “So we can set the agenda and lead globally.” Collaboration in data gathering, data sharing, and in supply chain management is the way forward and companies can be proactive in helping to develop this culture.

nies would be better able to assess their own progress. However, there remains no industry-wide approach to measuring sustainability. “If we don’t share knowledge, how do we learn?” Bruce Neilson-Watts asked the audience. “If we all have that information, then we can do something about the problem.” Many agreed: sharing data across the industry would make it easier for everyone to measure progress and growth. “Being able to measure is critical. You can’t fix what you can’t measure,” said Stephen Alexander.

In particular, one important approach to accountability is committing to lifecycle assessments and to sharing high-level data publicly. Transparency with data is critical to progress. This is particularly true when it comes to measuring carbon emissions, as good data is increasingly a request among customers, suppliers, and vendors. Speaking about the data center sector, Jonathan Atkin of RBC Capital observed that there should be more information “imparted to policymakers and regulators about the fact that there is inherently a more efficient way to consume IT.” He suggested that data centers should have a common scorecard to measure the progress of sustainability that includes carbon intensity, renewables, and Power Usage Effectiveness (PUE). The iMasons Climate Accord is one example of how collaboration across an industry can facilitate data sharing.

Some companies are moving in this direction by following standards and earning certifications for

Creating a common language for measuring improvements in sustainability is essential, several panelists argued. Having metrics for carbon emissions, for example, will enable companies to assess and reduce their emissions in new and different ways.

their environmental efforts, many of which require data collection. Bulk Infrastructure is one: as both a subsea cable and data center company, it has accreditations and standards that account for sustainability. Beyond quality, environmental, and business continuity management, Peder Naerboe reported that they also follow the European Standard for Data Center Design (EN 50600) and the European Commission Code of Conduct for Data Centre Energy Efficiency. In other cases, existing standards don’t quite fit the reality of industry practices on the ground, and so need to be re-tailored. ASN created a Green Charter based on their analysis of the gaps in the standards on sustainable development and social responsibility. In doing so, they ensured legal compliance, reduced energy consumption, and promoted “‘green’ ways of working for employees and contractors.”

This is also a strategy that NEC has implemented for their carbon neutrality goals. They are leveraging Scope 3 standards in order to reduce CO2 emissions from the supply chain. Takahiro Kashima said that Scope 3 efforts boost engagement to encourage suppliers to reduce emissions. NEC was able to accomplish reductions by announcing their policies and plans to their suppliers as well as surveying suppliers to learn about their emissions: measurements, standards, and information circulation all facilitate progress.

Conferences like PTC help to disseminate practices and knowledge across the industry. Here, companies can share the meaningful sustainability initiatives they are pursuing--and inspire others to follow. We look forward to seeing the same process

at the upcoming SubOptic conference in Bangkok, Thailand. Here the SubOptic Foundation will host the first Congress on Sustainability, which will be held Monday March 13 at 8:30am. The Congress will feature leading representatives from

(Bulk Infrastructure), Michael Clare (National Oceanography Centre), Mike Constable, René d’Avezac de Moran (Fugro), Emmanuel Danjou (Alcatel Submarine Networks), Alwyn du Plessis (Mertech Marine), Takahiro Kashima (NEC), Brian Lavallée (Ciena), Andy Palmer-Felgate (Meta), and Dean Veverka (Southern Cross Cables).

This article is an output from a SubOptic Foundation project funded by the Internet Society Foundation. STF

VIDEO LINK HERE: https://drive.google. com/file/d/1qAslSPZFQETUI6a7G x9ZkYu87DrFji6C/view?usp=sharing

all industry sectors, drawing expertise from planning, manufacturing, supply, installation, operation, and recycling. During the Congress, through an open and guided conversation, participants will discuss a series of sustainability metrics aimed at heightening awareness and improving the industry carbon footprint across a cable’s lifecycle. It is our hope the Congress and the many environmental sessions at SubOptic will continue the important conversations begun at PTC ‘23.

