KIRKBI A/S is the Kirk Kristiansen family’s private holding and investment company founded to build a sustainable future for the family ownership through generations. KIRKBI’s strategic activities include 75 % ownership of the LEGO Group.

Purpose

Building a sustainable future for the family ownership of the LEGO® brand through generations.

KIRKBI focuses on three fundamental tasks, all supporting the sustainable family ownership.

We work to protect, develop and leverage the LEGO idea and brand

We are committed to a responsible investment strategy to ensure a sound financial foundation and contribute to a sustainable development in the world.

We support the owner family members as they prepare future generations to continue the active and engaged ownership as well as support their private activities and philanthropic work.

LEGO Group founded in 1932

The LEGO Group was founded by Ole Kirk Kristiansen in 1932. Today, KIRKBI owns 75 % of the LEGO Group. KIRKBI is owned by the Kirk Kristiansen family.

75 % 25 %

Our name

Locations

1 Billund

2 Copenhagen

3 Baar

Support Activities

We support the owner family members in their active and engaged ownership which include administrative services to their investment activities, private activities, companies and philanthropic work.

The LEGO School is a preparational programme for the 5th generation owners of the Kirk Kristiansen family.

Associated Foundations

2023 was a milestone year for the family ownership of KIRKBI and the LEGO® brand as the gradual generational handover from the 3rd to the 4th generation of the Kirk Kristiansen family was successfully completed.

In May 2023, on the day of his 50th anniversary, the 3rd generation family owner Kjeld Kirk Kristiansen stepped down from the Chair role of KIRKBI handing over his last formal role to Thomas Kirk Kristiansen, the most active owner in the 4th generation. This was the final step in a successful generational handover carried out over more than ten years, during which Thomas Kirk Kristiansen has gradually taken on more roles and responsibilities. At the same time, Agnete Kirk Kristiansen, 4th generation owner, joined the KIRKBI board of directors as a member.

The handover was an opportunity to celebrate the invaluable impact that Kjeld Kjeld Kirk Kristiansen has had on the development of the LEGO brand, the LEGO Group and KIRKBI for five decades. Also, it was an opportunity for the owner family

to reflect on their ambitions for the future – leading to the articulation of a long-term vision which will guide the family ownership and its activities over coming generations.

2023 was a year of continued global instability, high inflation levels and interest rates increasing to a high ‘new normal’. The geopolitical instability including wars in Ukraine and Gaza impacted families and children across the world, increasing the need for support to which KIRKBI and associated foundations responded. For the year, KIRKBI granted DKK 0.2 billion to charity, the LEGO Foundation committed total grants of DKK 1.3 billion to Learning-throughPlay activities across the world, and Ole Kirk’s Fond granted DKK 0.3 billion to projects benefitting children and families.

Despite a declining toy market, the LEGO Group delivered a solid performance in 2023 leading to a significant market share gain. The performance across all business areas led to a consolidated KIRKBI result for 2023 of DKK 11.3 billion. The 2023 after tax cash inflows to KIRKBI were DKK 7.3 billion, 38 % lower than the DKK 11.7 billion realised in 2022, impacted by significant investments in production capacity in the LEGO Group.

During 2023, the LEGO brand continued to make a positive impact on millions of children of all ages through the LEGO Foundation and through digital, physical, and location-based experiences.

A highlight for the year included the LEGO Group’s launch of LEGO Fortnite in December. The first digital play experience to come from the strategic partnership between the LEGO Group and Epic Games initiated in early 2022. The financial performance of the LEGO Group showed growth in consumer sales and revenue of 4 % and 2 %, respectively and a profit before tax of DKK 17.1 billion. Throughout the year, the LEGO Group continued to prioritise strategic initiatives designed to drive long-term sustainable growth, including construction of new factories in the United States and Vietnam as well as expansion of three existing production sites.

Having fully recovered from the COVID-19 pandemic, Merlin Entertainments, including the LEGOLAND® Parks, saw a positive development in 2023 with 59 million visitors. The satisfactory underlying result of Merlin Entertainments was negatively impacted by

extraordinary write-downs and increased interest rates which led to a net loss for the year.

For BrainPOP, acquired by KIRKBI in 2022, the performance was impacted by lower growth following the end of federal COVID-19 funding. This has led to write-down of the goodwill recognised upon acquisition.

In a challenging market, KIRKBI maintained its focus on value creation in the Core Capital portfolio and expanded its activities within Thematic Capital. Among others, highlighted by further investments into the solar energy developer Adapture Renewables Inc. which doubled its development pipeline in 2023 to 4 GW and acquired a 450 MW portfolio of solar projects to commence construction in 2024. Further, investments were made in circular plastic solutions and planting of the first trees as part of the ambitious Project Evergreen, where up to 10,000 ha of low yield farmland will be turned into forest over the coming years.

The Core Capital portfolio showed a return of 4.7 % in 2023, supported by a positive market momentum towards the end of the

year. During 2023, the investment portfolio was reduced by DKK 11 billion related to share buybacks made by the owner family in connection with the generational handover from the 3rd to the 4th generation.

As active owners, KIRKBI continued to engage with its investment portfolio on sustainability. In 2025, 45 % of KIRKBI Scope 3 emissions from equities, bonds, private equity and debt portfolios must come from companies setting SBTi validated targets and at the end of 2023, the coverage reached 40 %. In addition, strong progress was also made in the reduction of emissions stemming from KIRKBI’s own operations, among others driven by continued focus on responsible travelling and reduced emissions from the Real Estate portfolio.

As we enter 2024, we look forward to building on the strong foundation established over previous years with the successful generational handover and continued growth of the LEGO® brand – and with the new long-term family vision as a north star to guide KIRKBI’s next chapter.

We want to send a warm thank you to all the dedicated and passionate employees, who have done their utmost throughout the year to drive impact each and every day. Also, a warm thank you to our many partners. We look forward to yet another year of fruitful collaboration executing on our strategy and building a sustainable foundation for the continued family ownership of KIRKBI and the LEGO brand.

Thomas Kirk Kristiansen Chair of the Board

Søren Thorup Sørensen CEO

Thomas Kirk Kristiansen Chair of the Board

Søren Thorup Sørensen CEO

The LEGO® brand mission is ‘To inspire and develop the builders of tomorrow’. The owner family aims to fulfil the mission by enabling children to develop their potential through meaningful play and learning experiences.

This mission is reflected in the LEGO Idea Paper. Written by the Kirk Kristiansen family, the LEGO Idea Paper outlines the mission, vision, values, and promises which unite all entities in the LEGO ecosystem. The KIRKBI Fundamentals reflect the LEGO Idea Paper and serve as the compass guiding all business activities in KIRKBI.

The LEGO Group ownership has been with the Kirk Kristiansen family for four generations and active family ownership has always been viewed as not only a task, but also as an obligation to make a meaningful difference for children and the world they grow up in.

The owner family defines active ownership of the LEGO brand as having a deep interest and engagement in how the business develop and engage with children as well as stakeholders – and how the values are lived. In each generation, one member of the owner family will take the role as most active owner and be engaged in KIRKBI and the LEGO branded entities on behalf of the family. Thomas Kirk Kristiansen is the most active owner in the 4th generation.

Mission Inspire and develop the builders of tomorrow

Purpose Building a sustainable future for the family ownership of the LEGO brand through generations

Fundamental objectives

LEGO Brand and Related Activities

We work to protect, develop, and leverage the potential of the LEGO idea and brand across entities

Investment Activities

We invest responsibly to ensure a sound financial foundation for the owner family’s activities and contribute to a sustainable development in the world

Support Activities

We support the owner family members as they prepare for future generations to continue the active and engaged ownership and support their private activities and philanthropic work

With the generational handover completed in May 2023, the 4th generation of the Kirk Kristiansen family has articulated an ambitious, long-term family vision – intended to guide their activities over the coming years.

Building on the legacy of the LEGO® brand and financial strength of KIRKBI, the owner family will work to:

• Enable all children to learn through play: The owner family will work to make a positive difference for all children – by bringing highquality play and learning experiences to the builders of tomorrow. Through the well-known LEGO branded activities – and by taking an ambitious role in digital learning to shape the education of children to deliver real learning outcomes.

• Drive impact on climate issues: The owner family will accelerate the efforts to drive impact on two of the biggest global climate issues of our time: climate change and pollution from nonsustainable plastic materials. Through ambitious investments, the owner family will work to reduce carbon emissions and drive progress in the development and scaling of circular plastic solutions.

