reportINDUSTRY 2022/2023 ISSUE 11

A Publication of Submarine Telecoms Forum, Inc. www.subtelforum.com ISSN No. 2640-4311

PRESIDENT & PUBLISHER: Wayne Nielsen | wnielsen@subtelforum.com | [+1] (703) 444-2527

VICE PRESIDENT: Kristian Nielsen | knielsen@subtelforum.com | [+1] (703) 444-0845

SALES: sales@subtelforum.com

EDITOR: Stephen Nielsen | snielsen@subtelforum.com

INDUSTRY REPORT AUTHORS: Rebecca Spence | rspence@subtelforum.com | [+1] (703) 268-9285 Kieran Clark | kclark@SubTelforum.com | [+1] (540) 533-6965

DESIGN & PRODUCTION: Weswen Design | wendy@weswendesign.com

CONTRIBUTING AUTHORS:

Alex Chase, George Ramírez, Greg Otto, Hunter Vaughan, Nicole Starosielski, and Phillip Pilgrim

REPORT VIDEO COMMENTATORS:

Alex Chase, Anders Ljung, Daniel Leza, George Ramírez, Greg Otto, Houlin Zhao, Julian Rawle, Kieran Clark, Mike Conradi, Rebecca Spence, and Rene D’Avezac de Moran

AUTHOR AND ARTICLE INDEX: www.subtelforum.com/onlineindex

Submarine Telecoms Forum, Inc. www.subtelforum.com/corporate-information

BOARD OF DIRECTORS: Margaret Nielsen, Wayne Nielsen and Kristian Nielsen

SubTel Forum Continuing Education, Division of Submarine Telecoms Forum, Inc. www.subtelforum.com/education

Contributions are welcomed and should be forwarded to: pressroom@subtelforum.com. Submarine Telecoms Forum Industry Report is published annually by Submarine Telecoms Forum, Inc., and is an independent commercial publication, serving as a freely accessible forum for professionals in industries connected with submarine optical fiber technologies and techniques. Submarine Telecoms Forum may not be reproduced or transmitted in any form, in whole or in part, without the permission of the publishers. Liability: While every care is taken in preparation of this publication, the publishers cannot be held responsible for the accuracy of the information herein, or any errors which may occur in advertising or editorial content, or any consequence arising from any errors or omissions, and the editor reserves the right to edit any advertising or editorial material submitted for publication.

New Subscriptions, Enquiries and Changes of Address: 21495 Ridgetop Circle, Suite 201, Sterling, Virginia 20166, USA, or call [+1] (703) 444-0845, fax [+1] (703) 349-5562, or visit www.subtelforum.com. Copyright © 2022 Submarine Telecoms Forum, Inc.

2 SUBMARINE TELECOMS INDUSTRY REPORT

VOICE OF THE INDUSTRY

CONTENTS Impressum 2 Exordium 8 Foreword: Thoughts From Houlin Zhao, ITU Secretary-General .................................................. 10 Methodology 12 1. GLOBAL OVERVIEW ......................................... 14 1.1 Industry Sentiment .......................................... 16 1.2 Phillip Pilgrim’s Look at Subsea Telecom Industry’s 150th Anniversary 22 1.3 System Growth 27 1.4 Out of Service Systems .................................. 31 1.5 Evolution of System Ownership and Customer Base 33 2. CAPACITY ........................................................ 36 2.1 Global Capacity ............................................. 38 2.2 Lit Capacity 40 2.3 Capacity Pricing: Perspectives of Alex Chase 44 3. OWNERSHIP FINANCING ANALYSIS ............. 46 3.1 Historic Financing Perspective 48 3.2 Regional Distribution of Financing 50 3.3 Current Financing .......................................... 52 4. SUPPLIER ANALYSIS ...................................... 54 4.1 Suppliers 56 4.2 Installers ........................................................... 58 4.3 Surveyors ......................................................... 62 4.4 Recent Mergers, Acquisitions, and Industry Activities 64 5. SYSTEM MAINTENANCE ................................ 68 5.1 Publicity ........................................................... 70 5.2 Reporting Trends and Repair Times 71 5.3 Club Versus Private Agreements 72 6. CABLE SHIPS ................................................... 74 6.1 Current Cable Ships 76 6.2 Shore-End Activity 79 7. MARKET DRIVERS AND INFLUENCERS ........ 80 7.1 Hyperscalers 82 7.2 Data Centers 85 8. SPECIAL MARKETS......................................... 90 8.1 Offshore Energy: Thoughts from Greg Otto 92 8.2 Unrepeatered Systems 98 8.3 Specialized Technologies 101 8.4 Sustainability in Subsea: Perspectives of George Ramírez, Nicole Starosielski, and Hunter Vaughan 103 9. REGIONAL ANALYSIS AND CAPACITY OUTLOOK ..................................... 106 9.1 Transatlantic Region 108 9.2 Transpacific Region 112 9.3 Americas Region 116 9.4 AustralAsia Region ....................................... 122 9.5 EMEA Region 128 9.6 Indian Ocean Region 134 9.7 Polar Region................................................... 138 Afterword ....................................................................... 142 Biographies of supporting authors 144 Works Cited 145 Table of SUBMARINE TELECOMS INDUSTRY REPORT 3

Video

Video

Video

4 SUBMARINE TELECOMS INDUSTRY REPORT Video 1: Wayne Nielsen, Publisher - Submarine Telecoms Forum, Inc. ............................................................................................ 8 Video 2: Houlin Zhao, Secretary-General - ITU................................................................................................................................. 10 Video 3: Rebecca Spence, Project Manager - Submarine Telecoms Forum, Inc. 12 Video 4: Julian Rawle, Principal - Julian Rawle Consulting 15 Video 5: Philip Pilgrim, Subsea Business Development Leader North America – Nokia .............................................................22 Video 6: Alex Chase, Senior Director - AP Telecom 36 Video 7: Daniel Leza, Vice President – TMG Telecom 48

8: Rene D’Avezac de Moran, Service Line Manager - Hydrography - Fugro ..................................................................... 62 Video 9: Mike Conradi, Partner – DLA Piper 64 Video 10: Greg Otto, Technical Director - WFN Strategies, LLC 92 Video 11: Anders Ljung, Sales Manager, Submarine Cable Systems – Hexatronic Cables & Interconnect Systems AB ......... 98 Video 12: George Ramírez, Research Assistant for Sustainable Subsea Network – SubOptic Foundation 103

13: Kieran Clark, Analyst – Submarine Telecoms Forum, Inc. 107

14: Kristian Nielsen, Vice President - Submarine Telecoms Forum, Inc. ............................................................................. 142 VIDEOSList of Table 1: Per-Message” Price Data 1866 to 1872 (Plotted in Figure 2 below) 23 Table 2: 1872 Cable Operators ............................................................................................................................................................... 25 Table 3: 1866 to 1872 Points of Interest 26 Table 4: Recent Multilateral Development Bank Projects 53 Table 5: Transatlantic Systems, 2012-Present....................................................................................................................................... 110 Table 6: Transatlantic Planned Systems 111 Table 7: Transpacific Systems, 2012-Present 114 Table 8: Transpacific Planned Systems ................................................................................................................................................. 115 Table 9: Americas Systems, 2012-Present 119 Table 10: Americas Planned Systems 120 Table 11: AustralAsia Systems, 2012-Present ....................................................................................................................................... 124 Table 12: AustralAsia Planned Systems 126 Table 13: EMEA Systems, 2010-Present 130 Table 14: EMEA Planned Systems ........................................................................................................................................................ 133 Table 15: Indian Ocean Systems, 2012-Present ...................................................................................................................................136 Table 16: Indian Ocean Planned Systems 137 Table 17: Polar 2010-Present 140 Table 18: Polar Planned Systems ........................................................................................................................................................... 141 TABLESList of

List of

FIGURES

Figure 27: Transpacific Capacity Growth, 2016-2020 42

Figure 28: Transpacific Capacity Growth, 2021-2025 42

Figure 29: Americas Capacity Growth, 2016-2020 42

Figure 30: Americas Capacity Growth, 2021-2025 43

Figure 31: Intra-Asia Capacity Growth, 2016-2020 43

Figure 32: Intra-Asia Capacity Growth, 2021-2025 43

Figure 33: Monthly Lease Pricing on Major Routes

45

Figure 34: Median 100G IRU Pricing on Major Routes 45

Figure 35: Financing of Systems, 2012-2022 49

Figure 36: Investment Distribution of Systems, 2012-2022

49

Figure 37: Distribution of MDB Investment, 2012-2022 50

Figure 38: Distribution of Debt/Equity Financed Investment, 2012-2022

51

Figure 39: Distribution of Self-Financed Investment, 2012-2022 51

Figure 40: System Investment, 2012-2022 52

Figure 41: System Deployment, 1992-2022

52

Figure 42: Regional Investment in Submarine Fiber Systems, 2018-2022 53

Figure 43: Number of Systems by Supplier, 2018-2022

56

Figure 44: KMS of Cable Produced by Supplier, 2018-2022 57

Figure 45: Planned Systems by Supplier, 2022-2025 57

Figure 46: Systems Installed by Company, 2018-2022

58

Figure 47: KMS Installed by Region, 2018-2022 59

Figure 48: Planned KMS by Region, 2022-2026 59

Figure 49: Systems Surveyed by Company, 2018-2022

63

Figure 50: Survey Status of Planned Systems, 2022-2026 63

Figure 51: Cable Fault Stories Per Region, 2014-2022 70

Figure 52: Total Cable Fault Stories, 2014-2022 70

Figure 53: Average Reported Repair Time in Days, 2014-2022 71

Figure 54: Traditional Club Agreements Map 72

SUBMARINE TELECOMS INDUSTRY REPORT 5 Figure 1: Worldwide Map of Submarine Cable 15 Figure 2: Overall State of the Industry 16 Figure 3: Market Activity ............................................................... 17 Figure 4: Project Status 17 Figure 5: Regional Activity 17 Figure 6: Work Status ..................................................................... 18 Figure 7: Industry Investment 18 Figure 8: Job Function of Surveyed 18 Figure 9: Purchasing Power of Surveyed 19 Figure 10: Years of Industry Experience 19 Figure 11: Location of Surveyed 19 Figure 12: Sir James Anderson 25 Figure 13: Plot of “Per-Message” Price Decline for the First Five Years of Transatlantic Cable Communications 26 Figure 14: Maximum Yearly Transatlantic Cable Revenue Assuming Fully Loaded 26 Figure 15: New System Count by Region, 2018-2022 27 Figure 16: KMS Added by region, 2018-2022 27 Figure 17: Planned Systems by Region, 2022-2025 28 Figure 18: Global Contract in Force Rate, 2022-2027 ............... 28 Figure 19: Decommissioned Systems 2002-2022 29 Figure 20: Projected System Maturity 2022-2032 32 Figure 21: Single vs Multiple Owner Cable Systems, 2012-2022 33 Figure 22: Single vs Multiple Owner Cable Systems, 2022-2025 33 Figure 23: Global Capacity Growth on Major Routes, 2018-2022 39 Figure 24: Planned Capacity Growth on Major Routes, 2023-2025 39 Figure 25: Transatlantic Capacity Growth, 2016-2020 41 Figure 26: Transatlantic Capacity Growth, 2021-2025 41

..................

.......

....................................................................

................................

.............

..............

............