Participants in the SubOptic Foundation Congress on Sustainability: Nigel Bayliff (Aqua Comms), Merete Caubet

NICOLE STAROSIELSKI is Associate Professor of Media, Culture, and Communication at NYU. Dr. Starosielski’s research focuses on the history of the cable industry and the social aspects of submarine cable construction and maintenance. She is author of The Undersea Network (2015), which examines the cultural and environmental dimensions of transoceanic cable systems, beginning with the telegraph cables that formed the first global communications network and extending to the fiber-optic infrastructure. Starosielski has published over forty essays and is author or editor of five books on media, communications technology, and the environment. She is co-convener of SubOptic’s Global Citizen Working Group and a principal investigator on the SubOptic Foundation’s Sustainable Subsea Networks research initiative.

GEORGE N. RAMÍREZ is a PhD candidate in the Department of Media, Culture, and Communication at New York University, where his work focuses on sensation and performance in Latinx popular culture.

Do you have further questions on this topic?

ASK AN EXPERT

Conferences like PTC help to disseminate practices and knowledge across the industry. Here, companies can share the meaningful sustainability initiatives they are pursuing--and inspire others to follow.

WHERE IN THE WORLD ARE THOSE PESKY CABLESHIPS?

BY KIERAN CLARKAs the first quarter of 2023 wraps up it’s the perfect time to once again ask: Where in the World Are All Those Pesky Cableships?

SubTel Forum tracks AIS updates every 6 hours from 53 vessels that make up the global cable ship fleet. Between January 1 and March 2, the cableship fleet logged 14,925 AIS updates based on SubTel Forum’s tracking system. Over half of these updates indicated no movement speed during this 60-day period showing no significant change in overall activity compared to the previous period. This lack of movement is generally attributed to repairs, scheduled maintenance and upgrades.

For this edition of Where in The World Are Those Pesky Cableships, our analysts have created a heat map showing where the cable ship fleet was most active around the world. Red, orange and then yellow indicate the highest amount of activity while lower activity is represented by increasing shades of blue. As indicated by the heat map, the main AIS zones of activity over the past 60 days were East Asia, Indonesia, North Sea, North East Atlantic Ocean and South East Asia. From the total 26 AIS zones, these five accounted for 45 percent of all AIS activity for the cable ship fleet.

The cableship fleet grew more in 2022 than any year in the last 10, and the distribution of vessel ownership has shifted quite significantly. At the end of 2021, SubTel Forum was only tracking 44 cableships but this number increased to include nine more vessels between December 2021 to December 2022. A handful of these additions are vessels that have only recently been added to SubTel Forums AIS tracking data. Some were

added after seeing a shift in their focus from power cables to telecoms cables. In October, the Normand Clipper signed an extended contract with NTT for installation projects over the next several years.

There have also been several conversions, like ASN’s Ile de Molene, which was christened this past summer. Orange Marine’s new vessel the Sophie Germain is now active and will be tracked accordingly in the SubTel Forum system moving forward. She is the first battery powered, energy efficient submarine cable laying vessel in the entire fleet and a further indication of how committed this industry is to overall sustainability and lowering its environmental impact.

Despite this high amount of activity and new vessels added to the fleet, there is a real concern that there is a cable ship capacity crunch. As Dan Swinhoe of DatacenterDynamics discussed in early December, and based on new cable activity observed by SubTel Forum there is some concern that there is not enough cable ship capacity to keep up with new cable demand. Several installers such as ASN are fully booked through 2024 and external vessels are being hired on a more frequent basis to keep up with project workloads. Additionally, the overall age of the fleet is quite high – between 20 and 30 years old – with only a handful of new, modern vessels coming into service over the last few years.

However, it is clear the cable ship fleet will remain busy for the foreseeable future. This is always a nice problem to have! STF

KIERAN CLARK is the Lead Analyst for SubTel Forum. He originally joined SubTel Forum in 2013 as a Broadcast Technician to provide support for live event video streaming. He has 6+ years of live production experience and has worked alongside some of the premier organizations in video web streaming. In 2014, Kieran was promoted to Analyst and is currently responsible for the research and maintenance that supports the Submarine Cable Database. In 2016, he was promoted to Lead Analyst and his analysis is featured in almost the entire array of Subtel Forum Publications.