Guided by the long-term family vision the Kirk Kristiansen family will center its activities around four business themes with a separate function supporting the family members and their private activities and philanthropic work.

Bring the LEGO Idea to children of all ages – through a sustainable and unified brand experience

Build a leading position in digital learning to shape children’s education

Financial Investments

Family Support

Work to become a global frontrunner in building a sustainable future for generations to come

Ensure a sound financial base for the owner family and its activities through generations

Maintain a future-proof Family Support function that all family members and associated foundations can turn to for support

Operations and charity

LEGO Brand and Related Activities

• Brand development and protection

• Digital play and learning

Investment Activities

• Core Capital

• Thematic Capital

LEGO Foundation grants which support children reaching their full potential

The consolidated financial statements of the KIRKBI Group have been prepared in accordance with IFRS and the accounting policies are unchanged from last year.

To ensure appropriate presentation of relevant information for the user of the financial statements, certain materiality judgements of content and presentation have been made. Please refer to note 10.1 Basis of reporting in the financial statements for further information.

For the statutory report on CSR in accordance with the Danish Financial Statements Act §99a reference is made to the sections ‘People & Operations’ (page 32-35) and ‘Sustainability’ (Page 41-47).

Financial ratios have been calculated in accordance with the “Guidelines and Financial Ratios” as issued by the Danish Society of Financial Analysts.

KIRKBI’s greenhouse gas (GHG) data is prepared in accordance with the principles set out in note 10.3 to the financial statements to which reference is made.

KIRKBI’s activities are focused on three fundamental tasks all contributing to enabling the Kirk Kristiansen family to succeed with the mission to inspire and develop the builders of tomorrow.

KIRKBI supports the owner family in its active ownership of the LEGO® brand and activities related to the LEGO Idea. Each LEGO branded entity has a dedicated role in fulfilling the LEGO Brand Vision – to become a global force for Learning-through-Play.

‘play well’ in Danish, thought of by Ole Kirk Kristiansen, who founded the company in 1932 – and closely connected to the LEGO System in Play, developed by Godtfred Kirk Christiansen, which gives children the possibility to build whatever they can imagine with the LEGO brick building system.

The LEGO brand vision to become a global force for Learning-through-Play is anchored in the LEGO Idea and fundamental belief that playful activities help children of all ages learn and develop essential skills such as creativity, curiosity, imagination, and critical thinking. And while playfulness is not the only way to learn, it is a powerful approach to learning in general, including classical curriculum concepts such as reading, writing and arithmetic which help children succeed in life.

The LEGO brand vision outlines the efforts to establish, innovate and offer playful learning across a wide spectrum of online, physical and hybrid experiences in children’s free time, family time and school time. It was initially expressed in the name, ‘LEg GOdt’, meaning

Thus, for more than 90 years, the Kirk Kristiansen family has been active owners of the LEGO brand and with the strong growth of the LEGO Group and related LEGO branded activities, KIRKBI has supported the owner family in the work to protect, develop and leverage the full potential of the LEGO Idea and brand across entities. Now following the completion of the generational handover from the 3rd to the 4th generation of the Kirk Kristiansen family, the governance of all activities related to the LEGO Brand and LEGO Idea has been further streamlined and fully consolidated in KIRKBI as the holding company supporting the long-term family ownership.

Read more about the active ownership

Following the completion of the generational handover in 2023, it was decided to consolidate the active ownership of the LEGO® brand in KIRKBI and phase out the LEGO Brand Group established in 2017.

The LEGO Brand Group functioned as a separate virtual entity within KIRKBI having a dual-purpose: To protect, develop and leverage the full potential of the LEGO brand across the LEGO branded entities, and to enable the active and engaged family ownership of the LEGO brand through generations.

Chaired by Jørgen Vig Knudstorp in close partnership with Deputy Chair and 4th generation family owner Thomas Kirk Kristiansen, the LEGO Brand Group facilitated the 2032 LEGO brand strategy and vision – to become a global force for Learning-through-Play. Since it was established, the LEGO Brand Group has executed key strategic step changes important from an owner and development perspective and separate from daily operational tasks – such as:

• Investments in digital play and digital learning, culminating with KIRKBI investing in Epic Games and acquiring BrainPOP Education in 2022

• Investments in improving the experiences in LEGOLAND® Discovery Centers and LEGOLAND® Resort Parks, supported by KIRKBI joining a consortium taking Merlin Entertainments private in 2019

• Collaboratively building a new LEGO Brand Platform guiding numerous activities as well as supporting the digital transformation and sustainability aspirations for the LEGO branded entities

• Through established brand and advisory boards explore ideas at the perimeter of the LEGO brand and align on brand governance fundamentals

After the final handover from the 3rd to the 4th generation of the owner family and with Thomas Kirk Kristiansen now chairing KIRKBI, the LEGO

Group, and the LEGO Foundation, it has been a natural development to consolidate the family ownership and governance of activities related to the LEGO brand and Idea in KIRKBI. As a way of simplifying the governance set-up and continuing the owner family’s commitment to explore the full potential and possibilities of the LEGO Idea. It also formally ends Jørgen Vig Knudstorp’s governance and leadership roles with regards to the LEGO brand, a role he has played for the past 20 years, first as responsible for brand and business development, then as CEO and President and finally as executive chair of the LEGO Brand Group.

Jørgen Vig Knudstorp continues to support the Kirk Kristiansen family in realising the new long-term family vision through board positions, as Special Partner to the family and as member of the KIRKBI leadership team.

Despite a challenging market environment and a global toy market declining with 7 % in 2023, the LEGO Group delivered a solid performance with growth in consumer sales of 4 % leading to significant market share gain.

Revenue for the year increased by 2 % to DKK 65.9 billion and the profit before tax ended at DKK 17.1 billion compared to DKK 17.7 billion in 2022. The profit for 2023 was driven by strong consumer demand in especially Americas, partly offset by a drop in momentum in China. The operating margin was 26.0 % in 2023 against 27.7 % in 2022. Excluding the impact of foreign currency exchange rates, operating profit declined by 2 % against 2022.

The operating profit was impacted by accelerated but balanced strategic initiatives supporting long-term growth, including brand awareness, product innovation, retail platforms, digitalisation and sustainability. Further, the LEGO Group made substantial investments in increasing production capacity. The LEGO Group’s net profit was DKK 13.1 billion in 2023 against DKK 13.8 billion in 2022.

Based on the world-famous LEGO® brick and the philosophy of Learning-throughPlay, the LEGO Group provides unique play experiences for children of all ages.

Through creative play, the LEGO Group aims to inspire and develop the builders of tomorrow and nurture the skills to help future generations thrive and develop. When children play, they learn. They learn about problem-solving, communication, and collaboration. Skills that are more critical than ever. In the future, children will hold jobs that have not yet been invented. The only way children become prepared is by developing skills that can be applied universally.

Play is an effective way to develop these skills from a young age, and LEGO play is especially powerful as it offers children endless possibilities. Just six two-by-four LEGO bricks can make 915 million

different combinations. And they are made with such precision that they stick together like glue, but come apart easily so they can be built, unbuilt and rebuilt into whatever a child can imagine.

Today, the LEGO Group employs +28,000 colleagues and the products are sold in more than 120 countries. Among others through 1,031 LEGO branded stores, which include 195 stores owned and operated by the LEGO Group, and 836 LEGO Certified Retail stores owned and operated by partners.

Production facilities are located in Denmark, the Czech Republic, Hungary, China and Mexico and new factories are being etablished in Virginia, USA, and Vietnam. In addition to the headquarters in Billund, Denmark, the company has main offices in USA, UK, China and Singapore.

In december 2023, LEGO Group and Epic Games launched the muchawaited LEGO® Fortnite®. A survival crafting game launched inside the Fortnite platform and the first play experience from the strategic partnership between the LEGO Group and Epic Games that aims to

develop fun and safe digital spaces for children and families.

The partnership between Epic Games and the LEGO Group was initiated in 2022 and followed by a 1 billion USD investment from KIRKBI in Epic Games in the spring of 2022.

It attracted more than 2.4 million concurrent users at launch, making it the most popular experience within Fortnite at the time.

