SO H

SAROVAR'S BOLD BET

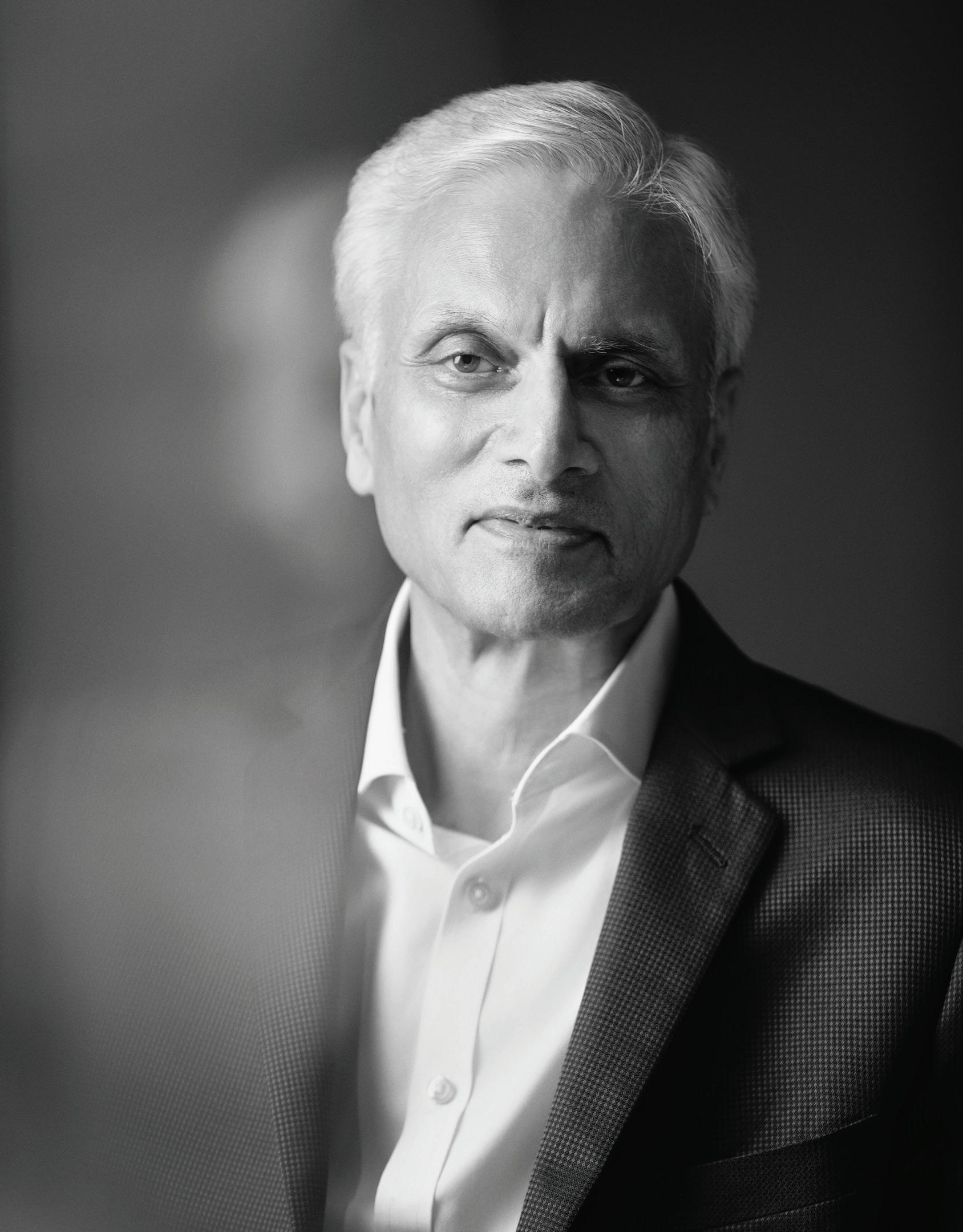

Ajay Bakaya on three decades of championing the mid-market when luxury ruled!

JOURNEY OF EXCELLENCE

PRESENTED BY

Ajay Bakaya on three decades of championing the mid-market when luxury ruled!

PRESENTED BY

Team SOH is pretty chuffed!

Our inaugural issue sparked a phenomenal response. While working on the debut edition, we were cautiously optimistic about how it would resonate with the industry—but this truly surpassed our expectations. We seem to be doing something right! Just as the first issue highlighted the passion, creativity, and resilience of our community, the response to it is a testament to the industry's thirst for insights, meaningful narratives and genuine connections. We're humbled by the appreciation and encouragement we've received, and we're eager to continue delivering content that inspires, educates, and uplifts. As we move forward, we'll be working tirelessly to set new benchmarks for ourselves, showcasing the soul of hospitality through SOH, not only to this industry but other sectors as well.

As a small celebratory dinner, I sit at my favourite table in Hakkasan Mumbai, surrounded by friends who embody the intrepid spirit of entrepreneurship. At this iconic restaurant, thirteen and still going strong, I'm reminded of the magic that happens when passion meets perfection. Tonight, our conversation turns to the vibrant hospitality landscape. My friends, a diverse tribe of entrepreneurs, are eager to explore investment opportunities in this dynamic sector.

And dynamic it is, for in my interactions over a month with stakeholders and leaders from the hospitality industry and other fields of business, one thing is constant: the upbeat sentiment that's propelling this sector forward.

Domestic tourism is booming, with travellers flocking to new and familiar destinations. Chefs are crafting culinary journeys that beckon adventurous palates. Mixologists are pushing the boundaries of craft cocktails, creating signature drinks that complement the dining experience. From boutique hotels to innovative F&B concepts, the creativity and energy are palpable. The recent Union Budget has brought some welcome cheer, with initiatives that will boost travel and tourism.

The numbers tell a compelling story— and savvy investors are taking notice, ready to bankroll the next big idea. They are eager to capitalise on this momentum, injecting capital into projects that promise to disrupt the status quo. From cuttingedge hotel concepts to immersive culinary experiences, the opportunities for growth are vast.

The heartbeat of hospitality is strong, fuelled by the passion and perseverance of its people. As Peter Drucker says, “The best way to predict the future is to create it.” And I'm proud to be part of this resilient, vibrant and beautiful community!

GURMEET KAUR SACHDEV gurmeetsachdev@soulinkkworldwidemedia.com

ED'S LETTER

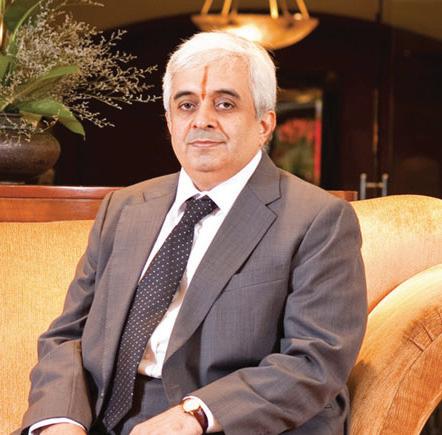

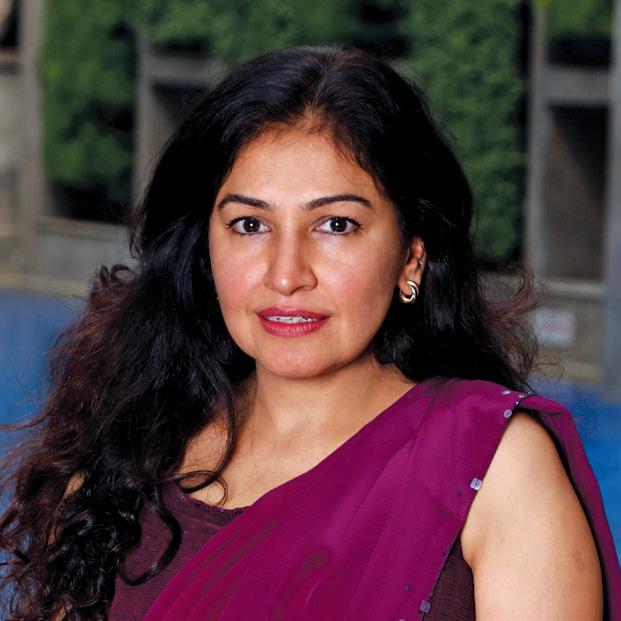

The first time I read about Ajay Bakaya, co-founder of Sarovar Hotels, I was struck by his unconventional journey. From a start in pharmaceuticals to preparing for the IPS exams, Bakaya’s entry into hospitality was serendipitous. He began his career with The Oberoi, one of India’s leading luxury hotel groups, and eventually co-founded Sarovar Hotels with his colleague, the late Anil Kumar Madhok. Sarovar has become synonymous with democratising the Indian hotel landscape, offering impeccable service across the country at affordable rates.

As Sarovar Hotels celebrates 30 years, Bakaya graces our cover to share insights on carving out the mid-market segment in hospitality.

This edition also features Neel Raheja, Director of K Raheja Corp, known for his strategic partnerships that have propelled Chalet Hotels to the forefront of the industry. Raheja, along with Chalet’s CEO Sanjay Sethi, reveals how strategic expansions and efficient asset management have shaped their success.

One of the most unraveling story in this edition is the compelling narrative of the burgeoning desi middle class, whose newfound aspirations are fueling a surge in travel enthusiasm.

From a design spotlight on Aurika, India’s largest hotel by the number of keys, to the growing trend of hospitalityled luxury branded residences, this edition is packed with intriguing reads.

We’re overwhelmed by the positive response to SOH’s first edition and are grateful for the warm welcome from the hospitality and travel industry. Enjoy Edition 2!

