ON THE ROAD TO GLORY

Despite global economic headwinds and stock market tremors, India's hospitality sector stands firm alongside a rebounding equity market.

Despite global economic headwinds and stock market tremors, India's hospitality sector stands firm alongside a rebounding equity market.

I often marvel at how a simple visit can do what diplomacy sometimes cannot. When a traveller from afar spends time in India, they are not merely on holiday—they are contributing to our economy and forging a cultural bridge. Tourism, I believe, is India’s silent superpower: an invisible export that faces no tariffs at any border. Every pound or dollar spent by a foreign guest—on a handcrafted souvenir or a night in a homestay—is hard currency earned without a single container shipped. In 2023, India recorded 18.89 million foreign tourist arrivals, generating ₹231,927 crore in foreign exchange earnings. These numbers represent livelihoods, opportunity, and aspiration blooming across the country.

India’s allure is as vast as it is varied. From the snow-capped Himalayas to the backwaters of Kerala, our landscapes offer a richness few nations can rival. Add to that our wellness traditions—yoga, Ayurveda, meditation—and India becomes a sanctuary for those seeking healing and balance. I have met visitors who come for the yoga and stay for the culinary diversity, from Delhi’s street chaats to Goa’s seafood curries. No trade pact can recreate the experience of watching the Taj Mahal by moonlight or listening to a folk song in a Rajasthani desert. Every region offers a new story.

Yet tourism demands accessibility. India is more connected today than ever. In the past decade, the number of operational airports has doubled from 74 to 148. Towns from Kanpur to Kannur are now within easy reach thanks to initiatives like UDAN. Our highways have expanded by 60% since 2014, and over 50 Vande Bharat Express trains now link cities and emerging tourist hubs. This web of connectivity is opening up new circuits and bringing growth to corners of India where tourism once barely touched. What resonates most with me is tourism’s ability to lift up communities. A traveller’s spending reaches

rural entrepreneurs, farmers, and artisans. A single purchase can support an artisan’s family; an increase in guesthouses creates jobs for masons, chefs, and guides. Every wildlife sanctuary and temple town sustains a micro-economy. We must keep investing in training and capacity-building so that rural youth can find futures in hospitality and heritage.

At the same time, we must tell India’s story far more compellingly to the world. Other nations spend lavishly on tourism marketing; India must be equally bold. We need a fresh campaign—a new 'Incredible India'—that showcases our hidden gems, wellness traditions, and festivals. Storytelling, social media, and our diaspora must all play a part.

Ease of travel must underpin these efforts. The e-visa was a leap forward, but simpler visas, cleaner cities, multilingual signage, and a culture of courteous service must become non-negotiables. A traveller who feels safe and cared for becomes our greatest ambassador, spreading goodwill across borders.

Beyond the economics, tourism is a bridge for global understanding. When someone journeys through India, they carry back memories that challenge stereotypes and build empathy. Tourism fosters respect and friendship in ways few other forces can.

As we look ahead, we are filled with optimism. India has the history, nature, and spirit to lead the world in tourism. At SOH, we are committed to doing our part—amplifying stories, celebrating innovation, and supporting every endeavour that brings travellers closer to India’s soul and drives investment into the sector. Together, we are helping to write the next chapter of India’s story— one where every journey through India transforms the traveller, and each journey, in turn, helps transform India.

GURMEET KAUR SACHDEV gurmeetsachdev@soulinkkworldwidemedia.com

The Indian hospitality industry is at a point of inflection. From here, it could either be affected by the growing global headwinds, at least in terms of rolling out projects, or it can leverage the booming domestic tourism and grow from here to a global behemoth. Global brands are exploring the Indian market; there is a modicum of FDI, though not enough. However domestic investors are putting in their billions into creating a world-class hotel network. We explore where we go from here in our cover story.

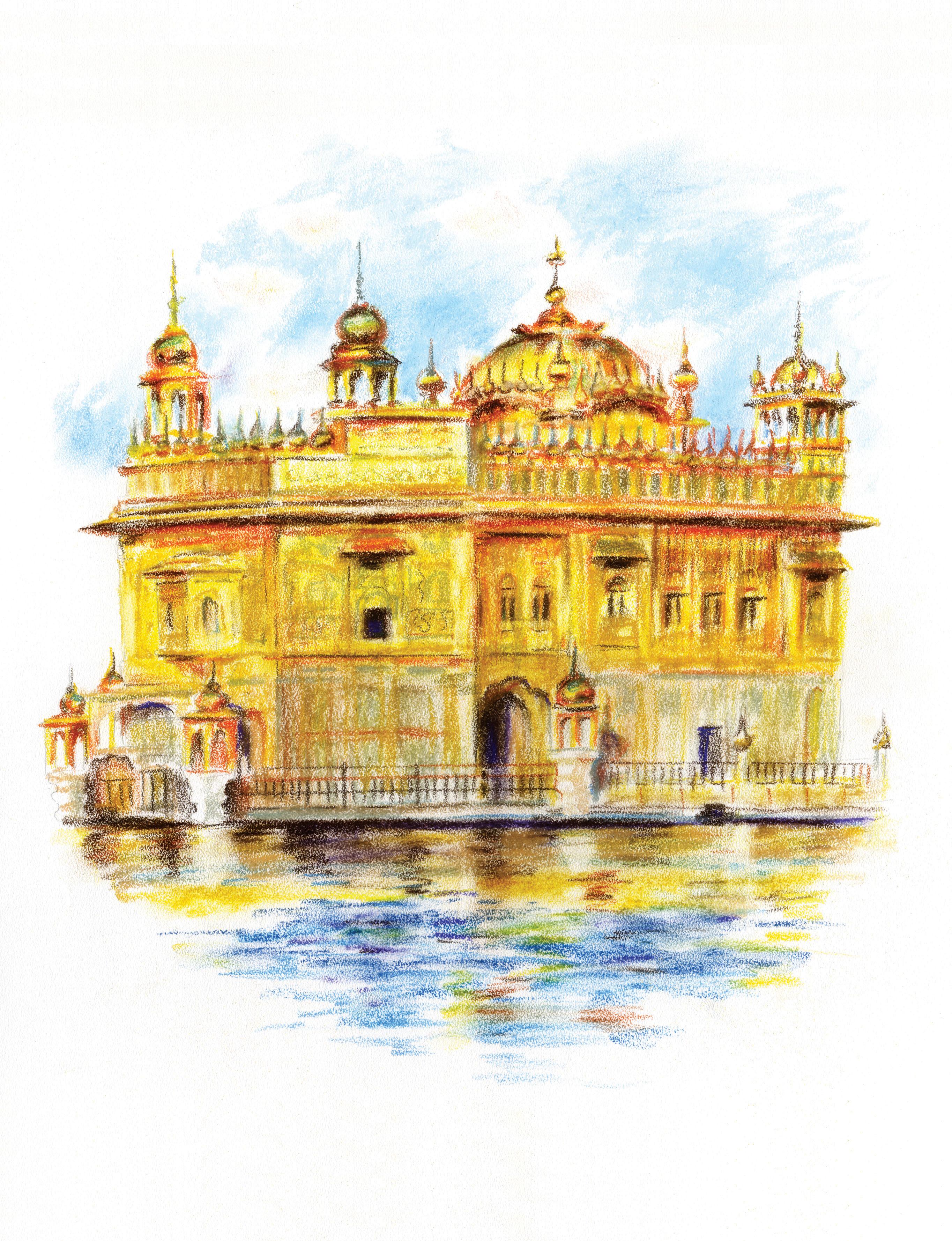

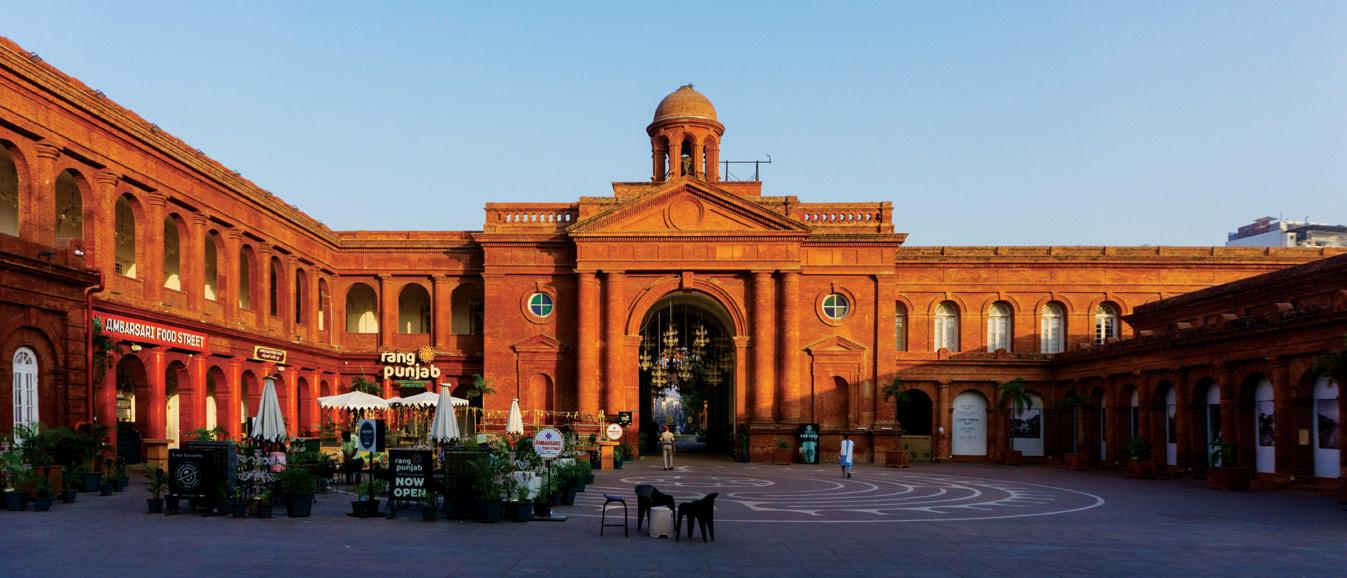

In our other major story, we speak to the general managers of hotels in Amritsar about what moves the market. Amritsar is a huge religious tourism market, but it is also a heritage destination where the wounds of the past have been packaged into martyr monuments and a museum dedicated to the memories of those who had to flee their homeland during a bloody partition. But Amritsar is also a premier food destination, which deserves an entire article of its own.

One of my favourite articles in the edition you hold in your hand is on the restoration of the Haveli Dharampura, within the labyrinths of Purani Dilli, or more specifically Chandni Chowk. Within the ancient walled city, though the walls no longer exist, this part of Shahjahanabad was once home to the rich and elite of the past era, from Mirza Ghalib to Begum Sumroo. Read how this beautiful haveli was restored and attracts among the highest ARR in the capital city.

Two global groups enter India, and for one, it is their second arrival. Dusit and Minor are making a play for India again, and the stakeholders tell us what swung the decision to look at India as a possible destination for their hotels. This ties together our cover story on the thriving, pulsating Indian hospitality industry.

Enjoy the edition.

