LANDLORD TIMES

Monthly news for landlords brought to you by:

September 2025

IS MORE FINANCIAL PAIN ON THE CARDS FOR LANDLORDS?

The prospect of more financial pain for private sector landlords has forced our lettings director to write to the government in protest.

Information reported in the Times newspaper late last month indicated the Treasury was

considering making landlords pay National Insurance (NI) on profits from their rental income. If implemented it could raise an additional £2.3 billion for the government.

Under the proposals, the national insurance system – which currently

excludes property income – would be expanded as part of wider efforts to address a projected £40bn gap in the public finances. Stamp duty reform and capital gains tax on principal homes have also been suggested, all aimed at raising additional income.

The NI proposal has been widely condemned by many in the private rental sector (PRS) as yet another tax on landlords.

Sheldon Bosley Knight’s lettings director, Rebecca Dean said: “If introduced, the introduction of NI on rental income will be another negative for landlords and will encourage more landlords to exit the sector as well is discouraging new landlords from making a buyto-let investment.

“This means the number of available properties – already

not enough to meet demand –reduces even more and rents will continue to increase making rental property even more unaffordable for tenants.

“The issue of stock vs tenant demand is one we have seen for a number of years now and the constant challenges landlords have to face only make this problem greater and creates a negative impact for everyone.

“Landlords need to be given some relief and reasons for them to feel that rental investment is still a

great opportunity.

“If we continue to push good landlords out of the PRS, this will continue to put a strain on both landlords and tenants alike as well as the social housing sector.

“I will be writing to the chancellor Rachel Reeves MP to make our position clear – that any further financial burden on landlords will be detrimental to the sector, in particular tenants, the very group of people the government is trying to protect. She will need to think again.”

THE Q&A ZOOPLA EXECUTIVE DIRECTOR, RICHARD DONNELL

What do you feel is the single biggest issue affecting the private rental sector?

The primary issue affecting the private rented sector is the lack of

supply, which has been a key reason for the rapid increase in rents over the last three years. The rental market today is the same size as it was a decade ago at c.5.5m homes as new investment has slowed.

What can be done to improve the situation?

The quickest way to alleviate high rents is to grow the stock of homes for rent in both the social and private rented sectors. Growing housing supply is a key government target and it's vital the stock of rented homes is expanded across all tenures.

What's the best piece of advice you'd give to someone looking to become a residential landlord?

Investing in residential property is

all about the strength of the cashflow from the rental income after costs, rather than chasing or expecting strong capital gains. Focus on buying homes that are in demand, generate a good yield and don’t need huge amounts of investment, ideally with an A, B or C energy rating. Consider using a letting agent to help manage the property and adhere to all the new regulations. The complexity of being a landlord has increased in recent years.

The Renters’ Rights Bill is going to have a huge impact on the private rental sector when it becomes law. What are your thoughts – positive and negative – on the Bill?

The key parts of the Renters’ Rights Bill are already built into most landlord’s plans, although awareness is low on the full extent of the changes beyond section 21. If you are a landlord running your portfolio as a business and are focused on the cashflow over the long run, then the RRB isn't so bad for you as we are unlikely to see

a spike in sellers. We will continue to see some landlords deciding to sell at a slow and steady rate, but that has more to do with age and life stage than policy and regulation.

What part will letting agents and property portals play in the new, post-RRB, landscape? What do you see as the key trends emerging in the next five years? They will continue to play an important role in helping tenants find homes and supporting landlords’ decisions. The proposed introduction of minimum energy standards in 2030 will potentially have a larger impact on landlords deciding to sell than the RRB. A sizeable proportion of rented homes are EPC D or lower so need investment which may be too much for some landlords but hopefully most retrofits will come in as a reasonable investment.

Post-RRB, what do you think will happen to rents, yields and rental stock levels over the next five years?

Rents rise with earnings over the long run but the pace at which rents have risen recently means lower growth in the short term of 2% to 3%. Rents will keep increasing at an above-average rate in more affordable areas close to large cities. Less restrictive mortgage lending will help some higher-income renters leave the rental market to buy homes. This will mean slower rental growth in the higher rental price brackets, particularly in large cities. Despite improved conditions in the mortgage market, homeownership remains out of reach for a large proportion of households on lower to middle incomes with small deposits. This is a large and important group of private renters, who still face strong competition

Rent and supply pressures ease

The rate of rent increases in the private rented sector has fallen by around a third over the past year.

