Retail Management & Operations Toolkit

3.2

b.

Introduction to the Toolkit: Realizing the potential of hotel retail

THE PURPOSE OF THE TOOLKIT

Hotel retail in APAC is particularly challenging given the stiff competition it faces (from convenience stores, cafes, food delivery and vending machines etc.) and a lack of retail know-how among hoteliers

This Toolkit aims to create a “base” of core retail knowledge to help hoteliers improve retail operations quickly with less effort, supported by practical, real-life guidance and best practice sharing

THE POTENTIAL OF HOTEL RETAIL – WHAT’S IN IT FOR YOU?

Examining successful hotel retail operations in APAC both within and outside Hilton, we found that retail has the potential to:

REINFORCE THE BRAND PROMISE

Bring the hotel’s brand and personality to life, add to the overall atmosphere of the property and create a sense of place

On the flipside, poorly managed retail can hurt guests' perception of the property

PROVIDE CONVENIENCE AND DELIGHT

Delight guests with not only needed essentials but also elevated and desirable offerings they would want

DRIVE INCREMENTAL REVENUES/PROFITS THROUGH RETAIL NICHES

While hotel retail will not outcompete convenience stores in APAC, there are niches where hotels can shine; more financially successful offerings include:

Investing some management attention into retail could unlock outsized rewards by primarily enhancing the customer experience but also potentially strengthening revenue streams from retail

This Toolkit covers 3 retail formats

HOTEL SHOPS & SELF-SERVICE FORMATS

STORE FORMAT: MANNED OR SELF-SERVICE

STORE FORMAT: MANNED GRAB & GO SEASONAL POP-UPS 01 02 03

STORE FORMAT: MANNED

Retail shops operated by the hotel formats with products commonly ranging from snacks to traveler’s essentials and gifts such merchandise and locally produced lifestyle products/ souvenirs

Retail shops operated by the hotel that offer takeaways options such as pastries and coffee as well as a retail section in-store; larger Grab and Go formats may also include dine-in

Non-permanent retail concepts operated by the hotel that provide customers with a selection of seasonal products such as Christmas cookies and mooncakes through hotel pop-up shops

How to use the Toolkit? (1/2)

This Toolkit is designed to provide general advice on retail mgmt. and operations

• Recommendations outlined in the Toolkit should be taken as reference guidelines; implementation is encouraged but left to the discretion of property leadership

• Specific brand guidelines would take precedence over Toolkit recommendations

<hyperlink text> Click to be redirected to specific individual page Understanding key elements

Key principles and considerations for implementation A step-by-step guide for implementation

Supporting tool(s) (templates in MS Excel or otherwise)

: Recommended best practices Watchout/key area(s) to take note of Reference use cases

Step by step implementation guidelines

IDENTIFY

Use self-assessment questions to identify key sections of the Toolkit to focus on

Click here to begin the self-assessment (Link directs you to self-assessment questions on the next page)

Prioritize key Toolkit sections, starting with sections with biggest gaps identified in the self-assessment

Refer to “Getting Started” checklist as a base to help you get started – a general approach is outlined below

Step A Read through relevant Toolkit section

Step B Assign person(s) in charge and budget (if needed)

Step C Develop implementation plan

Step D Execute and measure progress, setting milestones/check ins every 1-2 weeks

Click here to get started (Link directs you to Appendix I)

Self-assessment checklist (1/6)

QUESTIONS FOR SELF-ASSESSMENTS

Prioritize reading through the section if any of the following is true…

1. We do not have SOPs for key store operations processes (e.g., daily operations checklists, repairs & maintenance, refunds & exchange policy etc.)

1.1aiv. Refunds, exchanges and product recalls

1.1ai. Unmanned store ops checklist Click here to get started 1.1aii. Manned store ops checklist 1.1aiii. Store repairs and maintenance

2. We do not have tools to store and share information and manage retail operations planning 1.1bi. Information repository 1.1bii. Project management and team collaboration tools

3. We do not track and monitor KPIs for retail financial performance (e.g., revenue and profitability) as well as nonfinancial operational metrics

KPIs and performance reporting 4. We do not use sales forecasting for retail

Sales forecasting

The next page provides a comparison of the tools → QUESTIONS

SECTION 1.1 GENERAL STORE OPERATIONS

Self-assessment checklist (2/6)

QUESTIONS FOR SELF-ASSESSMENTS

Prioritize reading through the section if any of the following is true…

SECTION 1.2 STORE INVENTORY MANAGEMENT

1. We do not have SKU identifiers for our products

2. We do not have/follow guidelines on storeroom set up and management 1.2bi. Storeroom setup and management

3. We do not have/follow guidelines on management of inventory levels and/or face issues such as stockouts or overstocking 1.2bii. Inventory level management

Annual stock take

Create a Stock Keeping Unit (SKU) Click here to get started

Negative stock

4. We do not perform regular stock takes and shrinkage checks

5. We do not actively manage soon-to-expire products

6. We do not use tools to manage inventory (e.g., inventory expiry and shrinkage)

Shrinkage adjustment

Review shrinkage report

Expiry management

Review shrinkage report

Expiry management

Self-assessment checklist (3/6)

QUESTIONS FOR SELF-ASSESSMENTS

Prioritize reading through the section if any of the following is true…

1. (For manned stores) We do not have/follow guidelines for customer service in stores (e.g., greeting customers, helping them when they shop, helping customers checkout products etc.) 1.3ai. Greeting customers Click here to get started 1.3aii. Helping customers while they shop 1.3aiii. Helping customers checkout 1.3av. Handling customer complaints 1.3avi. Handling customer compliments

2. (For unmanned stores) We face challenges in implementing checkout for unmanned store or are looking into other options for self checkout 1.3aiv. Self-checkout for unmanned stores

3. There is no training of team members involved in retail

4. There is no tracking of customer feedback and satisfaction for retail

Training team members

Feedback channel options

Additional guidelines for customer satisfaction surveys

SECTION 1.2 STORE INVENTORY MANAGEMENT

Self-assessment checklist (4/6)

QUESTIONS FOR SELF-ASSESSMENTS

Prioritize reading through the section if any of the following is true…

QUESTIONS

SECTION 1.4 OTHER CHANNELS

1. We feel there might be a demand for in-room delivery of items from our store and we also currently offer room service

2. We feel there might be a demand for a click and collect service for our store

SECTION 2.1 CATEGORY STRATEGY

1. We face challenges in category and product selection

2. We do not currently tailor product mix to segment needs

3. We are interested in developing branded/ or co-branded merchandise

4. We do not plan any seasonal campaigns/promotions for our shop or face challenges in doing so

1.4a. In-room delivery and click and collect Click here to get started

2.1a. Category strategy and product selection Click here to get started

2.1b. Seasonal planning

5. We do not have an SOP for listing new products 2.1c. Listing new products

Self-assessment checklist (5/6)

QUESTIONS FOR SELF-ASSESSMENTS

Prioritize reading through the section if any of the following is true…

SECTION

2.2

ASSORTMENT RATIONALIZATION

1. We face challenges in optimizing our product assortment 2.2a. Assortment Optimization

2. We do not have/follow guidelines for rationalization of product assortment

3. We do not have any SOPs for delisting products 2.2b. Delisting process

SECTION 2.3 PRODUCT PRICING

2. We do not consider price competitiveness in pricing

1. We face challenges in pricing products 2.3a. Price setting Click here to get started

3. We face challenges in using discounts/ promotions in store

4. We do not have a discount/promotions strategy

Discounts and promotions

Self-assessment checklist (6/6)

QUESTIONS FOR SELF-ASSESSMENTS

Prioritize reading through the section if any of the following is true…

QUESTIONS

1. We face challenges in visual merchandising

2. We do not have/follow guidelines in visual merchandising

3. We do not use strategically use visual merchandising elements (e.g., lighting, displays, shelving, spacing, color etc.) to improve the attractiveness of our store

4. We do not plan product placement on shelving or in displays

5. We do not use point of sales materials (POSM) in our store

2.4a. Visual merchandising and planograms Click here to get started

6. We face challenges in designing and using POSM in our store 2.4b. Point of Sales Materials (POSM)

7. We do not have/follow guidelines on POSM use

SECTION 2.4 VISUAL MERCHANDISING

Addressing key questions in retail operations & management….

A customer wants a refund, what should I do next?

The coffee machine is spoilt, what should I do now?

How should I rearrange the displays?

are

What do I have to do on my shift?

General Store Operations

This section contains guidance on how to perform essential store activities, ensure service excellence and uniformity across stores as well as how to track and manage store performance

SECTION CONTENTS

a. SOPS FOR STORE OPERATIONS PROCESSES

i. Unmanned store operations checklist

ii. Store opening and closing checklist

iii. Store repairs and maintenance

iv. Refunds, exchanges and product recalls

b. COMMUNICATION AND COLLABORATION TOOLS

i. Information repository

ii. Project management and team collaboration tools

c. KPIS AND PERFORMANCE REPORTING

d. SALES FORECASTING

HGI Danang, Vietnam

Unmanned store operations checklist (1/5) – F&B team

Team members to ensure shop floor is cleaned and rubbish is cleared and removed

Team members to replenish shelves at least twice a day (day and night shift)

Shelf replenishment is a good opportunity for team members to note when inventory is low

Team members to inspect the following areas: (Refer to next page for full checklist)

Team members to check email/systems for important updates – supply chain instructions, updates on marketing, prices changes etc.

