Greater Understanding of Cell & Gene Therapies Supports Plan Coverage

At the heart of expecting the unexpected

Get the peace of mind and support it takes to self-fund your healthcare.

Self-insuring your healthcare benefits can open up new possibilities for your business — affording greater flexibility in how you manage your healthcare spend. Trust the expert team at QBE to tailor a solution that meets your unique needs.

We offer a range of products for protecting your assets, your employees and their dependents:

• Medical Stop Loss

• Captive Medical Stop Loss

• Organ Transplant

We’ll find the right answers together so no matter what happens, your business is prepared.

By Laura Carabello

By Laura Carabello

By David Ostrowsky

By Bruce Shutan

Greater Understanding of Cell & Gene Therapies Supports Plan Coverage

G

GivenWritten By Laura Carabello

that cell and gene therapies are so often paired together, people often think they are interchangeable. While these terms seem similar and both are rapidly advancing areas of modern medicine, they are in fact unique, including their price tags and plan sponsor willingness to cover the cost of treatment. While both are characterized by high costs, they do not necessarily cost the same.

Naga Vivekanandan, Esq., a health benefits consulting attorney with The Phia Group, observes, “Cell and gene therapies (“CGTs”) have moved from the laboratory into mainstream clinical practice, reshaping how serious and often life-threatening conditions are treated. For insurers, these therapies present both promise and peril. Though CGTs are state-of-the-art, transformative treatments that can potentially cure diseases where previously only symptom control was possible, they also carry extraordinary costs and, in their relative infancy, uncertainty about sustainability and long-term outcomes.”

She also comments on the sense of urgency, which is underscored by the market’s explosive growth. The global CGT market topped $21 billion in 2024 and is projected to grow by 19% annually, making CGT a permanent fixture in benefits planning.

While CGTs offer transformative potential, they create a defining challenge for the self-insurance community, as Vivekanandan advises, “As these treatments quickly become an expected part of both modern benefit design and medicine, a purely reactive approach is fiscally untenable. Proactively building a strategy for network access, cost containment, and risk management is no longer simply an option, but an essential component of responsible and sustainable plan stewardship.

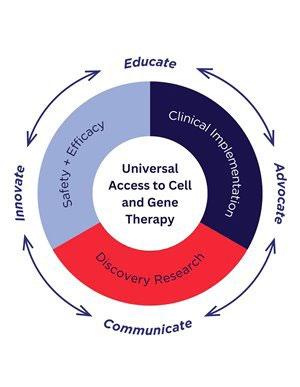

Source: Alliance for Cancer Gene Therapy

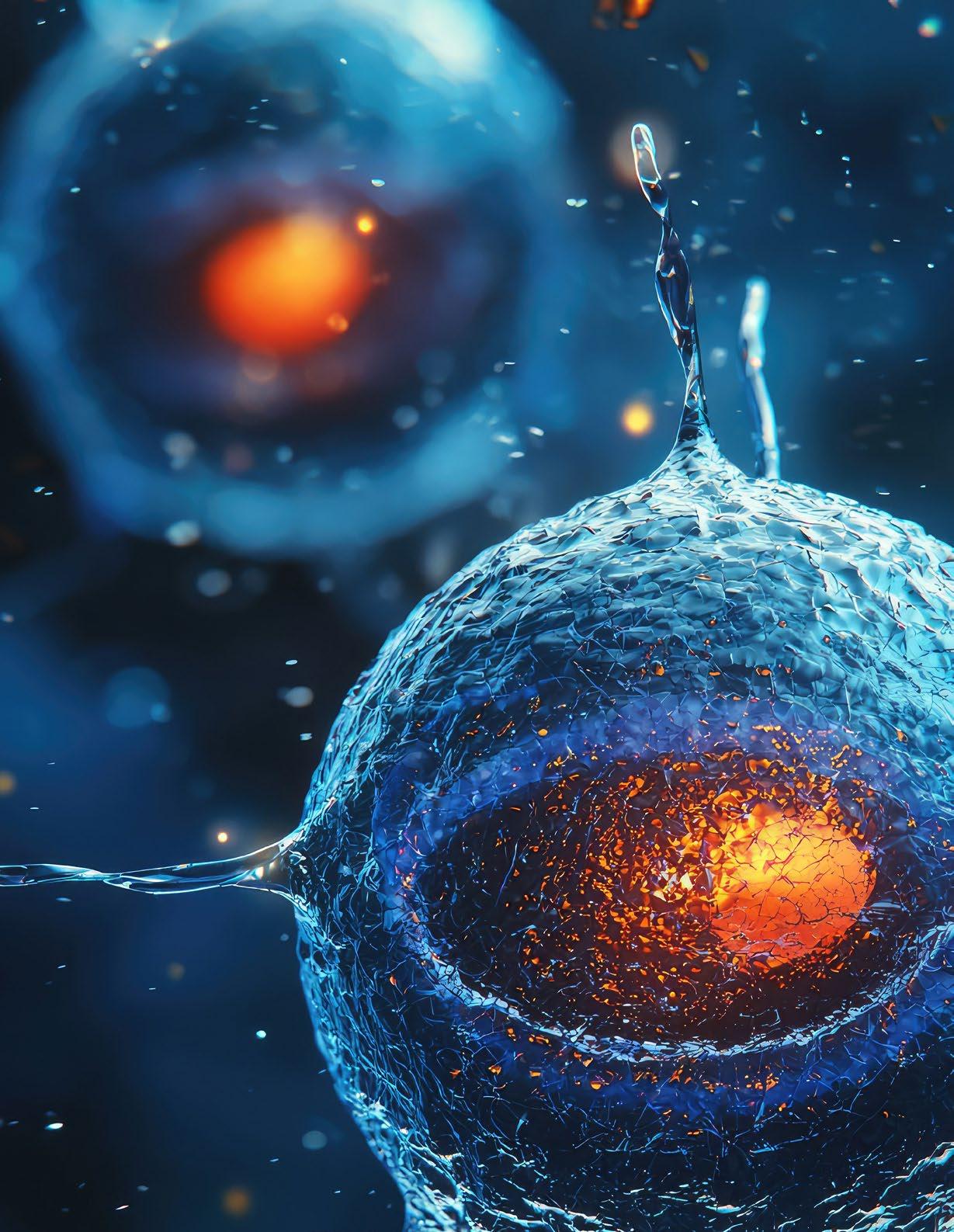

Jakki Lynch, RN, CCM, CMAS, CCFA, director of cost containment, Carbon Stop Loss Solutions, proposes that CGTS have the potential to change how we treat many serious diseases, but they are complex and not well understood. She explains that some therapeutic strategies combine both cell and gene therapy, and in such cases, stem cells are harvested from the patient, genetically modified in a laboratory to express a therapeutic gene, expanded in number, and then reintroduced into the patient.

“It’s important to raise awareness about what these therapies are, how they differ, their potential benefits, risks and high costs," offers Lynch, suggesting that the American Society of Gene and Cell Therapy is an excellent resource for understanding the differences between cell and gene therapy. “FDA-approved CGTs are generally covered benefits under health plans, although coverage depends upon the plan’s specific medical policy or plan coverage definition for each therapy. Approval for individual patients requires the correct diagnosis and meeting all established criteria without any contraindications.”

Naga Vivekanandan, Esq

Mayo Clinic provides the right answers with the right care

Complex is costly. Did you know that, on average, 1% of employees account for 30% of overall health costs2? This is often due to complex, misdiagnosed or undiagnosed medical conditions.

The Mayo Clinic Complex Care Program helps employers simplify the complex, by providing quick and easy access to the top-ranked hospital in the world. Our collaborative approach to medicine helps minimize costs and frustrations by identifying the right patients and delivering the right diagnosis and care.

Assessing the safety, efficacy, and suitability of these therapies can be complex and challenging, especially in clinically intricate cases. A specialized review by a matched, board-certified, and actively practicing physician can offer an independent expert opinion to be considered as documentation for the evaluation of potential plan coverage for the proposed treatment.

