MED OIL & GAS

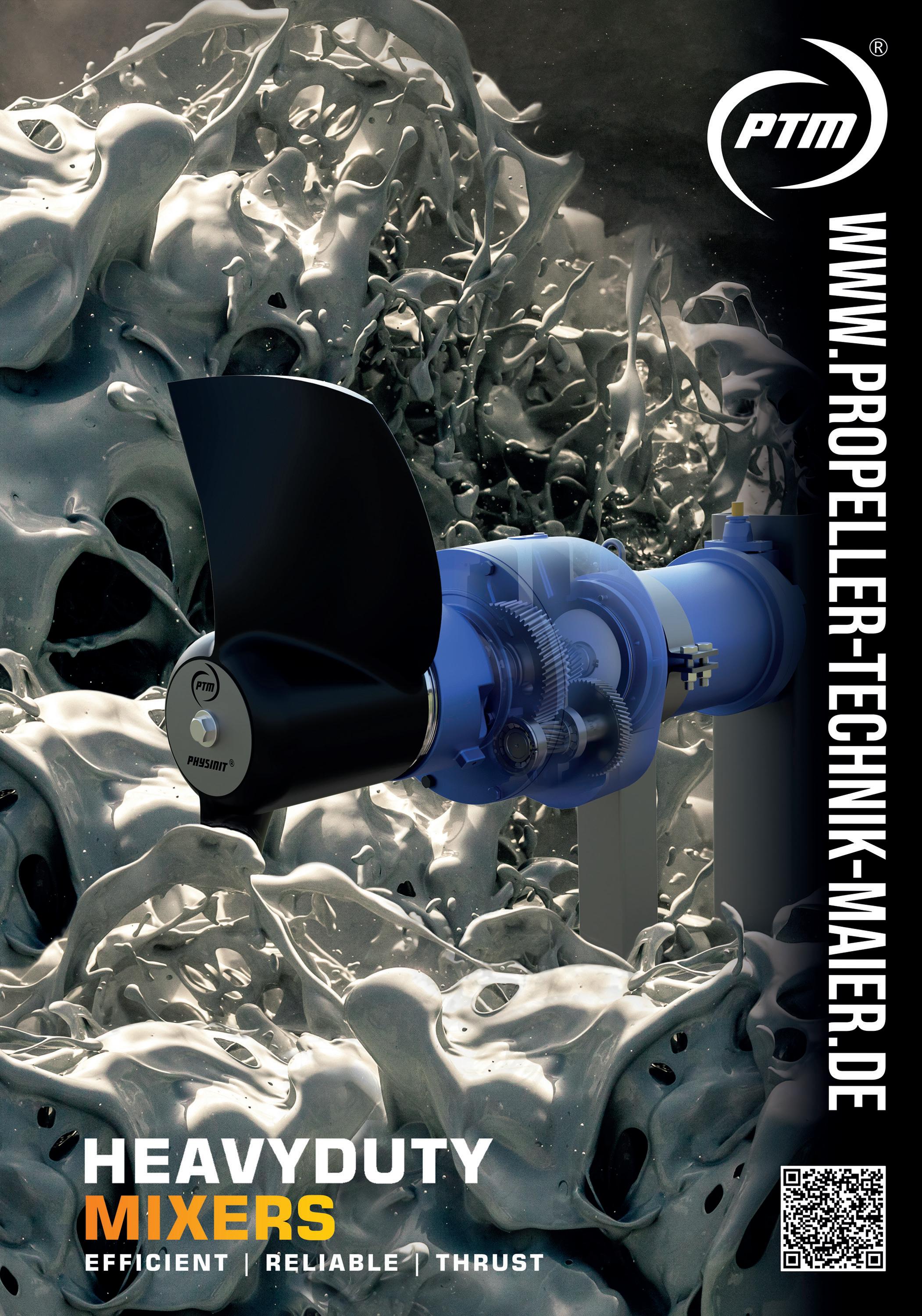

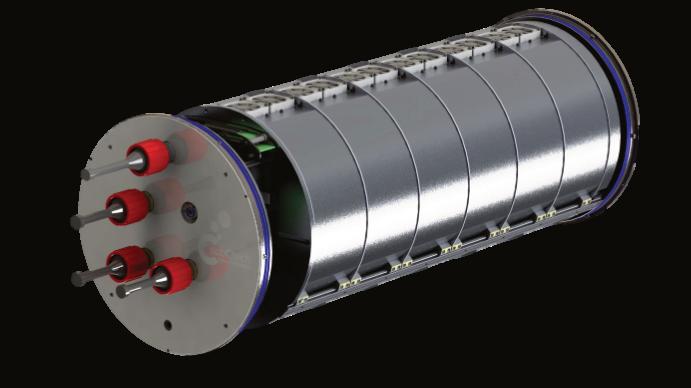

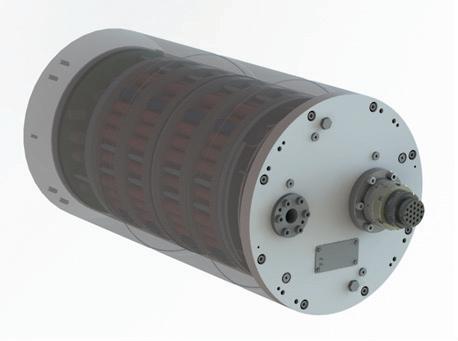

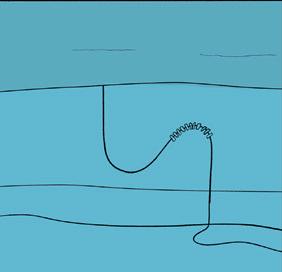

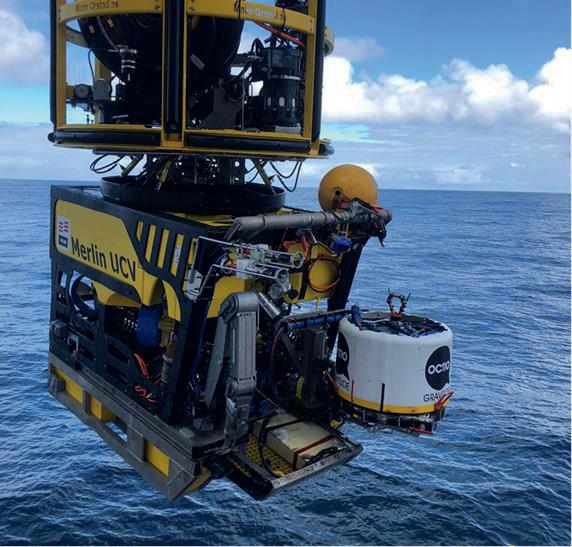

The Series 1275 Subsea Control Valves are a new and fully qualified range, designed, engineered and tested at our Brighouse facility in the UK.

Key features include:

- Specialist trim technology to suit all applications

- Repeatable and dependable operation

- Enhance wear resistance

- Backlash removal

- Highly accurate

- Power efficient

KOSO Kent Introl has over 35 years’ experience in the subsea industry manufacturing a range of Control and Choke Valves for the world’s largest energy companies.

Shell reported a write-down of $5 billion on its exit from Russia last year but said that would not affect its oil and gas profits. It was one of the first companies to declare it would leave Russia after the Ukraine invasion.

TotalEnergies, on the other hand, was slow to exit. The French supermajor had a stake in an LNG project led by Novatek and, in late 2022, Total said it would drop it and leave, taking an impairment of $3.7 billion since it could not sell it back to Novatek because of the Western sanctions on Russia.

• BP, Shell, and TotalEnergies collectively account for 40% of the total $110 billion losses after leaving Russia.

• While higher oil and gas prices helped buffer these energy giants, other industries like carmakers and utilities also faced substantial financial setbacks from their Russian exit.

• Despite hefty exits, over half of European businesses and some Japanese energy majors continue to operate in Russia for varied reasons, including energy security.

The oil industry, including companies BP, Shell, and TotalEnergies, was the industry that suffered the greatest financial losses from leaving Russia, an analysis by the Financial Times has revealed.

Out of total losses of some 100 billion euro, or some $110 billion, the losses incurred by Big Oil majors account for about 40%. Next were utilities, which account for over 15% of the total losses.

BP last year booked an impairment cost of $24 billion on its Russian business after it left the country. The supermajor had a minority stake in Rosneft. The 19.75% interest accounted for around 50% of BP’s total oil and gas reserves and a third of its oil and gas production.

Earlier in the year, TotalEnergies said it would incur an impairment of some $4.1 billion on its exit from Russia, to be booked in its first-quarter 2022 report. The biggest portion of that impairment came from the Arctic LNG 2 project of Novatek and the reduction in gas reserves TotalEnergies had to book with its pullout. According to FT calculations, TotalEnergies’ total cost of leaving Russia came in at $14.8 billion.

‘Paris, April 27, 2022 – On March 22, 2022, TotalEnergies announced that, given the uncertainty created by the technological and financial sanctions on the ability to carry out the Arctic LNG 2 project currently under construction and their probable tightening with the worsening conflict, TotalEnergies SE had decided to no longer book proved reserves for the Arctic LNG 2 project.

Since then, on April 8th, new sanctions have effectively been adopted by the European authorities, notably prohibiting export from European Union countries of goods and technology for use in the liquefaction of natural gas benefitting a Russian company. It appears that these new prohibitions constitute additional risks on the execution of the Arctic LNG 2 project.

As a result, TotalEnergies has decided to record in its accounts, as of March 31, 2022, an impairment of $4.1 billion, concerning notably Arctic LNG 2.’

Yet these were only the direct hits to the supermajors. The Financial Times studied their more recent financial reports to calculate the losses, meaning those impairment charges

were just the start. The calculations also did not include the surge in oil and gas prices last year.

That surge certainly benefited oil and gas companies, somewhat cushioning the blow for BP, Shell, and TotalEnergies, but at the same time, it delivered a blow to all other companies that had already booked billions in losses from their pullout from Russia.

Meanwhile, BP, Shell, and Total booked the biggest individual write-downs on their Russian operations when they left because of the size of their exposure to the local oil and gas industry. Yet higher oil and gas prices more than made up for those impairments as the three booked a combined 95 billion euro in profits, equal to some $104 billion and more than twice as high as the combined impairment costs of around $40 billion.

Carmakers such as Volkswagen and Renault, as well as chemicals producers, also suffered hefty losses from their exit from Russia. But there are also some multinational majors such as Nestle and Unilever that remain in Russia. Banks, including UniCredit and Raiffeisen, also continue to operate in the country, although both have said they were looking for a buyer for their Russian businesses. Utility companies such as Uniper and Wintershall Dea also lost billions from leaving Russia, with the total cost coming in at 14.7 billion euro, equal to about $16 billion.

Even so, more than half of European businesses that were operating in Russia prior to 2022 remain in the country, according to the Kiev School of Economics, a research institute. Prior to 2022, these totalled 1,871 entities, according to the KSE data.

A couple of Japanese energy majors also remain in Russia despite G7 sanctions, to which Japan is a party. The government in Tokyo last year judged the stakes Japanese companies held in the Sakhalin-1 and Sakhalin-2 oil and gas projects as critical for the country’s energy security. As a result, the Japanese shareholders in these projects were offered to retain their stakes, which they did.

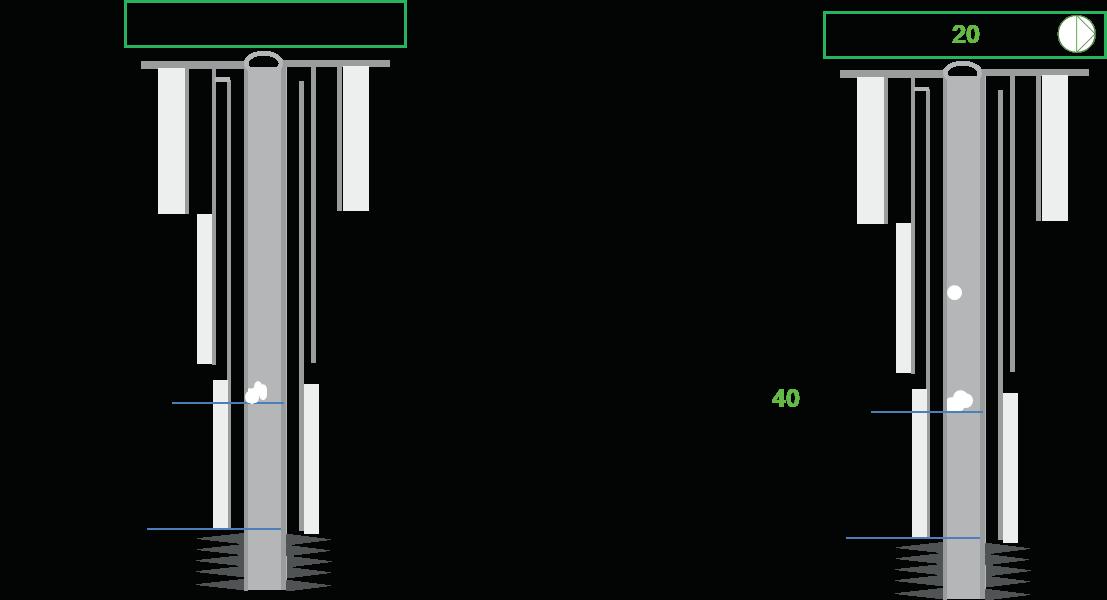

Digital twins have in recent years received increasingly more attention as their value creation has become more apparent when utilised in an efficient manner. More are realizing that an efficient use of digital twins might be the key to not only a more optimised future, but also in supporting other important aspects in the industry.

By Nadir Azam and Anders Andreasen, RambollThere are many understandings of what a digital twin is and what it is not. In this article, a digital twin is understood as a virtual representation of an object or system that potentially spans its lifecycle, can be updated from real-time data, and uses simulation, machine learning and reasoning to help decision-making.

A digital twin consists of several facets and layers, which may separately or combined contribute to increased value in their own way within different disciplines. In this article, we will focus on showing how digital twins specific for structural integrity, referred to in this article as True Digital Twin, and process simulations, referred to as Process Digital Twin, have been used to create value and support a safer, more optimised, and sustainable industry.

