Resolving Healthcare Claim Disputes and Denials

At the heart of expecting the unexpected

Get the peace of mind and support it takes to self-fund your healthcare.

Self-insuring your healthcare benefits can open up new possibilities for your business — affording greater flexibility in how you manage your healthcare spend. Trust the expert team at QBE to tailor a solution that meets your unique needs.

We offer a range of products for protecting your assets, your employees and their dependents:

• Medical Stop Loss

• Captive Medical Stop Loss

• Organ Transplant

We’ll find the right answers together so no matter what happens, your business is prepared.

By Laura Carabello

By Laura Carabello

By Joanne Wojcik

By Bruce Shutan

Alston & Bird, LLP Health Benefits

Resolving Healthcare Claim Disputes and Denials

WhatWWritten By Laura Carabello

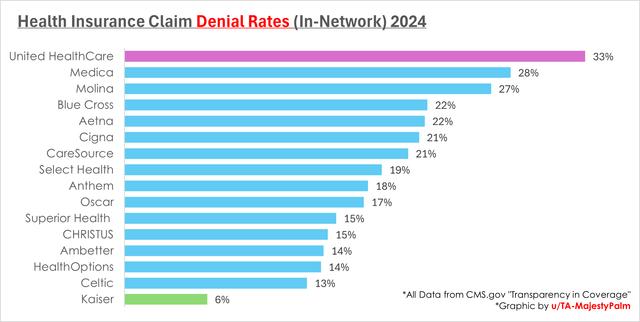

industry observers describe as the ‘new normal,’ record-high statistics on the rate of claims denials are anything but comforting to healthcare providers and plan members alike.

In the newest analysis of more than four billion claims by the health analytics company, Komodo Health, prescription drug denials by private insurers in the US jumped 25 percent from 2016 to 2023. While most private insurers keep that information confidential, Komodo draws from private databases that collect denial details from pharmacies, insurers, and intermediaries.

Meanwhile, the American Medical Association reports that denial rates jumped to 11% in 2023, up from 8% just two years prior. Healthcare revenue cycle management professionals at Aspirion advise that for an average health system, this translates to approximately 110,000 unpaid claims—a financial burden that no healthcare organization can afford to ignore.

In fact, the American Hospital Association reports that nearly 15% of all claims submitted to private payers initially are denied, including many that were preapproved during the prior authorization (PA) process. Overall, 15.7% of Medicare Advantage and 13.9% of commercial claims were initially denied.

In the opposite corner of the ring stand self-insured employers that need a comprehensive strategy to address claims disputes and denials -- issues that impact employee satisfaction, increase administrative burdens, and can lead to financial losses. These matters increasingly confront plan sponsors as they face tougher compliance scrutiny than ever before – from complex treatment reviews to urgent appeals.

In contrast, the insurance trade organization AHIP says that health plans approve the majority of claims submitted. In a statement, AHIP spokesperson Chris Bond stated, "There are valid reasons for the small percentage of claims subject to further review, and we recognize this can be frustrating. ... An appeal is always available for patients and providers with internal and external review processes in place and communicated to health plan members."

CAN EMPLOYERS DO MORE TO EASE THE BURDEN ON PROVIDERS?

A recent survey conducted earlier this year by Delaware-based Intelliworx reports that healthcare providers ‘chafe’ when insurance companies second-guess their medical decisions. Half of the providers surveyed said that employers could do more to ease the weight of denials and help them manage these challenges. They contend that the frustration level has grown to the extent that nearly 4 in 10 providers have considered quitting.

PLAN PARTICIPANTS CAUGHT IN THE MIDDLE

Christine Cooper, CEO of aequum, which represents plan members with dispute resolution on both the Federal and State level, says, “The member needs someone on their side to navigate the complex world of claims processing and medical billing. Plan members benefit from advocacy during claim disputes.”

She says that often, when the NSA does not apply, “The plan member can be caught in the middle of their health plan and the provider. It is not unusual for members to receive bills -- maybe even for the full billed charge -- as disputes regarding medical necessity or other reasons for denial are ongoing.

Cooper rightfully maintains that the member deserves an advocate to aid them through the claim resolution process.

For Peggy Plair, Senior Director of Claims, UnitedAg, providing member advocacy can reduce the stress and burden on the member and, ultimately, increase satisfaction with their health plan. She acknowledges that claim disputes are just part of doing business, noting, “Members should absolutely have the right to question a decision if they think something was processed incorrectly. But one of the biggest challenges we see is that members and providers often

don’t fully understand what’s covered under their plan — especially when they appeal decisions for services that aren’t included.”

When it comes to making determinations, she states that external review agencies, both state and federal, tend to side with the member.

“That can be good or bad, depending upon the case and how much clinical detail is involved,” says Plair.

One area that she feels is often misunderstood is medical necessity, adding, “We’re not here to override the provider, but we do want to advocate for our members. It’s about making sure they get the right care, at the right time, for the right reasons. That’s where TPAs can really help — by balancing clinical needs with what the plan allows and helping everyone make sense of it.”

Chris Harber, chief operating officer at Vālenz Health®, contends that plan members should largely be excluded from the dispute process, adding, “The extent of their involvement should be following the appropriate channels through their TPA. TPAs and vendors should be responsible for ensuring all member communication from the provider ceases, so we can engage in coming to a reasonable resolution. Therefore, the first step of the resolution process should always be a request that the provider puts the patient account on hold.”

DISPUTES OR DENIALS – WHAT’S THE DIFFERENCE?

Claims Disputes

Disputes are initiated when the denial is believed to be incorrect or unjustified. The process usually involves gathering additional documentation, submitting an appeal, and potentially engaging in further review or legal action. Essentially, this term reflects a difference of opinion regarding what the provider should be paid for its services.

Claim Denials

A claim denial applies to a claim that has been processed and found to be unpayable. This means the insurer has finished reviewing the

Chris Harber

Christine Cooper

claim and decided not to pay based on the policy. Claim denials fall into three categories: administrative, clinical, and policy, with the majority of claim denials due to administrative errors. Denials can happen for various reasons, such as missing information, incorrect billing codes, lack of pre-authorization, or the service being deemed not medically necessary. Providers typically appeal the denial to attempt to get the payment.

“Coverage denials are becoming more frequent and more legally fraught,” says Bruce D. Roffé, president and CEO, H.H.C. Group. "As insurers and TPAs lean into AI-based tools and automated decision engines, the margin for error grows. Denials issued too quickly or without clinical rigor are increasingly challenged by members, regulators, and courts.”

When a dispute gets out of control, Roffé explains that the consequences can include:

• Compliance breaches that lead to investigations or fines.

• Litigation risks that drain resources and damage credibility.

• Unpaid claims ballooning into larger financial liabilities.

• Reputation loss that undermines confidence with plan participants.

“In most states, once the internal appeal process is exhausted, insurers must refer the external review to the state, which assigns it to an approved Independent Review Organization (IRO)," he continues. "In others, insurers can contract directly with an IRO like H.H.C. that is fully equipped to support both pathways. Having a medical review process in place isn’t enough. It must be structured, defensible and trusted—internally and externally.”

He describes that what used to be routine coverage decisions are now potential compliance flashpoints, adding, “Minor disputes are under legal and regulatory microscopes and outdated processes; slow responses or patchwork expertise can put an entire plan at risk. In today’s environment, it’s not enough to stay compliant. Plan sponsors need to lead with confidence and promote faster resolutions, airtight compliance and decisions that stand up to any challenge.”

With all that has transpired in the last year, claim denials are now under the microscope for many organizations.

Mayo Clinic provides the right answers with the right care

Complex is costly. Did you know that, on average, 1% of employees account for 30% of overall health costs2? This is often due to complex, misdiagnosed or undiagnosed medical conditions.

The Mayo Clinic Complex Care Program helps employers simplify the complex, by providing quick and easy access to the top-ranked hospital in the world. Our collaborative approach to medicine helps minimize costs and frustrations by identifying the right patients and delivering the right diagnosis and care.

Harber affirms, “Whether it be pre-certification denials or post-service claim appeals, the Vālenz Health® goal is to ensure we are looking out for the best interest of the plan and the employer by executing based on their plan document. While there are certain guidelines and processes vendors can put in place, they should be done with the best intentions of the plan and its participants — meaning we should make informed decisions based on their expectations. Denials only become an issue when a party in the value chain has an incentive for them to be."

Vālenz Health® is involved in dispute resolution, primarily at the federal level and occasionally at the state level.

