HOTEL SURGE

How affluence and aspirations are fuelling a luxury travel and hotel boom in India, and driving experiential travel.

CREATING LEGACIES WAS A ROYAL TRADITION. KEEPING THEM ALIVE IS OURS.

FOUNDER'S NOTE

HOSPITALITY, WITHOUT HESITATION

In a world where tourism is often measured in arrivals and RevPAR, the Indian hospitality sector continues to remind us that it is also an emotional economy. That its real strength lies not only in scale or luxury, but in values.

When the headlines turned grim after the recent attack in Pahalgam—26 lives lost, dozens injured—the hospitality industry didn’t wait for instructions. It did what it has always done best: it showed up. Within hours, local hoteliers and community-run lodges opened their doors to the stranded. Meals were arranged. Phone batteries were charged. Shelters were made available without question or cost. Yawar Lone, a hotelier in Pahalgam, was among the first to offer free accommodation, followed swiftly by others in Srinagar and Anantnag. Volunteers pooled their cars to take tourists safely to airports. It was spontaneous, unscripted, and deeply human.

But none of this should surprise us. We’ve seen this before.

In 2020, when the country came to a halt during COVID-19, it was this same industry—brought to its knees by shutdowns and uncertainty—that reached out the fastest. Hotels converted into quarantine centres. Staff stayed on-site for weeks to cook, clean, and care for frontline workers. Brands like OYO offered free stays to doctors. The Taj in Mumbai housed nurses working around the clock at neighbouring hospitals. Across cities, thousands of hotel workers stepped in—not to run a business, but to serve a nation in crisis.

The truth is, hospitality in India is not a transaction. It’s a mindset. A way of being. And in moments when the country is shaken, it reveals itself not in marketing campaigns, but in acts of instinctive generosity.

These aren’t one-off instances. This is a pattern. When war broke out in Ukraine and Indian students returned in droves, it was airport hotels that set up makeshift dorms. During train cancellations, it was roadside dhabas and small lodges that let travellers stay the night. This sector has consistently gone beyond its economic mandate. It doesn’t just host.

It helps.

And in the face of growing global complexity—where political positions impact personal movement—the industry is also displaying moral clarity. The recent citizen-led boycott of Turkey as a tourist destination, in protest of its posturing on Kashmir, is one such moment. While not state-driven, it reflects how deeply travel is now entangled with identity and ethics. Operators, travel companies, and even hotels are navigating this shift with quiet maturity. There is no gloating, just a firm understanding: when national sentiment is hurt, business cannot continue as usual.

Here’s to the ones who stayed up late to make guests feel safe. To those who gave, even when business was slow. To those who instinctively put people before policies. You are not just caretakers of comfort—you are caretakers of conscience.

GURMEET KAUR SACHDEV gurmeetsachdev@soulinkkworldwidemedia.com

THE QUEST FOR UNIQUENESS

New global research by a leading luxury hotel marketing firm and Harris Poll, an American research firm, reveals a subtle but important shift: 62% of affluent travellers feel luxury experiences are becoming repetitive, and 72% refuse to pay for anything resembling the generic offerings online. This points to a growing luxury fatigue that remains unaddressed.

In India, luxury hotels and travel are booming, fuelled by rising affluence and a generation craving fresh experiences. Yet hoteliers admit that constant innovation is needed to captivate travellers seeking more than just lavish stays. Our cover story explores why luxury is surging in India—and what still needs to be done.

From Nashik, we bring you the story of Sula Wines and an exclusive interview with founder Rajeev Samant, who shares how he built India’s premier integrated wine experience blending winemaking, music, and hospitality.

This edition features compelling interviews on hospitality’s evolving landscape in India—from Mandarin Oriental’s James Mabbutt to Accor’s Lifestyle & Leisure Brands CEO Gaurav Bhushan, who will lead a joint board between Accor and InterGlobe.

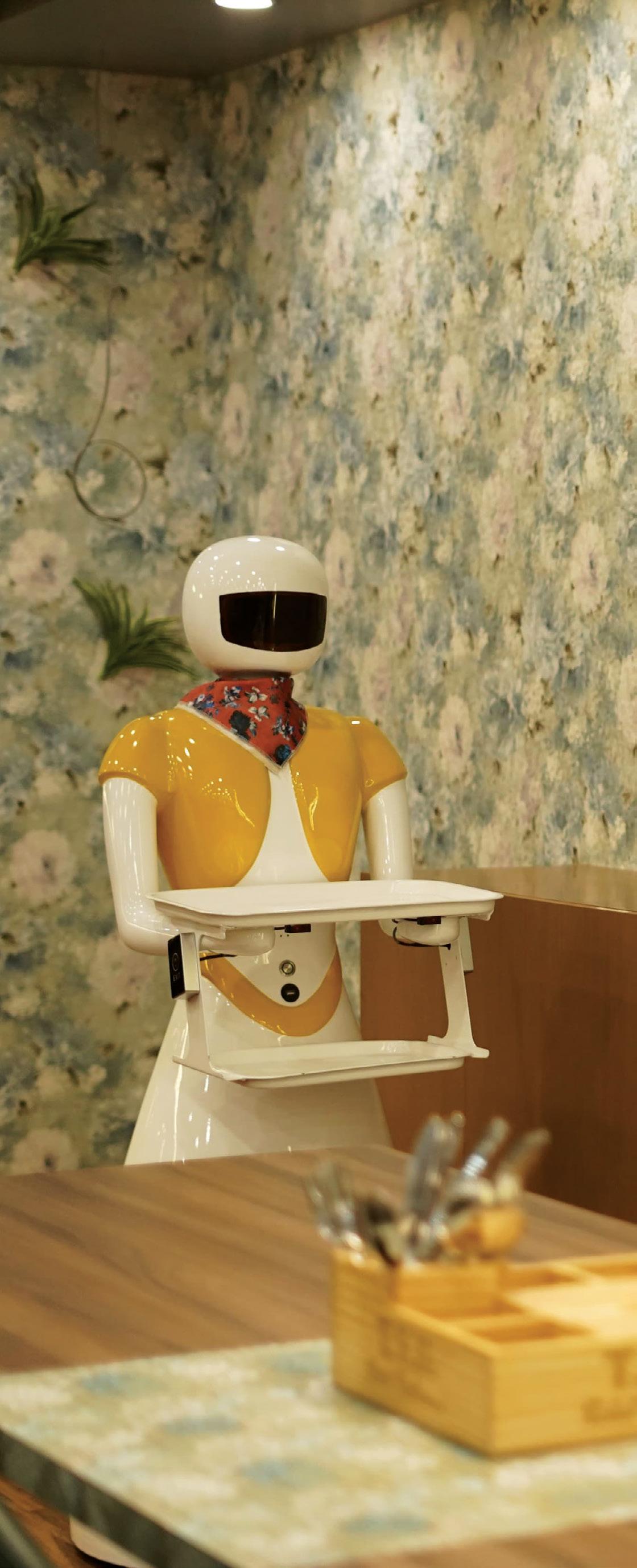

Technology is reshaping how we live, travel, and dine. Our tech section highlights how AI is helping global hotel kitchens drive sustainability and culinary innovation, alongside India’s ambitious e200X urban mobility project—an electric VTOL aircraft backed by aviation pioneer and Akasa Air co-founder Aditya Ghosh.

There’s much more to explore in this edition. We hope you enjoy the read.

Warm regards,

DEEPALI NANDWANI, EDITOR, SOH

Founder and Publisher

Gurmeet Sachdev

Editorial

Editor Deepali Nandwani

Managing Editor Rupali Sebastian

Contributing Editor Suman Tarafdar

Digital Editors Nolan Lewis, Rachna Virdi

Contributing Writer

Maria Louis Neeta Lal

Columnists

Manav Thadani

Harish Chandra

Creative

Creative Director Tanvi Shah

Team Shiv Soni

Contributing Artist Govinda Sao

Business Head

Vipin Yadav

Sales Manager

Deepa Rao

Office Manager

Deepak Rao

Accounts Head

Amey Acharekar

For queries: editorial@soulinkkworldwidemedia.com sales@soulinkkworldwidemedia.com info@soulinkkworldwidemedia.com

Printed and Published by Gurmeet Sachdev on behalf of Soulinkk World-Wide Media LLP. Registered office: 1/2, Old Anand Nagar, Nehru Road, Santacruz East, Mumbai, Maharashtra - 400055. Printed at Silverpoint Press Pvt. Ltd., A-403, TTC Industrial Area, Near Anthony Motors, Mahape, Navi Mumbai – 400709. Editor: Deepali Nandwani. All rights reserved worldwide. Reproducing in any manner without prior written permission prohibited. SOH takes no responsibility for unsolicited photographs or material all photographs, unless otherwise indicated, are used for illustrative purposes only. Unsolicited manuscripts will not be returned unless accompanied by a postage pre-paid envelope. All disputes are subject to the exclusive jurisdiction of competent courts and forums in Mumbai only. Copyright Soulinkk World-Wide Media LLP.

Luxury Hospitality Fuels India’s Travel Boom

Rising affluence and aspirations drive demand for authentic, immersive luxury experiences. India’s rich heritage and innovative hotels create a vibrant future for discerning travellers.

78

Next Stop: India?

Mandarin Oriental weighs entry into booming market.

AI helps Indian hotels cut waste, and stay creative.

84

Currents of Change Luxury cruises gain momentum on India’s scenic rivers.

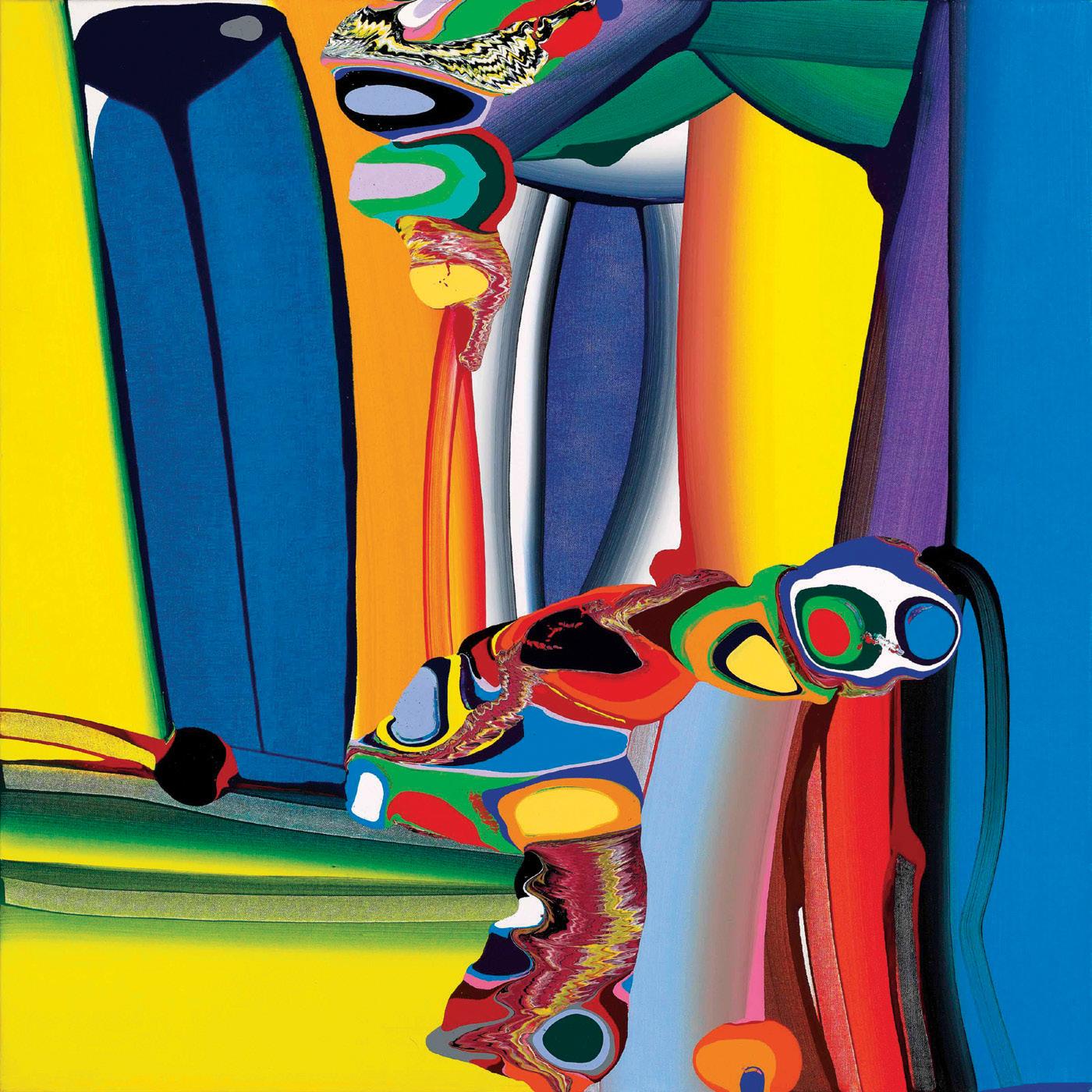

100 Canvas of Travel Bose Krishnamachari traces art through his myriad journeys.

72

Accor's India Push Merged entity aims to accelerate growth across India.