Warm regards,

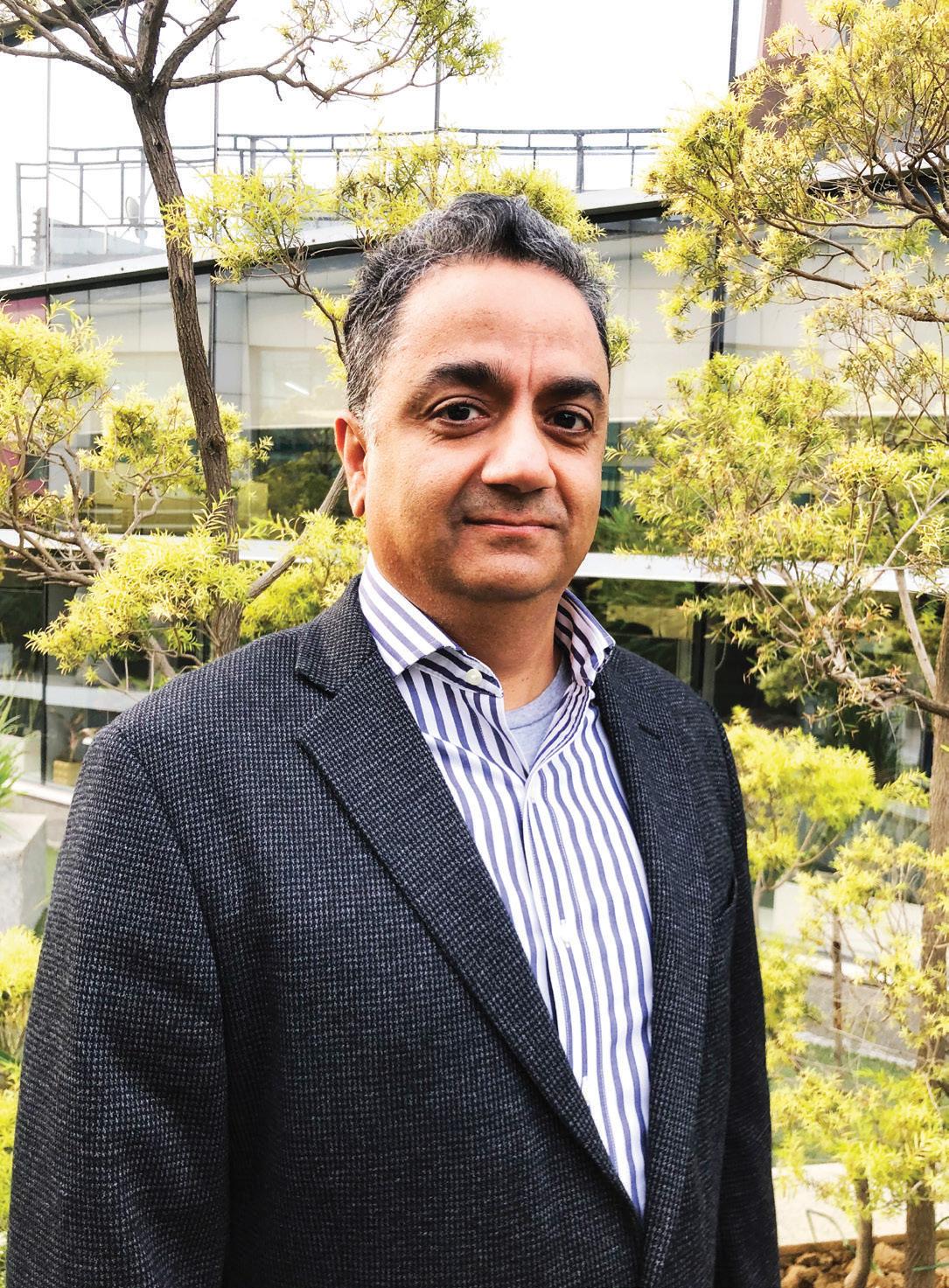

DEEPALI NANDWANI, EDITOR, SOH

Founder and Publisher

Gurmeet Sachdev

Editorial

Editor Deepali Nandwani

Managing Editor Rupali Sebastian

Contributing Editor Suman Tarafdar

Digital Editors Nolan Lewis, Rachna Virdi

Contributing Writer

Chandreyi Bandyopadhyay

Pooja Bhula

Creative

Creative Director Tanvi Shah

Team Shiv Soni

Contributing Artist Govinda Sao

Business Head

Vipin Yadav

Sales Manager

Deepa Rao

Office Manager

Deepak Rao

Accounts Head

Amey Acharekar

For queries:

editorial@soulinkkworldwidemedia.com sales@soulinkkworldwidemedia.com info@soulinkkworldwidemedia.com

Printed and Published by Gurmeet Sachdev on behalf of Soulinkk World-Wide Media LLP. Registered office: 1/2, Old Anand Nagar, Nehru Road, Santacruz East, Mumbai, Maharashtra - 400055. Printed at Silverpoint Press Pvt. Ltd., A-403, TTC Industrial Area, Near Anthony Motors, Mahape, Navi Mumbai – 400709. Editor: Deepali Nandwani. All rights reserved worldwide. Reproducing in any manner without prior written permission prohibited. SOH takes no responsibility for unsolicited photographs or material all photographs, unless otherwise indicated, are used for illustrative purposes only. Unsolicited manuscripts will not be returned unless accompanied by a postage pre-paid envelope. All disputes are subject to the exclusive jurisdiction of competent courts and forums in Mumbai only. Copyright Soulinkk World-Wide Media LLP.

Homegrown demand and new tourism hubs are propelling India’s hospitality sector forward, defying the slowdown gripping international markets and stock exchanges.

72 Golden Momentum

Amritsar’s hotel GMs map faith, heritage, and future growth.

110 Liquid Legacies

India’s native spirits revive tradition with every pour.

62 Reset and Rise

OYO charts a dramatic recovery under Ritesh Agarwal.

24 A Second Awakening Two Havelis redefine heritage restoration in Old Delhi.

68

Dusit 2.0 Thailand's oldest hospitality group is back in India.

52 Voyages of Influence

Pico Iyer shares his reflections on solitude and travel.

84 Couture Dining

Where luxury, style, and culinary craft meet seamlessly.

96 Minor’s Big Bet

Minor Hotels charts a bold course across Indian markets.

At BNP Interiors, over two decades of consistent success reflect our relentless pursuit of perfection — in quality, identity, and an unwavering commitment to planning, execution, and delivery at 110%. Under the visionary leadership of Punam Kularia, Founder and Managing Director, we continue to evolve and expand both locally and nationally, promising to exceed expectations with unparalleled, customised solutions that set new benchmarks in interior excellence.

Inside The Kin, Mumbai’s boutique hideaway crafted with family, food, and flair.

India has only a select few boutique hotels, and fewer still that are truly design-forward. The latest addition to this niche is The Kin, which debuted just weeks ago along Dadar’s Shivaji Park skyline. The 15-key hotel, housed in an architecturally-rich building dating to the 1970s, has five rooms on each of its three floors.

All in the family

Sibling duo—restaurateur Imrun Sethi and product designer Guneet Sethi—recalibrated their family’s legacy into a profitable, design-forward boutique stay in the heart of Dadar, each bringing distinct expertise to the venture. Imrun, a well-known Indian restaurateur and chef, is best

CLOCKWISE FROM LEFT: There's a vintage rotary phone in every room; a fresh, garden salad; the retro cage elevator; the under-thestaircase vinyl record player.

known for founding Terttulia, an all-day dining brand inspired by the Spanish tradition of lively social gatherings. Established in Pune, Terttulia later expanded to Mumbai—where it continues to occupy the ground level of The Kin—and in 2023, to Panaji in Goa. Guneet lends her creative vision to the hotel’s interiors, with her design sensibilities evident in both the thoughtfully curated spaces and the concept store in the lobby. Their combined talents define the hotel’s unique identity and appeal. Hospitality runs in the family’s blood. The building was once the two-star Hotel Parkway, owned by the Sethis’ maternal grandfather, who also founded Pritam da Dhaba. During the peak of the pandemic’s first lockdown, it was repurposed as a quarantine centre for doctors and nurses from Hinduja Hospital. This turning point highlighted the need for transformation, inspiring the

siblings to reimagine the hotel’s future as it emerged on the other side.

Tucked behind a fluted glass façade, the three-storey retreat invites guests into a light-filled passage, where the scent of fresh florals from nearby phool gully (the street of flowers)—where hundreds of vendors trade in blooms against a backdrop of striking street art—lingers in the air. It’s a signature touch from Guneet, who arrives each morning with armfuls of flowers and carefully arranges them into delicate bouquets.

The design is in the details. Architect Samir Raut of Atelier Nowhere shaped the hotel’s distinctive aesthetic, but it was Guneet’s keen eye as a product designer that brought the details to life—every curated piece, from custom KIN furnishings to handcrafted terrazzo flooring, feels deeply considered. While each of the 15 rooms offers a unique experience, subtle unifying elements—open wardrobes, retro-style analogue phones, and playful window designs—tie them together. Thoughtful nooks, like a vinyl listening station tucked under a staircase, a retrofitted elevator, and sculptural lighting, complete this boutique hideaway. The hotel’s terrace features a rooftop callisthenics gym for a gravity-free workout, while guests can also opt for in-room deep tissue or hot stone massages.

The Kin's co-founder Imrun Sethi admits Terttulia’s loyal following may have given it a head start on hotel bookings. The inhouse bistro brings a slice of European café culture to Dadar, its ground floor abloom with fresh flowers and buzzing from morning to midnight. Sundays ease in with the soulful strains of a live saxophone, while Saturday nights belong to DJs spinning till 1:30 am.

Breakfast is a leisurely, all-day affair—whether you rise at dawn or roll out at sundown, you’ll find crisp bacon, eggs Benedict, golden cinnamon French toast, and vibrant smoothie bowls (don’t miss the in-house sourdough and gluten-free bread). Lunch and dinner offer a dynamic interplay between Terttulia’s classics and monthly specials—think colourful salmon poke bowls, katsu curry with serious depth (the tofu version rivals the chicken), and steak frites with sweet potato fries. When indulgence calls, the award-winning beef burger or bang bang noodles deliver—especially when paired with a cocktail.

Terttulia’s bar leans into inventive mixology, blending classic techniques with bold flavour: the crisp Green Appletini, refreshing Watermelon Caprioska, fragrant Orange Basil Mojito, and summery Sparkling Sangria are standouts. For those who like a little heat, the Japanese Pear and Ginger Martini strikes a perfect sweet-spicy balance. Beyond meals, the sunroom invites lingering over Nandan Coffee cortados and cappuccino.

“The original building’s Art Deco heritage inspired us to integrate elements like slanted and circular windows—gestures that anchor the hotel in its neighbourhood while giving it a distinct character. These architectural cues eventually shaped the hotel’s branding too,” Raut says.

The siblings are well aware that running a boutique hotel in a city like Mumbai—teeming with hospitality options—is no easy feat. Yet, since opening earlier this year, Imrun shares that The Kin has been consistently overbooked, thanks purely to word-of-mouth buzz and glowing reviews from design journals and travel magazines. During this interview, Imrun debated whether to capitalise on the hotel's organic success by maintaining exclusivity or to list The Kin on booking platforms—an obvious choice for most hotels.

What do they attribute The Kin’s early success to? While the family had no choice in selecting the location, they believe being in Dadar—an area often overlooked by major hospitality brands—has worked in their favour. Its central position offers convenient access to both of Mumbai’s airports, Bandra’s vibrant bar scene, and South Mumbai’s art and culture. For guests who’d rather stay local, a brisk walk leads to the vibrant phool gully. Music lovers will find their fix at The Revolver Club, Mumbai’s beloved vinyl haven, while fashion enthusiasts can lose themselves in the district’s sari shops. Architecture aficionados can admire the Art Deco gems scattered around Shivaji Park or explore the historic Dadar Parsi Colony—the city’s largest Zoroastrian enclave. For cricket devotees, Shivaji Park’s legendary grounds—where a young

Sachin Tendulkar once honed his craft—are just a stone’s throw away.

OPPOSITE PAGE: Curated accents and a clean-lined aesthetic reflect The Kin's minimalist aesthetic.

ABOVE: The reception area.

BELOW: Circular windows anchor the building to its Art Deco neighbourhood.

The Kin also embraces the concept of a shoppable hotel, where nearly every element is available for purchase. Curated by Guneet, guests can take home everything from ceramic phrenology heads and the iconic Michelin mascot to art books, hand-poured candles, and singular decorative pieces. The concept has resonated beyond the hotel’s walls. “We’ve had people reach out after seeing us on Instagram, asking how they can purchase and ship items beyond the city, even internationally,” Guneet shares, delighted that her sensibility has found a wider audience.

Ultimately, The Kin’s greatest strength lies in the warmth of its hospitality. Guneet walks the floors each morning, ensuring every detail is in place, while Imrun makes his evening rounds at the bistro, engaging with guests like an old friend. With the freedom to handpick and train their team, they’ve cultivated a service ethos that goes beyond efficiency, embracing genuine care. Thoughtful gestures—like handwritten welcome notes awaiting each guest at checkin—may seem small, but leave a lasting impression. In an industry where luxury is often measured in extravagance, The Kin proves that true hospitality is felt in the little details.

Inspired by Bengal’s grand Rajbaris, the reimagined The Chambers, Taj Bengal blends the elegance of the past with a design language that is classic, nuanced, and timeless.

RUPALI SEBASTIAN

When architect Bobby Mukherji took on the task of redesigning The Chambers at Taj Bengal, he wasn’t just revamping a space—he was bringing back a forgotten era, reinterpreting history in a way that felt both timeless and alive.

For the uninitiated, The Chambers is no ordinary club. Established in 1975 at The Taj Mahal Palace, Mumbai, it has long been the country’s most exclusive business club—an address that signals power, influence, and access. Over the years, its presence has expanded across Taj properties, offering private sanctuaries for industry leaders, diplomats, and global achievers. In Kolkata, however, The Chambers needed more than a refresh—it required a reawakening.

“It had classic elements before, but it felt dated. Not timeless. We wanted to take it to the next level,” Mukherji says. “Now, there’s nothing left of the old Chambers. We stripped it down to its bare shell and started from scratch.”

