LANDLORD TIMES

Monthly news for landlords brought to you by:

October 2025

YIELDS REACH A 10 YEAR HIGH BUT RENT RISES ARE SLOWING

Buy-to-let profitability has rebounded strongly, with average rental yields now at their highest levels in a decade.

The latest Landlord Trends report (Q2 2025) from mortgage market specialist Pegasus Insight found the average rental yield stands at 6.5%, the same as the 10-year peak recorded in Q3 2024. Regionally, landlords in the East Midlands, north west and north

east report the strongest returns with averages of more than 7%. London has the lowest at 6.1%. Profitability is also robust with 87% of landlords saying they are making a profit. A fifth describe it as a “large” profit and 66% as a “small” profit. Only 5% report any loss.

Pegasus suggests this highlights the resilience of the buy-to-let market despite the backdrop of

looming legislative changes with the Renters’ Rights Bill likely to receive Royal Assent by the end of this month and ongoing tax pressures.

Elsewhere the report found the majority of landlords (61%) expect to increase rents in the year ahead. However this is fewer than the 78% a year ago.

For those intending to raise rents, the average anticipated rise is 6%,

compared with 5% in Q2 2024. Those expectations closely mirror official data from the Office for National Statistics which reported the average UK private rents have continued to rise strongly in the year to August 2025, climbing 5.7% to £1,348 a month.

Sheldon Bosley Knight’s assistant lettings manager Katie Fitzgerald said: “I hope these figures give confidence and reassurance to those landlords worried about the

impending financial and legislative changes.

“They show the sector is still a good place in which to invest albeit they do suggest the market is perhaps reaching its natural limit.

“Although yields and rents are still high, there was always going to come a point where they could end up being unaffordable given the demand for rental stock outweighs that of supply. I think

landlords are being very mindful of their tenants’ ability to afford the rent.

“However with the legislative and tax changes we know to be coming later this autumn, many investors are adjusting their rents now.

“If any of our landlords would like advice regarding rent levels, please do not hesitate to get in touch as we are here to help.”

“SMOOTH TRANSITION” FOR RRB

The government has promised a “smooth transition” to the new system once the Renters’ Rights Bill becomes law.

Housing minister Matthew Pennycook MP made the comments as the Bill entered Parliament for its final debates ahead of being given Royal Assent, now expected to be by the end of October.

However he stopped short of giving out details of implementation dates for specific measures within the Bill except for tenancies themselves which will immediately convert to the new system.

This has caused frustration for those in the private rental sector (PRS) who had hoped for clarity on when specific elements of the Bill would be implemented.

Speaking in Parliament as the Bill came back from the Lords Mr Pennycook said: “Following Royal Assent, we will allow for a smooth transition to the new system and we will support tenants, landlords

and agents to understand and adjust to the new rules.

“We want to make that change as smoothly and efficiently as possible and to introduce the new tenancies for the private rented sector in one stage.

“On that date, the new tenancy system will apply to all private tenancies: existing tenancies will convert to the new system and any new tenancies signed on or after the date will be governed by the new rules.”

The government rejected almost all the amendments proposed by the Lords when it came back to the Commons for further debate. This included allowing an extra deposit for tenants wanting pets.

As well as the new rules the Bill will bring in, the sector has also got a new housing secretary. Steve Reed MP was given the job following the resignation of Angela Rayner last month.

Sheldon Bosley Knight’s lettings director, Rebecca Dean, said: “With the Bill so close to

getting Royal Assent, I urge the government to give landlords an implementation timeline as soon as possible.

“Everyone, from landlords, tenants and the courts, needs to know what is expected of them and when as none of us can operate effectively and properly without.

“This Bill will have a seismic impact on the PRS and it’s imperative the government gets it right and gives everyone involved enough time to get to grips with it all.”

Matthew Pennycook Members/4520/Portrait

Most landlords have no plans to sell up

In good news for the private rental sector (PRS), UK landlords have no plans to sell up this year.

Nearly 60% of buy-to-let investors said they were committed to staying in the sector and had no intention of selling any of their properties in the next 12 months.

Research by Landbay found the figure was a jump from 47% in the previous survey last year, which took place immediately following the autumn budget.

Among those with no plans to sell, the strongest intention came from non-portfolio landlords with less than four mortgaged properties (32%), followed by nearly a quarter (24%) who own portfolios of between four and 10 rental properties.

Although there are some investors keen to sell, only 15% of respondents said they plan to sell up to 10% of their properties. Just

4% plan to sell up to a quarter of their portfolio, while less than one in 10 intend to sell up to 50% of their properties.