Read case story on LEGO Fortnite launch

Merlin Entertainments

Merlin Entertainments, operator of the LEGOLAND® Parks and LEGOLAND® Discovery Centers, reported continued revenue growth in 2023, supported by a recovery in international tourism after the COVID-19 pandemic, most notably in the early part of the season.

During the year, Merlin continued its partnerships and investments to enable a unified LEGO brand experience across LEGOLAND® Parks and other play experiences. Among others announcing a global partnership with luxury car brand Ferrari and with the opening of a second attraction with the new ‘next generation’ LEGOLAND® Discovery Centre format in Washington D.C., USA in August. Merlin Entertainments continued to work with partners on the development of three LEGOLAND® resorts in China throughout the year, planned to open from 2025.

Merlin increased the number of visitors in their attractions with more than 12 % in 2023 and revenue increased by 6 % compared to 2022. The result for the year for the underlying business was slightly negative, impacted by increased interest rates. KIRKBI’s share of the net result showed a loss of DKK 0.8 billion,

In 2023, Merlin Entertainments announced a global partnership with luxury car brand Ferrari to develop immersive themed brand experience at selected LEGOLAND® Parks.

The unique LEGO® Ferrari Build and Race experience, originally introduced in LEGOLAND® California, opened in Spring at LEGOLAND® Billund and LEGOLAND® Windsor and puts visitors in the driver’s seat to build, test and race their very own LEGO Ferrari with cutting-edge digital technology, the first of its kind at any LEGOLAND® theme park.

The partnership with Ferrari is the latest development in Merlin’s strategy of creating IP partnerships with some of the world’s most popular brands.

negatively impacted by extraordinary writedowns in two LEGOLAND® Parks.

KIRKBI, through its subsidiary LEGO Juris A/S, owns the LEGO® and LEGOLAND® trademarks, which are licensed to the LEGO Group and Merlin Entertainments, respectively. In 2023, investments in strengthening the LEGO® brand continued, among others with a contribution of DKK 400 million to the global brand campaign ‘Rebuild the World’.

Throughout 2023, LEGO Education continued the execution of its strategy, focusing on growth in core subject classrooms within the United States as well as key international markets. In the post-pandemic Education market progress was made on reaching more students in core subject classrooms, delivering joyful hands-on learning experiences.

Acquired by KIRKBI in 2022, BrainPOP has continued its development of digital learning solutions for classrooms across the U.S.

By delivering student engagement and actionable insights on essential skills development, BrainPOP empowers educators to meet students where they are and improve learning outcomes. The company is investing in expanded assessment capabilities and new solutions, including BrainPOP Science - its first subject-specific offering, having already received multiple industry awards of excellence.

In 2023, the financial performance of BrainPOP was impacted by lower growth following the end of one-time federal funding related to COVID-19 and in general lower local school budgets. This has led to writedown of the goodwill and part of tax assets capitalised upon acquisition.

The LEGO® House in Billund offers the ultimate LEGO experience for fans of all ages.

In 2023 the LEGO House had a world class guest satisfaction of 85 (net promotor score) and welcomed 312,000 guests, 62 % of whom were international visitors.

Effective 1 January 2024 the ownership of the LEGO House operations transitioned from Koldingvej 2, Billund A/S, a subsidiary of the LEGO Foundation, to the LEGO Group.

KIRKBI’s Investment Activities are split into a Core Capital portfolio focusing on long-term value creation and a Thematic Capital portfolio which aims to maximise impact for a more sustainable development in the world.

To reflect the strategic objectives, the investment portfolio is split into two areas:

Core Capital and Thematic Capital.

Across all investment activities, KIRKBI aspires to create value through responsible ownership and investments characterised by:

• Long-term mindset

• Engaged, ambitious, and active ownership of the companies and properties we invest in

• Practice active ownership that lives up to high ESG standards

• Work with partners with high integrity to create mutual long-term value

• Focus on investments where rigorous due diligence enables deep insights into risk and return

ESG factors are integrated in KIRKBI’s assessment of attractiveness and performance of an investment. ESG is considered both in the due diligence phase and as part of the ongoing ownership supporting a responsible behavior both for companies and properties to protect the value and enhance long-term returns.

Investment activities are regularly screened for compliance with international conventions and norms as well as measured against high responsibility standards and KIRKBI’s guidelines have appropriate flexibility to address differences among strategies and managers.

KIRKBI assesses its potential investments and monitors its portfolio considering the following:

• Alignment with KIRKBI’s overall values

• Activities on the negative list

• Performance in areas of material ESG risks and ability to manage these relative to industry peers

• Involvement in notable ESG controversies related to the company’s operations and/or products, possible breaches of international norms and principles,

such as the UN Global Compact, and performance with respect to these

Furthermore, investments in certain industries such as tobacco, armament, gambling, and adult entertainment are excluded.

Strategic objectives Investment Portfolio Aim

Long-term and responsible investment strategy to ensure a sound financial foundation for the family’s activities

Contribution to a sustainable development in the world

Capital (Equity, Real Estate, Fixed income investment)

Deliver a long-term, attractive riskadjusted return and a responsible investment strategy. Secure financial flexibility and liquidity for the owner family, the LEGO® branded entities and other strategic activities

Thematic Capital (Energy Transition, Circular Plastics, Land Sustainability, Building Billund)

Maximise impact and contribution towards a more sustainable development in the world, through long-term investments and active ownership

KIRKBI engages actively with portfolio companies and investment partners with the following four primary focus areas:

Strategy

Clear long-term vision for the company. The company’s robustness and positioning for long-term sustainable growth as well as 3-5 years’ value creation planning

Focusing on the company’s continuous improvement to ensure sustainable growth via continuous progress within environmental and social areas.

Ensuring a strong foundation for responsible business conduct

60,000

40,000

30,000

20,000

1 3 2 4 10,000

Ensuring that the right people and competencies are present on the Board of Directors and in management teams as well as a clear division of responsibility across owners, board, and executive management. Ensuring that the company’s systems and procedures are appropriate and supportive of its long-term development

The company’s efficiency around capital allocation and structure which supports the strategic plan.

50,000 Equity Real Estate Fixed Income Opportunities

6,000

4,000

3,000

2,000

1,000

70,000 2023 2022 0

5,000 Energy Transition Circular Plastics Land Sustainability Other Building Billund

7,000 2023 2022

In 2023, KIRKBI’s Core Capital Investment portfolio showed a return of 4.7 % supported by a positive market momentum towards the end of the year.

At year-end 2023, KIRKBI’s Core Capital portfolio had a total value of DKK 85 billion which was DKK 5 billion lower than at year-end 2022, impacted by share buybacks totalling DKK 11 billion effectuated in connection with the generational handover in the owner family from the 3rd to the 4th generation.

The investment portfolio delivered a return of DKK 3.8 billion in 2023 equal to 4.7 % (2022: -4.1 %). Overall, the return is considered satisfactory with especially the Fixed Income, Quoted Equity and Real Estate portfolios showing relatively strong returns while the Long-term Equity and Private Equity portfolios showed performance below expectations.

Throughout the year, KIRKBI maintained its focus on long-term value creation and responsible ownership. The investment portfolio continues to show robustness across changing market conditions, demonstrated by a 10-year average annual return of 7.2 %.

The Long-term Equity portfolio comprises significant minority stakes in listed and

privately held companies to increase KIRKBI’s exposure to investments compounding value over longer holding periods.

In 2023, KIRKBI continued the gradual roll-out of our new Long-term Equity investment strategy, targeting growing companies supported by global trends closely aligned to KIRKBI’s mission.

The Long-term Equity portfolio mainly focuses on three sectors:

• Sustainability: Companies whose products, services, or solutions contribute to limiting resource waste or reducing emissions. An example is KIRKBI’s investment in Tomra ASA, a company developing technology solutions for sorting of reusable materials.

• Healthcare: Businesses that contribute to making healthcare and life science more efficient, of higher quality, or more accessible. An example includes the investment into Surgical Science, a provider of surgical and medical simulation solutions.

• Education & Play: Companies offering playful or innovative services, software, content, and other key elements of the education and playful learning ecosystem. An example includes the investment into Kahoot!, a Norwegian game-based learning platform.

Below are details on the Long-term Equity portfolio at year-end 2023.

Long-dated US equity funds focused on

1) Ownership at year-end 2023.

2) As per latest available public information.