Data from the Office for National Statistics shows in the year to July 2025, average private rents increased by 5.9% across the UK, down from 8.6% in the year to July 2024.

The figures come alongside a slight easing of tenant demand, with property portals Zoopla and Rightmove showing signs of a nominal increase in the supply of rental housing.

However despite tenant demand dropping, Pegasus Insight’s Landlord Trends report for Q2 2025, shows it is still high.

It found 71% of landlords rate

tenant demand as “strong” in the areas they are letting properties. This is despite it being a drop of 11% year-on-year.

A third (33%) of the 794 landlords questioned said demand was “very strong” and 39% said “quite strong”.

Only 4% describe demand as “weak”, while 18% describe it as “average”.

This cooling follows a period of exceptionally high demand driven by low rental supply and sustained pressure on affordable housing. While levels remain high by historic standards, an easing in demand could affect rental growth, yields and investment appetite.

for rented property. Policymakers need to prioritise measures to grow the supply of affordable rented homes to boost choice for lower income renters.

Is buy-to-let still a good investment? Why should current landlords stay in the sector?

The motivations for being a landlord have changed. Today’s landlords are focused on strength of cashflow and rental income rather than letting rising house prices boost returns which was the motive in the 2000s. Almost two in five landlords bought their first property to live in and it is this group who are leaving the market as they never saw being a landlord as a business. It’s the larger professional landlords who remain seeing it as an income-focused business.

The report found 81% of landlords in Yorkshire and Humber reported “strong” demand and 36% “very strong”. By contrast, only 63% of landlords in the East Midlands thought demand was “strong”.

Sheldon Bosley Knight senior lettings manager Josh Jones said: “While tenant demand and average rents are easing, the simple fact is way more demand than housing available.

Josh Jones

Last call for SBK’s landlords and investor event

There is still time to sign up for an industry focused event later this month.

The Landlord and Investor Evening will be at Stratford-upon-Avon town hall on Thursday, September 18.

It will feature a series of short presentations from guest speakers covering a range of important topics including a market update, buy-to-let mortgages, taxation, the Renters’ Rights Bill, referencing and rent guarantee and EPC changes.

Sheldon Bosley Knight’s senior lettings manager, Josh Jones,

said: "The private rental market is currently undergoing significant transformations and so staying ahead of these changes is absolutely crucial for landlords.

“This event will provide in-depth, practical information on the latest legislative updates and evolving market dynamics – essential for our landlords to not only understand what is going on but to survive and thrive.

“We urge all landlords to join us to gain vital insights and discover how we can support you every step of the way for future success."

Protection from pet damage

A pet damage protection policy is being offered to buy-to-let investors ahead of the Renters’ Rights Bill becoming law.

Under the new legislation, landlords will not be able to refuse pets into a tenancy without very good reason.

While animals bring much-needed joy and companionship to tenants, they can also pose a risk to the landlord’s property. Damage can range from scratches on flooring and walls and chewed furniture or skirting boards to stains on carpets and damage in the garden. It can often be costly to repair,

and without proper protection, landlords may incur significant financial costs.

Costing £134.40 per year per tenanted property, insurance company Total Landlord’s new policy will provide landlords with up to £2,500 per period to cover loss or damage to buildings and contents (if insured) caused by pets. It is available for tenanted residential properties with up to three pets.

Landlords will need to have taken a traditional security deposit from the tenant in accordance with the

LANDLORD AND INVESTOR EVENING

Doors will open at 6pm for a 6.45pm start. Please email Josh Jones at jjones@ sheldonbosleyknight.co.uk or call 01386 444900 for more information or to sign up. Click on the link to listen to our latest podcast.

Tenant Fees Act and protected it with a formal tenancy deposit protection scheme.

Following the Bill’s passage through the House of Lords in July, there is still some uncertainty as to whether it should be the tenant or landlord to ensure they were adequately covered for any potential pet damage.

It is hoped there will be clarity when the Bill returns to Parliament

Mike Cleary MARLA

Co-Owner

Landlords eyeing up investment opportunities

Buy-to-let (BTL) investors are planning to add to their property portfolios in the next 12 months. In what is welcome news for the private rental sector, research by lender Landbay, found 52% indicated they would buy more stock.