Unmanned store operations checklist (2/5) – F&B team

OBJECTIVES & BENEFITS

Electrical Fixtures (in working order)

o Ceiling lights

o Air-conditioning

Appliances (in working order and cleaned – non-exhaustive depends on operations)

o Open/closed display chillers

o Ice cream fridge/ freezer

o Microwave/ oven

o Ice machine

Product Displays (cleaned and updated/ replenished)

o Shelves fully replenished, based on planogram

o Expiry dates – remove from display if expired

o Lighting in fixtures – ensure they are working

o Condiments refilled (e.g., sugar sachets)

o Enough packaging available at self-serve station (e.g, paper bags, cups, lids, straws, stirrers etc.)

Selling Floor and Stock Room (cleaned and dust free)

o General cleanliness

o Rubbish cleared away

o Coffee machine

o Water dispensers/ zipline

o Shelves/ fixtures condition – not broken

o Price labels – latest updated pricelist (if any)

o Price labels – promotions are up to date and valid

o Point Of Sales Materials (POSM) (up to date etc.)

Note : Co-ordinate any store-related in room cards/ pricelist replacement with housekeeping department

o No signs of pest infestation (ants, insects, etc.)

o Glass fixtures/ shelves – ensure they are dust-free

Note : Dusty products are a huge turn off for customers, ensure products and shelves are neat and clean

Consider incorporating general store cleanliness and maintenance as part of housekeeping public area checklist

TOOL: CHECKLIST

Unmanned store operations checklist (3/5) – Front desk team

FREQUENCY

When taking over shift from F&B team members

To ensure that the store is in an acceptable condition for operations 01 02

Team members to ensure shopfloor is cleaned and rubbish is cleared and removed 03 04 05 06

Front desk team members to replenish shelves (task may also be assigned to other team members or even Security during the night shift)

Shelf replenishment is a good opportunity for team members to note when inventory is low

Team members to inspect the following areas: (Refer to next page for full checklist)

• Electrical fixtures

• Appliances

• Front desk cashier

• Product displays

• Selling floor and storeroom

Front desk team members to conduct end of shift sales reconciliation (aligned with front desk cash management)

Front desk team members to check POS float (cash in cash register) (aligned with front desk cash management)

Team members to check email/systems for important updates – supply chain instructions, updates on marketing, prices changes etc.

©

Unmanned store operations checklist (4/5) – Front desk team

FREQUENCY

When taking over shift from F&B team members

OBJECTIVES & BENEFITS

To ensure that the store is in an acceptable condition for operations

Electrical Fixtures (in working order)

o Ceiling lights

o Air-conditioning

Appliances (in working order and cleaned – non-exhaustive depends on operations)

o Open/closed display chillers

o Ice cream fridge/ freezer

Front desk cashier (in working order)

o POS

o Microwave/ oven

o Ice machine

o Coffee machine

o Water dispensers/ zipline

o Receipt printer o Credit card terminals, QR payments e.g., Alipay, etc.

Product Displays (cleaned and updated/ replenished)

o Shelves fully replenished, based on planogram

o Expiry dates – remove from display if expired

o Lighting in fixtures – ensure they are working

o Condiments refilled (e.g., sugar sachets)

o Enough packaging available at self-serve station (e.g, paper bags, cups, lids, straws, stirrers etc.)

o Shelves/ fixtures condition – not broken

o Price labels – latest updated pricelist (if any)

o Price labels – promotions are up to date and valid

o Point Of Sales Materials (POSM) (up to date etc.)

NOTE: Co-ordinate any store-related in room cards/ pricelist replacement with housekeeping department

Selling Floor and Stock Room (cleaned and dust free)

o General cleanliness

o Rubbish cleared away

o No signs of pest infestation (ants, insects, etc.)

o Glass fixtures/ shelves – ensure they are dust-free

NOTE: Dusty products are a huge turn off for customers, ensure products and shelves are neat and clean

Consider incorporating general store cleanliness and maintenance as part of housekeeping public area checklist

TOOL: CHECKLIST

Unmanned store operations checklist (5/5) – Preventing theft

GUIDELINES

CCTVs

Install a CCTV to allow for continuous monitoring. Depending on alignment with hotel branding, discreet yet visible signs indicating the presence of CCTVs can also help deter potential shoplifting

SIGNAGES

Place signages in the store to remind and direct customers to pay at the front desk/ via self-checkout etc.

VIGILANCE

Engage front desk team, security guards and lobby ambassadors to keep an eye on the store. Team members must be trained and briefed on how to recognize suspicious behavior and how to approach customers professionally so potential shoplifters feel noticed and deterred

INVENTORY COUNTS

Implement effective inventory control to track and identify discrepancies quickly

CASE STUDY: HGI Serangoon took the following steps to deter theft

• Ensured that there would be CCTV coverage of the shop

• Added multiple signages around the shop reminding guests to pay at the front desk

• Engaged help of security guard or lobby ambassador to keep an eye on the store as they patrol the lobby area

Store opening checklist (1/2)

To ensure that the store is in an acceptable condition for operations 01 02 03

Team members to inspect the following areas: (Refer to next page for full checklist)

• Electrical fixtures

• Appliances

• Cashier

• Product displays • Selling floor • Storeroom

Team members to check POS float (cash in cash register)

Team members to check email/systems for important updates

– supply chain instructions, updates on marketing, prices changes etc.

Optimize store operating hours by understanding patterns in guest flows, peak traffic hours; helping in resource planning such as staffing and allow the store to potentially save on some labor costs

CASE STUDY: Hilton Tokyo Bay changed opening hours to 11am – 10pm as traffic flow analysis showed that guest did not visit stores earlier in the day, and demand surged after 9pm as guests returned from the nearby Disneyland attraction. This enabled them to cut the early morning shift

Store opening checklist (2/2)

FREQUENCY Daily

OBJECTIVES & BENEFITS

To ensure that the store is in an acceptable condition to welcome customers

Electrical Fixtures (in working order)

o Ceiling lights

o Air-conditioning

Appliances (in working order and cleaned – non-exhaustive depends on operations)

o Open/closed display chillers

o Ice cream fridge/ freezer

Front desk cashier (in working order)

o POS

o Microwave/ oven

o Ice machine

o Receipt printer

Product Displays (cleaned and updated/ replenished)

o Shelves fully replenished, based on planogram

o Expiry dates – remove from display if expired

o Lighting in fixtures – ensure they are working

o Condiments refilled (e.g., sugar sachets)

o Enough packaging available at self-serve station (e.g, paper bags, cups, lids, straws, stirrers etc.)

o Coffee machine

o Water dispensers/ zipline

o Credit card terminals, QR payments e.g., Alipay, etc.

o Shelves/ fixtures condition – not broken

o Price labels – latest updated pricelist (if any)

o Price labels – promotions are up to date and valid

o Point Of Sales Materials (POSM) (up to date etc.)

o Allergy labels and use-by dates for freshly made

NOTE: Co-ordinate any store-related in room cards/ pricelist replacement with housekeeping department

Selling Floor and Stock Room (cleaned)

o General cleanliness

o Glass fixtures/ shelves – dust free

o No signs of pest infestation (ants, insects, etc.)

o Store exterior e.g., glass panels, store displays etc.

NOTE: Dusty products are a huge turn off for customers, ensure products and shelves are neat and clean

TOOL: CHECKLIST

Store closing checklist

END OF STORE OPERATING HOURS

o Clean and disinfect shopfloor

o Empty rubbish bins

o Ensure shelves are replenished

o For stores with seating, cordon off the area after operating hours to prevent guests from entering

Best Practice: Invite customers who wish to enter after last order timing to visit our store the next day instead and inform them of store operating hours

o Close POS counters and complete sales reconciliation

Note: Ensure discrepancies are escalated to supervisor/ manager on duty

AFTER STORE IS CLOSED

o Ensure cash is deposited/managed according to Property’s cash management guidelines

o Highlight any concerns/incidents/feedback on the daily report or communication log to ensure prompt action is taken

o Turn off unneeded lights and electrical appliances

o Close area and ensure drawers are locked

Optimize store operating hours by understanding patterns in guest flows, peak traffic hours; helping in resource planning such as staffing and allow the store to potentially save on some labor costs

CASE STUDY: Hilton Tokyo Bay changed opening hours to 11am – 10pm as traffic flow analysis showed that guest did not visit stores earlier in the day, and demand surged after 9pm as guests returned from the nearby Disneyland attraction. This enabled them to cut the early morning shift

TOOL: CHECKLIST

Store repairs and maintenance

FREQUENCY

Daily checks with regular maintenance

OBJECTIVES & BENEFITS

• Fully functional store

• Safe and pleasant shopping experience

GUIDELINES

PLANNING AND SCHEDULING

• F&B and Engineering to ensure a scheduled routine for maintenance of appliances