There are several quantifiable and unquantifiable benefits of using a digital twin. The True Digital Twin technology, focusing on structural integrity of structures, has demonstrated its value throughout the past 25 years. It enables cost reduction, provides safer operation, and supports sustainability by allowing for optimisation of operational performance and life cycle management. These benefits are highly valuable in for example lifetime extension projects where the technology may be the differentiator between being able to reuse existing

structures or having to decommission and build new ones.

The technology may at the same time provide invaluable information in time of need, for example during expected or unexpected critical events such as storms, ship impacts, vibrations etc.

The True Digital Twin technology allows for moving from costly and time-consuming experimental testing in the laboratory to cost-reducing full-scale testing in the field under real operational conditions, which enables safer and more cost-efficient operation of the asset.

Utilising a digital twin for process simulations can enable optimisation and offers unparalleled insight and facilitates increase in revenue, reduction in OPEX and more importantly reduced greenhouse gas emission footprint. The methodology presented in this article can be applied for brownfield optimisation as well as for basic design of greenfield facilities. In the design phase, the method can assist in choosing the best process scheme and selecting favourable operating conditions for minimisation of both CAPEX and OPEX. Another interesting and increasingly important area is lifetime extension and maximising the usability of existing facilities for tie-backs through detailed bottleneck identification studies.

Digital Twin

Ramboll combines digitalisation with innovative structural health monitoring to create the True Digital Twin for structures. The technology is a state-of-the-art methodology to facilitate coupling between the real physical conditions and their structural analysis models, which captures the real-life behaviour of structures in real-time.

The True Digital Twin technology has several applications within optimised operational performance and life cycle management.

Specific use cases include among others lifetime extension projects, root cause analyses, uncovering knowledge gaps, detection of changes, and predictive maintenance.

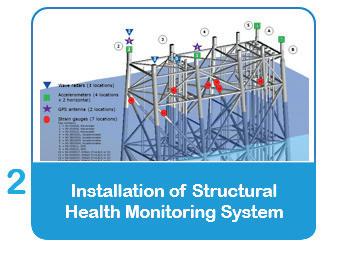

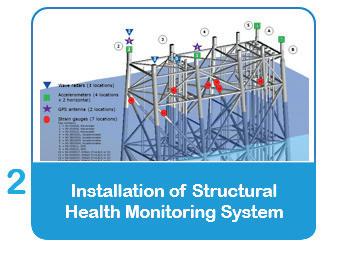

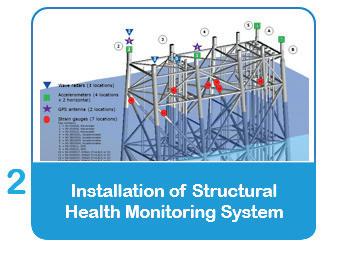

The value creation expected from a True Digital Twin starts already in the specification of a structural health monitoring system as illustrated in figure 1. It is critical that the sensors defined are up to the required task and placed at the right locations to fulfil the overall purpose and objectives. There are several parameters to consider and evaluate when specifying a structural health monitoring system with the purpose of utilising it within structural integrity assessments. These parameters

for thesensors include

for example: type, frequency range, accuracy, sensitivity, resolution, location of sensors and which post-processing methods will be utilised.

When the system is up and running, the real conditions are continuously identified using the Structural Health Monitoring System (SHMS), which provides information about the actual environmental loads and the corresponding structural response before the data from the monitoring system are analysed through a cloud computing solution. The True Digital Twin technology combines a variety of sensing technologies with an embedded measurement controller to capture, log and analyse real-time data.

The real-time data from the Structural Health Monitoring System (SHMS) is used to compare the real-time behaviour with the analysis model, and the analysis model is updated by using several novel methods to create a True Digital Twin, i.e. a structural analysis model that simulates the real-life behaviour of the structure.

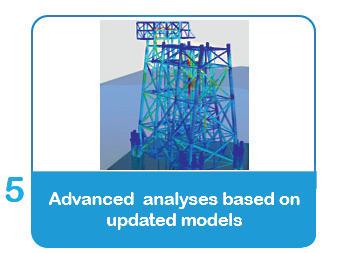

Advanced analyses may now be performed using the True Digital Twin and assessment of the measured uncertainties associated with the analysis of structures, relating to elements such as quantification of model uncertainties and the direct link to Risk- and Reliability-Based Inspection planning (RBI).

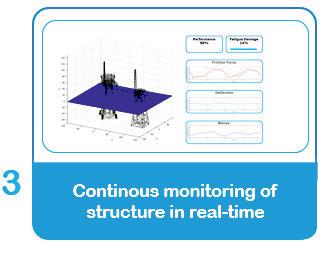

Continuous monitoring hence allows for continuous assessment of the structural integrity of the structures.

Lifetime extension

The technology has been used in several lifetime extension projects throughout the years. The use of True Digital Twins in lifetime extension projects have resulted in large savings and sustainable reuse of structures, since quantifying the actual uncertainties leads to a safer and usually more optimised predictive risk-based inspection program.

Currently there are on-going projects where reusing oil & gas platforms as substations for offshore wind farms is being investigated and will also include this technology combined with advanced analyses.

In cases where unexpected and unknown events occur, it might be invaluable to have measurement data from the events and being able to utilise it within structural integrity when it comes to understanding the root causes and how to mitigate these events from occurring in the future. Such events could for example include vibrations of either entire platforms or parts of a platform such as a topside module

or flare tower. The technology has been used to monitor large structures to identify root causes of unexpected and unknown events, to provide an efficient mitigation strategy.

The process digital twin is a process simulation representation of the chemical (and physical) processes taking place inside the plant process equipment. The process simulation invokes appropriate thermodynamic models of the fluid phase behaviour as well as correlations for transport properties etc. The process simulation combines several unit operations to make a digital representation of the real plant, which can be explored for several tasks such as for example: plant design, optimisation studies, diagnostics and troubleshooting, bottleneck identification and mitigation, training, safety studies, and what-if scenarios.

Process simulations have been used for decades as a representation of the real plant. However, extensive multi-parameter optimisation of complex process facilities is a more recent discipline, which has not yet achieved widespread foothold in the industry, especially where machine learning and multi-objective evolutionary algorithms are applied. In the following, we aim at describing the basic methodology and presenting some recent examples.

The starting point is a high-fidelity model of the real plant. While the highest fidelity can be provided by a detailed process simulation model, a surrogate model may be a better choice, provided the model is well trained via e.g. supervised machine learning.

Using a surrogate, the insight of the model can be fully leveraged through massively parallel computations while minimising software license cost. The model is leveraged in combination with global optimisation methods. The number of variables of interest, which for example may include pressure, temperature, flow etc. from various places in the process, range from a few parameters up to hundreds of variables, with a typical range being 10-20 variables of interest.

The objective of the optimisation may for example be maximisation of a product yield, improved product quality, minimisation of production cost/OPEX, minimisation of emission-footprint / energy optimisation or any combination of these objectives. However, not all variables can be set freely due to natural limitations such as design pressure limits, design temperature limits, cooling/heating medium constraints etc. Constraints may include product quality such as crude oil export RVP/TVP, gas export quality, equipment constraints etc. All these limitations and constraints must be handled while seeking the best solution for the objectives.

Increased product yield

In various optimisation studies considering both full process simulation as well as surrogate models, the process digital twin approach has identified a significant optimisation potential for increased stabilised oil production.

Authors

is Business Development Manager, working with digitalisation and innovation within structural integrity management for offshore structures. He has 15 years of experience in working with complex lifetime extension projects.

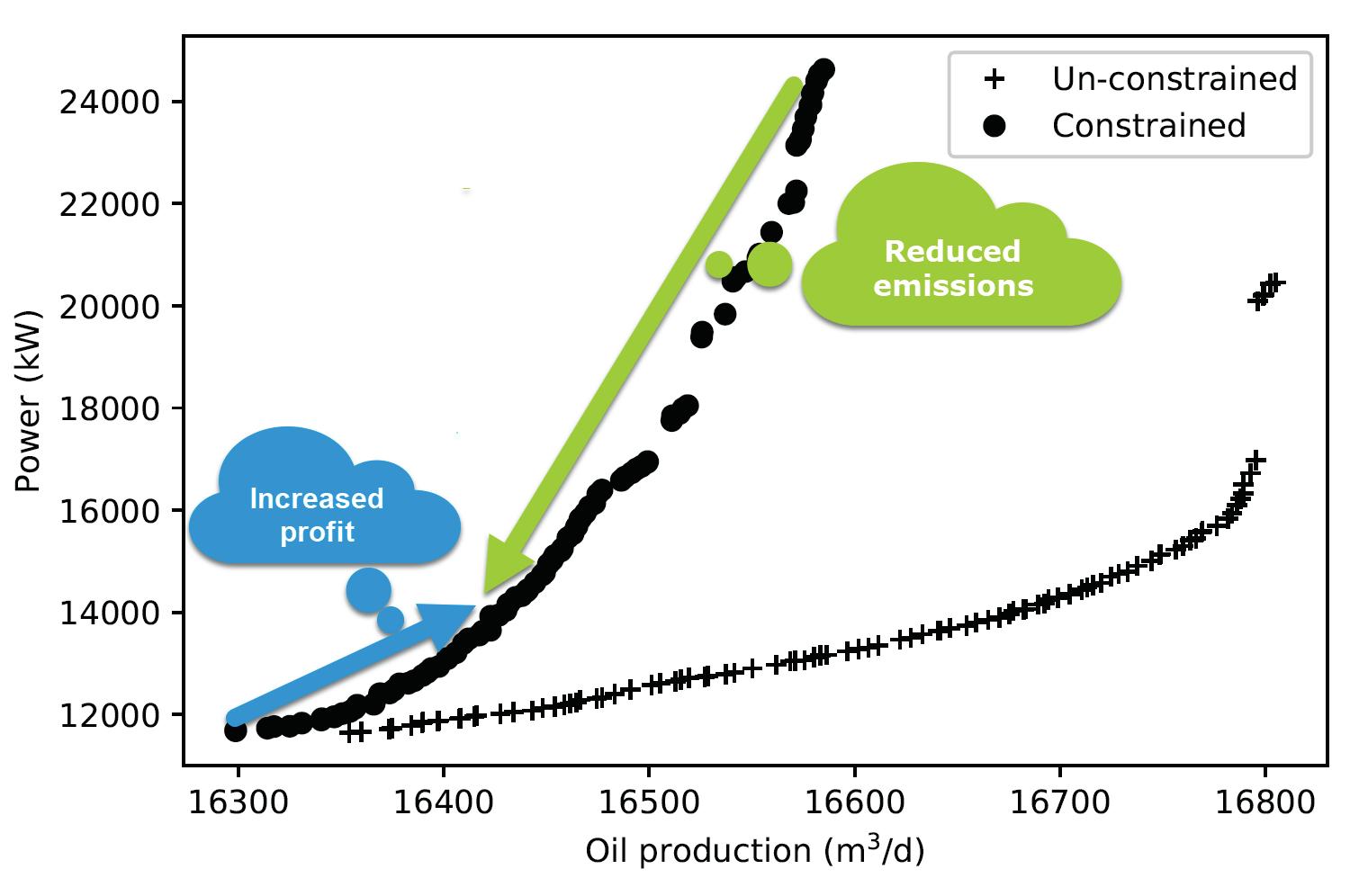

An increase of 0.1-1.3 % can be achieved, which over lifetime is a significant increase in revenue, and this is achieved without any hardware modifications, i.e. only obtained through changes in the operating parameters. The magnitude depends on for example the reservoir fluid and plant topology. Elucidating the optimisation potential requires a vast amount of simulation realisations, often 10,000-100,000 evaluations.

A main challenge is competing forces of different objectives. Often an increase in recoverable stable oil comes with an expense of increased power demand, see figure 2. Thus, the challenge is to identify the sweet spot that gives the most value for money - either the highest increase in production (starting from operating point A) at the lowest increase in energy demand or the highest reduction in energy demand for the lowest penalty in oil

production (starting at point B). For processes not continuously optimised it may be possible to improve both parameters (starting at suboptimal point C).

During recent years, several projects including various development phases for reservoirs rich in NGL (natural gas liquids) have been executed, such as for example the Hejre and the Solsort fields in the Danish sector of the North Sea and the Yme re-development on the Norwegian continental shelf.

Such fluids are challenging since NGL may build up in the compression system and condensate recycle streams, increasing the power requirement substantially. For some fluids it may not be feasible to extract NGL offshore and it may be chosen to export excess NGL via either off-spec gas or off-spec crude. Using a process digital twin approach, it has been demonstrated that for a realistic hypothetical fluid, the topside energy requirement could be reduced by approx. 20% by choosing the gas export over the crude export for transport of NGL to shore for downstream extraction. This would translate into a significant downsizing of the entire compression system and gas treatment facilities with a significant concurrent reduction in CAPEX.

Anders

is Technical Manager and chemical engineer, working with chemical process design for energy storage, carbon capture, utilisation & storage, Power-to-X, and gas production and utilisation.

We are still in the early days of digitalisation, but we believe it will be a vital part in creating an optimised transition from fossil fuels to renewables and support the green transition with accelerated technology-based knowledge.

Bright ideas. Sustainable change.

Bright ideas. Sustainable change.

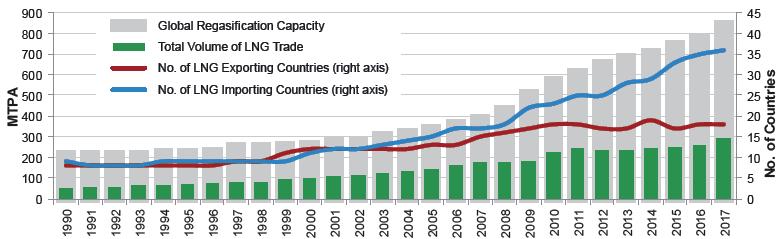

Since the first tanker shipment of LNG took place in 1958 aboard the experimental vessel (the Methane Pioneer)1 the LNG global market has undergone an unprecedented expansion of production capacity. During the last 50 years, LNG started being imported from Pacific countries and later from the Atlantic Basin (Europe, North America), and the market developed in an exponential manner, averaging, in last decades, an annual growth of 7.5%2.