(continued)FIGURESList of

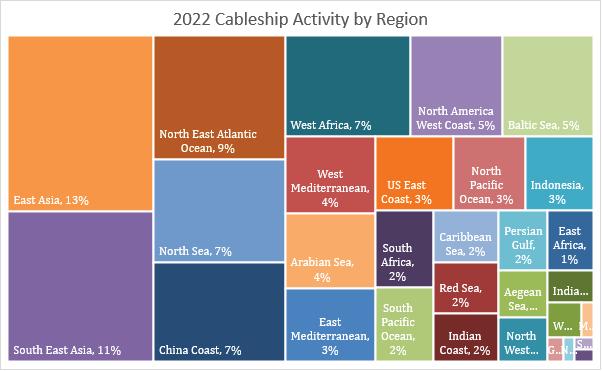

Figure 55: Private Maintenance

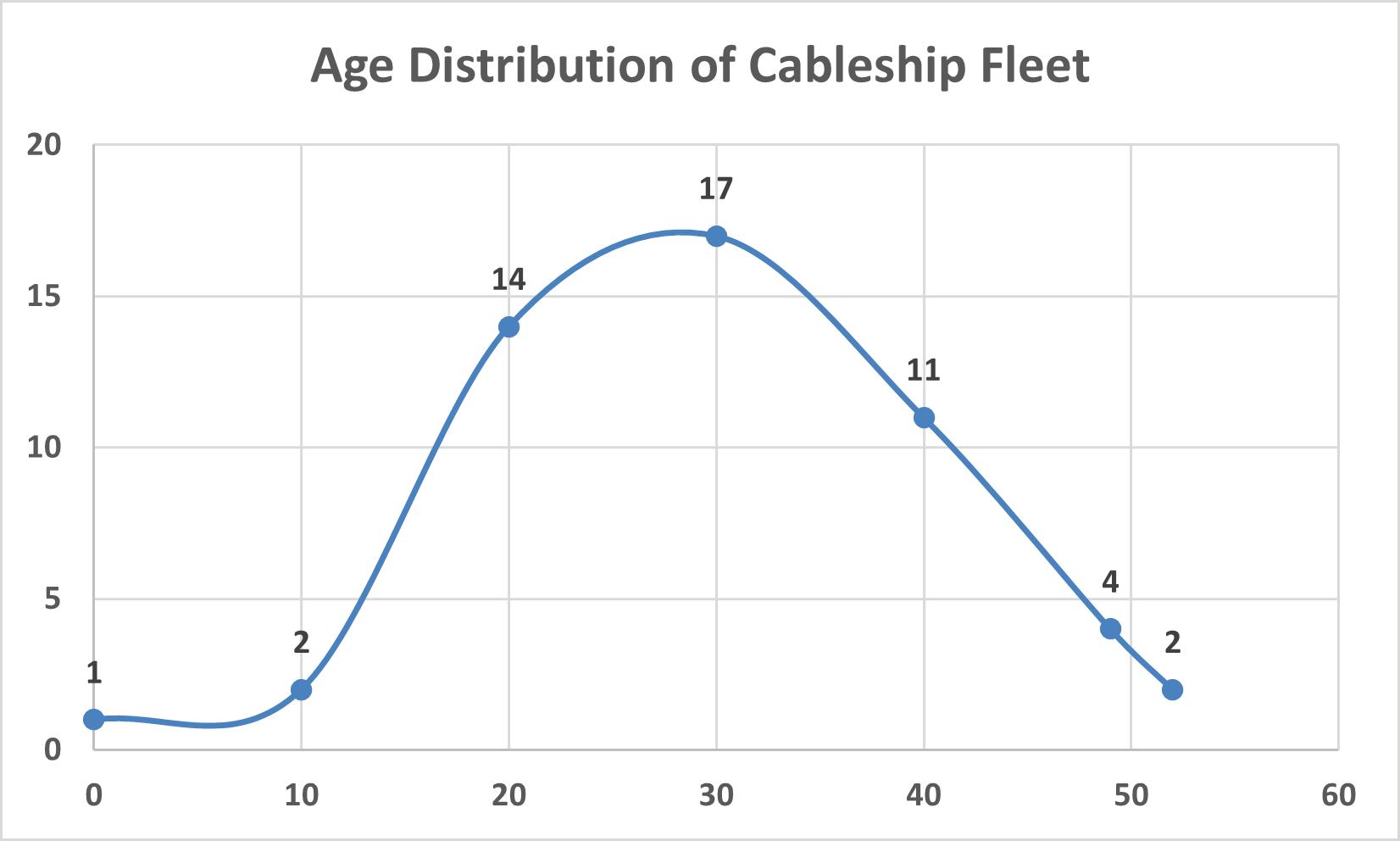

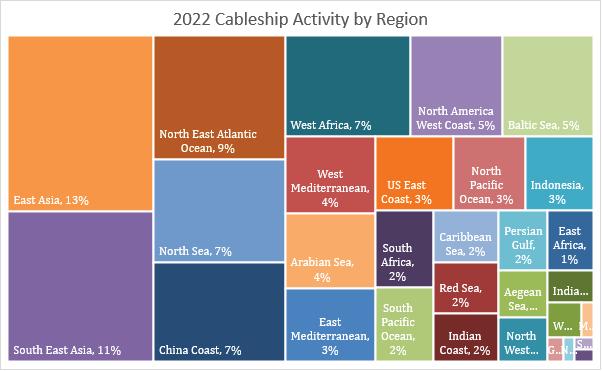

56: Cable Ship Fleet

57: Cable Ships Added

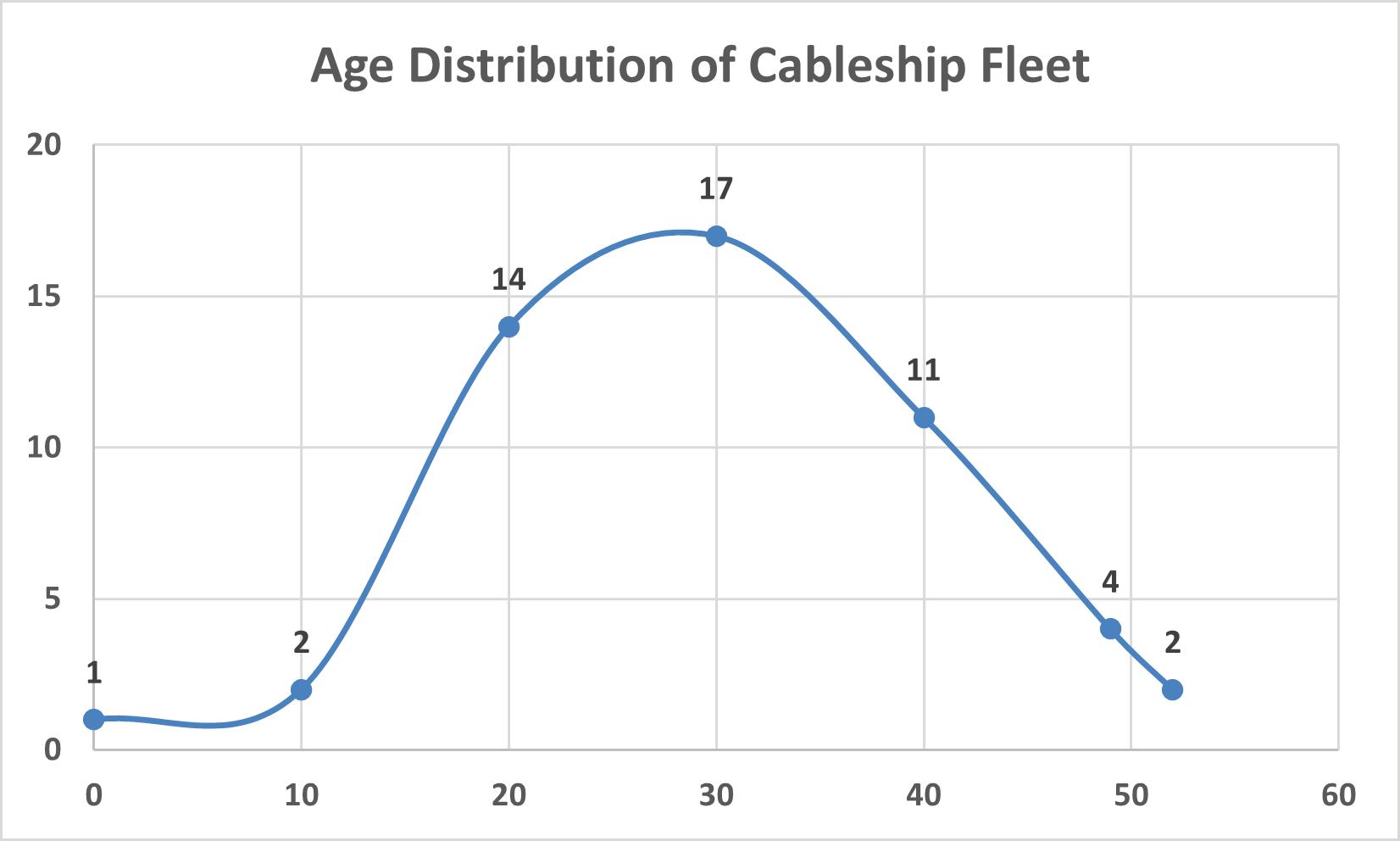

58: Age Distribution

59: Cable

60: Landing Distribution by Region,

61: Landing Distribution

62: Systems Driven

63: Systems Impacted

Figure 64: Hyperscaler System

Hyperscalers,

Hyperscalers,

Figure 65: Systems Driven by Hyperscalers,

66: System Investment Driven by Hyperscalers, 2022-2025

Figure 67: Global Data Center

68: Enterprise Public Cloud

2022 (Flexera,

Figure 69: Enterprise Public Cloud

2020-2021 (Flexera,

70: World Liquid Fuels

Figure 71: Systems by Year, 2018-2025

72: KMs Added by Year,

73: Brent Crude Quarterly

74: Unrepeatered Systems

75: Unrepeatered Systems

Region,

Figure 81: Contract in Force – Transatlantic, 2022-2025 111

82: In-Service & Planned Systems –Transpacific, 2012-2025

114

Figure 83: Total KMs In-Service & Planned –Transpacific 2012-2025 115

Figure 84: Contract in Force – Transpacific, 2022-2025 115

Figure 85: In-Service & Planned Systems –Americas, 2012-2025 118

Figure 86: Total KMS In-Service & Planned –Americas, 2012-2025 118

Figure 87: Contract in Force – Americas, 2022-2025

118

Figure 88: In-Service & Planned SystemsAustralAsia 2012-2025 124

Figure 89: Total KMs In-Service & PlannedAustralAsia 2012-2025 126

Figure 90: Contract in Force – AustralAsia, 2022-2025 126

91: In-Service & Planned Systems - EMEA 2012-2025 130

92: Total KMs In-Service & Planned - EMEA 2012-2025 132

Figure 93: Contract in Force – EMEA, 2022-2025 132

Figure 94: In-Service & Planned Systems - Indian Ocean 2012-2025 136

Figure 95: Total KMs In-Service & Planned - Indian Ocean 2012-2025 137

Figure 96: Contract in Force - Indian Ocean, 2022-2025

137

97: In-Service & Planned Systems - Polar 2012-2025 140

Figure 98: Total KMs In-Service & Planned - Polar 2012-2025

140

Figure 99: Contract in Force – Polar 2022-2025 141

6 SUBMARINE TELECOMS INDUSTRY REPORT

Agreements Map 73 Figure

Distribution by Company 76 Figure

by Year, 2002-2022 ................... 77 Figure

of Cable Ship Fleet 77 Figure

Ship Activity 78 Figure

2018-2022 ............ 79 Figure

by Region, 2022-2026 79 Figure

by

2018-2022 82 Figure

by

2018-2022 ....... 83

Ownership Distribution 84

2022-2025 84 Figure

84

Clusters 85 Figure

Provider Usage,

2022) ...................................................................... 86

Provider Adoption Rate,

2022) 86 Figure

Production and Consumption Balance 2017-2023 ................................................. 93

93 Figure

2018-2025 94 Figure

Price History, 2018-2022 ..... 94 Figure

by Year, 2018-2022 99 Figure

by

2018-2022 99 Figure 76: Unrepeatered KMS by Year, 2018-2022.................. 100 Figure 77: Unrepeatered Investment by Region, 2018-2022 100 Figure 78: Unrepeatered Planned Systems by Region, 2022-2025 100 Figure 79: In-Service & Planned Transatlantic Systems, 2012-2025 110 Figure 80: Total KMs In-Service & Planned –Transatlantic, 2012-2025 ................................................................ 111

Figure

.................................................................

...............

Figure

Figure

........

Figure

.......................................................................................