The cableship fleet grew more in 2022 than any year in the last 10, and the distribution of vessel ownership has shifted quite significantly. At the end of 2021, SubTel Forum was only tracking 44 cableships but this number increased to include nine more vessels between December 2021 to December 2022.

31st May - 1st June 2023

Business Design Centre, London

Submarine Networks EMEA is the leading annual subsea connectivity event in the region, bringing together 800 senior leaders from the global subsea market for two jam-packed days of learning, collaboration and networking.

In addition to offering plenty of networking opportunities, attendees will be able to enjoy thought-leading panels, technical presentations, workshops and cable project and connectivity hub updates.

SPEAKING OPPORTUNITIES: kerry.merritt@totaltele.com

MARKETING OPPORTUNITIES: laura.curwen@totaltele.com

5 QUESTIONS WITH RYAN WOPSCHALL

Talking Network Industry With ICPC’s General Manager

1.

WHAT IS ICPC’S MISSION?

The ICPC is guided by its vision statement which is to be the recognized guardian of subsea cable infrastructure, providing leadership, guidance and a voice for the industry. As the leading submarine cable industry membership-based trade organization focusing on cable protection issues, we support and advocate for our members on technical, environmental, and regulatory aspects of implementing, owning and operating submarine telecom and power cables.

The ICPC was founded in 1958 and has seen tremendous change as an organization since that time. And just as the organization has changed, we acknowledge that the industry is always changing, as are the critical issues facing the protection of submarine cables. As a result, our organization, through the leadership of our Executive Committee, routinely evaluate our vision statement to ensure it aligns with the current events of our industry.

2. HOW DOES ICPC PARTICIPATE IN THE SUBMARINE CABLE MARKET?

The ICPC is a membership-based industry organization. We are comprised of about 190 member companies in over 69 countries globally who work throughout various levels of the submarine cable supply chain

from cable owners, suppliers and installers, marine survey companies, to professional service companies and governments. The ICPC, led by its Executive Committee and supported by its Secretariat team, promotes the awareness of submarine cable protection globally. From the perspective of the submarine telecoms industry, our members represent approximately 98% of all international fiber optic cables. We not only participate in the submarine cable market, we are composed of the submarine cable market.

3.

WHAT ARE THE ELEMENTS OF ICPC’S SUCCESS?

As an industry organization, ICPC’s success draws on its members’ collective experiences installing and operating submarine telecom and power cables. Successes include our outreach and affiliations work with other industry and maritime organizations who operate or have a stake in ocean use, our advocacy of submarine cables as critical infrastructure, our best practice guidance to governments on cable resilience, and our cornerstone event, the annual Plenary, where members and guests share the latest developments in environmental, law and policy, and technical aspects of submarine cables.

4.

AS SUSTAINABILITY HAS BECOME A HOT BUTTON ISSUE IN OUR INDUSTRY, WHAT ARE ICPC’S PLANS FOR SUSTAINABLE OPERATIONS GOING FORWARD?

The ICPC has recognized a growing interest within the submarine cable industry on sustainability. As an organization, our members are sharing information on their own relative carbon footprints for various operational activities, as well as discussing new ideas on reducing the overall footprint. Additionally, the ICPC has engaged through our Marine Environmental Advisor, Dr. Mike Claire, support of other industry organizations who are studying sustainability topics relevant to the submarine cable industry.

5.

WHAT IS NEXT FOR ICPC?

The ICPC acknowledges that the submarine cable industry is changing every year, particularly when viewed from a global scale. We work towards staying current on emerging topics and issues facing the submarine cable industry and our members, and work together to provide guidance and leadership. Additionally, there is a growing interest and awareness on cable security. We view security as an aspect of overall infrastructure resilience and work to provide governments and members guidance on cable resilience planning. Our organization is growing each year, there is new blood coming into the membership, making these exciting times to be part of the ICPC and at the forefront of our industry. The big next step, however, is simply returning back to in person events with the much anticipated in person Plenary occurring this April in Madrid – the first in person Plenary since 2019. STF

RYAN

The ICPC has recognized a growing interest within the submarine cable industry on sustainability. As an organization, our members are sharing information on their own relative carbon footprints for various operational activities, as well as discussing new ideas on reducing the overall footprint.

