LANDLORD TIMES

Monthly news for landlords brought to you by:

November 2025

RENTERS’ RIGHTS ACT BECOMES LAW

The Renters’ Rights Bill, which will see the biggest shake-up to the private rental sector in a generation, has finally received Royal Assent.

The Bill passed through Parliament at the end of last month and has now become law.

Housing minister Matthew Pennycook has not yet set out a timeline for when the reforms would take effect, but it is likely elements of the Act will go live from spring next year.

Some parts, such as the end of fixed term tenancies, an end to so called “no fault evictions” with

the abolishment of Section 21, an end to rental bidding wars and the right for each tenant to request a pet, are likely to be implemented first.

The Decent Homes Standard, the implementation of Awaab’s Law and the introduction of the ombudsman are thought to be brought in later.

Sheldon Bosley Knight’s director of lettings, Rebecca Dean said: “This is a seismic change for the private residential lettings sector and our teams have been working very hard to ensure we as agents, and our landlords and tenants,

have all the information needed to navigate what is to come.

“We’ll continue to work closely with our landlords to help them be prepared, understand the practical implications of these reforms and give them confidence to plan for the months ahead.

“Until we get a timetable for the changes to come into place, it is business as usual and there is no need to panic.

“However if any of our landlords or tenants would like advice or more information please do not hesitate to get in touch.”

Click above icon to view podcast.

Don’t tax landlords anymore!

Speculated tax increases on the private rented sector (PRS) risk causing economic harm and causing more landlords to exit the market.

That’s the message to chancellor Rachel Reeves from those within the sector ahead of this month’s budget.

The Treasury has been flying political kites in the last few months with ideas to fill the fiscal black hole of between £20bn and £40bn. These have included changes to capital gains tax and extending National Insurance (NI) to landlords’ rental income.

Propertymark is just one organisation warning the chancellor tax hikes will directly hurt the PRS saying it is already “overburdened by regulation and taxation”, making it harder for small investors to enter the market.

It wants the government to reinstate full mortgage interest tax relief, reduce additional property taxes on buy-to-lets, unify capital gains tax rates and reintroduce the Landlord’s Energy Saving Allowance to help fund energy efficiency improvements.

It added any proposal to apply NI contributions to rental income would worsen affordability and drive landlords out of the market.

This was echoed by the Intermediary Mortgage Lenders Association (IMLA) which said such a move would not apply to incorporated landlords, thus creating a two-tier system that would widen the gulf between individual and corporate property owners.

It said for many smaller investors the impact could be

devastating as it could push many landlords’ effective tax rates to unsustainable levels.

IMLA’s research found 58% of higher-rate taxpayers letting properties in their own name would face total tax and NI bills exceeding their entire rental profit and would be paying more than 100% back to the Treasury.

It said imposing NI on top could further reduce the number of buy-to-let properties, which has already fallen by more than 110,000 since 2022 and drive up rents as supply continues to contract.

IMLA’s analysis found while extending NI to landlords might raise around £2.2 billion annually, the damage to rental supply, market confidence and tenant affordability would far outweigh the benefit.

IMLA’s executive director, Kate Davies, warned it would be a short-sighted and self-defeating move.

She said: “Extending National Insurance to landlords’ rental income may appear an easy way to raise money, but in practice it would hit exactly the wrong people.

“It would punish smaller, often parttime landlords who provide homes for more than four million UK households, while leaving larger incorporated operators untouched. That is both unfair and

economically counterproductive.”

Sheldon Bosley Knight associate director Nik Kyriacou said: “We would urge the chancellor not to add extra financial burdens to landlords.

“At a time of great change within the sector, particularly now the Renters’ Rights Act has been passed, landlords need stability and confidence to stay within it.