The inspiration? The regal Rajbaris of Bengal—the grand mansions built by zamindars and influential traders, whose fortunes were made trading everything from tea to opium under British rule. “These were men who built big,” the architect explains. “Their homes weren’t just about wealth, they were about stature. You see it in the multifoil arches, the intricate jaalis, the grand staircases.” Mukherji wanted to bring that same sense of grandeur, but with restraint—not in an over-the-top, gilded way, but in a manner where luxury whispers, rather than shouts. Incidentally, this is the same aesthetic the architect is following for the rest of the hotel—which is also being updated under his creative vision.

The new 8,000sq.ft. Chambers enjoys an expanded footprint. “Earlier everything was micro: smaller rooms, less number of rooms, no proper bar,” reveals Mukherji. “Plus, it was too heavy on wood. We balanced it out.” Painted walls, wallpaper, plaster of Paris, mirror panelling, luxurious fabrics—each surface was chosen to feel fresh. The flooring, once a plain expanse of wood, now reveals intricate patterns—a detail that draws the eye the moment you notice it.

The limited height meant they kept the ceiling deliberately understated so as to not draw attention: subtle, white-on-white patterns, except in places where they wanted to carve out functionalities through a shift in ceiling materials—like the bar, which has a wooden expanse overhead.

The entry to The Chambers, marked by a glass door, is through the reception area, part of the lift lobby of the hotel, with its scattering of seating. Inside, a lounge acts as the heart of the space where everything converges. Turn right, and you enter the dining area, a setting for sit-down lunches, high-powered dinners, and quiet negotiations. Walk left, and a corridor leads you to a series of private meeting rooms— each space crafted for intimate discussions, small gatherings, or full-fledged board meetings in a room that seats twenty.

The bar is the soul of The Chambers, shifting in mood with the rhythm of the day. Mornings are bright, with sunlight streaming in. Evenings are moody, with warm lampshades casting a soft glow, reflecting off Bengal-inspired artwork. The cognacs and single malts

gleam against the bar’s rich, dark wood backdrop, waiting for conversations that stretch long past their first pour. The cigar room, with its dedicated humidor and custom exhaust system, is a quiet nod to the indulgences of a bygone era.

Seating was reconfigured to offer layered flexibility. “We wanted to create permutations and combinations that could work for both privacy and interaction,” he says. Alcoves were carved out between columns, and arched seating introduced with carpeted undersides—an unexpected, almost whimsical touch that softens the formality of the space.

The space abounds in thoughtful details. In the light fixtures, polished brass rods end in a frostedglass bloom and in the bar stool, a tiny metal dragon holds up the footrest. “This was a labour of love,” Mukherji states.

LEFT: The alcoved seating by the window sees a whimsical touch through the carpeted undersides of the arches.

ABOVE: Details such as the tall flower-shaped, frosted-glass light shades add to the bespoke atmosphere.

ABOVE LEFT: Architect Bobby Mukherji.

More than just a refurbishment, this was a balancing act—between past and present, grandeur and subtlety, nostalgia and reinvention. “The colonial British story began in Calcutta,” Mukherji says. “We had to acknowledge that history, but we also had to make it relevant today.”

It has been received exactly as intended. Unlike other Chambers properties, which lean towards contemporary influences, this one remains true to its classic roots. Rich wood, warm lighting, fabrics that feel as good as they look—every detail considered, every element intentional. And it all came together in just four months. “We didn’t have the luxury of time,” Mukherji says. “The hotel was operational, we couldn’t block out The Chambers for too long. But we had the right team and that made all the difference.”

Today, The Chambers at Taj Bengal isn’t just a space—it’s a story well told. A place where history finds a new voice, and where every detail is a quiet nod to the past, reinterpreted for those who will shape the future.

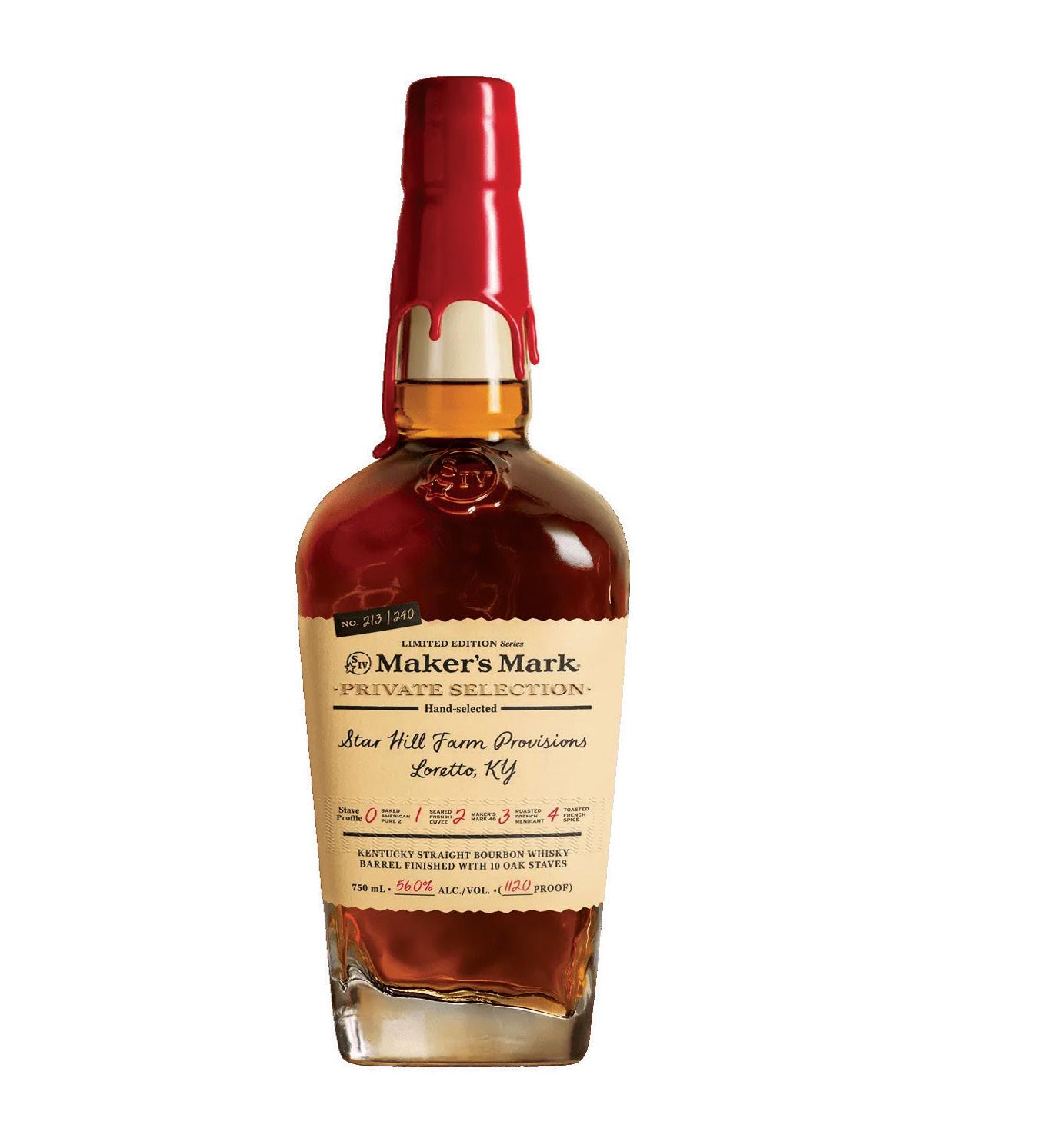

Baccarat’s Private Barrel Program brings together two storied whiskey and champagne brands to create oak barrel-aged libations like no other.

DEEPALI NANDWANI

The global hospitality industry increasingly offers an array of unique experiences that blend elegant luxury and bespoke moments to discerning and discriminating travellers on the hunt for things new and fun.

One such experience, revolving around spirits, has been designed by Saiff Hammad, the wine director at the uberluxury Baccarat Hotel and Bar in New York City. She has spent most of 2024 crafting a bar program that balances tradition with innovation. Hammad, who previously worked at the Michelinstarred restaurant Eleven Madison Park, said that the curation of the beverage programme goes beyond getting the best libations and the rarest of offerings. It includes curating and crafting new spirits so exclusive that you have to check into Baccarat to taste them.

The current barrel, selected by Hammad’s predecessor, was

CLOCKWISE FROM LEFT: The libation that comes out of the experimentation will be served in the bar or the Grand Salon; the bar at the Baccarat Hotel, New York serves up several rare and exclusive spirits; Baccarat has collaborated with bourbon brand Maker’s Mark that brings a rare level of customisation to the whiskey experience.

and personality to bubbles as the bourbon. “We’re looking at a couple of different providers,” he shares. “The idea is to pick the blend and dosage, then bottle it under our own label.”

At the heart of the hotel’s spirits philosophy is the Baccarat Private Barrel Program—an elevated collaboration with Maker’s Mark that brings a rare level of customisation to the whiskey experience. Hand-selected barrels, finished with a bespoke combination of oak staves, yield a flavour profile designed exclusively for the hotel’s guests.

Served in signature Baccarat crystal glassware in the bar or the Grand Salon, the program’s flagship cocktail—the Baccarat Old Fashioned—epitomises refinement and restraint.

finished with custom oak staves— an artisanal touch that subtly shapes its flavour profile. “They go down to the distillery, select the barrel, and then choose the finish,” Hammad explains. “The staves add that final layer of flavour.”

The result is a rich, complex bourbon, with each barrel yielding around 250 bottles. Unsurprisingly, supplies are quick to disappear—typically selling out before the holiday season. A fresh barrel is already on its way, with more Kentucky sourcing trips in the works.

As Hammad looks ahead, he’s also steering the hotel toward new expressions of exclusivity— this time through champagne. Building on the vision laid by his predecessor, he is developing a private-label champagne program that brings the same precision

“It’s a way for guests to engage with something truly unique,” Hammad explains. “It’s not just a drink—it’s a conversation.”

Each element of the beverage program—from champagne and bourbon to cocktails—reflects the Baccarat Hotel’s dedication to craftsmanship, exclusivity, and elegance. With plans underway for more collaborations and future releases, Hammad is clearly raising the bar—one bespoke bottle at a time.

The global whiskey market is said to have surpassed $72.7 billion in 2024 and is poised for sustained growth, with a projected compound annual growth rate of 6.7% from 2025 to 2034, according to Global Market Insights. This surge is fuelled by a rising consumer preference for premium and craft whiskey, reflecting a broader shift toward high-quality, bespoke offerings.