List of

ACRONYMS

ACRONYMS DESCRIPTION

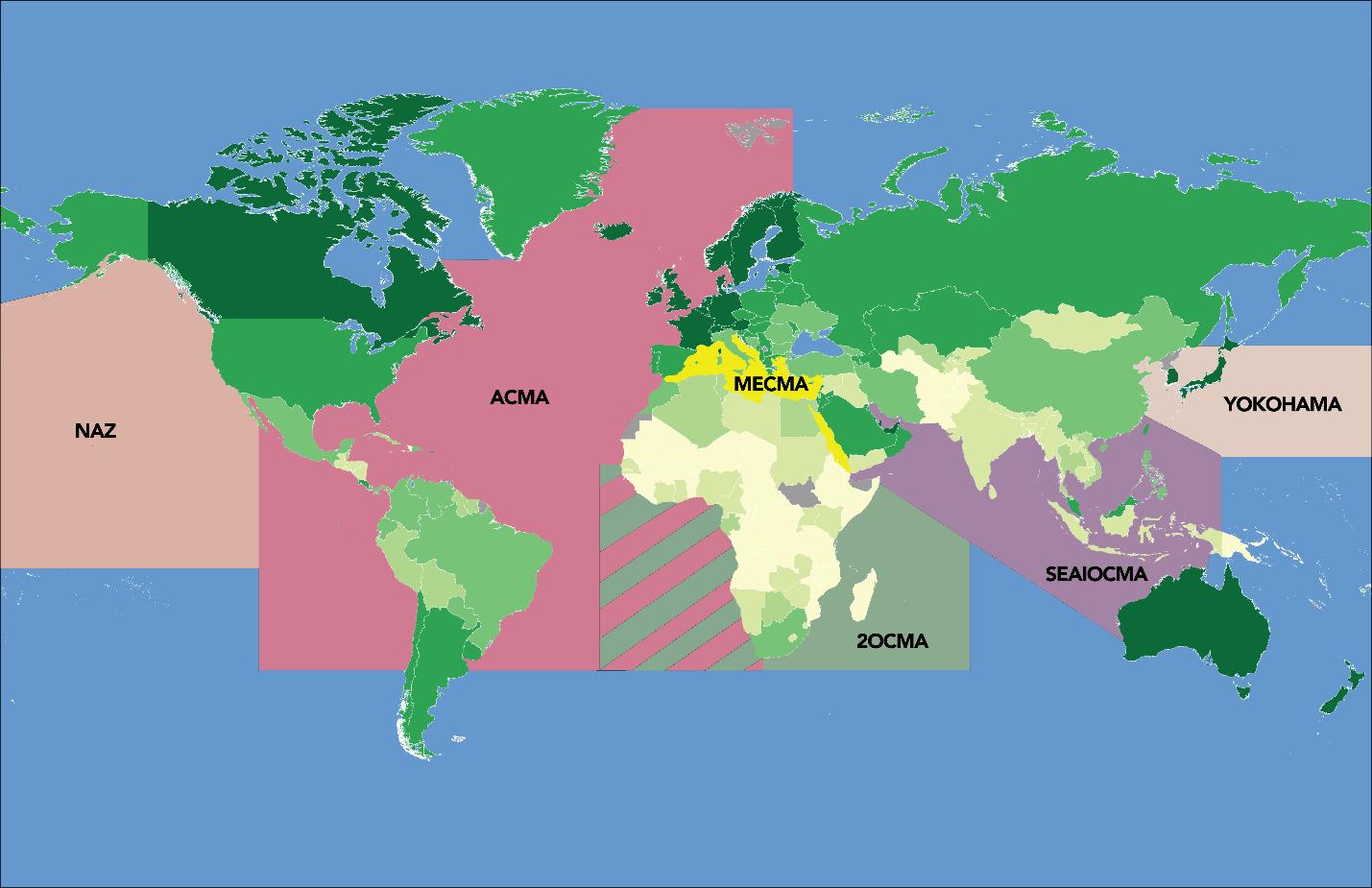

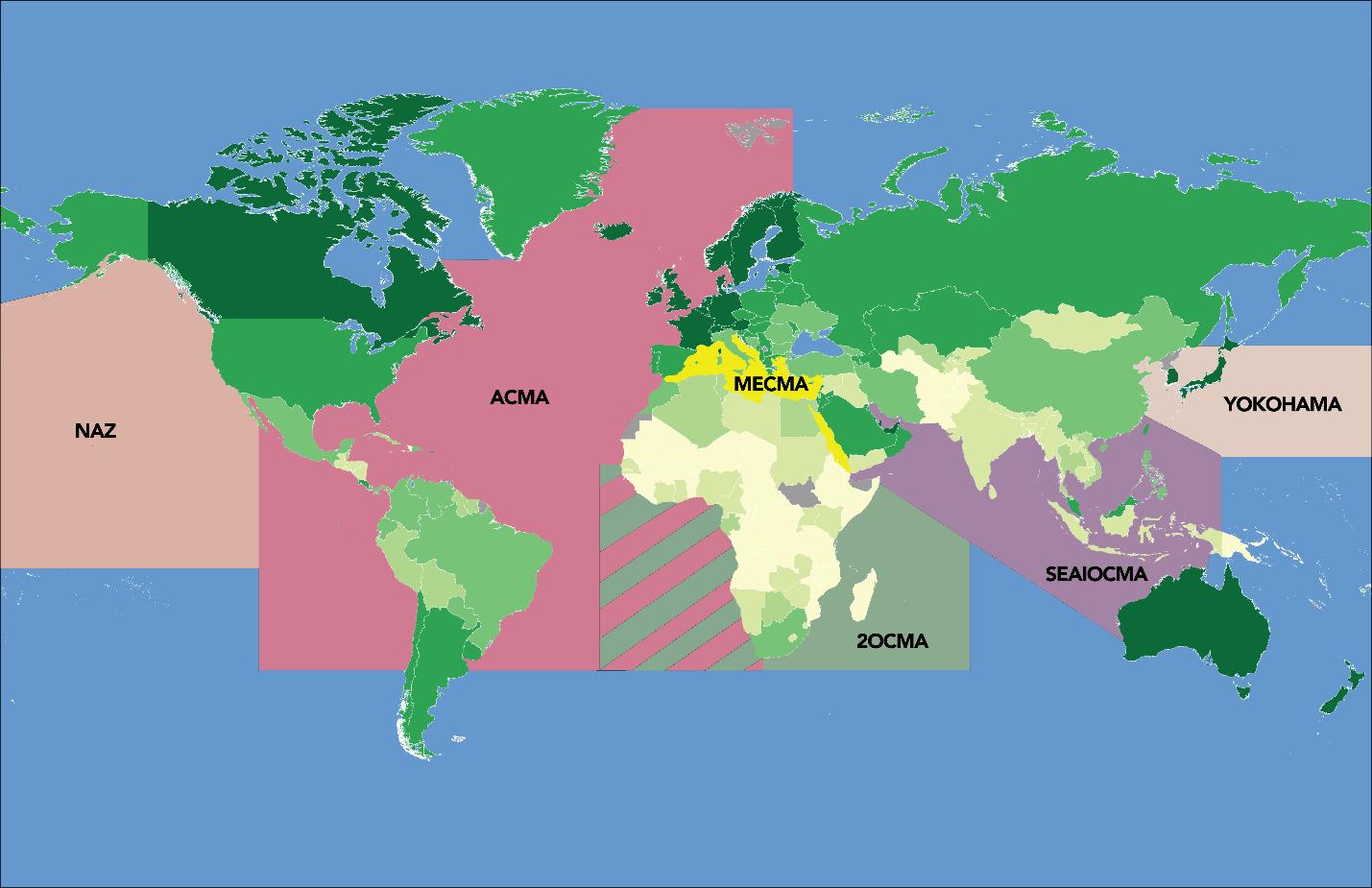

2OCMA 2 Oceans Cable Maintenance Agreement

ACMA Atlantic Cable Maintenance Agreement

ANACOM Autoridade Nacional de Comunicações

APMA The Atlantic Private Maintenance Agreement

APMMSA Asia Pacific Marine Maintenance Service Agreement

ASN Alcatel Submarine Networks

CAGR Compound Annual Growth Rate

CIF Contract in Force

CWDM Coarse Wavelength Division Multiplexed

DFC United States Indernational Development Finnacne Corporatoin

DWDM Dense Wavelength-Division Multiplexing

EMEA Europe, the Middle East, & Africa

EOS End of Service

FCC Federal Communications Commission

FP Fibre Pairs

GDP Gross Domestic Product

HMN Huawei Marine Services

HS Hyperscaler

ICPC International Cable Protection Council

ICT Information and Communications Technology

IFC International Finance Corporation

IOT Internet of Things

IRU Indefeasible rights of use

ITU International Telecoms Union

KMS Kilometers

LTE Long-Term Evolution

MDB Multilateral Development Banks

ACRONYMS DESCRIPTION

MECMA Mediterranean Cable Maintenance Agreement

MPLS Multiprotocol Label Switching

MW Megawatt

NAZ North American Zone Cable Maintenance Agreement

OOS Out of Service

OPEC Organization of the Petroleum Exporting Countries

OTEC Ocean thermal energy conversion

OTT Over-the-top

RFS Ready for Service

SCIG Submarine Cable Improvement Group

SDM Spatial Division Multiplexing

SEAICMA Southeast Asia / Indian Ocean Cable Maintenance Agreement

SMART Scientific Monitoring and Reliable Telecommunications

SPMA South Pacific Maintenance Agreement

SSN Sustainable Subsea Networks

SWAC Seawater Air Conditioning

UN United Nations

UNCTAD United Nations Conference on Trade and Development

UNESCO Intergovernmental Oceanographic Commission

USD United States Dollar

USV Uncrewed Surface Vessel

VSAT Very-small-aperture terminal

WDM Wavelength-Division Multiplexing

WIOCC West Indian Ocean Cable Company

WMO World Meteorological Organization

SUBMARINE TELECOMS INDUSTRY REPORT 7

EXORDIUM

Welcome to the 11th edition of SubTel Forum’s annual “Submarine Telecoms In dustry Report,” which was authored by our analysts without whom this report would not be possible.

2022 has turned into a year few would have seen coming. The world survived COVID-19 only to be thrown into a major war in Europe, the likes of which we have not felt since 1945. And in spite of this state sponsored craziness, our industry continues on its busy pace to connect all of the world, and this year was no exception. As such, we have witnessed new submarine cables just about every where, including major transoceanic routes. Our industry has much of which to be proud.

11TH ANNUAL INDUSTRY REPORT – A SNAPSHOT

At SubTel Forum, we continually strive for our annual Industry Report to serve as an analytical resource with in the trio of our products of Submarine Cable Map published every January, Submarine Cable Almanac published quarterly, and online Submarine Cables of the World Interactive Map. The Submarine Telecoms Industry Report features in-depth analysis and forecasts of the submarine cable industry and hopefully serves as an invaluable resource for those seeking to comprehend the health of the submarine industry. It strives to exam ine both the worldwide and regional submarine cable markets; including issues such as the new-system and upgrade supply environments, ownership, financing, mar ket drivers, and geopolitical/economic events that may impact the market in the future.

The presentation of the annual Industry Report draws upon the highly successful formatting of our Submarine Telecoms Forum Magazine as inspiration, as well as in cludes again personal video commentaries from multiple industry representatives from around the world. The goal is for the Industry Report to be read online or download ed for browsing elsewhere. As such, we have attempted to make a significant, encompassing view of the submarine fiber industry available to you – our readers.

Last year’s report was downloaded more than 500 thousand times and was quoted by numerous business journals and periodicals. We are optimistic, yet confident that this year’s edition stands up to the same scrutiny. We hope you will agree.

In this annual Industry Report, we have identified more than $15.2 billion in new projects that are being actively pur sued by their developers. Of those, some $7.3 billion worth are executed contract-in-force, and $2.5 billion of those new, contract-in-force systems are slated for 2023 alone.

8 SUBMARINE TELECOMS INDUSTRY REPORT

Video 1: Wayne Nielsen, Publisher - Submarine Telecoms Forum, Inc.

SURVEY OF INDUSTRY SENTIMENT

We recently accomplished our annual industry senti ment survey, the results of which are highlighted in this Industry Report. We believe these results are a barometer, albeit imperfect, of future industry activity, as well as provide an understanding of how participants feel about their role in the industry.

THANKS TO AUTHORS, COMMENTATORS AND ADVERTISERS

We are thrilled once again that the Secretary-Gener al of the International Telecommunication Union, Mr. Houlin Zhao, provided this year’s foreword and accompa nying video commentary, discussing the state of the ITU, the advent of climate-conscious cables, and the organiza tion’s submarine cable related initiatives.

We utilized insights from a number of articles from recent issues of Submarine Telecoms Forum Magazine and our proprietary Market Sector Reports, where neces sary, allowing us to better discuss various industry topics. Thanks especially to Phillip Pilgrim for providing again this year’s industry history section, Alex Chase for his insights on Capacity Pricing, Greg Otto for his expertise on Oil & Gas systems, and George Ramírez, Nicole Sta rosielski, and Hunter Vaughan for their perspectives on various subsea sustainability initiatives. We also received some excellent video commentary from several industry super stars, including:

• Alex Chase, Senior Director - AP Telecom

• Anders Ljung, Sales Manager, Submarine Cable Sys tems – Hexatronic Cables & Interconnect Systems AB

• Daniel Leza, Vice President – TMG Telecom

• George Ramírez, Research Assistant for Sustainable Subsea Network – SubOptic Foundation

• Greg Otto, Technical Director - WFN Strategies, LLC

• Houlin Zhao, Secretary-General - ITU

• Julian Rawle, Principal - Julian Rawle Consulting

• Kieran Clark, Analyst – Submarine Telecoms Forum, Inc.

• Mike Conradi, Partner – DLA Piper

• Rebecca Spence, Product Manager - Submarine Telecoms Forum, Inc.

• Rene D’Avezac de Moran, Service Line ManagerHydrography - Fugro

We would also like to say a special thank you to this year’s sponsors as below who helped make the annual Industry Report possible, namely:

• APTProcure

• Fugro

• Hexatronic Cables & Interconnect Systems AB

• Mertech Marine

• Southern Cross Cable Networks

• WFN Strategies

CLOSING THOUGHTS

While the crystal ball will rarely be completely clear, one fact remains – that our more than 175-year-old in ternational enterprise continues to be a thriving, essential and ever-evolving industry.

In the coming months, we will continue to strive to make available as much new data as possible in a timely and useful fashion – as we say, an informed industry is a productive industry.

Thank you as always for honoring us with your interest in SubTel Forum’s 11th annual “Submarine Telecoms Industry Report.”

With closing thoughts on the situation in Ukraine, let me quote Churchill’s marvelous words: “This is not the end, this is not even the beginning of the end, this is just perhaps the end of the beginning.” In a world full of Putins, be a Zelenskyy. #Ukraine

Good reading and stay safe, ■

WAYNE NIELSEN is Publisher & President of Submarine Telecoms Forum, Inc. and possesses more than 35 years’ experience in submarine cable systems, including polar and offshore Oil & Gas submarine fiber systems, and has developed and managed international telecoms projects in Antarctica, the Americas, Arctic, Europe, Far East/Pac Rim and Middle East. In 2001, he founded Submarine Telecoms Forum magazine, the industry’s considerable voice on the topic. He is also Managing Director of WFN Strategies, which provides design, development, and implementation support, as well as commercial and technical due diligence of submarine cable systems for commercial, governmental, and Oil & Gas clients. He received a postgradu ate master’s degree in International Relations, and bachelor’s degrees in Economics and Political Science, and is a former employee of British Telecom, Cable & Wireless and SAIC.

SUBMARINE TELECOMS INDUSTRY REPORT 9

FOREWARD

THOUGHTS FROM HOULIN ZHAO, ITU SECRETARY-GENERAL

The Submarine Telecoms Indus try Report shares a wide variety of perspectives to offer a global view of the latest developments in the industry and expectations for its future. This is an objective that the International Telecommunication Union (ITU) is pleased to support as the United Nations specialized agency for information and commu nication technologies (ICTs).