• In the case of urgent/ ad-hoc repairs, F&B to contact relevant vendors for on-loan appliances and Engineering for inhouse appliances

STORE SECURITY

• Ensure identity of the maintenance personnel is verified by security before they are given access to unauthorized areas

• Any repairs/ maintenance work should be supervised

PRIORITIZATION OF REPAIRS/MAINTENANCE WORK

• Repairs and maintenance issues can be grouped based on two levels of urgency:

URGENT

Issues that impact business operations, put team members or customers in danger or create security risks need to be resolved such as:

• Issues with fixtures/shelving/glass displays etc. that put customers or team members at risk of getting hurt

• Issues with appliances (e.g., coffee machine, microwave etc.) and fridges/chillers

• Air conditioning leaks

• Sink leakages

• Lighting issues in the storefront

LESS URGENT

• Issues that do not affect daily operations and can be resolved at the next scheduled maintenance or on a later date

• These issues include but are not limited to:

• Issues with fixtures/shelving/glass displays that do not put customers or team members at risk of getting hurt

• Minor lighting issues

Refunds, exchanges and product recalls (1/2)

GUIDELINES (1/3) FREQUENCY

• Deliver a consistent client experience

• Ensure a clear and ethical framework for handling refunds and faulty products

NOTE: Country-specific rules and regulations must be adhered to, and may supersede guidelines in this Toolkit

TO PREPARED FOOD AND BEVERAGES)

• Made within 7 days of purchase

• Product is a packaged product

• Products in original, unused/unopened and resalable condition

• Refunds and exchanges must be made in same store where it is purchased

• Original receipt is required as a proof of purchase

• Refunds are made using the original mode of payment

• Amount refunded should equal amount paid, inclusive of taxes (including any promotional discounts)

• Other terms and conditions may apply to specific promotional or seasonal items e.g., Christmas Cookies

Refunds, exchanges and product recalls (2/2)

FREQUENCY

As requested

OBJECTIVES & BENEFITS

• Deliver a consistent client experience

• Ensure a clear and ethical framework for handling refunds and faulty products

DEFECTIVE PRODUCTS

• For non-isolated/ repeated incidents of product defects, incident should be recorded and reported to manager on duty

PRODUCT RECALL CAMPAIGNS

Should there be a need to recall products, the following would need to be communicated to team members:

• List of affected items and descriptions

• Communications to customers

• In-store communications

• Instructions for processing (e.g., destroy/dispose or return to supplier)

• FAQ for customer’s queries GUIDELINES (2/3)

GENERAL STEPS WHEN CUSTOMER REQUESTS REFUND/ EXCHANGE

Listen to request and understand reason for refund/exchange

Check and verify if conditions are met (item condition, time from date of sales etc.)

Check and verify original receipt against item

Process the refund/ exchange, ensuring the following are entered correctly in the POS:

• Refund/ exchange Reason Code (if any as required by respective POS systems)

• Refund/ exchange price matches the value in the initial transaction receipt (including any discounts etc.)

NOTE: It is the same refund process as with any other front desk or F&B transaction

Cash: Reverse transaction and pay out cash to the guest

Credit card: Submit refund request to the bank to process and refund the cardholder’s account

Room charge: Remove charge

Document the refund transaction

Document the refund transaction

• A duplicate copy of the Refund/Exchange receipt must be counter-signed by the manager on duty and the cashier to confirm that checks have been completed

• Ensure a signed duplicate copy of the receipt is kept for any end of day POS closing processing

Information repository

FREQUENCY

Update as needed

OBJECTIVES & BENEFITS

• Provide team members with access to all relevant business information

• Facilitate team member’s day-to-day execution of tasks

GUIDELINES

CONTENTS

1. KPI targets for the period

2. Current promotions, events, competition and incentives (if any)

3. Reference FAQ sheets

4. Up-to-date Product information (outlining key selling points of products)

5. Up-to-date team member roster/ schedule

6. Up-to-date store floorplan

7. Up-to-date reference display photos (to help with restocking)

8. Up-to-date planogram

9. Evacuation procedures and safe meeting place

10. Emergency & crisis procedures

11. Business telephone lists (including but not limited to) : -

• Key suppliers

• Maintenance company/ team

• Cleaning team

• Emergency hotline

• Property security office

• Key Hilton Regional Head Office personnel

CHANNELS FOR INFORMATION ACCESS

Internal site (if any)

Mobile group chats (e.g., WhatsApp, WeChat, LINE etc.)

Noticeboard(s) in storeroom

Project management and team collaboration tools (1/2)

FREQUENCY As requested

TOOLS (1/2)

OBJECTIVES & BENEFITS

• Deliver a consistent client experience

• Ensure a clear and ethical framework for handling refunds and faulty products

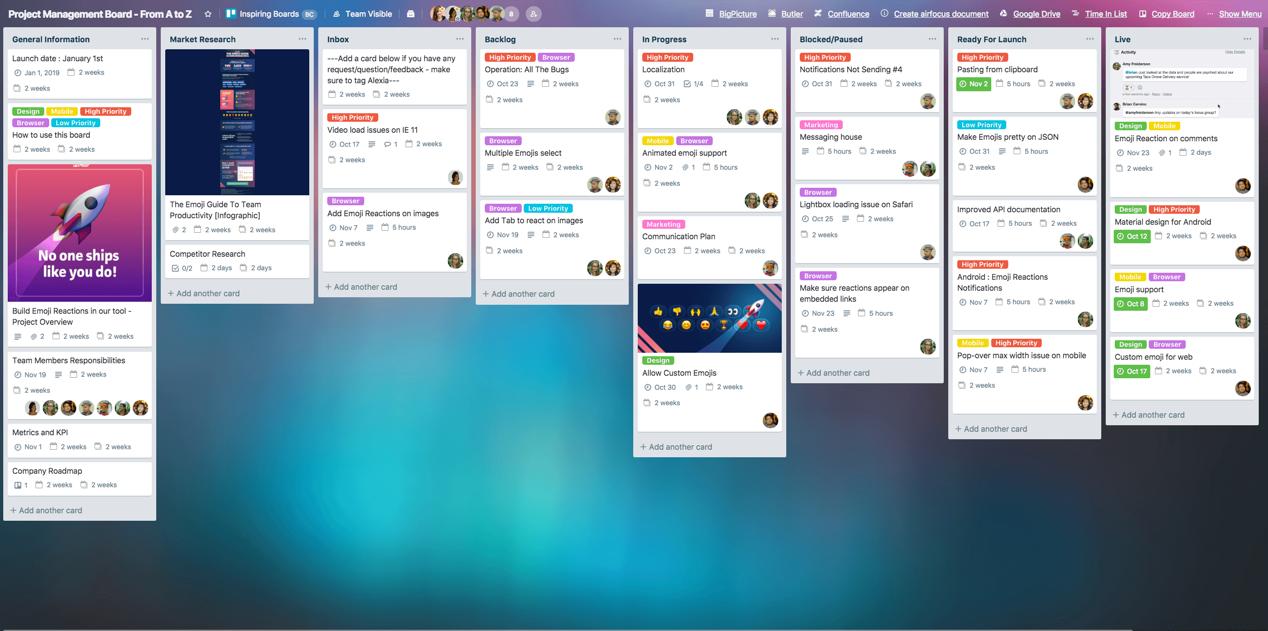

Project management tools help managers and organizations plan, execute, and monitor projects more effectively, ultimately leading to improved project outcomes and greater efficiency. They enable collaboration within the team, help to visualize tasks and progress to keep the team on track, and are easy to use with practice.

When can these tools be used for retail operations management and planning?

SPECIAL PROJECTS SUCH AS…

• Store renovations

• New supplier sourcing

ROUTINE PLANNING OPERATIONS SUCH AS…

• Team member training (and refresher) planning (refer to Section 1.3avii. Training team members)

• Category strategy planning and execution (refer to Section 2.1a. Category strategy and product selection)

• Seasonal planning (refer to Section 2.1b. Seasonal planning)

TYPES OF TOOLS

There are many project management and team collaboration tools available on the market, some of the more widely used tools include the following: The next page provides a comparison of the tools

Project management and team collaboration tools (2/2)

a

client

Ensure a clear and ethical framework for handling refunds and faulty products

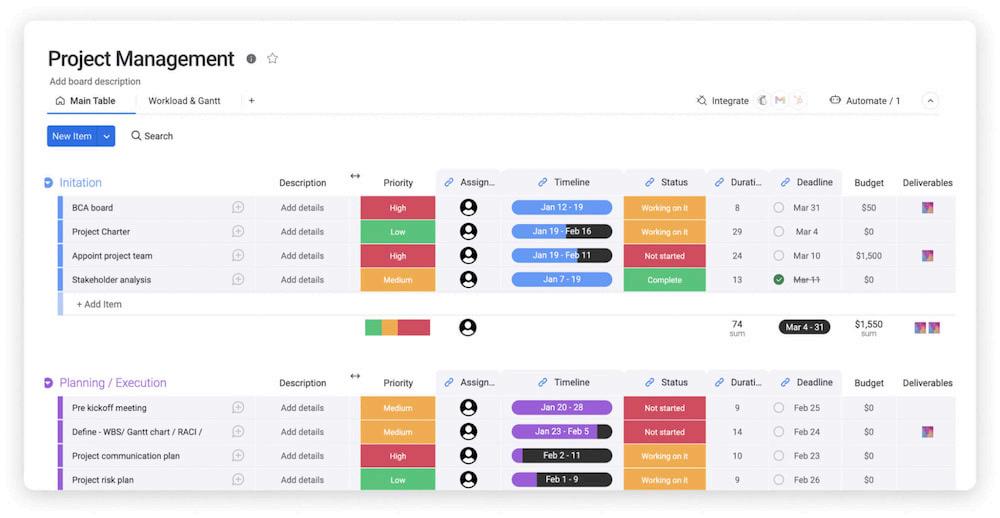

COMPARISON OF PROJECT MANAGEMENT AND TEAM COLLABORATION TOOLS

Below is a comparison of the free plans (paid upgrades also available) for some popular project management and team collaboration tools

Recommended

METRICS

Number of Workspaces

Number of tasks views (e.g., List view, gantt chart, calendar view etc.)