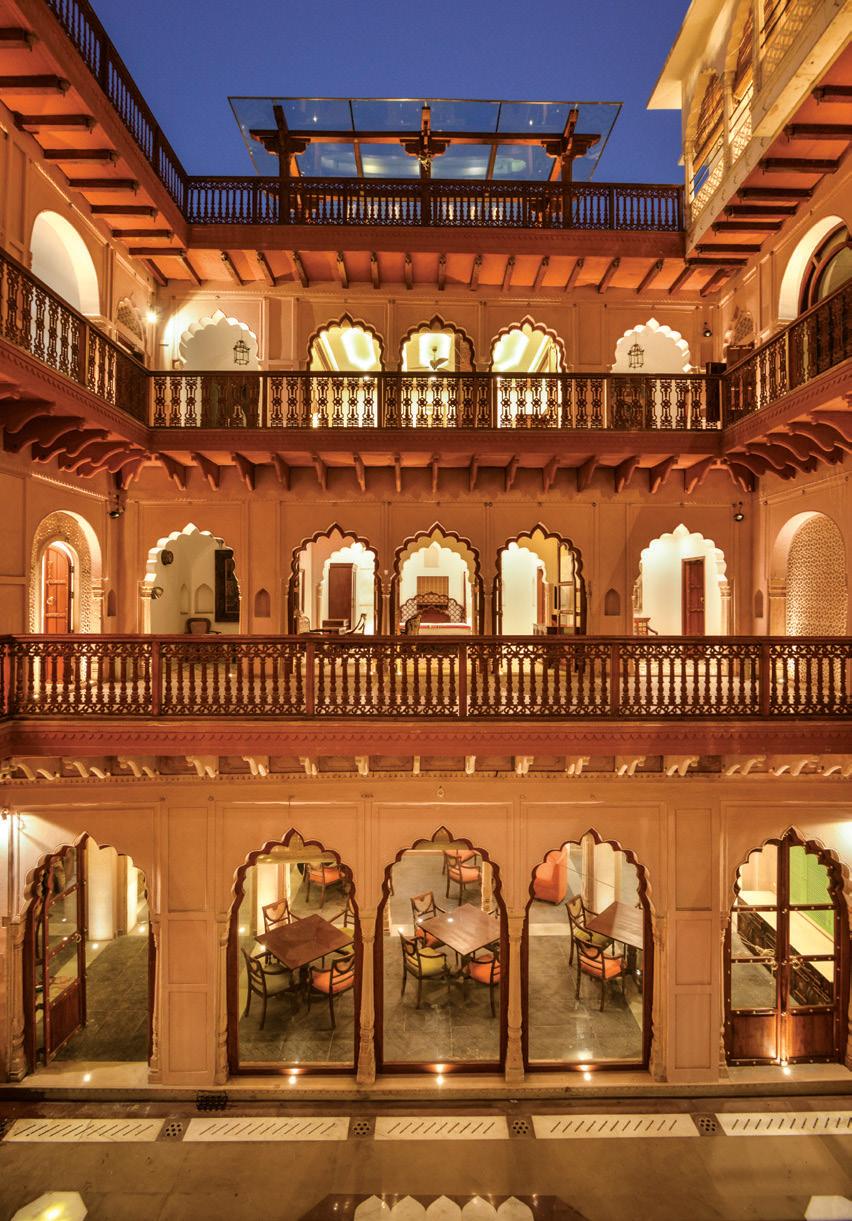

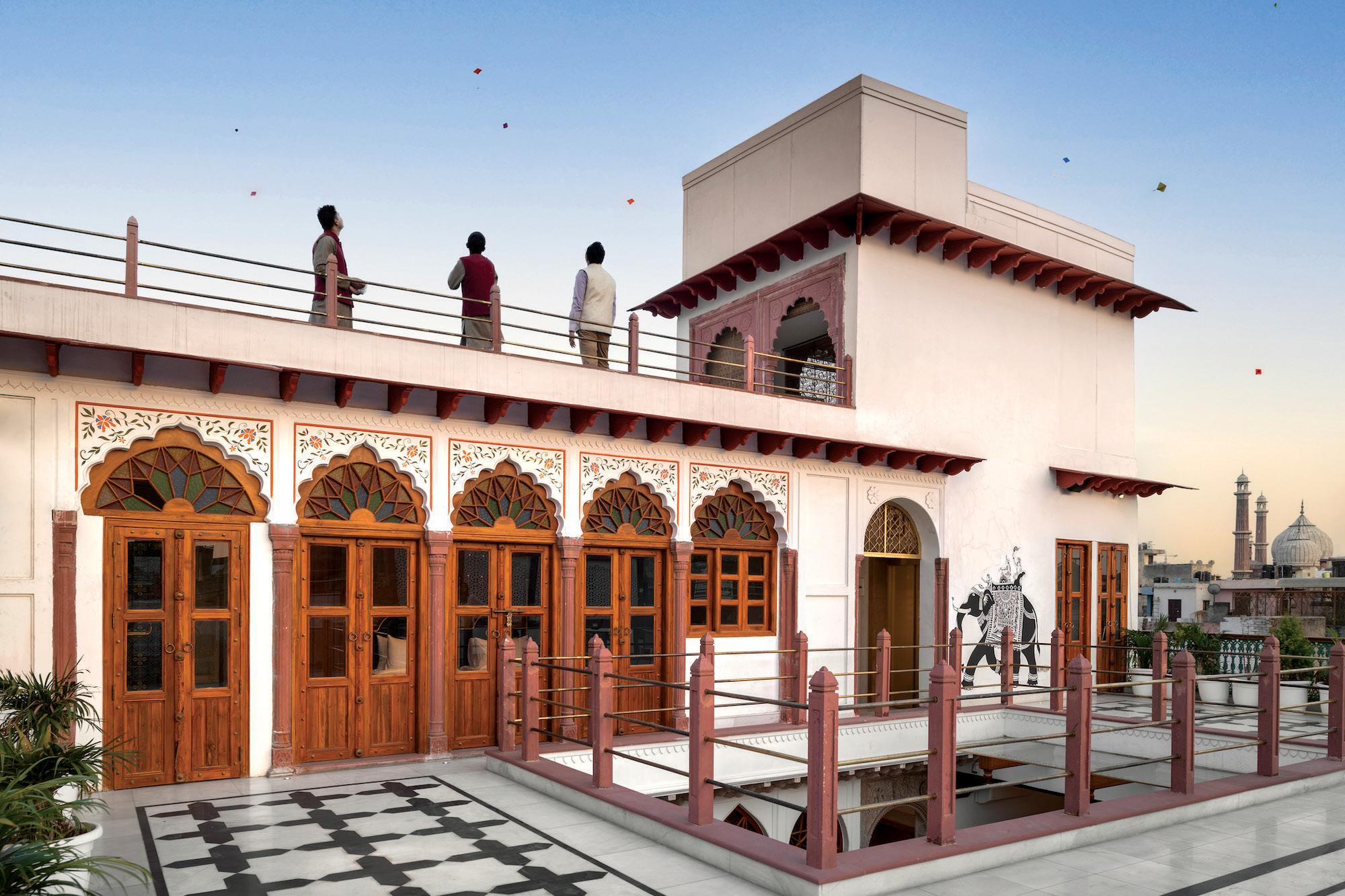

A decade after Haveli Dharampura established a new benchmark for restoration in ‘Purani Dilli’, comes its sister property, Golden Haveli, setting similar benchmarks in restoration.

ABOVE LEFT AND RIGHT: The transformation of a dilapidated structure is striking and complete.

BELOW: Lakhori, the main restaurant, is named after the type of brick commonly used in the area.

The success of Haveli Dharampura, deep inside the labyrinth that is old Delhi today, can be measured in several ways. For starters, it is easily the most expensive hotel accommodation in the area. Its occupancy levels in peak season are such that it is usually sold out. It was recognised for Cultural Heritage Conservation with the UNESCO Asia Pacific Award. Its praise has spread as much by word of mouth from travellers worldwide.

And it’s hard to believe that it’s been a decade since I first spoke to Vijay Goel. As the visionary behind Haveli Dharampura, he achieved what was considered impossible—restoring/conserving a dilapidated structure inside Delhi’s ‘Walled City’. Remarkable conservation projects have been carried out in the city, such as Humayun’s Tomb and Sundar Nursery by the Aga Khan Trust, and less proficient ones by the Archaeological Survey of India, at Red Fort, for example.

A restored Haveli Dharampura re-opened in early 2016, and soon proved to be a stupendous success. Even today, its 14-room inventory is almost always sold out in season. That was one of the reasons, that Vidyun Goel, Vijay Goel’s daughter, who has been entrusted with the running of the property, pushed for an extension, which has finally resulted in what is today Golden Haveli.

Just 50mts. down the lane from Haveli Dharampura, Golden Haveli is very similar to its older sibling. With a dozen suites, the property offers an intimate escape in the heart of old Delhi. Golden Haveli, located in Gali Anar, one of countless lanes and bylanes that crisscross this area, dates back about 200 years. It is located a stone’s throw away from the city’s Jama Masjid, and structures like the Red Fort are clearly visible. What is even more apparent

is the contrast—between a restored haveli and the heartbreakingly dilapidated state of most of the surrounding structures. In their heydays, they too would have been grand mansions, populated by the city’s elite. Their fading splendour can still be glimpsed in that odd achingly beautiful surviving arch, or once ornate railings.

So it is even more remarkable to gauge not just the effort but the thought to restore these havelis, thus also offering a glimpse into what they once were. The haveli has been painstakingly restored to reflect an era of wealth and elegance that this area was once known for. Like havelis of the time, Golden Haveli, too, has a central courtyard embraced by rooms all around. Stepping into Golden Haveli from the seemingly continuous cacophony of the neighbourhood can seem an unreal, almost fantastic

transition, straight out of a scifi novel. It’s an oasis of calm, of ornate splendour, a throwback into a resplendent past—albeit with modern plumbing and aircon.

As with Haveli Dharampura again, no two rooms are alike, with choices ranging from the Gandhi Suite on the ground level to the Jahan Ara Rooms and Mumtaz Mahal Suites on the upper levels. Yes, it is said Gandhi stayed at this property during his visits to the city!

Incidentally, the restoration work at the Red Fort played a crucial role in the initial restoration of Haveli Dharampura. For one, the staircase for this haveli is narrow (often the case in the past—to prevent thieves from carrying stolen sanduks perhaps?). So all the material for this four-level structure had to be lowered by cranes onto each floor.

Golden Haveli has benefitted from the learnings of the restoration process of the earlier project, where architect Kapil Aggarwal and Vijay Goel worked together. As there had been no benchmark for this kind of restoration then, they worked with intuition. About 50 artisans laboured for five years on the initial structure. As the top priority was to retain the original structure and character of the haveli—and in the absence of any written-down plans, the process also included getting a sense of what the original layout would have been. Over the years, people had added extensions or divided rooms, leading to structural complications and damage.

The original haveli, as was the practice in the late 19th century, had included elements from Mughal, Rajasthani and colonial architectural styles. From establishing the original spaces to cleaning up took an enormous effort, recollects Goel. Original construction materials were used during the restoration process. This included ingredients usually associated with food—belgiri, gur

sheera, methi, daal (lentils) along with sun (jute fibre) and chuna (lime mortar). Original Lakhori bricks (after which the main restaurant at Haveli Dharampura is named), which are more slender, were used where possible.

Walls were redone to suit modern requirements of wiring and plumbing, using the same materials as used in the original structures. Of course, internal changes, such as those involving mild steel (MS) strips to repair cracks, carefully preserved the integrity of the original structure. Gaps were filled with gravity grouting. Sal wood was used for joints. In the case of furniture, which was infested with termites, pieces were either treated or replaced. Some elements, such as pillars clad in Dholpur stone, were found to be in good condition after layers of grime were washed off.

The main door was sent to Rajasthan for re-making in a style similar to what would have been the norm when the havelis were built. Cast iron railings were remade in the old Shahjahanabad style. The furnishings, reflective of a bygone era, have been updated to reflect modern aesthetics. Catch glimpses of Delhi in tastefully placed black-and-white images of the city from a century or so ago, capturing an era long lost. Once inside Golden Haveli, you can still be transported to the grandeur of the era.

Haveli Dharampura is a restored 19th-century mansion tucked away in the bustling lanes of Chandni Chowk, Old Delhi. Commissioned by Jahanara Begum in the 1650s, Chandni Chowk was once a grand, tree-lined boulevard with a central water canal that shimmered under moonlight. It was part of Shahjahanabad, the Mughal capital built by Shah Jahan, centred around the Red Fort.

Haveli Dharampura’s history, architecture, and location serve as a microcosm of Shahjahanabad’s (Old Delhi's) layered heritage—a city of traders, poets, royalty,

and artisans. The city was home to poet Mirza Ghalib; Begum Samru, who started her career as a nautch girl in 18th century India, and eventually became the ruler of Sardhana, a small principality near Meerut; Unani physician Hakim Ajmal Khan; the Jain merchants of Dariba Kalan; freedom fighter and India’s first education minister Maulana Azad; British residents and colonial officers.

Haveli Dharampura is said to have been constructed around 1887. It was originally a residence for a prominent merchant family, reflective of the prosperity of Chandni Chowk's trading community during the late Mughal and colonial era. Located in Gali Guliyan, a narrow, labyrinthine alley near Jama Masjid, in a part of Old Delhi where once wealth and aesthetics coexisted in confined spaces, it fell into disrepair like many havelis of Shahjahanabad.

The initiation story of Haveli Dharampura is a fascinating one, and Vidyun Goel, Director, Haveli Dharampura, sheds light on how a once neglected mansion came to be restored.

How did the initial restoration of Haveli Dharampura come about?

There is a back story to this. My father, Vijay Goel, Rajya Sabha MP, earlier represented the constituency in Lok Sabha. During his Lok Sabha tenure, he initiated several projects to spruce up the area, including removing encroachments, getting shop fronts in Chandni Chowk painted, restoring the old Town Hall, and starting a festival called Chaudhvi ka Chand (1998-2004)… the whole idea was to bring the limelight back to Old Delhi. He also wrote the book called Delhi: The Emperor’s City that documents all historical buildings—havelis, temples, mosques, churches, etc., including Haveli Dharampura. Little did we know that he would end up restoring it. At that time, he focused on advocacy for heritage conservation under the banner ‘Save the Walled City’. He wrote to INTACH, and ASI, worked on a lot of research papers, and held seminars and conferences on how Old Delhi could be restored through publicprivate partnerships. Facing multiple challenges, he worked on it for 10 years and possibly out of frustration said, ‘If I don't do it and I don't show that it could be done, it will not be ever done’.

He acquired this property about a decade and a half ago, and got me to Dharampura one day, saying I am going to take you to the Taj Mahal of Delhi. And I was standing in front of this completely ruined building, where the entire second floor was falling. His idea was to restore a part of it and to show the government that it could be restored. There was no concept of a hotel at the time.

Was there any information about the haveli?