“If landlords feel they are being targeted further, they will likely exit the market forcing tenants to look for places to live in a sector which already has a huge supply

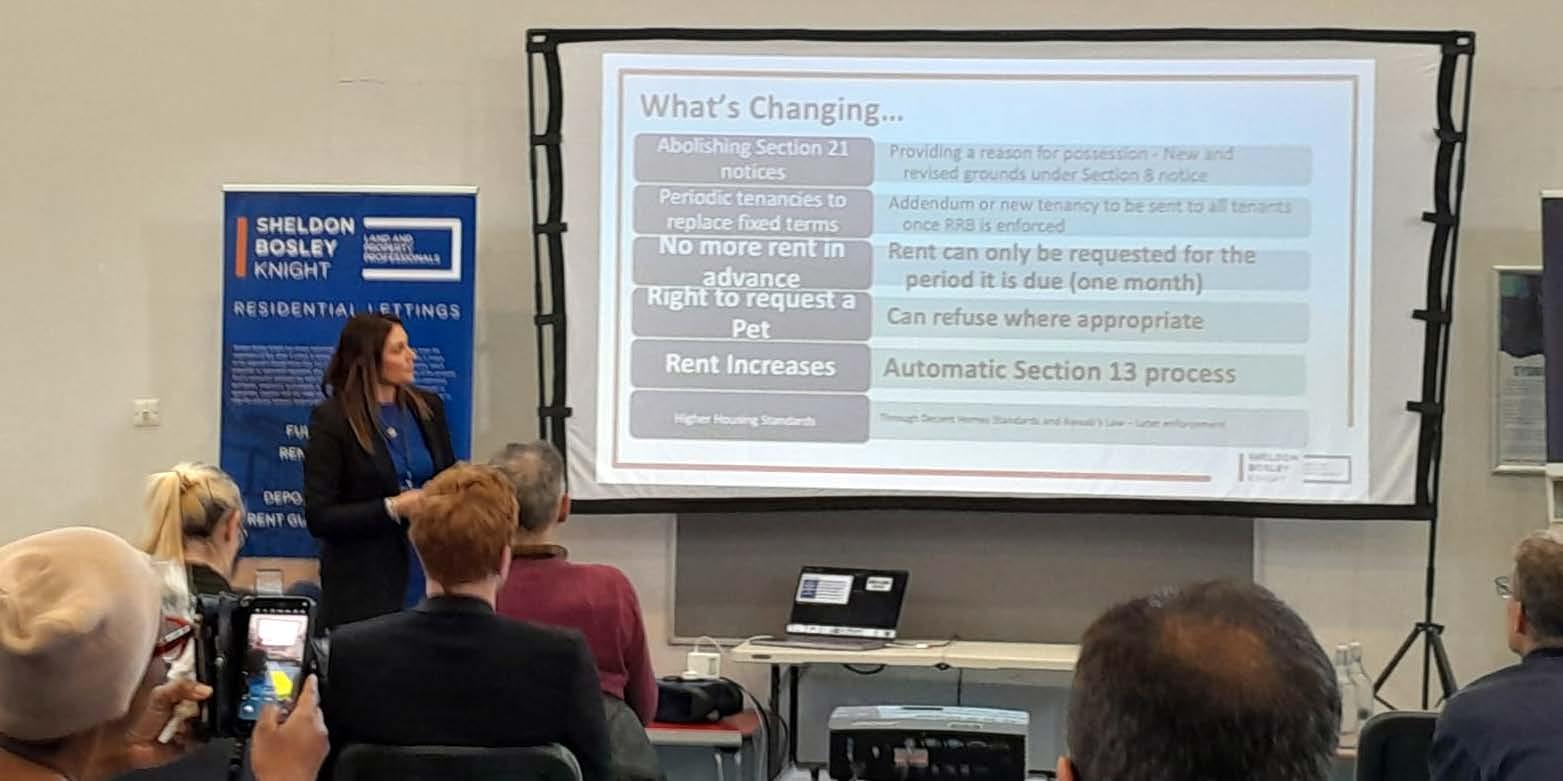

Good turnout for Landlord Forum

Landlords from across south Warwickshire came together to listen to a series of bitesize talks on a range of subjects focusing on the private rental sector.