“We handle as much of the process as a group or TPA is willing to cede to us,” states Harber. “As a cost-containment vendor, we have the data and resources to support complex negotiations and provide the required support should a claim enter IDR. This includes assistance with IDR fees and final offer submissions that provide detail on each decision point the IDR entity may use to make a decision.”

Addressing the issues of claims denials and appeals – not disputes related to the No Surprises Act -- Joanna Wilmot, director, PACE® (Plan Appointed Claim Evaluator®), The Phia Group, offers this perspective of a consultant, not a plan sponsor:

"As a vendor working in the appeal space, when a plan design, supporting policies and a claim system are developed and applied accurately, the claim denial rate should mirror the plan's intent," says Wilmot. "However, with economic concerns, the denial rate could increase if a plan is looking to reduce its expenses by reducing benefits. If a plan is well designed and well applied, a reduction in benefits becomes a moot point. PACE relies upon the plan language, policies, and procedures to make a non-biased decision regarding any claim denial. “

Her organization determines medical necessity by collecting and submitting medical records and claimrelated documents to physicians specializing in the related medical condition at a URAC-accredited organization.

HIGH-COST MEDICAL CLAIMS REQUIRE HIGH-POWERED NEGOTIATIONS

Lower your expenses on in- and out-of-network claims with savings as high as 90%

STOP LOSS INSURANCE

Prudential’s Stop Loss insurance helps reduce unpredictable risks from self-funded medical plans. This way you can focus on giving your employees the coverage they deserve, while helping to reduce your worries about the increased frequency of catastrophic claims.

Get Stop Loss insurance from a partner you can rely on:

• A highly rated, experienced carrier recognized for 150 years for strength, stability, and innovation

• Efficient, responsive service with streamlined processes across quoting, onboarding, and reimbursements

• A dedicated distribution team that works hand-in-hand with your existing relationships

• Flexible policy options so we can build a coverage plan that meets the unique needs of your organization

Did you know, medical and prescription drug costs are expected to rise 8.5% annually.* See how Prudential can help you manage the risk from your self-funded medical plan.

For more information, contact us at stoploss@prudential.com or visit our website: www.prudential.com/stoploss

She says that often, plan members require support or advocacy regarding claim disputes, adding, “Yes, we see plan members require support, and this comes from the administrator or another advocate group. Many appeals that we evaluate are submitted by the medical provider on behalf of the member.”

Source: 2025 Forvis Mazars

Julie A. Wohlstein, M.A.S., CSFS, board member, HCAA, president/CEO, Centrix Benefit Administrators, Inc., offers this perspective from the vantage point of a TPA: “We view claim disputes and denials not as administrative hurdles, but as opportunities to reinforce our value to both plan sponsors and members. While denial rates themselves aren’t our primary concern, the clarity and consistency behind those decisions are. Our role is to ensure plan documents are precisely interpreted, and that claims are adjudicated fairly, transparently, and in alignment with ERISA and applicable state or federal laws.”

She explains that medical necessity and appropriateness determinations follow evidence-based criteria and URAC-accredited guidelines, though her organization regularly engages an IRO for nuanced or emerging treatments.

“We also participate in dispute resolution at both the state and federal level, particularly with increased regulatory scrutiny under the No Surprises Act,” she continues. "In our experience, claim resolutions— especially in arbitration settings—have increasingly leaned in favor of providers, which can create sustainability concerns for self-funded plans. This makes proactive oversight and rigorous plan design more important than ever.”

Conceding that plan members often feel lost navigating denials, Wohlstein observes, “Yes—they do require support. We see advocacy not as optional, but essential. Educating members, communicating clearly, and walking them through their options preserves trust and strengthens the long-term success of the plan.”

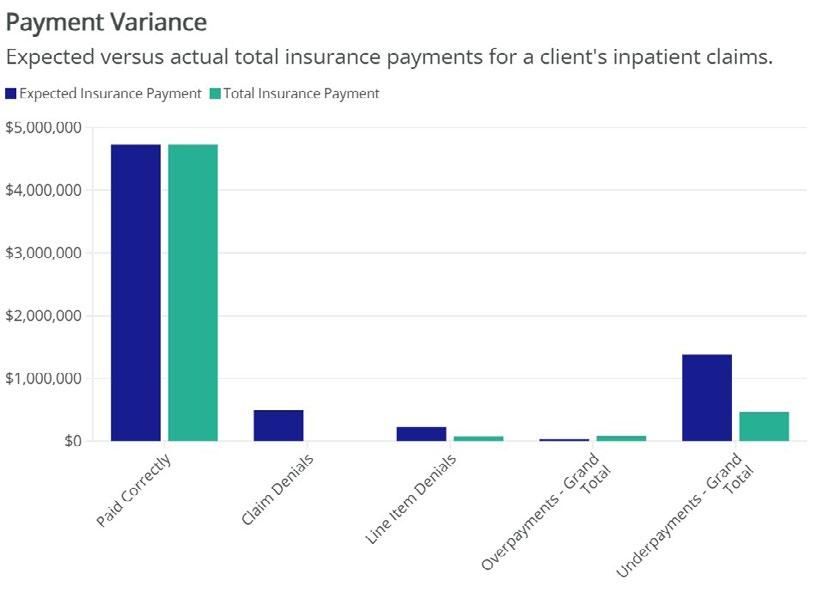

IMPORTANCE OF CLAIM PAYMENT INTEGRITY

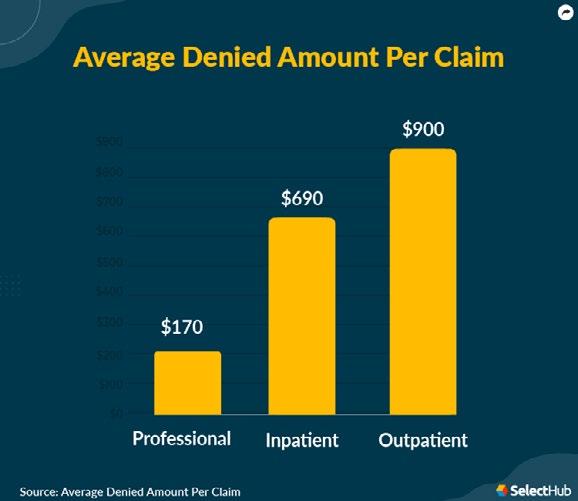

High-dollar facility (inpatient and outpatient) claims pose significant financial risk for health plans, employers, reinsurers and TPAs. In recent years, plans have reported seeing a significant rise in potentially undetected charge irregularities, resulting in significant financial challenges across the sector.

In FY2024, CMS reported over $85 billion in improper payments, primarily due to overpayments. Wrongful billing practices can range from duplicate and redundant billing, upcoding, charges for non-covered services and differences for services received by the patient yet billed at a higher intensity or acuity.

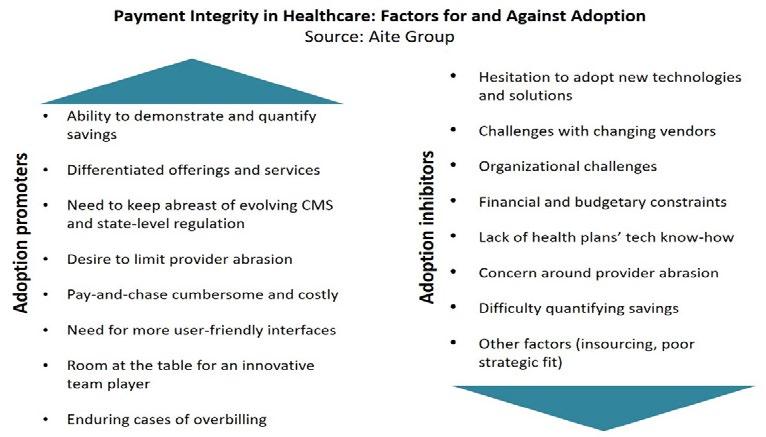

If undetected, these practices lead to substantial financial losses for health plans and overstated costs of care. This underscores the importance of payment integrity, which is based on due diligence charge reviews and identification of charge adjustments to ensure that claims are paid timely and accurately.

Jakki Lynch, RN, CCM, CMAS, CCFA, director of cost containment, Carbon Stop Loss Solutions, maintains, “Claim payment integrity processes are a best practice solution to address the increasingly complex claims and to proactively ensure correct health plan or third-party administrator payments based on defined plan benefits. Payment integrity processes should include a detailed review of each charge and supporting medical records performed by specialty clinicians, the determination of plan-covered services, and the validation of charge accuracy based on transparent industry references and plan payment policies.”