90

Vineyard Vanguard How Sula intrepidly pioneered the Indian wine scene.

MICHELIN'S HIGH ROLLERS

From Ibiza to New York City and Tokyo, these restaurants prove that food is more than a collection of ingredients cooked well. It is emotion, technique, and perfection— served on a plate at prices starting at $500 and reaching up to $2000 per meal.

In the hallowed dining rooms of Michelinstarred marvels spanning from the vibrant shores of Ibiza to the bustling streets of Tokyo and the iconic skyline of New York City, food transcends mere sustenance. Here, it's an emotion, a meticulously honed technique, sheer perfection artfully presented on a plate, all at a price point that begins around $500 and can soar to upwards of $2,000 for a single, unforgettable meal.

SOH’s list of some of the world’s most expensive Michelin-starred restaurants spans continents, from China to Japan and Spain.

SUBLIMOTION Ibiza, Spain

The 2-Michelin-starred restaurant Sublimotion, led by Chef Paco Roncero, fuses avant-garde cuisine, molecular gastronomy, and cuttingedge technology into a multisensory ‘gastronomic show.’ It embraces the philosophy that “a meal is a theatrical performance,” blending food, art, music, virtual reality, and illusion into a singular experience.

Ambience: The dining room, or ‘capsule,’ accommodates just 12 guests at a single table. Through 360-degree projections, dynamic lighting, and soundscapes, the table transforms into immersive environments, such as the North Pole or futuristic landscapes. A 20-person team manages advanced technology to control temperature, humidity, and aromas. Diners often wear VR headsets, while each dish is choreographed with visual and auditory effects to engage all the senses.

Food: The experience includes a 20to 25-course tasting menu featuring luxurious ingredients like caviar, foie gras, saffron, and gold leaf. Molecular gastronomy techniques create dramatic presentations, including smoke-encased dishes and interactive desserts. The seasonally evolving menu is shaped by contributions from top chefs such as David Chang, Dani García, and Paco Torreblanca.

Cost: A meal here costs $1,740 per person.

KYOTO KITCHO ARASHIYAMA HONTEN

Kyoto, Japan

Kyoto Kitcho Arashiyama Honten is set in Kyoto’s scenic district, framed by the Katsura River and Arashiyama mountains. Founded by Yuki Teiichi and now helmed by third-generation chef Tokuoka Kunio, it is renowned for its autumn foliage and iconic pink cherry blossoms. Unlike most high-end Michelin-starred establishments, this one is a Ryotei (traditional Japanese restaurant), celebrated for its exquisite Kaiseki cuisine and immersive cultural experience.

Ambience: This 3-Michelin-starred restaurant is housed in a traditional ryokan-style building featuring six private tatami rooms and the renovated Taikotei Grand Hall, showcasing Shoinstyle architecture and ceiling paintings. A Momoyama-period screen bearing Toyotomi Hideyoshi’s Paulownia crest pays homage to Japan’s tea ceremony heritage.

Food: Kaiseki, rooted in tea ceremony traditions, highlights seasonal ingredients, umami flavours, and Omotenashi— the Japanese ethos of wholehearted hospitality. Dishes are crafted from the finest ingredients sourced from Japan and presented as edible art on antique tableware. Signature offerings include Hassun (a seasonal delicacy platter served in a 24x24 cm wooden box), crab dishes, matcha-infused creations, and desserts like Shizuoka Melon with basil sauce or sweetened Chestnut with Adzuki Bean Jam. The Hassun course, a tea ceremony staple, underscores seasonality and visual artistry.

Cost: Kaiseki menus are typically 10–12 courses, with options like:

Menu 1: ¥50,000++ (approx. $340)

Menu 2: ¥60,000++ (approx. $410)

Chef’s Omakase Course: Priced based on the ingredients, tailored to the day’s best offerings.

AZABU KADOWAKI

Tokyo, Japan

Within Tokyo’s upscale Azabu-Juban district is Azabu Kadowaki, a 3-Michelinstarred Kaiseki restaurant celebrated for its innovative approach to Japanese cuisine. It blends traditional techniques with Western ingredients, creating a distinctive dining experience centred on seasonality and artistry. It was opened in 2000 by chef Toshiya Kadowaki, whose family businesses included a sushi restaurant. He trained at well-known establishments such as Koshi, Tsukiji Umemura, Kamogawa,

and Uientei, before becoming head chef at 27.

Ambience: Nestled in a quaint, historic neighbourhood near Roppongi, the restaurant’s unassuming exterior bears only its name in Japanese, with a Michelin-star plate at the entrance. The intimate space seats six at a counter for a front-row view of chef Kadowaki and his team’s meticulous work.

Food: Much like other Japanese restaurants, Azabu Kadowaki focuses on Kaiseki cuisine, rooted in seasonal ingredients and meticulous presentation. Kadowaki’s innovative twist incorporates Western ingredients such as truffles in dishes that ‘transcend

borders’ while staying true to Japanese sensibilities. Among its signature dishes are Truffle Clay Pot Rice (Truffle Kamado-gohan), a course in which steaming rice is topped with generous shavings of black truffles, infusing it with earthy aroma, and served with pickles and nori. Crab Chawanmushi (steamed egg custard) is topped with squid ink and prawn head, offering a warm-cold contrast and an umami burst.

Cost: Fourteen seats are accommodated in three private rooms with low ceilings evoking tearooms. Tasting menus range from ¥37,510–¥121,000 ($255–$820 USD), with an average of $450 per person.

GINZA KITAFUKU

Tokyo, Japan

Ginza Kitafuku, located in Tokyo’s upscale Ginza district—renowned for luxury boutiques, cocktail bars, and sushi counters—celebrates the versatility of crab as a culinary ingredient. Led by head chef Daisuke Yamazaki, who trained at several prestigious establishments before taking the helm, the restaurant

earned a Michelin star within months of opening.

Ambience: The serene private rooms feature either tatami mats or chairs and accommodate up to 16 guests. The interiors reflect modern Japanese aesthetics, with calligraphyadorned grills. Each room is assigned a dedicated chef, ensuring a personalised experience.

Food: The 1-Michelin-starred menu focuses on live crab cuisine (katsukani

ryōri), showcasing king crab, snow crab, and horsehair crab prepared in various styles—sashimi, boiled, grilled, and shabu-shabu. Seasonal Kaiseki courses complement the offering, with fugu (pufferfish) and suppon (soft-shell turtle), paired with sake or wine. The Omakase-style tasting menu revolves around crab, with courses serving the entire animal, including rare parts like golden crab (crab fat) and fundoshi (apron).

Cost: A meal here costs $400 per person.

MASA

New York City

Masa, located in New York City’s Shops at Columbus Circle, is a 3-Michelin-star Japanese and sushi restaurant renowned for its meticulously crafted Omakase experience, led by chef Masayoshi ‘Masa’ Takayama. Raised in a family fish shop, Takayama trained under sushi master Sugiyama Toshiaki at Tokyo’s famed Ginza Sushi-ko. He moved to Los Angeles in 1980 to open Ginza Sushiko, one of the city’s most expensive sushi destinations. Backed by chef Thomas Keller, he relocated to New York to launch Masa and Bar Masa. His culinary philosophy embraces Shibui (understated elegance), respecting each ingredient’s natural essence through precise preparation.

Ambience: The 26-seat dining space—10 at the hinoki wood counter and 16 in the dining room—features minimalist, Zen-

inspired decor that allows the food to take centre stage.

Food: The 26-course pre-set Omakase menu showcases premium seafood flown daily from Tokyo’s Toyosu fish market, alongside luxurious ingredients like truffles, caviar, and Ohmi beef. The experience combines traditional techniques with Takayama’s inventive touch, reflecting Kaiseki’s harmony of taste, texture, and presentation. Signature dishes include Roasted Sea Urchin with Black Truffles, fusing umami and earthy depth; Toro Tartare topped with Osetra caviar; and Tuna Bacon—tendon cuts transformed into smoky, melt-in-your-mouth nigiri.

Cost: The Standard Omakase is priced at $750 per person (dining room). The Hinoki Counter Experience is priced at $950 per person, while the Lunch Omakase experience is at $495 per person.

CAVIAR RUSSE

New York City

Caviar Russe in Midtown Manhattan is a 1-Michelin-star restaurant and caviar boutique specialising in premium caviar and contemporary French cuisine. This destination for caviar aficionados and fine-dining enthusiasts draws inspiration from co-owner Marianne Magnotta’s grandfather, Jerry Burns, co-founder of the iconic 21 Club. Chef Edgar Panchernikov leads the kitchen, crafting a menu that fuses classic French techniques with Japanese influences.

Ambience: The elegant second-floor ‘jewel box,’ adorned with crown mouldings, hand-painted wallpaper, and Hollywood-style bench seating, evokes a lavish townhouse atmosphere. Views of Madison Avenue lend a quintessential New York charm. The boutique offers mother-of-pearl spoons, Christofle silver servers, and takeaway caviar tins, letting guests recreate the experience at home.

Food: Signature dishes include Chilled White Asparagus Velouté with

scallop tartare, almond, and caviar; Long Island Pekin duck with foie gras croquette; Japanese mackerel, white asparagus, and oysters—all elevated with caviar; and King crab in lemongrass consommé.

Cost: In the Dining Room, tasting menus range from $195 to $975 per person, while à la carte dishes are priced between $30 and $150. Caviar service begins at $65 for 25g, with premium selections like Almas Beluga at $595 for 25g.

A dinner for two with drinks can total $1,000–$2,000.

TAIAN TABLE

Shanghai,

China

The 3-Michelin Green star restaurant stands out for its inventive take on Western cuisine and intimate setting. Founded in 2016, it is helmed by German chef Stefan Stiller, a Shanghai dining veteran with over 20 years in Asia, known for his precise, ingredientfocused approach. Since 2022, the kitchen has been led by young chef de cuisine Christiaan Stoop.

Ambience: The 26-seat, sleek, minimalist dining room features an open kitchen, dark wood finishes, soft lighting, and neutral tones. French windows provide views of Shanghai’s bustling streets, grounding the refined experience in the city’s vibrant energy.

Food: Taian Table offers a Western-style tasting menu with global influences, blending French and German techniques with Asian accents, and using premium ingredients like caviar, lobster, and Wagyu. The three Michelin Green stars recognise a menu that champions seasonality, creativity, and sustainability. Signature dishes include Maine Lobster with Beurre Blanc and caviar; Wagyu Beef with Truffle Jus; Foie Gras with seasonal fruit compote, balancing richness and acidity; and molecular gastronomy-inspired desserts like Yuzu Sorbet with edible flowers.