Globally, in 2017 the LNG volumes traded set an historical annual record of 293.1 Mtpa (Million Tonnes Per Annum) with an increase of 35.2 MT (see Figure 1). For the same year, LNG demand across Mediterranean markets were enhanced by severe summer drought (resulting in low hydropower energy production) and heat waves (correlated with strong air conditioning demand) with an increase of LNG imports for France (+2.0 Mtpa), Italy (+1.5 Mtpa), Portugal (+1.5 Mtpa), and Spain (+2.3 Mtpa)3

Based on demand estimates, it is plausible that LNG trade will grow to 360-420 Mtpa by 2020 and the number of LNG importing countries will probably reach about 404

Nonetheless, even if these numbers are impressive, the LNG trade market has been in a state of overproduction since late 2014, with a plethora of suppliers competing with each other, resulting in prices fluctuations and investors insecurity, that it is likely to produce a ‘boom and bust cycle’. Also, investors were counting on higher prices to guarantee that their new LNG plants would be economical and remunerative5. This condition is the product of on historical element of the LNG trade: the idea that LNG plants must be supported by long-term contracts covering most of their capacity due to high capital costs. Anyway,

this assumption is clearly conflicting with current saturated market conditions since the oversupply situation is challenging the future of long-term contracts as they stand today6,7

It is not surprising that LNG trade is already going through an interesting shifting from the traditional pattern of long-term contracts of distribution to one based on spot and shortterm contracts (contracts of less than four years)8. If in the early 2000 spot and shortterm contract accounted only for 5.4% of the LNG trade, in 2014 they rose up to 29% and they are expected to continue rising, potentially reaching 45% of global LNG trade by 2020. The rise in spot and short-term LNG trade will allow buyers to source more and more of their LNG from the oversupplied market rather than rely on long-term contracts, possibly leaving cargoes available at penurious prices, below long-term oil-indexed contracts9

In the present market condition, it seems unlikely that new greenfield LNG projects will move ahead. Brownfields expansion are probably standing better chances, but demand uncertainty is still a challenge10

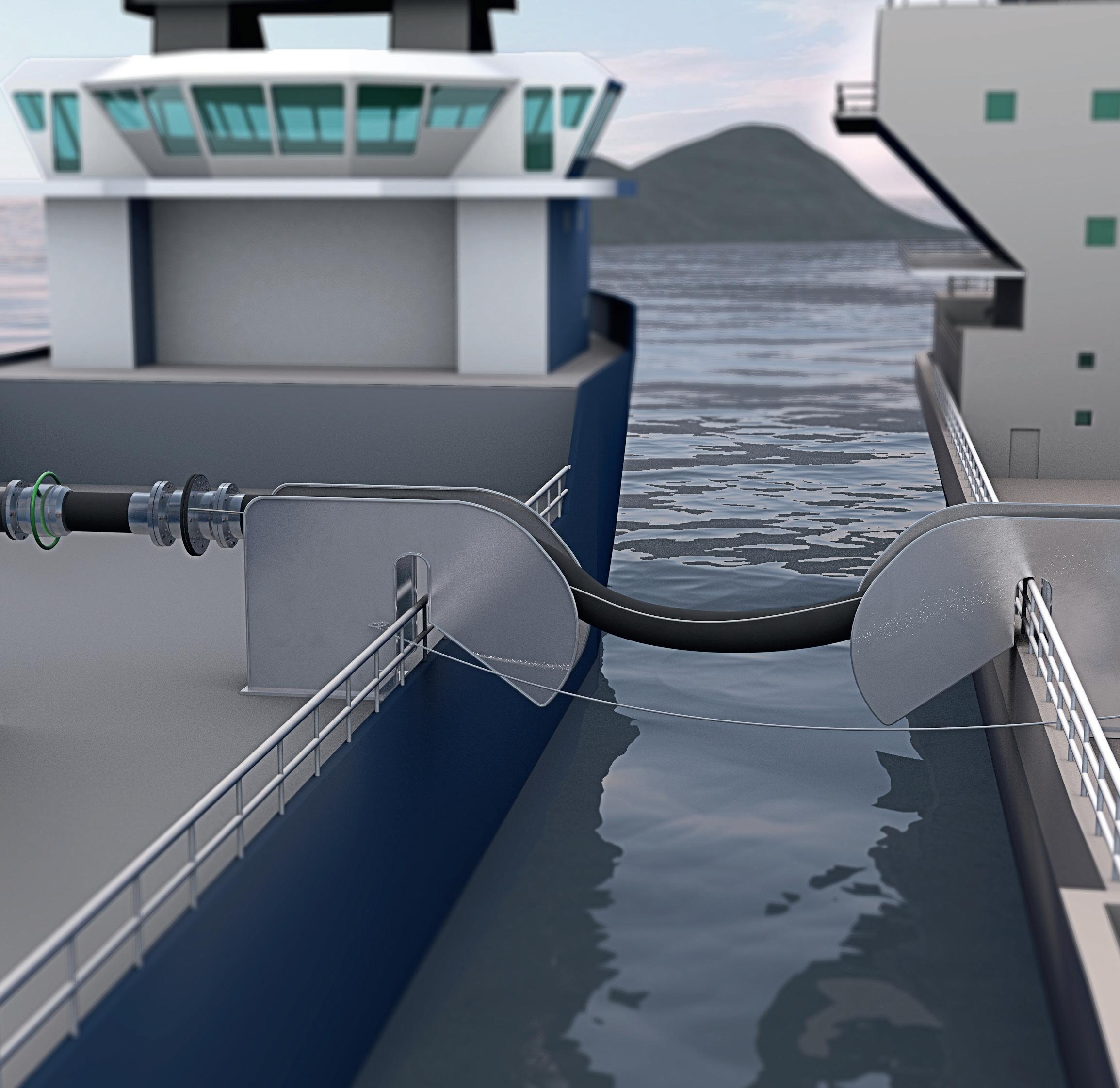

This complex market condition, joint with new environmental emissions policies and the advancement of new technologies, are together leading the affirmation of a new trend in LNG project development: the LNG Small Scale business (SSLNG)11. This business is receiving growing attention form exporters, since allows the convenient distribution of LNG to several kind of end-users. Due to relatively novelty of SSLNG market, statistical figures are not yet available. Figures and volumes on SSLNG provided in this report are the result of thorough research of the study group, but may not be exhaustive.

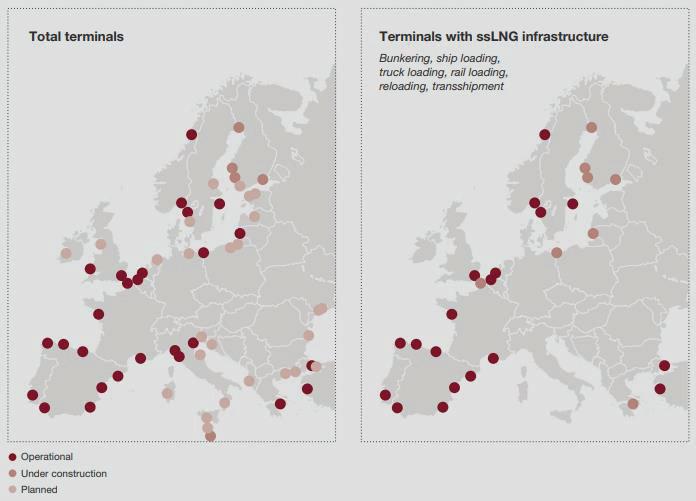

Today, a total amount of approximately 100 small scale LNG production plants is found globally. In 2017 in Europe, the number of LNG import terminals offering SSLNG infrastructure was clearly on the rise, with hotspot concentrated in Spain and Northern Europe, Greece and Turkey12. As illustrated in Fig. 2, it must be noted that, to date, no Italian regasification terminal is able to provide SSLNG services yet; however, with appropriate technical modifications, it would be feasible to adapt present regasification terminals and make them capable to also offer LNG storage and refuelling services for both vessels and road-vehicles. In addition, at 2018 several projects exist in Italy for covering at least some SSLNG activities, especially in the field of LNG storage and refuelling services vessels13

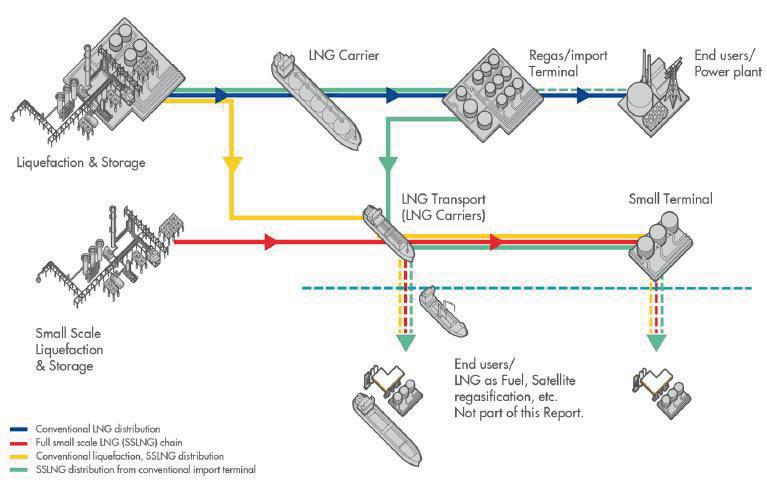

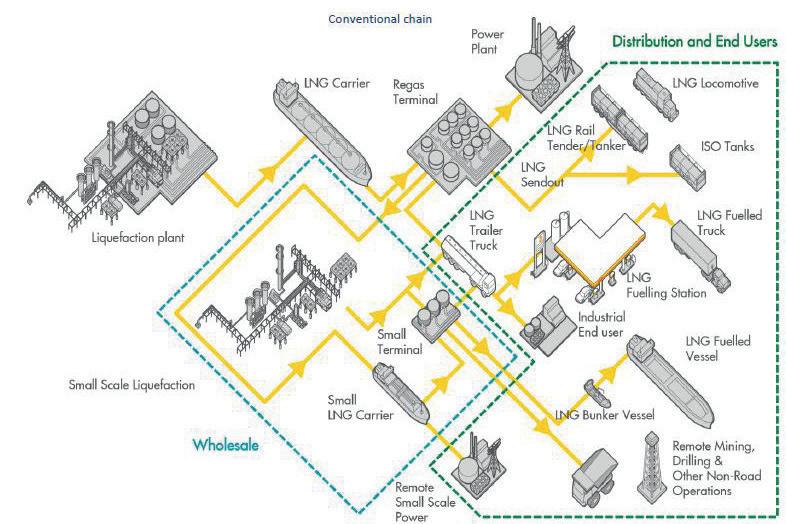

But what exactly is SSLNG? While the traditional pattern of LNG market can be assimilated to a “straightforward chain” of activities, mainly consisting of a liquefaction plant, transport, regasification and end-users (power plant or domestic); the small-scale business can be defined as 3 a “network of activities” related to the transport, distribution and supply of LNG deriving directly from traditional large-scale LNG (hereafter LSLNG)14.

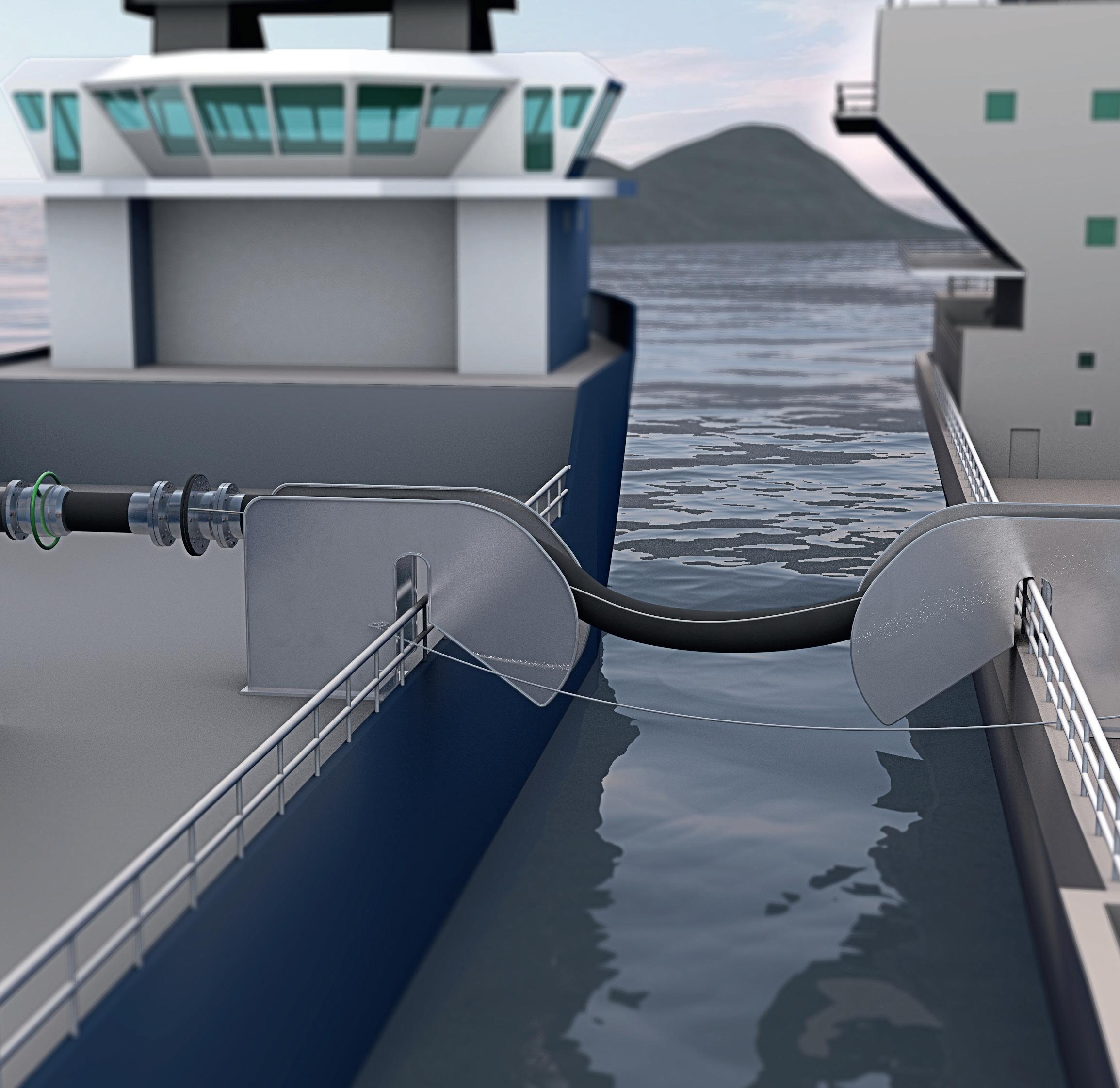

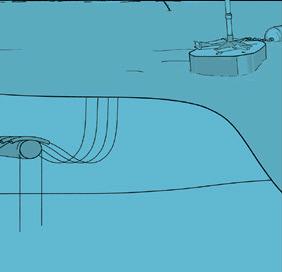

The main nodes (activities) of SSLNG network can be summarised as follows (see also Fig. 3): • supply of LNG from break-bulk, (i.e. the distribution of LNG cargoes into smaller fractions and the loading of LNG from carriers or regasification terminals onto bunker vessels1 or coastal or land storage depots, by ship, truck or train);

transport of the LNG cargoes, by ships or tankers, to LNG storage depots possibly equipped with small regasification plants, also for the purpose of streaming natural gas into the distribution network;