ICPC ’23 PLENARY PREVIEW SPOTLIGHT

The pandemic has been a topic to report on throughout the industry and the world for the last few years. And while much of the world has moved on and returned to a certain level of homeostasis or normalcy, for the ICPC we are now only (and with much enthusiasm) turning the corner back to our ‘normal’ – having an in-person annual Plenary meeting, the cornerstone event for our members.

The Plenary has always been a gathering point for ICPC members which now includes over 190 companies in over 69 countries serving the submarine telecom and power cable industries. Three days are spent together exchanging technical, environmental and regulatory information, experiences, and lessons learned related to current and emerging cable protection issues. It’s a chance to hear from people on the ground implementing and operating submarine cables and how best to protect them from human activity, increased use of the seabed, changing regulatory frameworks, and how to develop and promote resilient digital and power cable infrastructure. The ICPC not only serves the industry, but we are also composed of the industry and as a result remain at the forefront of cable protection topics worldwide.

The pandemic shifted the Plenary to a virtual event simply out of necessity and as much as we can claim success

in putting on two virtual Plenary events in 2021 and 2022, the experience was not necessarily something we wanted to keep replicating. The value of our Plenary is in the faceto-face interactions with our members to learn from one another, share information, develop relationships across the industry, and gain knowledge on current and emerging issues related to cable protection.

The pandemic, however, had an interesting effect on our organization. Global awareness of digital infrastructure boomed as people shifted to remote working environments, dependent on reliable broadband connections for video conferencing services, cloud products, and a whole host of other services we all learned to become dependent on. Take this to another order of magnitude and the companies providing the streaming and cloud services saw even greater adoption and use, placing more demand on connectivity. The interest and awareness in submarine cables flourished in helpful and not so helpful ways all across the media, also fueled by geopolitical events and heightened discussions about cable security. In turn, however, at least for the ICPC, our membership numbers saw one of the largest increases over time than ever before. With this increase we have also seen new entrants into the industry including both cable owners as well as professional service companies. The cable industry has been very active over the

last ten years in many new and exciting ways, but right now is a very exciting time for our organization.

We are holding our 2023 annual Plenary in Madrid over three days from April 18th through 20th. There has so far not only been a large amount of registrations for the event, but member companies are showing interest in bringing several people including newer hirers or younger professionals to expose them to the ICPC and the broader aspects of the submarine cable industry. This is a welcomed occurrence as our organization is also contemplating how to bring in the newer generations of professionals into the ICPC and show them that they are working in a global yet relatively close-knit community of peers tackling the same or similar challenges in developing, operating and maintaining submarine cable infrastructure.

The Madrid Plenary is largely a closed event for ICPC members, though we do accept guest speakers and observ-

AGENDA

(Subject to modification and EC approval)

PRE-PLENARY EC-ONLY MEETING

MONDAY, 17TH APRIL 2023

9:00 PM – 6:00 PM

Pre-Plenary Executive Committee Meeting

7:00 PM - 8:30/9:00 PM

Welcome Cocktail Reception for ICPC Members and their accompanying person(s)

Dress code: ‘Business/Smart Casual’ Duque Networking Area

DAY ONE: TUESDAY, 18TH APRIL 2023

8:30 AM

Morning meet and greet with coffee Exhibition Area (Hall Convención)

9:00 AM

Day One of the ICPC Plenary Begins Oslo-MadridVienna Meeting Room

ers. While the agenda is not released publicly, it is composed of industry leaders presenting on topics such as cable security, protecting cables from a legal perspective, global cable repair statistics, planning more resilient cable routes and landings, permitting and regulatory best practices, management of cable and other infrastructure crossings, regional perspectives and lessons learned from around the world, fiber optic sensing, geospatial planning, among many other topics.