Financial highlights (m DKK) 2023 2022

Profit from Core Capital activities 3,777 (3,699)

Core Capital 5 years’ performance (m DKK)

in Kahoot!

In 2023, KIRKBI invested alongside Goldman Sachs Asset Management, General Atlantic and other co-investors to acquire Norwegian game-based learning platform Kahoot! in the context of a publicto-private transaction of the company.

Kahoot! is a game-based digital learning and engagement platform with global reach that among other things helps make learning more fun

and engaging for children, as well as for adult learners in a corporate setting. Kahoot! was founded in 2012 and has since reached over 9 billion participants in more than 200 countries.

At year-end 2023 KIRKBI owned 12.2 % of Kahoot!’s shares. The financial investment in Kahoot! is part of KIRKBI’s long-term equity portfolio.

Read case story on Kahoot! investment

The Private Equity portfolio is comprised by buy-out funds and co-investments with the objective of generating attractive long-term returns. In addition, the Private Equity Portfolio provides diversification across industries and geographies as well as access to opportunities in the private market that are otherwise not in the scope of the Long-term Equity portfolio.

KIRKBI’s Venture Capital portfolio consists of investments into funds focused on seed capital through series C/D financing, as well as direct minority investments into early-stage companies. The Venture Capital portfolio is focused on funds and companies within the gaming, education and deep-technology spheres.

The Quoted Equity portfolio is comprised by investments in high-quality listed companies across industries and geographies. The primary objective of the portfolio is to provide attractive long-term returns and to serve as provider of liquidity for KIRKBI and related entities as well as diversification of the overall Core Capital portfolio. KIRKBI applies its influence by exercising shareholder voting rights at the annual general meeting of the portfolio companies. KIRKBI voted at 100 % of all annual general meetings during 2023.

The main objective of KIRKBI’s Real Estate portfolio is to provide long-term stable returns through sound and high-quality properties as well as by looking at redevelopment opportunities with a high sustainability and

long-term value potential, mainly in the office sector.

Geographically, the 27 investment properties in the portfolio are located in:

• Copenhagen, Denmark

• London, United Kingdom

• Munich, Germany

• Hamburg, Germany

• German-speaking part of Switzerland

During 2023, KIRKBI continued the work to DGNB certify its buildings. The total number of certified buildings is now 14 out of 27 and the certification process has been initiated for four additional buildings.

By end of the year, all of KIRKBI’s properties have climate action roadmaps in place outlining how each property can become CO2 neutral by 2030. This process is to be supported by increased data usage process automation and tenant engagement.

The Fixed Income portfolio serves as a source of cash management, stable returns, and adds less volatile and less cyclical elements to the overall portfolio relative to equity investments.

case story on biodiversity in Ecopark Tivoli

In the fall of 2023, KIRKBI completed the renovation of Ecopark Tivoli in Spreitenbach, Switzerland – a rental space covering an area of 19,000 m2. This former printing facility has gone through a thorough sustainability-focused refurbishment and will operate as a carbon-neutral property in the future.

A key property feature is the expansive roof top park covering 2,000 m2, which showcases rich biodiversity and provides a space for tenants to engage in social and physical activities. Currently, the occupancy is 85 %, reflecting a strong interest in this eco-friendly workspace.

During 2023, KIRKBI continued its progress within thematic capital, leveraging the foundation and capabilities established over recent years to scale investments across the portfolio.

KIRKBI’s thematic investments are driven by the owner family’s commitment to contribute to a sustainable development in the world. To maximise impact while ensuring long-term return on investment, KIRKBI focuses on four investment themes: Energy Transition, Circular Plastics, Land Sustainability, and Building Billund.

The approach is twofold: KIRKBI invests in companies with more mature technologies, where exercise of active ownership can strengthen their performance and support them reach their full potential. An example is KIRKBI’s investment in Adapture Renewables Inc., a US-based developer of solar facilities and energy storage. At the same time, KIRKBI explores new technologies that have moved beyond the prototype phase and require risk-willing and long-term capital to reach scale. An example is the investment in the German company APK AG, which operates in the plastic recycling space.

Building on the foundation, capabilities and partnerships established over recent years, KIRKBI overall made good progress within thematic capital during 2023. Achievements include expansion within Land Sustainability,

scaling existing investments in Energy Transition and completing new investments in Circular Plastics.

KIRKBI has an ambition to drive impact within decarbonisation by investing in mature renewable technologies such as solar and wind – complemented by investments in emerging renewable technologies, notably within energy storage and power-to-x.

Over the coming years, KIRKBI intends to expand its Energy Transition portfolio by investing in growth-focused platforms, bolstering off-take and end-use adoption of renewables. Simultaneously, KIRKBI will fund technology and capacity builders within the emerging technologies space – to enable a higher penetration of renewable energy and support decarbonisation of hard-to-abate industries.

By end of 2023, the Energy Transition portfolio comprised the following:

Energy

Circular

Northern

Worldwide

Land

Building

• 25 % of the Burbo Bank Extension offshore wind farm with a total capacity of 258 MW, located off the coast of Liverpool, UK.

• Full ownership of the solar energy developer Adapture Renewables Inc., specialised in developing, engineering, building, and operating distributed utilityscale solar photovoltaic (PV) projects in North America. The company operates more than 30 solar power projects in 19 states across the USA with a combined capacity of 262 MW and a development pipeline of 4 GW, increased by close to 2 GW during 2023. Investments continue to be made to expand the organisation, its greenfield development activities as well as acquisitions of late-stage development projects – in 2023, highlighted by the acquisition of a 450 MW portfolio of solar projects expected to commence construction in 2024. During the year, Adapture continued to scale its platforms, grow the organisation to a total of 60 FTEs and strengthen its development capabilities now with presence in three regions across the US.

• Copenhagen Infrastructure Partners (CIP) Energy Transition Fund I, focusing on investments in next generation renewables energy infrastructure, including carbon capture and energy storage technologies.

• Minority share of Monolith, a US-based developer of hydrogen and clean materials technologies, such as carbon black and ammonia.

• Decarbonization Partners Fund I, founded by BlackRock and Temasek, focusing on investments in late-stage venture capital and early-stage growth companies whose activities and technologies support the acceleration of decarbonisation and the transition to a net zero economy.

In 2023, KIRKBI increased its investment in Adapture Renewables Inc. to triple solar energy capacity

Adapture Renewables Inc., owned by KIRKBI, tripled its portfolio capacity in 2023 among others through the acquisition of three solar projects in the US with a combined capacity of 450 MW. Upon completion, the projects will provide clean energy to over 72,000 US homes annually.

Since KIRKBI’s initial investment in Adapture Renewables Inc. in 2019,

significant strides have been made to increase operational capacity and build a solid development pipeline. The acquisition of the three solar projects and a first battery project investment in 2023 are important milestones for Adapture Renewables Inc. that besides being financially attractive also supports KIRKBI’s overall ambition for the thematic investment area – to drive positive impact across sectors and contribute to a sustainable development.

Plastic plays an important role in society due to its qualities, but it is also a significant problem given it is typically based on fossil fuels emitting greenhouse gases and not yet subject to proper circular solutions. Consequently, plastic pollution has become a fundamental threat to our planet.

Through its investments in Circular Plastics, KIRKBI wishes to contribute to converting the plastics economy from the existing linear ‘take-make-waste’ model to a circular one, where plastics are sustainable and continue to be a valuable resource. The investment focus is continuously being refined to provide the highest impact per invested amount – overall the activities are guided by three investment theses: less plastic, better plastic, and better systems as investments within these three areas support the transition towards a world where plastic waste and CO2 emissions are reduced

By the end of 2023, the Circular Plastics portfolio comprised the following:

• Minority shareholder of Ambercycle – a US-based advanced recycling company building circularity in the fashion industry by regenerating end-of-life textiles into new materials for brands and manufacturers. In 2023, KIRKBI supported the company with an additional USD 5 million investment as part of a funding round, which will mainly be used to scale and mature Ambercycle’s technology before the planned construction of a larger scale commercial plant.

• Minority shareholder of APK – a Germanbased company that specialises in the production of plastic granulates using a wide variety of material flows to do so and an efficient recycling process called Newcycling®

case story on APK AG investment

1 2 3

In 2023, KIRKBI invested in the German company APK AG, alongside LyondellBasell, a global leader in the chemical industry and other co-investors. APK specialises in a unique solventbased recycling technology for low density polyethylene (LDPE).