She says that these processes support timely claim review and payment due diligence to ensure plans control costs, address regulatory compliance, and ensure fair and defensible payments to providers and facilities.

“Our complex claim payment integrity review program is not a formulaic or software-based solution as these reviews result in limited savings and they do not identify high-value key clinical charge adjustments and communicate the findings to the providers and facilities to ensure consensus for resolution and payment transparency,” she continues. “Charges identified on a claim that are determined to be not separately payable stem from a combination of plan policy and regulatory compliance. Identifying the distinct charge adjustments and supporting them with the detailed references (Plan and

Jakki Lynch

Regulatory) to substantiate the audit exceptions is material to the defensibility and final claims settlement based on our work product.”

Lynch offers these guidelines when evaluating plan-eligible charges:

• Are they investigational, experimental, or unproven?

• Are they effective and safe?

• Are they plan benefits since coverage is based on the definitions identified in the plan document, and in accordance with the services documented in the medical record?

At Vālenz Health®, Harber states that the company leverages comprehensive evidence-based criteria developed via a thorough review of the most recent research, academic articles, and data.

“To ensure the most accurate information, we leverage review by a third-party vendor and only update criteria when there’s a preponderance of evidence that something should be covered," he explains. "In other words, just because something has worked in an experimental use case does not mean that we would approve it in the same use case. Instead, we require additional research, literature, and data to conclusively confirm that this is the right clinical care in the right clinical setting (i.e., inpatient vs. outpatient) under the correct clinical circumstances.”

PRIOR AUTHORIZATION QUANDARY

In virtually every discussion of healthcare claims denials, issues around Prior Authorization (PA) of treatment and services rise to the top. Receiving PA does not automatically ensure payment, although it is a crucial step in the process and indicates the payer’s intention to cover the service.

As providers view denials as a growing problem, a recent AMA survey shows that 61% of physicians fear payers’ unregulated use of AI tools will increase prior authorization denials. They point to a payer's automated decision-making system as the culprit in creating systemic batch denials with little or no human review.

PA is not a definitive guarantee of payment, and it is not binding. Claim reviews following a service may deny payment for various reasons, such as member eligibility or coverage status on the date of service. Here are some of the other reasons for potential denials:

• Retrospective review by the payer that deems the service experimental, unnecessary or that the provider billed for a different service than the one authorized.

• Ineligibility or benefit limitations that deem the service not medically necessary or inappropriate for the healthcare setting.

• Incorrect paperwork, missing information, or outdated information.

• Payer failure to notify the pharmacy/provider of the approval.

• Expired approval, since PAs are typically only valid for a limited time period, and resubmission may be required.

• Failure to try a less expensive option before approving more costly alternatives.

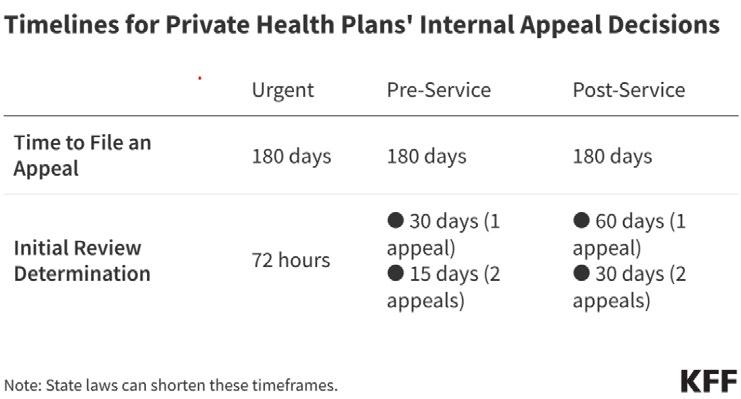

UNDERSTANDING THE REVIEW AND APPEALS PROCESS

Essentially, self-insured employers should focus on a proactive and data-driven approach to claims denial management. By preventing errors in the first place, implementing efficient claims processing systems, and strategically managing the appeals process, employers can significantly reduce denied claims, improve cost-efficiency and enhance the overall experience for their employees.

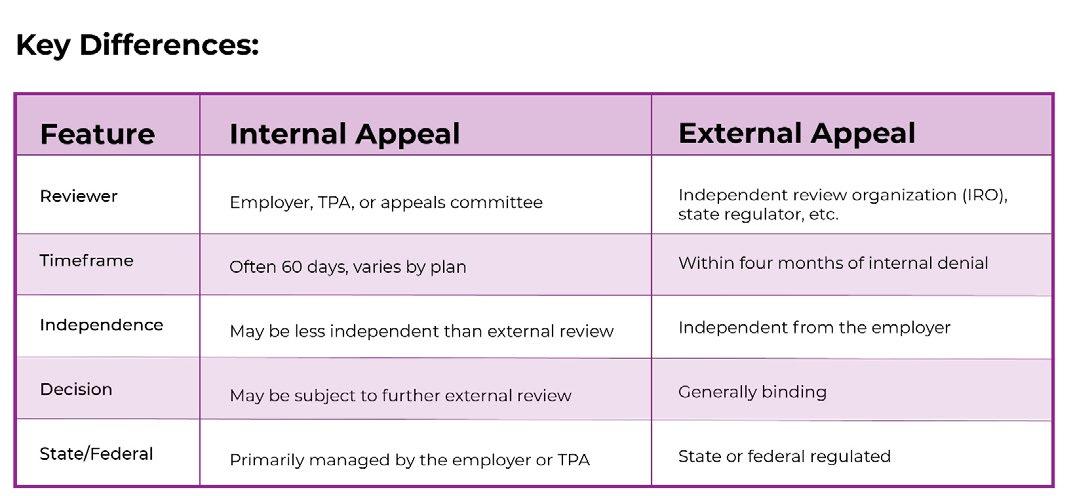

Self-insured employers use two main types of appeal processes for healthcare claims: internal and external.

INTERNAL REVIEWS AND APPEALS

Internal appeals are handled by the employer or their thirdparty administrator (TPA) to make critical decisions about medical necessity, experimental treatments, and clinical appropriateness. The initial appeal is handled within the employer's health plan or by their TPA and typically adheres to a timeframe for filing after receiving a denial. If the internal appeal is denied, the claimant can proceed to an external appeal.

Under self-insured plans, the employer assumes responsibility for all financial risks of claims and costs. For administrative convenience, self-insured plan sponsors typically rely on a TPA to make claims decisions and handle internal appeals.

“When the health plan’s internal team or TPA lacks a specific specialty or when time is short and objectivity matters, an outside resource like H.H.C. Group provides board-certified experts who step in with fast, unbiased, evidence-based opinions that support plan integrity and protect against downstream risk,” explains Roffé. “These reviews are your frontline clinical decision support and are essential for preventing costly coverage errors. Responding quickly to complex or high stakes claims and strengthening claims defensibility before external escalation. Internal reviews that defuse problems early and keep decisions aligned with medical necessity turn disputes into decisive wins.”

EXTERNAL REVIEWS AND APPEALS:

External reviews must be conducted by an IRO that is approved by the state, which recognizes the organization's clinical excellence, compliance standards and operational reliability.

“External reviews are typically assigned by state regulators when a member challenges a denial,” clarifies Roffé. “These reviews carry legal weight and must be handled with precision, providing fair, balanced and

fully documented reviews that meet or exceed state requirements. Stakeholders call upon an organization like H.H.C. Group to ensure that disputes are resolved cleanly, with no regulatory gaps or friction.”

An Independent Review Organization like H.H.C. Group directs its board-certified specialists to determine if the insurer must provide coverage and decide whether or not to pay for the treatment or service. Coverage questions usually regard medical necessity, medical appropriateness or whether the treatment is experimental or investigational.

An Independent Review Organization like H.H.C. Group directs its board-certified specialists to determine if the insurer must provide coverage and decide whether or not to pay for the treatment or service. Coverage questions usually regard medical necessity, medical appropriateness or whether the treatment is or is not experimental.

At Carbon Stop Loss Solutions, Lynch explains, “Our process utilizes a proactive facility outreach to resolve the audit adjustments based on the detailed work product. This approach is resource-intensive and demonstrates a good-faith effort based on engagement and transparency to encourage dialogue and resolution of the audit exceptions while demonstrating to the facility that we stand behind the quality of the audit findings.”

She says this proactive approach often results in facility acceptance of the payment integrity charge adjustments, reducing potential appeals, provider abrasion, and effectively mitigating member balance billing.