Organised by Warwick district council and the Landlord Steering Group, the Landlord Forum featured updates on local licensing arrangements for HMOs, the Renters’ Rights Bill, tips for self-managing landlords and the benefits of solar panels.

Speakers at the event on October 22 at the SYDNI Centre in Leamington included

representatives from Sheldon Bosley Knight, the National Residential Landlords Association, Stratford Energy Solutions and the council.

In her speech to the 100 delegates who packed the room, Sheldon Bosley Knight lettings director Rebecca Dean gave an update on the Renters’ Rights Bill.

She said: “It is a challenging time for landlords, particularly those self-managing which is why events such as this are so important.

“When the Bill becomes law and enforceable it will be the most

significant shake-up of the rental market in a generation and it’s essential it works for both tenants and landlords.

“The government must engage properly with landlords to ensure all expectations are clear and comprehensive.

“However it is also vital landlords understand all that will be expected of them and the changes which are coming down the line.

“All the lettings teams at Sheldon Bosley Knight are here to help those who need advice or support in navigating their way through.”

Vital industry event for landlords

Landlords are being urged to come along to an industry focused event in Leicester next month.

The Landlord and Investor Evening will be at St Martin’s House, LE1 5PZ on Tuesday, November 18. It features a series of short presentations covering a range of topics including updates on the Renters’ Rights Act, financial advice, rent guarantee and referencing and EPCs. There will also be speakers from flatfair and Homelet.

Sheldon Bosley Knight’s lettings director, Rebecca Dean, said: “We are really excited to be hosting

our second Landlord and Investor evening just two months after our first.

“Our first evening was a huge success - the room was full landlords who were keen to hear all about what is happening in the industry and there was a lot of information shared.

“The feedback we received afterwards was fantastic and 100% of those who completed a feedback form said they would definitely attend another evening which confirms this is not an event to be missed.

“We are putting on these events

Abolish landlords?

The Green party has hit back at claims it wants to “abolish” landlords.

During its party conference a motion was passed calling for the party to “seek the effective abolition of private landlordism”.

It was in a package of wider measures including the introduction of rent controls, abolishing the right-to-buy and new taxation on Airbnbs and short lets.

Also proposed were councils being given first refusal when a landlord sold a property, double taxation on empty properties and a ban on

buy-to-let mortgages.

A programme of council house building, which had been included in the party’s manifesto, was also included in the motion.

In a statement to Landlord Times, Green party MP, Carla Denyer, said: "While the motion to conference had an eye-catching name, it does not actually ‘abolish’ landlords.

“It does however address the housing crisis, empowers tenants and improves their wellbeing.

It contains a range of policies which, over time, would reduce the proportion of the housing market that is privately rented, and

for the benefit of our landlords because we want to ensure they are educated and confident about the changes to come.

“So, if you have not registered your attendance then please reserve your spot by completing the form or contacting your nearest branch.

“It’s just two weeks until the event and we hope to see as many landlords there as possible.”

Doors will open at 6pm for a 6.45pm start.

Please email sophie.biddle@ sheldonbosleyknight.co.uk or call 01858 439080 for more information or to sign up.

increase the proportion of socially rented homes.

“The policies, many of which were contained in our 2024 manifesto, include the introduction of rent controls and giving councils powers to buy properties when landlords sell.

“The motion also calls for the mass building of council homes, which was another manifesto commitment, and adds a proposal for a state-owned housing manufacturer to support these efforts and innovate on housing design and manufacture.”

Millennials driving buy-to-let investment

In good news for the private rental sector (PRS) it’s millennials who are driving investment.

It is the first time this group has accounted for half of new shareholders in buy-to-let companies across England and Wales. Five years ago, they made up 40% of new buy-to-let shareholders.

Analysing the figures from Companies House, Hamptons says the rise of younger investors has helped sustain landlord purchases, even as tax hikes and tighter regulations have made the market more challenging.