It marks a rise from last year’s survey, carried out after the Autumn Budget in which only 27% said they planned to add more to their portfolios.

Last year’s Budget introduced a stamp duty increase for investment properties.

This year’s survey points to an increase in confidence among investors with nearly two thirds of those intending to buy (64%) saying they would factor in the

proposed stamp duty increase. Just over half (52%) said they would buy homes which needed little or no modification to meet future EPC deadlines.

Landbay polled its database of more than 1,500 buy-to-let landlords with portfolios totalling approximately 3,000 properties. While landlords plan to buy on average three more rental properties, some respondents are much more ambitious, planning to buy as many as 10 or more properties. Intention is well spread across the sector, with the biggest intention coming from nonportfolio landlords (less than four mortgaged properties) - at nearly a quarter – and from those with portfolios of between 16 and 30 properties (22%).

Lettings manager Claire Paginton said: “It’s great to see so many landlords aiming to add to their portfolios over the course of the next 12 months.

“Tenant demand remains high and looks set to remain that way as house prices continue to be out of reach for many first time buyers.

“Although rents have dipped a bit, they remain strong, as do yields and as you can see from the Investment Eye section later in this publication, there are plenty of buy-to-let opportunities available in the Midlands for those landlords looking to invest.

“If any of our landlords would like advice about how to grow their portfolio, please do get in touch.”

Landlords driving BTL mortgage activity

Limited company landlords are now significant drivers of buy-to-let (BTL) mortgage activity.

The latest Landlord Trends research from Pegasus Insight one in five landlords (20%) owns property through a limited company. The research also found 7% of landlords have their entire rental portfolio held within in a limited company, while 13% have a mix of individually-held and incorporated properties.

The average proportion of a limited company landlord’s portfolio held in this way has more than doubled from 36% in Q1 2020, to 74% in Q2 2025.

This increase is mainly driven by landlords incorporating at the point

of buying new rental property. Almost all those planning to buy a new investment properties in the next 12 months intend to do so within a limited company.

The research found incorporation is most common among portfolio landlords with four or more buy-tolet mortgages, with 34% of them having at least one incorporated property.

However, awareness of the specialist lenders operating in this market remains relatively low, suggesting many landlord borrowers may not know about the breadth of options available.

The findings come at a time when landlords are facing renewed regulatory and tax pressures,

including most recently, the rumours of a NI raid on rental income by the Treasury.

Against this backdrop, and the impact the forthcoming Renters’ Rights Bill will have, incorporation continues to appeal as a route to tax efficiency, suggesting room for further growth.

Sheldon Bosley Knight’s associate director Nik Kyriacou said: “It is always best to consult with a tax expert before setting up a limited company.

“However these figures show an upward trend in landlords looking to avoid some of the extra tax burdens and it’s clear it is becoming a more favourable route for many investors.”

• Allocated parking space

• Ground floor apartment

• Modern and well presented

• Convenient location and close to town

• Potential rent value of £825 pcm

• EPC - C

• 103 year lease remaining

• Two-bedroom flat in town centre location

yield of

£125,000

Street, Loughborough Gross yield of 6.2% £135,000

• Current rent value of £745 pcm

• EPC - C

• Convenient for University campus

• Highly sought-after location

and

Cadet Close, Coventry

Fennel

• A charming and characterful terraced home

• Excellent central location

• Perfect for a first-time buyer or investor

• Kitchen with built-in/fitted appliances

• Current rent value of £825 pcm

• No onward chain

• EPC - D

• End-terraced family home

• Ground floor W/C and upstairs bathroom

• Prime Earlsdon location

• Finham Park and Earlsdon Primary catchment

£185,000

• Current rent value of £1,200 pcm

• EPC - E

Road, Coventry Gross yield of 4.9% £190,000 SOLD

The Old Stables, High Street, Pershore

Poplar

Sheldon Bosley Knight is delighted to offer an off-market, exclusive opportunity of either individual plots or multiple unit discounted packages from developer David Wilson Homes. With various property styles there is plenty to suit your investment needs.

> Luxury three- and four-bedroom homes at Heritage Grange located just a short drive from Leamington Spa and Warwick.