The haveli had changed hands multiple times and has had Muslim and Jain owners. Around the time my father bought it, many people were squatting in the building, and lots of additional rooms had been created. He thought he could create a museum here for people to visit. Crucially, INTACH documented the building’s condition pre-restoration, something that helped us to apply for the UNESCO award because it was documented.

What were the main challenges to restoration?

To start with, my father did not have an architect or a contractor. Or artisans. There was no one to

advise; my father started on his own. There were multiple roadblocks. For the first three years, they were just trying to stabilise the structure. Every monsoon used to feel like the building was going to collapse under its weight. The first major problem they had was to reduce the weight of the building. Everything had to be traditional. Even to strengthen the structure of the building, we used organic material. We had set up a grinding mill right in the courtyard for pulses and jaggery.

How did the idea of a hotel come about?

After the initial three to four years of restoration, people began to take interest. They said things like we would love to sit here and have tea. We don't come from a hospitality background. My dad's a lawyer by degree. My mom's a professor at Delhi University. And I am an economics finance person. My parents went around asking different people if they wanted to run something here but nobody was interested. Anyway, the restoration was done by 2015, and soft furnishings took another year. So in 2016, we opened it up as a boutique hotel.

WHILE THE SHADOW OF U.S.-LED TARIFFS AND STOCK MARKET TURBULENCE LOOMS LARGE, INDIA'S VIBRANT HOSPITALITY SECTOR IS CHARTING ITS OWN COURSE. DRIVEN BY ROBUST DOMESTIC DEMAND AND THE EMERGENCE OF TIER-2 CITIES AS NEW TOURISM HUBS, THE INDUSTRY IS WITNESSING A SURGE IN INVESTMENT.

and stock market volatility, India’s vibrant hospitality industry remains a beacon of resilience and optimism, poised for quantum growth. Valued at $25 billion and driven by a 300-million-strong middle class—projected to reach 450 million by 2030—the sector thrives on robust domestic demand. Tier-2 cities like Indore, Surat, and many more are emerging as tourism hubs, buoyed by a 12% rise in hotel investments since 2023.

A weaker rupee at 86.71 (when we went into print) against the dollar positions India as a cost-competitive destination for international travellers, if only we were to shift focus to attracting them. Government initiatives, including new tourism circuits and infrastructure like airports in Jewar (Noida) and Navi Mumbai, enhance long-term prospects. As global supply chains realign, India stands to attract significant investment, solidifying its hospitality sector’s strength and transforming challenges into opportunities for sustained prosperity.

First off, let’s look at the state of the world, stock markets and the possibility of the U.S.-led tariffs, which hang as a sword of Damocles on our heads.

Industry experts on what will ensure the Indian hospitality’s growth and surge in 2025.

Jesper Palmqvist

“

Much of India’s hospitality sector isn’t overly dependent on capital markets. Family money, traditional conglomerates, and deep banking relationships insulated the industry during past shocks—and they’re doing the same now.”

PARTNER & CEO, CROWE ADVISORY INDIA AND MD, HORWATH HTL INDIA

“

In India, new demand drivers like sports, entertainment, and events are still in the early stages of development, suggesting strong future growth potential for the hospitality industry.”

The direct impact of ongoing global tariff disputes is negligible for now. However, global trade tensions and economic uncertainty inevitably influence investor sentiment across asset classes, including hospitality.”

Industry experts on what will ensure the Indian hospitality’s growth and surge in 2025.

Manav Thadani

FOUNDER CHAIRMAN, HOTELIVATE

The strength of the Indian economy has attracted a wave of new investors, particularly in the hospitality sector. Over the past three to four years, the hotel industry has become increasingly institutionalised.”

Investor enthusiasm for operational assets and land parcels underscores the sector's attractiveness, buoyed by favourable economic conditions, expanding commercial markets, and the government’s recent budget push for tourism.” – As quoted in a release sent out by JLL

Despite fluctuations—even with global trade issues causing some market swings—hotel stocks have remained fairly resilient. So from an investment perspective, both retail and institutional investors will likely continue investing in hotel stock.”

In April 2025, global markets reeled from new U.S. tariffs, including a 26% levy on Indian imports, though they temporarily paused the move for 90 days. The announcement sent the Sensex plummeting 2,200 points and the rupee to 86.68 against the dollar. On April 7, 2025, the day the tariffs were announced, the Nifty 50 crashed by 743 points, marking one of the largest single-day drops of the year, fuelled partly by fears of a trade slowdown. This volatility is increasing risk aversion among investors, leading to capital outflows from emerging markets like India and further pressuring the rupee. While global tariffs and stock market volatility don’t directly target India’s hotels, their economic ripples are hard to ignore. The U.S.'s 26% tariff on Indian exports—electronics, textiles, and gems—threatens sectors employing millions. In Surat, diamond polishing units face layoffs, with thousands of jobs reportedly at risk. A weaker rupee inflates import costs, pushing inflation to 3.62% in February 2025. For households, this translates into less disposable income for leisure travel—a cornerstone of hospitality revenue.

Jesper Palmqvist, Senior Director for Asia Pacific at STR, offers perspective: “I look at it from both short-term and long-term angles. Right now, escalating trade wars and tariff hikes could drag down GDP growth. If inflation rises again and interest rates don’t fall, consumer spending could slow, directly affecting hotel occupancy and rate growth. If tensions ease within a quarter or two, the impact will be limited. But if trade wars persist for six to nine months or longer, we could slip into global recessionary territory, and hospitality will feel the hit. In a tighter economy, discretionary spending, including travel, tends to fall—we already saw that in China last year. Fortunately, India and Indonesia, with their large domestic markets, are better insulated. India's low dependence on any single external market is an advantage. After the pandemic, funding access was very tight, but it had recently started opening up, with green loans and sustainability-linked financing gaining traction. With current global uncertainty, however, capital access will likely tighten again.”

What helps India, according to Palmqvist, is the strength of family money. “Much of India’s hospitality sector isn’t overly dependent on capital markets. Family money, traditional conglomerates, and deep banking relationships insulated the industry during past shocks—and they’re doing the same now. So even if public markets tighten, private money will still keep parts of the expansion alive.”

Operational challenges are mounting, as hotels relying on imported goods now face higher costs due to a weaker rupee. CBRE India notes a significant rise in food and beverage input costs, which may impact mid-scale hotels the most. Stock market turbulence has also triggered substantial outflows from Indian equities, potentially affecting high-net-worth travellers and corporate travel budgets. MICE events, crucial for metro hotels, are seeing cancellations as firms brace for uncertainty. Regional disparities are emerging, with leisure destinations facing sharper booking declines compared to metro areas buoyed by business travel. Industry forecasts suggest a potential downward revision in projected occupancy and Average Daily Rates if tariffs are reinstated post-July 2025.

The tariffs also have a knock-on effect on global supply chains, potentially increasing costs and causing delays for hospitality developments relying on imported materials. Rising input costs could affect ROI projections for new hotels and resorts, particularly in the luxury and upper-upscale segments.

Mandeep Singh Lamba, President & CEO, India & South Asia, HVS Anarock, says, “Trade disputes can drive up input costs, disrupt supply chains, and shift global investment flows as companies rethink their strategies. In hospitality, such economic uncertainty may dampen consumer confidence and curb discretionary spending on travel and leisure. The anticipated recovery in international travel could also face delays, with domestic demand remaining the primary growth engine for the Indian hospitality sector. In this environment, hospitality businesses must reassess cost structures, boost operational efficiencies, and adopt flexible pricing strategies to stay resilient. Although the immediate impact remains limited, vigilance and adaptability will be critical as global conditions continue to evolve.”

Skift Research has flagged concerns about the impact of U.S. tariffs and stock market volatility on hotel investments, with implications for India. Skift reports that U.S. tariffs, particularly those announced by President Trump, are creating significant challenges for the global hotel industry, including potential impacts in markets like India.

“The tariffs, which are on a 90-day moratorium, if brought back at 26% duty, are driving economic uncertainty and market volatility, which affect investor confidence and hotel performance. This uncertainty is causing a slowdown in bookings and prompting hotel asset managers to adopt cost-saving measures and rethink marketing strategies. For instance, HotelAVE, a major asset manager overseeing $12 billion in hotels, is advising hotels to stock up on critical imports and adjust pricing to mitigate supply chain disruptions caused by tariffs,” it states.

According to Lamba, while India’s hospitality sector is largely domestically funded and demand-driven, it does not operate in a vacuum. “The direct impact of ongoing global tariff disputes, such as the recent U.S. tariff announcement, currently under suspension, is negligible for now. However, global trade tensions and economic uncertainty inevitably influence investor sentiment across asset classes, including hospitality. Hospitality stocks have mirrored broader market trends, but the long-term appetite for quality assets in India remains intact.”

INVESTOR SENTIMENT – TEMPORARILY CAUTIOUS

15%

Global FDI into tourism-related sectors declined by ~15% YoY (UNCTAD, 2023).

India attracted $9.2B in tourism-related FDI between 2000–2023, but the pace slowed in late 2023 due to geopolitical uncertainty.

3–6

$9.2B

Greenfield projects in hospitality are experiencing 3–6 month decision delays, particularly from Europe and East Asia. MONTHS

INTERNATIONAL TRAVEL HEADWINDS

92%

Foreign tourist arrivals (FTA) to India in 2023 were 92% of pre-pandemic levels—recovery has plateaued in early 2024.

China, a major source market, down by 18% YoY due to travel restrictions and economic slowdown.

5–7%

18%

High-value tourist destinations (Goa, Udaipur, Jaipur) are seeing a 5–7% dip in international bookings.

$200B global shift in supply chains expected over next 5 years (McKinsey), with India among top 3 alternative destinations.

New airports in Tier-2 cities (e.g., Jewar and Navi Mumbai) expected to increase regional connectivity by 40% by 2026.

25,000

Midscale and budget segment RevPar growth ~15% YoY, outperforming luxury segment (STR India, Q1 2024). $200B

40%

Domestic and international hotel chains have announced ~25,000 new rooms in India between 2024–2028 (HVS Anarock).

Between April 2000 and December 2024, India’s hotel and tourism sector attracted approximately US$ 18.47 billion in cumulative FDI equity inflows, accounting for 2.57% of total FDI inflows across all sectors during this period. (HVS Anarock)

DOMESTIC DEMAND REMAINS RESILIENT

85%

85% of hotel demand in India is now domestic (FHRAI, 2024)

Urban leisure and weekend travel up 24% YoY (Cleartrip/MakeMyTrip reports).

15%

24%

The good news is that despite stock market volatility and the looming threat of a global recession if tariffs are enforced, India’s stock market and hospitality industry remain resilient. After months of withdrawals—Foreign Institutional Investors (FIIs) pulled $15 billion from Indian stocks in 2025, driving a 743-point Nifty drop in early April— they have stormed back, pumping nearly ₹15,000 crore into stocks over three trading sessions, a dramatic turnaround after nine straight sessions of selling. The Sensex has bounced back, partly attracted by a projected 6% GDP growth.

Jehangir Aibara, Director, Mahajan and Aibara, downplays the impact of global trade upheaval: “I don’t think the global macroeconomic situation has too much of an impact on the hospitality sector in India. Of course, there might be some effect on inbound tourism, but it won’t be significant. And, anyway, our dependence on inbound tourism is quite minimal—very little. Also, our base is still very low—inbound traffic numbers haven’t moved meaningfully for several years now.” He adds that despite volatility over the past two to three years, hotel stocks have performed remarkably well, often outperforming the broader market. “Despite fluctuations—even with global trade issues causing some market swings—hotel stocks

have remained fairly resilient. Also, because we’re not overly dependent on inbound travel—we're largely a domestic consumption story—the sector has been quite stable. So from an investment perspective, both retail and institutional investors will likely continue investing in hotel stocks. I’ve received a steady stream of inquiries from investors—mutual funds, and venture capitalists—seeking insights on specific hotel stocks. That wasn’t the case earlier. Hospitality was rarely on anyone’s radar, but today, hotel stocks are firmly in focus, with most portfolio managers now allocating towards the sector.”

As the economy stabilises, the hospitality industry’s growth continues unabated. JLL’s latest survey reveals that India's hospitality sector demonstrated remarkable resilience and growth in 2024, maintaining investment levels on par with the previous year. “This robust performance, as reported by JLL's latest analysis, signals a strong recovery and expanding footprint for the industry across the subcontinent,” it says.

The investor landscape has been diverse, with HNIs, family offices, and private hotel owners leading at 51% of transaction volume. Listed hotel companies followed at 34%, while owner-operators and real estate developers contributed 8% and 7% respectively. “CY 2024 witnessed 42,071 keys in terms of branded hotel signings and 11,352 keys in terms of branded hotel openings,” says the JLL analysis.