Warm regards,

DEEPALI NANDWANI, EDITOR, SOH

Founder and Publisher

Gurmeet Sachdev

Editorial

Editor Deepali Nandwani

Managing Editor Rupali Sebastian

Contributing Editor Suman Tarafdar

Contributing Writers

Shalbha Sarda

Priya Pathiyan

Columnists

Manav Thadani

K.B. Kachru

Vijay Thacker

Creative

Creative Director Tanvi Shah

Team Songjukta Banerjee, Shiv Soni

Contributing Artists Priyankk Nandwana, Shashank Gautam

Sales Manager

Deepa Rao

Office Manager

Deepak Rao

Accounts Head

Amey Acharekar

For queries:

editorial@soulinkkworldwidemedia.com sales@soulinkkworldwidemedia.com info@soulinkkworldwidemedia.com

Printed and Published by Gurmeet Sachdev on behalf of Soulinkk World-Wide Media LLP. Registered office: 1/2, Old Anand Nagar, Nehru Road, Santacruz East, Mumbai, Maharashtra - 400055. Printed at Silverpoint Press Pvt. Ltd., A-403, TTC Industrial Area, Near Anthony Motors, Mahape, Navi Mumbai – 400709. Editor: Deepali Nandwani. All rights reserved worldwide. Reproducing in any manner without prior written permission prohibited. SOH takes no responsibility for unsolicited photographs or material all photographs, unless otherwise indicated, are used for illustrative purposes only. Unsolicited manuscripts will not be returned unless accompanied by a postage pre-paid envelope. All disputes are subject to the exclusive jurisdiction of competent courts and forums in Mumbai only. Copyright Soulinkk World-Wide Media LLP.

THE MIDDLE PATH TO PROFITABILITY

Rising steadily to pole position in the midscale segment, Sarovar Hotels, helmed by Ajay Bakaya, has transformed the hospitality landscape in India.

34

Branded Residences

Luxury brands elevate high-end homes into coveted addresses.

106

Managing risks

Vijay Thacker shows the path to robust governance and operational success.

150 Destination Dining

Chefs craft unique gastronomic experiences in unexpected locations.

160

Speakeasy with style

The Leela Palace Bengaluru's awardwinning bar ZLB23.

86

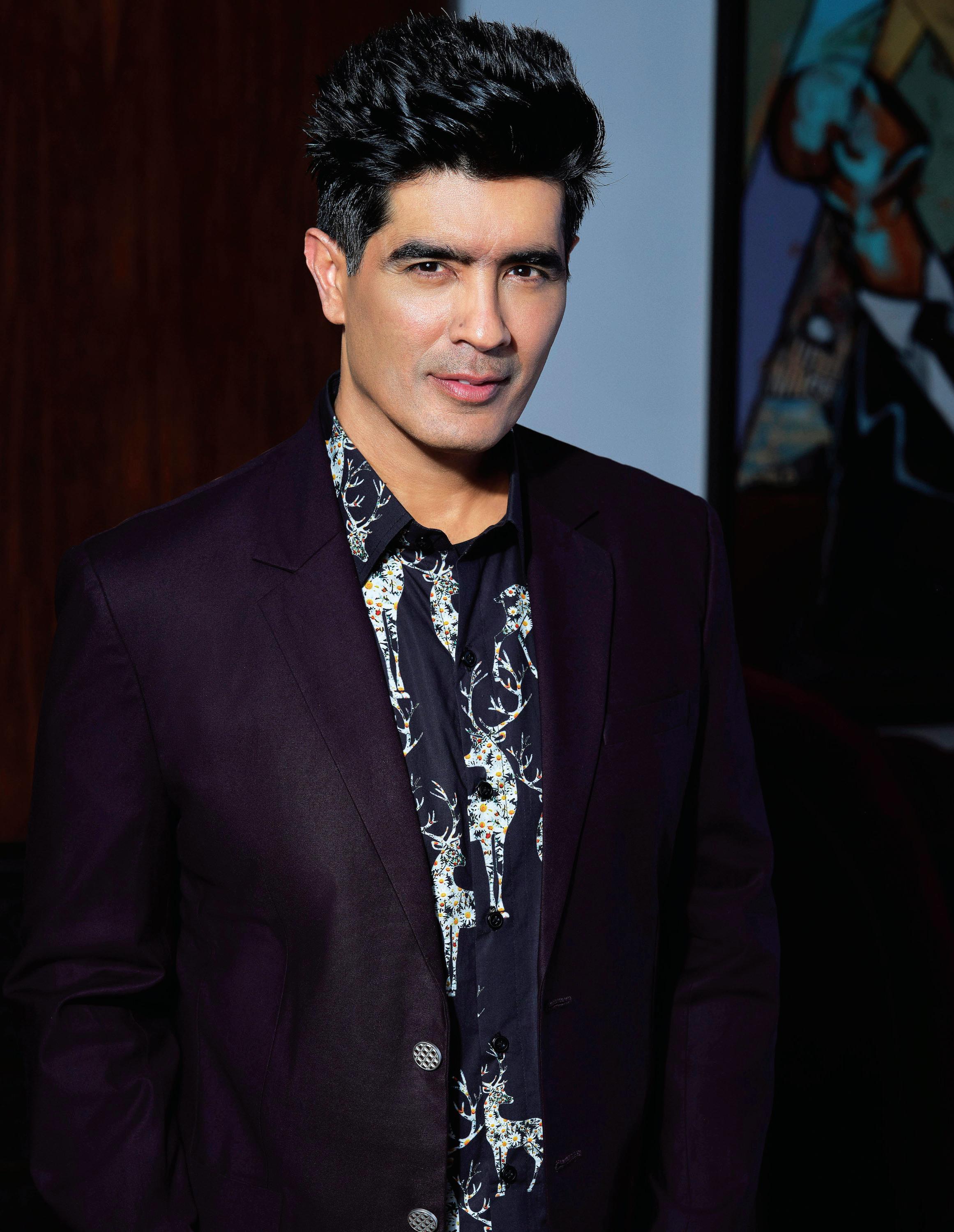

Crafting an experience

Manish Malhotra’s cultural and spiritual journeys take him to striking destinations.

62

Decoding the budget

KB Kachru of Radisson Hotel Group analyses the government's financial blueprint for FY ’24-25.

134

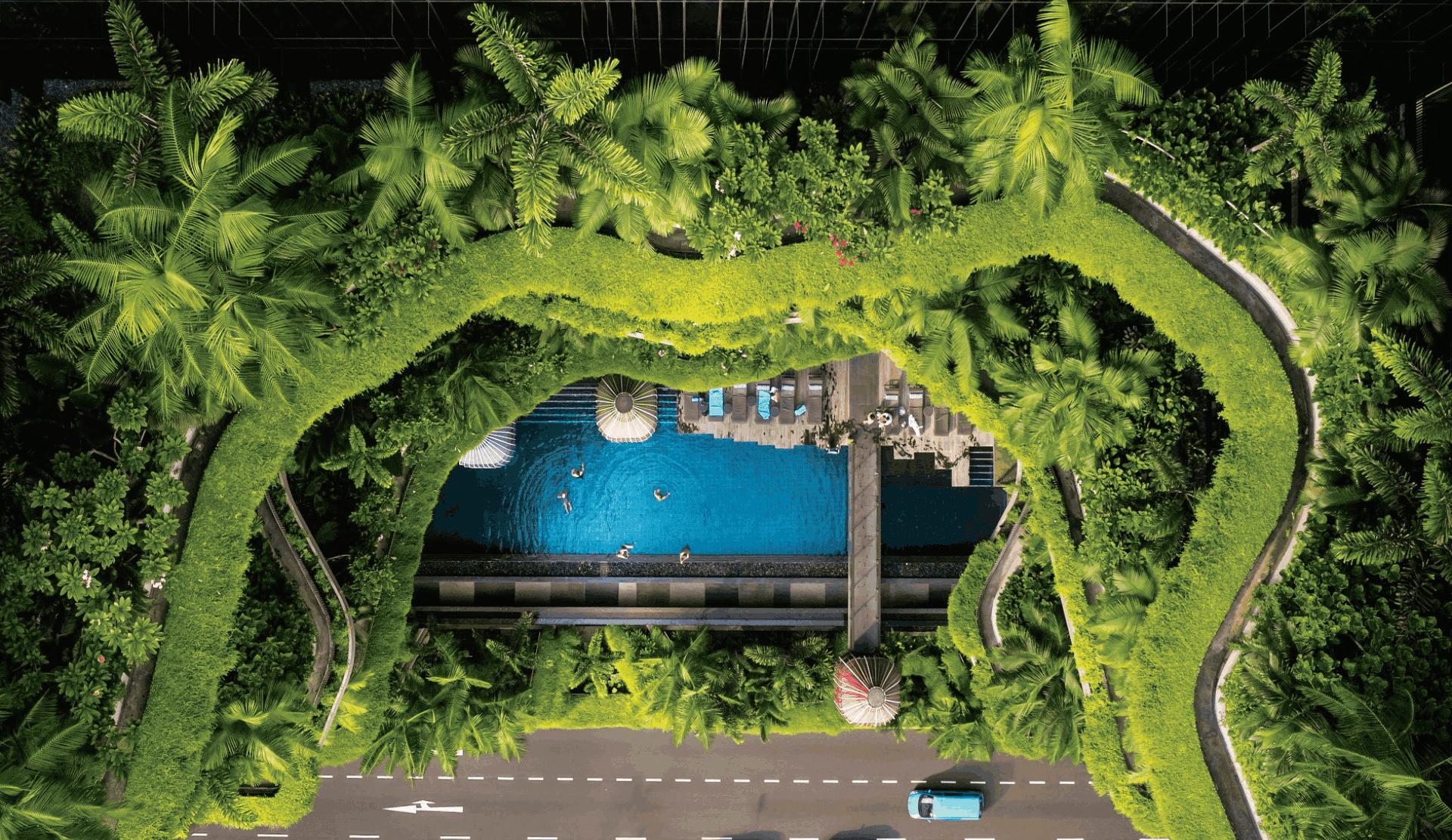

Aurika Mumbai Skycity

How did India's largest hotel overcome challenges of site and situation?

66

Domestic tourism

The Indian traveller is eager to visit new destinations and return to tested favourites.

Even while Fly 91 makes it affordable for people to explore the country's smaller destinations, Indigo is connecting Bengaluru to Lakshadweep. These movements are part of India’s gameplan to create an infrastructure that will connect destinations which are underserved.

DEEPALI NANDWANI

India’s new regional airline, Fly 91 (named after the country code 91, not ninety-one), is set to add more energy to domestic travel by bridging gaps between cities and towns that have often been overlooked in the national aviation network. Founded by Manoj Chacko, Fly 91 aims to spotlight India's smaller and harder-to-reach destinations, enhancing the vibrancy of domestic tourism.

Fly 91’s initial routes include unique destinations such as Agatti in Lakshadweep, the picturesque coastal region of Sindhudurg, Jalgaon and Pune in Maharashtra, as well as popular hubs like Goa, Bengaluru, and Hyderabad. These destinations are part of the government's Regional Connectivity Scheme (RCS), UDAN, which seeks to make air travel accessible to underserved areas.