Cost: The tasting menu is priced at ¥3,888–¥4,800 ($540–$670), with wine pairings adding ¥1,500–¥2,500 ($210–$350). A dinner for two with drinks typically totals $1,500–$2,000, making it Shanghai’s most expensive Michelin-starred restaurant.

A COASTAL SANCTUARY, REBORN

Jetwing Saman Villas, familiar to many Indians as the stunning backdrop of Anil Kapoor-starrer The Night Manager, has been restored to its original splendour. The iconic coastal retreat now marries the timeless elegance of nature with contemporary comforts, offering guests a refined and immersive tropical experience.

LEFT: The 27-villa Sri Lankan boutique resort occupies a rocky promontory lapped by the green waters of the Indian Ocean.

RIGHT: The resort follows the open-plan architecture of traditional temples. Seen here are, from top to bottom, the reception block, the main restaurant, and the spa—all sheltering under pitched roofs.

The first thing that strikes you about the enchanting Jetwing Saman Villas is the interplay of natural elements that illuminate its every nook and corner. Buttery gold sunlight creates a chiaroscuro of mesmerising hues in its seafronted lobby; waterbodies reflect dappled sunshine while the oceanic roar belts out a sonorous soundtrack welcoming you into the hotel’s innards. Ayubowan!

Nestled along the south-west coast of Sri Lanka in Aturuwella village in Bentota, Sri Lanka, the beach resort occupies a hilly promontory flanked by the glutinous Indian Ocean. It first grabbed eyeballs as the breathtaking location of the 2018 OTT superhit series

The Night Manager, starring Bollywood actors Aditya Roy Kapoor and Anil Kapoor (as a debonair businessman) who lives here with his sultry girlfriend (played by Sobhita Dhulipala).

The 27-suite property quickly captivated the hearts of the peripatetic who hotfooted here to luxuriate in its tranquil location and Instagrammable villas with lush gardens, oceanic views and private plunge pools. What's more, it became a much sought-after setting as a magical backdrop to celebrate your special day with true island luxury. “We’ve had many Indian couples who have proposed here and then also gone on to tie the knot here. The most perfect end to a romantic fairy tale,” adds General Manager Farell Blom with a smile.

Yet that’s not the only reason why the hotel has acquired renown. Jetwing Saman Villas holds the unique distinction of being Sri Lanka's first boutique

luxury resort. Launched in the 1990s, the vision behind its creation was double-pronged: to establish an authentically upscale tropical retreat and to provide a serene atmosphere where guests could escape from the whirligig of daily life.

Interplay of elements

The creative mind behind the hotel’s design was the late genius architect Geevaka de Zoysa, who was influenced by the serene openplan architecture of traditional temples. He wanted to craft a hotel that artfully incorporated the timeless elegance of nature with modern creature comforts.

The end product is a fusion of airy spaces, tranquil waterbodies, and tropical gardens that lend an air of a serene oasis. Iconic architect Geoffrey Bawa's tropical modernism influences can also be traced throughout the property, adding a distinctive touch that makes the Sri Lankan lived-in experience more immersive.

The hotel's unique design ensures that all 27 luxurious suites open up to the salty ocean breeze and the surf-tipped ocean. Each suite is a harmonious blend of spaciousness and effortless elegance, paying homage to the tropical architectural style of seaside Sri Lanka. Impeccably appointed wooden interiors, Italian leather furniture, and state-of-the-art amenities create an ambience of refined comfort. Some suites even offer the luxury of a private plunge pool, sun-kissed verandahs, or gardens.

Restoring an icon

Over the years, the hotel has witnessed a spate of minor nips

overlooked in elevating luxury,” says Hashan Cooray, DirectorMarketing and Development.

Post restoration, the rooms and suites contribute to a modern and sophisticated ambience. While the suites feature free-standing marble bathtubs, electronically controlled sun blinds, and calming water features, the rooms are equipped with single-touch mood controls and a rain shower with thermostatic smart flow. Dining experiences have also been transformed, with signature locations like Rock Dining and Spa Dining offering intimate, coastal culinary moments.

and tucks, but its comprehensive makeover has given it the imprimatur of a 21st-century property that also retains its Sri Lankan heritage. The new design follows the template of an openplan hotel, leveraging its seascape location and abundant natural sunlight to run sustainably and with minimal carbon footprint.

In its current avatar, the resort’s material palette is understated yet fulsome in detail. The interplay of stone, wood and natural wood furniture gives it a warm, lived-in feel rather than one of overpowering ostentation. Throughout, the interior spaces

are marked with subtle lighting: niches holding art collectables; designer furniture in earthy textures, and floors and walls awash in hues of ivory.

“The restoration of Jetwing Saman Villas marks the renaissance of an icon along Sri Lanka’s southern coast. The hotel was thoughtfully reimagined during a quieter tourism year, ensuring every enhancement is both meaningful and timeless. From the introduction of Italian leather furnishings and state-ofthe-art home theatre systems to handcrafted timber screens and mood lighting, no detail has been

“The hotel’s makeover transcends being a mere aesthetic upgrade—a celebration of escapism, privacy, and attentive service," continues Cooray. "With 24-hour butler service, personalised check-ins, and the serene Sahana Spa, we continue to set a benchmark for refined, tropical hospitality. The reawakening of this coastal sanctuary invites discerning travellers to rediscover romance, serenity, and indulgence in a space where every detail echoes elegance and authenticity.”

Rooms with a view

Accommodation comes in various categories—from deluxe suites to the gasp-worthy Saman Villa Suite (where Anil Kapoor stayed). Opulent without being overstated, the duplex villa exemplifies

refined restraint with subtle touches of marble, wood and terracotta. While the ground level is dedicated to a sitting room and lounge, the upper floor boasts a capacious bedroom awash in natural light and designed to effortlessly complement the tropical seascape.

But it doesn't matter where you stay. Each room comes with staple accoutrements—breathtaking views of the ocean, syrupy sunsets and breezy sunrises. Done up in tropical décor with polished wood floors, they flaunt large windows and a patio to soak in the almost therapeutic salty sea breeze. The terracotta tiled roof helps maintain coolth while offering an antidote to the catatonic tropical heat and whittling down electricity bills.

Feast for the eyes

The hotel has a large main restaurant with al fresco seating, incorporating Spanish designer Arturo Alvarez’s emotional lighting and handcrafted timber screens. A small adjoining bar

is a theatre for elemental pyrotechnics. So grab a seat here at sunset and keep cameras poised to capture the sky change colours faster than runway models—from brilliant orange to amber, russet, ochre, vermillion red...

Interestingly, because of their design elements, all culinary spaces offer visual drama,

ABOVE LEFT: The artisanal screens of the fine dine restaurant are beautiful examples of the resort's organic, textural aesthetic.

ABOVE: Guests can enjoy a scenic cycle tour across paddy fields. BELOW: Ocean vistas accompany memorable meals.

whether you’re dining ‘on the rock’ at the edge of the sea at the Pool Pavilion (a sought-after spot for an excellent high tea served in tiered silver trays or a multihued cocktail with colours that match the sunset!). Al fresco meals on the terrace overlook the glutinous infinity pool, while the verandah, surrounded by rustling palm trees, adds a different allure to gastronomic offerings.

Jetwing Saman Villas is also home to the Sahana Spa, celebrated as one of the island's most exquisite spa experiences, and Anil Kapoor’s fave haunt if rumours are to be believed! Equipped with a jacuzzi, sauna, floral bath, and more, the wellness centre nestles within a beautiful, secluded water garden.

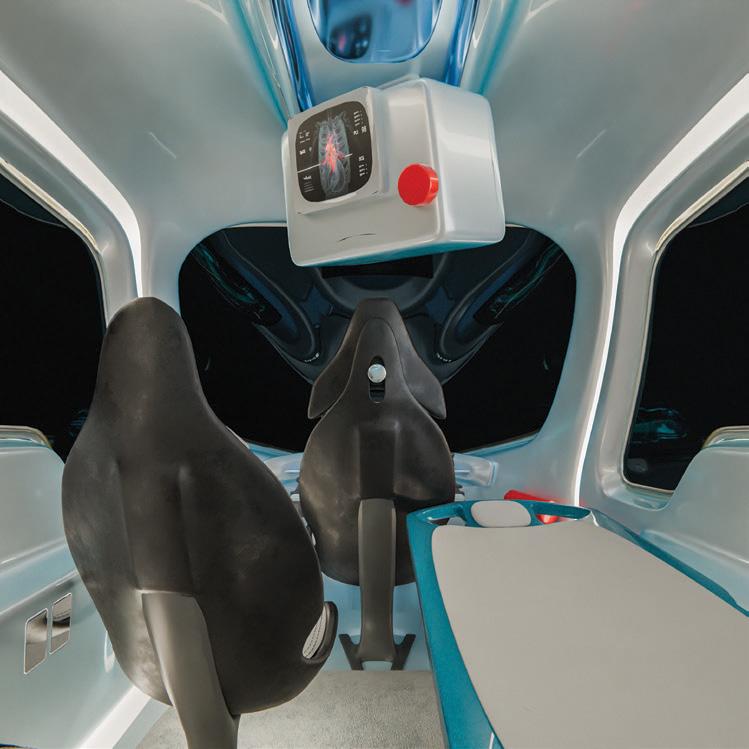

FLYING PAST GRIDLOCK

India’s most ambitious urban mobility startup, The ePlane Co., is building the future of flight: the e200X, a cutting-edge electric vertical takeoff and landing (eVTOL) aircraft. Aviation maverick and co-founder of Akasa Air, Aditya Ghosh, gives us the details.

On average, we spend nearly three years of our lives stuck in traffic, particularly in Indian cities, which are up to 150% more congested than other major urban centres in Asia. The implications extend beyond mere inconvenience: traffic congestion is estimated to have cost the Indian economy between three and five per cent of its GDP. Even more alarming is the human toll, with one road fatality occurring every four minutes. In response to these mounting challenges, companies worldwide are actively working to solve the urban air mobility puzzle. Among them is The ePlane Co., based in Chennai. Aditya

Ghosh—Founder of Homage, Co-founder of Akasa Air, and an investor in The ePlane Co.—says the company is developing India’s first electric vertical takeoff and landing (eVTOL) project as a solution to urban mobility. Ghosh, a prominent figure in the aviation industry, shares, “The e200X, the eVTOL (electric vertical takeoff and landing) passenger aircraft, is currently being designed and developed in India, but our vision is global. It is the largest vertical takeoff passenger aircraft being developed by The ePlane Co., founded by Professor Satya Chakravarthy and incubated at IIT Madras, alongside the space startup Agnikul Cosmos. I am

proud to be an investor in the company and to serve on its board.”

e200X is the future of aviation

The vertical mobility project, e200X is a compact eVTOL aircraft being envisioned as a solution for passenger mobility. The first application is urban transportation. Ghosh points out, “Think you’re at Bengaluru airport and want to get to the heart of the city. What currently takes 1.5 hours could be reduced to just seven or eight minutes. In India, it takes an average of 30 minutes to two hours for an ambulance to reach a patient. Imagine if

one could access a patient for emergency evacuation and address rural healthcare issues using e200X. The idea is to find a solution where you can skip roads completely and go from point A to point B within a city or over a hilly terrain.”

Offering another compelling example, he cites the journey from Dehradun to Mussoorie—a 35-kilometre stretch with 25 hairpin bends that typically takes three to four hours due to traffic. “Imagine if there were a solution that could complete this trip in just 10 minutes,” he says, “on a flight that takes off and lands in a space no larger than half a basketball court, and costs

the customer less than twice the price of an Uber ride.” The eVTOL aircraft promises to dramatically accelerate intra-city commutes and cargo transport, easing urban congestion and making travel significantly more efficient. For e-commerce companies—where logistics can account for up to 47% of total costs—the e200X represents a game-changing solution. Its technology is designed to streamline urban logistics and revolutionise cargo delivery, particularly for temperaturesensitive goods, by completing critical missions in mere minutes.