APK aims to increase recycling of multi-layer flexible packaging materials, through its unique Newcycling® process. The technology separates the different polymers of multi-layer packaging materials leading to high-quality, pure recycled materials, which can then be used in new packaging materials.

Land Sustainability was introduced as an investment area in 2022 with the initial focus being primarily on forestry. Production forestry allows for continued carbon sequestration and storage. By using the wood, e.g. in building materials and furniture, the sequestered CO2 will be stored long-term and replace more CO2 heavy alternatives.

By the end of 2023, a total of approximately 1,600 ha of agriculture land has been acquired in Jutland, Denmark with the aim of establishing new forest. In the spring, the first 60 ha of new forest was planted, and KIRKBI expects a significant ramp-up over the coming years.

Forests are established in accordance with internal guidelines and policies on tree species, biodiversity measures, CO2-uptake, wildlife management etc. The aim is to establish high yielding, climate robust mixed forests. In addition to establishment of new forests, KIRKBI has invested in approximately 1,500 ha of existing forest in Denmark. Via active forest management, the aim is to gradually increase the climate effect, resilience and biodiversity of these areas.

Billund is the founding place of the LEGO Group and KIRKBI remains dedicated to the local community by actively supporting the development of the town.

The Billund City Vision – a plan initiated by KIRKBI, Realdania, and Billund Municipality in 2015 – provides a framework for supporting and further building Billund’s unique character as the Capital of Children. For KIRKBI, the vision also serves as a frame for how we can

support this development through Real Estate and other activities.

In 2023, KIRKBI continued its engagement in real estate projects in the local area of Billund. In August, Efterskolen PLAY (an independent residential school) in Grindsted officially opened its doors to new students. With support from KIRKBI and Ole Kirk’s Fond, the former commercial high school has been transformed to an innovative residential school, where a playful learning approach is rooted in every aspect of the school to enhance motivation and help the students excel their abilities. In May 2023, Billund Church was reinaugurated in connection to the celebration of the church’s 50th anniversary. The church has undergone a revitalisation to a more contemporary interior with support from KIRKBI.

In the midtown of Billund, KIRKBI commenced the construction of a new building containing apartments for employees of the LEGO Group. The building will be certified in both DNGB Gold and Nordic Eco Label. An expansion of the International School of Billund was also initiated in 2023, set to be finished in 2024.

Next to the International School of Billund, KIRKBI is developing a new neighborhood called Travbyen. In December 2023, the district plan for the area was approved by the municipality of Billund and construction will begin in the spring of 2024. Once fully developed, Travbyen will be a diverse neighborhood, where Billund’s citizens and visitors can meet and experience new forms of play, movement, and communities. The area will have up to 500 residential units, small local shops, a day care center and space for creative professions, sports, and movement. Travbyen has a total investment framework of DKK +2.3 billion.

In 2023, KIRKBI continued its focus on leadership and diversity, equity, and inclusion (DE&I).

KIRKBI employs approximately 200 specialised and experienced professionals in a diverse set of fields, all dedicated to supporting the overarching purpose of building a sustainable future for the family ownership of the LEGO® brand through generations.

As a family-owned company, KIRKBI is guided by the beliefs and values in the KIRKBI Fundamentals including the four promises, which define how play, people, partner, and planet are integral for succeeding with the mission to inspire and develop the builders of tomorrow.

The People Promise is based on a fundamental belief that organisational success rests on the continued growth, development and inclusion of all employees including leaders. As the most important asset KIRKBI’s employees are instrumental for delivering on the vision and mission. To ensure the right competencies there is a continous focus on the existing employees as well as the possibility of attracting new

competencies and diversity from the outsideseen from a broader perspective.

Guided by the promise, KIRKBI continued its focus on both leadership and diversity, equity, and inclusion (DE&I) in 2023.

Among others, KIRKBI reviewed its recruitment process, aiming to make it more inclusive and unbiased. Also, an equal pay analysis was conducted across the organisation, and KIRKBI is now reporting continuously on gender representation at all job levels.

Overall, KIRKBI has a balanced and close to equal male/female representation across the organisation. One exception of special interest is the investment areas, where female representation is generally lower. KIRKBI has high focus on introducing additional measures to attract and develop female talent in this area.

Every year, the employees’ motivation, satisfaction, and engagement are measured in a PULSE Survey. The responses are used to identify possible areas of improvement both at team and organisational level.

The PULSE survey shows a 2023 motivation and satisfaction score of 82, which is slightly lower than in 2022 but still higher than the national benchmark of 75 (GELx) and among the 5 % best performing companies of KIRKBI’s size.

The PULSE Survey reflects a high level of loyalty and satisfaction across the organisation with employees generally showing a high appreciation of the purpose and values as well as high job satiscfaction with high trust in their teams and immediate leader.

Lifelong learning and development should at any time be available to all employees in KIRKBI to maintain and further build their professional and personal competencies. In 2023, KIRKBI therefore continued the organisational work with Individual Development Plans and Performance Management Programmes to foster employee motivation and performance.

At KIRKBI the work culture must be a safe space where employees feel a great sense of belonging and a high degree of inclusion. A diverse organisation and an inclusive

working environment represent a necessary base for this and an opportunity to succeed in the long term.

In 2023, KIRKBI continued its focus on the following three main areas:

• Engage employees & build inclusive culture

• Improve processes and systems

• Data insights and tracking

Pulse survey

100 as the highest score.

Response rate 2023: 98 %

In order to improve processes and systems to avoid structural inequity, a Structural Analysis of the organisation was conducted in 2023. The analysis was carried out by an external provider to detect embedded structural bias in people processes and policies.

Throughout 2023, teams have worked with the findings made in the Cultural Assessment of 2022. The result showed that KIRKBI’s employees generally experience a high level of inclusion and belonging across gender, age, and nationality. The team dialogues across the organisation have focused on how each employee can influence the ability to be inclusive of diversity in the teams.

Recognising that a change in cultural mindset has a greater chance of success when involving the organisation itself, KIRKBI established an Employee Advocacy Group (EAG) in 2021. The purpose of the EAG is to ensure that the process of exploring, learning, and adjusting our DE&I efforts is driven by employee engagement and ongoing involvement. This year, the EAG has helped initiate the Structural Analysis, and acted as a sounding board on processes and policies contributing with diverse input and

KIRKBI’s working environment policy (EHS Policy) lays down the general framework for activities relating to the working environment and aims to ensure that all activities are planned and carried out in a healthy and safe working environment and in compliance with working productivity and legislation.

out view. The group has also investigated what initiatives are needed to get the vision statement on DE&I fully implemented providing input for initiatives for 2024 and long term.

Gender representation

Gender is only one aspect of diversity; however, it is a focal point to ensure equal opportunities for all. Looking at the total KIRKBI organisation there is a satisfactory and close to even gender distribution. However, looking at the gender balance at the Director+ level1) below Board of Directors, KIRKBI has a lower female representation. A Gender Balance Policy has been published with targets and initiatives in line with the legal recommendations, both on the required levels and on additional levels.

To facilitate a balanced gender representation at all levels, the specific targets set out in the table below were defined in 2022 and constitute input for a strong, continuous focus area in the coming years. To reach the gender targets, KIRKBI has in 2023 reviewed its people processes and policies in collaboration with its Employee Advocacy Group. The main objective has been on ensuring bias-free policies as well as inclusive recruitment, promotion, and reward processes. Also, a structural analysis has been carried out by an external partner to identify further areas of improvement to be implemented in 2024 and beyond.

In May 2023, Agnete Kirk Kristiansen, 4th generation owner, was elected board member of KIRKBI A/S. With her entry into the Board of Directors, KIRKBI has a 50/50 gender balance.

balanced gender presentation at all levels

Acknowledging that gender is only one aspect of diversity, KIRKBI will continue the efforts to ensure a diverse workforce at all levels of the organisation, including a further strengthening of the internal diversity and inclusion agenda and understanding. KIRKBI wants to ensure that every employee feels valued and enabled to release his/her full potential.

The Code of Conduct for employees formalises KIRKBI’s policies related to human rights, labor, environment, and anti-corruption. The Code of Conduct is known by all employees and referred to by management. In the event of noncompliance with KIRKBI’s high standards for business ethics, it can be reported via the whistleblower line at KIRKBI.com.