• secondary transport, mainly by road, to: i. tanks located in areas not connected to existing networks for the supply of gas to industrial and civil users (so-called off-grid users); ii. vehicle refuelling stations;

• end uses: production of electricity with LNG, industrial and civil (off-grid) consumption, fuel for direct transport in liquid form.

lThe activities listed above are possible through the provision of specific “SSLNG Services”15 (see also Figure 4) such as:

• service of unloading LNG from carriers onto small scale vessels;

• storage service, using LNG depots at regasification terminals (typically used only for regasification service), or other LNG depots;

• LNG loading service on bunker vessels, (i.e. loading of ships with LNG stored in regasification terminal/coastal depots). Bunker vessels can, in turn, be used as refuelling stations for LNG-fuelled vessels (bunkering service) or for transporting LNG to other coastal depots;

• LNG loading service on tankers/ISO-containers (only for onshore terminals), used for road/rail transport. Tankers and ISO-containers can, in turn, be used as refuelling stations for LNG-fuelled vehicles, local storage facilities, bunkers, industrial and civil uses, trains;

• additional services (only for onshore terminals), such as supplying LNG through the use of infrastructures built near regasification terminals or LNG storage depots and directly connected to them (e.g. loading LNG onto bunker ships/tankers through a dedicated line connected to the terminal, or the refuelling service for road/ rail vehicles through a dedicated station connected directly to the terminal, etc.).

Considering all of the above, it seems that the LNG business is entering in a new era, and has started dealing with present necessity and trends, embracing the future possibility offered by present technologies16. In synthesis, LNG business has begun the process of adapting to an ever-changing market development scenario, and to (partially) free itself from largescale dynamics. In this context, SSLNG seems to be “the next big thing” in the LNG world, capable to offer real possibility of LNG market enlargement, with all the benefits associated to the diffusion of the cleanest hydrocarbon of all, as well as at the same time maintaining acceptable costs.

As always, during the affirmation of a new method/technology, the society is requested to understand it - in order to deal with possible unexpected issues, or criticalities - and to regulate it in order to allow a fair and sustainable use of it. In this context, the present article aims at providing an overview of, and gather

data on, two of the most important themes associated at SSLNG development:

• health, safety, social and environmental issues of LNG;

• the legislative framework of SSLNG installations, with a special focus on Italian permitting process.

When talking of LNG, several elements are usually misunderstood by general public, leading to an erroneous understanding of LNG real dangers, thus reducing project acceptability, today one of the main issues during project development. In the following, is presented a brief analysis of LNG typical HSSE elements that must be put at the center of discussion with general public during the promotion of a project.

First, it is necessary to highlight the lessons learned from the development of previous

LSLNG projects, suggesting that, in order to promote and boost the acceptance of projects, careful attention must be put on the following aspects:

• site location: it is always preferable to propose projects development in brownfield and other underused areas that can be converted for “cleaner” productive uses, and can be associated to the revival of an abandoned and/or contaminated area, linking the project to immediate benefits for the local population both in terms of employment opportunities in the energy sector and from the point of view of improving the health and safety of the area;

• identification of territorial constraints (land planning, natural protected areas, cultural goods, etc.): projects are better accepted when their interference with territorial constrains is minimized. In this manner, it is possible to avoid the typical drawbacks derived from the association of an “socio-emotional” value that any stakeholders detect in a given area, but also to minimize any problems that may arise in the authorization phase and that as a result could lengthen the time of implementation of a project;

• adequate baseline data collection, to assess the status of the environment prior the commencement of the work, and to identify potential sensitiveness, that in a similar manner to the above mentioned identification of territorial constrains, will help the project proponent to avoid many of the problems that may arise in the authorization phase, but also to identify adequate actions in order to reduce the footprint of the project; in depth impact assessment, resulting from the previous items, crossing the project actions vs the environmental sensitiveness;

• identification of mitigation measures and definition of monitoring plan for construction and operation phases: these elements are very important not only to comply with typical Authorities requests, but also are needed in order to present to the general public the considerable and remarkable effort of the proponent to improve the project ensuring its presence will not negatively affect the area in which is developed.

Of no minor importance, it is necessary to leverage on the understanding real proprieties of the LNG17: it is a high energetic fuel, clear,

odorless, non-corrosive, non-toxic, cryogenic liquid at normal atmospheric pressure. If spilled on water, it floats on surface and vaporizes rapidly because it is two times lighter than water, if spilled in open air, it rapidly dilutes18

In order to obtain LNG form natural gas (NG), the mixture of gasses must undergone to a liquefaction process. Such process is based on a pre-treatment of the natural gas stream to remove impurities such as water, nitrogen, carbon dioxide, hydrogen sulphide and other sulphur compounds. After that, the pre-treated gas is refrigerated to a temperature of approximately –160°C. At this temperature the gas liquefy and it is ready for storage and shipping. Liquefied gas occupies 1/600th of the original gas volume, clearly representing a very convenient way of moving GN around. Another advantage is that, since LNG is obtain through refrigeration, it can be stored at atmospheric pressure.

It can became flammable, but explosive only under certain (well-known) conditions. Anyways, in a closed, secure storage tank where the vapor concentration is approximately 100% methane, it cannot ignite because there is no oxygen to sustain the combustion. Methane gas will ignite only if the ratio gas/ air is within the limited flammability range (5 to 15%). An often-expected hazard is ignition from flames or sparks, therefore all LNG facilities are equipped with several fire detection and protection systems in order to eliminate

the ignition hazard. In addition, the NG auto-ignition temperature at atmospheric pressure is above 540°C, an unlikely condition that requires strong source of thermal radiation, heat or hot surface19, 20

In the end, all of the potential hazards concerning LNG facilities operators and surrounding communities are direct consequences of physical and chemical properties of natural gas. Primary and secondary containment, safeguard systems as well as separation distance are measures applied across the entire LNG value chain, from production, liquefaction and shipping, to storage and re-gasification, providing effective and redundant layers of protection from LNG hazards. This explain why the LNG industry has an excellent safety record: up to 2012 more than 50,000 LNG carrier voyages were performed, without significant accidents or safety problems either in port or in the high seas. Data form 1986 to 2016 show that globally, only 19 LNG-related accidents happened, of those, only 5 are considered “notable” by the EU Major Accident Hazards Bureau and only one with fatalities (2 victims, in 1989). All considered, LNG is the safest hydrocarbon. For reference, ITOPF (Internationfal Tanker Owners Pollution Federation Limited) estimated that between 1970 and 2016 approximately 5.73 million tons of oil were lost as a result of about 460 tanker incidents21

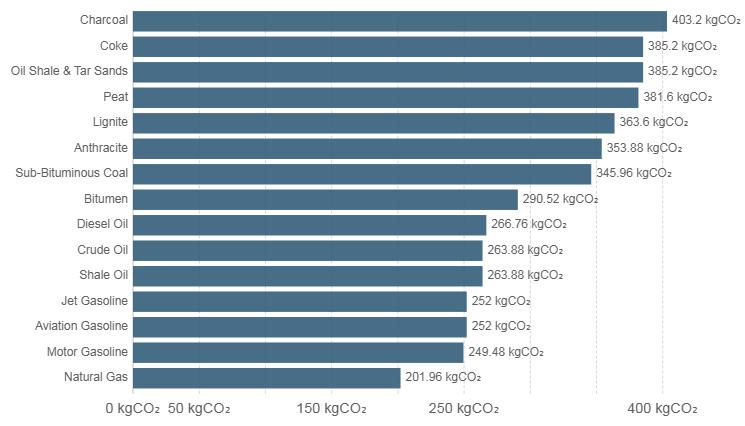

LNG is also the cleanest non-renewable energy source. In general, natural gas combus-

tions products are cleaner than other fossil fuels: air emissions resulting from combustion of vaporized LNG as a fuel in vehicles or for electric power generation present significant lower concentration of carbon monoxide (CO), nitrogen oxides (NOx), non-methane volatile organic compounds (VOC), and fine particulates (less than 2.5 microns in size). In addition, as shown in Fig. 5, natural gas has lower emissions of carbon dioxide (CO2) and toxic, heavy metals. Since the liquefaction process requires removal of all impurities from the produced natural gas, LNG actually has lower air emissions than natural gas when it is produced (since sulfur content of LNG is near zero)22.

The usage of LNG as a fuel for heavy-duty road transport, shipping and rail is the best alternative to diesel and heavy fuel oil. Indeed, due to recent stringent regulations on emissions in the marine sector (MARPOL 73/78 Annex VI)23, LNG is getting more and more attractive for ship builders. Up to 2017, LNG is used as a fuel in more than 100 vessels, and in 2019 LNG will fuel two of the world’s largest passenger cruise ships and the world’s first LNG-powered cruise ships. In the near future, a similar process is expected to involve also road and rail transport24

In this context, the affirmation of SSLNG may pose the foundation of a new beginning for the LNG market, contributing to a more sustainable usage of energy resources spurring further and in a capillary way the utilization of LNG among geographically isolated and infrastructure-poor regions and everywhere pipeline construction is not a viable investment.

The Directive 2014/94/EU of the European Parliament and of the Council of 22 October 201425 constitutes the common framework of measures for the construction of infrastructure for alternative fuels in the European Union. In Italy, the Directive was implemented by the Legislative Decree No. 257 entered in force on 16 December 2016, the so-called DAFI Decree26, aimed at defining a set of rules for the establishment of an infrastructure for “alternative fuels”, and of course, LNG is one of them. However, it must be highlighted that the regulatory framework governing LNG-related activities and the relative construction of facilities is still a “work in progress”, quite far from being completed.

Firstly, it must be noted that the current legislation (Article 2 of Legislative Decree No. 164/2000, the Italian implementation of Directive 98/30/EC concerning common rules for the internal market in natural gas)27 defines “LNG plant” as the terminal used for the liquefaction of natural gas or the import operations, and/or the unloading and regasification of LNG, including all the auxiliary services and temporary storage necessary for the regasification process and subsequent delivery to the transport system. It is immediately obvious that this definition does not correctly apply to SSLNG, since it excludes any tanks located in the plant that are not functional to the regasification cycle.

On the other hand, the law qualifies a “storage facility” as a facility used for the storage

of natural gas, including LNG, and owned or operated by a company. Again, this definition does not match exactly the SSLNG since it excludes the part of the facility used for production operations and facilities reserved for transmission system.

The much-needed clarification on the matter of SSLNG activities and services, expected with the Legislative Decree No. 257/2016, did not arrive. The Decree indeed regulates the administrative procedure, the so-called “Autorizzazione Unica” (on national, regional or communal scale according to the dimension of the activities), necessary to obtain authorisations for the construction of “storage and transport infrastructures” of LNG.

In particular Art. 9 regulates the case of facilities that are connected or functional to the construction of/ the linkage to the national gas transmission network, or isolated parts thereof, and thus defining them as “works of public utility” and “strategic importance”. Therefore, according to a strict literal interpretation of the Art. 9, the qualification of infrastructure of “strategic importance” can be attributed only to storage facilities that could have a functional or systemic role in the construction of portions of the national network for the transmission of natural gas. A role which would necessarily require the performance of the activity of LNG regasification. However, it is self-evident that DAFI Decree does not regulate traditional regasification infrastructures and their possibility of providing SSLNG services, for which the Decree merely redirect to the single procedure referred to in Article 46 of Decree No. 15 of 1 October 2007, valid for the construction of any type of regasification plant, regardless of size, thus linking them to more complex permitting national procedure.

In synthesis, it should be noted that the definitions referred in the DAFI do not succeed in resolving the complexity of the regulatory issues in relation to the variety of situations that arise in SSLNG practice. In particular, a grey area is left unsolved on the matter of which rules are applicable to mixed-purpose infrastructures under authorisation or design. Of those, some will be forced to mainly allocate their reception capacity to regasification activities, reserving a marginal share for the supply of so-called “SSLNG services”; while others, on the contrary, will have to act for the most part as storage depots not destined to supply natural gas transmission networks, but with the possibility of starting a regasification activity to the advantage of isolated network portions.

The above explains why, up 2018, all new Italian projects relating SSLNG are defined as “storage” depots of LNG that do not foresee the additional (and potentially remunerative) presence of small-scale sub-services28, 29. Anyways, it must be noted that other players are increasing their interest to SSLNG possibilities, with more projects being proposed every now and then (see Fig. 5)31

In addition to new projects, following the considerations on DAFI Decree, some LSLNG providers are imaging the possibility to modify their traditional regasification plants in order to propose SSLNG services.

In this context of blurred boundaries, it is also necessary to highlight the existence of a possible inconsistency in the administrative procedures required to obtain authorisation to build LNG facilities or storage facilities.

On one hand, Legislative Decree 257/2016 provides for the existence of three different procedures for the construction of storage facilities, each of which is calibrated on the basis of the size and function of the plant (Articles 9 to 11), while on the other hand, for the construction of traditional regasification infrastructure, the same Article 9 of the DAFI confirms the existence of the most burdensome procedure under Article 46 of Decree No. 15/2007, valid for the construction of any type of plant, regardless of size.

The absence of administrative procedures proportionate and appropriate to the capacity and functioning of regasification/liquefaction plants (especially those with reduced capacity that also perform activities functional to SSLNG services), may be an obstacle to the construction and development of new project, in clear contradiction with the role assigned to LNG in the national energy strategy.