Our global membership includes 193 Member States and over 900 companies, universities, and inter national and regional organizations working together to connect the world and ensure that our intercon nections make meaningful contribu tions to society.

ITU’s international standards have supported the submarine telecoms industry from its very beginnings and the industry is now contributing to standard ization work that could enable submarine cables to provide an even greater service to the public interest than they do today.

CLIMATE-CONSCIOUS CABLES

Submarine cables have the potential to form a realtime ocean observation network able to provide accurate early warnings of tsunamis and a wealth of valuable data for climate science.

A standard SMART cable – a submarine telecoms cable upgraded for “Scientific Moni toring And Reliable Telecommunications” – will include climate and hazardmonitoring sensors designed to coexist with telecom components and match the lifespan of commercial cables.

Two new ITU standards are under development in ITU-T Study Group 15 to provide for both SMART cables (work ing name G.smart) and cables ded icated to scientific sensing (working name G.dsssc). The upcoming standards will also be reflected by revisions to existing ITU standards.

SMART cables will include a minimum set of three sensors in cable repeaters to measure ocean bottom temperature as an indicator for climate trends; pressure for sealevel rise, ocean currents, and tsunamis; and seismic acceleration for earth quake detection and tsunami alerts.

This ITU standardization work builds on min imum requirements established by the Joint Task Force on SMART Cable Systems, formed in 2012 with the support of ITU, the UNESCOInt ergovernmental Oceanographic Commission (UNESCOIOC) and the World Meteorological Organization (WMO).

The Joint Task Force has helped develop the techni

10 SUBMARINE TELECOMS INDUSTRY REPORT

Video 2: Houlin Zhao, Secretary-General - ITU

cal and financial feasibility of SMART cables and now works closely with United Nations organizations, gov ernments, and businesses intent on deploying SMART cables at scale.

ITU’s support for the project stems from our technical expertise in submarine telecoms, our commitment to the United Nations Sustainable Development Goals, and our membership’s ability to stimulate progress on issues at the intersection of government, industry, and academia.

Our standardization work will support globally harmo nized development, implementation, and operation of these systems, as well as create the conditions necessary to make use of all the data generated by the envisaged ocean-observation network.

BUILDING MOMENTUM

Two years ago, Alcatel Submarine Networks became the first cable provider to commit to SMART, while Portugal’s telecom regulator ANACOM pledged to build SMART into the new CAM [ContinentAzoresMadeira] ring cable connecting the mainland to islands a thousand kilometers out in the Atlantic Ocean.

The submarine cable division of NEC Japan has installed more than 6000 kilometers of submarine cables dedicated to scientific sensing, which are now operated by Japan’s National Research Institute for Earth Science and Disaster Resilience. The first submarine cables for tsunami forecasts were deployed 12 years ago, and the network was expanded after the 2011 Great East Japan Earthquake — but without supporting commercial tele coms in parallel.

EllaLink, the BrazilPortugal transAtlantic cable system, was the first to dedicate a fibre of a commer cial telecoms cable to environmental sensing, between Madeira Island and the trunk cable. Portugal now plans to include fullfledged SMART capability in the new 3700-kilometre CAM cable ring.

SMART capability will form around 10 per cent (EUR 12 million, or about USD 13 million) of the total cost to deploy the new governmentsponsored CAM cable. Expected to enter service in 2025, the cable will set valuable precedents for similar systems around the world.

Looking ahead, the Joint Task Force calculates that the deployment of three SMART cables of a scale equivalent to CAM each year would result in our ocean floors host ing 2000 new SMART cable repeaters every 10 years.

The Joint Task Force adds that SMART capability does not impact the cost of cable operation and mainte nance. It also urges that its upfront costs are considered in view of the lives that could be lost to tsunamis and the costs to recover from those disasters.

Other SMART projects are in various stages of plan ning and development in Indonesia, the Vanuatu–New Caledonia island area, and connecting to Antarctica and crossing the Arctic connecting Europe and Asia.

The project between Vanuatu and New Caledonia –supported by the Joint Task Force with funding from the Gordon and Betty Moore Foundation – will play a pivot al part in creating an enduring science and early-warning ecosystem in the region and inspiring government and industry confidence in the SMART cable concept.

CONTRIBUTIONS WELCOME

In addition to SMART cables and cables dedicated to scientific sensing, ITU-T Study Group 15 is also working towards new ITU standards for Space Division Multi plexing (SDM).

A soon-to-be-published ITU technical report on optical fibre, cable and components for SDM transmis sion considers proposed SDM applications and clarifies technical and commercial aspects of SDM. It establishes a roadmap towards future ITU standards supporting a cost-effective network and ecosystem utilizing SDM fibre and cable technologies.

The ITU standardization process ensures that all participants’ voices are heard. Our work is driven by your contributions and consensus decisions. We offer reduced membership fees for academia, start-ups and small and medium-sized enterprises, and companies of all sizes in developing countries.

The ITU platform continues to grow in value, to a growing number of stakeholders, and I encourage you to join our global community. ■

HOULIN ZHAO was first elected 19th Secretary-General of the International Telecommunication Union at the Busan Plenipotentiary Conference in October 2014. He took up his post on 1 January 2015. ITU Member States reelected Houlin Zhao as ITU Secretary-General on 1 November 2018. He began his second four year term on 1 January 2019. Prior to his election, he served two terms of office as ITU Deputy Secretary-General (2007-2014), as well as two terms as elected Director of ITU’s Telecommunication Standardization Bureau (1999-2006).

Houlin Zhao is committed to further streamlining ITU’s efficiency, to strengthening its membership base through greater involvement of the academic community and of small- and medium-sized enterprises, and to broadening multistakeholder participation in ITU’s work.

SUBMARINE TELECOMS INDUSTRY REPORT 11

METHODOLOGY

This edition of the Submarine Telecoms Cable Industry Re port was authored by the an alysts at Submarine Telecoms Forum, Inc., who provide submarine cable system analysis for SubTel Forum’s Submarine Cable Almanac, online and print Cable Maps and Industry Newsfeed.

For the Submarine Cable Industry Report, we utilized both interviews with industry experts and our proprietary Submarine Cable Database which was purpose-built by Submarine Telecoms Forum in 2013 and regularly updated since.

The database tracks more than five hundred current and planned do mestic and international cable systems, including project in formation suitable for querying by client, year, project, region, system length, capacity, landing points, data centers, owners, installers, system cost, upgrade status, etc. The Submarine Cable Database is purpose-built by a dedicated database administration team and powered by MySQL. Maps are produced with ArcGIS Pro, in the same format and visual style as the Submarine Cables of the World print map.

To accomplish this report, SubTel Forum conducted continuous data gathering throughout the year. Data as similation and consolidation in its Submarine Cable Da tabase was accomplished in parallel with data gathering efforts. SubTel Forum collected and analyzed data from a variety of public, commercial, and scientific sources to best analyze and forecast market conditions.

For capacity growth, two different ways of determining Compound Annual Growth Rate (CAGR) are used. The first method calculates a CAGR for a given period – e.g., a CAGR for the period 2018-2022. The second method calculates a rolling two-year CAGR to minimize extreme variance while also showing a useful year-to-year growth comparison. From 2019 onwards, publicly reported data has been less comprehensive due to adjusted FCC report

ing requirements, so modeling had to be used to approx imate capacity growth. The average growth rates from 2015-2018 were applied to determine capacity growth numbers for 2019 and beyond.

For unrepeatered systems analysis, a maximum cable length of 250km with a couple of exceptions made for systems that have been publicly announced as unrepeated were applied to the database to determine which cable systems to consider as unrepeatered.

Trending is accomplished using known data with lin ear growth estimates for the following three years.

While every care is taken in preparation of this report, these are our best estimates based on information provid ed and discussed in this industry.

We hope you enjoy the Submarine Telecoms Cable Industry Report. ■

REBECCA SPENCE is the Product Manager from Submarine Telecoms Forum. Rebecca possessed more than 10 years’ experience as an analyst and database manager, including for the small business division of prominent government contractor, General Dynamics IT. She is a regular contributor to SubTel Forum Magazine and is based out of Hillsborough, North Carolina USA.

12 SUBMARINE TELECOMS INDUSTRY REPORT

Video 3: Rebecca Spence, Project Manager - Submarine Telecoms Forum, Inc.

play for offshore wind.

STAY

Climate Change

While the telecom industry has been operating for quite some time and has made significant advances in our knowledge of benthic marine environments, climate change is one issue that we will have to face in conjunction with all offshore maritime industries and the wider world. The push for projects concerning environmental monitoring and communications is spreading throughout the industry, with a current focus on issues relating to marine megafau na and fisheries targets. Initiatives such as SMART cables and similar monitoring systems in offshore wind will go a long way towards narrowing existing knowledge gaps and ensuring that we have lengthy and reliable data records as our seas undergo this period of immense change.

As mentioned previously, interdisciplinary initiatives such as ROSA will be integral in encouraging data sharing and data tracking as some common fisheries and conserva tion target species exhibit spatial and temporal distribution shifts. By working together, industry and local stakeholders can broaden our collective knowledge of how the oceans around us will be impacted by climate change related phe nomena. As such, we can hope to mitigate issues to the best of our abilities and focus on nurturing sustainable growth of both telecom and offshore wind industries, keeping the world connected and providing reliable sources of clean, renewable wind energy. Similarly, collective knowledge on natural system faults, both for subsea cables and offshore wind infrastructure, will contribute to our understanding of how best to shift future engineering and operation innova tions to cope with an increase in strength and frequency of inclement weather events and other climatic factors.

Summary

Throughout both industries, a common theme is the importance of early and continued stakeholder engage ment. “We stand by the idea that stakeholder engagement and outreach with other maritime users and operators is incredibly important,” Ryan Wopschall, ICPC GM states, “Raising awareness of subsea cables within the offshore renewable energy sector and encouraging developers and stakeholders to contact us in regard to new and ongoing projects will further facilitate safe and efficient use of ma rine resources and long-term protection of seabed infra structure.” All marine users must be considered throughout project development, and these considerations, alongside those of public perceptions, will help to pave the way for

community buy-in and long term success of these installa tions.

In the past century and a half, humans have come to understand a significant amount about our oceans and how they function. Through the course of hundreds of subsea cable installations, the telecom industry has been at the forefront of uncovering benthic knowledge. Our under standing of seafloor hydrology, shifting sediments, ecolog ical interactions, and even earthquakes and tsunamis has greatly increased. By taking what we have learned and ap plying it to the burgeoning offshore wind industry, we can best position ourselves to reap the rewards of an extensive renewables network while mitigating social, environmental, and ecological impacts. We have extensive local fisheries and communities networks, professional guard vessels and crews, broad knowledge of the marine environmental and applicable requirements and legislation, and, above all, we have a vision for long-term, sustainable success in harness ing our renewable natural resources for clean energy. To our partners in the offshore wind industry— we are ready and willing to help you reach your goals.

Emma Martin is the Marine Systems Associate at Seagard. She has her BA in Biology from Boston University, USA and her MSc in Marine Systems and Policies from the University of Edinburgh, Scotland. She has performed marine field work around the world and looks forward to continuing to support maritime infra structure developments.

SUBMARINE TELECOMS INDUSTRY REPORT 13

CURRENT FOLLOW US ON SOCIAL MEDIA @subtelforum @subtelforum subtel-forumSubTelForum

GLOBAL OVERVIEW

14 SUBMARINE TELECOMS INDUSTRY REPORT 1

SUBMARINE TELECOMS INDUSTRY REPORT 15

Figure

1:

Worldwide Map of Submarine Cable

INDUSTRYSentiment

SubTel Forum accomplished our annual industry senti ment survey in Q3 2022 with the goal of highlighting re sults in the Industry Report. This survey was accomplished over the course of multiple weeks and advertised in Submarine Telecoms Forum Magazine and other publi cations, as well as in social media.

Questions asked related to responder perceptions of the overall state of the industry, market activity, status of projects and work, regional activity, and levels of industry investment. Over 100 responses were received from read ers in the Americas, Asia-Pacific, and EMEA. Responders included senior and middle management, as well as submarine telecoms engineers and technicians, and the vast majority of responders possessed 20 or more years’ experience in our industry.

Their sentiments of the submarine cable industry are interesting reading.

The overall state of the indus try is resoundingly optimistic, with the categories of very pes simistic, pessimistic and neutral not even being selected by our survey responders. (Figure 2) As compared to last year, the very optimistic category has seen a roughly 15% increase, showing a very positive perspective of the industry as of late.

Following the trend of optimism in the industry, most respondents have seen an in

crease in their perception of the market’s activity. (Figure 3) More than half of responders have experienced or seen an increase in work since last year.