KIRKBI assesses sustainability and business ethics risks on an ad hoc basis across own operations and other business activities. As a family-owned holding and investment company, the risk of human and labor rights breaches as well as corruption within our own

operations is assessed to be low and covered by the implementation of the Code of Conduct. In 2023, no corruption or violation of human rights were observed. Within the investment activities, risks related to all areas in the UN Global Compact are managed via our approach to responsible investing and ownership.

The KIRKBI leadership team governs the data ethics. Our Data Ethics policy outlines the principles and what we believe is a lawful and ethical way of conducting day-today operation, and what employees and business partners can expect from KIRKBI when processing and procuring data.

Decisions related to individuals should always include human evaluation of data. To ensure this, KIRKBI promotes transparency towards the employees and business partners and has an approval process for the use of data.

KIRKBI only wishes to use data from trustworthy business partners and will, as part of our Code of Conduct, ensure that business

partners either have a data ethics policy or conduct their business in a way that is not detrimental to our Data Ethics Policy.

To ensure a high level of ethical behavior from KIRKBI’s employees when processing personal or non-identifiable data, all employees must complete e-learning training in GDPR and personal data compliance.

Moreover, the Data Ethics Policy is part of the mandatory onboarding procedure for new employees.

Play Day is an annual companywide event where all colleagues from the LEGO ® ecosystem around the world experience the power of Learning-through-Play together. Bringing all employees closer to the company vision as “a Global Force for Learning-throughPlay”, all employees play across all factories, offices and store locations. It is an important and highly anticipated tradition that reinforces our commitment to our Play Promise and the core values of fun, creativity, and imagination.

This year’s theme was the Mysteries of Play, where the day was spent playing detective and unlocking the personal meaning and benefits that play offers each LEGO employee. In addition to being fun, play also increases trust within the team, fosters an experimental mindset, and relieves stress.

New grants 2023

62

Grant level in 2023 1.3

As part of the commitment to give children better opportunities to reach their full potential, the LEGO ® owner family has entrusted the LEGO Foundation with 25 % ownership of the LEGO Group and it is primarily through this ownership that the foundation funds its activities.

When children play, they experiment, work things out and develop skills needed to thrive in a changing world. Play is an essential part of child development. But not every child gets the time and chance to play as they deserve.

To address this challenge, the LEGO Foundation works internationally to make Learning-through-Play a priority for every child through funding of research, backing of education initiatives, and support to partners, who can positively impact children’s lives.

Active grants

159

To programmes around the world helping children and families, including those in need and crises

2023 in the LEGO Foundation After a couple of years with extraordinary high grant levels in response to the global pandemic and last year’s celebration of the LEGO Group’s 90th anniversary, the LEGO Foundation returned to a grant level of DKK 1.3 billion in 2023. The grants continue to make a significant impact supporting children in being creative, engaged, lifelong learners who thrive in a constantly changing world by experiencing the benefits of Learning-Through-Play. In 2023, the LEGO Foundation also worked closely with partners to support humanitarian emergencies related to hurricane relief for children in Mexico, the devastating

earthquakes in Turkey and Syria as well as the wellbeing and education of refugee and displaced children in protracted crises across East Africa.

2023 was also a year of reflection for the LEGO Foundation with refocus of the organisation and development of a new strategy to better align with the core mission to inspire and develop the builders of tomorrow. As part of this, around 30 positions were made redundant. With the new strategy, the LEGO Foundation will focus on the core continuing its grantmaking where it can make the most significant impact on children’s opportunity to learn through play.

800,000 children under the age of 12 live in refugee and host communities in Uganda, Tanzania and Ethiopia and often miss out on education.

The LEGO Foundation partners with International Rescue Committee, Plan International, War Child Holland, Innovations for Poverty Action and the Behavioral Insights Team to provide safe, quality and playful learning to refugee and host community children.

See case from Danish Centre for Teaching Environments

In 2020, a survey from EVA (the Danish Evaluation Institute) showed that only a quarter of Danish daycare centres was designed for quality play.

The LEGO Foundation partnered with Danish Centre for Teaching Environments, Denmark (DCUM) to change that by helping kindergartens build playful learning spaces that work for both children and teachers.

Teachers worked with ideas provided by children to create great places to learn and play.

DCUM developed the approach with ten kindergartens to create a toolkit for all daycare centres. Then expanded to six more. A self-evaluation showed that children were more joyful and engaged when teachers gave them the agency to co-create their classrooms.

DCUM is now sharing the toolkit in every municipality in Denmark.

Ole Kirk’s Fond is a charitable foundation established in 1964 in memory of the LEGO® founder to make the town of Billund an attractive place for LEGO employees and their families. The foundation still supports local communities in and around Billund, but also focuses on creating safe surroundings, wellbeing, and opportunities for children’s development throughout Denmark to improve their quality of life. The social area has a special place in Ole Kirk’s Fond today, but the foundation also supports cultural, religious, humanitarian, and educational causes.

Mary Elizabeth’s Hospital, celebrating a milestone

The development of the new children’s hospital progressed quickly and safely in 2023 with the completion of one new floor ready every six weeks making the shell house

ready for the topping-out ceremony in June. An important milestone for the project, celebrated by the craftsmen, contractors, hospital staff and partner representatives and with participation from HM Queen Mary as well as current and formerly hospitalised children and families. The façade cladding was mounted all the way around the building before the end of the year while designers in close collaboration with clinical staff continued to work hard on developing the interior of the new building.

Since 2016, Ole Kirk’s Fond together with the Capital Region of Denmark and Rigshospitalet has worked to create the new ground-breaking hospital with the ambition to set new standards for the treatment of patients and their families. The hospital is expected to welcome the first patients in 2026. Ole Kirk’s Fond contributes with approximately one third of the total budget – approx. DKK 800 million.

In 2023, Ole Kirk’s Fond launched a new program called “A childhood without domestic violence”. The program will bring together a wide range of representatives from different welfare areas and disciplines with a common goal that fewer children grow up with violence. Children exposed to violence in their families is a cross-sectoral societal problem, thus part of the solution lies in increasing collaboration across disciplines and sectors such as the police, municipal administrations, health service, judiciary and more.

To 280 small and large projects

Today an average of two to four children in every Danish classroom experience domestic violence. At the same time, only one in ten children exposed to violence is found and helped. Children who grow up with violence in their families experience great loneliness, have a greater risk of self-harm, abuse and crime, and a higher suicide rate. In close cross-sectorial collaboration, Ole Kirk’s Fond aims to contribute to a sustainable and lasting change with this new 10-year program.

The QATO Foundation is a charitable foundation that works to improve animal welfare by supporting the creation of longterm and sustainable solutions to fight the problems that cause poor animal welfare paying special attention to the animals that do not thrive under human care.

Since 2012, the QATO Foundation has supported more than 100 projects worldwide spanning from Iceland in the North, to the African continent in the South; however, most projects have been based in the foundation’s home country of Denmark.

In 2023, the QATO Foundation chose to contribute to a new research project of the current living conditions and well-being of Danish school horses. The project is initiated by the Danish Equestrian Federation and Aarhus University, and with the support of the QATO Foundation, the project aims to provide knowledge on how to achieve the best

well-being for school horses. The project will focus on the overall living conditions of the horses, including their interaction with students and also look into giving the caretakers of the horses a better understanding of the animal’s behavior and needs.

The research project will run from 1 May 2023 to 31 December 2025.

In KIRKBI sustainability is a foundational layer for all business activities – and defined by the KIRKBI Fundamentals which serve as our compass.

As a family-owned holding and investment company working to make a positive difference for future generations, sustainability is at the very core of KIRKBI.

Guided by the four promises, KIRKBI is committed to running its business in a sustainable manner and doing its part to make a positive impact on the planet.

With the recent generational handover from the 3rd to the 4th generation of the owner family, KIRKBI’s commitment to sustainability was further elevated as the owner family articulated a long-term vision to guide their activities over coming years. A key ambition in this long-term vision is addressing the global climate challenges stemming from carbon emissions and plastic waste.

The ambition to drive climate impact and deliver on the Planet Promise will shape and fuel KIRKBIs sustainability efforts in the years to come. At the same time, KIRKBI will remain committed to driving progress on activities relating to the Partner and People promises.

To guide these efforts and ensure continuous improvement, KIRKBI sets sustainability targets on an annual basis. For 2023, these included ‘evergreen’ targets, such as employee engagement, diversity, CO2 emissions and sustainable building certification, as well as new targets focused on improving CO2 data coverage in KIRKBI’s holdings and committing to high-impact climate solutions.