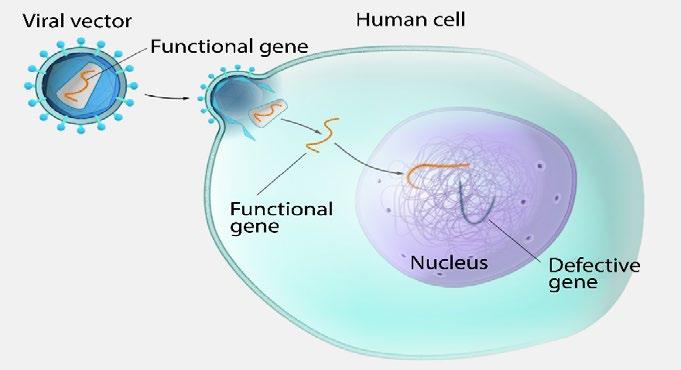

UNRAVELING GENE THERAPY

Gene therapies are primarily one-time treatments designed to alter a specific part of the genetic makeup to help treat genetic or inherited diseases. They promise to cure or slow the progression of aggressive, debilitating and often fatal conditions. A section of DNA or gene of interest is packaged within a vector – such as a ring of DNA called a plasmid. This is the vehicle that carries the DNA into the cell.

Once inside the correct cell, the DNA is expressed by the cell’s normal machinery, leading to production of the therapeutic protein and treatment of the patient’s disease.

Industry visionaries forecast that the future of gene therapy involves expanding applications beyond rare genetic diseases to common conditions like certain cancers, high cholesterol and obesity, with technologies like CRISPR enabling gene editing, not simply insertion.

2025 NY Institute of Technology

CRISPR stands for Clustered Regularly Interspaced Repeats. This new genome-editing technique is so much faster, easier and more accurate than anything that's come before that it's creating a new paradigm for biological research.

Here's how it works. Scientists program a guide RNA on a protein called Cas9 with the address of the targeted gene. The guide RNA directs the Cas9 protein to cut both DNA strands precisely at the correct spot, like a molecular scalpel. A new section of DNA is added to the cell and edited into the original DNA sequence, which now incorporates the characteristics of both sequences.

The CRISPR revolution is already happening in research labs worldwide. For better or worse, every life on Earth will soon be affected by our ability to reprogram the software of life.

Source: Britannica

Lynch describes gene editing as another related approach that uses specialized enzymes called nucleases to modify specific DNA sequences.

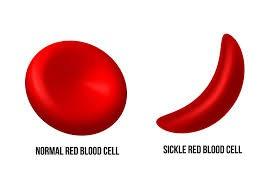

“This technique allows for the insertion, replacement, removal, or alteration of DNA at precise locations in the genome to treat diseases," she continues. "This includes Sickle Cell Disease and Transfusion-Dependent Beta-Thalassemia. One notable example is CRISPR (Clustered Regularly Interspaced Short Palindromic Repeats), a powerful and targeted gene-editing tool that can simultaneously modify multiple genes.”

Source: Mass General Brigham

Additional and potentially life-saving gene therapies are emerging, driven by rapid advancements in biotechnology, accelerated FDA approvals, significant investment and new delivery methods such as RNA therapeutics that aim to treat diseases at their source by controlling the production of harmful proteins or introducing therapeutic ones.

Source: 2025 National Human Research Institute

While challenges persist related to managing expectations for optimized outcomes, affordability of exorbitant price tags and the complexity of navigating new regulatory pathways, ongoing research aims to provide treatments for virtually all rare genetic disorders and beyond. In 2025, advancements include new treatments for genetic blindness, hemophilia, muscular dystrophy and cancer gene editing therapies.

Gene therapies generally have a higher average cost per dose compared to cell therapies, averaging around $1 million to $2 million per dose, with some treatments exceeding $4 million. The average cost per cell therapy treatment is typically around $1 million, according to the Institute for Clinical and Economic Review (ICER). However, prices can differ significantly depending on the specific therapy and indication. Some analyses suggest a lower average of $300,000 to $500,000 for cell therapies.

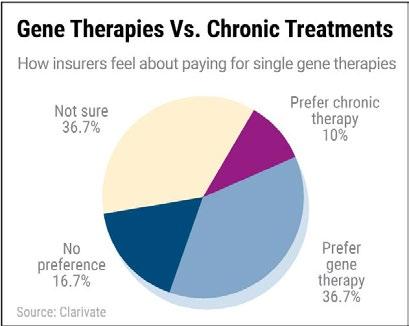

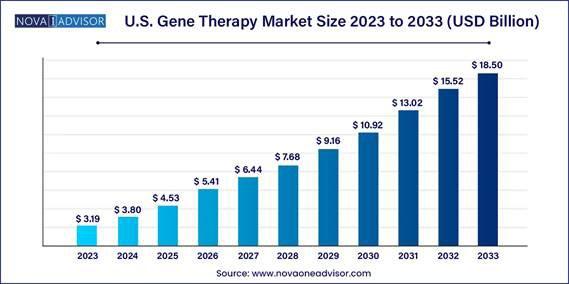

As the gene therapy market as a whole is projected to cost $18.5 billion in the U.S. by the end of 2033, plan sponsors face an unprecedented challenge in deciding which products to include in their plan design.

One way that employers can protect themselves against unpredictable healthcare costs is by purchasing stop-loss insurance. According to Evernorth, this type of coverage is designed for employers who want to hedge against the risk of assuming 100% liability for losses that stem from high-cost claims. As employers utilize stop-loss coverage in conjunction with their self-insured health plan to mitigate highcost claims for CGTs, this approach can be tailored to cover expenses that exceed a set dollar amount.

While most employers may not have seen the financial impact of CGTs yet, waiting to develop a strategy for these therapies is not a viable option, advises the Business Group on Health (BGH). They say that given that there are more than 3,600 CGTs currently in the pipeline, the number of approved therapies is poised to grow substantially. At this point in time, the majority of coverage decisions are made individually for each therapy, but the patient support structures, and payment mechanisms may be developed for all therapies in this class collectively due to shared challenges about the complex site-of-care considerations and high financial exposure.

BGH advisers insist that existing models, such as Center of Excellence (COE) programs or stop-loss insurance, are not designed for these therapies – despite the advice from other resources and the increased utilization of this approach. According to their survey, 9% of employers indicate that they will have a COE for cell and/or gene-based therapies in 2025, and another 10% are considering it for 2026/2027.

Our Roots Run Deep

True strength goes beyond the surface—at Berkley Accident and Health, our foundation is built on experience, financial stability, and disciplined leadership.

Member of W. R. Berkley Corporation, a

Rated A+ (Superior) by AM Best1

Decades of

Recognized for disciplined underwriting and long-term partnerships

BE AWARE OF THE RISKS

According to Ways2Well, altering the genetic material raises a danger of bad results. Including the issue that the inserted genes may not function as expected, or they may cause unintended effects. Immune reactions and insertional mutagenesis may occur. Since gene therapy works at the genetic level, the effects for a long period are not known, although additional trials are underway to help evaluate the safety and efficacy of this treatment.

There are also warnings from the National Heart, Lung and Blood Institute of the NIH that while genetic therapies hold promise to treat many diseases, they are still new approaches to treatment and may have risks. Potential risks could include certain types of cancer, allergic reactions, or damage to organs or tissues if an injection is involved. They point to recent advances that have made genetic therapies much safer, resulting in the FDA approving some gene transfer therapies for clinical use. But they

also caution that there have been few clinical studies on genome editing, a more recent approach than gene transfer that is still being reviewed for potential risks.

Among the setbacks, cancer cases in studies of sickle cell and hemophilia gene therapies renewed safety concerns as reported in the New England Journal of Medicine, including patient deaths in a neuromuscular disease trial.

Most recently, the deaths of two patients treated with a Duchenne muscular dystrophy treatment sparked controversy: In early September 2025, the drug developer initiated ongoing efforts to work with the FDA to complete an updated safety labeling for Elevidys, following a temporary halt in shipments and pauses in clinical trials initiated in July 2025 due to safety concerns -- including patient deaths from liver failure. While the FDA allowed the resumption of Elevidys shipments for ambulatory patients in late July 2025, the therapy's future for non-ambulatory patients remains under review.

The gene therapy market potential is also being tested since many carry seven-figure price tags, raising affordability issues. Even when insurers cover treatment, only a few have seen strong adoption. Despite these factors, the market size continues to grow: Estimates suggest a significant increase in FDA approvals, with industry groups projecting around 10-20 new cell and gene therapies annually by yearend 2025 and some anticipating as many as 35 novel therapies on the market by 2026.

While the FDA is pushing for faster drug reviews as part of a new accelerated approval pathway, the agency will consider drug affordability as one of the priorities of its new voucher-based program.

Accelerating Progress

We study it, research it, speak on it, share insights on it and pioneer new ways to manage it. With underwriters who have many years of experience as well as deep specialty and technical expertise, we’re proud to be known as experts in understanding risk. We continually search for fresh approaches, respond proactively to market changes, and bring new flexibility to our products. Our clients have been benefiting from our expertise for over 50 years. To be prepared for what tomorrow brings, contact us for all your medical stop loss and organ transplant needs.