The e-plane is designed to carry one pilot with two passengers, or a pilot, a paramedic and a patient, or just a pilot with cargo. The company has already signed an MOU to deploy one air ambulance per district, and with over 700 districts in India alone, the potential for its impact is immense.

Even more exciting is the flight path, which is optimised by AI that predefines the trajectory between the origin and destination. This will ensure that multiple eVTOLs can fly simultaneously at different altitudes, ensuring smooth and efficient parallel operations. The booking is simple, through an app operating the service.

The technology behind e200X

e200X is unique in its design and backed by regulatory recognition—The ePlane Co. is the only Indian company to have received Design Organisation Approval from the DGCA (Director General of Civil Aviation). At the heart of this innovative technology is a patented approach called synergistic lift, which combines the aerodynamic efficiency of fixed wings with the vertical lift capability of rotors, powered by a battery system.

The concept, originally inspired by a NASA design philosophy, is now patented in over 30 countries worldwide.

The e200X aircraft is being built not just for India but also for the global markets. To ensure safety, the company has incorporated five levels of redundancy. Unlike helicopters, which rely on a single main rotor, the e-plane features multiple rotors and a distributed electric propulsion system. Furthermore, the aircraft is powered by advanced artificial intelligence, machine learning, and neural networks, enabling it to identify, recognise, and avoid obstacles automatically for a safer and more efficient flight experience.

Ghosh explains, “We faced and solved several complex engineering challenges. How will the aircraft take off from extremely compact spaces? How can it perform multiple missions on a single charge, requiring it to fly slowly, safely, and efficiently, all with a battery that recharges in under 30 minutes? We’ve developed a subscale prototype and are now advancing toward a full-scale, state-of-theart version of the e200X—India’s most compact and capable eVTOL solution.”

ADITYA GHOSH

INVESTOR,

THE EPLANE CO.

“The e200X, the eVTOL (electric vertical takeoff and landing) passenger aircraft, is currently being designed and developed in India, but our vision is global.”

Opening new possibilities for tourism

Ghosh is optimistic that e200X aircraft will contribute to the future growth and transformation of India’s tourism sector. “This is an incredibly exciting space for both India and the world. One of the most promising applications of this aircraft will be in ecotourism, making remote and beautiful destinations more accessible. For instance, Hogenakkal Falls, a stunning location near Bengaluru, currently takes about four hours to reach by road. With the e200X, that journey could be reduced to just a 20-minute flight. This opens up countless opportunities for tourism, with aerial experiences,

customised tours, and luxury travel becoming more feasible, creating new possibilities for both local and international tourism.” Currently, The ePlane Co. is focused on the design, development, and manufacturing of the aircraft. “We are in the business of creating the equipment—much like a car or aircraft manufacturer,” says Ghosh. “There will be several companies either purchasing it for commuter services or personal use. Thanks to the brilliant team at IIT Madras, I’m privileged to be a part of this groundbreaking initiative. This isn’t a distant dream—it could become a reality within the next three years.”

CRUISING ON INDIA’S RIVER HIGHWAYS

River cruise tourism, already growing at record levels, is set to expand even faster on the back of new policies and private sector investment. Are they the next frontier of luxury travel?

SUMAN TARAFDAR

Long, long ago—well, nearly two decades ago —when in Kolkata for a hotel opening, I was invited to go on a cruise down the Hooghly. It was a hired vessel, which sailed from Outram Ghat to Belur and Dakshineshwar, both just north of Kolkata. Outram Ghat, along with Princep Ghat, was one of the most important entry points for ships to India. At the time, most ferries, largely decrepit, were used locally to cross the Hooghly, a practice that still continues. Not quite in pristine shape, the vessel we were in had a capacity of 150 passengers, and was occasionally used for parties and events, we were told. On average, it operated less than a month annually, the captain informed mournfully.

Two decades on, the same stretch, and more, are now home to some of the most expensive river cruises in the country. Yes, the scenario for river cruises has moved on considerably, growing at a record pace. Of course, river cruise tourism has had strong roots in some parts, such as in the backwaters of Kerala, especially in and around Lake Vembanad and Alappuzha, Dal Lake in Kashmir, Sundarbans, downstream Zuari and Mandovi rivers in Goa, amongst others.

According to Statista, by 2025, it is projected that the revenue in the cruise market will reach US$229.96m in India. The revenue is expected to display an annual growth rate (CAGR 2025-2029) of 8.53%, resulting in a projected market volume of US$319.05m by 2029. The number of

LEFT: Traversing for 51 days across two countries, five states and 27 river systems, Antara’s MV Ganga Vilas' 3,200kms. route is the longest in the world.

BELOW: Day cruises on the Mandovi, especially during the evenings, offer picturesque views of the Panjim promenade.

users in the cruise market is expected to amount to 1.20 million users by 2029, while the user penetration is expected to increase from 0.03% in 2025 to 0.08% by 2029. The average revenue per user (ARPU) is expected to be US$490.11.

Modern river cruising in India arguably started with Assam Bengal Navigation (or ABN), an Indo-British family-owned joint venture in 2002, when Andrew Brock and Ashish Phookan "both jumped at the chance to explore this exciting idea together". Two decades later, and with four cruise ships and houseboats, ABN is the most experienced operator.

River cruises have taken off in India. The Cruise Bharat Mission (CBM) was launched in September 2024 and aims to boost the tremendous potential of cruise tourism in the country, both for sea and inland waterways. CBM aims to double cruise passenger traffic within five years; i.e. by 2029, up from 4.71 lakhs cruise passengers in FY 2023- 24. CBM specifically aims to target 1.5 million river cruise passengers over more than 5,000kms. of operational waterways in India. The number of operational National Waterways has grown from three in 2014-15 to 24 by 2023-24, with a target of 29 by 2024-25.

The potential of river cruise tourism in India is significant as the country has a network of 110 navigable waterways of more than 20,000kms. in length, connecting around 400 rivers. CBM aims to create 400,000 jobs in the cruise sector by 2047, with river cruises contributing significantly due to their labour-intensive operations, such as crew, guides, and hospitality staff.

THE KEY TO DEVELOPING RIVER CRUISES

Initiatives taken by the Inland Waterways Authority of India (IWAI), established in 1986, to develop river tourism include:

Developing the navigational channel on waterways along with navigational aids and carrying out dredging (the process of removing sediments), if necessary, in some navigable waterways.

Construction of vessel berthing facilities at multiple points along the waterways for the ease of movement of tourists.

Developing an ecosystem for river cruise tourism along with the promotion of heritage sites and tourist attractions along the waterways.

The development of inland waterways holds great promise for transforming India’s logistics sector. "By leveraging our extensive network of rivers and water bodies, we can create a sustainable, costeffective, and efficient mode of transportation for goods," the Union Minister of Ports, Shipping and Waterways (MoPSW), Sarbananda Sonowal recently said while inaugurating the Inland Waterways Terminal (IWT) at Jogighopa, which is expected to serve as an international port of call for Bhutan and Bangladesh, facilitating seamless movement across northeast India.

"We are attempting to rejuvenate the support system of inland waterways so that we decongest railways and roadways, and at the same time, provide a viable, economic, sustainable and efficient mode of transportation for both passengers and cargo operators," Sonowal said recently.

"The government’s focus on ocean and river tourism is a game-changer for India’s inland waterways," Raj Singh, the founder and Chairman of Antara Cruises (Heritage River Journeys Pvt Ltd), said in an interview to The Week recently. Antara, which has five vessels currently, is on an expansion spree and has already become known for its luxurious vessels. "This initiative

not only promotes responsible travel but also positions India as a rising player in global river cruising. We see critical areas that need focus, including connectivity, amenities and safety."

Amongst the necessary upgrades, Singh suggests enhancing connectivity for better road and rail links to cruise terminals, world-class docking facilities with clean restrooms, waiting areas, safety standards and emergency protocols to build trust among travellers. "With targeted improvements and proactive policies, river tourism can become a major pillar of India’s travel industry, driving both economic growth and sustainable tourism."

In January 2023, the country’s longest river cruise was launched; it traverses 3,200kms. from Varanasi to Dibrugarh. Significantly, it uses the Ganga-PadmaBrahmaputra network across 27 river systems, five Indian states and Bangladesh.

A more recent development has been the signing of an MoU between IWAI and the Ministry of Ports, Shipping and Waterways (MoPSW) with various Delhi government agencies to develop a four-kilometre stretch of the Yamuna (NW-110) between Sonia Vihar

CONTD AHEAD

THE BEST RIVER CRUISES

Ganga Vilas Cruise

Ganga River Cruises

(UPPER AND LOWER GANGES)

Operator

Antara Luxury River Cruises.

Route

Varanasi to Dibrugarh via Bangladesh, covering 3,200kms. Across 27 river systems.

Duration

51 days (world’s longest river cruise); shorter 21- or 31-day options also available.

Highlights

Stops at UNESCO World Heritage sites such as Sundarbans, Kaziranga National Park, Majuli Island, and Varanasi’s spiritual ghats. Features 18 luxury suites for 36 passengers, gourmet dining, and cultural excursions.

Cost

₹25,000–50,000 per person per day.

Why choose?

Unmatched for its epic scale, combining India’s spiritual heart with Assam’s wildlife and Bangladesh’s deltas.

Operators

Antara Cruises, Assam Bengal Navigation, Pandaw, Avalon Waterways.

Routes

Upper Ganga: Kolkata to Varanasi (11–14 days).

Lower Ganga (Hooghly): Kolkata to Farakka or Kolkata roundtrip (4–8 days).

Highlights

Visits to Kalna’s terracotta temples, Murshidabad’s Hazarduari Palace, Chandannagar’s French colonial sites, and Varanasi’s Ganga Aarti. Ships like Ganges Voyager II (28 passengers) and RV Kalaw Pandaw offer premium cabins, onboard lectures, and guided shore excursions.

Cost

₹50,000–1 lakh per person for the trip.

Why choose?

Perfect for cultural immersion, with small passenger counts ensuring personalised experiences. Travellers praise the manageable group sizes and expert guides.

Kerala Backwaters Cruises

Operators

Oberoi Vrinda and other houseboats.

Route

Alappuzha or Kochi, navigating Vembanad Lake and backwater canals (1–7 days).

Highlights

Traditional houseboats (1–2 cabins) or luxury vessels like MV Vaikundam (18 passengers) glide past paddy fields, coconut groves, and villages. Includes authentic Kerala meals, birdwatching, and visits to Champakulam’s waterfront. Oberoi Vrinda offers 5-star amenities like private jetties.

Cost

₹10,000–50,000 per person, depending on vessel and duration.

Why choose?

Serene and intimate, showcasing Kerala’s laid-back charm and culinary delights. Perfect for shorter, relaxing trips.

Brahmaputra Cruises

Operators

Adventure River Cruises and Assam Bengal Navigation.

Route

Guwahati to Jorhat/Dibrugarh (eight to 10 days).

Highlights

Explores Kaziranga National Park (UNESCO site with onehorned rhinos), Majuli Island’s tribal culture, and Sualkuchi’s weaving villages. Ships like MV Mahabaahu (46 passengers) and Charaidew II (24 passengers) feature Assamese cuisine, spa facilities, and naturalist-led wildlife tours.

Cost

₹50,000–1 lakh per person.

Why choose?

Ideal for wildlife and cultural enthusiasts, offering access to Assam’s untouched landscapes and rare fauna. Local crews share deep regional insights.

Mandovi River Cruises (GOA)

Operators

Mandovi Cruises, Swastik Cruises, Paradise Cruises and others.