Hamptons estimates millennials – those born between 1981 and 1996 – will create 33,395 new buyto-let companies in 2025. This will

be more than double (+142%) the number registered in 2020.

Nationally, landlords accounted for 11.3% of purchases in Q3 2025, a slight increase from 11.2% the same time last year.

The data shows investor activity has also shifted northwards, with the north east being the hotspot for investors who account for 28.4% of purchases.

Gen X, those born between 1965 and 1980, accounted for 33% of new shareholders in companies set up so far this year.

Baby Boomers, those born between 1946 and 1964 only accounted for 7% of new shareholders, reflecting the fact they are more likely to be winding down their portfolios or

passing on to the next generation.

Sheldon Bosley Knight’s senior lettings manager Josh Jones said: “This is great news for the industry. There had been some worrying headlines about what would happen when the Baby Boomers approached retirement, but this shows the younger generation is eager to get involved and see property as a good investment.

“I hope this trend continues because there is still a shortfall of accommodation in the sector and we need young, committed investors to come in and take over the reins.

“If any of our landlords would like advice as to how to expand their portfolio please do get in touch as we’d be happy to help.”

LUXURY RIVERSIDE

£188,000 STARTING PRICE GROSS YIELD OF 6%

Heritage Meets Modern Living

A stunning riverside development in the heart of Market Harborough’s Welland Quarter.

• Allocated parking space

• Ground floor apartment

• Modern and well presented

• Convenient location and close to town

• Potential rent value of £825 pcm

• EPC - C

• End-terraced family home

• Ground floor W/C and upstairs bathroom

Road, Coventry Gross yield of 4.9% £190,000

• Prime Earlsdon location

• Finham Park and Earlsdon Primary catchment

• Current rent value of £1,200 pcm

• EPC - E

Cadet

Poplar

Sheldon Bosley Knight is delighted to offer an off-market, exclusive opportunity of either individual plots or multiple unit discounted packages from developer David Wilson Homes. With various property styles there is plenty to suit your investment needs.

> Luxury three- and four-bedroom homes at Heritage Grange located just a short drive from Leamington Spa and Warwick.

> Built within 14.3 acres of green space, enjoy scenic walks and a family-friendly play area.

> Energy efficient homes with solar panels and EV car charging points.

> 20 minute drive to Leamington Spa and Warwick town centres with a regular bus service available.

> Close to the M40 motorway with easy links to Birmingham and Oxford.

> Discover countryside living with city convenience.

*Discounts and exclusive multiple unit packages are only available

For more information please contact Jack Richardson and the New Homes Team on 01789 333 466

via Sheldon Bosley Knight, and not direct with David Wilson Homes.