The ICPC is looking into the future and with our return to ‘normalcy’ we are now looking forward to hosting Plenary meetings throughout the world just as we have done over our long history. Since we are a membership organization, our success and value is derived from our members. We look forward to continued growth in our membership and our continued dedication to providing leadership and guidance on cable protection issues. STF

9:00 AM

Opening of Meeting (Chairman)

9:05 AM

Welcome Speech (Host or Conference Dinner Sponsor)

9:20 AM

EC Elections and Appointments - Voting Reminder

9:25 AM

The Year in Review (Presentation by Chairman & General Manager)

9:50 AM

Working Group Reports

10:15 AM

End of Members’ Session

10:15 AM

Morning Coffee Break and External Speaker Registration in the Exhibition Area (Hall Convención)

10:45 AM

Open Session Commences

Oslo-Madrid-Vienna Meeting Room

10:45 AM

Welcome to External Speakers (Chairman)

10:50 AM

Keynote Speech

11:10 AM

Global Report of Cable Repair Commencement Times (Invited Paper)

11:30 AM

Presentation Session

Presenter & Presenter Title (30 minutes)

12:00 PM

Panel TBD (30 minutes)

12:30 PM

Onsite Lunch Break

1:30 PM

Legal Review (Presentation by ICLA)

2:00 PM

Liaison with Other Organisations and Seabed Users

• Europe Submarine Cable Association (ESCA)

• Denmark Cable Protection Committee (DKCPC)

• North American Submarine Cable Association (NASCA)

• Oceania Cable Protection Association (OSCA)

• International Hydrographic Organisation (IHO)

• SubOptic 2019

• International Telecommunications Union (ITU) Smart Cables Initiative

• UNEP-WCMC

• West African Cable Protection Event

• International Council on Large Electric Systems (CIGRÉ)

3:00 PM

Afternoon Coffee Break in the Exhibition Area (Hall Convención)

3:30 PM

Presentation Sessions

Presenter & Presenter Title (30 minutes)

Presenter & Presenter Title (30 minutes)

Presenter & Presenter Title (30 minutes)

5:00 PM

Summary of Issues Raised During Day One

5:15 PM

End of Business Day One

DAY TWO: WEDNESDAY, 19TH APRIL 2023

8:30 AM

Morning meet and greet with coffee Exhibition Area (Hall Convención)

9:00 AM

Day Two of the ICPC Plenary Begins Oslo-MadridVienna Meeting Room

9:00 AM

Presentation Sessions

Presenter & Presenter Title (30 minutes)

Presenter & Presenter Title (30 minutes)

Presenter & Presenter Title (30 minutes)

10:30:

Morning Coffee Break in the Exhibition Area (Hall Convención)

AGENDA

11:00 AM

Environmental Review (Presentation by MEA)

11:30 AM

Presentation Sessions

Presenter & Presenter Title (30 minutes)

Presenter & Presenter Title (30 minutes)

12:30 PM

Onsite Lunch Break

1:30 PM

Presentation Sessions

Presenter & Presenter Title (30 minutes)

Presenter & Presenter Title (30 minutes)

Panel TBD (30 minutes)

3:00 PM

Afternoon Coffee Break in the Exhibition Area

3:30 PM

Presentation Sessions

Presenter & Presenter Title (30 minutes)

Presenter & Presenter Title (30 minutes)

Presenter & Presenter Title (30 minutes)

5:00 PM

Summary of Issues Raised During Day Two

5:15 PM

End of Business Day Two

DAY THREE: THURSDAY, 20TH APRIL 2023

8:30 AM

Morning meet and greet with coffee Exhibition Area (Hall Convención)

9:00 AM

Day Three of the ICPC Plenary Begins Oslo-MadridVienna Meeting Room

9:00 AM

Presentation Sessions

Presenter & Presenter Title (30 minutes)

Presenter & Presenter Title (30 minutes)

Presenter & Presenter Title (30 minutes)

10:30 AM: Morning Coffee Break in the Exhibition Area

11:00 AM

UN Observer Representative Review (Presentation by UNOR)

11:30 AM

Presentation Sessions

Presenter & Presenter Title (30 minutes)

Presenter & Presenter Title (30 minutes)

12:30 PM

Onsite Lunch Break 1:30 PM Presentation Sessions

Presenter & Presenter Title (30 minutes)

Presenter & Presenter Title (30 minutes)

Presenter & Presenter Title (30 minutes)

3:00 PM

Afternoon Coffee Break in the Exhibition Area

3:30 PM

Presentation Sessions

Presenter & Presenter Title (30 minutes)

Presenter & Presenter Title (30 minutes)

4:30 PM

Request for Members’ Feedback on the 2023 Plenary (to be completed online)

4:35 PM

Arrangements for the 2024 Plenary

4:40 PM

EC Election and Appointments Announcement

4:45 PM

Meeting Closure

22 YEARS AGO

1 MARCH 2001

OUR COMPANY WAS FOUNDED

WE’RE A FAMILY BUSINESS AND WE TAKE GREAT PRIDE IN OUR PEOPLE, SERVICES AND PUBLICATIONS.