Chacko, with a background in major brands like Emirates and SOTC, highlights the importance of making air travel accessible: “People from smaller towns are aspirational, and those in big cities want to explore lesser-known locales that are rich in heritage and culture. Ensuring seamless and affordable air travel is key to fulfilling these aspirations.”

This greenfield airline marks a significant milestone, operating from a greenfield airport and reflecting the increasing number of airports and enhanced quality of life across India.

Even as Fly 19 took flight from Goa, Indigo announced that it would be connecting Bengaluru with Lakshadweep, making it easier to fly to the island cluster. And Alliance Air has also connected Kochi with Lakshadweep's Agatti island. Agatti, at the centre of the aviation transformation, is a 6 km long land surrounded by beautiful lagoons and coral reefs.

The distinctive feature of Tulum's eco-resort Azulik is an art museum called SFER IK. Azulik's founder, Eduardo Neira worked with local craftsmen and a symphony of materials that immerse guests in an extraordinary art-viewing experience.

As travellers increasingly seek authentic connections with nature, Indian hoteliers must tap into the power of biophilic design to stay ahead.

RUPALI SEBASTIAN

Biophilic interior designs foster a connection to the living world by incorporating elements such as Natural materials and furnishings, living walls, plants, natural lighting, and indoor water bodies.

Human Spaces 2.0: Biophilic Design in Hospitality, a study undertaken by Terrapin Bright Green (a sustainability consulting firm), Interface (a leading flooring company committed to ‘green’ products and practices) and Gensler (a global design and architecture giant active in earth-sensitive initiatives), found that biophilic hotel design and décor is a strong factor in creating a unique and memorable guest experience. Key takeaways include:

36% more guests spent time in biophilic hotel lobbies than in conventional lobbies.

While the websites of both hotel types discuss “experience” the same amount, guest reviews of biophilic hotels mention “experience” twice as often as reviews of conventional hotels.

Hotel guest rooms with a view to water are priced on average 11%-18% higher than rooms without a view.

Price premiums can be up to 12% for hotel guest rooms with views to famous landmarks or nature compared to rooms without a view.

A room facing a garden or a pool. A suite facing the valleys and mountains. We all love a room with a view. In fact, such spaces tend to be priced higher than a ‘normal’ room. Why is that? It's because of humanity’s deep affinity to nature. Summed up in one word—Biophilia, a term which originates from a combination of the ancient Greek words ‘bio’ (life), and ‘philia’ (love).

Studies centred on the impact of biophilic design on humans illuminate a number of physiological and psychological benefits: it can reduce stress, improve cognitive function and creativity, improve our wellbeing, and expedite healing. Hospitality design—which ultimately aims to create targeted, immersive experiences that are memorable and relieve stress—stands to gain a great deal from this nature-oriented spacemaking route.

In more recent years, accelerated by the pandemic and lockdowns, the affinity for this type of design has been steadily increasing as the number of travellers seeking to connect with the natural world rises. Additionally, with both millennials and adults in Gen Z standing out for their high levels of engagement with the issue of climate change, biophilic design becomes particularly important within the context of hospitality interiors while creating relevant and remarkable spaces.

Adopting biophilic design in a hotel can provide several commercial benefits:

Natural elements can create a calming and inviting atmosphere. This enhances the overall guest experience, leading to higher satisfaction and positive reviews.

Nature-oriented spaces attract guests seeking unique and aesthetically pleasing environments. This can lead to higher occupancy rates.

Hotels with biophilic designs can often charge premium rates an enhanced guest experience and unique appeal.

The relaxing and restorative environment can encourage guests to extend their stays.

This kind of design can create a strong brand identity that is sure to appeal to ecoconscious and wellnessoriented travellers.

Natural light and ventilation, can reduce the need for artificial lighting and HVAC systems, leading to lower energy costs.

Biophilic design can lead to employees being likely to be more satisfied and productive in a pleasant working environment.

Incorporating biophilic design can potentially qualify the property for green certifications and awards.

With a positive and memorable experience, guests are more likely to return and recommend the hotel to others, driving repeat business and word-ofmouth referrals.

Anchoring a busy avenue, a lush wall of green plants rises up neatly three storeys to clothe a façade of blackened steel opening profiles and timber panels. This is 1 Hotel Central Park, blanketed by English ivy, some 36,000 in number, working diligently to produce oxygen, absorb greenhouse gases, reduce the building’s surface temperature in the summer, and insulate it in the winter. Designed by AvroKO, this LEED-certified urban oasis is adorned with green clusters, artfully orchestrated against a rich material composition of exposed terracotta block walls, blackened steel columns and door and window frames, and reclaimed timber floor and ceiling elements.

Architect Bobby Mukherji, a leading name in the hospitality design niche, has always endeavoured towards natural elements even before the term ‘biophilic design’ became popular in the Indian sector. Hotel Sahara Star, which he designed in 2005, is articulated as a spaceship-like form. Within this futuristic envelope beats a green heart: a 50,000 sq.ft. central atrium, imagined as a tropical garden complete with waterbodies, water-facing decks, pathways, bridges, a waterfall and vegetation (including Royal Palms retained from an earlier hotel that once stood there). This soothing volume occupies centerstage of the spatial narrative, with rooms, restaurants and other services circling this natural space.

Located within the historic St Pauli Bunker in Hamburg, REVERB by Hard Rock is designed with a commitment to lessen environmental impact. A total of 4,700 shrubs and 16,000 perennials have been planted on the property. Around 10,000 sq.mtr. of green and communal spaces have been created with the help of environmental scientists. The roof garden, which is open to the public, can be reached via a 560-metre-long, rail-lined 'mountain path', which starts at ground level on the north side of the bunker and offers impressive panoramic views as you climb.

Singapore is the poster child for biophilic design, and one stunning example is the Parkroyal Collection Pickering Hotel, designed by WOHA. Envisioned as a hotel in a garden, the Green Mark Platinumrated building features cascading greenery that’s visible from guest rooms and communal spaces. Corridors, lobbies and common washrooms are designed as garden spaces with stepping stones, planting and water features. This creates an alluring resort ambience with natural light and fresh air. Deep overhangs work together with leafy foliage to screen spaces from the weather and direct sun.

SOH DRINK | THE BARTENDER’S HANDBOOK

Comte de Grasse, founded by an Indianorigin entrepreneur, fuses centuries-old perfumery traditions with innovative technology to craft luxurious spirits that can elevate any high-end bar.

DEEPALI NANDWANI

The fragrant heritage of Grasse, a picturesque town in southeastern France, has shaped the global perfume industry. This scenic region with fields of tuberose, roses, jasmine, and violets, provides the ideal environment for perfumeries crafting fragrances for the world's leading brands. Home to perfume development centres of luxury brands such as Chanel, Dior, and Louis Vuitton, Grasse is where the iconic jasmine for Chanel No. 5 is cultivated.

Bhagath Reddy, a former Bengaluru resident with tech antecedents and a passion for fine spirits, has leveraged Grasse’s perfumery traditions to establish the world’s first liquor-tech company to reinvent the rules of the luxury spirit game.

Comte de Grasse has distilled and launched luxury spirits that meld the best of distilling traditions and Grasse’s fragrance traditions. “We have used technology that pushes the boundaries of flavour extraction in the alco-bev industry,” says Reddy.

BY

Comte de Grasse's luxury spirits, backed by innovative distillation and unique perfume profiles, can elevate the offerings of any high-end bar. Their flagship 44°N Gin, the first to be distilled on the French Riviera, pays homage to Grasse with 22 botanicals, including local favourites such as verbena, immortelle, and jasmine. They also offer 06, a meticulously crafted 100% French Rosé Vodka, showcasing their mastery over flavour extraction.

Comte de Grasse's state-of-the-art distillery is housed in a repurposed 200-year-old perfume factory in the Provençal landscape. Drawing from perfumery techniques such as ultrasonic maceration and CO2 extraction, they craft 44°N Gin, a spirit capturing "light as a flavour and illumination as a scent," says Reddy. The gin's flavour layering, inspired by fragrance layering, results in a luxurious spirit with distinct notes. For 06, a meticulous liquid-to-liquid extraction

Fuelled by younger consumers and a growing economy, the Indian luxury market, including spirits, is set to triple by 2030. Globally, niche categories such as agave-based spirits and whiskeys are driving the industry, while in urban India, a shift towards "no and lowalcoholic beverages" is evident. In urban India, the consumption of hard spirits has declined by 20-30%.

Comte de Grasse, a brand merging perfumery and distillation, embodies this trend by creating sustainable luxury spirits rooted in history and sensory experience. They utilise innovative technology to challenge traditional notions of quality, offering a modern approach to spirit production.

Says Reddy, “Luxury drinks as a segment have relied heavily on age and tradition as a marker for quality and there has been little innovation other than exalted age claims. At Comte De Grasse, by using science as a disruptor for tradition, we aim to pioneer a more modern approach to sustainable luxury spirit production and create distinctive, qualitative spirits that offer a unique experience.”

B H AGAT H R E D DY FOUNDER, COMTE DE GRASSE

“We have used technology that pushes the boundaries of flavour extraction in the alco-bev industry.”

OPPOSITE: Comte de Grasse's distillery is housed in a 200-year-old perfume factory.

LEFT: 06 is concocted by infusing organic rosé wine into French winter wheat vodka.

BELOW: Rose is a popular botanical used in Comte de Grasses's luxury spirits.

infuses organic rosé wine from Chateau Vert, AOP Côtes de Provence into a velvety base of French winter wheat vodka, creating an elixir reminiscent of the French Riviera.

44°N gin boasts a complex aroma profile, with fresh citrus top notes, evolving into floral and herbaceous mid-notes, and finishing with warm, spicy base notes. Presented in a blue Klein glass bottle inspired by perfume bottles, its design echoes the sun and the Mediterranean Sea.

06 vodka, a delicate pink hue reminiscent of Provençal sunsets, is housed in a sleek bottle. Its aroma opens with floral notes and hints of strawberry, leading to a palate of luscious white peach. Enjoyed neat, with tonic, or in a martini, it offers a refined and complex drinking experience.

As dining trends shift from formal to casual, Japanese izakayas, focusing on seasonality, are becoming popular hangouts for Indians. They present an opportunity for food-forward hotels and standalone outlets to capitalise on the growing interest in this unfussy dining style.