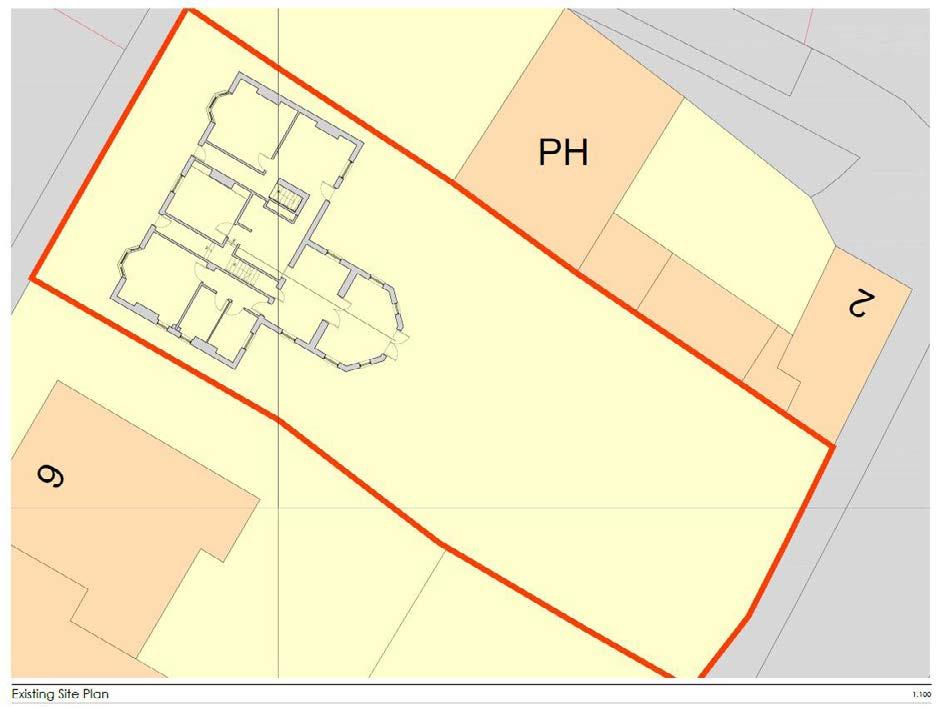

Knightthorpe Road, Loughborough

• Ideal development/investment opportunity (Subject To Necessary Planning Permissions)

• Currently three-bedrooms, with two additional multi-use rooms upstairs

• Current rent value of £15,00 pa

• Driveway, garage and workshop store with front and rear gardens

• Walking distance to railway station

• Secure gated development & CCTV

£195,000

Rodborough House, Coventry Gross yield of 6.8% £349,995

• 10 year Warranty & 999 yrs Lease

• Walking distance into City Centre (0.5 miles)

• Potential rent value of £1,995pcm

• Lift access

Kensington Road, Earlsdon, Coventry Potential

• Beautifully presented six-bedroom property

• No onward chain

• Fantastic Earlsdon location

• Six en-suites

• £650-£675 pcm per room

• Great addition to portfolio

• EPC - C

Church Street, Leamington Spa

• Prominent mixed use property with return frontage

• Newly refurbished

• Prominent for passing traffic

• Class E business and commercial

£450,000

• Estimated rent of £26,600 per annum

• 144.15 spm (1,550 sq ft)

• EPC - E

Gross yield of 5.6% £430,000

• Development potential STPP

• Investment opportunity

• EPC - D Forest Road, Loughborough

• Current rent £20,000 per annum

• 255m2 (2,739.81 Sq Ft)

• Centrally located close to the town centre

Large Car park

3-4

Court,

Bourton on the Water, GL54 2HQ

• The property comprises a modern two-storey industrial unit of approximately 373.05 m2 (4,015 ft2) GIA

• Suitable for B2 and B8 uses

• Current rental £34,000 per annum

• The property is let on a 6-year full repairing and insuring lease to Entwined Productions Ltd from 10th April 2024

• Modern, two-storey office extending to approx. 1,575 sq ft

• Let to Raycom Ltd on a five-year FRI lease from June 2022, providing secure income

• Bright office space with suspended ceilings, LED lighting, partitioned meeting rooms, kitchen & WC

• Current rental £14,500 per annum

• Situated in Abbey Lane Court, an established business park with on-site parking and easy access to A46 and Evesham town centre

£200,000

Hazel Court, Bourton on the Water

9 Abbey Court Lane, Evesham

• Generating £149,221 rental income per annum

• Service charge income of £38,962 per annum

• 1.35 acre freehold site with 3 high-quality bespoke office buildings

• Prior approval for conversion to 27 one- and two-bedroom flats Haddonsacre Business Centre, Station Road, Haddonsacre

• Thriving business park with landscaped gardens and ample on-site parking

• Planning permission granted to split flat into two x 1 bedroom flats

• Part exchange considered 9 Abbey Court Lane, Evesham Gross yield of ?.?% £825,000

• Highly desirable location

• Residential accommodation to be vacant upon sale

• Current rental £20,000 per annum

LOCAL BRANCHES ACROSS THE MIDLANDS