The survey found the biggest reason to sell was the prospect of regulation, such as the upcoming Renters’ Rights Bill. This was chosen by more than a third of those intending to jettison properties (35%) and closely followed by landlord taxation which was picked by 31% of respondents. In last year’s survey, this was chosen by more than half of landlords (51.4%).

Landbay polled its database of more than 1,500 buy-to-let landlords with portfolios totalling approximately 3,000 properties. In more good news, 52% of landlords saying they intend to expand their portfolios this year. This is up from just 27% in the previous year’s survey.

The survey took place before leaks

Free forum for landlords

Legislative changes, energy efficiency and the decent homes standard will be among the topics covered at an industry forum this month.

The Landlord Forum will take place at the SYDNI Centre in Leamington Spa on Wednesday, October 22 between 12.30 and 4pm.

Hosted by Warwick District Council it is being run in partnership with the local Landlord Steering Group and is sponsored by Sheldon Bosley Knight.

As well as the presentations, the free event will be a chance for

landlords to network and speak to and ask questions of the speakers and exhibitors which include a representative from the NRLA, the council, Tara & Co, the Tenancy Deposit Scheme and Act On Energy.

Sheldon Bosley Knight’s lettings manager Claire Paginton said:

“There are some great speakers at this month’s event and some very pertinent topics so we would encourage all our landlords to attend.

“We have supported it for many years now and it’s always wellattended and informative.

of potential Treasury plans ahead of the autumn budget which could see landlords paying National Insurance (NI) on their rental income.

Sheldon Bosley Knight’s lettings manager Meredith Redman said: “There is a lot of doom and gloom in the media regarding the PRS, not least as a result of all the legislative changes coming, so this survey is good news.

“Certainly from our experience, landlords are showing no signs of exiting the market, proving how robust and confident they feel.

“The fact some are actively looking to expand their portfolios is particularly welcome for tenants who are struggling to find somewhere to live.

“As ever if any of our landlords would like information or advice about how to maximise their investments, please do get in touch.”

“It’s a great way to ask questions, network and find out more about help and support available to landlords and investors particularly those who are let only.”

The forum takes place between 12.30pm and 4pm at SYDNI Centre, Cottage Square, Sydenham, CV31 1PT.

Free parking is available onsite. Email Warwick district council landlord liaison officer Balwant Rai, balwant.rai@warwickdc.gov.uk or call 01926 456733 to register.

LANDLORD AND INVESTOR EVENT

HUGE SUCCESS

It was standing room only at Sheldon Bosley Knight’s inaugural Landlord and Investor Evening.

Over 100 landlords packed Stratford-upon-Avon’s town hall to hear a series of presentations covering a range of topics including an update on the detail of the Renters’ Rights Bill, financial and accountancy information, rent guarantee and referencing and EPCs.

There were also plenty of questions specifically relating to the detail within the Renters’ Rights Bill.

Landlords and investors who attended the event, on Thursday, September 18, praised the content of the presentations.

Sue Collett said: “It was a very useful event with lots of information and advice. The tax presentation was particularly useful.”

Fellow landlord Sue Ayres said: “It was a very informative evening and Rebecca Dean’s presentation on the Renters’ Rights Bill was great with a lot of good information. The one on insurance was also good.”

Landlord Adam Simcox said the Homelet presentation was of great help. He said: “It reinforced why it’s sensible to use it. I was also especially keen to hear about the EPCs and updates there.

“Being kept up-to-date with what’s coming is crucial.”

Sheldon Bosley Knight’s senior lettings manager, Josh Jones, said: "The feedback from those who attended the event has been overwhelmingly positive.

“Our goal was always to equip our landlords with the knowledge they need to not only understand the changing private residential lettings landscape, but also to thrive within it.

“I am delighted we were able to deliver such a positive, informative and insightful event, one in which we reinforced our commitment to helping and supporting them so they remain complaint, profitable and confident.”

The next Landlord and Investor Event will be held in Leicester on Tuesday, November 18 at 6.30pm.

LAND& PROPERTYTALK Unplugged

SHELDON BOSLEYKNIGHT

Rental growth stalls and enquiries fall

Rental growth has stalled with 24% fewer enquiries from prospective tenants compared to a year ago.

The figures, from Zoopla’s Rental Market Report, reveals rental market conditions are the weakest they’ve been since 2020, although an improvement for tenants.

It shows rents are just 2.4% higher than this time last year, the slowest in four years and less than half the pace 12 months ago.

However they are still 36% higher than in 2020 which has made it attractive for landlords to invest in more properties.