SUB-SEA CABLES: A FINANCING PERSPECTIVE

BY IAN MATHEWSThe requirements of third-party financiers are often downplayed or overlooked when developers are initially contemplating a sub-sea cable. Much time is rightly spent by developers in optimising the tender documents to ensure a technically efficient and reliable sub-sea cable system and in obtaining commitments from potential capacity purchasers. Less time is spent in discussions with financial institutions as to how to fund the cable and, in particular, the structuring elements of the financing. As financial institutions may well be the largest single providers of capital, early engagement is important

to ensure that potential roadblocks and deal breakers are not discovered a long way down the cable’s development timeline. This article seeks, at a high level, to identify both potential financier requirements and various alternative means of financing the opportunity.

POTENTIAL STRUCTURES

The two most common approaches seen in the market are the Incorporated Joint Venture (“IJV”) and the Unincorporated Joint Venture (“UJV”).

At its simplest, the IJV is a special purpose vehicle that

incorporates one or (more commonly) several shareholders who hold a vested interest in developing the project. These can include both active (e.g. existing cable operators) and passive (e.g. governmental) investors. The IJV then seeks to raise the necessary finance required for the cable either from its shareholders’ own internal resources or from a combination of its shareholders’ own resources and debt finance from third parties. Investors are rarely willing to provide guarantees but may provide other forms of support for the mitigation of specific risks necessary to attract the financiers. However, far more commonly, investors will seek to limit their own financial exposure to the amount of equity committed and provide no other collateral to the financiers other than the assets of the cable company, a structure commonly known as “project finance”.

as an IJV and raises its share of the capital for the UJV as per the IJV model above. However, this is relatively uncommon as the specific nature of project financing at the IJV level provides additional protections for financiers that could, if triggered, limit the ability of the IJV to meet its share of the UJV’s costs as they fall due. This could cause material disruption to the broader financing of the UJV and would be unappealing for the other UJV investors.

FINANCIER CONSIDERATIONS

Banks are conservative. This is less of an issue for a UJV structure as any third-party finance raised will be at the developer rather than the asset level and would have full recourse to the sponsor. It is important under an IJV structure. As financiers would normally be the largest single layer of capital in the company, their views do need to be considered. The key risks fall broadly into the following generic categories.

TECHNOLOGY AND DESIGN

By contrast, under a UJV structure, there is no single legal entity that directly raises third party financing as each investor is required to fund its proportionate share of the costs as they fall due. This approach tends to be seen both in opportunities where there are multiple cable pairs owned by different parties under the wider umbrella of the cable’s development and also where the investors are sufficiently creditworthy that they can raise the financing on their own balance sheet and inject this as capital to cover their share of the costs. This is the quickest and simplest means of financing cables but does place the entire financial risk of the cable on the shoulders of the investors.

It is possible to incorporate an IJV into a broader UJV structure whereby one of the cable investors is incorporated

Financiers like proven technology. Whilst the cable industry does - and will continue to – evolve, the underlying technology is well-proven with most of the improvements in technology and efficiency tending to be incremental as opposed to dramatic in nature. Unproven technology risks will limit bank appetite for financing on a project finance basis and will require one or more of higher equity contributions from developers and/or completion guarantees and higher levels of liquidated damages under the cable construction contracts. Whilst some cable contractors may be prepared to accept higher obligations on their side to deliver unproven technology, this may come at an additional cost and may not, by itself, be sufficient to meet lender requirements. As such, the use of a credible third-party consultant would be required assist lenders to understand new technologies and explain how certain elements of the system design need to be in synchronisation with the business plan projections such as the ability to expand the “lit” capacity in the future with the corresponding capital expenditure built into the plan.