Move aside sushi-sashimi. The duo, which represented the cuisines of Japan in India for almost a couple of decades, is at last getting multiple support acts from a range of other dishes. With about 1,500 Japanese companies registered in India, and about 10,000 Japanese expats residing in the country, it is no wonder that the demand for Japanese restaurants has skyrocketed. However, the popularity of izakayas is not limited to the Japanese in India. Indians, themselves, are experimenting with izakaya-style dining.

Significantly, while the earlier generation of best-known outlets serving Japanese tended to be in premium locations—usually within luxury hotels, such as Wasabi by Morimoto, Megu, San:Qi, Sakura and many others, a newer generation of outlets are more casual in look and feel, taking inspiration from the

changes in Japan itself. Easily the most popular concept is that of the izakaya, a much more casual informal Japanese bar that is most often compared to an English pub. Comfort, unfussy food, meal bowls, shareable platters, beer… yes, but for geography, the concepts match considerably. In Japanese, izakaya translates to ‘stay-drink-place’ i.e. a place to enjoy a drink, eat a meal, and get comfortable!

One of the latest izakayas to open is Shin’ya at Hyatt Regency, Gurugram, which styles itself as a fresh dining concept set to revolutionise Japanese cuisine in Delhi NCR. It is unmistakably an izakaya but modulated to local preferences. “The restaurant is a place where people can come and unwind,” says Sonale Zagade, General Manager. “The soothing ambience, friendly well-trained staff, and the authentic Japanese gourmet spread heighten the izakaya experience.” Chef Adi

SONALE ZAGADE GENERAL MANAGER, HYATT REGENCY, GURUGRAM

“The soothing ambience, friendly well-trained staff, and the authentic Japanese gourmet spread heighten the izakaya experience.”

Melaz, who helms the outlet, says it is ideal for friends to chill and have some food and drinks after work hours. Indeed, the izakaya is open only from about 6 pm to 10.30 pm after which it converts to a bar. The hotel, which is located in an area where a lot of Japanese expats stay, has an almost captive audience. Despite being inside a premium hotel, it aims to be affordable and has designed its menu accordingly.

Indeed, Delhi, Mumbai and Bengaluru have seen a profusion of izakaya-style restaurants. Chef David Myers opened his Japanese izakaya-style restaurant Adrift Kaya, JW Marriott, Delhi, a couple of years ago, to spread his love of Japanese culture. “I live in Tokyo as well, so I'm immersed in the very best cuisine in Japan, and I eat out almost every night. And that's my inspiration for everything I do here. So, I've experienced all the dishes you see here in some way or the other throughout Japan, and I love them.”

OPPOSITE: Mizu focuses on providing quality at an affordable price;

Myers is conscious that despite being inside a luxury hotel, he wanted to capture the flavour of an izakaya. “People love eating Japanese, and, you know, they appreciate that we're bringing our version of an authentic izakaya to Delhi,” he says. That authenticity also extends to the look and feel, from tatami-style seating to high bars and red lamps. “The need for authentic Japanese cuisine has grown manifold in recent years in India," says Kojiro Honda, Co-Owner & Founder, Kuuraku India. “Most of Kuuraku’s outlet locations cater to areas with significant Japanese presence and aim to offer a more authentic experience, with multiple elements of a typical izakaya woven in."

“People just love eating Japanese, and, you know, they appreciate that we're bringing our version of an authentic izakaya to Delhi.”

CHEF DAVID MYERS

ADRIFT KAYA

Perhaps the greatest acceptance and popularity for the concept has come from outlets that have opened outside the luxury environs (though a note of caution here—Japan is one of the richest countries per capita, and just about everything is generally deemed as expensive by outsiders!). The approachability of an izakaya makes it popular; it's an informal space where one comes to unwind after a long day, reiterates Vedant Malik, Director & Founder, Mizu Izakaya, located in Mumbai’s Khar. “Why this model works in India because it simplifies Japanese food, it allows space for tweaking to a particular palate. As an izakaya, we also make sure that prices never intimidate a customer. We want to provide great quality at an approachable price while people can be in their casual attire, enjoying some of the best quality food.”

Malik scotches the idea that the ethos of Japanese cuisine has been only about sushi and sashimi; instead, it focuses on seasonality. “When we speak of classic Japanese cuisine forms, we talk about kaiseki or omakase. The concepts essentially revolve around what is available in season, and what is available around them. The general culture revolves around going to izakayas almost every night, post-work. The menu in most izakayas in Japan features what is available in season. They take those ingredients, grill them on a yakitori grill or put them in a shabu shabu (a hotpot dish). So, that's where the philosophy lies—in being able

Have you had Japanese cheesecake? asked my Delhi-based friend recently while at Harajuku, a modern interpretation of casual Japanese dining, full of cultural and culinary touchpoints. The aforementioned cheesecake, Mochi, Rainbow Cake Slice, Lemon Yuzu tart or indeed the Jiggly Pancake Matcha/ Boba—these are not desserts most Indians unfamiliar with Japan are likely to have come across. Yet, across Japanese restaurants, their popularity is on a rapid rise.

Japanese bakeries and confectionery are getting popular not just in India, but across the world, agrees Lakhan Jethani, Head Chef & Co-founder, Mizu Izakaya. “Some of the popular desserts include the Japanese cheesecake, you know, the light, soufflé, kind of a cheesecake. Also getting famous is the Shokupan bread, essentially Japanese milk bread, as well as ice creams. We love doing Japanese black sesame ice cream or matcha ice cream with azuki bean paste, which is a red bean paste. We serve these ice creams in waffles.”

In Japanese cuisine, traditional sweets are referred to as wagashi and are most often made using ingredients such as red bean paste and mochi. Japan, the land of inventions, has also evolved its desserts to a great extent, often with global influences, leading to ‘neo wagashi’ outlets.

to use what is around you and what is seasonal. It is a more sustainable approach towards food that highlights produce in its eternity. It emphasises season versus trying to create heaps and heaps of flavour by using different ingredients.”

Izakayas, whether in Japan or outside, are no longer sticking to traditional dishes. “Nowadays, when we talk about izakayas, we mean in a modern style, which means both the interiors and the menu,” says Melaz. He explains that often elements of the local flavour palate also seep into the menu, as well as innovative new dishes, along with longstanding favourites such as yakitori, robata grills, etc. “Now I see that in Japan as well, izakayas are becoming fancier.”

Of course, the quality of ingredients is paramount in Japanese cuisine. “We get a great response to our ingredients, which come from Japan,” says Myers. “All of our seafood—our uni that just arrived today, our ramen just came in, I mean, pretty much everything. Some of our fresh vegetables, we have a local farm here in Delhi that grows Japanese ingredients for us, such as some of our microgreens, lettuces, carrots, okra, ... So, that's really cool.”

Malik says there is considerable scope for izakayas in India. “They have a tremendous growth opportunity in India. But they must be done correctly. The aim has to be to create an experience and not just focus on the money the space can generate. You must focus on consistent quality while keeping your prices very tangible. At Mizu, our focus is always on consistency with food and service. We want to provide quality at an affordable price while catering to every palate.”

Add comfort, friends, and some sake—the formula seems guaranteed for success amongst the aspirational Indians. Given the health benefits and alluring flavours on the menu, Indian street corners might well see Harajuku-style modern iterations of izakayas with increasing frequency!

“At Mizu, our focus is always on consistency with food and service. We want to provide quality at an affordable price while catering to every palate.”

CHEF LAKHAN JETHANI AND VEDANT MALIK

The first fully digital age generation is here, and hospitality is gearing up to cater to their preferences, including launching new brands aimed at this emerging guest.

Shot on arrival! Yes, the welcome drink you are greeted with when you enter RONIL Goa —a JdV by Hyatt Hotel, comes in the form of a shot. The hotel’s main bar, Patrao’s, is the first point of engagement, straightaway getting the guest into the Goan vibe— almost akin to a religion for India’s upwardly mobile youth, and a world removed from the traditional, classic, standardised concept of hotels that have dominated modern hospitality since it began.

As the first fully digital generation gets ready to become earning—and paying members of the community, hospitality has been forced to take note of the changed aspirations—nay, demands of a new generation. According to US consulting major, McKinsey, post-millennials (1997-2012) are predicted to make up a third of global spending power by 2035. Meanwhile, millennials (1982-

PRATITI RAJPAL GENERAL MANAGER, JDV BY HYATT

“At Ronil Goa, Part of JdV by Hyatt, we capture the essence of Goa’s vibrant culture and energy, offering a unique experience for guests who are young at heart.”

1996), the preceding generation, roughly accounts for 23% of the world population, and most of the workforce globally today. Even the gap between the millennials and Gen Z seems to have caught the sector unaware, as it scrambles to cater to this new demand.

Gen Z and millennials, soon to reach their peak economic power in the APEC region, will account for the major chunk of the travelling population, according to a travel report commissioned by Marriott International earlier this year, again with huge implications for the sector. John Toomey, Chief Sales and Marketing Officer - APEC (Asia Pacific, excluding China), Marriott International, said that it is important for hotel companies to make sure that they have brands which constantly engage and speak to these emerging segments of the population.

According to the survey, 73% of this population will take at least two trips in the near future and an overwhelming majority of them have more budget to spend than the previous year.

When Accor’s ibis unveiled its New Generation Design at Vikhroli, Mumbai, at the end of 2021, it marked a departure from its established model. Glimpses of the model had been seen at ibis Rajarhat, Kolkata but this one, the 20th ibis in India, is the template for further ibis Hotels in India. As J.B. Singh, President & CEO, InterGlobe Hotels, said during the opening, “We created a new benchmark, not just for ourselves but also for the industry. This is the latest one, aimed at the young emerging Indian traveller.”

In India, approximately twothirds of the population is under age 35. Millennials are around 34%, or about 440 million individuals in absolute terms. Post millennials account for just a shade less. India’s

J.B. SINGH PRESIDENT & CEO, INTERGLOBE HOTELS

“We created a new benchmark, not just for ourselves but also for the industry. This is the latest one, aimed at the young emerging Indian traveller.”

median age is about 28 years. A report on millennials by Noesis, a hotel investment advisory firm, said that due to steady advancement in their professional careers, higher disposable income, and flexible work hours, they have more spending power, clearly bringing out the immense potential for the travel and hospitality industry.