In a press statement, Jaideep Dang, Managing Director, Hotels and Hospitality Group, India, JLL, said, “The first quarter of 2025 has ignited a dynamic hotel transactions market, with JLL already facilitating two deals in Chennai and Goa. Investor enthusiasm for operational assets and land parcels underscores the sector's attractiveness, buoyed by favourable economic conditions, expanding commercial markets, and the government's recent budget push for tourism. This positive outlook is reinforced by substantial hotel development across various tiers, with over 42,071 keys signed in 2024. Following 2024's record-breaking year in hotel investments, openings, and

signings, 2025 has commenced strongly and is further expected to maintain this momentum.”

Expansion plans of Indian hospitality groups are firmly in place and unlikely to be rolled back anytime soon. Puneet Dhawan, Head of Asia, Minor Hotels, underscores the growing investor confidence: “India will continue to attract increasing Foreign Direct Investment, as seen in recent hospitality IPOs like Samhi Hotels, Ventive Hospitality (a joint venture between Panchshil and Blackstone), and Embassy’s REIT announcement. This signals strong interest from institutional and international investors. With India on track to become the world’s third-largest economy in the next five years—growing from $3 trillion to $5 trillion—global investors are eager to tap into this growth. Post-COVID, they are viewing India through a fresh perspective. Additionally, returns in India are highly attractive. While mature markets offer an IRR of 10-12%, India is delivering around 15%. The growing interest is undeniable.”

Thacker highlights the financial strength of the sector: “FDI inflow into the Indian hospitality sector is relatively limited. Moreover, overall FDI in India has been declining. Nevertheless, the enthusiasm shown by major hotel chains in expanding their footprints shows continued strong belief in the India growth story. It’s important to note that many Indian hospitality companies—especially asset-heavy chains—currently have very low levels of debt. In a study we conducted covering around 54,000 rooms, we found average gearing was just 12.5%. This low leverage, combined with strong cash positions, gives these companies significant capacity to absorb shocks and fund future expansion, which augurs well for the sector.”

India’s hospitality industry stands at an inflection point. While exposed to global cost and sentiment volatility, its strong domestic fundamentals and longterm investment interest provide a foundation for resilience, say experts and industry insiders. Reports like HVS ANAROCK project only a mild slowdown, banking on domestic strength. Strategic focus on cost controls, growth in Tier-2 cities, and capturing the domestic market will be crucial to navigating uncertainties and ensuring continued growth.

Hotels, often buzzing with wedding banquets and corporate retreats, benefit from a robust 300-million-strong middle class, projected to reach 450 million by 2030. By blending caution with creativity and embracing innovation, India’s hotels are well-positioned to weather global turbulence, transforming challenges into opportunities.

Manav Thadani, Founder Chairman, Hotelivate, emphasises the sector’s domestic strength: “Post-COVID, the growth of India's tourism industry has been driven largely by domestic travel. The Government of India has made little effort to promote the 'Incredible India' campaign

internationally, and as a result, the sector’s progress has been primarily fuelled by domestic demand. Meanwhile, the strength of the Indian economy has attracted a wave of new investors, particularly in the hospitality sector. Over the past three to four years, the hotel industry has become increasingly institutionalised. Today, there are eight to nine publicly listed hotel companies, many of which have attracted international institutional investment. Investment activity has notably accelerated in the past two to three years, as seen in the public listings of companies like SAMHI, Ventive, and Juniper Hotels. The only three companies that potentially could go for an IPO are OYO, Leela Hotels and Lalit. Possibly they will wait and watch.”

He adds, “In my 25-plus years of being in India, I have never seen this kind of rush to build new greenfield sites. We did a staggering 160plus projects last year, despite turning away many, and most were for greenfield developments where we are seeing real movement.”

The industry is also demonstrating a strong capacity for adaptation. Hotels are increasingly embracing technology, with AI-driven pricing models and chatbots optimising rates and reducing operational costs. Local sourcing of food and beverages is on the rise, reducing reliance on pricier imports. Sustainability initiatives are gaining traction, leading to cost savings and enhancing the appeal of eco-conscious properties. Meanwhile, hotels are diversifying their offerings to meet evolving travel preferences, with wellness retreats and experiential tours gaining popularity.

Government initiatives to develop new tourism circuits and infrastructure further bolster the sector’s long-term prospects. Amid a global realignment of supply chains and investment priorities, India is poised to emerge as a key beneficiary, attracting long-term investment in tourism infrastructure, especially in Tier-2 cities and underserved leisure destinations.

PASSENGER

BY QUARTER (Q2 2024/25 - Q3 2024/25)

Q3 2023/24

Q3 2023/24

Q4 2023/24

Q1 2023/24

Q2 2024/25

Q3 2024/25 CHANGE (%) PASSENGER MOVEMENTS

Source: Airports Authority of India

Vijay Thacker, Partner & CEO, Crowe Advisory India and MD, Horwath HTL India, highlights the sector’s resilience: “If tariff levels, as initially announced by President Trump, remain elevated long term, they could cause significant global disruption. The extent, depth, and pace of recovery are hard to predict. However, India benefits from a strong domestic tourism sector, making it less reliant on international travel; even if global markets face pressure, domestic demand should keep the sector relatively resilient. If stock markets stay subdued for an extended period, discretionary spending— and by extension, leisure travel—could be affected. Yet, I do not expect a major long-term impact on Indian hospitality. Much of the new supply is concentrated in the mid-tier segment, spanning emerging leisure destinations, pilgrimage sites, and secondary and tertiary business cities.

Moreover, India remains significantly underserved in hotel room supply, providing a natural buffer. New demand drivers like sports, entertainment, and events are still in the early stages of development, suggesting strong future growth potential. India could also benefit from a shift in global manufacturing investments away from China, further strengthening its economy. Of course, if the US enters a recession, sectors like IT services could face pressure, indirectly affecting demand. But overall, given the strength of domestic tourism, the impact on the hospitality sector should be manageable.”

Lamba notes that the recent dip in hospitality stocks reflects cyclical investor sentiment, not structural weaknesses: “Long-term fundamentals remain strong, supported by robust domestic demand and growing travel from Tier-2, 3, and 4 cities.” While global economic headwinds and geopolitical tensions have led to a more cautious investment outlook, potentially slowing fresh inflows, he adds, “This environment may boost India’s appeal. Amid greater instability in many global markets, India’s macroeconomic resilience, strong domestic tourism, and investor-friendly policies position it as a stable and attractive market for long-term investment. As international players seek to diversify from more volatile or saturated regions, India’s hospitality sector, particularly in the economy and midscale segments and Tier-2/3 markets, stands to benefit. Barring a sharp escalation in global risks, we do not foresee significant disruptions to investor sentiment.”

Palmqvist observes that the sector’s expansion plans remain ambitious: “In some cases, slower growth could be healthier and more sustainable. India, like China before it, has some projects that frankly don’t seem fully viable for the next decade. Certain areas and product types might be overbuilt for current demand. So, a little recalibration isn't necessarily a bad thing.”

Thacker notes the investment dynamics: “Owners who have already committed funds— especially smaller, domestically funded players—are unlikely to pull back. However, large projects that depend on stock market performance, valuation gains, or inbound capital flows could see some delays or adjustments. That said, if new developments slow down, it would mean less

additional supply, which could strengthen the performance of existing hotels.”

Here are some ways in which the Indian hospitality industry is likely to grow:

Opportunity in diversification: On the flip side, there is the possibility that companies and investors look to diversify away from China and hedge risks, and India may benefit as an alternative destination. This could lead to long-term investment gains in hospitality infrastructure, especially in emerging leisure and Tier-2 cities.

Domestic travel as a growth anchor: Crucially, India's hospitality sector is underpinned by strong domestic demand. With a 300-million-strong middle class, India’s travel appetite remains a powerful engine. Domestic air traffic soared to 13.1 million passengers in August 2024, up 7% year-on-year, per DGCA data, reflecting a growing willingness to explore. Tier-2 cities like Indore, Surat, and Coimbatore are emerging as tourism hubs, with Knight Frank India noting a 12% rise in hotel investments there since 2023.

JLL’s new analysis of the investment scenario reveals that 2024 saw approximately 25 deals, primarily involving operational properties in both business and leisure destinations. “What's particularly noteworthy is the significant shift towards Tier II and III cities, which accounted for nearly half of all hotel transactions. This trend has effectively broadened the industry's reach, bringing quality accommodations to previously

underserved markets such as Amritsar, Mathura, Bikaner, and several others,” it states.

Unlike metro markets, these destinations rely less on volatile international arrivals, buffering the sector against global shocks. Nikhil Sharma, Managing Director & COO - South Asia, Radisson Hotel Group, emphasised this trend at a HICSA session: “Today, Radisson has a portfolio of 207 hotels including our pipeline. Notably, 50% of our properties are located in Tier 2, 3, and 4 cities— destinations like Saputara and Khopoli—which allow us to showcase our brand even in non-metro markets. We had a strong year in terms of signings—36 last year and already 20+ so far this year. As we look ahead, we’re focused on expanding not just our brand but the hospitality ecosystem in India through thoughtful scaling and impactful initiatives.”

The opportunity to attract inbound tourists: A weaker rupee, standing at 86.71 against the dollar in April 2025, positions India as a costcompetitive destination for budget travellers from Southeast Asia, the Middle East, and Africa, potentially mitigating the impact of a projected global tourism slowdown.

Trade dynamics offer further upside. If U.S. trade negotiations, hinted at by Foreign Minister S. Jaishankar, yield a favourable deal by July 2025, export sectors like textiles and electronics could rebound, restoring jobs and consumer confidence. HSBC estimates a 0.3% GDP boost from such an outcome, lifting discretionary spending on travel. India’s pivot as a manufacturing alternative to China—evident in Apple’s expanded iPhone production—could drive business travel to cities like Bengaluru and Chennai. CBRE India projects a 10% rise in corporate bookings in these hubs by 2026, as multinationals set up operations. Meanwhile, the RBI’s April 2025 rate cut to 6% eases borrowing costs, enabling hotels to fund expansions. Knight Frank forecasts 300,000 new rooms by 2030, with branded chains like Marriott and IHCL targeting Tier-2 growth to capture rising demand.

Adaptability is equally critical. Hotels are rapidly embracing technology to stay competitive. Deloitte reports a 20% surge in AIdriven pricing models, allowing chains like Lemon Tree to optimise rates in real-time. Chatbots now handle 25% of bookings industry-wide, cutting OTA commissions by 3-5%. Local sourcing is another gamechanger: FHRAI notes a 15% increase in domestic F&B procurement, reducing reliance on costly imports like olive oil and coffee, which rose 20% in price. Sustainability initiatives—solar panels, water recycling—shave 5-7% off utility bills, according to HVS ANAROCK, boosting margins for mid-tier properties. Experiential offerings, from wellness retreats in Rishikesh to heritage tours in Rajasthan, are drawing 10% more bookings, per MakeMyTrip data, as hotels pivot to “staycation” trends.

Government support could further amplify these gains. The Ministry of Tourism’s push for 100 new tourism circuits and 50,000 skilled workers by 2027 aims to elevate India’s global appeal. If infrastructure projects roll out on schedule, accessibility will drive arrivals. The sector’s $50 billion revenue target by 2030 remains ambitious but achievable, provided trade stabilises.

RUPEE VS. USD 83.5 (average)

(April 2025)

FII OUTFLOWS $8 billion (net) $15 billion (YTD April 2025)

8% (FHRAI) 6-7% (Deloitte projection)

2025 projection assumes stability; may rise to 4% if tariffs persist.

2025 value may weaken to 87 with continued market volatility.

2025 estimate reflects tariff-driven sell-offs; could grow further.

2025 assumes tariff impact; could dip below 6% with prolonged trade wars.

2025 reflects two-year low, tied to tariff and volatility concerns.

Data draws from RBI, FHRAI, Deloitte, and news Vigyananda reports, aligned with April 2025 updates. Projections for 2025 are estimates; actual values may shift if tariffs escalate or trade talks succeed. The table assumes stable trends but flags potential for worse outcomes (e.g., revenue growth below 6%).

Amid the global realignment of supply chains and investment priorities, India has the potential to emerge as a key beneficiary. As companies diversify beyond China and hedge against geopolitical risks, India may attract increased long-term investment in tourism infrastructure, particularly in Tier2 cities and underserved leisure destinations.

At a HICSA 2025 session, Mohit Arora, Managing Director, Blackstone, highlighted the investor view: “I believe that global fund markets are increasingly recognising the potential of the Indian hospitality industry. While there might be short-term uncertainties, the underlying fundamentals suggest strong growth. Many comments in the Indian hospitality stock market indicate a level of stability. From an

investor's standpoint, the recovery and increased interest in the hospitality sector, as well as related industries, present buying opportunities. Of course, there's a complete dislocation in the markets, and real estate and hospitality were among the biggest beneficiaries initially.”

