St John Ambulance Australia (NSW)

(ACN 001 738 370)

Notice of 132nd Annual General Meeting

Notice is hereby given that the 132nd Annual General Meeting of St John Ambulance Australia (NSW) will be held on:

Date: Thursday, 11 May 2023

Venue: via Zoom: Meeting ID: 860 8068 8799, Passcode: 429456

Time: 6.00pm

Business

1.Opening and Acknowledgement of Country

2.Apologies

3.Welcome

4. Confirmation of previous Minutes

5. Matters Arising

6.2022 Financial Statements

7. 2023 State Council Election Results

8.2022 Year in Review

9. General Business

10. Close

Any questions for the meeting should be received in writing via mail or emailed to agm@stjohnnsw.com.au no later than Sunday, 30 April 2023.

The papers for the meeting are attached and can also be accessed here

An interactive copy of the 2022 Annual Financial Statements can also be accessed here.

Proxy Voting

Pursuant to clause 16 of the Company’s constitution, each member is entitled to appoint a proxy to attend the meeting and vote on the proposed resolutions by notice given to the Company. The proxy must be a member of the Company. The Proxy Appointment form is attached and can also be downloaded here Proxy Appointment forms are to be sent to the Company Secretary before the meeting by email at agm@stjohnnsw.com.au

Yours sincerely

Sarah Lance Damien Spence Company Secretary Company Secretary

Sarah Lance Damien Spence Company Secretary Company Secretary

AGENDA

ANNUAL GENERAL MEETING

St John Ambulance Australia (NSW) (ACN 001 738 370)

The 132nd Annual General Meeting will commence at 6.00pm

1. Meeting Open and Acknowledgement of Country

The Chair opens the meeting and begins with an Acknowledgement of Country.

2. Apologies

The Chair calls on the CEO to read the apologies.

3. Welcome

The Chair welcomes Members and special guests

4. Confirmation of previous Minutes

• The Minutes of the 131st Annual General Meeting held on Tuesday 17 May 2022 to be confirmed and signed accordingly by the Chair.

• The Minutes of the General Meeting of Members held on Thursday 16 March 2023 to be confirmed and signed accordingly by the Chair.

5. Matters Arising

There were no matters arising from the previous meetings

6. Annual Financial Statements

Consider the report of the Board of Directors, the Financial Statements and Auditors’ Report for the year ended 31 December 2022.

7. 2023 State Council Election Results

Announcement of the results of the 2023 State Council Election.

8. Year In Review

Presentation of the 2022 Year in Review.

9. General Business

Any other business of which appropriate notice has been given

10. Close

The Chair declares the meeting closed.

St John Ambulance Australia (NSW) MINUTES OF THE 131st ANNUAL GENERAL MEETING

Held via Zoom

On Tuesday, 17 May 2022 at 6.00pm

1. OPENING

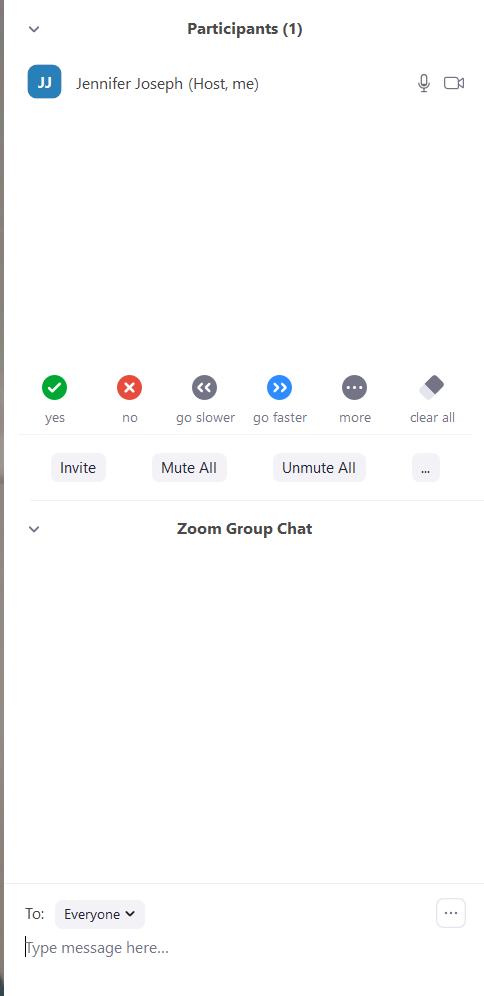

At 6.00pm, Sean McGuinness (The Chair) welcomed the attendees and confirmed that voting will be conducted through a show of hands counted by the Moderator, Leonie Smith (EA)

The Chair noted the documents pertaining to the meeting which were circulated to Members ahead of the meeting via email including: -

• The Notice of the Meeting and Agenda

• Minutes of the 130th AGM held on 20 May 2021

• Minutes of the General Meeting of Members held on 10 February 2022

• 2021 St John Ambulance Australia (NSW) Financial Statements

• Ordinary Resolution No. 1 Appointment of Auditor

• Special Resolution No. 1 New Constitution

• St John Ambulance Australia (NSW) Constitution with markup

• St John Ambulance Australia (NSW) Constitution clean

• Proxy Form

• 2021 St John Ambulance Australia (NSW) Impact Report and the Year in Review

The Chair welcomed attendees and noted that the meeting was being held online in accordance with ASIC and ACNC regulatory guidance.

The Chair advised that a quorum was present and declared the meeting open.

The Chair began with an Acknowledgement to Country

The Chair acknowledged the Members present, those guests in attendance and asked the CEO to acknowledge apologies received.

2. PRESENT VIA ZOOM

Sean McGuinness (Chair), Scott McDonald (Deputy Chair), Ilan Lowbeer (Commissioner), Coretta Bessi (Director), Sue Campbell-Lloyd (Director), Mick Campbell (Director), Stephen Woodhill (Director), Joanne Muller (NSW State Council President), Sarah Lance (CEO), Damien Spence (CFO), Peter Bouhalis, Rebecca Skeete, Andrew Sitaramayya, Marian Casey, Elliot Williams, Kathleen Miller, Matthew Glozier, Cheryl Langdon-Orr, Dane Smale, Frazer Shepherd, Tricia Spencer, Warren Philip-Clarke, John Clary, Rob Lang, Rhonda-Lee Hutchings, Helen Banu-Lawrence, Debbie Nilsson, Sven Nilsson, Hoshang Parekh, Geoffrey Ticehurst, Bryan Kempton, Keith Avery, Guy Chapman, Isabelle Moutia, John Ward, Virginia Kubik, Peter Cameron, Joanne Diacopoulos, Vincent Koc, Mark Hutchings, Udbhav Singla, Simon Frost, Jodie Jordan, Amarpreet Kaur, Martin Thomas, Malcom Little, Greg Edmonds, Sydney Hyett, Rhonda Sneddon, Liam Bruton, Lydia Sharpin, James Chandler, Samar Ahsan, Grant Whitten, John Hay, Paul Mackinder, Kerrie Hall, Debbie Benham (58)

IN ATTENDANCE VIA ZOOM

Katie Bruce (Company Auditor, HLB Mann Judd), Ms Leonie Smith (EA). (2)

Page 1 of 6

APOLOGIES

Michael John Bridger-Darling, Benjamin McClure, Tony Lawrence, Anthony O'Reilly, Pela O'Reilly, John McClement, Liz Eckermann, Steve Karger, Rus Wesslink, Rolf Schafer, Joan Ward, David Czerkies, Charlotte Cassell, Helen Harris, Paul Houghton, Michelle McIvor, Cheryl Lynch, Caroline Manalo, Christopher O'Donnell, Justin Tyra, Lyn Luu, Joan Kyriazis, Marisa Pirto, Arjay Raca, Terrill Steele, Maria Venettacci, Lynn Howlett, Tym Norman, Barry Metz, Richard Wessen, Gavin Purse, Salman Mustafa, Jasmin Craufurd-Hill, Helen Chant, Leanne Batey, Andrew North, Andrew Gallagher, David Cloran, James Garden, John Comyns, Damien Rodgers, Jason Mayo, Milan Stenek, Malcolm Knight, Betty Huang, Blake Edgecombe, Penelope Little, Jason Lacson, Neil Macfarlane, Trevor Mayhew, Haoyang Cai, Jason Wu, Breanna Gunning, Mark Sawszak, Meher Tarapore, Vanessa Lorford-Mills, Jason Bendall, Sandra haring, Ben Scott, Colin Lott, Sylvia Chan (61)

3. WELCOME TO MEMBERS

The Chair introduced his fellow Board Directors and the Executive Team present. The Chair welcomed State Councillors and Members of St John Ambulance Australia (NSW) (St John or the Company) to the 131st Annual General Meeting

The Chair also welcomed Ms Katie Bruce, Manager at HLB Mann Judd, the Company’s auditor, to answer any questions with respect to the auditor’s report and the conduct of the audit.