Tokio Marine HCC – A&H Group

HCC Life Insurance Company operating as Tokio Marine HCC – A&H Group

APPRECIATING CELL THERAPY

Cell therapy products place new cells into your body to treat certain health conditions –essentially, the transplantation of healthy cells into a patient to replace or repair damaged or diseased cells. They can be used for many purposes, ranging from treating cosmetic wrinkles to advanced prostate cancer. The goal of cell therapy is to improve the patient's health by introducing functional cells that can enhance the immune system, regenerate tissues or deliver therapeutic proteins or genes.

Industry observers contend that stem cells represent a type of “holy grail in regenerative medicine.” Since they can grow into any type of cell or tissue, they can potentially repair everything from the heart and bone to the pancreas and brain. Despite increased scientific interest, realizing their full promise has been challenging, and advancements are slow to emerge as drugmakers face multi-level production challenges.

Vivekanandan further clarifies that the hallmark of cell therapy is treatment through actual living cells, taken either from the patient (autologous) or from a donor (allogeneic).

“The goal is repairing or replacing damaged tissue or enhancing the body’s natural ability to fight disease,” she explains. “Gene therapy, in contrast, focuses not on delivering new cells, but on altering the genetic instructions inside the patient’s cells, to repair or replace faulty genes, silence harmful mutations, or introduce new genetic material altogether.”

For plan sponsors who treat cell therapy and gene therapy as separate benefits subject to different protocols, these distinctions matter.

“Clear, unambiguous plan language and participant education are key, and should ideally provide as much information as possible regarding coverages, case management, and ancillary factors such as travel and lodging, particularly since the specialized nature of CGT often means that the necessary treatments are not available locally,” he continues.

“When members understand the value and limitations of coverage, they are more likely to engage constructively in the care process and to have realistic expectations regarding outcomes. Furthermore, for members in need of CGT, benefit ambiguities or disputes can become serious, sensitive issues, especially for employers -- as opposed to traditional insurers, which have no other relationship with the patient.

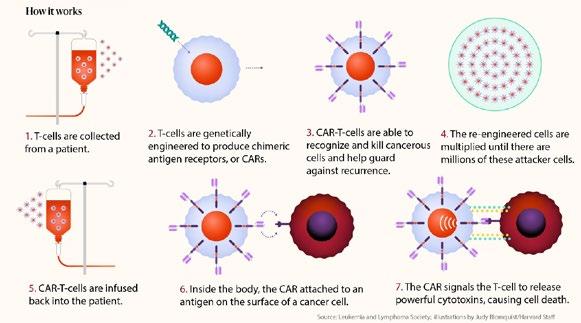

SPOTLIGHT ON CAR-T CELL THERAPY

One of the more promising developments has been CAR-T cell therapy, first approved by the FDA in 2017. CAR-T-cell therapy recruits the body’s immune system in the fight against cancer. Some

Jakki Lynch

of the sickest patients experience rapid improvement, bringing optimism to people who had given up hope with the failure of one treatment after another.

Vivekanandan further explains, “Unlike chemotherapy, which indiscriminately targets both cancerous and healthy cells, or radiation, which similarly carries significant collateral damage, CAR-T is designed to be highly specialized and precise, reducing or mitigating many of the risks and downsides associated with traditional cancer treatments. Clinical trials and real-world use have shown remarkable remission rates in patients with certain blood cancers who had exhausted every other treatment option; in some cases, individuals who were given little chance of survival achieved sustained remission after a single course of therapy.”

Operationally, the initial infusion is not all that needs to be considered.

“Health plans should expect significant critical-care utilization following the initial CAR-T episode, as evidence suggests that ICU admissions occur in roughly a quarter to a third of infused patients, with a median ICU stay lasting around four days and approximately 18% ICU readmission within 30 days,” says Vivekanandan. “These are costs that are easy to overlook, especially when serving as the baseline to the initial cost of the therapies themselves.”

CAR-T cell therapies have been approved in the U.S. market for several types of leukemia, lymphoma and multiple myeloma. Studies conducted by the American Society of Hematology now support their use earlier in a patient’s disease, rather than after all other treatment options have been exhausted. The FDA has also taken steps to make them more accessible.

Cell therapy’s impact on cancer care is growing, and biotech companies have continued to invest in ways to improve it. Just last year, two new approaches -- known as TCT and TIL cell therapy -- reached the market and may be providing additional options that are now showing up on plan sponsor claim costs. There is even the potential for cell therapy in areas outside, such as autoimmune disease, where promising research from German scientists has sparked a flurry of drug research.

Vivekanandan asserts that market trends indicate that utilization of CAR-T is accelerating, as regulatory approvals have expanded to cover treatments for multiple subtypes of leukemia, lymphoma, and myeloma, dramatically expanding the eligible patient pool. Researchers are also exploring CAR-T’s application to solid tumors – a frontier that could help exponentially more people. As evidence builds and awareness grows, both physicians and patients are increasingly considering CAR-T earlier in the treatment pathway rather than only as a last resort.

Alarming Rise of Cancer Diagnoses

According to the 2026 Employer Health Care Strategy Survey by the Business Group on Health, cancer remains the leading factor driving employer healthcare costs for the fourth consecutive year. This trend is exacerbated by an increasing number of cancer diagnoses and rising treatment expenses, including immune and cell therapies.

The American Society of Gene and Cell Therapy (ASGCT) reports that CAR-T cell therapies continue to dominate the pipeline of genetically modified cell therapies, accounting for 55% of these therapies. The ‘other’ category, which includes less common technologies like TCR-NK, CAR-M, and TAC-T, makes up 25%.

“Notably, 83% of CAR-T therapies are being developed for cancerrelated indications, though some are also targeted at non-oncology diseases, with a few exclusively focusing on conditions such as lupus, multiple sclerosis, and HIV/ AIDS,” notes Lynch.

FACTOR IN COST DYNAMICS

He cautions that the cost dynamics are sobering, adding, “Acquisition alone often ranges between $373,000 and $465,000 per infusion, excluding hospitalization and any complication-related costs - which, given CGT’s relative novelty, can be unexpectedly high. Total perpatient expenditures can exceed $500,000, and severe side effects like cytokine release syndrome can cost an additional $30,000 to $56,000 to manage. Medicare inpatient cases alone averaged around $498,700, with observed costs hovering over $1,000,000.”

Medicare payment data show that CAR-T is still predominantly inpatient (about 79%), and the average inpatient CGT cost exceeds the average outpatient cost by approximately 21%.

Vivekanandan illuminates the discussion, “Like all services, however, private payers can expect to be billed significantly more than the Medicare rate.

Even a conservative reference-based pricing model can expect to pay at least 25% more than these averages.”

She makes it clear that for self-funded employers, this presents a significant risk: “Specific or even aggregate stop-loss deductibles can be reached with even just one claim, and the likelihood of 'special risk limitations,' or lasers, being placed on individuals who are in need of CGT is high. Unlike chronic drug costs, which accumulate gradually, CAR-T concentrates the cost into a one-time event, creating unique financial and actuarial challenges.”

For this reason, CAR-T therapies are often seen as the most tangible example of the “double-edged sword” of medical innovation –potentially curative treatments that can transform lives, but at a price that tests the limits of benefit design and risk management.

Some adverse effects can appear during stem cell therapy, including the possibility of immune rejection of donor stem cells, tumor formation and unintended development of stem cells into inappropriate cell types. However, stem cell therapy constitutes a relatively safe procedure, although it must be carefully monitored.

Landmark Florida Legislation

On July 1, 2025, the state quietly passed Senate Bill SB1768, a law allowing physicians to offer patients certain stem cell treatments that have not yet been approved by the FDA, for use in treating specific indications and subject to regulatory compliance.

This under-the-radar change raised eyebrows from clinicians, patients and policymakers across the country. Many see this as a long-overdue step toward expanding treatment options for patients who are not satisfied with the current standard of care.

As the demand for stem cell therapies continues to grow worldwide, this legislation is expected to bring about many differing options across the entire healthcare ecosystem. For physicians, it introduces an opportunity to offer patients new treatment alternatives while also shining a spotlight on the complex intersection of innovation, oversight and clinical ethics, especially in a space that has long lacked regulatory clarity.

Source: 2025 Next Gen Biomed

CAR-T CELL THERAPIES: RISING HIGH-COST CLAIMS RISK

Of all FDA-approved cell and gene therapies, Kirby Eng, R.Ph., Chief Clinical Officer, OutcomeRx, maintains that Chimeric Antigen Receptor T-Cell therapies (CAR-Ts) have emerged as the most commercially successful—and the most frequently flagged by health plans and self-insured plan sponsors as a clear highcost claims risk.