Moreover, the lack, in the Italian normative, of a precise legal definition of the so-called “Small Scale LNG services”, generally recognised as the means by which liquefied natural gas is managed in small/medium quantities directly in liquid form, such as the loading, storage and subsequent unloading of part of the LNG not destined for the national natural gas transmission network (see Introduction), also weighs heavily on the regulatory level and exacerbate the complexity of the permitting processes.

On top of that, SSLNG services, as confirmed by the Authority in its resolution No.

141/2017/R/GAS of 16 March 2017, are not subject to tariff regulation but would be managed on a free market basis. With this in mind, the Authority, with the aforementioned resolution, initiated a procedure aimed at gathering the main information necessary for

the definition of an initial regulation of the technical and economic conditions of access to/supply of the services provided by the LNG storage facilities and infrastructures referred to in Article 9 of DAFI Decree, and for the exact qualification of SSLNG services

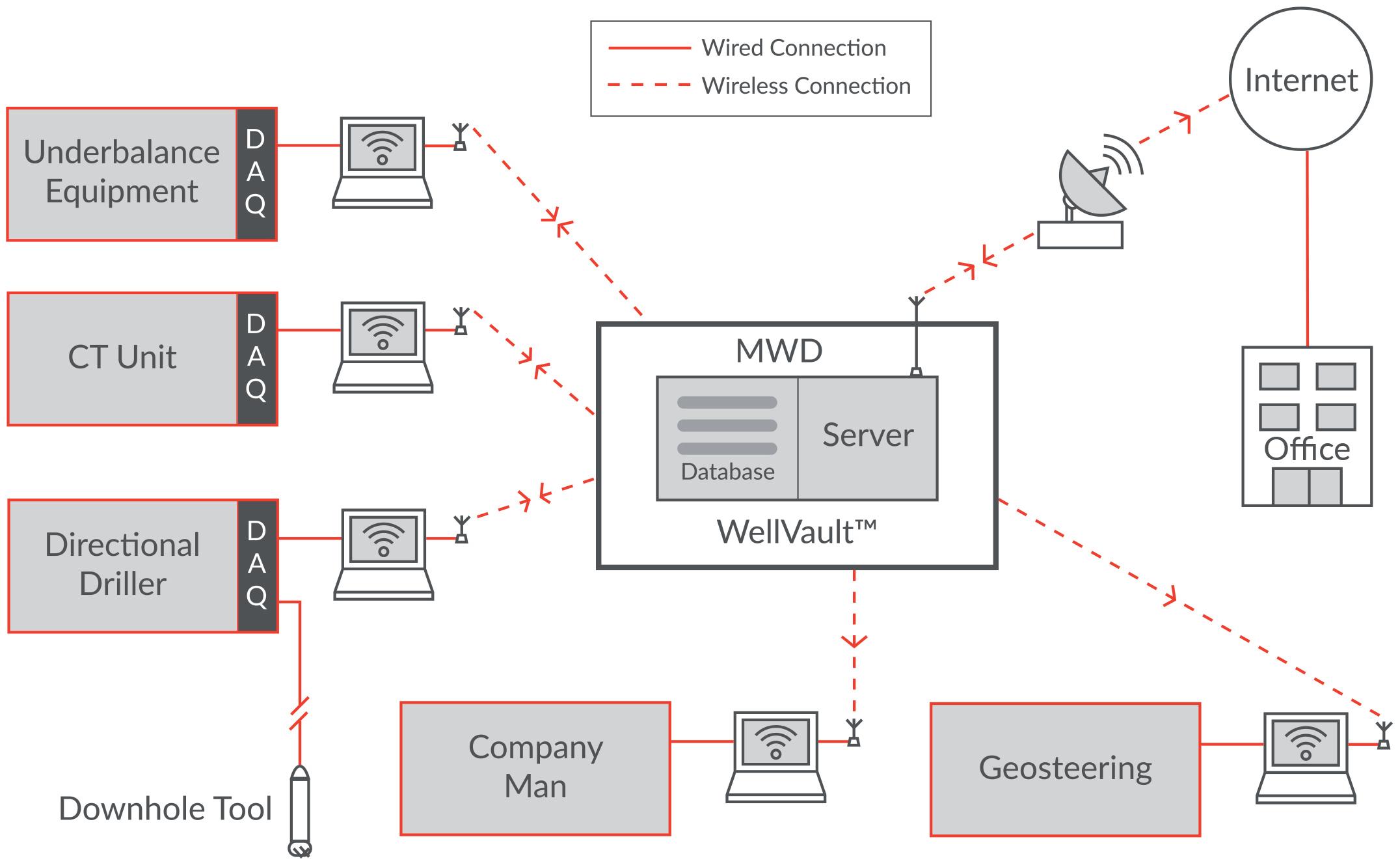

Laptops on wellsites were once a rare sight, but a much-needed evolution in wellsite IT is providing the system capability, reliability and security needed to support today’s technically advanced, data-intensive drilling techniques.

Despite the staggering volume of data required for Underbalanced Coiled Tubing drilling (UBCTD) applications, for a recent UBCTD job in Western Australia it would have been perfectly possible for a directional driller to have steered the directional drilling assembly from the comfort of an office in the UK via satellite internet. Whilst this might not always be desirable in practice, the mere fact that it is possible demonstrates the significant capability of modern communications and computing systems, and highlights the opportunities this can bring to the field.

Just as Internet servers in data centres driving e-commerce and online banking are managed remotely using software specifically adapted to configure, monitor and control hardware from a distance, this same capability can be employed in the oilfield where the fundamental requirements are the same (namely to provide timely, reliable and secure data to users).

To understand why UBCTD is so data intensive, it is worth considering the measurements being acquired. Downhole data from up to 200 sensors at a time is transferred at electric wireline speeds, rather than slow mud pulse speeds. This downhole data is then combined with surface data from the CT rig and the flowback equipment in real time. Throw in the complica-

tion of these data points being controlled by different providers and you begin to get an idea of the processing power required. In short, traditional methods of data transfer are no longer viable for these applications.

Before the advent of the PC, the most sophisticated piece of IT at the wellsite was the wireline logging truck. As PC technology became more widespread, it was harnessed by the industry and internet-enabled laptops were increasingly used on wellsites for reporting, email and data acquisition. However, this evolution has not been without its problems and, in many cases, the solution has been ad hoc fixes rather than long term strategy.

Clearly, wellsites are rugged environments that require robust equipment. However, consumer

grade equipment is significantly cheaper and more readily available, thus it often tends to be the preferred choice. But dust and other contaminants inevitably shorten the useful life of consumer grade equipment, making this a flawed logic. Then there’s the connectivity issues. Back before equipment was WiFi enabled, cables were strung across the wellsite and many hours were frequently lost repairing communications cables damaged by trucks. When WiFi did become available, many of us will recall instances where the source of a slow-running communication link was tracked down to a crew member streaming video on their mobile phone. In addition, data stored on desktop computers is inaccessible from the time it’s packed up to the time it arrives back at base, resulting in the costly and inefficient loss of valuable post job processing and reporting time. These factors and the associated security

risks and performance issues are all common features of an IT system under limited control, but by adopting a new strategy using readily available technology, things can be improved dramatically.

The speed, reliability and ubiquity of the internet has unquestionably made it an integral feature of modern life. Long gone are the days of dial-up and logging into a single server with static web pages. Nowadays it’s all about load balanced server farms, redundant databases that power e-commerce and network switches that efficiently and quickly connect users globally.

Billions of dollars and man hours have been spent rigorously improving the technology necessary to enable companies to operate their businesses online. This has primarily included automating the IT tasks that keep the system running. A key feature of modern internet management is that the person doing the managing is very rarely anywhere near the physical hardware being used, and the end user (in oilfield terms: the wellsite crew) requires minimal understanding of the technology to be able to use it. This is made possible by running many applications directly online through a browser without having to download any additional software. These so-called web apps can be up-

dated centrally, and all updates are available to end users at the same time.

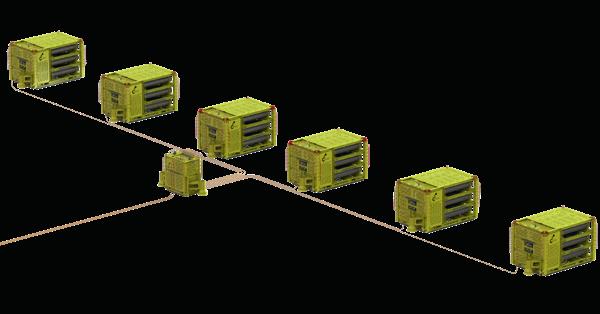

This concept can be applied to the wellsite by installing a mini data center at the heart of the wellsite IT system and ensuring a reliable connection to it. This ensures on-site quality-of-service to local users is maintained, essentially becoming part of the ‘cloud’ for the purposes of management and remote data processing.

The key to optimising the wellsite IT system is to treat it as an integral part of the wellsite, central to wellsite operation, rather than an added productivity tool. In a UBCTD setup, the time between rig up and rig down is relatively short, and there is usually no existing installation such as a rig communication system to plug into, and certainly not one configured for the data-intensive nature of a UBCTD operation.

The essential features are:

Environmental protection: Heat, cold, water, dust and vibration, all common wellsite features, are the enemies of delicate IT equipment. While these factors can be mitigated, measures can conflict with one another. For example, specifying fan-less computers may seem the obvious choice for minimising the impacts of

excess dust, but such computers have reduced computer clock speed impacting performance. Therefore it will be necessary to provide dust protection and filtering for fan cooled computers. In addition, protective cases can isolate equipment from shock and vibration in use and during shipping.

Internet connection: Optimum connection type (e.g. satellite, mobile internet or microwave link) is location-dependent, but must always be planned and tested rather than being considered as an afterthought or nice-to-have feature as has often been the case.

Data interfaces and displays: Individual data displays placed around the wellsite provide the communication required for integrated operations such as UBCTD. These also serve as a connection to third party data sources and drive the WiFi access points.

Long range point-to-point WiFi: Specialist WiFi access points provide longer range than consumer items. The challenge here is to be able to offer a range of secure fixing methods in order to position them as required, preferably on the outside of cabins with reliable cable entry into cabins.

Remotely configurable routers: Every device must be able to be configured, monitored and

maintained remotely to avoid costly downtime. Consumer products are cheap and readily available but, unlike enterprise-grade devices, don’t offer the control of configuration or feedback of data required for a remotely controlled industrial system.

Redundancy: To ensure reliability, especially where there is limited IT knowledge on site, a

The advantages of the new WellVault™ mini data centre were demonstrated during a recent project in Australia. UBCTD was used to drill a multilateral well with RockSense® porosity log used for geosteering. The objective was to drill two laterals in the reservoir section. The remoteness of the operation, 1200km north of Perth, and the fact that the support locations were in the US and the UK meant a minimum 2 day travel time to bring in equipment and support staff if required. Therefore, it was essential that equipment was reliable and could be configured remotely. The requirement was to send real-time data and logs to the client’s office in Perth and to the UK for interpretation. Additionally, the equipment maintenance data and inventory usage needed to be recorded in

The era of ad-hoc IT systems at the wellsite that do not meet the requirements for functional capability, reliability, security or remote control required for advanced drilling applications has passed. Modern development of internet data storage and communications technologies means it is possible to place a portable, internet connected, mini data center at the wellsite that can match the data security and equipment uptime capability of larger systems. Suitable precautions must be taken to physically protect hardware from harsh wellsite environments but, with care, this is achievable with relative ease.

robust redundancy setup is required. At least two servers must operate concurrently so that in the event the first server goes down, operation can switch to the backup servers without a loss of data. Currently, the switch over requires intervention by a remote engineer, but newer technologies can enable an automated switch over, potentially removing server failure as a cause of downtime.

Encryption and access control: To ensure data security, end-to-end encryption is essential and each device must have its own firewall and anti-virus software. To prevent the system being used by crew members for non-operational reasons, access should be limited using IP address control.

the cloud-based ERP system to provide daily updates on cost and any pending spares or stock requirements.

This was the first operation where it was deemed unnecessary to send a dedicated IT engineer to provide pre-job setup. A satellite link from the wellsite provided an internet connection and the WellVault™ data centre was configured to automatically provide a secure VPN connection to the UK, with any further setup tasks completed remotely. WiFi access points were setup around the wellsite by the local crew to provide connectivity to the underbalance equipment and the CT unit. Their data was provided in WITS format, with communication links having been tested before the job started.

Reliable, if slow, satellite internet connection meant that the wellsite database could be replicated in the UK for job support, troubleshooting and to create the RockSense® log for geosteering. Wellsite equipment needed to withstand extreme heat and pervasive dust. The value of a robust internet setup was proven during a server power supply failure on-site. Whereas a less sophisticated setup might have meant stopping operation for a few hours, and would have created data splicing problems later on, the new redundant setup allowed the backup server to be activated remotely, minimising downtime.

While most operations are not as data intensive as UBCTD, the era of integrated wellsite IT systems drawing and streaming data from multiple sources is most definitely upon us. Implementation of cutting edge remote controlled internet technologies enables wellsite crews to focus on their primary roles without having to undergo training to support additional equipment, while reducing the need for additional specializations on site and placing control of IT hardware and data within the IT department, where it can be managed and kept secure. The evolution of internet technology relies on users adapting the way they interact with it. Oilfield IT needs to similarly adapt in order to fully benefit from the digital transformation.

About the author

Toni is founder and Managing Director at AnTech Ltd where he has led the company’s entry in the Underbalanced Coiled Tubing Drilling market. Before founding AnTech, Toni worked for Schlumberger both in the field and in engineering development. He has a Batchelor’s degree in Mechanical Engineering from Imperial College, London and is the holder of several patents for downhole technology.