NOTE:

1. Workspaces are highest level in file hierarchy and task organization. At a store level, one Workspace can represent one department, or even a specific initiative

2. Boards/Spaces are generally subordinate to/belong to a larger Workspace (e.g., if Workspace is defined as special projects, one Board/Space can be on store renovation)

KPIs and performance reporting (1/2)

OBJECTIVES & BENEFITS

Provide a comprehensive view of performance, review against target set, and allow for data-driven decision making

01 02 03 04 05

PRINCIPLES FOR KPI SETTING

KPIs ARE SIMPLE

Select a few essential KPIs that are aligned to business objectives and key improvement areas – there is no need to track every single possible KPI and overcomplicate monitoring.

KPIs ARE REALISTIC THERE IS OWNERSHIP OF KPIs

Define, measure and understand baseline performance to guide setting of achievable targets.

Create accountability by clearly assigning personnel in charge of setting and tracking KPIs; they will help to ensure that actions are enforced.

KPIs ARE COMMUNICATED THERE ARE REVIEW MILESTONES

Foster a sense of shared purpose, a common understanding of goals and a culture of transparency by making key KPIs and performance visible to team members.

Set regular interim reviews for the progress against targets, to allow for timely intervention wherever necessary.

KPIs and performance reporting (2/2)

OBJECTIVES & BENEFITS

Provide a comprehensive view of performance, review against target set, and allow for data-driven decision making

Sales and performance reports help with data-driven decision making. Comparison of performance against previous periods (year-on-year etc.) can provide an objective perspective on progress.

COMMON FINANCIAL METRICS THAT ARE TRACKED AND REPORTED

Each report should consist of a few key financial metrics aligned to strategic goals as well as how revenues are generally reported in the property to leadership

METRIC HOW CAN THE METRIC BE USED?

Revenue

• Total: Revenue target

• Breakdown (by category): Determine the viability of a particular category

• Breakdown (by SKU): Determine the performance of individual item which will be used for further analysis (refer to 2.1a. Category strategy and product selection or 2.2a. Assortment optimization)

• Average basket size: Understand if customers are buying more from cross-sell/upsell/pricing strategy

Inspire the team by sharing a “big number” everybody can work towards

Profit

• Profit (total): Assess the overall financial performance of the store

• Cost (by category): Understand key cost drivers

NOTE: Cost allocation philosophy – Consider only marginal costs when calculating the profits, not including fixed costs that would continue to be incurred without retail operations (e.g., for those stores with existing F&B team members/managers, these labour costs have already been accounted for and therefore, reallocate a portion respective to the hours manned)

Beyond financial metrics, non-financial metrics are important to gauge store performance

COMMON NON-FINANCIAL METRICS THAT ARE TRACKED AND REPORTED

• Turnover rate

• Shrinkage (e.g., expiry, theft/ missing etc.)

INVENTORY MANAGEMENT

SUPPLIER PERFORMANCE

• Stockout % (optional as it can be difficult to track, team should weigh cost vs. benefits of tracking stockouts)

• Lateness of delivery

• Quality of delivery (e.g., whether items are delivered as agreed with no defects etc.)

CUSTOMER SATISFACTION

Profit per sq m

• Profit per sqm (overall or by section in the store): To compare retail profitability vs other spaces in the property or to identify sections within the store that generate most returns

Sales reports can be used to optimize store operating hours by detecting trends in number of transactions:

• Time of the day (i.e., morning, afternoon, night, midnight or any specific hours etc.)

• Day of the week (i.e., weekday versus weekends)

PROMOTIONAL CAMPAIGN (if relevant)

• CSAT and/or NPS

• Number of positive feedback received

• (Optional) Social media followership/ engagement

• (Optional) Online reviews

• AI tools e.g., ChatGPT can help with sentiment analysis

• Coupon / discount redemption rate

• Uplift in revenues/ profitability

Sales forecasting (1/3)

FREQUENCY

Annually

GUIDELINES (1/2)

OBJECTIVES & BENEFITS

Create a baseline for sales tracking against performance, as well as parameters for operations planning (e.g., quantities for reordering etc.)

A sales forecast can be used to estimate future sales at various levels of granularity, frequencies and over various time horizons. Although forecasts are a prediction of the future and accuracy of forecasts may vary wildly, to be useful, forecasts should be accurate enough to provide directional guidance to users.

PRINCIPLES OF FORECASTING

01 02 03

GRANULARITY FIT FOR PURPOSE

Forecasts can be done at an overall or individual SKU level depending on the objective for creating the forecast. Forecast at an aggregate level tends to be more accurate and less complex than SKU-level forecasting

A. Uses of overall sales forecasts (usually sales revenues)

• Financial planning and budgeting

• Target setting and tracking (forecasted goals versus actual sales)

• Operations and resource planning, including inventory and staffing (e.g., decision to either build up inventory during low period, or factor in increase in resources during peak periods etc.)

B. Uses of SKU-level forecasts (usually quantities)

• Guide product ordering of key SKUs (e.g., “A” category SKUs; refer to 1.2aii. Sales status categorization for more information), thereby preventing overstocking or understocking

TIME HORIZON

The further the time horizon, the more inaccurate the forecast is. The rule of thumb is to forecast up to 1 year of sales

FREQUENCY

Forecasting is not a one-time exercise, but managed actively with a process to update the data frequently to allow any model selected to capture new information – making forecasting more accurate

Sales forecasting (2/3)

FREQUENCY

As requested

OBJECTIVES & BENEFITS

• Deliver a consistent client experience

• Ensure a clear and ethical framework for handling refunds and faulty products

Forecasting methodologies

There is no single best forecasting method, select the most appropriate methodology for your needs. Comparing forecasts to actual realized figures can help determine the accuracy of the forecast. GUIDELINES (2/2)

HISTORICAL APPROACH

A method that uses historical data to predict future sales. This approach is useful when past sales data is readily available in a clean and consistent format for analysis

TECHNIQUES

• Year-on-Year Growth: The simplest approach; a growth benchmark % used to estimate retail’s growth (e.g., hotel’s overall growth)

• Moving Average: The avg. of the <x> past periods to get the next period’s forecast (e.g., avg. of the last 3 months)

• Exponential Smoothing: A forecasting method that gives more weight on the most recent data

Microsoft Excel has a built-in function for this (more information on the next page)

Decompose historical data1 into components to fully understand any underlying insights

Trend: Growing or declining (without seasonality)

Seasonality: Regular fluctuations (e.g., holidays)

QUALITATIVE APPROACH

A method that converts qualitative inputs to quantitative estimates. This approach is useful when there is no historical data (e.g., new product introductions, new launch of retail space)

TECHNIQUES

• Customer Surveys: Gauge their satisfaction, loyalty, and future buying intentions can help inform sales forecasts

• Proxy: Use the demand of a similar SKU that the store used to sell (e.g., use the demand of a can of Coca Cola to forecast demand of a can of Pepsi)

• Expert opinions: The experts' inputs can be from in-house (e.g., GMs, F&B Mgr. Commercial Directors) or external resources (if any)

• Industry reports/ publications: Utilizing industry-specific reports, publications, and market research studies can provide valuable information on market trends, customer behavior, and emerging opportunities

CAUSAL APPROACH

A method that seeks to explore relationships between factors to determine their relative impact. It is more useful for overall sales forecasting than SKU-level forecasting.