“CAR-Ts are personalized, one-time cancer treatments that require a complex sequence of pre-treatment requirements, patient-specific cell manufacturing, intricate logistics, and intensive post-treatment monitoring, often including extended hospitalization,” he explains. “The result is frequently a total claim cost exceeding $1 million per case, covering both the therapy and administration requirements.”

Eng points to several market dynamics that are expected to further increase CAR-T claims exposure:

FDA approvals for earlier lines of treatment

Expanded manufacturer production capacity

Recent removal of Risk Evaluation and Mitigation Strategy (REMS) requirements.

“Although currently limited to hematologic (blood) cancers, CAR-Ts are advancing in clinical trials for solid tumors and autoimmune diseases, which represent significantly larger patient populations,” he continues.

While value-based/outcome-based and extended payment programs exist, they are generally negotiated between manufacturers and health plans, making them largely inaccessible to self-insured plan sponsors.

“It becomes an imperative strategy for plan sponsors to seek a solution designed to provide cost-effective coverage that specifically addresses the complexities related to these therapies,” he suggests. “Companies such as OutcomeRx are uniquely positioned to work closely with brokers and benefits consultants to structure effective coverage solutions for their clients in a manner that mitigates financial exposure and obtains access to comprehensive patient support services.”

As CAR-T indications expand—particularly into earlier treatment settings and beyond hematologic cancers—Eng says the question for self-insured plan sponsors is no longer if they will see a CAR-T claim, but when and how often. Therefore, he recommends proactive strategies that balance financial exposure, cost containment and personalized care management as essential to protecting both the plan sponsor and their covered employees.

Lynch concurs: “CAR T-cell therapies are complex, high-touch, and extremely costly treatments. To manage these expenses effectively, a comprehensive cost-management strategy must account for the entire care continuum, including post-treatment monitoring, rehabilitation, and any additional care related to complications or side effects.”

Kirby Eng

She further observes that the process is intensive and carries significant risks, including serious adverse events such as cytokine release syndrome and Immune Effector Cell-Associated Neurotoxicity Syndrome (ICANS)—a potentially life-threatening neurological condition that often requires hospitalization.

Lynch also points out that the average wholesale acquisition cost (WAC) for currently FDA-approved CAR T-cell therapies is approximately $525,000.

“However, this figure excludes significant ancillary costs such as facility and professional fees, invoice markups, and the management of comorbidities during the cell manufacturing period,” she reports. “Facility claims data indicate that while the therapy list price accounts for a substantial portion of expenses, it does not reflect the full financial risk burden. Our claims analysis shows that average total billed charges can reach $2.2 million per treatment episode—highlighting the substantial cost exposure beyond the drug itself.”

NAVIGATING THE COSTS OF CAR-T

CAR [T-cell therapy] is the most expensive Medicare diagnosis-related drug, reports the Chronic Lymphocytic Leukemia Society, citing these cost components of direct costs:

• Apheresis (a process that draws blood and, using a cell separator, collects T cells before returning the remaining blood to the body)

• Biopsies

• CAR T-cell production

• Hospital stays

• Imaging studies

• Medicines

• Other related expenses may include housing, travel and caregiver support

Depend on Sun Life to help you manage risk and help your employees live healthier lives

By supporting people in the moments that matter, we can improve health outcomes and help employers manage costs.

For over 40 years, self-funded employers have trusted Sun Life to help them manage financial risk. But we know that behind every claim is a person facing a health challenge and we are ready to do more to help people navigate complicated healthcare decisions and achieve better health outcomes. Sun Life now offers care navigation and health advocacy services through Health Navigator, to help your employees and their families get the right care at the right time – and help you save money. Let us support you with innovative health and risk solutions for your business. It is time to rethink what you expect from your stop-loss partner.

Ask your Sun Life Stop-Loss Specialist about what is new at Sun Life.

For current financial ratings of underwriting companies by independent rating agencies, visit our corporate website at www.sunlife.com. For more information about Sun Life products, visit www.sunlife.com/us. Group stop-loss insurance policies are underwritten by Sun Life Assurance Company of Canada (Wellesley Hills, MA) in all states, except New York, under Policy Form Series 07-SL REV 7-12 and 22-SL. In New York, Group stop-loss insurance policies are underwritten by Sun Life and Health Insurance Company (U.S.) (Lansing, MI) under Policy Form Series 07-NYSL REV 7-12 and 22-NYSL. Policy offerings may not be available in all states and may vary due to state laws and regulations. Not approved for use in New Mexico. © 2024 Sun Life Assurance Company of Canada, Wellesley Hills, MA 02481. All rights reserved. The Sun Life name and logo are registered trademarks of Sun Life Assurance Company of Canada. Visit us at www.sunlife.com/us.

BRAD-6503-z

#1293927791 02/24 (exp. 02/26)

CAR T-cell therapy is only accessible at a certified center, requiring the member to stay no farther than 2 hours away from the center for at least 4 weeks. Inability to work may result in lost income, further escalating the total costs.

Certain plan designs may stipulate out-of-pocket expenses that aren’t covered, including deductibles and other expenses, while others may pay for inpatient stays but not for certain medicines or medical devices

ARE CAR-T THERAPIES WORTH THE COST?

Doctors and patients are literally awestruck by the results of CAR-T therapies. Specialists at the pediatric and young adult cancer cell therapy program at Dana-Farber/Boston Children’s Cancer and Blood Disorders Center report astonishing results: “tumors melting away over weeks or even just days and people who appeared to be on death’s door getting up and reclaiming their lives. One leukemia patient who almost died while receiving the therapy was cancer-free and snowboarding within two weeks.

According to the Harvard Gazette, the therapy has been most effective against leukemia, lymphoma, and myeloma, which together accounted for 9 percent of U.S. cancer cases last year, affecting 187,000 Americans. One important new frontier is to

extend these gains to solid tumors, but equally important is the reality that CAR-T doesn’t work for everyone.

Researchers report that remission rates are currently between 50 and 90 percent, depending on the condition, and cancer is still the largest single cause of mortality for those undergoing the treatment. They also cite a major concern with the severity of side effects: a 2024 study blamed side effects for almost 12 percent of non-cancer deaths among CAR-T patients. Sometimes, the body overreacts to treatment and can cause severe nausea, vomiting, rapid heartbeat and hallucinations among the symptoms. Another dangerous side effect affects the brain, causing temporary confusion in mild cases and coma in serious ones.

However, they say that for patients who have exhausted other options, CAR-T-cell therapy, even with the side effects, is almost always worth trying. By moving CAR-T from a last resort to a second-line treatment, they appear confident that this treatment has the potential to clear cancer from the body.

Advocacy in Action

Legal services and innovative technology combined to defend health plans, plan sponsors and member participants nationwide aequum advocacy programs & services successfully resolve surprise billing and unreasonable out-of-network and balance billings

average, aequum resolves claims within just 244 days of placement.

aequum has achieved a remarkable 95.6% savings off disputed charges for self-funded plans.

Expertise aequum has successfully handled claims in all 50 states.

Another word of restraint emanates from doctors and scientists at The American Society for Hematology, the world’s largest professional society of clinicians and scientists who are dedicated to conquering blood diseases. They concede that not all patients are cured, and at least half will relapse and still require further lines of therapy.

They also acknowledge the uncertainty surrounding the true costs for administering these relatively new treatments, issues that are also tied to questions about reimbursement. In August

2019, the Centers for Medicare and Medicaid Services (CMS) issued a final rule that raises payments for new technologies, including CAR T-cell therapies, from 50% to 65%.

While healthcare experts welcomed this decision, some expressed concern that it does not provide enough relief for hospitals. As more of these therapies are FDA-approved, they worry about whether health systems can afford to pay for these therapies and whether they're going to be adequately reimbursed by insurance companies.

CELL VS. GENE THERAPY: IS ONE BETTER?

This is not a question of one over the other. Receiving a cell or gene therapy is a very personalized experience that depends upon the individual situation. These treatments are only used in certain situations, and the best option is the one that takes into account a variety of factors, including:

Alternative health plan solutions built for today

Employers navigate enough challenges without the strain of large, annual healthcare increases. We help employers take back control of their health plan costs with integrated solutions designed to meet today’s demands.

Medical history

Current health condition(s)

Lab and imaging test results

Access to treatment (depending on your geographic area)

Previously used medications

Treatment goals

Insurance coverage status

Personal preferences

Cost

There are also marked differences in the scope of treatment:

Hereditary illnesses are caused by changes in certain genes, and gene therapy works best to manage these conditions. It fixes and adds genes to replace broken and missing ones. It is reported that there are substantial and powerful effects in treating cystic fibrosis and muscular dystrophy.