Route

Panaji, cruising past Chorao and Divar Islands (a few hours).

Highlights

Short but vibrant, with Goan folk music, traditional dances, and local cuisine onboard. Offers scenic views of Goa’s lush riverbanks and a lively atmosphere.

Cost

₹1,000–5,000 per person.

Why choose?

Ideal for a quick cultural dive into Goa’s heritage.

THE BEST OF INDIA’S WATERWAYS

National Waterway 1 (Ganga-Bhagirathi-Hooghly)

1,620 kilometres

This is the longest and most important national waterway, linking Allahabad (Prayagraj) in Uttar Pradesh to Haldia in West Bengal, traversing Uttar Pradesh, Bihar, Jharkhand, and West Bengal.

National Waterway 2 (Brahmaputra)

891 kilometres

This waterway extends from Dhubri to Sadiya in Assam, a major artery for transportation in the Northeast.

National Waterway 3 (West Coast Canal)

205 kilometres

This waterway comprises a network of canals in Kerala, including the Kottapuram-Kollam stretch, Champakara Canal, and Udyogmandal Canal, vital for inland transport in the region.

National Waterway 4 (Krishna)

The stretch Muktiyala to Vijyawada in Andhra Pradesh of river Krishna 82 kilometres long.

National Waterway 68 & 111 (Zuari and Mandovi)

41 + 50 kilometres

Usgaon Bridge to Arabian Sea on the Mandovi and Sanvordem Bridge to Marmugao on the Zuari.

ABOVE: A kettuvallam or houseboat on Lake Vembanad is a grand sight.

BOTTOM, LEFT TO RIGHT: The Viceroy Suite on Ganges Voyager; The Oberoi Vrinda gets up close to Kerala’s backwaters; an inside view of the Oberoi Vrinda.

and Jagatpur into a hub for eco-friendly cruise tourism. The project plans to deploy electric-solar hybrid boats equipped with bio-toilets and safety features, and install two HDPE jetties to support smooth operations, promoting sustainable, short-distance navigation and recreational tourism in Delhi.

IWAI has committed approximately ₹100 crore to develop cruise tourism infrastructure and experiences across Chenab (NW-26), River Jhelum (NW-49), and River Ravi (NW-84). IWAI has also entered into a tripartite agreement with the governments of Gujarat and Madhya Pradesh to start cruise operations from Kukshi to the Sardar Sarovar Dam.

The country has seen the First Inland Waterways Development Council meeting held on the vessel

CRUISE BHARAT MISSION

PHASE 1

(01.10.2024 - 30.09.2025)

To focus on conducting studies, master planning, and forming cruise alliances with neighbouring countries.

Modernise existing cruise terminals, marinas, and destinations to enhance the potential of cruise circuits.

PHASE 2

(01.10.2025 - 31.03.2027)

To concentrate on developing new cruise terminals, marinas, and destinations to activate high-potential cruise locations and circuits.

PHASE 3

(01.10.2024 - 30.09.2025)

To focus on integrating all cruise circuits across the Indian Subcontinent, marking the maturity of the cruise ecosystem while continuing the development of cruise terminals, marinas, and destinations.

RIVER CRUISE OPERATIONS ON NWS (OPERATIONAL STRETCHES)

NW-1 (GANGA RIVER)

NW-2 (BRAHMAPUTRA RIVER)

NW-3 (WEST COAST CANAL)

NW-27 & NW-68 (CUMERJUA AND MANDOVI RIVERS)

NW-97 (SUNDERBANS WATERWAYS)

INDO- BANGLADESH PROTOCOL ROUTE

NW-5 (MATAI RIVER & EAST COAST CANAL)

NW-8 (ALAPPUZHA-CHANGANASSERY CANAL)

NW-9 (ALAPPUZHA- KOTTAYAMATHIRAMPUZHA CANAL)

NW-1 (GANGA RIVER)

NW-14 (BAITARNI RIVER)

NW-47 (JALANGI RIVER)

NW-73 (NARMADA RIVER)

NW-87 (SABARMATI RIVER)

OUTSIDE NW

Source: PIB

KOLKATA-VARANASI STRETCH (UP, BIHAR, JHARKHAND & WEST BENGAL)

DHUBRI-DIBRUGARH STRETCH (ASSAM)

KOLKATA-VARANASI STRETCH (UP, BIHAR, JHARKHAND & WEST BENGAL)

TOURISM JETTY PATTO - CHORAO ISLAND - OLD GOADIVAR ISLAND - TOLTO FERRY GHAT - CORTALIM

NAMKHANA - BHAGABATPUR - SAJNEKHALI - HEMNAGAR WEST BENGAL)

KOLKATA-BALI ISLAND

BHITIRKANIKA-HUKITOLA-PARADIP (ODISHA AND WEST BENGAL)

ALAPPUZHA AND CHANGANASSERY (KERALA)

ALAPPUZHA AND CHANGANASSERY (KERALA)

ENGINEERING COLLEGE - DIGHA BRIDGE, PATNA (BIHAR)

ARADI - NALITPATIA - KHOLA (ODISHA)

MAYAPUR - KADAMTALA GHAT (WEST BENGAL)

MAYAPUR - KADAMTALA GHAT (WEST BENGAL)

GANDHI BRIDGE - NEHRU BRIDGE, AHMEDABAD (GUJARAT)

BARKUL - KALIJAI - NALABAN - NAIRI - SATAPADA ON CHILIKA LAKE

TOURIST MOVEMENT THROUGH RIVER CRUISE ON IWT (INLAND WATERTRANSPORT)

Data for 24 vessels across NW-1, NW-2, N-3 and PIWT&T (Protocol on Inland Water Transit and Trade) Routes

Source: PIB

Ganges Queen in Kolkata. The meet, with an objective to enable inland waterways as channels of economic growth and commerce in the country, committed an investment ₹45,000 crore for the development of river cruise tourism. Of this, an estimated ₹35,000 crore has been earmarked for cruise vessels and another ₹10,000 crore for the development of cruise terminal infrastructure by 2047.

In January, a River Cruise Tourism Roadmap 2047 was launched at the inaugural session of IWDC (Inland Waterways Development Council). This roadmap focuses on four vital pillars, including infrastructure, integration, accessibility, and policy for promoting

LEFT: Antara’s MV Bengal Ganga explores the cultural heritage of Bengal.

BELOW: MV Mahabaahu offers a unique way of experiencing Assam.

river cruise tourism. As a part of the roadmap, over 30 possible routes and tourist circuits along inland waterways have been identified for further development. To ensure sustainability, Harit Nauka, Guidelines for Green Transition of Inland Vessels and River Cruise Tourism Roadmap, 2047, was also launched.

According to an analysis by Statista, one of the key trends in the Indian cruise market is the introduction of shorter cruise itineraries to cater to the preferences of Indian consumers. Cruise operators offer weekend getaways and short trips to nearby destinations to attract first-time cruisers and young professionals. Additionally, themed cruises focusing on wellness, adventure, and cultural experiences are gaining popularity among Indian travellers.

As for the level of increase in the intervening period since my first river cruise on the Hooghly, on the same stretch, Antara now operates luxury cruising where room nights rates are at par with the most expensive ones in the city. India’s modern river journey has just begun, with lots of potential headwinds to aid a fast growth journey.