While some experts have noted that the Zoomers may not have considerable spending power at the moment, it is likely to be a very different scenario in the next 10 years. The YouGov Travel & Tourism Report 2022 revealed that 37% of Gen Z travellers consider travel prices to be a hindrance, with the cost of lodging being a major concern.

Nearly all hospitality majors have launched brands specifically designed to cater to this demographic, even if they are often couched in terms of ‘local’,

‘design-led’, and ‘sustainable’. Moxy is a millennial hotel by Marriott, while Hilton has launched Canopy, Tempo and Tru, Accor has launched 25 hrs by Accor, IHG has Indigo and Hyatt has JdV and Caption. Significantly, none of the Indian hospitality brands have yet catered to this category, even as they are all expanding their brand portfolios. Interestingly, almost none of these brands are positioned in the luxury segment, where there already are brands such as W (Marriott) and Andaz (Hyatt).

But it is in the standalone space or new brands that new-age hotels

are making a mark. ‘A hotel that moves as fast as you.’ That’s how Yotel, which claims to offer guests a hotel experience that challenges the status quo, with a promise to deliver a different kind of stay through awesome people, smart design and the creative use of technology, describes itself.

“Our hotels have adapted with the way people travel now— appealing to ‘Generation Go’–digital nomads, who can work remotely but are also culturally curious, and willing to try new types of accommodation. They want to stay in central locations and be in the

JOHN TOOMEY CHIEF SALES AND MARKETING OFFICERAPEC (ASIA PACIFIC, EXCLUDING CHINA), MARRIOTT INTERNATIONAL

“It is important for hotel companies to make sure that they have brands which constantly engage and speak to these emerging segments of the population.”

heart of the action, and so value accommodation offering where they can check in quickly, and then get out and explore,” says a spokesperson.

While there is no Yotel in India yet, it already has staff in the market, which it sees as a crucial one. “India specifically requires its development strategy due to the size of the country and the opportunity. We are looking at opportunities across the region and that strategy includes finding new partners to spark regional growth and expand with them to new cities and countries.”

Design is a huge differentiator for hotels aimed at younger guests. Design-led brands, such as JdV, part of Hyatt’s ‘Independent Collection’ of hotels, and Caption are the new brands from the hospitality major with a huge focus on design. The design features art murals by local artists, reflecting the free-spirited and inclusive personality of JdV by Hyatt. Moxy, Marriott’s attempt to catch loyalties young, also embraces bold, contemporary decor infused with whimsy. Colourful

The Social Hub Amsterdam City (formerly The Student Hotel) is a hotel where travellers, locals and students get together to learn, stay, work and play.

Selina, nicknamed the ‘Millennial and Gen Z Hotel’ offer hostels, dormitory-style rooms and CoLiving spaces across the world.

Ion Adventure, Iceland offers attractions of this remote world, plays up its sustainability credentials.

In Japan, Hoshino Resorts recently debuted BEB5 Tsuchiura, a property themed on cycling.

artwork and quirky furnishings create a fun and engaging atmosphere. Moxy’s interiors feature vibrant, edgy decor with an industrial-chic aesthetic, creating a youthful and energetic ambience.

The vibe of ibis Vikhroli represents an urban-influenced design with very accessible technology, style and a social atmosphere to enhance experiences and keep pace with the new-age visitors and guests at the property, says Manoj Agarwal, Head – Asset Management, InterGlobe Hotels.

Five, Dubai is squarely aimed at the party goer, with younger guests making up most of the guests.

Freehand Hotel, Miami, US has rooms that are retro chic, a nod to their 1930s Art Deco roots.

At Curiocity Maboneng, Johannesburg, South Africa, Gen Z can connect with other travellers and locals through a mix of communal lounges and co-working spaces.

“At Ronil Goa, Part of JdV by Hyatt, we capture the essence of Goa’s vibrant culture and energy, offering a unique experience for guests who are young at heart,” says Pratiti Rajpal, General Manager. Even the quickest of glances reveal just how different it is from a regular hotel. JdV has DJ GoaGirl, a resident DJ, who plays music creating an evolving atmosphere from French-inspired morning tunes to high-energy evening beats and, over the course of your stay, will get your musical preferences.

Evo Hotel in Salt Lake City, US is adventurethemed and has a mega climbing wall.

Generator Hostel Washington DC, US is a design-led hostel.

In China, Mini Cooper’s Nomad Hotel offers minimal footprint stay in remote Yunnan.

The Soul Station is a retreat with books, noise-cancellation headphones, customised playlists, and comfortable seating. The merchandise is squarely aimed at the trendy millennial. The bright rooms have no closed closets, while the mini bars are complimentary.

Moxy Hotels cater specifically to younger, millennial, and Gen Z guests, offering an energetic and stylish environment, says Anuradha Venkat, Hotel Captain, Moxy Bengaluru Airport Prestige Tech

Cloud. “Moxy’s lobbies serve as dynamic social hubs, encouraging interaction and socialising. These open-plan areas feature a 24/7 bar, communal tables, and cosy seating, facilitating guest connections.”

According to Toomey, brands such as Moxy have been received well across countries in the APAC region including in India by Gen Z and millennials.

Tech, of course, is crucial for the generation that studies indicate spends more than 10 hours on their gadgets per day, chiefly the smartphone. “Moxy provides highspeed Wi-Fi, multiple power outlets, and smart TVs with streaming capabilities,” points out Venkat. “The streamlined check-in process often includes self-service options, enhancing convenience for techsavvy guests. Mobile check-in, digital keys, and app-based services for convenience are a must. The compact yet stylish rooms are equipped with high-tech amenities like keyless entry, motion-activated LED lights, and flat-screen TVs with streaming capabilities.”

The hotel experience goes well beyond just the food and stay options. Moxy hosts diverse events, from live music performances to art installations and themed parties. These experiences resonate with the interests and lifestyles of millennial and Gen Z travellers, explains Venkat. “Curated guides, local business partnerships, and events showcasing local talent enhance the experience.”

Younger generations prioritise experiences, technology, and sustainability differently than previous generations, says Venkat. “Recognising these shifts allows businesses to tailor their offerings effectively. In a crowded market, differentiated products and services stand out. By understanding emerging customer segments, companies can create unique value

ANURADHA VENKAT GENERAL MANAGER, MOXY HOTELS

“Moxy’s lobbies serve as dynamic social hubs, encouraging interaction and socialising.”

propositions. Instagrammable spaces and unique, shareable experiences are crucial.”

Interestingly, both JdV and Moxy in India seem to employ a staff markedly younger than the average hotel. “We are breaking norms, and it is easier to train younger people who are more open to this new way of interacting with guests,” adds Venkat. Sustainability, at least for Zoomers in the first world, seems to be a priority. According to the Booking.com Destination Z report, this demographic is more likely to

choose eco-friendly and sustainable travel options, with 56% of young travellers indicating they would prefer to stay in green or ecofriendly accommodations, and 60% claiming they are looking for more environmentally friendly means of transportation once they arrive. A report by Skift seems to agree, noting that 54% of Gen Z travellers would pay higher rates to an ecofriendly service provider.

Hospitality majors, through a combination of adaptability and innovation, have placed major bets that future guests, especially those in their teens now, will want these new models.

Generalising Gen Z, most experts agree that the common denominators seem to be a sense of adventure, curiosity, and joy, seeking new experiences and staying engaged with the world.

To what extent Gen Z accepts these new brands remains to be seen, especially where the Indian Zoomer is, in some ways, not homogenous. Chains claim their new brands are doing well even as newer players, including AirBnB, new-age chains such as Yotel, and homestays threaten with their disruptive models.

A CAGR growth of 75% for the last five years of individuals with a combined wealth of ₹1,000 crore. A sales record high of 42,731 luxury cars in 2023. Disposable income levels on the rise. Aspiration for finer things in life on the increase. This discerning demographic is eyeing luxury residences, made more covetable by association with a high-end brand, with great interest.

RUPALI SEBASTIAN

India’s economy is on the rise. Spectacularly. From a GDP of 1856.72 billion USD in 2013, it has burgeoned, in merely 10 years, to 3572 billion USD in 2023 (source: statista.com). This upward trajectory is matched by increase in disposable income and the number of high-net-worthindividuals (HNWIs) and ultra-high-net-worth-individuals (UHNWIs). In their report The Landscape of Branded Residences in India-2024, hotel investment company Noesis points out to India’s rank as the world’s third wealthiest nation, with 271 billionaires. These are discerning buyers, whose views have already been shaped by the traditional outlook of investing in real estate. This approach is now coloured by the aspiration for an opulent, curated and high-quality living experience, tempered with impeccable service and prestige. Branded residences occupy this spot.

Considered at the pinnacle of all luxury residential formats, branded residences are high-end housing projects to which a hospitality chain or other luxury brands lend their 'name'. In case of hospitality brands, the added advantage is that they provide management services, albeit for a fee. Such an association benefits all three stakeholders—that is, the developer, the brand and the buyer. For the developer, it translates to sales price premiums and higher sales velocity; for the brand it means opening up of new income streams and diversification of their offerings; and the buyer stands to reap financial rewards from rental returns, capital appreciation, quality assurance and a more refined lifestyle.

The true desirability of a branded residence lies in the amenities and services offered by this format. This depends on the location and type of

development—whether hotel-led, mixed-use or standalone. Services will include those incorporated into the annual charges, and some which can be availed on-demand. Clubhouse access, security, valet parking and loyalty programmes (in case of hotel-branded residences) can be grouped under the former, while spa, personal trainer sessions and in-room dining fall in the latter.

Historically, the branded residences market has been dominated by hotel brands, which are in a unique position to offer world-class services as well as lend their brand equity for a heightened perception of the development. But residences can and, in fact increasingly are, collaborating with luxury consumer brands from the fashion, automotive and restaurant sectors, as well

FAR LEFT AND LEFT: Bulgari Lighthouse Dubai reflect's the brand's unrivalled craftsmanship, thoughtful precision, and timeless elegance.

TOP: The Six Senses Residences Dubai Marina will reach a height of 517 mtrs. The offerings include apartments and 'sky mansions' spread over three levels.

BOTTOM: St. Regis Residences, Sunny Isles Beach, Miami, comprise two to five-bedroom condos with no hotel component on-property.

as celebrity architects/interior designers. This, in turn, is fuelling the trend towards standalone branded residences—in other words, residences without a hotel located within the same building or nearby.