The Chair noted the format of the meeting was set out in the agenda and included the Notice of Meeting and the Financial Statements for the Company that were distributed to Members prior to the meeting on 21 April 2022 The Chair requested that with the permission of Members present that the Notice of Meeting would be taken as read.

4. ANNUAL GENERAL MEETING MINUTES OF 20 MAY 2021

The Chair tabled the Meeting Minutes of the 130th Annual General Meeting of the Company held on 20 May 2021 which had been tabled at a meeting of the Board on 10 April 2022.

Motion

That the minutes of the 130th Annual General Meeting held on 20 May 2021 be adopted as an accurate record of the meeting.

Moved

By The Chair

SECONDED

Geoffrey Ticehurst

The Chair invited any Members to raise any queries or questions regarding the minutes.

There were no queries or questions.

The motion was submitted to a vote and was CARRIED unanimously on a show of hands.

Page 2 of 6

5. GENERAL MEETING OF MEMBERS MINUTES OF 10 FEBRUARY 2022

The Chair tabled the Meeting Minutes of the General Meeting of Members of the Company held on 10 February 2022 which had been tabled at a meeting of the Board on 10 April 2022.

Motion

That the minutes of the General Meeting of Members of the Company held on 10 February 2022 be adopted as an accurate record of the meeting.

Moved

By The Chair

SECONDED

Helen Banu-Lawrence

The Chair invited any Members to raise any queries or questions regarding the minutes.

There were no queries or questions.

The motion was submitted to a vote and was CARRIED unanimously on a show of hands.

6. ANNUAL FINANCIAL STATEMENTS

The Chair noted the Financial Statements of the Company and its controlled entity for the year ended 31 December 2021, together with the accompanying Auditors’ Report and Independence Declaration as required under the Australian Charities and Not-for-profits Commission Act 2012, were previously distributed to Members.

Prior to the meeting, one question was received from a Member with respect to the Financial Statements from Guy Chapman:

1. The financial statement lists a property at Granville. This is incorrect - that property was never owned by St John. It is a council property - and in fact St John has not used that property now for several years

The Chair noted that the CFO had advised that the error in Note 12 had been identified after the Financial Statements were signed and would be corrected in the 2022 Financial Statements

The error in the disclosure note has no impact on the 2021 Financial Statements as the building is recorded in the Financial Statements at nil value.

The Chair opened the forum to allow Members to raise any questions or queries on the Financial Statements.

There were no further queries or questions.

Motion

That the Financial Statements for the year ended 31 December 2021 be adopted.

Moved

By The Chair

SECONDED

Debbie Benham

The motion was submitted to a vote and was CARRIED unanimously on a show of hands.

Page 3 of 6

7. APPOINTMENT OF AUDITOR (Ordinary Resolution No. 1)

The Chair tabled the matter of the Appointment of the Auditor of St John Ambulance Australia (NSW) (Ordinary Resolution No. 1) and noted that an overview of the Auditor selection progress was included in the Explanatory Statement distributed to Members on 21 April 2022.

The Chair advised members that subsequent to the distribution of the AGM Notice, consent has been received from ASIC by the Company for HLB Mann Judd to resign as Auditor of the Company at this Annual General Meeting and all other regulatory requirements have been met.

The Chair opened the forum to allow Members to raise any questions or queries on the resolution.

There were no queries or questions.

Motion

For the purposes of section 327B(1) of the Corporations Act and for all other purposes, KPMG of Level 38 Tower 3, 300 Barangaroo Avenue Sydney NSW 2000, having been nominated by a member and consented in writing to act as auditor of the Company, be appointed as auditor of the Company, with effect from the close of the meeting

Moved

By the Chair

Seconded Syd Hyett

The motion was submitted to a vote and was CARRIED unanimously as an ordinary resolution on a show of hands.

The Chair thanked HLB Mann Judd for their service as Auditors of the Company and welcomed KPMG.

8. ADOPTION OF A NEW CONSTITUTION OF ST JOHN AMBULANCE AUSTRALIA (NSW) (Special Resolution No. 1)

The Chair tabled the matter of the adoption of a new Constitution of St John Ambulance Australia (NSW) (Special Resolution No. 1) and noted that an overview of the constitutional review process was included in the Explanatory Statement distributed to Members on 21 April 2022 together with clean and marked up copies of the Constitution

The Chair noted that the proposed Constitution was endorsed unanimously by Members of the NSW State Council on 10 March 2022

The Chair opened the forum to allow Members to raise any questions or queries on the special resolution.

There were no queries or questions.

Motion

That the members of the Company approve and adopt the revised constitution as circulated with the notice of meeting in substitution for, and to the exclusion of, the existing constitution of the Company

Moved By the Chair

Page 4 of 6

Seconded

John Ward

The motion was submitted to a vote and was CARRIED unanimously as a special resolution on a show of hands.

9. YEAR IN REVIEW

The CEO noted that through COVID-19, floods and other crises, the need for our organisation remains greater than it has ever been, 2021 truly was a turning point for St John NSW. We learnt that by embracing our strengths, we could accelerate innovation and rapid change when we needed it most.

The CEO noted the introduction of one of the first fully online first aid courses in the country, allowing people to continue accessing first aid skills even when is isolation and our early adoption of the provision of rapid antigen testing products and services helping organisations keep their staff safe as 2 examples of St John NSW innovating to support our communities in 2021

The CEO noted the work of members as the COVID-19 pandemic continued, covering 1,000 shifts a month in January, to 6,500 shifts in March and over 11,500 shifts per month by September 2021. The emergence of the Omicron variant presented the health system with new challenges and through it all St John NSW was there. The CEO noted the significant role played by St John NSW in enabling the COVID-19 vaccination roll-out in NSW with our people trained as marshals, administrators and vaccinators and encouraged members to look back on the role our organisation played in this critical time in history with immense pride.

The CEO thanked the Chair and Commissioner for their leadership, advice and support, the Board for their constant support, and the Executive Team and Deputy Commissioners, whose passion and dedication has helped shape St John NSW for the future. The CEO thanked volunteers and staff who have worked tirelessly to support communities across the State

The Chair noted that despite the impact the COVID-19 pandemic, our organisation made significant progress on the 4 key pillars of our 2025 Strategic Plan – Capability, Knowledge, Safety and Access

The Chair noted that the growth achieved in recent years has enabled a more resilient organisation with the ability to further respond to crisis events which have impacted our communities over the past 2 years, while also continuing to deliver core lifesaving services.

The Chair noted the achievement of a financial surplus of $3.554 million for 2021, following the surplus of $4.412M recorded in 2020, which continues to be reinvested into enabling our organisation to deliver on our social purposes.

The Chair recognised the incredible work of the Board, Executive Team and Deputy Commissioners, and the dedicated staff and selfless volunteers.

10. GENERAL BUSINESS

The Chair noted that Members were requested to provide questions for the meeting prior to Tuesday 3 May 2022. No questions were received prior to this date.

3 questions were received from a Member after the due date which are currently being reviewed and responded to by the management team and will be reviewed by the Board in due course.

The Chair opened the forum to allow Members to raise any matters of general business, questions or queries.

Page 5 of 6

There were no queries or questions.

11. CLOSE

The Chair thanked everyone for taking the time to join the meeting, and with no further business, declared the 131st Annual General Meeting closed at 6.28pm

CERTIFIED AS CORRECT

CONFIRMED at AGM

Chair: Chair:

Date: Date:

Page 6 of 6

St John Ambulance Australia (NSW) MINUTES OF THE GENERAL MEETING

Held via Zoom

On Thursday, 16 March 2023 at 6.00pm

1. OPENING

Mr Sean McGuinness (The Chair) welcomed the attendees and confirmed that voting would be conducted through a show of hands counted by the Moderators, Ms Leonie Smith and Ms Jennifer Joseph

The Chair noted the following documents pertaining to the meeting were circulated to Members ahead of the meeting via email:

• Notice of Meeting and Agenda

• Explanatory Statement

• St John Ambulance Australia (NSW) Constitution with markup

• St John Ambulance Australia (NSW) Constitution clean

• Form of appointment of a proxy

The Chair welcomed attendees and noted that the meeting was being held online in accordance with ASIC and ACNC regulatory guidance.

The Chair advised that a quorum was present and declared the meeting open

The Chair acknowledged the Eora people who are the traditional custodians of the land on which he was attending this meeting and acknowledged the traditional custodians of each of the lands in which St John Ambulance Australia NSW and St John Ambulance Australia operates paying his respects to elders both past present and emerging.