.Stem cell therapy is mostly used to treat diseases and injuries that have resulted in tissue damage and degeneration. Some examples of these disorders are osteoarthritis and heart disease. Stem cell therapy doesn't fix genetic abnormalities. It helps tissues mend and grow again.

IMPROVING ACCESS TO THERAPY

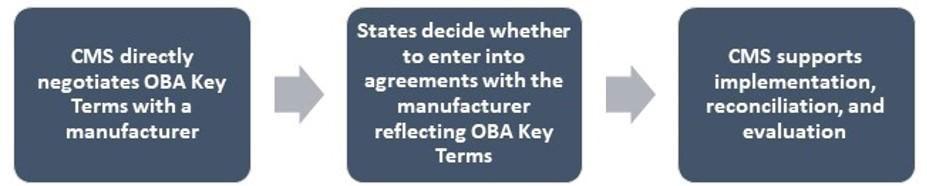

In their decision-making process of whether or not to cover CGTs, employers are following the results of the CMS Cell and Gene Therapy (CGT) Access Model, which aims to improve the lives of people living with rare and severe diseases by increasing access to potentially transformative treatments. It is a multiyear, voluntary model for states and manufacturers to test whether a CMS-led approach to developing and administering outcomes-based agreements (OBAs) for cell and gene therapies increases Medicaid beneficiaries’ access to innovative treatment, improves their health outcomes, and reduces healthcare costs and burden to state Medicaid programs. The model underscores CMS's commitment to accelerating access to innovative therapies, improving patient health, and tying payment to outcomes.

On July 15, 2025, CMS announced that 33 states, along with the District of Columbia and Puerto Rico, will be participating in the CGT Access Model. Of these, seven states and the District of Columbia have applied for and been awarded Cooperative Agreement funding. The initial focus of the model is on access to gene therapy treatments for people living with sickle cell disease, a genetic blood disorder.

Source: 2025 CMS.gov. Centers for Medicare and Medicaid Services

Furthermore, the U.S. Food & Drug Administration (FDA) recently removed its Risk Evaluation and Mitigation Strategies (REMS) designation from CAR T immunotherapies. REMS is occasionally applied to drugs with serious potential safety issues, requiring providers to pursue and document more robust mitigation strategies.

Removing the designation is often a routine regulatory change. This shift signals that both the regulatory and medical communities are comfortable that providers can rely on CAR T’s prescribing information to manage risks and benefits.

STRATEGIES FOR MANAGING CGT COSTS

The initial question employers need to ask themselves is whether to cover these therapies to begin with. Vivekanandan advises that from a design perspective, considerations include whether coverage aligns with fiduciary responsibilities and member expectations, the cost of these services, the employee population and whether this coverage is right for the plan as a whole, medical management techniques, and how stop-loss will treat a claim.

“For some plans, excluding these therapies might make sense in the near term, while for others, partial coverage with strict oversight might strike a better balance,” she says.

“Others still may choose to broadly cover CGT as necessary for employee well-being, in the same way that specialty drugs are typically covered.”

Because these therapies are unique in their structure and delivery, plan language should be drafted precisely.

“Ambiguity around whether a given item of CGT falls under a medical or pharmacy benefit, how complications are handled, or uncertainty regarding medical necessity or the experimental nature of services to begin with can create member confusion, legal risk for the plan, and even reputational risk for the employer,” he expounds. “Additionally, as the market evolves and science progresses, a given plan’s initial CGT coverage intentions may change.”

For those who do decide to cover these therapies, the question then becomes how to manage their impact responsibly.

Vivekanandan suggests that stop-loss coverage remains a primary tool for protecting against catastrophic claims, but employers should carefully review policies for exclusions or limitations related to CGTs and coverage for complications in addition to the therapy itself. She cautions that stop-loss is not a permanent solution.

“Diagnosis-specific disclosures aside, in the first policy year after incurring a large CGT claim, most stop-loss carriers will apply a Special Risk Limitation, or 'laser', excluding that individual's claims from future stop-loss reimbursement,” he notes.

Another strategy is contracting with certain providers or with vendors who specialize in directing and managing patient utilization.

“This can help maintain consistent protocols and, ideally, relatively favorable pricing,” he continues. “However, there may be a stigma attached to contracting efforts on an as-needed basis rather than doing so proactively. One multi-center study found that approximately 35% of privately insured patients’ coverage required a single-case agreement, which delayed financial clearance and lengthened decision-to-vein time. Patients who never reached infusion had markedly worse survival rates, and when this was due to an inability to reach a negotiated rate, it signals an avoidable administrative failure.”

Anecdotally, few employers are likely to view engaging and paying a vendor, or taking the time to find, negotiate, and contract with CGT providers on a proactive basis, as a prudent expenditure of resources. Instead, employers will typically rely on their claims administrators to handle CGT needs reactively, despite their potential time-intensive, yet time-sensitive, nature.

“In this environment, a variety of financing and risk-sharing models have emerged to address the challenges of paying for CGTs,” says Vivekanandan. “Employers looking to move beyond traditional stoploss will need to assess these new approaches when contracting with health plans, PBMs and other partners in the healthcare ecosystem.”

While the importance of coverage decisions cannot be understated, the key challenge for plan sponsors is to develop proactive strategies to address access to quality care, support for the duration of treatment, medical complexity and long-term implications of CGTs for employees' well-being.

Lynch captures response to these challenges, adding, “In an effort to address the upfront high cost of care and uncertainty of the clinical outcomes, we have explored several innovative proposed payment models in the form of therapy product carve-outs, pay over time methodologies, clinical warranty templates based on retrospective payment adjustments, and cost rebates tied to patient outcomes.”

She asserts that outcomes-based contracts are the preference, but they come with ambiguity secondary to challenges in establishing transparent and verifiable clinical outcomes criteria and require substantial resources for tracking outcomes. They may not address the total cost of care with provider markup, administration charges, and additional costs for potential complications, and there are only a few manufacturers accepting innovative payments for their therapies.

“Currently, to ensure value and financial sustainability, we have adopted a comprehensive costmanagement approach,” she states. “This includes evaluating the entire episode of care—from pretreatment workup and inpatient monitoring to post-treatment rehabilitation and management of complications— to accurately assess and manage the total cost of care.”

Beyond ensuring proper utilization and validating plan coverage for treatment to provide patients with the most effective care—thereby supporting optimal member outcomes and plan benefits, she advises that managing costs through well-structured, financially sound facility contracts is essential.

“Not all facility rate contracts offer the same value,” she informs. “We conduct a thorough analysis and aim to secure all-inclusive, financially sound-rate agreements and value-based contracts—where available—with manufacturer-designated Centers of Excellence to ensure cost-effectiveness and highquality outcomes.”

Laura Carabello holds a degree in Journalism from the Newhouse School of Communications at Syracuse University, is a recognized expert in medical travel and is a widely published writer on healthcare issues. She is a Principal at CPR Strategic Marketing Communications. www.cpronline.com

Group health solutions from a carrier you can trust

Why work with Nationwide?

• More than 20 years of trusted stop-loss solutions

• Comprehensive and innovative Self-Funded Program and stand-alone stop-loss solutions

• Flexible plan designs to meet employer and agent needs

• Access to national networks or reference-based pricing

• Supporting employer groups from 2 to 5,000+ members

Nationwide® is a strong and stable FORTUNE 100 company with resources to help employers manage their self-insured plans. Our specialists are ready to help your customers stay ahead of rising health care costs. Visit nationwide.com/grouphealth to learn more.

Right On Target with Direct Contracting

Direct contracting with high-performance provider networks expected to raise the bar on quality of care

TWritten By Bruce Shutan

Targeted

direct contracting, also known as a narrow or high-performance network, has garnered growing attention in recent years – and for good reason. The push for greater transparency on the price and quality of healthcare, as well as a market teeming with data-driven solutions, deserves the most credit alongside other considerations.

This more sophisticated model enables self-insured health plans to assert great control over the cost and quality of surgery, imaging, dialysis, physical therapy and other specialty medical services, observes Bud Brooks, president of Luminary Health Providers, LLC.

He points to a host of distribution or channel partners who play an important role in deploying direct contracts to multiple payers, other health plans and various groups that need access to preferred rates and contracts. What these partners in effect do is place those contracts into a host of different employers downstream that are their clients, he explains. The convenience of having them do all the work makes it particularly palatable. Also in the mix are convener clients such as Lantern, formerly SurgeryPlus, which acts as the TPA, although he says they're only doing the surgical benefit program and nothing else.