With the increase in work, comes inevitable slow down due to longer queues for work. Since last year, responders have observed a nearly 20% increase in project delays, while the cat egory of “significant delay” has decreased. (Figure 4)

The EMEA region remains the powerhouse of the industry, especially with projects such as 2Africa and Sea-Me-We 6 taking up much of the indus try’s attention. There have been increases in other regions, such as AustralAsia and Transpacific; these can be attributed to new routes being explored in these

16 SUBMARINE TELECOMS INDUSTRY REPORT

Very Optimistic (36%) Optimistic (64%) FIGURE 2: OVERALL STATE OF THE INDUSTRY

1.1

Video 4: Julian Rawle, Principal - Julian Rawle Consulting

(Figure 5)

While the shadow of COVID-19 has been lifting slowly from the industry, its effects are still far reaching. Most responders are still working remotely and have seen their travel limited. (Figure 6)

While the industry appears to be booming, our survey

responders have observed a slight cooling of investment since this poll was taken a year ago. The industry appears to remain at near average levels of investment; however, the “below average” category has seen a near 15% increase from last year. (Figure 7)

OF THE INDUSTRY

4:

5:

SUBMARINE TELECOMS INDUSTRY REPORT 17 GLOBAL OVERVIEW | INDUSTRY SENTIMENT RESPONDER SENTIMENT

Significantly More Work More Work No Change Less Work Significantly Less Work FIGURE 3: MARKET ACTIVITY 7% 22% 7% 7% 57% Polar Indian Ocean Pan-East Asian EMEA AustralAsia Americas Transpacific Transatlantic 12% 6% 6% 17% 6% 18% 35% FIGURE

REGIONAL ACTIVITY No Delay Significant Delay Some Delay FIGURE

PROJECT STATUS 57% 14% 29% regions.

18 SUBMARINE TELECOMS INDUSTRY REPORT Above Average Below Average Average FIGURE 7: INDUSTRY INVESTMENT 14% 57%29% Other Middle Management Engineer, or other Technical Duties Senior Management FIGURE 8: WHAT IS YOUR JOB FUNCTION? 14% 21% 21% 36% My travel has been cancelled Increased travel time to accommodate quarantine My travel has been limited I am working remotely FIGURE 6: WORK STATUS 29% 38% 28% 6%

SUBMARINE TELECOMS INDUSTRY REPORT 19 20+ Years 16-20 Years 11-15 Years 7-10 Years 4-6 Years 65% 7% 14% 7% 7% FIGURE 10: HOW MANY YEARS HAVE YOU BEEN IN THE INDUSTRY? Asia/Pacific Africa/Middle East Europe South America North America FIGURE 11: WHERE DO YOU RESIDE? 14% 14% 14% 22% 36% Recommendation and No Influence Recommendation and Little Influence Recommendation and High Influence Final Decision Maker FIGURE 9: WHAT IS YOUR PURCHASING POWER IN YOUR ORGANIZATION? 28% 36% 7% 29% GLOBAL OVERVIEW | INDUSTRY SENTIMENT