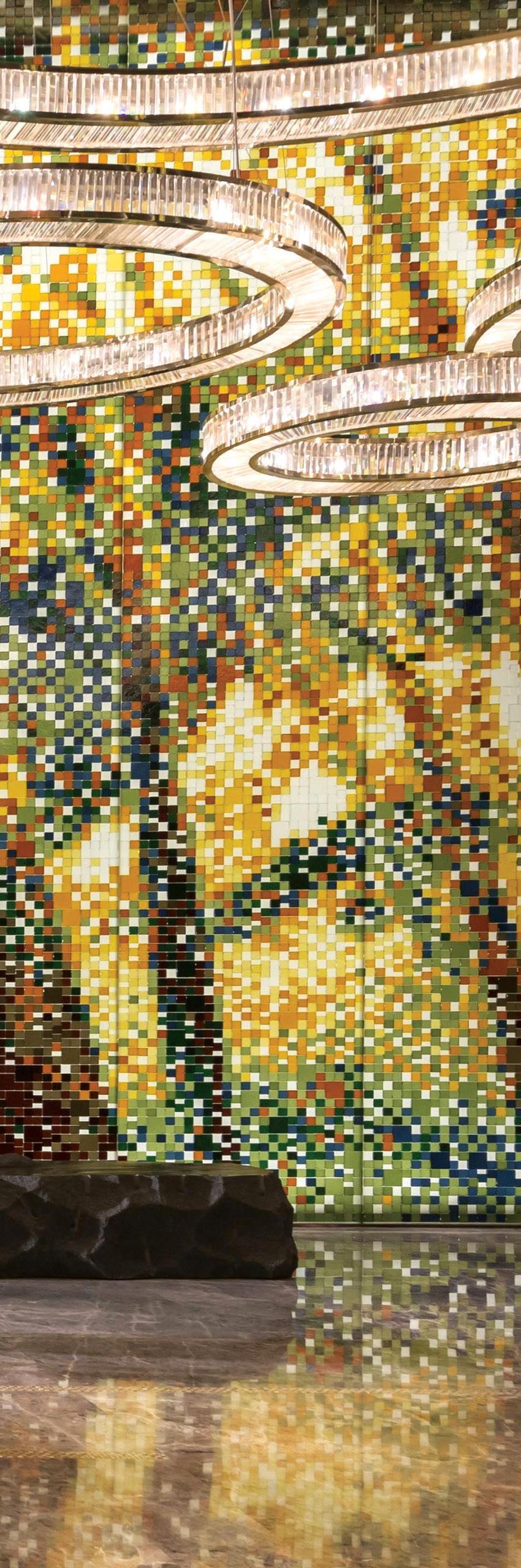

Investing in in du ence l g

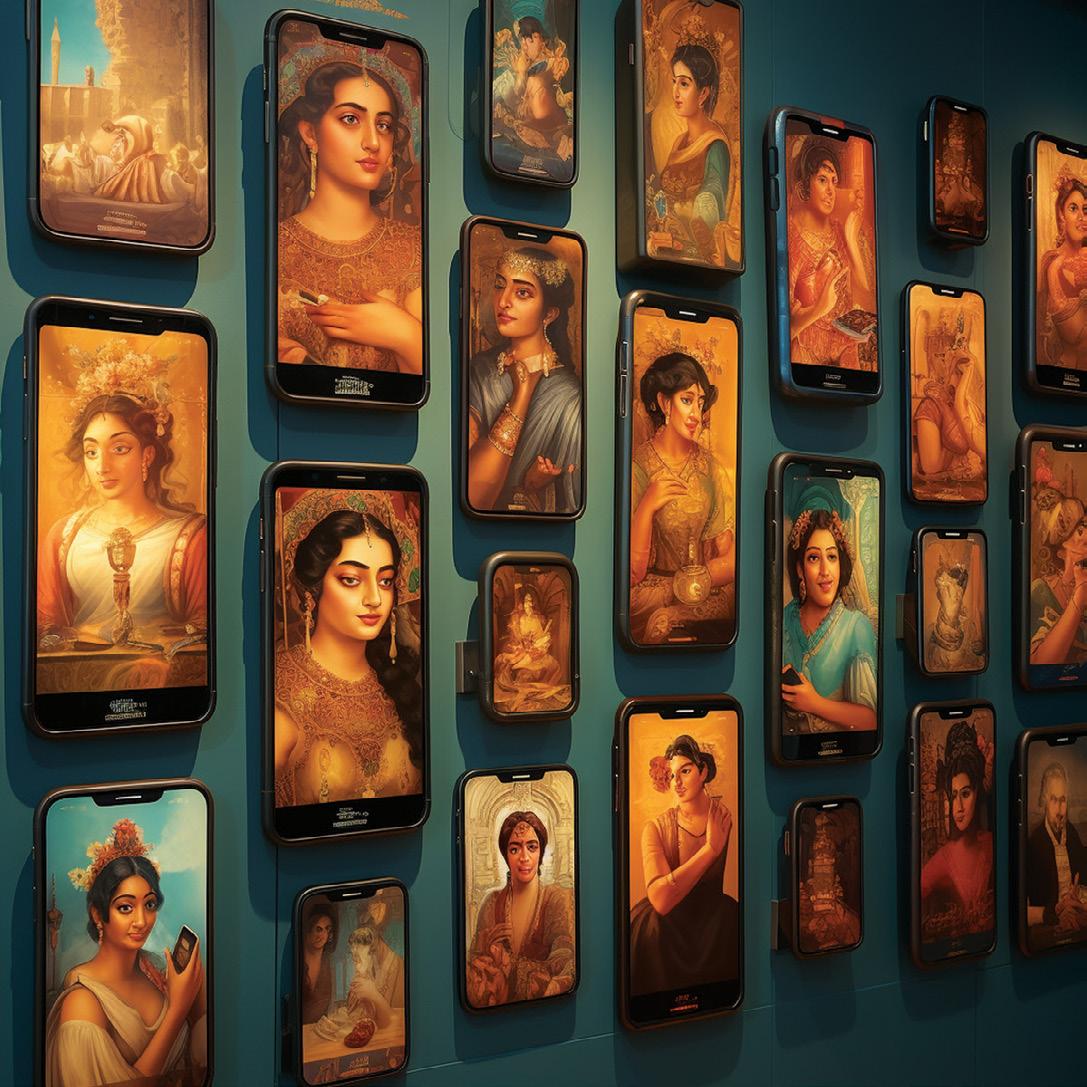

Affluence and aspirations are fuelling a luxury hotel and travel boom. With discerning travellers increasingly seeking authentic, immersive, and personalised experiences, the country’s unparalleled cultural heritage, combined with innovative luxury hospitality offerings, creates a compelling narrative for the future.

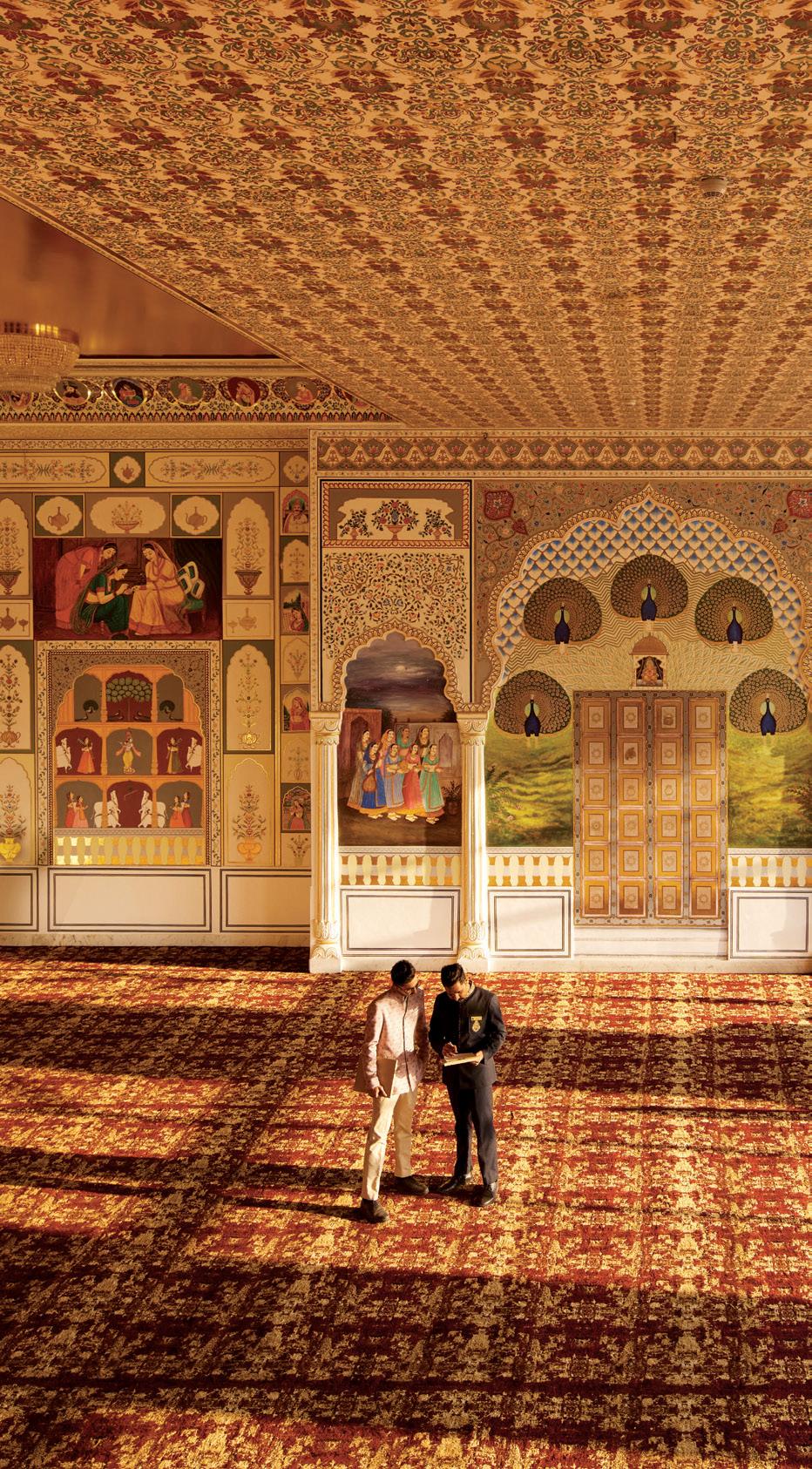

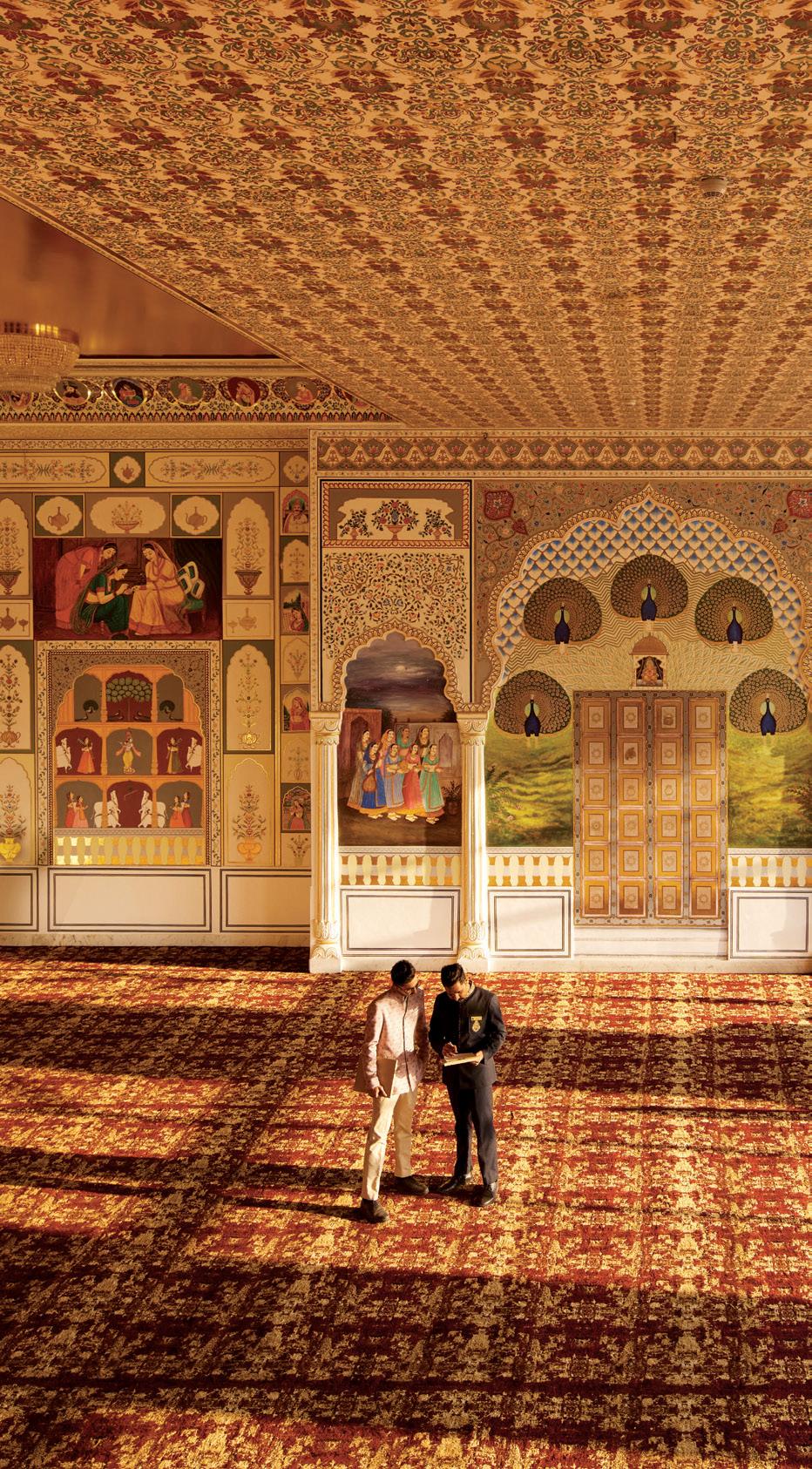

CLOCKWISE FROM LEFT: India’s first Waldorf Astoria, targeted at the wedding market, will open in Jaipur; The Leela Udaipur’s restaurant Sheesh Mahal, with a view of Lake Pichola; Taj Taal Kutir is a luxury haven situated in the heart of New Town in Kolkata.

for years, there was only one Fairmont in India, in Jaipur, India’s new luxury hotel haven. Eleven years after Accor’s luxury hotel brand opened its doors in the pink city, there are now a slew of Fairmonts on the horizon.

Fairmont Mumbai, a homage to Mumbai’s art deco architectural heritage, opened about a month ago. Fairmont Udaipur Palace is opening soon, and so is Fairmont Agra. Fairmont Fagu Shimla has been announced, and so has Fairmont Goa Shiroda, along with Raffles Goa Shiroda, which will bring tourists to the unexplored beach belt in north Goa.

The growth story of Fairmont is indicative of the growth story of India’s travel and hotel segments, which are experiencing a huge boom phase. There are indications that the hospitality industry is placing crucial bets on luxury across all segments—business, resort, and wellness.

India’s luxury hotel sector is experiencing a dynamic upswing, with a surge in investment and development between

2023 and 2025 reflecting the country's growing appetite for premium travel experiences. Both domestic and international hospitality brands are expanding their footprint to meet rising demand, with industry reports highlighting 481 projects and 57,879 rooms in the pipeline. Notably, the luxury segment accounts for around 20% of rooms signed during this period, signalling a significant shift toward high-end hospitality as India emerges as a key market for luxury accommodation.

Candice D'Cruz, Vice President of Luxury Brands at Hilton, Asia Pacific, notes that India’s 6% yearover-year GDP growth has created a new generation of travellers and a projected 9% annual growth in travel spending through 2030.

“The aspiring luxury travellers are typically younger and have their preferences,” she explains. “They might splurge on special occasions, prefer visibly branded luxury, demand value for their money, and pay close attention to loyalty program points and benefits. They may be willing to spend big on individual components—such as a helicopter tour or fine-dining experience— but not necessarily on every aspect of a trip.”