The Chair acknowledged the Members present, those guests in attendance and asked the Company Secretary to acknowledge the apologies received

2. IN ATTENDANCE VIA ZOOM

Sean McGuinness (Chair), Scott McDonald (Deputy Chair), Ilan Lowbeer (Commissioner), Coretta Bessi (Director), Sue Campbell-Lloyd (Director), Mick Campbell (Director), Larissa Cook (Director), Evelyne Tadros (Director), Joanne Muller (NSW State Council President), Sarah Lance (CEO), Damien Spence (Company Secretary), Kerrie Hall, Saad Mirza, Marian Casey, Geoff Ticehurst, Debbie Nilsson, Bryan Kempton, John Clary, Wayde Walker, Kathleen Miller, David Czerkies, Keith Avery, Helen Chant, Chris Chant, Mark Hutchings, Rhonda-Lee Hutchings, Sven Nilsson, Damon Quinn, Ben Scott, Helen Banu-Lawrence, Anthony Stevens, Jeffrey Parker, Rob Lang, Kelly McGowan, Andrew North, Benjamin McClure, Lydia Sharpin, Emerson Worthington, Rolf Schafer, Blake Edgecombe, Colin Lott, Jodie Jordan, Louise Eckersley, Harry Delaney (via phone), Peter Arnott, Rebecca Skeete, Elliot Williams, Hoshang Parekh, Vanessa Lorford-Mills, Peter Cameron, Malcom Little, Leonie Smith, Jennifer Joseph (52)

APOLOGIES

Kane Mortlock, Malcolm Knight, Madeline Khun, Brent Murray, Matthew Glozier, Charlotte Cassell, Abigail Sia, Barry Metz, David Luck, Walter Gray, Mark Sawszak, William Wesslink, Michael Bridger-Darling, Ingolf Peter Hickling, Geoffrey Arigho, Penelope Little, Robert

Page 1 of 5

Tremethick, Stephen Cheung, Anthony O'Reilly, Alex Warwar, Guy Chapman, Cheryl Langdon-Orr, James Gray, Bob Walker, Isabelle Moutia, Sandra Haring, Garry Huang, Jason Whyte, Jason Liu, Lachlan Liao, Frazer Shepherd, Brian Doyle, Greg Edmonds, Susanne Page, Leonie Ahmed, Brian Chan, Ann Foley, Gregory Ford, Peter Irvine, Moeen Goolam, Jarren Kay, Tsang So Lin Leung, Brett McCarthy, Abdul Takkoush, Frank Vella, John Ward, Salman Mustafa, Amarpreet Kaur, Juliet Nguyen, Udbhav Singha, Jenny Rivera, Maha Elnajjar, Rachelle Ann Mortera, Kalpana Rayichandran, Patricia Bolivoro, Lyn Berghofer, Ken Schneider, Kathy Virag, Dane Smale, Didier Moutia, Craig Hutchins, Caroline Manalo, Justin Tyra, Joan Kyriazis, Mary Bahra, Celia Thistleton, Virginia Kubik, Matthew Griffiths, Stephen Karger, Jake Henning, Steven Rafter, Erica Kaldas, Jasmine Butwell, Meher Tarapore, Rozina Koya, James Garden, Leigh Ries, John Tyler, Kylie Korner, Jorgelina Betancur, Nicholas Deane, Christopher O'Donnell, Michelle McIvor, Marisa Pirto, Jessica Robson, Adrian Guevarra, Ida Ghalandari, Emma Deadman, Cassandra Darcy, Joan Ward, James Chandler, David Murphy, Paul Houghton, Valerie Murray, Jason Mayo, Milan Stenek, David Kerr, Brooke Carrier, Belinda Iemma, Patricia Spencer, Evan Roubekas, Karen Knight, Peter Bouhalis, Aaron Wanke, Chris Hucker, Stephen Woodhill, Sharron Martin, Ikky Khan, Margaret Vincent, Margie McCullough, Brett Ovenden, Anthony Lawrence, Peta O'Reilly, Jason Bendall, Karen Lott, Stephen Woodhill (117)

3. WELCOME TO MEMBERS

The Chair noted that the meeting format was as set out in the agenda included in the Notice of Meeting that was distributed to Members on 22 February 2023 The Chair requested that, with the permission of the Members present, the Notice of Meeting would be taken as read.

4. ADOPTION OF A NEW CONSTITUTION of ST JOHN AMBULANCE AUSTRALIA (NSW) (Special Resolution No. 1)

The Chair tabled the Adoption of a New Constitution of St John Ambulance Australia (NSW) (Special Resolution No. 1) and highlighted:

• Members were requested to approve amendments to the Constitution of St John Ambulance Australia (NSW) to clarify whether certain references to “members” in the current Constitution refer to either “Members” which is a defined term meaning members of the Company who are the approximately 430 members of St John NSW who have applied to become and have been accepted as a “Member” of the Company, or to all “Members of the Organisation” which refers to the approximately 2,600 members of St John (NSW) aged 18 years and over.

• The proposed amendments corrected the typographical errors in the Constitution that were inadvertently created in a tidy-up of inconsistently capitalised terms and the introduction of gender-inclusive language that occurred in May 2022 and would provide clarity on the definition of members.

• The Deputy Chair Mr Scott McDonald provided an overview of the proposed changes to the Constitution, and highlighted that the proposed amendments did not revisit the previous constitutional amendments which had been designed to ensure that all 2,600 adult “Members of the Organisation” have the right to nominate for State Council and participate in the State Council election process as these amendments were:

• Unanimously endorsed by State Council in September 2021;

• Unanimously endorsed by State Council in November 2021;

• Unanimously approved by Members of the Company at the General Meeting in February 2022;

• Unanimously endorsed by State Council in March 2022;

Page 2 of 5

• Unanimously approved by Members of the Company at the Annual General Meeting in May 2022;

• Endorsed by a clear majority of State Council (83%) in November 2022; and

• Endorsed by a clear majority of State Council (91%) in February 2023

Non-Executive Director Ms Larissa Cook provided an overview of the proposed changes to the Constitution and emphasised that, if the current Board endorsed resolution did not succeed, this would not cause the constitution to revert to a situation where only Members of the Company could participate in the State Council election process, which was the position advocated by Sven Nilsson in opposition to the resolution. Rather, the previously endorsed constitutional amendments would stand together with the current internal inconsistency in the constitution as to whether “member” referred to “Member of the Company” or “Member of the Organisation.

Ms Cook also advised that, in those circumstances the Board would have to act to resolve the inconsistency having regard to the will of the Members of the Company and State Council expressed at the meetings, referred to above, in which all or a significant majority had voted in favour of ensuring that all Members of the Organisation participate in State Council elections.

The Chair NOTED that no questions were received prior to the meeting.

Ms Cook advised the Chair of a question in the chat box of the meeting as to whether voting would be via a physical show of hands (on screen) or by the use of the hand raised in the chat. The Chair confirmed that voting would be via a physical show of hands.

The Company Secretary NOTED the 114 valid proxies received ahead of the meeting:

• 62 valid proxies received in favour of the Chair: William Wesslink, Frazer Shepherd, Susanne Page, John Ward, Salman Mustafa, Amarpreet Kaur, Juliet Nguyen, Udbhav Singha, Jenny Rivera, Maha Elnajjar, Rachelle Ann Mortera, Kalpana Rayichandran, Patricia Bolivoro, Lee Easton, Simon Frost, Alvin Wong, Dane Smale, Craig Hutchins, Caroline Manalo, Justin Tyra, Joan Kyriazis, Celia Thistleton, Virginia Kubik, Matthew Griffiths, Stephen Rafter, Erica Kaldas, Jasmine Butwell, Meher Tarapore, Rozina Koya, James Garden, Leigh Ries, Jorgelina Betancur, Nicholas Deane, Christopher O’Donnell, Michelle McIvor, Marisa Pirto, Jessica Robson, Adrian Guevarra, Ida Ghalandari, Emma Deadman, Cassandra Darcy, Joan Ward, Paul Houghton, Valerie Murray, David Kerr, Brooke Carrier, Belinda Iemma, Patricia Spencer, Evan Roubekas, Karen Knight, Peter Bouhalis, Chris Hucker, Stephen Woodhill, Jason Li, Sharron Martin, Ikky Khan, Margaret Vincent, Margie McCullough, Jake Henning, Brett Ovenden, Stephen Woodhill

• 3 valid proxies received in favour of Helen Banu-Lawrence: Anthony Lawrence, Peter O’Reilly, Jason Bendall

• 1 valid proxy received in favour of Ilan Lowbeer: Vanessa Lorford-Mills

• 2 valid proxies received in favour of Leonie Smith: Matthew Glozier, Kathy Virag

• 46 valid proxies received in favour of Sven Nilsson: Barry Metz, David Luck, Malcolm Knight, Walter Gray, Mark Sawszak, Michael Bridger-Darling, Ingolf Peter Hickling, Geoffrey Arigho, Penelope Little, Robert Tremethick, Stephen Cheung, Anthony O’Reilly, Alex Warwar, Guy Chapman, Cheryl Langdon-Orr, James Gray, Bob Walker, Isabelle Moutia, Sandra Haring, Garry Huang, Jason Whyte, Brent Murray, Jason Liu, Lachlan Liao, Brian Doyle, Greg Edmonds, Brian Chan, Ann Foley, Gregory Ford, Moeen Goolam, Jarren Kay, Tsang So Lin Leung, Brett McCarthy, Abdul Takkoush, Frank Vella, Abigail Sia, Lyn Berghofer, Ken Schneider, Didier Moutia, Stephen Karger, John Tyler, James Chandler, David Murphy, Aaron Wanke, Jason Mayo, Milan Stenek, Aaron Wanke.