TECHNIQUES

• Regression models (Linear or multiple): (Example, non-exhaustive factors that can impact sales)

• Room occupancy

• Breakdown of guests versus non-guests

• Hotel types

• Seasons

NOTE: 1. To fully determine any trend or seasonality within a time series would require the data sets to cover a longer timeframe, minimally 2 years

Sales forecasting (3/3)

FREQUENCY

As requested

OBJECTIVES & BENEFITS

• Deliver a consistent client experience

• Ensure a clear and ethical framework for handling refunds and faulty products

Try it out! The template provided allows for users to estimate forecast at both a

A. Overall sales forecasts (sales revenues) as well as at a

B. SKU level (quantities) for the next 12 months

There are 2-3 main parameters that should be changed in the template

1. SKU identifier (for SKU-level forecasts, not needed for overall sales forecasts)

2. Starting date (key this in “dd mmm yyyy” format e.g., 01 mar 2021)

3. Sales data

• Aggregated by month (i.e., total sales of SKU in the month)

• Should be recorded in quantities of the smallest unit available for sale (e.g., 1 bar of chocolate, 1 can of beer)

• There should be 2 years' worth of data points

NOTE: If there are insufficient data points, do consider using alternative historical forecasting approaches such as projections using historical year-on-year growth or moving average forecasting

Introduction to Excel’s built-in Forecasting function

The template is built with Microsoft Excel’s function, FORECAST.ETS. It is a function that is built on exponential smoothing and adjusts forecast with seasonality detected in the dataset (if any)

Pros: Excel can extrapolate missing fields

Cons: Excel cannot automatically detect promotional periods; users need to manually remove datapoints that might represent inflated sales due to promotions

NOTE: Excel will adjust for only up to ~30% of missing fields before forecast becomes inaccurate

Plotting a simple line chart can help visualize seasonality over time

TOOL: FORECAST TEMPLATE

Inventory management overview: from receiving to sales to returns

ILLUSTRATION OF INVENTORY MANAGEMENT PROCESSES

KEY ACTIVITIES

Organize storeroom –designated space for receiving

Denotes an update required to systems - either manually or automatically Inspect goods on quality, quantity and expiry dates

Create SKU identifier (for new products only)

Organize storeroom –main storage area

Conduct stock and tally with system

Check expiry dates and rotate facing

Reorder when stocks are low

(REFUNDS AND EXCHANGES)

Organize storeroom –designated space for unsellable returns

Process returns (e.g., contact supplier)

SYSTEM(S)/ TOOL

To support inventory management

Accept goods into main storage area

Check expiry dates

Report shrinkage (from theft, expiry, defects etc.)

management systems (if any)

Store Inventory Management

This section contains guidance on how to tag and classify products, manage store inventory and storeroom(s) as well as manage expiring products

SECTION CONTENTS

a. PRODUCT IDENTIFICATION AND TAGGING

i. Create a Stock Keeping Unit (SKU)

ii. Sales status categorization

b. INVENTORY MANAGEMENT

i. Storeroom setup and management

ii. Inventory level management

iii. Annual stock take

iv. Negative stock (in the system)

v. Shrinkage adjustment

vi. Review shrinkage report

c. EXPIRY MANAGEMENT

DoubleTree by Hilton Guangzhou, China

Create a Stock Keeping Unit (SKU)

FREQUENCY

Create for every new product

GUIDELINES

OBJECTIVES & BENEFITS

• Create a consistent and standardized set of understanding for product tagging1

• Minimize confusion and errors

WHAT IS

A STOCK KEEPING UNIT (SKU)?

• A unique product identifier used in an internal inventory management system to distinguish each individual product

• SKUs can comprise of an either set of letters, numbers or a combination of both

• SKUs are used to identify characteristics about each product, such as category, manufacturer, brand, style, color, flavor etc.

• SKUs should be human readable – employees should not need any equipment to read them

• There are no fixed rules on the length of each identifier, but it should not be a full spelling out of the descriptions

Chips à CHIP

Plasters à PLAS

Noodles à NDL

Lays à LAYS

Hansaplast à HSP

Nissin à NSN

à

Sales status categorization (1/2)

FREQUENCY

At least once a year

GUIDELINES (1/2)

OBJECTIVES & BENEFITS

• Evaluate products in an objective manner

• Help with decision making in areas such as assortment rationalization and product placement in stores

Sales status of an SKU shows the life stage (Active vs. Inactive) and popularity of a product for the store

STATUS –ACTIVE PRODUCTS

A: Fast Items

B: Core Items

C: Slow Mover

SL: Seasonal product

NP: New Product

DESCRIPTION

• Represents SKUs that contribute ~70% of the sales turnover

• Represents SKUs that contribute ~25% of the sales turnover

• Represents SKUs that contribute less than ~5% of the sales turnover

• Represents product ordered only special seasons (e.g., mooncakes, Christmas cakes etc.)

• A new product that is non-seasonal or limited edition will maintain this status for 3 months

• After 3 months, article will be retagged with a new sales status

HOW TO CALCULATE PRODUCT STATUS FOR A/B/C CATEGORIES?

01 02 03

TAG EACH SKU TO A CATEGORY

• Discover our city

• Stay connected

• Simple pleasures

• Frozen

• Chilled

• Hot

SUM UP THE SALE OF EACH SKU, FOR THE PAST 12 WEEKS

NOTE: Exclusion rules to remove special promotional events periods (e.g., promotion campaigns)

RANK THE TOTAL SALES OF EACH SKU WITHIN CATEGORY

• A = TOP 70% of cumulative sales

• B = NEXT 25% of cumulative sales

• C = LAST 5% of cumulative sales

Sales status categorization (2/2)

FREQUENCY

At least once a year

OBJECTIVES & BENEFITS

• Evaluate products in an objective manner

• Help with decision making in areas such as assortment rationalization and product placement in stores

GUIDELINES (1/2)

MANAGEMENT OF INACTIVE PRODUCTS

Some of these inactive SKUs may still be in kept in the storeroom while pending further action, and thus may still be tagged with the following statuses in the inventory system

STATUS –INACTIVE PRODUCTS

Delisted

DESCRIPTION

• A normal deletion of an SKU listing

• Items that are maintained in respective financial system (e.g., CheckSCM) while the store continue to sell the SKU until it is depleted

NOTE: Refer to existing Finance procedures/ policies on how to delist items

• SKUs tagged with this status while awaiting confirmation/ collection from supplier 01 02

Returned to Supplier

Storeroom setup and management (1/2)

FREQUENCY

At least once a year

OBJECTIVES & BENEFITS

• Evaluate products in an objective manner

• Help with decision making in areas such as assortment rationalization and product placement in stores

GUIDELINES (1/2)

STOREROOM LAYOUT

• Besides the main inventory storage area, there are some areas within the storeroom that should be clearly demarcated and labelled:

• Receiving area – Cartons from delivery must not obstruct entry and exit

• Outgoing area – Area used for returns to warehouse or vendor

• Separate area for defective/ expired goods – should not be mixed with selling stock

There are two general approaches to consider when selecting a storeroom layout

APPROACH 1: BY PRODUCT STATUS

• Faster moving/best selling SKUs to be stored at eye level and near the front of storeroom for quicker replenishment

• Slower moving stocks can be put away deeper inside the storeroom

• This approach is recommended when there is a significant difference is replenishment rates between products in store

APPROACH 2: BY MIRRORING STORE LAYOUT

• Align to the layout of the selling floor for ease of identification of sections

• Similar items are placed together for ease of category identification (e.g., packaged foods, gifts etc.)

• The layout would need to be updated whenever there is a floorplan change

• This approach is recommended when there is sufficient storeroom space to replicate layout

Given space constraints in many hotels, inventory may be stored in multiple places, or even within on the selling floor. If storing extra stock on the selling floor, a good practice would be to store items in physical proximity to where they are displayed.

Storeroom setup and management (2/2)

FREQUENCY

At least once a year

GUIDELINES (1/2)

OBJECTIVES & BENEFITS

• Evaluate products in an objective manner

• Help with decision making in areas such as assortment rationalization and product placement in stores

INVENTORY ORGANIZATION

• Storage containers should be used to store items and should be clearly labelled

• Heavy items should be placed on low shelves while lighter items are on higher shelves

• There should be a safe clearing between the merchandise on the top shelf and the ceiling to ensure there are no obstructions to sprinkler heads etc.

• Personal belongings or food and drink should not be allowed into the storeroom

Inventory level management (1/2)

FREQUENCY

Recalculate at least twice a year

GUIDELINES (1/2)

OBJECTIVES & BENEFITS

Define an inventory levels management structure; either through a fixed reorder quantity model or a periodic inventory review model

WHAT IS INVENTORY LEVEL MANAGEMENT?

Excess inventory can incur unwanted costs such as loss due to obsolesce, storage costs, and ultimately impact working capital. However, having too little inventory can result in lost sales from stockouts and loss of customer goodwill. This section will provide guidance on determining optimal inventory reordering quantities and safety stock levels

APPLICABILITY

These guidelines are applicable for ABC permanent SKUs and not applicable for SL (seasonal & limited edition) products (refer to 1.2aii. Sales status categorization for more information on ABC and SL SKUs). They also do not apply to prepared food/drinks.