Lynch expands, “Our claim review determinations are nearly absent appeals (3-4%) due to findings that are thoroughly documented from medical record excerpts and substantiated using provider-considerate means of resolving the issues identified. All appeals are addressed fairly and timely as a part of the overall process and are based on the facility documentation provided for potential charge payment consideration.”

Lynch and colleagues coordinate their appeal responses with TPAs or Health Plans to ensure alignment and compliance with plan appeals procedures.

“Our

Brad Hansen VP of Provider Relations

OUT-OF-NETWORK DISPUTES: WHO’S WINNING?

A much higher volume of out-of-network pay disputes was being filed and processed through the first half of 2024 than during 2023, reports Health Affairs Forefront. While federal government data shows that cases remain concentrated among a small handful of states and large provider groups, providers are still topping health plans in most out-of-network pay disputes.

The report reviewed independent dispute resolution (IDR) cases and outlined a continuation of plans’ low win rates: 14% of resolved cases in the first quarter of 2024 and 18% of resolved cases in the second quarter of 2024.

The Georgetown University researchers who conducted the analysis concluded that in cases where plans prevailed, the median prevailing offer amount was 105% of the qualifying payment amount (or the QPA, the price point used during the arbitration process that is meant to represent the median amount an insurer would pay for a service in a particular region.

These analysts demonstrate that historically, provider groups have initiated the majority of IDR cases, with a high volume in just a few states like Texas, Florida, and Arizona. What they say is escalating is the amounts they won: While median prevailing provider offers ranged between 320% and 350% of QPA across 2023, they rose to 383% in the first quarter of 2024 and even higher to 447% in the second quarter of 2024.

Amid providers’ greater share of wins, the researchers also noted that resolved cases “predominantly” came from a few large provider organizations that tended to have private equity backing.

Cooper adds this observation, “If we are talking about NSA IDR awards, then yes, claim resolutions are primarily in favor of providers rather than payers. This is backed by the statistics each time they are released by the government. However, with the recent decision out of the 5th Circuit in Guardian Flight, LLC, et al. v. Health Care Service Corporation, holding that there is no mechanism for providers to enforce the awards, the awards are useless. This was a huge oversight by Congress in drafting the NSA.”

As background, there is no provision in the No Surprises Act that allows the provider to sue to enforce the IDR awards. The NSA does not provide any private right of action for a provider -- or plan. For that matter,

We get the basics right.

Health plans can be complex. Relationships shouldn’t be.

Our dedicated account management teams have decades of expertise and knowledge in the self-funded landscape. They pride themselves on delivering to meet your needs, no matter the scale of plan or program. And they’re always just a call, text, or email away.

When you need solutions, AmeriHealth Administrators has them.

Experience. Insight. Support. How it should be. Let’s start our relationship today. Visit amerihealthtpa.com.

to bring an action under the NSA for enforcement or reversal of the award.

The court decision referenced above technically only applies to the 5th Circuit (Texas, Louisiana, and Mississippi). While some courts may not agree with the decision, Cooper says other courts may adopt the decision, potentially the US Court of Appeals for the Second Circuit, located in New York City, that exercises appellate jurisdiction over courts in six districts within the states of Connecticut, New York, and Vermont.

The latest response to this issue came in late July when bipartisan members of the US House and Senate again proposed legislation -- the No Surprises Act Enforcement Act -- that would punish payers that refuse to reimburse claims for out-of-network healthcare services. Providers continue to report problems with insurers refusing to pay up following "independent dispute resolution" (IDR) rulings.

Sponsors of the legislation attest that it will crack down on those who are willfully defying the law and double down on protecting patients by increasing penalties for not complying with payment deadlines and increasing reporting transparency. Three medical societies-The

American College of Radiology, American College of Emergency Physicians, and the American Society of Anesthesiologists – are voicing support for the bill. Radiology and emergency medicine were the two specialties with the highest volume of resolved cases under the NSA, accounting for about two-thirds of all determinations in 2024, according to a recent Health Affairs study.

Harber perceives that claim resolutions still favor providers, “… mainly because they are privy to the information required in an IDR situation. Many times, the payer tries to gather certain information but is unable to

Thus, the QPA calculation becomes critical, even more so when explaining to the IDR entity how you arrived at that number. In certain cases, there are flaws with the provider’s case. We see this most often in the air ambulance space.”

William Figueroa, chief information technology officer of RxLogic, a technology company for pharmacy benefit claims processing that provides a SaaS-based platform of smart adjudication solutions, states that claim denial rates are a major concern for their customers.

“We focus on delivering tools that enhance transparency and reduce avoidable denials,” says Figueroa. “The RxLogic platform can integrate clinical rules and evidence-based guidelines to help determine medical necessity and experimental status. We support, but do not directly participate in, dispute resolution—our role is to facilitate compliance with both federal and state requirements through configurable workflows.” He maintains that claim resolutions often trend toward providers, reinforcing the need for clear documentation.

“Members benefit from integrated advocacy and support tools in our solution,” he explains. “This offsets the perceived favorability towards providers.”

RESPONSIBILITY OF THIRD-PARTY ADMINISTRATORS

Mike Lanza, senior vice president, USBenefits Insurance Services, LLC, enlightens the complex role of TPAs, “The best starting point of a TPA’s role is from the employer’s expectation due to fiduciary obligations and to mitigate other legal consequences. That said, the TPA must review each claim against the Plan document to ensure claims are paid appropriately. Denials should be clear and state exactly what Plan provision is being used to deny the claim.”

With respect to claims for medical necessity/experimental treatment, he says it is critical to utilize cost containment services to review the appropriate claim documents and medical notes.

The service should have the medical expertise to review the specific claim and produce a report that is based on current medical protocols,” he continues. “When done properly and timely, this will reduce appeals/disputes. Having a thorough report upfront puts the TPA and Plan in the best position should the provider dispute the analysis.”

Lanza maintains that since the member will trust their provider and follow their instructions, the TPA should support the member by directly communicating with the provider to resolve any claim disputes.

“Another important variable is the relationship between the TPA and Stop-Loss carrier,” he adds. "Working in concert ensures the best outcome for all parties. In our experience, this process has been shown to financially benefit the plan."

Advisors at NFP, an AON company, further explain that employers sponsoring group health plans subject to ERISA must determine their role in deciding appeals of denied claims. They counsel that plan sponsors can either designate a TPA as claims fiduciary with final decision-making authority over appeals or assume the role of claims fiduciary themselves.

Mike Lanza

Importantly, they recommend that even if the claims fiduciary role has been delegated to a TPA, the plan sponsor’s broader fiduciary duty to monitor the TPA’s service to the plan cannot be delegated. In these instances, monitoring can become particularly challenging when the plan sponsor does not play the role of final decision-maker.

In this litigious environment, however, serving as a claims fiduciary demands strict compliance with considerable regulatory claims and appeals procedures. The decision whether to play a more hands-on role as claims fiduciary requires weighing the ability to monitor the TPA and the ability to satisfy the regulatory requirements related to appeals processes.

WHEN DENIALS ARE NOT AN ISSUE

Claim denials aren’t a major concern for Nick Soman, CEO, Decent, and his staff.

“We work with a Utilization Management partner that looks at each case carefully using medical evidence and the member’s records,” maintains Soman. "If there’s a disagreement, we help manage the appeal process and may even take part in external reviews if it escalates.”

Since his organization runs ERISA health plans, Soman says, “We sometimes have to be involved at the federal level. Members can file disputes on their own, but we offer extra support when it’s needed, like in surprise billing situations. We always aim for decisions that are fair and easy to understand.”

SURPRISE MEDICAL BILLS STILL ARRIVING

These unwelcome invoices were supposed to be a thing of the past – but they’re not, reports KFF.

New accounts relate that while the No Surprises Act (NSA) is successfully protecting insured patients from certain types of unexpected out-of-network charges—primarily those involving emergency care or unintentional out-of-network services—NSA does not cover a wide range of other unexpected charges from in-network providers or services lacking clear cost estimates.

Members may have been led to believe that provisions in the law intended to provide cost transparency for insured patients—such as good-faith estimates—have not yet been implemented. This leaves many individuals vulnerable to unexpected and confusing charges, even when they believe they are following all necessary procedures.

As a result, and despite the law, many people are caught off guard and face unanticipated medical bills with unclear explanations and complex billing systems. Clearly, the law's intentions and the actual patient experience are not aligned, fueling calls for broader reforms and enforcement.

The road ahead for employers may be littered with even more claims disputes and denials.