“They’re not a benefits administrator in the classic sense,” he says. “They’re the ones who have the actual downstream employers, and they get the contracts and deploy them to the members of their clients.

Cristin Dickerson, M.D., founding partner of Green Imaging, lauds narrow networks and some of the nontraditional, direct primary care (DPC)-centric health plans that are emerging, noting how direct contracting arrangements are increasing markedly and moving upstream.

“Patients want to feel like they have a health plan, not all these silos with different numbers to call,” she explains. “People of different socioeconomic levels use healthcare differently, “and so I think we have to answer their pain points.”

SCALING BARRIERS

While believing that medical providers working directly with employers is always a good move, Employers Health Network (EHN) CEO Blake Allison says the challenge is overcoming a scale problem involving a limited set of employers of all sizes in aggregate, trying to work with a health system or providers. "How does a $10 billion organization in Houston that sees millions of lives do a direct deal for an employer that might have 500 lives? The two just don't add up," he says, noting the importance of creating a scale point that enables health plan sponsors and members to get the value they pay for.

Employers are finding barriers to high-quality care, which is why they're paying an extra fee for

concierge access to a primary care physician and urgent care for their employees, notes Tayebe Shah-Mirany, vice president of PsycHealth Care Management, LLC.

In her area of expertise, which is behavioral health, she recalls how the pandemic made coverage for mental health and substance use disorder all the rage with payers approving these services for the first time via telehealth.

"All of a sudden, you had a lot of organizations popping up nationwide that were part of a behavioral health network," without any care coordination or handholding, she says, concerned that the virtual deliverable was nothing more than watered-down care. Lawmakers have taken note of the role technology plays. In Illinois, where her firm is based, she reports that one of the nation’s first state laws was passed banning the use of artificial intelligence for therapy in behavioral health.

With targeted direct contracting, the mission is to secure access to quality providers in a specialty network who know what they're doing and understand quality measures, such as following up after discharge. Behavioral health is top of mind for reinsurers who have told her these claims are among their most costly cases.

While telehealth can significantly widen access to behavioral health, Shah-Mirany says there are caveats to consider. "You would be shocked how many folks prefer brick and mortar to telehealth to really connect with someone in person," she says. "It's the same thing we're finding why employers are bringing people back to the office and why employees are being isolated in their workspace. They have nobody to talk to. This is what happened with Covid."

When it comes to vetting providers for targeted networks, Dickerson appreciates the philosophy of Nurse Deb Ault, president of Ault International Medical Management, who believes that great care, no matter what the price tag is up front, is going to be cheaper because it will avoid problems down the line.

A RESPONSE TO DILUTED VALUE

Two factors have accelerated the use of direct contracting in recent years, Allison opines. They include the realization that PPO networks

Bud Brooks

Cristin Dickerson

were diluting value over time and post-COVID price increases on the back end of inflation. Health systems also started to push back on reference-based pricing, which made it more difficult to access health systems. The way around that was to contract directly with providers. His company works exclusively with specific health systems in a market to build highperformance provider networks around directly held contracts.

Addressing why there's not more widespread adoption of directing contracting, Allison cites decades of muscle memory from familiar name-brand BUCA plans, creating a sense of comfort with their coverage options. Another is post-COVID employee sprawl. For example, if 20% of a 100-life group based in Orlando, Fla., now

work remotely from Bozeman, Mont., Jackson Hole, Wyo. or other areas, it's not possible to cover everyone with a direct contract – though different options could be made available to employees outside headquarters as a workaround. The site of care is as much

about quality assurance as it is convenience. Multistate employers preferring to contract with one national organization to handle their employee behavioral health needs is short-sighted, according to Shah-Mirany. “They should find the best of breed within a state or metropolitan area if they want to ensure quality, outcomes, cost savings and oversight,” she suggests. “All healthcare is indeed local – and it’s important to work with organizations that understand the locality and the patient populations that reside there.”

Shah-Mirany encourages self-insured employers to prioritize with their broker and TPA the importance of having employees access a cost-effective network of hands-on care in direct contracts rather than continue to pay an extraordinary access rate for a mediocre network featuring arms-length transactions.

MEMBER NAVIGATION

Patient engagement, of course, starts at open enrollment. “Most of our TPA partners on the high-performance, narrow network side require that there’s a concierge program,” Allison says. “The member needs additional support because healthcare is hard enough to navigate.” Members also need to be incentivized to choose certain providers, he adds.

Care navigation is fundamental to the success of direct contracts, according to Brooks. "You've got to have somebody who can advocate with patients, explain to them the options and then gently convince them that the right thing to do is to go to see this surgeon at this facility because the quality of the doctor's experience level, where there will be zero out-ofpocket cost that the member will enjoy," he says.

Having the right navigation in place offers tremendous value. “I

think consumerism has failed in healthcare because seeking any type of healthcare is stressful and it is complicated,” Dickerson observes, noting the importance of examining how navigators are being paid so that incentives are aligned with ethics. Some are receiving a referral fee from the imaging center on top of a per-employee-per-month fee from the employer, she cautions.

Another issue she says to consider is how they’re assuring quality and what tools they’re using. “If a pre-auth is used to redirect to a higher quality, lower cost site of care, that’s fantastic and what it should be doing, especially if there are no delays,” she notes.

The most successful marketplace solutions are steeped in the education they provide – not so much the platforms themselves and IT talent behind their creation, Dickerson believes. “It helps to have subject matter experts in your health plan,” she explains. “I can’t tell you how often the HR person or broker calls me saying, ‘we’ve got a patient with this problem. Can you help with this?’ Having subject matter experts and physicians in your health plan is critical.”

PHYSICIAN RESISTANCE

It’s not surprising that the medical establishment’s response to direct contracting has been largely lukewarm. Brooks believes it’s difficult for providers to divest themselves from large health systems because they provide such a huge revenue pipeline. While a direct-contracting program with employers may result in slightly lower reimbursements, he says it's a much smoother, cleaner and seamless process for providers who don't have to put up with BUCA payer hassles.

HIGH-COST MEDICAL CLAIMS REQUIRE HIGH-POWERED NEGOTIATIONS

Lower your expenses on in- and out-of-network claims with savings as high as 90%

Tayebe Shah-Mirany

“They may be the only game in town, so therefore they’re getting patients who they otherwise may or may not have ever seen, and there’s no out-of-pocket expense to collect,” he explains. “The cases are referred by a care navigator who has the authority to make the referral. Therefore, they don’t have to worry about pre-authorization anymore.”

In preparation for a Free Market Medical Association meeting in Houston, Dickerson noticed a resistance to direct-contracting alternatives. "I think people coming out of training programs are just so ingrained that they're going to work for a large hospital system, and they have so much debt that they hope these entities will assist them with that; it's hard for them to see another path," she laments.

On the other hand, she spots more doctors her age who are frustrated with the system, doing locums (temporary medical services to fill a staffing gap at a healthcare facility) to bypass the pressures of an office practice or embracing DPC, which is a means of direct contracting.

In spite of doctors' perceptions of the direct-contracting model, Dickerson says it’s imperative that self-insured employers carefully read their contracts. “You’ve really got to look at how a TPA gets paid and be willing to pay more upfront so that they won’t take kickbacks on the other side,” she advises.

A TRACK RECORD OF RESPECTABILITY

Those who are best positioned to thrive in targeted direct contracting will be individuals who have been engaging with independent physician associations, value-based health systems and payers since the 1980s, Shah-Mirany believes.

"In order to be in a risk arrangement or HMO, you have to have all the tools in your organization to manage healthcare, almost like a miniHMO system because you're taking on utilization responsibility, care coordination, responsibility, credentialing and the financial risk of ensuring care at the right time, right place and right cost," she says.

While direct contracting may dabble in case management, wellness and other areas, she notes that they’re actually getting to what is driving the cost of care. “Those of us who’ve been doing this for a long time understand the wraparound services that are necessary to have good outcomes and quality,” she says, noting that payers regularly audit the specialty network of behavioral health services her firm offers for quality, utilization and case management.

Her firm has peer review and credentialing committees, does primary source verification to confirm the accuracy of a clinician's credentials and checks each individual's malpractice history. "At the end of the day, you're looking for qualified folks with proper licensing and education," she says. "Once you're working with them, then you can start to discern where these people are falling on the continuum of quality and outcomes."

One major goal is to avoid the burn-and-churn cycle, wherein patients become dependent on their clinician. Rather, the mission is to teach patients the coping skills needed to stay sober and live their best possible life. Periodic check-ins with clinicians about their patients also help manage the quality of care being given.