PERMITTING AND APPROVALS

Financiers like legal certainty. Evidence from various industries, including sub-sea cables in Asia-Pacific, has shown that the lack of the correct permits, licenses and approvals – such as environmental approvals - can undermine the viability of the project. It is not enough to inform

potential lenders that, in the fullness of time, the required permits will be forthcoming. Such permits and approvals will be required as a condition precedent to closing the financing and permitting drawdown. The time required to obtain approvals such as environmental approvals can be unpredictable and time-consuming. This applies to all cable opportunities, but is particularly more important where approvals are required from one or more governments or from one or more layers of government within one country e.g., federal, province and region. A cable without the required landing station permit or permits - it has happened before – is an expensive seafloor decoration.

CABLE CONSTRUCTION AND LAYING

Financiers like competence. The cable industry is dominated by a limited number of well-established and proven names such as Alcatel Submarine Network, Fujitsu, NEC, TE SubCom and Huawei. All represent names that are not only extensively banked but which have used innovative financing approaches to present attractive financing options for developers such as deferred payment schemes. For financiers, if the cable is not made and laid to the required specifications, there is no cash flow and no means to repay the debt. As such, contractor selection is key. However, it is recognised that there has increasingly been diplomatic pressure put on countries such as the Pacific Island Nations to increasingly consider security concerns when selecting a contractor.

Other than the competence of the contractor the main financier considerations are the contractual protections against potential cost increases (other than for change orders by the IJV, which would require the prior consent of the financiers), delays in completion (including the ready availability of cable laying vessels) and performance shortfalls. In general, the protections for delay and performance shortfalls would tend to be in the range of 10-20% of the contract value, but any failure to complete the construction and installation can see liability caps of up to 100% of the contract value. In the case of liquidated damages for delay, these should be structured to cover fixed costs including debt servicing and in the case of liquidated damages for performance shortfalls, these should be structured to allow for the pay-down of third-party debt by an amount sufficient to restore debt service coverage ratios to those originally envisaged.

OPERATIONS AND INSURANCE

Financier like certainty of revenues. Assuming the commercial viability of the transaction is proven (see below), the

main concern for financiers is the interruption or breakage of the cable and the time and costs taken to repair the cable. Under capacity purchase agreements signed with the end users, the cable operator may have to start paying compensation for the loss of service after an allowed period. For financiers, not only do they face the lack of revenues coming into the company but they may be faced with cash outflows as the company makes payments to its customers on account of liquidated damages. These issues would normally be dealt with through a combination of self-insurance achieved through combining with other cable owners to pay fees to ensure an installation / repair vessel is maintained within the region, a short-term working capital facility to cover operating costs that would fall due within the next sixty or ninety days and a reserve account to cover the next six months interest and principal repayment that would fall due. These elements would help to buy time to repair any damage to the cable and ensure that debt service is not affected.

COMMERCIAL VIABILITY

Financiers like financial certainty. The perception of “commercial viability” can differ markedly between developers and financiers. Whilst developers will tend to look at market growth projections when developing their revenue forecasts, financiers rarely bank the upside potential of additional growth unless there is compelling evidence to do so such as the proposed cable replacing an existing cable nearing the end of its operating life or where such cash flow projections are verified by credible third-party market consultants that have thoroughly analysed the underlying revenue assumptions. Financiers like to see committed revenues locked in whether through long-term leases or upfront indefeasible rights of use (or both) and will debt size their base case based upon such committed revenues. The payment arrangements need to be backed by credible capacity purchasers, either on a standalone basis or supported via bank guarantees. Without credible capacity purchasers, financiers will not lend to the extent that may be sought by the developer.

This is seen in countries where lack of scale and creditworthiness often go together. Many of the cables to the Pacific Island Nations have been funded by International Financial Institutions such as the Asian Development Bank (“ADB”), World Bank and, increasingly, the Australian Infrastructure Financing Facility for the Pacific (“AIFFP”). This is because they are not commercially viable from a private sector financing perspective. That is not to say that smaller transactions cannot be financed by the private sector as ANZ financed the Interchange sub-sea cable be-

tween Fiji and Vanuatu. Notwithstanding a market report that showed the potential upside arising from the cable’s introduction, the debt was sized on contractually pre-committed revenues from parties with acceptable credit profiles.