Laura Carabello holds a degree in Journalism from the Newhouse School of Communications at Syracuse University, is a recognized expert in medical travel and is a widely published writer on healthcare issues. She is a Principal at CPR Strategic Marketing Communications. www.cpronline.com

Nick Soman

Lost in Translation

Member education is key to closing the health literacy gap

InIWritten By Bruce Shutan

an increasingly unhealthy country where two-thirds of the population is overweight and many have comorbidity factors, consensus is building about the importance of self-insured group health plan members accepting personal responsibility for their lifestyle decisions. While patient advocacy helps them navigate their way through the complexity of care, the baseline for better health is elevating the level of health literacy so that people can make more informed choices.

But nearly 90% of U.S. adults struggle with health literacy or understanding their benefits, according to the Center for Health Care Strategies – an estimate that is also supported by the Centers for Disease Control and Prevention.

Given the minimal level of patient support in navigating a complex U.S. healthcare system, low health literacy was cited by BMC Health Services Research – alongside significantly higher care expenses – as a factor that contributes to an annual cost of $238 billion.

The topic appears to be a priority in the second Trump Administration. U.S. Food & Drug Administration Commissioner Marty Makary, M.D., has described Americans as health illiterate in calling for the need to adopt a more patient-centered and efficient system. In addition, U.S. Secretary of Health and Human Services Robert F. Kennedy, Jr. has emphasized the importance of better education about the benefits of nutrition and exercise to Make America Healthy Again.

EMPLOYEE ENGAGEMENT

With health literacy, however, there’s “a huge disconnect between what every academic expert says and what happens in the marketplace,” notes Quizzify CEO Al Lewis. “Consultants don’t offer it because it’s not a point solution. It’s not a category.”

Educating employees about their health is a tricky business when it’s difficult to gauge whether they’ve actually absorbed the material. “You can give people all the literature you want about health literacy, and you have no idea if they’ve read it or learned anything from it,” according to Lewis, whose company uses trivia to make learning about one’s health fun and engaging.

He adamantly dismisses pry, poke and prod wellness solutions that line up employees for biometric screening as “a complete waste of time and money.” He also cites “ridiculous compliance issues” associated with the Affordable Care Act and notes that huge incentives or penalties in these programs violate the Americans with Disabilities Act.

Healthcare consumers cannot make sound choices unless they have a command of the topic that they’re making a decision around, observes Rob Gelb, CEO of Vālenz Health®. “Just because you have access to information doesn’t mean you understand what to do and how to use it,” he says.

The role of health literacy is to help people make behavioral changes by understanding what might be driving their need for healthcare services. He was surprised to learn from a recent survey that only 38% of the American public agreed with the premise that the fast-food industry is a heavy contributor to the nation’s diabesity epidemic.

“That to me is astounding and seems way too low,” he says. “Look at the portion sizes. Look at the oils they’re using. Look at all the ingredients that are listed. Until we change the mindset of these people and get them to realize what they ingest is going to affect their need for, and cost of, healthcare, then we can really get to true literacy.”

The same holds true at the checkout counter of every supermarket for consuming food at home. A huge concern is that people don’t know how to read a nutrition label, and Lewis says it’s not their fault because they’re highly misleading.

His favorite example is how the food industry lobbied hard to advertise zero trans fats so that consumers would think these products are healthy. A similar story unfolds when products advertise no cholesterol, which he says usually means they’re full of sugar or salt. That list may include such family favorites as potato chips, cereal, or fruit juice – all of which don't have any cholesterol in the first place.

In addition, products that boast no added sugar could be full of added sugar that’s disguised under different descriptions. Consider the Naked-brand green juice, which is sold at health food stores as well as general supermarkets. Lewis cites a loophole: a fruit juice concentrate used to sweeten the drink is an added sugar that doesn’t count as one in a juice product.

A popular rule with label-reading is to study the order of ingredients, but even that can be misleading. Granola bars are fertile ground for such confusion. With Quaker quinoa bars, the healthiest ingredient (quinoa) is listed first because the pecking order is based on volume, giving the impression that it's healthy. However, Lewis says all 10 of the sugars used have been split into different kinds (i.e., white, and brown sugar, molasses, honey, etc.), so they don't appear first. While Cliff bars are advertised as organic, he notes that the first ingredient is organic brown rice syrup, which is simply another description for sugar.

Al Lewis

A RECIPE FOR DISASTER

It’s estimated that upwards of 65% to 75% of covered lives within a self-funded plan would benefit from enrolling in a high-deductible health plan (HDHP) with an HSA. However, poor health literacy means members will offset that risk by opting for a plan that might be considered more generous with lower cost-sharing, notes Matthew McCormick, vice president of growth strategy for Talon.

Anytime an HDHP is mentioned, it’s naturally accompanied by the phrase “skin in the game” – a reference to members shouldering more personal responsibility for their health plan decisions. “But when consumer-directed health accounts were enacted, it very much led to these particular plans being seen as designed for those with low utilization and potentially white-collar workers who were using the HSA as an investment vehicle because of its tax advantages,” he says.

In a nation with high health illiteracy, this movement has been a recipe for disaster. The opacity of healthcare pricing has significantly led to poor health outcomes because so many health plan members avoid necessary care for fear of the unknown final tab, McCormick explains.

Most of the top five chronic conditions and disease states driving at least 85% of healthcare claims cited in a recent stop-loss industry report are controllable through better health literacy, Gelb says. The U.S. leads the world in deaths tied to cardiovascular disease, diabetes, and obesity, and most of it is preventable and manageable, he adds.

Scheduling adequate time to meet with a primary care physician (PCP) for a meaningful discussion about one’s healthcare needs, which is easier to do under the monthly subscriptionbased direct primary care model, will be more efficient economically and produce better outcomes. Improved health literacy ultimately is about avoiding the need for care in the first place and, therefore, not developing costly chronic conditions. By making health literacy highly visible, Gelb

says, "think of the outcomes that could be improved just on that alone."

But there are systemic issues that must be addressed. David Blair, CEO of LucyRx, laments that the hands of overscheduled PCPs are tied. On average, they’re only able to devote about 12 and a half minutes to each patient visit, which significantly limits their ability to influence behavior.

McCormick believes incentives are key to improving health literacy. “Show me the incentives, and I’ll show you the outcomes,” he says. “There’s an opportunity to get a lot more creative with incentives.”

One example is wearable technology like an Apple Watch, which can promote a better understanding of one's health. The thinking is that pulling or pushing on particular levers of that data can promote more health-conscious behaviors when rewards are deployed in a meaningful way to mitigate an employee's out-of-pocket exposure or have a meaningful impact on their premium deductions.

THE WEIGHT OF GLP-1S

The most visible attempt to educate people about their health involves pharmaceuticals, which have long been the fastestgrowing segment of healthcare costs. Countless 60-second TV commercials depict users of prescription drugs skipping

Matthew McCormick

Rob Gelb

through a field, appearing happy and healthy, observes Blair, citing GLP-1s for weight loss as the biggest example of a concerted effort to push a costly specialty script.

If not used correctly, he warns that GLP-1s will make Americans less healthy because people will lose muscle mass. Given that an estimated 137 million Americans meet the criteria to be on a GLP-1, Blair says the price tag for treating all of those individuals would be a staggering $1.5 trillion.

It’s important to view several of the top GLP-1 drugs as an adjunct therapy to diet and exercise, Lewis points out. He says those who receive injections without actually learning how to live healthily or change their grocery shopping habits will simply gain back all the weight they lost when they go off the drug. It's also worth noting that these drugs "have a ridiculous number of side effects, which is why two-thirds of people drop out," he adds.

While GLP-1s have had a meaningful impact on obesity, McCormick questions their long-term impact after treatment ends. “It’s very much the American way to search for that pure miracle drug that will solve an issue that really can be solved in a multitude of ways,” he says.

McCormick likens this drug category to musculoskeletal surgeries, noting that 40% of those procedures related to the back are deemed low value or unnecessary. His point is that they’re done because of a just-fix-me mindset that has taken hold in the culture. Rather than view health literacy as an opportunity for saving, he believes the focus should be on where wasteful spending occurs and why that's the case.

Gelb laments the band-aid culture that has shaped healthcare, especially when it comes to prescription drugs. “I’m not a big fan of drugs, and these pharmaceuticals that are being

It’s

utilized to treat illnesses and mental health are not intended to be forever drugs, but that’s what they’ve become,” he cautions. There’s not only a drug for every possible condition nowadays, but also a drug for the side effect that that drug creates, he adds.