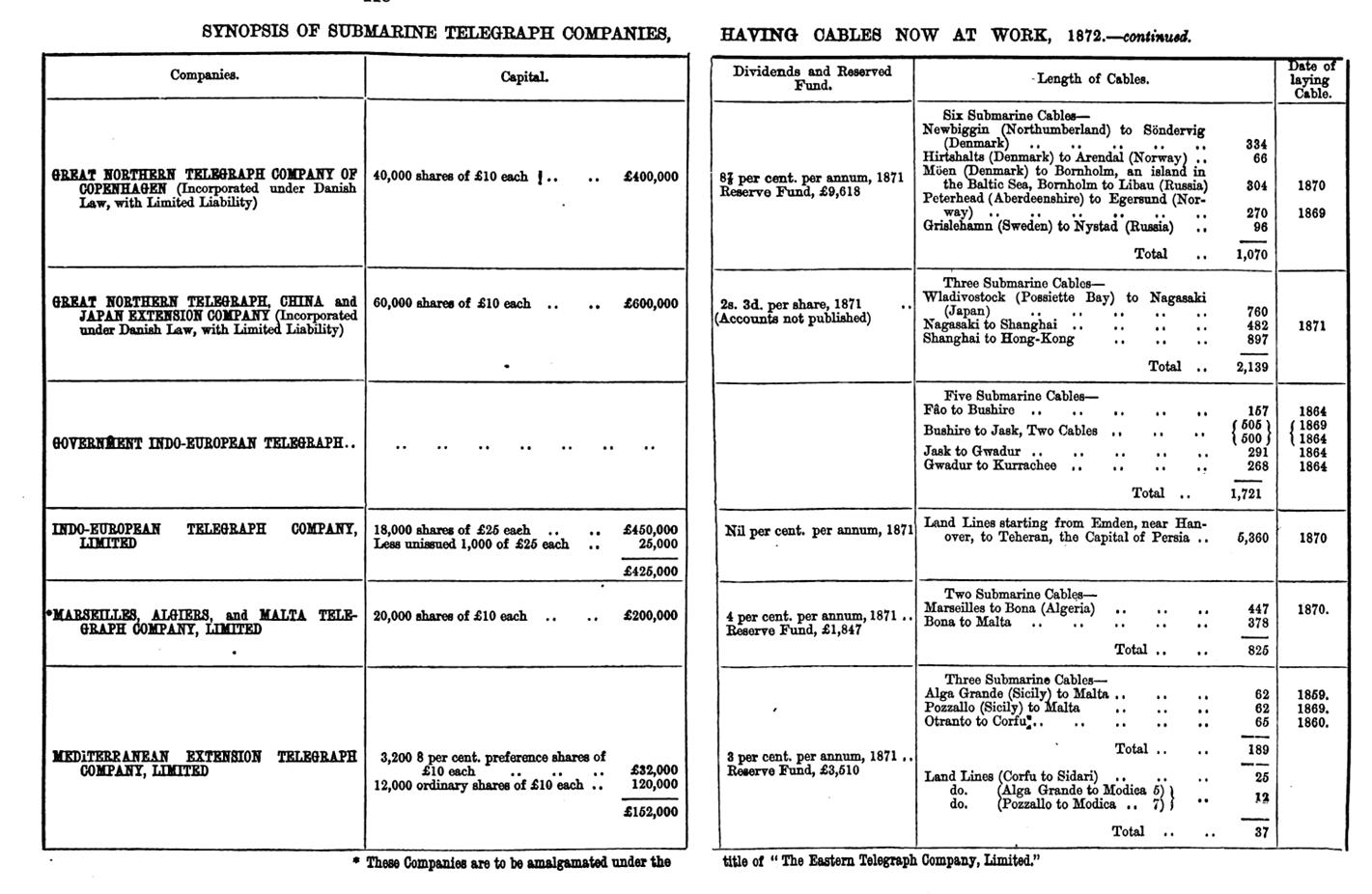

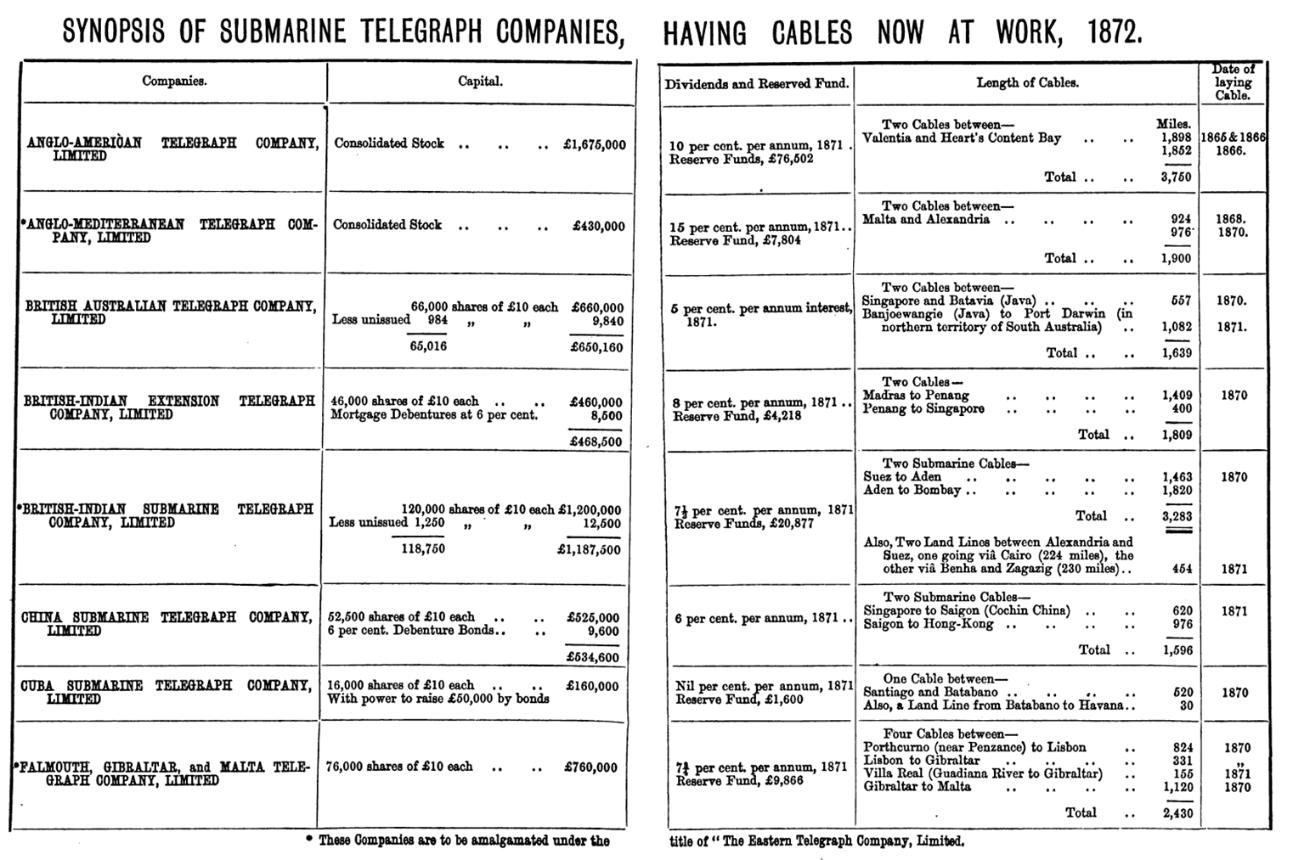

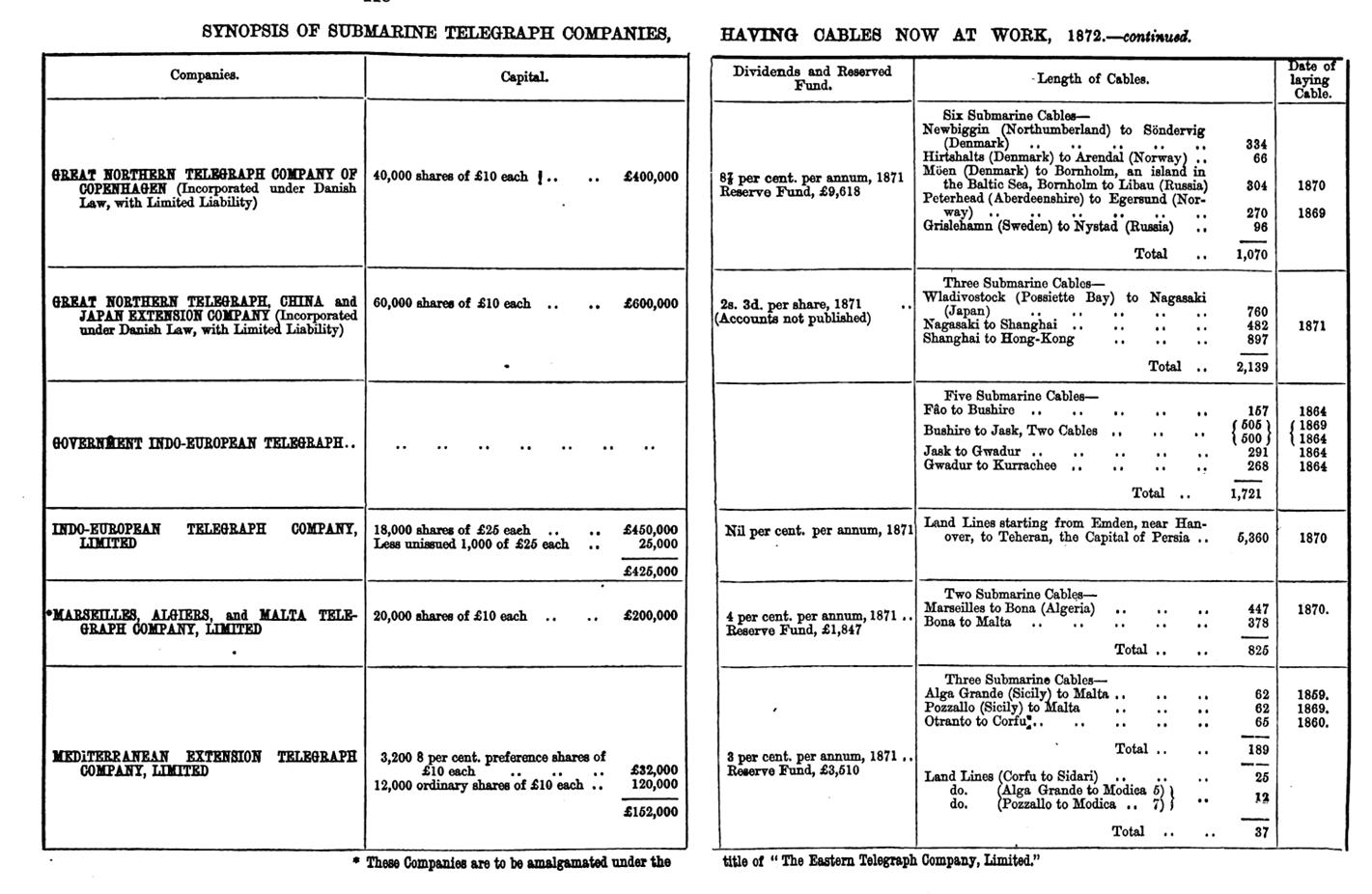

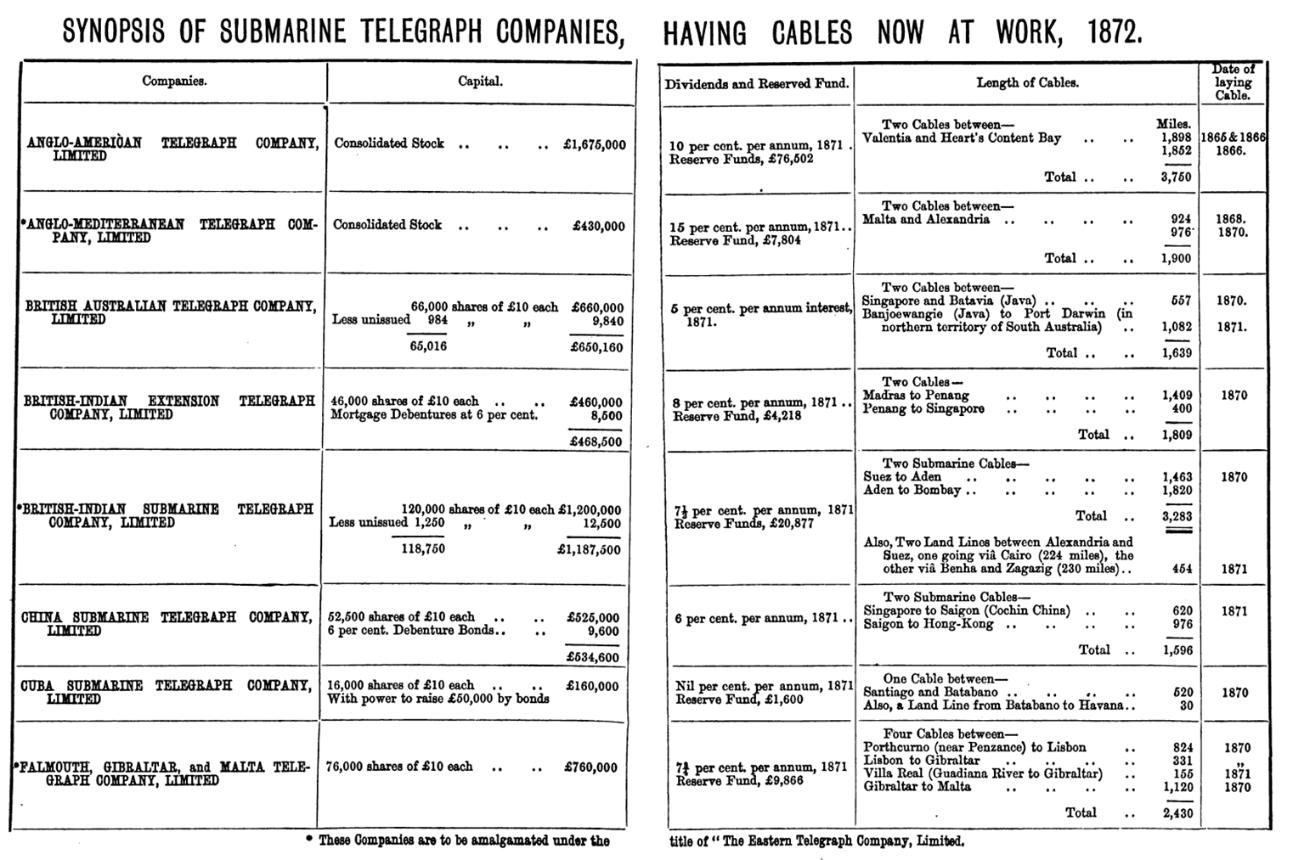

Perhaps the first industry report for the subsea sector is contained in the report: Statistics of Telegraphy; written by Sir James Ander son and presented to the Statistical Society (of London) in June 1872. Sir Andersen provides data and analysis for the “first 20 years” of Telegraphy.

This report is similar in nature to those currently published by Submarine Telecoms Forum, Tele Geography, Pioneer Consulting, SubCable News, Terabit Consult ing, Capacity Magazine and others I may have missed. It contains data on traffic, capacity, submarine ca bles in operation, routes, technolo gy, and of course information on the subsea operators. A gem in this report is a summary of the causes of cable failures that parallels the recent works of the Submarine Cable Improvement Group (SCIG).

The 1872 report covers far more ground than just sub sea. It includes statistics on terrestrial “International” traf fic between countries as well as “Internal” traffic within countries. In particular there is detailed information for the United Kingdom, Belgium, Switzerland, and Egypt.

For this article, I have chosen to select a few sections of the 1872 report, related to submarine telecommunica tions, and update the currency value references to modern values. Hopefully this and the addition of a few tables and graphs will convey that not much has changed over the past 150 years.

Before we begin this journey back in time, many

thanks to Google for digitizing these books that are now windows through time: Reference: https://www.google.ca/books/edition/Statistics_ of_Telegraphy/xnPNAAAAMAAJ

Note: Telegraph communications of the past, predated voice (Telephone) communications. Telegraphic messages were much like today’s text messages, but you had to pay for each message.

PREFACE

A most wise excerpt snipped from Sir James Ander son’s Preface: “Although the Telegraph has been twenty years

22 SUBMARINE TELECOMS INDUSTRY REPORT

Video 5: Philip Pilgrim, Subsea Business Development Leader North America – Nokia

PHILLIP PILGRIM’S 1.2 LOOK AT SUBSEA TELECOM INDUSTRY’S 150TH ANNIVERSARY

in general use, it is still a comparatively new power, startling in its effects even yet, and so much a part of the Imperial, commercial, and social system of every civilized nation, that it be maintained and extended; cost what it may, it can never be abandoned.”

ATLANTIC TELEGRAPHY

There are many, and sufficient reasons which render it inexpe dient on my part to publish all the details of private companies which are open to me, and. have been well considered with the desire to find material of some practical value for this paper.

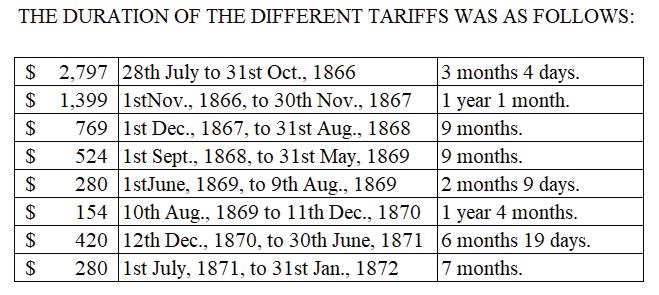

It must be sufficient for the present to prove that even under the most favourable conditions for international telegraphy the world can produce there is no exception to the rule, “That a reduction of tariff leads to a diminution of the net product.”

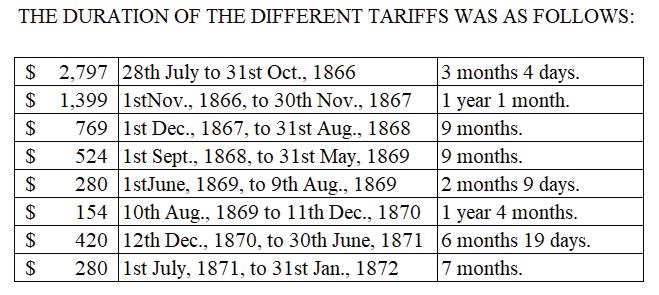

The actual earnings of the Atlantic Telegraph Compa nies from 28th July, 1866, to 31st December, 1871, were $303,636,060.

Assuming the tariff to have remained at $1,796 [per message] (the mean for the first 11 months), and the traffic to have increased annually at the rate of 12.5%, the gross

earnings would have amounted to $352,167,480. Differ ence in favour of $ 1,796 tariff: $48,531,420. Add—Ex penses which would not have been incurred: $3,566,420

The above statement assumes the mean tariff for the first twelve months to be maintained, and 12.5 per cent.

as the normal rate of increase of traffic for each year, an increase which would only have pro duced an average of 114 mes sages per day for the year ending December, 1871, less than onefourth of the real traffic, and a number so low that no one can suppose it would not have been attained even with the tariff at $2,797 per message.

Could the high tariff have been maintained, one cable would have sufficed for the limited traffic, all the capital and working expenses of the French Atlantic Cable would have been saved, and the Anglo-American Company would now be enjoy ing 27 per cent. dividend upon a capital of $234,265,500.

If, then, this small number of messages would have yielded a larger revenue than the greater number with the series of reduced tariffs given above; it follows that some other motives than cheapness must prevail to induce any pri vate company to reduce their tariff.

These motives have hitherto been expediency, compe tition, and the attempt to combine and stave off further opposition; and we shall probably see reproduced the experience of the competing Land Lines in this country already referred to:

“One or more will be ruined or forced to amalgamate; higher tariff will be resorted to in order to preserve good dividends with a large reserve, and further extensions will be avoided.”

We have already three Atlantic Cables laid and in good working order, represented by a capital of $513,985,500.

There two additional cables projected, one to be laid by the French Atlantic Company at a cost of $125,874,000, and another by the Great Western Telegraph Company, whose capital is $188,811,000 making together $314,685,000. Total [5 cables] $828,670,500.

The revenue earned by the Atlantic Cables, including the Newfoundland Company’s proportion, amounted, as far as can be ascertained from the published accounts of the Companies for the year 1871, to $85,314,600. During

SUBMARINE TELECOMS INDUSTRY REPORT 23

Table

1:

“Per-Message” Price Data 1866 to 1872

GLOBAL OVERVIEW | PHILLIP PILGRIM

the first six months of that year a $420 tariff was in force, and during the last six months $280 was charged. Taking the mean rate of $350. We can assume that 245,000 messages were sent.

From existing data, we can say that the normal increase of traffic may be estimated at 25 per cent., which would give a total of 306,250 messages for the current year, and 382,812 for 1873.

The effect of lowering the tariff from $280 to $140 will probably be to increase the number of messages 75 per cent. In the first year after the reduction.

As the two new cables cannot be laid until after the lapse of the first six months of next year, we may estimate the num ber of messages for the June half-year of 1873 at 191,406; these at a $280 tariff will give a revenue of $53,540,086

Upon the assumption of a $140 tariff increasing the traffic 75 per cent., the number of messages for the second half of 1873 would be 334,960, and the total revenue for the six months $46,847,506. Together $100,387,592.

Estimating the expenses attending the working of the 5 cables at $15,384,600 per annum, the balance of revenue for 1873 would yield upon the gross capital about 10 per cent. for dividend and reserve.

But for 1874, suppos ing the regular increase of traffic to be 25 per

Table 2a: 1872 Cable Operators [A to F]

Table 2b: 1872 Cable Operators [G to M]

24 SUBMARINE TELECOMS INDUSTRY REPORT

cent. upon the num ber of messages sent in 1873, the total revenue at a $140 tariff would only be $92,021,866, and less working charges would return on the gross-capital 9 per cent. for dividend, reserve and repairs. I must, however, state that this is probably the worst view of the case as regards the traffic—what may be required for repairs, and how much wasted upon competition, I need not now consider.

Better results might be shewn if the traffic of the last two years were alone referred to, but we cannot always rely upon Alabama disputes and Erie Ring contests; and in calculating the probable results of the next few years, may reasonably expect that there will be one year at least without much, if any, increase.

There are fluctuations in the commercial world which it would be folly to ignore, and I give the above figures as the minimum which may safely be anticipated; but who can say what the maximum would be if it were sought to establish only a self-supporting instead of a dividend-earning system. We must, however, at once dis card all idea of ever making the tariff so low as it is for interior telegrams, the local relations do not exist to any extent requiring an outlay of even $70 for a [transatlan tic] telegram. No one can order his dinner by telegram. The small tradesmen in the suburbs provincial towns cannot order their daily or weekly supply of goods by telegram. All the questions of minor importance relating to the inner life of a nation have no equivalent outside the limits of any country.

But still it cannot be disputed that Atlantic telegraphy under a self-supporting tariff, would within ten years require several additional cables. The interchange upon a grand scale of the products of the old and new world. The intimate political relations with this country, possessing as we do a great dominion extending from the Atlantic to

the Pacific Ocean Islands, besides islands bordering upon the United States. The demand for the investment of capi tal by all the Teutonic and Scandinavian States in Europe, both in the State loans and in railways, promoting, as it does, eager speculation and ever-increasing activity in this class of correspondence, all combine to create activity in international correspondence worthy of a great sacrifice to develop, and certain to result in a great international benefit. But no one will expect that this sacrifice should be met by private investors.

SIR JAMES ANDERSON

Sir James Anderson was born in Dumfries, Scotland in 1824. He worked as a captain for Cunard Lines of Halifax, Nova Scotia in 1851. He captained the Great Eastern cable ship for both the 1865 and 1866 transatlantic lays. He went on to work as direc tor for many cable companies throughout the world. He passed away in 1893.

SUBMARINE TELECOMS INDUSTRY REPORT 25

Table 2c: 1872 Cable Operators [M to Z]

Figure 12: Sir James Anderson

GLOBAL OVERVIEW | PHILLIP PILGRIM

FUN WITH DATA!

Since Sir James has provided insight into the first years of transatlantic telecommunications. Let’s review the data and contrast to today.