The above categorisations are not meant to be exhaustive but are to provide an overview of the typical financing considerations that need to be taken into account by a developer if they wish to raise third-party financing particularly from commercial banks for an IJV structure. The developer may also request the contractor to mobilise a financing package, but the same considerations will still apply to lenders. The section below outlines the potential financier options that will need to be considered to optimise the financing of a sub-sea cable.

FINANCIER OPTIONS

Traditionally the choice of financiers for cable projects has been binary – public sector lenders such as the International Financial Institutions for the politically and/or nationally important but commercially non-viable cables and private finance institutions such as commercial banks for the commercially viable opportunities. This duality has become increasingly blurred with not only an increased degree of collaboration and crossover between the two groups of financiers, but also the increased role of new actors as potential sources of capital.

Public sector institutions are often perceived by developers as bureaucratic, slow moving and hamstrung by internal policies and procedures. Whilst such perceptions are not necessarily incorrect by themselves, such a view is to tar unfairly all such institutions with the same brush. From ANZ’s interactions with many public sector institutions – both in the sub-sea cable sector and elsewhere in Asia-Pacific - we would argue that there are two main areas where public sector financing can play, and has played, an important role in the financing of projects.

The first relates to the private sector teams within the larger public institutions. These teams are often staffed by experienced financiers drawn from the private sector with many of them previously working in the project finance teams of commercial banks. This has seen, for example, the Private Sector Operations Department of the ADB develop a “speed to market” that is not dissimilar to that of many commercial banks.

Taking the ADB as an example, they can

provide loans both directly from their own resources and through mobilisation under their B Loan Programme. They can also provide political risk mitigation products such as guarantees that protect against expropriation, civil war, political violence and breach of contract by the host government. They also, through their wider involvement as a provider of grants and concessionary funding to governments, provide a “halo” effect to the transaction as any illegal action taken by a government against a company benefitting from an ADB loan (or analogous Multilateral Agency) would have severe ramifications across the wider government relationship.

The “halo” effect of Multilateral Agencies is of significant importance in mobilising commercial finance as one of the biggest challenges facing commercial lenders in many countries is the political risk of doing so and the capital costs that need to be factored into pricing. ANZ worked closely with a Multilateral Agency on a potential cable financing opportunity in the Pacific and was close to finalising the financing plan when the host government arbitrarily awarded the construction contract to a party that was not the preferred bidder under the tender overseen by the Multilateral Agency: both prospective lenders elected to exit and the proposed cable was not financed.

A second group of public sector institutions that can provide material assistance in raising financing from the private sector are Export Credit Agencies (“ECAs”). These are governmental bodies from, in the most part, OECD na-

tions that have traditionally supported the export of capital goods such as cables from their home country through the provision of guarantees that provide commercial and political risk protection for commercial lenders. Whilst the ECA would still need to be satisfied on the points raised above, the result could be not only extended tenors and lower pricing than would otherwise be the case, but potentially also the financing of transactions that would otherwise not have been capable of being financed. For example, as part of a response to a tender, Alcatel Submarine Networks could be asked to mobilise French ECA Bpifrance to assist the developer both in raising commercial bank financing for its project and potentially supporting either vendor financing or deferred payment schemes that would minimise the initial capital outlay of the project: similar ECA support are also available for the other major cable contractors.

Historically, ECAs provided support for up to 85% of the eligible costs under an export contract plus additional cover for a percentage of local costs and other incidental costs. In recent years, the scope of some ECAs has broadened to include providing direct loans as well as guarantees. In addition, the fundamental requirement for capital good exports has been widened by some ECAs to include the loosely defined term “national interest”. This can range from supporting goods and services in the home market to being politically beneficial to the ECA’s government. The Australian ECA Export Finance Australia has embraced this wider national interest approach across Asia-Pacific supporting key projects. The Australian Government also established the AIFFP to deliver sustainable, transparent and high-quality infrastructure, including cables, in its geopolitical sphere of influence. The AIFFP financed the Coral Sea Cable System to Papua New Guinea and the Solomon Islands and is working on other cable projects involving Timor Leste and Palau.