Roughly one-third of employer clients for transparent pharmacy benefit manager (PBM) LucyRx covered GLP-1s for weight loss last year, a number that’s now about 40% and Blair predicts could reach 100% in just a few short years. Sadly, he believes a significant number of Americans aren’t curious enough to understand how these drugs work and can be used in conjunction with lifestyle changes.

Blair characterizes the high-profile promotion of GLP-1s as part of a growing social movement in search of magic pills, noting that antiquated reimbursement models restrict the ability of pharmacists to educate the public in a meaningful way about what they can expect from their prescribed medication. On top of that, he says drug manufacturers seek to bring their products to market without any friction by promising huge rebates and removing prior authorization as an obstacle.

Those efforts, if allowed to go unchecked, already have far-reaching implications beyond health plan management. This new drug category has become so popular that it’s now one of the most sought-after employee benefits. “We’ve had employers specifically tell us that when they recruit talent, they ask if GLP-1s are covered,” reports Blair, who also chairs the board for the Partnership for a Healthier America. And since a GLP-1 oral agent is in clinical trials for patients who are queasy about injecting themselves, he believes that making it available in pill form will serve to increase pressure on employers to make these expensive drugs more readily available.

One helpful approach he suggests would be for PBMs to require that health plan members who want GLP-1s commit to lifestyle changes before they’re prescribed and hold them accountable for doing so. The reason is simple: “We can’t put individuals on a roughly $1,000 a month drug in perpetuity,” he says.

He’s hopeful that with the right education in place to raise the bar on health literacy, progress will be made over time. An 11,000-life employer group that implemented LucyRx’s program over 18 months with the help of health coaches found that the average member on a GLP-1 lost 22 pounds in 12 weeks with a 40% improvement in medication adherence. Concerned about the effort being perceived as too heavy-handed, a member satisfaction survey was conducted, which generated a 90% positive rating.

Another way to improve health literacy is to wrap thoughtful health plan design in a caring culture. Vālenz Health® has taken this approach for its own employees – one that mirrors the company’s approach to serving customers – and has found that it serves as a recruitment and retention tool. “We care about our teams and their families,” Gelb says, noting a low turnover rate of less than 3.6% for the first half of 2025.

Bruce Shutan is a Portland, Oregon-based freelance writer who has closely covered the employee benefits industry for more than 35 years.

David Blair

January 26-28, 2026

Dubai, UAE | St. Regis Downtown Dubai

CONFERENCE

HWritten By Laura Carabello

Here’s the international event that the self-insurance industry has been waiting for: SIIA’s International Conference will be held January 26-28, 2026, in the vibrant city of Dubai, UAE. Event details can be accessed at www.siia.org.

Program Chairman of the Event, Greg Arms, says, “There couldn’t be a better place to hold this event as Dubai is a well-established gateway to the Middle East, Africa, and South Asia. It is uniquely positioned to support the expanding interests of self-insurance – particularly for captives with energy exposures that seek to diversify their service portfolios. Attendees can expect to meet leading international and regional third-party administrators (TPAs) utilizing AI-enabled platforms, as well as outstanding self-insurance businesses that have been established by major local companies and US multinational firms.”

Arms highlights the title sponsorship by AscellaHealth and support from leading healthcare organizations that provide a runway for valuable networking and educational opportunities during conference hours – and robust socialization opportunities in the exciting city of Dubai.

“During the conference, we’ll explore best practices for self-insurance, making it interesting for everyone to learn about different markets and what is driving them,” observes Arms. “This will be a great opportunity to network in a new environment with attendees from outside countries as well as local communities.”

He points out that about 20% of SIIA members are involved in international activities and either have offices locally in that part of the world or they conduct business operations in the region. There has been growing internal demand and, over the years, enthusiastic uptake for different markets.

“Dubai has always been on our list, and now with direct flights from many parts of the world, it was finally time,” he adds. “People are very excited about Dubai. “When it comes to insurance and financial services, it is a gateway for the whole Middle East, really for all of South Asia and Africa. Some people, including myself, spent time living and working in Dubai some years ago, and it has just changed dramatically in recent years. Revisiting the city will be very different, but some things will be familiar.”

Over the years, Dubai has developed characteristics that are most similar to US health benefits, just in terms of the way plans are designed and the formation of provider networks. Americans who go to that part of the world are quickly familiar with how the health plan, health benefits and private health insurance work.

“It's very different than Europe, very different than Latin America,” says Arms. “You don't really have government programs, and it's mainly the private sector. So, it's pretty natural that self-insurance would enter the marketplace. Self-insurance has been there for 45 years, but it started slowly with multinational companies adopting this model for their employees living in the region and extending self-insured practices for expats.”

Recently, there has been substantial interest in embracing self-insurance with larger local companies, like Emirates Air and its tens of thousands of employees.

“What a wonderful brand from that part of the world – one that everyone knows – talking about the benefits of self-insurance," says Arms. “People have also heard of Aramco, the large energy company in Saudi Arabia that’s bigger than EXXON -- financially as well as the number of employees. These companies all practice self-insurance and appreciate the cost containment and wellness bells and whistles that companies expect.”

STRONG SPONSORSHIP

“AscellaHealth is thrilled to be the title sponsor for the SIIA International Conference and take a leadership role in supporting the expanded interests of self-insurance worldwide,” says Bill Oldham, chairman and president of AscellaHealth. “Our global footprint, patient-centric approach and expertise in specialty pharmaceuticals for complex, chronic conditions and rare diseases are especially valuable for captive managers that are seeking to diversify their service portfolios.”

He points to this conference as a unique opportunity to engage with prominent international and regional third-party administrators (TPAs) in addition to major self-insurance groups established by leading local companies and US multinational firms.

Bill Oldham

Greg Arms

“We plan to have a significant presence at the event, including several AscellaHealth US-based team members, along with our UK-based Director of Business Development for AscellaHealth Europe, Alexis Moss, a valued member of our global senior management team,” continues Oldham. “Alexis is chairing the Specialty Rx Session, drawing upon her expertise and pivotal role in planning, executing, and driving revenue growth strategies across the EU and UK markets. We’re all excited to participate in the development and presentation of many educational sessions and look forward to connecting socially with attendees.”

In addition, AscellaHealth’s global affiliate, Chapper healthcare, will contribute its perspective on supporting patients and distributing specialty pharmaceuticals across the more than 70 global markets they’ve served.

2025 Snapshot of Dubai

Dubai continues to embody luxury, innovation, and ambitious development goals. It's a city seamlessly blending ancient traditions with cutting-edge advancements, rising from the desert sands as a glittering jewel in the heart of the UAE.

Dubai in 2025 is a city on the rise, driven by innovation, sustainability, and a clear vision for the future. It's a thriving economic center, a hub for visionary development and a city embracing a greener, more sustainable future.

Economic Powerhouse:

• Dubai's GDP is projected to grow by 5%, outpacing global GDP growth.

• This growth is fueled by strong non-oil economic activity, reflecting successful diversification efforts.

• Strategic investments in infrastructure, innovation, and economic development continue, alongside policies aimed at attracting foreign talent and capital.

• Tourism remains a significant contributor, with a push to develop tourism offerings and attract further investment.

• Increased revenue base from diversified sources supports prudent fiscal spending and investment in key sectors.

“Dubai’s enchanting culture and history are evident: Stroll along the picturesque Dubai Creek, explore the intricacies of wind-towers and traditional courtyards, marvel at artisans’ crafts in museums and galleries, and admire the breathtaking Burj Khalifa, the world’s tallest building," recommends Greg Arms. "For those seeking adventure, indulge in a round of golf at one of the several world-class waterfront 18-hole courses or embark on a desert safari for thrilling dune bashing and camel rides.”

DYNAMIC PROGRAMMING

Arms reports that there is going to be a blending of US techniques with local techniques, sharing, “I've always been a believer that sharing best practices is a two-way street. Too often, it's one way out to global markets, but you learn a lot from the local markets. I can remember in my career adopting practices from the Middle East and taking them back into other countries. And I think the same will be found today. We're going to focus on global benefits, all kinds of healthcare, cost containment, wellness, what's unique, what works.”

Our Roots Run Deep

True strength goes beyond the surface—at Berkley Accident and Health, our foundation is built on experience, financial stability, and disciplined leadership. 1

Rated A+ (Superior) by AM Best1

Decades of

Programs will include some case studies on diabetes management and chronic care management that have actually been implemented in the UAE. There will also be a focus on the estimated 15 captives that are active in the region. Most of them emanated from the energy sector, and a number of them are beginning to expand into additional coverages, including health benefits.