Thacker offers an example of how India could gain as investment shifts from China: “With China pulling back from Boeing aircraft orders amid the trade war, Indian carriers waiting for deliveries could benefit, shortening their delivery timelines. So, while there are sectoral risks, netnet, given the size and momentum of India's economy, the overall outlook remains positive.”

Government initiatives like Dekho Apna Desh and the National Tourism Policy further enhance India’s appeal as an alternative growth market. The broader lesson is clear: hospitality mirrors India’s ability to navigate global storms. Hotels must innovate—embracing AI, local sourcing, and experiential packages—while policymakers push tourism incentives and trade diplomacy. Risks remain; a global recession could deepen the slowdown, hitting mid-tier players hardest.

Inbound tourist numbers remain sluggish, but global hospitality brands are making their way into India, drawn by its strong domestic market. “Global players are already in China. The elephant is just waking up and providing newer opportunities to global brands,” says Thadani. For now, India’s hotels stand at a crossroads. As markets sway and tariffs loom, the sector’s strength lies not just in the guests welcomed, but in resilience forged.

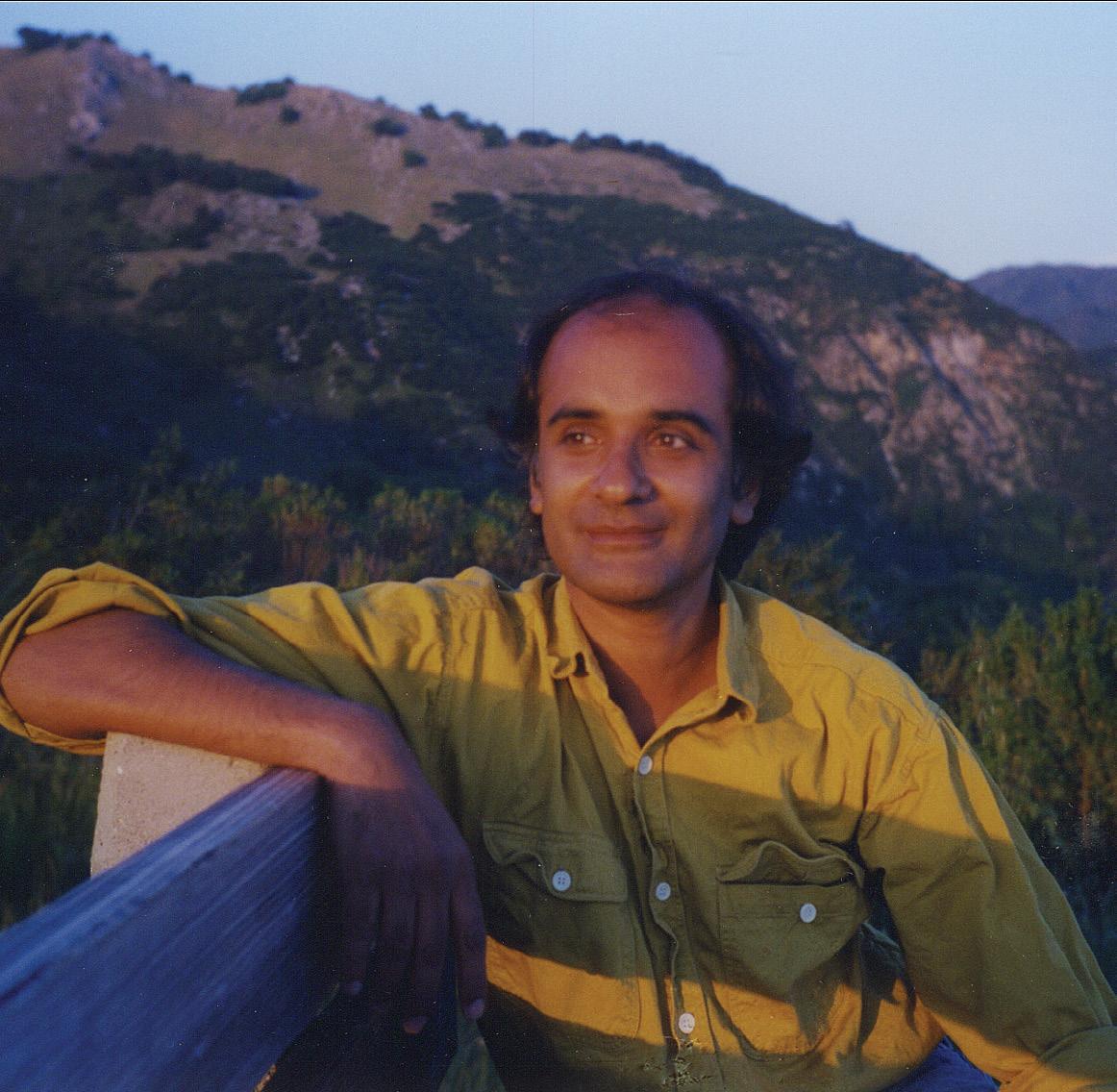

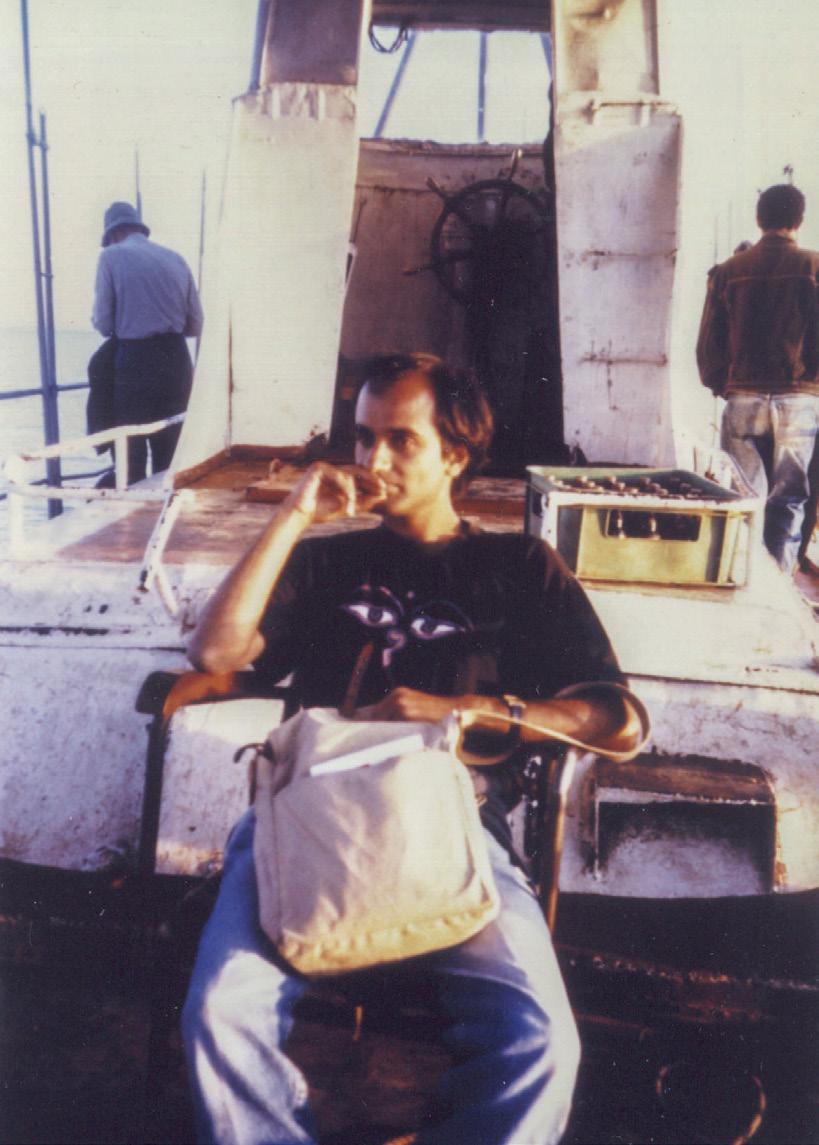

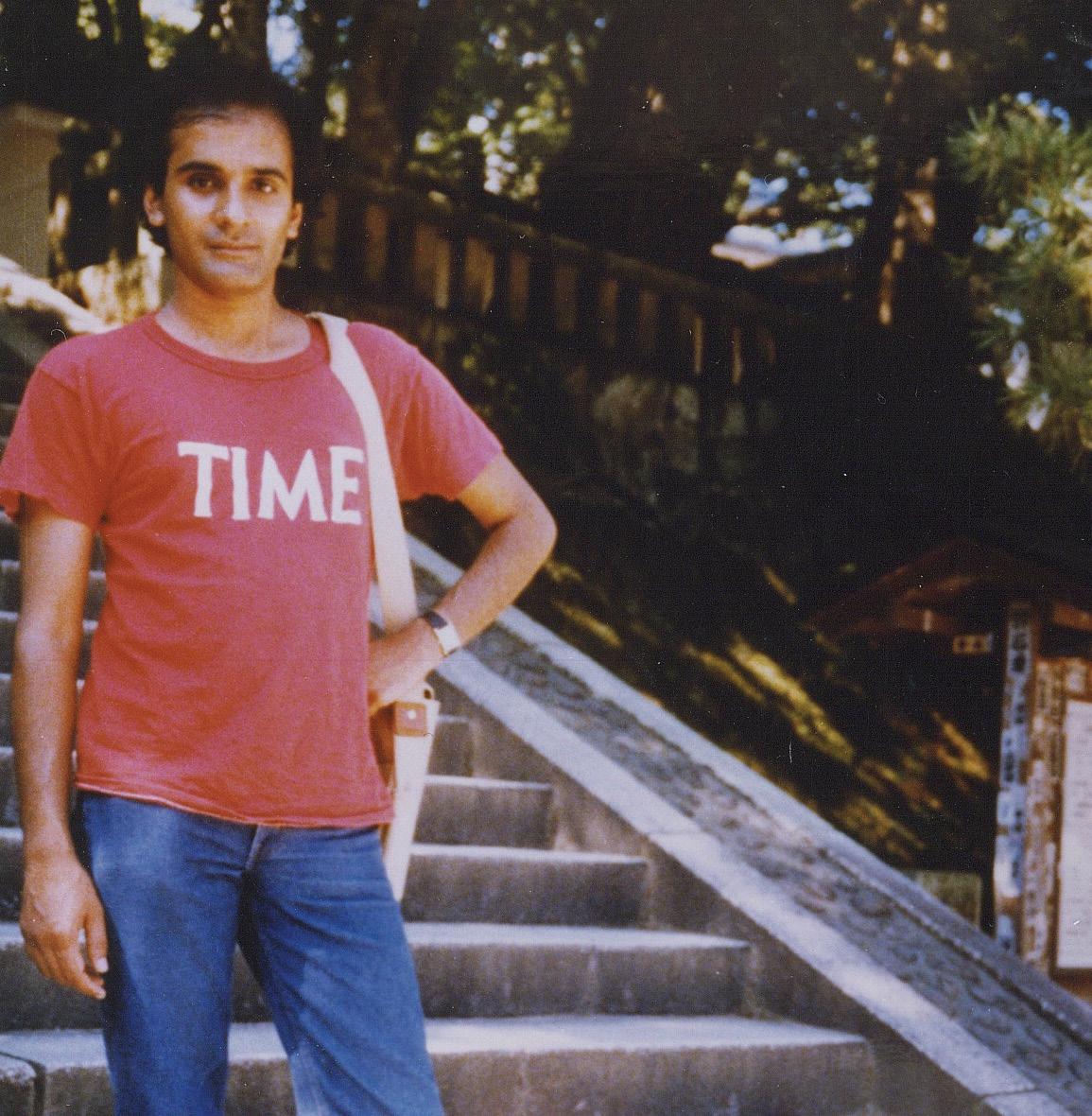

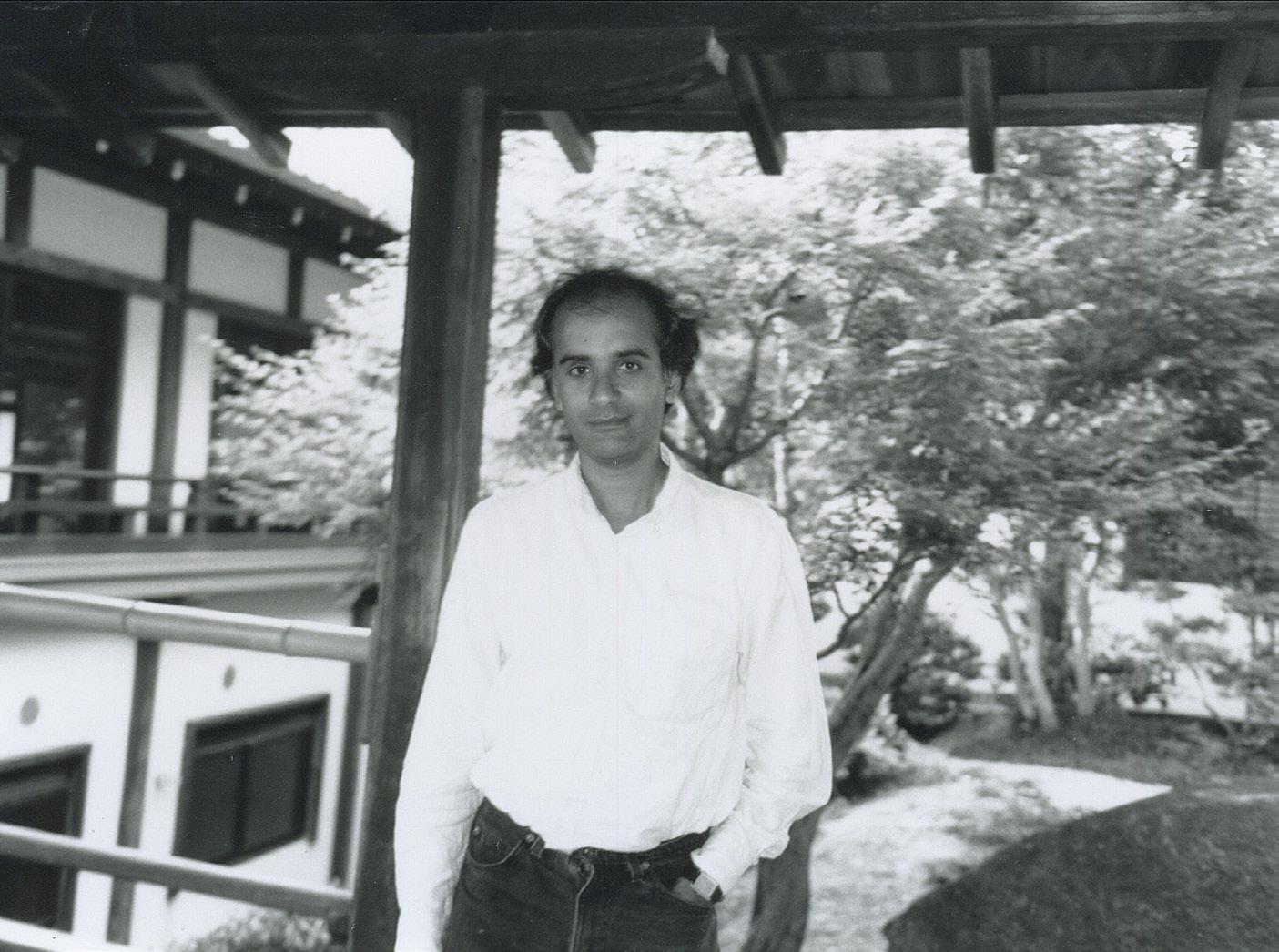

Pico Iyer, the acclaimed essayist and novelist, has long explored the nuances of cultural identity, the meaning of home, and the art of stillness. In his latest book, Aflame: Learning from Silence , Iyer draws on his decades-long experience of retreating to a Benedictine hermitage in Big Sur, California, a deeply personal reflection on the power of silence. He speaks about his many journeys.

ABOVE: Pico Iyer at the Benedictine monastery in Bir Sur, California.

ABOVE RIGHT: The travel writer and essayist was born in Oxford, England.

BOTTOM: The writer spent time in Dharamshala while penning the book on His Holiness, the Dalai Lama.

OPPOSITE PAGE

TOP LEFT: Iyer in Ethiopia.

TOP CENTRE: Arichal Munai, Tamil Nadu. While the novelist's second name shows his linkage to this state, he has spent only a day here.

CLOCKWISE FROM TOP RIGHT: Kashmir, Ladakh, Varanasi and Sri Lanka are featured in Iyer's The Half Known Life

I started going to school by plane from the age of nine. We moved to California when I was seven. I tried schooling for two years, but the educational system there was so different from England, where I was born and grew up—I wasn’t learning much. So I decided to go back. Both my parents were professors, but their great respect for education was also an aspect of India. Although it was very difficult for them to part with their only child, they (too) felt it would be good in the long term, knowing I’d get a solid education there. The exchange rate in the 1960s was also such that it was cheaper for me to go to England, get a better education and fly back thrice a year than going to the best local school 10 minutes from home.

I learned a lot from making that commute—to be more independent, selfsufficient, less spoilt. It was a huge formative influence. It certainly made me a traveller; and got me used to setting two very different worlds against one another—a 15th-century school in England, rooted in the past and tradition, and California rooted in the future. I often felt I was travelling between

history and hope, a distant past and the future. By only living in the future, without a solid sense of what's happened before, you wouldn’t know what to do. And if I'd only lived in that 15th-century past, I'd be mired in dust, as it were, and cobwebs, and wouldn't have a sense of where to go.

So growing up, I felt I had three sets of eyes—Indian, British and American. Whereas my classmates were entirely English, and had only one. I could mix and match mine—see California with English or Indian eyes, or England with Californian or Indian eyes. I thought what a blessing not to be confined to one way of seeing things. This probably helped to make me a writer.

It also trained me for the 21st century, where more and more people in India and everywhere, have many homes. And their sense of home is a sort of mosaic—drawing from many places to make a composite home. It was very unusual in the 1960s.

I've spent painfully little time in India. When I was two, I sailed back from England to spend time with my maternal grandparents at Marine Lines. But at 17 was the first time I really came and spent a couple of weeks in Bombay, visiting uncles, aunts and cousins. Then in 1985, I returned to write part of my first book, Video Night in Kathmandu. Nowadays, occasionally, I make lightning visits. So sadly I haven't spent much time in Bombay, but it’s still better than Tamil Nadu, where the Iyer name’s from and I’ve only spent a day of my life.

Half the chapters of my last book, The Half Known Life, published two years ago, involved South Asia. One each on Ladakh, Kashmir and Varanasi, the main and concluding chapter, and two on Sri Lanka. I also spent springs in Dharamshala while writing a book on His Holiness, the Dalai Lama. So I've travelled a bit in India, but there are many places I’d like to go to and still haven’t.

I always felt a bit of a fake. People would always respond to my face and name as Indian, but having spent so little time and not speaking any of the languages—English was our only common one as my mother’s Gujarati and father’s Tamil—I knew less about India than

have been Japanese in a past life’, and maybe that's true.

many from Britain or the United States…So I'm not in a position to say much about India. But as the years have gone by, I see how much many things I depend upon now qualities I'm so grateful for, come from my Indian parents and are very much Indian. One is the level of intellectual excitement, energy, caring about words, and interest in books I see every time I come to a literature festival. I don't find it anywhere else in the world. So I ascribe my love of words and ability to live off words to India, and also my ease with numbers. My father had it—people from South India often do—and probably passed it down to me.

I also absorbed so much, in semi-invisible ways…such as growing up implicitly believing in karma and reincarnation. My parents were vegetarian, and although I’m not, I really respect vegetarianism. My parents were teetotalers, I’ve never drunk…So Britain formed me, India gave me my blood, mind, heart and many other things, but America, zero percent. I've officially been a resident since the age of seven, but it hasn’t left any imprint on me. It's a very foreign country.