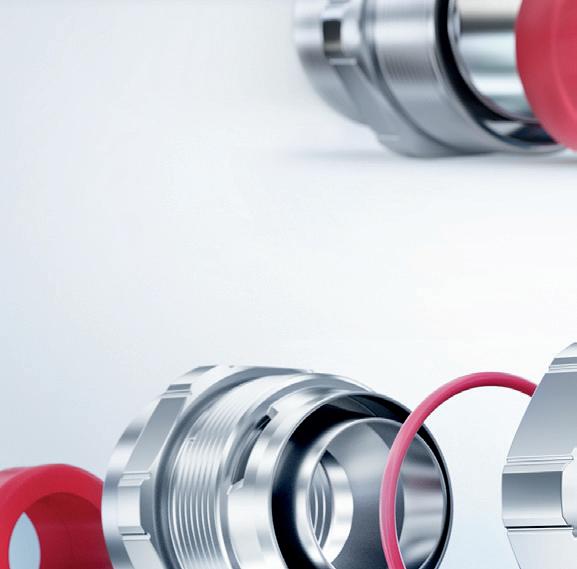

The LevelEx cable gland for non-armoured cables and the LevelEx AC for armoured cables o er you excellent explosion protection with all the necessary certifications such as ATEX and IECEx. With the ignition protection types „Ex d“ flameproof enclosure and „Ex e“ increased safety, they guarantee reliable protection in the potentially explosive atmospheres G (Gas) and D (Dust).

You are also on the safe side when it comes to costs: thanks to the outstanding ease of installation and a convincing price-performance ratio. What else speaks in favour of LevelEx and LevelEx AC? You can find out at www.pflitsch.de/en

LevelEx and LevelEx AC. Simply ingenious. Ingeniously simple.

The zone will include decommissioning and late life technology service providers, and a conference theatre programme.

In partnership with OGTC and Elevator, featuring cutting-edge innovation from UK & International start-ups.

Purpose-built for OE: Input from the event directors has shaped the new 48,000m2 venue

More space, better facilities: New on-site hotels, conference areas and expanded parking

Advanced Technology: Lightening fast connectivity, interactive seminar rooms and luxurious VIP lounges

Following successful launch of the ENGenious event, the community has clearly outlined the need for a platform to showcase the ever developing technologies in oil and gas. The ENGenious Zone will bring together Automation, Data Analytics, Robotics and Smart Communications.

Introduction

Due to the ever more challenging, and thus “investment-intensive”, contexts in which new wells are to be drilled, together with uncertainties of the current market, existing oil & gas assets do not only ensure an important cash source for Operators, but they also represent a low-risk and maybe the easiest opportunity to sustain production and reserves with a relatively limited cost. Furthermore, the availability of effective secondary and tertiary enhanced recovery technologies allows today to2 achieve a longer productive life of mature fields. These factors put together, definitely suggest that the extension of the existing wells’ life is a more advisable option than the drilling of new wells.

However, wells age and, if not properly maintained, may generate safety risks and environmental concerns, due to the degradation of the relevant Well Barrier Elements (WBEs).

Similar considerations also apply to gas storage wells, for which the degradation of WBEs is even amplified compared to production wells, because of the alternating production and injection cycles at the original reservoir pressures every year.

That said, a specific methodology and software for the proactive management of ageing wells have been developed. Such methodology is described herein, in terms of tasks involved and the related software functionalities to support them. Moreover, the results achieved from their implementation in two gas storage fields in France are also provided, namely the opportunity to keep wells ageing under control through a customized Workover Plan.

The concept of Well Life Extension is to keep wells “young”; to this aim, it is necessary not only to get a comprehensive understanding of

their current “health conditions”, but also to predict future critical WBEs in order to put in place suitable preventive measures. In other words, it is key to analyse the ageing mechanisms of specific WBEs and proactively maintain them.

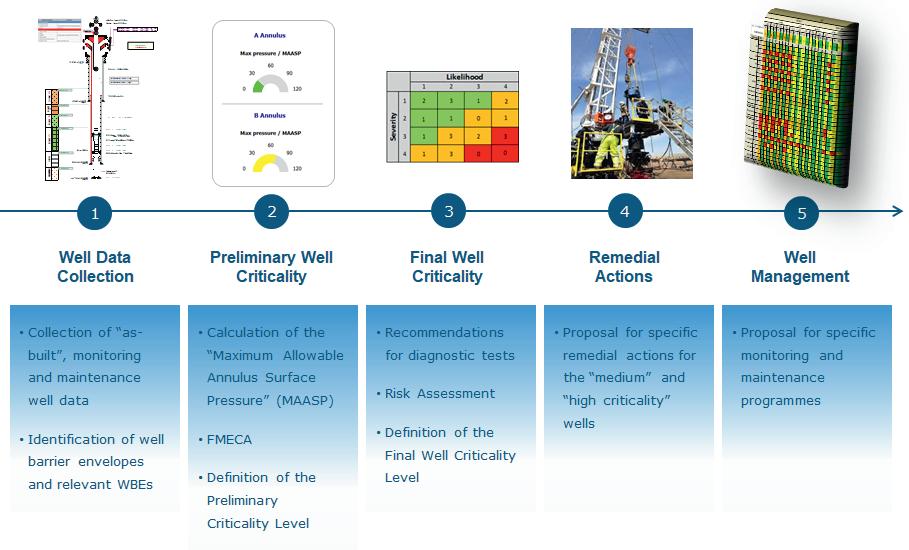

A typical Well Life Extension Study consists of the following tasks:

1. Assessment of the current integrity status of well, along with the execution of a Failure Modes, Effects and Criticality Analysis (FMECA), to identify the potential failure modes of WBEs and assess the related risks.

2. Collection of well integrity failures experienced in the field, analysis of corrosion logs, and definition of possible corrosion scenarios and degradation mechanisms.

3. Estimation of WBEs degradation factors (tubing and casing corrosion/erosion factors and elastomers degradation factors).

4. Prediction of current and future criticalities and estimation of the residual well life (“well ageing”) of each well subject of the study.

5. Definition of various Workover Plan options for the specific field, based on the priority levels resulting from wells and asset integrity, ageing, safety and performance factors.

6. Execution of a cost-benefit analysis.

Substantially, the Well Life Extension Methodology includes three main phases:

• Well Integrity Assessment

Estimation of Wells Ageing

Definition of Workover Plan Options

Each phase is described below, along with the main results obtained for two gas storage fields in France.

A typical Well Life Extension Study consists of the following tasks:

1. Assessment of the current integrity status of well, along with the execution of a Failure Modes, Effects and Criticality Analysis (FMECA), to identify the potential failure modes of WBEs and assess the related risks.

2. Collection of well integrity failures experienced in the field, analysis of corrosion logs, and definition of possible corrosion scenarios and degradation mechanisms.

3. Estimation of WBEs degradation factors (tubing and casing corrosion/erosion factors and elastomers degradation factors).

4. Prediction of current and future criticalities and estimation of the residual well life (“well ageing”) of each well subject of the study.

5. Definition of various Workover Plan options for the specific field, based on the priority levels resulting from wells and asset integrity, ageing, safety and performance factors.

6. Execution of a cost-benefit analysis.

Substantially, the Well Life Extension Methodology includes three main phases:

• Well Integrity Assessment

Estimation of Wells Ageing

Definition of Workover Plan Options

Each phase is described below, along with the main results obtained for two gas storage fields in France.

The first phase of any Well Life Extension Study is represented by the assessment of the current integrity status of wells, with the aim to evaluate whether the wells can be still operated safely. Previous papers Fig. 1. (1), (2) describe the applied well integrity assessment methodology, whose main steps are summarized in Fig. 1.

In the specific case of the well integrity assessment performed for two gas storage fields in France, the main results achieved are as follows:

• Field A: 10 wells have been identified as having a Medium Criticality Level

Field B: 6 wells have been identified as having a Medium Criticality Level.

Within the assessment, calculation of MAASPs and the definition of the preliminary wells criticality level has been performed by using the well integrity software developed in accordance with the criteria established by the ISO/ TS 16530-2.

The future performance standards of WBEs,

and consequently the “ageing mechanisms” of wells, are affected by degradation over time; from this point of view, the main “time-dependant factors” are:

corrosion/erosion factor, which has a progressively increasing impact on the resistance of WBEs due to possible corrosion/ erosion phenomena;

• elastomer ageing factor, which has a progressively increasing impact on the sealing capability of WBEs, due to degradation of elastomers.

The application of such degradation factors to the current WBEs’ performance standards allows to predict when the resistance of the weakest WBE(s) will become lower than the operational load it is exposed and, therefore, evaluate the residual well life and identify the

WBEs that are expected to become critical in the future. The residual well life has been estimated by using the previously mentioned well integrity software.

Such software starts introducing “non-time dependant (safety) factors”:

• Design safety factor, which is normally included in Operators’ well design standards, to take into account the uncertainty of the manufacturing process.

• Hydrostatic factor, to take into account the differential pressures generated by fluids inside and outside tubing/casings, as a result of their different densities and the related uncertainties.

• Wear factor, to take into consideration the possible erosion of casing internal diameter, caused by drill string during the drilling

of the subsequent well phase,

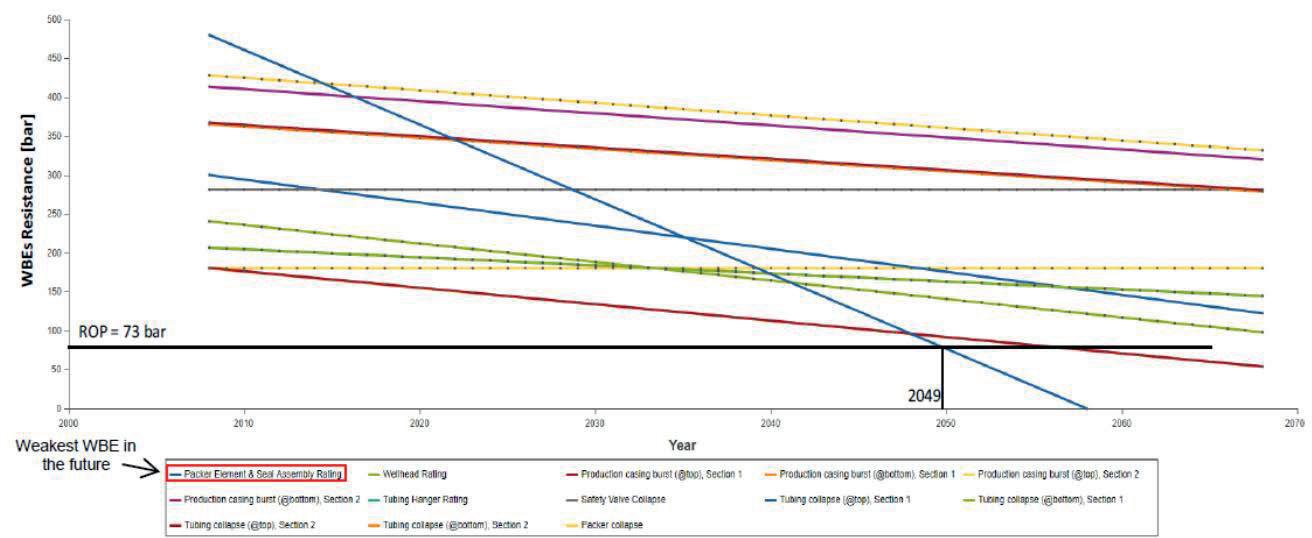

to calculate the resistance of each WBE at the time of installation. Then, by applying the above mentioned time-dependant degradation factors, the software provides the graph shown in Fig. 2.

Such graph, produced for each well included in the study, shows how the resistance of each WBE of the well decreases over time.

As operation load, a Reference Operating Pressure (ROP) equal to the maximum Tubing Head Pressure (THP) of the well under study is used. THP is the maximum pressure value that can be potentially found in the tubing and affects the barrier elements of the A-Annulus.

By drawing the horizontal line of ROP, the first declining line that is intersected defines the weakest WBE that is expected to become critical in the future (in the example of Figure 1, it is the Packer and Seal Assembly elastomers). The intersection point defines the well remaining life-time (in the example, 2049).

It is worth pointing out that the residual well life is an estimation aimed at anticipating the WBEs which are more likely to fail in the future; as such, it should not be considered as an exact value, but rather as a range of years in which failure may occur.