“There's a lot of learning that visitors from the US can share with the local teams and vice versa,” he notes. “There could be opportunities with big health benefit programs that are seeking cost containment solutions. For vendors or TPAs that offer programs, there might very well be significant opportunities.”

Since healthcare is always local, attendees will learn some of the issues that impact access in the region. Local experts will explore what it’s like in these markets to go to a hospital, and what issues challenge the population, especially since the population in the UAE is probably 80% non-national with many imported workers.

"These multinational workforces have a unique healthcare journey,” observes Arms. “It’s not always pretty, to be honest. There are some high-end solutions for some of those folks, and we'll be reviewing the options and hearing from the leaders in the local market. Many of the brands are recognizable to American audiences, but there are also local brands that will be unique.”

SELECT SESSION HIGHLIGHTS

The Gulf Region as a Destination for Healthcare

Participants will have an opportunity to attend a luncheon on Wednesday, January 28th, featuring a special presentation by Ms. Alisha Moopen, Managing Director and Group CEO, Aster DM Healthcare.

"The UAE and the Middle East are positioning themselves as a global destination for medical value travel, where world-class healthcare meets the warmth of hospitality," says Ms. Moopen. "With advanced hospitals, skilled professionals, and an efficient ecosystem, the region offers a seamless experience for patients seeking critical care, wellness or aesthetic treatments."

Moopen will share her experiences at Aster and Medcare, supporting this vision by delivering high-quality clinical care across specialties such as rare disease therapies, orthopedics, mother and childcare, neurology, cardiology, among many others, paired with world-class hospitality, advanced technology, and dedicated international patient coordination teams.

“From advanced procedures to preventive health, we ensure every detail is seamless,” she says. “The UAE’s strength lies in this balance of innovation and precision with empathymaking it a true destination for healing and well-being.”

Additionally, Moopen's team will also conduct optional Aster Health Medical Facility Tours, offering attendees a first-hand experience of the quality care available at these local healthcare delivery sites.

Access to Quality Healthcare

Jon Vineyard, senior director, Contracting & Payer Relations at Mayo Clinic, chairs this session, which will focus on Centers of Excellence linked to health interventions, access to different providers and the type of expert care available for people looking for different treatments abroad. The panel will offer innovation spotlights, including case examples with measurable outcomes.

One of the points for discussion, and an area where Mayo has done quite a bit of work, is ensuring that there is contractual access to care through many large global payers that provide Intelligent Platform Management Interface (IPMI) services and benefits. Additionally, there may be some other large employers that have a multinational presence whose beneficiaries have access to facilities in the US. It is important that members are aware of the benefits that they have and that they can access those services at Mayo or a designated COE.

Mayo has three primary locations for international patients: Rochester, Minnesota; Phoenix and Scottsdale, Arizona; and Jacksonville, Florida. All of those sites are characterized as destination medical centers (DMCs), and patients can seek care for complex and high acuity cases at each one of those DMCs.

“We intend to share guidance on determining the level of appropriateness in care,” explains Vineyard. “For example, every one of our DMCs has an international office and we have representatives throughout the globe to ensure that patients have the ability to access Mayo and help to navigate their appointments. There is an additional layer of service to help patients understand if Mayo can have an impact on their specific case. We want to ensure that patients are appropriately utilizing their benefits.”

He says there may be some cases in which Mayo has the answers and can provide the care. But sometimes, there are cases where the care that they're receiving locally is sufficient and would not be materially different from that of the Mayo Clinic.

Alisha Moopen

Jon Vineyard

“For the latter instance, we would say to patients that they may be better off staying home or locally versus traveling to the US for care,” he adds. “It is important to ensure that the appropriate cases do access Mayo for the care that may not be provided locally or the expertise that may not be easily accessible closer to home.”

Vineyard will also discuss the opportunity to utilize telehealth or telemedicine consults whenever possible. We can utilize virtual care for follow-up visits and additional follow-up care for specific specialties,” he says. "It's not appropriate for every single specialty, but where we can, we will utilize telehealth visits.”

Mayo has agreements in place and relationships with major IPMI providers, as Vineyard states, “I think it's safe to say that the vast majority of IPMI benefits do have access to Mayo, in one form or another. It may be through a large network like United, Aetna, Cigna, or a Blue Cross Blue Shield plan or through a direct agreement. We have connectivity and contractual access to just about every single major global payer.”

Generally speaking, Mayo Clinic sees about 1.3 million patients on an annual basis from over 135 different countries, and that continues to grow.

“We do see a good number of patients from Latin America, and a high number of patients from Europe, the Middle East and Asia Pacific,” he explains. “Many patients seek Mayo Clinic experts for their diagnostics, confirming diagnoses or seeking diagnostic answers that they've not been able to receive from other providers.”

MORE THAN JUST “OFF-THE-SHELF” OPTIONS

When it comes to Excess of Loss, one size doesn’t fit all. That’s why our team of experts is dedicated to delivering customized solutions that are as unique as your business. At StarLine, we pride ourselves on being concierge underwriters, offering tailored, flexible coverage options to meet your specific needs. Visit starlinegroup.com or call (508) 495-0882 to discuss how we can get started for you.

Specialty Rx

As global healthcare systems grapple with rising specialty drug costs and evolving models of care, payers in both government and private sectors are prioritizing partnerships that deliver both cost containment and patient-centric solutions. With global reach and deep expertise in specialty pharmacy, the right approach combines evidence-based strategies, efficient distribution, and real-world data insights to ensure patients receive therapies they need —no matter where in the world they may be located.

This informative session, moderated by Alexis Moss, UK-based director of business development at AscellaHealth Europe, will provide attendees with important perspectives on the value of targeted interventions, the role of specialty pharmacy HUB services and patient-reported outcomes.

“Attendees can expect to gain a better understanding of the advantages of integrating custom-designed specialty pharmacy programs and the importance of collaborating with partners who prioritize the patient journey,” she says. “This will be particularly important for the expat population who may not be familiar with local healthcare systems and the associated processes of accessing specialty pharmaceuticals.”

Panelists will also address the importance of having the ability to import and export pharmaceuticals to multiple countries. Moss will call upon colleagues to provide background on global specialty pharmacy distribution and sourcing.

“We will explore the growing need to go beyond compliance and emphasize patient-centered care,” continues Moss. “One of the most exciting trends is the capability to supply medications directly to patients’ homes, with support provided by dedicated patient care teams via specialty pharmacy HUB services.”

As the adoption of Advanced Therapy Medicinal Products (ATMPs) continues to rise, panelists will explore the evolving healthcare landscape and its shift toward home-based and alternative sites of care.

"The discussion will highlight what the optimal distribution model of the future could look like, particularly the transition from ambient and cold chain storage to more complex frozen storage requirements," explains Moss. "This is critical for managing emerging cell and gene therapies."

Discussions will also examine the global multifaceted challenges facing the UK’s National Health System (NHS) and the complexities of Dubai healthcare.

” Based upon our collective experience in the global marketplace, we will address opportunities to integrate these therapies and seize the growing market interest to deliver pharmaceuticals directly to patients in the home setting," notes Moss.

Moss will also spotlight the differences between distribution and service dimensions in comparison to the US. while offering a clear vision for the future. She expects this future to include a broader understanding of how organizations manage the distribution of products in cold storage to increase cost efficiency.

"I look forward to exploring these opportunities during this session as well as the social events that are scheduled throughout the meeting," she concludes. "This is a fantastic opportunity to widen my network and look out for exciting collaborations."

Alexis Moss

Captive Insurance Developments in the Middle East

This session will provide attendees with a better understanding of the regulatory environment in Dubai, as John Capasso, SIIA panel coordinator, CEO, Captive Planning Associates, explains, “We know that they're very strong in the energy sector, but over the years of my involvement in this region, there has been the issue of using a captive to provide some sort of employee or healthcare benefit to impact services for expats. We are going to take a look at how they are dealing with these issues.”

Capasso recalls the early years of Dubai development and the arrival of shiploads of people from China, India and Pakistan seeking healthcare and employment. He also remembers reports in the Wall Street Journal about people being injured, not having healthcare, and ending up in a hospital in Dubai with no coverage.

“This session will provide some interesting discussion points to expand understanding on the role of captives to fill this void," he says. "Equally important will be a focus on the region's strength in the energy segment, and a look at what other sectors are up-and-coming that have an appetite to explore captive formation – including but not limited to healthcare and employee benefits.”