Page 3 of 5

The Chair MOVED that Special Resolution No. 1 be put to the Members of the Company to approve and adopt the revised Constitution as circulated on 22 February 2023 in substitution for and to the exclusion of the existing constitution of the Company.

MOVED Chair

SECONDED Mark Hutchings

The Chair called for a Poll of Members present

The Chair called for Members abstaining from the vote to do so by a show of hands. Nil

The Chair called for Members voting against the Special Resolution No. 1 to do so by a show of hands.

Debbie Nilsson and Sven Nilsson indicated their vote against the Special Resolution No. 1 by a show of hands

The Chair called for Members in favour of the Special Resolution No. 1 to do so by a show of hands

• Sean McGuinness (Chair), Scott McDonald (Deputy Chair), Ilan Lowbeer (Commissioner), Coretta Bessi (Director), Sue Campbell-Lloyd (Director), Mick Campbell (Director), Larissa Cook (Director), Evelyne Tadros (Director), Joanne Muller (NSW State Council President), Sarah Lance (CEO), Damien Spence (Company Secretary), Kerrie Hall, Saad Mirza, Marian Casey, Geoff Ticehurst, Bryan Kempton, John Clary, Wayde Walker, Kathleen Miller, David Czerkies, Keith Avery, Helen Chant, Chris Chant, Mark Hutchings, Rhonda-Lee Hutchings, Damon Quinn, Ben Scott, Helen Banu-Lawrence, Anthony Stevens, Jeffrey Parker, Rob Lang, Kelly McGowan, Andrew North, Benjamin McClure, Lydia Sharpin, Emerson Worthington, Rolf Schafer, Blake Edgecombe, Colin Lott, Jodie Jordan, Louise Eckersley, Harry Delaney (via phone), Peter Arnott, Rebecca Skeete, Elliot Williams, Hoshang Parekh, Vanessa Lorford-Mills, Peter Cameron, Malcom Little, Leonie Smith, Jennifer Joseph.

The Chair, Company Secretary and Moderators left the meeting to tally the vote count and proxies received. The Deputy Chair of the Board Chaired the meeting in the Chair’s absence.

The Chair, Company Secretary and Moderators returned to the meeting at which point Mr Nilsson raised with the Chair that he had had his hand raised virtually prior to the vote and had wished to present his alternative position on the resolution.

The Chair apologised to Mr Nilsson for having not seen his raised hand and explained that he had not assumed that Mr Nilsson would necessarily want to address the meeting as he had engaged in written correspondence with the Members of the Company prior to the meeting and provided a paper which had been distributed together with the Notice of Meeting expressing his opposition to the resolution.

Harry Delaney addressed Mr Nilsson and asked that he desist from his opposition to the resolution indicating that the issue had been debated and voted on extensively over a long period and was now becoming needlessly divisive and a waste of everyone’s time and energy.

The Chair invited Mr Nilsson to address the meeting which Mr Nilsson did, expressing his opposition to the resolution on the grounds that participation in the State Council election process should be restricted to Members of the Company

Page 4 of 5

The Chair asked if any other Members wished to be heard on the special resolution, no Members indicated they wished to address the meeting.

The Chair asked the Company Secretary to announce the results of the poll.

The Company Secretary announced that:

118 votes of Members present in person and via proxy had been cast in favour of the Special Resolution

48 votes of Members present in person and by proxy had been cast against the Special Resolution

71% of votes cast were in favour of the Special Resolution and 29% of votes cast were against the Special Resolution.

The Chair indicated that, in light of the outcome of the vote, the Board would have to consider how to proceed with the forthcoming State Council election process.

The Company Secretary declared that Special Resolution No.1 had been defeated

5. CLOSE

There being no further business the Chair declared the General Meeting of Members of the Company closed at 6.45pm

CERTIFIED AS CORRECT

CONFIRMED at AGM

Chair: Chair:

Date: Date:

Page 5 of 5

report

St John Ambulance

Australia (NSW )

Saving lives through first aid

financial

2022

St John Ambulance Australia (NSW) and controlled entity

ABN 84 001 738 370

Financial Report

For the year ended 31 December 2022

Pictured on cover: Sarah Harris

Sarah has been part of the St John

Ambulance Sutherland Combined Division since 2020. Speaking of volunteering with St John Ambulance NSW, Sarah said “I love the opportunity of being able to learn from, and collaborate with, a diverse group of people from all over the state at events and emergency deployments.”

St John Ambulance Australia (NSW) and its controlled entity ABN 84 001 738 370 Contents Directors' Report 3 Consolidated Statement of Profit or Loss and Other Comprehensive Income 11 Consolidated Statement of Financial Position 12 Consolidated Statement of Changes in Equity 13 Consolidated Statement of Cash Flows 14 Notes to the Consolidated Financial Statements 15 Directors' Declaration 37 Directors’ Declaration Under the Charitable Fundraising Act 38 Auditor's Independence Declaration 39 Independent Auditor's Report 40

St John Ambulance Australia (NSW) and its controlled entity

Directors' Report

The Directors present their financial report for St John Ambulance Australia (NSW) (“the Company” or “St John Ambulance”) and its controlled entity, which are together referred to in this report as (“the Group”), for the year ended 31 December 2022.

The Company is an entity limited by guarantee with no share capital under the provisions of the Australian Charities and Not-for-profits Commission Act 2012.

OUR PURPOSE

Every day, Australians are at risk of vulnerability, illness, injury, and potentially life-threatening situations at home, in the workplace and the community.

We believe that every Australian should have access to responsive healthcare and wellbeing support when and where they need it.

SERVING OUR COMMUNITIES

St John Ambulance has come a long way during our 135-year history and we are constantly evolving to ensure we continue to best serve the NSW community.

With COVID-19 still prevalent and natural disasters continuing to affect the NSW community, the need for our services has remained strong, both in our traditional emergency response role, but also in supporting the health system and workplaces. As events, small and large, made a comeback, we saw a high demand for much-needed first aid support in the community.

Community health and safety remained constantly challenging. Some communities struggled with both COVID-19 and flooding. Our focus was on how we could evolve and change to ensure we continue to meet the needs of the community and help NSW stay safe.

Here are just some of the ways we have helped the community in 2022:

Flood Response

We played a significant role in assisting our regional communities during the devastating floods in 2022. Providing medical and emergency assistance, we worked alongside NSW Health, the SES and NSW Police to assist members of the community and emergency service workers.

Event Health Services

Our teams attended over 2,200 events in 2022. From school sporting matches to major festivals and events such as the City to Surf, Bathurst 1000, the Royal Easter Show, Truegrit and New Year's Eve celebrations, we were there on the sidelines to assist the community with first aid, medical and mental health services.

Health Services

Throughout 2022 our teams have worked closely with Local Health Districts all over the state including in regional and remote NSW to assist with staffing shortages caused by the COVID-19 pandemic.

With COVID-19 still affecting our community, St John Ambulance was a provider of choice and one of the first to market providing both Rapid Antigen Self Testing to the public to help them continue their daily lives in a safe way; and supervised Rapid Antigen Screening to the RFS, SES and NSW Ambulance to provide employee and volunteer confidence and mitigate the risks of workplace shutdowns at these essential services.

St John Ambulance supported NSW HealthShare with the transport of low acuity ambulant patients during the periods of peak demand through the COVID-19 pandemic. Through our contribution, NSW HealthShare has been able to reduce wait times and redirect its resources to those who need greater support, are less ambulant or in need of more comprehensive medical care while being transported.

001 738

ABN 84

370

Page 3 of 42

Directors' Report

Innovative Training to Engage further within the Community

In 2022, we launched the Little First Aiders program which enables primary school students to learn first aid through video and interactive activities, no matter where they are located. During this period we trained over 20,000 students across 167 schools.

In partnership with Marathon Health, a registered charity and not-for-profit organisation, St John Ambulance developed a specialised Indigenous First Aid Program which was launched in 2022. The First Aid Program is part of Marathon Health’s Preventative Health Culturally Safe First Aid Training and has been designed to be culturally sensitive to meet the unique needs of indigenous communities.