In 2023, Armacell, a leading provider of advanced insulation and engineered foams, committed to the Science Based Targets initiative (SBTi) to set near-term, companywide emissions targets that will put them on a path with the goals of the Paris agreement. Armacell is the fourth company in KIRKBI’s Longterm Equity portfolio to commit to

setting SBTi-validated targets. Having a science-based reduction target is a key sustainability topic of KIRKBI’s active ownership model. End of 2023, 40 % of KIRKBI Scope 3 emissions from equities, bonds, private equity and debt portfolios came from companies setting SBTi validated targets, closing the gap to meet KIRKBI’s 2025 target of a 45 % coverage.

2023 targets

People & Play Maintain PULSE score 5 points above benchmark

Maintain gender balance of 45 %/55 % in organisation

Reach gender balance of 45 %/55 % at Director+ level by 2027

Maintain gender balance of 45 %/55 % among people leaders

Partner Engage all General Partners (private equity) on ESG and Climate management

Planet Reduce CO2e emissions in Own Operations by 5 %*

Reduce CO2e emissions in Real Estate by 5 % in a like-for-like portfolio*

Increase portfolio SBT coverage by 5p.p.*

Achieved 2023 Performance highlights

• PULSE score decreased by 2, but is well above benchmark, at 82 %

• Gender balance in organisation remained within target

• Gender balance at D+ decreased by 3 percentage points to 28 %

• Gender balance among people leaders decreased by 1 percentage point to 44 %

• KIRKBI is committed to the ESG Data Convergence Initiative and has encouraged our preferred GPs to do the same. We have seen improvements in both ESG and climate reporting

• A reduction in the use of company-owned aircrafts and improved data on employee commuting contributed to a 19 % reduction compared to 2022

• Increases both in the purchase of green energy and in green lease coverage lowered emissions by 40 % compared to 2022 in a like-for-like portfolio

• 23 percentage point increase in cat. 15 emissions covered by verified SBTs or committed to setting SBTs has been driven by a mix of SBTi commitments, including that of Armacell, and changes to the portfolio

2024 targets

• Maintain PULSE score for employee motivation and satisfaction within top 5 % of benchmark

• Maintain gender balance of 45 %/55 % in organisation

• Increase gender balance by 4 percentage points compared to 2023

• Obtain gender balance of 45 %/55 % among people leaders

• Increase CO2e data coverage of holding and investment activities by 7 percentage points compared to 2023

• Reduce CO2e emissions from Own Operations by 5 % compared to 2023

• Reduce CO2e emissions from Real Estate by 5 % in a like-for-like portfolio compared to 2023

• Maintain portfolio SBT coverage compared to 2023

Certify 5 properties to sustainable building standards

* Compared to 2022.

• 2 certifications finalised, with additional 10 awaiting approval; delay due to increased processing times at certification bodies

• Certify 3 properties to sustainable building standards

KIRKBI has assessed climate change to be a central sustainability topic that affects and is affected by all Business Areas.

KIRKBI’s negative impact on climate change is due to the emissions generated by the use of non-renewable energy in both our own operations and our holding and investment activities. While KIRKBI has always worked to manage its negative impact on climate, efforts have accelerated following KIRKBI’s first assured Carbon Inventory in 2019 and the ambitious science-based carbon reduction target set in 2022. Last year, KIRKBI introduced a link to its carbon reduction goals to the compensation of all employees with bonus schemes. This ensures that all employees are incentivised and rewarded for driving a more sustainable business.

Given the development in the carbon inventory, KIRKBI will use 2024 to recalculate its baseline and to develop new ambitious carbon reduction targets to ensure that the company is on the long-term path to net zero emissions.

KIRKBI’s carbon footprint is calculated every year. As illustrated in the table on page 45,

there was a 22 % decrease in emissions from KIRKBI’s own operations, largely driven by a continuing reduction in the use of companyowned aircrafts, and the commitment to purchase sustainable aviation fuel, which can lower emissions by up to 80 %, compared to traditional jet fuel. In 2023, KIRKBI was able to purchase a volume of SAF equivalent to approximately 24 % of total fuel use. These two initiatives have driven the 60 % reduction in scope 1 and 2 emissions from the 2019 baseline, which means that KIRKBI has met this part of its Science Based Target eight years ahead of schedule.

Emissions from the KIRKBI Real Estate portfolio continued the trend of recent years and were reduced by an additional ~2300t throughout 2023. While ~1,000t of these savings were from divestments, the remaining savings were due to the purchase of greener options for energy, such as renewable electricity and biogas, as well as an increase in green leases, which require tenants to purchase green energy options and to share their use data.

The early achievement of our Science Based Target to reduce absolute scope 3 emissions by 55 % by 2032 is driven by the development

of Real Estate emissions over time. This development is due in part to actual reductions, as described, but also to a significant improvement in data quality over time.

For the investment portfolio, KIRKBI has committed to a target defining that 45 % of listed equities, bonds, private equity and debt portfolio set SBTi validated targets by 2025. Since setting this short-term target, KIRKBI has systematically engaged its investments to improve carbon emission disclosure and management, including setting science-based reduction targets. At the end of 2023, 40 % of emissions

from investments and holdings had SBTiverified reduction targets. A further 22 % of emissions come from companies that have committed to set a science-based target over the next two years, which would bring the portfolio coverage to 62 %. The increase in portfolio coverage in 2023 is attributable to a combination of companies starting to work with science-based targets and changes to portfolio allocation, including exiting high-emitting investments. No investment has been exited due to carbon management alone, but progress on climate management does impact KIRKBI’s view of an investment.

Own operations

3,138 tCO2e

-19 % from 2022

-58 % from 2019

Holding and investment activities

390,153 tCO2e

-17 % from 2022

-28 % from 2019

1) 2022 emissions updated following improved data. KIRKBI’s greenhouse gas (GHG) data is prepared in accordance with the principles set out in note 10.3 to the financial statements.

2) Subtotals may not add up exactly due to rounding of the underlying dataset.

3

Ensure that 45 % of KIRKBI Scope 3 emissions from equities, bonds, private equity and debt portfolios come from companies setting SBTi validated targets by 2025

To complement its emissions reductions, KIRKBI is committed to supporting and catalysing impactful climate solutions that have the potential to permanently remove and sequester carbon dioxide at scale.