As a captive manager, Capasso is also concerned with additional market segments, adding, "The Middle East isn't known for growing crops, but being that they're dominant in energy, how are they geared to handle carbon insurance for carbon credit? The future value of carbon credits and other issues potentially dealing with the agricultural and business fields could be very interesting. I'd like to come away with a better understanding of their desire for these opportunities.”

Capasso expects a great deal of interest in this international event, and the chance to gain global perspectives and share different ideas from the international community on alternative risk: how they deal with it, the different opportunities that they face overseas compared to what we do in the US, and merging those together to be able to perform on the international stage much more fluently.

"I look forward to the kind of dialogue that we get into during cocktail hours or at breakfast or lunch meetings," he says. "It is critical to meet socially and take advantage of the opportunity to network and meet new people, understand markets and initiate projects forming captives. This will be a huge takeaway that I'm extremely interested in, opening doors to potential new markets."

From a networking perspective, he feels this is a two-way street: “I've already had experience dealing with markets in Dubai looking for paper on an international market that was difficult to place," he explains. "And there are markets in Dubai that were able to help us connect with some very difficult risks to place.”

US attendees can identify opportunities to expand and discover new business channels and explore different markets that they may not be familiar with, as Capasso continues, “That's why these SIA conferences are so beneficial to all parties involved. It’s not just Americans traveling overseas; it is also an opportunity to meet these risk managers and professionals who are actively working in the overseas markets. They can provide valuable insights into the kind of risks we're looking at and insuring stateside.”

John Capasso

Delivering More Value with Seamless Ancillary Benefits

Unlock the potential of Stealth Ancillary products, designed to help brokers offer customized, cost-effective plans. Work with a team of industry leaders who provide data-driven insights and access to top ancillary carriers. Together, we negotiate competitive, high-performing solutions tailored to your clients’ needs.

Our Ancillary Services Include:

Customized Benefit Analysis & Plan Design

Dedicated Account Management Support

End-to-End Carrier Coordination

Flexible Implementation and Service Options

Centralized Billing & Commission Management

Partner with us to elevate your client offerings today.

Expatriates / Third Country National Medical

Moderating this session, Gavin Richards, director, A&H, Price Forbes, will lead the discussion of different coverage designs for distinct workforces, as well as dual-tier systems and the implications for cost and care quality.

“It's really good that SIIA is doing some more international type business, and I think that in the US -- certainly for stop-loss coverage -- there's over capacity and the prices are relatively low,” observes Richards. “This session is a really good opportunity for reinsurers to look outside the US at other areas of the world, which may be attractive to them, especially in places like Dubai, where you are not required to give unlimited medical expenses. Unlike Obamacare, in other parts of the world, they don't perform unlimited treatment.”

Attendees will learn about dollar limits, which Richards says for expat medical care is either $50,000 or $75,000 per person per year for coverage on a 24-hour basis. This is not just covering activities outside work; it covers all activities.

“It’s a 24-hour product and it's a requirement in Dubai if you want a visa and intend to work there," he explains. "It's mandatory to have medical expense coverage. And when I say expat, I'm not talking really about the high earners, I'm talking about the construction workers, the people who work in hotels and hospitality. Lots of these people come from India, Pakistan, Sri Lanka, and the Philippines. They basically do all the hard work, and they go to Dubai and other Gulf states to make money. If they're not working, basically they don't get paid.”

During the session, Richards will expound on the terms of an annual contract: “Normally, expats work at least six days a week, and they send the money home. So, the expat medical coverage would cover the worker for accidents at work. For instance, if you're a construction worker and you fell and broke a leg, it would be covered -- but it's not really going to cover you for long-term sicknesses or anything like that.”

Since it's predominantly young males in the construction industry who come to work in Dubai, Richards’ office has primarily been involved in these issues for about 10 years.

“We have an office in Dubai that specializes in these programs," he continues. “We perform as a reinsurance arm of a local admitted company in Abu Dhabi. It's then reinsured by various reinsurance companies all around the world. This is completely different from a self-funding type business.”

He expects this session to be highly educational, with additional explanations of how the healthcare system works in the Gulf State. Information will span the types of coverage available, including for the high earners seeking care at Centers of Excellence or major hospitals.

“I'd say 95% of our expat business is for blue-collar medical," he states. "Within the Price Forbes office, we have our own doctor, nurse, pharmacist and experts in many areas. We also have some underwriting authority there, and we review all the claims. My colleagues in the UK office have been working on these issues for about 20 years, and basically every couple of months, they go out to Dubai. It's an expanding business. You've only to look at Dubai, probably 30 years ago, when it was a couple of tall buildings. Now, it’s absolutely massive with the amount of building going on.”

Gavin Richards

Multicultural Challenges in Global Benefits Programs

Cultural attitudes and expectations around work, healthcare and wellness vary widely from one region to the next. What motivates employees in one country may not resonate in another. For example, in some cultures, employers may prioritize basic healthcare benefits while others provide support for Social Determinants of Health (SDOH), spanning housing, education, eldercare or other areas that may impact health. The program will address these and other related considerations.

TRAVEL TIPS FOR DUBAI

Arms advises attendees not to worry about vaccines, but suggests, “I would always encourage people to read up a little bit prior to travel. What's the history? What are some of the social norms?”

He points out certain social customs: “One very basic is you don't cross your legs and show the sole of your foot. It's considered to be rude. To be blunt, it’s almost like giving someone the finger in the US.”

What’s more, if you're offered a cup of coffee as a welcome, “You better take it. If you refuse it, it is an affront. You're saying you're not accepting them if you refuse a coffee or something like that.”

He says that language is not a problem, adding, “Almost everyone, including the Emiratis who are in business, is fluent in English. I don't see any language barriers at all, but considering the world affairs, don't wear a big American flag on your t-shirt if you go out walking around.”

Steadfast protection for the unpredictable

Our Stop Loss Insurance mitigates the impact of costly medical claims through flexible contracts, customizable plans and a consultative, client-focused approach. Our experience and service in the Stop Loss market has provided a guiding hand for 50 years - while maintaining a pulse on new trends. We work with self-funded groups down to 100* lives and individual deductibles down to $25,000. Our Stop Loss Edge program offers an innovative way to take advantage of self-funded health plan coverage for employers with 100*-500 employees. Whether you’re carving out Stop Loss for the first time or an experienced client looking for cost containment solutions, we can help. We’ll be by your side every step of the way.

Visit voya.com/workplace-solutions/stop-loss-insurance for more information

* 150 enrolled employee minimum for policies issued in CA, CO, CT, NY, or VT.

Excess Risk (Stop Loss) Insurance is issued and underwritten by ReliaStar Life Insurance Company (Minneapolis, MN) and ReliaStar Life Insurance Company of New York (Woodbury, NY). Within the State of New York, only ReliaStar Life Insurance Company of New York is admitted, and its products issued. Both are members of the Voya® family of companies. Voya Employee Benefits is a division of both companies. Excess Risk Policy #RL-SL-POL-2013; in New York Excess Risk Policy #RL-SL-POL-2013-NY. Product availability and specific provisions may vary by state and employer’s plan. ©2025 Voya Services Company. All rights reserved. CN4405221_0527 216993 216993_050125

He recommends a dress code similar to what people wear in the US., noting, “If you're going to Saudi Arabia, the dress code is much more conservative -- think about covering your wrists and your ankles and being respectful.”

Arms emphasizes that Dubai is a terrific location for this meeting since many SIIA members enjoy great local connections and already conduct business in this part of the world.

We're getting interest from leading companies, like Berkshire Hathaway, Tokio Marine, CB Star and many familiar US brands, such as Mercer, Marsh and Aon,” he concludes. "They're all active in this part of the world, and they've responded very warmly. Some are going to be sponsors, and many are going to be attending. We're really trying to develop the local component of getting folks registered, and we're getting a lot of support for that."

Laura Carabello holds a degree in Journalism from the Newhouse School of Communications at Syracuse University, is a recognized expert in medical travel and is a widely published writer on healthcare issues. She is a Principal at CPR Strategic Marketing Communications. www.cpronline.com

Do

you aspire to be a published author?

We would like to invite you to share your insight and submit an article to The Self-Insurer! SIIA’s official magazine is distributed in a digital and print format to reach 10,000 readers all over the world.

The Self-Insurer has been delivering information to top-level executives in the self-insurance industry since 1984.

Articles or guideline inquires can be submitted to Editor at Editor@sipconline.net

The Self-Insurer also has advertising opportunties available. Please contact Shane Byars at sbyars@ sipconline.net for advertising information.

Depend on Sun Life to help you manage risk and help your employees live healthier lives