Secretly, I also feel very Japanese. After my first 20 hours—on an unwanted airport layover—I knew that if I didn't spend time here, I’d be an exile for life. Japan has offered me a deep kind of home. I live here because in some mysterious way, I feel an affinity with the culture and its values. I always feel I was meant to be here. My mother would always say, ‘Oh, you must

When I found myself in Japan and married Hiroko—whom I met at Tōfuku-ji temple—my mother was probably a little relieved because even though Japan and India are such different cultures in their character and pace, they share a lot at some deeper level in terms of the way family, and relations within family, are regarded. She knew a Japanese daughter-in-law might be more respectful and kind to her than one from countries that don't have that feeling for family. Though the surfaces are modern and global, deep down, Japan is a very ancient place, just as India is. Both share the quality that they can take in lots from the world, but they'll always remain India and Japan…So when I see shopping malls and McDonald's in Varanasi, it's still truly 100% Varanasi. Just as Kyoto,

flooded with American surfaces, remains 100% Japanese.

In my 20s, I was glad to be able to visit every corner of the world thanks to travel and Time magazine giving me a big leash. For many years it was an interesting way to be alone, get a lot of reading done, learn about the world and get material for writing. As soon as I’d arrived at the age of 25, Time allowed me to take a four-week vacation, then a two-week and three-week one. Within two years, I'd taken three long holidays in Asia. Hardly back, I asked for another six months off… by the end of it, I’d written my first book. And then returned to my bosses, saying, ‘Now I'm leaving for good…to live in a temple in Japan’. They said ‘All right, but would you mind if we send you a salary? Occasionally, you could write columns from the temple because you'll bring a very different perspective from the one we get from New York and Washington.’

The big change I wanted to be part of. When I started writing in 1985, the tradition was still very much of colonial countries

India, not surprisingly, is one of the richest tourist destinations on earth. The hotels in India are the best in the world at this point, something I wouldn't have said 20 years ago... Staying at the Trident in Bombay last year—it’s obviously a nice hotel—I couldn't get over the level of service, food, everything. It’s far beyond what I’d get almost anywhere in the West, and Asia too. So India has limitless potential and I'm glad it's realising it more and more. So many of my friends are going there, getting married and taking honeymoons.

Food is a non-existent part of my travel experience. My palate was destroyed at birth, growing up in England, and made worse by boarding school, where the only food I could get was boiled potatoes. So my parents said you’ll have to starting eating meat now or you'll starve…so I have no feeling for food. When I’m travelling I try to spend as little time eating as possible, and as much as possible devouring the culture. So if I'm in Paris, I’ll only eat fast food or eat while walking, and try ensuring that my three meals take no more than 35 minutes

a day, and spend the rest of it walking the streets, taking in as much as possible.

I'm much more a city person, a person of culture than nature. Places that excite me—Havana, Bangkok, Beirut, Hanoi, Paris, Kyoto—are nearly all rich, dense, intense cities.

I almost never take a vacation. If I'm going somewhere, I'm much more alive if I ask myself questions about it; I try to see around my own prejudices. I assign myself something to write about it even if no editor’s interested and then I’m out of the door, looking around the next corner. Otherwise, I'm too inclined to be lazy.

So when I wrote about Thailand in my first book, I stayed in a very fancy hotel, a middling one and a rock-bottom hostel to get a range of experience because backpackers only get one glimpse and luxury travellers one. I wanted as many glimpses as possible.

writing about the colonised. Travel writing was principally British people writing about Kenya, India, West Indies...places they’d ruled. I thought how interesting it would be to have an Indian write about these. My take on anywhere will be very different from a classical American or British person. At the time, Salman Rushdie was revolutionising English literature by writing very literate, witty, intelligent works in English flooded with terms from Urdu, Hindi, everywhere, and describing a world of melting borders and people who belonged everywhere. A part of me was aiming to do something similar in non-fiction just by bringing my voice that’s partly Eastern and partly Western to countries that are partly Eastern and partly Western.

Indians are my most loyal and engaged readers. There were almost no Indian names in the American media, maybe three maximum, when I joined Time. So seeing an Iyer in the magazine, many from India, who read it devotedly, claimed me heartily as one of their own. To this day, no one in Britain would ever think of me as British, right, or have any interest in claiming me, nor, of course, anybody in Japan. The one country that has really warmly embraced me is India. And I'm so grateful for that.

All the travelling, it's humbled me. It reminds me how local and provincial I remain, and how little I know. For example, when I go to North Korea, it feels almost like another planet, and I realise that everything I might say about human reality or universal values doesn't begin to apply to the 26 million people there. That's probably true of many places I visit. I assume my way’s the norm, but to most people in the world it would be abnormal or exceptional—and that's a very good lesson to learn.

I've become more committed to sustaining relationships at a distance than I might be otherwise, often just through letters. Many of my closest friends are from school even though, for years on end, I'm not on the same continent as they are. It's opened doors to different forms of connection,

where I've never felt I need to be exactly in the same room as somebody to maintain a close, intimate connection.

Travel though was never my greatest interest. I concocted it as a pretext to escape the office and a means to become a writer, a passionate interest of mine. If I’d tried to write a novel, I'd be competing against Dostoevsky and RK Narayan, and there’s a lot I couldn't write. But as I'd grown up travelling a lot, I thought travel writing would come relatively easily… After four years, I was able to leave Time magazine and become a self-employed writer for the rest of my life.

After a certain point, I'd seen a lot of the places that I'd always wanted to, and the real adventure was at the desk, and what to do with the material I've collected became a greater challenge.