T HE SIGNPOSTS OF LUXURY RESURGENCE

Raffles has already opened two properties in Rajasthan— Jaipur and Udaipur—while Minor Hotels selected Jaipur as the debut location for Anantara in India. Upcoming Raffles openings include Raffles Ranthambore, a 67-villa ultra-luxury wildlife resort, and Raffles Goa Shiroda.

Waldorf Astoria has announced a 22-acre property overlooking the Aravalli Hills in Jaipur, featuring 51 expansive pool villas,

T HE L EADE R S HI P V O ICE S

Anuraag Bhatnagar

CEO, THE LEELA PALACES, HOTELS & RESORTS

The modern Indian luxury traveller seeks storytelling, heritage connections, wellness that rejuvenates both body and mind and intuitive, anticipatory service. At The Leela, we’re curating luxury that’s deeply rooted—like Leela Ke Phool, which upcycles floral waste into empowerment.”

Candice D'Cruz

VICE PRESIDENT OF LUXURY BRANDS AT HILTON, ASIA PACIFIC

The global perception of India still tends to lean heavily on narratives of budget travel or spiritual exploration, often overlooking the country’s evolution into a destination of design-forward hospitality, curated wellness, and contemporary luxury.”

Vikram Madhok

MANAGING DIRECTOR, ABERCROMBIE & KENT INDIA

We’re absent from the customer’s view—both through intermediaries like travel agents and directly. As a result, India doesn’t rank among the world’s top 10 destinations, a gap the Ministry of Tourism must urgently address.”

Parveen Chander

EXECUTIVE VICE PRESIDENT – COMMERCIAL, IHCL

The resurgence of luxury hospitality is being fuelled by a new generation of affluent travellers who value authenticity, personalisation, and immersive experiences. At IHCL, we are aligned with this evolution. Earlier this year, we launched the Claridges Collection—a curated portfolio of boutique luxury hotels that blend timeless elegance with historical charm.”

Santosh Kumar

COUNTRY MANAGER FOR INDIA, SRI LANKA, MALDIVES, AND INDONESIA, BOOKING.COM

While mid-range stays remain popular, 39% opt for 5-star properties; 54% choose Indian-branded stays; 51% prefer heritage accommodations; and 47% select international brands. 49% of Indian travellers now choose luxury accommodations, with glamping emerging as a popular premium alternative for over 20%.”

174 elegant guest rooms, and the iconic Peacock Alley lounge and bar. “The upcoming Waldorf Astoria Jaipur is being purposebuilt with Indian weddings in mind,” says D’cruz. “It will offer grand indoor and outdoor spaces, regal design, and a deep focus on personalisation and privacy. We collaborate closely with wedding planners, stylists, and culinary consultants to ensure every element—from rituals and décor to entertainment and guest engagement—meets the highest standards of creativity and care.”

Hilton is also making moves with plans to debut its LXR Hotels & Resorts brand in Bengaluru in 2026. D’Cruz states, “We’re preparing to launch The Den, LXR Hotels & Resorts in Bengaluru, along with new Conrad and Signia by Hilton properties in Jaipur. Earlier this month, at Hilton Asia Pacific’s first-ever brand showcase in Bengaluru, we announced our ambition to double our luxury presence in India over the next five years—deepening our footprint in one of Hilton’s most dynamic growth markets. Our roadmap for growth in India is strategic and selective. Each new opening is designed to elevate the country’s luxury landscape and reflect a more refined, experienceled expression of local luxury.”

Marriott International recently opened the 226-room Udaipur Marriott Resort near Fateh Sagar Lake, offering rooms and suites with mountain or lake views. Soon to open are Marriott Marquis and St. Regis in Delhi Aerocity—part of a single project that will feature the upmarket Astor Bar—along with JW Marriott Alibaug, The Ritz-Carlton Jaipur, and Edition Mumbai. Shimla, too, has emerged as a luxury hotspot, with The RitzCarlton, Amla Hills announced for the region.

These are primarily international hotel chains, while prominent Indian groups like The Leela Group, ITC, and IHCL have distinct strategies for the luxury hospitality segment.

Of all the IHCL openings in FY’25 (April 2024–March 2025), at least four of IHCL’s hotels were Taj-branded luxury hotels (Cochin International Airport, Dehradun, Patna and Puri). The Claridges, New Delhi, a landmark luxury hotel, will be managed by IHCL starting sometime in 2025, counting as a luxury addition. According to Parveen Chander, Executive Vice President – Commercial, IHCL, the resurgence of luxury hospitality is being fuelled by a new generation of affluent travellers who value authenticity, personalisation, and immersive experiences. “At IHCL, we are aligned with this evolution,” he says. “Earlier this year, we launched the Claridges Collection—a curated portfolio of boutique luxury hotels that blend timeless elegance with historical charm. The collection debuts with The Claridges, New Delhi, and will soon include the iconic Connemara in Chennai and Blue Diamond in Pune, tailored for globally attuned travellers seeking bespoke experiences.”

With a legacy of pioneering new destinations, IHCL continues to broaden the reach of the Taj brand, offering discerning guests fresh, inspiring choices. “From the scenic landscapes of Darjeeling and Gangtok to upcoming properties in Lakshadweep—celebrated for its pristine beaches and coral reefs—Taj is redefining luxury across India.

A sh if t is underway. Indi a is poised to be among Asi a Pac if ic’s top th ree contributors to luxu ry travel growth.

Lakshadweep has emerged as a destination that several branded luxury hotels are exploring.

Internationally, the brand is set to debut in Frankfurt, Germany, and in the tranquil settings of Paro and Phobjikha in Bhutan,” adds Chander.

ITC recently launched Mementos by ITC Hotels, Ekaaya in Udaipur, pivoted towards the trillion-rupee wedding market and high-end leisure travellers and signals ITC’s serious intent in the luxury space. The group has one more Mementos property planned over the next four years (223 rooms). Another boutique luxury resort in a key leisure destination may be fast-tracked.

Most recently, The Leela Group unveiled The Leela Hyderabad, which Anuraag Bhatnagar, Chief Executive Officer, The Leela Palaces, Hotels and Resorts, calls “our jewel in the heart of Banjara Hills, redefining luxury in the city. Our pipeline is robust, with a focus on iconic heritage locations and emerging lifestyle destinations, including the muchanticipated The Leela Srinagar, which will further elevate our position in the ultra-luxury segment.”

IHG Hotels & Resorts, which has built a strong luxury portfolio through strategic acquisitions like Regent, Kimpton, and Six Senses, as well as new launches such as the Vignette Collection, is preparing to introduce several of these brands in India. “We are witnessing unprecedented growth in India, driven by a booming economy, rising affluence, and a growing appetite for new-age luxury experiences,”

Sudeep Jain, Managing Director, South West Asia, IHG Hotels & Resorts has said. “India is a priority growth market, and we’re actively exploring opportunities to bring more of our global luxury brands here. Six Senses is expanding with award-winning properties in Rajasthan and Dehradun, and discussions are underway to launch Regent, Kimpton and the Vignette Collection in India with the right partners in the right locations.”

In the boutique luxury space, Postcard Hotel is set to open one of the country’s most expensive hotels next year. Located in Ranthambore, Rajasthan, and targeting discerning travellers, the Postcard Hotel will offer rooms starting at ₹1.95 lakh per night (approximately $2,350).

WHAT IS DRIVING T HE LUXURY TRAVEL AND HOTEL INDUSTRY?

Skift Research describes India’s luxury travel and hotel markets as dynamic sectors driven by a tripling of affluent households, a shift toward experiential and sustainable travel, and strong investments from both international and domestic hotel brands. Leela’s IPO, expansions by Hilton and Marriott, and the rise of lifestyle hotels all underscore India’s growing global influence. “However, challenges like sustainability execution, inbound tourism promotion, and visa issues must be addressed to fully capitalise on this boom. For businesses, success in 2025 hinges on personalisation, cultural immersion, and aligning with evolving preferences for wellness and adventure,” the report states.

This shift is further amplified by increasing global exposure and a heightened appetite for wellness, authenticity, and bespoke experiences. Bhatnagar explains: “The desire for privacy, exclusivity, and authentic cultural experiences has driven demand for bespoke luxury stays. Post-pandemic, we’ve seen a clear pivot from traditional tourism to experiential travel, experiences The Leela has always championed. The growing preference for destinations offering both luxury and a deep connection to local culture aligns perfectly with The Leela’s ethos of merging Indian luxury with modern, contemporary elegance.”

JLL’s Evolution of Global Luxury Hospitality identifies India as a must-watch market, with luxury hotels expanding beyond traditional leisure hubs to heritage and business destinations. India’s growing middle class (approaching 500 million) is fuelling demand for luxury travel experiences, it states.

D'Cruz cites McKinsey’s State of Tourism and Hospitality 2024 report: “It’s not just about where people go—it’s about why and how. Today’s luxury traveller values emotional resonance, personalisation, and transformative experiences over transactional ones. They seek meaning beyond traditional opulence—whether through regenerative Ayurveda wellness retreats, chef-led local cuisine journeys, or immersive cultural tours that capture a destination’s soul.” McKinsey also highlights that most travel remains close to home, with intraregional and domestic tourism driving the majority of spending. “This presents a strong opportunity for brands to offer luxury in proximity—elevated, contextrich experiences that deliver deep emotional impact and local relevance without requiring long-haul travel.”

Mordor Intelligence, in its report Luxury Hotels Market in India –Size and Share Analysis, 2025/2026, notes that a growing number of international sports events, trade fairs, exhibitions, and concerts by global pop stars are expected to boost international tourist inflows and domestic travel. “The rise in the travel and tourism industry, along with evolving lifestyle standards, is driving steady growth in luxury hotel market trends,” the report states. Key drivers include rising purchasing power among domestic travellers, a growing airline industry, increasing foreign tourist arrivals, and relaxed visa norms. Additionally, the GST council’s rate cut from 28% to 18% for luxury hotels is expected to further propel market growth over the forecast period.

Luxury hotels are positioning themselves as premier venues with top-tier amenities, world-class service, and refined ambience—drawing high-profile guests and fuelling further investment in the sector. This

rising demand is driving the development of more high-end properties and contributing to the strong growth of India’s luxury hotel market.

D’cruz emphasises that the luxury boom isn’t about volume— it’s about values. “It’s about understanding nuanced traveller segments and what truly moves them. In a world increasingly marked by excess, luxury is the quiet confidence of a stay that feels deeply personal. At Hilton Luxury Brands, we don’t just craft beautiful stays—we create meaningful memories and foster connection. Our goal is to design

moments that are restorative, intentional, and unforgettable.”

A new report, The Future of Travel 2025: From Dreamers to Doers—India’s Global Travel Generation by US-based FINN Partners and research agency GSIQ, reveals a seismic shift in the Indian travel mindset. Based on a survey of 2,000 Indian international leisure travellers across Gen Z, Millennials, and Gen X, the report highlights evolving motivations, behaviours, and emotional triggers., “Luxury is no longer a trophy of status, but a meaningful indulgence,” it notes. A new wave of travellers—especially from Tier II and III cities—is driving this change, fuelled by greater disposable income, digital access, and a growing desire for cultural immersion, spiritual journeys, beach getaways, and mountain retreats.

JLL’s Evolution of Global Luxury Hospitality report adds that enhanced airport infrastructure and road connectivity are making premium destinations more accessible, accelerating luxury tourism in leisure and heritage cities. The expanding road network is encouraging luxury brands like IHCL, Hyatt, and Fairmont to venture into emerging destinations such as Tripura, Bhopal, and Shimla.

Improved profit margins for existing luxury properties have sparked investor interest in both existing properties and new developments. The luxury segment accounted for 23% of hotel transaction volumes in H1 2024, with upscale (44%) and midscale (31%) segments leading. JLL’s report predicts an additional 46,000 ultra-luxury hotel rooms globally by 2033, with India as a key growth market, particularly in cities like Mumbai and heritage-rich destinations like Jaipur, Udaipur, and Agra.