When vetting providers, EHN will tap into national data from Leapfrog and the Centers for Medicare & Medicaid Services, as well as work with health systems that do value-based work, "and have as much data as we can get our hands on," Allison says, including a mechanism to remove poor-performing providers from their network.

Targeted direct contracting is expected to continue trickling down market, Blake Allison

where smaller employers will be able to leverage the same high-quality care as their larger counterparts. What's so appealing about a group stop-loss captive for Dickerson is that her company doesn't have to onboard 50 small level-funded plans and do 50 different implementations. “We get the whole group. We can do one implementation,” she says. “It helps us provide access to smaller groups.”

Whether or not enough of her fellow physicians decide to take the plunge on this emerging care model, she’s sanguine about the future. “There are a lot of tremendous opportunities out there not just for holding down costs, but also for providing better access and giving people better care,” Dickerson observes. “And I think it’s critical that any new healthcare ecosystem basically gain back trust from patients because it’s not there right now.”

Bruce Shutan is a Portland, Oregon-based freelance writer who has closely covered the employee benefits industry for more than 35 years.

EXPANDED OPTIONS WITH HOSPITAL AND PROVIDER-OWNED ENTITIES

HHospitals

Written By Laura Carabello

and health systems are queued up to serve employers with better options for high-quality care at more affordable costs, allowing for more customized and personalized benefit packages that address the specific needs of an employer's workforce, according to some industry observers.

Experienced teams at these provider organizations are adept at managing costs for employees with expensive medical conditions, such as cancer or chronic diseases, and offering new strategies to manage pharmacy spending. They also tout their capabilities for virtual-first health models to offer more accessible, convenient services that may also integrate mental health support. With access to AI and data analytics, many are creating personalized wellness programs, identifying high-risk employees and guiding plan members to high-value providers, which helps to improve outcomes and lower costs.

It is also worth noting that hospital leaders nationwide face a growing concern when it comes to the patient experience. According to reports, complaints are on the rise, and federal data show the problem is only intensifying. During contract negotiations, employers should be aware that, according to the latest State Performance Standards System report from CMS, complaints against hospitals have surged by 79% over the past five years and topped 14,500 in fiscal year 2024. That increase is straining the oversight

Barbora Howell

system designed to ensure hospital quality and safety, while also revealing frustrations from patients about their care experiences. Provider-owned entities are particularly sensitive to these issues and are striving to dispel these sentiments.

Barbora Howell, CEO and founder, TrueClaim, asserts, “TPAs are essential in vetting these plans—not just for pricing, but for their operational flexibility and tech stack. AI tools are invaluable in analyzing network performance, identifying gaps, and modeling future cost trends.”

Her organization evaluates provider-owned plans based on their integration capabilities with TPAs and commitment to data transparency: “When they align on those fronts, we’re happy and able to form deep partnerships that benefit self-insured employers.”

Johns Hopkins Medicine cites three distinct benefits of the Provider-Sponsored Plan (PSP) model:

1. Enhanced Patient Relationships

Members of a PSP are the same patients that health system clinicians see every day in their offices. This relationship facilitates trust and collaboration with members. By affiliation with a local health system, the PSP benefits from established familiarity, enhancing members' adherence, self-care and better health outcomes.

2. More Integrated Approach

PSPs are uniquely positioned with direct access to the health system. Using care coordination and care management strategies, PSPs are able to more deftly assist with communication between primary care providers and specialists and improve information sharing. This enhanced integration can improve the quality of the care and reduce costs, while providing an optimal experience for members and patients.

3. Inherent Value-Based Care

PSPs break the constraints of fee-for-service payment models with an inherent value-based structure, incentivizing care to be delivered efficiently and effectively, including using virtual and team-based care. PSP payment incentives are better aligned for investing in preventive care and quality improvement.

Advisors throughout the marketplace also point to these advantages:

• Custom and narrow networks. Self-insured employers can design custom provider networks in collaboration with the PSP, allowing plan sponsors to steer employees toward preferred providers and facilities that offer high-quality care at a lower cost, which can result in significant savings.

• Data and analytics. The employer gains direct access to healthcare data from the provider, offering transparency into how and where healthcare dollars are being spent. This allows for data-driven interventions and strategies to improve employee health and manage costs.

• Value-based incentives. The partnership moves away from the traditional fee-for-service model, whereby the provider is incentivized to focus on preventive care, wellness programs and better patient outcomes vs. the volume of services delivered.

UNDERSTAND THE DIFFERENCE

Hospital and Health System-owned Health Plans

Unlike traditional health plans, which operate as intermediaries between patients and providers, providersponsored health plans (PSHPs) are health insurance products directly owned and operated by a provider entity, such as a hospital, health system or physician group. PSHPs aim to coordinate care, advance health and align provider and payer incentives.

American Hospital Association Trustee Services contends that PSHPs offer a good way for hospitals and health systems to take on risk as they move toward value-based care, often beginning with plans for their own employees. They suggest that health plan products are a new way for health systems to control their destinies as their revenue shrinks. Taking on risk is one way to avoid the ups and downs created by payment shifts in the move to bundled payments.

The PSHP market is diverse, with a broad range of players operating in different geographic regions, each with unique strengths. Advisers at Alvarez and Marsal suggest that large PSHPs benefit from scale,

integration, and access to advanced technologies, while mid-market and small PSHPs capitalize on their agility, deep community engagement, and personalized care models. Regardless of size, PSHPs are increasingly focused on delivering value-based care, improving patient outcomes, and addressing the social determinants of health.

DIRECT-TO-EMPLOYER CONTRACTING

Direct contracting models bypass traditional intermediaries, allowing employers to contract directly with a curated group of providers to offer healthcare at negotiated rates, often with more transparent pricing and a focus on quality outcomes. The employer then pays claims out of its own funds, often managed by a Third-Party Administrator (TPA) that coordinates claims processing and network access.

Small and large employers alike want to ensure their workforce achieves and maintains optimal health to maximize productivity. By working directly with a healthcare system, these companies can control costs and maximize the value of employee benefits.

Essentially, these arrangements represent a partnership: Employees have the opportunity to work more directly with their providers, better communicate their needs and create a personalized approach to health improvement that enhances satisfaction with the benefit plan.

Successful implementation of the partnership requires employers to navigate detailed contracts that clearly outline expectations, outcomes, and responsibilities for both employers and the health systems. It is important to strike the right balance between cost and care quality, especially with employer demands on providers to scale their services to meet expectations for increased service levels. As with all healthcare partnerships, the need for technology integration is essential to manage contractual arrangements.

“Hospital-owned health plans and direct contracting organizations can contain medical costs by leveraging integrated care models, emphasizing preventive care, and utilizing data analytics to identify high-risk patients,” says Bruce D. Roffé, president and CEO, H.H.C. Group. "Examples include identifying high expense patients using ICD-10 Stop-loss Trigger Diagnosis Codes as well as other cost control monitoring tools, such as FairHealth data. “

Roffé points to the importance of direct provider-payer alignment that reduces administrative overhead and enables value-based reimbursement strategies, adding, “Negotiating bundled payment models and promoting site-of-service optimization—such as shifting care from inpatient to outpatient settings—can further reduce expense. Additionally, investing in care coordination and chronic disease management improves outcomes while lowering long-term costs. These organizations are uniquely positioned to align financial incentives with clinical performance, driving efficiency and enhancing patient care.”

ENTER THE WORLD OF PROVIDER-SPONSORED HEALTH PLANS

Meet the Health Plan Alliance, comprised of the nation’s leading provider-sponsored health plans. The organization includes leaders in 10 of the top 20 U.S. markets and covers underserved rural areas. Members range in size, from less than 50,000 members to more than 1 million members and operate in all lines of business. While there are varying business models, they are all regional health plans with strong provider ties. Overall, there are several advantages for employers to contract with these plans:

Bruce Roffé

Local advantages and their ability to bring everything to the table – including level-funding opportunities.

Local network, local service and local care management – including relationships with local brokers who live and work in the same community.

Cost containment and the ability to deliver services on a local basis that can't be matched by the nationals

Customization, with a nimbler approach to benefit design.

Focus on the employer partnership mindset – treating employers as strategic partners.

Rick Koven, a longtime consultant to the HPA who handles most of their commercial programming, describes the organization as “A group of about two dozen plans among their members who are working on their selffunded books of business together and are focused on self-funding. As a longtime fan of SIIA, I have been going to many, many national meetings. In fact, in the last three years, we've organized a field trip among some of these plans to come to the annual conference and participated as part of their focus on self-insurance.”