It suggests a reduction in migration levels, more stable mortgage rates and rising incomes which encourage renters to buy property are among the reasons.

Average rents have increased by almost £80 per week over the last five years, adding up to an extra £4,100 a year. The average monthly rent now stands at £1,300pcm, up £30 over the last year.

In the West Midlands rents are up 2.4% to £932 pcm with the East Midlands seeing a 2.1% increase to £910.

However, five years of rapid increases has meant that rental growth has slowed down across most of the UK as a result of

affordability constraints.

Elsewhere the report says the number of homes available to rent has increased by 19% over the last 12 months.

The report suggests homeowners who are struggling to sell are choosing to rent out their properties instead, further boosting the number of available homes. This is giving renters more options and reducing the pressure.

Sheldon Bosley Knight’s lettings teams said they felt the figures were broadly in line with what they are seeing locally.

Evesham’s senior lettings manager Josh Jones said: “Since the start of September we have had a little dip and have had to reduce a couple of properties. The quality of enquiries isn’t always great.

“Add to that, from our recent landlord evening presentation and Rightmove stats, tenant demand has declined over the last few years so the figures Zoopla has suggested don’t come as a huge surprise.”

However regional lettings manager Jo Egan said: “We aren’t getting fewer enquiries but what we have noticed is those we are getting are of a lower standard.

“The level of enquiries for good

quality family homes is still high and we tend to have at least six viewers for each property.

“We have recently had a lot of oneand two-bedroom apartments on the market so that has generated interest from singles and couples, but we are due to have more family homes in the next week or two.”

In Leamington, lettings manager Claire Paginton said overall enquiries are slow due to the time of year.

She said: “In general we haven’t struggled with enquires or feel we have received fewer, however we have lost some tenants due to them purchasing properties.

“Leamington, Warwick and Kenilworth have seen a huge amount of new build developments which has aided this turnaround.

“However, any property of approximately £1,200 per month is letting rapidly.

“What has been noticeable is that of larger homes on the market which are taking longer to let as we are working with a smaller pool of affordability.

“A lack of local recruitment has also watered down the quality of applicants and slowed down our ‘rush’ of homes.”

Cadet Close, Coventry

• Allocated parking space

• Ground floor apartment

• Modern and well presented

• Convenient location and close to town

• Potential rent value of £825 pcm

• EPC - C

• 103 year lease remaining

• Two-bedroom flat in town centre location

of 8.2% £120,000

Street, Loughborough Gross yield of 6.2% £135,000

• Current rent value of £745 pcm

• EPC - C

• Convenient for University campus

• Highly sought-after location

and

Fennel

• A charming and characterful terraced home

• Excellent central location

• Perfect for a first-time buyer or investor

• Kitchen with built-in/fitted appliances

• Current rent value of £825 pcm

• No onward chain

• EPC - D

• End-terraced family home

• Ground floor W/C and upstairs bathroom

• Prime Earlsdon location

• Finham Park and Earlsdon Primary catchment

£185,000

• Current rent value of £1,200 pcm

• EPC - E

Road, Coventry Gross yield of 4.9% £190,000 SOLD

The Old Stables, High Street, Pershore

Poplar

Sheldon Bosley Knight is delighted to offer an off-market, exclusive opportunity of either individual plots or multiple unit discounted packages from developer David Wilson Homes. With various property styles there is plenty to suit your investment needs.

> Luxury three- and four-bedroom homes at Heritage Grange located just a short drive from Leamington Spa and Warwick.

> Built within 14.3 acres of green space, enjoy scenic walks and a family-friendly play area.

> Energy efficient homes with solar panels and EV car charging points.

> 20 minute drive to Leamington Spa and Warwick town centres with a regular bus service available.

> Close to the M40 motorway with easy links to Birmingham and Oxford.

> Discover countryside living with city convenience.

*Discounts and exclusive multiple unit packages are only available

For more information please contact Jack Richardson and the New Homes Team on 01789 333 466

via Sheldon Bosley Knight, and not direct with David Wilson Homes.