> Built within 14.3 acres of green space, enjoy scenic walks and a family-friendly play area.

> Energy efficient homes with solar panels and EV car charging points.

> 20 minute drive to Leamington Spa and Warwick town centres with a regular bus service available.

> Close to the M40 motorway with easy links to Birmingham and Oxford.

> Discover countryside living with city convenience.

*Discounts and exclusive multiple unit packages are only available

For more information please contact Jack Richardson and the New Homes Team on 01789 333 466

via Sheldon Bosley Knight, and not direct with David Wilson Homes.

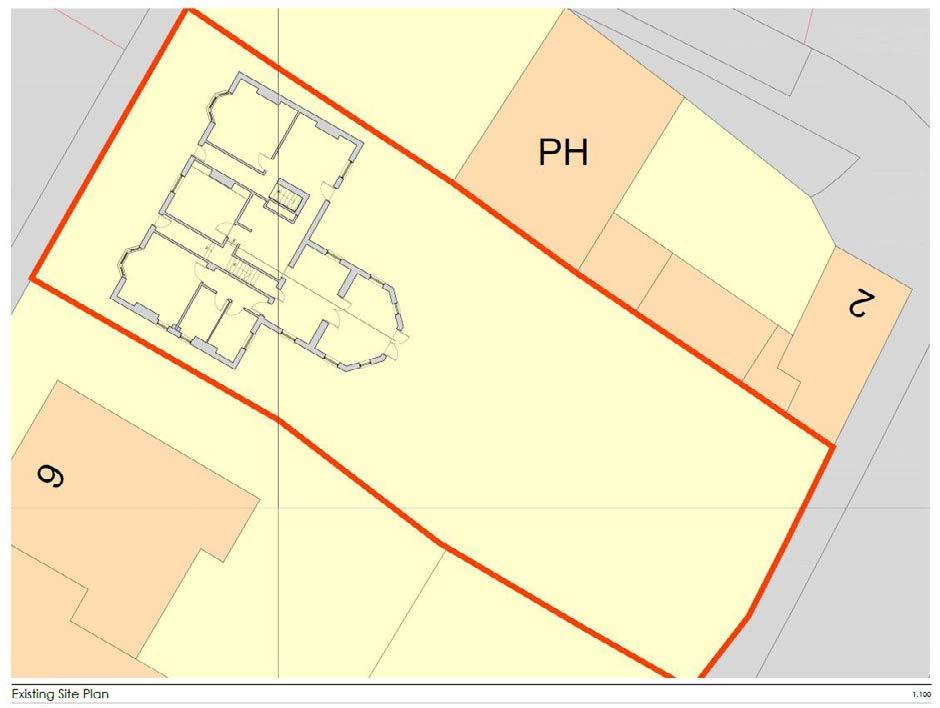

Knightthorpe Road, Loughborough

• Ideal development/investment opportunity (Subject To Necessary Planning Permissions)

• Currently three-bedrooms, with two additional multi-use rooms upstairs

• Current rent value of £15,00 pa

• Driveway, garage and workshop store with front and rear gardens

• Walking distance to railway station

• Secure gated development & CCTV

£195,000

Rodborough House, Coventry Gross yield of 6.5% £365,000

• 10 year Warranty & 999 yrs Lease

• Walking distance into City Centre (0.5 miles)

• Potential rent value of £1,995pcm

• Lift access

Kensington Road, Earlsdon, Coventry Potential

• Beautifully presented six-bedroom property

• No onward chain

• Fantastic Earlsdon location

• Six en-suites

• £650-£675 pcm per room

• Great addition to portfolio

• EPC - C

Church Street, Leamington Spa

• Prominent mixed use property with return frontage

• Newly refurbished

• Prominent for passing traffic

• Class E business and commercial

• Estimated rent of £26,600 per annum

• 144.15 spm (1,550 sq ft)

• EPC - E

Gross yield of 5.6% £430,000

• Development potential STPP

• Investment opportunity

• EPC - D Forest Road, Loughborough

• Current rent £20,000 per annum

• 255m2 (2,739.81 Sq Ft)

• Centrally located close to the town centre

Large Car park

LOCAL BRANCHES ACROSS THE MIDLANDS