NOTE: This process step is to be calculated at an individual SKU level, and stores can choose to prioritize the top 20% SKU

PROCESS (1/3)

DEFINE BASELINE PARAMETERS

PARAMETER DESCRIPTION

Average supplier lead time

Average demand

Standard deviation of demand

Inventory review period

Desired service level

z of desired service level

• (Calculated) average time taken between order sent to supplier and receiving the order

• (Calculated) average demand within a specified time period

• (Calculated) standard deviation of demand within a specified time period

• (Pre-defined) a time between two periods to verify the inventory count

• (Pre-defined) in %, the expected probability of not facing stock-out (e.g., 95%) ; higher service levels = higher safety stocks = less stock outs

• (Calculated) in Microsoft Excel, key in “=norm.s.inv(<desired service level in percentage>)”

NOTE: Ensure parameters are in the same unit of time prior to calculations (days, weeks, or months)

Inventory level management (2/2)

PROCESS (2/3)

A predetermined order quantity will be triggered/ alerted upon reaching a certain predetermined reorder point (ROP), regardless of the interval between orders

STOCK LEVEL

This represents the

This represents the average units sold while awaiting replenishment

POINT (ROP)

This represents the quantity when a reorder is triggered and submitted to supplier Safety stock + demand during lead time

REORDER QUANTITY

This represents the reorder quantity ordered. Given the low volumes in hotel retail operations, this will likely be the Minimum Order Quantity (MOQ)

PROCESS (3/3) OPTION 2: PERIODIC REVIEW MODEL

Inventory in the system is to be reviewed at pre-defined regular intervals (e.g., weekly, monthly, quarterly etc.) and thereafter an appropriate reorder quantity (Q) is ordered after each review, with order quantities based on a calculated target inventory level

AVERAGE DEMAND BETWEEN EACH REVIEW PERIOD

This

SAFETY STOCK LEVEL

This

TARGET INVENTORY LEVEL

This represents the order up to level

demand between each review period + safety stock level REORDER QUANTITY

Inventory level management (2/2)

ILLUSTRATIVE EXAMPLE OF CALCULATION (PERIODIC REVIEW MODEL)

INPUT

PARAMETERS (calculated, predefined and estimated)

EXAMPLE: PERIODIC REVIEW

Inventory in the system is to be reviewed at pre-defined regular intervals (e.g., weekly, monthly, quarterly etc.) and thereafter an appropriate reorder quantity (Q) is ordered after each review, and order up to the calculated target inventory level

BETWEEN EACH REVIEW PERIOD

STOCK LEVEL

This represents the recommended safety stock level to hold to handle variations in demand

This

Annual stock take (1/2)

FREQUENCY Annually

OBJECTIVES & BENEFITS

• Inventory accuracy – system record tallies with on hand inventory

• Accurate figures for end of financial year for business or tax purposes

GUIDELINES (1/2)

WHAT IS A STOCK TAKE?

A stock take (or inventory count/ physical inventory), is a process in which a store physically counts and records all the items or products it holds in its inventory (both on the selling floor and in the storeroom) at a specific point in time. This is usually done with help from the Finance department.

APPLICABILITY

Stock takes apply to packaged items in store (does not include prepared food and drinks)

GUIDELINES

• Usage of scanners for stock counting where possible is highly recommended

• If team member identifies any discrepancies during the first count, a recount should be performed to verify

• Any final discrepancies will be reported to F&B Manager and Finance for shrinkage adjustments and reporting

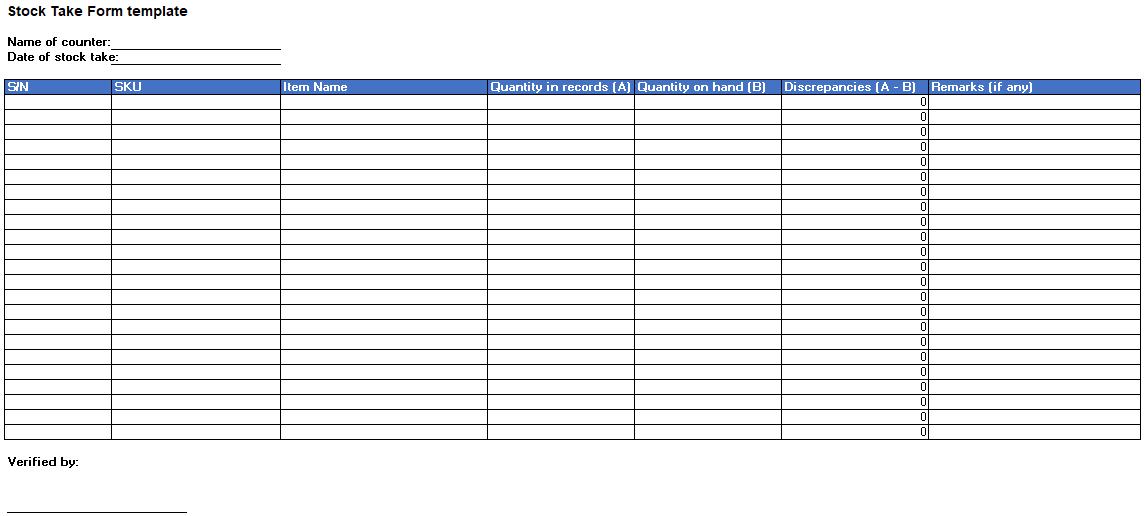

TOOL: STOCK TAKE FORM TEMPLATE

DOCUMENTATION

• Components of a Stock Take Form include:

• Name of team member performing count

• Date of stock take

• Item code/ product identifier

• Item name

• Quantity in system

• Quantity on hand (counted – to be filled)

• Discrepancies

• Remarks (if any)

NOTE: Only use the provided Microsoft Excel template when there is no access to existing Stock Take Forms in CheckSCM

Addressing key questions in retail operations & management….

GUIDELINES (2/2)

CYCLE COUNTING (ALTERNATIVE TO ANNUAL STOCK TAKES)

• Instead of conducting an annual stock stake, stores may choose instead to adopt Cycle Counting

• Unlike traditional annual stock takes where the entire stock is counted at once, in cycle counting, a subset of the total inventory is counted

• The benefits of cycle counting include the earlier discovery of issues, improved operational efficiency and reduced need for time-consuming and potentially disruptive annual physical counts

• Cycle counting allows store to better understand their inventory as well as discover issues with inventory early

ALIGNING CYCLE COUNTS FREQUENCIES TO SKU POPULARITY

• For more efficient cycle counts, one best practice is to use item popularity to guide cycle count frequency (refer to 1.2aii. Sales status categorization for more information on ABC SKUs)

• Reference frequency:

• A (Fast Moving Items) – Every quarter

• B (Core Items) – Every six months

• C (Slow Movers)– Once a year

BEFORE THE STOCK TAKE

• Ensure that stock on hand in the system/ physical records is up to date, especially if the store has just performed goods receiving

DURING THE STOCK TAKE

• Perform a first count

• Fill up the Stock Take Form

• Items inside opened (carton) boxes must be individually counted

• Count items placed in all possible locations on the selling floor and storeroom. (i.e., Behind cash desk, drawers etc.)

AFTER THE STOCK TAKE

• Once the F&B and Finance representatives are satisfied with the result of the count and the investigation, a Shrinkage Report should be filled and submitted to F&B Manager for final approval and to sign off the Stock Take Form (refer to 2.2bvi. Review shrinkage report)

• Thereafter, an authorized Finance personnel is to perform needed adjustments in the system

Negative stock (in the system)

FREQUENCY Daily

OBJECTIVES & BENEFITS

• Inventory accuracy – system record tallies with on hand inventory

• Effective stock replenishment (if using automated software)

GUIDELINES

WHAT IS NEGATIVE STOCK?

Negative stock refers to a situation where there is a difference in a store’s recorded inventory levels and actual stock on hand such that records indicate that it has fewer items in stock, perhaps even showing a negative quantity. Various reasons can cause this discrepancy, but it is often a sign of issues in inventory management and should be addressed promptly.

WHAT CAUSES NEGATIVE STOCK?

• Delivery was not received in the system correctly

• Item was sold before it was accepted into the system (e.g., from a delivery that has not been received in the system)

• Wrong count on a previous Stock Take/ Cycle Count (if applicable)

• System glitches (this tends to be rare)

WHAT ARE THE ACTIONS REQUIRED?

• Any SKU in stock with a “0” or negative quantity found in the system should be investigated immediately

• Upon approval, of investigation results, F&B and/or Finance personnel to make the necessary stock adjustment in the system based on the actual quantity counted

• Implement controls to prevent negative stock from happening again

Shrinkage adjustment (1/2)

FREQUENCY On demand

OBJECTIVES & BENEFITS

• Enable inventory reconciliation – system record tallies with on hand inventory

GUIDELINES

WHAT IS SHRINKAGE?

Shrinkage is the loss of inventory that occurs between the time it is received by a business and the time it is sold to customers and can be caused by a variety of factors including defects, expiry, theft and breakage/destruction in store

WHAT CAN QUALIFY FOR SHRINKAGE ADJUSTMENT?