Here are interesting take-aways from the first five years of continued transatlantic telecommunications:

Transatlantic

Rate

Table

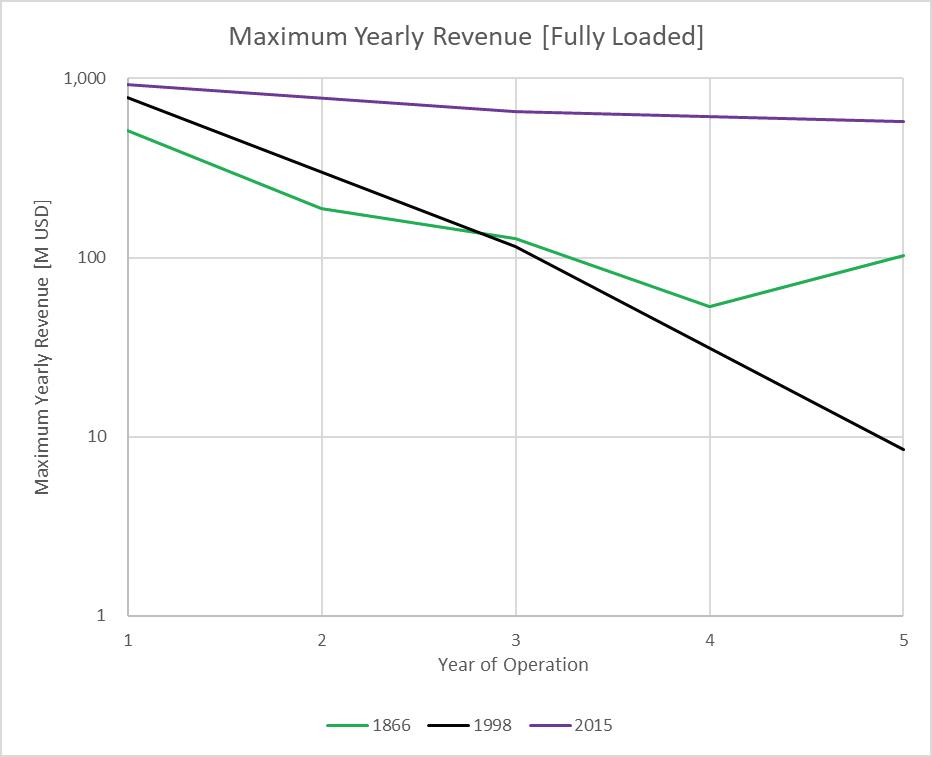

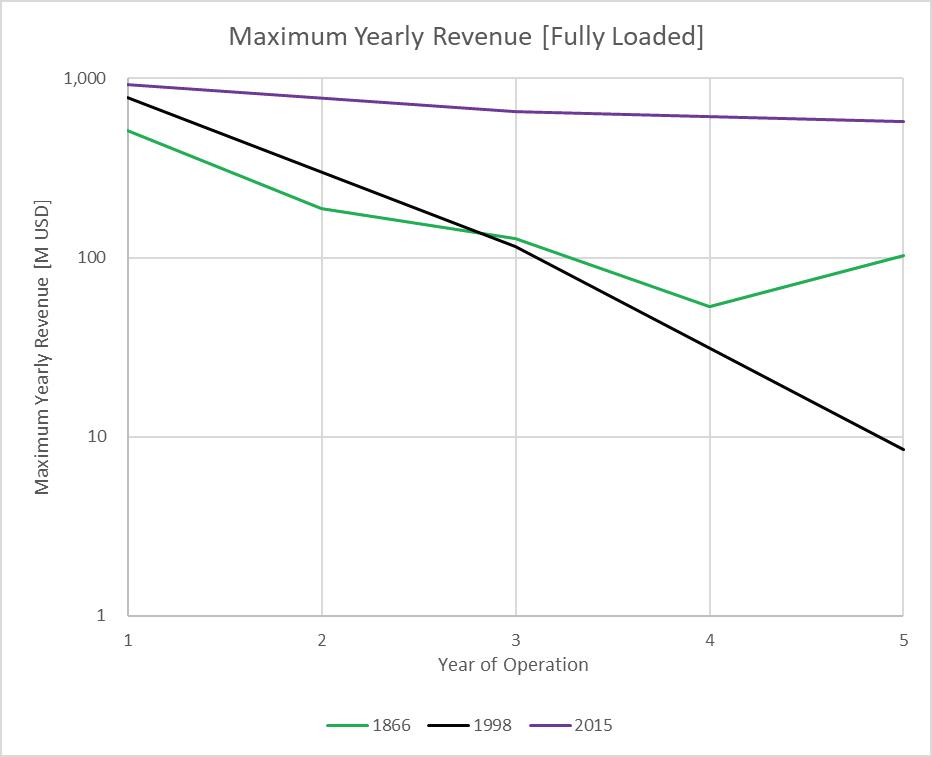

We can use the data from Sir James (traffic growth, price-per-message, and messages-per-year) to calculate the yearly revenue for each of the first five years of the 1866 transatlantic cable from 1866 to 1870 inclusive. Message price is shown in Table 3.

Similarly, we can also easily find transatlantic pricing data and maximum capacity data for modern cables and calculate their theoretical maximum-revenue-per-year for their first five years. To do this we must make some as sumptions. The key two are: 1.) the cable is fully filled from day one and 2.) pricing is based on a small basic unit com parable to an 1866 message. For this second assumption, I used 10Gb/s services.

For modern times, nothing as revolutionary as the 1866 start of reliable transatlantic telecoms has occurred. However, one event in the past 25 years is significant: the advent of WDM/DWDM from 1998 to 2002. I used data from this period, and from a more recent 2015 cable, to compare against the 1866 cable. Figure 14 is a graph comparing the maximum possible yearly revenue for the three cables.

Figure 13 shows the 1866 cable revenue decreased rapidly for the first two years then the rate of decrease stabilized to a lower value with some fluctuations. Like the 1866 cable, the new 1998 cable’s maximum revenue decreased rapidly. This was due to price erosion from competitive/greedy overbuilds on the same route and from rapid technological improvements (2.5G to 10G waves and 8nm to 20nm traffic spectrum widening). History has shown that similar technology advancements in capacity, and increased competition, would also affect the 1866 cable. These events occurred after Sir James’ 1872 report; so, no data was available to plot.

The 2015 cable has less price decline due to more sta bilized prices and less competition on the route. Its high

er overall revenue potential is due to more capacity from a higher fibre count and higher data rates/ baud rates. Of course, contemporary cables can take many years to decades to fully-fill, and constant technological advance ments continually increase the maximum capacity; so, the 2015 cable is not as static or profitable as assumed in the Figure 14. With this in mind, please take the numbers from this fun exercise with a grain of salt. The key point is not much has changed in our industry. The time-cor rected 1866 cable revenues fall within the same order of magnitude of contemporary cables.

If we were to look at cost of construction, rate of price erosion, and rate of annual traffic growth, we would find the 1866 values to be in the ballpark of contemporary transatlantic cables.

I wonder if someone will be reading this 2022 industry report in the year 2172. If so, Happy 300th Anniversary! ■

Figure

Figure

26 SUBMARINE TELECOMS INDUSTRY REPORT

cable system build cost: $ 167 M USD Revenue for 1 year: $ 86 M USD Cable operating & repair costs for 1 year $ 3 M USD

of Traffic Growth: ~ 25% Price Erosion (first 5 years): ~ 32% per year

3: 1866 to 1872 Points of Interest

14: Maximum Yearly Transatlantic Cable Revenue Assuming Fully Loaded

13: Plot of “Per-Message” Price Decline for the First Five Years of Transatlanti c Cable Communications GLOBAL OVERVIEW | PHILLIP PILGRIM

As any avid follower of the sub marine cable industry will know, the true effects of COVID on the submarine cable industry were not seen in 2020 or even 2021 but will be felt more over the next several years. Systems that were planned for installation during the pandemic were able to keep working towards their goals, albeit with some significant delays in some circumstances. However, planned systems that had not yet been surveyed, manufactured, or scheduled for installation suffered the most signif icant setbacks. From start to finish, the planning and preparation of a cable sys tem takes far less time overall than the actual installation and commissioning. Therefore, the number of cable systems accomplished over the next several years will be less than the number anticipated prior to the pandemic.

After the last Industry Report was pub lished, PRAT, CDSCN, NO-UK, Cross Channel Fibre and HAVSIL all accom plished commissioning and acceptance and were lit at the end of 2021, bringing the total to 18 for the year. So far in 2022 eleven more submarine cable systems have been lit, with Equiano and Grace Hop per additionally expected to be ready for service before the end of this year.

The four regions that have had new submarine cable systems accomplished this year are EMEA, Polar, Trans pacific and AustralAsia. AustralAsia has experienced a steady decline in submarine cable installations over the past five years with only three systems having been installed in 2022 but still maintains the highest number of new systems added over the last five years, for a total of 29 systems. (Figure 15) The Indian Ocean has not

added any new systems this year but the Americas and Transatlantic will soon see a system added once Amitié has entered service.

EMEA is the region with the second largest num ber of cable system installations over the past five years at 22, including five systems in 2022 alone. Africa has been going through a digital transformation over the past decade with almost every country in Africa hav

SUBMARINE TELECOMS INDUSTRY REPORT 27

SYSTEMGrowth 1.3 Figure 15: New System Count by Region, 2018-2022 Figure 16: KMS Added by region, 2018-2022 0 5 10 15 20 Transpacific Transatlantic Polar Indian Ocean EMEA AustralAsia Americas 20222021202020192018 FIGURE 15: NEW SYSTEM COUNT BY REGION 2018-2022 0 10 20 30 40 50 60 70 80 Transpacific Transatlantic Polar Indian Ocean EMEA AustralAsia Americas 20222021202020192018 KMS (in thousands) FIGURE 16: KMS ADDED BY REGION 2018-2022

ing at least one submarine cable connection. The continued investment in submarine cable capacity will allow for the digital divide between Africa and the rest of the world to narrow even farther. These new systems create a “significant reduction in in ternational bandwidth costs, increased bandwidth consumption, and demand for emerging technolo gies.” (AFR-IX, 2021)

Southern Cross NEXT and Jupiter were both ready for service in July 2022 adding two new Transpacific systems. Five new systems have been added to this region over the last five years.

The total kilometers of cable installed gives a very different view than that of new systems added. While a given region may have had a larger number of new systems added, the overall length added has not been as high. For instance, while the Trans pacific region only saw the addition of three cable systems this over the past five years, those cable systems collectively covered nearly 72,000 kilome ters – more than any other region. (Figure 16) The Transpacific also received the largest amount of new cable in one year for the period 2018-2022 with a full 30,000 kilometers installed in 2022 alone.

Globally, there are 88 planned systems in the works over the next five years. (Figure 17) A signif icant portion of the 88 planned systems, 31 systems to be exact, are still publicizing a 2022 RFS date. Though some systems like Equiano, Grace Hopper, and Amitié are close to completion and will likely go live before the end of the year; it is very unlikely that all remaining systems planning for a 2022 RFS date will reach this goal. A few have already begun installation and should not be delayed too much – simply sliding into 2023 – while others will encounter more significant delays.

Regionally, EMEA and AustralAsia will see the largest growth percentage through 2025. EMEA has Africa1, Equiano, 2Africa, PEACE and SHARE among others, all aiming to be completed in the next few years, so it is no surprise that 29 percent of all announced future sys tems touch the region. Another 22 percent of all planned projects will touch the AustralAsia region, including ADC, PDSCN and Apricot to name a few.

So far, the Americas look to add 14 more systems: 12 in the Indian Ocean and 10 in the Transpacific region through the end of 2025. The Transatlantic is expected to produce an additional four systems during this same period.

The Polar region, though still only four percent of the total announced systems through 2025, plans to add 4 systems, which would be a 166 percent increase.

In late November 2021, Chile announced their interest in installing a cable to connect Antarctica, “to promote scientific and technological development of the southern regions of Chile.” It would be the first cable to connect to the continent should it come to fruition. (Wenger, 2021)

For a variety of reasons, some systems never make it past the planning stages. SubTel Forum has found that the announcement of being Contract in Force (CIF) is a good indicator of whether a system will enter service or not. Currently 51 percent of planned systems have announced they are CIF while 49 percent have yet to reach this important milestone. (Figure 18) Some are still in early development stages, having just been announced recently and will provide further updates in the coming months. But some will never see the bottom of the ocean floor. ■

28 SUBMARINE TELECOMS INDUSTRY REPORT

GLOBAL OVERVIEW | SYSTEM GROWTH Transpacific Transatlantic Polar Indian Ocean EMEA AustralAsia Americas FIGURE 17: PLANNED SYSTEMS BY REGION 2022-2025 3% 5% 11% 16% 22% 26% 14% FIGURE 18: GLOBAL CONTRACT IN FORCE RATES 2022-2027 Yes (51%)No (49%) Figure 18: Global Contract in Force Rate, 2022-2027 Figure 17: Planned Systems by Region, 2022-2025

OUT OF SERVICESystems

Unlike the commissioning of a new system, the de commissioning of an Out of Service (OOS) cable system hardly ever makes the headlines. In prepa ration for this year’s Industry Report, the analysts at SubTel Forum were not able to find news of any systems having been decommissioned over the last year, even though a fair number are well past their estimated End of Service (EOS) dates.

Though there were no announce ments of out of service systems this year, two submarine cable systems are confirmed to have been decommis sioned recently as ICPC spread the word of the cable recovery work being done by the team at Mertech Marine.