Community Engagement

We worked closely with the NSW Government to develop the public register of defibrillators (AED) locations, which is now part of the Service NSW App providing communities access to these life saving devices in cardiac emergencies.

We supported the NSW Volunteering Taskforce, convened by Minister Natasha Maclaren-Jones (Minister for Families and Communities and Minister for Disability Services) to improve volunteering in NSW.

In 2022, we continued to promote first aid knowledge through community events and media engagement, demonstrating first aid skills and CPR at many events throughout the year, including Bstreetsmart, Restart a Heart Day and Start from the Heart Day.

Investing in our Capability

Throughout 2022 we continued to invest in our capability to ensure we remain a capable and reliable partner supporting NSW communities:

• We developed an engaging and flexible volunteer service model, attracting more than 570 new volunteers to our organisation;

• We dedicated resources to invest in our youth members, increasing youth and parent/carer engagement, investing in the recruitment of new roles to support our youth programs, and providing more youth leaders; and

• We made significant investments in training our people and upgrading our operational fleet, equipment, and systems.

For further information on our community impact in 2022 please refer to our digital impact report which can be accessed here www.stjohnnswimpact.com.au

Financial Results

In 2022 our operating results remained strong, the investment of current and prior year surpluses into enhancing our capability has resulted in a reported net deficit for 2022 of ($0.326M) following the surplus of $3.554M recorded in 2021. The 2022 financial result includes an investment of $0.696M into the development of a new customer relationship management (CRM) system, new website and customer portal. The expenses associated with these investments have been recognised in 2022 however the systems will support our organisations continued growth in future years.

Significant investments we made into enhancing our capability in 2022 included:

• 25 new vehicles ordered to support community and disaster response capability;

• Invested in operational equipment to ensure our members are able to support their communities and respond to natural disasters;

• Developed a new Customer Relationship Management system, new website, and customer portal to improve customer experience;

• Launched a state-of-the-art training facility in the Sydney CBD;

ABN 84 001 738 370

St John Ambulance Australia (NSW) and its controlled entity

Page 4 of 42

Directors' Report

• Invested in the training and development of our members. In 2022, 220 members completed their Certificate II in Medical Service First Response, 84 members enrolled to complete the Certificate IV in Leadership and Management and 23 members became Clinical Educators;

• Invested in programs to make volunteering with us even more engaging and flexible; and

• Invested into protecting and promoting the wellbeing of our young people recognised by our Child Wise accreditation.

We continue to be committed to investing in our people and upgrading our operational fleet, equipment, and systems to ensure St John Ambulance remains a capable and reliable partner supporting NSW communities.

We are committed to ensuring the long-term sustainability of St John Ambulance and will continue to explore ways that we can grow and diversify our income streams.

Thank you

To all of our stakeholders, we thank you for your continued support of St John Ambulance in 2022.

To our staff and volunteers whose dedication has continued to keep communities right across NSW safe in challenging circumstances throughout 2022, thank you. We are incredibly proud of the work that you do, your commitment and service to the communities of NSW.

To our donors and supporters, we are honoured by your generosity. Your donations, grants and bequests directly support our community programs and volunteers, saving lives in communities across the state.

To our corporate partners, your support enables us to fulfil our goal of saving lives and building community resilience. Every time you engage St John Ambulance to train staff in first aid, install a St John Ambulance workplace first aid kit or defibrillator, engage St John Ambulance corporate health services, make St John Ambulance products available for sale or support a St John Ambulance division with goods or services, you directly help us to deliver a greater impact to the NSW community.

738

St John Ambulance Australia (NSW) and its controlled entity ABN 84 001

370

Page 5 of 42

St John Ambulance Australia (NSW) and its controlled entity

ABN 84 001 738 370

Directors' Report

DIRECTORS' DETAILS

The Directors of the Group at any time during or since the end of the financial year are:

Name and qualifications

SEAN MCGUINNESS

BCom (Fin/Acc), FCA, FAICD, OStj

Board & Committee Membership Experience

Independent Non-Executive Director

Chair of the Board of Directors

Member of the Honours & Awards Committee

▪ C-Suite executive with extensive listed and private company experience in Australia, Europe, United States and Asia, specialising in the areas of risk management, governance, M+A and finance strategy.

▪ Extensive Health, Consumer Products and Natural resources experience.

▪ Fellow of the Institute of Chartered Accountants Australia.

▪ Graduate of the Australian Institute of Company Directors.

▪ Director of St John Ambulance Australia.

▪ Experienced Non-Executive Director & Chairmancommitted to supporting profit for purpose organisations.

SUE CAMPBELLLLOYD AM

Independent Non-Executive Director

AM, RN, CStJ Chair of the Honours & Awards Committee

Member of the People & Clinical Governance Committee to October 2022

Member of the Clinical Governance Committee from October 2022

Member of the People & Culture Committee from October 2022

▪ Extensive experience in public health policy and program management at state and national level, including the promotion and implementation of nationwide immunisation programs, HR, governance, and risk management.

▪ Retired.

Page 6 of 42

St John Ambulance Australia (NSW) and its controlled entity

Directors' Report

SCOTT MCDONALD

BA, LLB, FAICD

Independent Non-Executive Director ▪ Legal Practitioner

Deputy Chair of the Board of Directors

▪ Senior Member, NSW Civil & Administrative Tribunal, Consumer & Commercial Division.

CORETTA BESSI

BCom, MBA, GAICD

Member of the Audit, Risk & Investment Committee

▪ Facilitator, Australian Institute of Company Directors, Company Directors’ Course.

▪ Fellow, Australian Institute of Company Directors.

▪ Lead partner in the pro-bono practice and successfully run appeals involving human rights to the High Court of Australia.

Independent Non-Executive Director

Chair of the People & Governance Committee to October 2022

Chair of the People & Culture Committee from October 2022

Member of the Audit, Risk & Investment Committee

▪ Experienced C-Suite Executive.

▪ Extensive experience across procurement, supply chain, financial services, risk and compliance and information technology.

▪ Leadership experience in public, private and not-forprofit organisations.

▪ Lecturer University of Wollongong / Sydney Business School (Procurement / Negotiations).

STEPHEN WOODHILL

BA, MComm, FCCPA, AFAMI, MAICD, MPRIA, CPM

Independent Non-Executive Director

Member of the Honours & Awards Committee

▪ Experienced Chief Executive Officer.

▪ Extensive experience in corporate governance, issues and crisis management, government relations, investor relations, corporate & social responsibility, media relations and internal communication.

Member of the People, Clinical & Governance Committee to October 2022

Member of the People & Culture Committee from October 2022

▪ Leadership experience in Not-for-Profit industry association and advocacy groups.

ABN 84 001 738 370

Page 7 of 42

St John Ambulance Australia (NSW) and its controlled entity

Directors' Report

MICK CAMPBELL

Independent Non-Executive Director

BSc, GAICD Chair of the Audit, Risk & Investment Committee

▪ Internationally experienced CIO / IT Director of 20 years.

▪ Specialises in technology transformations and turnarounds.

▪ Industry experience includes Higher Education, Healthcare, Professional Services, Technology and Finance.

ILAN LOWBEER

B. Eng (Hons 1), M Sc (Logistics), GAICD

Commissioner and Director

Member of the Honours & Awards Committee

Member of the People, Clinical & Governance Committee to October 2022

Member of the Clinical Governance Committee from October 2022

▪ 15 years’ experience in commercial and supply chain management.

▪ Graduate, Australian Institute of Company Directors.

▪ 20 years’ experience in volunteer leadership and management roles.

LARISSA COOK

Independent Non-Executive Director (Appointed 15 September 2022)

Strategic commercial and legal advisor with nearly 30 years' experience in-house and in private practice both in Australia and internationally with particular focus on health and emergency management.

BA (Hons), LLB (Syd), FGIA, GAICD

Chair of the Clinical Governance Committee from October 2022

Member of the Audit, Risk & Investment Committee from October 2022

DR EVELYNE TADROS Independent Non-Executive Director (Appointed 15 September 2022)

DHSc, MBehSc, BA, GAICD

Member of the Honours & Awards Committee from October 2022

Member of the People & Culture Committee from October 2022

Member of the Clinical Governance Committee from October 2022

Experienced non-executive, Fellow of the Governance Institute of Australia and Graduate of the Australian Institute of Company Directors.

Former Senior Legal Member of the Guardianship Division of the NSW Civil & Administrative Tribunal

C-suite Executive and Board Director.

Experience across NFP and Government.

Expertise in strategic leadership, governance and operations.

Conscious and servant leadership involving quality mentoring, coaching and employee/volunteer capability building.