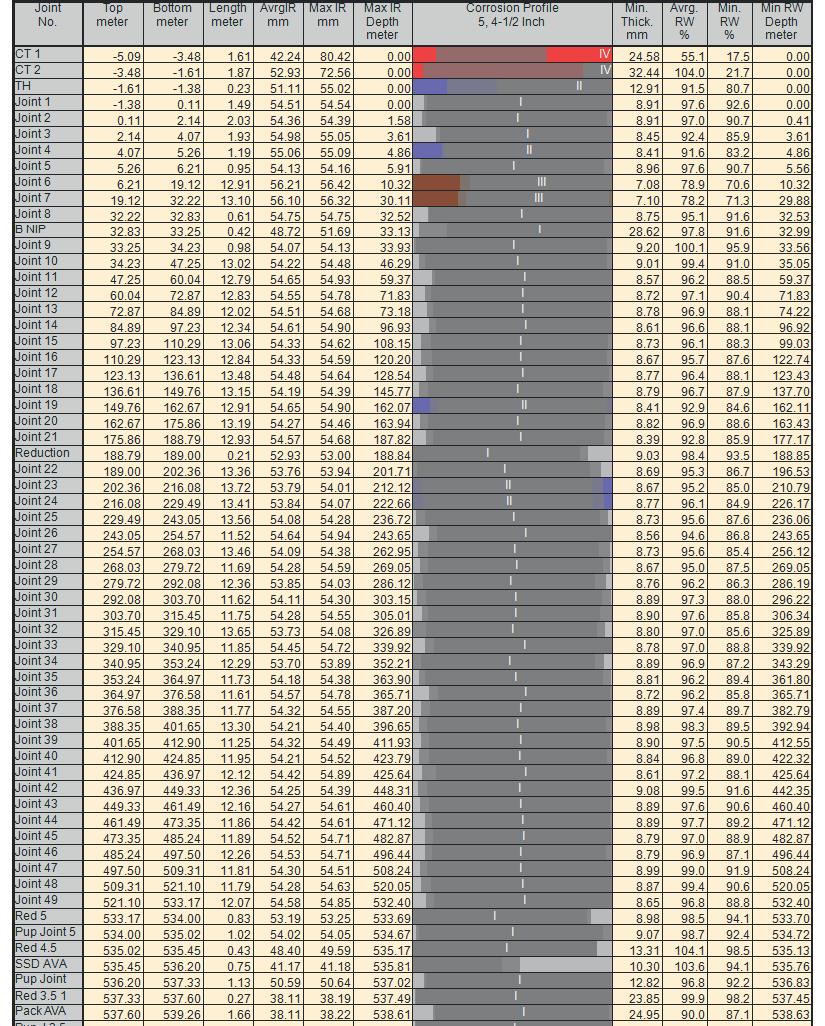

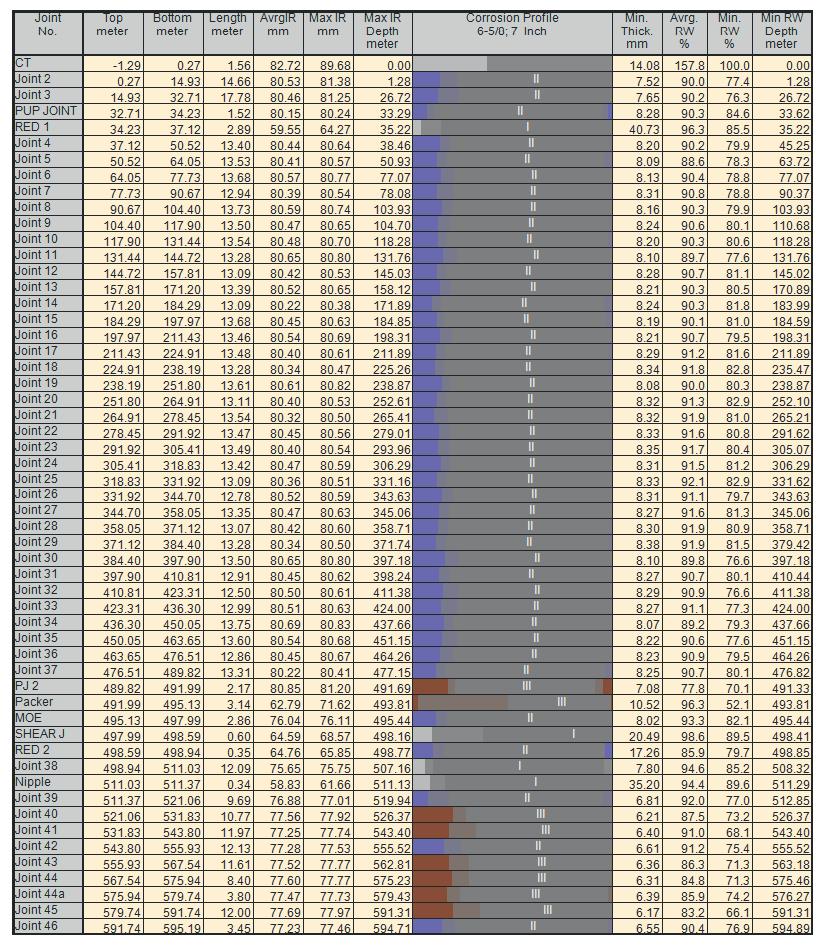

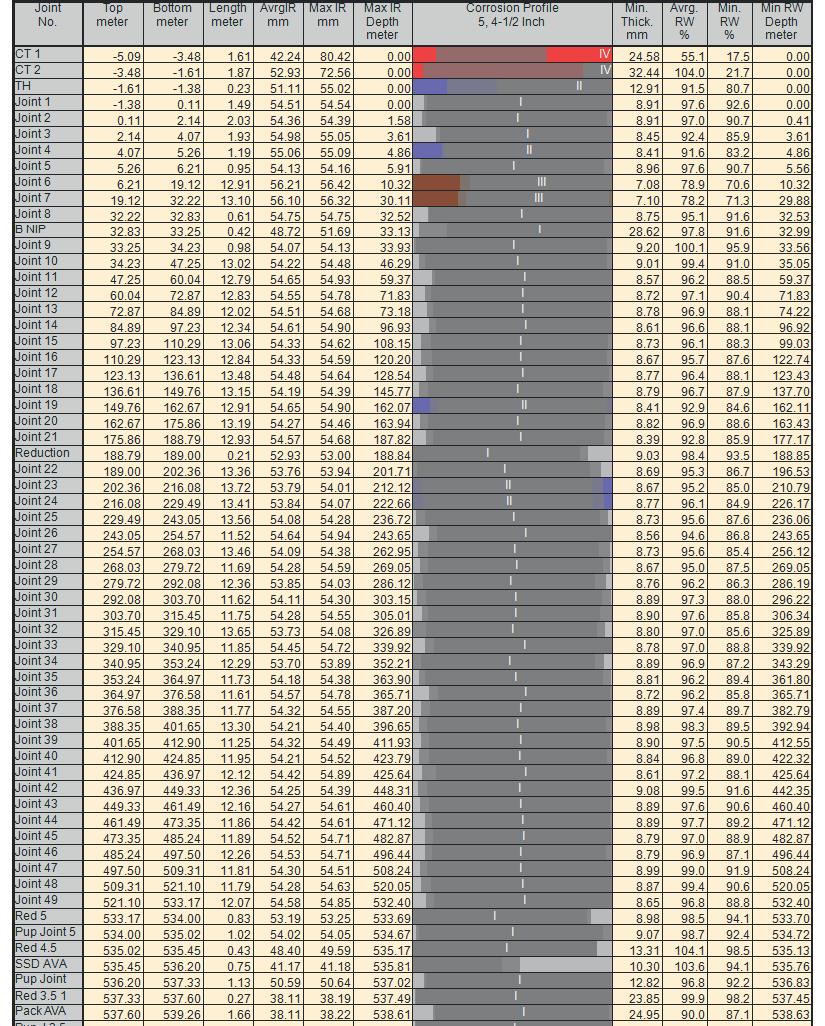

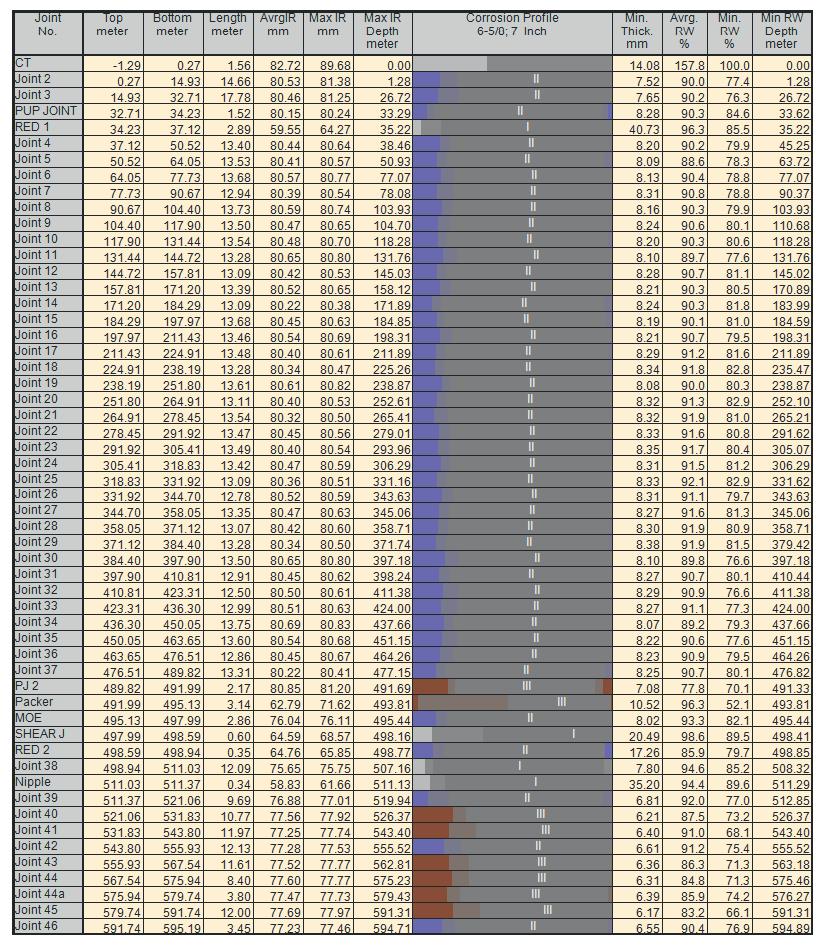

Corrosion/erosion factors are typically defined based on the analysis of the logs performed in the well of interest or in reference wells. In the performed gas storage fields applications, in addition to the extensive experience gained in similar works, the results of the Multifinger Caliper/Electro-Magnetic Defecto-Scope (MFC/EMDS) logs carried out on two reference wells of the fields (a gas storage well and a reservoir pressure monitoring well) have been used. Such logs had the objective of evaluating the extent of wear and corrosion on both the tubing and production casing: the combination of the two tools has allowed determining the reduction of wall thickness (WT) from inside and outside of both pipes.

By deeply analysing, joint by joint, the values of the average and minimum remaining wall pipe thickness reported in the two logs, some “false” erosion/corrosion detections have been identified and excluded. In particular:

Fig. 3. The “PJ2” of the reference gas storage well’s tubing showed a very different thickness reduction compared to previous joint. By verifying the joint top and bot

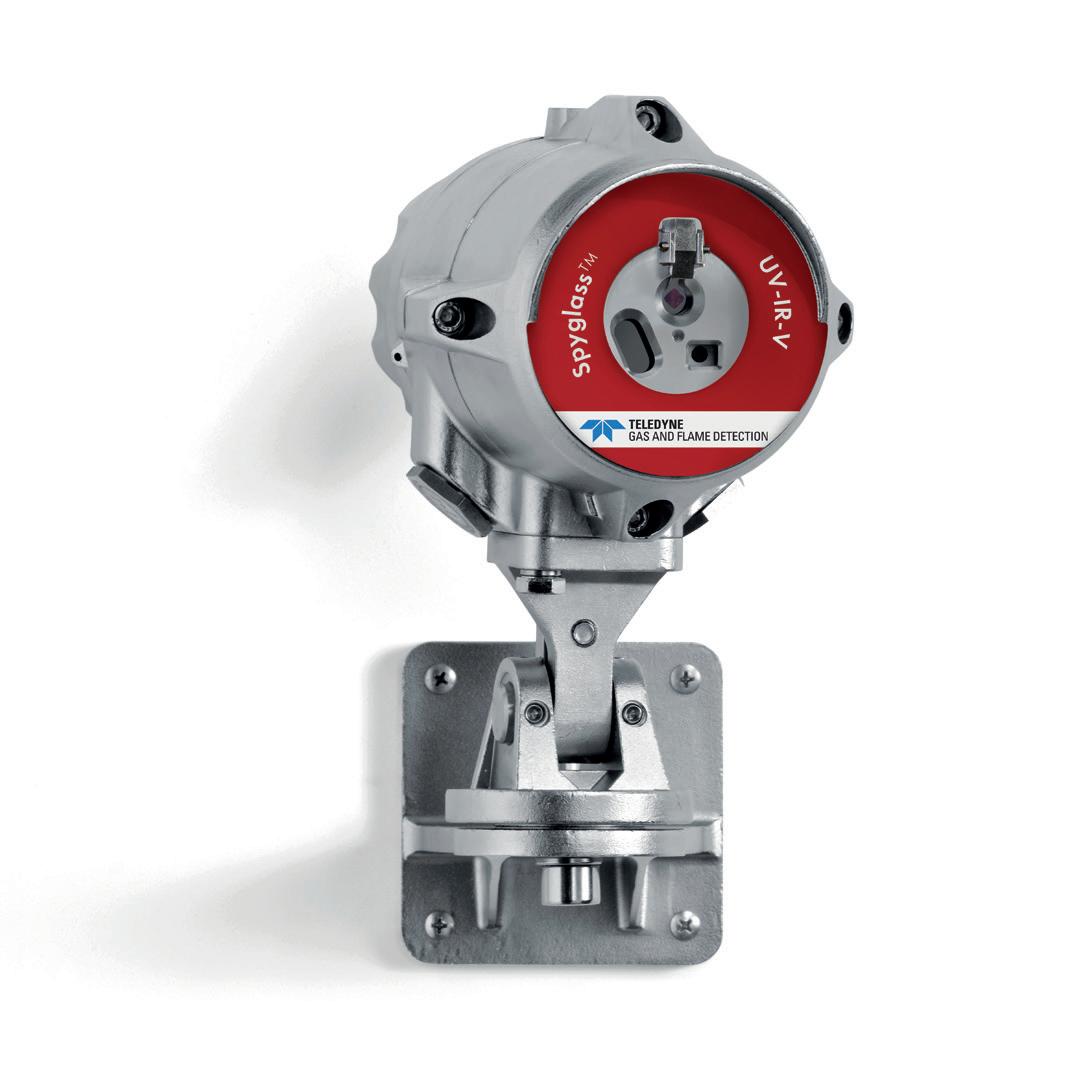

The Spyglass™ family of triple IR and UV-IR flame detectors feature top-tier optical technology, providing the fastest and most effective detection of fires and explosions to prevent or reduce damage to people and property.

UV-IR & UV-IR-F - Hydrocarbon, ammonia and metal fires

www.teledynegasandflamedetection.com

gasandflamedetection@teledyne.com

IR3 - Hydrocarbon fires

IR3-H2 - Hydrogen fires

IR3 - Hydrocarbon fires

IR3-H2 - Hydrogen fires

the third from the average remaining wall pipe measured for each

(low scenario).

In each scenario, the values of resulting corrosion factors are given by the average of the calculated for each joint (Table 1).

values of the “low corrosion scenario”, a sensitivity analysis has been performed to assess the impact of the “high” and “medium” corrosion/erosion scenarios on wells residual life, and define the final tubing corrosion/erosion factor.

t has been decided to use the tubing corrosion/erosion factors

After the decision to exclude the values of the “low corrosion scenario”, a sensitivity analysis been performed to assess the impact of the “high” and “medium” corrosion/erosion scenarios wells residual life, and define the final tubing corrosion/erosion factor.

sensitivity analysis, it has been decided to use the tubing corrosion/erosion summarized in Table 2

previously defined tubing and casing corrosion/erosion factors have to as storage fields applications, the following factors have been used: tubing/casing corrosion/erosion factors: values of the “high corrosion scenario”; elastomers degradation factors: three sets of annual degradation factors, as shown For permanent packers with locator, a higher annual degradation factor retrievable packers and permanent packers with anchor has been used in all scenarios, to take into account the greater degradation to which elastomers could incur due to their possible movements.

Table 2

Tubing Corrosion/Erosion Factors Used in the Sensitivity

also performed for production casings, for which two corrosion scenarios have been defined: a “high corrosion scenario” and a “low corrosion scenario”. In this maximum corrosion/erosion factor calculated from the log of 0.045 mm/y). The same value has been applied to intermediate

As the result of the sensitivity analysis, it has been decided to use the tubing corrosion/erosion the “high corrosion scenario”, as they better meet the frequency of the failures fields.