In one of the biggest movements in the Indian sector of branded residences, realty firm Whiteland Corporation signed an agreement with Marriott International to bring 'Westin Residences' to Gurugram in early July this year. The development is slated to be India’s largest branded residential project and the first standalone one sans a hotel onsite from the Westin brand. On the occasion of signing the agreement with Marriott International, Pankaj Pal, Managing Director, Whiteland Corporation, said that the development would “redefine premium home ownership with exceptional service and attention to detail, offering a prestigious address that will bring pride and joy to its residents.”

July, again, saw Samarth Bajajfounded Boheim, a global Indian luxury living brand, announcing its debut in the luxury real estate

sphere in India with high-end villas designed by, for starters, interior designer Gauri Khan, and fashion designers Abu Jani & Sandeep Khosla and Kunal Rawal. Unlike a designer space offered as a premium, albeit readymade, product, these ultra-luxurious bespoke homes will be tailor-made for the owner to the last detail. While the initial roll-out will cover Goa, Hyderabad (Bajaj’s hometown) and Alibaug, international markets like Dubai, Africa, Sri Lanka and Thailand are already on Boheim’s radar. “Why did I enlist fashion designers to curate our interior spaces?” rhetorises Bajaj. “The answer lies in their unparalleled mastery of design and luxury. Freed from the constraints of conventional space design education, fashion designers naturally think beyond traditional boundaries, a quality that enhances their exceptional talent in creating bespoke homes for Boheim patrons.”

Does service enjoy an edge or a ‘designer’ space? Harsh Bansal, co-founder, Unity Group, throws light on what prompted them

OPPOSITE: The size of the residential units at Taj Sky View Hotel and Residences, Chennai, ranges from 2,500 sq.ft. to 5,900 sq.ft. Being developed by AMPA Group, the project has created quite a buzz in the Chennai market.

to approach a consumer luxury brand—Versace, in this case—instead of a hotel brand for the branded residences that are part of their The Amaryllis development in Karol Bagh, New Delhi. “A designer brand like Versace or Armani comes with their independent, full-fledged design team and product offerings. Therefore, they not only support you in interior design but also procuring designer products,” he states, adding, “I'm not quite convinced about the value the service angle (of a hotel-branded residence) brings to the individual home, in a country where house help is readily and cheaply available, and will do things your way.”

On the other hand, Mumbai luxury real estate developer Hubtown is actively looking for a hotel as a brand partner for an “enhanced product differentiation” because “high-end marble will only take you so far,” says managing director Vyomesh Shah. “I can speak only for Mumbai, but service is critical in this market. The level of service even in 100-200 crore apartments is still unorganised. And there is a certain expectation people have of service standardisation.”

However, whether a hotelbranded residence is consumed better than its non-hotel counterpart, “is wholly market dependent,” says Anuj Puri, Chairman, Anarock. “In fact, both types are being offered across cities depending on the demand. For instance, in Mumbai we saw developers collaborate with both consumer luxury brands

Considered at the pinnacle of all luxury residential formats, branded residences are high-end housing projects to a which hospitality chain or other luxury brands lend their 'name'.

like Armani and hotel chains. In Chennai and Bengaluru, we have seen builders collaborate with hospitality brands (to create) Taj Sky View Hotel & Residences and Leela Residences, respectively.”

An architect's perspective

Architect Bobby Mukherji, who is actively engaged in the luxury residential real estate market as well as several branded residential projects, both in the hotel and luxury brand verticals, enjoys a unique insight into this space from this vantage. “The luxury residential market in India has exploded. Real estate developers have upped the ante in terms of amenities and quality. The benchmarks are incredibly high. Clubs, gyms, salons, valet parking… you name it, a high-end residential complex will have all these and more. This trend is not restricted to metro cities alone. We’re seeing it across India, wherever we’re involved in luxury developments—in Ahmedabad, Surat, Indore, Jaipur, Ludhiana… The Indian home-buyer has never been so aspirational. They have the money, and they have the ambition. In this scenario, the entry of hotels as brand partners has only made the segment more aspirational for the well-travelled, well-heeled Indian consumer. The brand association extends further assurance and commitment vis-a-vis service quality. Customers come to expect a level of professionalism in this regard. ”

Mukherji also has an interesting observation to make about the behavioural trait that differentiates the Indian consumer from his western

THE SECTOR CONTINUES TO GROW THROUGH SCHEMES AS WELL AS EMERGING LOCATIONS. INTERNATIONAL BRANDS SUCH AS MARRIOTT AND FOUR SEASONS HAVE ALREADY MADE A MARK ON THE INDIAN LANDSCAPE OF BRANDED RESIDENCES. NOW, INDIAN BRANDS HAVE ENTERED THE FRAY

BENGALURU-BASED DEVELOPER PRESTIGE GROUP HAS COLLABORATED WITH 7-STAR HOTEL THE LEELAVENTURE TO BUILD PRESTIGE LEELA RESIDENCES.

THE OBEROI GROUP AND BI GROUP HAVE JOINED HANDS FOR TWO DEVELOPMENTS: TRIDENT RESIDENCES, NEW DELHI AND OBEROI RESIDENCES AT NANDI HILLS, BENGALURU

IHCL RECENTLY ANNOUNCED THEIR TIE-UP WITH AMPA GROUP FOR A NEW HOTEL TAJ SKY VIEW THAT WILL ALSO INCLUDE LUXURY RESIDENCES IN CHENNAI.

ITC HAS MADE ITS INTERNATIONAL DEBUT WITH ITC RATNADIPA, COLOMBO. OF ITS GLITTERING TWO MODERN TOWERS, THE LARGER ONE INCLUDES 123 SAPPHIRE RESIDENCES, HIGH-END HOMES DESIGNED BY YOO INSPIRED BY STARCK

Lamborghini

Aston Martin

Buggatti

Porsche

Mr C

Hard Rock

Casa Tua

Major Food Group

Nobu

Ellie Saab

Armani

Versace

Fashion TV

Roberto Cavalli

Fendi

Baccarat

Bvlgari

Missoni

Ferre

Trump Candy & Candy Related

Berkeley Group

Emaar and Aldar

Source: JLL Hotels & Hospitality Group - Data as of Q1 2024 & The Landscape of Branded Residences in India-2024 by Noesis

counterpart when it comes to such high-value real estate purchases.

“Internationally, a branded residence means everything comes readymade to you: the service, the public spaces and the interiors of your home. But when it comes to India, things are appreciably different when it comes to the last point. The customer will have spent multiple crores on buying a home, and wants things his way when it comes to how it is going to be designed. So the interiors end up being designed by the professional of his choice, obviously at his cost.”

Mariott International

Four Seasons

Accor

Minor Hotels

Hyaat Hotels Corporation

IHG

Hilton Worldwide Aman Resorts

Mandarin Oriental

Hotel Group

Capella Hotel Group

Yoo

Pinafarina

LightArt

Greg Norman

Phillipe Starck

Kelly Hoppen

1508

Yabu

HBA

Tristan Aeur

What determines the success of a branded development for an investor?

Several factors, actually. JLL, in its report The Rise of Branded Residences in Asia Pacific, advises developers/investors to decide whether they would be selling furnished or unfurnished units, and kind of services that would be offered to the buyers. Developers must also take into account the various license costs and fees. These include the residential marketing license fee, which allows developers to use the brand’s name and trademarks in marketing materials. The brand commitment fee ensures ongoing support and brand maintenance throughout the project’s lifecycle. The technical service fee covers design and pre-opening support provided by the brand during the development stage of the property. Additionally, the report points out, there may be homeowners association management fees for maintaining shared spaces and amenities.

The sales price premium advantage

Ampa Palaniappan, Managing Director, AMPA Group, who recently inked

The distinctive façade of Bugatti Residences by Binghatti. With its serene undertones, the hyper-form will juxtapose the city’s bustling energy retreat in the heart of the metropolis.

Source: The Landscape of Branded Residences in India-2024 by Noesis

105,00 BRANDED RESIDENCE UNITS ACROSS 750 PROJECTS WORLDWIDE

OVER 1,200 SCHEMES FORECAST BY 2027.

HOTEL BRANDS DOMINATE WITH A SHARE OF 80% OF THE PROJECTS.

MARRIOTT IS THE LARGEST OPERATOR, FOLLOWED BY ACCOR WITHIN THE HOTEL SEGMENT. YOO IS THE LEADING NON-HOSPITALITY BRAND.

DUBAI IS THE WORLD’S LEADING HOTSPOT FOR BRANDED RESIDENCES FOLLOWED BY SOUTH FLORIDA, NEW YORK, PHUKET AND LONDON

Bentley Residence Miami. The core of the building will house a patented car elevator that will take the residents directly to their home in their car.

ANUJ PURI CHAIRMAN AND FOUNDER, ANAROCK

“(Hotel and non-hotel residences) are being offered across cities... (Consumption) is wholly market dependent.”

JAIDEEP DANG MANAGING DIRECTOR, HOTELS & HOSPITALITY GROUP, JLL

“India-born global hotel operators are exploring opportunities with their luxury hotels being at the heart of such lifestyle-oriented developments.”

PAL

MANAGING DIRECTOR, WHITELAND CORPORATION

“The Westin Residences Gurugram will redefine premium home ownership with exceptional service and attention to detail.”

VENKATESH EXECUTIVE VICE PRESIDENT, REAL ESTATE & DEVELOPMENT, IHCL

“Mixed use developments, with co-existence of residential and luxury hotels, is a growing format in metro cities.”

BOBBY MUKHERJI FOUNDER, BOBBY MUKHERRJI ARCHITECTS

“The Indian home-buyer has never been so aspirational. They have the money, and they have the ambition.”

PALANIAPPAN MANAGING DIRECTOR, AMPA GROUP

“Branded residences like the Taj Sky View are usually valued about 30%-40% higher than a regular residence.”

SAMARTH BAJAJ FOUNDER, BOHEIM

“Fashion designers think beyond traditional boundaries, a quality that enhances their exceptional talent in creating bespoke homes for Boheim patrons.”

UNITY GROUP

“I'm not quite convinced about the value the service angle (of a hotel-branded residence) brings to the individual home.”

VYOMESH SHAH MANAGING DIRECTOR, HUBTOWN

“The level of service even in 100-200 crore apartments is still unorganised. And there is a certain expectation people have of service standardisation.”