ABN 84 001 738 370

Page 8 of 42

St John Ambulance Australia (NSW) and its controlled entity

ABN 84 001 738 370

Directors' Report

The People & Clinical Governance Committee was replaced with the People & Culture Committee and the Clinical Governance Committee in October 2022.

MEETINGS OF DIRECTORS

The number of Directors’ meetings (including meetings of committees of Directors) and number of meetings attended by each of the Directors of the Group during the financial year are:

Board Meetings Audit Risk & Investment Committee

EVENTS SUBSEQUENT TO BALANCE DATE

No matters or circumstances have arisen which have significantly affected, or may significantly affect, the operations of the Group, the results of those operations or affairs of the Group in future financial years.

Page 9 of 42

Honours

Award Committee Directors Eligible to Attend Attended Eligible to Attend Attended Eligible to Attend Attended Sean McGuinness 11 11 - - 3 3 Scott McDonald 11 11 5 4 -Coretta Bessi 11 8 5 4 -Sue Campbell-Lloyd 11 10 - - 3 3 Ilan Lowbeer 11 11 - - 3 3 Mick Campbell 11 11 5 5 -Stephen Woodhill 11 9 - - 3 3 Larissa Cook 3 3 1 1 -Evelyne Tadros 3 3 - - 1 1

and

Directors Eligible to Attend Eligible to Attend Attended Attended Sean McGuinness - - -Scott McDonald - - -Coretta Bessi 3 3 -Sue Campbell-Lloyd 3 2 1 1 Ilan Lowbeer 3 3 1 1 Mick Campbell - - -Stephen Woodhill 3 2 -Larissa Cook - - 1 1 Evelyne Tadros 1 - 1 1

People, Clinical & Governance Committee Clinical Governance Committee

St John Ambulance Australia (NSW) and its controlled entity ABN 84 001

Directors' Report

Sean McGuinness Chair

Date: 23 March 2023

Mick

Date: 23 March 2023

738 370

Page 10 of 42

Campbell Director

Consolidated Statement of Profit or Loss and Other Comprehensive Income

St John Ambulance Australia (NSW) and its controlled entity ABN 84 001 738 370

The Consolidated Statement of Profit or Loss and Other Comprehensive Income are to be read in conjunction with the accompanying notes to the consolidated financial statements. Page 11 of 42 For the financial year ended 31 December 2022 2022 2021 Note $,000 $,000 REVENUE Product Sales Revenue 10,923 10,633 Training Course Fees Revenue 7,859 6,251 Medical Support Services 5,213 9,877 Event Fees Revenue 2,657 1,173 Donations and Bequests 199 189 Government Grants 2 3,574 16,284 Other Grants - 61 Other Revenue 3 1,646 1,438 OTHER INCOME Gain on Sale of Property, Plant & Equipment - 4 EXPENSES Administration Expenses (3,123) (3,037) Contribution to St John Ambulance Australia (National Office) (428) (405) Depreciation and Amortisation 4 (2,224) (2,218) Distribution Expenses (5,535) (5,334) Employee Expenses (15,782) (26,216) Finance Expenses 5 (118) (135) Marketing Expenses (278) (375) Property Expenses (907) (656) Training Expenses (508) (466) Transport Expenses (1,170) (653) Volunteer Service Expenses (1,210) (743) Other Expenses (1,114) (2,118) (Deficit)/Surplus from operations (326) 3,554 (Deficit)/Surplus for the financial year (326) 3,554 OTHER COMPREHENSIVE INCOME Changes in the fair value of equity instruments (3,974) 2,680 Total Comprehensive Deficit (4,300) 6,234

St John Ambulance Australia (NSW) and its controlled entity

ABN 84 001 738 370

Consolidated Statement of Financial Position

As at 31 December 2022

The Consolidated Statement of Financial Position

to be read in conjunction with the accompanying notes to

consolidated financial statements. Page 12 of 42 2022 2021 Note $,000 $,000 ASSETS CURRENT ASSETS Cash and Cash Equivalents 6 17,414 5,979 Trade and Other Receivables 7 2,330 1,996 Finance Assets 8 162 162 Inventories 9 2,609 1,281 Other Assets 1,060 1,051 Total Current Assets 23,575 10,469 NON-CURRENT ASSETS Financial Assets 8 19,682 29,836 Property, Plant and Equipment 10 3,603 3,228 Intangibles 11 204 190 Right-of-Use Asset 12 2,453 2,403 Other Assets 214 76 Total Non-Current Assets 26,156 35,733 Total Assets 49,731 46,202 LIABILITIES CURRENT LIABILITIES Trade and Other Payables 13 3,533 3,279 Employee Entitlements 14 882 853 Provisions 15 535 678 Lease Liabilities 12 1,396 957 Other Liabilities 16 8,198 725 Total Current Liabilities 14,544 6,492 NON-CURRENT LIABILITIES Employee Entitlements 14 305 280 Lease Liabilities 12 1,463 1,711 Other Liabilities 16 10 10 Total Non-Current Liabilities 1,778 2,001 Total Liabilities 16,322 8,493 Net Assets 33,409 37,709 EQUITY Reserves 17 (400) 3,574 Accumulated Funds 33,809 34,135 Total Equity 33,409 37,709

are

the

St John Ambulance Australia (NSW) and its controlled entity

ABN 84 001 738 370

Consolidated Statement of Changes in Equity

As at 31 December 2022

The Consolidated Statement of Changes in Equity

to be read in conjunction with the accompanying notes to

financial

Page 13 of 42 OCI Reserve Accumulated Funds Total $,000 $,000 $,000 Balance as at 1 January 2021 894 30,581 31,475 Surplus for the Year - 3,554 3,554 Other Comprehensive Income 2,680 - 2,680 Total Comprehensive Income 2,680 3,554 6,234 3,574 34,135 37,709 Balance as at 31 December 2021 Balance as at 1 January 2022 3,574 34,135 37,709 Deficit for the Year (326) (326) Other Comprehensive Deficit (3,974) - (3,974) Total Comprehensive Deficit (3,974) (326) (4,300) Balance as at 31 December 2022 (400) 33,809 33,409

are

the consolidated

statements.

St John Ambulance Australia (NSW) and its controlled entity

ABN 84 001 738 370

Consolidated Statement of Cash Flows

For the year ended 31 December 2022

The Consolidated Statement

Cash Flows

to be read in conjunction with the accompanying notes to the consolidated financial statements. Page 14 of 42 2022 2021 $,000 $,000 OPERATING ACTIVITIES Receipts from Customers 37,176 22,123 Payment to Suppliers and Employees (34,538) (38,547) Donations and Grants Received 3,773 16,535 Dividends received 1,461 1,205 Interest Paid (118) (135) Interest Received - 1 Net Cashflow from Operating Activities 7,754 1,182 INVESTING ACTIVITIES Acquisition of Property, Plant and Equipment (1,435) (1,524) Acquisition of Intangibles (63) (129) Reinvestment/drawdown of Funds 6,179 (4,335) Net Cash from/(used in) Investing Activities 4,681 (5,988) FINANCING ACTIVITIES Payment of Lease Liabilities (1,001) (1,333) Net Cash from/(used in) Financing Activities (1,001) (1,333) Net Increase/(Decrease) in Cash and Cash Equivalents 11,434 (6,139) Cash and Cash Equivalents at the Beginning of the Period 5,979 12,118 Cash and Cash Equivalents at the End of the Period 17,413 5,979

of

are

Notes to the Consolidated Financial Statements

For the financial year ended 31 December 2022

1) REPORTING ENTITY

The financial report includes the consolidated financial statements and notes of St John Ambulance Australia (NSW) (“the Company”) and its controlled entity (“the Group”). The Group is registered as a Company limited by guarantee.

These consolidated financial statements were authorised for issue by the Board of Directors as of the date of the Directors Declaration.

2) BASIS OF PREPARATION

a) Statement of Compliance

These consolidated financial statements are general purpose financial statements for distribution to the members and for the purpose of fulfilling the requirements of the Corporations Act 2001. They have been prepared in accordance with Australian Accounting Standards - Simplified Disclosures made by the Australian Accounting Standards Board and the Corporations Act 2001

These consolidated financial statements are the first general purpose financial statements prepared in accordance with Australian Accounting Standards - Simplified Disclosures. In the prior year the consolidated financial statements were special purpose financial statements. There was no impact on the recognition and measurement of amounts recognised in the consolidated statements of financial position, profit and loss and other comprehensive income and cash flows of the Group as a result of the change in the basis of preparation.

b) Basis of measurement

The consolidated financial statements have been prepared on an accruals basis and are based on historical costs unless otherwise stated in the notes.

c) Functional and presentation currency

These consolidated financial statements are presented in Australian dollars, which is the Group's functional currency.

d) Use of judgements and estimates

In preparing these consolidated financial statements, management has made judgements and estimates that affect the application of the Group’s accounting policies and the reported amounts of assets, liabilities, income and expenses. Actual results may differ from these estimates.

Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to estimates are recognised prospectively.

Details of the specific judgement, estimates and assumptions that have the most significant effects on the amounts recognised in the consolidated financial statements are summarised in the Notes.

e) Key estimates

i) Impairment - general

The Group assesses impairment at the end of each reporting period by evaluation of conditions and events specific to the Group that may be indicative of impairment triggers. Recoverable amounts of relevant assets are reassessed using value-in-use calculations which incorporate various key assumptions.

ii) Estimation of useful lives of assets

The estimation of the useful lives of assets has been based on historical experience as well as manufacturers' warranties (for plant and equipment) and turnover policies (for motor vehicles). In addition, the condition of the assets is assessed at least once per year and considered against the remaining useful life. Adjustments to useful lives are made when considered necessary.

St John Ambulance Australia (NSW) and its controlled entity ABN 84 001 738 370

The Consolidated Notes to the Financial Statements are to be read in conjunction with the accompanying notes to the consolidated financial statements. Page 15 of 42

Notes to the Consolidated Financial Statements

For the financial year ended 31 December 2022

iii) Lease term

The lease term is a significant component in the measurement of both the right-of-use asset and lease liability. Judgement is exercised in determining whether there is reasonable certainty that an option to extend the lease or purchase the underlying asset will be exercised, or an option to terminate the lease will not be exercised, when ascertaining the periods to be included in the lease term. In determining the lease term, all facts and circumstances that create an economical incentive to exercise an extension option, or not to exercise a termination option, are considered at the lease commencement date. Factors considered may include the importance of the asset to the Group's operations; comparison of terms and conditions to prevailing market rates; incurrence of significant penalties; existence of significant leasehold improvements; and the costs and disruption to replace the asset. The Group reassesses whether it is reasonably certain to exercise an extension option, or not exercise a termination option, if there is a significant event or significant change in circumstances.

iv) Incremental borrowing rate

Where the interest rate implicit in a lease cannot be readily determined, an incremental borrowing rate is estimated to discount future lease payments to measure the present value of the lease liability at the lease commencement date. Such a rate is based on what the Group estimates it would have to pay a third party to borrow the funds necessary to obtain an asset of a similar value to the right-of-use asset, with similar terms, security and economic environment.

v) Lease make good provision

A provision has been made for the present value of anticipated costs for future restoration of leased premises. The provision includes future cost estimates associated with closure of the premises. The calculation of this provision requires assumptions such as application of closure dates and cost estimates. The provision recognised for each site is periodically reviewed and updated based on the facts and circumstances available at the time. Changes to the estimated future costs for sites are recognised in the statement of consolidated financial position by adjusting the asset and the provision. Reductions in the provision that exceed the carrying amount of the asset will be recognised in profit or loss.

vi) Allowance for expected credit losses

The allowance for expected credit losses assessment requires a degree of estimation and judgement. It is based on the lifetime expected credit loss, grouped based on days overdue, and makes assumptions to allocate an overall expected credit loss rate for each group. These assumptions include recent sales experience and historical collection rates.

vii) Provision for impairment of inventories

The provision for impairment of inventories assessment requires a degree of estimation and judgement. The level of the provision is assessed by taking into account the recent sales experience, the ageing of inventories and other factors that affect inventory obsolescence.

viii) Comparatives

Where required by Accounting Standards comparative figures have been adjusted to conform to changes in presentation for the current financial year. Where the Group has retrospectively applied an accounting policy, made a retrospective restatement or reclassified items in its financial statements, an additional statement of financial position as at the beginning of the earliest comparative period will be disclosed.

St John Ambulance Australia (NSW) and its controlled entity ABN 84 001 738 370

The Consolidated Notes to the Financial Statements are to be read in conjunction with the accompanying notes to the consolidated financial statements. Page 16 of 42

Notes to the Consolidated Financial Statements

For the financial year ended 31 December 2022

SIGNIFICANT ACCOUNTING POLICIES

The principal accounting policies adopted in the preparation of the financial report are set out below. These policies have been consistently applied to all the years presented, unless otherwise stated.

BASIS OF CONSOLIDATION

i. Controlled entities

The consolidated financial reports comprise of the financial statements of the Group and its subsidiaries. Subsidiaries are entities controlled by the Group. Control exists when the entity has the power to govern the financial and operating policies of an entity so as to obtain benefits from its activities.

The financial statements of controlled entities are included in the consolidated financial report from the date control commences until the date control ceases.

ii. Loss of control

When the Group loses control over a subsidiary, it derecognizes the assets and liabilities of the subsidiary and other components of equity. Any resulting gain or loss is recognised in the profit or loss. Any interest retained in the former subsidiary is measured at fair value when control is lost.

iii. Transactions eliminated on consolidation

Intra-group balances and transactions, and any unrealized income and expense arising from intra-group transactions, are eliminated. Unrealised gains arising from transactions with associates are eliminated against the investment to the extent of the Group’s interest in the investee. Unrealised losses are eliminated in the same way as unrealized gains, but only to the extent that there is no evidence of impairment.

FOREIGN CURRENCY

Transactions in foreign currencies are translated into the respective functional currencies of the Group companies at the exchange rates at the dates of the transactions.

Monetary assets and liabilities denominated in foreign currencies are translated into the functional currency at the exchange rate at the reporting date. Non-monetary assets and liabilities that are measured at fair value in a foreign currency are translated into the functional currency at the exchange rate when the fair value was determined. Nonmonetary items that are measured based on historical cost in a foreign currency are translated at the exchange rate at the date of the transaction.

Foreign currency differences are generally recognised in profit or loss and presented within finance costs.

INCOME TAX

The Group are exempt institutions from income tax under Division 50 of the Income Tax Assessment Act 1997 The Group has deductible gift recipient (DGR) status.

INVENTORIES

Inventories are measured at the lower of cost and net realisable value. Net realisable value represents the estimated selling price for inventories less all estimated costs of completion and costs necessary to make the sale.

St John Ambulance Australia (NSW) and its controlled entity ABN 84 001 738 370

The Consolidated Notes to the Financial Statements are to be read in conjunction with the accompanying notes to the consolidated financial statements. Page 17 of 42

Notes to the Consolidated Financial Statements

For the financial year ended 31 December 2022

PROPERTY PLANT & EQUIPMENT

i. Recognition and measurement

Items of property, plant and equipment are measured at cost, which includes capitalised borrowing costs, less accumulated depreciation and any accumulated impairment losses.

If significant parts of an item of property, plant and equipment have different useful lives, then they are accounted for as separate items (major components) of property, plant and equipment.

Any gain or loss on disposal of an item of property, plant and equipment is recognised in profit or loss.

Land and buildings are carried at cost, less depreciation and impairment losses on buildings. The carrying amount of land and buildings is reviewed annually by the Directors to ensure that it is not in excess of the recoverable amount from those assets.

ii. Subsequent expenditure

Subsequent expenditure is capitalised only if it is probable that the future economic benefits associated with the expenditure will flow to the Group.

iii. Depreciation

Depreciation is calculated to write off the cost of items of property, plant and equipment less their estimated residual values using the straight- line method over their estimated useful lives, and is generally recognised in profit or loss. Land is not depreciated.

The estimated useful lives of property, plant and equipment for current and comparative periods are as follows:

Buildings

Furniture and equipment

Motor vehicles

20 – 30 years

3 – 15 years

5 years

Depreciation methods, useful lives and residual values are reviewed at each reporting date and adjusted if appropriate.

LEASES

At inception of a contract, the Group assesses whether a contract is, or contains, a lease. A contract is, or contains, a lease if the contract conveys the right to control the use of an identified asset for a year of time in exchange for consideration.

i. As a lessee

At commencement or on modification of a contract that contains a lease component, the Group allocates the consideration in the contract to each lease component on the basis of its relative stand-alone prices. However, for the leases of property the Group has elected not to separate non-lease components and account for the lease of property the Group has elected not to separate non-lease components and account for the lease and non-lease components as a single lease component.

The Group recognises a right-of-use asset and a lease liability at the lease commencement date. The right-of-use asset is initially measured at cost, which comprises the initial amount of the lease liability adjusted for any lease payments made at or before the commencement date, plus any initial direct costs incurred and an estimate of costs to dismantle and remove the underlying asset or to restore the underlying asset or the site on which it is located, less any lease incentives received.