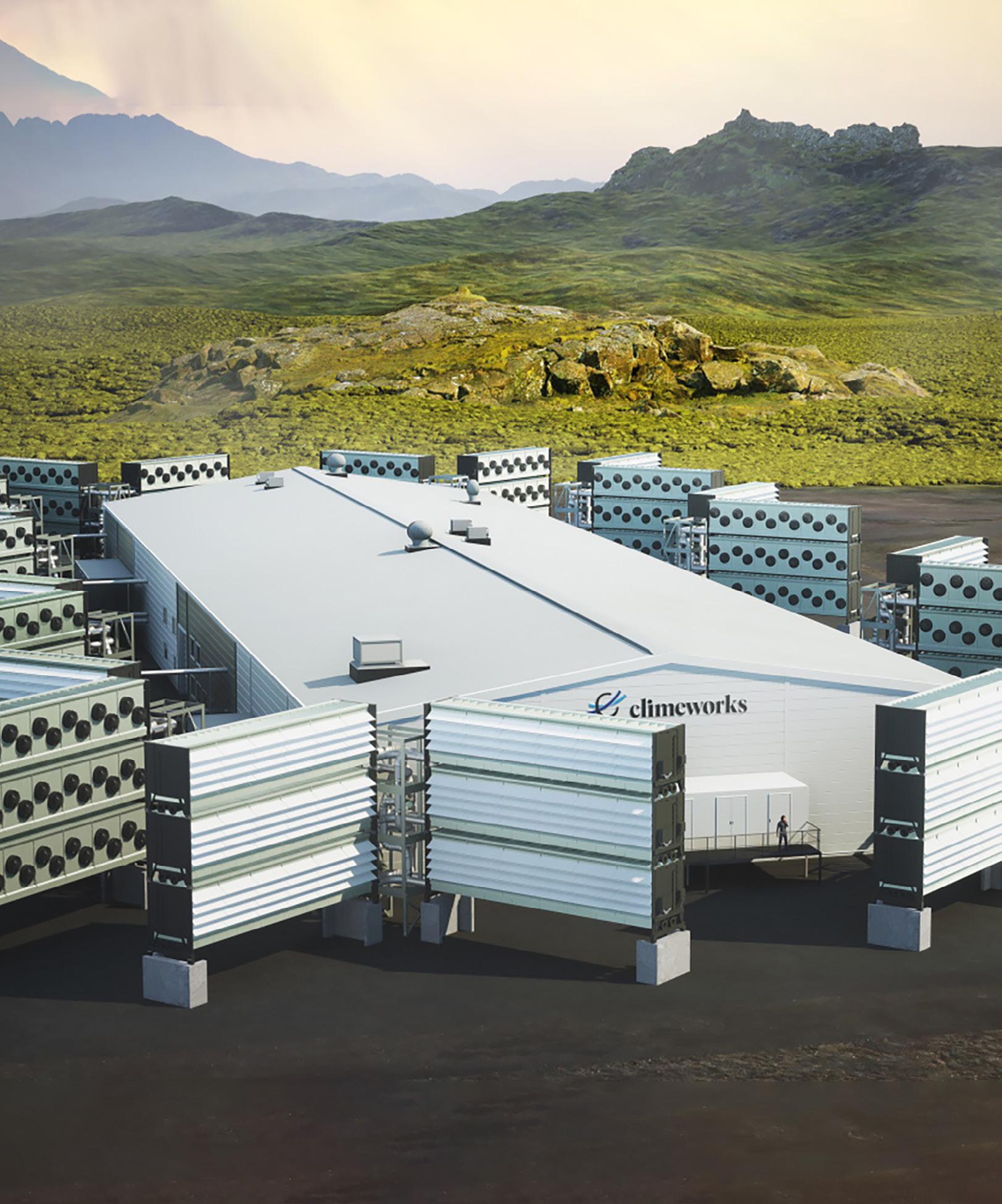

End of 2023, KIRKBI signed a longterm agreement with Climeworks to purchase high-quality carbon removal services. Climeworks is a pioneer in the carbon dioxide removal industry, successfully deploying its Direct Air Capture (DAC) technology to safely remove CO 2 from the air and performantly store it underground, for example via the Carbfix method. Climeworks operates the world’s largest commercial DAC plant in Iceland.

KIRKBI will continue to explore and contribute to high-integrity climate solutions, both nature and engineered, to play our part in tackling climate change.

KIRKBI’s financial strategy is to create long-term value to support the purpose of building a sustainable future for the family ownership of the LEGO® brand through generations.

KIRKBI’s financial strategy is to create long-term value to support the company’s purpose of building a sustainable future for the ownership of the LEGO® brand through generations. The financial performance is driven by the activities related to the LEGO Idea and the return from Investment Activities.

At the end of 2023, KIRKBI’s total assets amounted to DKK 163 billion which is an increase of 59 % over the five-year period from 2018. In the same period, total equity has grown 55 % from DKK 88 billion to DKK 136 billion. During 2023, total assets and

equity were reduced by DKK 11 billion in share buybacks related to the final handover from the 3rd to 4th generation of the Kirk Kristiansen family and to Sofie Kirk Kristiansen’s desire for privately investing in various projects among others within nature conservation.

Below is set out a graph illustrating the development of total assets and equity over the past five years.

The financial year 2023 showed a profit before tax of DKK 16.4 billion (2022: DKK 13.6 billion) which comprised an;

• operating profit from LEGO Brand and Related Activities of DKK 13.8 billion (2022: DKK 18.4 billion), negatively impacted by goodwill and asset write-downs in BrainPOP, Merlin and Epic Games, and

• return from Investment Activities of DKK 3.7 billion (2022: negative DKK -4.1 billion).

The after tax profit for the year was at DKK 11.3 billion slightly higher than in 2022 at DKK 10.7 billion. The tax expense for 2023 of DKK 5.1 billion was 75 % higher than in 2022, impacted by the non-deductible asset write-downs as well as a higher tax percentage in the LEGO Group (23.2 % vs 22.0 % in 2022). In addition to KIRKBI’s corporate tax expense, the owner

family has in 2023 paid around DKK 6 billion in Danish dividend and generational taxes related to the share buybacks effectuated during 2023 in connection with the generational handover in the owner family from the 3rd to the 4th generation.

The key contributor to the financial result of KIRKBI continues to be the LEGO Group which overall delivered a solid performance in 2023. In a challenging environment with a decline in the global toy market of 7 %, the LEGO Group delivered a strong performance with growth in consumer sales of 4 %. This outperformance of the toy industry led to a significant increase in market share.

Total assets and Equity (m DKK)

Revenue for the year increased by 2 % to DKK 66 billion while operating profit of DKK 17 billion was 5 % lower than in 2022, impacted by continued strategic investments to deliver current and long-term sustainable growth. This included areas such as brand awareness, product innovation, retail platforms, production capacity, digitalisation and sustainability.

Merlin reported a growth in revenue of 6 % driven by an increase in number of visitors of 12 %. The underlying result for the year was slightly negative, impacted by higher interest costs following the increase in market interest rates. KIRKBI’s share of net result was

a loss of DKK 0.9 billion (2022: profit of DKK 0.5 billion), impacted by write-down of assets in the LEGOLAND® Parks in New York and Korea as well as costs incurred as part of Merlin’s refinancing of part of their debt.

BrainPOP’s first full financial year after KIRKBI’s acquisition in October 2022 showed a revenue growth of 2 % and an operating profit of DKK 0.2 billion. While the profitability overall was in line with expectations the top line growth was significantly lower than assumed in the business case, negatively impacted by a challenged market for education and playful learning products to school districts in the US among others due to reductions in public funding. Due to this structural change in the US school market with expected lower growth rates and need for increased investments in digital technologies, KIRKBI has at year-end 2023 written-down goodwill and part of the tax assets related to the acquisition, in total a write-down of DKK 2.6 billion.

Royalties from the LEGO® and LEGOLAND® trademarks increased by 1 % to DKK 2.5 billion (2022: DKK 2.5 billion). Other LEGO brand related activities comprising costs and investments to protect, develop, and leverage the full potential of the LEGO brand, including investments within digital play, costs centered around the global LEGO brand campaign ‘Rebuild the World’ and

costs for IPR and legal compliance showed a total expense of DKK 2.3 billion in line with 2022.

The investment Activities are separated into a Core Capital and a Thematic Capital portfolio.

The Core Capital portfolio delivered a return of DKK 3.8 billion equal to 4.7 %. The financial return is overall considered satisfactory, with especially the Fixed Income, Quoted Equity and the Real Estate portfolios showing relatively strong returns while the Long-term Equity and the Private Equity portfolios showed performance below expectations.

For the Thematic Capital portfolio, the 2023 return was negative with DKK 0.1 billion equal to -1 %. The highlights for 2023 were Adapture Renewables Inc.’s commitment to acquire a 450 MW late-stage development solar project in the US, investment into APK and Decarbonization Partners within Circular Plast and continued acquisitions of land within Land Sustainability, now totalling a portfolio of approximately 1,600 ha of agriculture land.

Costs to operate KIRKBI’s support functions including donations and sponsorships totalled DKK 0.8 billion in 2023 (2022: DKK 0.7 billion), of

which donations and sponsorships amounted to DKK 0.2 billion comprising donations to, among others, K2 Fonden af 2023, Ole Kirk’s Fond, Qato Foundation, Danmarks Idrætsforbund (DIF) and Billund Church.

Overall net result for 2023 lower than expectations

The net result for 2023 of DKK 11.3 billion was lower than the expectations disclosed in the annual report for 2022, primarily due to negative impact from the one-off writedowns of goodwill and assets in BrainPOP and Merlin. Excluding these one-off items, the underlying financial performance is considered satisfactory.

As illustrated in the five-year overview below, the underlying profitability for the LEGO Brand and Related Activities continues to be at a high and stable level. For the Investment Activities, returns are by nature relative volatile dependent on the fluctuations in the financial markets. It should be noted that the vast majority of the contribution to net profit from the Investment Activities comprises unrealised value adjustments of the portfolio with no impact on cash flows.

Cash flows impacted by significant investments in the LEGO Group

For KIRKBI to deliver on its strategy it is essential with strong and stable cash inflows, the majority of which is coming from the LEGO Group. For