Mumbai

Ashford Chambers, Old Citylight Theatre | Lady Jamshedji Road | 400 016 Mahim, Mumbai 022 2446 7750/51/52/54 | mumbai@pluschliving.com

Bangalore No 37, 4th B Cross, 5th Block | Industrial Layout Koramangala | 560 095 Bengaluru 080 2550 4444 | bengaluru@pluschliving.com

Hyderabad

Plot No, 761, Rd Number 39 | CBI Colony, Jubilee Hills | 500 033 Hyderabad +91 82972 25491 | hyderabad@pluschliving com

Delhi

F 3/1, Okhla Industrial Area | Phase 1, Near Crowne Plaza | 110 020 New Delhi 011-41553333/6789 | delhi@pluschliving.com

a development under management contract with IHCL for Taj Sky View, a hotel and branded residences complex in Chennai, says: “Branded residences like the Taj Sky View are usually valued about 30%-40% higher than a regular residence. Because of their unique service offerings and professional management, real estate valuation of such branded residences experiences higher appreciation over a period of time.” Jaideep Dang, Managing Director, Hotels and Hospitality Group, JLL India, concurs. “On an average, branded residences in the Indian market are priced approximately 30% more than other comparable residential developments in a particular micro market,” he says. Shah prefers to tread on the side of caution. ”We’ve currently not budgeted too much for premium,” he says. “Generally, we allow the market to decide that. But from whatever research we’ve seen, we expect anything from 5 to 15% premium.”

Increasing affluence in urban centres across India translates to demand opportunities for this real estate format. “Mixed use developments with coexistence of commercial, retail, residential and luxury hotels is a growing format in the real estate segment in metro cities,” says Suma Venkatesh,

Source: JLL Hotels & Hospitality Group – Data as of Q1 2024

Executive Vice President, IHCL. India, according to the Noesis report, is expected to mirror the 12% CAGR of the global branded residence market. Major metro cities, it states, indicate an established appetite for luxury lifestyle. Mumbai, DelhiNCR and Bengaluru are witnessing a surge in branded residences. However, emerging cities like Surat, Ahmedabad, Jaipur, Chandigarh and Indore show a promise of infrastructure development, FDI and commercial growth. This, says the report, will also satiate the appetite of investors looking to own a branded residence in the area. Pune, Chennai and Goa are attracting interest from developers and investors as well.

Historically, the branded residences market has been dominated by hotel brands, which are in a unique position to offer world-class services as well as lend their brand equity for a heightened perception of the development.

The evolution of the concept beyond the conventional approach has encouraged developers to explore standalone residences, branded villas and mixeduse developments to cater to diverse buyer preferences. While established metro cities might be suitable for standalone branded residential development, emerging markets would best benefit from the hotel + residences combination whereas in key leisure destinations, a resort + branded villa development would thrive. “The magic is in the mix,” states Dang.

Marriott leads the market. “Not only in the hotel + residences space but also it is amongst the very few companies which has brought its residences-only model to India i.e. without a hotel in the precinct,” discloses Dang. “We are also witnessing other hotel operating companies such as Hilton and IHG, who have successful hotels-cum-residences models overseas, and are exploring prospects in India. Also, other India-born global operators such as IHCL, The Oberoi Group and The Postcard Hotels are exploring opportunities with their luxury hotels being at the heart of such lifestyle-oriented developments.”

While the luxury branded residence vertical is certainly being viewed positively by both developers and brands, hotel operators, not surprisingly, are being extremely careful in their assessment, and all have a strict diligence process of selection. “As a part of our growth strategy, we will evaluate such opportunities with a sharp focus on the project’s design complementing the aesthetics and ethos of the Taj brand including the approach to architecture, landscape, interiors and sustainability,” reveals Ventakesh. Hubtown’s Shah speaks of the alignment of vision and brand on a philosophy level and the ability to complete documentation on a process level, as being pivotal to such partnerships. “What defines luxury? Even within the hotel space it’s different. A JW Marriott is different from a St. Regis. To get aligned on that front is first and foremost critical,” he says. “And then there’s the documentation. We’ve had a couple of instances where everything was aligned, but from a legal standpoint, or process standpoint, or documentation standpoint, we were unable to bridge that (gap).”

Whatever the challenges, the advent of branded residences in India celebrates the successful marriage of India’s favourite asset class with bestin-class hospitality—and this has further strengthened investor commitment to this segment. Looks like branded residences are here to stay!

Three decades, 120+ hotels. The remarkable success story of Sarovar Hotels 30 years on, especially in the hitherto oft-ignored midscale segment of Indian hospitality, has transformed the hospitality landscape in India.

CREATIVE DIRECTOR TANVI

PHOTOGRAPHED BY PRIYANKK NANDWANA

Mid-scale hotels. In 1994, the year Sarovar Hotels began its remarkable journey, they were not a reality in the branded segment. At least not in India. But then relatively young and already with a wealth of experience, two The Oberoi Hotels veterans, Anil Madhok and Ajay Bakaya, joined hands to venture into this hitherto ignored space in Indian hospitality. The fact that they came from a luxury hotels background and created a brand like Sarovar, one of the fastestgrowing hotel brands in India, with a score of openings this year alone, is a feat almost unmatched in the sector.

While the group’s largest presence is in metros such as Delhi NCR (14 hotels) and Bengaluru (10), its success lay in going to Tier II towns, usually becoming the first hotel brand to do so. From Saharanpur to Shravasti, from Siliguri to Somnath, Sasan Gir and Sonipat, the Sarovar flag has been setting benchmarks across the country. As the brand marks its 30th anniversary, SOH looks back at this remarkable journey.

“When we started, we had clarity,” points out Ajay Bakaya, Managing Director, Sarovar Hotels. “I can't claim that we saw things as they are today or as good as they are today. And we were new to the game. None of us had had any successful exposure to being entrepreneurs. Mr Madhok had moved from a very corporate life into Sarovar and he was finding direction. I had one stint as an entrepreneur, which had nothing to do with hotels. When we joined hands we knew our strengths, we knew our competency in terms of running hotels, in terms of being able to sell hotels and doing business to the hotels. We were all expert operators.”

Bakaya also mentions the timing of their decision to go into business. “Liberalisation had happened. The questions to ask were: what are your strengths? What are the competencies? We knew we could run hotels. We knew there was a huge market in India where hotels were not run properly. So, we were there at the right time. The only people

who'd been before us was Choice, and they had gone very largely into a franchise model.” Madhok, who passed away last year, made a similar point in an interview in 2012. “Of course, there was an element of being in the right place at the right time, but I would credit us for figuring out the right approach to business. It was simple—none of the big chains were looking at small hotels. We were virtually the only company to do so.”

Madhok worked with The Oberoi Group for 25 years, with postings in Mumbai, Sri Lanka and Singapore, rising to be vice president of operations. He had been inspired to exit the ‘make-believe world’ of luxury hospitality while in Singapore, and decided to start his own venture. “Due to the liberalisation in 1991, there were a lot of hotels mushrooming everywhere but there was no company to manage them,” he said in the same interview. “So, I started Sarovar Hotels and Resorts in 1994 with ₹50,000 from my personal savings. I believed there was an opportunity to give a burgeoning, amateur hotel industry access to operational expertise, and I could do that.”

Bakaya recollects that Madhok and he were clear on three key factors when they started. “One was building long-term owner relationships. The owner is the king. He’s putting in the money, he is taking the risk. We are providing a service to the owner. And as an entrepreneur, we had to start thinking as an owner or as a true business person would: where is the money coming from? Where is it going? What are the returns? If he is hurting, you need to hurt with him and change and modify and adapt to make sure he hurts as little as possible.”

The other pillar was to bring in key people with strong experiences that the owners could not possibly attract or retain. “So from day one, in our very early stages, when we had the Marine Plaza in Mumbai,

In Indian hospitality, only a select few visionaries have been gamechangers. In that list, Anil Madhok (1945-2023), founder and former managing director, Sarovar Hotels and Resorts, ranks towards the very top. An economics graduate from the University of Delhi, he almost joined the army when fate took him to the hotel management programme offered by The Oberoi School of Hotel Management. And he remained with the group for a quarter of a century! Leaving Oberoi in 1991, he joined the Al Bawadi group for a couple of years before starting Sarovar in 1994. The rest, indeed, was pathbreaking.

we brought in a corporate housekeeper, a corporate chef, and we had a corporate engineer,” recollects Bakaya. “Two of these three were also the executive housekeeper and the executive chef in the hotel. I am the only company in this country that can pitch ourselves against anybody. We have IT training and HR, etc. So we have a huge team.” The Sarovar team is already over a thousand members strong, plus another about 7,000 odd in the hotels.

The third element was the ability to bring business to the hotels. “We started with three sales offices in city centre locations,” says Bakaya. “Today we have 16 sales offices. Sarovar delivers 25% of its business through these offline channels. I offer support services that no other company in this country offers. I have owners who have given me two hotels, three hotels, and four hotels. I have multi-property owners, which means I must be doing something right for those relationships.”

As the group reflects on their journey from one hotel to 120 over the past 30 years, they recognise the need to continuously evolve our operations. Says Jatin Khanna, CEO, Sarovar Hotels, “Each decade has brought transformative changes in our strategies and today, we stand on the brink of another significant shift. We've always been proactive in deploying manpower and over the past year-and-a-half, we've doubled the size of our revenue, marketing and HR teams, as well as expanded our sales offices.”

Paris-based hospitality firm Groupe Du Louvre acquired a majority stake in the group in 2017, and then, as Bakaya says, “the ball got rolling”.

He points to the advantage of being local as a crucial recipe for success. “We click with the owners; we talk in a language that they understand. We give them

SAROVAR PREMIERE OFFERS UPSCALE 5-STAR PROPERTIES THAT ARE DESIGNED TO RESONATE WITH A COSMOPOLITAN VIBE.

SAROVAR PORTICO OFFERS FULL-SERVICE 3 AND 4-STAR HOTELS THAT OFFER ACCESS TO COMMERCIAL AND TOURIST CENTRES.

HOMETEL IS A VALUE BRAND THAT REDEFINES THE CONCEPT OF AN ECONOMY HOTEL

ROYAL TULIP OFFERS LUXURIOUS ACCOMMODATION, FINE DINING, AND MATCHING SERVICES IN ELEGANT SETTINGS.