REASONS

Defective

Expired

Missing/ theft

Breakage/ destroyed in store

Transferred to another department within the hotel

DESCRIPTION

• Defective products includes returns from customers due to quality issues

• These should be charged back to relevant supplier

NOTE: This is applicable for products with quality issues and is not to be confused with “Damaged upon Delivery” which should be promptly documented and returned upon receiving

• Expired goods that can no longer be sold/ consumed, may include food wastage for foods prepared and previously recorded in inventory

• Discrepancies in quantity highlighted during Cycle Counts or Annual Stock Take

• Evidence of theft such as empty boxes or packaging found in store or signs of break-ins

• Spoilt on selling floor during retail operations (e.g., bottles breaking, or biscuits shattered after product is accidentally thrown on the floor)

• Inventory transferred to other departments within the hotel for use before expiring (e.g., serve as guest amenities or in the breakfast/dinner buffet)

Shrinkage adjustment (2/2)

•

ACTIONS REQUIRED

1. Adjust the quantity in inventory records (physical or system) and finance system to tally with on hand inventory

• Use the correct reason code (if any)

• Only authorized team member(s) can adjust records with approvals from the F&B Manager as well as Finance

2. Update the Shrinkage Report for the month (refer to 2.2bvi. Review shrinkage report)

3. For expired or broken products, dispose of items properly from store premises (For defective products, if applicable) Return product(s) to supplier(s) and ensure charge back is completed

Review shrinkage report

• Monitor shrinkage to identify stocks with issues such as high rates of expiry or theft and enable mitigating actions to be taken to prevent further losses

GUIDELINES

SHRINKAGE REPORT AND ANALYSIS

• A Shrinkage Report documents the inventory shrinkage experienced by the store over a certain period (in this case, over a period of a month)

• Director of F&B/ F&B Manager to provide guidance on the total Shrinkage KPI/ threshold of each month to the store

• Outlet Manager is to investigate any shrinkage of any item that is found to be excessive (compared to history or trend) or exceeds a pre-determined threshold

• Respective Outlet Manager to create an action plan/ implement controls (where possible/practical) to monitor and control the identified shrinkage

• The completed Shrinkage Report must be submitted to Director of F&B/ F&B Manager for review every month

TOOL: SHRINKAGE REPORT TEMPLATE

Expiry management (1/2)

Proactively optimize inventory levels and quality

Conduct routine sample inspections on the expiry dates of incoming orders, ensure that products have a reasonable expiry dates before accepting

Continuously monitor expiry which allows for early detection and management Implement preventive measures through an organized inventory management strategy

Expiry management (2/2)

•

GUIDELINES (2/2)

ADDITIONAL GUIDELINES ON PREVENTIVE MEASURES AND CONTINUOUS MONITORING

Different product categories in the store can have varying shelf lives; we can group them broadly into 2 categories, Non-edibles and Packaged foods/drinks, each with recommended days before mitigating actions should be taken:

CATEGORIES NON-EDIBLES

Example of products

• Toiletries (e.g., shampoos)

• Scents

PACKAGED FOOD/ DRINKS

• Snacks

• Canned drinks

Recommended days before mitigating actions 365 days 60 days

An entry in the tool is made for each item that has a different date

There are 2 recommended options to track and monitor expiry dates of products

OPTION 1: MONTHLY STORE CHECKS

Do a monthly sample check in-store to examine expiry dates (especially for items in the packaged food/ drinks category)

• Inform store manager immediately if the products fall within the recommended period before expiry so that mitigating actions can be taken in a timely manner

Having the monthly check on the same day of every month (e.g., first day of the month) can help make this a routine for team members and reduce the likelihood of missing a check.

• One entry/line is needed for each SKU with a different expiry date within the delivery order ,

• Adding a batch number to differentiate between same SKUs with different expiry dates is optional

NOTE: SKUs with no expiry dates (e.g., umbrella, books etc.) do not have to be included

• Tool will calculate if SKU requires urgent expiry management and flag out SKUs that are “close to expiring” based on pre-defined recommended days before mitigation actions (e.g., 60 days for food items)

Assigning a batch number can help increase the speed of identifying expiring products within each SKU as there may be multiple batches with different expiry dates for each SKU. However, any batch number assignment should be complemented by tagging/ separation by batch of products in the storeroom, so team members can identify when earlier batches of products are in storage, on display or otherwise sold and hence can be removed from the tracker.

OPTION 2: USING THE EXPIRY TRACKER TEMPLATE

Bringing the customer journey to life: exploring an unmanned shop by the lobby

Where can I buy some souvenirs?

AWARENESS OF RETAIL SPACE

CHLOE

LEISURE TRAVELERS

Chloe is an avid traveler that enjoys exploring new cultures. As Chloe is nearing the end of her trip, she decides to bring home a memento that will remind her of the fond memories of this holiday.

This store looks bright, neat and inviting! Is there anything of interest to me here?

01 INTEREST IN EXPLORING STORE

02

(During check-in) we have a shop in the lobby, do take a look!

“The store looks amazing and there’s lots of interesting things on display”

• In-room note in minibar

• Signages around hotel premises

• In room QR code catalogue/ menu

“They have a Starbucks machine here as well – this is something different from the canned coffee from the 7-11 nearby”

CONSIDERATION OF PURCHASE

06 REVISIT

There’s no one in the store, how should I pay?

03 MAKING THE PURCHASE

“This keyring seems well made”

“According to these story cards, the keyrings are made from 100% recycled plastic”

“I love how this tote bag features a print by a local artist! The Hilton logo is a nice touch”

I really love this purchase! (or not)

04 POST-PURCHASE AND LOYALTY

05

“Looks like I can pay for my coffee with a credit card”

“For the rest of the items I will have to pay at the front desk, or I can use this QR code to pay online”

“Oh nice, I can get a mini chocolate bar after scanning this QR code and completing a survey…”

“Overall, I would rate the store 4/5 – I wish there was a larger selection of cup noodles, I didn’t like any of the ones on offer”

Bringing the customer journey to life: exploring an unmanned shop by the lobby

Where can I grab a quick bite?

BUSINESS TRAVELERS

John is a frequent business traveler. He is constantly on the go; taking calls and meeting clients.

It’s been an arduous flight and taxi ride to the hotel, he’s hungry and wants to grab a quick bite while he prepares for an important client meeting tomorrow.

The sandwiches look fresh and tasty Is this product unique?

06 REVISIT

What are some of my payment options?

Can I get rewards as a Hilton Honors member?

AWARENESS OF RETAIL SPACE

01 INTEREST IN EXPLORING STORE

02

(During check-in) … you can grab coffee and quick meals at the cafe!

• In room directory

• Signages around hotel premises

• In room QR code catalogue/ menu

“The cakes on promotion look good – maybe I’ll treat myself to one tomorrow…”

“That’s a nice Christmas display… I think my client might like these Christmas cookies – it’s in a lovely jar too”

CONSIDERATION OF PURCHASE

The BLT is the best seller but if you’d like to try something new, the cranberry turkey ciabatta melt is our seasonal special!

Would you also like to get a drink with your sandwich Sir?

03 MAKING THE PURCHASE

04 POST-PURCHASE AND LOYALTY

05

How would you like to pay? You can also charge the payment to your room

Are you a Hilton Honors member?

If you sign up now, you can get a discount immediately on this purchase

Service Operations

This section contains guidance on how customer facing team members should interact with customers and how to collect and respond to customer feedback

SECTION CONTENTS

a. CUSTOMER SERVICE GUIDELINES

i. Greeting customers

ii. Helping customers while they shop

iii. Helping customers checkout

iv. Self-checkout for unmanned stores

v. Handling customer complaints

vi. Handling customer compliments

vii. Training team members

b. CUSTOMER FEEDBACK AND SATISFACTION MEASUREMENT

i. Feedback channel options

ii. Additional guidelines for customer satisfaction surveys

Greeting customers

FREQUENCY Every time a customer walks into the store

OBJECTIVES & BENEFITS

• Provide team members with confidence in providing in-store service to deliver a consistent and exceptional Hilton customer experience

GUIDELINES (1/2)

For manned stores, greeting customers as they enter a store is a crucial aspect of creating a welcoming atmosphere and setting the right tone for the customer’s shopping experience

GUIDELINES ON GREETING CUSTOMERS

• Greet customers with a simple, friendly but non-invasive greeting

Hello, good morning/ afternoon/ evening, welcome to [store name]

• Use a professional, polite yet enthusiastic tone

• Greet customers with a smile and eye contact, and if culturally appropriate, a bow/nod

Go the extra mile if you recognize a returning customer; you can use this information to personalize your greeting e.g., “Welcome back”

Helping customers while they shop (1/2)

FREQUENCY

Every time a customer walks into the store

OBJECTIVES & BENEFITS

Provide team members with confidence in providing in-store service to deliver a consistent and exceptional Hilton customer experience

GUIDELINES (1/2)

Helping customers who are browsing in the store and providing thoughtful recommendations is a valuable part of the retail experience and can increase customer satisfaction as well as sales

GUIDELINES ON HELPING CUSTOMERS WHILE THEY SHOP

• Be attentive but not intrusive, observing the individual customer’s body language for cues on their preferences

• After greeting customers, allow customers some space before approaching them

• Pay attention to their body language and expressions – do they look like they are simply exploring or are they looking for something in particular? Do they seem like they are looking for assistance?