Over the past 18 years Mertech Ma rine has developed a system by which they acquire the cable from the owner, recover sections as feasible and recycle the various materials. This year, they have worked to recover portions of six separate systems, according to the member notifications sent by the Inter national Cable Protection Committee. A small number of other companies are

also working to repurpose decommissioned cables to be utilized for scientific research.

Based on information found in the public domain, less than 60 submarine telecommunications cable systems

SUBMARINE TELECOMS INDUSTRY REPORT 29

1.4 Figure 19: Decommissioned Systems 2002-2022 0 10 20 30 40 50 60 Indian Ocean Americas Transpacific Transatlantic AustralAsia EMEA FIGURE 19: DECOMMISSIONED SYSTEMS 2002-2022

SUBMARINE TELECOMMUNICATION CABLE RECOVERY EXPERTS WHO RECYCLE TO REPURPOSE

We are the global leaders in turnkey solutions for the recovery and recycling of out-of-service submarine telecommunication cables.

As the only provider utilising its own fleet of vessels and processing facilities to perform end-to-end decommissioning and recycling of submarine telecommunication cables, we are pioneering the process of commercially dismantling marine cables sustainably, economically and responsibly.

Submarine telecommunication cables come in various shapes and sizes and commodities such as polyethylene, lead, copper, aluminium and steel are extracted from them. We put these materials back into the circular economy, reimagining submarine cables and the possibilities they can contribute to the next generation.

Mertech Marine is run by an exceptionally experienced team of marine and cable recovery experts. We are known for our reliable innovative solutions in marine projects, providing shore-end removal, along with worldwide clearance services.

We challenge businesses to look for the opportunities that lie beneath the surface of the ocean and join our circular economy to reinvent what already exists. Out-of-service submarine telecommunication cables Own fleet of recovery vessels and processing facilities Cable recovery and recycling, depot clearance, shore-end services End-to-end decommissioning and recycling SEE A LITTLE CLEARER World Leader In Submarine Cable Recovery & Recycling GO A LITTLE FURTHER The Circular Economy World-class ISO-certified processing facilities Innovation that changes industries Responsible recovery toour oceans and planet Submarine telecommunication cable recovery THINK A LITTLE DEEPER Innovation 30,000 square metres of specialised facilities in South Africa Displaced 245,000mt of carbon dioxide equivalent (tco2e) 2,500 subsea repeaters recovered and recycled Over 95,000mt of cable recovered and recycled

have been taken OOS in the last 20 years. This is roughly 11 percent of the total number of cables that have ever been lit, according to available informa tion on early cable systems. Once a sys tem is taken out of service it is typically left at the bottom of the ocean floor. This practice is mainly to protect the marine life that may have grown around the cable, but also because it is a costly process to have the cable reclaimed.

EMEA has seen the largest number of cables removed, accounting for 46 percent of the total pool. 24 percent were in AustralAsia and the Transat lantic has lost less than 10. The Trans pacific, Americas and Indian Ocean regions all decommissioned less than 5 systems in the last 20 years and the Po lar region has not lost any as its oldest active cable was only activated 15 years ago. (Figure 19)

With technology advancing every day, more cable systems are living past their estimated EOS dates. Though there are undoubtedly systems that have been taken out of service without a formal an nouncement, many are still actively used well passed their industry standard 25-year life span. This is possible with the aid of system upgrades and equipment replacements in the landing stations and data centers. As such, there are already dozens of systems that have passed their EOS dates – some by as many as eight years.

Of those that have not yet reached their maturity dates, 85 systems will reach EOS in the next five years, and another 53 by 2032. (Figure 20) Considering that

less than 60 systems have been taken out of service in the last 20 years, the number of maturing systems that will reach end of service in the coming 20 years is some cause for concern.

Altogether, 43 percent of the current submarine cable systems relied on today will be technologically obsolete or OOS within the next ten years. Some of these systems will be replaced by state-of-the-art projects that can ful fill the same capacity requirements using less cables, but the subsea cable industry cannot rest on its laurels over the next several years; new systems need to be imple mented to replace aging infrastructure at a steady pace considering rising bandwidth demands. ■

32 SUBMARINE TELECOMS INDUSTRY REPORT

GLOBAL OVERVIEW | OUT OF SERVICE SYSTEMS

Figure

20:

Projected System Maturity

2022-2032 After 2032 (47%) EOS Through 2032 (31%) Past EOS (12%) FIGURE 20: PREDICTED MATURITY OF CURRENT SYSTEMS 2022-2032

EVOLUTION OF SYSTEM OWNERSHIP and Customer Base

Based on data in the public do main for systems accomplished between 2012 and 2022, as the number of systems increased, the split between single and multiple owner cable systems stayed consistent. Single owner cable systems averaged 57 percent of all cable systems installed in the last ten years. (Figure 21) Though there has been an increase in the num ber of Consortiums working together to bring a system to fruition, it is balanced by the number of companies that have the means to implement a cable without assistance.

Looking forward, the percentage of single owner cable systems is increasing and will account for roughly 75 percent of the projects planned over the next 4 years. (Figure 22) With the influx of Hyperscaler driven systems, it is no surprise that single owner cable systems are on the rise. Their ability to finance an entire system and desire to control all its capacity is shifting the industry norm. However, while single owner systems have more flexibility in the early design stages, it is not as easy for funding to be secured as it would be for consortia systems. Those single owner systems that are not Hyperscaler driven have a much higher rate of falling off, so these projec tions will certainly change over time. ■

SUBMARINE TELECOMS INDUSTRY REPORT 33

1.5 Figure 21: Single vs Multiple Owner Cable Systems, 2012-2022 Figure 22: Single vs Multiple Owner Cable Systems, 2022-2025

0 100 200 300 400 500 Single Multiple 20222021202020192018201720162015201420132012 FIGURE 21: SINGLE VS. MULTIPLE OWNER CABLE SYSTEMS 2012-2022 0 10 20 30 40 50 60 70 80 Single Multiple '2026'2025'2024'2023'2022 FIGURE 22: SINGLE VS. MULTIPLE OWNER CABLE SYSTEMS 2022-2025

Cross

Network is proud to be a leading

of international

Australia and New Zealand

to the USA and Pacific Islands.

Mission critical networks trust Southern Cross

be with

for the long term.

...

Low latency. High Quality. Rapid Scalability. Southern

Cable

independent provider

cable connectivity between

Three cables

One eco-system.

Maximum Flexibility. Financial Security. to

them

POWERING THE CLOUD, UNDER THE SEA fast. direct. secure

CAPACITY

36 SUBMARINE TELECOMS INDUSTRY REPORT

2

Video 6: Alex Chase, Senior Director - AP Telecom

Video 6: Alex Chase, Senior Director - AP Telecom

GLOBAL CAPACITY

38 SUBMARINE TELECOMS INDUSTRY REPORT

2.1

The world continues to con sume ever-increasing amounts of data, with bandwidth continuing to skyrocket. This demand – driven by a contin ued shift towards cloud services, an explosion of mobile device usage and mobile technology like 5G –provides numerous opportunities for the submarine fiber industry.

For the period 2018-2022 submarine fiber capacity on major routes has increased at a Com pound Annual Growth Rate (CAGR) of 13.3 percent, including upgrades and new system builds. (Figure 23) This is down as com pared to the same analysis at this time last year, when the CAGR along major submarine cable routes was 18.2 percent.

As global demand continues to increase at a rapid pace, sustain ing infrastructure growth will be challenging and potentially cause demand to exceed supply. To date, the industry has been able to keep up with demand— but it will be necessary to continue focusing on increasing capacity even further to meet the increasing demand. This is where technology like 400G wave lengths and high fiber pair count systems can have a positive impact.

Based on reported data and future capacity estimates, global capacity is estimated to increase up to 75.4 percent by the end of 2025. (Figure 24) Despite multiple systems planned over the next three years boasting design capaci ties of more than 200 terabits per second, overall capacity growth projections are less than they were a year ago when there was a 100 percent capacity increase planned for the following three years.

However, not all announced systems are far enough along in the development process to have decided things

like fiber pair counts and design capacity, so expect to see an increase in possible bandwidth as these details are finalized and new systems are announced – especially as 400G wavelength technology and high fiber pair count systems become more prevalent. Additionally, the de mand impact brought about by COVID-19 forced many people to re-evaluate their bandwidth needs and gear up for additional capacity to facilitate remote working environments. ■

SUBMARINE TELECOMS INDUSTRY REPORT 39

0 500 1000 1500 2000 2500 3000 3500 4000 15% 20% 25% 30% 35% CAGR Transpacific Transatlantic Intra-Asia Americas 20222021202020192018 FIGURE 23: GLOBAL CAPACITY GROWTH ON MAJOR ROUTES 2018-2022 (Tbps) 0 1000 2000 3000 4000 5000 6000 7000 8000 10% 15% 20% 25% CAGR Transpacific Transatlantic Intra-Asia Americas 202520242023 FIGURE 24: GLOBAL CAPACITY GROWTH ON MAJOR ROUTES 2023-2025 (Tbps) Figure 23: Global Capacity Growth on Major Routes, 2018-2022 Figure 24: Planned Capacity Growth on Major Routes, 2023-2025 CAPACITY | GLOBAL CAPACITY

LIT CAPACITY

Since 2015, major submarine cable routes have aver aged 18 percent lit of total design capacity. A large capacity buffer is designed for cable systems to deal with sudden spikes in demand, such as handling rerouted traffic due to a cable fault.

2.2.1 TRANSATLANTIC REGION

Transatlantic routes are the most competitive globally – especially those connecting the two biggest economic hubs in the world of New York and London – and carry traffic between the highly developed economies and tech nology markets of North America and Europe.

The Transatlantic region has seen low to moderate

design capacity growth during the period 2016-2020 at a CAGR of 16 percent due to regular upgrades and a new system each year for the period 2015-2018 and one new system in 2020. (Figure 25) This is down from last year where the CAGR for the period 2015-2019 was 22.9 percent. On average, the Transatlantic route has maintained a lit capacity at 23 percent of total for this five-year period, well over the global average of 18 per cent. The last two years have seen 27.3 and 36.8 percent, respectively. Additionally, lit capacity has increased at a CAGR of 40.9 percent during this period, indicating that demand is greatly outpacing capacity build out.

Based on publicly announced information, lit capacity

40 SUBMARINE TELECOMS INDUSTRY REPORT

2.2

growth in the Transatlantic region is currently projected to outpace design capacity growth by 2025. (Figure 26) While there is still time for systems for 2025 to be developed, that window is closing considering a typical submarine cable project takes 2-3 years to implement. The mete oric rise in bandwidth demand is driven by individuals and businesses continuing to switch to cloud and web based services as they have since the start of COVID.

However, with the advent of 400G technology and high fiber pair count systems (16 to 24 or more) it is possible that design capacity will be able to stay ahead of demand through system upgrades and new systems an nounced over the next 12-18 months.

2.2.2 TRANSPACIFIC REGION

As in the Transatlantic region, Hyperscalers continue to expand their infrastructure across the Pacific and account for a significant portion of new system builds. Systems along this route connect the economies of the United States and Canada with Australia and East Asia.

The Transpacific has observed similar growth to that of the Trans atlantic with 16.6 percent CAGR for the period 2016-2020. This is about the same last year where the CAGR for the period 2015-2019 was 15.7 percent. The region has maintained an average of 29.4 percent lit capacity during this time – noticeably higher than global averages. (Figure 27)

In 2015, lit capacity was as low as 15 percent, indicating a short-term capacity overbuild in this region that has only recently begun to recede with 2019 and 2020 observing lit capacities of 29.3 and 47 percent, respectively. As in the Transatlantic region, Hyperscalers continue to expand their infrastructure across the

SUBMARINE TELECOMS INDUSTRY REPORT 41

0 100 200 300 400 500 600 700 800 30% 40% 50% 60% 70% 80% Lit CAGR Total Lit 20202019201820172016 FIGURE 25: TRANSATLANTIC CAPACITY GROWTH 2016-2020 (Tbps) 0 100 200 300 400 500 600 20% 30% 40% 50% Lit CAGR Total Lit 20202019201820172016 (Tbps) FIGURE 27: TRANSPACIFIC CAPACITY GROWTH 2016-2020 0 500 1000 1500 2000 Total Lit 20252024202320222021 (Tbps) FIGURE 26: TRANSATLANTIC CAPACITY GROWTH 2021-2025 Figure 25: Transatlantic Capacity Growth, 2016-2020 Figure 27: Transpacific Capacity Growth, 2016-2020 Figure 26: Transatlantic Capacity Growth, 2021-2025 CAPACITY | LIT CAPACITY

Pacific and account for a majority of new system builds.

As one of the more competi tive regions in the world – with a diverse number and type of both systems and customers – the Transpacific is expected to increase from its CAGR of 26.6 percent to 27.3 percent through 2025 based on publicly announced system information. (Figure 28) While lit capacity is not currently expected to outpace design capacity by 2025 as in the Transatlantic, based on currently available information lit capacity may reach as high as 69.7%. More systems need to be developed and additional upgrades performed along Transpacific routes to stay ahead of this steep rise in demand.

2.2.3 AMERICAS REGION

The Americas region has seen significant growth in the last few years, almost quadrupling in total capacity from 233.5 Tbps. in 2016 to 803.5 Tbps in 2020 along major routes. This region has observed a CAGR of 27.9 percent for the period 2016-2020. (Figure 29) This is about the same as last year where the CAGR for the period 20152019 was 28.5 percent.