RE G I O N S D RI VI N G

F L U X U R Y

E I S U RE T R A VE L

As the region’s economy grows, a rising affluent class and corporate travel are driving demand for upscale hospitality. Booking.com data shows that 52% of inbound travellers see India as a standalone destination, while 22% include it in broader Asian itineraries— highlighting India’s growing appeal as a primary and complementary stop. Booking.com's Santosh Kumar notes, “Metro cities like Delhi, Mumbai, Bengaluru, Jaipur, and Chennai remain top choices, combining luxury with rich cultural experiences. These hubs feature iconic properties with world-class amenities that cater to evolving global tastes.”

The luxury travel industry is segmented into different categories by reports such as Mordor Intelligence and Custom Market Insights. Among them:

RE G I O N S

Rajasthan is emerging as a key destination for luxury leisure travellers, while the southern states lead in business travel growth, followed by Mumbai and Delhi. According to the Custom Market Insights report, “South India drives India’s luxury hotel market with its rich cultural heritage, diverse landscapes, and expanding economic influence.” Its historic temples and palaces, alongside scenic spots, attract high-end domestic and international travellers. Cities like Bengaluru, Chennai, and Hyderabad, as major IT hubs, fuel business tourism and demand for luxury accommodations.

DE S T I NA T I O N S

Luxury travellers in India typically seek destinations that combine heritage, culture, and world-class amenities, says Anuraag Bhatnagar, CEO, The Leela Palaces, Hotels, and Resorts.

“Leela properties are strategically located in iconic cities like Jaipur, Udaipur, Delhi, Chennai, and Bengaluru, as well as serene spots such as Ashtamudi and Kovalam. These travellers crave unique experiences—whether a private dinner at Mohan Mahal or a spa rooted in ancient healing traditions.”

Booking.com data shows luxury travel expanding beyond metros to destinations like Rishikesh, Munnar, Manali, and Darjeeling, attracting growing interest from Indian travellers. “These places offer world-class accommodations and experiences—from wellness retreats to bespoke mountain escapes and heritage stays—blending luxury with meaningful, purpose-driven travel,” says Kumar.

The platform’s How India Travels 2024: The Inbound Edit Report reveals key preferences: while mid-range stays remain popular, 39% opt for 5-star properties; 54% choose Indian-branded stays; 51% prefer heritage accommodations; and 47% select international brands. Kumar adds, “49% of Indian travellers now choose luxury accommodations, with glamping emerging as a popular premium alternative for over 20%, showing comfort and creativity are reshaping travel.”

Candice D'Cruz, Vice President of Luxury Brands at Hilton, Asia Pacific, notes luxury travellers seek rare, authentic, and deeply personal experiences—areas where India excels. “Interest is rising in offbeat destinations—whether the serenity of the Himalayas, private beach enclaves, or immersive cultural and spiritual journeys. The growing appeal of exclusive lodges, wellness retreats, and heritage-driven itineraries reflects a shift: travellers want deeper connections—with themselves, others, and their surroundings.”

While gateway cities like Delhi, Mumbai, and Bengaluru remain vital hubs for business and luxury short stays, Hilton is also focusing on emerging destinations. From Jaipur to Bengaluru, the opportunity lies in crafting experiences that are both elevated and locally resonant.

WHAT ARE LUXURY TRAVELLERS SEEKING OUT?

Authenticity with Intention: Booking.com’s How India Travels 2024: The Inbound Edit reveals that luxury travel in India is evolving beyond indulgence to focus on transformative experiences rooted in authenticity and lasting memories.

Bhatnagar says that the modern Indian luxury traveller is defined less by materialism and more by emotional and cultural depth. “They seek storytelling, heritage connections, wellness that rejuvenates both body and mind and intuitive, anticipatory service. At The Leela, we’re curating luxury that’s deeply rooted in culture yet strikingly contemporary. Initiatives like Leela Ke Phool, which upcycles floral waste into empowerment, and Icons of India, which celebrates changemakers like Sawai Padmanabh Singh, reflect the evolving preferences of today’s traveller.”

D'Cruz echoes the shift: “Indian luxury travellers value authenticity wrapped in comfort. They’re discerning, globally aware, and seek experiences that balance immersion with indulgence. At Hilton, luxury is defined by thoughtful nuance—privacy for multi-generational families, meticulously crafted Jain or vegetarian menus, or wellness journeys inspired by ancient Indian traditions with a modern touch.” Today’s travellers also seek tech-enabled ease and meaningful details that reflect their values. “There’s a growing awareness around ethical luxury,” D'Cruz adds. “Guests want to know their choices matter—that the hotels they stay in support local communities, source ingredients responsibly, and prioritise sustainability.”

LEFT: The Taj Puri Resort & Spa, Odisha is a beachfront retreat nestled along the eastern coast of India in the sacred city of Puri.

BELOW: Pushpabanta Palace, a significant historical and cultural landmark in Agartala, Tripura, is being converted into a Taj by IHCL.

Heritage: According to Mordor Intelligence, India’s heritage trail is projected to hold the highest market share in the luxury segment over the forecast period. Heritage-themed hotels—like The Leela Palaces in Rajasthan or IHCL’s palace hotels—offer immersive luxury rooted in regional art, traditional cuisine, and historical architecture, all wrapped in the warmth of Indian hospitality. In contrast, contemporary luxury hotels focus on high-end IoT-enabled infrastructure and the “relax-inliving” concept. A 2024 survey by the Hotel Association of India (HAI) found heritage hotels enjoy

an average occupancy rate of 80%, significantly above the national average of 65%. The survey also revealed that cultural tourists are increasingly willing to pay a premium for authenticity and deeper connection to India’s past that these properties provide.

Culinary: Chander says luxury travellers increasingly seek out distinctive dining experiences.

“For over a century, we’ve introduced several firsts, from Sichuan and contemporary Japanese to Mediterranean, Thai, and Vietnamese cuisines.”

Expanding this legacy, IHCL recently launched the third outpost of Loya at The Taj Mahal Palace, Mumbai—celebrating the diverse culinary traditions of northern India.

Wildlife: Hotelivate in its report 2024 Indian Hospitality: Trends & Opportunities, states that new supply in the luxury leisure space, especially in wildlife locations such as Pench, Bandhavgarh and Kanha, have contributed to the RevPAR growth in 2023/24.

Wedding and MICE: Properties like Waldorf Astoria Jaipur and Fairmont Mumbai are tapping into India’s ₹1 trillion wedding market and the expanding MICE segment. The Great Indian Wedding industry is valued at $130 billion, with Indians spending nearly 10 times their per capita GDP on weddings, according to Jefferies Research. The surge in destination weddings—especially among affluent families and NRIs—has significantly boosted demand for luxury hotels.

Bhatnagar remarks that travel tied to celebrations goes beyond weddings. “The rise in celebratory travel—anniversaries, milestone birthdays, and festive getaways—is shaping luxury travel. India’s cultural richness offers the perfect backdrop for these experiences. There’s also a growing trend of Indians abroad returning for culturally rooted yet globally refined weddings. Guests are drawn to Jaipur’s palatial charm, Udaipur’s regal intimacy, and the urban elegance of Bengaluru and Hyderabad. Celebrations have become a gateway for many to experience the full depth of Indian luxury.”

According to Chander, IHCL’s Timeless Weddings sets a benchmark for destination weddings, extending across iconic venues, curated themes, and the legendary Taj service to transform celebrations into unforgettable experiences.

The India MICE market is projected to grow from $4.59 billion in 2025 to $14.62 billion by 2032, at a CAGR of 18%, according to Coherent Market Insights. The rise in destination weddings and MICE events is driving demand for luxury accommodations, with brands like Raffles, Waldorf Astoria, and The Oberoi, and IHCL catering to this upscale segment. IHCL’s Innergise Green Meetings, for instance, is a sustainable solution for corporate meetings and conferencing needs offering guests a choice to reduce their carbon footprint and contribute to a more sustainable future.

Religious and spiritual tourism: The Indian government’s initiatives, such as Pilgrimage Rejuvenation and Spiritual Heritage Augmentation

Drive (PRASHAD) and Swadesh Darshan Scheme, have invested $195.43 million to enhance connectivity to 73 pilgrimage and spiritual sites. New airports in Shirdi and Kushinagar, high-speed trains, and upgraded roads like the Varanasi-Ayodhya route have improved accessibility. Ayodhya is set to welcome a 300-key Taj hotel by IHCL and a 100-room palatial Leela Palace, while Puri now features the Taj Puri Resort & Spa. JLL reports a 30% rise in average room rates at luxury hotels in spiritual hubs, driven by affluent domestic and international pilgrims seeking comfort alongside spiritual experiences.

HOW CAN INDIA FURT HER BOOST ITS LUXURY HOTEL AND TRAVEL INDUSTRIES?

While India holds immense potential as a luxury destination, a few systemic barriers continue to limit its ability to capture a greater share of the high-end international traveller market. “Visa processing remains a key friction point, particularly for spontaneous or short-lead luxury travel, where ease and speed are non-negotiable. Infrastructural gaps—especially in remote, heritage-rich, or emerging destinations—can impact the seamlessness that discerning travellers expect,” says D’cruz. Moreover, the global perception of India still tends to lean heavily on narratives of budget travel or spiritual exploration, often overlooking

the country’s evolution into a destination of design-forward hospitality, curated wellness, and contemporary luxury. “To address these challenges, a multipronged, public-private approach is essential.”

Vikram Madhok, Managing Director of Abercrombie & Kent India, said at HICSA 2025, “While people know India’s vast population and rich culture, we haven’t capitalised on the postpandemic momentum. Despite managing the pandemic well and gaining goodwill, that interest is fading. We’re absent from the customer’s view—both through intermediaries like travel agents and directly. As a result, India doesn’t rank among the world’s top 10 destinations, a gap the

LUXURY HOTEL INDUSTRY IN NUMBERS

The Indian luxury hotel segment is projected to grow from $2.99 billion in 2025 to $4.83 billion by 2030, at a CAGR of 10.06% during 2025–2030.

(Mordor Intelligence)

Hotel signings and openings are rising sharply, with 481 projects and 57,879 rooms in the pipeline—about 20% of which are luxury rooms

Domestic leisure travel is the fastest-growing category in luxury hospitality, accounting for 80% of luxury bookings in 2024. This growth is driven by a 10.5% rise in India’s highnet-worth population in 2024 and a projected 60% surge by 2027

The overall leisure segment is expanding at 10–11%, with domestic leisure travel growing even faster.

(Mordor Intelligence)

A study finds that 81% of luxury consumers in India prefer spending on travel over lavish weddings or luxury goods, signalling huge opportunities for travel advisors, airlines, and tour operators.

Indian travellers prioritise immersive experiences over material possessions: 81% prefer luxury travel to lavish weddings, 74% over designer purchases, and 56% choose hotel upgrades over flight upgrades.

(FINN-GSIQ report)

The Hotelivate 2024 report shows India’s branded inventory surpassed 180,000 rooms last fiscal, with upscale-to-luxury segments making up 39% of operating rooms.

Six luxury projects confirmed in the past year include Fairmont Shimla, Waldorf Astoria Jaipur, Radisson Collection Hyderabad, Hyatt Unbound Collection Bhopal, Ritz-Carlton Shimla, and Fairmont Goa Shiroda

Leisure destinations account for 43% of the pipeline, with a 12% rise in projects in religious hubs like Ayodhya.

Growing domestic luxury travel has driven average room rates up by as much as 30% in luxury and upper-upscale segments across India’s top 12 markets—and by up to 40% in key leisure destinations like Goa (JLL)

Premium and luxury hotel occupancy rates are expected to reach 70–72% in FY 2025–26, the highest in a decade, driven by rising demand in Tier-II cities and spiritual tourism destinations (Investment Information and Credit Rating Agency)