NOTE: If you notice a customer looking at a specific product for an extended period or appearing confused, this might be a cue that they would appreciate help.

• Offer assistance if it seems suitable

Is there anything specific you’re looking for today? May I help you with anything today?

• If customer prefers to browse independently, say “sure, feel free to let me know anytime if you need any help”

• Practice active listening

• Pay close attention to customer’s questions or their answers to your questions

• Ask follow-up questions to gather more details

• Based on their response, tailor any recommendations/ suggestions without being pushy

• It might be helpful to keep in mind best sellers/ customer favorites should they ask for recommendations

• Inform customers of ongoing promotions/sales or special events

• Especially if they appear to be interested in items on promotion/ sale

Helping customers while they shop (2/2)

FREQUENCY

Every time a customer

OBJECTIVES & BENEFITS

Provide team members with confidence in providing in-store service to deliver a consistent and exceptional Hilton customer experience

GUIDELINES (2/2)

• Suggest complementary items

• For example, if the customer has selected a pastry, follow up with “would you like anything to drink”?

• Provide information on the products when it seems appropriate to do so

• Provide a quick and clear summary of relevant product information

• Share the stories behind the products, including unique brand stories and/ or any causes it might be supporting such as supporting local communities or environmental sustainability

• CASE STUDY: HGI Serangoon uses story cards used in unmanned shop to help explain product stories to customers

Note: special attention should be paid to hygiene; hand sanitizers may make customers more comfortable towards trying products

• Express enthusiasm and confidence in the store’s products

• Express enthusiasm for the products recommended and display confidence in their quality and suitability

• Offer assistance with carrying items

• Especially if a customer looks like they might be struggling to carry items or will be browsing for a while, offer assistance with carrying items to the checkout counter

• Thank and invite them back

• Regardless if a customer leaves with or without purchasing, express gratitude for their visit, and invite them to return to the store in the future

Thank you, we hope to see you again!

Prepare and place shopping baskets at store entrance so that customers can notice and use them; team members can also direct customers to baskets, or pass them one if customers missed them

Helping customers checkout

FREQUENCY

Every time a customer decides to checkout their purchases

GUIDELINES

OBJECTIVES & BENEFITS

Provide a pleasant, efficient and environmentally friendly checkout experience to customers

Helping customers check out smoothly and efficiently is an important part of the retail experience

GUIDELINES ON CHECKING OUT

• Greet customers with a friendly demeanor as they approach the checkout counter

NOTE: Thank them for waiting if they have been waiting in a queue

• Be prepared for small talk and to engage customers in friendly conversation

NOTE: This may be more common with guests from certain countries

• Scan and input items efficiently, be careful and gentle when handing delicate/fragile items

NOTE: Be prepared to provide information on exchange and return policies

• Double check that discounts/ promotions have been applied accurately

• Ask about Hilton Honors loyalty program (if the store offers benefits for Hilton Honors members)

This is a good opportunity to drive membership program sign up

• Ask customers their preferred payment method

• Ask customers if they would like a receipt and or a paper bag(s)

• Bag items neatly

• Hand items over to the customer and thank them for the purchase

NOTE: in some Asian cultures it is more polite to use two hands to collect or hand over items

Ask customers if they need help carrying the items to the transport area especially if they have made a large purchase and look like they might struggle

Self-checkout for unmanned stores

FREQUENCY

Every time a customer decides to checkout their purchases

GUIDELINES

OBJECTIVES & BENEFITS

Provide a pleasant, efficient and easy-to-use checkout experience for customers of unmanned shops

Pay at front desk POS

CHECKOUT AT FRONT DESK QR SELFCHECKOUT PAY AT MACHINE

Scan QR to check out via an online store

• Customer service provided

• May include integration with HH1 program

• Includes cash transactions

• Reduces manpower burden on front desk

• May include integration with HH1 program

• Additional manpower burden on front desk; esp. for properties where manpower is already lean

SELF-CHECKOUT KIOSKS

Payment first before product dispensed (e.g., Self checkout systems on Starbucks coffee machines, vending machines)

Unmanned self-checkout machines (commonly used in grocery stores)

• Reduces manpower burden on front desk

• Prevents theft

• Cumbersome if there is a need to key in credit card details

• Requires additional Hilton-approved software

• Limited to machine dispensed products

• No integration with HH1

• No integration with hotel’s payment gateway

• Reduces manpower burden on front desk

• May include integration with HH1 program

• Expensive to invest

• Checkout machine takes up significant space

Handling customer complaints (1/2)

• Provide team members with confidence in handling customer complaints in a professional manner

• Resolve customer’s complaint amicably and avoid unpleasant misunderstandings with customers

When faced with a customer’s complaint, it is crucial to maintain a calm and professional attitude, regardless of the tone of the complaint. Do not take the complaint personally, as guests are more likely to be upset at the issue.

KEY CONSIDERATIONS

• Address customer’s complaints as soon as possible

• Team members should be empowered to handle complaints, but they can escalate to the supervisor on duty/ F&B manager who would be ultimately responsible for handling complaints from customers

• Whenever possible, complaints should be handled away from the POS so that transactions for other customers can continue

the customer for their patience and understanding

customer’s complaint and learn from it

Handling customer complaints (2/2)

NOTE: Each brand might have brand specific requirements which should be referred to. The category strategy and product selection recommendations below only serve as general guidelines for reference.

GUIDELINES (4/11)

STEPS TO HANDLE A CUSTOMER’S COMPLAINT (DETAILED STEPS)

01 02 03 04 05

LISTEN ATTENTIVELY AND ACTIVELY

ACKNOWLEDGE THE COMPLAINT AND APOLOGIZE SOLVE THE PROBLEM, TAKE PROMPT FOLLOW UP ACTIONS

THANK THE CUSTOMER FOR THEIR PATIENCE AND UNDERSTANDING WHILE THEY WAIT FOR THE PROBLEM TO BE RESOLVED

• Give the customer your full attention and listen without interrupting

• Understand why and how their expectations have not been met

• Ask clarifying questions to better understand the situation

• Let the customer know you understand their complaint

• Apologize for the situation, regardless of what caused the situation and whether its in your control.

Express empathy for their disappointment and frustration

I'm sorry to hear about the problem you've encountered, and I apologize for the inconvenience

• Look to reach an agreement. Propose practical and effective solutions; if appropriate, ask the customer for suggestions

• If an agreement cannot be reached and the customer continues to dispute, escalate it to the supervisor on duty/ F&B Manager

NOTE: Ensure adherence with company policies but also consider going above and beyond to exceed customer’s expectations

• Ensure the customer is satisfied with the resolution

• Ask if there is anything else you can help them with

Once again, we would like to apologize for the inconvenience. Is there anything else we can help you with?

DOCUMENT THE CUSTOMER’S COMPLAINT AND LEARN FROM IT

• Ensure all complaints are documented and used to improve

NOTE: If there is a recurring complaint, managers should take time to analyze root causes of these issues and take steps to address them

Handling customer compliments

FREQUENCY

Whenever a customer pays a compliment

OBJECTIVES & BENEFITS

• Provide team members with confidence in accepting customer compliments graciously

• Strengthen customer relationships and foster a positive atmosphere in the store

GUIDELINES

Accepting compliments from customers graciously is a key but often overlooked part of providing excellent customer service

GUIDELINES ON HANDLING CUSTOMER COMPLIMENTS

• Express sincerity and gratitude for their compliment with a “thank you” and a warm smile

• If the compliment is specific, be specific in your response

That’s a beautiful Christmas display!

Thank you, that’s very kind of you. Our team takes pride in putting together seasonal displays for our customers and we are delighted to know you like it

• Respond with humility and avoid appearing boastful or proud, but refrain from self-deprecating comments

• Keep your responses customer centric and focus on recognizing the customer’s kindness

We’re delighted to hear you had a great experience

Your kind words mean a lot to us

• Don’t overwhelm the customer

• While it's important to acknowledge the compliment, avoid prolonging the interaction or overwhelming the customer with excessive responses. Keep it concise and respectful of their time.

• Use compliments to motivate the team

• Document and share compliments with the team so it can serve as motivation

• Documenting compliments can also be helpful for management to understand what is working well for customers and what resonates

Training team members (1/2)

FREQUENCY

• Refresh training as needed

• Ensure new joiners are trained

OBJECTIVES & BENEFITS

Ensure team members are trained in customer service and are provided with the support they need to succeed

GUIDELINES (1/2)

Training is not a one-time event but an ongoing process – regular refreshers are needed to maintain excellent customer service

KEY CONSIDERATIONS (1/2)

• Assign a team trainer/ department trainer to ensure all relevant team members (for both manned and unmanned stores) are trained on relevant duties

• Ensure new team members are given the training they need

• Create and refer to a “Job Skills Checklist” which summarizes relevant duties for team members

• Train team members on key topics such as

• Customer service guidelines (including escalation protocols)

• Product knowledge (regularly updated as needed)