EMDS tool for each joint at a specific depth and azimuth (high corrosion scenario); the second from the maximum wall thickness reduction measured for a specific depth over the entire tubing circumference (medium corrosion scenario); the third from the average remaining wall pipe measured for each joint (low corrosion

In each scenario, the values of resulting corrosion factors are given by the average of the values calculated for each joint (Table 1).

After the decision to exclude the values of the “low corrosion scenario”, a sensitivity analysis has been performed to assess the impact of the “high” and “medium” corrosion/erosion scenarios on wells residual life, and define the final tubing corrosion/erosion factor. To carry out the sensitivity analysis, it has been decided to use the tubing corrosion/erosion factors summarized in Table 2.

Furthermore calculations have been also performed for production casings, for which two

corrosion scenarios have been defined: a “high corrosion scenario” and a “low corrosion scenario”. In this case, it has been decided to use the maximum corrosion/erosion factor calculated from the log of the reference gas storage well (0.045 mm/y). The same value has been applied to intermediate casings as well.

alculations have been also performed for production casings, for which two scenarios have been defined: a “high corrosion scenario” and a “low corrosion scenario”. t has been decided to use the maximum corrosion/erosion factor calculated from the reference gas storage well (0.045 mm/y). The same value has been applied to intermediate

the sensitivity analysis have shown that: by applying the elastomers degradation factors of the “minimum degradation scenario all the wells of the fields under study have a residual well-life that goes beyond 2029 (the decade 2020-2029 has been the period of interest for the definition of lan). A number of 18 wells have shown a residual well-life lower than

Elastomers Degradation Factors

in order to estimate the impact that packer and seal assembly have on the residual wells life, taking into account the past and those identified within the Well Integrity Assessment.

As the result of the sensitivity analysis, it has been decided to use the tubing corrosion/ the “high corrosion scenario”, as they better meet the frequency of the previously experienced in the specific fields.

y applying the elastomers degradation factors of the “medium degradation scenario

- 6 wells have shown a residual well-life between 2020-2029;

As the result of the sensitivity analysis, it has been decided to use the tubing corrosion/ erosion factors relevant to the “high corrosion scenario”, as they better meet the frequency of the failures previously experienced in the specific fields.

- the total number of wells having a residual well-life less than 30 years is 26;

• by applying the elastomers degradation factors of the “high degradation scenario”:

- 13 wells have shown a residual well-life between 2020-2029;

values of the “high corrosion scenario”; elastomers degradation factors: three sets of annual degradation factors, as shown in Table 3. For permanent packers with locator, a higher annual degradation factor than retrievable packers and permanent packers with anchor has been used in all the scenarios, to take into account the greater degradation to which elastomers could incur due to their possible movements.

A sensitivity analysis is carried out in order to estimate the impact that packer and seal elastomers annual degradation factors have on the residual wells life, taking into account failures experienced in the specific field and those identified within the Well Integrity Assessment.

- the total number of wells having a residual well-life less than 30 years is 30.

The results of the sensitivity analysis have shown that:

It has been decided to apply the elastomers degradation factors defined in the second scenario, which have been deemed to be able to reliably represent the actual wells ageing conditions:

• retrievable packers and permanent packers with anchor: 1,5%

• permanent packers with locator: 2%

A sensitivity analysis is carried out in order to estimate the impact that packer and seal assembly elastomers annual degradation factors have on the residual wells life, taking into account the past failures experienced in the specific field and those identified within theWell Integrity Assessment.

• annual degradation of wellhead and tubing hanger elastomers: 0,5% (as derived the experiences in similar works)

• by applying the elastomers degradation factors of the “minimum degradation scenario”, all the wells of the fields under study have a residual well-life that goes beyond 2029 (the decade 2020-2029 has been the period of interest for the definition of the Workover Plan). A number of 18 wells have shown a residual well-life lower than 30 years;

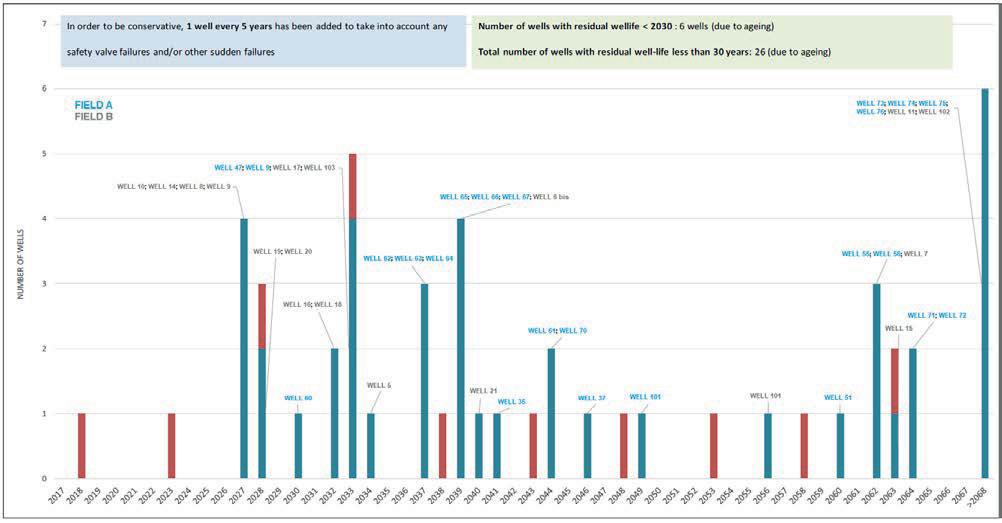

By applying the above corrosion/erosion and elastomers degradation factors, the wells ageing been defined for the studied fields, as shown in Figure 5:

• 4 wells with a residual well-life within 2027;

• by applying the elastomers degradation factors of the “medium degradation scenario”:

In such analysis, the previously defined tubing and casing corrosion/erosion factors have to be considered.

• 2 wells with a residual well-life within 2028;

• 26 wells with a residual well-life less than 30 years

- 6 wells have shown a residual well-life between 2020-2029;

In the performed gas storage fields applications, the following factors have been used:

• tubing/casing corrosion/erosion factors:

- the total number of wells having a residual well-life less than 30 years is 26;

• by applying the elastomers degradation factors of the “high degradation scenario”:

- 13 wells have shown a residual well-life

In order to define a suitable W orkover Plan, based on past failures and able to anticipate the future ones, in addition to wells ageing, possible failures of SCSSV and other sudden failures have been also considered, which do not depend on WBEs degradation and, thus, cannot be foreseen advance.

between 2020-2029;

- the total number of wells having a residual well-life less than 30 years is 30.

It has been decided to apply the elastomers degradation factors defined in the second scenario, which have been deemed to be able to reliably represent the actual wells ageing conditions:

• retrievable packers and permanent packers with anchor: 1,5% permanent packers with locator: 2% annual degradation of wellhead and tubing hanger elastomers: 0,5% (as derived from the experiences in similar works).

By applying the above corrosion/erosion and elastomers degradation factors, the wells ageing has been defined for the studied fields, as shown in Fig. 5:

4 wells with a residual well-life within 2027;

• 2 wells with a residual well-life within 2028;

• 26 wells with a residual well-life less than 30 years.

On the basis of the well integrity failures experienced in the two fields of interest and with a conservative approach, it has been decided to consider one further failed well every 5 years, additional to those which are expected to fail due to ageing.

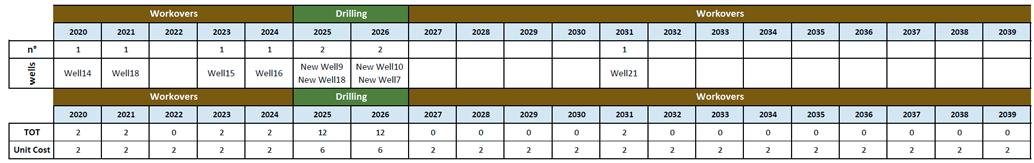

The final results of the study are shown in Fig. 6, where:

• blue bars indicate the wells that are expected to fail because of their ageing condition; red bars indicate the additional wells that are expected to fail due to SCSSV/other sudden failures.

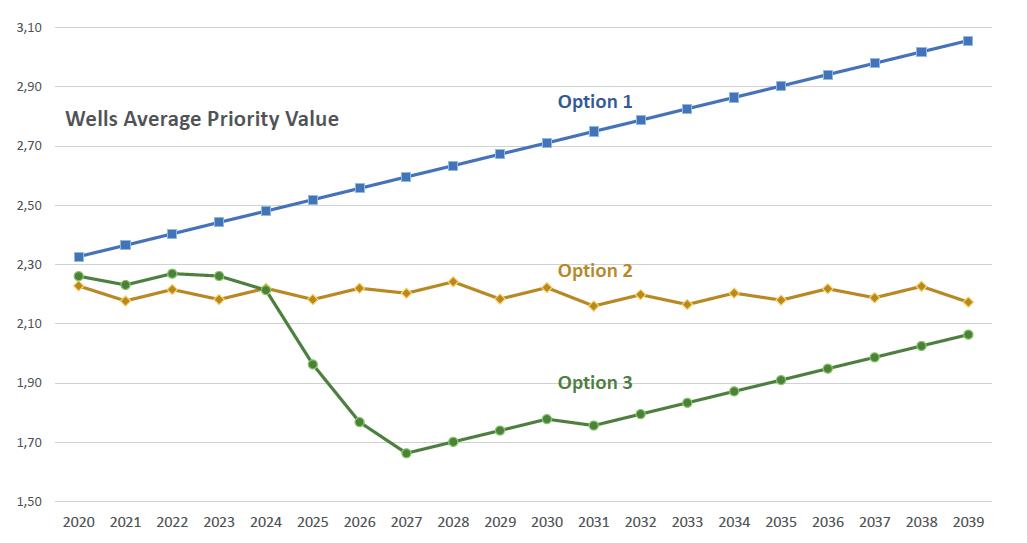

Based on the results of previous phases, wells are classified as a function of specific parameters such as well integrity, ageing, performance, asset and safety in order to produce Priority Lists for planning future workover activities. Then, a cost/benefit analysis is carried out.

• Performance: assigned based on the maximum production flow rate of each well. Safety/Location: this parameter refers to the distance from houses or facilities of each well; the greater the distance, the lower the assigned priority level.

• Asset: this parameter takes into consideration if a well is an isolated well or not: higher priority levels are assigned to isolated wells.

For the analysed fields, priority levels assignment criteria have been defined as described in Table 4, which also reports the values attributed to each priority level.

Then, a weight has been assigned to each of the above parameters in order to attribute them a “percentage of impact” on the final well priority value (Table 5).

In order to define a suitable Workover Plan, based on past failures and able to anticipate the future ones, in addition to wells ageing, possible failures of SCSSV and other sudden failures have been also considered, which do not depend on WBEs degradation and, thus, cannot be foreseen in advance.

To define a priority list for future workover activities, priority levels (and related priority values) are assigned to each well for the following parameters:

The weights for Safety/Location and Asset parameters have been assumed equal to zero because, when performing a workover, the geographic position of the well does not change; therefore, these parameters have no impact on the wells final priority values in the definition of a Priority List for workovers.

On the basis of the well integrity failures experienced in the two fields of interest and with a conservative approach, it has been decided to consider one further failed well every 5 years, additional to those which are expected to fail due to ageing. The final results of the study are shown in Figure 6, where:

Well Integrity: assigned based on the results of the Well Integrity Assessment.

• Ageing: assigned based on the results of the Wells Ageing Study.

• blue bars indicate the wells that are expected to fail because of their ageing condition;

A third factor has been finally attributed to each well, named function, aimed at reducing (or excluding) the impact of a specific parameter to specific wells (e.g., a function factor equal to zero has been assigned to the per

• red bars indicate the additional wells that are expected to fail due to SCSSV/ other sudden failures.

Based on the results of previous phases, wells are classified as a function of specific parameters such as well integrity, ageing, performance, asset and safety in order to produce Priority Lists for planning future workover activities. Then, a cost/benefit analysis is carried out.

To define a priority list for future workover activities, priority levels (and related priority values) are assigned to each well for the following parameters:

• Well Integrity: assigned based on the results of the Well Integrity Assessment.

• Ageing: assigned based on the results of the Wells Ageing Study.

• Performance: assigned based on the maximum production flow rate of each well.

• Safety/Location: this parameter refers to the distance from houses or facilities of each well; the greater the distance, the lower the assigned priority level.

• Asset: this parameter takes into consideration if a well is an isolated well or not: higher priority levels are assigned to isolated wells.

For the analysed fields, priority levels assignment criteria have been defined as described in Table 4, which also reports the values attributed to each priority level.

(*) A low priority level for Well Integrity has been assigned to wells with pressure in B-Annulus, since a workover would not be able to restore the integrity of such wells.

the definition of a Priority List for

(*) A low priority level for Well Integrity has been assigned to wells with pressure in B -Annulus, since a workover would not be able to restore the integrity of such wells. Table 4 Priority Levels Criteria for the definition of a Priority List for Workover

Then, a weight has been assigned to each of the above parameters in order to attribute them a “percentage of impact” on the final well priority value (Table 5).

The weights for Safety/Location and Asset parameters have been assumed equal to zero because, when performing a workover, the geographic position of the well does not change; therefore, these parameters have no impact on the wells final priority values in the definition of a Priority List for workovers.

Then, a weight has been assigned to each of the above parameters in order to attribute them “percentage of impact” on the final well priority value (Table 5).

The weights for Safety/Location and Asset parameters have been assumed equal when performing a workover, the geographic position of the well does not change; parameters have no impact on the wells final priority values in the definition workovers.

A third factor has been finally attributed to each well, named function, aimed at reducing (or excluding) the impact of a specific parameter to specific wells (e.g., a function factor equal to zero has been assigned to the performance parameter of monitoring wells, to exclude it from the calculation of the weighed priority value of these wells).

A third factor has been finally attributed to each well, named function, aimed excluding) the impact of a specific parameter to specific wells (e.g., a function has been assigned to the performance parameter of monitoring wells, to calculation of the weighed priority value of these wells).

By entering the defined priority values, weights and functions in the following equation, the current weighed priority value of each well has been calculated.