GOLDEN TULIP CATERS TO THE UPSCALE SEGMENT, OFFERING LUXURY EXPERIENCES.

TULIP INN PROVIDES AFFORDABLE ACCOMMODATION, MODERN AMENITIES, AND WARM HOSPITALITY

THE GROUP ALSO RUNS SEVERAL RADISSON BLU, RADISSON, PARK PLAZA AND PARK INN BY RADISSON BRANDED HOTELS.

THE GROUP HAS A COUPLE OF F&B BRANDS— GEOFFREY’S PUB AND ORIENTAL BLOSSOM. THE ORIENTAL BLOSSOM IS A SPECIALTY CHINESE RESTAURANT CHAIN WHILE GEOFFREY’S, A METRO-CENTRIC PUB CHAIN, IS A CONTEMPORARY INTERPRETATION OF A TYPICAL OLD-WORLD ENGLISH PUB.

THE GROUP ALSO MANAGES LODGING AND CATERING FACILITIES AT VARIOUS INSTITUTIONS IN THE COUNTRY.

continuity that large companies don't give them. For an international company, a guy comes in and then disappears, after which the owner talks to somebody else, and somebody else, and somebody else. With us, there are also cultural gaps to deal with. We don't talk down to our owners. We understand, we empathise, but we are not subservient either. We are on equal footing. We are partners.”

Interestingly, Bakaya claims that at least 70% of his owners are first-time investors for whom this is their only large business. “That is a different dimension altogether, because you are not dealing with people who are used to dealing in millions here and there and could not care if it goes right or wrong one way or the other, or we'll wait three months.”

While today, every hotel brand that desires to scale up is looking at the mid-market opportunity, Sarovar began its journey with this segment and remains focused on the space. “We were very clear we wanted to position ourselves in the mid-market. That's my core. I run deluxe hotels, but they are a small minority. I keep telling my team, luxury feels nice, but that's not our DNA.”

There is very clear clarity on the basic values that are not going to change, underscores Bakaya. “There are things that are changing. Yes, we need to wake up and we need to learn and we need to listen, and we need to treat people differently today than we did earlier on. It's a changing world. But our main narrative is Tier II and Tier III. I think our experience has been phenomenal.

“The markets in these two segments are growing today largely because of people’s aspirations. They are travelling often, and they want similar facilities in their cities. Tier III is not going as fast as it possibly could. Land is equally expensive, of course. Land in Indore or even Kanpur is no less expensive than the bigger cities. That's why the growth is smaller. But our niche is anywhere from a 60-room to 110-

120-room hotel, a space in which there is huge demand. That’s a smaller investment package because we position ourselves in the aspirational middle class.”

Going to an emerging destination also has paid off exceptionally well for Sarovar. “When we went to Lucknow, it was a very small city at that time. Amritsar too. Tier II and III cities give you even more opportunity to showcase your talent and your experience because they just don’t have anything,” says Bakaya. He admits there were considerable challenges in going to smaller cities, especially in the group's early years of operation. “The scale of the opportunity was still small at that time because there weren't a lot of people building opportunities in these destinations. The demand was low, though you were assured of a certain level of success. Your freight connections weren't there, roads were horrible. You went on trains to a lot of these places.”

WE WERE VERY CLEAR WE WANTED TO POSITION OURSELVES IN THE MID-MARKET. THAT'S MY CORE. I RUN DELUXE HOTELS, BUT THEY ARE A SMALL MINORITY. I KEEP TELLING MY TEAM, LUXURY FEELS NICE, BUT THAT'S NOT OUR DNA.” “

1994 Sarovar Hotels was founded. The first hotel was Bogmallo Beach Resort, Goa.

1996 Marine Plaza, Mumbai is refurbished and opens with a Sarovar flag.

1997 The group’s second hotel, Radha Regent Chennai, formerly Radha Park Inn, opens.

1999 Park Plaza, Ludhiana opens.

2000 Muthoot Plaza, Thiruvananthapuram opens.

2005 Sarovar Premiere, Sarovar Portico and Hometel added to the existing Park Plaza and Park Inn hotels. The group’s sub-brand, Hometel, is launched with Radha Hometel in Whitefield, Bengaluru.

2007 Paris-based hospitality firm Groupe Du Louvre enters India with its Golden Tulip brand.

2011 Sarovar opens its 50th hotel.

2012 Sarovar opens The Heron Portico in Nairobi, its first hotel in Africa.

2016 Wyndham was reportedly in talks to acquire Sarovar.

2017 Groupe Du Louvre gets majority stake in Sarovar Hotels, buying out earlier investors. Golden Tulip Hotels is amalgamated into Sarovar Hotels.

2018 Sarovar opens its first hotel in Africa, in Zambia.

2022 The group opens its 100th hotel as it expands rapidly.

2024 The group marks its 30th year and has grown to be one of India’s largest hospitality groups with 120 operational hotels in 77 destinations.

I THINK MY BIGGEST CHALLENGE IS PEOPLE. WE ARE AT A STAGE WHERE I AM VERY DEEPLY CONCERNED THAT I AM NOT ALWAYS DELIVERING WHAT I PROMISED TO MY OWNERS BEFORE THEY SIGNED UP .” “

The essentials for Tier II and Tier III markets

What does a traveller need when he heads to a Tier II or III town or city? Bakaya says the top priority is cleanliness. “Housekeeping was non-negotiable. When you put food on the plate, it should taste good. Forget all the other fancy dramas. As I tell people, your guest in a hotel is like a guest coming to your home. You make sure you take care of him, and he goes out happy.”

Bakaya is confident Sarovar can take on the competition even as hospitality majors such as Taj (Ginger), Marriott (Aloft, Moxy), Accor (ibis), Hyatt (Hyatt Place), ITC (Fortune), Radisson (Park Plaza, Park Inn), Wyndham (Ramada, Days Inn, Microtel, Howard Johnson), Lemon Tree (Red Fox) and others increasingly deepen the foray into the midmarket and economy space.

As for the potential of the midscale segment in India, Bakaya reiterates a point that Dmitri Manikis, President EMEA, Wyndham Hotels and Resorts, made at HICSA earlier this year to

the industry: even going by the most generous estimate, the luxury and premium customer do not make up more than 10% of the market. “The rest is us.”

India is currently experiencing remarkable growth, often referred to as the shining story of this decade. With a burgeoning middle class and supporting data, India stands as the youngest country in the world and will remain so for years to come, says Khanna. “This youthful demographic brings to the table an increasing capacity for spending and a strong inclination towards travel, including holidays and long weekends. Sarovar, as a leading domestic brand in the mid-market and premium segments, is uniquely positioned to cater to this demand, offering unparalleled hotel experiences.”

The group ended 2023 with double-digit growth and the first quarter of 2024 has seen double-digit gains, Bakaya elaborates. “Excluding the election months, which understandably were slower, we see the market as very stable.”

Bakaya admits to the challenge of staffing, which is impacting the entire sector significantly. “I think my biggest challenge today is people. We are at a stage where I am very deeply concerned that I am not always delivering what I promised to my owners before they signed up.” He says that a hotel requires a room-to-staff ratio of 1.2.

“Anybody thinks it can be done in less is cheating you.”

Cultural habits are changing in India. “You have to make sure you are paying more. You have to make sure you're not cutting corners. You have got to ensure that the back of the house in terms of cafeterias and locker facilities is as clean as the front of the house is. And this is not expensive to do. We have started building our army,” Bakaya says.

Sarovar has tied up with the Indian School of Hospitality to train executive staff. “Starting from August 1, we are starting a programme

THE GROUP HAS OPENED EIGHT HOTELS ALREADY THIS YEAR AND PLANS TO OPEN A FURTHER 8 TO 12, TAKING THE TOTAL TO 130 PLUS OPERATIONAL HOTELS BY THE END OF 2024

BY THE END OF 2025, THE GROUP IS TARGETING OPENING 150 HOTELS THAT IS AN AVERAGE OF AT LEAST TWO OPENINGS A MONTH—AN IMPRESSIVE NUMBER FOR ANY GROUP.

THE GROUP HAS A PIPELINE OF ABOUT 70-80 HOTELS

WHILE THE COMPANY ITSELF OWNS TWO OF ITS EXISTING HOTELS, A THIRD COMPANY-OWNED HOTEL IS COMING UP IN CHENNAI

LEFT TOP: Marasa Sarovar Premiere, Bodhgaya.

LEFT BOTTOM: Hotel V Sarovar

Portico MI Road Jaipur.

BOTTOM: Located in the heart of Dalhousie, Presidium Sarovar

Premiere offers breathtaking views of snow-covered mountains.

where I will pick up youngsters from hotel schools and for 12 months, I will pay for them. In that year, they will be certified with a proper school. They will be trained either as young assistant managers, young housekeeping executives or young chefs. We are making this investment in people. And hopefully, they will understand our philosophy. Even if half of them remain with us, we are building a certain culture that can multiply over time.”

Bakaya points out that the recent spurt in growth means that he can no longer be in touch with hotels as frequently as earlier. “The systems and the structure that we had in place in these early stages, even in the first 10 or 15 years, don't work anymore. So I can't visit all my hotels, nor can my CEO. I don't necessarily know what's going on. Yes, I look at my reports weekly, and monthly, but I'm not in touch with the hotels, day-to-day. We are now developing a system, a brand deck that will prompt me which hotel has gone down in say the last four days, or which hotel is performing subpar. We're moving to that level of technology now, which will help us manage things better. We were always hungry, and we remain hungry.”

With the Louvre association, the group has embarked on a technology revolution, “which is way ahead. Currently leading the industry, the company offers systems that allow every employee to access e-learning on a mobile phone, providing the flexibility to train whenever

“It's crucial to establish a culture of openness and transparency right from the start. This means clearly defining expectations, goals, and performance targets. Regular meetings and updates between owners and brand representatives help maintain alignment and quickly address any issues that arise.”

they choose,” says Bakaya. “We are making sure that in India, the translation is available in multiple languages because right now, everything is in English. More recently, we have the advantage of being the only Indian hotel company with a global distribution system and reach through the Louvre systems.”

On the technology front, all Sarovar hotels are integrated into a best-in-class Central Reservation System (CRS), adds Khanna. “We are also aligning our backend technology with that of Louvre Hotels, which operates 1,800 hotels globally. This alignment will enable us to develop new tools, enhance business analysis, and improve product offerings, all from a guest experience perspective.”