St John Ambulance Australia (NSW) and its controlled entity ABN 84 001 738 370

The Consolidated Notes to the Financial Statements are to be read in conjunction with the accompanying notes to the consolidated financial statements. Page 18 of 42

Notes to the Consolidated Financial Statements

For the financial year ended 31 December 2022

The right-of-use asset is subsequently depreciated using the straight-line method from the commencement date to the end of the lease term, unless the lease transfers ownership of the underlying asset to the Group by the end of the lease term or the cost of the right-of-use asset reflects that the Group will exercise a purchase option. In that case the right-of-use asset will be depreciated over the useful life of the underlying asset, which is determined on the same basis as those of property and equipment. In addition, the right-of-use asset is periodically reduced by impairment losses, if any, and adjusted for certain remeasurements of the lease liability.

The estimated useful life used for each class of right-of-use assets is:

3 – 5 years

3 – 5 years

The lease liability is initially measured at the present value of the lease payments that are not paid at the commencement date, discounted using the interest rate implicit in the lease or, if that rate cannot be readily determined, the Group’s incremental borrowing rate. Generally, the Group uses its incremental borrowing rate as the discount rate

The Group determines its incremental borrowing rate by obtaining interest rates from various external financing sources and makes certain adjustments to reflect the terms of the lease and type of the asset leased.

Lease payments included in the measurement of the lease liability comprise the following:

- fixed payments, including in-substance fixed payments;

- variable lease payments that depend on an index or a rate, initially measured using the index or rate as at the commencement date;

- amounts expected to be payable under a residual value guarantee; and

- the exercise price under a purchase option that the Group is reasonable certain to exercise, lease payments in an optional renewal period if the Group is reasonably certain to exercise an extension option, and penalties for early termination of a lease unless the Group is reasonably certain not to terminate early.

The lease liability is measured at amortised cost using the effective interest method. It is remeasured when there is a change in future lease payments arising from a change in an index or rate, if there is a change in the Group’s estimate of the amount expected to be payable under a residual value guarantee, if the Group changes its assessment of whether it will exercise a purchase, extension or termination option or if there is a revised insubstance fixed lease payment.

When the lease liability is remeasured in this way, a corresponding adjustment is made to the carrying amount of the right-of-use asset, or is recorded in profit or loss if the carrying amount of the right-of-use asset has been reduced to zero.

ii. Short-term leases and leases of low-value assets

The Group has elected not to recognise right-of-use assets and lease liabilities for leases of low-value assets and short-term leases. The Group recognises the lease payments associated with these leases as an expense on a straight-line basis over the lease term.

CASH AND CASH EQUIVALENTS

Cash and cash equivalents includes cash on hand, deposits held at call with financial institutions, other short-term, highly liquid investments with original maturities of three months or less that are readily convertible to known amounts of cash and which are subject to an insignificant risk of changes in value and bank overdrafts. Bank overdrafts are shown within borrowings in current liabilities on the consolidated statement of financial position.

St John Ambulance Australia (NSW) and its controlled entity ABN 84 001 738 370

The Consolidated Notes to the Financial Statements are to be read in conjunction with the accompanying notes to the consolidated financial statements. Page 19 of 42

Leases of land and buildings

Leases of plant and equipment

Notes to the Consolidated Financial Statements

For the financial year ended 31 December 2022

FINANCIAL INSTRUMENTS

i. Recognition and initial measurement

Trade receivables and debt securities issued are initially recognised when they are originated. All other financial assets and financial liabilities are initially recognised when the Group becomes a party to the contractual provisions of the instrument.

A financial asset (unless it is a trade receivable without a significant financing component) or financial liability is initially measured at fair value plus, for an item not at FVTPL, transaction costs that are directly attributable to its acquisition or issue. A trade receivable without a significant financing component is initially measured at the transaction price.

ii. Classification and subsequent measurement Financial assets

On initial recognition, a financial asset is classified as measured at amortised cost or FVTPL.

Financial assets are not reclassified subsequent to their initial recognition unless the Group changes its business model for managing financial assets, in which case all affected financial assets are reclassified on the first day of the first reporting period following the change in the business model.

A financial asset is measured at amortised cost if it meets both of the following conditions and is not designated as at FVTPL:

- it is held within a business model whose objective is to hold assets to collect contractual cash; and - its contractual terms give rise on specified dates to cash flows that are solely payments of principal and interest on the principal amount outstanding.

Financial assets not classified as measured at amortised cost as described above are measured at FVTPL. On initial recognition, the Group may irrevocably designate a financial asset that otherwise meets the requirements to be measured at amortised cost as at FVTPL if doing so eliminates or significantly reduces an accounting mismatch that would otherwise arise.

Financial assets in the “at amortized cost” category particularly include trade accounts receivable (not including factoring), cash and cash equivalents and other receivables.

Cash equivalents are short-term, extremely liquid financial investments that can be converted to cash at any time and that are only subject to insignificant risks of changes in value.

Financial assets - Business model assessment

The Group makes an assessment of the objective of the business model in which a financial asset is held at a portfolio level a because this best reflects the way the business is managed and information is provided to management. The information considered includes:

- the stated policies and objectives for the portfolio and the operation of those policies in practice. These include whether management’s strategy focuses on earning contractual interest income, maintaining a particular interest rate profile, matching the duration of the financial assets to the duration of any related liabilities or expected cash outflows or realising cash flows through the sale of the assets;

- how the performance of the portfolio is evaluated and reported to the Group’s management;

- the risks that affect the performance of the business model (and the financial assets held within that business model) and how those risks are managed;

- how managers of the business are compensated - e. g. whether compensation is based on the fair value of the assets managed or the contractual cash flows collected; and

St John Ambulance Australia (NSW) and its controlled entity ABN 84 001 738 370

The Consolidated Notes to the Financial Statements are to be read in conjunction with the accompanying notes to the consolidated financial statements. Page 20 of 42

Notes to the Consolidated Financial Statements

For the financial year ended 31 December 2022

- the frequency, volume and timing of sales of financial assets in prior periods, the reasons for such sales and expectations about future sales activity.

Transfers of financial assets to third parties in transactions that do not qualify for derecognition are not considered sales for this purpose, consistent with the Group’s continuing recognition of the assets.

Financial assets that are held for trading or are managed and whose performance is evaluated on a fair value basis are measured at FVTPL.

Financial assets - Assessment whether contractual cash flows are solely payments of principal and interest

For the purposes of this assessment, ‘principal’ is defined as the fair value of the financial asset on initial recognition. ‘Interest’ is defined as consideration for the time value of money and for the credit risk associated with the principal amount outstanding during a particular period of time and for other basic lending risks and costs (e. g. liquidity risk and administrative costs), as well as a profit margin.

In assessing whether the contractual cash flows are solely payments of principal and interest, the Group considers the contractual terms of the instrument. This includes assessing whether the financial asset contains a contractual term that could change the timing or amount of contractual cash flows such that it would not meet this condition. In making this assessment, the Group considers:

- contingent events that would change the amount or timing of cash flows;

- terms that may adjust the contractual coupon rate, including variable- rate features;

- prepayment and extension features; and

- terms that limit the Group's claim to cash flows from specified assets (e. g. non-recourse features).

A prepayment feature is consistent with the solely payments of principal and interest criterion if the prepayment amount substantially represents unpaid amounts of principal and interest on the principal amount outstanding, which may include reasonable compensation for early termination of the contract. Additionally, for a financial asset acquired at a discount or premium to its contractual per amount, a feature that permits or requires prepayment at an amount that substantially represents the contractual par amount plus accrued (but unpaid) contractual interest (which may also include reasonable compensation for early termination) is treated as consistent with this criterion if the fair value of the prepayment feature is insignificant at initial recognition.

Financial assets - Subsequent measurement and gains and losses

Financial assets at FVTPL

Financial assets at amortised cost

These assets are subsequently measured at fair value. Net gains and losses, including any interest or dividend income, are recognised in profit or loss.

These assets are subsequently measured at amortised cost using the effective interest method. The amortised cost is reduced by impairment losses. Interest income, foreign exchange gains and losses and impairment are recognised in profit or loss. Any gain or loss on derecognition is recognised in profit or loss.

Financial liabilities - Classification, subsequent measurement and gains and losses

Financial liabilities are classified as measured at amortised cost or FVTPL. A financial liability is classified as at FVTPL if it is classified as held- for- trading. Financial liabilities at FVTPL are measured at fair value and net gains and losses, including any interest expense, are recognised in profit or loss. Other financial liabilities are subsequently measured at amortised cost using the effective interest method. Interest expense and foreign exchange gains and losses are recognised in profit or loss. Any gain or loss on derecognition is also recognised in profit or loss.

St John Ambulance Australia (NSW) and its controlled entity ABN 84 001 738 370

The Consolidated Notes to the Financial Statements are to be read in conjunction with the accompanying notes to the consolidated financial statements. Page 21 of 42

Notes to the Consolidated Financial Statements

For the financial year ended 31 December 2022

Financial liabilities in the category “at amortized cost” are mainly liabilities (borrowings) to banks and trade accounts payables.

iii. Derecognition

Financial assets