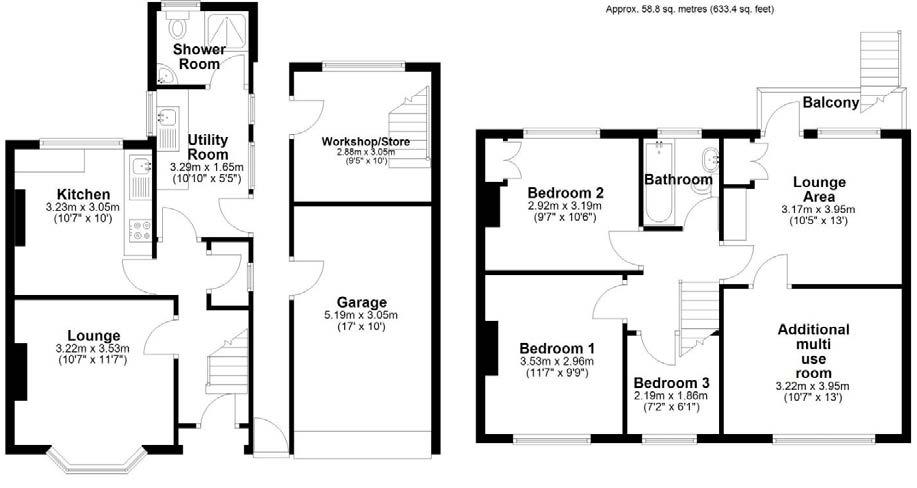

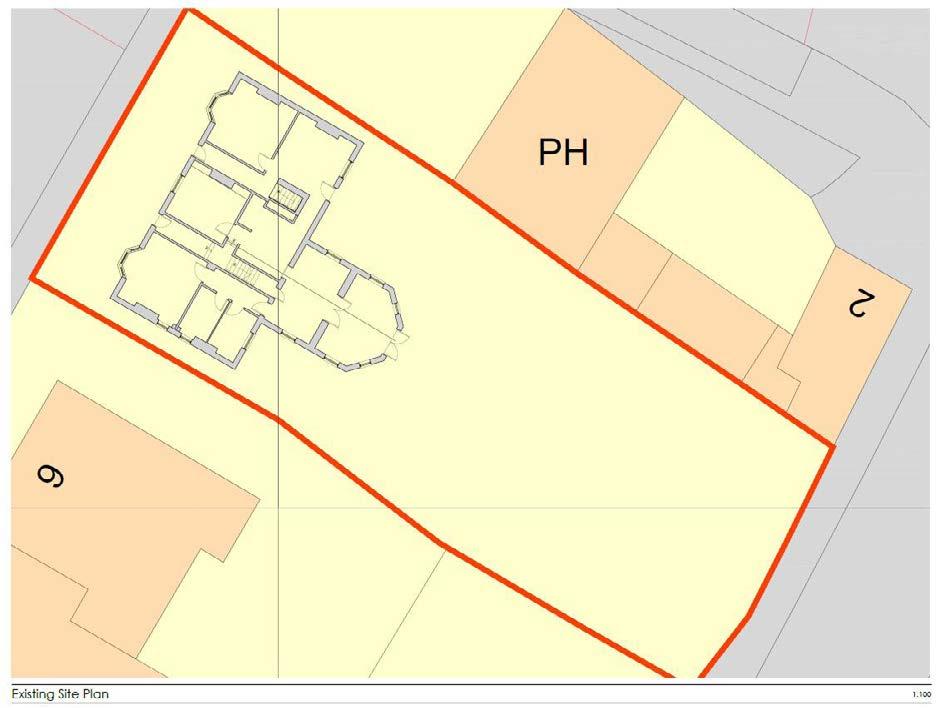

Knightthorpe Road, Loughborough

• Ideal development/investment opportunity (Subject To Necessary Planning Permissions)

• Currently three-bedrooms, with two additional multi-use rooms upstairs

• Current rent value of £15,00 pa

• Driveway, garage and workshop store with front and rear gardens

• Walking distance to railway station

• Secure gated development & CCTV

£195,000

Rodborough House, Coventry Gross yield of 6.8% £349,995

• 10 year Warranty & 999 yrs Lease

• Walking distance into City Centre (0.5 miles)

• Potential rent value of £1,995pcm

• Lift access

Kensington Road, Earlsdon, Coventry Potential

• Beautifully presented six-bedroom property

• No onward chain

• Fantastic Earlsdon location

• Six en-suites

• £650-£675 pcm per room

• Great addition to portfolio

• EPC - C

Church Street, Leamington Spa

• Prominent mixed use property with return frontage

• Newly refurbished

• Prominent for passing traffic

• Class E business and commercial

• Estimated rent of £26,600 per annum

• 144.15 spm (1,550 sq ft)

• EPC - E

Gross yield of 5.6% £430,000

• Development potential STPP

• Investment opportunity

• EPC - D Forest Road, Loughborough

• Current rent £20,000 per annum

• 255m2 (2,739.81 Sq Ft)

• Centrally located close to the town centre

Large Car park

LOCAL BRANCHES ACROSS THE MIDLANDS