Shawna Dandridge, chief program and strategy officer, HPA, further articulates, “The HPA has been around for about 30 years, a collection of about 50 provider-sponsored health plans from across the country. We're very, very careful about membership, so we don't allow any of the Blues, no BUCAs, no Kaiser, none of the big guys. And we do that because we really like to create intimate spaces where our member plans can come together and share, learn and feel validated.”

The intention is to not include entities that are much bigger, that can come in and sort of take that information and stomp on our members or sort of clam-up our crew. The beauty of what we do is to get members in a room together and hear about this year’s commercial strategy or how they are thinking about brokers. We just had a call last week on broker compensation, and they were sharing information across themselves.”

Dandridge says they look like an association, but the HPA is a for-profit organization that is owned by the members – a characteristic that sets it apart.

“Most of our members are also shareholders, and we do give them back a sort of dividend when we are doing well," she continues. "When I introduce myself, I say: ‘I'm Shauna and I work for you here at the HPA.’ We really are here to serve the members.”

Rick Koven

Shawna Dandridge

Source: Health Plan Alliance

The organization also runs projects and will often pay for a consultant on behalf of the members so that one member doesn’t have to foot the bill. For instance, this year they are running an AI accelerator with a group out of Silicon Valley.

“We paid a decent chunk of money to have them join us, and we've got about 25 plans who are coming together with regularity to really think about how they move the needle on AI,” explains Dandridge. “There are other examples that demonstrate opportunities for members, and we are able to leverage our network in lots of really interesting ways. We've been talking about ‘blue carding’* for years, as well as private exchange IRAs, and these types of possibilities. We've also discussed rebate aggregation on the pharmacy side, and so there's lots of opportunity here. We are an amazing group across the country, and we're pretty well plugged into the provider-sponsored space.”

*NOTE: “Blue carding" refers to the BlueCard Program, a national and international network that allows Blue Cross and Blue Shield (BCBS) members to receive in-network benefits when seeking medical care outside of their home service area.

All of the HPA plans are connected to a health system that owns them, although there are some independent plans. Reflecting on 2025, Dandridge says, “This year and last year have been particularly disruptive for our members. They are hanging on by a thread. I think if we don't begin to have more honest conversations about what regulations and policy changes are doing to this group of our members, nationals are going to dominate the country.”

Strategic data. Safe distance.

Curv® Group Health transforms the industry’s most powerful risk score into actionable insight without compromising privacy. Curv’s new qualitative clinical reports decode the costliest impairments with built-in condition analysis, delivering the depth stop loss insurers need for confident pricing and risk decisions—minus the perils of reidentification. No noise. No exposure. Just meaningful interpretation that protects and performs. go.rxhistories.com/curv/group-health Milliman IntelliScript

Dandridge decries this impact, adding, “I think if that happens, we lose a lot when it comes to community-anchored provider and payer systems that can't just pull out of a market when the dollars and cents don't make sense anymore. Our folks are absorbing the members when the big guys like Anthem, Aetna, and others say, ‘We're not profitable here, we're going to leave.’ Our little guys are left holding the bag; they can't just leave. So, they absorb all that unprofitable membership, and they really are trying to meet the community needs.”

Koven expounds, “Within our group of 50, about half have active self-funded blocks of business that they're interested in growing in a sustainable and profitable way. We convene with those groups, share experiences and talk about the issues of the day. The strength of our members is their local presence: contracts with their local parent health system tend to offer very favorable contracted rates. They have a strong brand and can provide customer service at the local level. Traditionally, these contracts focus upon cost containment. This becomes an important asset to leverage into the self-funded market.”

He cites a primary challenge to serve larger employers that are more likely to have multistate out-of-area business with membership that's more geographically dispersed.

“That's an issue,” he admits. “Traditionally, they went with the rental networks, the MultiPlans of the world and many use First Health. That had been the solution to provide contracting outside of their service area. But more recently, with the advent of national carrier leasing arrangements, a number of them have formed partnerships or just contractual arrangements with Cigna, Aetna and a little bit with United. It's not a perfect solution, but it's a solution.”

Another important issue is their history of coming from the HMO prepaid route, as he explains, “They traditionally weren't used to unbundling, so I often say to them, ‘You guys are like the fancy restaurant with the prefixed menu and the TPAs are like the Greek diner with page after page after page of things you can order.’ I urge them to make that transition from the ‘we do everything package deal’ to the unbundling dynamics that we all know are very common.”

Finally, he points to reference-based pricing (RBP) as a solution to this problem since it obviates the need for a contracted network, saying, “As you can imagine, reference-based pricing is entirely anathema to their owner parent. There's been reluctance, but more recently -- at least for several of them -- that RBP is becoming a tool for the out-of-network claims that come in. I think you're going to see some more of that.”

Local vs. National

Local plans hang their hats on quality, credibility and pricing, but Dandridge says the nationals have really been co-opting that approach.

“I think the nationals are starting to look or try to look more like our plans," says Dandridge. “Some of our member plans report that their customers are going to nationals because they're repricing in a way that's maybe not entirely honest. Then, they’re coming back to our plans because our plans really deliver what they promise.”

Managing the Drug Spend

“This is the ever question with our plans,” notes Dandridge. “We have a pharmacy executive network that comes together with some regularity, and pharmacy costs are the biggest cost driver for our plans right now. Unfortunately, there's truly not a good solution to this across the board, although there's been some reinsurance on some of the cell and gene therapies.”

She believes the conversation around pharmacy spend is really about PBMs, adding, “Frankly, there are some plays with Mark Cuban and cost-plus models for more transparency, but the entire system is

Nelligan brings you the dedicated expertise of an Ancillary General Agency backed by the resources of Amwins Group Benefits.

With the strength of Amwins behind us, we deliver stronger service, smarter tools, and the support brokers need. We simplify ancillary benefits and help brokers grow with confidence.

Our Ancillary Services Include:

– Strategic Benefit Analysis & Plan Design

– Dedicated Account Management Support

– Complete Carrier Coordination from Start to Finish

– Flexible Implementation & Service Options

– Benefit Administration & Billing Support

– Broker Revenue Optimization

– Broker Training & Education Resources

– Resources that Enhance Broker & Client Success

built on rebates and all of our plans partner with PBMs who aren't transparent in what their pass-throughs look like and what rebates are looking like. Until there are broader system changes, we're going to continue to see things just tighten and tighten and tighten on these highcost drugs.”

Group Purchasing Organizations

For many years, the organization has had group purchasing arrangements and runs a vendor database, basically leveraging its buying power with the PPOs to get favorable arrangements and access discounts on a contract for its members.

“We know most of the vendors across the plans, so if someone's looking for a new claim system, I'll reach out and say, ‘What's the leading claim system? Who's using what?" says Dandridge. "We can then connect them so they can hear experiences of other members and sort of feel comfortable as they enter procurement.”

She says it can be really hard to get good GPO contracts in place because every plan is so different, and because they're connected to health systems, sometimes they're doing some contracting with their health system and leveraging the buying power in that way.

"But we have a number of interesting arrangements," she adds. "A GPO contract with Avalon around lab services and even one for reinsurance."

This approach has been very helpful for the plans, as Koven also points to a GPO with a stop-loss program and one that is basically an MGU that is owned by a southwest carrier that helps plans move through that continuum – a very longstanding and successful program.

Focus on Level-Funding:

As level funding gains in popularity, Koven says that surprisingly, “We see a lot of success with about six plans serving that market niche, and all the others interested -- either looking at it, developing it or launching it. Locally, level funding actually plays into plan strengths for serving smaller employers, offering bundled services that align with their typical mode of operations.”

DIRECT CONTRACTING –

NOT AN AT-RISK HEALTH PLAN

SPOTLIGHT ON NORTHWELL DIRECT

Long Island, NY-based Northwell Direct provides an example of a forprofit subsidiary that is wholly owned by the Northwell Health System but is not a health plan. It acts as the employer partnership vehicle to provide employee health benefits and customized health services to employers across the tri-state area. Using RWJBarnabas Health (NJ), along with CT-based Nuvance Health System, a seven-hospital system in Connecticut in the Hudson Valley, which it recently acquired, Northwell Direct has broadened its network to minimize disruption for employers throughout the tri-state region.

Independent physicians are also a part of their network to access this direct-to-employer work that they couldn't do on their own. An individual practice or set of practices is too small to know how to interact and build the infrastructure to interact with employers. This includes smaller health systems like Garnet Health and the Optum physician groups.

Chelsea Glenn, chief growth officer, Northwell Direct, explains, “It is really important to emphasize that we are not licensed as an insurance company, and we don't offer insurance. I just want to be super crisp on that issue. We do offer health benefit solutions for selfinsured employers.”